Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDED CURRENT REPORT - San Lotus Holding Inc | v359883_8ka.htm |

| EX-10.7 - EXHIBIT 10.7 - San Lotus Holding Inc | v359883_ex10-7.htm |

| EX-99.1 - EXHIBIT 99.1 - San Lotus Holding Inc | v359883_ex99-1.htm |

| EX-99.2 - EXHIBIT 99.2 - San Lotus Holding Inc | v359883_ex99-2.htm |

Case No.: 13ZMT04071

Entrusting Party: Green Forest Management Consulting Inc

Appraised object: three parcels including No. 163, 164 and 233, Darong Section, Beitun District, Taichung City

Reconnaissance date: April 29, 2013

Liaison office in Taipei: No.11, Alley 59, Lane 790, Section 5, Zhongxiao East Rd, Xinyi District ,Taipei City

TEL: (02)2747-0780 FAX: (02)2728-2099

Position Statement

| 1. | Position statement |

| (1) | We, as an impartial third party, complete this objective appraisal. |

| (2) | We just have pure business relation with the entrusting party and the appraised units. There is no affair about stakeholder or substantial stakeholder as stipulated in SFAS No.6. |

| (3) | Contents of this report include no fictive or hidden matters. Fact descriptions in this report are all real and accurate. | |

| (4) | All of the analyses, opinions and conclusions shown in this report are based on presumptions and restrictive conditions which have been explained in this report; these analyses, opinions and conclusions are personal neutral and professional comments. |

| (5) | The appraised object is of no current or expected benefit to us; we have no interest relationship with or prejudice against interested parties of the appraised object. |

| (6) | Reward received by us is a due pay based on professional work rather than improper compete price. | |

| (7) | Contents of this appraisal report comply with Real Estate Appraisers Law and Regulations on Real Estate Appraisal Technology stipulated by Ministry of the Interior as well as domestic and foreign real estate appraisal theories. A reference is also made to format of “A Model for Narrative Appraisal Report” published by Republic of China Real Estate Appraisers Association. |

| 2. | Basic declarations: |

This appraisal report is completed under following basic presumptions:

| (1) | Unless otherwise stated, ownership of the appraised object is considered as normal and marketable. | |

| (2) | Unless otherwise stated, the appraisal conclusion is drawn without consideration of mortgage or other rights of real estate. | |

| (3) | Authenticity and reliability of information provided by others and quoted in this report are proved through appraiser’s careful verification. |

| (4) | Lands and their superficial structures of the appraised object are regarded as normal situation in this report; no hidden or undiscovered condition affects value of the real estate. Therefore, this report is not responsible for conditions that are hidden or can’t be discovered in common reconnaissance. |

| ~1~ |

| (5) | Unless otherwise stated, the appraised real estates all conform to stipulations of laws and regulations on environmental protection and are not restricted by any event. |

| (6) | Unless otherwise stated, possible or impossible risk factors of the appraised object are not within appraiser’s reconnaissance scope. Real estate appraisers neither have knowledge ability of knowing internal components and potential hazards of real estate nor own qualification of testing these substances. Existence of materials such as asbestos, urea and amine/formaldehyde foam insulation and other potential hazardous materials may influence value of the real estate. Presumption of this appraisal report is that the appraised object doesn’t have these materials, which will cause decrease in value. The appraisal report is not responsible for these situations and professional or engineering knowledge used for discovering these situations. If necessary, the report user must employ expert of this field to conduct analysis. |

| 3. | Restrictive conditions of using this appraisal report |

General restrictive conditions of using this appraisal report are as the following:

| (1) | Holders of this report or its copy have no right to publish this appraisal report. | |

| (2) | All of or a part of contents of this report (especially conclusion of the appraisal, appraiser’s status, the firm where the appraiser works) should not be made public through advertisements, public relations, news, sales or other communication media without appraiser’s written approval. |

| (3) | Evaluation result of this report is only applied to appraisal of the whole real estate. Unless otherwise stated, any division of the whole appraised real estate value by rights ratio or other manners will make appraisal result of this report invalid. |

| (4) | Forecast, predictions or business result estimations shown in this report are based on current market conditions, expected short-term demand and supply factors as well as continuous and stable economical foundation. Therefore, these predictions will change along with different conditions in the future. |

| ~2~ |

| (5) | Result of this report is only used as a reference under the purpose of urban renewal rights transformation appraisal. Change in appraisal purpose may alter the appraisal value. Therefore, this report cannot be used as a reference for other appraisal purposes. |

| (6) | Result of this appraisal report is formed under the appraising conditions provided by the executor. The entrusting party or report user should know appraisal conditions explained in this report so as to avoid a misuse of appraisal value indicated in this report. |

| (7) | Evaluation result of this report only has a feature of real estate reference and doesn’t necessarily become the final amount of the real estate decided by the entrusting party or user. |

| ~3~ |

Appraisal Report

| 1. | Abstract |

| 1.1 | Case No.: 13ZMT04096 |

| 1.2 | Entrusting party: Green Forest Management Consulting Inc. |

| 1.3 | Purpose of appraisal: to provide a reference for assets certificate |

| 1.4 | Basic information of the appraised object: |

| ( 1 ) | Contents: |

| 1. | Location: three parcels including No. 163, 164 and 233, Darong Section, Beitun District, Taichung City |

| 2. | Area: 37,273.6800 m2 (about11,275.2882 Ping) |

| 3. | Land zoning: scenic spot |

| 4. | Type of the appraised right: land ownership |

| ( 2 ) | Property right analysis: |

| 1. | Owner and scope of property right: property right of the land is owned by Talent (Da Ren) International Development Co., Ltd. |

| 2. | Other property rights: the appraised three parcels including No. 163 plot jointly provide a guarantee and set a mortgage offered to Zhensong Chang. Total amount of secured claim is NTD 60,000,000. Details are shown in attachment “List of Other Property Rights EXTABLISH”. |

