Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CorMedix Inc. | crmd_8k.htm |

EXHIBIT 99.1

DRIVES EVERYTHING WE DO

Company Overview

NYSE MKT: CRMD

December 2013

© 2013 CorMedix

2

Forward Looking Statements

This presentation contains certain statements that constitute forward-looking statements

within the meaning of the federal securities laws. Statements that are not historical

facts, including statements about our beliefs and expectations, are forward-looking

statements. These statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict. The forward looking

statements in this presentation include statements about our business, including

commercialization plans and potential markets for our products and product candidates,

clinical trials, potential indications for our product candidates, development timelines,

regulatory timelines and future events that have not yet occurred. Pharmaceutical and

medical device development inherently involves significant risks and uncertainties,

including the risks outlined in “Risk Factors” in our Annual Report on Form 10-K filed

with the Securities and Exchange Commission on March 27, 2013 and in “Risk Factors”

in our Quarterly Reports on Form 10-Q filed with the Securities and Exchange

Commission on May 15 and August 14, 2013. Our actual results may differ materially

from our expectations due to these risks and uncertainties, including, but not limited to,

our dependence on the success of our lead product candidate, and factors relating to

commercialization and regulatory approval thereof, ability to raise sufficient capital,

retaining our stock’s listing on the NYSE MKT, research and development activities,

intellectual property protection, competition, industry environment, and other matters.

Any forward-looking statements included in this presentation are based on information

available to us on the date of this presentation. We undertake no obligation to update or

revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

within the meaning of the federal securities laws. Statements that are not historical

facts, including statements about our beliefs and expectations, are forward-looking

statements. These statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict. The forward looking

statements in this presentation include statements about our business, including

commercialization plans and potential markets for our products and product candidates,

clinical trials, potential indications for our product candidates, development timelines,

regulatory timelines and future events that have not yet occurred. Pharmaceutical and

medical device development inherently involves significant risks and uncertainties,

including the risks outlined in “Risk Factors” in our Annual Report on Form 10-K filed

with the Securities and Exchange Commission on March 27, 2013 and in “Risk Factors”

in our Quarterly Reports on Form 10-Q filed with the Securities and Exchange

Commission on May 15 and August 14, 2013. Our actual results may differ materially

from our expectations due to these risks and uncertainties, including, but not limited to,

our dependence on the success of our lead product candidate, and factors relating to

commercialization and regulatory approval thereof, ability to raise sufficient capital,

retaining our stock’s listing on the NYSE MKT, research and development activities,

intellectual property protection, competition, industry environment, and other matters.

Any forward-looking statements included in this presentation are based on information

available to us on the date of this presentation. We undertake no obligation to update or

revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

© 2013 CorMedix

© 2013 CorMedix

Investment Highlights

CorMedix (NYSE MKT: CRMD) develops and markets

products to treat renal, cardiac and infectious diseases

products to treat renal, cardiac and infectious diseases

Lead product Neutrolin®

Class III CE Mark approved (drug-device) in July 2013

Catheter-related bloodstream infections (CRBSI)

