Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Dealertrack Technologies, Inc | v363494_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - Dealertrack Technologies, Inc | v363494_ex2-1.htm |

| EX-10.1 - EXHIBIT 10.1 - Dealertrack Technologies, Inc | v363494_ex10-1.htm |

| EX-99.1 - EXHIBIT 99.1 - Dealertrack Technologies, Inc | v363494_ex99-1.htm |

© 2013. All Rights Reserved. © 2013. All Rights Reserved. Uniting to Transform Automotive Retail

© 2013. All Rights Reserved. 2 Statements in this presentation regarding the expected benefits of the acquisition of Dealer . com, the long - term outlook for Dealertrack Technologies’ business , and all other statements in this release other than the recitation of historical facts are forward - looking statements (as defined in the Private Securities Litigation Reform Act of 1995 ) . These statements involve a number of risks, uncertainties and other factors that could cause actual results, performance or achievements of Dealertrack Technologies to be materially different from any future results, performance or achievements expressed or implied by these forward - looking statements . Factors that might cause such a difference include : economic trends that affect the automotive retail industry or the indirect automotive financing industry including the number of new and used cars sold ; reductions in auto dealerships ; increased competitive pressure from other industry participants, including Open Dealer Exchange, RouteOne, CUDL, Finance Express and AppOne ; the impact of some vendors of software products for automotive dealers making it more difficult for Dealertrack Technologies’ customers to use Dealertrack Technologies’ solutions and services ; security breaches, interruptions, failures and/or other errors involving Dealertrack Technologies’ systems or networks ; the failure or inability to execute any element of Dealertrack Technologies’ business strategy, including selling additional products and services to existing and new customers ; Dealertrack Technologies’ success in implementing an ERP system ; the volatility of Dealertrack Technologies’ stock price ; new regulations or changes to existing regulations ; the integration of recent acquisitions and the expected benefits, as well as the integration and expected benefits of any future acquisitions that Dealertrack Technologies may pursue ; Dealertrack Technologies’ success in expanding its customer base and product and service offerings, the impact of recent economic trends, and difficulties and increased costs associated with raising additional capital ; the impairment of intangible assets, such as trademarks and goodwill ; and other risks listed in Dealertrack Technologies’ reports filed with the Securities and Exchange Commission (SEC), including its most recent Annual Report on Form 10 - K and its Quarterly Reports on Form 10 - Q . These filings can be found on Dealertrack Technologies’ website at www . Dealertrack . com and the SEC’s website at www . sec . gov . Forward - looking statements included herein speak only as of December 19 , 2013 and Dealertrack Technologies disclaims any obligation to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances, except as required by law . Safe Harbor for Forward - Looking Statements

© 2013. All Rights Reserved. Dealertrack Technologies To Acquire Dealer.com 3 © 2013. All Rights Reserved. Chairman & CEO – Mark O’Neil

© 2013. All Rights Reserved. 4 Transaction Summary ▪ $620 million in cash and approximately 8.7 million shares of Dealertrack stock, for a total consideration of approximately $987 million based on 20 - day volume weighted average price (VWAP) per the merger agreement ▪ The new issuance of stock equates to less than 20% of our shares outstanding Purchase Price Financing Income Statement Impact ▪ Full bank commitment for a $625 million 7 - year senior secured term loan credit facility, with a new senior secured revolving credit facility of $200 million ▪ Purchase price and related transaction fees to be funded by the proceeds of the senior secured credit facilities, Dealertrack’s equity, and cash on hand ▪ Initial Net Debt / LTM EBITDA leverage ratio expected to be between 4.4x to 4.6x ▪ Expect multi - year total organic revenue in excess of 20% for combined company ▪ Transaction is expected to be accretive to diluted adjusted net income per share ▪ Expect net run - rate synergies of approximately $10 million annually ▪ Entered into a stock purchase merger agreement with Dealer.com and a majority of it’s stockholders ▪ Unanimously approved by Dealertrack’s Board of Directors ▪ No additional stockholder approvals required ▪ Expected closing during the first quarter of 2014 ▪ Subject to customary closing conditions and regulatory approvals, including HSR ▪ New Digital Marketing Group combining Dealer.com and Dealertrack’s current Interactive solution under the leadership of Dealer.com CEO, Rick Gibbs The Transaction Balance Sheet Impact ▪ Strong forecasted cash flow expected to drive deleveraging over the term of the senior secured term loan credit facility ▪ Combined company presents strong credit profile

