Attached files

| file | filename |

|---|---|

| 8-K - AMERICAN SPECTRUM REALTY, INC. 8-K - AMERICAN SPECTRUM REALTY INC | a50777745.htm |

| EX-99.1 - EXHIBIT 99.1 - AMERICAN SPECTRUM REALTY INC | a50777745ex99_1.htm |

| EX-3.2I - EXHIBIT 3.2(I) - AMERICAN SPECTRUM REALTY INC | a50777745ex3_2i.htm |

| EX-3.1I - EXHIBIT 3.1(I) - AMERICAN SPECTRUM REALTY INC | a50777745ex3_1i.htm |

| EX-10.2 - EXHIBIT 10.2 - AMERICAN SPECTRUM REALTY INC | a50777745ex10_2.htm |

Exhibit 10.1

CONTRIBUTION AGREEMENT

AND JOINT ESCROW INSTRUCTIONS

By and Among

Asset Managers, Inc.

D&A Daily Mortgage Fund III, L.P.

D&A Semi-Annual Mortgage Fund III, L.P.

D&A Intermediate-Term Mortgage Fund III, L.P.

American Spectrum Realty, Inc.

American Spectrum Dunham Properties LLC

American Spectrum Operating Partnership, L.P.

Effective Date: December __, 2013

TABLE OF CONTENTS

|

Page

|

||

|

ARTICLE 1

|

CERTAIN DEFINITIONS AND FUNDAMENTAL PROVISIONS | 1 |

| ARTICLE 2 |

CONTRIBUTION OF PROJECTS AND ISSUANCE OF SENIOR PREFERRED STOCK

|

4 |

| ARTICLE 3 |

CONTRIBUTION VALUE AND PAYMENT OF CONTRIBUTION VALUE

|

4 |

| 3.1 |

Contribution Value

|

4 |

| 3.2 | Payment of Contribution Value |

4

|

| 3.3 |

Allocation of Contribution Value, Sale Payment and Participation Payment

|

7 |

| 3.4 |

Project Indebtedness

|

9 |

| ARTICLE 4 |

INTENTIONALLY OMITTED

|

10 |

| ARTICLE 5 | ENTRY, INSPECTIONS AND DUE DILIGENCE | 11 |

| 5.1 |

Inspections, Tests and Studies

|

11 |

| 5.2 |

Dunham's Books and Records

|

11 |

| 5.3 |

Indemnity

|

12 |

| ARTICLE 6 | ESCROW | 12 |

| 6.1 |

Opening of Escrow

|

12 |

| 6.2 |

Rights and Obligations of Escrow Holder

|

12 |

| 6.3 |

Closing Date

|

13 |

| 6.4 |

Dunham's Deliveries

|

13 |

| 6.5 |

American Spectrum's Deliveries

|

15 |

| 6.6 |

Prorations

|

16 |

| 6.7 |

Disbursements and Other Actions by Escrow Holder

|

19 |

| 6.8 |

Dunham's Deliveries to American Spectrum Dunham Properties Upon Closing

|

20 |

| 6.9 |

Information Report

|

21 |

| 6.10 |

Natural Hazards Disclosure

|

21 |

| ARTICLE 7 |

CONDITIONS TO CLOSING

|

22 |

| 7.1 | Conditions Precedent to Buyer's Obligations | 22 |

| 7.2 | Conditions Precedent to Dunham's Obligations | 23 |

| ARTICLE 8 |

DUNHAM'S REPRESENTATIONS AND WARRANTIES

|

23 |

| 8.1 | Dunham's Authority | 23 |

| 8.2 |

Project

|

25 |

(i)

|

Page

|

||

| 8.3 | Existing Financing, Tenant Leases, etc | 27 |

| 8.4 |

General

|

28 |

|

|

||

|

ARTICLE 9

|

PROJECTS CONVEYED "AS IS"

|

29 |

| ARTICLE 10 |

AMERICAN SPECTRUM'S REPRESENTATIONS AND WARRANTIES

|

30 |

| 10.1 |

Due Formation

|

30 |

| 10.2 |

Power

|

30 |

| 10.3 |

Requisite Action

|

30

|

| 10.4 |

Authority

|

30 |

| 10.5 |

Validity

|

30 |

| 10.6 | No Conflicts | 30 |

| 10.7 |

Valid Issuance of Senior Preferred Stock

|

31 |

| 10.8 | Governmental Consents and Filings | 31 |

| 10.9 |

SEC Filings; Financial Statements

|

31 |

| 10.10 |

General Representation

|

31 |

| 10.11 |

Survival

|

32 |

| ARTICLE 11 |

COVENANTS OF DUNHAM AND AMERICAN SPECTRUM

|

32 |

| 11.1 |

Broker

|

32 |

| 11.2 |

Required Actions of Parties

|

32 |

| ARTICLE 12 |

REMEDIES

|

32 |

| 12.1 |

General

|

32 |

| 12.2 |

Attorneys' Fees

|

32 |

| 12.3 |

No Assumption of Liability

|

32 |

| 12.4 |

Termination

|

33 |

| 12.5 |

Effect of Termination

|

33 |

| ARTICLE 13 |

INTENTIONALLY OMITTED

|

33 |

| ARTICLE 14 |

ARBITRATION OF DISPUTES

|

34 |

| ARTICLE 15 |

CONFIDENTIALITY

|

36 |

| 15.1 |

Use of Confidential Information

|

36 |

| 15.2 |

Disclosure of Confidential Information

|

36 |

| 15.3 |

Breach and Remedies

|

36 |

| ARTICLE 16 |

MISCELLANEOUS

|

37 |

| 16.1 |

Entire Agreement

|

37 |

| 16.2 | Agreement Binding on Parties | 37 |

| 16.3 |

Notice

|

37 |

(ii)

|

Page

|

||

| 16.4 |

Governing Law

|

38

|

| 16.5 |

Partial Invalidity

|

38 |

| 16.6 |

No Implied Agreement

|

38 |

| 16.7 |

Facsimile or Electronic Mail Signatures

|

38 |

| 16.8 |

Waivers

|

38 |

| 16.9 |

Time of Essence

|

38 |

| 16.10 |

Construction

|

38 |

| 16.11 |

Business Day

|

39 |

| 16.12 |

Currency

|

39 |

| 16.13 |

Multiple Counterparts

|

39 |

(iii)

