Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sorrento Therapeutics, Inc. | d630332d8k.htm |

November 2013

Next-Generation

Cancer Therapeutics

Sorrento Therapeutics

Exhibit 99.1 |

| 2

This presentation contains "forward-looking statements" as that term is

defined under the Private Securities Litigation Reform Act of 1995 (PSLRA),

including statements regarding expectations, beliefs or intentions regarding

our business, technologies and products strategies or prospects. Actual

results may differ from those projected due to a number of risks and

uncertainties, including, but not limited to, the possibility that some or all of

the pending matters and

transactions

being

considered

by

the

Company

may

not

proceed

as

contemplated,

and

by

all other matters specified in Company's filings with the Securities and Exchange

Commission, as well as risks inherent in funding, developing and obtaining

regulatory approvals of new, commercially-viable and competitive

products and product candidates. Sufficiency of the data for approval with

respect to Cynviloq™ will be a review issue after NDA filing.

These statements are made based upon current expectations that are subject

to risk and uncertainty and information available to the Company as of the

date of this presentation. The Company does not undertake to update

forward-looking statements in this presentation to reflect actual

results, changes in assumptions or changes in other factors affecting such

forward-looking information. Assumptions and other information that

could cause results to differ from those set forth in the

forward-looking information can be found in the Company's filings with the

Securities and Exchange Commission, including its most recent periodic report. We

intend that all forward-looking statements be subject to the

safe-harbor provisions of the PSLRA. Safe Harbor Statement

NASDAQ: SRNE |

3

Management Team

Henry Ji, Ph.D.

President & CEO, Director

Vuong Trieu, Ph.D.

CSO and Director

George Uy

Chief Commercial Officer

David (Zhenwei) Miao, Ph.D.

CTO

Richard Vincent

EVP, CFO, Director

•

Inventor

of

G-MAB

®

Technology

•

President & CEO of Stratagene Genomics

•

VP of CombiMatrix and Stratagene

•

Founder and CEO of IgDraSol

•

Co-inventor of

IP

covering

Abraxane

®

•

Instrumental

in

the

approval

of

Abraxane

®

•

Celgene acquired Abraxis Biosciences for > $3 billion

•

CCO of IgDraSol

•

Directed

the

launches

of

Abraxane

®

,

Xeloda

®

&

Fusilev

®

•

Built commercial infrastructures and organizations in startup companies

•

President and CSO of Concortis Biosystems

•

Co-inventor of IP covering ADC technologies

•

Head of Chemistry at Ambrx

•

$430M sale of Elevation to Sunovion-Dainippon

•

Meritage

Pharma

option

agreement

with

ViroPharma

($90M

upfront

+

milestones)

•

$310M sale of Verus asthma program to AstraZeneca

•

Elan: various acquisitions and divestitures with aggregate values in excess of

$300M |

4

Investment Highlights

Intractable Pain in Advanced Cancer

•

Ongoing Phase 1/2 study

•

Orphan drug status received

•

Two potential drug products from same API (Resiniferatoxin)

Targeted Drug Delivery (ADC)

•

G-MAB

®

antibody as specific targeting warhead

•

Proprietary toxins as potent tumor killing payload

•

Selective conjugation chemistry for homogenous ADC generation

Late Stage Oncology Drug with Exclusive US and EU Rights

•

Addresses multi-billion dollar paclitaxel market

•

Abbreviated regulatory pathway (“bioequivalence”) for approval

•

Bioequivalence registration trial in 2014 (study direct costs ~ $5M)

•

Product launch in 1H 2016

Therapeutic Antibody Engine

•

Antibody market >$50B in 2012

•

First antibody drug candidate in clinic 1H 2015

Cynviloq™

RTX

G-MAB

®

ADC |

5

Sorrento’s Next-Generation Cancer Therapeutics

TUMOR

AfDC:

•

•

ADC:

