Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EXELON CORP | d640475d8k.htm |

Exhibit 99.1

Change to Format of Exelon Generation Disclosures

All numbers as of September 30, 2013

Exelon®

Change to Format of Exelon Generation Disclosures – Gross Margin, O&M and Depreciation & Amortization Definitions

Direct costs incurred to generate revenues (“Cost of Sales”) for certain Constellation businesses (Energy Efficiency, BGE Home and Upstream) have been included in O&M or Depreciation & Amortization (“D&A”) in previous Exelon Generation disclosures

Cost of Sales previously included in O&M and D&A is approximately $250M -$300M/year

Including the Cost of Sales in Gross Margin better reflects the scale of these Constellation businesses while reducing volatility in disclosures resulting from only capturing changes in revenue

Beginning with Q4 2013 Exelon Generation disclosure, Exelon is revising Gross Margin to include “Cost of Sales” for certain Constellation businesses; while simultaneously reducing O&M and D&A by an equal amount

Effect of revised format:

Gross Margin lowered by $250M—$300M

O&M/D&A lowered by $250M—$300M

Net Change to EBIT $0

1

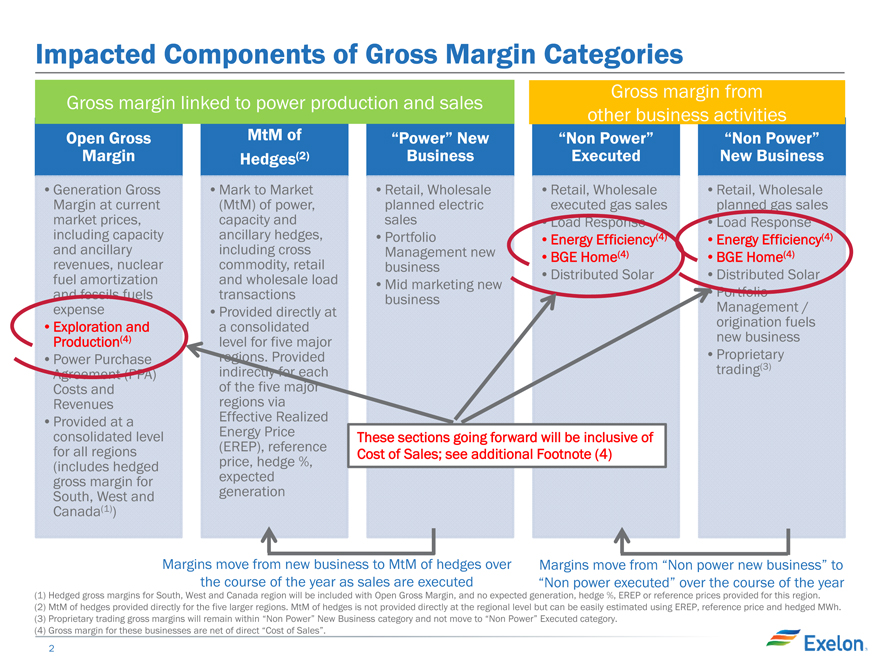

Impacted Components of Gross Margin Categories

Gross margin linked to power production and sales

Open Gross Margin

Generation Gross Margin at current market prices, including capacity and ancillary revenues, nuclear fuel amortization and fossils fuels expense

Exploration and Production(4)

Power Purchase Agreement (PPA) Costs and Revenues

Provided at a consolidated level for all regions (includes hedged gross margin for South, West and Canada(1)) MtM of Hedges(2)

Mark to Market (MtM) of power, capacity and ancillary hedges, including cross commodity, retail and wholesale load transactions

Provided directly at a consolidated level for five major regions. Provided indirectly for each of the five major regions via Effective Realized Energy Price (EREP), reference price, hedge %, expected generation

“Power” New Business

Retail, Wholesale planned electric sales

Portfolio Management new business

Mid marketing new business

Gross margin from other business activities

“Non Power” Executed

Retail, Wholesale executed gas sales

Load Response

Energy Efficiency(4) BGE Home(4)

