Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Surgical Care Affiliates, Inc. | d655231d8k.htm |

Exhibit

99.1 Surgical Care Affiliates, Inc.

32

nd

Annual J.P. Morgan Healthcare Conference

January 2014 |

| Certain

statements herein are “forward-looking statements” made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Statements contained herein that are not clearly historical in nature are forward-looking, and the words

“anticipate,”

“believe,”

“continues,”

“expect,”

“estimate,”

“intend,”

“project”

and similar expressions and future or conditional verbs

such as “will,”

“would,”

“should,”

“could,”

“might,”

“can,”

“may,”

or similar expressions are generally intended to identify forward-

looking statements.

These forward-looking statements speak only as of the date hereof and are based on the

Company’s current plans and expectations and are subject to a number of known and

unknown uncertainties and risks, many of which are beyond the Company’s control.

As a consequence, current plans, anticipated actions and future financial position and results of operations may differ

significantly from those expressed in any forward-looking statements in the presentation.

You should consider the numerous risks and uncertainties described in the

Company’s Form 10-Q for the quarter ended September 30, 2013 and in other documents we have filed

with the U.S. Securities and Exchange Commission, including those described under the headings

of “Risk Factors” and “Forward-Looking

Statements”

in the Form 10-Q. You are cautioned not to unduly rely on such forward-looking

statements when evaluating the information presented and we do not intend to update any

of these forward-looking statements. This presentation includes “unaudited

non-GAAP financial measures” as defined in Regulation G under the Securities

Exchange Act of 1934 , including Adjusted Net Income, Adjusted EBITDA-NCI, and Free

Cash Flow. We present non-GAAP measures when we believe that the additional

information is useful and meaningful to investors. Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similar measures presented by other companies.

The presentation of non-GAAP financial measures is not intended to be a substitute

for, and should not be considered in isolation from, the financial measures reported in

accordance with GAAP. Systemwide growth measures should not be considered substitutes

for and are not comparable to GAAP measures. Systemwide growth measures are intended as

supplemental measures of our performance. See the appendix for a reconciliation of

certain non-GAAP financial measures to the comparable GAAP measures. This

presentation also contains estimates and other information concerning our industry that are based on industry publications,

surveys

and forecasts. This information involves a number of assumptions

and limitations, and we have not independently verified the accuracy

or completeness of the information.

Disclaimer

Note: Unless we indicate otherwise or the context requires, references made in this

presentation to “Surgical Care Affiliates”, “the Company”, “SCA”, “we”, “us” and “our”

refer to ASC Acquisition LLC and its consolidated subsidiaries prior to our conversion to a

Delaware corporation on October 30, 2013 and to Surgical Care Affiliates, Inc. and its

consolidated subsidiaries after our conversion to a Delaware corporation on October 30, 2013.

|

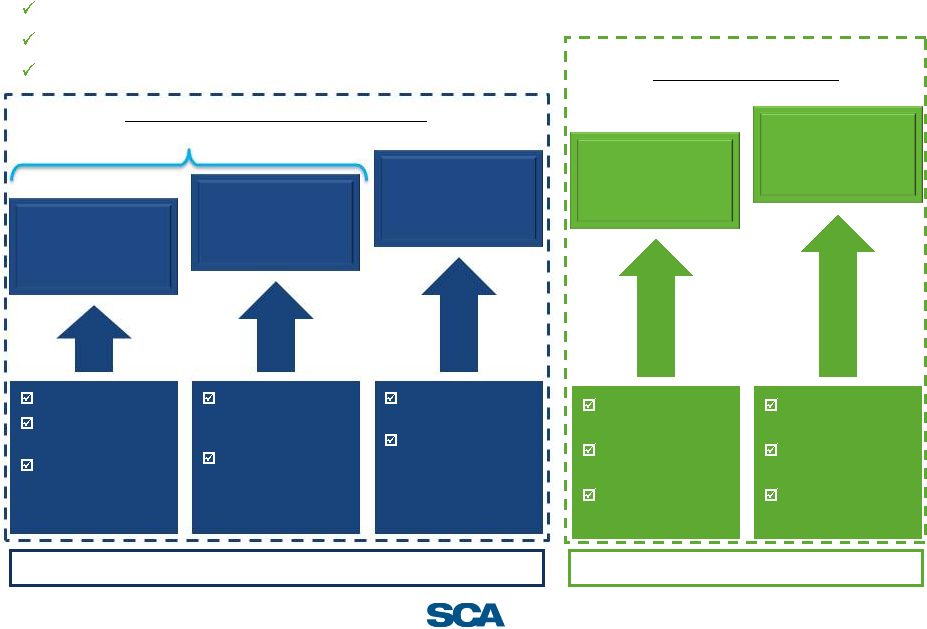

2

Perioperative

services

Management

agreements

ASCs

(majority

ownership

model)

ASCs

(minority

ownership

model with

health

systems)