| ( 3 ) | Product pattern: land of scenic spot. |

| 1.5. | Price type and appraisal condition: |

| ( 1 ) | Price type: normal price |

| ( 2 ) | Pricing date: April 29, 2013 |

| ( 3 ) | Appraisal condition: as per condition of common normal market price |

| 1.6. | Explanation of current condition reconnaissance: |

| (1) | Reconnaissance date: April 29, 2013 |

| (2) | Reconnaissance leader: make reconnaissance personally |

| (3) | References: land registration transcript, cadastral map, etc. |

| 1.7. | Total amount of the appraise land: NTD 91,329,834 (NTD8,100/Ping) |

| - 4 - | Zhanmao Real Estate Appraisers Firm |

| 1.8. | VAT calculated as per announced current value: NTD 995,304 |

| 1.9. | Net value after deducting VAT of announced current value: |

NTD 90,334,530

| 1.10. | Explanation of appraisal data resources: |

| (1) | This report is based on cadastre approved and issued by Chungcheng Land Office of Taipei City on April 29, 2013, etc. |

| (2) | Respective conditions and regional environmental contents of the real estate are all obtained through personal onsite reconnaissance at the appraised object as well as verified and recorded as per relevant data such as urban plan and cadastre. |

| (3) | Appraisal of real estate price is based on onsite actual investigation into transaction information and obtained through summarizing Zhanmao Real Estate Appraisers Firm’s filed data. |

| 1.11. | Operation criterion of this report |

Operation of this report complies with “Regulations for the Real Estate Appraisal Techniques” published by Ministry of The Interior and specifications of “Real Estate Appraisal Techniques Announcement” issued by Republic of China Real Estate Appraisers Association.

| 1.12. | Real estate appraiser |

Real estate appraiser (signature or seal) Real estate appraiser’s Certificate No.: (2006) No. 000013

Kaohsiung Real Estate Appraisers Association membership certificate No.: (2013) No. 063

| 2. | Analysis of main factors of price formation |

| 2.1 | Analysis of general factor: |

| (1) | Analysis of major policies over the years: |

| - 5 - | Zhanmao Real Estate Appraisers Firm |

In Taiwan, housing market has experienced three business cycles and the most recent one occurred between 1987 and 1990. At that time, rapid economic growth in Taiwan caused surplus hot money; due to limited investment channel, capitals rushed into stock market and house market and thus resulted in a sharp rise in house price. Finally, along with stock market bubble and influences of the government’s selective monetary control, housing market began to decline. For redeeming the ever-decreased willing to buying house, since 1990s, the government successively put forward many major favorable policies such as low-interest loan, reducing land value increment tax by half for two years, permitting foreign and mainland capitals to purchase real estates in Taiwan, modifying farmland acquirement qualifications, enacting Regulations on Real Estate Securitization, prolonging the period of halving land value increment tax in January 2004, and permanent halving of land value increment tax in 2005. Due to severely backward infrastructure, insufficient economical kinetic energy in face of globalized competition and financial tsunami happening in the fourth season of 2008, the government not only actively promotes various economic revitalization measures, but also loosens laws and significantly improves cross-straits relationships. For the sake of continuously strengthening national infrastructure construction and laying a foundation for accelerated economic growth and enhanced competitive power in Taiwan, “'The Third-Term Plan for National Development in the New Century” is adopted as the blueprint and assisted by the government’s various important administration works including “overall plan for i-Taiwan 12 projects”, “Economic Revitalization Policy-Project to Expand Investment in Public Works”, “Strategic Plan for National Spatial Development”, “The Economic Stimulus Act”, “Plan for Stabilizing Current Prices”, “Promotion of Six Emerging Industries”, “Program for Strengthening Regional Constructions and Expanding Domestic Demand”, “Program for Expediting the Implementation of Urban Renewal”, etc. “I -Taiwan 12 projects” is expected to push forward 12 infrastructure constructions from 2009 to 2016, in hope of promoting industrial innovative development, increasing domestic investment, activating Taiwan economy, improving people’s life quality, balancing regional development, etc. After this plan is implemented, annual average substantial GDP can be enhanced by 2.95% and 247000 career opportunities can be added each year.

| (2) | Main shaft of national development policy: |

| - 6 - | Zhanmao Real Estate Appraisers Firm |

In 2012, face with changes in external situation such as spread of Euro Crisis, high American financial deficit and slowing down of global economic climate as well as internal issues including industrial transformation, education reform, ageing of population, regional balance, environmental change and government efficiency, the government will embark on eight principal shafts of policies-“innovative & vigorous economy”, “fair & stable society”, “uncorrupted & efficient government”, “high-quality culture & education”, “sustainable low-carbon environment”, “promoting comprehensive construction”, “peaceful cross-Straits relationship” and “friendly international society”, conducts all-round construction, simultaneously enhance soft and hard power and lay a solid foundation for realizing “Golden Decade” of Taiwan. On the other hand, the government also implements related measures of “economic stimulus plan”, increases strengthens of domestic demand and exportation, as well as facilitates steady growth of economy and constant enhancement of employment status.

| A. | Innovative and vigorous economy: |

The government actively promotes “economic stimulus plan”, extensively attracts global investment, pushes forward program of “homes for industries, industries for homes”, develops regional competitive industries, and strengthens development of “six major emerging industries”, “four major emerging intelligent industries” and “ten key service industries”, so as to optimize industrial structure, facilitate economic prosperity and create job opportunities.

| B. | Fair and stable society: |

Adhering to a principle of being “fair and sustainable”, the government is committed to narrowing gap between the rich and the poor, realizing housing justice, taking better care of the disadvantageous group, easing burden on bringing up children, enhancing fertility rate, guaranteeing the elderly’s life, maintaining national fitness, strengthening crime prevention and punishment, ensuring women and children’s safety, advocating gender equality, promoting ethnic harmony and establishing a perfect social security system.

| C. | Uncorrupted and efficient government: |

The government actively promotes clean politics reform, improves corruption preventing and eliminating mechanism, pushes forward national anti-corruption, implements civil rights convention, strengthens guarantee of human rights, improves judicial morale and constructs friendly judicial environment. In terms of administrative reform, the government actively provides more flexible laws through organizational reconstruction, simplifies administrative procedures, promotes electronic management and performance-oriented administrative culture, as well as establishes pragmatic, flexible and efficient government.

| - 7 - | Zhanmao Real Estate Appraisers Firm |

| D. | High-quality culture and education: |

To make Taiwan into a high- quality great cultural nation and an important place of East-Asia higher-education, in 2012, the government will continue to promote development of cultural creativity, accumulate soft cultural power, activate educational reform, create top-quality educational environment, cultivate excellent human resources, strengthen connection between education and industry, and arrange global talents.

