Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TWO HARBORS INVESTMENT CORP. | a8kq3-2013investorpresenta.htm |

Third Quarter 2013 Investor Presentation

CONFIDENTIAL Safe Harbor Statement F O R W A R D - L O O K I N G S T A T E M E N T S This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2012, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our residential mortgage-backed securities, the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover credit losses in our portfolio, changes in interest rates and the market value of our assets, the availability of financing, the availability of target assets at attractive prices, our ability to manage various operational risks associated with our business, our ability to maintain our REIT qualification, limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, our ability to acquire mortgage loans or securitize the mortgage loans we acquire, our involvement in securitization transactions, the timing and profitability of our securitization transactions, the risks associated with our securitization transactions, our ability to acquire mortgage servicing rights, the impact of new or modified government mortgage refinance or principal reduction programs, unanticipated changes in overall market and economic conditions, and our exposure to claims and litigation, including litigation arising from our involvement in securitization transactions. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. 2

Mission-Based Strategy OUR MISSION IS TO BE RECOGNIZED AS AN INDUSTRY -LEADING MORTGAGE REIT: • We are the largest hybrid mortgage REIT focused on investing in residential mortgage assets, with a market capitalization of $3.3 billion.(1) BENEFITS OF OUR HYBRID MORTGAGE REIT MODEL: • As a hybrid mortgage REIT, we have the flexibility to take advantage of opportunities in both the Agency and non- Agency residential mortgage-backed securities (RMBS) sectors and unsecuritized mortgage assets. Our target assets include: ― RMBS ― Residential mortgage loans ― Mortgage servicing rights (MSRs) ― Other financial assets OBJECT IVES: • Optimize stockholder value • Provide attractive risk-adjusted returns • Maintain best-in-class disclosure and corporate governance • Logically diversify our business model 3 (1) Source: Bloomberg, as of December 3, 2013.

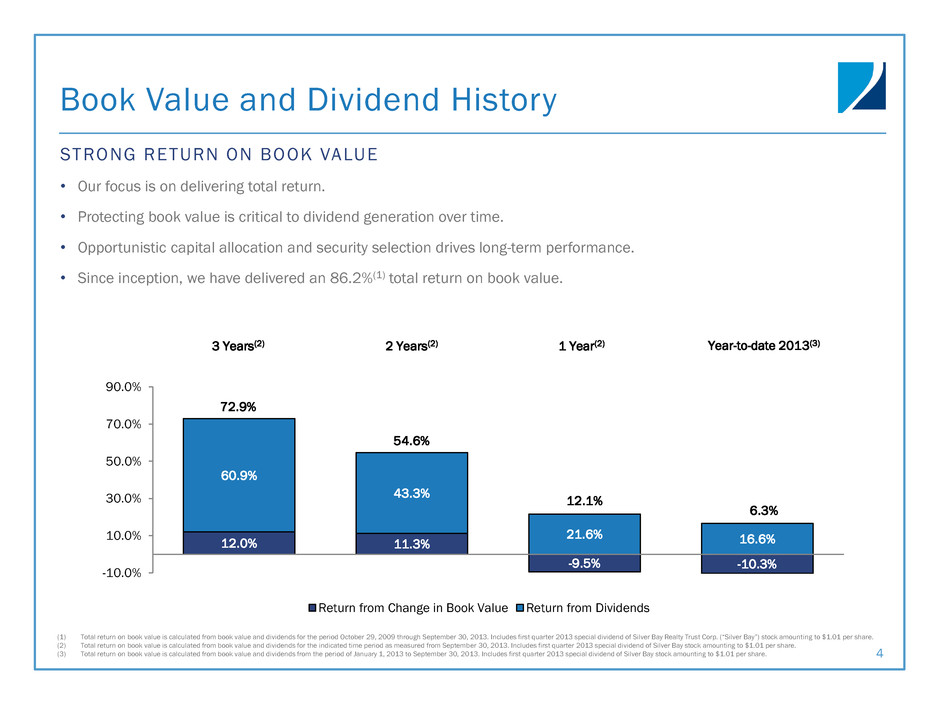

Book Value and Dividend History STRONG RETURN ON BOOK VALUE • Our focus is on delivering total return. • Protecting book value is critical to dividend generation over time. • Opportunistic capital allocation and security selection drives long-term performance. • Since inception, we have delivered an 86.2%(1) total return on book value. 4 12.0% 11.3% -9.5% -10.3% 60.9% 43.3% 21.6% 16.6% -10.0% 10.0% 30.0% 50.0% 70.0% 90.0% Return from Change in Book Value Return from Dividends (1) Total return on book value is calculated from book value and dividends for the period October 29, 2009 through September 30, 2013. Includes first quarter 2013 special dividend of Silver Bay Realty Trust Corp. (“Silver Bay”) stock amounting to $1.01 per share. (2) Total return on book value is calculated from book value and dividends for the indicated time period as measured from September 30, 2013. Includes first quarter 2013 special dividend of Silver Bay stock amounting to $1.01 per share. (3) Total return on book value is calculated from book value and dividends from the period of January 1, 2013 to September 30, 2013. Includes first quarter 2013 special dividend of Silver Bay stock amounting to $1.01 per share. 6.3% 12.1% 54.6% 72.9% Year-to-date 2013(3) 1 Year(2) 2 Years(2) 3 Years(2)