•

•

Cynviloq™

•

•

•

G-MAB

®

•

•

•

G-MAB targets toxin to cancer cell

Programs include VEGFR2, c-Met

High-diversity human Ab library

Lead mAb programs include

PD-L1, PD-1, and CCR2

FTO and no stacking royalties

Bioequivalence (BE)

pathway for approval

Efficacy demonstrated

US and EU rights

G-MAB targets approved chemotherapeutics to the tumor

Effective against heterogeneous

tumors

Next-generation

Abraxane

®

ntibody

A

f

ormulated

D

rug

onjugate

C

ntibody

A

D

rug

onjugate

C |

6

PHASE 1

PHASE 2

INDICATION

Cynviloq™

Metastatic Breast Cancer

Non-Small Cell Lung Cancer

Bladder Cancer (sNDA)

Ovarian Cancer (sNDA)

1H 2014

1H 2015

505(b)(2) Bioequivalence

}

Pancreatic Cancer (BE* or sNDA)

INDICATION > TARGET

G-MAB

®

ADC

Oncology > PD-L1 Oncology/Inflammation >

CCR2, CXCR3 Oncology > VEGFR2, c-Met, CXCR5, EGFR 1H

2015 2H 2015

2H 2015

RTX

Refractory Pain in Cancer Patients

In progress

1H 2015

Multiple

Strategic

Partnership

Opportunities

Pipeline

Oncology > PD-1 1H 2015

* Abraxane

®

orphan drug status (FDA approval, September 2013) |

Lead

Product Opportunity Cynviloq™

Registration

Trial

7 |

8

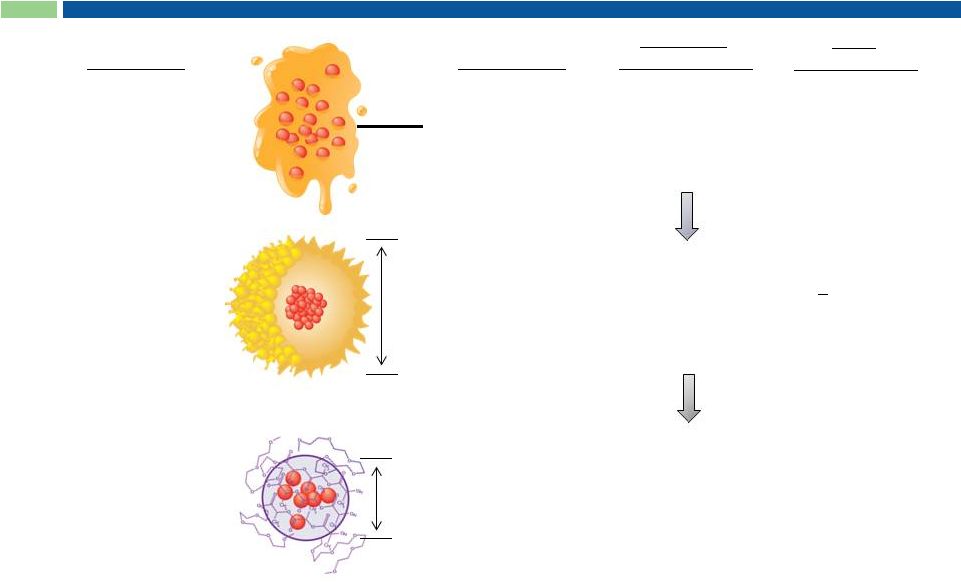

Cynviloq is the 3 Generation Paclitaxel Therapy

Abraxane

®

nab-paclitaxel

Mean size

130 nm

Biological

polymer:

Donor-derived human

serum albumin (HSA)

2

nd

260 mg/m

2

Taxol

®

paclitaxel

Cremophor EL

excipient:

Polyoxyethylated

castor oil

Formulation

Generation

1

st

175 mg/m

2

Maximum

Tolerated Dose

Peak

Product Sales

~ $1.6B (WW in 2000)

Est. >$1.7B* (US)

($430M in 2012)

Conversion of

Abraxane sales +

new indications

*Analyst projection ; in MBC + NSCLC + PC

Mean size

~25 nm

Cynviloq™

paclitaxel

polymeric micelle

Chemical

polymer:

Poly-lactide and

polyethylene glycol

diblock copolymer

3

rd

>300 mg/m

2

(up to 435 mg/m

2

)

rd |

| 9

Cynviloq is a High Value Proposition

1.