© 2013. All Rights Reserved. 5 ▪ A leader in the digital automotive marketing space in North America ▪ Hosts websites for over 7,000 Dealers in the United States as will as a significant customer base in Canada ▪ Consistently increasing average spend per dealership ▪ Rapidly growing digital advertising business just scratching the surface of a massive opportunity ▪ Long - term track record of outstanding double - digit revenue growth ▪ Unique culture of excellence and innovation with a proven world - class management team Dealer.com Overview

© 2013. All Rights Reserved. 6 Coming Together Coming together around a shared vision. “Deliver the market leading suite of integrated technologies capable of transforming automotive retailing.” 2001 The platform that revolutionized automotive credit. 2007 SaaS tools to - drive end - to - end efficiency . 2013 and Beyond Enabling the transformation of automotive retail. Specific Needs Broader Needs Higher Order Needs 1998 Web - based solutions to make car buying better. Automotive Retail Marketplace

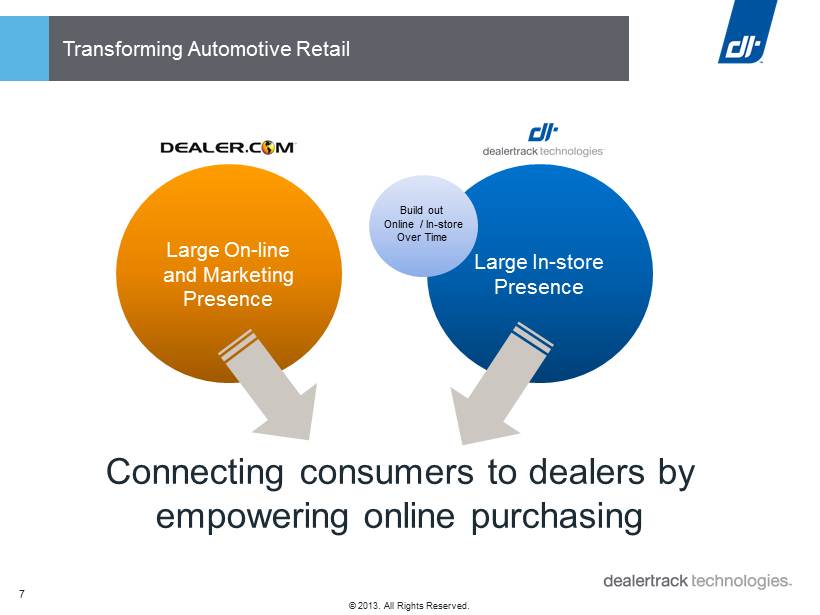

© 2013. All Rights Reserved. 7 Transforming Automotive Retail Large On - line and Marketing Presence Large In - store Presence Build out Online / In - store Over Time Connecting consumers to dealers by empowering online purchasing

© 2013. All Rights Reserved. 8 ▪ Strengthens our dealer and OEM relationships ▪ Further shifts our revenue mix to subscription - based recurring revenue ▪ Accelerates our revenue growth forecast over the next several years ▪ Significant synergy opportunities ▪ Consistent with our growth strategy and focus on integrating complementary technologies and diversification of our revenue base Transaction Rationale Realizing our shared vision for the technology - enabled transformation of automotive retail Providing the comprehensive suite of integrated workflow for automotive dealers

© 2013. All Rights Reserved. Dealer.com Overview 9 © 2013. All Rights Reserved. Dealer.com – CEO Rick Gibbs

© 2013. All Rights Reserved. 10 We Drive Retail Automotive Our vision is to innovate software and services that transform today’s digital consumer experiences into tomorrow’s retail automotive strategies.

© 2013. All Rights Reserved. 11 17,850 Franchise Dealers… © 2013. All Rights Reserved.

