Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LaPorte Bancorp, Inc. | a8-kinvestorpresentation.htm |

LaPorte Bancorp, Inc. LPSB Investor Presentation December 2013 Lee A. Brady - Chief Executive Officer Michele M. Thompson – President & Chief Financial Officer

Forward-Looking Statements The presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of said safe harbor provisions. You can identify these forward- looking statements through our use of the words such as “may”, “will”, “anticipate”, “assume”, “should”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “plan”, “project”, “could”, “intend”, “target” and other similar words and expressions of the future. These forward-looking statements include, but are not limited to: ► Statements of our goals, intentions and expectations; ► Statements regarding our business plans, prospects, growth and operating strategies; ► Statements regarding the asset quality of our loan and investment portfolios; and ► Estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. 2

Forward-Looking Statements (continued) The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations express in the forward-looking statements: ► general economic conditions, either nationally or in our market areas, that are worse than expected; ► changes in prevailing real estate values and loan demand, both nationally and within our current and future market area; ► inflation and changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; ► increased competitive pressures among financial services companies; ► changes in consumer spending, borrowing and savings habits; ► the amount of assessments and premiums we are required to pay for FDIC deposit insurance; ► legislative or regulatory changes that affect our business, including the Dodd-Frank Act and its impact on our compliance costs or capital requirements; ► changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the financial Accounting Standards Board, the Securities and Exchange Commission and Public Company Accounting Oversight Board; ► our ability to successfully manage our commercial lending; ► our ability to enter new markets successfully and capitalize on growth opportunities; ► our ability to successfully integrate acquired entities; ► changes in our organization, compensation and benefit plans; ► changes in the financial condition, results of operations or future prospects of issuers or securities that we own; ► the financial health of certain entities, including government sponsored enterprises, the securities of which are owned or acquired by us; ► adverse changes in the securities market; ► the costs, effects and outcomes of existing or future litigation; ► the economic impact of past and any future terrorist attacks, acts of war or threats thereof and the response of the United States to any such threat and attacks; ► the success of our mortgage warehouse lending program, including the impact of the Dodd-Frank Act on the mortgage companies; and ► our ability to manage the risks associated with the foregoing factors as well as the anticipated factors. This list of important factors in not all inclusive. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the Company’s Prospectus dated August 10, 2012 on file with the SEC. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date of the Presentation. Except as required by applicable law or regulation, we do not undertake, and specifically disclaim any obligation, to update any forward-looking statements, whether written or oral, that may be made from time to time by or on behalf of the Company or The LaPorte Savings Bank. 3

Franchise Overview ► Established in 1871 ► Eight full-service locations in LaPorte and Porter Counties ► In 2007, acquired Michigan City, Indiana-based City Savings Financial Corp. in an MHC conversion/ acquisition ► Completed second step conversion in October of 2012 ► Opened a mortgage origination office in southwest Michigan (St. Joseph) in October 2013 4 (1) FDIC June 30, 2013 deposit information 1 Deposit Market Share - La Porte County, IN (1) 2013 Rank Institution (ST) Type 2013 Number of Branches 2013 Deposits in Market ($000) 2013 Market Share (%) 1 Horizon Bancorp (IN) Bank 6 541,910 34.37 2 LaPorte Bancorp Inc (IN) Thrift 7 300,604 19.06 3 Wells Fargo & Co. (CA) Bank 1 222,706 14.12 4 1st Source Corp. (IN) Bank 5 198,133 12.57 5 PNC Financial Services Group (PA) Bank 3 142,102 9.01 Total For Institutions In Market 29 1,576,839 LPSB Mortgage Office LaPorte Savings Bank Branch

