Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STIFEL FINANCIAL CORP | d630042d8k.htm |

November 2013

Stifel Investor Presentation

Exhibit 99.1 |

Disclaimer

Forward-Looking

Statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

that

involve

significant

risks,

assumptions,

and

uncertainties,

including

statements

relating

to

the

market

opportunity

and

future

business

prospects

of

Stifel

Financial

Corp.,

as

well

as

Stifel,

Nicolaus

&

Company,

Incorporated

and

its

subsidiaries

(collectively,

“SF”

or

the

“Company”).

These

statements

can

be

identified

by

the

use

of

the

words

“may,”

“will,”

“should,”

“could,”

“would,”

“plan,”

“potential,”

“estimate,”

“project,”

“believe,”

“intend,”

“anticipate,”

“expect,”

and

similar

expressions.

In

particular,

these

statements

may

refer

to

our

goals,

intentions,

and

expectations,

our

business

plans

and

growth

strategies,

our

ability

to

integrate

and

manage

our

acquired

businesses,

estimates

of

our

risks

and

future

costs

and

benefits,

and

forecasted

demographic

and

economic

trends

relating

to

our

industry.

You

should

not

place

undue

reliance

on

any

forward-looking

statements,

which

speak

only

as

of

the

date

they

were

made.

We

will

not

update

these

forward-looking

statements,

even

though

our

situation

may

change

in

the

future,

unless

we

are

obligated

to

do

so

under

federal

securities

laws.

Actual

results

may

differ

materially

and

reported

results

should

not

be

considered

as

an

indication

of

future

performance.

Factors

that

could

cause

actual

results

to

differ

are

included

in

the

Company’s

annual

and

quarterly

reports

and

from

time

to

time

in

other

reports

filed

by

the

Company

with

the

Securities

and

Exchange

Commission

and

include,

among

other

things,

changes

in

general

economic

and

business

conditions,

actions

of

competitors,

regulatory

and

legal

actions,

changes

in

legislation,

and

technology

changes.

Note

Regarding

the

Use

of

Non-GAAP

Financial

Measures

The

Company

utilized

non-GAAP

calculations

of

presented

net

revenues,

compensation

and

benefits,

non-compensation

operating

expenses,

income

before

income

taxes,

provision

for

income

taxes,

net

income,

compensation

and

non-compensation

operating

expense

ratios,

pre-tax

margin

and

diluted

earnings

per

share

as

an

additional

measure

to

aid

in

understanding

and

analyzing

the

Company’s

financial

results.

Specifically,

the

Company

believes

that

the

non-GAAP

measures

provide

useful

information

by

excluding

certain

items

that

may

not

be

indicative

of

the

Company’s

core

operating

results

and

business

outlook.

The

Company

believes

that

these

non-GAAP

measures

will

allow

for

a

better

evaluation

of

the

operating

performance

of

the

business

and

facilitate

a

meaningful

comparison

of

the

Company’s

results

in

the

current

period

to

those

in

prior

periods

and

future

periods.

Reference

to

these

non-GAAP

measures

should

not

be

considered

as

a

substitute

for

results

that

are

presented

in

a

manner

consistent

with

GAAP.

These

non-GAAP

measures

are

provided

to

enhance

the

overall

understanding

of

the

Company’s

current

financial

performance. |

Market Overview |

Domestic Equity

Flows Equity Risk Premium

4

Market Overview |

Stifel Overview |

Stifel Overview

Global Wealth Management

Institutional Group

Independent Research

Institutional Equity & Fixed Income

Brokerage

Equity & Fixed Income Capital Raising

M&A Advisory / Restructuring

Private Client

Stifel Bank & Trust

Customer Financing

Asset Management

(1) As of 11/11/13. (2) Insider ownership percentage includes all fully

diluted shares, units outstanding, options outstanding, as well as shares owned by Stifel’s former Chairman as of 11/13/13.