How we

monetize

Ancillary

services

Development

Informatics

Systems

Our

capabilities

Payors

Who we are

Health

systems

Physicians

Patients

Who we

serve

Optimize the delivery of surgical care in partnerships with

physicians and major non-profit health systems

Our

solution |

3

SCA snapshot

Health systems and physician

JV model

2009

Today

1

National footprint

168 ASC’s; 5 surgical hospitals; 1

sleep center

18 to 42 health system partners since 2007

$146mm of LTM Adjusted EBITDA-NCI, grew 12% in 2012

Revenue ($mm)

$194

$575

1

At 9/30/13 / LTM ended 9/30/13; ² Includes one

facility comprised of 11 sleep center locations Average %

ownership

25%

# of facilities

22

Physician only JV model

2009

Today

1

$660

$705

54%

103

83

91

2

1 |

4

We transformed the business for growth

Health system

partnerships

Organization

building

Suite of services

Carve-out from

HealthSouth

Andrew Hayek

joins as CEO

Physician

Leadership

Board

ECOSystem™

Pete Clemens

joins as CFO

MDetective™

Online SCA

Resources

SCA Insight

Established leadership through continuous investments in the business

Joe Clark

becomes CDO

SCA Knowledge

Library

Michael Rucker

promoted to

COO

SmartSystem

Added sales

team

Transition to health system partnership strategy

Phase of

development

131

127

174

# of centers

Rationalize footprint

Accelerated growth w/ health system partners

Build new leadership

125

123

142

147

1

At 12/31, except 2013 at 9/30/13

2007

2008

2009

2010

2012

2013

2011

1982–Surgical

Care Affiliates was

founded

1 |

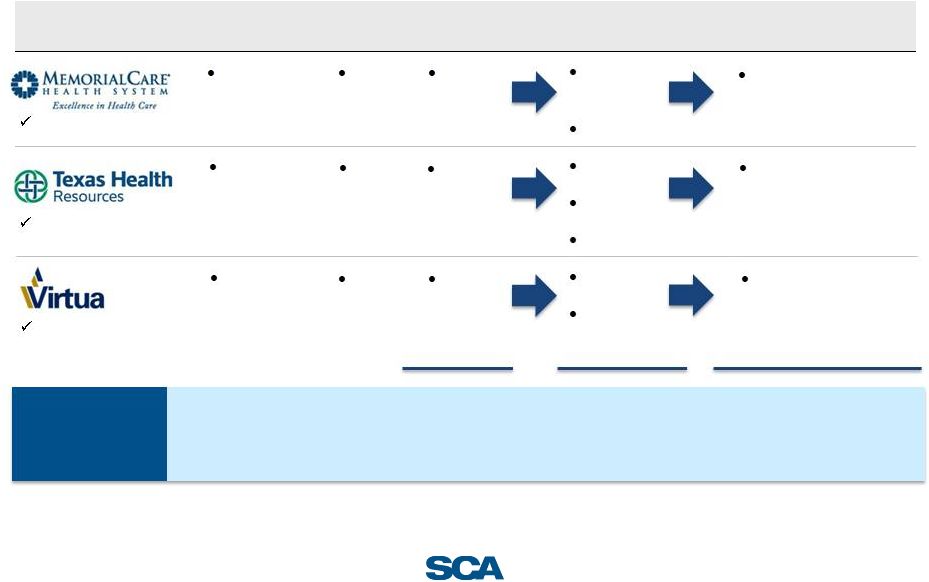

5

Strategic focus on building health system partnerships…

Health system partner

Key metrics

Revenue: $6.7bn

Inpatient market share in

MSA - 27.4%

2nd largest inpatient

market share in NY MSA

Revenue: $1.1bn

Inpatient market share in

MSA – 30.7%

Highest inpatient market

share in Southern New

Jersey

Revenue: $4.6bn

Inpatient market share in

MSA – 16.2%

Highest inpatient market

share in Chicago

Partnership implications

Growing importance of local market leading health

systems

Health systems play larger role in delivery of care, both

primary and specialist

Health systems searching for partners on surgical

strategy (systems, expansion, people)

Enhanced ability to capture surgical volumes

Immediate relevance with Payors in local markets

Capital efficient platform for growth

Unique acquisition / co-development opportunity

•

Non-controlling status in partnered facilities

•

Impact on financial accounting (growth of health

system partnerships will drive equity in non-

controlling interest)

Leading health system in

New York

Leading health system in

New Jersey

Largest health system in

Illinois

Source: Respective audited financial statements, Health Leaders Interstudy reports and

S&P rating reports

Partnered with “winners”

