Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Homes 4 Rent | v364803_8k.htm |

January 2014

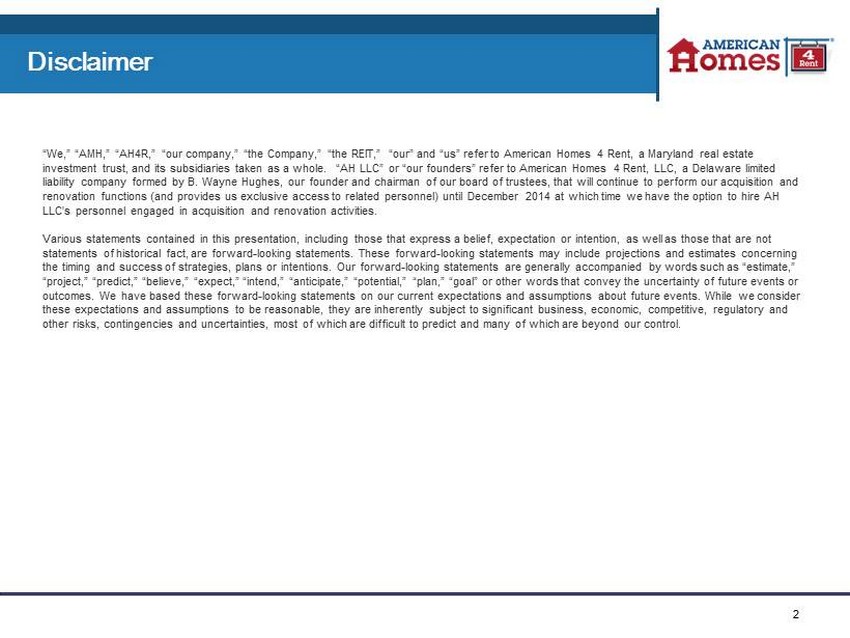

2 Disclaimer “We,” “AMH,” “AH4R,” “our company,” “the Company,” “the REIT,” “our” and “us” refer to American Homes 4 Rent, a Maryland real es tate investment trust, and its subsidiaries taken as a whole. “AH LLC” or “our founders” refer to American Homes 4 Rent, LLC, a Del aware limited liability company formed by B. Wayne Hughes, our founder and chairman of our board of trustees, that will continue to perform ou r acquisition and renovation functions (and provides us exclusive access to related personnel) until December 2014 at which time we have the op tio n to hire AH LLC’s personnel engaged in acquisition and renovation activities. Various statements contained in this presentation, including those that express a belief, expectation or intention, as well a s t hose that are not statements of historical fact, are forward - looking statements. These forward - looking statements may include projections and esti mates concerning the timing and success of strategies, plans or intentions. Our forward - looking statements are generally accompanied by words suc h as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the un certainty of future events or outcomes. We have based these forward - looking statements on our current expectations and assumptions about future events. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competiti ve, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control .

Overview of American Homes 4 Rent 3

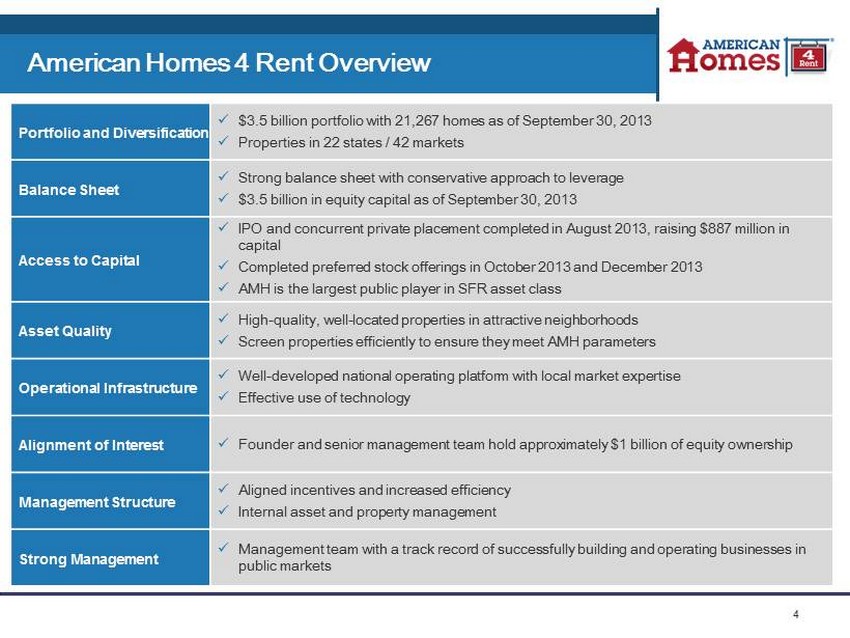

4 Portfolio and Diversification x $ 3 . 5 billion portfolio with 21 , 267 homes as of September 30 , 2013 x Properties in 22 states / 42 markets Balance Sheet x Strong balance sheet with conservative approach to leverage x $3.5 billion in equity capital as of September 30, 2013 Access to Capital x IPO and concurrent private placement completed in August 2013, raising $887 million in capital x Completed preferred stock offerings in October 2013 and December 2013 x AMH is the largest public player in SFR asset class Asset Quality x High - quality, well - located properties in attractive neighborhoods x Screen properties efficiently to ensure they meet AMH parameters Operational Infrastructure x Well - developed national operating platform with local market expertise x Effective use of technology Alignment of Interest x Founder and senior management team hold approximately $1 billion of equity ownership Management Structure x Aligned incentives and increased efficiency x Internal asset and property management Strong Management x Management team with a track record of successfully building and operating businesses in public markets American Homes 4 Rent Overview

