Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Lakes Dredge & Dock CORP | d626432d8k.htm |

INVESTOR

PRESENTATION

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

2013 | Q4

INFO@GLDD.COM | GLDD.COM

Exhibit 99.1 |

SAFE

HARBOR GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

This

presentation

includes

“forward-looking”

statements

within

the

meaning

of

Section

27A

of

the

Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, the

Private Securities Litigation Reform Act of 1995 or in releases made by the

SEC, all as may be amended from time to time. Such statements include

declarations regarding the intent, belief, or current expectation of the Company

and its management. The Company cautions that any such forward-looking

statements are not guarantees

of

future

performance,

and

involve

a

number

of

risks,

assumptions

and

uncertainties

that

could cause actual results of the Company and its subsidiaries, or industry

results, to differ materially from those expressed or implied by any

forward-looking statements contained herein, including, but not limited

to, as a result of the factors, risks and uncertainties described in other securities filings of the

Company made with the SEC, such as the Company’s most recent Report on Form

10-K. You should not place undue reliance upon these

forward-looking statements. Forward-looking statements provided

herein are made only as of the date hereof or as a specified date herein and the

Company does not have or undertake any obligation to update or revise them,

unless required by law. 2 |

PRESENTERS

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

Chief Executive Officer,

Director

> JONATHAN BERGER

Treasurer, Director of

Investor Relations

> WILLIAM STECKEL

Senior Vice President,

Chief Financial Officer

> KATIE HAYES

>

Board member since December 2006

>

Former Managing Director and

Co-head of Corporate Finance

for Navigant Consulting, Inc.

>

Former partner at KPMG, LLP and

past National Partner in charge of

Corporate Finance at KPMG

>

Previously served as CEO,

president, CFO and treasurer at

Daystar Technologies, Inc.

>

Served as senior vice president,

CFO and treasurer at Norwood

Promotional Products

>

Held management positions

with Invensys in its Lambda

Power, Seibe Climate Controls

and CTS Corporation Divisions

>

Named Treasurer in March 2011

>

Served as Director of Investor

Relations since the Company

went public in 2006

>

Joined the Company in 2006 and

has over 20 years of accounting

and finance experience

>

Previously worked at

TransUnion as Director of

Corporate Accounting.

3 |

01

ABOUT US

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

4 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

> WHO IS GREAT LAKES

DREDGE & DOCK CORPORATION?

>

Domestic Dredging

>

International Dredging

>

Environmental Services

>

Demolition

ABOUT US

01

Infrastructure & Environmental

5 |

ABOUT US

01

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

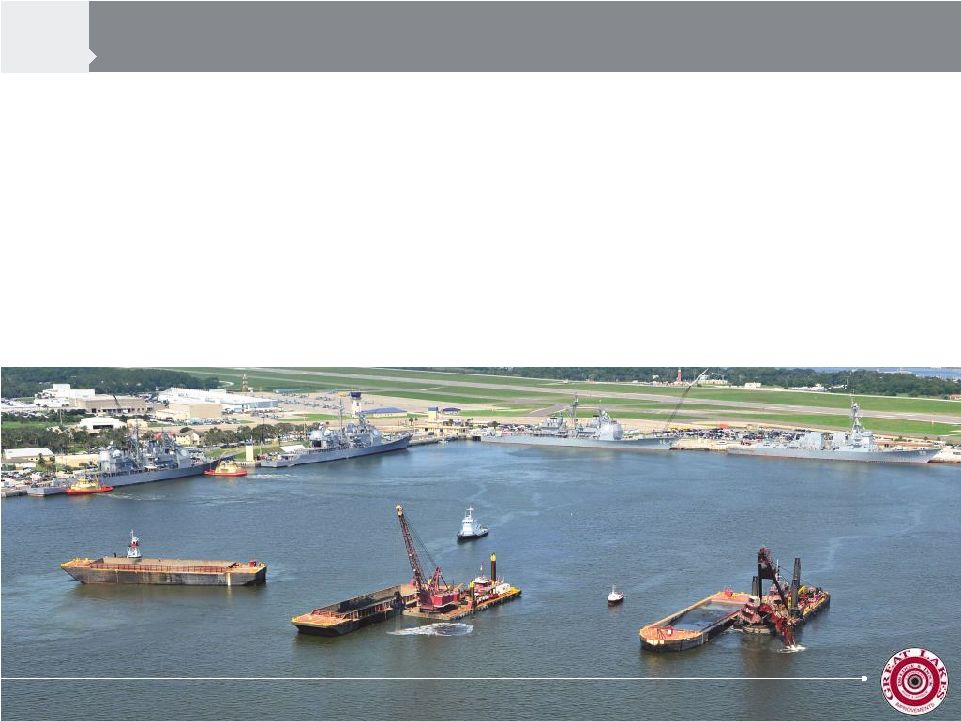

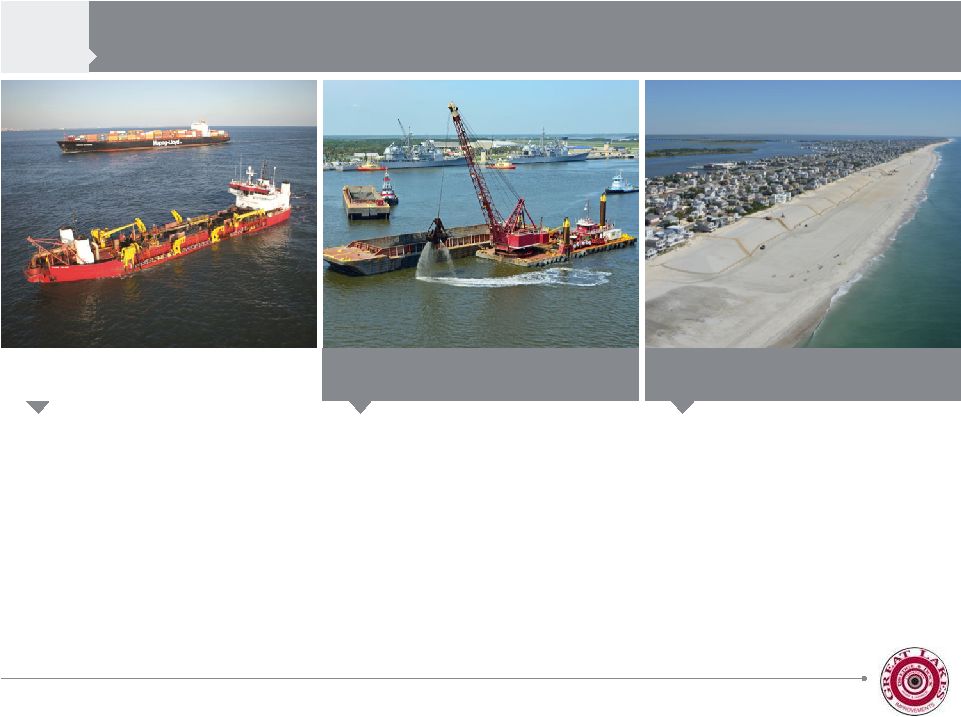

> DREDGING & THE ECONOMY

“The health of the U.S. economy depends, in part, upon the vitality and

expansion of international trade. International trade depends upon the

Nation’s navigation infrastructure, which serves as a conduit for

transportation,

trade,

and

tourism

and

connects

us

to

the

global

community.

Marine transportation is one of the most efficient, effective, safe and

environmentally sound ways to transport people and goods. It is a keystone

of the U.S. economy. Ninety-five percent of our international trade moves

through the Nation’s ports.”