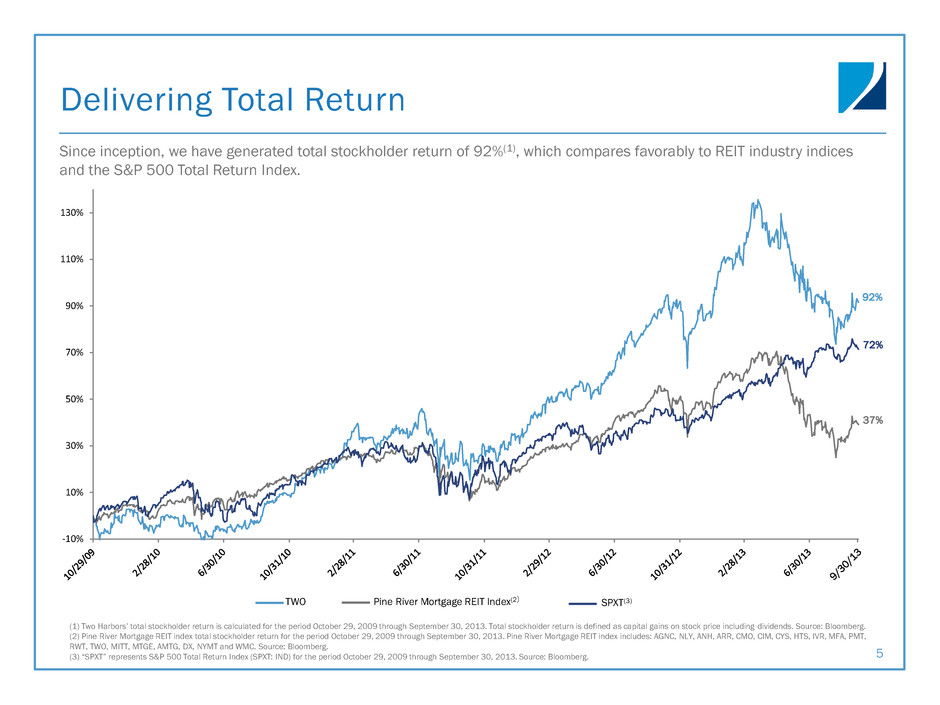

-10% 10% 30% 50% 70% 90% 110% 130% Delivering Total Return Since inception, we have generated total stockholder return of 92%(1), which compares favorably to REIT industry indices and the S&P 500 Total Return Index. (1) Two Harbors’ total stockholder return is calculated for the period October 29, 2009 through September 30, 2013. Total stockholder return is defined as capital gains on stock price including dividends. Source: Bloomberg. (2) Pine River Mortgage REIT index total stockholder return for the period October 29, 2009 through September 30, 2013. Pine River Mortgage REIT index includes: AGNC, NLY, ANH, ARR, CMO, CIM, CYS, HTS, IVR, MFA, PMT, RWT, TWO, MITT, MTGE, AMTG, DX, NYMT and WMC. Source: Bloomberg. (3) “SPXT” represents S&P 500 Total Return Index (SPXT: IND) for the period October 29, 2009 through September 30, 2013. Source: Bloomberg. 5 TWO Pine River Mortgage REIT Index(2) SPXT(3) 92% 72% 37%