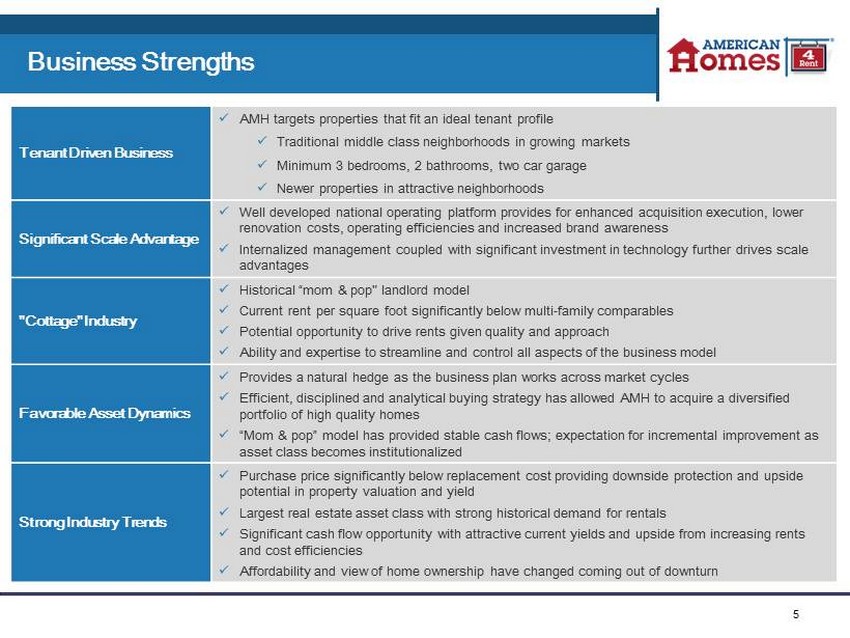

Business Strengths Tenant Driven Business x AMH targets properties that fit an ideal tenant profile x Traditional middle class neighborhoods in growing markets x Minimum 3 bedrooms, 2 bathrooms, two car garage x Newer properties in attractive neighborhoods Significant Scale Advantage x Well developed national operating platform provides for enhanced acquisition execution, lower renovation costs, operating efficiencies and increased brand awareness x Internalized management coupled with significant investment in technology further drives scale advantages "Cottage" Industry x Historical “mom & pop" landlord model x Current rent per square foot significantly below multi - family comparables x Potential opportunity to drive rents given quality and approach x Ability and expertise to streamline and control all aspects of the business model Favorable Asset Dynamics x Provides a natural hedge as the business plan works across market cycles x Efficient, disciplined and analytical buying strategy has allowed AMH to acquire a diversified portfolio of high quality homes x “Mom & pop” model has provided stable cash flows; expectation for incremental improvement as asset class becomes institutionalized Strong Industry Trends x Purchase price significantly below replacement cost providing downside protection and upside potential in property valuation and yield x Largest real estate asset class with strong historical demand for rentals x Significant cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies x Affordability and view of home ownership have changed coming out of downturn 5

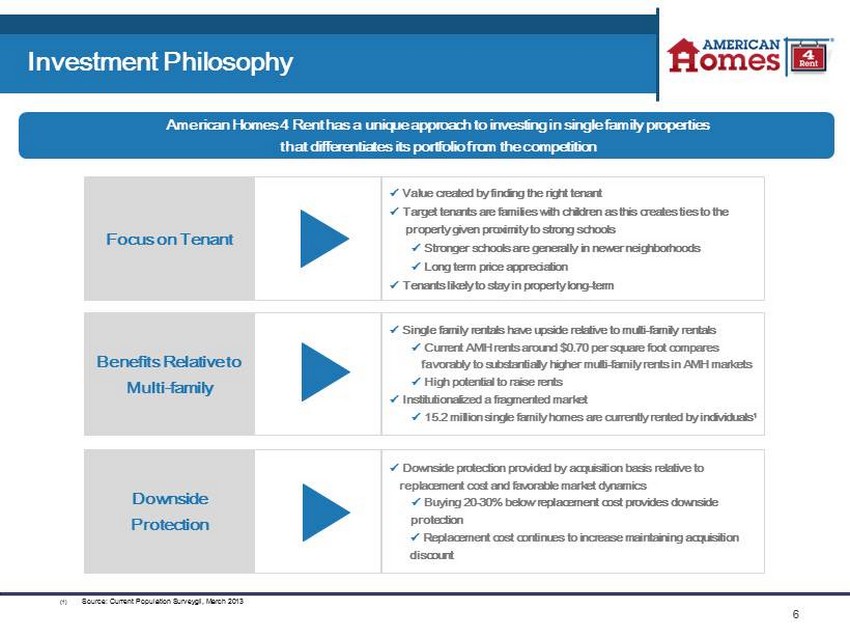

6 Investment Philosophy Focus on Tenant x Value created by finding the right tenant x Target tenants are families with children as this creates ties to the property given proximity to strong schools x S tronger schools are generally in newer neighborhoods x Long term price appreciation x Tenants likely to stay in property long - term Benefits Relative to Multi - family x Single family rentals have upside relative to multi - family rentals x Current AMH rents around $0.70 per square foot c ompares favorably to substantially higher multi - family rents in AMH markets x High potential to raise rents x Institutionalized a fragmented market x 15.2 million single family homes are currently rented by individuals 1 Downside Protection x Downside protection provided by acquisition basis relative to replacement cost and favorable market dynamics x Buying 20 - 30% below replacement cost provides downside protection x Replacement cost continues to increase maintaining acquisition discount American Homes 4 Rent has a unique approach to investing in single family properties that differentiates its portfolio from the competition (1) Source: Current Population Surveygil , March 2013