>> Honorable Jo-Ellen Darcy, Assistant Secretary of the Army (Civil

Works) << 6 |

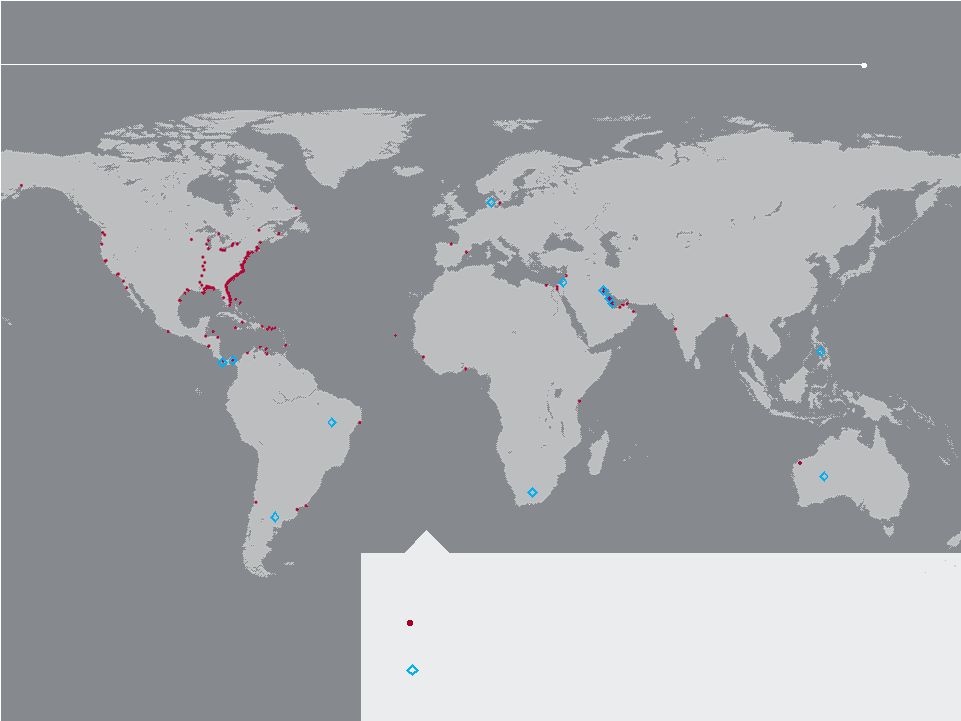

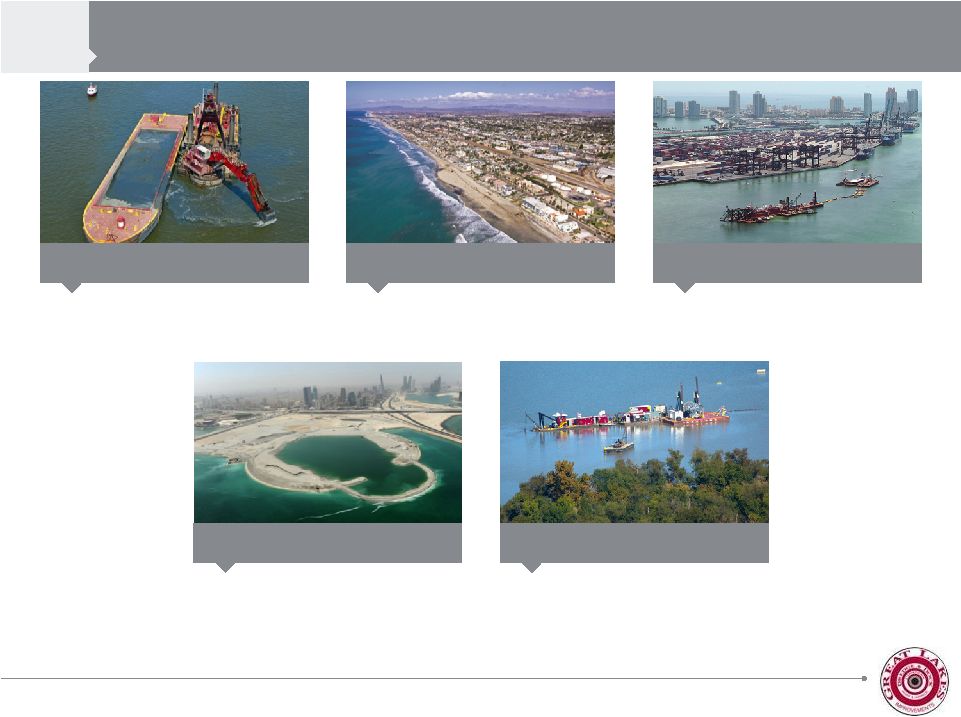

> DREDGING WORLDWIDE

WHERE WE HAVE WORKED

COUNTRIES WHERE WE SEE OPPORTUNITIES

GLOBAL REACH

7 |

02

FUTURE GROWTH

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

8 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

FUTURE GROWTH

02

GROW

PURSUE

EXPAND

CAPITALIZE

ENHANCE

BUILD

Build upon Great

Lakes’

preeminent

position in the

U.S. dredging

market

Enhance the

Company’s

operating

capabilities via

prudent and

cost-effective

investments and

asset

management

Capitalize on

adjacent

market

opportunities in

the

Company’s

domestic

markets

Expand the

Company’s

presence in

foreign

markets

Pursue

growth

opportunities

in

the

environmental

remediation

market

Looking

at

acquisitions

that

fit

in

well

with

our

strategy

> WHERE ARE WE GOING

Great Lakes intends to grow the business by continuing to execute the following

strategies: Announced

construction

of

Hopper

Dredge

-

strategic

investment

by the Company in providing the most productive, efficient and

capable dredging equipment in the domestic industry

The 12/31/12 Terra Contracting acquisition fits

the Company’s strategic vision to gain a stronger

foothold in the environmental remediation market. |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

FUTURE GROWTH

02

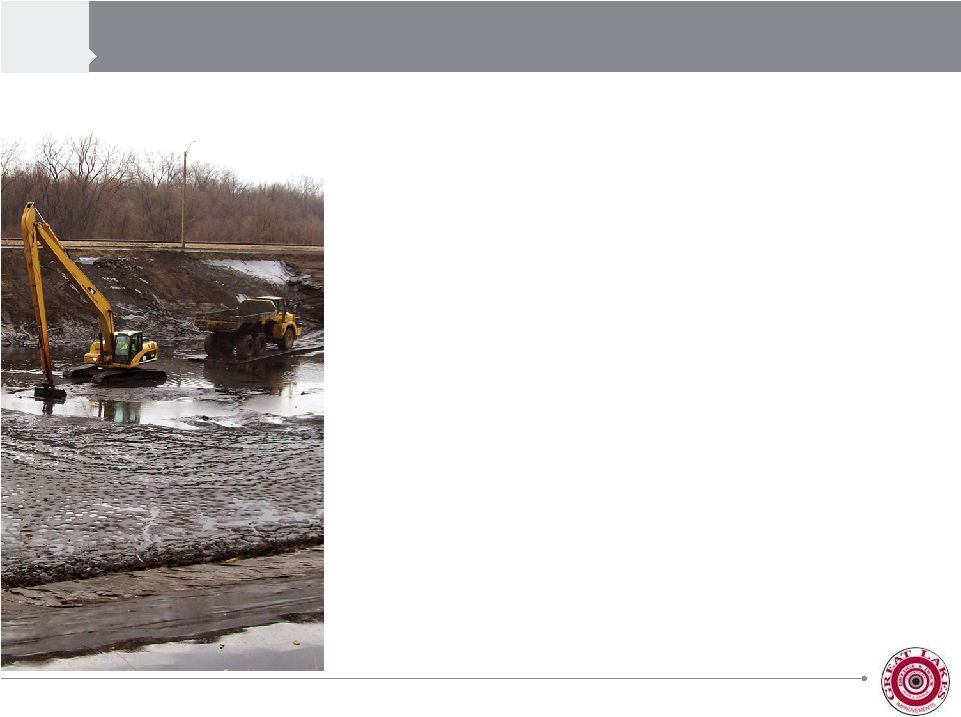

> ACQUISITION OF TERRA CONTRACTING, LLC

>

On December 31, 2012, Great Lakes acquired the assets of Terra

Contracting, LLC (Terra).