in local markets

Health system partnership rationale |

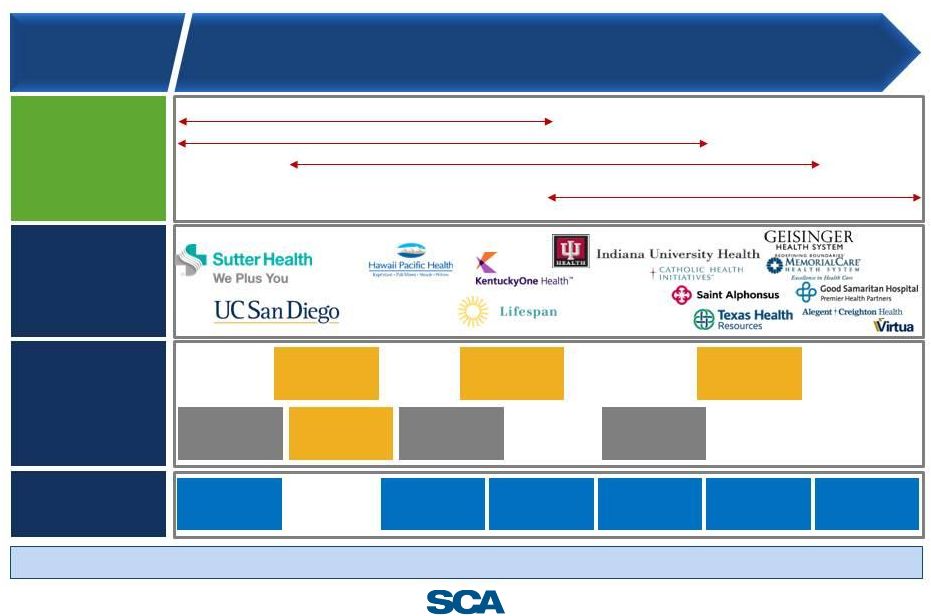

6

…becoming a Partner of Choice for leaders in the industry

42 health system partners | 650K+ surgical procedures per year |

~2,000 physician partners

Slide represents only selected partners as of 12/31/2013 |

7

Multiple

partnerships

in

early

stages

–

Significant

embedded

growth

Total

10 centers

13 centers

3 LOI’s/pending

1 de novos

21-25 centers in 2014

2

7-11 new ASC’s

annually

2

Largest health system in

Orange County, CA

Largest health system in

Dallas/Fort-Worth

Largest health system in

Southern New Jersey

Health system partner

Health system

network

Launch

date

Status at launch

Current status

Runway for growth and

expansion

6 hospitals

2013

2 ASCs

4 ASCs

+ periop

1 LOI

Expect to acquire 2-3

ASCs annually

25 hospitals

2012

3 ASCs

4

ASCs

1

de novo

Expect to acquire 3-5

ASCs annually

4

hospitals

2013

5 ASCs

5 ASCs

1 Pending

Expect to acquire 2-3

ASCs annually

1

1

2

2

2

3

1 LOI

1

Note: Represents management estimates of facility acquisitions for the next several years.

Actual number of acquisitions in any period may vary subject to market conditions and other factors.

Acquisition of facilities may not lead to revenue growth. Management’s view of overall

pipeline remains robust.

1

Source: Applicable health systems’ website; ² Based on management assessment of local markets and demand for affiliated ASCs; ³ As of

10/1/13 |

8

Rigorous operational discipline

Strong results

Health system

partnerships

2.3x

Financial performance

(Adjusted EBITDA-NCI, $mm)

13.1% CAGR

Attractive

case

mix

1

1

As a percentage of net patient revenue, consolidated, as of 1H 2013

General

Surgery

24%

Orthopedic

31%

Ophthalmology

17%

Gastro

11%

Pain

8%

ENT

9%

$89

$102

$117

$130

2009

2010

2011

2012

18

42

2007

9/30/2013

LTM

9/30/13

$146 |

Key investment

highlights 1

12 months ended 9/30/13

2

1-year forward FV/EBITDA multiple

Aligned with transition to lower-cost, higher-quality care

Differentiated model —

JVs with leading health systems

Market opportunity expanding

Partnerships create capital efficient acquisition model

Significant

investment

in

“Systems

&

Processes”

to

drive

continuous mix and volume improvement

Value-based care driving new opportunities

Track record of execution

Advantageous cash generation

ASCs on average cost 42% less than

hospitals

42 health systems partnerships

17 new partnerships over the past

12 months

Acquired 52 facilities since 2010 at

effective first year multiple of 4.3x

Same-site systemwide 2012 growth:

Net Operating Revenue : 6%

Net Patient Revenue per case : 4%

Pursuing partnerships with ACOs,

IPAs, and payors

2009-YTD, Adjusted EBITDA-NCI

CAGR of 13%

Value of NOL, cash conversion

9

1

2 |

10

Our solution |

11

Healthcare is at an inflection point

Pressure on both physician groups and health systems

Consolidation is accelerating

Increasing focus on lowering costs and delivering value

Health systems, physicians and payors are looking for

solutions |

The transition

to value-based care creating new opportunity Surgery represents ~30% of medical

spend for individuals with commercial insurance

Source: Based on management estimates and SCA analysis of commercial payor data sets

Significant

addressable

opportunity

Cataract

Upper GI

Endoscopy

Colonoscopy

$964

$341

$378

$1,670

$591

$655

Source: Ambulatory Surgery Center Association report (2011)

Secular migration

to optimal setting

Surgery

30%

Medical/other

70%

Hospital -

Outpatient

ASC

Hospital -

Inpatient

Surgery spend by setting

Cost comparison ASC vs. hospital

outpatient dept.

