Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d659722d8k.htm |

| EX-2.1 - EX-2.1 - IBERIABANK CORP | d659722dex21.htm |

| EX-99.1 - EX-99.1 - IBERIABANK CORP | d659722dex991.htm |

Acquisition of Teche

Holding Company

January 13, 2014

Exhibit 99.2 |

Safe Harbor Language

2

Statements contained in this presentation which are not historical facts and which

pertain to future operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the results discussed in these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to, those discussed in IBERIABANK Corporation’s periodic filings with the

SEC.

In connection with the proposed merger, IBERIABANK Corporation will file a Registration

Statement on Form S-4 that will contain a proxy statement / prospectus. INVESTORS AND

SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT /

PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE,

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may

obtain a free copy of the proxy statement / prospectus (when it is available) and other documents

containing information about IBERIABANK Corporation and Teche Holding Company, without

charge, at the SEC’s website at http://www.sec.gov. Copies of the proxy statement / prospectus

and the SEC filings that will be incorporated by reference in the proxy statement / prospectus

may also be obtained for free from the IBERIABANK Corporation website, www.iberiabank.com,

under the heading “Investor Information”. This

communication is not a solicitation of any vote or approval, is not an offer to purchase shares of

Teche Holding Company common stock, nor is it an offer to sell shares of IBERIABANK Corporation

common stock which may be issued in any proposed merger with Teche Holding Company. The

issuance of IBERIABANK Corporation common stock in any proposed merger with Teche Holding Company

would have to be registered under the Securities Act of 1933, as amended, and such IBERIABANK

Corporation common stock would be offered only by means of a prospectus complying with the Act.

|

3

3

3

3

3

3

Transaction Rationale

•

In-market acquisition of a Louisiana-based community bank

•

Established and complementary customer profile

•

20 branch offices located in current IBKC markets

•

Retail/Small Business focus with $651 million in deposits and

$686 million in gross loans

•

Adds approximately $857 million in assets

•

Neighboring franchise enhances our Louisiana base

•

Significant identifiable cost savings given branch overlap

•

Approximately 6% accretive to 2015 earnings per share

•

Tangible book value dilution of 2% excluding one-time acquisition and

conversion related costs on a pro forma basis at September 30, 2013

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, of approximately four years

•

Transaction has limited impact on capital ratios

•

Anticipate internal rate of return in excess of 20%

•

Comprehensive due diligence completed, including credit review

•

Strong credit culture and asset quality

•

Limited loss content expected (2.6% of gross loans)

•

Familiar franchise and proximity reduces transaction risk

•

Conversion and integration experience reduces integration risk

Compelling

Strategic

Rationale

Financially

Attractive

Low Risk |

4

4

4

4

4

4

Transaction Overview

•

Tax-free, stock-for-stock exchange

•

Fixed exchange ratio of 1.162 shares of IBKC common stock

for each TSH share within price collars and floating exchange

ratios outside collars

(1)

•

$161 million

(2)

for common stock outstanding based on IBKC

closing price of $62.10 on January 10, 2014

•

$72.16 per TSH share outstanding

(2)

•

Price / Total Book

(2)

: 171%

•

Price / Tangible Book

(2)

: 178%

•

Completed comprehensive due diligence

•

TSH shareholder approval

•

Customary regulatory approvals

•

Expected closing in second quarter of 2014

(1)

The agreement provides for a fixed exchange ratio with pricing collars that fix the

value received by Teche shareholders if the weighted average trading price of

IBERIABANK common stock were to decline below $55.80 per share, or exceed $68.20 per share, over a specified period

(2)