| E. | Sustainable low-carbon environment: |

For the sake of responding to climatic variation and reducing vulnerability of society, the government will continue to promote “Master plan of energy conservation and carbon mitigation”, lower carbon emission, create green life, popularize low-carbon transportation, establish low-carbon city, push forward national land restoration and security, accelerate river improvement, execute disaster prevention & control, as well as set up a brand-new green homeland.

| F. | Promoting comprehensive construction: |

The government will reinforce national software and hardware infrastructure, extensively implement “I-Taiwan 12 projects”, promote spatial development of national land, perfect sea, land and air transport, improve government finance, and expedite financial upgrade and development, so as to enhance public service quality, facilitate regional balanced development and increase national competitiveness.

| G. | peaceful cross-Straits relationship: |

Under the principle of “reciprocity, dignity and mutual benefit”, the government strives to promote healthy development of cross-Strait relationship, construct long- term, stable and systematic cross -Strait relationship, establish elite national military, lay a solid foundation of national defense capabilities, consolidate national sovereignty and guarantee peace of Taiwan Strait.

| H. | Friendly international society: |

The government continues to reinforce friendly and substantive international relationships, expand participation in global and regional organizations and activities, combine folk force with the government’s power, actively provide humanitarian aid, develop culture with Taiwanese features, make use of diversified landscapes of Taiwan, improve sightseeing quality, as well as enhance national image and international influence.

| - 8 - | Zhanmao Real Estate Appraisers Firm |

| (2) | Economy: |

(1) International economy:

Since October of this year, economic conditions of USA and Mainland China have been better than expectation, Greek debt crisis has been remitted temporarily, and international economic climate has presented a sign of being stabilized. However, negative factors still exist including Euro crisis, American Fiscal Cliff and unstable subsequent development of situation in the Middle East. Motive power of global economic recovery is still weak. Trends of main international economic indicators are described as below:

| A. | Weak growth of global economy: |

Global economy is gradually stabilized recently thanks to constant recovery of American employment status and real estate market, significant enhancement in production and exportation of Mainland China, and Greek debt deal preliminarily reached by EU. However, Euro Crisis may not be solved thoroughly in a short time, problem of American Fiscal Cliff is needs to be negotiated, Japan has the possibility of economic depression, and development of situation in Middle East is uncertain after amicable settlement of Israeli-Palestinian conflict. Therefore, uncertainty of global economy is still high and this may restrict global economic growth.

Latest Economic Outlook published by major international economic institutions in November still show a conservative viewpoint of global economic climate of this year and next year. Organization for Economic Co-operation and Development (OECD) downgrades its original forecast (May) for global economic growth rate from 3.4% to2.9%, and that of next year from 4.2% to 3.4%. Global Insight (GI) estimates that global economic growth rates of this year and next year are 2.5% and 2.6% respectively, same with predicted values of last month.

| B. | Rise in global price slows down: |

Along with weak global demand and stabilization of international grain and oil prices, global price has been steady recently. GI (November 15) forecasts that global Consumer Price Index (CPI) will increase by 3.0% this October and this is the same with September. It is expected that main countries will adopt loose monetary policy and tensions in the Middle East will be difficult to ease in the future. Such condition contributes to an anticipation of global inflation. In consideration of continuously weak international economic prospect, GI forecasts global CPI of this year and next year will increase by 3.2% and 2.8% respectively. These predicted values are at last month’s levels and present a stable trend.

| - 9 - | Zhanmao Real Estate Appraisers Firm |

| C. | Unemployment rate of Euro area constantly hits new high: |

Unemployment rate of Euro area constantly hits new high. Unemployment rate of September 2012 is 11.6%, which rises by 0.1% and hits a new peak since 1995. In America, unemployment rate of October is 7.9%, increasing by 0.1% compared with last month. Enterprises’ willing to employ is depressed due to weak economic growth and the approaching “Fiscal Cliff”. Japanese unemployment rate of September is 4.2%, equal to last month. Korean unemployment rate of October is 3.0%, 0.1%lower than that of last month. In Hongkong, unemployment rate is 3.4% in October, increasing by 0.1% compared with last month.

| D. | Exportations of emerging East Asian nations stabilize: |

Under influences of international downturn, global trade activities decrease rapidly. Recently, damages to exportations of Four Asian Tigers have been stabilized. Korean and Singaporean exportations of October respectively increase by 1.1% and 6.1% compared with the same period last year and stop recession trend of last few months. Benefiting from rise in demands of Mainland China, Europe and America, Hongkong shows a significant increase of15.8% in export in September and this is the optimal performance over the last one year and a half. Motivated by European and American Christmas orders, Mainland China presents a 11.6% rise in product exportation in October and achieves the biggest increase over the past five months.

| E. | International oil price fluctuates and commodity price continues to decrease in November: |

Brent oil price fluctuates between 105 and 112 dollars/ barrel in November and average price declines by 1.75% compared with October (7D3B oil price index drops by 1.34%). The primary reasons include recovery of North Sea crude supply and poor economic prospect. Recently, exacerbated Israeli -Palestinian conflict induces increase in oil price; then, under influences of Gaza Strip cease-fire negotiation, upward trend of oil price slows down. Global commodity futures index (CRB, Commodity Research Bureau) is 295 in November and decreases by 3.0% compared with October. This is the second consecutive decline mainly caused by significant decrease in soft commodities such as coffee and sugar and basic metal including silver, platinum and copper.

| - 10 - | Zhanmao Real Estate Appraisers Firm |

| F. | Ups and downs in “main stock markets” and “exchange rates between main currencies and U.S. dollar” in October: |

Since November, global stock market and foreign currency market have experienced ups and downs under influences of bad and good news. From November 1st till 30th, among major stock markets around the world, Nikkei 225 Index and Taipei Weighted Stock Index have the biggest increase rate of 5.6%, followed by Paris CAC-40 General index which rises by 2.4%. On the contrary, Shanghai A -share Index presents the biggest decline rate of 5.9%, followed by DJIA Index with a drop of 1.6%. In terms of exchange rate from November 1st till 30th, appreciation of the euro against the U.S. dollar is 0.04%. Among Asian currencies, depreciation of the yen against the U.S. dollar is 3.2%; other Asian currencies show an appreciation against the U.S. dollar: South Korean won appreciates by 0.8% and NTD and RMB both present an increase of 0.6%.