Procedure

Medicare

procedure

billed at ASC

Medicare

procedure billed

at hospital

As health systems transition to value-based strategies, the need to manage surgical

costs will only increase

42% lower price

at ASC vs. hospital

12 |

Delivering a

comprehensive surgical solution Models to align health systems,

physicians and payors

Flexibility in partnership model to

attract health systems

Co-management agreements, joint

ventures and alternative payment

models

Proprietary systems & informatics

Proprietary systems optimize

case/facility profitability and drive

productivity

Analytics support clinical and

quality-based metrics

Growing suite of ancillary services

Surgical solutions

Perioperative services

ACO analytics

Development model

Experience negotiating and executing

partnerships

Deploy resources to drive market

strategy

Co-invest with partners and acquire

facilities at attractive multiples

13 |

14

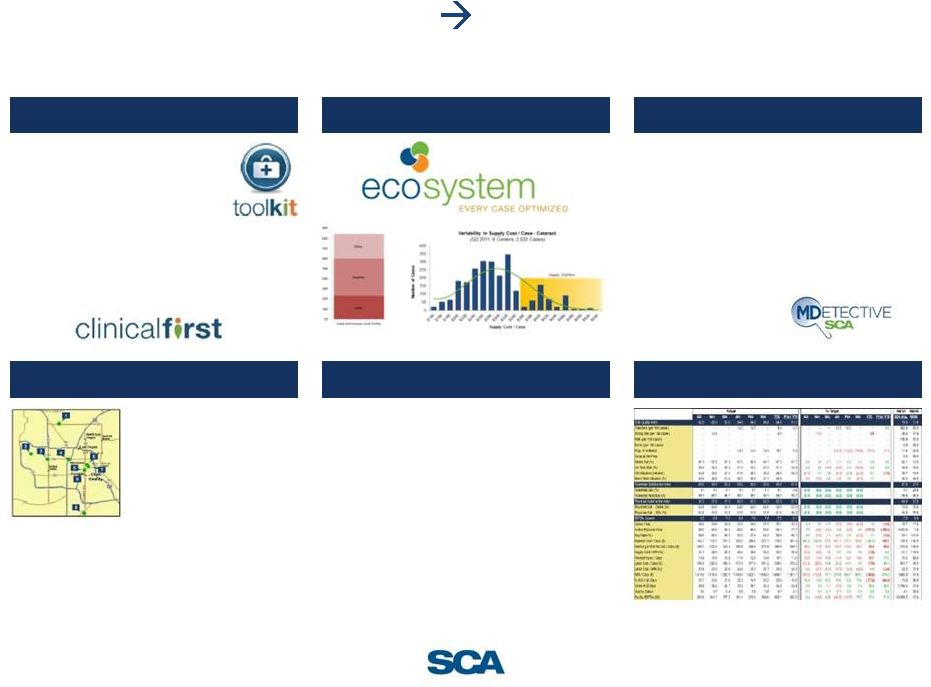

Technology and informatics

Performance management

•

SCA Quality Index

•

Clinical Consulting Team

•

Regional Quality

Councils

•

Clinical Excellence Universe (in-

center education workstations)

•

Highest opportunity specialty

determination

•

Physician target mapping and

prioritization

•

Disciplined recruitment process

and tracking

•

Experts in service

line

expansion

•

Expansion

•

Consolidation

•

Resyndications

•

Target

identification

•

Integration

•

Perioperative services

•

Revenue cycle analytics

•

Schedule optimization

•

Supply chain

•

Labor efficiency

•

Best practices

•

Fully integrated IT system

Clinical excellence

Case profitability

Physician recruitment

Development

Operational efficiency

Benchmarking/informatics |

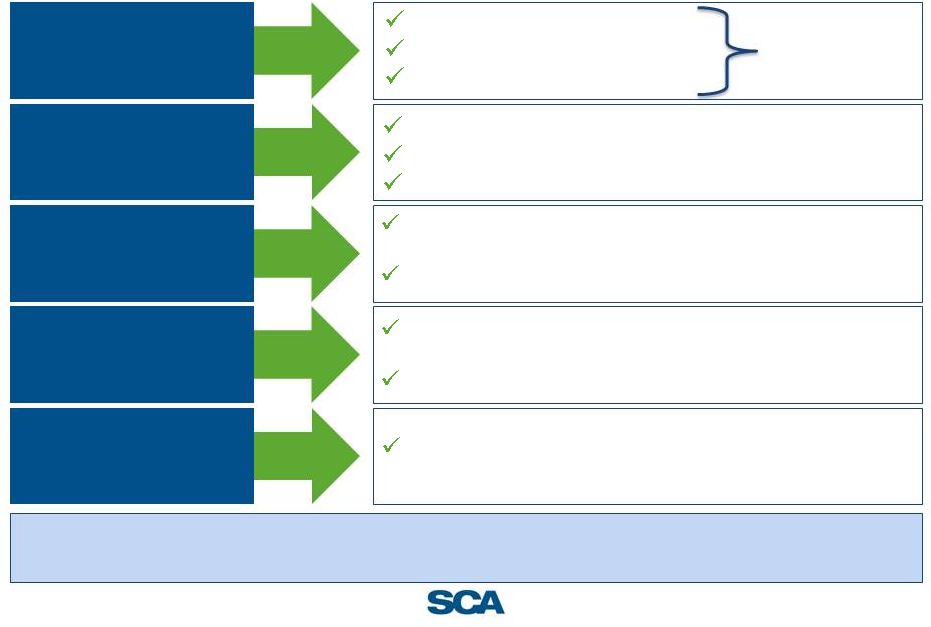

15

Expanding

suite

of

solutions

-

Perioperative

services

Providing

surgical

solutions

•

SCA partners seek broader set of

solutions

•

Hired strong team with perioperative

services experience

•

Adapted their know-how to SCA system

of data, process, and execution

•

Began referencing perioperative services

to SCA’s partner base through SCA’s

development team

•

Now generates profit with 14 surgery

departments engaged

Multi-Site

Perioperative

Clients

Perioperative services have gained meaningful traction and strengthen relationships