cost approx. $25,000-40,000/hospitalization, or $6+ B/year, in the US

Clear European commercialization strategy

specialized and highly experienced EU sales force

Using a catheter lock solution (CLS) such as Neutrolin can reduce

occurrence of CRBSI by as much as 60-90 percent

occurrence of CRBSI by as much as 60-90 percent

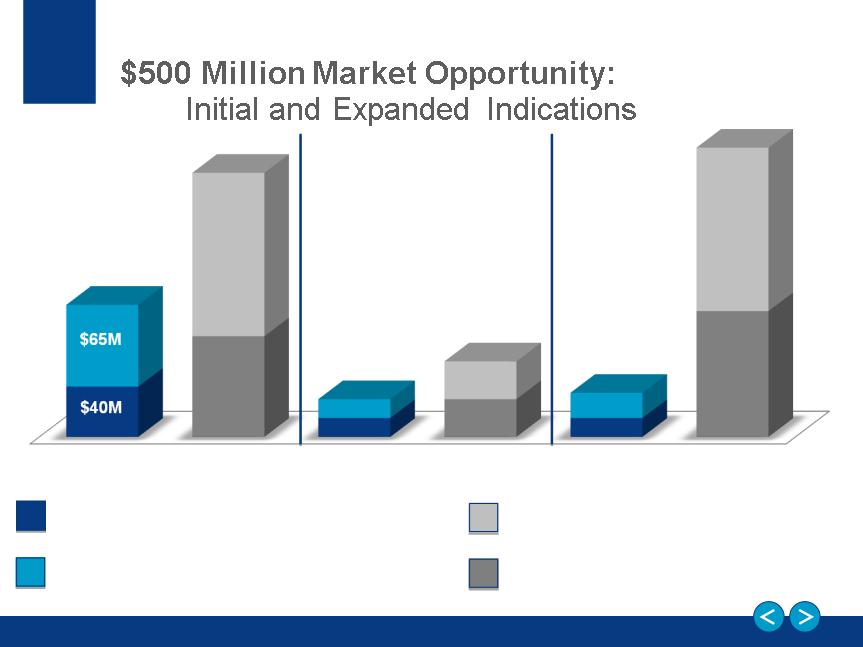

$500M worldwide market potential

Solid Global IP portfolio

17 issued U.S. patents

4

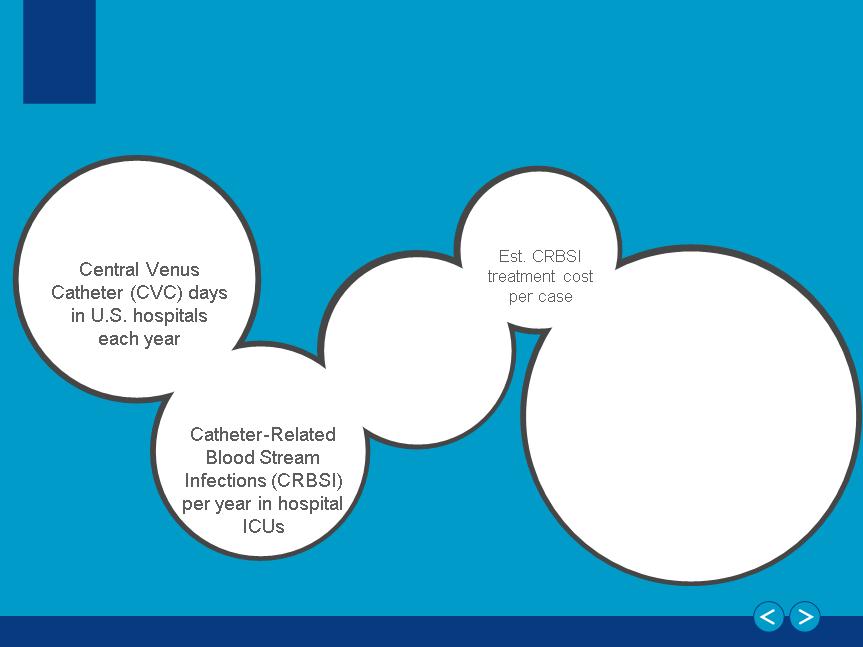

Catheter Safety and Efficacy:

15 Million

80,000

$25,000-

40,000

40,000

$6+ Billion

Total CRBSI cost to the

U.S. healthcare system

U.S. healthcare system

per year

By the Numbers

250,000

Estimated CRBSI

across all

across all

hospitals

© 2013 CorMedix

Sources: U.S. Centers for Disease Control and Prevention. Trish Perl, M.D., professor, medicine and pathology, Johns Hopkins School

of Public Health, Baltimore; Eyal Zimlichman, M.D., research associate, The Center for Patient Safety, Brigham and Women's Hospital,

Boston; Sept. 2, 2013, JAMA Internal Medicine, online

of Public Health, Baltimore; Eyal Zimlichman, M.D., research associate, The Center for Patient Safety, Brigham and Women's Hospital,

Boston; Sept. 2, 2013, JAMA Internal Medicine, online

What could save the US Healthcare system

Billions per year?

© 2013 CorMedix

6

Neutrolin®

A Catheter Lock Solution (CLS)

that fills the catheter to:

that fills the catheter to:

• Significantly decrease CRBSI

• Decrease catheter blood clotting

episodes

episodes

Neutrolin® contains:

