Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SunCoke Energy Partners, L.P. | d643242d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

SunCoke Energy Partners, L.P.

2014 Guidance

Conference Call

December 16, 2013

|

|

Forward-Looking Statements

This slide presentation should be reviewed in conjunction with the 2014 Guidance Update of SunCoke Energy Partners, L.P. (SXCP) and the conference call held on December 16, 2013 at 12:15 p.m. ET.

Some of the information included in this presentation constitutes “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements in this presentation that express opinions, expectations, beliefs, plans, objectives, assumptions or projections with respect to anticipated future performance of SunCoke Energy, Inc. (SXC) or SXCP, in contrast with statements of historical facts, are forward-looking statements. Such forward-looking statements are based on management’s beliefs and assumptions and on information currently available. Forward-looking statements include information concerning possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “will,” “should” or the negative of these terms or similar expressions.

Although management believes that its plans, intentions and expectations reflected in or suggested by the forward-looking statements made in this presentation are reasonable, no assurance can be given that these plans, intentions or expectations will be achieved when anticipated or at all. Moreover, such statements are subject to a number of assumptions, risks and uncertainties. Many of these risks are beyond the control of SXC and SXCP, and may cause actual results to differ materially from those implied or expressed by the forward-looking statements. Each of SXC and SXCP has included in its filings with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. For more information concerning these factors, see the Securities and Exchange Commission filings of SXC and SXCP. All forward-looking statements included in this presentation are expressly qualified in their entirety by such cautionary statements. Although forward-looking statements are based on current beliefs and expectations, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date hereof. SXC and SXCP do not have any intention or obligation to update publicly any forward-looking statement (or its associated cautionary language) whether as a result of new information or future events or after the date of this presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the end of the presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided in the Appendix.

SXCP 2014 Guidance Call

| 1 |

|

|

|

2013 Accomplishments

IPO Launched January 2013

First steel facing MLP with first-mover advantage

Grew quarterly cash distributions with Q4 ‘13 expected rate of $0.4750 per unit representing 15% increase over the minimum quarterly distribution

Cokemaking Outperformance

YTD Q3 ‘13 capacity utilization 109%, on production of

1.3+ million tons

Raised FY 2013 guidance in October on strength of operations and acquisitions

Positioned for Growth

Completed two accretive coal logistics acquisitions

Received favorable IRS ruling on iron ore concentrating/pelletizing activities

Strong, Flexible Financial Foundation

Expect to achieve 2013 financial targets

SXCP and SXC capitalized for future growth

SXCP 2014 Guidance Call

2

|

|

2014 Priorities

Operations Excellence

Sustain high-level of operating and safety performance in cokemaking and coal logistics

Drive Growth

Leverage coal logistics team to grow volumes and pursue potential follow-on M&A opportunities

Pursue entry into ferrous value chain

Anticipate greenfield coke opportunity to deliver EBITDA growth beginning in 2017

Optimize Business and Capital Structure

Evaluate structuring alternatives post expiration of SXC’s tax-sharing agreement

Leverage existing assets and acquisitions to drive further increases in cash distributions per unit