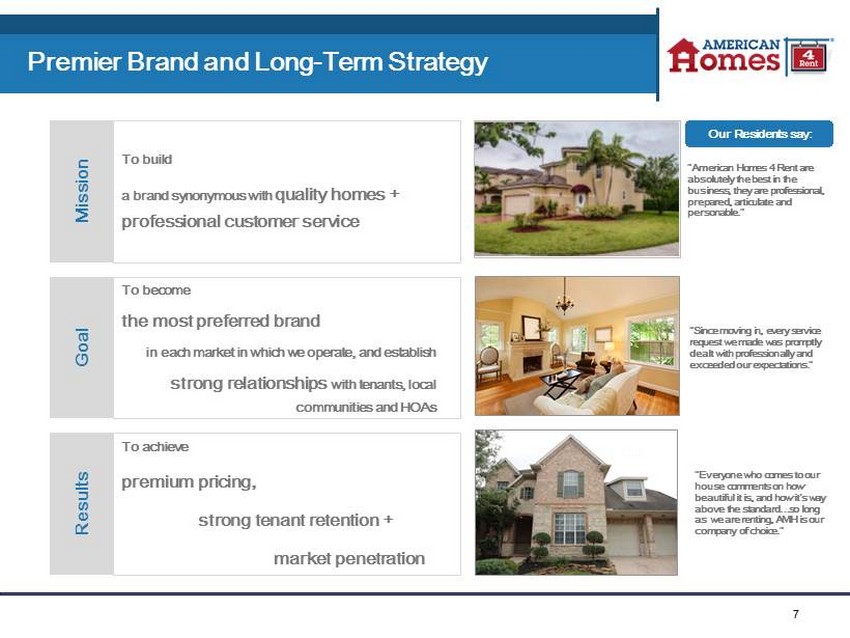

7 Premier Brand and Long - Term Strategy Mission To build a brand synonymous with quality homes + professional customer service Goal To become the most preferred brand in each market in which we operate, and establish strong relationships with tenants, local communities and HOAs Results To achieve premium pricing, strong tenant retention + market penetration “Everyone who comes to our house comments on how beautiful it is, and how it's way above the standard…so long as we are renting, AMH is our company of choice.” “Since moving in, every service request we made was promptly dealt with professionally and exceeded our expectations.” “American Homes 4 Rent are absolutely the best in the business, they are professional, prepared, articulate and personable.” Our Residents say:

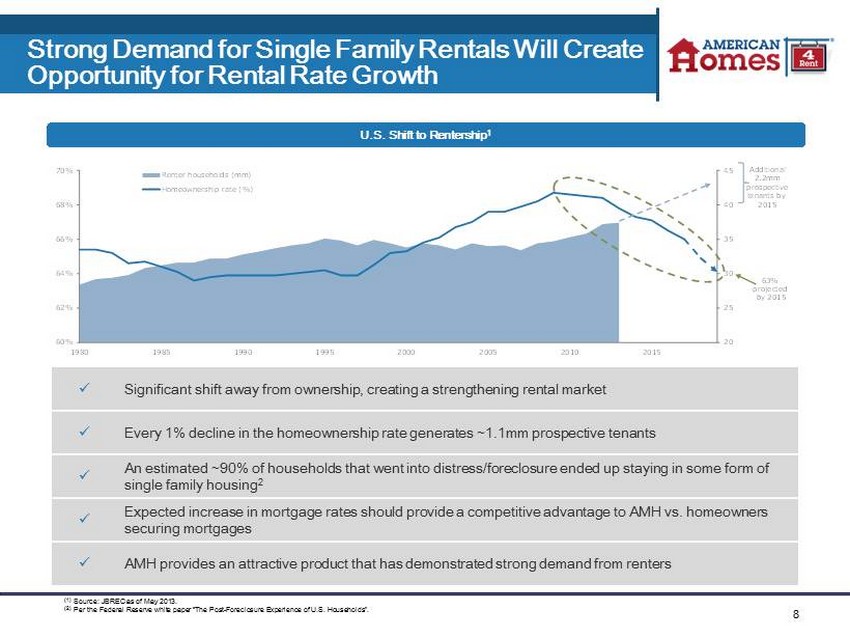

20 25 30 35 40 45 60% 62% 64% 66% 68% 70% 1980 1985 1990 1995 2000 2005 2010 2015 Renter households (mm) Homeownership rate (%) Additional 2.2mm prospective tenants by 2015 63% projected by 2015 8 Strong Demand for Single Family Rentals Will Create Opportunity for Rental Rate Growth U.S. Shift to Rentership 1 (1) Source: JBREC as of May 2013. (2) Per the Federal Reserve white paper “The Post - Foreclosure Experience of U.S. Households”. x Significant shift away from ownership, creating a strengthening rental market x Every 1% decline in the homeownership rate generates ~1.1mm prospective tenants x An estimated ~90% of households that went into distress/foreclosure ended up staying in some form of single family housing 2 x Expected increase in mortgage rates should provide a competitive advantage to AMH vs. homeowners securing mortgages x AMH provides an attractive product that has demonstrated strong demand from renters

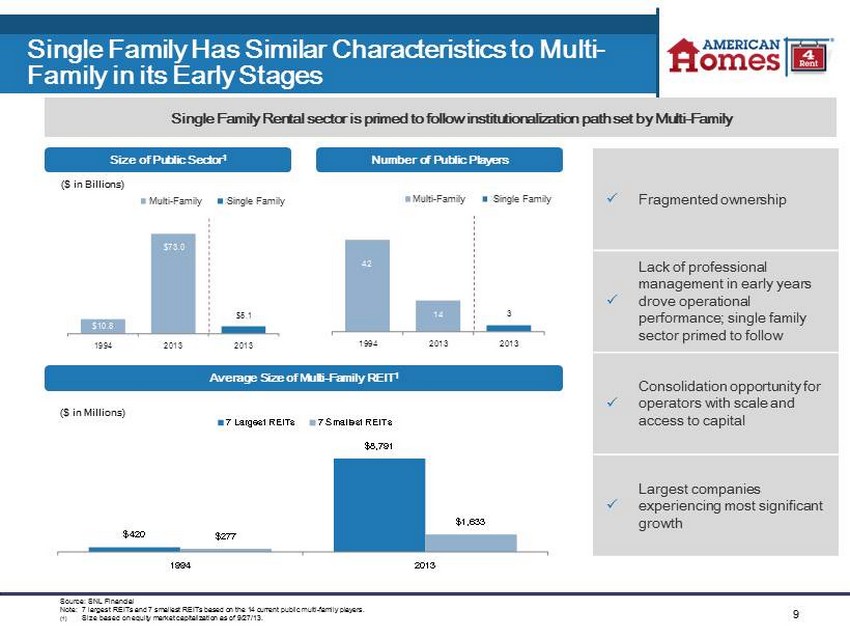

$10.8 $73.0 $5.1 1994 2013 2013 1994 2013 $420 $8,791 $277 $1,633 1994 2013 7 Largest REITs 7 Smallest REITs 9 Single Family Has Similar Characteristics to Multi - Family in its Early Stages Size of Public Sector 1 Number of Public Players Average Size of Multi - Family REIT 1 x Fragmented ownership x Lack of professional management in early years drove operational performance; single family sector primed to follow x Consolidation opportunity for operators with scale and access to capital x Largest companies experiencing most significant growth ($ in Billions) ($ in Millions) 42 14 3 1994 2013 2013 1994 2013 Source: SNL Financial Note: 7 largest REITs and 7 smallest REITs based on the 14 current public multi - family players. (1) Size based on equity market capitalization as of 9/27/13. Multi - Family Single Family Single Family Rental sector is primed to follow institutionalization path set by Multi - Family Multi - Family Single Family