Stifel Financial (NYSE: SF)

National presence with over 2,000

Financial Advisors

$153 billion in total client assets

Largest U.S. equity research platform

Broad product portfolio & industry

expertise

_________________________________________________________

|

7

Stifel’s Market Opportunity

Stifel’s Differentiated Value Proposition: Growth, Scale, and

Stability Bulge Bracket

Middle Market

Firm focus

Good research

Growth investor access

Issues

Lack of focus

Banker turnover

Lack of commitment

Research indifference

Lack of growth investors

Issues

Financial / firm stability

Trading support

Few with retail

Size / scale

Firm focus

Stability (financial &

personnel)

Large distribution

Growth investor access

Trading

Outstanding research

Retail

Size / scale

Large distribution

Trading

Retail |

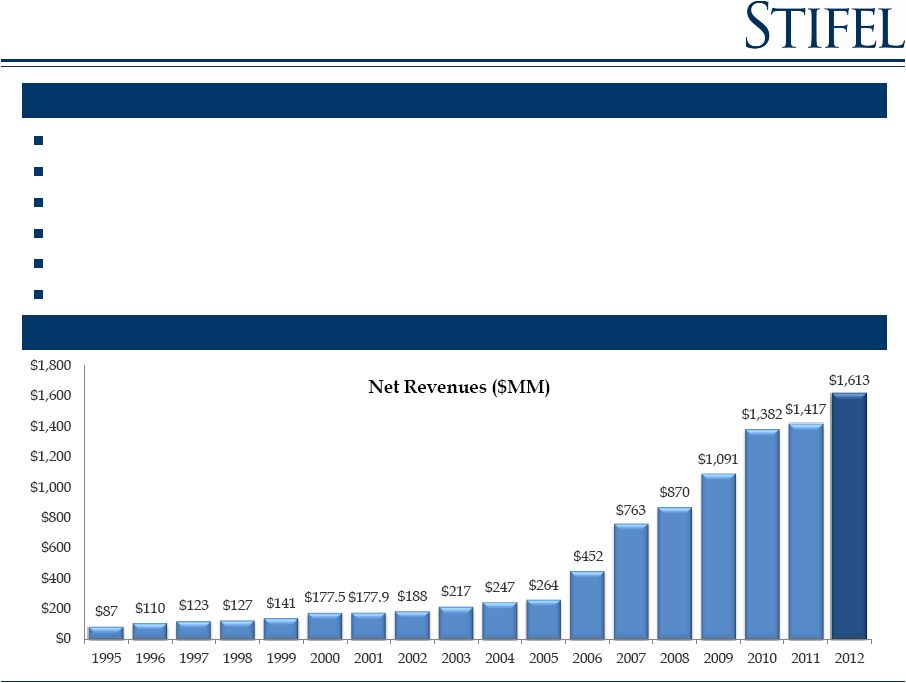

Strategy: Building the Premier Investment Bank

8

Unburdened by capital constraints

Low leverage business model and conservative risk management

Built the Company through 12 acquisitions since 2005; prudently evaluate

all opportunities Capitalize on headwinds across the industry

Select growth of high-quality talent

Drive revenue synergies by leveraging the global wealth and institutional

businesses 17

Consecutive Year of Record Net Revenues

Position Stifel to Take Advantage of Opportunities

th |

(1)

CAGR reflects years 2006 to 2012.

(2)

Client

assets

-

Includes

FDIC-insured

products

as

of

9/30

for

years

2008-2013

(3)

Includes Independent Contractors.

(4)

Book Value Per Share adjusted for April 2011 three-for-two stock

split (2006-2010). A Growth Story…

9

Net Revenues ($MM)

(1)

Core Net Income ($MM)

(1)

Total Equity ($MM)

Total Client Assets ($BN)

(2)

Book Value Per Share

(4)

Financial Advisors

(3)

