Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUNTINGTON BANCSHARES INC /MD/ | d627869d8k.htm |

Bank

of America Merrill Lynch

Banking & Financial

Services Conference

Steve Steinour

November 13, 2013

Exhibit 99.1 |

This

document contains certain forward-looking statements, including certain plans, expectations, goals, projections,

and statements, which are subject to numerous assumptions, risks, and

uncertainties. Forward-looking statements may be identified by

words such as expect, anticipate, believe, intend, estimate, plan, target, goal,

or similar expressions, or future or conditional verbs such as will, may,

might, should, would, could, or similar variations. While there is no

assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors

which could cause actual results to differ materially from those

contained or implied in the forward-looking statements:

(1) worsening of credit quality performance due to a number of factors such as the

underlying value of collateral that could prove less valuable than otherwise

assumed and assumed cash flows may be worse than expected; (2) changes in

general economic, political, or industry conditions; uncertainty in U.S. fiscal and monetary policy, including the interest

rate policies of the Federal Reserve Board; volatility and disruptions in global

capital and credit markets; (3) movements in interest rates; (4) competitive

pressures on product pricing and services; (5) success, impact, and timing of our

business

strategies,

including

market

acceptance

of

any

new

products

or

services

implementing

our

“Fair

Play”

banking

philosophy; (6) changes in accounting policies and principles and the accuracy of

our assumptions and estimates used to prepare our financial statements; (7)

extended disruption of vital infrastructure; (8) the final outcome of significant

litigation; (9) the nature, extent, timing and results of governmental actions,

examinations, reviews, reforms, regulations, and interpretations, including

those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the

Basel III regulatory capital reforms, as well as those involving

the OCC, Federal Reserve, and CFPB; and (10) the

outcome of judicial and regulatory decisions regarding practices

in the residential mortgage industry, including among

other things the processes followed for foreclosing residential mortgages.

Additional factors that could cause results to differ materially from those

described above can be found in Huntington’s 2012 Annual Report on Form 10-K, and

documents subsequently filed by Huntington with the Securities and Exchange

Commission. All forward-looking statements included in this document are

based on information available at the time of the release. Huntington assumes

no obligation to update any forward-looking statement.