Company History and Senior Management 10

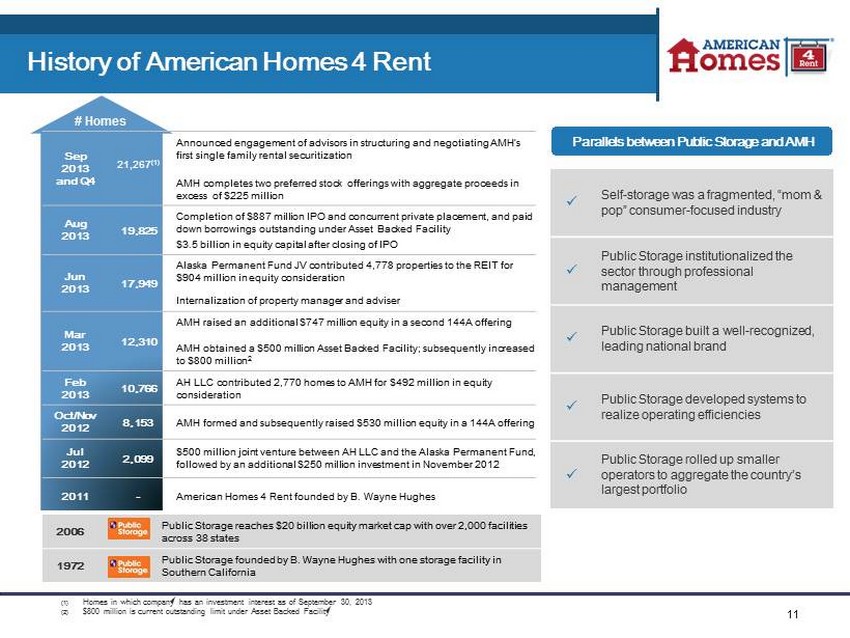

History of American Homes 4 Rent Sep 2013 and Q4 21,267 (1) Announced engagement of advisors in structuring and negotiating AMH’s first single family rental securitization AMH completes two preferred stock offerings with aggregate proceeds in excess of $225 million Aug 2013 19,825 Completion of $ 887 million IPO and concurrent private placement, and paid down borrowings outstanding under Asset Backed Facility $3.5 billion in equity capital after closing of IPO Jun 2013 17,949 Alaska Permanent Fund JV contributed 4,778 properties to the REIT for $904 million in equity consideration Internalization of property manager and adviser Mar 2013 12,310 AMH raised an additional $747 million equity in a second 144A offering AMH obtained a $500 million Asset Backed Facility ; subsequently increased to $800 million 2 Feb 2013 10,766 AH LLC contributed 2,770 homes to AMH for $492 million in equity consideration Oct/Nov 2012 8,153 AMH formed and subsequently raised $530 million equity in a 144A offering Jul 2012 2,099 $500 million joint venture between AH LLC and the Alaska Permanent Fund, followed by an additional $250 million investment in November 2012 2011 - American Homes 4 Rent founded by B. Wayne Hughes Parallels between Public Storage and AMH x Self - storage was a fragmented, “mom & pop” consumer - focused industry x Public Storage institutionalized the sector through professional management x Public Storage built a well - recognized, leading national brand x Public Storage developed systems to realize operating efficiencies x Public Storage rolled up smaller operators to aggregate the country’s largest portfolio # Homes 2006 2006 Public Storage reaches $20 billion equity market cap with over 2,000 facilities across 38 states 1972 1972 Public Storage founded by B. Wayne Hughes with one storage facility in Southern California 11 (1) Homes in which company has an investment interest as of September 30, 2013 (2) $800 million is current outstanding limit under Asset Backed Facility

