Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST FINANCIAL BANCORP /OH/ | a8-k122013mergerffbcinsight.htm |

| EX-99.1 - EXHIBIT 99.1 - FIRST FINANCIAL BANCORP /OH/ | exhibit991ffbc-insightanno.htm |

First Financial Bancorp Acquisitions of The First Bexley Bank and Insight Bank December 20, 2013 EXHIBIT 99.2

2 Forward Looking Statement Certain statements contained in this release which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act (the ‘‘Act’’). Such statements include certain plans, expectations, goals, projections, and benefits relating to the merger transaction among First Financial, First Bexley and Insight, which are subject to numerous assumptions, risks, and uncertainties. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” ‘‘intends,’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Please refer to First Financial’s Annual Report on Form 10-K for the year ended December 31, 2012, as well as its other filings with the SEC, for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward-looking statements. In addition to factors previously disclosed in reports filed by First Financial with the SEC, risks and uncertainties for First Financial, First Bexley, Insight and the combined institution include, but are not limited to: the possibility that any of the anticipated benefits of the proposed mergers will not be realized or will not be realized within the expected time period; the risk that integration of First Bexley’s and/or Insight’s operations with those of First Financial will be materially delayed or will be more costly or difficult than expected; the inability to close the mergers in a timely manner; the inability to complete the mergers due to the failure of First Bexley and/or Insight shareholders to adopt the merger agreement; diversion of management's attention from ongoing business operations and opportunities; the failure to satisfy other conditions to completion of the mergers, including receipt of required regulatory and other approvals; the failure of the proposed mergers to close for any other reason; the challenges of integrating and retaining key employees; the effect of the announcement of the mergers on First Financial’s, First Bexley’s, Insight’s or the combined company's respective customer relationships and operating results; the possibility that the mergers may be more expensive to complete than anticipated, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and fluctuations. All forward-looking statements included in this presentation are based on information available at the time of distribution. Neither First Financial, First Bexley nor Insight assume any obligation to update any forward-looking statement. Additional Information This communication does not constitute an offer of any securities for sale. This communication is being made in respect of proposed transactions involving First Financial and First Bexley and First Financial and Insight. In connection with the proposed transactions, First Financial intends to file with the SEC registration statements on Form S-4 to register the shares of its common stock to be issued to the shareholders of First Bexley and Insight. The registration statements will include a proxy statement/prospectus which will be sent to the shareholders of First Bexley and Insight in advance of special meetings of shareholders that will be held to consider the proposed mergers. INVESTORS AND SECURITY HOLDERS OF FIRST BEXLEY AND INSIGHT ARE URGED TO READ THE PROXY STATEMENTS/PROSPECTUS’ AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTIONS BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT FIRST FINANCIAL, FIRST BEXLEY AND INSIGHT AND THE PROPOSED TRANSACTIONS. Investors and security holders may obtain free copies of these documents through the website maintained by the SEC at http://www.sec.gov. Investors may also obtain these documents, without charge, from First Financial’s website at http://www.bankatfirst.com or by contacting First Financial’s investor relations department at (877) 322-9530. First Bexley and Insight and their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions. Information about the directors and executive officers, as well as additional information regarding the interests of such participants in the proposed transactions, will be included in the proxy statements/prospectus’ when they becomes available. Forward Looking Statement and Additional Information

