Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Smartag International, Inc. | Financial_Report.xls |

| EX-32 - EXHIBIT 32 - Smartag International, Inc. | exhibit32.htm |

| EX-31 - EXHIBIT 31 - Smartag International, Inc. | exhibit31.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | |

| [ X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the year ended September 30, 2013 | |

| OR | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SMARTAG INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Commission file number: 000- 53792

| Nevada | 81-0554149 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

3651 Lindell Road Ste D269 Las Vegas, NV |

89103 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(949) 310-1762

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | ||

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [x] |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes [ ] No [x]

As of March 31, 2013 (last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $127,430.

As of November 22, 2013, there were 10,637,151 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| Table of Contents | ||

| Part I | Page | |

| Item 1 | Business | 3 |

| Item 1A | Risk Factors | 13 |

| Item 1B | Unresolved Staff Comments | 19 |

| Item 2 | Properties | 19 |

| Item 3 | Legal Proceedings | 19 |

| Item 4 | Submission of Matters to a Vote of Security Holders | 19 |

| Part II | ||

| Item 5 | Market for Registrant’s Common Equity and Related Stockholder Matters | 20 |

| Item 6 | Selected Financial Data | 22 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 23 |

| Item 7A | Quantitative and Qualitative Disclosure about Market Risk | 25 |

| Item 8 | Financial Statements and Supplementary Data | 26 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 36 |

| Item 9A | Controls and Procedures | 36 |

| Part III | ||

| Item 10 | Directors, Executive Officers of the Registrant | 38 |

| Item 11 | Executive Compensation | 39 |

| Item 12 | Security Ownership of Certain Beneficial Holders and Management | 40 |

| Item 13 | Certain Relationships and Related Transactions | 40 |

| Item 14 | Principal Accountant Fees and Services | 41 |

| Part IV | ||

| Item 15 | Exhibits, Financial Statement Schedules | 42 |

| Signatures | 44 |

| -2- |

FORWARD LOOKING STATEMENTS

There are statements in this registration statement that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under “Risk Factors.” Although management believes that the assumptions underlying the forward looking statements included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Registration Statement will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

PART I

ITEM 1 BUSINESS

(a) Business Development

Smartag International, Inc., a Nevada corporation (“Smartag,” “Company,” “we,” “us,” or “our”), was formed as Theca Corporation on March 24, 1999 in Colorado. On November 29, 2004, we merged with Art4Love, Inc., a Delaware corporation, into Art4Love, Inc. a Nevada corporation. Art4love, Inc. attempted to sell and lease art to companies and individuals from artists’ collections worldwide. The Company ceased operations in December 2006.

On December 31, 2008, pursuant to a Share Purchase Agreement Chad Love Lieberman, the Company’s former majority stockholder and President, sold to Smartag Solutions Bhd. an aggregate of 10,000,000 shares of Company common stock (the “Sale”) which amounted to 98.6% of the Company.

On February 19, 2009, Art4Love changed its name to Smartag International, Inc.

In September 2013, the Company commenced operations specializing in traceability and mobile payments. We provide food traceability, RFID solutions, near field communications, track and trace services and micro payment services.

Amongst the list of accomplishments of the Smartag Group of companies include:

- Smartag provides innovative solutions and services to various industries in the private and government sectors through Internet and Mobility applications technologies to deliver our products and services to homes and businesses.

- Smartag has been selected by government sponsored Multimedia Development Corporation (MDEC) in Malaysia, the mandated organization to visualize, and drive Digital Malaysia to establish a Trusted Mobile Digital Wallet System based on Near Field Communication for Mobile Phones.

| -3- |

- Fully developed Smartrack™ EPCIS (Electronic Product Code Information Services), which culminated in the company receiving the ‘Best of e-Logistics Merit Award’ for Smartrack™ at the MSC Malaysia APICTA Awards 2010, and Merit Winner under the category of e-Logistics and Supply Chain Management at the Asia Pacific ICT Alliance Awards 2010. Smartrack™ is also the first in Asia Pacific, and the second in the world to pass all nine (9) conformance test branches conducted by MET Laboratories Inc. on behalf of GS1 International whereupon Smartrack™ was subsequently awarded with the EPC Global Software Certification Mark. This allows us to link up multiple supply chain logistics company systems together safely into one traceability system using RFID and Bar Codes.

- Developed comprehensive Food Traceability solution from Farm to table, using GPS, Internet and mobility technologies. The solution is suitable for products like Palm Oil, Frozen meat, high value herbs and health care products.

Licensing Agreement

On September 19, 2013, we entered into a Licensing and Technology Agreement (“Licensing Agreement”) with, Smartag Solutions Berhad, a Malaysian company (“SSB”). Under the terms of the Licensing Agreement, SSB licensed to the Company the exclusive rights to use, modify and further enhance and develop SSB’s Smartrack™ software engine for any project handled or sponsored by the Company and hereby designates the Company in perpetuity from the date hereof to redistribute, outsource or further enhance the Smartrack™ engine for any projects, whether within North America or even between North America and any other country in the world provided however that the traceability project is sponsored by the Company. The Company is to pay $200,000 for the license (“Licensing Fee”). The Licensing Fee shall be made within three months from the date of invoice from SSB to the Company after the completion and handing over to the Company of the server with the Smartrack™ engine together with the installation and commissioning of the Company’s new website. Any delay in payment after three months shall incur an interest at market rate and in any event shall not be delayed beyond end of March 2014.

Under the Agreement, SSB also agrees to develop, install and commission the Smartrack™ in North America at its own costs and place one SSB’s server in a data center in the United States and subsequently develop and install traceability systems for the retail North American market as well as link up SSB’s related solutions and services currently in place with all the certification and/or accreditation as may be required by EPC GS1 Global within two months from the date hereof.

Loan Agreement

On September 19, 2013, we entered into a Loan Agreement (“Loan Agreement”) with SSB. Under the terms of the agreement, SSB loaned the Company $200,000 (“Loan”). The Loan shall be repaid on or before September 30, 2014 and interest shall accrue from the date of any advances on any principal amount withdrawn, and on accrued and unpaid interest thereon, at the rate of zero percent (0%) per annum, compounded annually. A copy of the Loan Agreement is attached to this Current Report on Form 8-K as Exhibit 10.5 and is incorporated herein by reference.