_________________________________________________________

|

10

Building Scale…

Growth Focused

Investment Banking

Research, Sales and Trading

Achieved cost efficiencies

July 2010

Private Client

Revenue production has exceeded

expectations

October 2009

Significant enhancement to our

Capital Markets business

Achieved cost savings objectives

December 2005

Bank holding company

Financial holding company

Grown assets from ~ $100M to $3.2B

April 2007

Private Client

Public Finance

Seamless & efficient integration

December 2008

Fixed Income IB

Fixed Income Sales and Trading

Private Client

Seamless & efficient integration

October 2011

FIG Investment Banking

FIG Sales and Trading

FIG Research

February 2013

56 UBS Branches

Private Client

Capital Markets

Achieved cost savings objectives

February 2007

Each merger has been accretive to Stifel

Retention remains high

Restructuring advisory

December 2012

Knight

Fixed Income

Fixed Income Sales and

Trading –

U.S. & Europe

Fixed Income Research

July 2013

Asset Management

Announced October 2013

Clean portfolio of 1-4 family

residential mortgages

October 2013 |

Stability Achieved Through A Balanced Business Model

11

Net Revenues

Balanced business model facilitates growth during volatile markets

Stable GWM business is augmented by profitable and growing Institutional

Group Proven ability to grow all businesses

Operating Contribution

9 mo 2012

9 mo 2013

9 mo 2012

9 mo 2013

Note:

Net

revenues

and

operating

contribution

excludes

the

Other

segment.

11

_________________________________________________________

|

12

Leverage Ratio

Total Assets ($ in Billions)

Book Value Per Share

(1)

Total Capitalization ($ in Billions)

(1)

Per share information adjusted for April 2011 three-for-two stock

split Strong Balance Sheet Facilitates Growth

As September 30, 2013 |

13

Top Performing Stock

Cumulative Price Appreciation As of November 12, 2013

Since 12/31/12

Since 12/31/07

Since 12/31/00

Morgan Stanley

55.65%

Stifel Financial Corp.

82.97%

Stifel Financial Corp.

1027.47%

Stifel Financial Corp.

33.72%

Raymond James Financial

40.63%

Raymond James Financial

196.32%

Goldman Sachs Group

27.70%

S&P 500 Index

20.39%

Goldman Sachs Group

52.32%

S&P 500 Index

23.94%

JMP Group

-24.17%

S&P 500 Index

33.89%

Raymond James Financial

19.21%

Goldman Sachs Group

-24.25%

Oppenheimer

-17.84%

Oppenheimer

14.65%

Piper Jaffray

-24.44%

Morgan Stanley

-62.45%

SWS Group

10.59%

Morgan Stanley

-43.97%

SWS Group

-62.70%

Piper Jaffray

8.93%

Oppenheimer

-53.25%

JMP Group

NM

JMP Group

5.93%

SWS Group

-53.83%

Piper Jaffray

NM |

Attract and retain high-quality talent

Continue to expand our private client footprint in the U.S.

Continue to expand fixed income businesses

Continue to expand investment banking capabilities

Focus on quality asset generation within Stifel Bank

Expand traditional asset management capabilities

Approach acquisition opportunities with discipline

Opportunities Drive our Growth

14

Initiatives |

Recent Merger Updates |

16

We

announced

KBW

transaction

November

5,

2012

and

closed

February

15,

2013.

Integration

has

gone

very

well.

YTD

advisory

success:

#1

by

number

of

bank

mergers

(1)

#1

by

number

of

Insurance

mergers

(2)

#2

by

number

of

FIG

mergers

(1)

#3

by

bank

deal

value

(1)

Seeing

increased

market

share

in

common

equity

FIG

deals

and

equity

trading

volumes.

Achieved

superior

recognition

in

independent

research,

sales

and

trading

rankings.

Successful

conference

pattern

with

a

number

attracting

record

levels

of

attendees

Miller

Buckfire

transaction

was

completed

December

31,

2012.

Transaction

has

already

resulted

in

nine

completed

or

ongoing

transactions.

A

number

of

these

were

won

by

leveraging/including

other

capabilities

across

Stifel.

Won

assignments

on

a

number

of

high

profile

advisory

engagements

including

the

City

of

Detroit,

Lehman

Brothers,

UniTek,

Furniture

Brands,

Excel

Maritime,

and

OnCor.

Fixed Income

Knight

Fixed

Income

transaction

closed

on

July

1,

2013.

Welcomed

approximately

90

professionals

to

the

firm.

3Q

revenues

in

line

with

our

expectations.

Sales

and

trading

integration

has

gone

very

well

and

complimenting

existing

Stifel

capabilities.

Investment

grade,

high

yield,

and

loan

trading

focus.