>

Terra is a respected provider of a wide variety of essential services for

environmental, maintenance and infrastructure-related applications.

>

Headquartered in Kalamazoo, MI, Terra employs approximately 200

engineering, operations and administrative staff and serves customers in

more than thirty states in the environmental, infrastructure, energy,

industrial, transportation, waste water and construction sectors.

>

Terra will broaden our demolition segment with additional services and

expertise as well as expand our footprint in the Midwest. Terra reinforces

our efforts to develop relationships with larger industrial and governmental

clients. Additionally, our rivers & lakes operations can leverage

Terra's environmental remediation focus to accelerate its participation in

the environmental dredging market.

>

The purchase price was approximately $26 million.

>

The Company has announced that it is assessing strategic alternatives with

respect to its historical demolition business –

which would not include Terra

Contracting.

10 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

FUTURE GROWTH

02

> INFRASTRUCTURE & ENVIRONMENTAL

INLAND

DREDGING

PORT

DEEPENING

PORT

MAINTENANCE

COASTAL

RESTORATION

COASTAL

PROTECTION

LAND

RECLAMATION

DEMOLITION

CONTRACTORS*

SITE

DEVELOPMENT

BRIDGE

DEMOLITION*

HAZARDOUS

MATERIAL

REMOVAL

SERVICES

SEDIMENT

& SOIL

REMEDIATION

LEVEE

CONSTRUCTION

ENVIRONMENTAL

& REMEDIATION

SERVICES

11

* The Company has announced that it is assessing strategic alternatives with

respect to its historical demolition business. |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

FUTURE GROWTH

02

> INFRASTRUCTURE & ENVIRONMENTAL

INLAND

DREDGING

PORT

DEEPENING

PORT

MAINTENANCE

COASTAL

RESTORATION

COASTAL

PROTECTION

LAND

RECLAMATION

DEMOLITION

CONTRACTORS*

SITE

DEVELOPMENT

BRIDGE

DEMOLITION*

HAZARDOUS

MATERIAL

REMOVAL

SERVICES

SEDIMENT

& SOIL

REMEDIATION

LEVEE

CONSTRUCTION

ENVIRONMENTAL

& REMEDIATION

SERVICES

12

* The Company has announced that it is assessing strategic alternatives with

respect to its historical demolition business. |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

FUTURE GROWTH

02

>

U.S. port deepening, post

Panama Canal deepening

>

Gulf Coast Restoration

>

Other sources of dredging

demand include port development

and levee repair/replacement

>

RESTORE Act requires 80% of

penalties to be deposited into a

coastal protection works fund

which includes dredging

>

Calls for appropriations of HMTF

monies so that total budget

resources on harbor maintenance

will be equal to the level of receipts

>

Senate and House passed their

versions of WRDA with favorable

HMTF reform language. Could be

reconciled and passed before

year-end

>

Provides a very high level of attention

and funding for coastal protection

work

>

Provides a surge in work load for the

balance of the year and perhaps into

next year. It is anticipated that the

attention will result in increased

sustainable funding in future years.

>

Provides $800 million for

maintenance dredging in addition to

Corps’

annual budget

ATTRACTIVE NEAR & LONG-TERM

CATALYSTS IN U.S. DREDGING MARKET

MAP-21 TRANSPORTATION BILL

SANDY SUPPLEMENTAL

APPROPRIATIONS BILL

13 |

DELAWARE 40’

NEW YORK 50’

BOSTON 40’

CHARLESTON 45’

SAVANNAH 42’

JACKSONVILLE 40’

PORT EVERGLADES 42’

MIAMI 42’

MOBILE 45’

NEW ORLEANS 45’

HOUSTON 45’

SAN DIEGO 35’

PORTS WITH DEEPENING EXPEDITED

BY OBAMA ADMINISTRATION

PORTS WITH PLANS FOR EXPANSION

> PORTS WITH PLANS FOR EXPANSION

International trade, particularly in the intermodal container shipping business,

is undergoing significant change as a result of the Panama Canal expansion.

Many shipping lines have announced plans to deploy larger ships which, due

to channel dimension requirements, currently cannot use many U.S. East and

Gulf Coast ports. PORTS

14 |

03

DREDGING

OVERVIEW

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

15 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

DREDGING OVERVIEW

03

CAPITAL

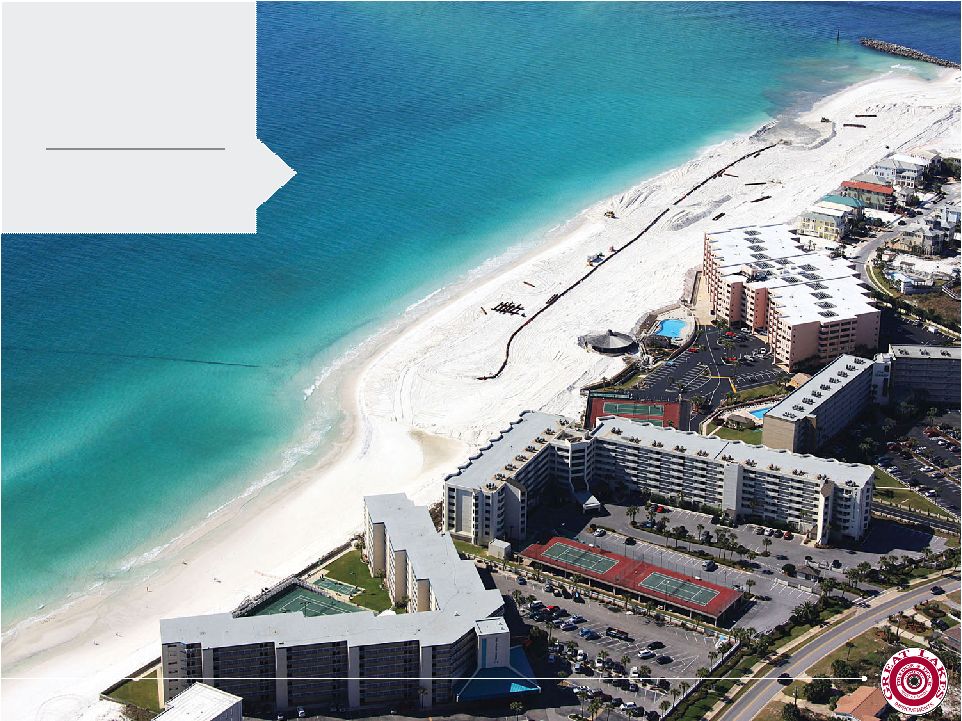

COASTAL PROTECTION

MAINTENANCE

INTERNATIONAL

RIVERS & LAKES

Deepening ports, land reclamation, and

excavation of underwater trenches

Bid Market Share* 29%

Creating and rebuilding beaches

Bid Market Share* 60%

Maintaining depth of shipping channels

Bid Market Share* 31%

International land reclamations, channel

deepening and port infrastructure development

3-year Average Revenue $91M

Inland maintenance and lake dredging,

Environmental and habitat restoration

Bid Market Share* 43%

*The Company’s bid market is defined as the aggregate dollar value of domestic

projects on which the Company bid or could have bid if not for capacity

constraints. Bid market share represents bid market average over the prior three years.