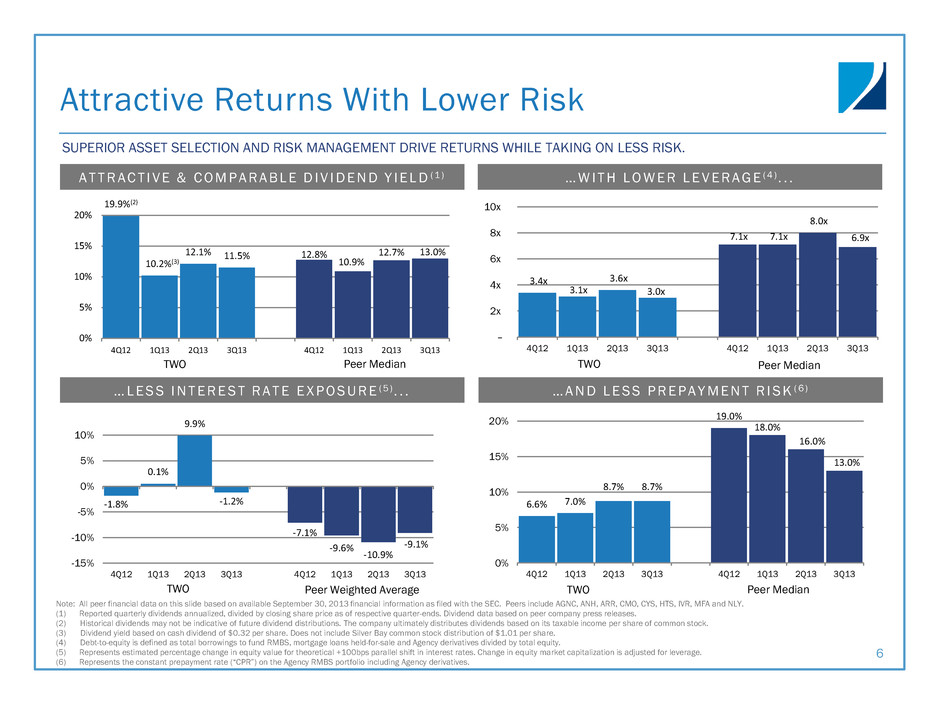

…LESS INTEREST RATE EXPOSURE ( 5 ) . . . Attractive Returns With Lower Risk 6 A T T R A C T I VE & C O M P A R A B L E D I V I D E N D Y I E L D ( 1 ) …WITH LOWER LEVERAGE ( 4 ) . . . SUPERIOR ASSET SELECTION AND RISK MANAGEMENT DRIVE RETURNS WHILE TAKING ON LESS RISK. 19.9%(2) 10.2%(3) 12.1% 11.5% 12.8% 10.9% 12.7% 13.0% 0% 5% 10% 15% 20% 4Q12 1Q13 2Q13 3Q13 4Q12 1Q13 2Q13 3Q13 TWO Peer Median 3.4x 3.1x 3.6x 3.0x 7.1x 7.1x 8.0x 6.9x – 2x 4x 6x 8x 10x 4Q12 1Q13 2Q13 3Q13 4Q12 1Q13 2Q13 3Q13 TWO Peer Median -1.8% 0.1% 9.9% -1.2% -7.1% -9.6% -10.9% -9.1% -15% -10% -5% 0% 5% 10% 4Q12 1Q13 2Q13 3Q13 4Q12 1Q13 2Q13 3Q13 TWO Peer Weighted Average …AND LESS PREPAYMENT R ISK ( 6 ) 6.6% 7.0% 8.7% 8.7% 19.0% 18.0% 16.0% 13.0% 0% 5% 10% 15% 20% 4Q12 1Q13 2Q13 3Q13 4Q12 1Q13 2Q13 3Q13 TWO Peer Median Note: All peer financial data on this slide based on available September 30, 2013 financial information as filed with the SEC. Peers include AGNC, ANH, ARR, CMO, CYS, HTS, IVR, MFA and NLY. (1) Reported quarterly dividends annualized, divided by closing share price as of respective quarter-ends. Dividend data based on peer company press releases. (2) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per share of common stock. (3) Dividend yield based on cash dividend of $0.32 per share. Does not include Silver Bay common stock distribution of $1.01 per share. (4) Debt-to-equity is defined as total borrowings to fund RMBS, mortgage loans held-for-sale and Agency derivatives divided by total equity. (5) Represents estimated percentage change in equity value for theoretical +100bps parallel shift in interest rates. Change in equity market capitalization is adjusted for leverage. (6) Represents the constant prepayment rate (“CPR”) on the Agency RMBS portfolio including Agency derivatives.

AGENCY RMBS NON- AGENCY RMBS MACROECONOMIC & POLICY CONSIDERATIONS Third Quarter 2013 Market Update • The Fed is the largest buyer in the mortgage market today • Fed tapering can create opportunities for investors like Two Harbors; uncertainty remains on timing • Non-Agency fundamental performance is strong; prepays were higher • Continued improvements in housing metrics were good for portfolio • Strong technical factor in place • Supply remains muted • Macroeconomic considerations include: ― Highly volatile interest rates ― Improving unemployment metrics ― Improving home prices; CoreLogic Home Price Index +12%(1) on a rolling 12-month basis • Policy considerations include: – New Federal Reserve Chair – Future of Federal Reserve’s Quantitative Easing plan – GSE reform – Potential new FHFA Director – Final Qualified Mortgage (QM) and proposed Qualified Residential Mortgage (QRM) rules 7 (1) Source: CoreLogic Home Price Index rolling 12-month change as of August 31, 2013.

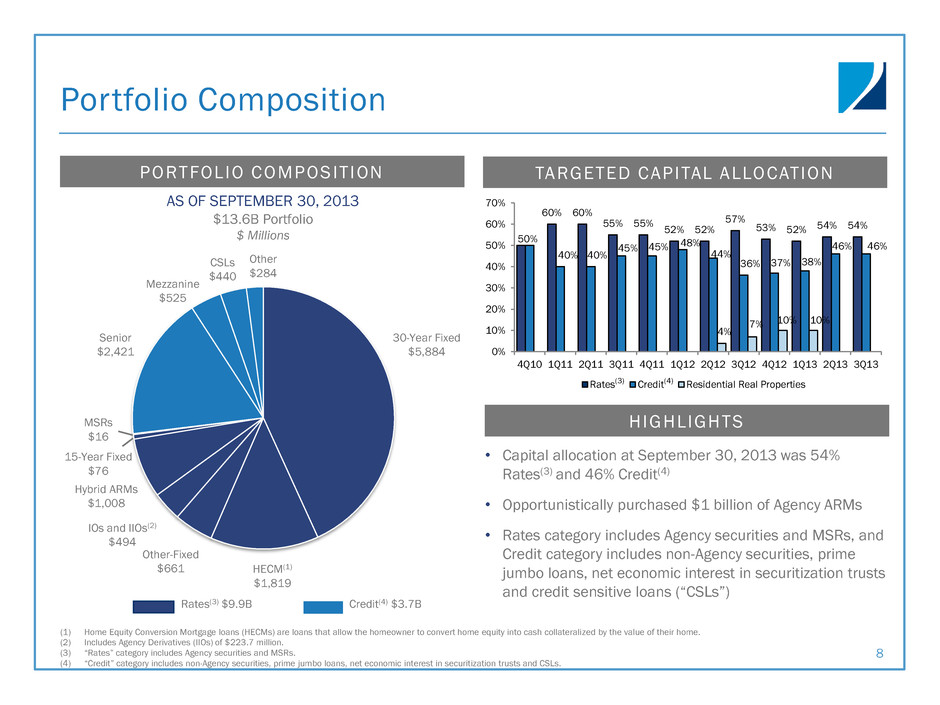

TARGETED CAPITAL ALLOCATION HIGHLIGHTS PORTFOLIO COMPOSITION Portfolio Composition 8 50% 60% 60% 55% 55% 52% 52% 57% 53% 52% 54% 54% 40% 40% 45% 45% 48% 44% 36% 37% 38% 46% 46% 4% 7% 10% 10% 0% 10% 20% 30% 40% 50% 60% 70% 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 Rates Credit Residential Real Properties • Capital allocation at September 30, 2013 was 54% Rates(3) and 46% Credit(4) • Opportunistically purchased $1 billion of Agency ARMs • Rates category includes Agency securities and MSRs, and Credit category includes non-Agency securities, prime jumbo loans, net economic interest in securitization trusts and credit sensitive loans (“CSLs”) Rates(3) $9.9B Credit(4) $3.7B AS OF SEPTEMBER 30, 2013 $13.6B Portfolio $ Millions 30-Year Fixed $5,884 15-Year Fixed $76 HECM(1) $1,819 Other-Fixed $661 IOs and IIOs(2) $494 Hybrid ARMs $1,008 Mezzanine $525 Senior $2,421 Other $284 CSLs $440 MSRs $16 (1) Home Equity Conversion Mortgage loans (HECMs) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (2) Includes Agency Derivatives (IIOs) of $223.7 million. (3) “Rates” category includes Agency securities and MSRs. (4) “Credit” category includes non-Agency securities, prime jumbo loans, net economic interest in securitization trusts and CSLs. (3) (4)