|

Page

|

||

|

Exhibits

|

||

| 1.16 |

Existing Financing

|

|

| 1.25 |

Preliminary Title Reports

|

|

| 1.26 |

Identification of Projects

|

|

| 3.2.2 |

Allocation of Senior Preferred Stock Among Dunham Funds

|

|

| 3.3.1 |

Allocation of Net Contribution Value Among Projects

|

|

| 3.3.2 |

Examples of Sale Payments, Participation Payments and Deficit Payments

|

|

| 6.4.1 |

Form of Deed

|

|

| 6.4.2 |

Form of Bill of Sale

|

|

| 6.4.3 |

Form of Tenant Lease Assignment

|

|

| 6.4.4 |

Form of General Assignment

|

|

| 6.4.9 |

Form of Assignment of Interest

|

|

| 6.4.10A |

Form of Federal Non-Foreign Certificate

|

|

| 6.4.10B |

Form of California Non-Foreign Certificate

|

|

| 6.4.12 |

Form of Dunham's Affirmation Certificate

|

|

| 6.5.4 |

Form of American Spectrum's Affirmation Certificate

|

|

| 7.2.3 |

Form of Articles Supplementary

|

|

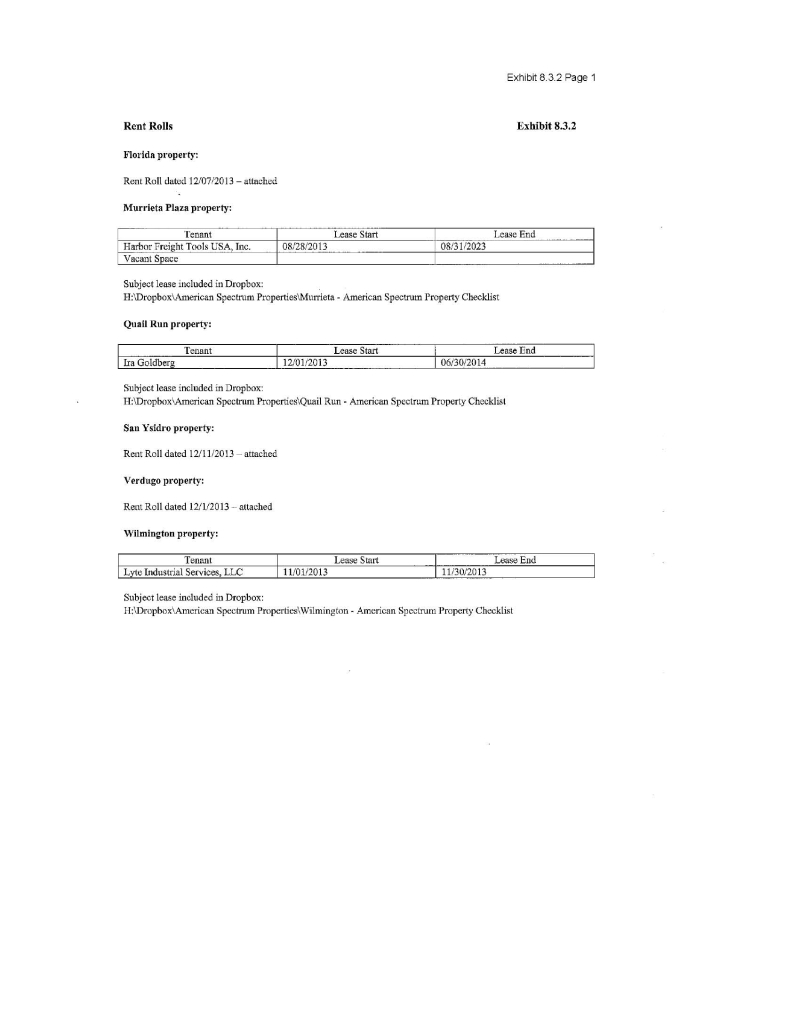

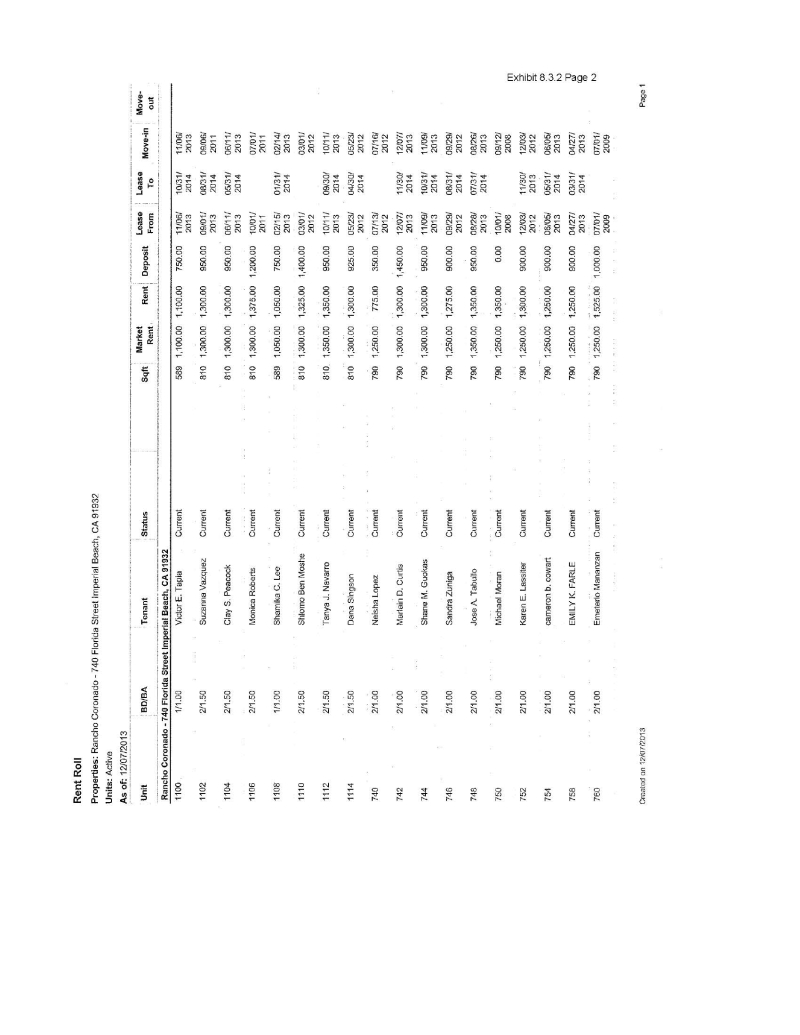

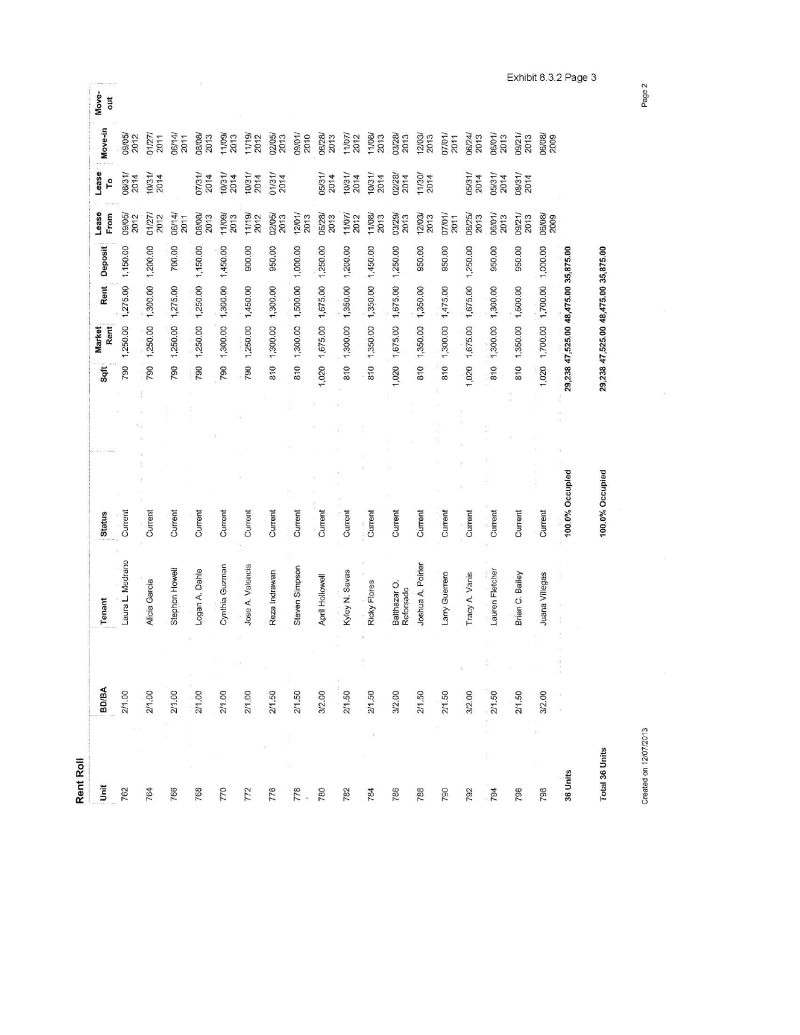

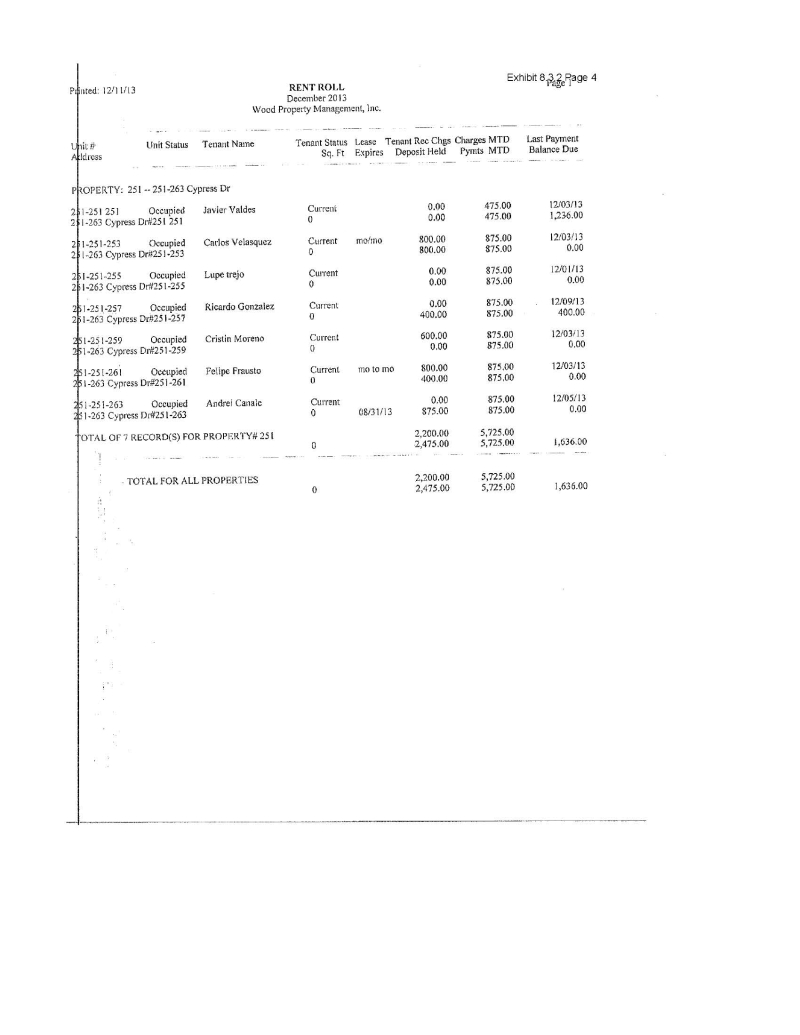

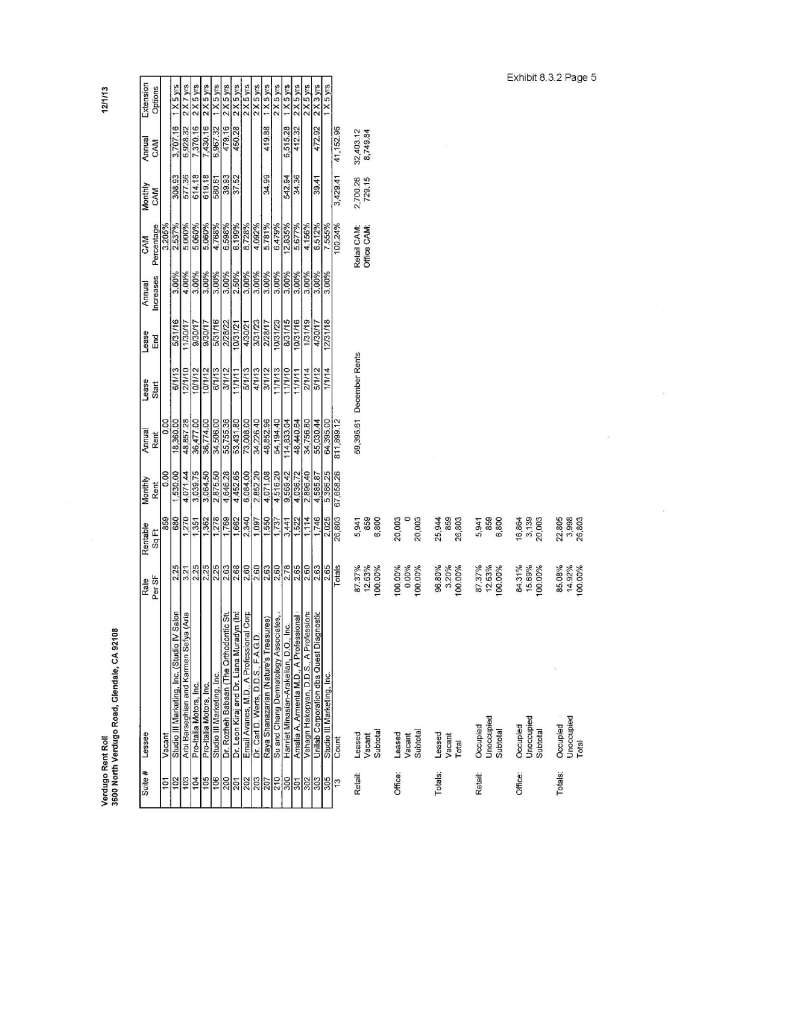

| 8.3.2 |

Rent Rolls

|

(iv)

CONTRIBUTION AGREEMENT AND JOINT ESCROW INSTRUCTIONS

THIS CONTRIBUTION AGREEMENT AND JOINT ESCROW INSTRUCTIONS ("Agreement") is made and entered into as of the Effective Date by and among Asset Managers, Inc., D&A Daily Mortgage Fund III, L.P., D&A Semi-Annual Mortgage Fund III, L.P., D&A Intermediate-Term Mortgage Fund III, L.P., American Spectrum Realty, Inc., American Spectrum Realty Operating Partnership, L.P., and American Spectrum Dunham Properties LLC. The terms of this Agreement and the Escrow Holder's instructions are as follows

CERTAIN DEFINITIONS AND FUNDAMENTAL PROVISIONS

Set forth below are certain definitions and fundamental provisions for the purposes of this Agreement.