with health system partners

1

As of September 30, 2013

1 |

16

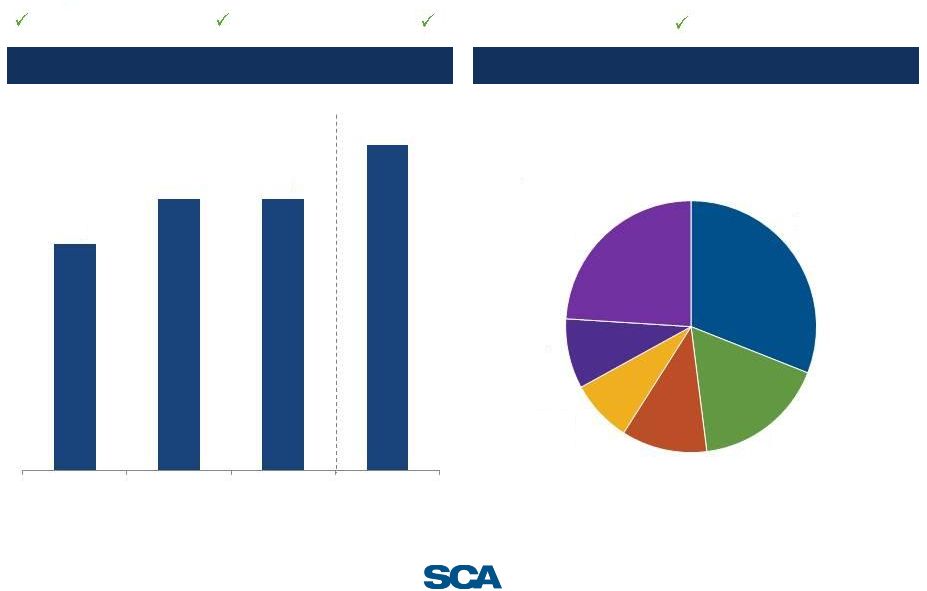

Leveraging our capabilities to drive industry-leading same-

site growth

1

As a percentage of net patient revenue, consolidated only; 1H 2013

Driving case mix

Driving efficiency

Industry-leading metrics

Driving volume growth

5%

6%

6%

7%

2010

2011

2012

9 Mo 2013

Orthopedic

31%

Ophthalmology

17%

Gastro

11%

Pain

8%

ENT

9%

General

Surgery

24%

Same-site systemwide net op. rev. growth

Consolidated

case

mix

1 |

17

Leadership position

High return on capital, given partnership strategy

Expanding universe of health systems seeking partners

Multiple levers for sustainable growth

1/3

1/3

1/3

Acquisitions/

development with

existing partners

New partnerships

and selected

acquisitions

Optimize

same-site

performance

Expanding

platform

Attractive returns on

in-market capital

deployment

Multiple partnerships

in early stages of

opportunity

Multiple ways to

enter a new market

Inflection point in

market creating

opportunity

Perioperative

services

Physician group /

MSO management

Data and analytics

Price/volume

Maximize procedure

mix

Physician recruitment

Transition to value

Surgery benefits

management

Partnerships with

risk-bearing entities

Payor partnership

Organic

Upside opportunities

Long-term target: 10-12% Adjusted EBITDA-NCI growth

Upside

Drivers of Adj. EBITDA-NCI growth |

18

Financials |

Financial model

highlights Multi-pronged growth

Attractive same site

systemwide revenue

growth

Growth in partnerships

creates sustainable