16 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

DREDGING OVERVIEW

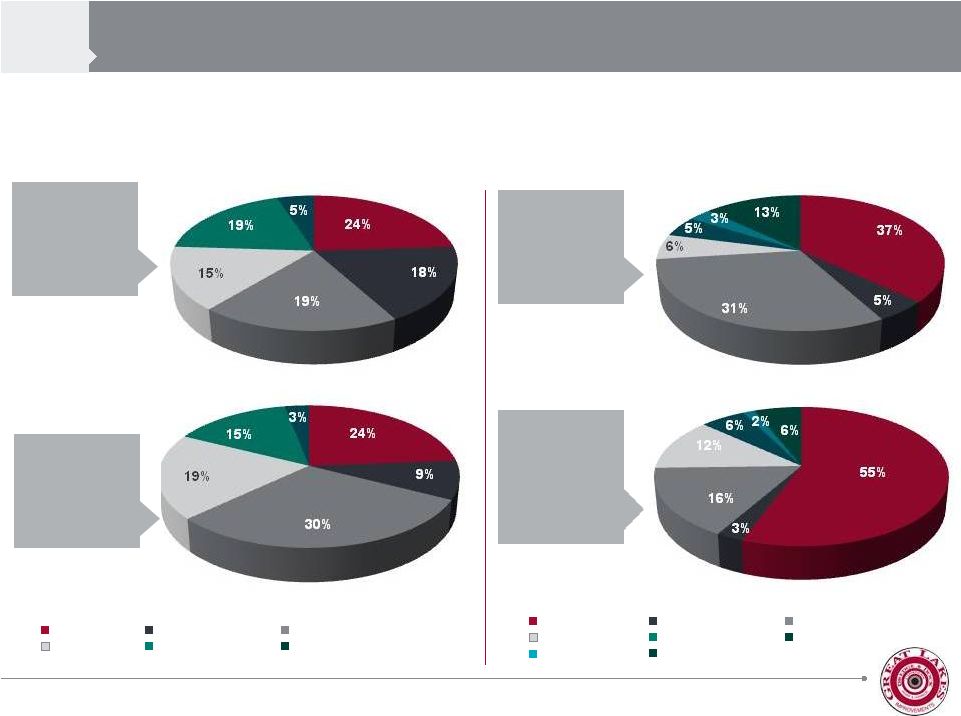

03

> LARGEST PROVIDER OF DREDGING

YTD Q3 2013

REVENUE

BY WORK TYPE

$541 MILLION

2012 REVENUE

BY WORK TYPE

$688 MILLION

2012 DOMESTIC

DREDGING BID

MARKET SHARE

DOM. BID MARKET:

$939 MILLION

YTD Q3 2013

DOMESTIC

DREDGING BID

MARKET SHARE

DOM. BID MARKET:

$1,059 MILLION

GREAT LAKES

DON JON

NORFOLK

DUTRA

ORION

WEEKS

MANSON

OTHER

CAPITAL

DEMOLITION

MAINTENANCE

RIVERS & LAKES

COASTAL PROTECTION

FOREIGN

17 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

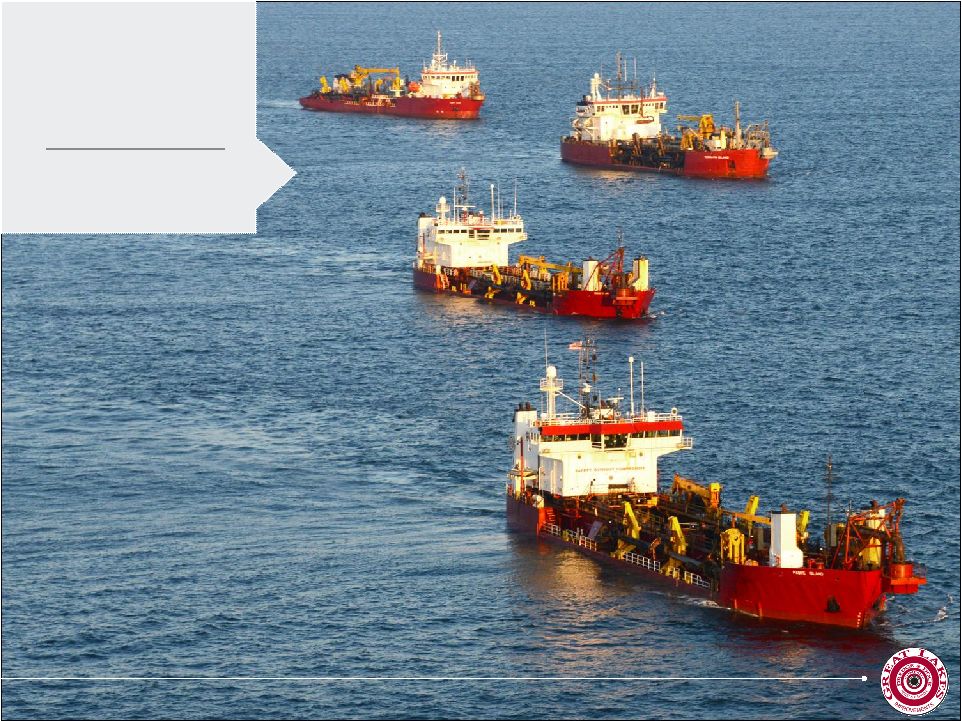

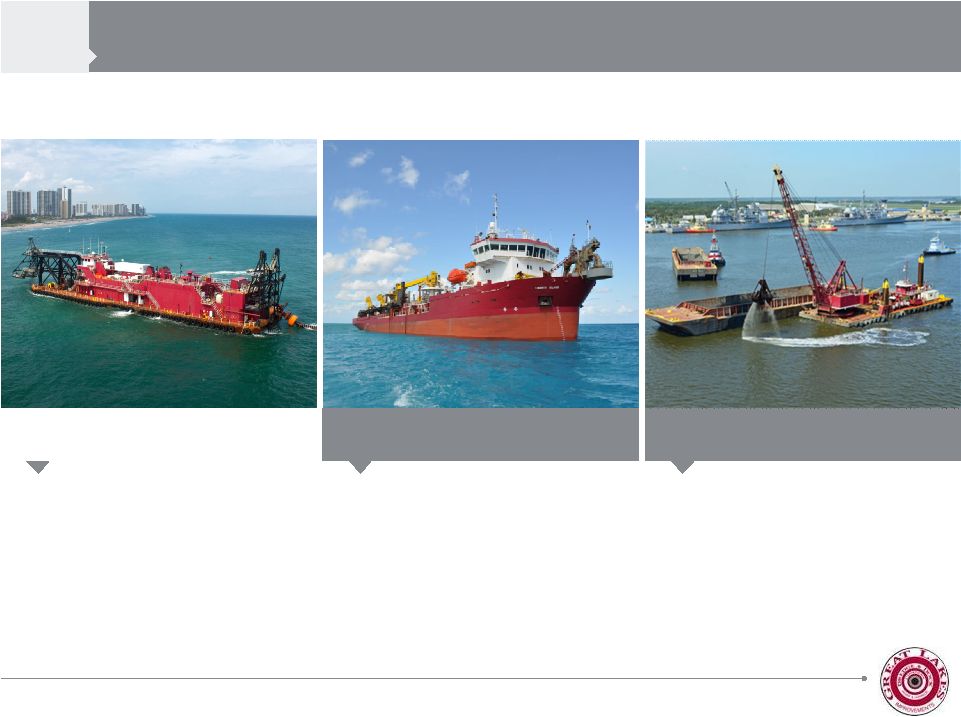

>

20 Vessels*: 16 U.S., 4 Middle

East (19 U.S.

flagged) >

Including the only two large electric

cutterhead dredges available in the

U.S. for environmentally sensitive

regions requiring lower emissions

>

7 Vessels: 4 U.S., 3 Middle

East,

(4 U.S. flagged)

>

Highly mobile, able to operate

in rough waters

>

Little interference with other

ship traffic

>

5 Vessels: 3 U.S., 2 International,

(All U.S. flagged)

>

Operates one of two environmentally

friendly electric clamshell dredges in

the U.S.

>

Maneuverability in tight areas such

as docks and terminals

HYDRAULIC

HOPPER

MECHANICAL

DREDGING OVERVIEW

03

*Note:

Nine

vessels

were

added

from

2010

rivers

&

lakes

acquisition

which

are

hydraulic

but

have

less

capacity,

ideal

for

rivers

and

environmental

dredging.