Forward Looking Statements

2 |

Presenter

Steve Steinour

Chairman, President, & Chief Executive Officer

Also Present

Todd Beekman

–

Senior Vice President –

Investor Relations

Mark Muth

–

Vice President –

Investor Relations

Participants

3

•

Who is Huntington

•

2010 Strategy and Investments

–

Visible Results: Customers, Fee Income, Lending Discipline

•

2014 -

Continued Positive Operating Leverage

•

Performance vs. Top 100 Banks & Regional Peers

Discussion Topics |

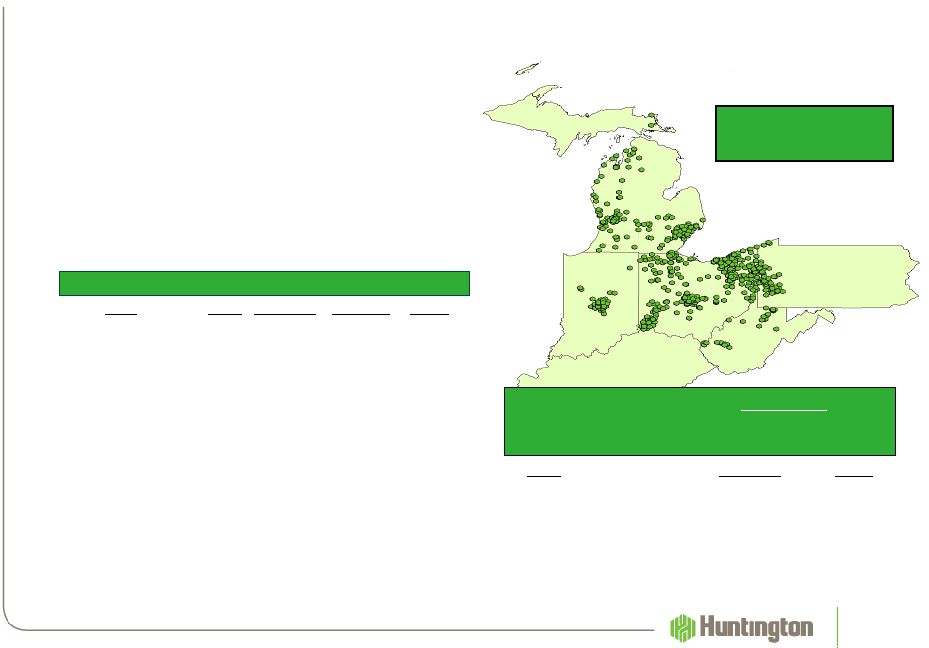

MSA

Rank

Branches

Deposits

Share

Columbus, OH

1

95

$14,436

28.3%

Cleveland, OH

4

90

4,261

8.2

Detroit, MI

7

65

4,478

4.5

Toledo, OH

2

40

2,045

22.4

Pittsburgh, PA

8

40

2,512

2.7

Cincinnati, OH

4

40

2,109

2.8

Youngstown, OH

1

45

2,082

23.0

Indianapolis, IN

4

45

2,859

7.8

Canton, OH

2

28

1,494

25.1

Grand Rapids, MI

3

28

1,855

10.7

Who is Huntington (HBAN)

Midwest financial services holding company

Founded

-

1866

Headquarters

-

Columbus, Ohio

Total assets

-

$57 Billion

Total loans

-

$43 Billion,

90% in footprint

Employees

(1)

-

11,956

4

(1)

Full-time equivalent (FTE) (2) Includes 15 Private Financial Group

Offices Branches 731

(2)

ATMs

1,516

% Deposits

#1 Share markets

38%

#1-

#4 Share markets

63%

State

Branches

ATMs

Ohio

408

941

Michigan

163

230

Pennsylvania

54

108

Indiana

48

69

West Virginia

31

145

Kentucky

12

23

Deposits

-

Top

12

MSAs

Source:

SNL Financial, company presentations and filings

FDIC deposit data as of June 30, 2013 |

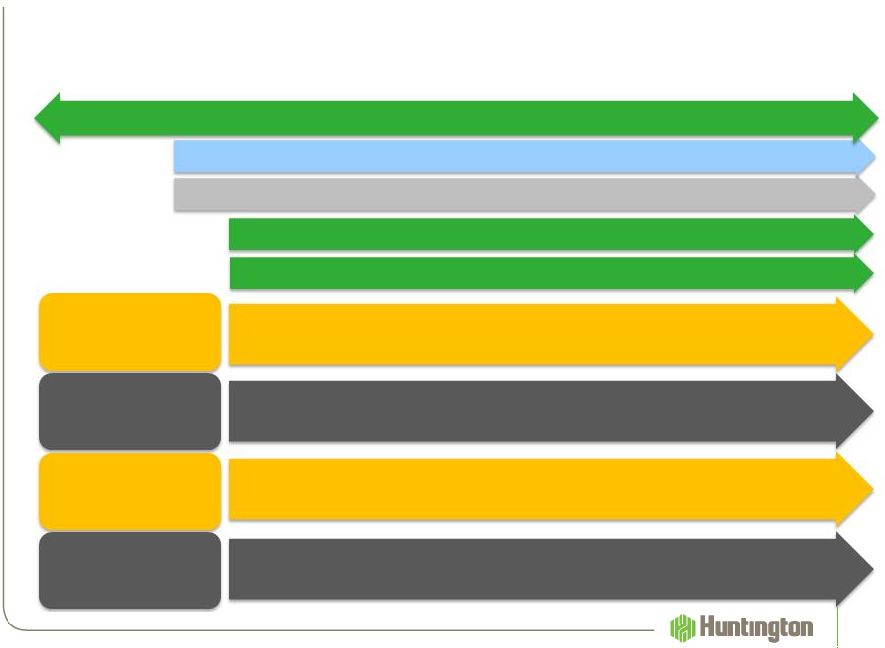

Continuing To Invest

But At a Moderated Pace

5

Retail and

Business

Banking

Commercial

Banking

Auto Finance

Wealth Advisors,

Gov’t Finance, and

Home Lending

Investing for the Long Term

2010

2011 2012

2009

Credit & Risk Management and IT Infrastructure

Strategic Plan

24-Hour Grace

®

Added 150 Sm Bus. Bankers

Giant Eagle / In-Store

Asterisk-Free Checking™

Huntington Plus Checking™

Treasury Management

Equipment Finance

Capital Markets

Expand to PA and

New England

Expand Personal Trust Offices

Huntington Asset Services

Foundation of Service

Common Sales Process: OCR / Cross Sell

Building a Powerful Brand

Expand to

WI & MN

Healthcare & Not-For-

Profit Verticals

Launched ETFs

Meijer / In-Store

Energy, Ag, &

International Verticals

Credit Card

Expand to

CT & IA

2013 |

Grow

market share and share of wallet •

How

–

Best in class consumer products

–

Commercial focus on Small & Middle Market and select Specialty

Verticals

–

Best in class customer service with increased marketing & branding

–

Deep community involvement

–

Alignment of employees and shareholders through long-term

ownerships of equity

•

Outcome

–

Extending life of relationship... “stickier”