tail-wind

Strong cash conversion

reinvested to drive

capital efficient growth

Adjusted EBITDA-NCI is

the key financial metric

contribution

equally

weighted

Same-site growth

In-market co-development

New partnerships/acquisitions

Physician recruitment

Continued efficiency

Focus on case mix

Significant in-market co-development opportunity within

early stage health system partnerships

Growing pipeline of partnerships given market demands

Expectation of no federal cash taxes until 2018 given

significant NOL

Acquiring assets at attractive effective multiples

Nonconsolidated facilities Adj. EBITDA-NCI will grow

faster than consolidated facilities

Long-term target: 10-12% Adjusted EBITDA-NCI growth and

strong double-digit cash Adjusted net income growth

19 |

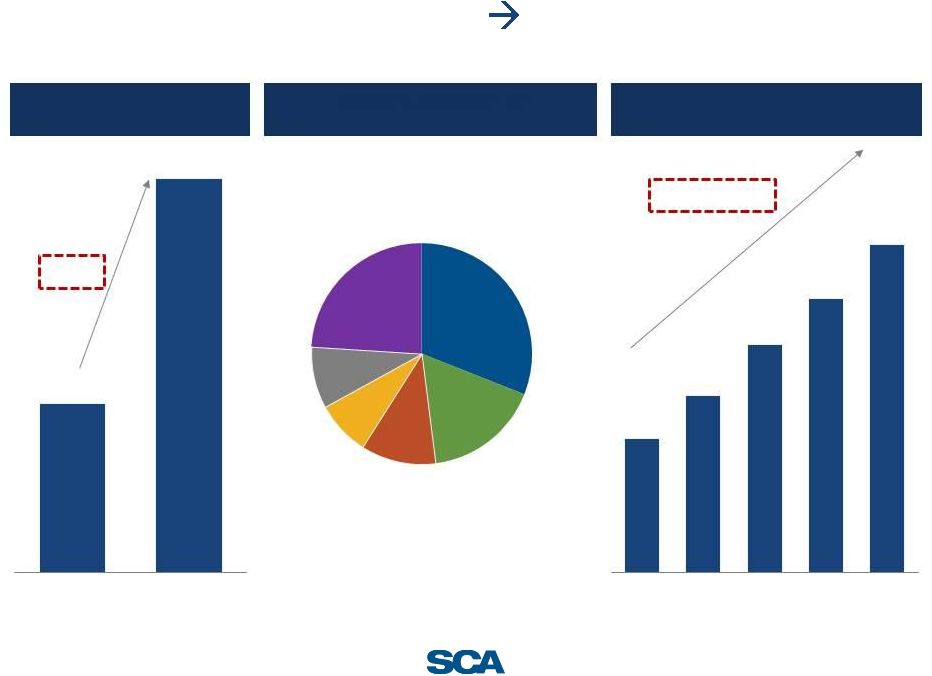

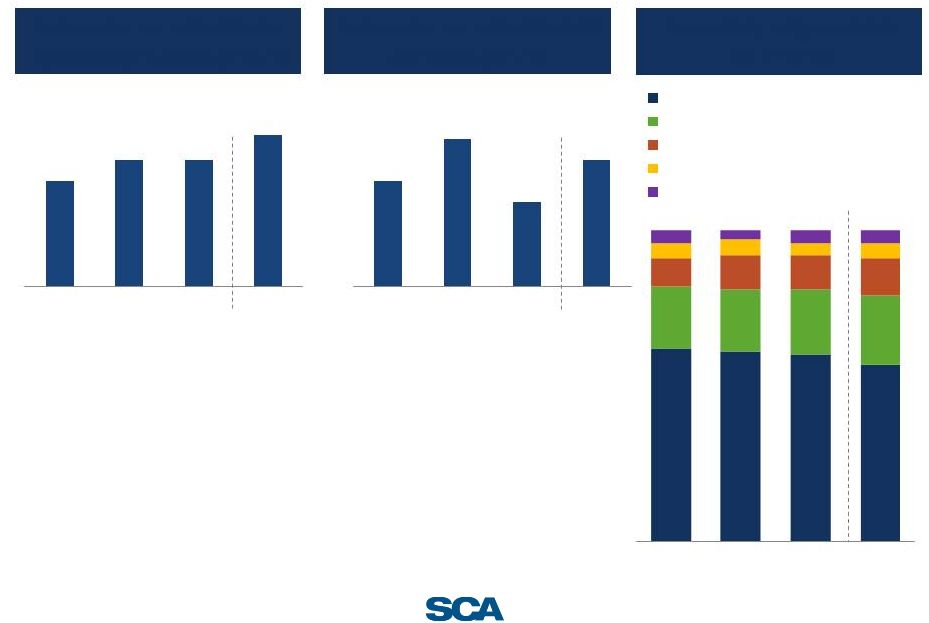

20

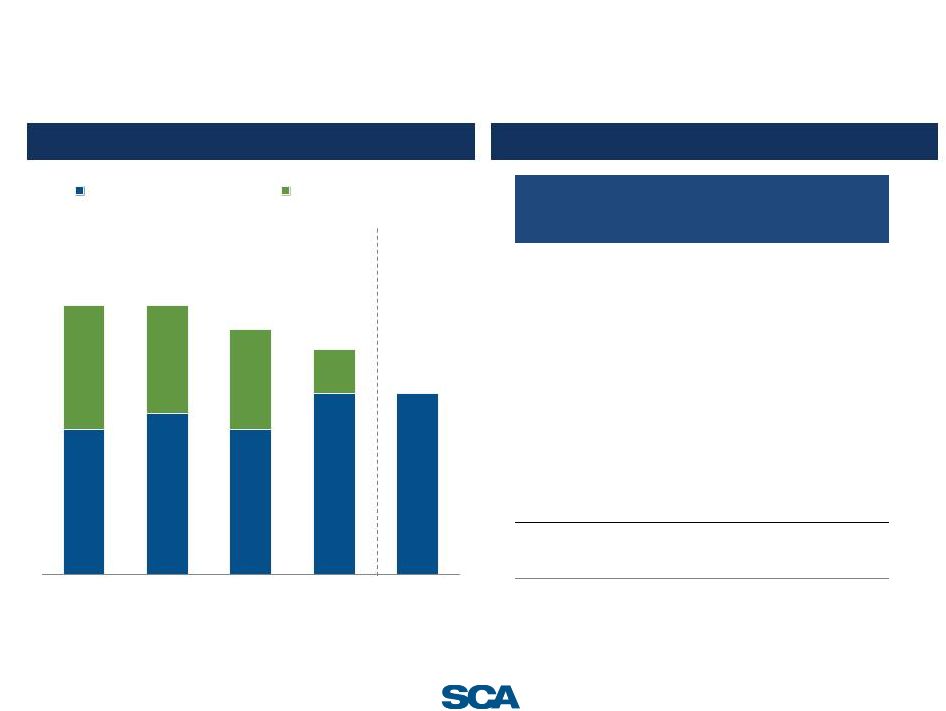

Track record of growth

Systemwide net operating revenue growth

Adjusted EBITDA–NCI ($mm)

17.8%

•

Systemwide net operating revenue growth results

from NPR/case increases, volume increases and new

affiliated centers

•

Managed care contract wins in two markets in late

2012 that rolled through into 2013

•

Q4 2013 expected to be lower than Q4 2012 due to

non-recurring OH benefits booked in Q4 2012.

5.8%

5.6%

17.0%

16.4%

12.1%

2009

2010

2011

2012

9 Mo 2013

$89

$102

$117

$130

$89

$105

2009

2010

2011

2012

9 Mo

2012

9 Mo

2013 |

21

Same-site systemwide performance and payor mix

Same-site systemwide net

operating revenue growth

Same-site systemwide NPR

per case growth

