Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERMUNE INC | d659710d8k.htm |

| EX-99.1 - EX-99.1 - INTERMUNE INC | d659710dex991.htm |

J.P.

Morgan 2014 Healthcare Conference

January 13, 2014

Exhibit 99.2 |

Forward-looking Statements

This

presentation

contains

forward-looking

statements

made

pursuant

to

the

"safe

harbor"

provisions

of

the

Private

Securities Litigation Reform Act of 1995. Investors are cautioned that, without

limitation, statements in this presentation regarding InterMune's plans and

expectations; anticipated availability of top-line results from the ASCEND trial; the

estimated patient populations suffering from IPF and market potential for Esbriet;

anticipated timing of pricing and reimbursement discussions and/or

initiating commercial launches for Esbriet; intellectual property protection for Esbriet;

and expectations regarding the ASCEND trial and prospects for success thereof are

forward-looking statements. All forward-looking statements

included in this presentation are based on information available to InterMune as of the date

hereof, and InterMune assumes no obligation to update any such forward-looking

statements. Actual results could differ materially from those described in

the forward-looking statements. Factors that could cause or contribute to such

differences

include,

but

are

not

limited

to,

those

discussed

in

detail

under

the

heading

“Risk

Factors”

in

InterMune’s

periodic reports filed with the SEC, including but not limited to the following:

(i) the risks related to the uncertain, lengthy and expensive clinical

development process for the company’s product candidates; (ii) risks related to the regulatory

process for Esbriet, including that the results of the ASCEND trial may not be

satisfactory to the FDA to receive regulatory approval; (iii) risks related

to unexpected regulatory actions or delays or government regulation generally; (iv) risks related

to the company’s manufacturing strategy; (v) government, industry and general

public pricing pressures; (vi) risks related to the company’s ability

to successfully launch and commercialize Esbriet; and (vii) the company’s ability to maintain

intellectual property protection. The risks and other factors discussed above

should be considered only in connection with the risks and other factors

discussed in detail in InterMune’s Form 10-K, Form 10-Q and its other periodic reports filed

with the SEC, which are also available at www.intermune.com.

1 |

Our

Company: A Fully Integrated Global Biotech Company with Significant Growth

Potential 2

Demonstrated

Research

Capability

–

first

in

HCV,

now

delivering

in

fibrosis

Development and Regulatory expertise in Specialty Diseases

–

Multiple, high-quality, multi-national clinical trials in Phases

1-4 –

Esbriet approved by EMA and Health Canada

A Successful Commercial Organization

–

Built high-performing EU and Canadian organizations

–

Achieved

attractive

pricing

and

reimbursement

in

13

countries

in

Europe

–

Strong year-on-year revenue growth in 2013 and more expected in 2014

($115-$135M) Poised to Launch in the United States

–

ASCEND results early Q2 2014

U.S. launch in 1H 2015

–

ITMN is building its U.S. capability

ITMN is the Leader in IPF and expanding via R&D and BD into new growth areas

focused primarily on fibrosis |

Our

Franchise: Idiopathic Pulmonary Fibrosis (IPF) A Large, Lethal Orphan Disease

Progressive scarring of the

lungs with no known cause

–

Median survival: 2-5

years*

Large market in North

America + European Top-15:

–

118K to 158K prevalence

–

28K to 37K incidence

Esbriet

®

is the only approved

IPF medicine in EU or

Canada

–

None approved in U.S.

% Patients Surviving at 5 Years

100

0

80

60

40

20

Lung

Cancer

IPF

Ovarian

Cancer

PAH

Colo-

rectal

Cancer

Breast

Cancer

*

Bjoraker JA, Am J Respir Crit Care Med. 1998 Jan; 157(1):199-203.

3 |

Our

Strategy: Maximize the Value of Esbriet and Grow Beyond Esbriet and IPF

Grow Beyond

Esbriet and IPF

Expand

Esbriet in IPF

New formulations

Phase 4

ISTs

Registries

Leader in IPF:

Commercialize Esbriet

Key launch and

commercialization

activities

Vision: Leader

in Specialty

Fibrotic Diseases

4

New

indications

Pirfenidone

Analog

LPA-1

Biomarkers

Business

Development

A

B

C |

InterMune Is a First Mover in an Emerging Growth Area

with Significant Unmet Need: Fibrotic Diseases

Lung, kidney, liver,

bone, heart, GI tract,

others

~40M patients

in all fibrotic diseases

High Unmet

Need and

Severity

Affecting

Multiple

Organ

Systems

Fibrotic

Diseases

5

~120 assets in

development

(50 from top biopharma)