customers

–

Relationship-based customer selection…

reduced impact of irrational

competition

–

Improved funding mix…

higher percentage of low-

and no-cost deposits

–

Higher mix of fee income…

higher ROE revenue stream

–

Disciplined growth and capital deployment

Huntington’s Strategy Since 2010

6 |

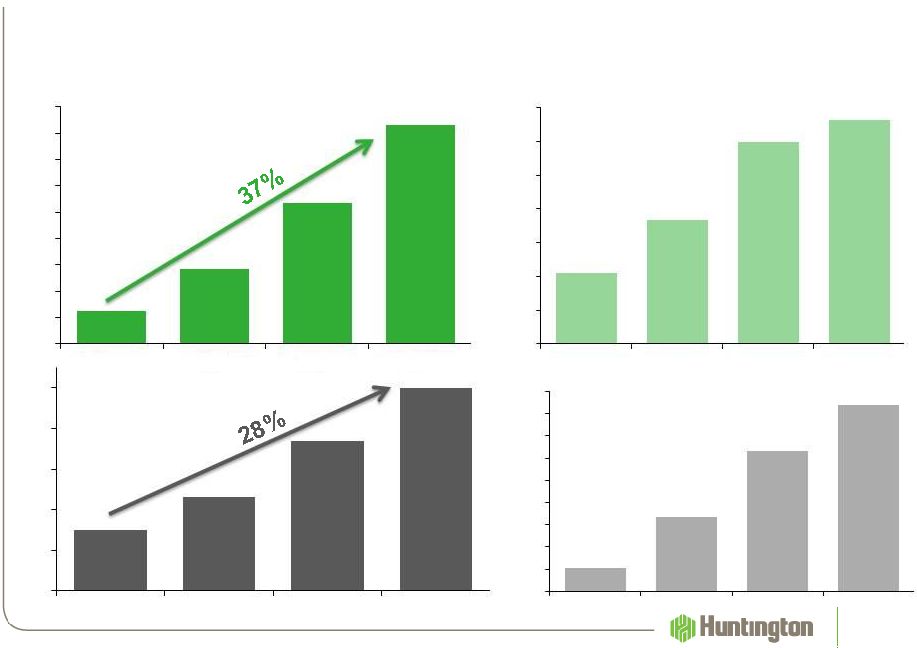

Consumer Checking Households (000s)

7

Commercial Relationships (000s)

4+ Services / Consumer Household

4+ Services / Commercial Relationship

Outcome…

Growing “Stickier”