SXCP 2014 Guidance Call

3

|

|

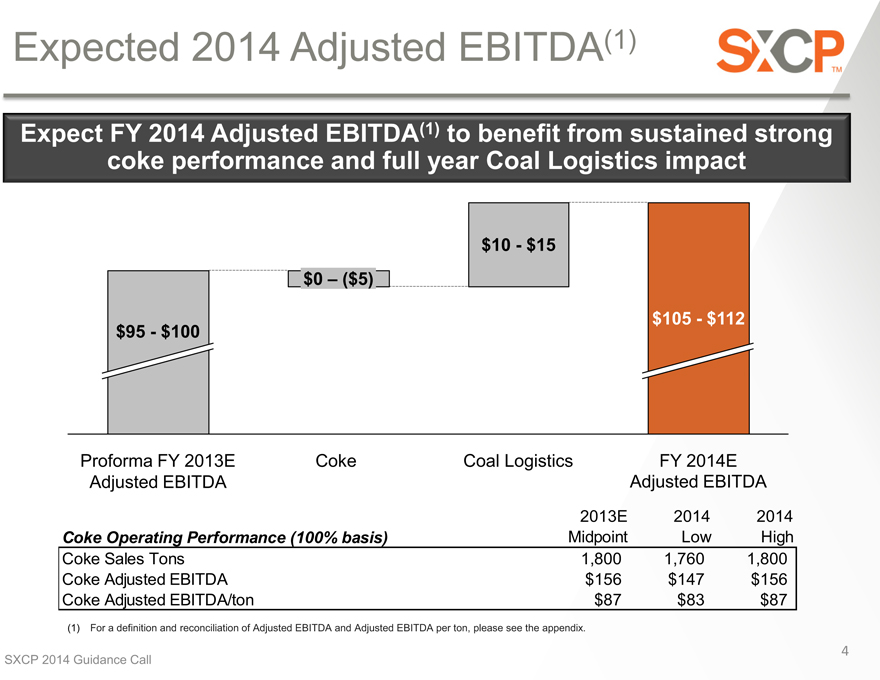

Expected 2014 Adjusted EBITDA(1)

Expect FY 2014 Adjusted EBITDA(1) to benefit from sustained strong coke performance and full year Coal Logistics impact

$10—$15

$0 – ($5)

$95—$100

$105—$112

Proforma FY 2013E Coke Coal Logistics FY 2014E Adjusted EBITDA Adjusted EBITDA

2013E 2014 2014

Coke Operating Performance (100% basis) Midpoint Low High Coke Sales Tons 1,800 1,760 1,800 Coke Adjusted EBITDA $156 $147 $156 Coke Adjusted EBITDA/ton $87 $83 $87

| (1) |

|

For a definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA per ton, please see the appendix. |

SXCP 2014 Guidance Call

| 4 |

|

|

|

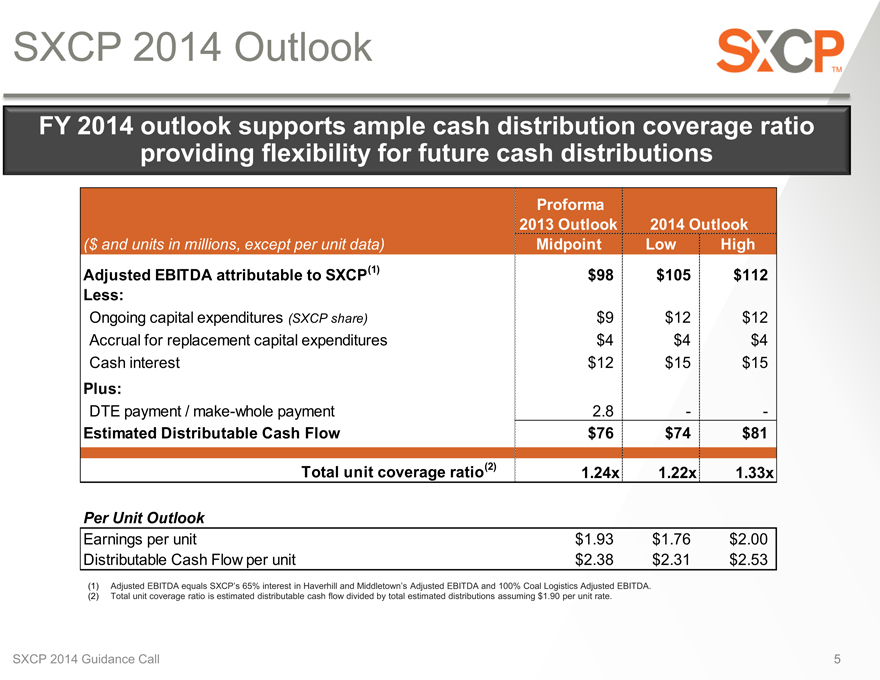

SXCP 2014 Outlook

FY 2014 outlook supports ample cash distribution coverage ratio providing flexibility for future cash distributions