+ 19 Material Transportation Barges and Over 160 Other Specialized Support

Vessels > LARGE & FLEXIBLE FLEET, U.S. & INTERNATIONAL MARKETS

18 |

GREAT LAKES

DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

DREDGING OVERVIEW

03

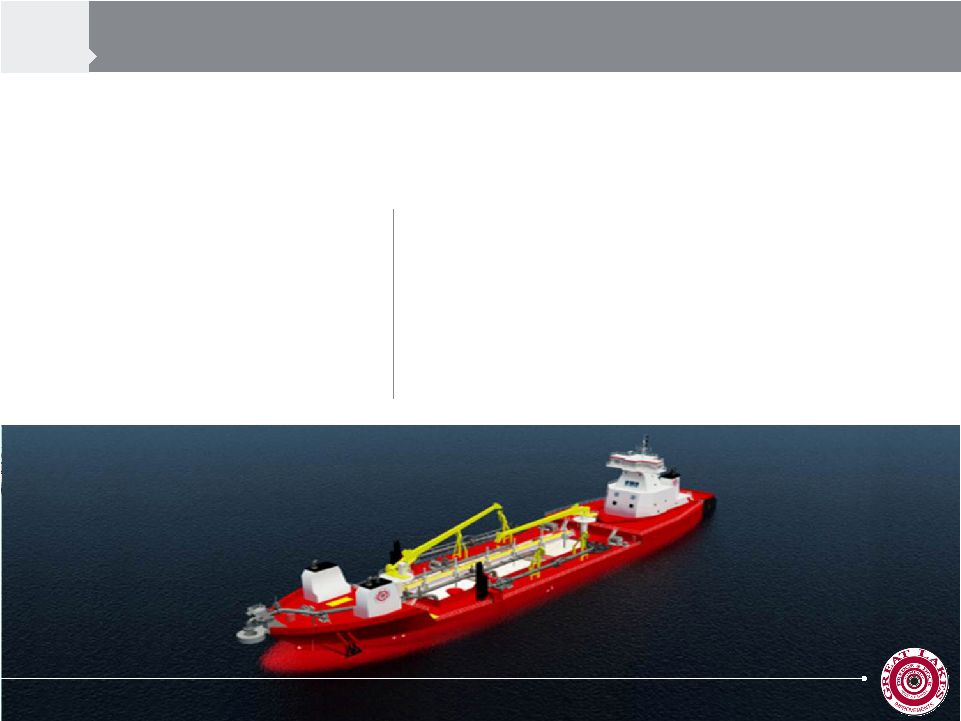

The dredge represents a strategic investment

by the Company in providing the most

productive, efficient and capable dredging

equipment in the domestic industry.

> ARTICULATED TUG HOPPER DREDGE

>

Build the low cost producer for U.S. Hopper Market

>

Improve operating margins

>

GLDD capacity grows and new technology positions us as the low

cost hopper dredging competitor, expanding market leadership role

>

Meet future market needs with HMTF & Gulf Coastal Restoration

>

Positions us for competitive advantage in new market opportunities

GREAT LAKES’

HOPPER DREDGE OBJECTIVES:

>

Currently in design phase with expected

completion in 2016

>

GLDD is in discussions with other shipyards

to proceed with construction of the vessel

NEW HOPPER DREDGE

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

19 |

GREAT LAKES

DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

DREDGING OVERVIEW

03

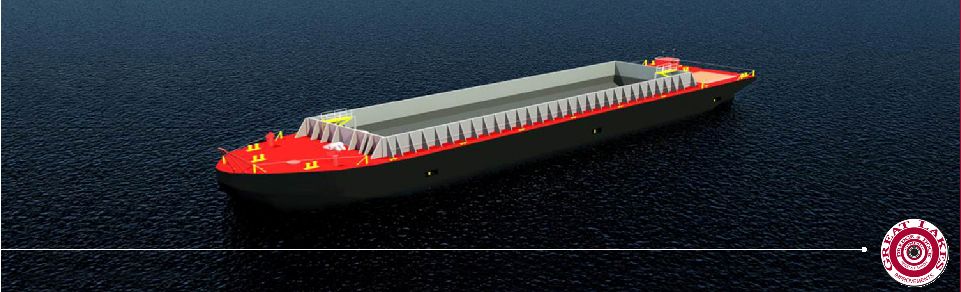

> TWO NEW MATERIAL SCOWS

>

The scows will be used primarily on capital deepening and coastal restoration

work on the East and Gulf coasts.

>

GLDD has become very successful loading scows with cutter suction dredges.

This has allowed us to match the dredging ability of the cutter suction dredges

on projects, giving us an effective transportation system and a cost

advantage over our competitors.

>

Construction of the dredge and scows created approximately 250 new U.S.

shipyard and engineering jobs over the construction period.

GREAT LAKES’

NEW MATERIAL SCOWS

>

Estimated cost: $17 million

($8.5 million each)