1.2 ASROP means American Spectrum Realty Operating Partnership, L.P., a Maryland limited partnership.

1.4 American Spectrum means, collectively and jointly and severally, American Spectrum Realty, ASROP and American Spectrum Dunham Properties unless the context expressly requires that the reference is applicable only to one of such Parties whereupon such reference shall apply only to such Party.

1.5 American Spectrum Dunham Properties means American Spectrum Dunham Properties LLC, a Delaware limited liability company and a wholly owned subsidiary of American Spectrum and a special purpose entity organized for the purpose of acquiring and owning the Projects and the Nevada Treasure Interest pursuant to this Agreement.

1.8 Closing Date means the date (but not later than the 3rd Business Day after the satisfaction or waiver of the last of the conditions set forth in Article 7, other than those conditions that by their nature are to be satisfied at Closing, but subject to the satisfaction or waiver of such condition) on which the Closing actually occurs.

1.9 Contribution Value means Eighty-Four Million Eight Hundred Twenty-Thousand Dollars ($84,820,000).

1.10 Daily Fund means D&A Daily Mortgage Fund III, L.P., a California limited partnership, the general partner of which is AMI.

1.11 Due Diligence Materials means those items, documents, correspondence and other matters described in that certain Drop Box entitled “American Spectrum Realty.”

1.12 Dunham means AMI, Daily Fund, Semi-Annual Fund and Intermediate Fund collectively and jointly and severally unless the context expressly requires that the reference is applicable to one of such Parties whereupon such reference shall apply only to such Party.

1.13 Dunham Funds means Daily Fund, Semi-Annual Fund and Intermediate Fund, together with their respective successors and assigns, collectively unless the context expressly requires that the reference is applicable to one of such Parties whereupon such reference shall apply only to such Party.

|

First American Title Insurance Company

18500 Von Karman Avenue, Suite 600

Irvine, California 92612

Attn: Patty Beverly

Facsimile No.: 877-372-0260

Telephone No.: 949-885-2465

E-Mail Address: pbeverly@firstam.com

Escrow No.: NCS-636862

|

1.16 Existing Financing means the indebtedness described on Exhibit 1.16 attached hereto with an outstanding unpaid principal balance of approximately Seventeen Million Two Hundred Thousand Dollars ($17,200,000) as of the Effective Date, which Exhibit describes the Existing Financing on a Project by Project basis and lists each of the documents which evidences, secures and/or governs the Existing Financing ("Existing Financing Documents").

1.17 Improvements means all buildings, fixtures, structures, parking areas, landscaping and other improvements now or hereafter constructed and located on the Land, together with all machinery and mechanical, electrical, HVAC and plumbing systems (other than Personal Property) used in the operation of the Land, but excluding any such items owned by Tenants in possession or public or private utilities or contractors under contract.

1.18 Intermediate Fund means D&A Intermediate-Term Mortgage Fund III, L.P., a California limited partnership, the general partner of which is AMI.

1.19 Land means that certain real property described in and the subject of the Preliminary Title Reports, together with all right, title and interest, if any, of any Owner in and to (i) all strips and gores and any land lying in the bed of any street, road or avenue, opened or proposed, in front of or adjoining a Project, (ii) any real property owned, claimed or fenced by any Owner which adjoins a Project, (iii) any unpaid award made or to be made for the taking by condemnation or otherwise of a Project, for public or quasi-public use or purpose of such right, title or interest, (iv) any unpaid award for damage to any or all of the Land by reason of change of grade of any such street, road or avenue, (v) all easements, right-of-way, privileges, licenses (written or oral), and (vi) any and all development rights, mineral rights, oil and gas rights, and other intangible rights, titles, interests, privileges and appurtenances of every kind and description appurtenant to or benefiting a Project.

2

1.20 Net Contribution Value means the Contribution Value less the sum of the principal amount of the Existing Financing on the Closing plus or minus any adjustments to be debited or credited, as applicable, to American Spectrum pursuant to Section 6.6.

1.22 Nevada Treasure Interest means one hundred percent (100%) of the limited liability company interest and/or other equity or ownership interest in Nevada Treasure.

1.25 Preliminary Title Reports means those Preliminary Title Reports issued by the Title Company with respect to each Property listed on Exhibit 1.25.

1.26 Project(s) means, collectively, (a) the Nevada Treasure Interest, and (b) all of Dunham’s right, title and interest, in and to the Land described in each of the Preliminary Title Reports together with the Improvements thereon. Each of the Projects is identified on Exhibit 1.26 attached hereto and shall be conveyed to American Spectrum Dunham Properties pursuant to the terms and conditions of this Agreement.

1.28 Semi-Annual Fund means D&A Semi-Annual Mortgage Fund III, L.P., a California limited partnership, the general partner of which is AMI.

|

First American Title Insurance Company

5 First American Way

Santa Ana, California 92707

Attn: Vince Tocco and Linda Slavik

Facsimile No.: 877-461-2094

Telephone No.: 858-410-3886

E-Mail Address: vtocco@firstam.com

|

3

In addition to those terms defined above, capitalized terms used in this Agreement shall have the meanings following the use of such terms or, if no definition is so set forth, such capitalized terms shall have the meanings set forth in the Glossary of Terms attached to this Agreement.

CONTRIBUTION OF PROJECTS AND ISSUANCE OF SENIOR PREFERRED STOCK

On the Closing Date, Dunham hereby agrees to contribute each of the Projects to American Spectrum Dunham Properties, and, in consideration thereof, American Spectrum Realty agrees to issue to Dunham the Senior Preferred Stock, all upon the terms and conditions set forth in this Agreement. The Senior Preferred Stock shall be allocated among and issued to the Dunham Funds in proportion to each such entity’s respective share of the Net Contribution Value in accordance with Section 3.2.2.

CONTRIBUTION VALUE AND PAYMENT OF CONTRIBUTION VALUE

3.1 Contribution Value. The aggregate Contribution Value for the contribution and conveyance of the Projects is specified in Article 1.

3.2 Payment of Contribution Value. The Contribution Value shall be payable by American Spectrum to Dunham as follows:

3.2.1 Assumption of Existing Financing. American Spectrum Dunham Properties shall acquire the Projects subject to the Existing Financing (except that the Existing Financing affecting San Jacinto which shall be released and expunged by Dunham from the Official Records on or prior to Closing). Upon the terms and subject to the conditions set forth in this Agreement, on the Closing Date, American Spectrum hereby assumes and agrees to pay, perform and discharge, as and when due, any and all obligations owing with respect to the Existing Financing, together with any and all costs, fees, expenses and other amounts associated therewith which accrue and are payable on or after the Closing Date. Dunham hereby agrees and/or represents and warrants that it has paid or will pay, has performed and discharged or will perform and discharge any obligations owing with respect to the Existing Financing together with any and all costs, fees, expenses and other amounts associated therewith which have accrued and/or will accrue prior to the Closing Date. Notwithstanding anything in this Agreement to the contrary, American Spectrum shall be solely responsible for any and all amounts which become due and payable with respect to the Existing Financing as a result of the assumption by American Spectrum of the Existing Financing, including without limitation, any penalties, assumption costs or related costs fees or expenses; provided, however, for all purposes, American Spectrum shall not be in default of any obligation to Dunham or the holder of any Senior Preferred Stock or the holder of any Dunham Note by reason of any default under the Existing Financing which (a) arose prior to the Closing or (b) arises by reason of the transactions described in this Agreement (including the assumption of the Existing Financing without consent of the holder of the Existing Financing) unless and until the holder of the applicable Existing Financing forecloses upon or otherwise acquires the Project which is governed by a lien created by such Existing Financing. At Closing, the amount of the then outstanding principal balance of the Existing Financing shall be applied and credited toward payment of the Contribution Value. American Spectrum hereby agrees, from and after the Closing, to indemnify, defend and hold harmless Dunham and its respective partners, directors, managers, officers, employees, affiliates and representatives from and against any and all losses, liabilities, damages, claims, suits, settlements, liabilities, costs, expenses and other amounts (including reasonable attorneys fees) arising out of or related to a breach by American Spectrum of its obligations set forth in this Section 3.2.1 with respect to the Existing Financing (except the Existing Financing affecting the San Jacinto Project). Dunham hereby agrees, from and after the Closing, to indemnify, defend and hold harmless American Spectrum and its respective partners, directors, managers, officers, employees, affiliates and representatives from and against any and all losses, liabilities, damages, claims, suits, settlements, liabilities, costs, expenses and other amounts (including reasonable attorneys fees) arising out of or related to a breach by Dunham of its obligations set forth in this Section 3.2.1 with respect to the Existing Financing.