Customers

With Increased Share of Wallet

•

Average expected length of consumer relationship is up over 10%

962

1,315

900

950

1,000

1,050

1,100

1,150

1,200

1,250

1,300

1,350

2Q10

2Q11

2Q12

3Q13

68%

71%

76%

77%

64%

66%

68%

70%

72%

74%

76%

78%

2Q10

2Q11

2Q12

3Q13

1,167

1,042

125

160

110

120

130

140

150

160

2Q10

2Q11

2Q12

3Q13

133

147

22%

27%

33%

37%

20%

22%

24%

26%

28%

30%

32%

34%

36%

38%

2Q10

2Q11

2Q12

3Q13 |

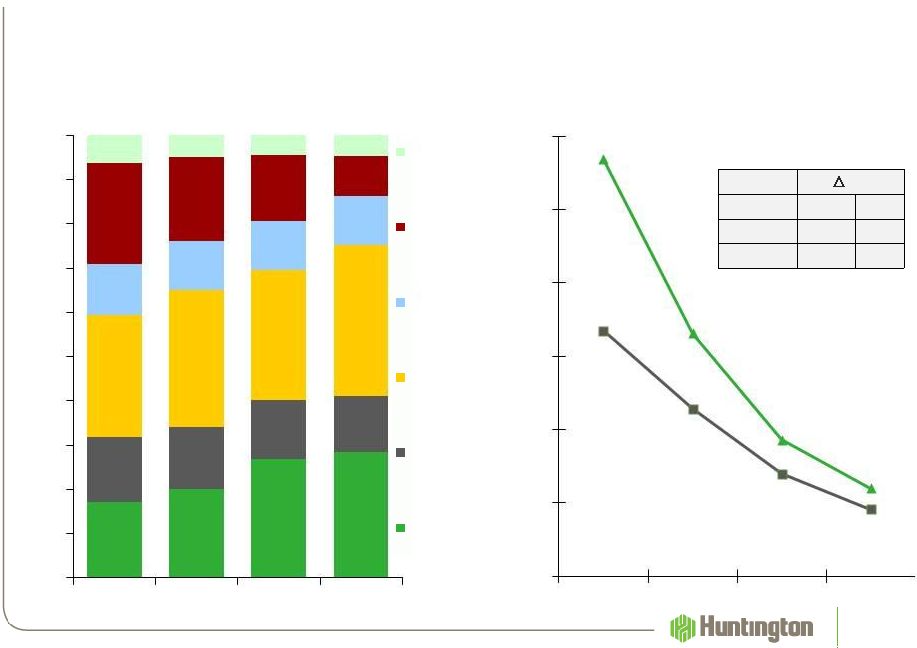

Avg.

Total Deposits – Mix

8

Source: SNL

Peers include ASBC, BBT, CMA, FHN, FITB, FNFG, KEY, MTB, PNC, RF, STI, &

ZION. bp

3Q13 vs.

HBAN

Peer

2Q10

-90

-49

2Q12

-13

-10

Avg. Total Deposits –

Rate

Outcome…

Better Deposit Mix at Lower Costs

•

Targeted mix of noninterest bearing of low to mid 30%’s

•

Deposit cost, in a higher interest rate environment, should be below peers

17%

20%

27%

28%

15%

14%

13%

13%

28%

31%

29%

34%

12%

11%

11%

11%

23%

19%

15%

9%

6%

5%

5%

5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2Q10

2Q11

2Q12

3Q13

Noncore

Core

CDs

Savings

/ Other

MMA

DDA

Int.

Bearing

DDA

Nonint.