Primarily

located

in

London,

Greenwich

and

New

York.

M&A Statistics Source: SNL Financial

(1) Includes transactions announced since 1/1/2013; Data as of

10/21/2013 (2) Includes transactions announced since 1/1/2005; Data

as of 10/29/2013 Recent Merger Updates

_________________________________________________________

|

17

Previously announced acquisition of Acacia Federal Savings Bank

($525mm in assets) by Stifel Bank & Trust closed on October 31, 2013

at an attractive discount to tangible book value.

All non-performing loans were excluded from transaction

Expect significant synergies in connection with single branch closing in

1Q2014

Immediately accretive to Stifel Financial tangible book value/share.

Expected to add $10 million to core earnings for the next few

years. Entirely funded with Bank deposits

Consistent with asset generation strategy within the bank.

Announced acquisition of Ziegler Lotsoff Capital Management (ZLCM)

October 16

Chicago and Milwaukee based asset management company that currently

manages $4.3 billion in assets.

ZLCM management team brings additional experience and capabilities to

Stifel’s existing Asset Management efforts

Opportunity to bring other Stifel Asset Management capabilities under

one umbrella. Total AUM of combined entities will exceed $9

billion. Expected closing 11/30/2013

Recent Merger Updates

th |

Global Wealth Management |

Global Wealth Management

Provides Securities Brokerage Services and Stifel Bank Products

19

Grown

from

600+

financial

advisors

in

2005

to

over

2,000

(1)

financial

advisors

currently

Proven

organic

growth

and

acquirer

of

private

client

business

(56

UBS

branches,

Butler

Wick,

Ryan

Beck)

Retail

investors

are

generally

mid-

to

long-term

buyers

Goal

of

providing

price

stability

and

support

to

the

institutional

order

book

Strategy

of

recruiting

experienced

advisors

with

established

client

relationships

Expanding

U.S.

footprint

Net Revenues ($MM)

(2)

Overview

Operating Contribution ($MM)

(2)

(1)

Includes Independent Contractors.

(2)

CAGR reflects years 2006 to 2012.

_________________________________________________________

|

(1)

Includes

Independent

Contractors.

(2)

Client

assets

include

FDIC-insured

products

as

of

9/30/13

for

years

2008-2013.

Global Wealth Management

20

Opportunity Through Growth

GWM Account Growth

GWM

Broker

Growth

(1)

GWM

Assets

Under

Management

Growth

($MM)

(2)

GWM Branch Growth

_________________________________________________________

|

Global Wealth Management –

Stifel Bank & Trust

Offers banking products (securities based loans and

mortgage loans) within the GWM client base,

including establishing trust services

Built-in source of business

High net worth clients

Highly efficient due to lack of “brick and mortar”

deposit focused facilities

Overview

Strength of Brokerage Position

21

Acquired FirstService Bank, a St. Louis-based,

Missouri-chartered commercial bank, in April 2007

Stifel Financial became a bank holding company and

financial services holding company

Balance sheet growth with low-risk assets

Funded by Stifel Nicolaus client deposits

Maintain high levels of liquidity

Interest Earnings Assets

(1)

Investment Portfolio

Loan Portfolio (Gross)

Total: $4.0 Billion

Total: $3.0 Billion

(2)

Total: $1.1 Billion

(3)

Note: Data as of 9/30/13

(1) Average interest earning assets as of 9/30/13.

(2) MBS makes up less than 1% of Investment Portfolio (3) Construction and Land and Commercial Real Estate make up less than 1% of the loan portfolio

_________________________________________________________

|

Institutional Group |

(1) Based on 2012 U.S. trading volume per Bloomberg. (2)

Includes TWPG historical investment banking and brokerage revenues for years 2006 through September 30, 2010.

(3) 2012 includes realized and unrealized gains on the Company’s

investment in Knight Capital Group, Inc. of $39.0 million.

