Attached files

| file | filename |

|---|---|

| 8-K - SHARPS COMPLIANCE CORP. 8-K 1-10-2014 - SHARPS COMPLIANCE CORP | form8k.htm |

Exhibit 99.1

Comprehensive Medical Waste and Unused Medication

Management Solutions Provider

Management Solutions Provider

INVESTOR PRESENTATION

JANUARY 2014

NASDAQ: SMED

2

Safe Harbor

These slides contain (and the accompanying oral discussion will contain) “forward-

looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. The words “believe”, “estimate”, “anticipate”, “project” and “expect” and

similar expressions are intended to identify forward-looking statements. Such

statements involve known and unknown risks, uncertainties and other factors that

could cause the actual results of the Company to differ materially from the results

expressed or implied by such statements, including general economic and business

conditions, conditions affecting the industries served by the Company, conditions

affecting the Company’s customers and suppliers, competitor responses to the

Company’s products and services, the overall market acceptance of such products

and services, the effectiveness of the Company’s strategy and other factors

disclosed in the Company’s periodic reports filed with the Securities and Exchange

Commission. Consequently, such forward looking statements should be regarded

as the Company’s current plans, estimates and beliefs. The Company does not

undertake and specifically declines any obligation to publicly release the results of

any revisions to these forward-looking statements that may be made to reflect any

future events or circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995. The words “believe”, “estimate”, “anticipate”, “project” and “expect” and

similar expressions are intended to identify forward-looking statements. Such

statements involve known and unknown risks, uncertainties and other factors that

could cause the actual results of the Company to differ materially from the results

expressed or implied by such statements, including general economic and business

conditions, conditions affecting the industries served by the Company, conditions

affecting the Company’s customers and suppliers, competitor responses to the

Company’s products and services, the overall market acceptance of such products

and services, the effectiveness of the Company’s strategy and other factors

disclosed in the Company’s periodic reports filed with the Securities and Exchange

Commission. Consequently, such forward looking statements should be regarded

as the Company’s current plans, estimates and beliefs. The Company does not

undertake and specifically declines any obligation to publicly release the results of

any revisions to these forward-looking statements that may be made to reflect any

future events or circumstances after the date of such statements or to reflect the

occurrence of anticipated or unanticipated events.

3

Company Overview

Sharps Compliance is a leading full-service provider of cost-effective,

customized, and unique solutions for the proper management of

medical waste and unused medications.

customized, and unique solutions for the proper management of

medical waste and unused medications.

§ Comprehensive mail-back solutions

§ Ability to “bolt-in” route-based pick-up services where needed to

complement mail-back

complement mail-back

§ Provides valuable data to support regulatory and patient compliance

§ Serving high growth “alternate site” areas of the market: pharmaceutical

manufacturer, retail pharmacy, professional, and assisted living/long-term

care

manufacturer, retail pharmacy, professional, and assisted living/long-term

care

Investment Considerations

§ 7.7% organic 4-year CAGR in core business segments

§ Sales and marketing team in place to drive continued growth

Long-Term Organic

Growth

Growth

§ Aging population

§ Shift to alternative site healthcare

§ Increasing medical waste regulations

§ Need to save money in changing healthcare environment

At Nexus of Several

Compelling Trends

Compelling Trends

§ Industry has historically relied on expensive and inefficient waste haulers

§ Sharps offers a better option for small quantity generators

§ One of only two providers that can service nation-wide customers

Challenging the

Industry Standard

Industry Standard

§ Asset-light; low maintenance capital expenditures

§ Recurring revenue and high operating leverage

§ High barriers to entry: highly regulated market, sophisticated tracking

software, and one of ten medical waste incinerating facilities in the country

software, and one of ten medical waste incinerating facilities in the country

Attractive Business

Model

Model

§ $15.3M in cash as of September 30, 2013

§ No long-term debt

§ 15.4M shares outstanding

§ 44,000 shares repurchased under current repurchase plan

Solid Balance Sheet

§ Creates “touch points”

§ Improves patient compliance

§ Extends medication adherence

§ Builds brand loyalty

Transforming How

Pharma Interacts with

Patients

Pharma Interacts with

Patients

§ 21.7% YOY revenue growth in 1Q14

5

Mail-back

in home

healthcare

in home

healthcare

Expanded markets:

§ Assisted Living

§ Retail Pharmacy

§ Distributors

Pharmaceutical

Manufacturer

Patient Support

Programs

Manufacturer

Patient Support

Programs

Launch of

inside sales and

e-commerce

driven website -

Professional

Market

inside sales and

e-commerce

driven website -

Professional

Market

Alliance with

Daniels

Sharpsmart

Daniels

Sharpsmart

1996

2006

2010

2012

6

Full Service Provider: Daniels Alliance

Traditional Pick-up Services

(Dedicated truck & driver)

Mail-back Solutions

(using existing USPS infrastructure)

Sharps’ Comprehensive Solution

§ Sharps + Daniels alliance services entire U.S. medical waste market

§ Allows Sharps to provide pick-up service where needed to complement mail-back

§ Stericycle is only other national provider

§ Key for customers with large quantity locations

§ Enhances pipeline by over $30 million

Alliance with Daniels Allows Sharps to Remain Asset-Light

While Offering a Full Solution

While Offering a Full Solution

7

TRENDS DRIVING GROWTH

8

Traditional

Healthcare

Setting

Healthcare

Setting

§ Core Traditional Waste

Hauler Market

Hauler Market

§ Core Sharps Markets

Urgent Care

Clinics

Clinics

Assisted

Living/Long-

Term Care

Living/Long-

Term Care

Home Health

Care

Care

Clinics/Retail

Pharmacies

Pharmacies

Sharps Serves All Medical Waste Markets

9

Large Healthcare

Setting

Setting

Non-hospital/Alternative Care

Retail Pharmacies

Clinics

Home Healthcare

Setting

Setting

Assisted Living

Larger Market

Faster Growth

10

Aging Demographic

Source: US Census Bureau

US Population Aged 65+ Expected to Double Within Next 25

Years

Years

11

Growing North American Drug Market

Source: MarketsandMarkets

North American Injectable Drug Market Projected

CAGR of 12.3%

CAGR of 12.3%

12

BUSINESS OVERVIEW

14

Unused Medication Management Solutions

Market Opportunity

§ United States generates an estimated 250

million pounds of unused medication waste

million pounds of unused medication waste

§ Changing regulatory environment that would

require pharmaceutical manufacturers to pay

and allow collection and transportation of

controls

require pharmaceutical manufacturers to pay

and allow collection and transportation of

controls

Customers

§ Assisted Living Facilities

§ Independent Pharmacies (drive foot

traffic)

traffic)

§ Retail Pharmacies (resell to

consumers)

consumers)