Proforma

2013 Outlook 2014 Outlook

($ and units in millions, except per unit data) Midpoint Low High Adjusted EBITDA attributable to SXCP(1) $98 $105 $112 Less:

Ongoing capital expenditures (SXCP share) $9 $12 $12 Accrual for replacement capital expenditures $4 $4 $4 Cash interest $12 $15 $15

Plus:

DTE payment / make-whole payment 2.8 — -

Estimated Distributable Cash Flow $76 $74 $81

Total unit coverage ratio(2) 1.24x 1.22x 1.33x

Per Unit Outlook

Earnings per unit $1.93 $1.76 $2.00 Distributable Cash Flow per unit $2.38 $2.31 $2.53

(1) Adjusted EBITDA equals SXCP’s 65% interest in Haverhill and Middletown’s Adjusted EBITDA and 100% Coal Logistics Adjusted EBITDA. (2) Total unit coverage ratio is estimated distributable cash flow divided by total estimated distributions assuming $1.90 per unit rate.

SXCP 2014 Guidance Call

| 5 |

|

|

|

QUESTIONS

SXCP 2014 Guidance Call

| 6 |

|

|

|

APPENDIX

SXCP 2014 Guidance Call

| 7 |

|

|

|

Definitions

Adjusted EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization (“EBITDA”) adjusted for sales discounts and the interest, taxes, depreciation, depletion and amortization attributable to our equity method investment. EBITDA reflects sales discounts included as a reduction in sales and other operating revenue. The sales discounts represent the sharing with customers of a portion of nonconventional fuel tax credits, which reduce our income tax expense. However, we believe our Adjusted EBITDA would be inappropriately penalized if these discounts were treated as a reduction of EBITDA since they represent sharing of a tax benefit that is not included in EBITDA. Accordingly, in computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted EBITDA also includes EBITDA attributable to our equity method investment. EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure of the operating performance of the Company’s net assets. We believe Adjusted EBITDA is an important measure of operating performance and provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on GAAP measures and because it eliminates items that have less bearing on our operating performance. Adjusted EBITDA is a measure of operating performance that is not defined by GAAP, does not represent and should not be considered a substitute for net income as determined in accordance with GAAP. Calculations of Adjusted EBITDA may not be comparable to those reported by other companies.

EBITDA represents earnings before interest, taxes, depreciation, depletion and amortization.

Adjusted EBITDA attributable to SXC/SXCP equals Adjusted EBITDA less Adjusted EBITDA attributable to noncontrolling interests.

Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold.

SXCP 2014 Guidance Call

8

|

|

Definitions

Distributable Cash Flow equals Adjusted EBITDA less net cash paid for interest expense, on-going capital expenditures, accruals for replacement capital expenditures, and cash distributions to noncontrolling interests; plus amounts received under the Omnibus Agreement and acquisition expenses deemed to be Expansion Capital under our Partnership Agreement. Distributable Cash Flow is a non-GAAP supplemental financial measure that management and external users of the Partnership’s financial statements, such as industry analysts, investors, lenders and rating agencies use to assess:

the Partnership’s operating performance as compared to other publicly traded partnerships, without regard to historical cost basis; the ability of the Partnership’s assets to generate sufficient cash flow to make distributions to the Partnership’s unitholders; the Partnership’s ability to incur and service debt and fund capital expenditures; and the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

We believe that Distributable Cash Flow provides useful information to investors in assessing the Partnership’s financial condition and results of operations. Distributable Cash Flow should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance or liquidity presented in accordance with generally accepted accounting principles (GAAP). Distributable Cash Flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net income and net cash provided by operating activities and used in investing activities.

Additionally, because Distributable Cash Flow may be defined differently by other companies in the industry, our definition of Distributable Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Ongoing capital expenditures (“capex”) are capital expenditures made to maintain the existing operating capacity of our assets and/or to extend their useful lives. Ongoing capex also include new equipment that improves the efficiency, reliability or effectiveness of existing assets. Ongoing capex does not include normal repairs and maintenance, which are expensed as incurred, or significant capital expenditures. For purposes of calculating distributable cash flow, the portion of ongoing capex attributable to SXCP is used.

