Attached files

| file | filename |

|---|---|

| 8-K - PLUG POWER INC | esplugpower8k.htm |

| EX-99 - PLUG POWER INC | e99-1.htm |

2013 December Business Update

The content of this presentation is

PLUG POWER INC. PROPRIETARY AND CONFIDENTIAL.

Copyright 2013 by Plug Power Inc.

1

Plug Power Inc. Safe Harbor Statement

This communication contains statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements contain projections of our future results of operations or of our financial position or state other forward-looking information. These forward-looking statements include, without limitation, statements regarding financial expectations for the fourth quarter of 2013 and the year 2014, growth prospects for future orders, bookings and revenues, EBITDA projections, reductions in material and service costs and alternative supply sources. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Investors are cautioned not to unduly rely on forward-looking statements because they involve risks and uncertainties, and actual results may differ materially from those discussed as a result of various factors, including, but not limited to: the risk that we continue to incur losses and might never achieve or maintain profitability, the risk that we expect we will need to raise additional capital to fund our operations and such capital may not be available to us; the risk that we do not have enough cash to fund our operations to profitability and if we are unable to secure additional capital, we may need to reduce and/or cease our operations; the risk that a "going concern” opinion from our auditors, KPMG LLP, could impair our ability to finance its operations through the sale of equity, incurring debt, or other financing alternatives; the recent restructuring plan we adopted may adversely impact management’s ability to meet financial reporting requirements; our lack of extensive experience in manufacturing and marketing products may impact our ability to manufacture and market products on a profitable and large-scale commercial basis; the risk that unit orders will not ship, be installed and/or converted to revenue; the risk that pending orders may not convert to purchase orders; the risk that our continued failure to comply with NASDAQ’s listing standards may result in our common stock being delisted from the NASDAQ stock market, which may severely limit our ability to raise additional capital; the cost and timing of developing, marketing and selling our products and our ability to raise the necessary capital to fund such costs; the ability to achieve the forecasted gross margin on the sale of our products; the actual net cash used for operating expenses may exceed the projected net cash for operating expenses; the cost and availability of fuel and fueling infrastructures for our products; market acceptance of our GenDrive systems; our ability to establish and maintain relationships with third parties with respect to product development, manufacturing, distribution and servicing and the supply of key product components; the cost and availability of components and parts for our products; our ability to develop commercially viable products; our ability to reduce product and manufacturing costs; our ability to successfully expand our product lines; our ability to improve system reliability for our GenDrive systems; competitive factors, such as price competition and competition from other traditional and alternative energy companies; our ability to protect our intellectual property; the cost of complying with current and future federal, state and international governmental regulations; and other risks and uncertainties discussed under “Item IA—Risk Factors” in Plug Power’s annual report on Form 10-K for the fiscal year ended December 31, 2012, filed with the Securities and Exchange Commission (“SEC”) on April 1, 2013 and as amended on April 30, 2013 and the reports Plug Power filed from time to time with the SEC. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable law, we do not undertake or intend to update any forward-looking statements after the date of this communication.

2

3

Progress Path to Success

Current negotiations to deploy GenDrive at multiple-site distribution centers will significantly impact fourth quarter bookings.