InterMune, AbbVie, AstraZeneca,

BI, BMS, Celgene, Gilead, GSK,

Incyte, J&J, Lilly, Merck, Novartis,

Pfizer, Roche, Sanofi

~$15-$30B in R&D

investment in fibrotic

diseases

Growing

R&D

Investment

Major

Players

Growing

Pipeline

Emerging growth

area

InterMune is well-

positioned

–

Research

–

Development

capabilities

–

Esbriet

commercialization |

Commercializing

Esbriet

®

(pirfenidone)

in IPF |

Esbriet is now available for prescription for 85%

of the IPF patients in the Top 15 EU countries

7

Focus First on

Top 5 Countries:

Germany, France,

Italy, UK, Spain

Population of 314

million

~ 70-75% of EU

market value

Esbriet has

launched in

4 of 5 Top 5

Countries

Invest in 10 Mid-Sized

Countries & Regions:

Austria, Nordics (4),

Netherlands, Belgium

Ireland, Iceland and

Luxembourg

~ 10% of EU market

value

Esbriet has

launched in

9 of 10 Mid-

Sized

Countries

Successful EU Commercialization Strategy:

Focus First on Top 15 |

Esbriet Revenue –

EU and Canada

Nine Consecutive Quarters of Growth

8

2.7

4.9

5.5

7.5

8.2

10.5

14.4

19.7

25.6

0

2

4

6

8

10

12

14

16

18

20

22

24

26

Q4’11

Q1’12

Q2’12

Q3’12

Q4’12

Q1’13

Q2’13

Q3’13

Q4’13 |

The

U.S. IPF Market |

The

U.S. IPF Market Is Very Attractive Very Large Orphan

Disease –

Incidence ~ 15-20K/year

–

Prevalence ~ 30-50K mild/moderate

Desperate Unmet Need

–

No FDA-approved IPF medicines

Attractive Business Model

–

Value based, Orphan Disease pricing

–

Small molecule margins

–

No third-party royalties

–

Specialty target audience: 3,000 MDs

–

Targeted

salesforce

of

~

75

-

100

reps

10

U.S. IPF Prevalence

Mild to Moderate

(30,000-50,000)

Severe

(~20,000) |

Esbriet

®

EU: $33K to $45K

Canada: $42K

Benchmark Products in the U.S. Have

a Broad Range of Prices ($000’s/year)*

11

*

Wholesale Acquisition Cost (WAC). Source: AnalySource (12/17/13)

(PAH)

(PAH)

(mCRPC)

(cystic

fibrosis)

29

(severe

epilepsy)

41

(multiple

sclerosis)

49

(multiple

sclerosis)

58

(multiple

sclerosis)

55

(cataplexy)

63

78

83

(multiple

sclerosis)

60

Oral or inhaled administration

Infusion or injection administration |

ASCEND Phase 3 Study

for U.S. Registration |

Three

Phase 3 Trials Support Clinically Meaningful Effect on Lung Function, with

Generally Consistent Results at One Year 13

PIPF-004: FVC Change Week 72*

PIPF-006: FVC Change Week 72*

0

72

48

36

24

12

60

Weeks

0

-15

-10

-5

0

72

48

36

24

12

60

Weeks

0

-15

-10

-5

Week 48

52% reduction

P<0.001

Week 48

27% reduction

P=0.005

*

Pre-specified primary endpoint

Pirfenidone

2403 mg/d

Placebo

Pirfenidone

2403 mg/d

Placebo

SP3: VC Change at Week 52*

0

52

24

Weeks

0

-140

-40

-20

-60

-80

-100

-120

Week 52

44% reduction

P=0.042

36

12

Pirfenidone

1800 mg/d

Placebo

P=0.042

P=0.501

P=0.001 |

Rigorously Analyzed our IPF Databases to Determine “Predictors of

Progression” 14

Variables*

2 CAPACITY Trials

ASCEND Trial

Time Since Diagnosis

No time limitation

6 to 48 months

Baseline % Predicted FVC

>50%, no upper limit

50% -

90%

% DLco

>35%, no upper limit

30% -

90%

FEV1 / FVC Ratio

(lower is Indicative of

emphysema)

>0.70

0.80

*Variables

consistently

associated

with

greater

FVC

progression

in

placebo

patients

(CAPACITY

and

INSPIRE

data

bases)

ASCEND Design Based on Key Learnings from Prior IPF

Trials to Maximize Probability of Success (1)

Red font

indicates change from CAPACITY Phase 3 Studies |

ASCEND Design Based on Key Learnings from Prior IPF

Trials to Maximize Probability of Success (2)

15

Duration

A 52-Week Study –

All three Phase 3 studies of pirfenidone

have “won”

at 1 year

Primary

Endpoint

FVC Change Versus Placebo (difference versus placebo)