Exclusive US and EU Rights

2.

Cynviloq efficacy demonstrated in Phase 2 and Phase 3 studies

a.

Approved and marketed under brand name Genexol-PM in S. Korea

3.

FDA concurred

a.

Available data support pursuing 505(b)(2) regulatory pathway

b.

Bioequivalence (BE) study sufficient for approval of indications

in Abraxane

label (MBC and NSCLC)

4.

Large market opportunity

a.

Abraxis (Abraxane) sold to Celgene for > $3B

b.

$1.7B in projected US peak revenues for Abraxane |

10

Total number of patients across all trials: 1,260

Phase 1:

Trials established higher MTD in US -

Dana Farber Cancer Inst, Russia, & S. Korea (total n=80)

>300 mg/m

2

(q3w) vs. 175

mg/m

2

(Taxol;

weekly)

and

275

mg/m

2

(Abraxane; q3w)

Phase 2:

Completed trials in MBC, NSCLC, PC, OC, BC; in US -

Yale Cancer Center, Russia, S. Korea

(total n=259)

Data suggestive of efficacy comparable to historic data for Abraxane and superior

to historic Taxol data or Standard-of-Care

Possible Phase 3 sNDA programs in these tumor types

Phase 3:

Ongoing trial for MBC in S. Korea (total n=209; Cynviloq n=105)

GPMBC301. An Open-label, Randomized, Parallel, Phase 3 Trial to Evaluate

the Efficacy and Safety of Cynviloq compared

to

Genexol

®

(Paclitaxel with Cremophor EL) in Subjects with Recurrent or Metastatic

Breast Cancer)

Interim analysis suggests ORR superior to Taxol and comparable to historic

Abraxane efficacy Efficacy and safety data

supportive of 505(b)(2) BE submission

PM-Safety:

Completed for MBC and NSCLC (total n=502)

Efficacy and safety data supportive of 505(b)(2) BE submission

Clinical Efficacy & Safety Summary

Phase 2b (IIS):

Chemo-naïve Stage IIIb/IV NSCLC vs Taxol in S. Korea (total n=276;

Cynviloq n=140) 230 mg/m

2

+ cis (q3w) vs. Taxol 175

mg/m

2

+ cis; non-inferiority established

Phase 2 (IIS):

1

st

line treatment of OC vs Taxol in S. Korea (total n=100; Cynviloq n=50)

260 mg/m

2

+ carbo (q3w) vs. Taxol 175

mg/m

2

+ carbo; non-inferiority established |

11

Drug

HL (h)

T max (h)

AUCinf

(h*ng/mL)

Vz (mL/kg)

Cl (mL/h/kg)

Abraxane

2.99

0.08

61561.33

2103.71

487.32

Cynviloq

2.83

0.08

58151.31

2103.58

515.90

IV bolus at 30 mg/kg; n = 3

Equivalent Pharmacokinetics in Mice

Data on file

Cynviloq

Abraxane |

12

Abraxane data from: Nurad K. Ibrahim, Phase I and Pharmacokinetic Study of

ABI-007, a Cremophor-free, Protein-stabilized, Nanoparticle Formulation of

Paclitaxel. Clinical Cancer Research 2002;8:1038-44

Data from 2 separate studies

(3 h infusion, 135 mg/m

2

dose, n=3)

Comparable Pharmacokinetics in Human |

13

Simulated PK Parameters Supportive of BE:

Cynviloq vs. Abraxane

*

Gardner et all, 2008

•

PK BE was calculated as 95% confidence interval (CI)

•

Ratio

T/R

(Cmax

and

AUCinf)

within

80-125%

(FDA

Guidance

for

establishing

BE)