Assumes exercise of options

Consideration

Deal Value

Valuation

Multiples

Due Diligence

Required

Approvals

Timing |

5

5

5

5

5

5

Teche Holding Company

Source: SNL Financial

Data as of 9/30/13

•

Headquartered in New Iberia, LA

•

Sixth largest publicly-traded bank holding

company headquartered in Louisiana

•

Teche Federal Bank was founded in

1934

•

Holding company established through a

mutual conversion and IPO in 1995

•

Total Gross Loans: $686 million

•

Total Assets: $857 million

•

Total Deposits: $651 million

•

Total Equity: $89 million common

equity

Overview

Financial Highlights

At September 30, 2013

ROAA (%)

ROATE (%) |

6

6

6

6

6

6

Solidifies Our

Louisiana Franchise

Deposit Market Share

Source: SNL Financial, June 30, 2013

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Capital One Financial Corp. (VA)

189

19,079,203

20.44

2

JPMorgan Chase & Co. (NY)

159

16,310,884

17.48

3

Hancock Holding Co. (MS)

113

8,814,319

9.44

4

Regions Financial Corp. (AL)

114

7,117,492

7.63

Pro Forma IBKC

97

6,222,981

6.67

5

IBERIABANK Corp. (LA)

77

5,567,803

5.97

6

First NBC Bank Holding Co. (LA)

31

2,534,868

2.72

7

Community Trust Finl Corp. (LA)

21

1,428,804

1.53

8

MidSouth Bancorp Inc. (LA)

45

1,265,700

1.36

9

First Guaranty Bancshares Inc. (LA)

21

1,263,537

1.35

10

Red River Bancshares Inc. (LA)

20

1,155,720

1.24

16

Teche Holding Co.

20

655,178

0.70

Total For Institutions In Market

1,621

93,330,163

State Of Louisiana

•

20 South Louisiana branches

•

Over 11,000 active loan accounts

•

Over 70,000 active deposit accounts; approximately

40,000 debit cards

•

Operates in five Louisiana MSAs: Lafayette, Morgan

City, Houma-Thibodaux, Opelousas, and Baton

Rouge

•

South Louisiana has a healthy and growing economy

with low unemployment, robust job growth, and strong

real estate values

IBKC

TSH |

7

7

7

7

7

7

Louisiana MSA

Deposit Market share

Source: SNL Financial, June 30, 2013

Lafayette, La - MSA

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

Pro Forma IBKC

29

2,725,108

27.26

1

IBERIABANK Corp.

21

2,396,650

23.97

2

JPMorgan Chase & Co.

19

1,205,432

12.06

3

MidSouth Bancorp Inc.

17

640,356

6.40

4

Capital One Financial Corp.

10

624,469

6.25

5

Hancock Holding Co.

9

515,667

5.16

6

Home Bancorp Inc.

9

514,466

5.15

7

Financial Corp. of Louisiana

10

504,531

5.05

8

Regions Financial Corp.

9

448,032

4.48

9

Teche Holding Company

8

328,458

3.29

10

Gulf Coast Bancshares Inc.

15

319,470

3.20

Total For Institutions In Market

201

9,997,812

Morgan City, La - MSA

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Hancock Holding Co.

4

301,106

26.10

2

M C Bancshares Inc.

4

274,764

23.82

3

Patterson Bancshares Inc.

3

183,970

15.95

4

Teche Holding Company

4

160,000

13.87

5

Regions Financial Corp.

2

74,751

6.48

6

Capital One Financial Corp.

2

69,457

6.02

7

Jeanerette Frst Natl Bncp Inc.

2

50,803

4.40

8

MidSouth Bancorp Inc.

1

38,837

3.37

Total For Institutions In Market

22

1,153,688

Houma-Bayou Cane-Thibodaux, LA - MSA

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

Capital One Financial Corp.

14

1,140,249

26.62

2

JPMorgan Chase & Co.

14

577,390

13.48

3

Hancock Holding Co.

7

387,219

9.04

4

South Louisiana Finl Corp

6

375,028

8.76

5

Synergy Bancshares Inc.

5

372,760

8.70

6

Coastal Commerce Bcshs Inc.

6

348,485

8.14

7

Regions Financial Corp.