(2) Domestic economy:

Due to weak external demands, import and export become negative again this October. Especially, thanks to innovations of sci-tech products, export orders have shown positive growth for two consecutive months. Industrial production index have grown positively for four consecutive months. Because of bad climate and slightly-low base period of last year, CPI (Consumer Price Index) continues to rise in October. Workforce, quantity of employment and labour- force participation all increase. There’s also a mild elevation in unemployment rate. Affected by international factors, NTD appreciates and Taiwan's stock market declines. Monitoring indicator have been yellow and blue, indicating domestic economic recovery power is still weak but not in depression any more. Performances of various domestic economic indicators are described as follows:

| A. | Positive growth of industrial production for four consecutive months: |

Industrial production index of October is 133.46, which is 4.56% higher than same month of last year and shows a positive growth four consecutive months. Among main industries, electronic part has the biggest increase of 12.32%. Primary reasons include innovative intelligent devices, urgent demand on upstream components, active replenishment of panel stock, and a response to demands of European & American Christmas and Mainland China’s New Year's Day, which all contribute to an increase in production of wafer, IC, PCB etc. The next is chemical material industry, which rises by 5.59% under various effects such as recovered productivity of domestic naphtha cracking plants and stock replenishment of downstream petrochemical plants that have completed inspection and repair successively.

| - 11 - | Zhanmao Real Estate Appraisers Firm |

| B. | Negative growth of foreign trade: |

As global economic growth tends to slow down and information & communication products are affected by Samsung and Apple in European and American markets, export value of August is 24.69 billion US dollars, reduced by 4.2% compared with the same month of last year. This is the sixth consecutive negative growth. Import value is 21.38 billion US dollars, 7.6% lower than the same month of last year. Capital equipment importation shows a decrease of 4.7%. In August, exportations from Taiwan to other major countries or regions all present a negative growth except six nations of ASEAN and Japan. Exportations to Europe and Korea decline sharply and the decrease rate reaches two digits.

| C. | Weak performance in import and export: |

Export value of October is 26.53 billion US dollars, 1.9% lower than the same month of last year. Main cause is a significant decrease of 36.1% in information and communication products; cellphone exportation declines by 64.9% and becomes the primary reason that has negative effect on overall export performance of Taiwan. From perspective of different regions, exportations from Taiwan to six nations of ASEAN, Japan, Mainland China and Hongkong all maintain a positive growth in October, but the growth rate is significantly lower than last month. Exportations to America and Europe are still in negative growth, and decline rate of export to Europe even reach two digits; such condition is caused by slow economic recovery and weak import demands of these regions. With regard to importation, total import value of October is 23.27 billion US dollars, dropping by 1.8% compared with the same month of last year. Capital equipment importation increases by 4.2%, mainly contributed by aircraft import.

| D. | Positive growth of export order for two consecutive months: |

Under influences of innovative new sci-tech products such as handheld device, overseas orders present a month- by-month increase in the second half year. Amount of export order reaches 38.33 billion US dollars in October, an increase of 3.2% compared with the same month of last year. Positive growth has lasted for two consecutive months. Precise instrument export rises by 10.1% compared with same month of last year, and the annual growth rate has been positive for three consecutive months, indicating that the panel industry has been out of recession. In terms of areas, orders from Mainland China, Hongkong, America and six countries of ASEAN all increase positively. Amount of orders from ASEAN nations and America sets a new single-month record. However, exportations to Europe and Japan are still in negative growth.

| - 12 - | Zhanmao Real Estate Appraisers Firm |

| E. | Mild increase in unemployment rate and decrease in real & regular wage: |

Number of labor force is 11, 391,000 in October, an increase of 22000 persons or 0.30% compared with last month. Labour-force participation rate is 58.45%, 0.06% higher than last month. The unemployment of October is 49,2000, an increase of 2000 persons or 0.50% compared with last month. Unemployment rate is 4.33%, 0.01% higher than last month. Compared with same month of last year, there’s also a 0.03% enhancement.

In September, average monthly wage of each staff employed by industrial and service industry is NTD 44,028, increasing by 5.23% compared with last month. Such phenomenon appears because some manufacturers offer bonus or non-monthly merit pay. This figure is also 1.44% higher than the same month of last year. Regular wage is NTD37, 256, which is 0.46% higher than same month of last year. 2.96% increase in consumer price causes a 1.48% decrease in average real wage. Real regular wage also declines by 2.43%.

| F. | Continuous rise in price: |

Consumer price index (CPI) of October increases by 2.36% compared with same period last year. Significant rise in vegetable and fruit price is caused by climate influences and slightly low value of last -year base period. In addition, overseas tour group fee and eat- out expense go up, and prices of aquatic products, fuel oil, gas and electricity are still high. However, the price increase is partially offset by continuous decrease in prices of 3C consumer electronics and relatively low meat price and communication fee. After deducting core pries of vegetables, fruits, aquatic products and energy, CPI rises by 1.06%.

Compared with same month of last year, October shows a 3.64% decline in Wholesale Price Index (WPI), mainly resulting from relatively low prices of chemical materials, basic metal and electronic components. However, increases in prices of petroleum and coal products partially offset such decrease. Domestic consumer goods show a 0.19% increase in price; prices of imported commodities and exported commodities respectively drop by 5.53% and 5.32%.

Moreover, under effects of rise in prices of food, water, electricity, gas and fuel oil, all living price indexes of October go up compared with same month of last year: types A, B and C increase by 5.00%, 3.73% and 4.09% respectively, all higher than overall CPI growth rate of 2.36%.

| - 13 - | Zhanmao Real Estate Appraisers Firm |

| G. | Decrease in annual growth rate of monetary aggregates (M2) and stock market decline: |

Annual growth rate of monetary aggregates (M1B) is 3.57% in October, 0.22% higher than last month, because many current deposits were converted into time deposits same period last year and the base period was on the low side. Annual growth rate of M2 is 3.29%, which is 0.67% lower than last month. This is because some capitals flow into non-deposit commodities such as insurance and common fund.