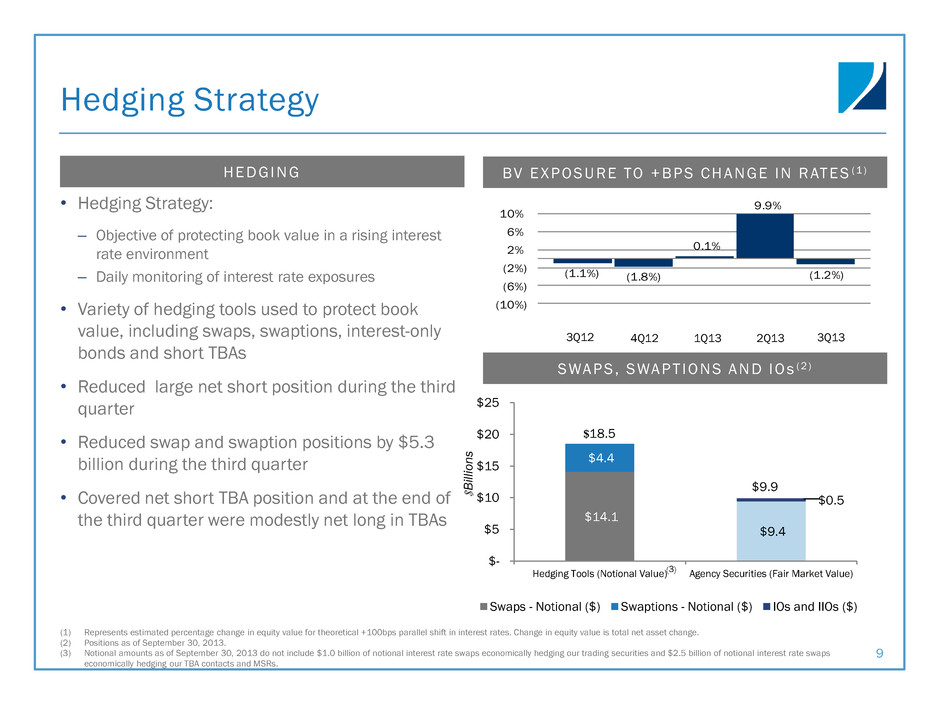

BV E X P O S U R E TO + BP S C H A N GE I N R AT E S (1 ) SWA P S , SWA P T IO N S A N D I O s (2 ) H E D G I N G Hedging Strategy 9 • Hedging Strategy: – Objective of protecting book value in a rising interest rate environment – Daily monitoring of interest rate exposures • Variety of hedging tools used to protect book value, including swaps, swaptions, interest-only bonds and short TBAs • Reduced large net short position during the third quarter • Reduced swap and swaption positions by $5.3 billion during the third quarter • Covered net short TBA position and at the end of the third quarter were modestly net long in TBAs (1) Represents estimated percentage change in equity value for theoretical +100bps parallel shift in interest rates. Change in equity value is total net asset change. (2) Positions as of September 30, 2013. (3) Notional amounts as of September 30, 2013 do not include $1.0 billion of notional interest rate swaps economically hedging our trading securities and $2.5 billion of notional interest rate swaps economically hedging our TBA contacts and MSRs. 2Q13 1Q13 4Q12 3Q12 3Q13 (1.1%) (1.8%) 0.1% 9.9% (1.2%) (10%) (6%) (2%) 2% 6% 10% $14.1 $9.4 $4.4 $0.5 $- $5 $10 $15 $20 $25 Hedging Tools (Notional Value) Agency Securities (Fair Market Value) Swaps - Notional ($) Swaptions - Notional ($) IOs and IIOs ($) $18.5 $9.9 (3) $B illi o n s