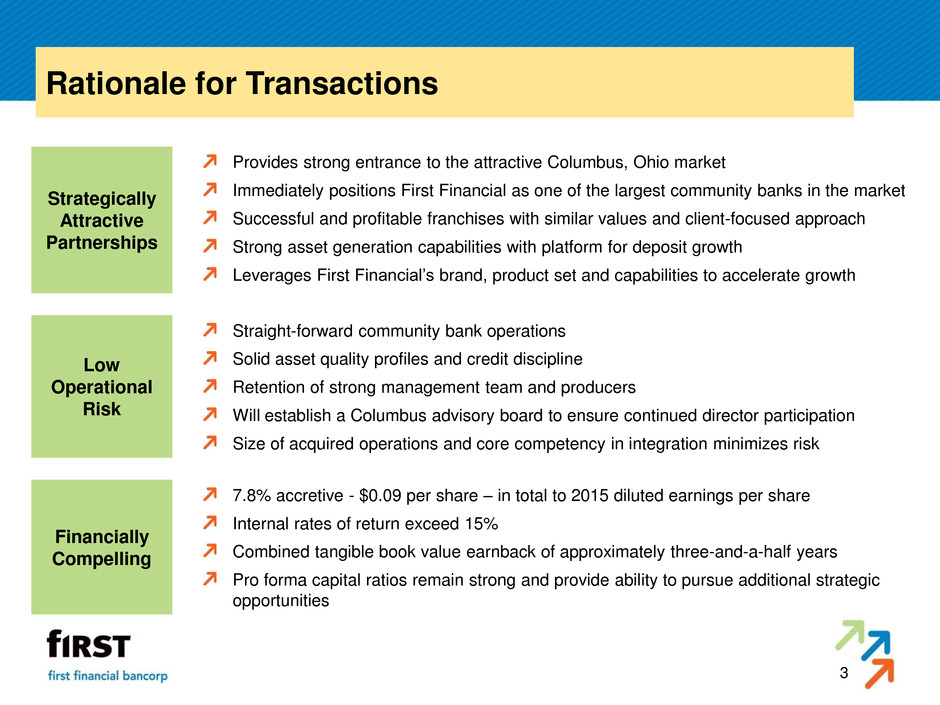

3 Rationale for Transactions Strategically Attractive Partnerships Provides strong entrance to the attractive Columbus, Ohio market Immediately positions First Financial as one of the largest community banks in the market Successful and profitable franchises with similar values and client-focused approach Strong asset generation capabilities with platform for deposit growth Leverages First Financial’s brand, product set and capabilities to accelerate growth Low Operational Risk Straight-forward community bank operations Solid asset quality profiles and credit discipline Retention of strong management team and producers Will establish a Columbus advisory board to ensure continued director participation Size of acquired operations and core competency in integration minimizes risk Financially Compelling 7.8% accretive - $0.09 per share – in total to 2015 diluted earnings per share Internal rates of return exceed 15% Combined tangible book value earnback of approximately three-and-a-half years Pro forma capital ratios remain strong and provide ability to pursue additional strategic opportunities

4 Transaction Overview The First Bexley Bank Insight Bank Deal Value $44.5 million $36.6 million Consideration1 Fixed price of $30.50 per common share 80% stock / 20% cash For explanatory purposes: exchange ratio of 1.473 shares of First Financial (2,035,000 shares) Options are cashed out Fixed price of $20.50 per common share 80% stock / 20% cash For explanatory purposes: exchange ratio of 0.990 shares of First Financial (1,614,000 shares) Options are cashed out Board Seat Intend to appoint one director to First Financial’s board Intend to appoint one director to First Financial’s board Due Diligence Business lines, operations, risk management and compliance Commercial, consumer and mortgage loan review Business lines, operations, risk management and compliance Commercial, consumer and mortgage loan review Required Approvals First Bexley shareholders Regulatory and customary closing conditions Insight Bank shareholders Regulatory and customary closing conditions Closing First half 2014 First half 2014 1 Example exchange ratio and shares issued based on First Financial’s closing price on December 17, 2013; the final exchange ratio will be based on the average closing price of First Financial’s stock over the 20-consecutive trading day period ending on the third business day prior to close.

5 Transaction Assumptions The First Bexley Bank Insight Bank Loan Mark Assumptions Credit mark of 1.75% on total gross loans, or $4.5 million Interest rate mark of $3.2 million Credit mark of 1.75% on total gross loans, or $2.9 million Interest rate mark of $4.7 million Cost Savings 20% of noninterest expenses 75% phased in first full year 30% of noninterest expenses 75% phased in first full year Core Deposit Intangible CDI of 1.5%, or $2.0 million, on non-time deposits Eight year amortization using DDB CDI of 3.0%, or $2.2 million, on non-time deposits Eight year amortization using DDB Deposit Mark Assumptions Rate mark of $1.6 million on time deposits Rate mark of $0.9 million on time deposits Restructuring Costs Pre-tax restructuring costs of $3.5 million Pre-tax restructuring costs of $4.5 million Balance Sheet Restructuring None Redemption of $4.25 million of SBLF pref. Redemption of $10.0 million FHLB adv. Revenue Synergies Several areas of opportunity but excluded for modeling purposes Several areas of opportunity but excluded for modeling purposes

6 Entrance to the Columbus, Ohio Market First Financial First Bexley Insight Bank Third fastest growing metropolitan market in the Midwest Population of 1.9 million with projected growth of 4.3% through 2017 – highest in Ohio Diverse economy anchored by 15 Fortune 1000 companies Pro Forma Deposit Market Share Columbus MSA FDIC Deposit Data as of June 30, 2013 - Holding Company Level Number Total Market 2013 of Deposits Share Rank Name City, State Branches ($000s) (%) 1 Huntington Bancshares Inc. Columbus, OH 97 14,501,332 31.4 2 JPMorgan Chase & Co. New York, NY 80 10,889,297 23.6 3 PNC Financia l Services Group Inc. Pi ttsburgh, PA 62 5,901,337 12.8 4 Fi fth Third Bancorp Cincinnati , OH 59 4,171,643 9.0 5 Park National Corp. Newark, OH 32 1,791,588 3.9 6 KeyCorp Cleveland, OH 27 1,671,130 3.6 7 U.S. Bancorp Minneapol is , MN 40 1,263,717 2.7 8 WesBanco Inc. Wheel ing, WV 11 506,517 1.1 9 Heartland BancCorp Gahanna, OH 12 478,154 1.0 10 Firs tMerit Corp. Akron, OH 15 459,808 1.0 11 Union Savings Bank Cincinnati , OH 7 448,137 1.0 12 DCB Financia l Corp Lewis Center, OH 16 447,607 1.0 13 Pro Forma First Financial Cincinnati, OH 2 414,336 0.9 16 First Bexley Bank Bexley, OH 1 248,065 0.5 21 Insight Bank Worthington, OH 1 166,271 0.4 Other institutions 122 4,195,532 9.1 Market total 559 46,244,391$ 100.0 Source: SNL Financial LC Columbus MSA Market Highlights1 1 Source: the Columbus Chamber, SNL Financial LC