6

333,670

7.79

8

Community Bancorp of LA Inc

7

323,466

7.55

9

Lafourche Bancshares Inc.

5

150,449

3.51

10

SBT Bancshares Inc.

4

106,433

2.48

11

Teche Holding Company

3

68,393

1.60

Total For Institutions In Market

86

4,283,401

Opelousas-Eunice, LA

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

St. Landry Bancshares Inc.

6

221,369

17.57

2

St. Landry Homestead FSB (LA)

3

168,921

13.41

3

JPMorgan Chase & Co.

4

154,894

12.29

4

Tri-Parish Bancshares Ltd.

2

132,545

10.52

5

Washington State Bcshs Inc.

5

124,436

9.88

6

American Bancorp Inc.

6

123,607

9.81

7

Teche Holding Company (LA)

2

67,582

5.36

8

Hancock Holding Co.

2

54,398

4.32

9

Sunset Bancorp Inc.

2

49,669

3.94

10

Jeff Davis Bancshares Inc.

1

49,442

3.92

Total For Institutions In Market

40

1,259,850

Baton-Rouge, LA

Rank

Institution

Branches

Deposits

($ mm)

Market

Share %

1

JPMorgan Chase & Co.

34

6,852,657

38.40

2

Capital One Financial Corp.

28

3,139,663

17.59

3

Hancock Holding Co.

32

2,001,741

11.22

4

Regions Financial Corp. (AL)

27

1,831,329

10.26

Pro Forma IBKC

10

560,855

3.14

5

IBERIABANK Corp.

7

530,110

2.97

6

Investar Holding Corp.

5

326,973

1.83

7

American Gateway Finl Corp. (LA)

11

265,113

1.49

8

Bus. First Bancshares Inc.

1

258,683

1.45

9

First Guaranty Bancshares Inc.

5

225,300

1.26

10

Citizens Bancorp. Inc. (LA)

7

201,700

1.13

36

Teche Holding Company

3

30,745

0.17

Total For Institutions In Market

247

17,847,736 |

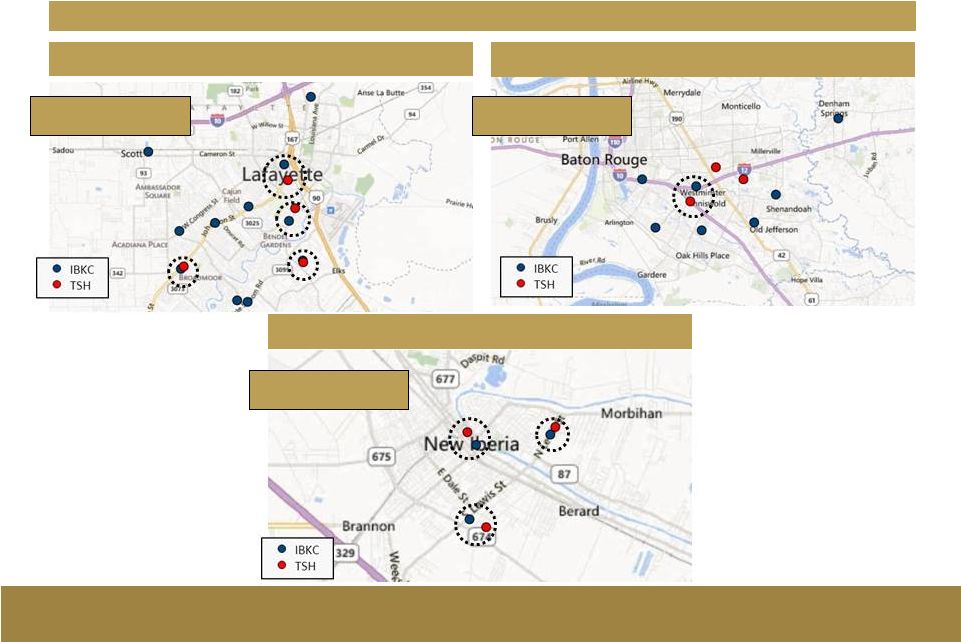

Expansion in Current Markets

Eight TSH branches within one mile of an existing IBKC branch

8

Baton Rouge MSA

Lafayette MSA

Source: SNL Financial, June 30, 2013

Map highlights select areas within the specified MSA only; not all branches located