© 2013. All Rights Reserved. 12 And we have 7, 000* of them. © 2013. All Rights Reserved. * Indicates approximation for US Dealers

© 2013. All Rights Reserved. 13 Dealer.com Snapshot 1 9 9 8 Dealer.com Was Founded 8 3 0 Employees 8 7 % Of Top 125 Dealer Groups 1 3, 0 0 0 Franchise Websites 3 2 M M Unique Visitors / Month 4 3 . 7 M M Vehicles Viewed / Month A Platform at Scale ▪ Steady gains in market share in the U.S. and Canada ▪ Growth in our average revenue per dealer and advertising dollars captured (U.S. & Canada) $2 0 B N 2018 Total Advertising Addressable Market 7,0 0 0 * US rooftops 1. Google Analytics. 2. Borrell Associates: Addressable market for online advertising spend at the Tier 3 franchise dealer level. * Indicates approximation. (2) (1)

© 2013. All Rights Reserved. 14 Industry Shift That Requires Our Products Consumer Control Desire/Demand Dealer Control Pre - Owned Data Margin Price Control Consumer Control Pre - Owned Data Word of Mouth/Reach Margin Price Control Dealer Control Supply / Warranty For decades, dealers controlled the majority of the car buying experience. Consumers are pressuring dealer’s profit margins while challenging them to keep pace technologically. Consumer Information Revolution We Shift the Balance And Service The Dealer…First. By providing connectivity and visibility across their marketing and operations, so they can better manage their business. Inventory Merchandising Digital Marketing Digital Retailing Customer Engagement

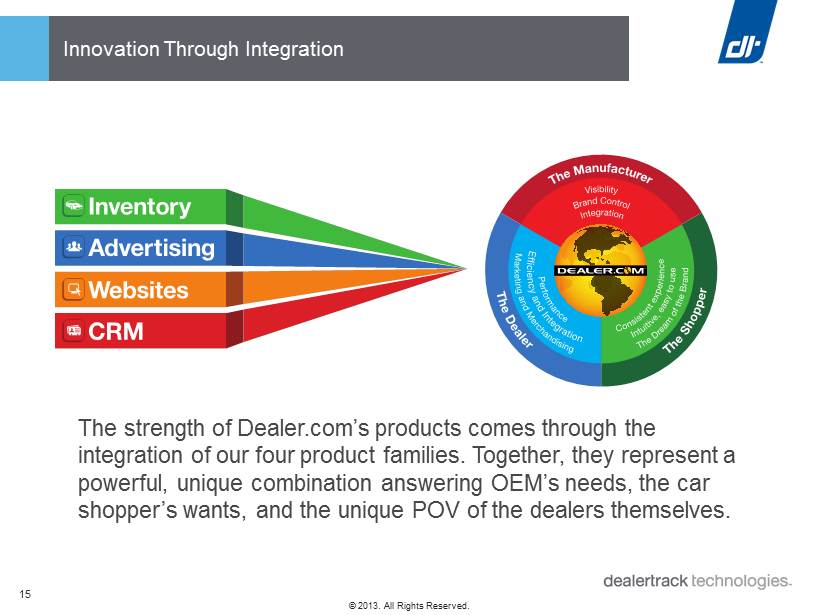

© 2013. All Rights Reserved. 15 Innovation Through Integration The strength of Dealer.com’s products comes through the integration of our four product families. Together, they represent a powerful, unique combination answering OEM’s needs, the car shopper’s wants, and the unique POV of the dealers themselves.

© 2013. All Rights Reserved. 16 Research Drives Our Insights Whether it ’ s a deep dive into digital channels with massive — but misunderstood — momentum, or a pioneering point of view on where the future of online auto marketing is going, research underpins our opinions and our insights. Propensity to Engage (P2E) Engaged viewers are 33% of a dealer’s site visitors. Social Influence 13% of Facebook users are interested in cars. The Value of VDPs Mobile Behaviors Multiple VDP Views = Decreased Time on Lot An uncompromised experience is the baseline expectation.

© 2013. All Rights Reserved. 17 Dealer.com’s Core Growth Strategy • New subscribing dealer relationships • Expand number of rooftops through OEM relationships Grow Install Base • Provide a comprehensive suite of solutions • Add additional entry points such as CRM and Advertising Greater Wallet Share of Existing Customers • Innovate new features, functions and integration for products • Introduce new products and cross - sell into existing customer base New Products and Services • Increase product adoption through cross selling dealer groups and OEM programs Deeper Product Adoption

© 2013. All Rights Reserved. 18 Presentation is Proprietary Chairman & CEO – Mark O’Neil