NEW SCOWS

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

20 |

04

INVESTMENT

HIGHLIGHTS

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

21 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

INVESTMENT HIGHLIGHTS

04

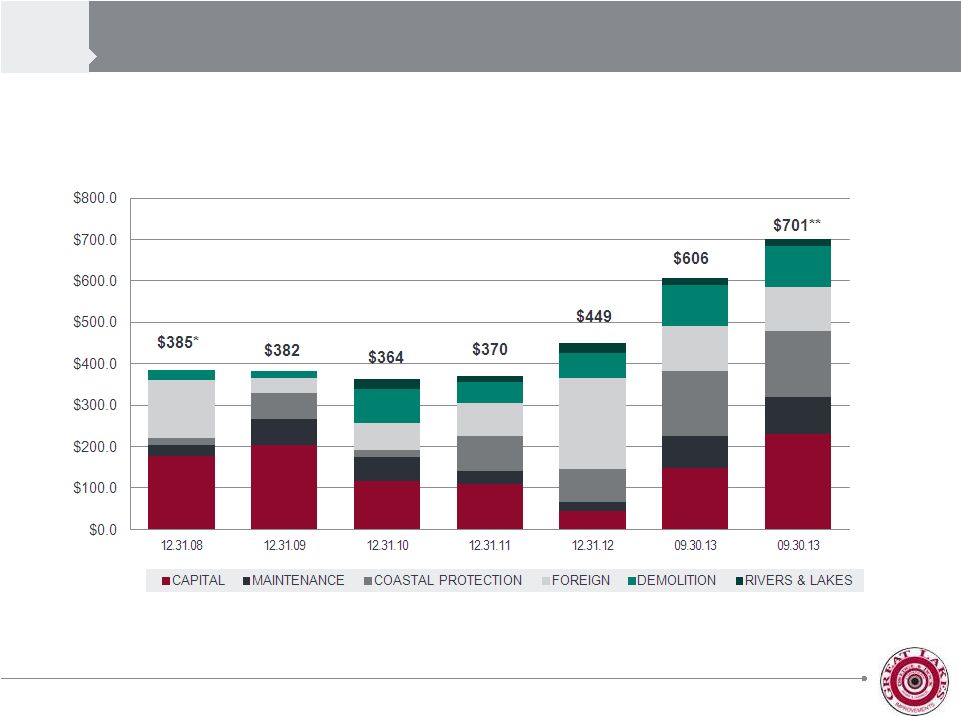

*Foreign backlog at December 31, 2008 has been adjusted for the portion of the

Diyar contract that became an option pending award in the first quarter of 2009

**Includes domestic dredging low bids and options pending award of $95

million > BACKLOG

BY WORK TYPE | $ IN MILLIONS

22 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

INVESTMENT HIGHLIGHTS

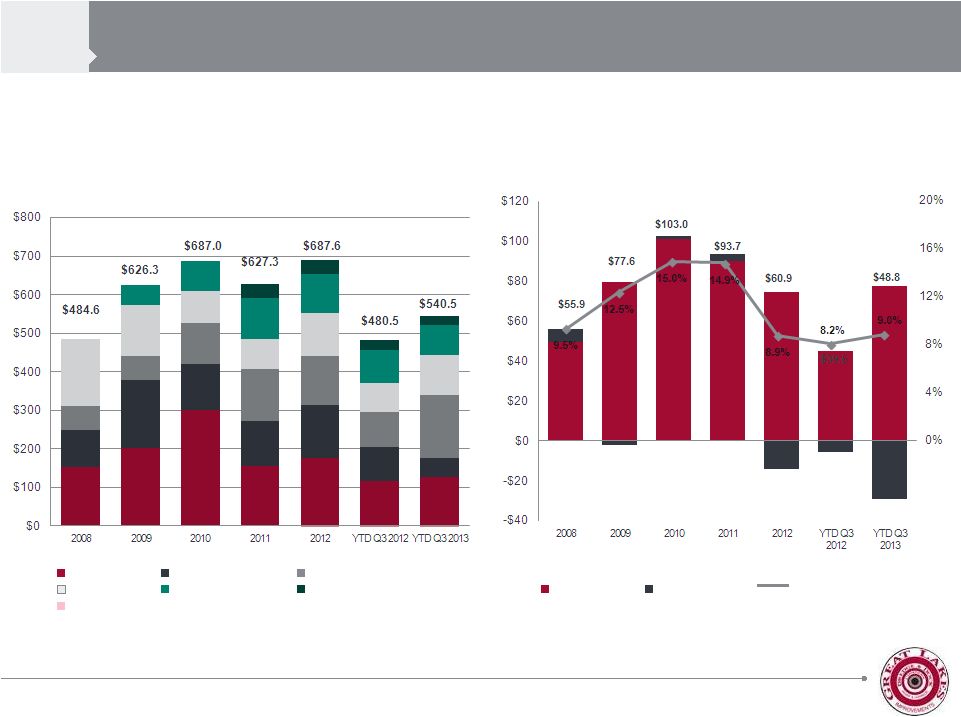

> ANNUAL REVENUE

> ANNUAL ADJUSTED EBITDA*

*Adjusted EBITDA represents net income (loss), adjusted for net interest expense,

income taxes, depreciation and amortization expense, accelerated

maintenance expense, goodwill impairment and debt restructuring expense. Please

see reconciliation of Net Income (Loss) to EBITDA at the end of this

presentation. Note: Great Lakes went public in December 2006

CAPITAL

DEMOLITION

MAINTENANCE

RIVERS & LAKES

INTERSEGMENT

COASTAL PROTECTION

FOREIGN

DREDGING

DEMOLITION

EBITDA MARGIN

04

23 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

INVESTMENT HIGHLIGHTS

04

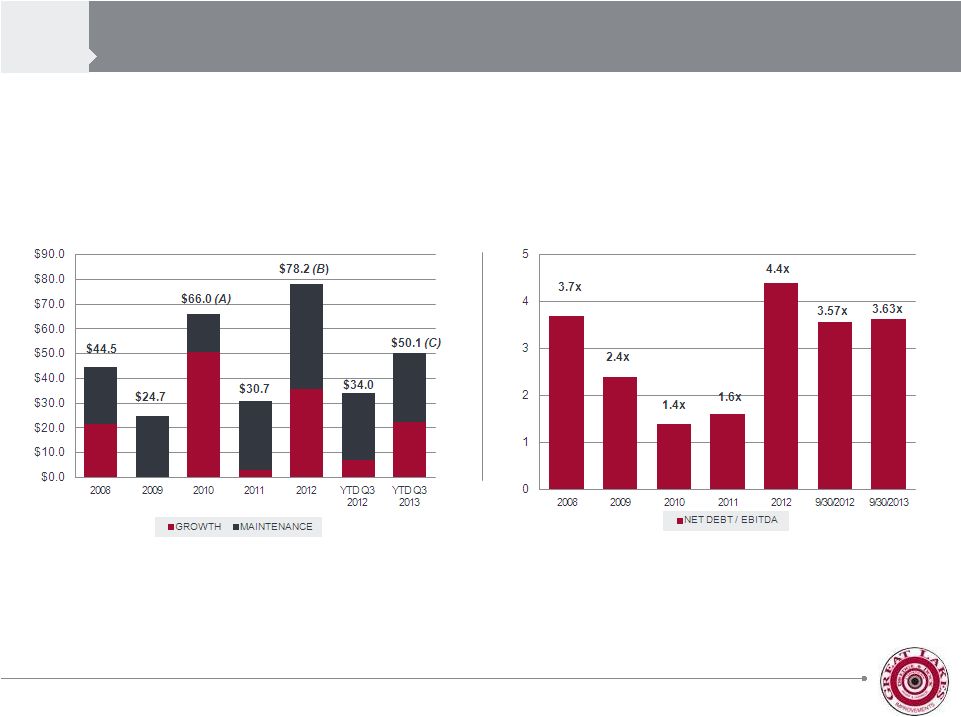

> CAPEX

$ IN MILLIONS

> LEVERAGE

(A)

Includes

$14.6

related

to

the

upgrade

of

the

dredge

Ohio

and

$36

related

to

Matteson

acquisition.

(B)

Includes$13.7 related to the Empire Pipeline, $3.6 related to the ATB Hopper

Dredge, $6.8 related to two new scows and $11.7 related to the Terra Contracting

acquisition.

(C)

Includes $14.7 related to the ATB Hopper Dredge and $7.6 related to two new

scows. 24 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

>

“Dredging Act”

and “Jones Act”

effectively serve as barriers

to entry for non-U.S.-owned

dredging companies

>

Demonstrated record of successful

project completion having never

failed to complete a marine project

>

U.S. dredging operator with

significant international presence

>

Portfolio of flexible fleet enables

repositioning of vessels as necessary

>

Added sediment & soil remediation

capabilities with Terra acquisition

>

Continuing bridge demolition

business

PROTECTED MARKET

& PROVEN RECORD

INTERNATIONAL PRESENCE

REMEDIATION & DEMOLITION

CAPABILITIES

INVESTMENT HIGHLIGHTS

04

25 |

05

REMEDIATION &

DEMOLITION

SERVICES

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

26 |

GREAT LAKES

DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

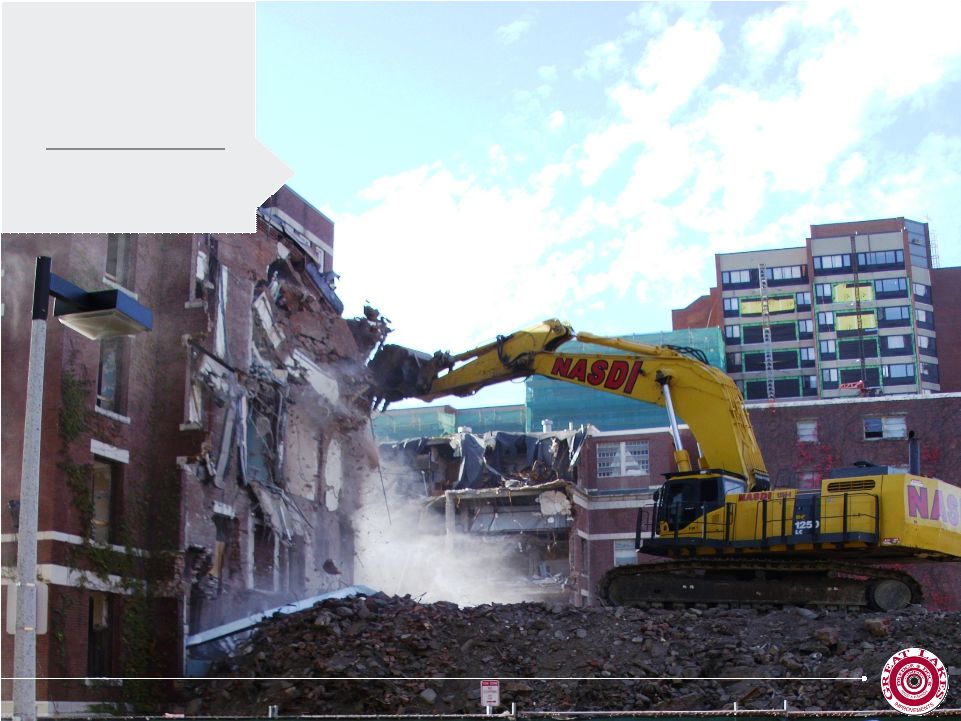

DEMOLITION & SITE REMEDIATION SERVICES

05

> DEMOLITION AND SITE REMEDIATION SERVICES

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

>

Major U.S. provider of commercial and industrial demolition services, including

bridge demolition; preferred in New England

>

Rated in the Top 10 Demolition Companies According to 2011 Engineering

News-Record (ENR) >

Purchased Yankee in 2009; able to offer removal of asbestos and hazardous

materials >

Bidding work nationally

>

The Company has announced that it is assessing

strategic alternatives with respect to its historical demolition

business.