(b) Business of Issuer

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”). We will continue to be an emerging growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of $1,000,000,000 or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year period, issued more than $1 billion in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer, as defined in Section 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| -4- |

As an emerging growth company, we are exempt from:

| - | Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation; |

| - | The requirement to provide, in any registration statement, periodic report or other report to be filed with the commission, certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement; |

| - | Compliance with new or revised accounting standards until those standards are applicable to private companies; |

| - | The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002 to provide auditor attestation of our internal controls and procedures; and |

| - | Any Public Company Accounting Oversight Board (“PCAOB”) rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

We specialize in traceability and mobile payments. We provide food traceability, Radio Frequency Identification (“RFID”) solutions, near field communications, track and trace services and micro payment services.

| -5- |

In 2009, SSB’s dedicated R&D team commenced development of Smartrack™ EPCIS (Electronic Product Code Information Systems), which culminated in the company receiving the ‘Best of e-Logistics Merit Award’ for Smartrack™ at the MSC Malaysia APICTA Awards 2010, and Merit Winner under the category of e-Logistics and Supply Chain Management at the Asia Pacific ICT Alliance Awards 2010. Smartrack™ is also one of the first in Asia Pacific and in the world to pass all nine (9) conformance test branches conducted by MET Laboratories Inc. on behalf of GS1 International whereupon Smartrack™ was subsequently awarded with the EPC Global Software Certification Mark. This allowed SSB to link up multiple supply chain logistics company systems together safely into one traceability system using RFID and Bar Codes.

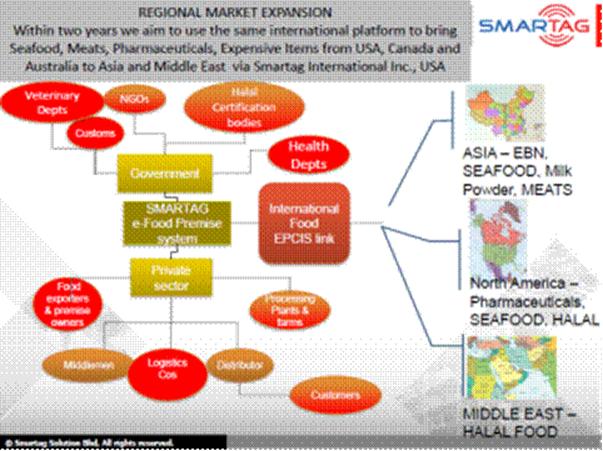

Our plan is to connect to the extensive food traceability platform which has been developed by SSB. The extended network will thus allow us to have a wide reach which will cover not only Malaysia, China, Hong Kong, Taiwan, and Indonesia but will also penetrate new markets in the USA and Canada.

We have been funding our operations through loans from SSB over the past few years. Going forward, our ability to continue as a going concern is dependent upon our ability to raise additional capital and to ultimately achieve sustainable revenues and profitable operations. We are currently in discussions with several investment banks and private lenders to obtain additional debt or equity financing. There is no guarantee that we will be able to obtain additional financing.

Our Products and Services

We specialize in traceability and mobile payments. We provide food traceability, RFID solutions, near field communications, track and trace services and micro payment services. In 2011, we adjusted our business plan to take advantage of opportunities to expand our business worldwide and tap into the market for Regional Food traceability solutions and we intend to expand operations to take advantage of increasing global demand.

| -6- |

Meat Traceability Solutions and Platforms

In the immediate future we will focus on food traceability and in particular meat traceability. Thus we will provide “farm-to-table” meat traceability system which includes the ability to facilitate product recall.

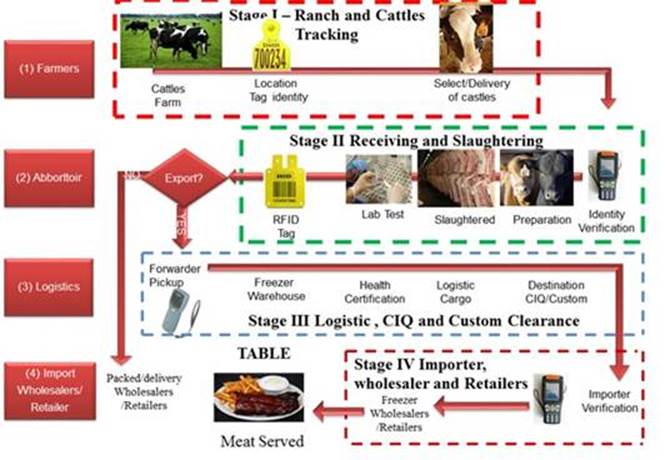

The meat supply chain tracking start from the farms using the animal ear RFID tags to identify and manage the animal from birth certificate and its health records. At the slaughter house the animal ear tag is used to identify the slaughtered animal’s origin and retrieve its records. The information from the slaughter house will be included and passed on supply chain. Companies and governmental organizations access to the system to track the meat supply chain information from birth to current state and monitor the slaughtered animal to ensure it is slaughtered in a licensed abattoirs and the parties are involved in the whole supply chain. In this respect, our long standing relationship to markets in the Far East becomes very important for Smartag’s customers from North America supply frozen meats to markets in China, Indonesia, Malaysia and the Middle East, where SSB’s strengths are. Thus we will link importers/wholesalers from across the pacific rim to use the system to record the frozen meat supplied and check its source.

Other Track and Trace Solutions - Halal Traceability System

Halal is an Arabic word “حلآل” mean “permitted’ or “lawful”.

Halal Certification is a process carry out by an authorized Muslim body to ensure that food preparation processes comply with Islam Law or Syariah’.

Halal Traceability System Features

The system involves three components namely

- Halal and Health Premise Certification

- Halal Logistic Certification

- Halal Food Traceability

| -7- |

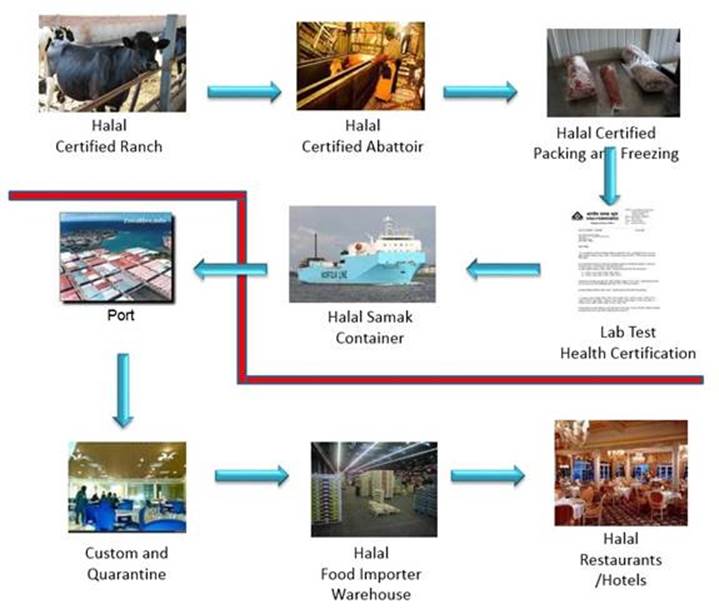

The system is designed to manage the Halal Certificated issued by the authority and allow a Muslim to verify the Halal outlets authenticity. Halal logistic certification is to ensure the transport system used, warehouse and freezer are certified Halal, and avoid any contamination from non-Halal elements. The Halal Food Traceability system is to provide supply chain tracking of raw material supply and processed finished goods to ensure compliance with Halal requirements.