4

3.2.2 Senior Preferred Stock. In accordance with Section 6.5, American Spectrum Realty shall deposit into Escrow Certificates (the "Senior Preferred Stock Certificates") evidencing the Senior Preferred Stock to be designated “8% Cumulative Preferred Stock, Series B” ("Senior Preferred Stock") to be issued by American Spectrum Realty to Daily Fund, Semi-Annual Fund and Intermediate Fund. The value of the Senior Preferred Stock shall equal the Net Contribution Value. At the Closing, each of the Dunham Funds shall be issued a Senior Preferred Stock Certificate for that number of shares of Senior Preferred Stock set forth opposite its name on Exhibit 3.2.2 attached hereto. The Senior Preferred Stock shall have those rights, preferences and privileges set forth in the Articles Supplementary (hereinbelow defined).

|

|

Senior Preferred Stock Dividend. As set forth in more detail in the Articles Supplementary, the Senior Preferred Stock shall earn a dividend calculated like simple interest as follows: (i) at the rate of eight percent (8%) per annum on the then outstanding Net Contribution Value for the period commencing on the Closing Date and terminating on December 31, 2014 (the “Initial Interest Period”), and (ii) thereafter until the Senior Preferred Stock has been redeemed in full, at the rate of twelve percent (12%) per annum on the then outstanding Net Contribution Value. The accrued and outstanding dividend shall be paid monthly on the first business day of each calendar month commencing January 1, 2014 (each, a “Dividend Payment”); provided, however, that in connection with each Dividend Payment attributable to the Initial Interest Period, only fifty percent (50%) of the accrued dividend payable with respect each Dividend Payment shall be payable in connection with the applicable Dividend Payment and the balance of such dividend shall accrue and be paid in one lump sum payment on December 1, 2015, which accrued amount shall earn simple interest at the same rate as the then applicable dividend rate of the Senior Preferred Stock. All Dividend Payments shall be paid electronically via wire transfer of immediately available funds to account(s) designated by Dunham.

|

5

|

|

Redemption of Senior Preferred Stock. As set forth more fully in the Articles Supplementary, American Spectrum Realty shall be obligated to redeem the Senior Preferred Stock issued to each of the Dunham Funds, pro rata in accordance with the Senior Preferred Stock held by each of the Dunham Funds, as follows: (i) an aggregate of Seventeen Million Dollars ($17,000,000) on December 1, 2014 in consideration of approximately twenty-five percent (25%) of the Senior Preferred Stock, (ii) an aggregate of Seventeen Million Dollars ($17,000,000) on June 1, 2015 in consideration of twenty-five percent (25%) of the Senior Preferred Stock and (iii) on December 1, 2015 an amount equal to the Net Contribution Value less the amounts theretofore paid in consideration of the redemption of Senior Preferred Stock in consideration of the balance of the unredeemed Senior Preferred Stock (each a "Redemption Payment"). Upon redemption of any of the Senior Preferred Stock (A) the accrued but unpaid dividend with respect to such redeemed Senior Preferred Stock shall also be paid to the holder of the Senior Preferred Stock being so redeemed and (B) the Net Contribution Value shall be reduced for purposes of determining the dividend to be earned thereon. Notwithstanding the foregoing, the accrued and unpaid dividend on the Senior Preferred Stock that would not otherwise be payable until December 1, 2015 shall continue to accrue and earn interest as herein provided and be payable on December 1, 2015. Any Sale Payments (herein below defined) paid with respect to the Senior Preferred Stock pursuant to this Agreement (x) shall reduce the Net Contribution Value by the amount of such Sale Payment when such Sale Payment is made and (y) shall be credited to the next Redemption Payment required to be made by American Spectrum Realty. Participation Payments (herein below defined) shall not reduce the Net Contribution Value or be credited to any Redemption Payment. All Redemption Payments, Sale Payments and Participation Payments shall be paid electronically via wire transfer of immediately available funds to account(s) designated by Dunham.

|

|

|

Unconditional Payments. Notwithstanding anything in this Agreement to the contrary, the obligations of American Spectrum Realty to make the Dividend Payments and the Redemption Payments pursuant to the schedule set forth herein and in the Articles Supplementary is not conditioned in any way upon any future sales or refinancings by American Spectrum Dunham Properties of any of the Projects.

|

|

|

Articles Supplementary. In the event of any conflict between the terms of the Articles Supplementary and this Agreement, the Articles Supplementary shall control.

|

6

|

|

Compliance Certificate. If the Chief Executive Officer or Chief Financial Officer of American Spectrum Realty certifies to a third party lender that American Spectrum Realty or any of its subsidiaries is in compliance with its organizational documents (including the Articles Supplementary) and that no consents (other than those obtained) are required for any transaction, such third party lender shall have the right to conclusively rely on such certificate. American Spectrum Realty shall as soon as practicable provide a copy of any such certificate to Dunham.

|

3.3.1 Allocation of Contribution Value. Exhibit 3.3.1 sets forth the mutually agreed upon allocation of the Net Contribution Value to each Project as of the Closing Date (the "Project Allocation Amount").

3.3.2 Sale Payment and Participation Payments. As set forth more fully in the Articles Supplementary (except as otherwise provided in this Agreement) when a Project is sold after the Closing to a Person unrelated to American Spectrum (excluding the granting of any deed of trust or mortgage to secure the repayment of any financing or refinancing), American Spectrum Realty shall pay to the holders of the Senior Preferred Stock at the closing of such sale, pro rata to the then outstanding Senior Preferred Stock then held by each such holder, the sum of the following:

|

|

if the gross sales price for such Project exceeds the Project Allocation Amount with respect to such Project, an amount equal to fifty percent (50%) of the difference between the applicable Project Allocation Amount for such Project and the indebtedness secured by the Project which is repaid at the closing of such sale; or

|

|

|

if the Project Allocation Amount with respect to such Project exceeds the gross sales price for such Project, an amount equal to fifty percent (50%) of the difference between the gross sales price for such Project and the indebtedness secured by such Project which is repaid at the closing of such sale.

|

The Dunham Loan will be evidenced by two (2) separate Secured Promissory Notes (each, a “Dunham Note”), each in the original principal amount of $3,000,000. The repayment of each of the Dunham Notes will be secured by, among other things, a deed of trust on one or more of the Projects. As set forth in each of the Dunham Notes, the lenders thereunder have agreed that, in connection with the sale of one or more of the Projects securing repayment of such Dunham Note, that in lieu of repaying the applicable Note with the proceeds from such transaction that the applicable Project may be replaced by a substitute property (including one or more of the Projects) (a “Substitute Property”) on terms and conditions set forth in the applicable Dunham Note. In the event a Project securing repayment of a Dunham Note is properly replaced by a Substitute Property in accordance with the terms of the Note, then for purposes of calculating the Sale Payments for purposes of Section 3.3.2(a)(i) and (ii), the amount owing under the applicable Dunham Note shall not be included in calculating the aggregate indebtedness being repaid at the closing of such sale.

7

|

|

Participation Payment. Subject to the provisions of Section 3.3.3, in the event the gross sales price of a Project exceeds the Project Allocation Amount for such Project, a payment ("Participation Payment") in an amount equal to twenty-five percent (25%) of the Profits (herein below defined) attributable to the sale of such Project shall be paid to the Dunham Funds, pro rata to each based on the Project Allocation Amount of the properties contributed by each of the Dunham Funds pursuant to this Agreement. For purposes hereof, the term “Profits” with respect to the sale of a Project shall be an amount equal to the gross sales price of such Project, less the sum of the following:

|

|

|

any amounts paid by American Spectrum to third parties with respect to such Project to make capital improvements thereto or to pay to third party brokers to secure leases thereof, plus

|

|

|

any third-party costs incurred by American Spectrum to sell or market such Project, including the cost of marketing materials, broker commissions, consultant fees (including reasonable attorneys and accountants, etc.), plus

|

|

|

normal and customary third-party closing costs paid by American Spectrum in connection with the sale of such Project.

|

For purposes of calculating Profits, there shall not be deducted from the gross sales price of such Project fees paid to American Spectrum or any other "soft" costs of American Spectrum Dunham Properties other than as specified above, including without limitation, any fees or interest paid to American Spectrum or interest expense paid by American Spectrum, property taxes, insurance, or the net income or loss generated from rents or operating activities with respect to such Project. Exhibit 3.3.2 sets forth examples with respect to the making of a Sale Payment and a Participation Payment.

|

|

Termination of Sale Payments; Survival of Participation Payments. American Spectrum Dunham Properties’ obligation to make any Sale Payment pursuant to this Section 3.3.2 shall terminate upon the redemption in full of the Senior Preferred Stock. Additionally, American Spectrum Dunham Properties’ obligation to make any Participation Payment shall survive the redemption in full of the Senior Preferred Stock and shall continue until all of the Projects have been sold by American Spectrum Dunham Properties.

|

8

|

|

Transfer of Senior Preferred Stock. In the event of any transfer or assignment of any Senior Preferred Stock by the holder thereof, such holder shall be obligated to transfer and assign to the applicable recipient such holder’s rights to receive the Sale Payments attributable to the applicable Senior Preferred Stock in connection with such transfer or assignment, and such transferee shall acknowledge in writing that such transferee is taking the Senior Preferred Stock subject to the applicable provisions of this Agreement.

|

3.3.3 Deficit Payments. In the event the gross sales price for any Project is less than the Project Allocation Amount with respect to such Project (such difference being called the “Deficit,”), then one hundred percent (100%) of the Profits associated with future sales of Projects shall be paid to the then holders of the Senior Preferred Stock, pro rata to each based on the then outstanding shares of Senior Preferred Stock, until the aggregate Deficit has been paid in full (each, a “Deficit Payment”). All such Deficit Payments pursuant to this Section 3.3.3. shall be treated as a Sales Payment. Exhibit 3.3.2 sets forth examples with respect to the making of a Deficit Payment.

3.4 Project Indebtedness. American Spectrum covenants that it shall not finance or refinance any Project that results in the aggregate outstanding indebtedness on any Project (including Nevada Treasure) to exceed at any time forty percent (40%) of the Project Allocation Amount of such Project (the “Indebtedness Limit”). American Spectrum further covenants that it shall not permit any loan covenant that restricts or limits in any manner the payments owing with respect to the Senior Preferred Stock hereunder and under the Articles Supplementary. The Limited Liability Company Agreement of American Spectrum Dunham Properties shall contain covenants and restrictions evidencing the rights granted with respect to the Senior Preferred Stock pursuant to this Section 3.4, which covenants and restrictions may not be amended without the prior written consent of AMI. Notwithstanding anything contained herein to the contrary, (a) the Existing Indebtedness (excluding any refinance of all or any portion of the Existing Financing) shall not constitute a breach of this Section 3.4 to the extent the Existing Financing with respect to any Project securing the Existing Financing exceeds the Indebtedness Limit for such Project, and (b) the Dunham Loans shall not constitute a breach of this Section 3.4 to the extent the Dunham Loans with respect to any Project securing the Dunham Loans exceeds the Indebtedness Limit for such Project.