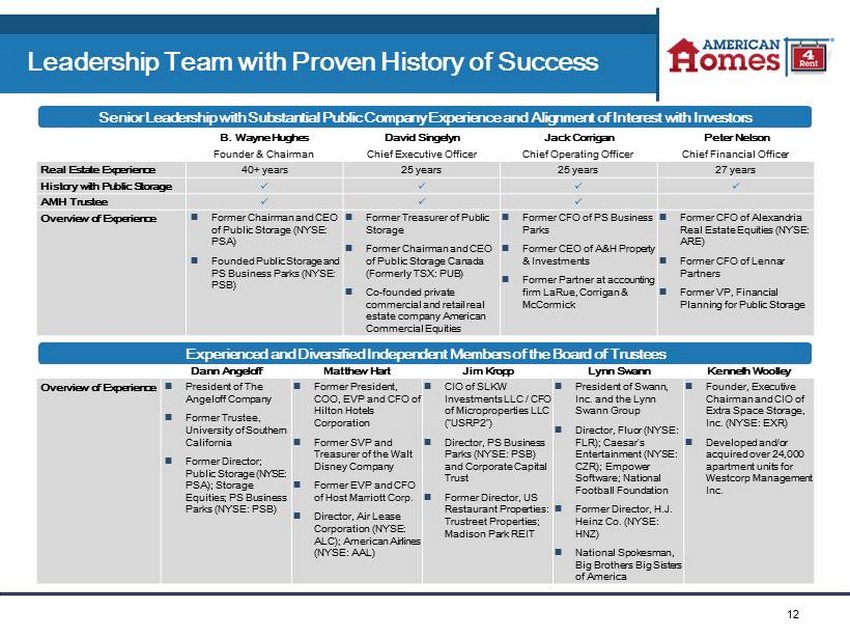

12 Leadership Team with Proven History of Success B. Wayne Hughes David Singelyn Jack Corrigan Peter Nelson Founder & Chairman Chief Executive Officer Chief Operating Officer Chief Financial Officer Real Estate Experience 40+ years 25 years 25 years 27 years History with Public Storage x x x x AMH Trustee x x x Overview of Experience ; Former Chairman and CEO of Public Storage (NYSE: PSA) ; Founded Public Storage and PS Business Parks (NYSE: PSB) ; Former Treasurer of Public Storage ; Former Chairman and CEO of Public Storage Canada (Formerly TSX: PUB) ; Co - founded private commercial and retail real estate company American Commercial Equities ; Former CFO of PS Business Parks ; Former CEO of A&H Property & Investments ; Former Partner at accounting firm LaRue, Corrigan & McCormick ; Former CFO of Alexandria Real Estate Equities (NYSE: ARE) ; Former CFO of Lennar Partners ; Former VP, Financial Planning for Public Storage Experienced and Diversified Independent Members of the Board of Trustees Dann Angeloff Matthew Hart Jim Kropp Lynn Swann Kenneth Woolley Overview of Experience ; President of The Angeloff Company ; Former Trustee, University of Southern California ; Former Director; Public Storage (NYSE: PSA); Storage Equities; PS Business Parks (NYSE: PSB) ; Former President, COO, EVP and CFO of Hilton Hotels Corporation ; Former SVP and Treasurer of the Walt Disney Company ; Former EVP and CFO of Host Marriott Corp. ; Director, Air Lease Corporation (NYSE: ALC); American Airlines (NYSE: AAL) ; CIO of SLKW Investments LLC / CFO of Microproperties LLC (“USRP2”) ; Director, PS Business Parks (NYSE: PSB) and Corporate Capital Trust ; Former Director, US Restaurant Properties: Trustreet Properties; Madison Park REIT ; President of Swann, Inc. and the Lynn Swann Group ; Director, Fluor (NYSE: FLR); Caesar’s Entertainment (NYSE: CZR); Empower Software; National Football Foundation ; Former Director, H.J. Heinz Co. (NYSE: HNZ) ; National Spokesman, Big Brothers Big Sisters of America ; Founder, Executive Chairman and CIO of Extra Space Storage, Inc. (NYSE: EXR) ; Developed and/or acquired over 24,000 apartment units for Westcorp Management Inc. Senior Leadership with Substantial Public Company Experience and Alignment of Interest with Investors

Operations 13

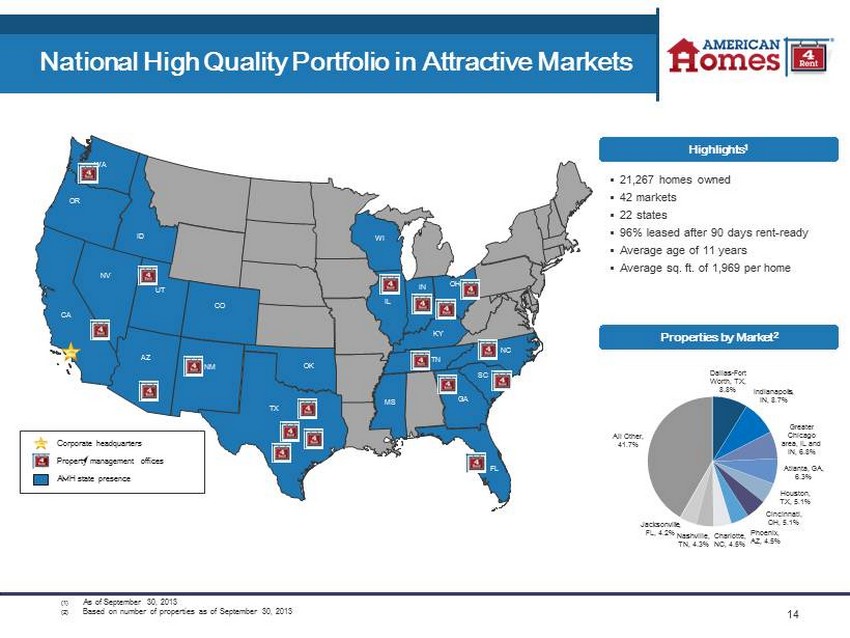

14 National High Quality Portfolio in Attractive Markets (1) As of September 30, 2013 (2) Based on number of properties as of September 30, 2013 SC TN WA OR CA NV UT CO AZ TX IL IN OH GA FL SC TN NC KY Corporate headquarters Property management offices AMH state presence OK WI ID NM MS ▪ 21,267 homes owned ▪ 42 markets ▪ 22 states ▪ 96% leased after 90 days rent - ready ▪ Average age of 11 years ▪ Average sq. ft. of 1,969 per home Highlights 1 Properties by Market 2 Dallas - Fort Worth, TX, 8.8% Indianapolis, IN, 8.7% Greater Chicago area, IL and IN, 6.8% Atlanta, GA, 6.3% Houston, TX, 5.1% Cincinnati, OH, 5.1% Phoenix, AZ, 4.5% Charlotte, NC, 4.5% Nashville, TN, 4.3% Jacksonville, FL, 4.2% All Other, 41.7%