Categorical FVC for treatment effect size

Key

Secondary

Endpoints

6MWT

Distance,

Progression-Free

Survival*

Power

A large study (n=555) –

the

largest pirfenidone Phase 3 study

Centralized

Procedures

HRCT Review –

for high level of confidence in IPF diagnosis

Pulmonary

Function

Testing

–

to

minimize

variability

in

primary

endpoint metric

Red

font

indicates

change

from

CAPACITY

Phase

3

Studies

*DLco component replaced with 6MWT |

Clinically Meaningful Changes in FVC in IPF Studies (1)

The Clinical Reality:

–

~2/3 of IPF patients have little decline in FVC in clinical studies of ~ one

year –

~1/3 of IPF patients have significant decline in FVC

–

Therefore MEAN decline in FVC of a study population is not the best measure

of treatment effect size

What is the minimal clinically important difference (MCID) in FVC in IPF patients?

–

MCID is the difference to an individual patient

that is meaningful

–

MCID for FVC in an IPF patient is a 2-6% decline*

–

FVC declines of 5-10% in an IPF patient translate to 2-5X risk of

death* Categorical Change in FVC is the clinically meaningful metric:

16

*

du Bois RM Am J Respir Crit Care Med 184: 1382-9, 2011

Percent of patients with a 10% FVC Decline

|

17

Why is Categorical Change in FVC the best metric of clinical

meaningfulness?

–

Measures

changes

in

an

individual

patient

–

Addresses the statistical problem of the population mean

–

Can be easily tied to the MCID (a population mean cannot)

–

Relevant to clinicians and regulators

Esbriet label in Europe and Canada only reference Categorical FVC

Change

Clinically Meaningful Changes in FVC in IPF Studies (2)

Measure of Clinical Meaningfulness in ASCEND:

Categorical

FVC

Change

Percent

of

patients

with

a

10%

FVC

Decline |

Categorical FVC Results at One Year From CAPACITY ITT

18

*Rank ANCOVA

p < 0.001*

Pirfenidone

Placebo

40% Reduction

36% Increase

0

5

10

15

20

25

30

35

40

45

10% Decline/Death/LT

No Decline (>0%)

Patients

(%)

Categorical

FVC:

Patients

with

10%

FVC

Decline/Death/Lung

Transplant

(LT) |

P<0.0001

P=0.0002

P<0.0001

P=0.002

Patients

(%)

Pirfenidone

2403 mg/d

Placebo

CAPACITY ITT Patients

40% Reduction

Proportion of patients with No FVC decline was 36% greater relative to

placebo

19

0

5

10

15

20

25

30

35

3 Months

6 Months

9 Months

12 Months

Clinically

Meaningful

Outcome:

Proportion

of

Patients

with

10%

FVC Decline/Death/LT Reduced by 40% Relative to Placebo |

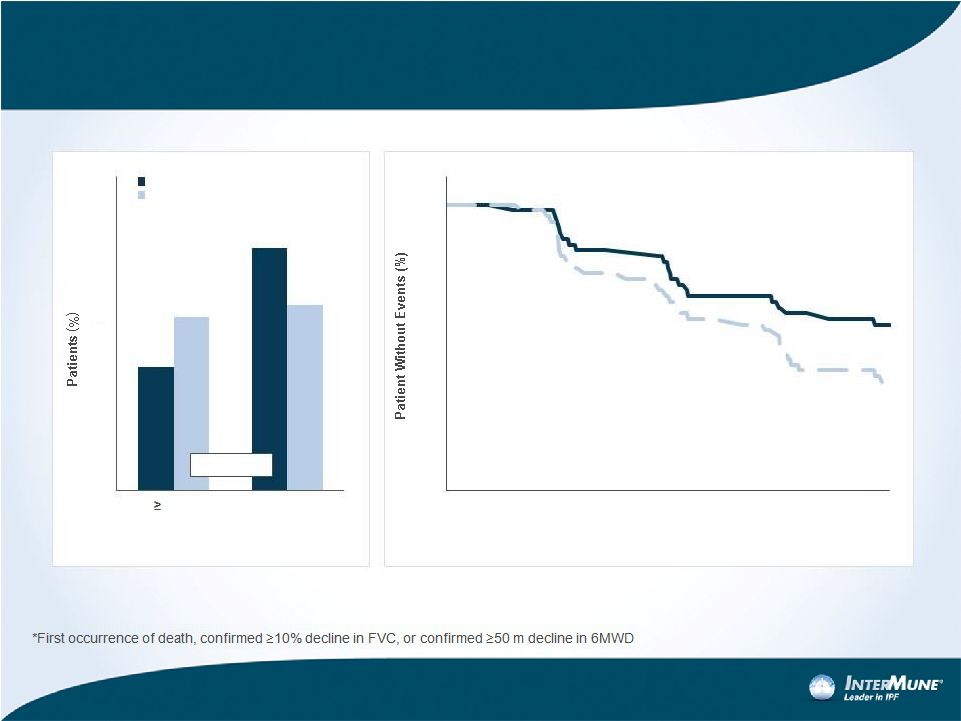

Two

Other Key Secondary Endpoints In ASCEND Showed Clinically Meaningful Change in

CAPACITY at One Year 29%

Reduction

31%

Increase

HR 0.62 (0.46 –

0.84)