Replacement capital expenditures (“capex”) represents an annual accrual necessary to fund SXCP’s share of the estimated costs to replace or rebuild our facilities at the end of their working lives. This accrual is estimated based on the average quarterly anticipated replacement capital that we expect to incur over the long term to replace our major capital assets at the end of their working lives. The replacement capex accrual estimate will be subject to review and prospective change by SXCP’s general partner at least annually and whenever an event occurs that causes a material adjustment of replacement capex, provided such change is approved by our conflicts committee.

SXCP 2014 Guidance Call

9

|

|

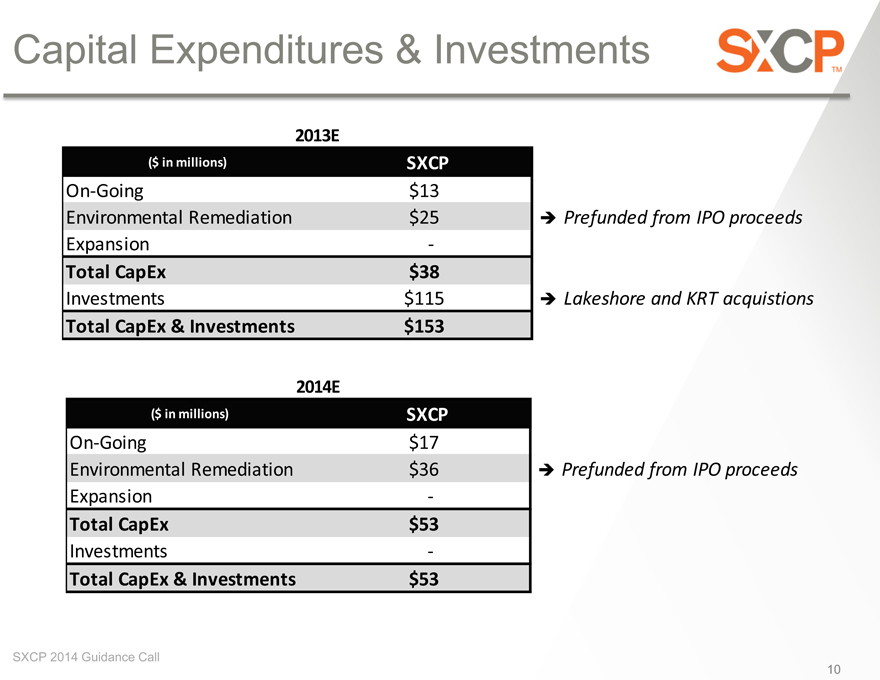

Capital Expenditures & Investments

2013E

($ in millions) SXCP

On-Going $13 Environmental Remediation $25 Expansion —

Total CapEx $38

Investments $115

Total CapEx & Investments $153

2014E

($ in millions) SXCP

On-Going $17 Environmental Remediation $36 Expansion —

Total CapEx $53

Investments —

Total CapEx & Investments $53

SXCP 2014 Guidance Call

Prefunded from IPO proceeds

Lakeshore and KRT acquistions

Prefunded from IPO proceeds

10

|

|

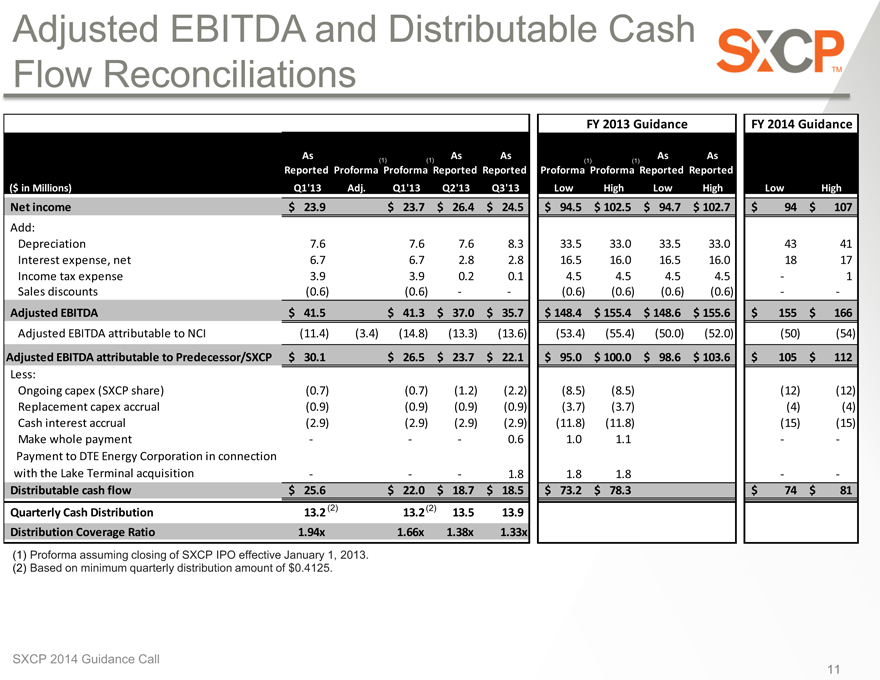

Adjusted EBITDA and Distributable Cash Flow Reconciliations

FY 2013 Guidance FY 2014 Guidance

As As As As As

(1) (1) (1) (1)

Reported Proforma Proforma Reported Reported Proforma Proforma Reported Reported