Halal and Health Premise Certification

This component registers all premises (ranches, abattoirs, warehouses, freezers, restaurants, hotels and etc) that had been certified Halal compliance by an Islamic body. The certified body will received a Halal Certificate and Premise RFID and QR-code tag that record its registration number of GPS location. Anyone could use the mobile application provided to scan or read the tag to verify the Halal Certification authenticity in real-time.

Halal Logistic Certification

All trucks, warehouse and shipping containers used for transporting Halal food must comply with the Halal guidelines, for instant a Container has to be “Samak” clean if it was previously used to transport non-Halal goods. The “Samak” container will be issued with a “Samak” Certificates.

Halal Food Traceability

This component track all the raw material used to manufacture or produce Halal certified food, and its supply chain.

The following diagram illustrates the Halal Meat export to another country via sea.

|

| -8- |

The ranch and Abattoir have to be registered and audited by the Importer Agriculture department and Islamic Association to ensure they comply to the hygiene and Halal requirements. The registration of Halal Premise is based on GS1 standards. The Halal Certified Ranch owners are responsible to register all animal or stock under their care. The animal information are recorded in the Halal Traceability System. The Halal Certified Abattoir must first register their qualified “Imam” who offer prayer to animal prior to slaughter. The Abattoir must also record the animal identity required from Ranches. The animals are from Halal Certified Ranches. Once the animals are slaughtered the cut meat must be identified animal origin. Once they are identified and label and captured by the system, the meat will be packed and freeze.

Technology

We believe the core competencies of our company are the ability to develop and build a food traceability platform across borders using Smartrack™, one of the first certified EPCIS solutions in the world, together with the extensive knowledge and networking with customer requirements, customs regulations and logistics routes in areas where we operate. . Together with this core software platform we have used a combination of multiple hardware and application namely:-

- Online Internet Near Field Communication (“NFC”) applications

- Mobility handheld devices

- Global Positioning System (“GPS”) and SIM card technologies

- Long range antenna readers

- Central server applications and database shared services

- Tags personalization, security and encryption

- Secure food grade packing system

Supply Chain

The supply chain across borders remain a challenge in this industry and we plan to focus on this. The costs of doing food traceability relies on us convincing our clients to use our services for a slight increase in the normal costs of supplying food across borders. With the increasing demand across the world for food safety, we feel that clients are will to pay the slight increase because more and more importance is given to issues on food safety. Our system combines not only authentication of our client’s products but also actual traceability along the supply chain wherein our reliance on SMARTRACK has proven that it is a practical and safe way to link up multiple platforms along the supply chain into one cohesive system by providing actual online data to suit the client’s requirements.

By virtue of being one of the first internationally GS1 certified track & trace solutions provider specializing in food traceability with existing multiple platforms linked to government agencies such as customs departments and quarantine agencies as well as the ability to provide private sector logistics companies, sellers and buyers alike, we are in the position to be one of the first to offer a truly independent global food traceability cross border platform. By linking up the existing cross border network systems already established in the Far East and developed by SSB and its partners in countries ranging from Malaysia, Thailand, Indonesia, Hong Kong, Taiwan, China and the Middle East with new ones to be developed in North America via an immediate transfer of technology and the setting up of RFID food traceability network and infrastructure, we can offer a truly Asia-Pacific platform to food exporters and importers and well as logistics suppliers who are focused on food safety and traceability.

| -9- |

Marketing Strategy

We are set to target numerous sectors for its food traceability solutions, particularly: (i) the Halal market, including US Beef, Chicken, American Ginseng, pharmaceuticals, Australian and New Zealand beef, lamb, Vietnamese sea-foods, and Halal cosmetics; (ii) the Non-Halal market, including US pork for the greater China market; (iii) the sensitive products market, including milk powder, drugs, medicines, and other specialized products upon demand; and (iv) the exotic niche products market, including Malaysian edible bird’s nest, Maine and Canadian lobsters, California wines, and Scotch whiskey and Chinese white wine.

Within two years, we intend to expand the availability of its products to markets outside of South East Asia, including the U.S., Canada, Australia, Asia and the Middle East via Smartag International. We have developed successful tracing systems for the following products: (i) Edible Birds Nest - Smartag’s traceability system the capability to have online access, via the Department of Veterinary Services in Malaysia to thousands of government registered birds nest house throughout Malaysia; (ii) Pigs - Smartag’s traceability system has online access to one of the largest pig farm area in Malaysia with the capacity for 500,000 pigs; (iii) Edible Palm Oil - Smartag is also tracking Crude Palm Oil from the Palm Oil plantations to the Mill and onwards to the refinery for the Malaysian Palm Oil Board (MPOB) to China, India & Japan. Our traceability system has linked export permits online to the official China Import & Export Fair Trading system belonging to the Canton Trade Fair – currently the world’s largest trade fair; (ii) INDONESIA – we are currently linking to Indonesian Palm Oil from the some of the world’s biggest palm oil plantations to the designated tanker ports for onward distribution to Japan, India, the USA and China; and (iii) VIETNAM.

S

Sales Strategy

We may partner with other companies with competent sales and marketing expertise in the future in order for us to start the sale of our products and services. However, much of the sales would come from our ability to meet the requirements from the demand side in China and the Middle East. It is quite often the case that no one will seek for food traceability services unless there are issues concerning food safety, adulteration, and fake goods. In this respect, China, as a major food market for the USA, will provide us the initial sales, especially for wines and other higher value consumables. Likewise, the Middle East is a market for Halal Food, which also requires traceability in addition to issues addressing Halal certification. It is often the case that high end meats, including Wagyu beef, and high quality mutton is increasingly coming online as a Halal food item not only the Muslim markets in the USA, but also to our established markets in Malaysia, Indonesia as well as the Middle East.

| -10- |

Regulation

Wherever there are logistics services for food to be delivered cross borders, there are significant regulations which involve food safety and in this respect, this becomes a “double edge sword” as Smartag’s ability to provide a niche relies upon the fact that we can and shall work within the framework of these health and food safety regulations, which may differ in terms of one country to another, especially in terms of quarantine and inspection laws and regulations. These regulations are increasingly working in our favor as more and more jurisdictions are insisting on food traceability systems as part of the conditions for importing food into their countries. China’s Customs, Inspection and Quarantine (AqSIQ), for instance, has insisted that Edible Birds Nest imported from Malaysia and Indonesia, must come together with traceability records right from the “farm”. This augurs very well for us as it means that every exporter of such products from Malaysia or Indonesia would essentially require services such as ours. However, because each one of these regulations for every food item will take time for our clients to comply, our ability to expand our business will be such that we have to wait for the health and food safety regulators to regulate our clients and this may slow down our expansion plans.