Institutional Group

23

Net Revenues ($MM)

(2)(3)

Equity Brokerage + Investment Banking

(2)

Fixed Income Brokerage + Investment Banking

Overview

Provides securities brokerage, trading, research,

underwriting and corporate advisory services

Largest providers of U.S. Equity Research

2

largest

Equity

trading

platform

in

the

U.S.

outside

of

the

Bulge

Bracket

(1)

Full Service Investment Bank

Comprehensive Fixed Income platform

nd |

Largest provider of U.S. equity research

#1 in Overall, Mid and Small Cap Coverage

Largest provider of Financial Services coverage

Deep expertise across 12 major sectors

Ranked #2 in the FT/Starmine 2013 Survey

Largest U.S. Equity Research Platform

U.S. Equity Research Coverage

(1)

Coverage Balanced Across All Market Caps

(2)

Institutional Group –

Research

Stifel Research Highlights

24

(1)

Source: StarMine rankings as of 10/30/13. Does not include Closed End

Funds. (2) Small

Cap

includes

market

caps

less

than

$1

billion;

Mid

Cap

includes

market

caps

less

than

$5

billion.

Research

coverage

distribution

as

of

10/30/13.

Small Cap

29%

Mid Cap 35%

Large Cap

36%

_________________________________________________________

Rank

Firm

Overall

Mid Cap

Small Cap

1

Stifel/KBW

1,341

499

428

2

BofA Merrill Lynch

1,142

448

153

3

JPMorgan

1,115

423

162

4

Goldman Sachs

1,014

376

88

5

Raymond James

1,001

393

302

6

Wells Fargo Securities, Llc

988

394

161

7

Barclays

947

354

88

8

Credit Suisse

904

318

132

9

Citi

902

299

101

10

Deutsche Bank Securities

875

294

117

11

Jefferies & Co.

853

298

167

12

Morgan Stanley

844

286

82

13

S&P Capital Iq

833

234

33

14

RBC Capital Markets

788

298

112

15

UBS

737

245

67

16

Morningstar, Inc.

702

179

24

17

Robert W. Baird & Co., Inc.

676

260

156

18

Sidoti & Company LLC

650

216

426

19

BMO Capital Markets

592

211

80

20

Cowen And Company

571

179

156

21

William Blair & Company, L.L.C.

562

197

153

22

Piper Jaffray

522

185

173

23

Keybanc Capital Markets

510

248

105

24

Macquarie Research Equities

506

171

54

25

Oppenheimer & Co.

504

176

109 |

Institutional Equity Sales

110 person sales force, commission based

Experts in small and mid cap growth and value

Team based sales model with 2-4 sales people per

account

Team leaders have an average of 15 years experience

Offices in all major institutional markets in North

America & Europe

Accounts range from large mutual funds to small

industry focused investors

Managed over 741 non-deal roadshow days in 2012

Extensive experience with traditional and overnight

corporate finance transactions

Equity Trading

53 sales traders located in

Baltimore, New York, Boston, Dallas, San

Francisco, Cleveland and London

24 position traders covering each major industry

8 specialized traders focused on: Option Trading,

Convertible and ETF Trading

Agency model –

no proprietary trading or prime

brokerage

Profitable model with advantages of scale

Institutional Group –

Equity Sales and Trading

Powerful Platform Spanning North America and Europe

25

Extensive Distribution Network

Agency model –

no proprietary trading or prime brokerage

Major liquidity provider to largest equity money management

complexes Multi-execution venues: high-touch, algorithms,

program trading and direct market access Dedicated convertible

sales, trading and research desk |

Overview

Strong Fixed Income Capital Markets Capabilities

Institutional Group –

Fixed Income

Client Distribution

(1)(2)

Platform & Products

Focus on long-only money

managers and income

funds versus hedge funds

Consistency of execution

Identification of relative

value through security

selection

Agency/Gov't Securities

Money Markets

Mortgages & MBS

Reverse MBS

Asset-Backed Securities

Investment Grade Credit

High Yield & Distressed

Aircraft Finance & Credit

Solutions

Whole Loans

Municipals

Emerging Markets

Structured Products

Stifel Capital Advisors

Hybrid Securities

Dedicated Loan Trading Group

Capable UK Sales & Trading

platform (former Knight team)

(1)

Client

Distribution

is

for

1/1/12

–

10/31/13.