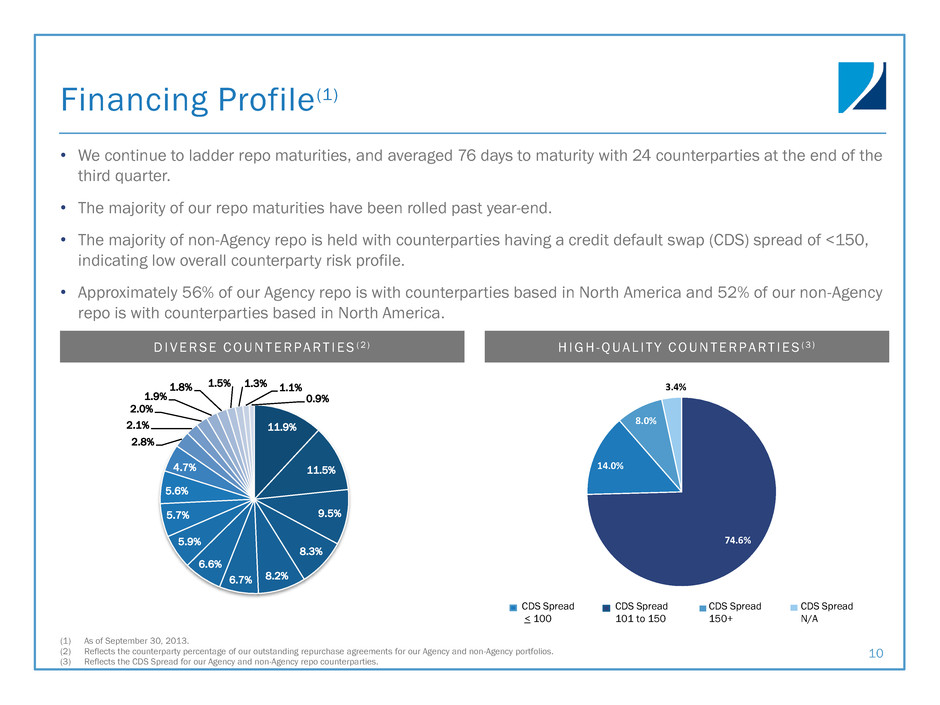

74.6% 14.0% 8.0% 3.4% 11.9% 11.5% 9.5% 8.3% 8.2% 6.7% 6.6% 5.9% 5.7% 5.6% 4.7% 2.8% 2.1% 2.0% 1.9% 1.8% 1.5% 1.3% 1.1% 0.9% D I V E R S E C O U N T E R P A R T I E S ( 2 ) H I G H - Q U A L I T Y C O U N T E R P A R T I E S ( 3 ) Financing Profile (1) 10 • We continue to ladder repo maturities, and averaged 76 days to maturity with 24 counterparties at the end of the third quarter. • The majority of our repo maturities have been rolled past year-end. • The majority of non-Agency repo is held with counterparties having a credit default swap (CDS) spread of <150, indicating low overall counterparty risk profile. • Approximately 56% of our Agency repo is with counterparties based in North America and 52% of our non-Agency repo is with counterparties based in North America. (1) As of September 30, 2013. (2) Reflects the counterparty percentage of our outstanding repurchase agreements for our Agency and non-Agency portfolios. (3) Reflects the CDS Spread for our Agency and non-Agency repo counterparties. CDS Spread < 100 CDS Spread 101 to 150 CDS Spread 150+ CDS Spread N/A

Mortgage Servicing Rights (MSRs) RECENT DEVELOPMENTS • Flow sale agreement with PHH Mortgage Corporation to acquire MSRs – Right to acquire MSRs on at least 50% of eligible new Fannie Mae and Ginnie Mae mortgage loans, subject to quarterly pricing – Subservicing agreement with PHH Mortgage Corporation to provide ongoing servicing of the underlying mortgage loans – Two-year term • Closed on two small bulk transactions in July 2013 • Potential for other significant investments in the near-term BUSINESS OBJECTIVES • Utilize the natural interest rate hedge for our portfolio and mortgage basis • Leverage one of our core competencies, prepayment risk management • Create flow relationships with high-quality originator and servicer partners • Enter the market when supply-demand dynamics present opportunity POTENTIAL BENEFITS OF MSRs IN OUR PORTFOLIO • Higher ROE from reduced hedging cost • Lower leverage • Reduced basis risk 11

Mortgage Loan Conduit & Securitization RECENT DEVELOPMENTS • During the third quarter, we completed Agate Bay Mortgage Trust 2013-1, a $434 million securitization of prime jumbo loans, using our own depositor ― Generated attractive subordinate and IO bonds for our portfolio • Ongoing progress building our originator platform – Approximately 30 originators in various stages of approval BUSINESS OBJECTIVES • Generate attractive credit and IO investments for our portfolio while providing capital to the U.S. mortgage market • Maintain strong originator network to source a variety of products including prime jumbo loans, MSRs and other products • Develop robust mortgage acquisition process and infrastructure to control and manage loans we purchase and securitize 12

Appendix 13

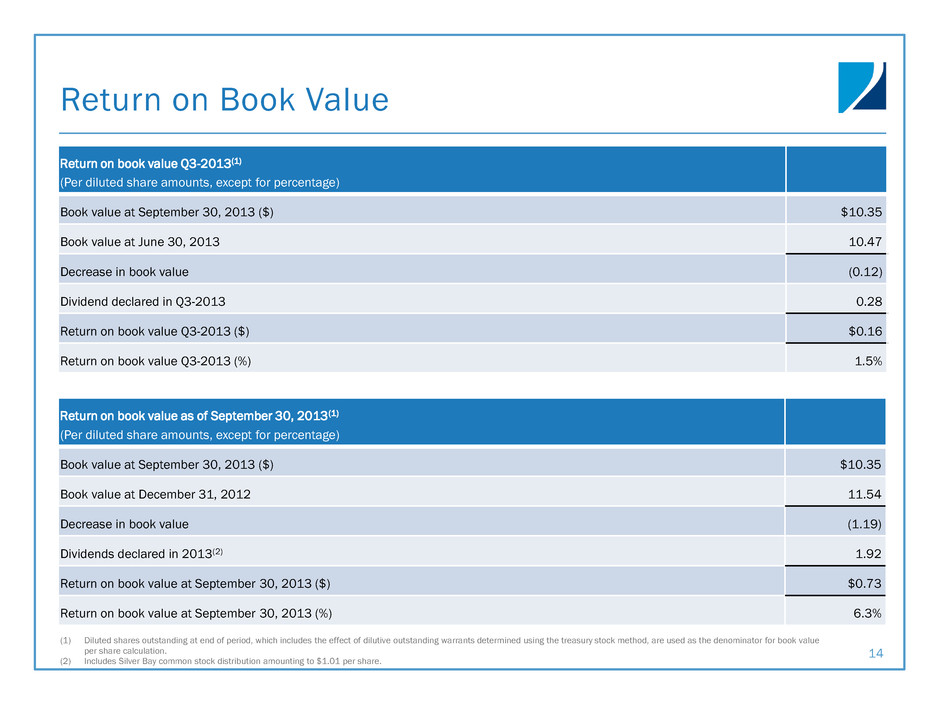

Return on Book Value 14 Return on book value Q3-2013(1) (Per diluted share amounts, except for percentage) Book value at September 30, 2013 ($) $10.35 Book value at June 30, 2013 10.47 Decrease in book value (0.12) Dividend declared in Q3-2013 0.28 Return on book value Q3-2013 ($) $0.16 Return on book value Q3-2013 (%) 1.5% Return on book value as of September 30, 2013(1) (Per diluted share amounts, except for percentage) Book value at September 30, 2013 ($) $10.35 Book value at December 31, 2012 11.54 Decrease in book value (1.19) Dividends declared in 2013(2) 1.92 Return on book value at September 30, 2013 ($) $0.73 Return on book value at September 30, 2013 (%) 6.3% (1) Diluted shares outstanding at end of period, which includes the effect of dilutive outstanding warrants determined using the treasury stock method, are used as the denominator for book value per share calculation. (2) Includes Silver Bay common stock distribution amounting to $1.01 per share.