Nevertheless, with our business strategy, we will start first with essentially high value products on a voluntary basis whereby even though the law in some cases may not require traceability systems in place. We believe that the higher end supply chain market forces will dictate the necessity for showing that their products is traceable from “farm to fork” thus creating the demand for our services. This may take some time but we believe it will happen very soon in a big way as food safety has become a major concern worldwide.

Competition

There may be many companies offering RFID and Bar Code technologies who are able food traceability services within the USA but there are not many companies which are able to offer cross border trans Pacific food traceability to China, Hong Kong, Taiwan as well as the growing population in South-east Asia. Those who are able to compete with us will be only a handful and in this respect, it is the quality of the online information provided that distinguishes between our services and those others which provide authentication and not true traceability along the supply chain.

In this respect, we believe that there are not many other companies whereby the EPCIS system such as ours has been certified by METLABS Inc on behalf of GS1 International outside of the USA. As such we feel that we are definitely one of the early pioneers in this respect, which can offer to our clients something definitely unique and truly independent.

Intellectual Property

By virtue of the technology transfer agreement, we have basically acquired the rights to use and distribute Smartrack™ indefinitely, which the parent company has filed for registration of the Smartrack™ name. It is pending approval. However, essentially this business is not critically dependent on Intellectual Property rights as it is a services orientated business, Clients will use our services because it brings them to the level of compliance with health authorities in some cases and in other cases, value added propositions to which they can distinguish their own products.

Seasonality

We believe that this business in not critically seasonal for essential food delivery save for seasonal demands during festivities whereby the demand for food, especially high end products such as wines and meats may increase.

Principal Executive Offices

Our principal executive offices are currently located at 3651 Lindell Road Ste D269, Las Vegas, NV 89103. Our telephone numbers are +1(206)4898965 and +1(949) 310-1762. We believe our facilities are inadequate to meet our current and near-term needs for the next twelve months and we intend to lease premises within the state of California or Nevada within this period.

| -11- |

Employees

As of June 2013, we had 2 full-time and 8 part-time consultants. Since inception, we have never had a work stoppage, and our employees are not represented by labor unions. We consider our relationship with our employees to be positive.

Legal Proceedings

We are not involved in any legal proceedings

(c) Reports to security holders.

(1) To the extent required by federal and state law, the Company will deliver an annual report to security holders.

(2) The Company will file reports with the SEC. The Company will be a reporting company and will comply with the requirements of the Exchange Act.

(3) The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Room at 100 F. Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

| -12- |

| ITEM 1.A | RISK FACTORS |

An investment in the Company is highly speculative in nature and involves an extremely high degree of risk.

We have a history of net losses and will not achieve or maintain profitability.

We have a history of incurring losses from operations. As of September 30, 2013, we had an accumulated deficit of approximately $1,514,419, of which approximately $1,164,967 was incurred prior to the cessation of the previous operating business on December 31, 2006. We anticipate that our existing cash and cash equivalents will be sufficient to fund our business needs in the near term. Our ability to continue may prove more expensive than we currently anticipate and we may incur significant additional costs and expenses in connection with the launching of our business.

We depend on key personnel to manage our business effectively, and, if we are unable to hire, retain or motivate qualified personnel, our ability to design, develop, market and sell our systems could be harmed.

The loss of the services of any of our key personnel may seriously harm our business, financial condition and results of operations. In addition, the inability to attract or retain qualified personnel, or delays in hiring required personnel, particularly operations, finance, accounting, sales and marketing personnel, may also seriously harm our business, financial condition and results of operations. Our ability to attract and retain highly skilled personnel will be a critical factor in determining whether we will be successful in the future.

We will continue to incur the expenses of complying with public company reporting requirements.

We have an obligation to continue to comply with the applicable reporting requirements of the Exchange Act which includes the filing with the SEC of periodic reports, proxy statements and other documents relating to our business, financial conditions and other matters, even though compliance with such reporting requirements is economically burdensome.

Our business is difficult to evaluate because we have no recent operating history.

As the Company has no recent operating history or revenue and only minimal assets, there is a risk that we will be unable to continue as a going concern and consummate a business combination. The Company has had no recent operating history nor any revenues or earnings from operations since inception. We have no significant assets or financial resources except for the financial support from our holding company

Our financial statements indicate conditions exist that raise substantial doubt as to whether we will continue as a going concern.

Our audited financial statements for the year ended September 30, 2012 indicate conditions exist that raise substantial doubt as to whether we will continue as a going concern. Our continuation as a going concern is dependent upon our ability to obtain financing to fund the continued development of products and working capital requirements.

Changes in the regulatory food safety requirements could adversely affect our business, financial condition or results of operations.

Our operations are subject to varying degrees of regulation by the FDA, other federal, state and local regulatory agencies and legislative bodies and their equivalent counter parts in other countries. Adverse decisions or new or amended regulations or mandates adopted by any of these regulatory or legislative bodies could negatively impact our operations by, among other things, causing unexpected or changed capital investments, lost revenues, increased costs of doing business, and could limit our ability to engage in certain sales or marketing activities.

| -13- |

Our products and networked platforms may be dependent on other third party software or networks which may contain defects or software errors, which could result in damage to our reputation, lost revenue, diverted development resources and increased service costs, warranty claims, and litigation

We warrant that our products will be free of defect for various periods of time, depending on the product. In addition, certain of our contracts include epidemic failure clauses. If invoked, these clauses may entitle the customer to return or obtain credits for products and inventory, or to cancel outstanding purchase orders even if the products themselves are not defective.

We must develop our products and networked platforms quickly to keep pace with the rapidly changing market, and we have a history of frequently introducing new products. Products and services as sophisticated as ours could contain undetected errors or defects, especially when first introduced or when new models or versions are released. In general, our products may not be free from errors or defects after commercial shipments have begun, which could result in damage to our reputation, lost revenue, diverted development resources, increased customer service and support costs, warranty claims, and litigation.