(2)

Other

category

includes:

Corporation,

Hedge

Fund,

Pension

Fund,

Trust

Company,

Foundation,

Endowment,

University

&

Non-Profit.

26

Comprehensive platform

69 traders with annual client trade volume

approaching $400 billion

33-person Fixed Income Research and Strategy

Group

Widespread distribution

More than 180 Institutional sales professionals

covering over 4,400 accounts

33 institutional fixed income offices nationwide

European offices in London and Zurich

_________________________________________________________

|

Accomplished U.S. Equity Underwriting Franchise –

All Equity Transactions

Investment Banking

Bookrun Equity Deals Since 2010

All Managed Equity Deals Since 2010

27

Source:

Dealogic.

Rank

eligible

SEC

registered

IPOs

and

Follow-On

offerings

since

2010.

Includes

demutualizations.

As

of

9/30/13.

Overlapping

deals

between

Stifel

and

its

acquired

firms

have

been

removed.

Note: $ Volume represents full credit to underwriter for All Managed

Equity Deals and apportioned credit to bookrunner for Bookrun Equity Deals. Bold font indicates middle-market firms.

($ in billions)

# of

$

Rank

Firm

Deals

Volume

1

Bank of America Merrill Lynch

781

$469.7

2

JPMorgan

769

$455.5

3

Citi

725

$451.3

4

Morgan Stanley

688

$436.5

5

Barclays

631

$369.1

6

Wells Fargo Securities

629

$337.1

7

Deutsche Bank

623

$380.9

8

Credit Suisse

616

$374.5

9

Stifel / Keefe, Bruyette & Woods

595

$221.9

10

RBC Capital Markets

569

$264.3

11

Goldman Sachs

546

$378.1

12

UBS

517

$292.3

13

Raymond James

424

$208.7

14

Robert W Baird & Co

308

$77.2

15

Piper Jaffray & Co

300

$142.2

16

Jefferies LLC

282

$58.0

17

Oppenheimer & Co Inc

264

$67.2

18

JMP Securities LLC

259

$50.3

19

William Blair & Co LLC

209

$61.8

20

Cowen & Co LLC

205

$50.2

($ in billions)

# of

$

Rank

Firm

Deals

Volume

1

Bank of America Merrill Lynch

710

$86.4

2

JPMorgan

670

$89.1

3

Citi

626

$81.9

4

Morgan Stanley

624

$100.1

5

Barclays

512

$74.0

6

Credit Suisse

490

$63.3

7

Goldman Sachs

482

$82.8

8

Deutsche Bank

474

$54.1

9

Wells Fargo Securities

437

$34.5

10

UBS

349

$36.3

11

Jefferies LLC

227

$13.5

12

RBC Capital Markets

193

$14.4

13

Stifel / Keefe, Bruyette & Woods

187

$9.3

14

Raymond James

118

$6.5

15

Piper Jaffray & Co

101

$4.4

16

Roth Capital Partners

79

$1.5

17

Cowen & Co LLC

77

$2.4

18

Robert W Baird & Co

69

$3.2

19

Lazard Capital Markets

62

$1.8

20

Leerink Swann LLC

56

$2.0

_________________________________________________________

|

Financial Results |

29

(1)

Non-core

adjustments

consist

of

merger-related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

a

U.S.

tax

benefit.

(2)

Core (non-GAAP) results for the three months ended September 30, 2012

are the same as GAAP results. Stifel Financial Results

Three months ended September 30, 2013

_________________________________________________________

|

30

Unusual Items

(1)

Included in compensation expense is a $5.0 million compensation accrual as

a result of the recognition of the U.S. tax benefit during the three months ended September 30, 2013.

(2)

Included

in

the

provision

for

income

taxes

is

a

U.S.

tax

benefit

arising

out

of

the

Company’s

investment

in

Stifel

Nicolaus

Canada,

Inc.

of

$58.2

million.