In October, as affected by loose monetary policy of various countries, Asian currency continues to present an uptrend. NTD once hits a new high of 29.200 against the US dollar. Then, increase in NTD slows down because Central Bank maintains dynamic stability of NTD exchange rate and importers’ remittance bought. At the end of October, due to flowing of hot money into Asian foreign currency market as well as political and economic influences of American presidential election, Asian currency keeps the uptrend and closes at 29.26 on October 31. There’s an appreciation of 0.08 compared with the end of last month. Average exchange rate of October is NTD29.34, respectively 0.93% and 3.10% higher than the same month of last year.

Taiwan’s stock market of October gradually falls due to decline in International stock market, IMF’s downward revision of global economic growth rate of this year and next year, worsening of economic prospect, decrease of investor confidence caused by issues such as domestic capital gains tax and second generation health insurance. In late October, although there’s good news that economic data of Chinese Mainland and USA are improved, domestic electronic industry revenue and financial statement are not as good as expected due to unapparent recovery of global economy and frequently -reported bad news about financial statements of American enterprises. Taiwan’s stock market continues to decline and closes at 7,166 at the end of October, sharply decreasing by 549 points compared with last month. Taiex index of October is 7,438, dropping by 172 points or 2.26%. Total trading value is 1trillion and 385.9 billion NT dollars, a decrease of 32 billion NTD or 18.74% compared with last month.

| H. | Increase in tax revenue: |

Monthly tax revenue is NTD110.6 billion, an increase of 3.9% or NTD4.1 billion compared with same month of last year. Among various main taxes, uniform income tax and commodity tax show the biggest increase: NTD5.3 billion and 4.6billion respectively. However, business tax is reduced by NTD 3.7 billion. Accumulated tax revenue from January to October is NTD 1trillion and 477.3 billion, a rise of 2.8% or NTD 39.9 billion compared with same period last year. Overall budget achieving rate of tax revenue is 83.6%; profitable business tax has the highest rate of 101.3%, followed by uniform income tax with a rate of 100.1%.

| - 14 - | Zhanmao Real Estate Appraisers Firm |

(3) Prospect:

Recently, economic performances of America and Mainland China have been better than expected; Greek debt crisis is also eased temporarily. These factors all contribute to gradual stabilization of international economic climate. However, motive power of global economic recovery is still limited by Euro Crisis, American Fiscal Cliff and instability in future development of Middle-East situation. In November, GI predicts that global economic growth rate will be 2.5% this year and 2.6% next year.

In October, domestic finance, production and consumption indicators all maintain positive growth; labor market is stable; trading performance is not so ideal. At the same time, indicator presents an uptrend. Decline of leading indicator tends to be slow. Monitoring indicators have been in yellow and blue. General score is 18, meaning that domestic recovery is still weak but out of recession. In the future, various uncertainties in global economic growth will continue to affect exportation of our country, In terms of domestic demands, most of economic indicators have recovered to positive growth. Non-government investment converts into positive growth in the third quarter and the growth rate will go up in the fourth quarter. On the contrary, power of stock market is on the low side, real wage doesn’t increase, and the rise in private consumption is limited. The government will continue to implement “Economic Power- Up Plan” and related short-term measures, so as to gradually realize expected benefits and enhance confidence in economy.

(3) Market:

In recent years, house price has been increasing and thus exceeds not only common people’s acceptability but also basic value of house. Survey by Research, Development and Evaluation Commission, Executive Yuan shows that exorbitant house price of metropolitan district occupies the first place of “top ten popular discontents”. As constantly-increasing house price may cause bubblization, related financial and economic units of the government have begun to pay attention to and guard against this problem, and thus lower the temperature of real estate market. The government plans to implement reverse annuity mortgage policy, which is expected to promote people’s willing to owning house and have somewhat positive effect on the market. Parking space volume award will be gradually abolished in the next six years, because this may enhance builder’s building cost and exert negative influence on market. Since May 2010, for real estate sales, main structure (internal area), ancillary structure (balcony, etc.) and public accommodation will be definitely divided and separately priced, and such measure’s effect on market is not clear now. Moreover, in terms of commercial real estate, under impetus of topics such as MOU and ECFA, cross-strait economic and trade development will be more rapid, commercial real estate transaction will begin to be active, and office rent will stop dropping in the future.

| - 15 - | Zhanmao Real Estate Appraisers Firm |

In terms of prospect of real estate market, main lido messages include continuous recovery of economy, increase in money supply, MOU signed by the both sides of Strait, continued low interest rate, enhanced CCI and 10% land value increment tax for one house. Primary unfavorable news include high unemployment rate, discontinuation of favorable housing loan, higher luxurious house tax, tightening loan for luxurious house and non-self-use house, stopping selling state-owned land at selected area of Taipei city, mainland capitals’ investment in real estate project not up to expectation, significant increase in total area of builders’ products, etc. To solve unreasonable increase in real estate price, Taxation Agency, Ministry of Finance reported on April 15, 2011 that the Legislative Yuan had passed “Specifically Selected Goods and Services Tax Act” after the third reading, in hope of eliminating unhealthy trend of investors’ real estate speculation and making house price return to reasonable price. Luxury tax is imposed upon real estate: in the event that the holder sell non-self- use house and its base or urban land with legally-issued building license within two years, a value of 15% or 10% of the selling price will be levied for the sale within one year or two years after holding the house. Such luxury tax causes a shrinking trend in trading volume of real estate market presently. Buyers keep a wait-and-see attitude. For real estates upon which a tax is imposed, space of price negotiation increases and time of transaction prolongs.

For establishing a healthy real estate market and satisfying basic house demands of people with low and medium income and salaried persons, from 2013 to 2016, the government will continue to implement “Integrated Housing-Subsidization Program”, “Youth's Housing Subsidy Program” and “Preferential Housing Loan for the Youth”, reasonably adjust announced land price and current appraised value of house, establish suitable and social houses, assist in professional business of real estate lease service industry, as well as facilitate the construction of house lease service platform, thus to make people of different levels, physical and mental functions, genders, ages, family compositions and group cultures can all own proper and dignified dwelling environment. In addition, to improve quality of people’s dwelling environment and enhance attractiveness and competitive strength of towns, the government will help various local governments promote overall planning program for building town images and integrate related department plans, so as to exert general effects of investment, push forward re-development of towns, and realize sharing and common prosperity of all municipalities and counties (cities) within the region.

| - 16 - | Zhanmao Real Estate Appraisers Firm |

Generally, along with continuous economic recovery, abundant market capitals and expectation of future cross-strait economic & trade development, current real estate market presents a trend of rise in both price and quantity. However, builders’ launching products actively results in a large increase in market supply. In addition, the government takes various measures to suppress the rise in house price such as enhancing taxation of non-self-use real estates, stopping selling state-owned land at selected area, financial restraint, etc. Therefore, it’s expected that risk of real estate market business and investment will increase in the short term.