Our products are highly technical, and some of our software relies on third party technologies including open source software, so if integration or incompatibility issues arise with these technologies, these technologies become unavailable or our products contain errors, defects or security vulnerabilities, our product and services development may be delayed, our reputation could be harmed and our business could be adversely affected

Our products, including our software products, are highly technical and complex and, when deployed, may contain errors, defects or security vulnerabilities. Some errors in our products may only be discovered after a product has been installed and used by customers. In addition, we rely on software that we license from third parties, including software that is integrated with internally developed software and used in our products to perform key functions. Errors, viruses or bugs may also be present in software that we license from third parties and incorporate into our products or in third party software that our customers use in conjunction with our software. In addition, our customers’ proprietary software and network firewall protections may corrupt data from our products and create difficulties in implementing our solutions. Changes to third party software that our customers use in conjunction with our software could also render our applications inoperable. Any errors, defects or security vulnerabilities in our products or any defects in, or compatibility issues with, any third party software or customers’ network environments discovered after commercial release could result in loss of revenues or delay in revenue recognition, loss of customers, theft of our trade secrets, data or intellectual property and increased service and warranty cost, any of which could adversely affect our business, financial condition and results of operations. Undiscovered vulnerabilities in our products alone or in combination with third party software could expose them to hackers or other unscrupulous third parties who develop and deploy viruses, worms, and other malicious software programs that could attack our products. Actual or perceived security vulnerabilities in our products could harm our reputation and lead some customers to return products, to reduce or delay future purchases or use competitive products.

The third party software licenses we rely upon may not continue to be available to us on commercially reasonable terms, or at all, and the software may not be appropriately supported, maintained or enhanced by the licensors, resulting in development delays. Some of these software licenses are subject to annual renewals at the discretion of the licensors. In many cases, if we were to breach a provision of these license agreements, the licensor could terminate the agreement immediately. We license technologies and patents underlying some of our software from third parties, and the loss of these licenses could have a material adverse effect on our business. The loss of licenses to, or inability to support, maintain and enhance, any such third party software could result in increased costs, or delays in software releases or updates, until such issues have been resolved. This could have a material adverse effect on our business, financial condition, results of operations, cash flows and future prospects.

| -14- |

We also incorporate open source software into our products. Although we monitor our use of open source closely, the terms of many open source licenses have not been interpreted by U.S. courts, and there is a risk that such licenses could be construed in a manner that could impose unanticipated conditions or restrictions on our ability to market or sell our products or to develop new products. In such event, we could be required to seek licenses from third-parties in order to continue offering our products, to disclose and offer royalty-free licenses in connection with our own source code, to re-engineer our products or to discontinue the sale of our products in the event re-engineering cannot be accomplished on a timely basis, any of which could adversely affect our business.

The volatility of our stock price could adversely affect an investment in our common stock

The market price of our common stock has been, and may continue to be, highly volatile. We believe that a variety of factors could cause the price of our common stock to fluctuate, perhaps substantially, including:

| • | announcements and rumors of developments related to our business or the industry in which we compete, | |

| • | quarterly fluctuations in our actual or anticipated operating results and order levels, | |

| • | general conditions in the worldwide economy, | |

| • | acquisition announcements, | |

| • | new products or product enhancements by us or our competitors, | |

| • | developments in patents or other intellectual property rights and litigation, | |

| • | developments in our relationships with our customers and suppliers, and | |

| • | any significant acts of terrorism. | |

In addition, in recent years the stock market in general and the markets for shares of “high-tech” companies in particular, have experienced extreme price fluctuations which have often been unrelated to the operating performance of affected companies. Any such fluctuations in the future could adversely affect the market price of our common stock, and the market price of our common stock may decline.

Our information systems or those of our outside vendors may be subject to disruption, delays or security incidents that could adversely impact our customers and operations

We rely on our information systems and those of third parties for things such as processing customer orders, delivery of products, providing services and support to our customers, billing and tracking our customers, hosting and managing customer data, and otherwise running our business. Any disruption in our information systems and those of the third parties upon whom we rely could have a significant impact on our business.

A security incident in our own systems or the systems of our third party providers may compromise the confidentiality, integrity, or availability of our own internal data, the availability of our products and websites designed to support our customers, or our customer data. Unauthorized access to our proprietary business information or customer data may be obtained through break-ins, breach of our secure network by an unauthorized party, employee theft or misuse, breach of the security of the networks of our third party providers, or other misconduct. It is also possible that unauthorized access to customer data may be obtained through inadequate use of security controls by customers. While our products and services provide and support strong password controls, IP restriction and other security mechanisms, the use of such mechanisms are controlled in many cases by our customers.

| -15- |

We may also experience delays or interruptions caused by a number of factors, including access to the internet, the failure of our network or software systems, or significant variability in visitor traffic on our product websites. It is also possible that hardware or software failures or errors in our systems, or in those of our third party providers, could result in data loss or corruption or cause the information that we collect to be incomplete or contain inaccuracies that our customers regard as significant. These failures and interruptions could harm our reputation and cause us to lose customers.

Although our systems have been designed around industry-standard architectures to reduce downtime in the event of outages or catastrophic occurrences, they remain vulnerable to damage or interruption from earthquakes, floods, fires, power loss, telecommunication failures, terrorist attacks, cyber-attacks, computer viruses, computer denial-of-service attacks, human error, hardware or software defects or malfunctions (including defects or malfunctions of components of our systems that are supplied by third-party service providers), and similar events or disruptions. Some of our systems are not fully redundant, and our disaster recovery planning is not sufficient for all eventualities. Our systems are also subject to break-ins, sabotage, and intentional acts of vandalism. Despite any precautions we may take, the occurrence of a natural disaster, a decision by any of our third-party hosting providers to close a facility we use without adequate notice for financial or other reasons, or other unanticipated problems at our hosting facilities could cause system interruptions and delays, and result in loss of critical data and lengthy interruptions in our services.

Our global operations expose us to risks and challenges associated with conducting business internationally, and our results of operations may be adversely affected by our efforts to comply with U.S. laws which apply to international operations, such as the Foreign Corrupt Practices Act and US export control laws, as well as the laws of other countries.