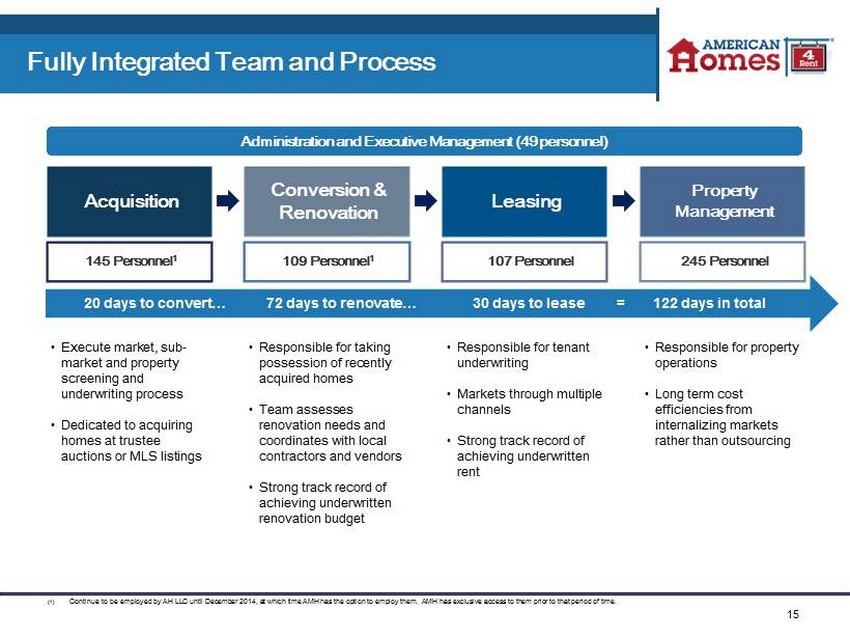

15 Fully Integrated Team and Process Administration and Executive Management (49 personnel) • Execute market, sub - market and property screening and underwriting process • Dedicated to acquiring homes at trustee auctions or MLS listings • Responsible for taking possession of recently acquired homes • Team assesses renovation needs and coordinates with local contractors and vendors • Strong track record of achieving underwritten renovation budget • Responsible for tenant underwriting • Markets through multiple channels • Strong track record of achieving underwritten rent • Responsible for property operations • Long term cost efficiencies from internalizing markets rather than outsourcing Acquisition Conversion & Renovation Leasing Property Management 145 Personnel 1 109 Personnel 1 107 Personnel 245 Personnel 20 days to convert… 72 days to renovate… 30 days to lease = 122 days in total (1) Continue to be employed by AH LLC until December 2014, at which time AMH has the option to employ them. AMH has exclusive ac ces s to them prior to that period of time.

Acquisitions and Renovations 16

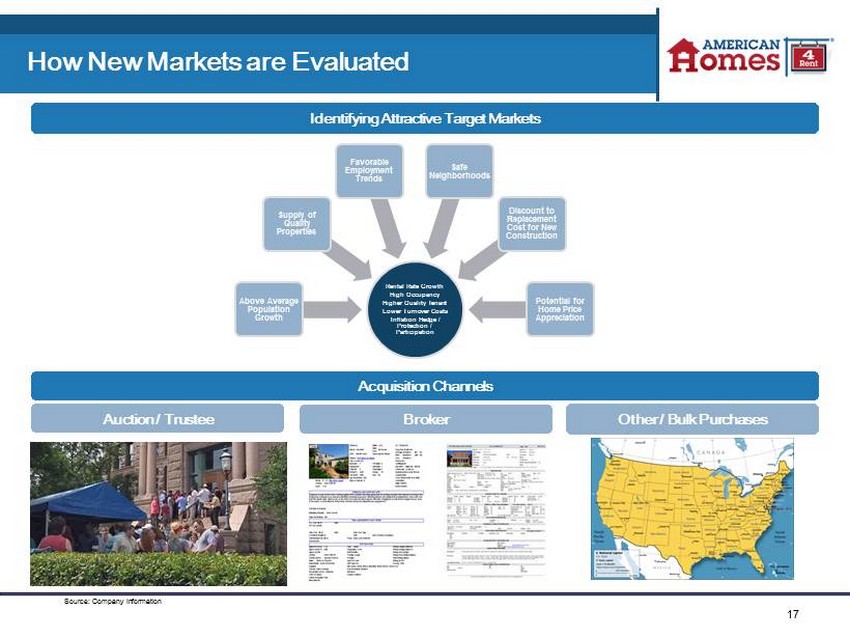

17 How New Markets are Evaluated Identifying Attractive Target Markets Auction / Trustee Broker Other / Bulk Purchases Acquisition Channels Source: Company Information Rental Rate Growth High Occupancy Higher Quality Tenant Lower Turnover Costs Inflation Hedge / Protection / Participation Above Average Population Growth Supply of Quality Properties Favorable Employment Trends Safe Neighborhoods Discount to Replacement Cost for New Construction Potential for Home Price Appreciation

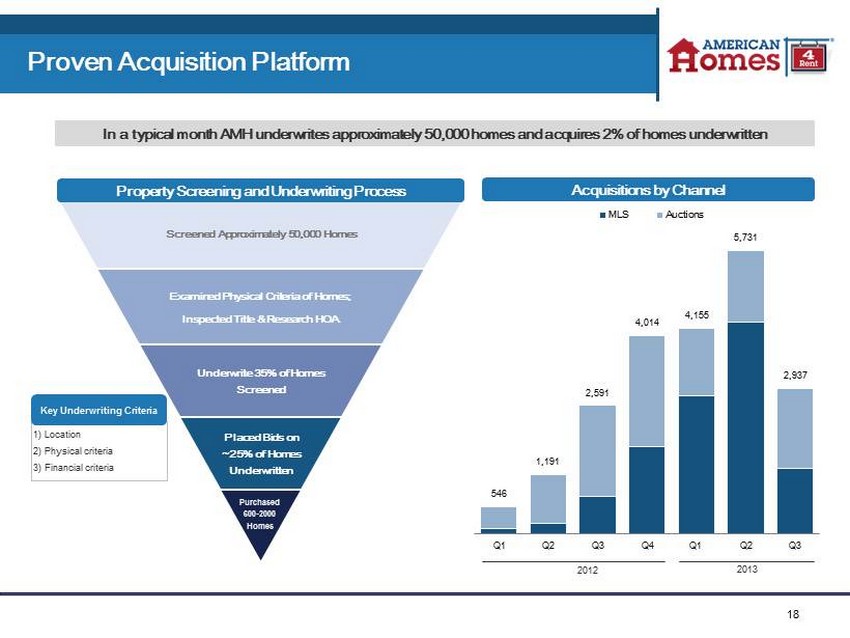

546 1,191 2,591 4,014 4,155 5,731 2,937 Q1 Q2 Q3 Q4 Q1 Q2 Q3 MLS Auctions 18 Proven Acquisition Platform Screened Approximately 50,000 Homes Examined Physical Criteria of Homes; Inspected Title & Research HOA Underwrite 35% of Homes Screened Placed Bids on ~25% of Homes Underwritten Purchased 600 - 2000 Homes Property Screening and Underwriting Process Acquisitions by Channel 2012 2013 In a typical month AMH underwrites approximately 50,000 homes and acquires 2% of homes underwritten Key Underwriting Criteria 1) Location 2) Physical criteria 3) Financial criteria