Distributed Solar

“Non Power” New Business

Retail, Wholesale planned gas sales

Load Response

Energy Efficiency(4)

BGE Home(4)

Distributed Solar

Portfolio Management / origination fuels new business

Proprietary trading(3)

These sections going forward will be inclusive of Cost of Sales; see additional Footnote (4)

Margins move from new business to MtM of hedges over the course of the year as sales are executed

Margins move from “Non power new business” to “Non power executed” over the course of the year

(1) Hedged gross margins for South, West and Canada region will be included with Open Gross Margin, and no expected generation, hedge %, EREP or reference prices provided for this region. (2) MtM of hedges provided directly for the five larger regions. MtM of hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh. (3) Proprietary trading gross margins will remain within “Non Power” New Business category and not move to “Non Power” Executed category.

(4) Gross margin for these businesses are net of direct “Cost of Sales”.

2

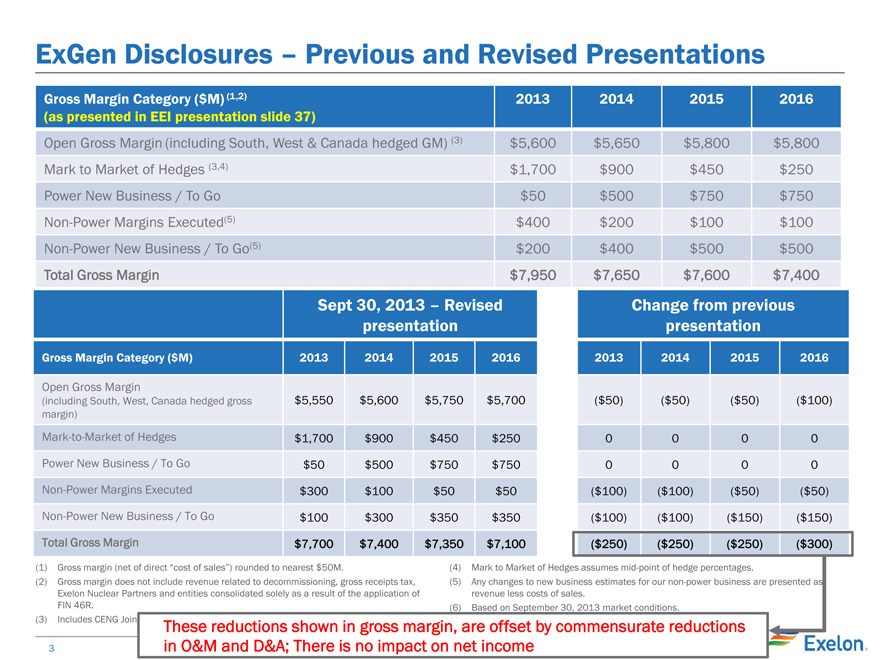

ExGen Disclosures – Previous and Revised Presentations

Gross Margin Category ($M) (1,2) 2013 2014 2015 2016

(as presented in EEI presentation slide 37)

Open Gross Margin (including South, West & Canada hedged GM) (3) $5,600 $5,650 $5,800 $5,800

Mark to Market of Hedges (3,4) $1,700 $900 $450 $250

Power New Business / To Go $50 $500 $750 $750

Non-Power Margins Executed(5) $400 $200 $100 $100

Non-Power New Business / To Go(5) $200 $400 $500 $500

Total Gross Margin $7,950 $7,650 $7,600 $7,400

Sept 30, 2013 – Revised

presentation

Gross Margin Category ($M) 2013 2014 2015 2016

Open Gross Margin

(including South, West, Canada hedged gross $5,550 $5,600 $5,750 $5,700

margin)

Mark-to-Market of Hedges $1,700 $900 $450 $250

Power New Business / To Go $50 $500 $750 $750

Non-Power Margins Executed $300 $100 $50 $50

Non-Power New Business / To Go $100 $300 $350 $350

Total Gross Margin $7,700 $7,400 $7,350 $7,100

Change from previous

presentation

2013 2014 2015 2016

($50) ($50) ($50) ($100)

0 0 0 0

0 0 0 0

($100) ($100) ($50) ($50)

($100) ($100) ($150) ($150)

($250) ($250) ($250) ($300)

(1) Gross margin (net of direct “cost of sales”) rounded to nearest $50M.