3.5 Board Observer Rights. For so long as Dunham Funds hold (and continue to hold) any of the Senior Preferred Stock, American Spectrum Realty shall permit a designee of Dunham Funds, reasonably approved by the Board of Directors (the "Observer"), to attend all meetings of its Board of Directors (whether in person, telephonic or other) (other than meetings of a committee of the Board of Directors, unless other observers of the Board of Directors are permitted to attend such meetings) in a nonvoting observer capacity and, in this respect, shall provide the Observer, concurrently with the members of the Board of Directors, with copies of all notices, minutes, consents, and other materials that it provided to such members (other than in meetings of a committee of the Board of Directors, unless other observers of the Board of Directors are provided such materials); provided, however, that the Observer agrees to hold in confidence and trust all information so provided to it or learned by it in connection with its rights hereunder; it being understood and agreed that, notwithstanding the foregoing, the Observer shall be permitted to use or disclose such information to Dunham Funds and its affiliates in connection with managing its investment in American Spectrum Realty; and provided, further, that American Spectrum Realty reserves the right to withhold any information or to exclude the Observer from any meeting or portion thereof if (i) access to such information or attendance at such meeting could adversely affect the attorney-client privilege between American Spectrum Realty and its counsel; or (ii) access to such information or attendance at such meeting could result in a conflict of interest between Dunham Funds or its representative and American Spectrum Realty. If requested, the Observer shall execute a standard non-disclosure agreement with respect to the information disclosed in any such board meeting. The initial Observer shall be Jeffrey Dunham, who may be replaced at any time by unanimous consent of the Dunham Funds, provided, however, that the replacement of Jeffrey Dunham by anybody other than Denise Iverson shall require the consent of American Spectrum Realty (which may not be unreasonably withheld).

9

3.6 American Spectrum Realty Obligations. American Spectrum Realty hereby agrees that it shall be jointly and severally liable for the performance and satisfaction of any and all of American Spectrum Dunham Properties' obligations owing under this Agreement or any of the other transaction documents entered into in connection herewith.

3.7 Joint Ventures. American Spectrum may transfer, assign, contribute or otherwise convey one or more of the Projects to a joint venture entity with a third party ("JV Transaction"); provided, however, that in connection with any JV Transaction, American Spectrum shall not subordinate its capital account in the joint venture entity attributable to the applicable Project to the capital account of any other party therein (but such capital accounts may be on a pari passu basis). In connection with any return of capital from such joint venture entity attributable to a sale of the applicable Project by the joint venture entity, the holders of the Senior Preferred Stock and the Dunham Funds shall be entitled to receive Sale Payments and Participation Payments from the cash returned to American Spectrum from the joint venture entity in accordance with the provisions of Section 3.3.2 hereof. Notwithstanding anything contained herein to the contrary, the provisions of Section 3.4 shall apply to any Project which is transferred, assigned, contributed or otherwise conveyed to a JV Transaction, which provisions with respect to the applicable Project shall be set forth in the organizational documents of such joint venture entity (the "JV Organizational Documents"). American Spectrum shall deliver to Dunham and the holders of the Senior Preferred Stock a copy of such JV Organizational Documents promptly following the closing of any such JV Transaction.

INTENTIONALLY OMITTED

10

ENTRY, INSPECTIONS AND DUE DILIGENCE

5.1 Inspections, Tests and Studies. Subject to the terms of this Agreement, American Spectrum shall have or has had the right to conduct such economic, market, title, survey, environmental, physical and structural examinations, inspections, tests, studies and investigations of each Property as American Spectrum deems necessary. Dunham shall permit American Spectrum and its authorized agents and representatives to enter upon each Project at all reasonable times during normal business hours to inspect and conduct reasonably necessary tests and studies of the Project. At Dunham's option, Dunham may be present for any inspections, tests or studies. American Spectrum Dunham Properties shall bear the cost of all such inspections, tests and studies. Notwithstanding the foregoing, American Spectrum shall not conduct or allow any physically intrusive testing of, on or under the Properties, without first obtaining Dunham’s prior written consent as to the timing and scope of the work to be performed and as to the contractor that American Spectrum will engage to conduct such work.

In conducting any inspections, tests or studies, American Spectrum and its authorized agents and representatives shall (a) comply with all applicable laws and all terms of the Tenant Leases regarding entry rights and obligations of Dunham to Tenants, (b) not unreasonably disturb the Tenants or unreasonably interfere with their use of the Property pursuant to their respective Tenant Leases, (c) not unreasonably interfere with the operation, use and maintenance of the Property, (d) not damage any part of a Property or any Personal Property owned or held by any Tenant or any third party, (e) not injure or otherwise cause bodily harm to Dunham or any of its respective agents, contractors and employees or any Tenant or other third party, (f) promptly pay, when due, the cost of all inspections, tests or studies, (g) not permit any liens to attach to a Property by reason of the exercise of the rights under this Section, (h) fully restore each Property to the condition in which the same was found before any such inspections, tests or studies were undertaken, (i) not reveal or disclose any information obtained as a result of such tests, inspections and studies concerning the Property except as may otherwise be permitted in this Agreement. If American Spectrum fails to promptly repair or restore a Property at its own expense as required above, American Spectrum agrees to reimburse Dunham for any costs incurred by Dunham to so repair or restore such Property. The obligations set forth in this Section shall survive the Closing or any earlier termination of this Agreement.

American Spectrum agrees that it will cause it and any person accessing the Properties hereunder to be covered by not less than $1,000,000 commercial general liability insurance (with, in the case of American Spectrum’s coverage, a contractual liability endorsement, insuring its indemnity obligations under this Agreement), insuring all activity and conduct of such Person while exercising such right of access and naming Dunham and its affiliates as insureds, issued by a licensed insurance company qualified to do business in the State in which the Property in question is located and otherwise reasonably acceptable to Dunham.

5.2 Dunham's Books and Records. During the period commencing on the date hereof and terminating on the Closing Date, Dunham shall permit American Spectrum and its authorized agents and representatives to inspect and examine all books, records and files of Dunham relating to the Property ("Dunham's Books and Records") at all reasonable times during normal business hours on not less than seventy-two (72) hours advance notice. At Dunham's option, AMI may be present for any inspection and examination of such Dunham Books and Records. American Spectrum shall be entitled to communicate directly with any holder of the Existing Financing, the Authorities and any Tenant in connection with the transaction contemplated by this Agreement. American Spectrum shall bear the cost of all inspections and examinations of Dunham's Books and Records and of all communications with the holder of the Existing Financing, the Authorities or any Tenant.

11

5.3 Indemnity. American Spectrum hereby agrees to indemnify, defend, protect and hold Dunham and its agents, employees, partners, shareholders, officers, directors, representatives and contractors harmless from and against any and all liens, claims, losses, liabilities, damages, costs, expenses, causes of action (including reasonable attorneys' fees and court costs) arising out of (a) American Spectrum's inspections, tests and studies (excluding the mere discovery of Hazardous Materials or other conditions that are not exacerbated by such inspections, tests and studies), (b) American Spectrum's examination and inspection of Dunham's Books and Records, (c) American Spectrum’s entry and access to the Projects, and (d) any violation by American Spectrum of the provisions of Article 16. The actions of American Spectrum’s agents, employees, partners, shareholders, officers, directors, representatives and contractors shall be deemed actions of American Spectrum for purposes of this indemnity. The foregoing indemnity shall survive the Closing or any earlier termination of this Agreement.

ESCROW

6.1 Opening of Escrow. The Parties shall promptly cause the Opening of Escrow to occur by delivering a fully executed copy of this Agreement to Escrow Holder and requiring Escrow Holder to execute and deliver the Escrow Joinder to the Parties. American Spectrum and Dunham hereby authorize their respective attorneys to execute and deliver to Escrow Holder any additional or supplementary instructions as may be necessary or convenient to implement the terms of this Agreement and close the transaction contemplated by this Agreement. American Spectrum and Dunham also agree to execute, if necessary, Escrow Holder's standard or pre-printed Escrow Instructions but only to the extent the same are consistent with this Agreement and do not impose any obligations or liabilities on American Spectrum and/or Dunham not contemplated by this Agreement or reduce or restrict any rights or remedies otherwise available to American Spectrum and/or Dunham; provided, however, any such additional, supplementary and/or preprinted standard Escrow Instructions shall not supersede or conflict with this Agreement and any such conflict shall be governed by the terms of this Agreement.

6.2.1 Indemnification of Escrow Holder. If this Agreement or any matter relating to this Agreement shall become the subject of any litigation or controversy, American Spectrum and Dunham agree, jointly and severally, to hold Escrow Holder free and harmless from any loss or expense, including attorneys' fees, that may be suffered by it by reason thereof except in connection with Escrow Holder's negligence, willful misconduct, or breach of its duties under this Agreement.

12

6.2.2 Nonliability of Escrow Holder. Escrow Holder shall not be liable for the sufficiency or correctness as to form, manner, execution or validity of any instrument deposited with it, nor as to the identity, authority or rights of any Person executing such instrument, nor for failure to comply with any of the provisions of any agreement, contract or other instrument filed with Escrow Holder or referred to herein except that Escrow shall not be released from any liability arising from its negligence, willful misconduct, or breach of its duties under this Agreement. Subject to the exceptions contained in the immediately preceding sentence, Escrow Holder's duties hereunder shall be limited to the safekeeping of such money, instruments or other documents received by it as Escrow Holder, and for their disposition in accordance with the terms of this Agreement. Notwithstanding the foregoing, if Escrow Holder is also acting as the Title Company under the terms of this Agreement, nothing in this Section 6.2.2 shall limit the liability of Title Company under the Title Policy.

6.4 Dunham's Deliveries. Dunham hereby covenants and agrees to deliver or caused to be delivered to Escrow Holder at least one (1) Business Day prior to the Closing Date the following instruments and documents with respect to each Project (other than Nevada Treasure):

6.4.1 Deed. A deed ("Deed"), duly executed by Dunham and acknowledged, and in a form suitable for recordation in the Official Records, conveying the Project to American Spectrum Dunham Properties. The Deed shall be in the form attached hereto as Exhibit 6.4.1 together with a customary owner’s affidavit sufficient to enable Title Company to remove the standard exceptions from the Title Policy.

6.4.2 Bill of Sale. One (1) counterpart original of a bill of sale ("Bill of Sale") duly executed by Dunham in favor of American Spectrum Dunham Properties, assigning and conveying to American Spectrum Dunham Properties all of Dunham's right, title and interest in and to the Personal Property. The Bill of Sale shall be in the form of attached hereto as Exhibit 6.4.2.