Bearing

-

-

1.14

0.66

0.37

0.24

0.67

0.46

0.28

0.18

0.00

0.20

0.40

0.60

0.80

1.00

1.20

2Q10

2Q11

2Q12

3Q13 |

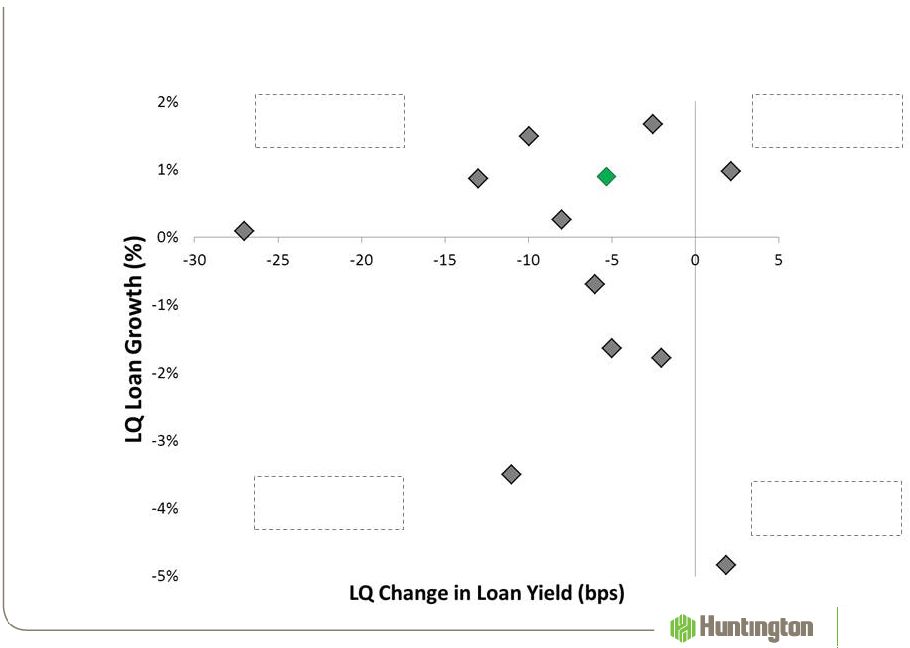

Outcome…

Disciplined Loan Growth With More

Stable Asset Yields

9

Loan Growth &

Increasing Yield

Loan Growth &

Declining Yield

Loans Decline &

Declining Yield

Loans Decline &

Increasing Yield

HBAN

Source: SNL Financial

Peers include ASBC, BBT, CMA, FHN, FITB, FNFG, KEY, MTB, PNC, RF, STI, &

ZION |

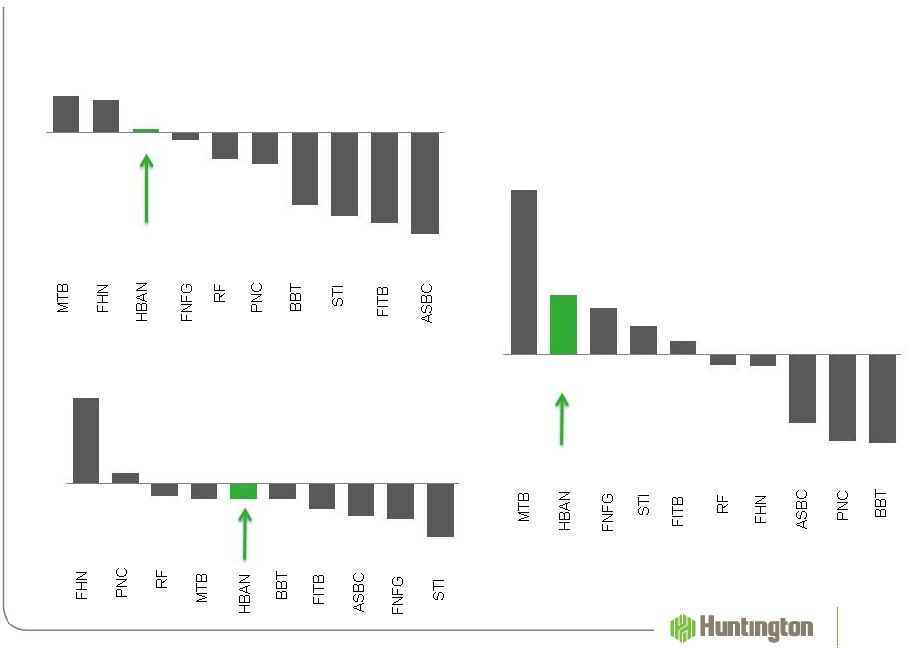

LQ

% Change Noninterest Income 10

Outcome…

Relationship Growth and Product Penetration

are Offsetting Fee Income Headwinds

Source: SNL Financial, see GAAP to Non-GAAP Reconciliation slide

LQ % Change Mortgage Banking Income

LQ % Change Noninterest Income

Excluding Mortgage

6

5

1

-1

-4

-5

-12

-13

-14

-16

-20

-15

-10

-5

0

5

10

159

19

-25

-29

-30

-30

-48

-61

-67

-99

-150

-100

-50

0

50

100

150

200

15

5

4

2

1

-1

-1

-6

-8

-8

-10

-5

0

5

10

15 |

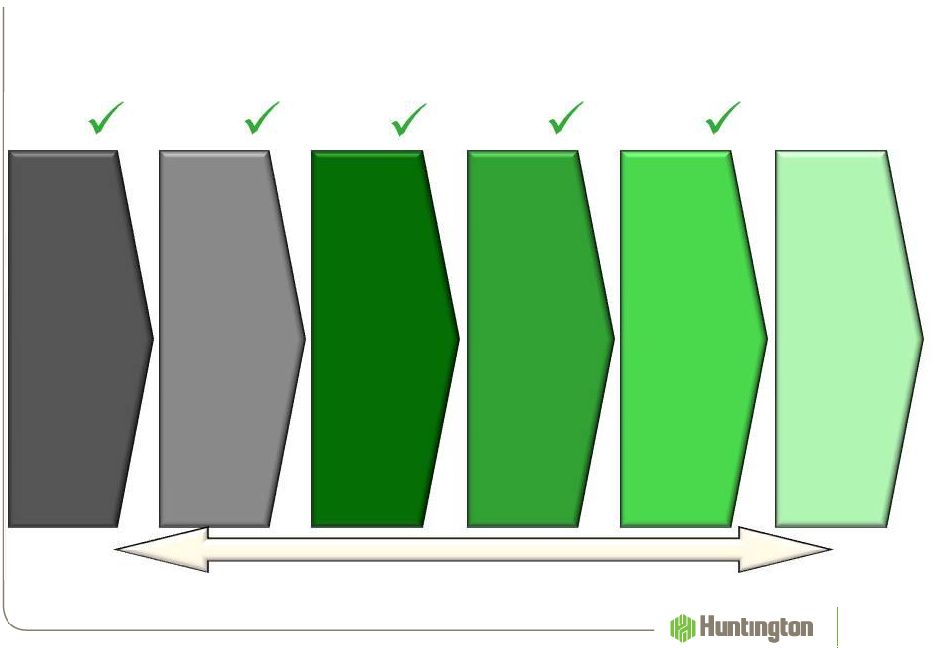

Optimize

Current

Franchise

•

Profitability /

pricing

•

Cross-sell /

share-of-

wallet

•

Launch new

brand

•

Invest in

capabilities

and begin

hiring

11

Lay

the

Foundation

•

Capital and

liquidity

•

Organizational

changes

•

Build

management

depth

•

Credit and

Risk

management

Invest

in the

Core

•

Build out