Experienced Management Team ► Lee A. Brady – Chief Executive Officer & Director • Serves as Chairman & CEO of The LaPorte Savings Bank • Started career at The LaPorte Savings Bank in 1974 • Graduate of Indiana University and the Graduate School of Banking at the University of Wisconsin-Madison ► Michele M. Thompson – President, Chief Financial Officer & Director • Joined The LaPorte Savings Bank in 2003 • More than 30 years of banking experience • Graduate of Ball State University and holds an MBA from Indiana University ► Daniel P. Carroll – Executive Vice President and Chief Credit Officer • Joined The LaPorte Savings Bank in 2011 • More than 15 years of commercial lending and management experience • Graduate of Notre Dame and the Graduate School of Commercial Lending at the University of Oklahoma ► Patrick W. Collins – Senior Vice President , Mortgage Warehouse Lending • Joined the LaPorte Savings Bank in 2009 • More than 15 years of mortgage warehouse lending experience • Graduate of DeVry University in Columbus, OH ► Kevin N. Beres – Senior Vice President, Lending • Joined The LaPorte Savings Bank in 2007 • More than 17 years of banking experience • Graduate of Indiana University and the Graduate School of Banking at the University of Wisconsin-Madison ► Joyce M. Fabisiak – Senior Vice President, Chief Accounting Officer • Joined The LaPorte Savings Bank in September 2013 • More than 17 years of SEC accounting experience (10 years banking experience) and more than 4 years of public accounting experience focused on community banks • Graduate of Indiana University 5 L. Charles Lukmann, III Partner, Harris, Welsh & Lukmann Dale A. Parkison, C.P.A. President, Parkison & Hinton, Inc. P.C. Michele M. Thompson President & CFO, The LaPorte Savings Bank Board of Directors Paul G. Fenker Chairman of the Board Owner, Fenker's Fine Furniture Jerry L. Mayes Vice Chairman of the Board Retired, Mayes Management Lee A. Brady Chairman & CEO, The LaPorte Savings Bank Ralph F. Howes Senior Partner, Howes & Howes Mark A. Krentz CEO, Thanhardt Burger

Our Story ► Strong Balance Sheet – Capital – Clean Asset Quality ► Consistent Earnings – ROAA increased from 0.61% in 2010 to 0.86% for the 9 months ended 9/30/2013 ► Diversified Balance Sheet: – Commercial – Mortgage Warehouse – Retail ► Strong & Improving Core Deposit Mix 6

2014 Strategic Focus Areas ► Maintain High Quality – Asset quality – Diversified lending portfolio – Emphasis on core deposits – Staff ► Increase lending volume – Opening of St. Joseph, MI residential loan production office – Addition of Porter County, IN residential mortgage loan originator – Increased commercial loan production & core deposits ► Earnings – Increased operating efficiencies (closing of Rolling Prairie branch) – Tax planning strategies – Enhance net interest margin ► Capital Management – Cash dividends – Share repurchases 7

Loan Composition 8 Historical Loan Trends Loan Composition Loan Type ($000) 12/31/2012 3/31/2013 6/30/2013 9/30/2013 CRE & Multi-Family 94,166 29.6% 91,348 30.9% 85,661 31.3% 93,342 33.6% Commercial & Industrial 20,275 6.4% 19,212 6.5% 19,264 7.0% 17,107 6.1% Mortgage 36,995 11.6% 35,409 12.0% 33,293 12.1% 32,669 11.8% Mortgage Warehouse 137,467 43.2% 120,182 40.6% 107,145 39.1% 105,261 37.9% Construction & Land 11,756 3.7% 12,772 4.3% 12,661 4.6% 13,047 4.7% Home Equity 12,320 3.9% 11,938 4.0% 11,550 4.2% 11,552 4.2% Consumer and Other 5,021 1.6% 4,866 1.7% 4,579 1.7% 4,858 1.7% Total Loans $318,000 100.0% $295,727 100.0% $274,153 100.0% $277,836 100.0% % of Total % of Total % of Total % of Total $318 $296 $274 $278 $0 $50 $100 $150 $200 $250 $300 $350 12/31/2012 3/31/2013 6/30/2013 9/30/2013 ($ in M il li o n s ) CRE & Multi-Family Commercial & Industrial Mortgage Mortgage Warehouse Construction & Land Home Equity Consumer and Other 33.6% 6.2% 11.8% 37.9% 4.7% 4.2% 1.7%

Deposit Composition 9 Historical Deposit Trends Deposit Composition 15.3% 52.8% 31.9% $273 $317 $334 $349 $0 $50 $100 $150 $200 $250 $300 $350 $400 12/31/12 3/31/13 6/30/13 9/30/13 (i n m ill io n s) Non-interest Bearing Savings, Now, MMA CDs and IRAs Deposit Type ($000) 12/31/2012 3/31/2013 6/30/2013 9/30/2013 Non-interest Bearing 50,892 14.6% 53,399 15.7% 46,935 13.7% 51,187 15.3% Savings, Now, MMA 173,247 49.6 174,302 51.2 175,784 51.2 177,234 52.8 CDs and IRAs 124,831 35.8% 112,825 33.1% 120,429 35.1% 107,026 31.9% Total Deposits $348,970 100.0 $340,526 100.0 $343,148 100.0 $335,447 100.0 % of Total % of Total % of Total % of Total