2. Regional factor analysis:

(1) Description of the region:

| 1. | Position | city urban edge country countryside edge others: |

| 2. | Landscape | commercial residential industrial agricultural and forestry commercial and residential others: |

(2) Land utilization condition of neighboring area:

| 1. | State of development & use: | highly developed developed under development undeveloped |

| 2. | Speed of development & use: | rapid moderate slow |

(3) Utilization of buildings of neighboring area:

| 1. | Condition of building utilization: | Condition of building utilization: commercial store office residence |

| 2. | Condition of building distribution: | high density medium density low density |

(4) General situation of public accommodation of neighboring area:

| - 17 - | Zhanmao Real Estate Appraisers Firm |

1. State of planning ¨ excellent ¨ good ¨ ordinary x poor ¨ bad

2. State

of implementation ¨ fully implemented ¨

mostly implemented x fractional implementation ¨

implementation

¨ unimplemented

3. Convenience of acquiring daily necessities ¨ excellent ¨ good ¨ ordinary x poor ¨ inferior

(5) General situation of transportation of neighboring area:

1. Main vehicles: ¨ MRT ¨ bus ¨ railway x Self-owned vehicle

2. Transportation convenience: ¨ excellent ¨ good ¨ ordinary x poor ¨ bad

(6) Dangerous or detestable facilities at neighboring area: x No ¨ Yes:

(7) Major public construction within the region: x No ¨ Yes:

(8) Future development trend of neighboring area: ¨ Commercial ¨ residential ¨ industrial x agricultural

| 2.3 | Analysis of respective factors: |

(1) Respective condition of land:

| 1. | Base property right relationship: x independently owned ¨ proportionally & jointly owned ¨ others: |

| 2. | Road adjacency: ¨ adjacent to road on four sides ¨ adjacent to road on three sides ¨ adjacent to road on two sides ¨ adjacent to road on one side x not adjacent to road |

| 3. | Landform: irregular shape |

| 4. | Terrain: high altitude |

(2) Legal use control of the land and other control measures:

The appraised object belongs to second, third and fourth phases of City Enlargement Plan of Taichung City (Dakeng Scenic Area). It is situated in scenic area, with a permitted building coverage ratio of 20% and a permitted plot ratio of 40%. The criterion is that no building base can be developed within scope of Dakeng Scenic Area. Use of the appraised object should comply with stipulations of “Chapter 13-building on hilly land” of “Architectural Design and Construction” of “Regulations on Architectural Technology”.

(3) Land use condition:

Land survey estimates Status Clearing weeds (mixed forestland)

(4) Environmental assessment:

¨ excellent ¨ good x ordinary ¨ poor ¨ bad

| - 18 - | Zhanmao Real Estate Appraisers Firm |

| (5) | Convenience of public facilities: |

¨ excellent ¨ good ¨ ordinary x poor ¨ bad

| (6) | Analysis of adaptability of building and base to surrounding environment: |

¨ excellent x good ¨ ordinary ¨ poor ¨ bad

| 2.4. | Information disclosure: |

Reasons of decision on price are now analyzed as follows:

| (1) | In terms of reliability of data collection: the appraised object is scenic area land, so comparative method is suitable for assessing value of the appraised object; data acquired through searching for similar market cases needed for the appraisal method has a good reliability. |

| (2) | In terms of differences in conditions of appraisal type and similarities in factors of price formation: result of the present appraisal functions as a reference for the appraised object compared with normal market price on the date of pricing, so evaluation result obtained through comparative method better meets demands of appraisal purpose. |

| (3) | Price of this appraisal is normal price. It refers to a reasonable value of marketable real estate represented by currency amount and unthreateningly formed between willing buyer and seller through professional knowledge, careful action, proper marketing and normal transaction condition. | |

| 3. | General condition of real estate market |

| 3.1 | Market supply and demand |

x Balance between supply and demand ¨ excess of supply over demand ¨ excess of demand over supply

| 3.2 | Type of market product |

¨ Commercial building ¨ residential and commercial building ¨ apartment house x town house

| 3.3 | Major plan of traffic construction |

| 1. | Condition of road planning: |

Main road of this region is the Dongshan Road with a width of 20meters. There’re also many criss-cross industrial roads with width from 4 to 6 meters. For example, Liankeng lane, Zhuoshui lane, Qingshui lane, Hengkeng lane, Ningyuan lane, Beikeng lane, Dahu lane and Zhukeng lane form traffic network of the whole Dakeng Scenic Area.

| 2. | Access road: |

Main access road of this region is the 20m-wide Dongshan Road, which runs through the whole region and connects with Taichung City and Taichung County.

| - 19 - | Zhanmao Real Estate Appraisers Firm |

| 3. | Public transportation system: |

Urban-district buses include bus services provided by Renyou Bus and Fengyuan Bus Transportation. These buses run intensively. Transportations between this region and “Taichung City & neighboring districts” are all convenient.

| 3.4 | Development prospect |

Dakeng Scenic Area, which locates at northeast part of Taichung City and belongs to Beitun District, neighbors Chung Hsing Ling in the north, Tou ke Mountain in the east, Buzikeng River in the south and Dali River in the west. Six natural streams lie within this region including Dakeng River, Zhuoshuikeng River, Qingshuikeng River, Hengkeng River, Beikeng River and Buzikeng River. Main access road is Highway No.129, which runs through the whole region and connects with Taichung City and Taichung County. Many criss-cross industrial roads are also available. For example, Liankeng lane, Zhuoshui lane, Qingshui lane, Hengkeng lane, Ningyuan lane, Beikeng lane, Dahu lane and Zhukeng lane form traffic network of the whole Dakeng Scenic Area. Beitun District of Taichung City is known as “Yangming Mountain of Taichung”. In 1976, Dakeng Scenic Area was set up by Taichung City Government and could be called back garden of Taichung. After 921 Earthquake, Chelungpu fault traverses Dakeng and severe change in stratum causes discovery of hot spring resources here. As a result, new sightseeing pattern is developed. Dakeng Scenic Area, which owns natural ecology, hot spring spa and convenient transportation, was once ranked among top ten hot tourist attractions of Taichung.