_________________________________________________________

Merger-Related Expenses, Discontinued Ops, & U.S. Tax Benefit

|

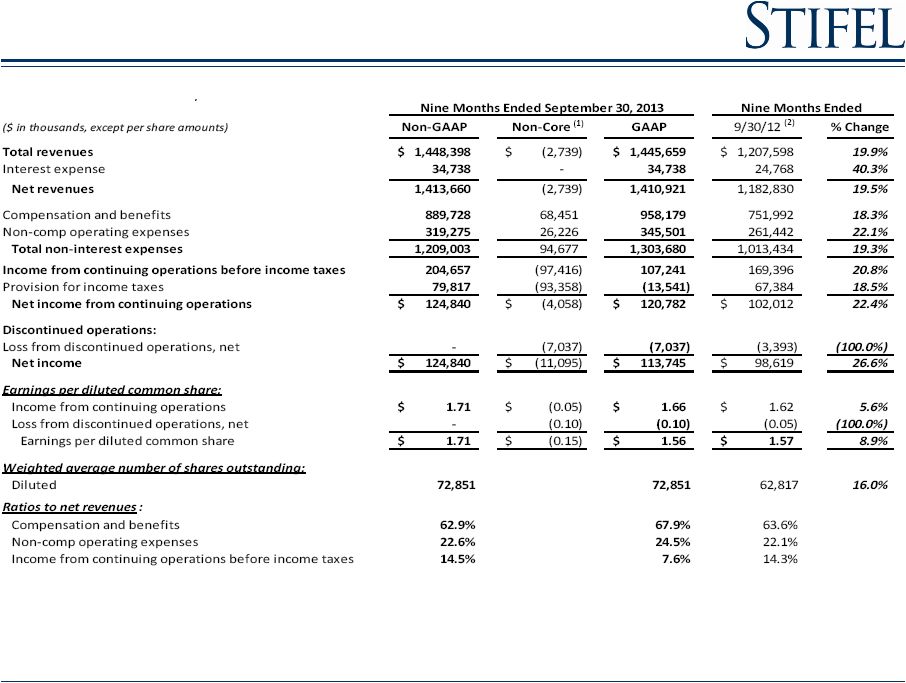

31

Discontinued Operations |

32

Stifel Financial Results

Nine months ended September 30, 2013

(1)

Non-core

adjustments

consist

of

a

charges

related

to

expensing

stock

awards

issued

as

retention

in

connection

with

the

acquisitions

of

KBW

and

the

Knight

Capital

Fixed

Income

business

and

other

merger-

related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

a

U.S.

tax

benefit.

(2)

Core (non-GAAP) results for the nine months ended September 30, 2012

are the same as GAAP results.

_________________________________________________________

|

33

Sources of Revenues

($ in thousands)

9/30/13

9/30/12

%

Change

6/30/13

%

Change

9/30/13

9/30/12

%

Change

Commissions

145,837

$

125,509

$

16.2%

154,795

$

(5.8%)

446,498

$

370,107

$

20.6%

Principal transactions

122,583

102,474

19.6%

111,306

10.1%

341,153

311,420

9.5%

Brokerage revenues

268,420

227,983

17.7%

266,101

0.9%

787,651

681,527

15.6%

Capital raising

53,665

44,563

20.4%

71,737

(25.2%)

175,252

139,441

25.7%

Advisory

39,186

27,180

44.2%

47,706

(17.9%)

113,947

68,901

65.4%

Investment banking

92,851

71,743

29.4%

119,443

(22.3%)

289,199

208,342

38.8%

Asset mgt and service fees

76,710

62,881

22.0%

76,088

0.8%

221,711

189,010

17.3%

Other

13,063

31,094

(58.0%)

11,787

10.8%

45,269

49,991

(9.4%)

Total operating revenues

451,044

393,701

14.6%

473,419

(4.7%)

1,343,830

1,128,870

19.0%

Interest revenue

39,130

26,360

48.4%

32,893

19.0%

101,829

78,728

29.3%

Total revenues

490,174

420,061

16.7%

506,312

(3.2%)

1,445,659

1,207,598

19.7%

Interest expense

11,535

5,904

95.4%

12,634

(8.7%)

34,738

24,768

40.3%

Net revenues

478,639

$

414,157

$

15.6%

493,678

$

(3.0%)

1,410,921

$

1,182,830

$

19.3%

Three Months Ended

Nine Months Ended |

34

Core Non-Interest Expenses

Three months ended September 30, 2013

($ in thousands)