19 Focus on High Quality Submarkets and Homes Through Disciplined Underwriting ▪ Supply of quality assets ▪ Family oriented areas and homes ▪ Safe neighborhoods ▪ Favorable employment trends ▪ Above average population growth ▪ Discount to replacement cost for new construction San Antonio, TX 1 Submarket Characteristics Typical Home Characteristics ▪ Average investment cost: approximately $166,000 ▪ Price range: $70,000 estimated minimum valuation – $400,000 maximum bid price ▪ Size: 3+ bedrooms, 2+ bathrooms ▪ Age: 1990 or newer ▪ Attached 2 - car garages Trustee / Auction Purchase (1) Includes acquisition, renovation, leasing and other property - specific information and may not be indicative of the acquisition, renovation and other information of the properties in our portfolio or properties we may acquire in the future. (2) Total cost / sq ft includes a 5% acquisition fee that is applied to the purchase price and renovation cost. Purchase price ▪ $144,801 Purchase date ▪ 8/7/2012 Year built ▪ 2009 Square footage ▪ 2,337 Total cost / sq ft ▪ $68.59 2 Monthly Rent ▪ $1,496 (pro forma) / $1,500 (actual) Renovation Cost ▪ $10,353 (pro forma) / $7,865 (actual)

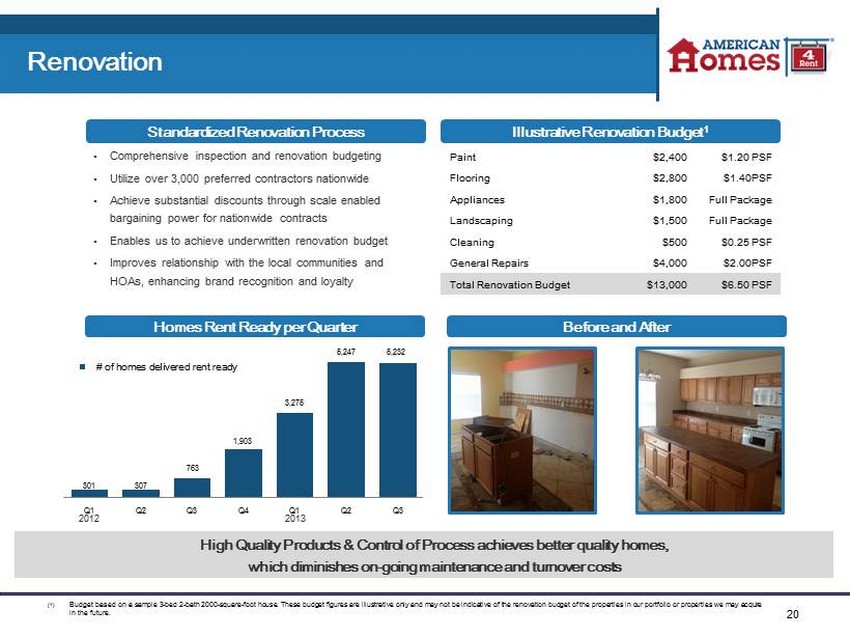

20 Renovation Standardized Renovation Process Homes Rent Ready per Quarter Before and After ▪ Comprehensive inspection and renovation budgeting ▪ Utilize over 3,000 preferred contractors nationwide ▪ Achieve substantial discounts through scale enabled bargaining power for nationwide contracts ▪ Enables us to achieve underwritten renovation budget ▪ Improves relationship with the local communities and HOAs, enhancing brand recognition and loyalty Illustrative Renovation Budget 1 Paint $2,400 $1.20 PSF Flooring $2,800 $1.40PSF Appliances $1,800 Full Package Landscaping $1,500 Full Package Cleaning $500 $0.25 PSF General Repairs $4,000 $2.00PSF Total Renovation Budget $13,000 $6.50 PSF (1) Budget based on a sample 3 - bed 2 - bath 2000 - square - foot house. These budget figures are illustrative only and may not be indicati ve of the renovation budget of the properties in our portfolio or properties we may acquire in the future. High Quality Products & Control of Process achieves better quality homes, which diminishes on - going maintenance and turnover costs 301 307 763 1,903 3,275 5,247 5,232 Q1 Q2 Q3 Q4 Q1 Q2 Q3 # of homes delivered rent ready 2012 2013

Leasing & Property Management 21

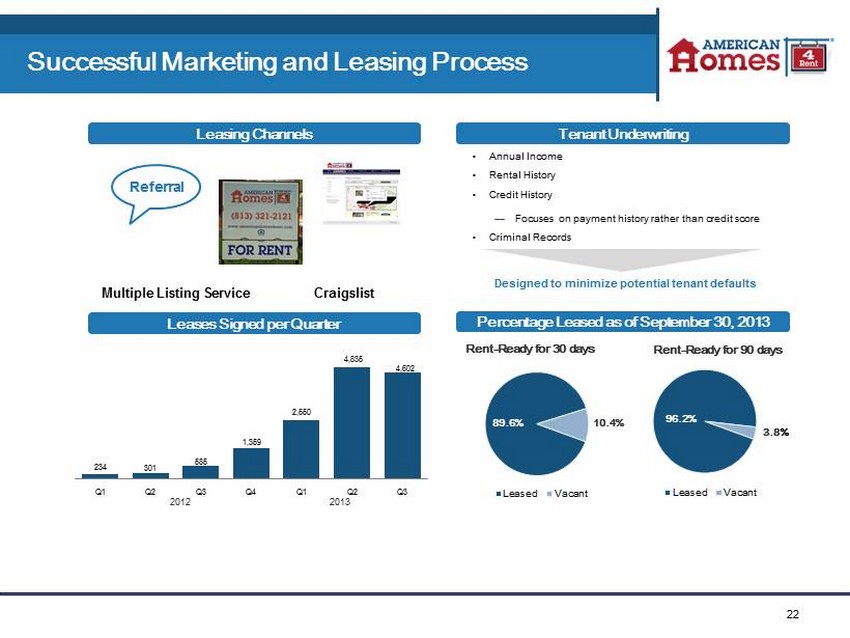

Leased Vacant Leased Vacant 22 Successful Marketing and Leasing Process Tenant Underwriting Percentage Leased as of September 30, 2013 Rent - Ready for 30 days Rent - Ready for 90 days 10.4% 89.6% 3.8 % 96.2% Leasing Channels Leases Signed per Quarter ▪ Annual Income ▪ Rental History ▪ Credit History — Focuses on payment history rather than credit score ▪ Criminal Records Designed to minimize potential tenant defaults 234 301 585 1,359 2,550 4,835 4,602 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2012 2013 Multiple Listing Service Referral Craigslist

