Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - Lithium Exploration Group, Inc. | form10q.htm |

| EX-10.32 - EXHIBIT 10.32 - Lithium Exploration Group, Inc. | exhibit10-32.htm |

| EX-31.1 - EXHIBIT 31.1 - Lithium Exploration Group, Inc. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Lithium Exploration Group, Inc. | exhibit31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Lithium Exploration Group, Inc. | exhibit32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Lithium Exploration Group, Inc. | exhibit32-2.htm |

Consulting Agreement

This consulting agreement dated this 25th day of July, 2013 by and between Advanced Capital Trading, LLC, a corporation organized under the laws of the State of New York having its principle office at 50 Broad St, Suite 1020 New York, NY 10004 (hereinafter referred to as The Company), and Lithium exploration Group Inc. (hereinafter referred to as The Client).

Recitals

I. The Client desires to obtain

consulting services from The Company as more particularly described

herein (“Scope of Services and Manner of

Performance”).

II. The Company is in

the business of providing such consulting services and has agreed to provide the

services on the terms and conditions set forth in this

agreement.

Now, therefore, in consideration of

the faithful performance of the obligations set forth herein and other good and

valuable consideration the receipt and sufficiency of which are hereby

acknowledged, The Company and The Client hereby agree as follows.

Terms

1. Scope of Services. The Company will perform financial consulting for and on behalf of The Client in relation to interactions with broker-dealers and will consult with and advise The Client on matters pertaining to corporate exposure/investor awareness, business modeling and development and the release of press materials.

2. Manner of performance. It is intended that The Company will provide research on Lithium exploration Group Inc. (hereinafter referred to as LEXG) and distribute company’s material to institutions, portfolio managers, broker-dealers, financial advisors and other persons whom The Company determines in its sole discretion, are capable of disseminating such information to the general public. The Company will also advise The Client concerning marketing and promotional matters relating to its business. The Company will act upon The Client’s behalf in the professional investment community. It is expressly agreed and acknowledged that The Company will not be expected to provide investment advice or recommendations regarding LEXG to anyone. The Company will focus on contacting persons, generally through conventional communications in order to familiarize them with information concerning LEXG. Additionally, The Company shall be available for advice and counsel to the officers and directors of LEXG at such reasonable and convenient times and places as may be mutually agreed upon. Except as aforesaid, the time, place and manner of performance of the services hereunder, including the amount of time allocated by The Company, shall be determined at the sole discretion of The Company.

3. Status of Consultant. The Company shall act as an independent Consultant and not as an agent or employee of The Client and The Company shall make no representation as an agent or employee of The Client. The Company shall furnish insurance and be responsible for all taxes as an independent Consultant. The Company shall have no authority to bind The Client or incur other obligations on behalf of The Client. Likewise, The Client shall have no authority to bind or incur obligations on behalf of The Company.

1

4. Disclosure of Material Events. The Client agrees to promptly disclose to The Company those events/ discoveries, which are known and/or anticipated that may or conceivably may have an impact on the stock price, business operations, future business, or public perception of LEXG. These disclosures may have a material impact on the ability and effectiveness of The Company and service rendered. It shall be understood that excluded from this disclosure shall be information deemed to be non-public or

“inside” information.

5. Confidentiality Agreement. In the event The Client discloses information to The Company that The Client considers to be secret, proprietary or non-public and so notifies The Company, The Company agrees to hold said information in confidence. Proprietary information shall be used by The Company only in connection with services rendered under this Agreement. Proprietary information shall not be deemed to include information that is in or becomes in the public domain without violation of this Agreement by The Client, or is rightfully received from a third entity having no obligation to The Client and without violation of this Agreement. In reciprocal, The Client agrees to hold confidential all trade secrets of and methods employed by The Company in fulfillment of services rendered.

