Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JUNIPER PHARMACEUTICALS INC | d657050d8k.htm |

| EX-99.1 - EX-99.1 - JUNIPER PHARMACEUTICALS INC | d657050dex991.htm |

Frank

Condella President & CEO

Columbia Laboratories

Columbia Laboratories, Inc.

(Nasdaq: CBRX)

Molecular Profiles, Ltd.

(a wholly-owned subsidiary of Columbia Laboratories)

Jonathan Lloyd Jones

VP & CFO

Columbia Laboratories

Dr. Nikin Patel

CEO

Molecular Profiles

*

*

*

*

*

*

Exhibit 99.2 |

Safe

Harbor 2

9 January 2014

This

presentation

contains

forward-looking

statements,

which

statements

are

indicated

by

the

words

“may,”

“will,”

“plans,”

“believes,”

“expects,”

“anticipates,”

“potential,”

“should,”

and

similar

expressions.

These

include

all

statements

relating

to

expected

financial

performance,

including,

without

limitation,

statements

involving

projections

of

revenue,

margin,

and

the

Company’s

future

growth

prospects.

Such

forward-looking

statements

involve

known

and

unknown

risks,

uncertainties,

and

other

factors

that

may

cause

actual

results

to

differ

materially

from

those

projected

in

the

forward-looking

statements.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

on

which

they

are

made.

Factors

that

might

cause

future

results

to

differ

include,

but

are

not

limited

to,

the

following:

completing

the

financial

reporting

closing

process

and

financial

audit,

which

could

necessitate

changes

to

these

preliminary

results;

the

effect

of

converting

Molecular

Profiles’

financial

statements

from

U.K.

to

U.S.

GAAP;

Actavis'

and

Merck

Serono's

success

in

marketing

CRINONE

for

use

in

infertility

in

their

respective

markets;

the

successful

launch

by

Actavis

of

the

next-generation

vaginal

progesterone

product

for

the

U.S.

market;

Molecular

Profiles’

ongoing

ability

to

retain

current

and

attract

new

customers;

difficulties

or

delays

in

manufacturing;

the

availability

and

pricing

of

third-party

sourced

products

and

materials;

successful

compliance

with

FDA,

MHRA

and

other

governmental

regulations

applicable

to

manufacturing

facilities,

products

and/or

businesses;

changes

in

the

laws

and

regulations;

the

ability

to

obtain

and

enforce

patents

and

other

intellectual

property

rights;

the

impact

of

patent

expiration;

the

impact

of

competitive

products

and

pricing;

the

strength

of

the

United

States

dollar

relative

to

international

currencies,

particularly

the

euro,

British

pound

and

the

Swiss

franc;

competitive,

economic,

and

regulatory

factors

in

the

pharmaceutical

and

healthcare

industry;

general

economic

conditions;

and

other

risks

and

uncertainties

that

may

be

detailed,

from

time-to-time,

in

Columbia's

reports

filed

with

the

SEC,

including,

but

not

limited

to,

its

Annual

Report

on

Form

10-K

for

the

period

ended

December

31,

2012.

Columbia

does

not

undertake

any

responsibility

to

revise

or

update

any

forward-looking

statements

contained

herein,

except

as

expressly

required

by

law. |

Columbia

Laboratories Overview •

World-class pharmaceutical development company providing to

multinational pharmaceutical companies:

–

Formulation development

–

Clinical trial manufacturing

–

High-end Analytical / IP support

•

Growing & diversified revenue streams

–

Molecular Profiles service contracts

–

CRINONE

®

(progesterone gel) sales to Merck Serono + royalty from Actavis

•

Potential for proprietary product pipeline

–

Leverages CBRX IP & MP expertise

–

Focus: New Therapeutic Entity (NTE) regulatory pathway

•

505(b)(2) in U.S.