sales

forces,

channels,

and

products

•

Continued

brand roll-

out

•

Enhance

investment

discipline

Selective M&A –

as opportunities arise

2009

Focus

Future

•

Build out

sales forces,

channels,

and

products

•

Expand

winning

“plays”

•

Drive

efficiency &

continuous

improvement

Extend and

Expand

•

Monetize

investments

•

Drive growth

•

Drive

positive

operating

leverage &

continuous

improvement

2010

2011

2012

2013

Execution of Long Term Strategic Plan

Driving Differentiated Results

Disciplined

Execution

•

Capital

Management

•

Operating

Leverage /

Continuous

Improvement

•

Delivering

Returns On

Existing

Investments

2014

2009: Warren Bank $0.5B in Deposits, FDIC

2012: Fidelity Bank $0.7B in Deposit & $0.8B in Assets, FDIC

2013 Announced: Camco Financial $0.6B in Deposit & $0.8B in Assets

|

Continued Execution is Driving Results

12

2014

•

Disciplined Capital Management

•

Grow the core business

•

Support the dividend

•

All other -

Repurchase, M&A, TruPS, …

•

Operating Leverage / Continuous Improvement

•

Deliver full-year positive operating leverage

•

Continue to invest -

At a slower pace but have increased

depreciation of recent investments

•

CI -

customer-centric, process-focused, data-driven decision

making to grow revenue, reduce expenses, cost/loss avoidance,

and improve customer and employee experience.