(2) Gross margin does not include revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners and entities consolidated solely as a result of the application of FIN 46R.

(3) Includes CENG Joint

(4) Mark to Market of Hedges assumes mid-point of hedge percentages.

(5) Any changes to new business estimates for our non-power business are presented as revenue less costs of sales.

(6) Based on September 30, 2013 market conditions.

These reductions shown in gross margin, are offset by commensurate reductions in O&M and D&A; There is no impact on net income

3

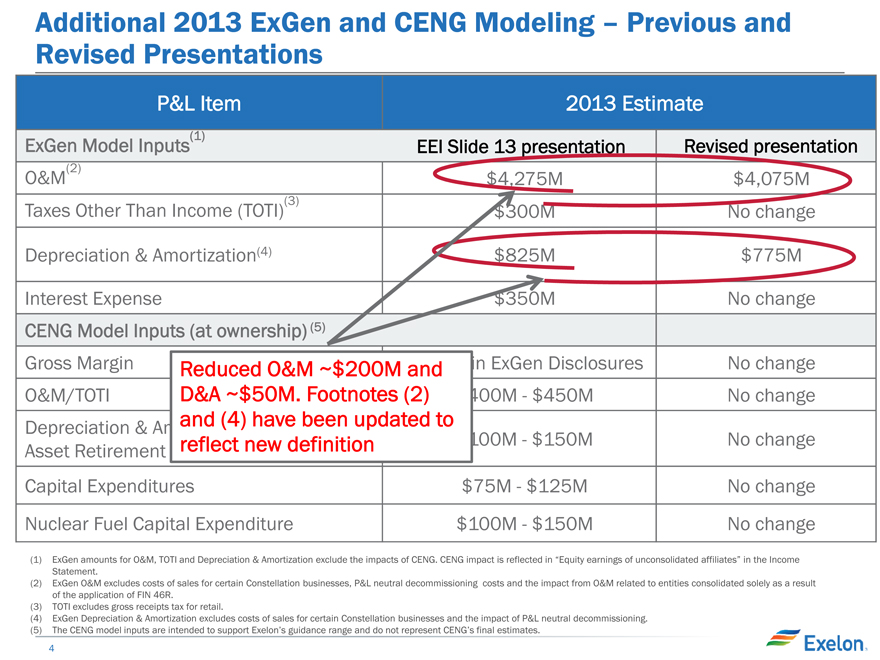

Additional 2013 ExGen and CENG Modeling – Previous and Revised Presentations

P&L Item 2013 Estimate

ExGen Model Inputs(1) EEI Slide 13 presentation Revised presentation

O&M(2) $4,275M $4,075M

Taxes Other Than Income (TOTI)(3) $300M No change

Depreciation & Amortization(4) $825M $775M

Interest Expense $350M No change

CENG Model Inputs (at ownership) (5)

Gross Margin in ExGen Disclosures No change

O&M/TOTI 400M—$450M No change

Depreciation & A

Asset Retirement 100M—$150M No change

Capital Expenditures $75M—$125M No change

Nuclear Fuel Capital Expenditure $100M—$150M No change

Reduced O&M ~$200M and

D&A ~$50M. Footnotes (2)

and (4) have been updated to

reflect new definition

(1) ExGen amounts for O&M, TOTI and Depreciation & Amortization exclude the impacts of CENG. CENG impact is reflected in “Equity earnings of unconsolidated affiliates” in the Income Statement.

(2) ExGen O&M excludes costs of sales for certain Constellation businesses, P&L neutral decommissioning costs and the impact from O&M related to entities consolidated solely as a result of the application of FIN 46R.

(3) TOTI excludes gross receipts tax for retail.

(4) ExGen Depreciation & Amortization excludes costs of sales for certain Constellation businesses and the impact of P&L neutral decommissioning. (5) The CENG model inputs are intended to support Exelon’s guidance range and do not represent CENG’s final estimates.

4