–

Plan: outlicense upon proof-of-concept

•

Profitable & cash-flow positive with solid balance sheet: $20m cash

3

9 January 2014 |

Experienced

Management Team •

Frank Condella, BS Pharm, MBA –

President & CEO

–

Over 30 years’

experience in life sciences industry

–

Skyepharma plc, IVAX Corp, Faulding Pharma, Roche

•

Dr. Nikin Patel, MRPharmS –

CEO, Molecular Profiles

–

Molecular Profiles co-founder

–

15+ years’

pharmaceutical industry experience

•

Jonathan Lloyd Jones, ACA, MBA –

Vice President & CFO

–

25+ years of corporate development & finance experience

–

TetraLogic Pharma, TransMolecular, Genzyme, Deloitte

•

Dr. Shen Luk, BSc –

CSO, Molecular Profiles

–

25+ years of technical expertise in pharmaceutical analysis & formulations

–

Courtaulds Corporate Research Laboratories

4

9 January 2014 |

Leveraging

Synergies Across the Business 5

Columbia Laboratories

Molecular Profiles

Development & Manufacturing Service Business

•

U.S. presence

•

Strong industry relationships

•

Capital to invest in business to support &

drive future growth

•

Contract formulation & development

•

Clinical trial manufacturing

•

Analytical & consulting

Over 100 clients

CRINONE

®

(progesterone gel) Global Franchise

•

Long-standing relationships

•

Product sales revenues from Merck

Serono: 60+ countries

•

Royalty from Actavis: U.S.

•

Quality Assurance

•

Supply Chain Operations

•

Life-cycle management

Potential

Proprietary Product Development

•

Intellectual Property

•

Nascent development programs

•

Successful history of transmucosal drug

delivery

•

Broad development expertise including

topical delivery

•

Analytical / IP Support

•

Clinical trial manufacturing

9 January 2014 |

Molecular

Profiles, Ltd. (a wholly-owned subsidiary of Columbia Laboratories)

6

*

*

*

*

*

9 January 2014 |

World Class

Pharmaceutical Provider 7

9 January 2014 |

Facilities and

Capabilities •

Flexible contract services

–

8 cGMP process rooms, expandable to 14

–

State-of-the-art Analytical, Development & Characterisation suites

–

Facilities

& processes to handle potent molecules

•

Highly

skilled & diversified team

–

60+ FTEs, over 25% with advanced scientific degrees

•

Solution-driven & science-led

–

Expertise & growing range of enabling technologies for difficult

to formulate

molecules

•

Trusted ability to deliver

–

Clients range from emerging biotech to top 10 Pharma

8

9 January 2014 |

Molecular

Profiles’ Growth Drivers

•

Favorable market dynamics

–

Addressable outsourced pharmaceutical development market

segment projected at $21.5 billion

(1)

–

Increasing trend toward pharmaceutical outsourcing

•

New state-of the-art facility can accommodate growth

•

Broadening service offerings to meet client needs

–

Specialty processing for challenging molecules

•

Expanding customer base

–

Virtual to top 10 Pharma

–

Leverage U.S. presence

•

Unsurpassed

specialty expertise

9

(1)

Source: Jeffries equity research report, 18 June 2013

9 January 2014 |

CRINONE®

(progesterone gel)

Franchise

10

*

*

*

*

9 January 2014 |

U.S. TRx Growth

(1)

CRINONE Continued Growth Globally

Ex-U.S. Opportunity

•

Ex-U.S. revenue CAGR was 13.4%

from 2009 -

2012

•

Key growth drivers of

ex-U.S.

in-market sales:

11

Most Major Markets Covered

(1)

Source: IMS data

•

Continued growth in emerging markets

•

Entry into new markets

9 January 2014 |

12

CRINONE Revenue Streams

U.S.

Pays us a 10% royalty on U.S.

net sales

Royalty continues with newly

launched next-gen CRINONE

Ex-U.S.

Markets CRINONE in 60+ countries

outside U.S.

CBRX is exclusive CRINONE supplier

to Merck Serono through May 2020

* Unaudited, preliminary estimates as announced on 09 January 2014

FY 2013 Royalty Revenues:

~$3.3-$3.6 million*

FY 2013 Product Revenues:

~$21.2-$21.6 million*

9 January 2014 |

Capabilities to

Support & Grow CRINONE Revenues 13

9 January 2014 |

14

*

*

*

**

*

*

*

*

9 January 2014 |

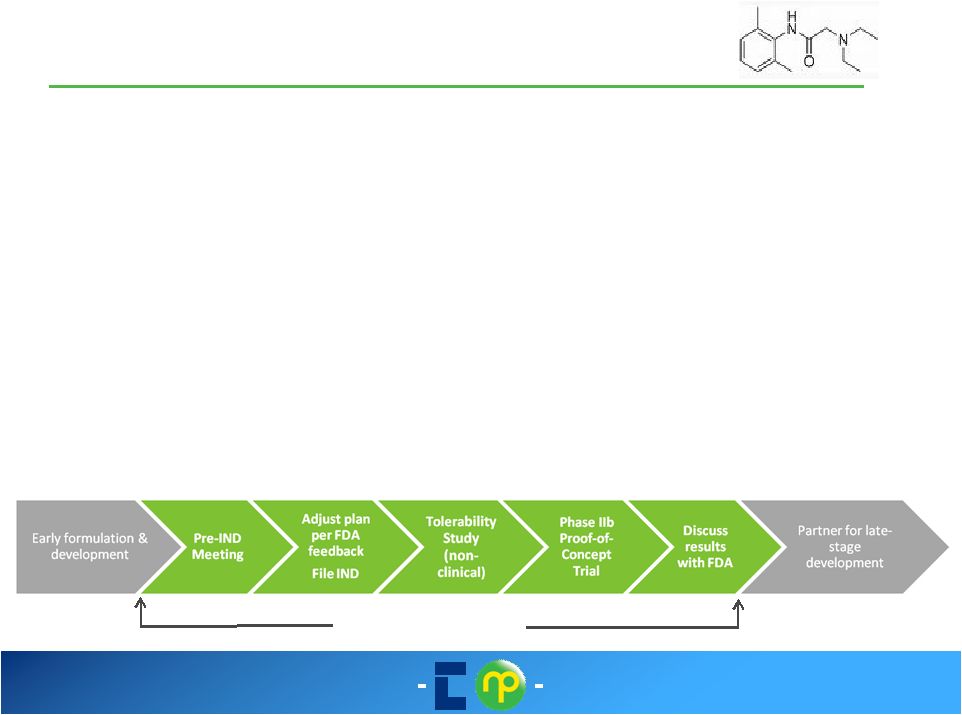

Product

Pipeline Strategy 15

•

Selectively develop product candidates

-

Commercially viable; relative low risk

-

Address an unmet patient need (women’s health)

-

Add value by applying our expertise in

formulation & manufacturing

-

Focus on New Therapeutic Entities

•

505(b)(2) regulatory path (US)

•

Reference safety & efficacy data of original molecule

•

Solid Intellectual Property coverage

•

Develop through Phase IIb

with

low-level capital investment

•

Partner for late stage

development

& commercialization

9 January 2014 |

Early-stage development

candidates

Intellectual Property

Proven Expertise in Product Development

Strong Internal Development Capability

16

Columbia Laboratories

Molecular Profiles

State-of-the-Art Characterisation

Enabling Technologies

Clinical Trial Manufacturing

Analytical Development & Support

9 January 2014 |

17

COL -1077: Potential Pipeline Product

•

Target indication: prevention of pain associated with gynecological

procedures (e.g. IUD insertion, endometrial biopsy)

–

Significant unmet medical need; currently no marketed products indicated

–

Peak sales projected at approx. $100m

•

Leverage clinical development work previously completed (Ph. I &

II)

•

Proprietary Formulation: extended-release lidocaine in bioadhesive gel

•

Exclusivity

–

Two approved patents; 1 pending

–

Hatch Waxman 3-year exclusivity

–

Other barriers to generic entry

•

Currently re-assessing commercial opportunity & development plan

Est. $2.5-$3.0m Investment

9 January 2014 |

Financials

18

*

*

*

*

**

*

*

*

*

9 January 2014 |

19

Nine-months Growth

Total Revenues by Type

(in millions)

Services (Molecular Profiles)

Other revenues

Royalties

CRINONE sales to Actavis

CRINONE sales to Merck Serono

Non-GAAP Adjusted Net Income

(1)

(in millions)

Nine months

ended

Reconciliation of

Nine months ended

GAAP to Non-GAAP Results

30 Sept. 2013

30 Sept. 2012

Net Income

$ 744,202

$ 7,285,932

Transaction costs

1,439,946

-

Severance and relocation costs

627,794

483,337

Change in fair value of stock

warrants

4,394,778

(5,399,569)

Total Non-GAAP adjustments to net

income

6,462,518

(4,916,232)

Non-GAAP Income from Operations

$ 7,206,720

$ 2,369,700

9 January 2014

Non-GAAP figures exclude transaction-related costs, severance & relocation costs

associated with workforce reduction & relocation, and the change in the fair

value of stock warrants.