•

Delivering Returns On Existing Investments

•

Continue to deliver household & commercial relationship growth

•

In-store branches expected to have $15MM-$18MM pretax

improvement

•

Commercial verticals expected to add $0.5B to $1B of loans

•

Treasury Management & Capital Markets continue to mature

•

Credit card ramping…

few million loss in 2013 to a slight benefit

in 2014

Disciplined

Execution

•

Capital

Management

•

Operating

Leverage /

Continuous

Improvement

•

Delivering

Returns On

Existing

Investments |

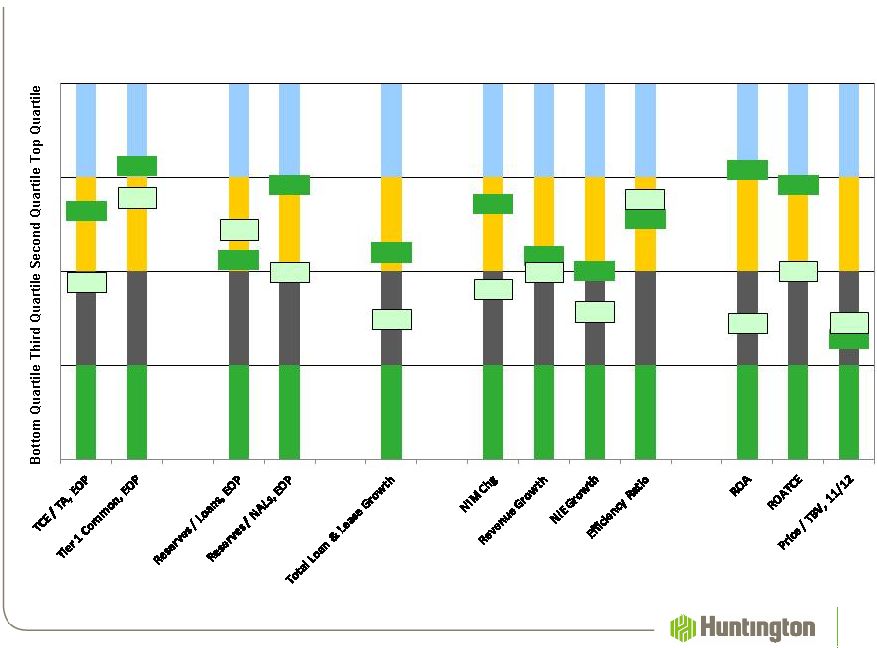

Comparison of Selected Performance Metrics Among Top 100 Bank Holding Companies

(1)

13

Strategy & Execution Differentiate Results

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

HBAN

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Peers

Best

Worst

(1) 100 largest BHCs, ranked by assets; data reflects 3Q13. Source: SNL Financial, as of

11/12/13 Peer

average includes ASBC, BBT, CMA, FHN, FITB, FNFG, KEY, MTB, PNC, RF, STI, and ZION. |

Challenge /

Opportunity

HBAN

Economy

Customer uncertainty from

uneven U.S. economic

recovery

Midwestern strength (e.g., manufacturing and housing recovery) and soundness

of HBAN strategy will drive growth.

Disciplined

Loan

Growth

Economic uncertainty

remains a hurdle to solid

loan growth and

competitiveness of the

market is intense

•

C&I growth to increase due to customer activity and maturing of recently

launched specialty lending verticals.

•

Indirect Automobile: On balance sheet exposure is expected to increase.

•

Residential Mortgages, Home Equity , and CRE are expected to grow modestly.

Interest

Rates

Prolonged low interest rate

environment & recent long-

end volatility

•

Net interest income expected to modestly grow.

•

Full Year NIM is not expected to fall below the mid 3.30%’s and will

experience continued downward pressure due to competitive loan pricing and

growth in investment securities ($1B to $1.5B).

Noninterest

Income

Anticipated continued

reduction in mortgage

banking activity

Relatively stable as the continued benefits from growth in new customers,

increased contribution from higher cross-sell, and the continued maturation of

strategic investments should offset lower mortgage banking income.

Noninterest

Expense

Modest continued

investment and continued

cost saving opportunities

•

Expenses, excluding the significant items, are expected to modestly increase

due to higher depreciation, personnel, occupancy, and equipment expense

related to our continued modest pace of investments.

•

$6 million of branch consolidation expense is expected in 4Q13.

•

We remain committed to posting positive operating leverage in 2013.

Credit

Quality

Continued improvement in

NPAs / credit costs at low

end of normalized range

•

NPAs: expected to continue to improve.

•

NCOs: continued performance in our long-term expected range of 35 to 55

bps. •

LLP: below long-term expectation in 3Q13; expect moderate quarterly

volatility. Expectations…

Next Several Quarters

14 |

Important Messages

•

Driving revenue with a continued focus on expense and rate

of investment

+ Multi-year process of executing our long-term strategic plan

+

Prior investments are not mature …. should continue to drive growth

+ Moderating level of investment given economic uncertainty

+

Continuous improvement focused on generating efficiencies

•

Managing to a lower risk profile and consistent performance

•

High level of employee and shareholder alignment

•

Expectations of positive operating leverage in 2014

15 |

Use

of non-GAAP financial measures This document may contain GAAP financial

measures and non-GAAP financial measures where management believes it to

be helpful in understanding Huntington’s results of operations or financial position. Where non-GAAP financial

measures are used, the comparable GAAP financial measure, as well as the

reconciliation to the comparable GAAP financial measure, can be found in

this document, the 2013 third quarter earnings press release, or the Form

8-K related to this document, all of which can be found on

Huntington’s website at www.huntington-ir.com. Annualized data

Certain returns, yields, performance ratios, or quarterly growth

rates are presented on an “annualized”

basis. This is

done for analytical and decision-making purposes to better discern underlying

performance trends when compared to full year or year-over-year

amounts. For example, loan and deposit growth rates, as well as net charge-off percentages,

are most often expressed in terms of an annual rate like 8%. As

such, a 2% growth rate for a quarter would represent

an annualized 8% growth rate.