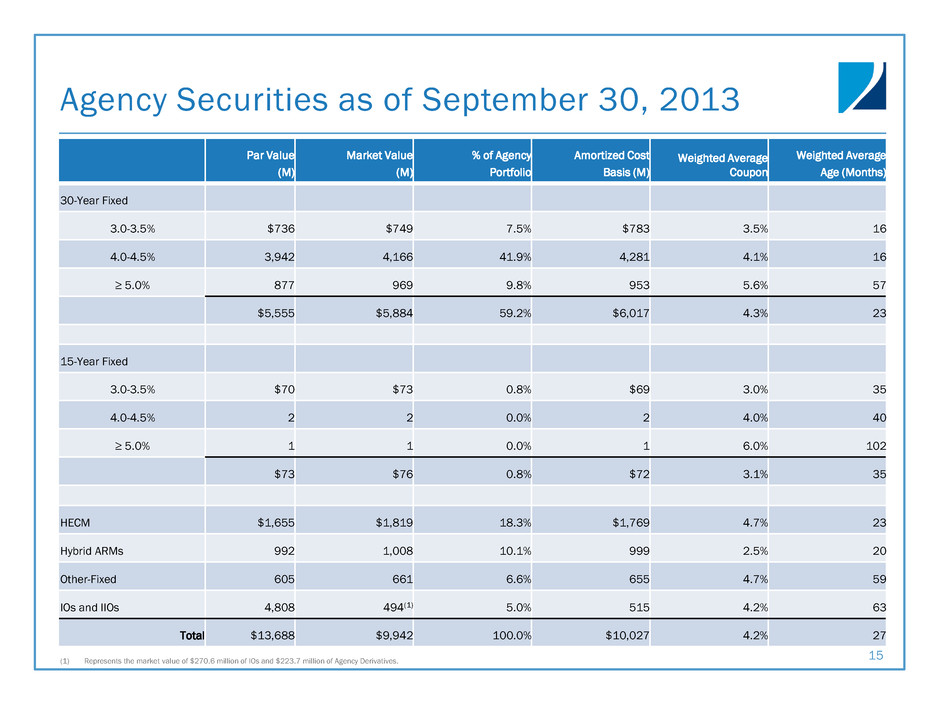

Agency Securities as of September 30, 2013 15 Par Value (M) Market Value (M) % of Agency Portfolio Amortized Cost Basis (M) Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 3.0-3.5% $736 $749 7.5% $783 3.5% 16 4.0-4.5% 3,942 4,166 41.9% 4,281 4.1% 16 ≥ 5.0% 877 969 9.8% 953 5.6% 57 $5,555 $5,884 59.2% $6,017 4.3% 23 15-Year Fixed 3.0-3.5% $70 $73 0.8% $69 3.0% 35 4.0-4.5% 2 2 0.0% 2 4.0% 40 ≥ 5.0% 1 1 0.0% 1 6.0% 102 $73 $76 0.8% $72 3.1% 35 HECM $1,655 $1,819 18.3% $1,769 4.7% 23 Hybrid ARMs 992 1,008 10.1% 999 2.5% 20 Other-Fixed 605 661 6.6% 655 4.7% 59 IOs and IIOs 4,808 494(1) 5.0% 515 4.2% 63 Total $13,688 $9,942 100.0% $10,027 4.2% 27 (1) Represents the market value of $270.6 million of IOs and $223.7 million of Agency Derivatives.