within specified MSA are shown Black circle represents branches within a

mile City of New Iberia

Pro Forma Market Share

#1

Pro Forma Market Share

#5

Pro Forma Market Share

#1 |

9

9

9

9

9

9

Credit Summary

Source: Company documents

Data as of 11/29/13

Diligence Scope

•

Approximately 100 people involved in due diligence

process; credit team included 27 associates

performing both on-site file and off-site portfolio

reviews

•

Reviewed 97% of outstanding loan balances and

nearly 100% of total number of loans

•

Approximately one-fifth of the loans were reviewed

on-site with the remainder analyzed by off-site

portfolio review

Loan Portfolio Comments

•

Majority are in-market loans

•

Primarily focused on real estate/small business/

consumer lending

•

Good asset quality metrics:

•

NPA / assets = 0.74%

•

Nonaccrual loans / loans = 0.35%

•

Allowance for loan losses $7.9 million

•

Credit mark of approximately $18.0 million on a pre-tax

basis

Loan Portfolio Composition

Loan Type

Balance

($ millions)

% of Total

1-4 Family Residential

$339.1

48.7%

Commercial & Industrial

97.4

14.0%

Mobile Home

88.8

12.8%

C&D

43.6

6.3%

CRE - Owner Occupied

33.3

4.8%

HELOC

26.8

3.9%

Consumer & Other

24.7

3.5%

CRE - Non Owner Occupied

23.9

3.4%

Multi family

18.5

2.7%

Total Loans

$696.0

100.0%

•

Granular loan portfolio with over 11,000

individual loan accounts

•

Approximately 82% of loan accounts have

balances under $500,000 |

10

10

10

10

10

10

Costs and Synergies

Merger Considerations

•

No corporate or bank board seats

•

TSH board members invited to join

IBKC’s local Advisory Boards

•

Significant branch consolidation

anticipated

•

Eight TSH branches are located within

one mile of an existing IBKC branch

•

Financial modeling conservatively

assumed small divestiture

Approximately $19 million annually pre-tax:

•

$11.4 million in compensation/benefits

•

$4.1 million in IT/Outside Services and

marketing expense

•

$3.0 million in occupancy expense

•

$0.5 million in other cost savings

Approximately $22 million in pre-tax costs:

•

$4.6 million in contract terminations

•

$4.6 million in severance/retention payments

•

$3.1 million in change-in-control agreements

•

$2.3 million in facilities expense

•

$1.9 million in system conversions

•

$1.0 million in marketing/communications

•

$0.2 million in lease terminations

•

$4.3 million in other merger-related expense

Merger-Related Costs

Annual Synergies |

11

11

11

11

11

11

Financial Assumptions & Impact

Conservative

Financial

Assumptions

Attractive

Financial

Impact

Other Marks:

Cost Savings:

Merger Related Costs:

•

Gross loss estimate of $18.0 million on a pre-tax basis

(2.6% of gross loan portfolio)

•

Loss estimate net of allowance of $10.1 million on a

pre-tax basis

•

Aggregate negative $13.1 million in other marks,

including securities portfolio, loan rate, allowance for loss

reversal, OREO, fixed assets, FHLB marks

•

Annual run rate cost savings of approximately $19

million on a pre-tax basis

•

Represents in excess of 50% of TSH’s fiscal year

2013 non-interest expenses

•

Savings expected to be achieved by first quarter

of 2015

•

Approximately $22 million on a pre-tax basis

•

Approximately 6% accretive to EPS in 2015

•

Tangible book value dilution of 2% excluding one-time acquisition and

conversion related costs on a pro forma basis at September 30, 2013

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, of approximately four years