NASDI & YANKEE ENVIRONMENTAL SERVICES

(IN MILLIONS)

THREE YEAR

AVERAGE

(FY2010-2012)

FY 2011

FY 2012

DEMOLITION REVENUE

$95

$107

$101

27 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

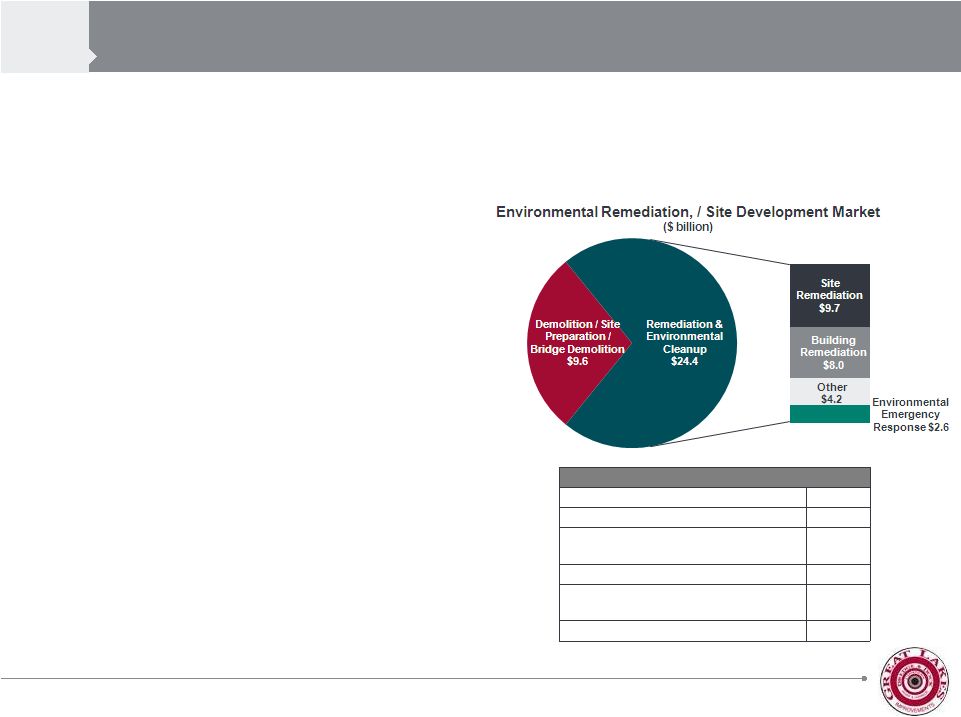

•

GLDD’s primary focus is in the following

services:

•

Remediation and Environmental Clean-up

•

Demolition & Wrecking

•

Site Preparation and Development

•

Brownfield Cleanup and Redevelopment

•

Bridge Renovation / Demolition

•

Special / Hazardous Waste Disposal

Services

•

Industrial and Municipal Services

•

Remediation and Environmental Clean-up

Services account for over 70% of the total

market –

and is Terra Contracting Services’

and

NASDI’s target market

Market for environmental remediation/ site development services is over

$34 billion

Source: Ibisworld and internal GLDD estimates

Forecasted Annual Growth (2013-2018)

Land Development

5.6%

Demolition & Wrecking

5.9%

Special / Hazardous Waste

Disposal

3.1%

Heavy Infrastructure Construction

3.0%

Remediation & Environmental

Services

1.4%

Average Annual Growth Rate

4.0%

INFRASTRUCTURE SERVICES

05

28

* The Company has announced that it is assessing strategic alternatives with

respect to its historical demolition business –

which would not include Terra Contracting. |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

Positive growth is expected over the next five years, primarily

driven by the private sector

Aging U.S.

Infrastructure

Expansion of

Energy

Infrastructure

Government

Regulations

Increased

Environmental

Focus

•

Decades of minimal capital expenditure in the industrial, oil & gas, utility,

and public sectors •

Average U.S. oil refinery was sited and constructed over fifty years ago

•

Average age of the U.S. coal fleet is 43 years, with more than half the plants

built before 1967 •

American Society of Civil Engineers estimates investment needed by 2020 in U.S.

infrastructure is $3.6 Trillion

•

Discovery of shale gas and fracking technology have resulted in increased

infrastructure spend and expected to lead to need for site cleanups and

waste disposal, as well as site remediation and redevelopment

•

Expansion and improvement of midstream assets and refining capacity is expected:

natural gas, natural gas liquids (NGL), and oil transmission infrastructure

spend is estimated to be more than $250 billion over the next 25

years •

New / specialized waste streams and treatment driving need for increased

environmental regulation •

Both federal and state governments have increased oversight of environmental

practices, tightened mandates, and increased legislation

•

EPA mandates to lower greenhouse gas emissions and improve efficiency of big power