§ Government

Solution

§ Mail and ship back proprietary solutions

for the proper treatment of unused

patient medications

for the proper treatment of unused

patient medications

15

Opportunity for Significant Growth in Markets We Serve

|

Market

|

Market Size

|

Market Growth

Rate |

Sharps

Revenue Run Rate |

Current

Penetration |

|

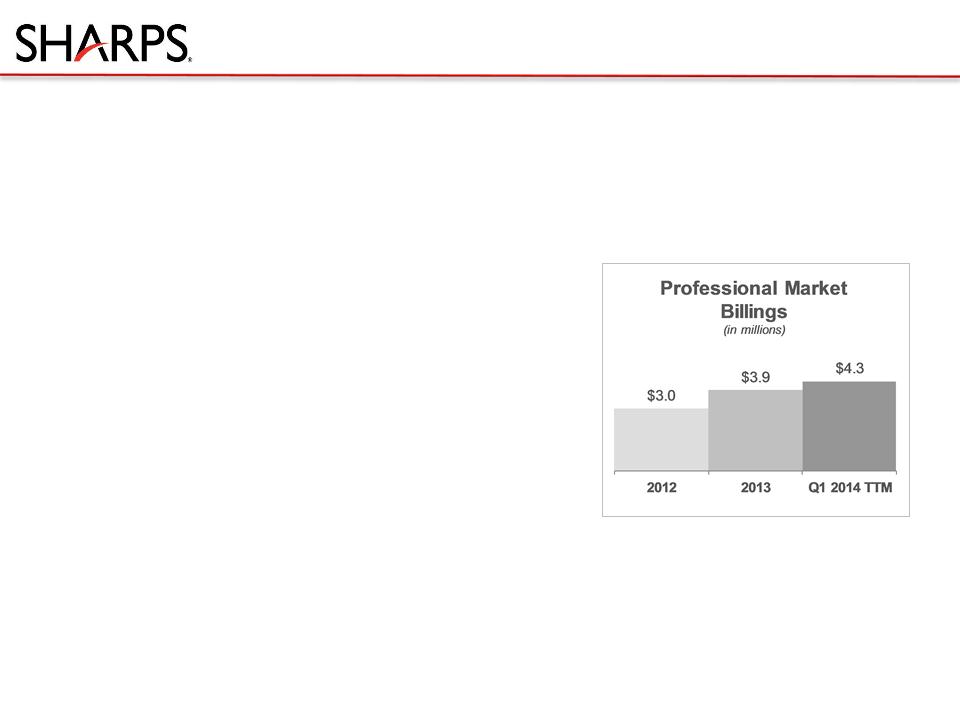

Professional

|

$648M

|

5%¹

|

$4.3M

|

<1%

|

|

Pharmaceutical

Manufacturer |

$23M²

|

12%

|

$2.5M

|

11%

|

|

Assisted

Living/Long- term Care |

$84M

|

5.7%

|

$1.6M

|

2%

|

|

Home Health

Care |

$100M

|

7.7%

|

$6.9M

|

7%

|

|

Retail

Pharmacy |

$8M³

|

15-20%

|

$5.7M

|

75-80%

|

³Assumes only 16% of U.S. flu shots administered in retail pharmacies (23% historical 5-year CAGR)

²Reflects only specific program opportunities we have identified, not the entire market

¹Average projected growth rates of physician, dental, and veterinary spending

16

Professional Market

Customers

Solution

§ Sharps Recovery System™ and pick up to

supplement larger chains

supplement larger chains

Market Opportunity

§ Currently 800,000 professional offices across

the US

the US

§ Translates to a $648M market opportunity

§ Dental

§ Veterinarian

§ Physicians

§ Other service-related practices

§ Dental and Veterinarian chains

Sales and Distribution Channels

§ Telemarketing/Inside Sales

§ E-commerce

§ Distributors

§ Direct (larger chains)

17

Pharmaceutical Manufacturer Market

Customers

Solution

§ Customized/branded solutions

§ Creating “touch points”

§ Data supporting improved drug compliance

§ Extended medication adherence

§ Building brand loyalty

Market Opportunity

§ North American injectable drug delivery technologies

market projected to grow at a CAGR of 12.3% from

2012 to 2017

market projected to grow at a CAGR of 12.3% from

2012 to 2017

Source: MarketsandMarkets

§ Large global Pharmaceutical Manufacturers

§ Self-injectable “high end” drugs

§ Complex injection devices

Sales and Distribution Channels

§ Direct/Enterprise Sales

Pharmaceutical

Manufacturer Market

Manufacturer Market

Billings

(in millions)

18

Creating Patient Touchpoints for Pharma Industry

§ Patient diagnosed

and prescribed

medication at

professional/

specialist office

and prescribed

medication at

professional/

specialist office

§ Patient “opts in” to

the Patient Support

Program including

mail-back

the Patient Support

Program including

mail-back

§ Sharps treats waste

and collects

valuable data used

to determine patient

compliance

and collects

valuable data used

to determine patient

compliance

§ Patient compliance

data provided to

Pharmaceutical

Manufacturer;

creates patient

“touch points”

data provided to

Pharmaceutical

Manufacturer;

creates patient

“touch points”