P-value = 0.0015

20

Pirfenidone

2403 mg/d

Placebo

0

10

20

30

40

50

60

50 m

Decrement or

Death

No Decline

p = 0.0037

50

60

70

80

90

100

0

1

2

3

4

5

6

7

8

9

10

11

12

Months

Pirfenidone

Placebo

6MWD Change

Progression-Free Survival |

ASCEND Summary and Timeline

ASCEND

is

designed

to

win

—

built

on

our

decade

of

IPF

experience

–

Large, one-year study

–

Over 95% power using CAPACITY ITT results

–

Centralized procedures for more homogeneity

–

Enrichment Strategy for patients with more FVC progression

Excellent Study Conduct

–

High retention rate (>90% of patients remain in study)

–

High persistence rate (>90% of patients are on study medicine)

–

High roll-over rate to open-label “RECAP”

study (>95%)

Top-line data expected in early Q2 2014

–

Presentation at ATS (May 2014)

21 |

Financial Outlook |

Worldwide Esbriet Revenue

Nine consecutive quarters of

growth since launch

168% revenue growth in 2013

–

New countries –

one-time effects

due to NPP conversion and pent-

up demand

–

Launched countries –

greater

penetration and persistence

2014 guidance range of $115 to

$135 million represents ~65% to

90% projected growth

Spain and the Netherlands

included

in

the

range

–

update

in

1H 2014

23

Guidance

Range

$115 -

$135

168%

65%-

90%

$70.2

$26.2

$2.8

2011

2012

2013

2014 |

Total

Operating Expenses – 2014: Building a

Commercial Company with an R&D Pipeline

24

$320 -

$345

$255 -

$265

2014

2013

R&D

SG&A

SG&A

R&D

Guidance

Important SG&A increase

–

U.S. launch preparations to ensure

successful launch of Esbriet

–

Expanding commercial presence in

Europe to maximize Esbriet growth

Sustained R&D investment to fund our

growing pipeline |

Research & Development Expenses —

2013 to 2014

Increased investment —

research

and early stage programs:

–

New formulation

–

Pirfenidone analog

–

LPA-1 inhibitor

–

Biomarkers program

–

New antifibrotic compounds

Stable

—

Worldwide

regulatory,

quality, and medical affairs expense

Increased

investment

—

NDA

preparation, RECAP and new

Esbriet clinical studies

Decreased

investment

—

ASCEND

as study completes in Q2

25

$110 -

$120

$110 -

$115

2014

2013

Regulatory,

quality and

medical

affairs support

Research and

early stage

programs

Regulatory,

quality and

medical

affairs

support

Research and

early stage

programs

NDA Prep,

RECAP and

New Clinical

ASCEND

ASCEND

NDA Prep,

RECAP and

New Clinical

Guidance |

30%

60%

10%

Selling, General & Administrative

Expenses —

2013 to 2014

26

$210 -

$225

$145 -

$150

2014

2013

EU/Canada

SG&A

U.S. Launch

Preparation

EU/Canada

SG&A

Corporate/US

G&A

Corporate/US

G&A

U.S. Launch

Preparation

Increase driven primarily by U.S.

commercial launch preparations

(“S”)

–

Weighted to H2 (post ASCEND)

Modest increase in Corporate/U.S.

G&A

Modest increase for EU/Canada

SG&A:

–

Full-year effect of commercial

organizations created mid-2013 (Italy

and UK)

–

Expansion beyond current 13

countries

in Europe

Guidance |

InterMune Showing Strong Momentum

and Poised to Enter the U.S. Market

With EU reimbursement now resolved, Esbriet is growing very well

–

Nine consecutive quarters of revenue growth since first launch

–

2013 revenue growth +168% vs. 2012

–

2014 guidance range: $115-$135 million (+65-90%)

–

Expect cash flows from European sales to fully support European operations

in late 2014

Phase 3 ASCEND study for U.S. Registration

–

High confidence: designed from our lessons of a decade in IPF

–

Excellent study conduct: extremely high retention and roll-over rates

–

Results expected in early Q2 2014 (previously Q2 2014)

Momentum

in

our

R&D

efforts

to

be

a

leader

in

specialty

fibrotic

diseases

27 |

|