plants are expected to increase

•

Sustainability

is

increasingly

viewed

as

a

source

of

revenue

and

business

growth

•

Consumers demanding greener technologies, products and services

•

Random and unfortunate events (e.g. BP oil spill) require environmental

remediation and clean-up, Hurricane Sandy clean-up is

continuing •

Superfund sites in the Northeast due to reduced land inventory are now obtaining

funding for environmental clean-up and remediation to develop

brownfields 05

DEMAND DRIVERS

29 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

The market is highly fragmented with approximately 5,000 small, local

and regional service providers and a few large public players

•

No

Dominant

Industry

Players

–

large

firms

offer

a

range

of

services

across

the

remediation industry, and may be contracted to complete all the different

requirements of a major cleanup. Smaller firms have competitive edge

based on specialized equipment or technology

•

High

Competition

–

Competition

is

growing

based

on

willingness

of

firms

to

agree

to

fixed

price contracts. Contractors are assuming greater risks in relation to

performance and liability

for

damage

and

injury

–

larger

operators

are

likely

better

positioned

here

•

High

Barriers

to

Entry

–

Based

on

increasing

share

of

financial

risks

associated

with

the

completion of remediation projects. Fixed price contracts and assuming other

liabilities also create high barriers to entry

•

Growth and expansion opportunities are to merge or acquire others to exploit

economies of scale, or specialize in niche, high-value services

COMPETITIVE LANDSCAPE

05

30

*

The

Company

has

announced

that

it

is

assessing

strategic

alternatives

with

respect

to

its

historical

demolition

business

–

which

would

not include Terra Contracting. |

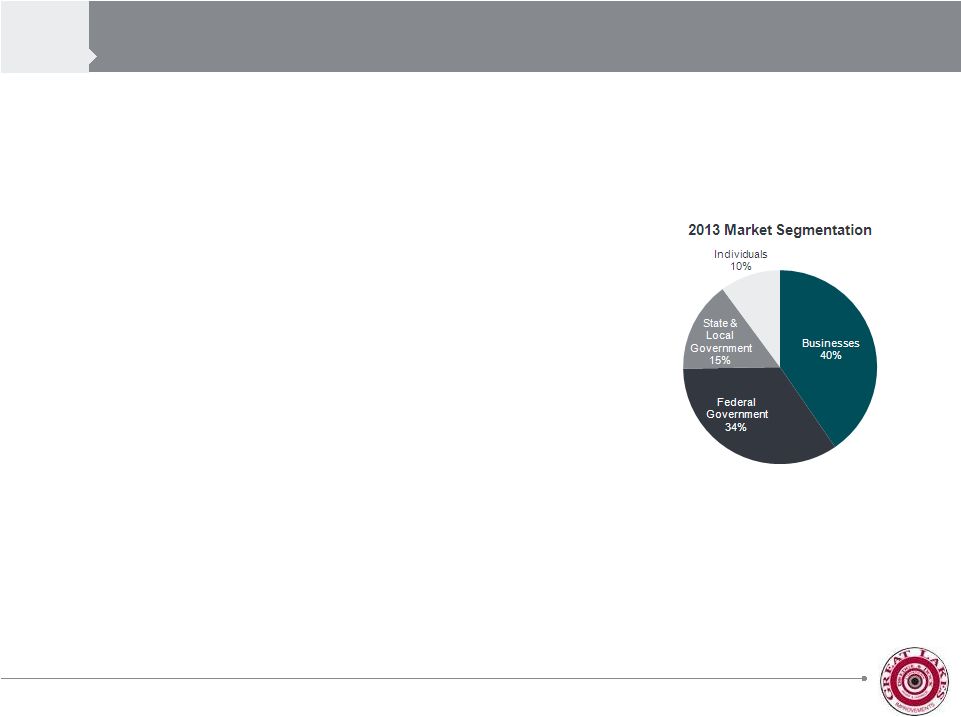

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

–

Public sector consists of both federal (e.g.,

EPA, DOE, DOD) and state and local

governmental entities

–

Private sector end markets include

Construction and Manufacturing, Utilities, Oil

& Gas, Mining and Waste Holding Facilities

Customers include public and private end users as well as environmental

consulting engineering and construction (EE&C) firms

CUSTOMERS

05

31

•

Customer base is equally split between public and

private sector

•

As federal stimulus funding declines, private sector

players are expected to exhibit higher demand for

remediation services

•

Services are procured either directly or via an EE&C firm,

which subcontracts parts of jobs to service providers

|

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

•

In

some

instances,

EE&C

firms

and

developers

manage

projects

on

behalf

of

an

end-user

–

The

EE&C

firm

/

developer

sub-contracts

out

specific

pieces

of

a

project

to

various

service

providers,

many

of

which

may

offer

a

specific

capability

•

However,

companies

with

a

robust

suite

of

service

offerings

and

sufficient

scale

are

able

to

more

often

be

the

primary

contractor

on

a

job,

thereby

collapsing

a

step

in

the

services

value

chain

With broad service capabilities and greater scale, we are better

positioned to capture more value by targeting end users directly

Service Provider

(e.g., Terra / NASDI)

Developers and

EE&C Firms

(e.g., Arcadis)

End-Users (e.g., Industrial, Utilities or

Governmental Entities)

ROUTES TO MARKET

BENEFITS OF SELLING DIRECT

•

Improved economics

•

Greater control over execution and

customer relationships

VALUE CHAIN

05

32 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

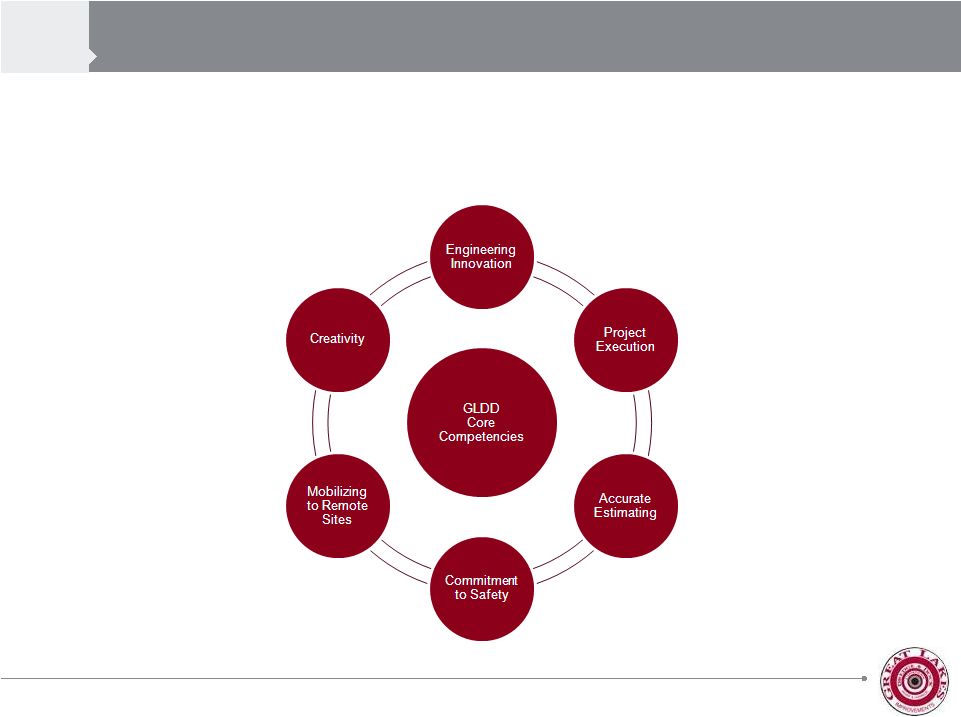

Our core competencies will ensure successful execution of projects

in the environmental services market

GLDD CORE COMPETENCIES

05

33 |

06

APPENDIX

GREAT LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

34 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

APPENDIX

06

FISCAL YEAR ENDING DECEMBER 31,

NINE MONTHS

ENDED JUNE 30,

($ IN MILLIONS)

2008

2009

2010

2011

2012

2012

2013

NET INCOME (LOSS) ATTRIBUTABLE TO

GREAT LAKES DREDGE & DOCK CORPORATION

$5.0

$17.5

$34.6

$16.5

$(2.7)

$(3.0)

$(23.4)

ACCELERATED MAINTENANCE EXPENSES

4.7

2.2

LOSS ON EXTINGUISHMENT OF DEBT

5.1

IMPAIRMENT OF GOODWILL

21.5

INTEREST EXPENSE -

NET

17.0

16.1

13.5

21.7

20.9

15.7

16.7

INCOME TAX PROVISION (BENEFIT)

3.8

11.0

20.6

9.5

(2.0)

(2.0)

(1.7)

DEPRECIATION AND AMORTIZATION

30.1

33.0

34.3

40.9

40.0

26.6

35.7

ADJUSTED EBITDA

$55.9

$77.6

$103.0

$93.7

$60.9

$39.5

$48.8

> RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA

35 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

APPENDIX

06

> STOCK PERFORMANCE

12.31.06

12.31.07

12.31.08

12.31.09

12.31.10

12.31.11

12.31.12

06.30.13

GLDD

100.0%

135.2%

64.3%

100.5%

114.3%

86.2%

138.4%

121.2%

PEERS

100.0%

132.6%

89.3%

96.6%

96.8%

79.3%

96.3%

117.7%

RUSSELL 2K

100.0%

97.3%

63.4%

79.4%

99.5%

94.1%

107.8%

124.1%

NASDAQ

100.0%

109.8%

65.3%

93.9%

109.8%

107.9%

125.0%

140.9%

INITIAL INVESTMENT $100

Note: Great Lakes went public in December 2006

36 |

GREAT

LAKES DREDGE & DOCK CORPORATION > INFRASTRUCTURE SOLUTIONS

INFO@GLDD.COM | GLDD.COM

37 |