(YoY growth)

(YoY growth)

•

Reflects recruitment of new

physicians and increasing

market share

•

Shift to longer, higher-acuity

cases (with higher

reimbursement)

•

Same-site systemwide NPR

per case increases are being

driven by preferable case mix

and managed care contracting

–

Offset by lower workers

comp reimbursement in

select markets

Consolidated payor mix

(% of NPR)

62%

61%

60%

57%

20%

20%

21%

22%

9%

11%

11%

12%

5%

4%

5%

4%

3%

4%

Managed care and other discount plans

Medicare

Workers' compensation

Patients and other third party payors

Medicaid

5%

4%

2010

2011

2012

9 Mo 2013

5%

6%

6%

7%

2010

2011

2012

9 Mo

2013

5%

7%

4%

6%

2010

2011

2012

9 Mo

2013 |

22

Strong cash conversion & efficient capital deployment

Historical free cash flow

•

No cash taxes expected through 2018 due to

NOLs drives attractive cash flow conversion

•

30-40% of Adjusted EBITDA-NCI typically

converts to free cash flow

Vintage analysis ($mm)

•

Capital efficient model —

generally acquire

at

4.0x

effective

multiple

,

due

to

strategic

benefits

•

Positions facilities for continued potential

growth post-acquisition through clinical

integration and market positioning

•

Increasing benefits to in-market density

with health system

Value created under SCA umbrella

Vintage

Purchase

Price

Yr 1 E-

NCI

Yr 2 E-

NCI

Yr 1

Multiple

Yr 2

Multiple

3

2010 Class

$16.8

$2.7

$2.5

6.3x

6.6x

2011 Class

138.4

26.5

33.9

5.2x

4.1x

2012 Class

30.5

13.6

15.6

2.2x

2.0x

2013 Class (YTD)

20.9

5.0

Average

$59.0

$13.7

$17.4

4.3x

3.6x

($mm)