7 Historical Financial Performance The First Bexley Bank Insight Bank As of or for the twelve months Year to date As of or for the twelve months Year to date ended December 31 September 30 ended December 31 September 30 (Dollars in millions) 2011 2012 2013 1 2011 2012 2013 1 Selected balance sheet amounts: Total assets $186.1 $229.9 $295.4 $157.3 $186.1 $200.2 Growth 15.2% 23.5% 38.0% 18.4% 18.3% 10.2% Total loans 159.1 210.6 259.4 129.5 144.9 165.2 Growth 28.6% 32.4% 30.9% 12.9% 11.8% 18.7% Total deposits 167.8 208.7 271.1 125.3 152.1 165.4 Growth 14.3% 24.4% 39.9% 20.7% 21.4% 11.7% Tangible common shareholders' equity 17.1 19.8 22.7 17.1 19.0 20.1 Earnings and profitability: Net income 2 $1.9 $2.7 $2.9 $1.6 $1.7 $1.1 Return on average assets 1.13% 1.28% 1.46% 1.13% 1.02% 0.78% Return on average equity 13.04% 14.48% 18.12% 9.11% 7.88% 6.37% Net interest margin 3.98% 4.21% 4.10% 3.95% 3.95% 3.49% Asset quality: NPLs / total loans 1.85% 1.36% 0.72% 0.72% 1.98% 1.33% NPAs / total assets 1.58% 1.25% 0.71% 0.59% 1.54% 1.10% Allowance for loan losses / total loans 1.41% 1.31% 1.24% 1.55% 1.51% 1.34% NCOs / average loans and leases 0.14% 0.72% 0.26% 0.00% 0.18% 0.06% Allowance for loan losses / NPLs 76.51% 96.21% 173.76% 215.76% 76.26% 100.14% 1 Balance sheet growth rates and NCOs / average loans and leases annualized 2 Insight Bank's 2013 YTD earnings reflect significant investments made in hiring commercial lenders Source: SNL Financial LC; call report data

8 Transaction Pricing and Financial Impact The First Insight (Dollars in millions, except per share amounts) Bexley Bank Bank Transaction Pricing: Price per share $30.50 $20.50 Total transaction value $44.5 $36.6 Tangible book value per share $16.45 $12.35 Price per share / tangible book value per share 185.4% 166.0% Total transaction value to total common equity 195.9% 181.8% Total transaction value to LTM earnings 12.1x 20.9x Financial Impact: 2014 accretion to diluted earnings per share $0.02 - $0.03 $0.01 2015 accretion to diluted earnings per share $0.06 $0.03 Pro forma dilution to tangible book value (%) (1.86%) (1.17%) Pro forma dilution to tangible book value ($) ($0.19) ($0.12) Tangible book value dilution earnback (years) < 3.5 ~ 3.5 Internal rate of return >15% >15%

9 Pro Forma Balance Sheet and Capital Ratios As of September 30, 2013 First Financial The First Insight Pro (Dollars in millions, except per share amounts) Bancorp Bexley Bank Bank Forma 1 Selected balance sheet amounts: Total assets $6,253.4 $295.4 $200.2 $6,750.4 Uncovered loans 3,430.9 259.4 165.2 3,853.1 Total deposits 4,729.0 271.1 165.4 5,167.7 Tangible common shareholders' equity 590.7 22.7 20.1 610.1 Tangible book value per share $10.24 $16.45 $12.35 $9.93 Balance sheet ratios: Total loans / total deposits 83.5% 95.7% 99.9% 84.6% Allowance for loan losses / total loans (uncovered) 1.33% 1.24% 1.34% 1.18% Tangible common equity / tangible assets 9.60% 7.69% 10.05% 9.22% Regulatory capital ratios: Tier 1 leverage ratio 10.29% 8.10% 11.99% 9.91% Common equity tier 1 ratio 15.26% 9.69% 15.58% 14.40% Tier 1 capital ratio 15.26% 9.69% 15.58% 14.40% Total capital ratio 16.53% 10.94% 16.83% 15.56% 1 Includes preliminary assumptions on merger and purchase accounting adjustments

10 Summary of Transactions Entering the growth-oriented Columbus market through the acquisition of two highly successful institutions with similar client-focused business models to First Financial Strong business development teams will have access to greater resources, higher lending limits and wider commercial and consumer product sets to drive further growth Board representation and establishment of local Columbus advisory board to ensure well-connected directors remain committed to the future success of the organization Attractive financial returns for shareholders before factoring in potential revenue synergies resulting from the enhanced product set and capabilities Integration risk is manageable and will not be a distraction to current and future strategic initiatives Pro forma capital levels are strong, leaving First Financial well-positioned to capitalize on future organic growth and acquisition opportunities

First Financial Bancorp Acquisitions of The First Bexley Bank and Insight Bank December 20, 2013