Comparison of mean non-compartmental pharmacokinetic parameters of

Cynviloq (T) and Abraxane (260 mg/m

2

) at 30 min infusion time:

Cmax

(ng/mL)

Ratio

Cmax(T)/Cmax(R)

AUCinf

(ng*h/mL)

Ratio

AUCinf(T)/AUCinf(R)

Cynviloq

(Simulated PK)

19486

99.6%

22198

109.2%

Abraxane

(Actual PK)*

19556

20324 |

14

Bioequivalence = Efficient Pathway to Market

•

Bioequivalence registration study in breast cancer patients (2014)

-

12 months of duration (including patient recruitment)

-

Direct trial cost ~$5M

Abraxane

®

(50 patients)

Cynviloq™

(50 patients)

Cynviloq™

Abraxane

®

Key Parameters*:

•

•

•

•

Cycle 1

Cycle 2

Dose: 260 mg/m

2

Infusion time: 30 min

Duration: 3 weeks +

crossover for 3 weeks

Endpoints: AUC and

Cmax (90% CI)

*

Based on FDA “Draft Guidance on Paclitaxel” – September 2012

|

15

Cynviloq Advantages

Cynviloq™

Abraxane

®

Taxol

®

Cynviloq

Advantage

Maximum Tolerated Dose

(mg/m

2

)

>300

260

175

Potential for

higher efficacy

Rapid reconstitution:

no foaming concerns

Convenience for busy

practices and pharmacies

No donor-derived human

serum albumin (HSA)

No viral / prion concerns

Convenient storage

conditions

No requirement for

controlled temp storage

No microbial growth

Chemical polymer

Cremophor-free

Reduced side effects

Dosing

q3w

q3w* &

weekly**

q3w & weekly

Exploits PK advantage

@ higher dose

* = MBC; ** = NSCLC & PC |

16

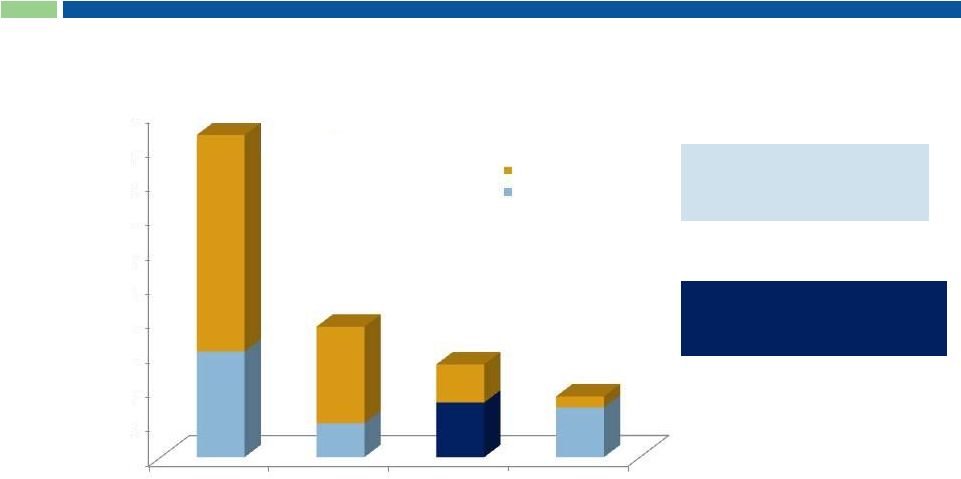

~55,000 patients with

paclitaxel

as

1

line

therapy

in MBC, NSCLC & OC

15,903 PC patients eligible for

treatment with Abraxane

®

+

Gemcitabine combination

Cynviloq Market Opportunity

Note: In Pancreatic Cancer, the blue portion

represents # patients treated with gem-based Rx in 2012 #

of Patients Treated in 1 line (US Only; 2012)

Sources: US information, SEER Annual Cancer Review 1975-2006; US Census;

Mattson Jack; UHC and Medicare Claims; IntrinsiQ; Synovate Tandem. WHO

mortality database 2008 http://www.who.int/whosis/whosis/. World Population Prospects. The 2008 Revision. UN Population