6.4.3 Assignment of Tenant Leases. Two (2) counterpart originals of an Assignment of Tenant Leases ("Tenant Lease Assignment") duly executed by Dunham assigning to American Spectrum Dunham Properties all of Dunham's right, title and interest in and to the Tenant Leases. The Tenant Lease Assignment shall be in form attached hereto as Exhibit 6.4.3.

6.4.4 General Assignment. Two (2) counterpart originals of an assignment ("General Assignment") duly executed by Dunham assigning to American Spectrum Dunham Properties all of Dunham's right, title and interest in and to all Intangible Property. The General Assignment shall be in the form attached hereto as Exhibit 6.4.4.

6.4.5 Tenant Notification Letter. A letter to each of the Tenants ("Tenant Notification Letter") duly executed by Dunham and dated as of the Closing Date, notifying each Tenant that: (a) the Project has been sold to American Spectrum Dunham Properties, (b) all of Dunham's right, title and interest in and to the Tenant Leases and Tenant Deposits have been assigned to American Spectrum Dunham Properties, including the security deposit, the amount of which shall be specified, and (c) commencing immediately, all rent and other payments and any notices under the Tenant Leases are to be paid and sent to American Spectrum Dunham Properties.

13

6.4.6 Non-Cash Tenant Deposits. All letters of credit and other non-cash Tenant Deposits for which American Spectrum Dunham Properties is not receiving a credit under Section 6.6 below, together with documents of assignment running in favor of American Spectrum Dunham Properties, if any.

6.4.7 Change of Address. Upon request of American Spectrum delivered not later than five (5) business days prior to the scheduled Closing Date, written notices executed by Dunham to each holder of the Existing Financing and to taxing Authorities having jurisdiction over a Project, changing the address for service of notice and delivery of statements and bills.

6.4.8 Lien Affidavits. Any lien affidavits or mechanic's lien indemnifications as may be reasonably requested by the Title Company in order to issue the Title Policy, without exception for mechanics’ liens for work at the Project, that is being performed by or for Dunham.

6.4.9 Nevada Treasure Interest and Assignment of Interest. Two counterpart originals of an assignment of interest ("Assignment of Interest") duly executed by Semi-Annual Fund assigning to American Spectrum Dunham Properties the Nevada Treasure Interest. The Assignment of Interest shall be in the form of Exhibit 6.4.12.

In addition to the above deliveries respecting the Projects, Dunham shall deliver or cause to be delivered to Escrow Holder at least one (1) business day prior to the Closing Date the following instruments and documents:

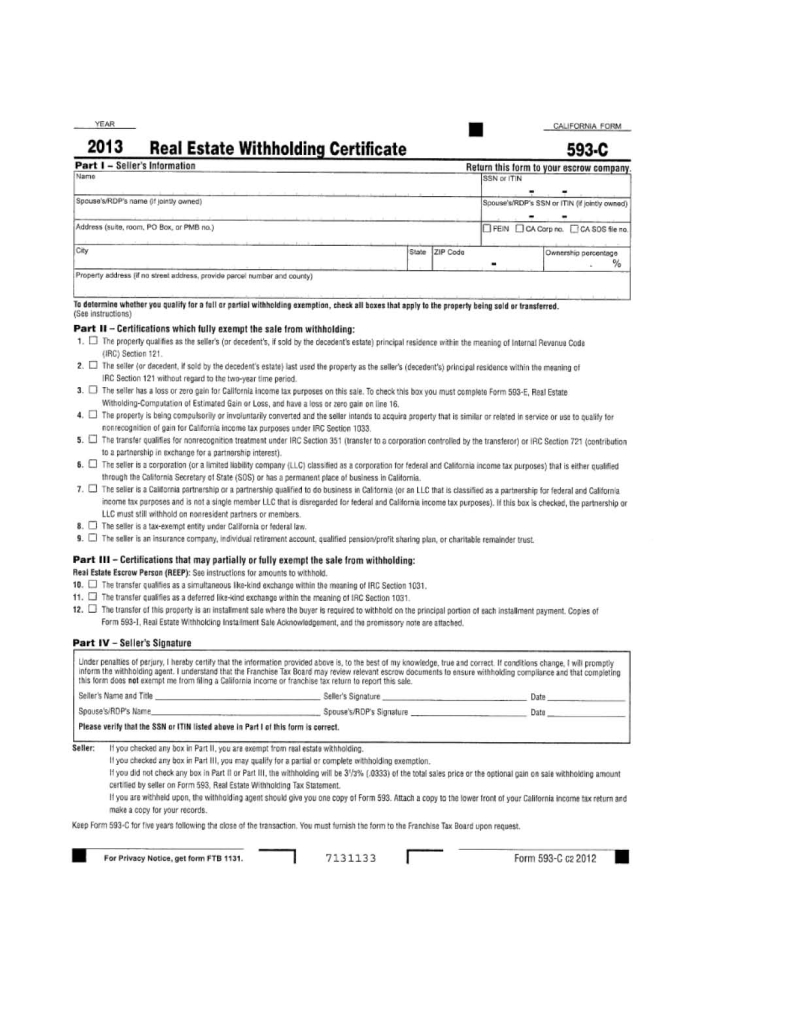

6.4.10 Non-Foreign Certification. A certification duly executed by the Dunham Funds, as applicable, under penalty of perjury in the form of (a) the Non-Foreign Certificate Transferor's Certification of Non-Foreign Status attached hereto as Exhibit 6.4.10A ("Federal Non-Foreign Certificate") and (b) the Real Estate Withholding Exemption Certificate and Waiver Request for (California Form 593-C) attached hereto as Exhibit 6.4.10B (the "California Non-Foreign Certificate").

6.4.11 Proof of Authority. Such proof of Dunham's authority and authorization to enter into this Agreement and to consummate the transactions contemplated by this Agreement, and such proof of the power and authority of the individual(s) executing and/or delivering any instruments, documents or certificates on behalf of Dunham to act for and bind Dunham as may be reasonably required by Title Company and/or American Spectrum.

6.4.12 Affirmation Certification. A certificate ("Dunham's Affirmation Certificate") made by Dunham indicating all of the representations and warranties made in this Agreement by Dunham remain as of the Closing Date true, correct and complete in all material respects as if remade on such date (except to the extent any representations and warranties address matters only as of a particular date or only with respect to a specific period of time, in which case as of such date or with respect to such period).

14

6.4.13 Resignation Letters. Resignation letters executed by Denise Iverson and Court Warren resigning as Managers of Nevada Treasure effective as of the Closing Date.

6.4.14 Additional Documents. Any additional documents that Escrow Holder or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement.

6.5 American Spectrum's Deliveries. American Spectrum hereby covenants and agrees to deliver or cause to be delivered to Escrow Holder on or at least one (1) Business Day prior to the Closing Date the following:

6.5.2 Tenant Lease Assignment. Two (2) counterpart originals of each Tenant Lease Assignment duly executed by American Spectrum Dunham Properties.

6.5.3 General Assignment. Two (2) counterpart originals of each General Assignment duly executed by American Spectrum Dunham Properties.

6.5.4 Affirmation Certification. A certificate ("American Spectrum's Affirmation Certificate") made by American Spectrum Dunham Properties indicating all of the representations and warranties made in this Agreement by American Spectrum remain as of the Closing Date true, correct and complete as if remade on such date.

6.5.5 Proof of Authority. Such proof of American Spectrum's authority and authorization to enter in this Agreement and to consummate the transactions contemplated by this Agreement, including without limitation, the filing of the Articles Supplementary and the issuance of the Senior Preferred Stock, and such proof of the power and authority of the individual(s) executing and/or delivering any instruments, documents or certificates on behalf of American Spectrum to act for and bind American Spectrum as may be reasonably required by Dunham, including evidence of approval of this Agreement and the transactions contemplated herein by the Board of Directors of American Spectrum Realty.

6.5.6 Additional Documents. Any additional documents that American Spectrum, Escrow Holder or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement.

On or before the first to occur of (a) ten (10) Business Days following the Closing Date , or (b) final prorations with respect to the Projects being approved in accordance herewith, American Spectrum shall instruct the transfer agent for American Spectrum Realty to issue to Daily Fund, Intermediate Fund and Semi-Annual Fund the Senior Preferred Stock Certificate(s) in accordance with Article 2.

15

6.6 Prorations.

6.6.1 General. Prorations and adjustments shall be made with respect to each Project (other than Nevada Treasure). All items to be prorated shall be prorated as of 11:59 P.M. on the day preceding the Closing Date. For purposes of calculating prorations, American Spectrum Dunham Properties shall be deemed to be in title to the applicable Project and therefore entitled to the income and responsible for the expenses for the Closing Date. All proration items pertaining to the month in which the Closing Date occurs shall be prorated based upon the actual number of days in such month.

6.6.2 Revenues. Subject to the provisions of Sections 6.6.3 and 6.6.4, Revenues shall be prorated as of the Closing Date.

6.6.3 Delinquent Revenues. Revenues are delinquent when payment thereof is due prior to the Closing Date but has not been received by the Closing Date. Delinquent Revenues shall be prorated between Dunham and American Spectrum Dunham Properties as of the Closing Date but not until they are actually collected by American Spectrum Dunham Properties. American Spectrum Dunham Properties shall have the right to collect any delinquent Revenues, but shall not have the obligation to do so. American Spectrum Dunham Properties shall use commercially reasonable efforts to collect or attempt to collect delinquent Revenues but shall have no obligation to bring a lawsuit against any Tenant. Dunham shall also have the right to collect delinquent Revenues from Tenants after the Closing, but shall not be entitled to commence any litigation or disposition or eviction proceedings against the delinquent Tenant. Delinquent Revenues collected by American Spectrum Dunham Property, net of the reasonable costs of collection (including attorneys' fees), shall be applied first against any amount currently due and then to amounts most recently overdue. Payments due to Dunham as a result of collected Delinquent Revenues shall be payable by American Spectrum Dunham Properties to Dunham upon receipt thereof.