We operate on a global basis with offices or activities in Asia, the Middle East, and North America. We face several risks inherent in conducting business internationally, including compliance with international and U.S. laws and regulations that apply to our international operations. These laws and regulations include data privacy requirements, labor relations laws, tax laws, anti-competition regulations, import and trade restrictions, export control laws, U.S. laws such as export control laws and the FCPA, and similar laws in other countries which also prohibit corrupt payments to governmental officials or certain payments or remunerations to customers. Many of our products are subject to U.S. export law restrictions that limit the destinations and types of customers to which our products may be sold, or require an export license in connection with sales outside the United States. Given the high level of complexity of these laws, there is a risk that some provisions may be inadvertently breached, for example through fraudulent or negligent behavior of individual employees, our failure to comply with certain formal documentation requirements or otherwise. Also, we may be held liable for actions taken by our local partners. Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers or our employees, and prohibitions on the conduct of our business. Any such violations could include prohibitions on our ability to offer our products in one or more countries and could materially damage our reputation, our brand, our international expansion efforts, our ability to attract and retain employees, our business and our operating results.

In addition, we operate in many parts of the world that have experienced significant governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. We may be subject to competitive disadvantages to the extent that our competitors are able to secure business, licenses or other preferential treatment by making payments to government officials and others in positions of influence or through other methods that U.S. law and regulations prohibit us from using. Our success depends, in part, on our ability to anticipate these risks and manage these difficulties.

| -16- |

In addition to the foregoing, engaging in international business inherently involves a number of other difficulties and risks, including:

| • | longer payment cycles and difficulties in enforcing agreements and collecting receivables through certain foreign legal systems, |

| • | political and economic instability, |

| • | potentially adverse tax consequences, tariffs, customs charges, bureaucratic requirements and other trade barriers, |

| • | difficulties and costs of staffing and managing foreign operations, |

| • | difficulties protecting or procuring intellectual property rights, and |

| • | fluctuations in foreign currency exchange rates. |

These factors or any combination of these factors may adversely affect our revenue or our overall financial performance.

Because our common stock is considered a "penny stock" any investment in our common stock is considered to be a high-risk investment and is subject to restrictions on marketability.

Our common stock is currently traded on the OTC Markets and OTC Bulletin Board and is considered a "penny stock." The OTC Markets and OTC Bulletin Board are generally regarded as a less efficient trading market than the NASDAQ Capital Market.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in "penny stocks." Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. The broker-dealer also must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer and any salesperson in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our common stock.

Since our common stock is subject to the regulations applicable to penny stocks, the market liquidity for our common stock could be adversely affected because the regulations on penny stocks could limit the ability of broker-dealers to sell our common stock and thus your ability to sell our common stock in the secondary market. There is no assurance our common stock will be quoted on NASDAQ or the NYSE or listed on any exchange, even if eligible.

We have additional securities available for issuance, including preferred stock, which if issued could adversely affect the rights of the holders of our common stock.

Our articles of incorporation authorize the issuance of 500,000,000 shares of common stock and 25,000,000 shares of preferred stock. The common stock and the preferred stock can be issued by, and the terms of the preferred stock, including dividend rights, voting rights, liquidation preference and conversion rights can generally be determined by, our board of directors without stockholder approval. Any issuance of preferred stock could adversely affect the rights of the holders of common stock by, among other things, establishing preferential dividends, liquidation rights or voting powers. Accordingly, our stockholders will be dependent upon the judgment of our management in connection with the future issuance and sale of shares of our common stock and preferred stock, in the event that buyers can be found therefore. Any future issuances of common stock or preferred stock would further dilute the percentage ownership of our Company held by the public stockholders.

| -17- |

The Company may be subject to certain tax consequences in our business, which may increase our cost of doing business.

We may not be able to structure our acquisition to result in tax-free treatment for the companies or their stockholders, which could deter third parties from entering into certain business combinations with us or result in being taxed on consideration received in a transaction. Currently, a transaction may be structured so as to result in tax-free treatment to both companies, as prescribed by various federal and state tax provisions. We intend to structure any business combination so as to minimize the federal and state tax consequences to both us and the target entity; however, we cannot guarantee that the business combination will meet the statutory requirements of a tax-free reorganization or that the parties will obtain the intended tax-free treatment upon a transfer of stock or assets. A non-qualifying reorganization could result in the imposition of both federal and state taxes that may have an adverse effect on both parties to the transaction.

The Company intends to issue more shares in a merger or acquisition, which will result in substantial dilution.

Our Certificate of Incorporation authorizes the issuance of a maximum of 500,000,000 shares of common stock and a maximum of 25,000,000 shares of preferred stock. Any merger or acquisition effected by us may result in the issuance of additional securities without stockholder approval and may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. Moreover, the common stock issued in any such merger or acquisition transaction may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional reduction in the percentage of common stock held by our then existing stockholders. Our Board of Directors has the power to issue any or all of such authorized but unissued shares without stockholder approval. To the extent that additional shares of common stock or preferred stock are issued in connection with a business combination or otherwise, dilution to the interests of our stockholders will occur and the rights of the holders of common stock might be materially and adversely affected.

We cannot assure you that following a business combination with an operating business, our common stock will be listed on NASDAQ or any other securities exchange.

Following a business combination, we may seek the listing of our common stock on NASDAQ or the American Stock Exchange. However, we cannot assure you that following such a transaction, we will be able to meet the initial listing standards of either of those or any other stock exchange, or that we will be able to maintain a listing of our common stock on either of those or any other stock exchange. After completing a business combination, until our common stock is listed on the NASDAQ or another stock exchange, we expect that our common stock would be eligible to trade on the OTC Bulletin Board, another over-the-counter quotation system, or on the “pink sheets,” where our stockholders may find it more difficult to dispose of shares or obtain accurate quotations as to the market value of our common stock. In addition, we would be subject to an SEC rule that, if it failed to meet the criteria set forth in such rule, imposes various practice requirements on broker-dealers who sell securities governed by the rule to persons other than established customers and accredited investors. Consequently, such rule may deter broker-dealers from recommending or selling our common stock, which may further affect its liquidity. This would also make it more difficult for us to raise additional capital following a business combination.

Authorization of preferred stock.

Our Certificate of Incorporation authorizes the issuance of up to 25,000,000 shares of preferred stock with designations, rights and preferences determined from time to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. Although we have no present intention to issue any shares of its authorized preferred stock, there can be no assurance that the Company will not do so in the future.

| -18- |

We are an emerging growth company within the meaning of the Securities Act, and as a consequence of taking advantage of certain exemptions from reporting requirements that are available to emerging growth companies, our financial statements may not be comparable to companies that comply with public company effective dates.