Division 2009. http://esa.un.org/unpp/. Roche-Genentech Clinical, Patient Chart

Audits. Total patient numbers represent treatable population. 1

~70,000

patients

treated

with

paclitaxel-based

regimen

in

1

st

line

NSCLC

n = 93,800

MBC

n = 38,000

Pancreatic Cancer

n = 27,000

Ovarian Cancer

n = 17,700

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

30,766

9,880

15,903

14,479

Other regimens

PAC+ treated

st

st

st

Line patient estimates from IntrinsiQ 2012 Monthly LOT Diag

Combo. |

17

Potential to Expand Label Indications –

For

Example:

2

Line

Bladder

Cancer

Cynviloq

Phase 2 (Korea)*

260-300

mg/m²

q3w

n=34

#

Best Supportive Care

Phase 2 (Japan) **/ Phase 3 (EU)***

n=23** / n=108***

Overall Response

Rate (ORR)

21%

-

/ 0%***

Progression Free

Survival

2.7 M

-

/ 1.5 M***

Overall Survival

6.5 M

2.3 M** / 4.3 M***

*

Invest

New

Drugs

(2012)

30:1984–1990

# advanced urothelial carcinoma patients refractory to gemcitabine and

cisplatin **

AUA-

San

Diego

May

4th-8 ;

***

JCO

(2009):

4454-61

Summary:

•

High

unmet

need

-

no

FDA-approved

2

nd

line

drug

•

Demonstrated clinical Overall Response Rate (ORR)

•

Phase

3-ready

for

development

as

2

nd

line

chemotherapy

in

patients

refractory

to

platinum-based therapy

th

nd |

18

Next Steps for Cynviloq

1.

Bioequivalence (BE) trial: 2014

2.

NDA filing: 2015

3.

Approval: 2016

a.

MBC and NSCLC

b.

Future Abraxane

indications (Pancreatic cancer and Melanoma)

4.

Product launch for MBC and NSCLC: 2016

5.

sNDA planning for label expansion into Bladder and Ovarian cancers

Bioequivalence

Trial

LAUNCH

2016

2016

2014

2015

NDA

Filing

FDA

Approval |

19

Expanded Clinical Pipeline with Multiple Opportunities

RTX

Intractable

Pain in

Advanced

Cancer

19 |

20

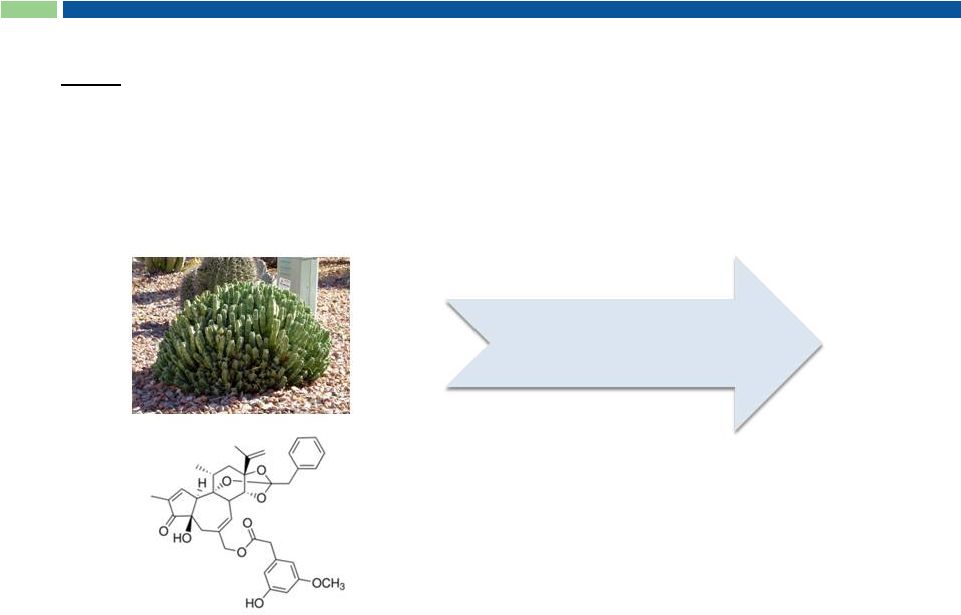

Resiniferatoxin (RTX):