(1) |

(1)

Includes Q4 2013 preliminary and unaudited estimated data as reported 09 January

2014 (2)

Total Revenues for 2011 of $43M included additional Other Revenues of $22.1M as

follows: $17M in amortization of the $34 million gain on the sale of the

progesterone assets to Actavis (concluded Q2 2011) The recognition of the

$5M milestone payment from Actavis for the filing of NDA 22-139 Core

Revenues (in millions)

Annual Revenue Growth

20

9 January 2014 |

Q4 2012

Q4

2013*

$7.1

$7.4 -

$8.0

FY 2012

FY 2013*

$25.8

$28.8 –

$29.4

Services (Molecular Profiles)

Other revenues

Royalties

CRINONE sales to Actavis

CRINONE sales to Merck Serono

Increasingly Diverse Revenue Stream

* Unaudited, preliminary estimates as reported on 09 January 2014

21

Revenues by Type

(in millions)

9 January 2014 |

•

Strong cash-flow + solid balance sheet

•

World-class pharmaceutical development services

business

–

Double digit year-over-year revenue growth

–

Market opportunity: $21.5 billion and growing

•

Strong ongoing revenue from CRINONE franchise

•

Potential product pipeline provides additional

upside opportunities

–

Leverages synergies across the business

–

Would be funded from free cash flow

CBRX: Positioned for Growth

22

9 January 2014 |

Jonathan Lloyd

Jones Chief Financial Officer

Columbia Laboratories, Inc.

T: 617.639.1522

jlloydjones@columbialabs.com

Investor Relations Contacts

Tricia Truehart

Senior Associate

The Trout Group

T: 646.378.2953

ttruehart@troutgroup.com

23

9 January 2014 |

9/30/2013

12/31/2012

Cash & Short Term Investments

$ 18.82

$ 28.64

Accounts Receivable

7.75

3.35

Inventories

1.99

2.63

Prepaid Expenses

2.81

1.28

Total Current Assets

$ 31.37

$ 35.90

Plant Property & Equipment

12.73

0.93

Goodwill and Intangibles, net

15.56

-

Other Assets

0.12

0.04

TOTAL ASSETS

$ 59.78

$ 36.87

Total Current Liabilities

$ 6.56

$

3.75 Deferred Revenues

2.32

0.03

Note Payable

3.73

-

Stock Warrant

5.57

1.17

TOTAL LIABILITIES

$ 18.18

$ 4.95

Series C Preferred

0.55

0.55

Total Shareholders Equity

41.05

31.37

TOTAL LIABILITIES & EQUITY

$ 59.78

$ 36.87

R-1

Balance Sheet (US $, millions)

9 January 2014 |

R-2

Cash Flow Statement (US $, millions)

9 Months Ended

9/30/2013

9/30/2012

Net Income

$

0.74

$

7.29 Non-Cash Items (net)

5.10

(3.67)

Cash Flow before movements in Working Capital

5.85

3.62

Movements in Working Capital (net)

(0.93)

(2.36)

Net Cash from Operations

4.92

1.25

Purchase of Plant & Equipment

(0.25)

(0.99)

Sale of Short Term Investments

15.35

(0.18)

Acquisitions

(14.52)

-

Investing Activities

0.59

(1.17)

Financing Activities (net)

(0.02)

(0.05)

Foreign Exchange

0.12

0.04

TOTAL INCREASE IN CASH

$

5.61

$

0.07 Cash Beginning

$

13.20

$

10.11 Cash End

$

18.82

$

10.19 9 January 2014 |

Nasdaq:

CBRX Shares Outstanding

12.15 M

Average

Preferred Shares

@

$ 6.70

0.1

Warrants*

@

$11.34

1.2

Options

@

$11.09

0.3

Fully Diluted Shares

(approximate)**

13.75 M

*

All warrants have “cashless”

exercise option

** At 12/31/13

CBRX Capitalization Table

R-3

9 January 2014 |