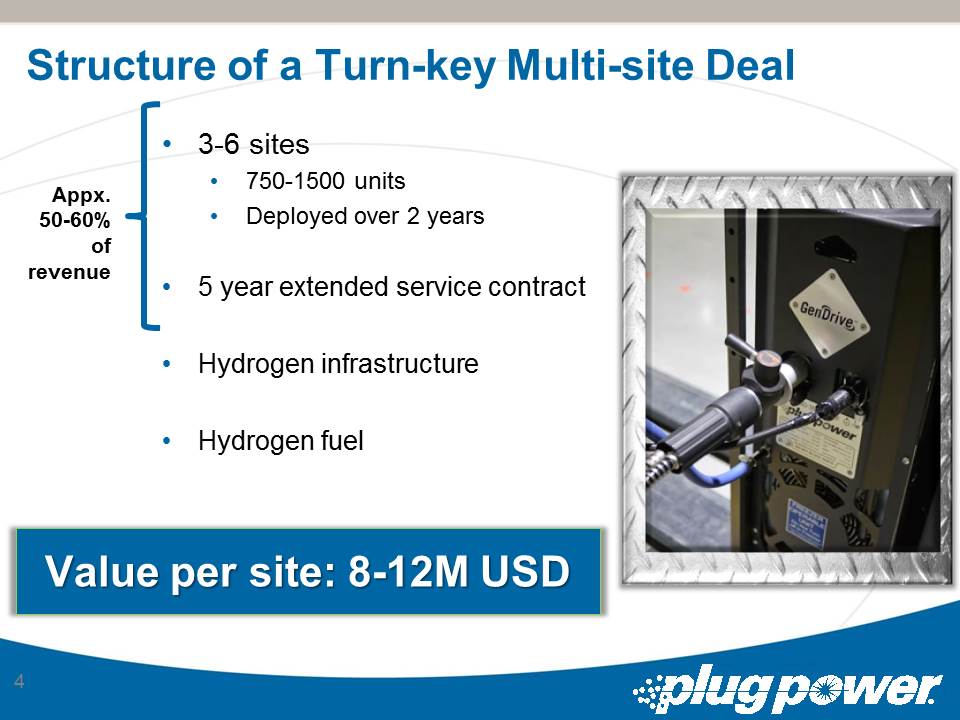

Structure of a Turn-key Multi-site Deal

•3-6 sites

•750-1500 units

•Deployed over 2 years

•5 year extended service contract

•Hydrogen infrastructure

•Hydrogen fuel

Appx. 50-60% of revenue

Value per site: 8-12M USD

4

All Products are Commercially Available NOW!

5

Typical Service Offering

•5 Year Contracts

•Labor

•Parts

•Hydrogen Infrastructure

•Represents 25% of total deal value

•Included in Plug Power turn-key solution

•Knowledge acquired by on-site support drives continual product improvement

•Some customers today:

•Sysco, Walmart, Kroger

A Growing Segment

6

Typical Hydrogen Offering

•Hydrogen infrastructure

•Today, portions deployed at Walmart Washington Court House

•Compression system designed for deployments

•Hydrogen re-sell

•Bulk purchase of hydrogen

•Daily, Plug Power customers purchase 2-3% of total available liquid H2 in the North America, today

•Provides Plug Power purchasing power

7

Material Handling Focused Segments

8

Success in Manufacturing: Auto Makers

•BMW, Spartanburg, South Carolina:

•205 GenDrive units in assembly hall

•118 GenDrive units in logistics, body and paint shot

•World’s largest users of fuel cells on a single site

•Mercedes-Benz, Tuscaloosa, Alabama:

•2012: 72 GenDrive units for vehicle assembly plant

•2013: Additional 123 GenDrive units for new warehouse

9

Success in Manufacturing: Auto Makers

•Batteries are undependable – GenDrive provides predictability

•Easy, fast operator refueling – minutes vs. hours

•Lower operational costs through eliminating battery room and charging equipment

•Reduction of greenhouse gas emissions by up to 80%

10

Success in Food: Kroger

•Compton, California

•Over 160 units deployed for over a year

•Stapleton, Colorado

•New contract win for Plug Power

•Will deploy over 200 GenDrive units in 2014

•Long term service contract in place at both facilities

Improves Productivity

11

Success at Walmart

•Deployments: Over 500 Units

•Cornwall, Canada

•Washington Courthouse, Ohio

•Calgary, Canada

•At Washington Courthouse facility - providing service and products

•Continuing to purchase additional units at these sites

•Another example of recurring revenue

Targeting providing turnkey solution for hydrogen, product and service at future sites.