($ in Millions) Q1’13 Adj. Q1’13 Q2’13 Q3’13 Low High Low High Low High

Net income $ 23.9 $ 23.7 $ 26.4 $ 24.5 $ 94.5 $ 102.5 $ 94.7 $ 102.7 $ 94 $ 107

Add:

Depreciation 7.6 7.6 7.6 8.3 33.5 33.0 33.5 33.0 43 41 Interest expense, net 6.7 6.7 2.8 2.8 16.5 16.0 16.5 16.0 18 17 Income tax expense 3.9 3.9 0.2 0.1 4.5 4.5 4.5 4.5 — 1 Sales discounts (0.6) (0.6) — — (0.6) (0.6) (0.6) (0.6) — -

Adjusted EBITDA $ 41.5 $ 41.3 $ 37.0 $ 35.7 $ 148.4 $ 155.4 $ 148.6 $ 155.6 $ 155 $ 166

Adjusted EBITDA attributable to NCI (11.4) (3.4) (14.8) (13.3) (13.6) (53.4) (55.4) (50.0) (52.0) (50) (54)

Adjusted EBITDA attributable to Predecessor/SXCP $ 30.1 $ 26.5 $ 23.7 $ 22.1 $ 95.0 $ 100.0 $ 98.6 $ 103.6 $ 105 $ 112

Less:

Ongoing capex (SXCP share) (0.7) (0.7) (1.2) (2.2) (8.5) (8.5) (12) (12) Replacement capex accrual (0.9) (0.9) (0.9) (0.9) (3.7) (3.7) (4) (4) Cash interest accrual (2.9) (2.9) (2.9) (2.9) (11.8) (11.8) (15) (15) Make whole payment — — — 0.6 1.0 1.1 — -

Payment to DTE Energy Corporation in connection with the Lake Terminal acquisition — — — 1.8 1.8 1.8 — -

Distributable cash flow $ 25.6 $ 22.0 $ 18.7 $ 18.5 $ 73.2 $ 78.3 $ 74 $ 81 Quarterly Cash Distribution 13.2(2) 13.2(2) 13.5 13.9 Distribution Coverage Ratio 1.94x 1.66x 1.38x 1.33x

(1) Proforma assuming closing of SXCP IPO effective January 1, 2013. (2) Based on minimum quarterly distribution amount of $0.4125.

SXCP 2014 Guidance Call

11

|

|

Investor Relations: 630-824-1987 www.suncoke.com