• Taurolidine, an anti-infective

• Citrate, a buffering compound

• Heparin, an anticoagulant

© 2013 CorMedix

7

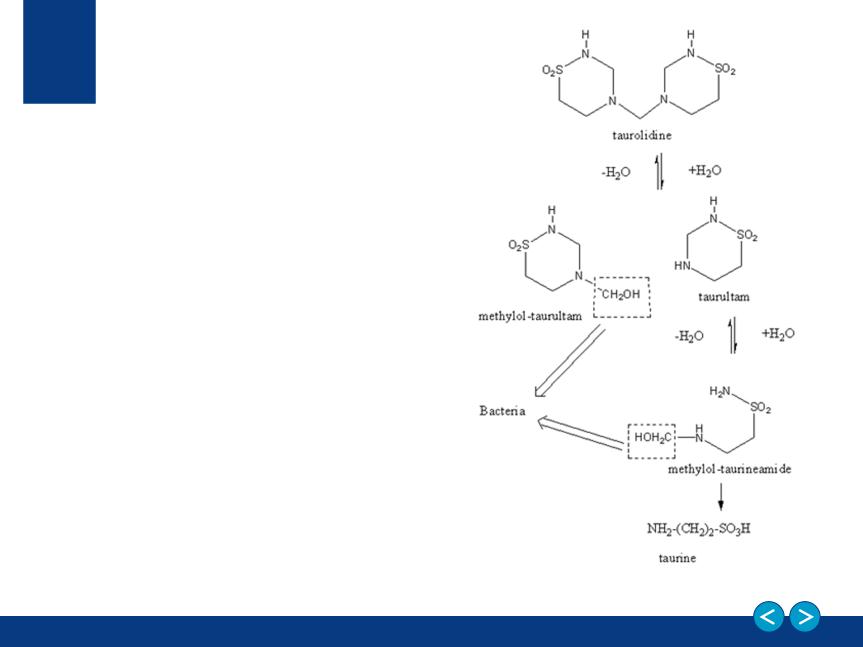

Neutrolin®

Mechanism of Action

Mechanism of Action

Taurolidine: a taurine amino acid

derivative

derivative

• Shows broad antibacterial action

against gram-positive and gram-

negative bacteria, mycobacteria and

some clinically relevant fungi

against gram-positive and gram-

negative bacteria, mycobacteria and

some clinically relevant fungi

• Shows a higher affinity than

mannose (the natural substrate) for

bacterial fimbriae protein responsible

for bacterial adhesion to human cells

mannose (the natural substrate) for

bacterial fimbriae protein responsible

for bacterial adhesion to human cells

© 2013 CorMedix

Source: Caruso F, Darnowski JW, Opazo C, Goldberg A, Kishore N, et al. (2010) Taurolidine Antiadhesive Properties on Interaction with E. coli; Its

Transformation in Biological Environment and Interaction with Bacteria Cell Wall. PLoS ONE 5(1): e8927. doi:10.1371/journal.pone.0008927

Transformation in Biological Environment and Interaction with Bacteria Cell Wall. PLoS ONE 5(1): e8927. doi:10.1371/journal.pone.0008927

8

Why is Antimicrobial Resistance a Problem?

© 2013 CorMedix

• Antibiotic/antimicrobial resistant infections cause:

– prolonged illness

– greater risk of death

– higher treatment costs

• A high percentage of hospital-acquired infections are

caused by highly resistant microorganisms

caused by highly resistant microorganisms

– Dialysis patients with catheters are susceptible to biofilm, which

nurtures and protects bacterial and fungal cell growth

nurtures and protects bacterial and fungal cell growth

– Neutrolin® controls bacteria growth in biofilm

Source: World Health Organization

9

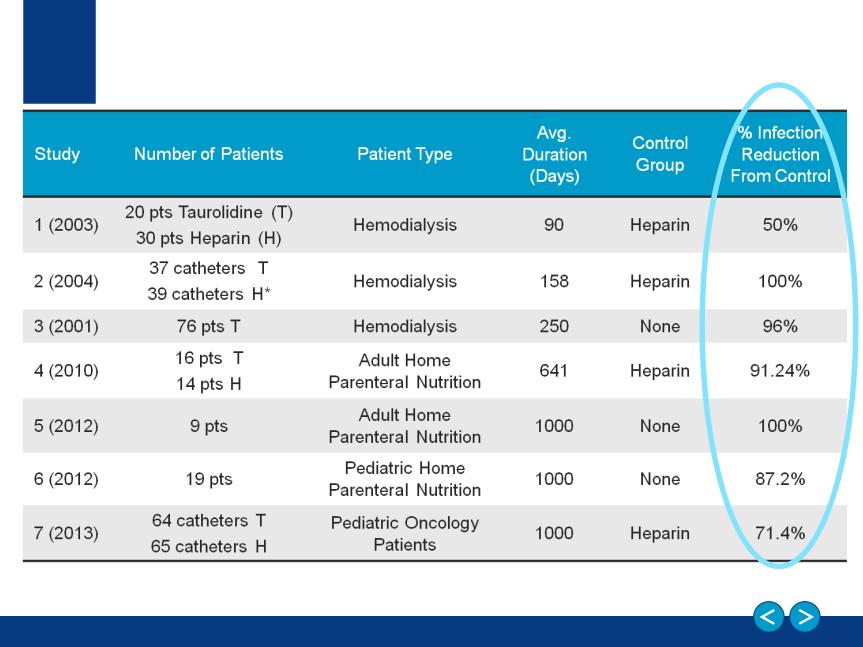

Taurolidine-Based Catheter Lock Solution:

Demonstrated Effectiveness

Demonstrated Effectiveness

*From 58 patients

1. Allon M Clin Infect Dis (2003) 36 (12):1539-44, 2. Betjes Nephrol Dial Transplant (2004) 19:1546-1551, 3. Sodemann K et al Poster: ASN 2001, 4. Bisseling, T. M., M. C. Willems, et al. (2010)

Clin Nutr 29(4): 464-8 , 5.Al-Amin, A. H., J. Sarveswaran, et al. (2013). J Vasc Access 0(0): 0., 6.Chu, H. P., J. Brind, et al. (2012). J Pediatr Gastroenterol Nutr 55(4): 403-7, 7Handrup, M. M.,

J. K. Moller, et al. (2013). Pediatr Blood Cancer 60(8): 1292-8

Clin Nutr 29(4): 464-8 , 5.Al-Amin, A. H., J. Sarveswaran, et al. (2013). J Vasc Access 0(0): 0., 6.Chu, H. P., J. Brind, et al. (2012). J Pediatr Gastroenterol Nutr 55(4): 403-7, 7Handrup, M. M.,

J. K. Moller, et al. (2013). Pediatr Blood Cancer 60(8): 1292-8

© 2013 CorMedix

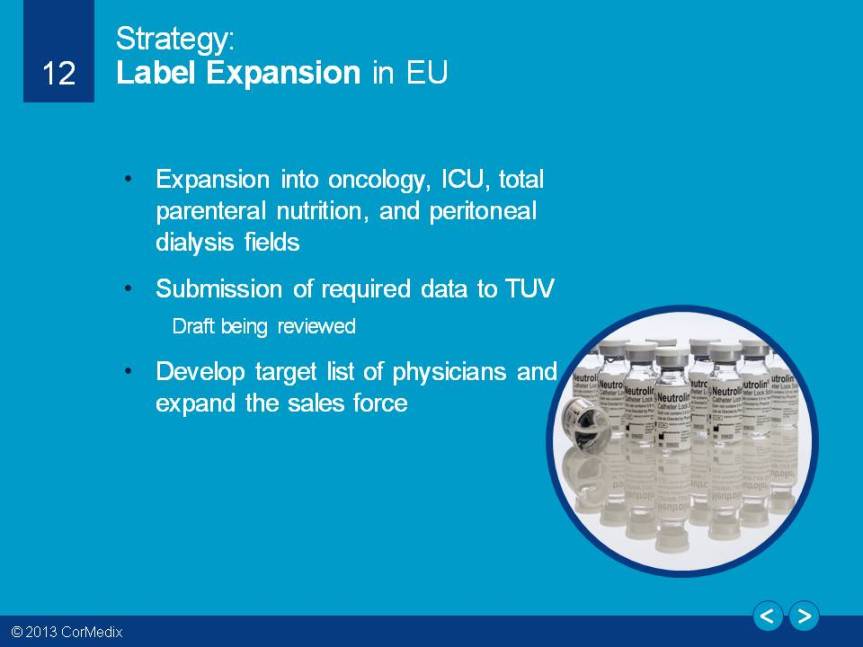

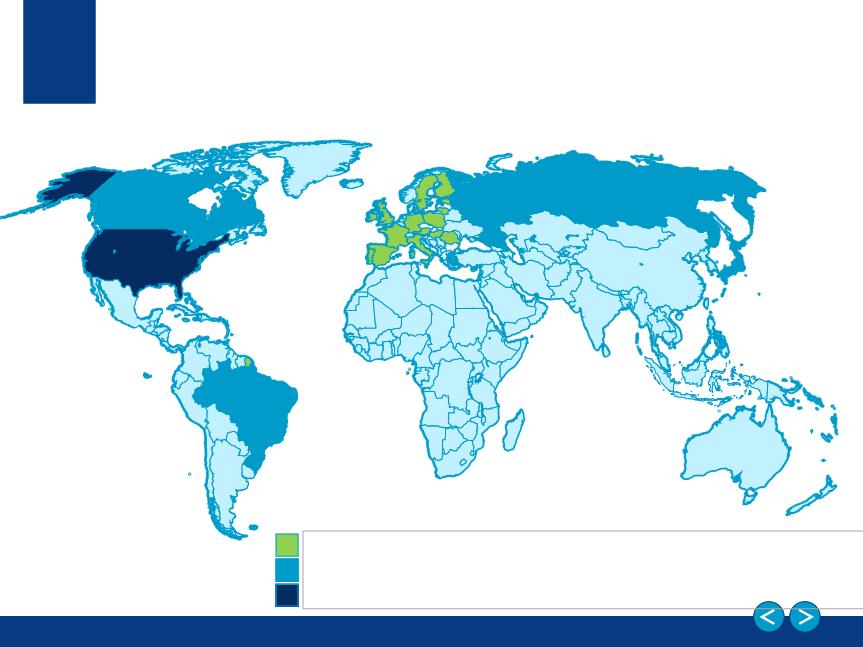

Successful EU Launch for Hemodialysis

Label Expansion in EU

Rollout to Other Key Countries

Neutrolin Growth Strategy

© 2013 CorMedix

1

2

3

Entry into US Market for Hemodialysis

4

Initial Neutrolin Indication:

Hemodialysis

Possible expanded Indications:

Oncology, ICU, Parenteral Nutrition, Peritoneal Dialysis

11

Strategy:

Successful EU Launch for Hemodialysis

Successful EU Launch for Hemodialysis

• Successful launch in Germany and Austria

– Experienced sales team

– Increase healthcare provider awareness

– Sales being booked: not yet shipped

• Negotiate partner arrangements

• Position Neutrolin® strategically

– Pricing

– Understand payer reimbursement policies

© 2013 CorMedix

13

Strategy:

Rollout to Other Key Countries

Rollout to Other Key Countries

• Identify best sales partners in

key countries

key countries

• Complete agreements

• Monitor product positioning

and coordinate manufacturing

capacity

and coordinate manufacturing

capacity

© 2013 CorMedix

14

Strategy:

Entry Into US Market

Entry Into US Market

• U.S. FDA discussions (pre-IND meeting, timelines)

– FDA clinical trial requirements

• Duration

• Clinical trial execution decision

• Strategic partner

© 2013 CorMedix

15

Neutrolin Growth Strategy

Phase I: Europe for Hemodialysis and label expansions

Phase II: Other key countries for Hemodialysis

Phase III: Hemodialysis in the U.S.

© 2013 CorMedix

16

$130M

© 2013 CorMedix

Hemodialysis - Defined Market