© 2013. All Rights Reserved. 19 ■ A leader in the digital automotive marketing space in North America ■ Over 7,000 dealers with solutions in the U.S. plus significant number of customer in Canada ■ Broad base of dealer and OEM relationships ■ Rapidly growing digital advertising business with significant runway Positions Combined Company as an Industry Leader A leading provider of end - to - end, high - value, web - based software and services to all major segments of the automotive retail industry + ■ A leading provider of web - based software and services that enhance the efficiency and profitability for all major segments of the automotive retail industry ■ Largest online credit application network in North America ■ Over 18,000 dealers with subscription solutions in the U.S. and Canada A leading provider of integrated technologies, transforming automotive retailing…

© 2013. All Rights Reserved. 20 Compelling Combination for All Stakeholders ▪ Complementary technologies and services enhance the combined company’s suite of solutions available to dealer and OEM clients by adding best - in - class digital marketing software and services ▪ Provides dealer and OEM clients with connectivity and visibility across marketing and operations so they can better manage their respective businesses Customers Investors Employees ▪ Transaction is expected to be accretive to diluted adjusted net income per share, starting in calendar year 2014 ▪ Dealer.com gives Dealertrack a strong growth platform and further shifts business mix to subscription - based recurring revenue ▪ Strong cash flow profile enables near - term deleveraging ▪ Significant synergy opportunities ▪ Dealer.com complements Dealertrack’s commitment to enhance efficiency and profitability for all major segments of the automotive retail industry ▪ Shared values and culture

© 2013. All Rights Reserved. 21 Presentation is Proprietary Financials Dealertrack – CFO Eric Jacobs

© 2013. All Rights Reserved. 22 Transaction Details Purchase Price Financing Income Statement Impact ▪ Expect multi - year total organic revenue in excess of 20% for combined company ▪ Transaction is expected to be accretive to diluted adjusted net income per share ▪ Expect net run - rate synergies of approximately $10 million annually Balance Sheet Impact ▪ $620 million in cash and approximately 8.7 million shares of Dealertrack stock, for a total consideration of approximately $987 million based on 20 - day volume weighted average price (VWAP) per the merger agreement ▪ The new issuance of stock equates to less than 20% of our shares outstanding ▪ Full bank commitment for a $625 million 7 - year senior secured term loan credit facility, with a new senior secured revolving credit facility of $200 million ▪ Purchase price and related transaction fees to be funded by the proceeds of the senior secured credit facilities, Dealertrack’s equity, and cash on hand ▪ Initial Net Debt / LTM EBITDA leverage ratio expected to be between 4.4x to 4.6x ▪ Strong forecasted cash flow expected to drive deleveraging over the term of the senior secured credit facility ▪ Combined company presents strong credit profile

© 2013. All Rights Reserved. 23 Advertising Business Model Mirrors Subscription Model ▪ Strong revenue visibility ▪ Significant recurring revenue ▪ High renewal rates Examples of Customer Advertising Spend Trends ($ in 000s) $0 $50 $100 $150 $200 $250 $300 $350 $400 2013-01 2013-02 2013-03 2013-04 2013-05 2013-06 2013-07 2013-08 2013-09 2013-10

© 2013. All Rights Reserved. 24 $87.0 $109.2 $124.9 $40.1 $73.5 $98.6 $127.1 $182.6 $223.5 $0.0 $100.0 $200.0 $300.0 $400.0 2011 2012 LTM 9/30/13 Subscription Media & Other Dealer.com Financial Performance Revenue

© 2013. All Rights Reserved. Thank You 25 Presentation is Proprietary Q&A

© 2013. All Rights Reserved. Appendix 26 Presentation is Proprietary

© 2013. All Rights Reserved. 27 ▪ 99% coverage of the web from general interest to in - market car shoppers ▪ Paid search ▪ Network display ▪ Premium display ▪ Social media ▪ Mobile ▪ Cross - channel and re - targeting Introduction To Dealer.com’s Advertising Business ▪ Technology - driven digital marketing solution for automotive retail ▪ Digital spend management and ROI optimization ▪ Create, serve and track customized ads across channels ▪ Real - time bidding engine ▪ Dashboards, analytics and strategic consulting ▪ Fully integrated with dealer web site offerings Digital Advertising: Extending the Platform’s Consumer Reach $8,708 $20,096 $0 $5,000 $10,000 $15,000 $20,000 $25,000 2013 2018 ($ in millions) Large and Growing Addressable Market (1) Products and Services Channels Source: Borrell, 2013. 1. Addressable market online advertising spend at the Tier 3 franchise dealer level.