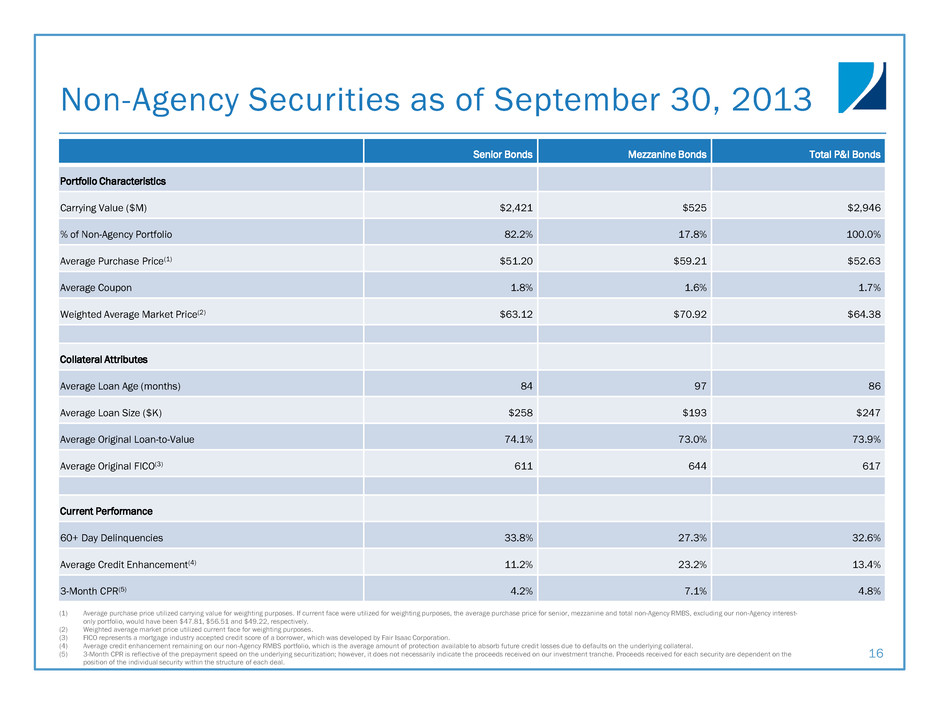

Non-Agency Securities as of September 30, 2013 16 Senior Bonds Mezzanine Bonds Total P&I Bonds Portfolio Characteristics Carrying Value ($M) $2,421 $525 $2,946 % of Non-Agency Portfolio 82.2% 17.8% 100.0% Average Purchase Price(1) $51.20 $59.21 $52.63 Average Coupon 1.8% 1.6% 1.7% Weighted Average Market Price(2) $63.12 $70.92 $64.38 Collateral Attributes Average Loan Age (months) 84 97 86 Average Loan Size ($K) $258 $193 $247 Average Original Loan-to-Value 74.1% 73.0% 73.9% Average Original FICO(3) 611 644 617 Current Performance 60+ Day Delinquencies 33.8% 27.3% 32.6% Average Credit Enhancement(4) 11.2% 23.2% 13.4% 3-Month CPR(5) 4.2% 7.1% 4.8% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total non-Agency RMBS, excluding our non-Agency interest- only portfolio, would have been $47.81, $56.51 and $49.22, respectively. (2) Weighted average market price utilized current face for weighting purposes. (3) FICO represents a mortgage industry accepted credit score of a borrower, which was developed by Fair Isaac Corporation. (4) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (5) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.

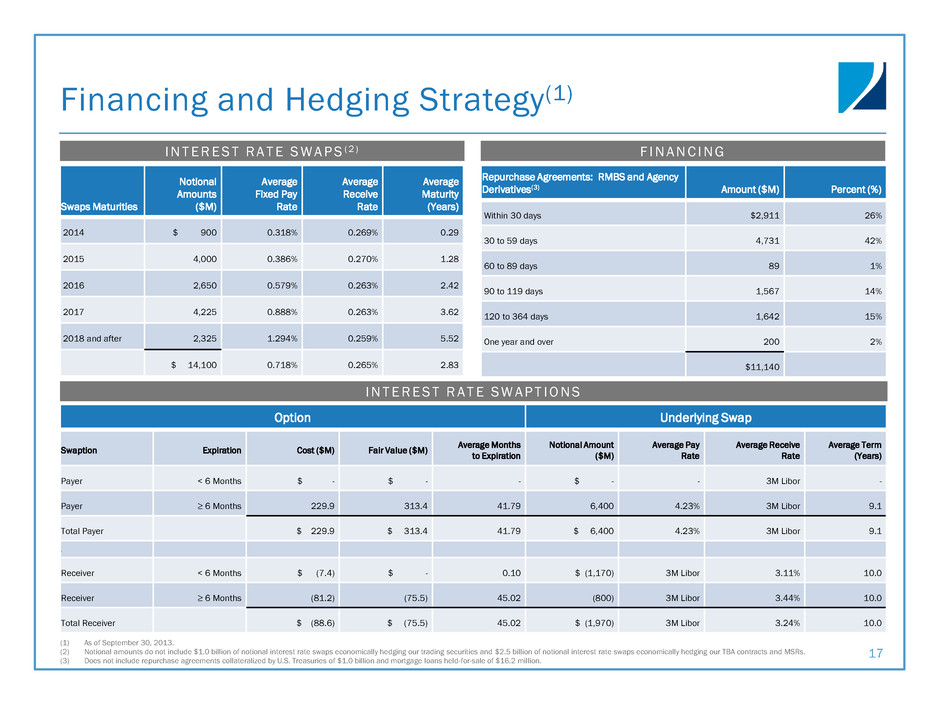

I N T E R E S T R A T E S W A P S ( 2 ) F I N A N C I N G I N T E R E S T R A T E S W A P T I O N S Financing and Hedging Strategy(1) 17 (1) As of September 30, 2013. (2) Notional amounts do not include $1.0 billion of notional interest rate swaps economically hedging our trading securities and $2.5 billion of notional interest rate swaps economically hedging our TBA contracts and MSRs. (3) Does not include repurchase agreements collateralized by U.S. Treasuries of $1.0 billion and mortgage loans held-for-sale of $16.2 million. Swaps Maturities Notional Amounts ($M) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) 2014 $ 900 0.318% 0.269% 0.29 2015 4,000 0.386% 0.270% 1.28 2016 2,650 0.579% 0.263% 2.42 2017 4,225 0.888% 0.263% 3.62 2018 and after 2,325 1.294% 0.259% 5.52 $ 14,100 0.718% 0.265% 2.83 Repurchase Agreements: RMBS and Agency Derivatives(3) Amount ($M) Percent (%) Within 30 days $2,911 26% 30 to 59 days 4,731 42% 60 to 89 days 89 1% 90 to 119 days 1,567 14% 120 to 364 days 1,642 15% One year and over 200 2% $11,140 Option Underlying Swap Swaption Expiration Cost ($M) Fair Value ($M) Average Months to Expiration Notional Amount ($M) Average Pay Rate Average Receive Rate Average Term (Years) Payer < 6 Months $ - $ - - $ - - 3M Libor - Payer ≥ 6 Months 229.9 313.4 41.79 6,400 4.23% 3M Libor 9.1 Total Payer $ 229.9 $ 313.4 41.79 $ 6,400 4.23% 3M Libor 9.1 \ Receiver < 6 Months $ (7.4) $ - 0.10 $ (1,170) 3M Libor 3.11% 10.0 Receiver ≥ 6 Months (81.2) (75.5) 45.02 (800) 3M Libor 3.44% 10.0 Total Receiver $ (88.6) $ (75.5) 45.02 $ (1,970) 3M Libor 3.24% 10.0