2010

2011

2012

10-'12

CAGR

Operating cash flow

$143.8

$165.3

$171.2

9.1%

Less: Capex

28.7

32.9

28.4

Less: Distributions

1

82.6

84.7

94.2

Free cash flow

$32.5

$47.7

$48.6

22.3%

2

2

3

3

Distributions to noncontrolling interests of consolidated affiliates; ²

Adjusted EBITDA-NCI; ³ Firm value/EBITDA multiple

1

2013 YTD as of 6/30/2013 |

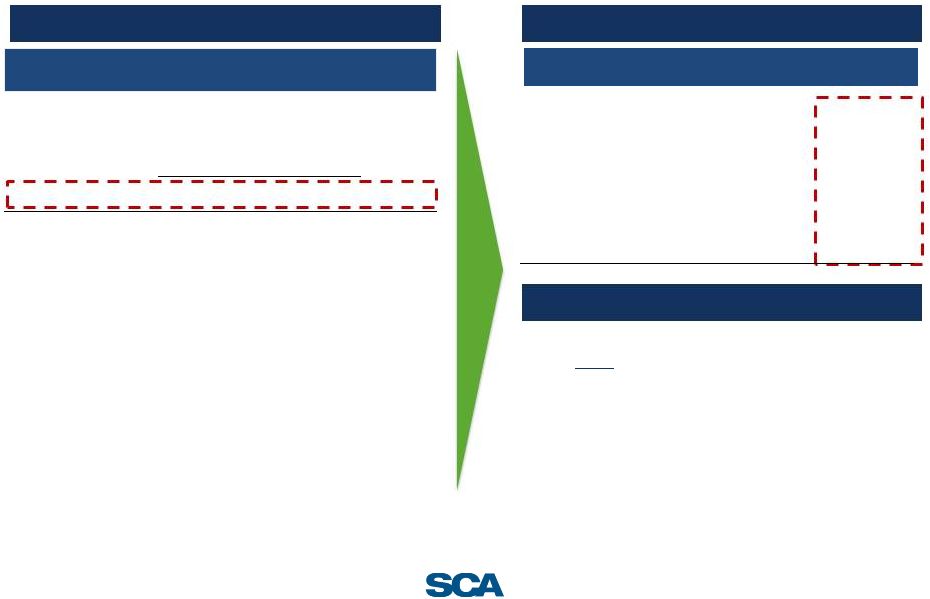

23

As of September 30, 2013

($mm)

As Adjusted

pro forma IPO

Cash and cash equivalents

$88.6

Long-term debt, including current portion:

$132mm revolving credit facilities due 2016

–

Class B term loans due 2017

215.0

Class C incremental term loans due 2018

388.1

10.0% senior subordinated notes due 2017

–

Notes payable to banks and others

38.9

Capital lease obligations

18.9

Total long-term debt

660.9

Net debt

$572.3

Gross leverage

4.5x

Net leverage

3.9x

Illustrative PF balance sheet

Overview of leverage

Gross leverage

1

Includes Class B and Class C term loans, capital leases and notes payable to banks and

others 2

Pro forma for redemption of senior subordinated notes due 2017

1

2

3.6x

4.0x

3.6x

4.5x

4.5x

6.7x

6.7x

6.1x

5.6x

4.5x

12/31/2010

12/31/2011

12/31/2012

9/30/2013

Pro forma

9/30/2013

Other leverage

Senior secured leverage |

24

Surgical solution partner positioned for sustainable growth

SCA’s competitive

advantages…

Leadership position with

health systems

…

which lead to strong financial

performance and position

the Company for growth

Early stages of multi-

pronged growth plan

Strong cash conversion /

capital-efficient model for

expansion

…

create tangible strategic and

economic benefits…

Differentiated by

proprietary technology

•

Health System partnership provides

unique advantages

•

Acquiring at low effective multiples

•

Proprietary systems to enhance

clinical, operational and financial

results

Aligned with transition to

value-based care

•

Deliver high-quality, cost-effective clinical

outcomes to patients and payors

•

Positioned to work with risk-bearing entities

•

Embedded potential growth in existing

partnerships

•

Capital efficient, disciplined acquisition

strategy

•

Substantial growth in health system

partnerships (from 18 to 42)

•

Strong operational and financial results

Experienced

Management Team

•

Strong prior healthcare experience

•

Proven ability to drive results

Strong same-site growth

Continued growth in

health system

partnerships

Long-term target of

double digit Adjusted

EBITDA-NCI growth

Strong return on

invested capital

Track-record of creating

shareholder value |

Appendix

25 |

26

Reconciliation of net income to Adjusted EBITDA-NCI

($mm)

($mm)

2010

2011

2012

2012

2013

Net income

$69.5

$83.5

$72.3

$55.6

$51.0

Plus (minus):

Internet expense, net

$51.1

$55.6

$58.5

$44.4

$48.7

Provision of income tax expense

14.6

20.4

8.3

8.7

10.2

Depreciation and amortization

37.4

40.5

41.7

30.4

31.9

Loss from discontinued operations, net

11.1

3.0

2.8

4.1

4.2

Equity method amortization expense¹

–

10.1

20.3

15.2

17.9

Loss (gain) on sale of investments

(2.1)

(3.9)

7.1

(2.0)

1.1

Loss on extinguishment of debt

–

–

–

–

3.8

Asset impairments

3.0

–

10.2

0.4

3.4

Loss (gain) on disposal of assets

0.4

(0.8)

(0.3)

(0.2)

0.3

IPO related expense

0.8

Non-cash stock compensation expense²

1.3

1.7

1.7

1.3

6.6

Adjusted EBITDA

$186.3

$210.1

$222.7

$158

$179.8

(Minus):

Net income attributable to non-controlling interests

(84.4)

(93.2)

(92.4)

(68.9)

(74.9)

Adjusted EBITDA-NCI

$101.8

$116.9

$130.4

$89.1

$105.0

¹ For the years ended December 31, 2012 and December 31, 2011, we recorded $20.3

million and $10.1 million, respectively, of amortization expense for definite-lived intangible assets attributable to equity

method investments. For the nine-months ended September 30, 2013 and 2012, we recorded

$17.9 million and $15.2 million, respectively, of amortization expense for definite-lived intangible assets

attributable to equity method investments. These expenses are included in Equity in net

income of unconsolidated affiliates in our consolidated financial statements. There was no such amortization expense

for the year-ended December 31, 2010. ²

Represents a non-cash expense relating our equity-based compensation program.

Year-ended December 31,

Unaudited Nine-months ended September 30, |