Fully-taxable equivalent interest income and net interest margin

Income from tax-exempt earning assets is increased by an amount equivalent to

the taxes that would have been paid if this income had been taxable at

statutory rates. This adjustment puts all earning assets, most notably tax-exempt

municipal securities and certain lease assets, on a common basis

that facilitates comparison of results to results of

competitors.

Earnings per share equivalent data

Significant income or expense items may be expressed on a per common share basis.

This is done for analytical and decision-making purposes to better

discern underlying trends in total corporate earnings per share performance

excluding the impact of such items. Investors may also find this information

helpful in their evaluation of the company’s financial performance

against published earnings per share mean estimate amounts, which typically exclude the impact

of Significant Items. Earnings per share equivalents are usually calculated

by applying a 35% effective tax rate to a pre- tax amount to derive an

after-tax amount, which is divided by the average shares outstanding during the respective

reporting period. Occasionally, when the item involves special tax treatment,

the after-tax amount is disclosed separately, with this then being the

amount used to calculate the earnings per share equivalent. Rounding

Please note that columns of data in the presentation may not add

due to rounding.

Basis of Presentation

16

Do we

consolidate

this and

next slide? |

Significant Items

From time to time, revenue, expenses, or taxes are impacted by items judged by

Management to be outside of ordinary banking activities and/or by items that,

while they may be associated with ordinary banking activities, are so unusually

large that their outsized impact is believed by Management at that time to be

infrequent or short term in nature. We refer to such items as

"Significant Items". Most often, these Significant Items result from factors originating outside the

company –

e.g., regulatory actions/assessments, windfall gains, changes in accounting

principles, one-time tax assessments/refunds, litigation actions,

etc. In other cases they may result from Management decisions associated

with significant corporate actions out of the ordinary course of

business –

e.g., merger/restructuring charges,

recapitalization actions, goodwill impairment, etc.

Even though certain revenue and expense items are naturally subject to more

volatility than others due to changes in market and economic environment

conditions, as a general rule volatility alone does not define a Significant Item. For

example, changes in the provision for credit losses, gains/losses from investment

activities, asset valuation write downs, etc., reflect ordinary banking

activities and are, therefore, typically excluded from consideration as a Significant Item.

Management believes the disclosure of “Significant Items”, when

appropriate, aids analysts/investors in better understanding corporate

performance and trends so that they can ascertain which of such items, if any, they may wish

to include/exclude from their analysis of the company’s performance

- i.e., within the context of determining how that

performance differed from their expectations, as well as how, if

at all, to adjust their estimates of future performance

accordingly. To this end, Management has adopted a practice of listing

“Significant Items” in its external disclosure

documents (e.g., earnings press releases, quarterly performance discussions,

investor presentations, Forms 10-Q and 10 K).

"Significant Items" for any particular period are not intended to be a

complete list of items that may materially impact current or future period

performance. A number of items could materially impact these periods, including those

described in Huntington’s 2012 Annual Report on Form 10-K and other

factors described from time to time in Huntington’s other filings with

the Securities and Exchange Commission. Basis of Presentation

17 |

GAAP to

Non-GAAP Reconciliation 18

($000)

Total Noninterest

Income

Mortgage Banking

Income

Noninterest Income

Excluding Mortgage

3Q 2013

2Q 2013

Change

3Q 2013

2Q 2013

Change

3Q 2013

2Q 2013

Change

HBAN

250,405

249,065

1%

33,659

23,621

-30%

215,406

226,784

5%

ASBC

70,668

84,276

-16%

15,399

6,015

-61%

68,877

64,653

-6%

BBT

905,000

1,023,000

-12%

168,000

117,000

-30%

855,000

788,000

-8%

FHN

150,456

142,983

5%

5,589

14,460

159%

137,394

135,996

-1%

FITB

630,000

736,000

-14%

233,000

121,000

-48%

503,000

509,000

1%

FNFG

91,422

92,516

-1%

6,882

2,268

-67%

85,634

89,154

4%

MTB

481,269

454,685

6%

91,262

64,731

-29%

363,423

416,538

15%

PNC

1,582,000

1,666,000

-5%

167,000

199,000

19%

1,499,000

1,383,000

-8%

RF

468,000

489,000

-4%

69,000

52,000

-25%

420,000

416,000

-1%

STI

743,000

858,000

-13%

134,000

1,000

-99%

724,000

742,000

2%

Source: SNL Financial |

19 |