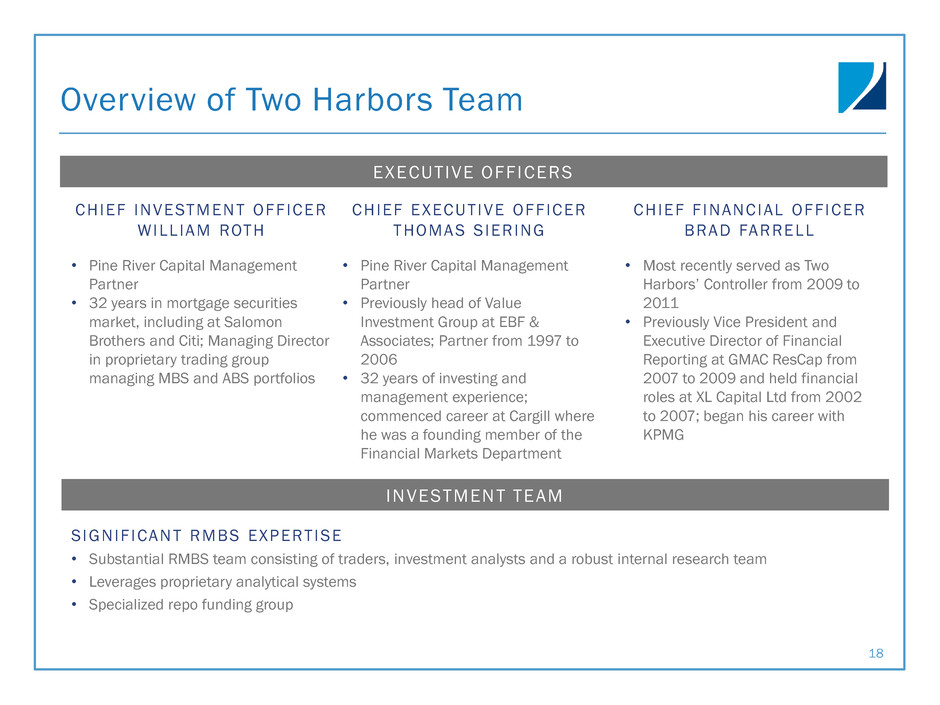

EXECUTIVE OFFICERS Overview of Two Harbors Team 18 CHIEF INVESTMENT OFFICER WILL IAM ROTH • Pine River Capital Management Partner • 32 years in mortgage securities market, including at Salomon Brothers and Citi; Managing Director in proprietary trading group managing MBS and ABS portfolios CHIEF EXECUTIVE OFFICER THOMAS SIERING • Pine River Capital Management Partner • Previously head of Value Investment Group at EBF & Associates; Partner from 1997 to 2006 • 32 years of investing and management experience; commenced career at Cargill where he was a founding member of the Financial Markets Department CHIEF F INANCIAL OFFICER BRAD FARRELL • Most recently served as Two Harbors’ Controller from 2009 to 2011 • Previously Vice President and Executive Director of Financial Reporting at GMAC ResCap from 2007 to 2009 and held financial roles at XL Capital Ltd from 2002 to 2007; began his career with KPMG SIGNIF ICANT RMBS EXPERTISE • Substantial RMBS team consisting of traders, investment analysts and a robust internal research team • Leverages proprietary analytical systems • Specialized repo funding group INVESTMENT TEAM

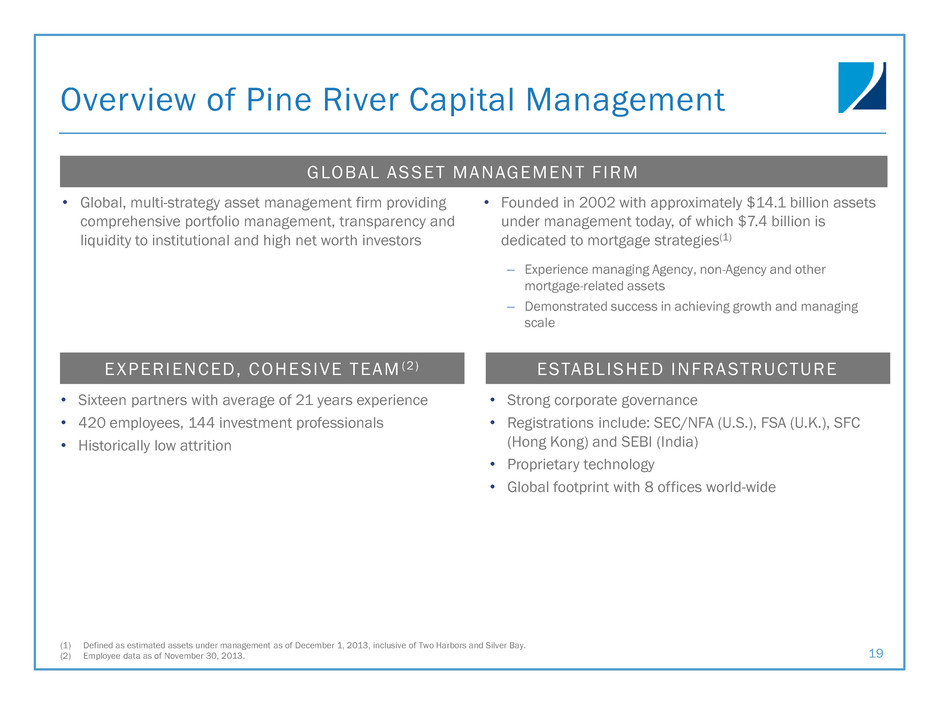

EXPERIENCED, COHESIVE TEAM (2) ESTABLISHED INFRASTRUCTURE GLOBAL ASSET MANAGEMENT FIRM Overview of Pine River Capital Management • Sixteen partners with average of 21 years experience • 420 employees, 144 investment professionals • Historically low attrition • Strong corporate governance • Registrations include: SEC/NFA (U.S.), FSA (U.K.), SFC (Hong Kong) and SEBI (India) • Proprietary technology • Global footprint with 8 offices world-wide 19 • Global, multi-strategy asset management firm providing comprehensive portfolio management, transparency and liquidity to institutional and high net worth investors • Founded in 2002 with approximately $14.1 billion assets under management today, of which $7.4 billion is dedicated to mortgage strategies(1) – Experience managing Agency, non-Agency and other mortgage-related assets – Demonstrated success in achieving growth and managing scale (1) Defined as estimated assets under management as of December 1, 2013, inclusive of Two Harbors and Silver Bay. (2) Employee data as of November 30, 2013.