23 Best in Class Processes Expedite Leasing Property Marketing • Renovation team transitions homes to marketing group when ready for lease - up • Marketing group coordinates pictures, writes description and posts to website • Property is uploaded to AMH’s site, Craigslist, Zillow and MLS • National leasing call center has dedicated staff to answer prospective tenant calls 7 days/week, 14 hours/day • Prospective tenants can call and schedule a tour with an agent or have immediate access to properties (key code sent via text message) Ability to have a signed lease within one hour of tenant entering property Lease - Up Process

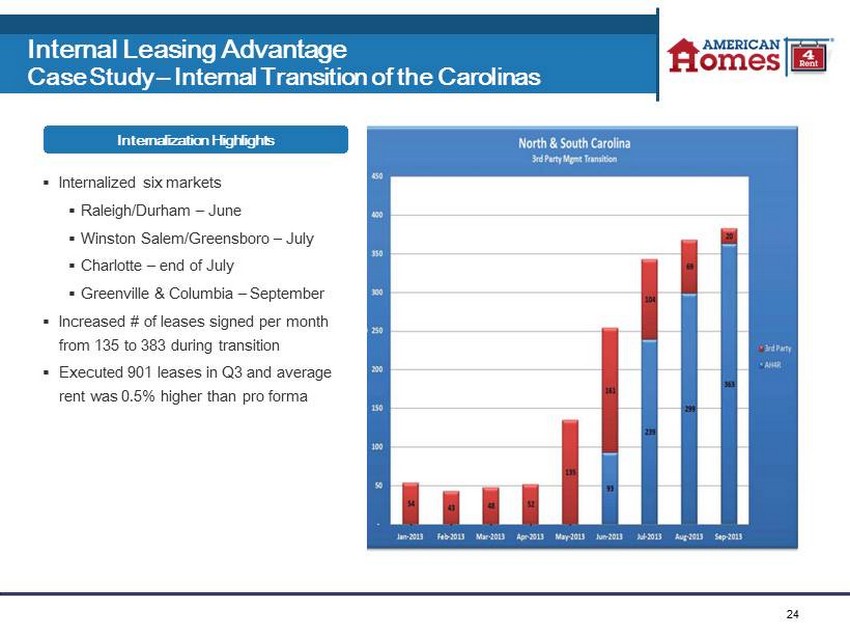

24 Internal Leasing Advantage Case Study – Internal Transition of the Carolinas Internalization Highlights ▪ Internalized six markets ▪ Raleigh/Durham – June ▪ Winston Salem/Greensboro – July ▪ Charlotte – end of July ▪ Greenville & Columbia – September ▪ Increased # of leases signed per month from 135 to 383 during transition ▪ Executed 901 leases in Q3 and average rent was 0.5% higher than pro forma

Reliable and Trusted Property Management 25 Benefits of In - House P roperty Management In - House Property Management Capabilities • Increase velocity of executing leases and reduce level of inventory • Enhance control over rents and ability to maximize rental growth • Economies of scale • Quality control • Incentives more closely aligned • Enhance communication and feedback • In - house management allows AMH to increase ramp - up speed and occupancy, maximize rents and create cost efficiencies • Built on Public Storage experience • Extensive infrastructure with modern systems and technology • Call center with dedicated staff to answer tenant and prospective tenant calls • B enefit from economies of scale in established finance, accounting and administration functions

26 Strong Property Management Ensures Tenant Satisfaction and Continuing Asset Quality Proactive Maintenance • Extensive walkthroughs with tenants prior to occupancy • Full property inspections performed every 6 months • Quarterly drive - bys of each property • HOA requirement is another line of defense to ensure property is being maintained to standards Maintenance • Service center in Las Vegas handles all incoming maintenance calls • Tenants can either call the service center, contact the property manager, or make requests online • Maintenance is outsourced to local vendors with agreed - upon pricing • Most maintenance calls happen within the first 30 days of a tenant renting a house; typically results in warranty work performed by the General Contractor during renovation

Technology and Systems 27

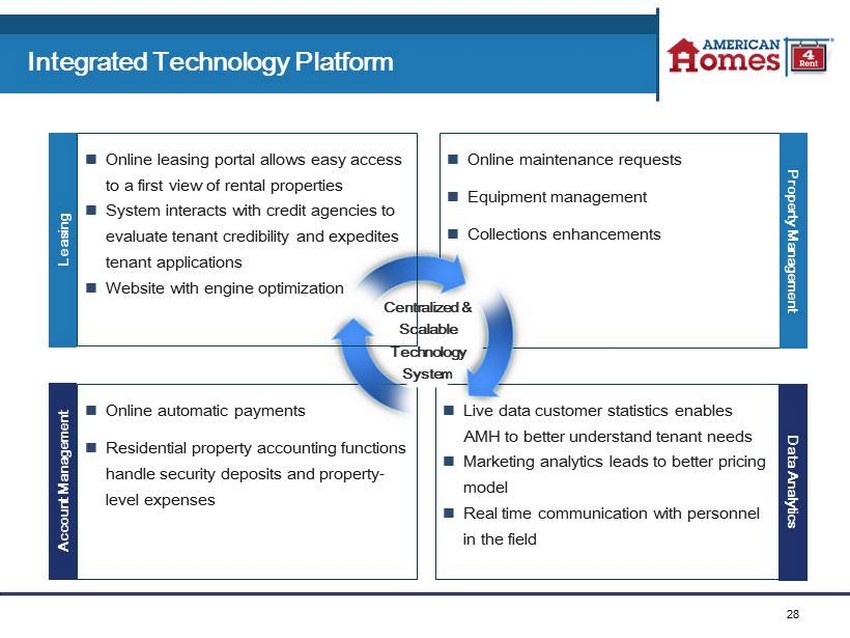

; Live data customer statistics enables AMH to better understand tenant needs ; Marketing analytics leads to better pricing model ; Real time communication with personnel in the field ; Online automatic payments ; Residential property accounting functions handle security deposits and property - level expenses ; Online maintenance requests ; Equipment management ; Collections enhancements 28 Integrated Technology Platform Centralized & Scalable Technology System Leasing Account Management Property Management Data Analytics ; Online leasing portal allows easy access to a first view of rental properties ; System interacts with credit agencies to evaluate tenant credibility and expedites tenant applications ; Website with engine optimization