Increasing Pharma’s Ability to Drive Sales and Ensure Medication Discipline

19

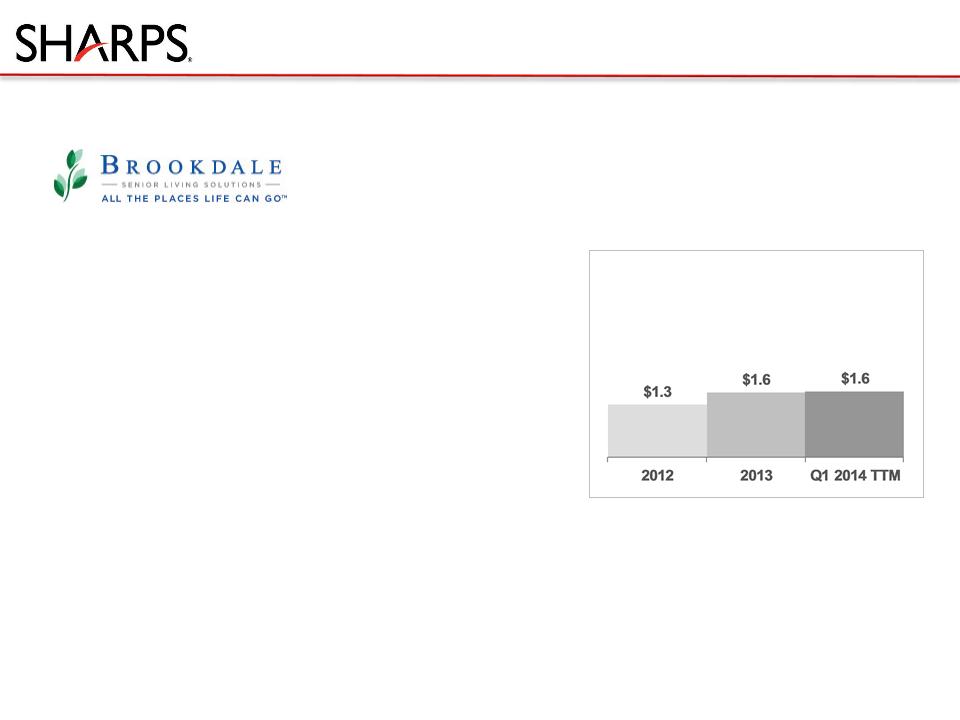

Assisted Living/Long-Term Care Market

Customers

Solution

§ Mail-back

Market Opportunity

§ Total addressable market of $84M

§ US population age 65+ expected to double

within the next 25 years

within the next 25 years

§ 1 of 5 Americans will be 65+ by 2030

§ Age 85+ fastest growing segment

Assisted Living /

Long-term Care

Billings

(in millions)

Source: National Institute on Aging

Sales and Distribution Channels

§ Direct/Enterprise Sales

20

Retail Pharmacy Market

Customers

Solution

§ Mail-back (Sharps Recovery System™)

Sales and Distribution Channels

§ Direct

§ Vaccine distributors

21

FINANCIAL OVERVIEW

22

Attractive Business Model

§ Costs are relatively fixed

§ Operating infrastructure in place to grow 2-3X

§ 50% gross margins on incremental revenues

§ 5-10% SG&A increase on incremental revenues

Significant Operating

Leverage

Leverage

§ Recurring revenue model; high retention

High Recurring Revenue

§ Alliance with Daniels allows Sharps to remain asset-light

while offering a full-service solution

while offering a full-service solution

Asset-Light Cost Structure

§ Sharps has no direct dependence on Medicaid, Medicare, or

other third-party payers

other third-party payers

No Third-Party Payer Risk

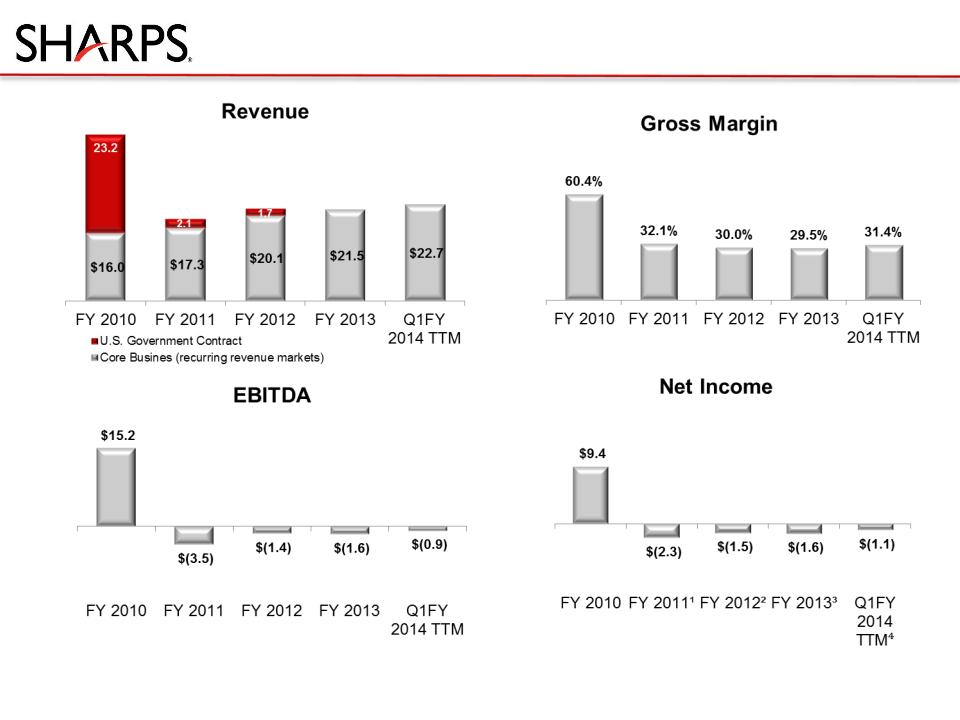

Start to Fiscal Year 2014 30.1% 37.1% ($ in millions, % of Revenue) $(0.4) $0.1 $(0.4) Q1FY13X Q1FY14Y X Excludes Q1 FY 2013 deferred tax valuation allowance of $217 thousand. Y Excludes Q1FY 2014 deferred tax valuation allowance benefit of $41 thousand. 6.3%