6.6.4 Operating Cost Pass-Throughs, Etc. Operating cost pass-throughs, percentage-rentals, additional rentals and other retroactive rental escalations, sums or charges (“Additional Rents”) payable by Tenants which accrue to the Closing Date but are not then due and payable, shall be prorated as of the Closing Date; provided, however, no payment thereof shall be made to Dunham unless and until American Spectrum Dunham Properties collects such revenues from the Tenants. American Spectrum Dunham Properties shall use commercially reasonable efforts to collect such Additional Rents on Dunham’s behalf and shall pay such amounts to Dunham promptly upon receipt. Dunham shall also have the right to collect, after Closing, Additional Rents due to Dunham from Tenants, but shall not be entitled to commence any litigation or disposition or eviction proceeding against a Tenant. Dunham shall not be entitled to any such Additional Rents received by American Spectrum Dunham Properties from a Tenant after the Closing Date unless such Tenant is current in its obligations under its Tenant Lease for periods occurring from and after the Closing. Such Additional Rents collected by American Spectrum Dunham Properties, net of the reasonable costs of collection (including attorneys' fees), shall be applied first to any amount currently due, and, to the extent amounts are available, American Spectrum Dunham Properties shall pay to Dunham amounts accruing prior to the Closing, computing same on a per diem basis after amortizing them over the respective periods for which such amounts are payable. Payments of such prorated amounts collected by American Spectrum Dunham Properties shall be made to Dunham promptly after receipt and shall be accompanied by a report showing how same were calculated and such reasonably detailed supporting documentation evidencing the calculation of the amount due Dunham.

-16-

6.6.5 Tenant Deposits. At the Closing, Dunham shall transfer all Tenant Deposits then held by Dunham to American Spectrum Dunham Properties (i.e., security deposits and cleaning deposits, whether in the form of cash or letters of credit) or, to the extent not transferred, American Spectrum Dunham Properties shall be credited and Dunham shall be debited with an amount equal to all Tenant Deposits being held by Dunham (or by any other Person for the benefit of Dunham) under the Tenant Leases and Dunham shall retain all such Tenant Deposits so credited and debited.

6.6.6 Prepaid Rentals. Rentals received by Dunham prior to the Closing Date attributable to periods after the Closing Date shall be credited to American Spectrum Dunham Properties and debited to Dunham at the Closing. Dunham shall retain all such prepaid rentals.

6.6.7 Taxes and Assessments. Real property tax refunds and credits received after the Closing which are attributable to a fiscal tax year which ended prior to the Closing shall belong to Dunham. Any such refunds and credits attributable to the fiscal tax year during which the Closing occurs shall be apportioned between Dunham and American Spectrum Dunham Properties after deducting the reasonable out-of-pocket expenses of collection thereof. All real estate taxes and assessments on each Project shall be prorated on the basis of the fiscal period for which assessed (if the Closing shall occur before the tax rate is fixed, the apportionment of taxes shall be based on the tax rate for the preceding period applied to the latest assessed valuation and when the actual real property taxes are finally fixed, the Parties shall promptly make a recalculation of such proration, and the appropriate Party shall make the applicable payment reflecting the recalculation to the other Party).

6.6.8 Operating Expenses. All utility service charges for electricity, water, heat, air conditioning service and other utilities, elevator maintenance, common area maintenance, taxes (other than real estate taxes and assessments) such as rental taxes, other expenses incurred in operating a Project that Dunham customarily pays, and any other costs incurred in the ordinary course of business and operation of a Project shall be prorated as of the Closing Date on an accrual basis and American Spectrum Dunham Properties shall receive a credit for any accrued and unpaid amounts, and Dunham shall be debited with such amounts. If any such amounts are paid in advance, Dunham shall receive a credit from American Spectrum Dunham Properties for the portion of such amounts allocable to any period from and after the Closing Date. Dunham shall pay all such expenses that accrue prior to the Closing Date and American Spectrum Dunham Properties shall pay all such expenses accruing on the Closing Date and thereafter. To the extent possible, Dunham and American Spectrum Dunham Properties shall obtain billings and meter readings as of the Closing Date to aid in such prorations. No proration shall be made with respect to operating costs that are paid directly by Tenants under the Tenant Leases. Notwithstanding the foregoing, American Spectrum Dunham Properties shall not receive any credit for operating expenses due after the Closing to the extent that (i) Tenants are obligated under their Tenant Leases to pay such amounts, and (ii) Dunham has not received any payments from such Tenants on account of amounts due after the Closing. Further, if Dunham has paid any operating credits that are required to be reimbursed by Tenants, American Spectrum Dunham Properties shall use commercially reasonable efforts to collect such amounts on Dunham’s behalf and shall pay such amounts to Dunham promptly upon receipt. Dunham shall also have the right to collect, after Closing, such reimbursable amounts due to Dunham from Tenants, but shall not be entitled to commence any litigation or disposition or eviction proceeding against a Tenant.

-17-

Utility Deposits, plus any interest on the Utility Deposits, to which Dunham will be entitled that are held by the provider of the utilities and which are freely transferable to American Spectrum Dunham Properties, shall at the election of Dunham be assigned by Dunham to American Spectrum Dunham Properties and American Spectrum Dunham Properties shall pay to Dunham the full amount thereof at the Closing. Dunham shall retain the right to obtain a refund of any Utility Deposits which are not assigned to American Spectrum Dunham Properties, and American Spectrum Dunham Properties will cooperate with Dunham as reasonably requested (at no out-of-pocket cost or expense to Dunham) in obtaining any refund.

Furthermore, Dunham shall retain all right, title and interest in and to all performance bonds, DRE postings and other similar amounts and shall be authorized to seek a return of such amounts from and after the Closing Date and American Spectrum Dunham Properties will cooperate with Dunham, as reasonably requested by Dunham, in obtaining any refund.

6.6.9 Lease Expenses. Dunham shall pay in full all Lease Expenses incurred with respect to new leases, or amendments of existing Leases executed prior to the Closing Date without contribution or proration from American Spectrum.

6.6.10 Capital Expenditures. All capital and other improvements (including labor and materials) which are performed or contracted for by Dunham prior to the Closing Date shall be paid by Dunham, without contribution or proration from American Spectrum.

6.6.11 Existing Financing. The outstanding principal balance of the Existing Financing as of the Closing Date shall be credited toward payment of the Contribution Value. Accrued and unpaid interest payable under the Existing Financing shall be prorated on an accrual basis. Dunham shall be debited with all such interest which accrues prior to the Closing Date and American Spectrum Dunham Properties shall be credited with such amount. Upon the Closing Date, title to any impound or escrow account under the Existing Financing for taxes, insurance, capital improvements, deferred maintenance or other items shall be deemed assigned by Dunham to American Spectrum Dunham Properties and Dunham shall be credited and American Spectrum Dunham Properties debited with the amount(s) in such account(s) as of the Closing Date.

6.6.12 Contracts. Amounts payable under Contracts shall be prorated on an accrual basis. American Spectrum Dunham Properties shall receive a credit for any accrued and unpaid amounts as of the Closing Date, and Dunham shall be debited with such amounts. If any such amounts are paid in advance, including any excess cash provided by Dunham to property managers with respect to any of the Projects, Dunham shall receive a credit (and American Spectrum shall be debited) for such amounts allocable to any period on or after the Closing Date. Dunham shall pay all amounts due thereunder prior to the Closing Date and American Spectrum Dunham Properties shall pay all amounts due on the Closing Date and thereafter. There shall not be any adjustment with respect to Contracts terminated prior to the Closing and any and all accounts payable under such Contracts shall be paid by Dunham.

-18-

6.6.13 Method of Proration. All prorations shall be made on a Project-by-Project basis in accordance with customary practice in the jurisdiction in which the Project is situated, except as expressly provided in this Agreement. Dunham shall cause its accountants or employees to prepare a schedule of tentative prorations. Such prorations, if and to the extent known and agreed upon by American Spectrum as of the Closing Date, shall be paid by American Spectrum to Dunham (if the prorations result in a net credit to Dunham) by increasing the Net Contribution Value by the amount owed to Dunham, or by Dunham to American Spectrum Dunham Properties (if the prorations result in a net credit to American Spectrum Dunham Properties), by decreasing the Net Contribution Value by the amount owed to American Spectrum Dunham Properties.

6.6.14 Nevada Treasure. All real property taxes and assessments with respect to Nevada Treasure shall be pro rated between the Parties as set forth in this Section 6.6. Notwithstanding anything to the contrary contained herein, there shall be no other pro rations with respect to Nevada Treasure.

6.7 Disbursements and Other Actions by Escrow Holder. Upon the Closing, Escrow Holder shall promptly undertake all of the following in the manner herein below indicated:

6.7.1 Recordation. Cause to be recorded in the appropriate Official Records the Deeds (with documentary transfer tax, if any, to be shown by a separate unrecorded statement), and any other documents which Dunham and American Spectrum may mutually direct to be recorded in the Official Records and obtain conformed copies thereof for distribution to American Spectrum and Dunham.

6.7.2.2 Combine into two separate fully executed originals and deliver one each to Dunham and American Spectrum Dunham Properties of the two (2) original counterparts of the Tenant Lease Assignment and General Assignment executed by Dunham and American Spectrum Dunham Properties.

6.7.2.3 Deliver to American Spectrum Dunham Properties the Federal Non-Foreign Certificate, the California Non-Foreign Certificate, the Bill of Sale, the Assignment of Interest and Dunham's Affirmation Certificate executed by Dunham.

6.7.2.4 Deliver the Tenant Notices to the applicable Tenants by certified mail, return receipt requested (and deliver to Dunham, the return receipts, when received by Escrow Holder).

6.7.2.5 Deliver to Dunham American Spectrum's Affirmation Certificate executed by American Spectrum.

-19-

6.7.3 Closing Costs. Dunham shall pay (a) the premium for the Title Policy allocable to the "standard coverage" thereunder, (b) all documentary and other transfer taxes assessed on recordation of the Deeds, (c) one-half (½) of all escrow fees and costs and (d) all sales and gross receipts taxes. American Spectrum Dunham Properties shall pay (w) all transfer, assumption and prepayment fees and similar costs incurred in connection with American Spectrum Dunham Properties acquiring any Project subject to the Existing Financing, (x) any document recording charges, (y) one-half (½) of all escrow fees and costs, and (z) the premium for the Title Policy allocable to the "extended coverage" thereunder and any endorsements attached thereto. Dunham and American Spectrum shall each pay all legal and professional fees and fees of other consultants incurred by American Spectrum and Dunham, respectively. All other costs and expenses shall be allocated between on a Project-by-Project basis (where applicable) among the Projects in accordance with the customary practice in the County where the particular Project is situated.

6.8 Dunham's Deliveries to American Spectrum Dunham Properties Upon Closing. Dunham shall deliver to American Spectrum Dunham Properties, on or prior to the Closing Date, the following with respect to each Project:

6.8.1 Possession. Possession of the Projects, subject only to the rights of Tenants under the Tenant Leases and rights created under the Permitted Exceptions.