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act. Pursuant to Section 107 of the Jumpstart Our Business Startups Act, we may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, meaning that we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have chosen to take advantage of the extended transition period for complying with new or revised accounting standards applicable to public companies to delay adoption of such standards until such standards are made applicable to private companies. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The Company utilizes rented offices at 3651 Lindell Road Ste D269, Las Vegas, NV 89103.

ITEM 3. LEGAL PROCEEDINGS

We have no outstanding, material legal proceedings.

ITEM 4. (REMOVED AND RESERVED)

| -19- |

PART II

| ITEM 5 | MARKET FOR REGISTRANTS COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCAHSES OF EQUITY SECURITIES |

(a) Market Information.

The Company’s common stock is currently quoted on the OTC Markets and OTC Bulletin Board under the symbol “SMRN”. Prior to February 9, 2009, the Company’s stock was quoted on the OTC Markets under the symbol “ALVN”. The following table sets forth the high and low per share sales prices for our common stock for each of the quarters in the period beginning October 1, 2011 through September 30, 2013 as reported by the OTC Markets.

| Quarter Ended | High | Low | ||||||||

| December 31, 2011 | $ | 0.05 | $ | 0.0065 | ||||||

| March 31, 2012 | 0.35 | 0.0065 | ||||||||

| June 30, 2012 | 0.35 | 0.35 | ||||||||

| September 30, 2012 | 0.35 | 0.20 | ||||||||

| December 31, 2012 | 0.20 | 0.20 | ||||||||

| March 31, 2013 | 0.20 | 0.20 | ||||||||

| June 30, 2013 | 0.20 | 0.20 | ||||||||

| September 30, 2013 | $ | 2.50 | $ | 0.20 | ||||||

The closing price of our common stock as reported on the OTC Markets on November 22, 2013, was $1.00.

(b) Holders

As of November 22, 2013, there were approximately 61 holders of record of our common stock.

(c) Dividends.

The Registrant has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Registrant's business.

(d) Securities Authorized for Issuance under Equity Compensation Plans .

None.

| Recent Sale of Unregistered Securities |

We relied upon Section 4(2) of the Securities Act of 1933, as amended for the above issuances. We believed that Section 4(2) was available because:

| • | None of these issuances involved underwriters, underwriting discounts or commissions; | |

| • | We placed restrictive legends on all certificates issued; | |

| • | No sales were made by general solicitation or advertising; | |

| • | Sales were made only to accredited investors |

| -20- |

In connection with the above transactions, we provided the following to all investors:

| • | Access to all our books and records. | |

| • | Access to all material contracts and documents relating to our operations. | |

| • | The opportunity to obtain any additional information, to the extent we possessed such information, necessary to verify the accuracy of the information to which the investors were given access. |

The Company’s Board of Directors has the power to issue any or all of the authorized but unissued Common Stock without stockholder approval. The Company currently has no commitments to issue any shares of common stock.

| Description of Securities |

(a) Common or Preferred Stock .

The Company is authorized by its Certificate of Incorporation to issue an aggregate of 525,000,000 shares of capital stock, of which 500,000,000 are shares of common stock, par value $0.001 per share (the "Common Stock") and 25,000,000 are shares of preferred stock, par value $0.001 per share (the “Preferred Stock”). As of November 22, 2013, 10,637,151 shares of Common Stock were issued and outstanding.

All outstanding shares of Common Stock are of the same class and have equal rights and attributes. The holders of Common Stock are entitled to one vote per share on all matters submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally in dividends, if any, as may be declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the holders of Common Stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders do not have cumulative or preemptive rights.

The description of certain matters relating to the securities of the Company is a summary and is qualified in its entirety by the provisions of the Company's Certificate of Incorporation and By-Laws.

Dividends

Dividends, if any, will be contingent upon the Company’s revenues and earnings, if any, capital requirements and financial conditions. The payment of dividends, if any, will be within the discretion of the Company’s Board of Directors. The Company presently intends to retain all earnings, if any, for use in its business operations and accordingly, the Board of Directors does not anticipate declaring any dividends prior to a business combination.

Trading of Securities in Secondary Market

The Company presently has 10,637,151 shares of common stock issued and outstanding, 10,000,000 of which are “restricted securities,” as that term is defined under Rule 144 promulgated under the Securities Act, in that such shares were issued in private transactions not involving a public offering.

The Company’s common stock is currently quoted on the OTC Markets and OTC Bulletin Board under the symbol “SMRN”. Prior to February 9, 2009, the Company’s stock was quoted on the OTC Pink Sheets under the symbol “ALVN”.

Following a business combination, a target company will normally wish to list its common stock for trading in one or more higher United States exchanges. The target company may elect to apply for such listing immediately following the business combination or at some later time.

| -21- |

In order to qualify for listing on the Nasdaq SmallCap Market, a company must have at least (i) net tangible assets of $4,000,000 or market capitalization of $50,000,000 or net income for two of the last three years of $750,000; (ii) public float of 1,000,000 shares with a market value of $5,000,000; (iii) a bid price of $4.00; (iv) three market makers; (v) 300 shareholders and (vi) an operating history of one year or, if less than one year, $50,000,000 in market capitalization. For continued listing on the Nasdaq SmallCap Market, a company must have at least (i) net tangible assets of $2,000,000 or market capitalization of $35,000,000 or net income for two of the last three years of $500,000; (ii) a public float of 500,000 shares with a market value of $1,000,000; (iii) a bid price of $1.00; (iv) two market makers; and (v) 300 shareholders.

If, after a business combination, we do not meet the qualifications for listing on the Nasdaq SmallCap Market. On April 7, 2000, the Securities and Exchange Commission issued a clarification with regard to the reporting status under the Securities Exchange Act of 1934 of a non-reporting company after it acquired a reporting “blank check” company. This letter clarified the Commission’s position that such Company would not be a successor issuer to the reporting obligation of the “blank check” company by virtue of Exchange Act Rule 12g-3(a).

We intend that any merger we undertake would not be deemed a “back door” registration since we would remain the reporting company and the Company that we merge with would not become a successor issuer to our reporting obligations by virtue of Commission Rule 12g-3(a).

Recent Sale of Unregistered Securities.

None

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable

| -22- |

| ITEM 7 | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with the Financial Statements and notes thereto included in Item 8 of Part II of this Transition Report on Form 10-K.