6/30/13

(1)

6/30/12

% Change

3/31/13

% Change

6/30/13

(1)

6/30/12

3/31/13

Net revenues

500,472

$

374,407

$

33.7%

441,788

$

13.3%

100.0%

100.0%

100.0%

Compensation and benefits

294,446

219,004

34.4%

259,135

13.6%

58.8%

58.5%

58.7%

Transitional pay

(2)

20,867

20,370

2.4%

22,806

(8.5%)

4.2%

5.4%

5.2%

Total compensation and benefits

315,313

239,374

31.7%

281,941

11.8%

63.0%

63.9%

63.8%

Occupancy and equipment rental

38,306

32,320

18.5%

31,501

21.6%

7.7%

8.6%

7.1%

Communication and office supplies

24,604

20,797

18.3%

21,858

12.6%

4.9%

5.6%

4.9%

Commissions and floor brokerage

9,616

7,747

24.1%

8,669

10.9%

1.9%

2.1%

2.0%

Other operating expenses

38,707

30,295

27.8%

34,127

13.4%

7.7%

8.1%

7.6%

Total non-comp operating expenses

111,233

91,159

22.0%

96,155

15.7%

22.2%

24.3%

21.8%

Total non-interest expense

426,546

330,533

29.0%

378,096

12.8%

85.2%

88.3%

85.6%

Income before income taxes

73,926

43,874

68.5%

63,692

16.1%

14.8%

11.7%

14.4%

Provision for income taxes

29,570

17,738

66.7%

23,808

24.2%

5.9%

4.6%

5.4%

Non-GAAP net income

44,356

$

26,136

$

69.7%

39,884

$

11.2%

8.9%

7.0%

9.0%

Non-core expenses (after-tax)

(14,921)

-

(25,265)

GAAP net income

29,435

$

26,136

$

14,619

$

Three Months Ended

% of Net revenues

_________________________________________________________

(1)

Excludes

non-core

adjustments

consisting

of

merger-related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

the

U.S.

tax

benefit..

(2)

Transition pay includes amortization of upfront notes, signing bonuses and

retention awards. |

35

Core Non-Interest Expenses

Nine months ended September 30, 2013

($ in thousands)

9/30/13

(1)

9/30/12

% Change

9/30/13

(1)

9/30/12

Net revenues

1,413,660

$

1,182,830

$

19.5%

100.0%

100.0%

Compensation and benefits

826,314

699,601

18.1%

58.5%

59.1%

Transitional pay

(2)

63,414

52,391

21.0%

4.5%

4.4%

Total compensation and benefits

889,728

751,992

18.3%

62.9%

63.6%

Occupancy and equipment rental

108,596

94,776

14.6%

7.7%

8.0%

Communication and office supplies

70,565

60,115

17.4%

5.0%

5.1%

Commissions and floor brokerage

27,599

22,339

23.5%

2.0%

1.9%

Other operating expenses

112,515

84,212

33.6%

8.0%

7.1%

Total non-comp operating expenses

319,275

261,442

22.1%

22.6%

22.1%

Total non-interest expense

1,209,003

1,013,434

19.3%

85.5%

85.7%

Income from continuing operations before income taxes

204,657

169,396

20.8%

14.5%

14.3%

Provision for income taxes

79,817

67,384

18.5%

5.6%

5.6%

Non-GAAP net income from continuing operations

124,840

$

102,012

$

22.4%

8.8%

8.6%

Non-core expenses (after-tax)

(4,058)

-

GAAP net income from continuing operations

120,782

$

102,012

$

Nine Months Ended

% of Net revenues

_________________________________________________________

(1)

Excludes non-core adjustments consisting of a charge related to

expensing stock awards issued as retention in connection with the acquisitions of KBW and the Knight Capital Fixed Income business and

other

merger-related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

a

U.S.

tax

benefit.

(2)

Transition pay includes amortization of upfront notes, signing bonuses and

retention awards. |

36

Segment Comparison

(1)

Core (non-GAAP) results for the three and nine months ended September

30, 2012 are the same as GAAP results.

_________________________________________________________

|