6.8.2 Tenant Leases. Originals of all of the Tenant Leases or, to the extent an original Tenant Lease is unavailable, the best copy thereof in Dunham's possession, Dunham warranting the authenticity of such duplicate original.

6.8.3 Rent Roll. A rent roll ("Rent Roll"), updated as of the Closing, certified as to its accuracy and executed by Dunham.

6.8.4 Contracts. Originals of all Contracts, or, to the extent an original of any such Contract is unavailable, the best copy thereof in Dunham's possession, Dunham warranting the authenticity of such duplicate original. American Spectrum acknowledges that the purchase and sale agreement with respect to the Project known as Calimesa which was previously entered into has been terminated.

6.8.5 Licenses and Permits. Originals of all Licenses and Permits or, to the extent an original of a License or Permit is unavailable, the best copy thereof in Dunham's possession, Dunham warranting the authenticity of such duplicate original.

6.8.6 Plans and Reports. Originals of the Plans and Reports, or to the extent an original of a Plan or Report is unavailable, the best copy thereof in Dunham's possession, Dunham warranting the authenticity of such duplicate original.

-20-

6.8.7 Keys. Keys to all entrance doors to the Improvements and keys to all Personal Property, which keys shall be properly tagged for identification.

6.8.9 Consents. A certificate from Dunham stating, (a) to the knowledge of Dunham, there are no defaults under the Existing Financing and (b) the amount of the outstanding principal due under the Existing Financing, the accrued and unpaid interest thereunder and being held in any impound or escrow account thereunder.

American Spectrum Dunham Properties shall have the right to waive the receipt of any of the foregoing at the Closing whereupon Dunham shall be required to obtain and deliver such item as soon as reasonably possible after the Closing but not later than ninety (90) days after the Closing.

6.9 Information Report. The "Reporting Person" within the meaning of Section 1.6045-4(e)(5) of the Regulations with respect to the transactions contemplated by this Agreement shall be Escrow Holder. It is agreed that Escrow Holder is an eligible person under Section 1.6045-4(e)(5)(ii) of the Regulations. Escrow Holder hereby agrees to be responsible for complying with the reporting and other requirements of Section 6045(e) of the Code. Pursuant to the Regulations, the address for the transferor and transferee are as set forth in this Agreement, and the identifying information regarding the real estate transferred is the legal description for the Land set forth in this Agreement. Escrow Holder agrees to file the form required by the Regulations between the end of the calendar year in which the Closing Date occurs and February 28 of the following calendar year. Dunham and American Spectrum agree (i) to cooperate with Escrow Holder and with each other in completing any report and/or other information required to be delivered to the Internal Revenue Service pursuant to Section 6045(e) of the Code regarding the real estate sales transaction contemplated by this Agreement, including without limitation, Internal Revenue Service Form 1099-S as such may be hereafter modified or amended by the Internal Revenue Service, or as may be required pursuant to any Regulation now or hereafter promulgated by the Treasury Department with respect thereto; (ii) that American Spectrum and Dunham, their respective employees and attorneys, and Escrow Holder and its employees may disclose to the Internal Revenue Service, this Agreement or the transaction contemplated herein as such party reasonably deems to be required to be disclosed to the Internal Revenue Service by such party pursuant to 6045(e) of the Code; (iii) that neither American Spectrum nor Dunham shall seek to hold any such party liable for the disclosure to the Internal Revenue Service of any such information; and (iv) to retain this Agreement for at least four (4) years following the end of the calendar year in which the Closing Date occurs.

6.10 Natural Hazards Disclosure. Dunham and American Spectrum acknowledge that the Disclosure Statutes provide that a seller of real property must make certain disclosures regarding certain natural hazards potentially affecting such real property, as more particularly provided therein. Dunham has ordered a Natural Hazard Disclosure Report (the "Disclosure Report") for each of the Projects from the Escrow Holder and shall deliver the Disclosure Report to American Spectrum promptly upon Dunham's receipt thereof. American Spectrum hereby agrees as follows with respect to the Disclosure Statutes and the Disclosure Report.

-21-

6.10.1 The delivery of the Disclosure Report to American Spectrum as provided above shall be deemed to satisfy all obligations and requirements of Dunham under the Disclosure Statutes.

6.10.2 Dunham shall not be liable for any error or inaccuracy in, or omission from, the information in the Disclosure Report.

6.10.3 The Disclosure Report is being provided by Dunham for purposes of complying with the Disclosure Statutes and shall not be deemed to constitute a representation or warranty by Dunham as to the presence or absence in, at or around a Project of the conditions that are the subject of the Disclosure Statutes.

6.10.4 The Disclosure Report is for Dunham and American Spectrum Dunham Properties only and is not for the benefit of, or be used for any purposes by, any other party, including, without limitation, insurance companies, lenders or the Authorities.

CONDITIONS TO CLOSING

7.1 Conditions Precedent to Buyer's Obligations. The Closing and American Spectrum's obligations with respect to the transactions contemplated by this Agreement are subject to the satisfaction, not later than the Closing Date (unless otherwise provided), of the following conditions:

7.1.1 Inspections and Studies. American Spectrum shall have approved, in American Spectrum's sole and absolute discretion, every aspect of the Projects.

7.1.2 Representations and Warranties of Dunham. Dunham's representations and warranties made in this Agreement shall be true and correct as of the Closing Date in all material respects as if made at and as of the Closing Date (except to the extent any representations and warranties address matters only as of a particular date or only with respect to a specific period of time, in which case as of such date or with respect to such period).

7.1.3 Covenants. Dunham shall have duly performed each and every covenant to be performed by Dunham under this Agreement prior to the Closing Date.

7.1.4 Title Insurance. As of the Closing Date, the Title Company be committed to issue to American Spectrum Dunham Properties one or more A.L.T.A. (Form B) Owner's Policies of Title Insurance with any title endorsements which are reasonably requested by American Spectrum and are customarily and reasonably available in the applicable jurisdiction, including, without limitation, the following: (a) Form 9 – Comprehensive endorsement (modified as appropriate for an owner's policy); (b) Form 3.1 Zoning (including parking and loading); (c) survey endorsement; (d) access endorsement; (e) if the land on which the Property is located consists of more than one parcel, a contiguity endorsement; (f) a tax parcel endorsement; (g) subdivision endorsement; (h) utility facility endorsement; (i) deletion of the creditor's rights exception; (j) deletion of the arbitration clause; (k) environmental lien endorsement; and (l) the so-called "fairway" endorsement, showing fee title to each Project vested in American Spectrum Dunham Property, subject only to the Permitted Exceptions (collectively, the "Title Policy") (other than Nevada Treasure, which shall be vested in Nevada Treasure). Dunham shall use its commercially reasonable efforts to cause any Unacceptable Exceptions to be satisfied, terminated, reconveyed or otherwise expunged from the Official Records prior to the Closing Date. The Title Policy shall be issued with liability in an amount equal to the Contribution Value. American Spectrum shall have the right, at no cost to American Spectrum, to require the Title Company to obtain coinsurance or facultative reinsurance (together with agreements in a form and content satisfactory to American Spectrum providing American Spectrum Dunham Properties with the right of "direct access" against the reinsurance) with respect to the Title Policy in such amount and with such title companies as American Spectrum determines in American Spectrum's reasonable discretion.

-22-

7.2 Conditions Precedent to Dunham's Obligations. The Closing and Dunham's obligations with respect to the transactions contemplated by this Agreement are subject to the satisfaction, not later than the Closing Date (unless otherwise provided), of the following conditions:

7.2.1 Representations and Warranties of American Spectrum Realty. American Spectrum's representations and warranties set forth in this Agreement being true and correct as of the Closing Date in all material respects as if made at and as of the Closing Date.

7.2.2 Covenants of American Spectrum. American Spectrum shall have duly performed each and every covenant to be performed by American Spectrum under this Agreement prior to the Closing Date.

7.2.3 Articles Supplementary. An Articles Supplementary (the "Articles Supplementary") in the form attached hereto as Exhibit 7.2.3 shall (a) have been filed with and approved by the Maryland Secretary of State not later than three (3) business days prior to the Closing Date; and (b) shall have been filed with and approved by the principal national securities exchange on which American Spectrum Realty's securities are listed or admitted to trading.

DUNHAM'S REPRESENTATIONS AND WARRANTIES

In addition to any express agreements of Dunham contained herein, the following constitute representations and warranties of Dunham to American Spectrum. All of the representations in this Article 8 are qualified by the matters set forth on the Schedules attached hereto.

8.1.1 Due Formation. AMI is a corporation duly formed and validly existing under the laws of the State of California and has the requisite corporate power and authority to carry on its business as now being conducted. Daily Fund, Intermediate Fund and Semi-Annual Fund, and each of them, are limited partnerships duly formed and validly existing under the laws of the State of California and are duly qualified or licensed in the State of California to do business as a limited partnership and are in good standing in such other states to the extent required by law. Each of the Dunham Funds has previously filed a Certificate of Dissolution with the California Secretary of State to affect the dissolution of such party pursuant to the affirmative consent of a majority of the Limited Partners in each such fund. Each of the Dunham Fund’s ability to conduct business and otherwise bind the Fund continues until such Fund ultimately files a Certificate of Cancellation with the California Secretary of State.

-23-

8.1.2 Power. Dunham has the legal power, right and authority to enter into this Agreement and the instruments referenced in this Agreement, and to consummate the transactions contemplated by this Agreement.

8.1.3 Requisite Action. All requisite action has been taken by Dunham in connection with (a) the entering into of this Agreement and the instruments referenced in this Agreement, (b) the performance of its obligations under this Agreement and (c) the consummation of the transactions contemplated by this Agreement. No other consent of any member, partner, shareholder, creditor, investor, judicial or administrative body, Authority or other Person is required in connection therewith.

8.1.4 Authority. The individuals executing this Agreement and the instruments referenced herein on behalf of Dunham have the legal power, right, and actual authority to bind Dunham, to the terms and conditions hereof and thereof.

8.1.5 Validity. This Agreement and all documents required hereby to be executed by Dunham are valid, legally binding obligations of and enforceable against Dunham, in accordance with their terms, subject only to applicable bankruptcy, insolvency, reorganization, moratorium laws or similar laws or equitable principles affecting or limiting the rights of contracting parties generally.