FORWARD-LOOKING STATEMENTS

All statements other than statements of historical fact included in "Management's Discussion and Analysis of Financial Condition and Results of Operations", which follows, are forward-looking statements. Forward-looking statements involve various important assumptions, risks, uncertainties and other factors which could cause our actual results to differ materially from those expressed in such forward-looking statements. Forward-looking statements in this discussion can be identified by words such as "anticipate," "believe," "could," "estimate," "expect," "plan," "intend," "may," "should" or the negative of these terms or similar expressions. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievement. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors including but not limited to, competitive factors and pricing pressures, changes in legal and regulatory requirements, cancellation or deferral of customer orders, technological change or difficulties, difficulties in the timely development of new products, difficulties in manufacturing, commercialization and trade difficulties and general economic conditions as well as the factors set forth in our public filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Annual Report or the date of any document incorporated by reference, in this Annual Report. We are under no obligation, and expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

For these statements, we claim the protection of the safe harbor for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934.

Critical Accounting Policies

Our financial statements were prepared in conformity with U.S. generally accepted accounting principles. As such, management is required to make certain estimates, judgments and assumptions that they believe are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the periods presented. The significant accounting policies which management believes are the most critical to aid in fully understanding and evaluating our reported financial results include the following:

Income Taxes — The Company records income taxes in accordance with the provisions of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 740, “Income Taxes.” The standard requires, among other provisions, an asset and liability approach to recognize deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the financial statement carrying amounts and tax basis of assets and liabilities. Valuation allowances are provided if based upon the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

Stock-Based Compensation — The Company records transactions under share based payment arrangements in accordance with the provisions of the FASB ASC Topic 718, “Share Based Payment Arrangements”. The standard requires recognition of the cost of employee services received in exchange for an award of equity instruments in the financial statements over the period the employee is required to perform the services in exchange for the award. The standard also requires measurement of the cost of employee services received in exchange for an award. The Company is using the modified prospective method allowed under this standard. Accordingly, upon adoption, prior period amounts have not been restated. Under this application, the Company recorded the cumulative effect of compensation expense for the unvested portion of previously granted awards that remain outstanding at the date of adoption and recorded compensation expense for all awards granted after the date of adoption.

| -23- |

The standard provides that income tax effects of share-based payments are recognized in the financial statements for those awards that will normally result in tax deduction under existing law. Under current U.S. federal tax law, the Company would receive a compensation expense deduction related to non-qualified stock options only when those options are exercised and vested shares are received. Accordingly, the financial statement recognition of compensation cost for non-qualified stock options creates a deductible temporary difference which results in a deferred tax asset and a corresponding deferred tax benefit in the income statement. The Company does not recognize a tax benefit for compensation expense related to incentive stock options unless the underlying shares are disposed in a disqualifying disposition.

Results of Operations

Comparison of the fiscal year ended September 30, 2013 to the fiscal year ended September 30, 2012

Selling, general and administrative costs:

We had a net loss of $122,587 for the year ended September 30, 2013 compared to a net loss of $25,748 for the year ended September 30, 2012. The increase of $96,839 was due to the commencement of operations in the fourth quarter of 2013.

Liquidity and Capital Resources

We have had minimal operating activity since commencing operations and are now relying on debt securities to fund our activities.

Net cash used in operating activities was $122,604 and $30,517 in the year ended September 30, 2013 and 2012, respectively. The increase was due to the commencement of operations in the fourth quarter of 2013.

Net cash used in investing activities was $25,000 and $0 in the year ended September 30, 2013 and 2012, respectively.

Net cash provided by financing activities as $239,427 and $24,666 in the year ended September 30, 2013 and 2012, respectively. The increase was due mainly due to the proceeds from a note payable of $200,000.

Going Concern Uncertainties

As of the date of this annual report, there is doubt regarding our ability to continue as a going concern as we have not generated sufficient cash flow to fund our business operations and loan commitments. Our future success and viability, therefore, are dependent upon our ability to generate capital financing. The failure to generate sufficient revenues or raise additional capital may have a material and adverse effect upon the Company and our shareholders.

Commitments and Contractual Obligations

On March 17, 2009, we entered into a Revolving Promissory Note (the “Secured Note”) with Smartag Solutions Bhd, a Malaysian corporation, the majority stockholder of the Company. Under the terms of the Note, Smartag Solutions Bhd., agreed to advance to the Company, from time to time and at the request of the Company, amounts up to an aggregate of $200,000 until September 30, 2013. All advances shall be paid on or before September 30, 2014 and interest shall accrue from the date of any advances on any principal amount withdrawn, and on accrued and unpaid interest thereon, at the rate of zero percent (0%) per annum, compounded annually. As of September 30, 2013, Smartag Solutions Bhd advanced us $192,457. The Secured Note ranks senior to all current and future indebtedness of Smartag and is secured by substantially all of the assets of Smartag.

On September 19, 2013, we entered into a Loan Agreement (“Loan Agreement”) with SSB. Under the terms of the agreement, SSB loaned the Company $200,000 (“Loan”). The Loan shall be repaid on or before September 30, 2014 and interest shall accrue from the date of any advances on any principal amount withdrawn, and on accrued and unpaid interest thereon, at the rate of zero percent (0%) per annum, compounded annually.

| -24- |

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk represents the risk of loss arising from adverse changes in market rates and foreign exchange rates. At September 30, 2013, we had outstanding debt instruments of approximately $392,457. The amount of our outstanding debt at any time may fluctuate and we may from time to time be subject to refinancing risk. A hypothetical 100 basis point increase in interest rates would have a material effect on our annual interest expense, our results of operations or financial condition as we rely on these notes to sustain our operations. Since we do not have transactions in foreign currencies, we do not consider it necessary to hedge against currency risk.

| -25- |

ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Smartag International, Inc.

(a development stage company)

September 30, 2013

TABLE OF CONTENTS

| PAGE | ||||

| REPORTS OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 27 | |||

| FINANCIAL STATEMENTS AS OF AND FOR THE YEARS ENDED SEPTEMBER 30, 2013 AND 2012 | ||||

| Balance Sheets | 28 | |||

| Statements of Operations | 29 | |||

| Statements of Stockholders' Deficit | 30 | |||

| Statements of Cash Flows | 31 | |||

| Notes to financial statements | 32 | |||

| -26- |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Stockholders and Directors

Smartag International, Inc.

Newport Beach, California

We have audited the accompanying balance sheets of Smartag International, Inc. ( a development stage company)(the “Company”) as of September 30, 2013 and 2012 and the related statements of operations, stockholders’ deficit, and cash flows for the years ended September 30, 2013 and 2012 and for the period from March 24, 1999 (inception) to September 30, 2013. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatements. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Smartag International, Inc. as of September 30, 2013 and 2012 and the results of its operations, stockholders’ deficit, and cash flows for the years ended September 30, 2013 and 2012 and for the period from March 24, 1999 (inception) to September 30, 2013 in conformity with U.S. generally accepted accounting principles.