6. Indemnification. The Client agrees to indemnify and hold harmless The Company against any losses, claims, damages, liabilities and/or expenses (including any legal or other expenses reasonably incurred in investigating or defending any action or claim in respect thereof) to which The Company may become subject to, because of the actions of The Client or its agents. Likewise, The Company agrees to indemnify and hold harmless The Client against any losses, claims, damages, liabilities and/or expenses (including any legal or other expenses reasonably incurred in investigating or defending any action or claim in respect thereof) to which The Client may become subject to, because of the actions of The Company or its agents. The Company is willing and capable of providing services on a “Best Efforts” basis. Payment by The Client to The Company is irrevocable and irreversible.

7. Conflict of Interest. The Company shall be free to perform services for other persons. The Company will notify The Client of its performance of consulting services for any other Client that could conflict with its obligations under this agreement.

8. Term. Refer to Schedule A.

9. Payment. Refer to Schedule B.

10. Payment Instructions. Refer to Schedule C.

2

11. Severability. This agreement may be dissolved at any time at the express consent of both parties. In the event any part of this agreement shall be held to be invalid by any competent court or arbitration panel, this agreement shall be interpreted as if only that part is invalid and that the parties to this agreement will continue to execute the rest of this agreement to the best of their abilities unless both parties mutually consent to the cancellation of this agreement.

This agreement shall be interpreted in accordance with the laws of the State o of New York. This agreement and attached schedules constitutes the entire contract of the parties with respect to the matters addressed herein and no modifications of this agreement shall be enforceable unless said modification is in writing and signed by both The Company and The Client. This agreement is not assignable by either party without the consent of the other.

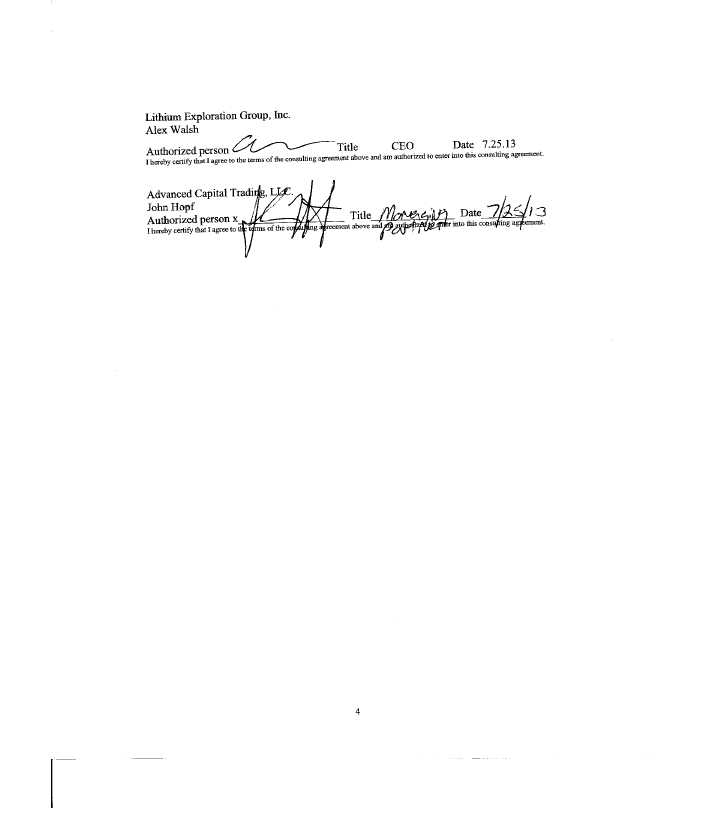

In witness hereof The Company and The Client have caused this agreement to be executed on the date indicated in Schedule A.

Schedule A

Term of Commitment

The term of commitment between The Company and The Client shall be for a period of 3 months. With an extension of an additional 3 months based upon performance. Commitment shall begin upon execution, by both parties, of this agreement. Provided that compensation has been received, services to be provided shall begin on August1st 2013.

| Schedule B |

| Payment |

| $10,000 USD per month, due upon execution of contract. |

| Schedule C |

| Payment Instructions |

| Advanced Capital Trading, LLC |

| 66 Harris Rd. |

| Katonah, NY 10536 |

| JP Morgan Chase Bank |

| Acct# 920499480 |

| ABA# 021000021 |

3