•

Strong pro forma capital ratios:

•

Tangible common equity ratio = 8.7%

•

Total risk based capital ratio = 13.2%

•

Internal rate of return over 20%; well in excess of our cost of capital

Credit Mark: |

Appendix |

13

13

13

13

13

13

Pro Forma Loans

Source: SNL Financial

Data as of September 30, 2013

Exclude purchase accounting adjustments

IBERIABANK

Teche Holding

Pro Forma IBKC |

14

14

14

14

14

14

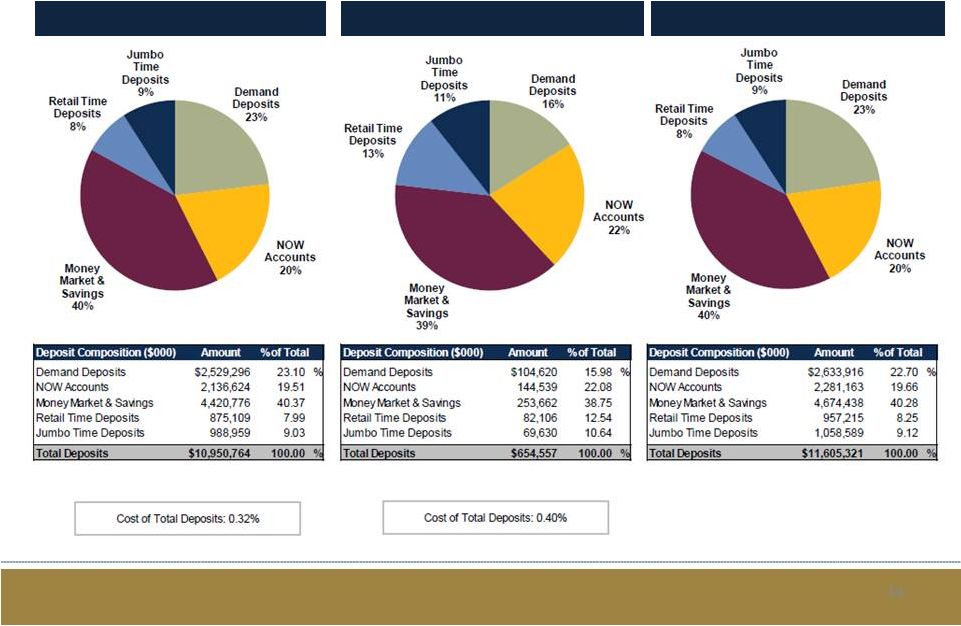

Pro Forma Deposits

Source: SNL Financial

Data as of September 30, 2013

Excludes purchase accounting adjustments

IBERIABANK

Teche Holding

Pro Forma IBKC |

15

15

15

15

15

15

Select Branch Locations

Source: Company documents

Deposits as of 10/31/2013

Grand Caillou Rd, Houma

Deposits -

$15 million

Pinhook Rd, Lafayette

Deposits –

$50 million

Jefferson Terrace Blvd, New Iberia

Deposits -

$51 million

Sherwood Forest Blvd, Baton Rouge

Deposits -

$34 million

Canal Blvd, Thibodaux

Deposits -

$19 million

Johnston St, Lafayette

Deposits -

$56 million |

16

16

16

16

16

16

Select Branch Locations

Source: Company documents

Deposits as of 10/31/2013

Barrow St, Houma

Deposits

-

$32

million

Southeast Blvd, Bayou Vista

Deposits

–

$34

million

7 Street, Morgan City

Deposits -

$65 million

Rees St, Breaux Bridge

Deposits -

$33 million

Essen Lane, Baton Rouge

Deposits -

$9 million

E. Landry St, Opelousas

Deposits -

$55 million

th |

|