12

Customer Base Continues to Grow

Backlog product shipments: 2014

•Today: 28M USD

•12/31: 43M USD

Recurring Revenue

•10M USD booked for 2014 and growing

Wegmans Food Markets

70% of 2014 requirements of 60M USD

13

Annual Product Business Break Even

|

Product Revenue |

$ 70,000,000 | $ 58,600,000 | $ 34,000,000 |

|

Material Cost |

$ 46,900,000 | $ 39,262,000 | $ 22,780,000 |

|

Production Labor Fully Burdened |

$ 4,850,000 | $ 4,850,000 | $ 4,850,000 |

|

All other Expenses |

$ 14,700,000 | $ 14,472,000 | $ 13,980,000 |

|

EBITDAS |

$ 3,550,000 | $ 16,000 | $ (7,610,000) |

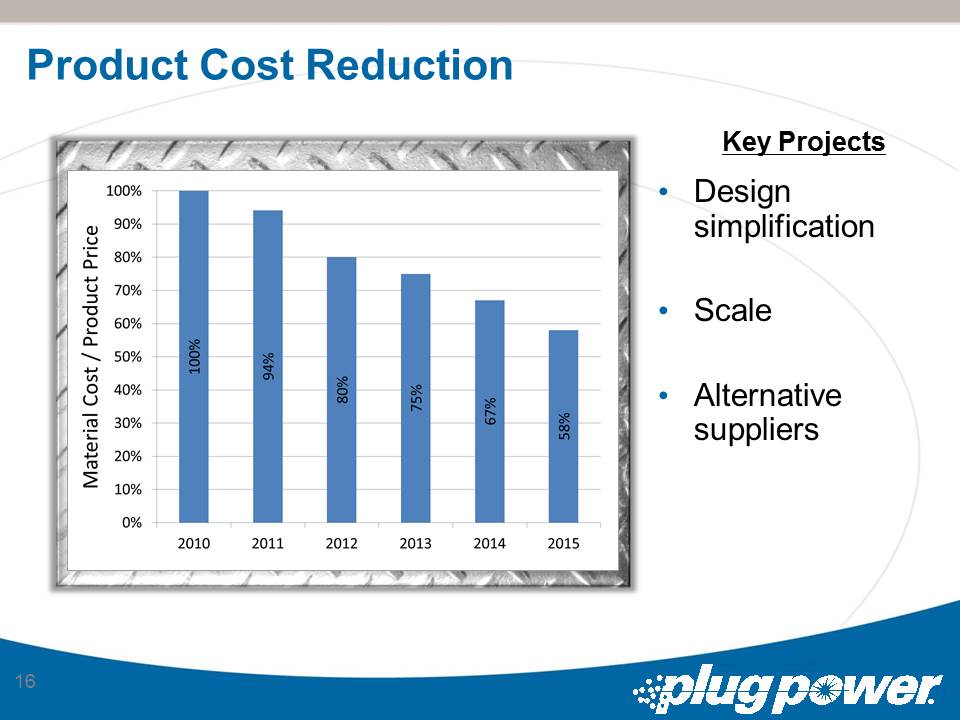

Assumes 67% Material Cost to Product Cost Targeted for Q2/Q3 2014 for a Breakeven EBITDAS Quarter

14

Service Cost: 75% Reduction in Breakdowns

Key Projects

•Addressed systematic failures

•Training – misdiagnostics

•Billing out staff

15

Product Cost Reduction

Key Projects

•Design simplification

•Scale

•Alternative suppliers

16

Second Source Options

•Key component – stacks

•Single sourced, today

•Considering:

•Alternative suppliers

•Joint development with Air Liquide

17

Alternative Suppliers

•Extensive review of potential substitutions

•Ground Support Equipment deployment will use one of the potential alternatives

•Looking to deploy GenDrive in 2014 with new supplier

18

Joint Development Opportunity

•Extensive survey of plate and membrane suppliers

•Large volumes for industry

•Great interest

•Leverage Plug Power’s system and mechanical design capability and Air Liquide electro-chemist know-how

•Opportunity to simplify our system, increase product life and reduce cost

•We’ll provide update in Feb. business update call

19

Market Expansion Opportunities

20

Market Expansion Through HyPulsion

•HyPulsion has completed one year of business and product development activities

•Europe greater market opportunity than North America

•7 collaboration projects in place:

•Jungheinrich, Linde/Fenwhich, Still, Crown, NACCO, Toyota Material Handling Equipment

•Starting initial deployments with many customers including BMW and IKEA

21

22

2013 is Not Over.

•17.8M USD orders to date this quarter, and building

•Will close a multi-site turn-key deal in coming weeks

•Expect 30-40M USD in bookings for the quarter

•Will reach EBITDAS breakeven in 2014

THIS WILL BE A BLOWOUT QUARTER FOR ORDERS

23

24

E-mail questions to: teal_vivacqua@plugpower.com