Non-opiate Drug Candidate for Treating Cancer Pain

“Prickly Painkiller: An experimental plant extract may end intractable pain

with a single injection”*

* Arlene Weintraub; Sci Am. 2013 Jul;309(1):14. |

21

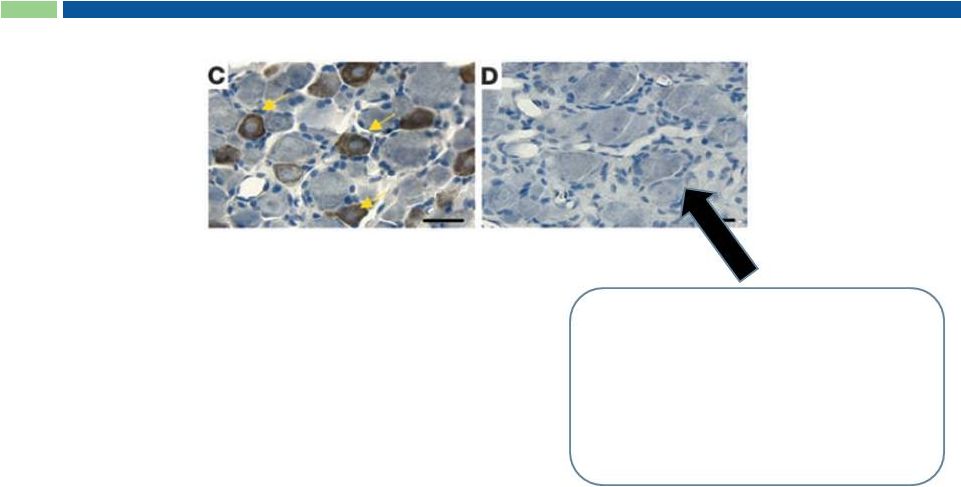

RTX Ultra Potent and Selective Toxin

* Adapted from Karai et al. 2004

Pharmacology:

Ultra potent agonist of the TRPV1 receptor

•

< 2 pM TRPV1 receptor binding

Binding in primate ex-vivo spinal cord

•

dorsal root ganglion

resiniferatoxin Ki = 309 pM

•

dorsal horn

resiniferatoxin Ki = 349 pM

RTX induces apoptosis of TRPV1-

expressing afferent nerves.

“ADC”-like killing, but no

antibody-mediated

targeting needed

Cross section of

spinal cord after

treatment* |

22

Brown et al, Anesthesiology 2005; 103:1052–9

n=18

n=18

n=8

n=5

n=4

Weeks

(p < 0.0001 for all time points)

Single intrathecal injection

Permanent ablation of nerves

Attractive therapeutic effect

All subjects responded

Personality & mood of animals

visibly improved

No opioid-associated side effects

Single Injection Addresses Cancer Pain in Dogs

Veterinary Market: Strategic Partnership Opportunity

|

23

Next Steps for Dual Pathway of RTX Development

2014

1.

2.

~3 years for clinical

development

Intractable cancer pain clinical trial (intrathecal injection); n~40

patients Phase 1/2 trial for intraganglionic injection

(osteosarcoma); n~15 patients |

Pre-IND Immunotherapy Programs

Antibodies

+

Proprietary

Toxins

G-MAB

®

ADC

24 |

25

G-MAB

®

: Library of Therapeutic Antibodies

High Value Oncology Targets:

Immunomodulation:

PD1 and PD-L1

Antibody Drug Conjugates: VEGFR2 and c-Met

Size of Target Antigen

Difficult Targets:

Small Peptides

Most Difficult Targets:

G Protein-Coupled Receptors

(GPCRs)

•

Proprietary technology

-

RNA amplification used for

library generation

-

Freedom-To-Operate

•

Very high library diversity:

2.1 x 10

16

distinct antibodies

•

Fully human antibodies

•

High successful screening hit rate

•

No stacking royalties |

26

Competitor mAb

Sorrento mAb

Anti-PD-L1 mAbs Exhibit Potent Activity

Immune Modulation*

Tumor Mouse Model**

Day

* mAbs @ 0.05 mg/mL

** xenograft model using H1975 human NSCLC cells; % inhibition relative to control mAb

treatment ***

p<0.05, mean tumor volumes are significantly reduced in STI-A1010 group versus control groups as determined by Mann-Whitney u-test |

27

Days After Disease Induction

Sorrento mAb

Untreated

Potent Antibody against Difficult GPCR Target*

mAb

Cell Binding

(EC

50

–

nM)

Sorrento

0.17

Competitor

21

0

0.5

1

1.5

2

2.5

3

3.5

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

* Sorrento mAb against C-C Chemokine Receptor 2 (CCR2) ** Experimental

Auto-immune Encephalomyelitis (EAE) = murine model of Multiple Sclerosis |

28

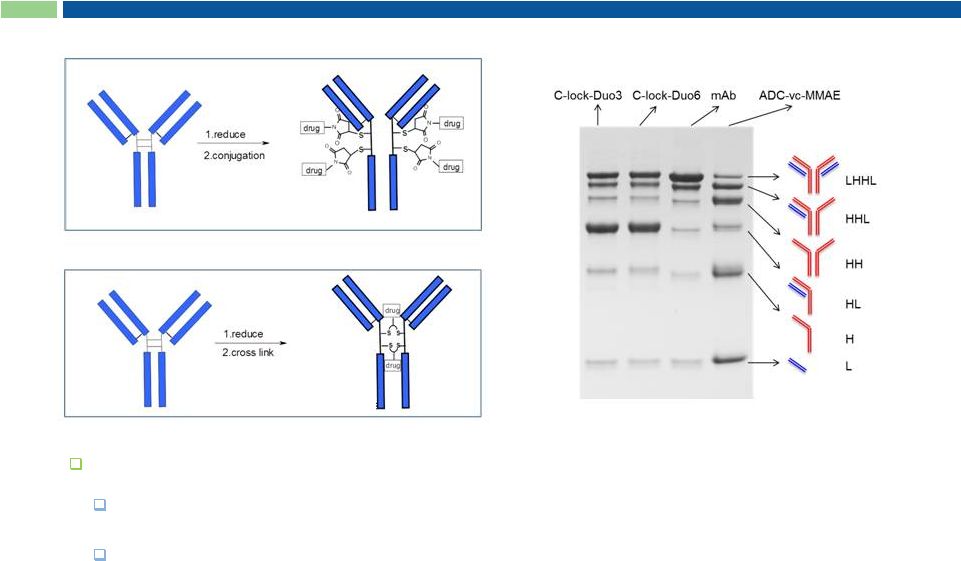

Antibody Drug Conjugates (ADC)

Key Components:

1.

Target-specific internalizing

antibody

2.

Potent cytotoxic prodrugs

3.

Linker and conjugation

chemistries Drug released in CANCER CELL

|

29

Proprietary ADC Screening and Optimization Panels

20-panel for discovery of lead ADCs

3 benchmark ADCs for rapid POC studies

20

ADCs

by

rationale

design

with

linker/conjugation

technologies

and

payload

pool

50-panel for generation of ADC candidates

Optimization of payloads

Optimization of linkers and conjugation methods

Expansion to new MOA payloads, if needed

Payload pool

20 panel

50 panel (up to)

Chemistry

•

linkers

•

conjugation |

30

0

1

2

3

2

purified

K-lock Conjugation Enables Homogeneous ADCs

K-lock

Selective ADC chemistry

Fewer positional isomers

Better control of DAR |

31

Irreversible C-lock-stabilized ADCs

C-lock enhances ADC stability leading to:

Prolonged PK profile

Reduced off-target effects |

32

Proprietary Toxin Potency 30-fold Higher than DM1*

SKBR3

(Breast Cancer Cell Line)

HCC1954

(Breast Cancer Cell Line)

IC

50

(nM)

0.017

0.019

0.3

(0.24 nM reported)

0.025

0.035

Duo6 (K-lock)

DM1 (NHS)

MMAE (C-lock)

MMAE (maleimide)

cleavable MC-vc-PAB linker

IC

50

(nM)

0.035

0.052

0.25

(0.24 nM reported)

0.091

0.091

DM1 (NHS)

MMAE (C-lock)

MMAE (maleimide)

cleavable MC-vc-PAB linker

Duo3 (K-lock)

Duo6 (K-lock)

Duo3 (K-lock) |

33

ONCOLOGY

PD-L1

PD-1

VEGFR2-ADC

EGFR

(STI-A100X)

(STI-A110X)

(STI-A020X)

(STI-A0168)

1H 2015

c-Met

(STI-A060X)

ADC

ADC

2H 2015

1H 2015

ONCOLOGY /

INFLAMMATION

(GPCR)

CCR2

CXCR3

CXCR5

(STI-B020X)

(STI-A120X)

(STI-B030X)

2H 2015

ADC

ADC

CCR2

(STI-B020X)

ADC

Multiple

Strategic

Partnership

Opportunities

G-MAB

®

and ADC Pipeline

Her2

ADC

(STI-A160X) |

34

Positioned to Become Oncology Leader

G-MAB

®

ADC

RTX

Antibodies

+

Proprietary

Toxins

Intractable

Pain in

Advanced

Cancer

Registration

Trial

Cynviloq™

34 |

35

Small Molecule Oncology Drug, Antibody Library

and ADC Company Valuations

Company

Small Molecule

Oncology Drug

Antibody

Platform

Targeted

Drug Delivery

Mkt Cap*

Puma:

PBYI

Pre-revenue

MBC (Phase 3)

~$1.2B

Clovis:

CLVS

Pre-revenue

NSCLC, MBC (Phase 1)

~$1.6B

MorphoSys:

MOR.DE

Pre-revenue

Antibody

Library

~$1.6B

CAT:

Acquired (2006)

Pre-revenue

Antibody

Library

~$1.4B

Domantis:

Acquired (2007)

Pre-revenue

Antibody

Library

~$450M

Seattle Genetics:

SGEN

Product sales + royalty

ADC

~$5.1B

ImmunoGen:

IMGN

Royalty only

ADC

~$1.3B

Sorrento: SRNE

NSCLC, MBC

(Ph3/Registration Trial)

Antibody

Library

ADC & AfDC

~$180M

* based on publicly-available information (11/14/13)

|

36

Investment Highlights

Intractable Pain in Advanced Cancer

•

Clinical Phase 1/2 study ongoing at NIH

•

Potential patients for treatment: ~150,000 in the U.S. annually

•

Two potential drug products from same API

Targeted Drug Delivery (ADC)

•

G-MAB

®

antibody as specific targeting warhead

•

Proprietary toxins as potent tumor killing payload

•

Selective conjugation chemistry for homogenous ADC generation

Late Stage Oncology Drug with Exclusive US and EU Rights

•

Addresses multi-billion dollar paclitaxel market

•

Abbreviated regulatory pathway (“bioequivalence”) for approval

•

Bioequivalence registration trial in 2014 (study direct costs ~ $5M)

•

Product launch in 1H 2016

Therapeutic antibody engine

•

Antibody market >$50B in 2012

•

First antibody drug candidate in clinic 1H 2015

Cynviloq™

RTX

G-MAB

®

ADC |

Sorrento Therapeutics

Next-Generation

Cancer Therapeutics

Contact:

Henry Ji

President and CEO

hji@sorrentotherapeutics.com

(858) 668-6923 |