24

Positioned for Margin Expansion

($ in millions)

$22.7

$39.2

$19.4

$21.8

$21.5

(2011)1 Excludes FY 2011 special charge of $378 thousand and unusual expense of $264 thousand.

(2012)2 Excludes FY 2012 unusual expense of $197 thousand and deferred tax valuation allowance of $2.0 million.

(2013)3 Excludes FY 2013 unusual expense of $102 thousand, special charge of $121 thousand and deferred tax valuation allowance of $923 thousand.

(2014 ttm)4 Excludes Q1FY 2014 TTM unusual expense of $102 thousand, special charge of $121 thousand and deferred tax valuation allowance of $665 thousand.

25

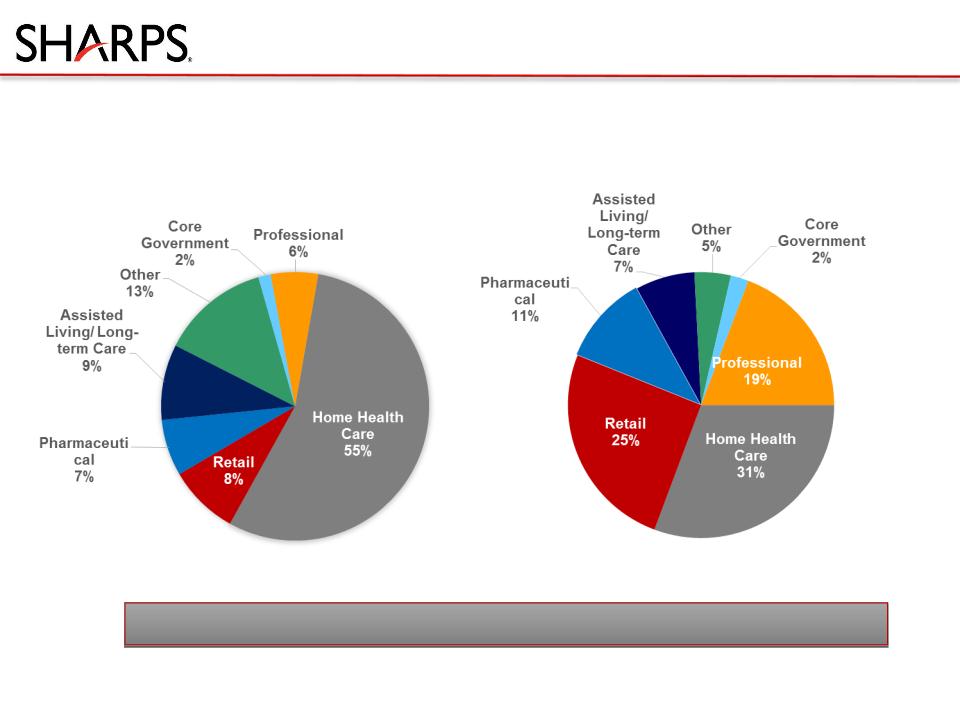

Diverse Revenue Mix

FY 2008 Billings

$13.2 million

$13.2 million

Q1 FY 2014 TTM Billings

$22.6 million

$22.6 million

Seeing Growth Across All Core Segments

26

Strong Balance Sheet Provides Financial Flexibility

Cash and Cash Equivalents

6/30/12

6/30/13

6/30/10

6/30/11

9/30/13

Cash Available for Organic Growth; No Long-

Term Debt

Term Debt

27

Growth Strategy

Increase awareness of Sharps’ services; pursue customers in the

high-growth alternative site areas of the healthcare market

high-growth alternative site areas of the healthcare market

Capture opportunities arising from favorable industry trends

Leverage pick-up service to pursue larger quantity national

customers

customers

Utilize capabilities to drive more business in the increasing self-

injectable market

injectable market

Control costs to maintain highly scalable business and operating

leverage

leverage

Thank You

INVESTOR PRESENTATION

JANUARY 2014

NASDAQ: SMED