Dividend Yield (%) 2.04 1.89 1.55 1.88 1.54 0.00 0.50 1.00 1.50 2.00 2.50 2009Y 2010Y 2011Y 2012Y 9/30/2013 1.07 1.42 1.26 1.35 1.52 1.28 1.90 1.92 2.38 2.19 0.00 0.50 1.00 1.50 2.00 2.50 3.00 2009Y 2010Y 2011Y 2012Y 9/30/2013 0.25 0.87 0.50 0.17 0.14 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 2009Y 2010Y 2011Y 2012Y 2013YTD 35.98 57.21 59.27 51.54 69.73 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 2009Y 2010Y 2011Y 2012Y 9/30/2013 (2) Asset Quality Profile NPAs / Assets (%) (1) LLR / Loans (%) LLR / NPLs (%) Net Charge-Offs / Loans (%) (1) NPAs/Assets excludes TDRs (2) Nonperforming loans excludes TDRs 10 Red bar = LLRs/Loans Gray bar = LLRs/Loans excluding mortgage warehouse loans and the reserves held against those loans

Dividend Yield (%) 0.65 0.61 0.72 0.91 0.86 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 2009Y 2010Y 2011Y 2012Y 2013YTD 5.25 5.12 6.15 6.91 4.93 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 2009Y 2010Y 2011Y 2012Y 2013YTD 3.21 3.59 3.31 3.57 3.21 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 2009Y 2010Y 2011Y 2012Y 2013YTD 74.66 62.06 68.36 63.34 67.70 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 2009Y 2010Y 2011Y 2012Y 2013YTD Profitability ROAA (%) ROAE (%) Efficiency Ratio (%) Net Interest Margin (%) 11

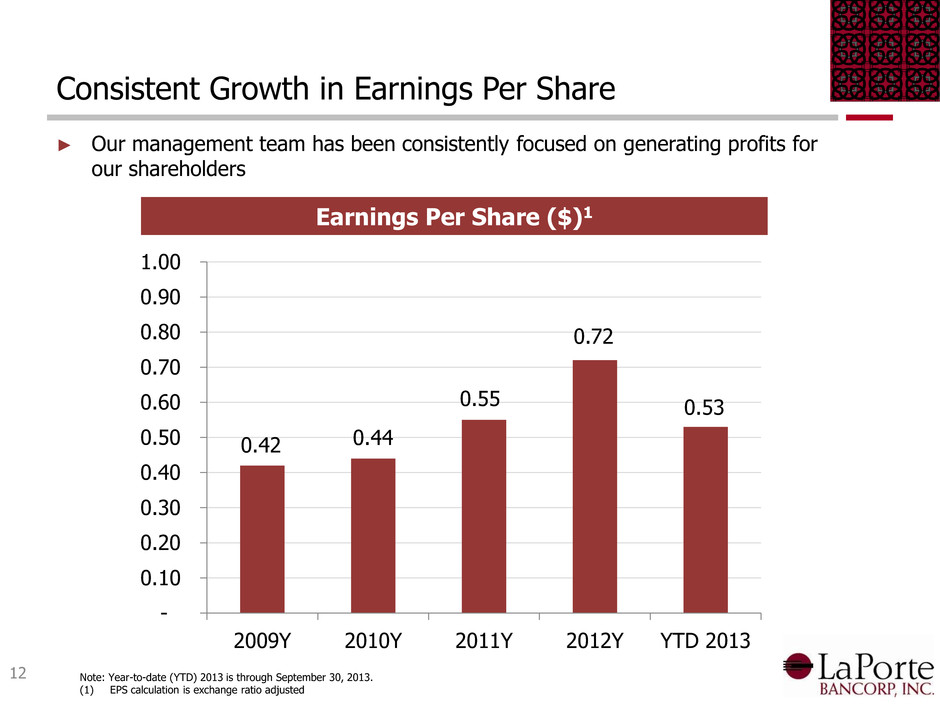

Consistent Growth in Earnings Per Share ► Our management team has been consistently focused on generating profits for our shareholders 12 Earnings Per Share ($)1 0.42 0.44 0.55 0.72 0.53 - 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 2009Y 2010Y 2011Y 2012Y YTD 2013 Note: Year-to-date (YTD) 2013 is through September 30, 2013. (1) EPS calculation is exchange ratio adjusted

Strong Capital Position ► LaPorte maintains a low risk profile with strong capital levels 13 Strong Capital Levels 10.2 9.4 10.0 15.6 15.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 2009Y 2010Y 2011Y 2012Y 2013Q3 T CE / T an g ib le A s s e ts ( % )

Use of Proceeds / Capital Management ► Share buyback (1) – Repurchase up to 5% (or 310,809 shares) of common stock ► Cash dividends – LPSB currently pays a $0.04 per share cash dividend ► Deliberate growth – Organic and select acquisitions 14 (1) Announced on October 24, 2013.

Investment Conclusions ► Experienced community banking team ► Well positioned for future growth ► Continued focus on shareholder returns ► Balance of growth & return of excess capital 15

Questions?