Label Expansions - Defined Market

(oncology, ICU, total parenteral nutrition and

peritoneal dialysis)

(oncology, ICU, total parenteral nutrition and

peritoneal dialysis)

$130M

$80M

$15M

$15M

$30M

$30M

$20M

$15M

$100M

$130M

Hemodialysis - Upside Potential

Label Expansions - Upside Potential

(oncology, ICU, total parenteral nutrition and

peritoneal dialysis)

(oncology, ICU, total parenteral nutrition and

peritoneal dialysis)

European Union

Rest of World (Ex. US)

United States

17

IP Status Update

© 2013 CorMedix

• Global Patent Portfolio - 17 issued

patents provide protection through 2019-

2025

patents provide protection through 2019-

2025

– Freedom to Operate in Europe

– Proprietary

• Planned additional filings

18

Financial Information

© 2013 CorMedix

• Total Pro Forma cash of

approximately $3.3 million

as of September 30, 2013

approximately $3.3 million

as of September 30, 2013

• Total Pro Forma debt of

approximately $0.3 million

as of September 30, 2013

approximately $0.3 million

as of September 30, 2013

• Capitalized to fund

operations through the

second quarter of 2014

assuming no sales and/or

strategic partnerships

operations through the

second quarter of 2014

assuming no sales and/or

strategic partnerships

• Approximately 16 million

common shares

outstanding as of

September 30, 2013

common shares

outstanding as of

September 30, 2013

© 2013 CorMedix

Investment Highlights

CorMedix (NYSE MKT: CRMD) develops and markets

products to treat renal, cardiac and infectious diseases

products to treat renal, cardiac and infectious diseases

Lead product Neutrolin®

Class III CE Mark approved (drug-device) in July 2013

Catheter-related bloodstream infections (CRBSI)

cost approx. $25,000-40,000/hospitalization, or $6+ B/year, in the US

Clear European commercialization strategy

specialized and highly experienced EU sales force

Using a catheter lock solution (CLS) such as Neutrolin can reduce

occurrence of CRBSI by as much as 60-90 percent

occurrence of CRBSI by as much as 60-90 percent

$500M worldwide market potential

Solid Global IP portfolio

17 issued U.S. patents

745 Route 202-206

Suite 303

Suite 303

Bridgewater, NJ 08807

908.517.9500 (ph)

908.429.4307 (fax)

NYSE MKT: CRMD

@CorMedix

rmilby@cormedix.com

Thank You

November 2013

November 2013

© 2013 CorMedix