Dakeng features abundant agricultural products and is especially famous for bamboo shoot, orange and free-range chicken. Diversified restaurants with delicious dishes and reasonable price are available within this region. It is indeed the first choice for enjoying countryside delicacies.

Flourishing and decaying of tourist district is dependent on policy. In the past, along with guidance of policy and introduction of recreational facilities, Dakeng region focused on axial development of tourism, leisure and recreation. However, after 921 Earthquake, real estate market of Dakeng mountain area suffers severe impact and land transaction almost stagnates. Presently, the development is steady. Future status of real estate market depends on whether regional development can be motivated by guidance of policy plan and introduction of emerging leisure recreation.

| 4. | Price appraisal: |

| 4.1. | Preconditions of price appraisal and types of price: |

| - 20 - | Zhanmao Real Estate Appraisers Firm |

| 1. | The appraised object belongs to land of scenic area, so comparative method is used for evaluation as per stipulations of “Regulations for the Real Estate Appraisal Techniques”. In addition, there’s no example of market return and slope is steep, so the land development is subject to stipulations of key points of Taichung City Dakeng Scenic Area development review and approval; whether the development is feasible depends on result of such review. Therefore, only market comparison approach is adopted for appraisal. Finally, after taking into consideration current market condition, suitability of each appraisal approach, purpose of appraisal, etc., appraisal price of the land is decided. |

| 2. | Comparative method: comparative price of the appraised land is obtained through making a reference to land transaction prices of comparative objects of neighboring and similar areas and then conducting condition comparison, analysis and price adjustment of the appraised object. |

| 4.2 | Selection of appraising method: |

| 1. | Selection of appraising method: |

The present appraisal adopts comparative method.

| 2. | Comparative method refers to calculating price of the appraised object through comparing, analyzing and adjusting prices of the comparative objects. | |

| 3. | Operational procedures of this appraisal adopt percentage method to conduct price discrepancy adjustment in accordance with transaction price of comparative market object, so as to estimate comparative price of the real estate. |

| 4.3 | Reasons of price deciding: |

| 1. | Evaluation process of comparative method: |

(1). With regard to evaluation process of comparative method, this Firm adopts percentage method to perform adjustment and assessment.

(2). Percentage method means making one -by-one comparison of regional factors and respective factors that affect price discrepancy between appraised object and comparative object, and then conducting price adjustment according to discrepancy percentages evaluated by degree of excellence (excellent>good>fine>poor>bad).

(3). Evaluation of conditions such as degree of excellence (excellent goodfinepoorbad) is completed through an objective comparison of various conditions of appraised object and comparative object.

| - 21 - | Zhanmao Real Estate Appraisers Firm |

(4). Regarding data related with comparative object, this Firm has tried best to make confirmation with data providers. If there is any insufficiency, it is because verification is impossible or difficult.

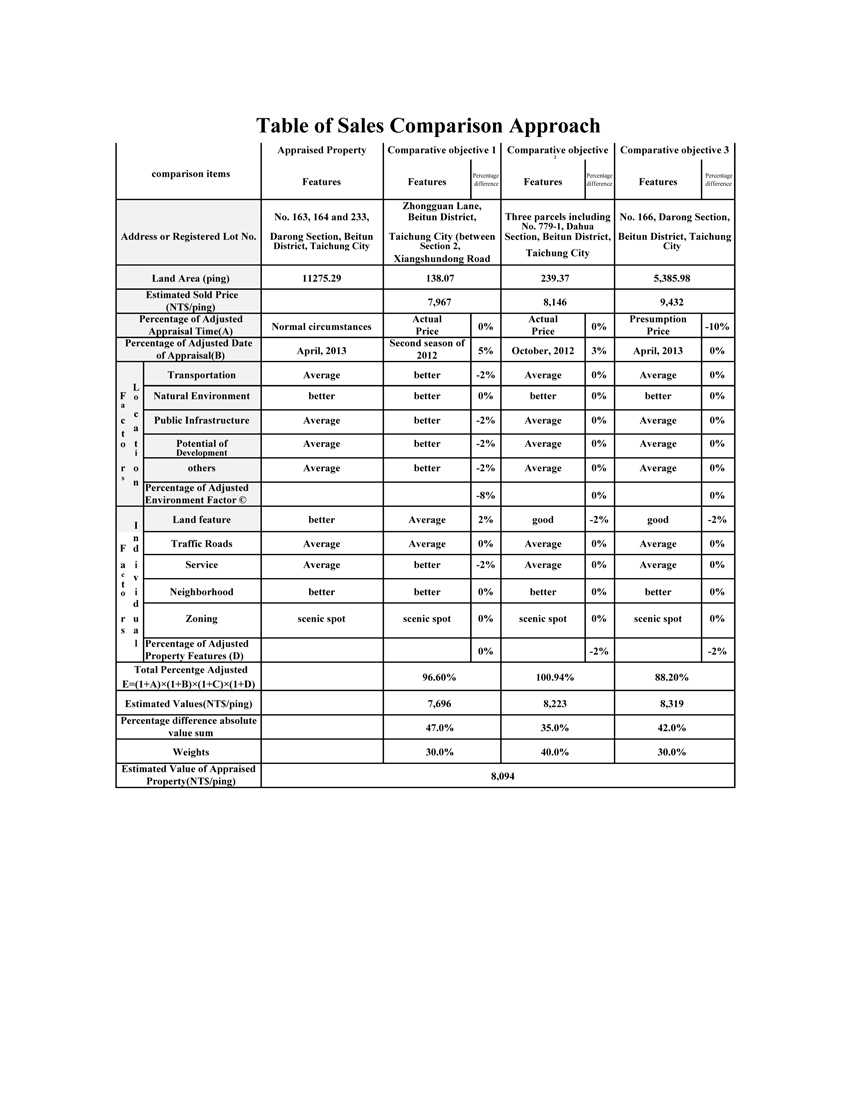

(5). Comparative analysis and adjustment of price of appraised object:

Compare differences between following market cases and the appraised object, make analysis and computation, and then comparative price of the appraised land is calculated as NTD8,094/Ping (details of comparison and calculation process are shown in “Sheet for Price Comparison, Adjustment and Calculation based on Plot Ratio at the time of Neighboring-Area Building Development”)

Comparative objectives of land sale examples

| Comparative objective | Comparative objective 1 | Comparative objective 2 | Comparative objective 3 |

| Pricing date | Second season of 2012 | October, 2012 | April, 2013 |

| Zhongguan Lane, | |||

| Beitun District, | Three parcels | ||

| Plot No. | Taichung City | including No. 779-1, | No. 166, Darong |

| (between Section 2, | Dahua Section, Beitun | Section, Beitun | |

| Xiangshundong Road | District, Taichung City | District, Taichung City | |

| and Kuozi Road) | |||

| Land use zone | Scenic area | Scenic area | Scenic area |

| Building coverage ratio/ plot ratio | 20%/40% | 20%/40% | 20%/40% |

| Landform | Quadrate | Irregular | Irregular |

| Adjacent road | No adjacent road | No adjacent road | No adjacent road |

| Adjacent road width (m) | — | — | — |

| Price type | Knock-down price | Knock-down price | For-sale price |

| Land area (Ping) | 138.0700 | 239.3652 | 5385.9823 |

| Total price (NTD) | 1,100,000 | 1,950,000 | 50,800,000 |

| Unit price(NTD/Ping) | 7,967 | 8,146 | 9,432 |

| Remark | — | — | — |

| 4.4 | Deciding price of the appraised land: |

As per calculation result of land price described above, comparative price of the appraised land is computed as NTD8, 094/Ping; in consideration of data reliability, real estate type and price formation factor, unit price of appraised land is decided as NTD8100/Ping (number at third position left of the decimal point will be rounded) and total value is NTD91,329,834. Computational process is as below: Total value of the appraised land:

= unit price × area

= 8,100×11,275.2882

= 91,329,834 (NTD)

| - 22 - | Zhanmao Real Estate Appraisers Firm |

| 5. | Annexed table: |

| 5.1 | Land Price Comparison, Adjustment & Calculation Sheet……1Page |

| 6. | Attachment: |

| 6.1 | Land appraisal sheet………………………………………………1 Page |

| 6.2 | Cadastral map transcript……… …………………………………1 Page |

| 6.3 | Diagram of appraised position……………………………………1 Page |

| 6.4 | Photos of current situation………………………………………4 photos |

| 6.5 | Land registration transcript………………………………………1 Page |

| 6.6 | Appraiser’s certificate………………………………………………2 Pages |

| 7. | Conclusion: |

| 7.1 | Appraisal of this report is completed by real estate appraiser of this Firm as per stipulations of “Regulations for the Real Estate Appraisal Techniques”, as well as with an emphasis on “comparative method &cost method-land development analysis” and a reference to features & development potential of this area. This report contains no false and hidden matters. Result of this appraisal is sufficient to reflect reasonable price of real estate in this case. |

| 7.2 | This report is made by real estate appraiser of this Firm with an impartial and neutral standpoint as well as a spirit of seeking preciseness and trueness, and then verified in accordance with rigorous checking system of this Firm. Therefore, this report has absolutely-fair significance and is not affected by any stake. |

It is our honor to request for your reference! We quite appreciate your advice!

| - 23 - | Zhanmao Real Estate Appraisers Firm |

LIST OF OTHER PROPERTY RIGHTEXTABLISH

| Case No.: 13ZMT04071 | Page: 1 | |

| Type of Property Right | Maximum mortgage | |

| Registration Priority | First priority | |

| Registration Date | August 30, 2011 | |

| Creditor | Zhensong Chang | |

| Claim Amount | NTD 60,000,000 | |

| Repayment Date | August 18, 2015 | |

| Obligor | Da Ren International Development Co., Ltd. | |

| Debtor | Da Ren International Development Co., Ltd. | |

| Co-guarantee | ||

| (Description of the land | Darong Section, Beitun District, Taichung City | |

| Land: plot No. 163, 164 and 233(1/1) | ||

| and building) | ||

| Certificate Number | No. 008602 of 2011 | |

TABLE OF LAND APPRAISAL

| Entrusting Party : Green Forest Management Consulting Inc | Page 1 | |||||||

| Entrusted by : - | ||||||||

| Item | Location | Lot No. | Category | Permitted Zoning | Area | Owner | Ratio

of Owner |

Appraised area |

| 1 | (Darong

Section, Beitun District,) Taichung City |

163 | forest | scenic spot | 12,417.08  |

Da

Re International Development Co., Ltd. |

1 | 12,417.0800  |

3,756.1667  |

1 | 3,756.1667  | ||||||

| 2 | (Darong

Section, Beitun District,) Taichung City |

164 | forest | scenic spot | 14,593.15  |

1 | 14,593.1500  | |

4,414.4279  |

1 | 4,414.4279  | ||||||

| 3 | (Darong

Section, Beitun District,) Taichung City |

233 | forest | scenic spot | 10,263.45  |

1 | 10,263.4500  | |

3,104.6936  |

1 | 3,104.6936  | ||||||

37,273.6800  | ||||||||

| Total | 11,275.2882  | |||||||

| Appraised Value | ||||||||

| Item | Transfer

Date of Previous |

(Transfer

Value) of Previous.NT$/  |

Commodity Price Index |

Current Promulgated Value of .NT$/  |

Total

Value of Current Promulgated |

NT$ / Ping | Sum-total(NT$) | Increment Tax(NT$) |

| 1 | 100.8 | 680 | 101.3% | 868 | 10,778,025 | 8,100 | 30,424,950 | 444,929 |

| 2 | 100.8 | 470 | 101.3% | 551 | 8,040,826 | 8,100 | 35,756,866 | 218,576 |

| 3 | 100.8 | 643 | 101.3% | 813 | 8,344,185 | 8,100 | 25,148,018 | 331,799 |

| Total | 27,163,036 | 8,100 | 91,329,834 | 995,304 | ||||