Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EQUITY ONE, INC. | d627106d8k.htm |

Investor Presentation

November 2013

Improving retail real estate in urban communities

Exhibit 99.1 |

Forward

Looking Statements 1

Certain matters discussed by Equity One in this presentation constitute forward-looking statements

within the meaning of the federal securities laws. Forward-looking statements can be

identified by the use of forward-looking terminology such as “may,”

“will,” “might,” “would,” “expect,” “anticipate,” “estimate,” “could,” “should,” “believe,” “intend,” “project,”

“forecast,” “target,” “plan,” or “continue” or the negative of

these words or other variations or comparable terminology. Although Equity One believes that

the expectations reflected in such forward-looking statements are based upon reasonable

assumptions, it can give no assurance that these expectations will be achieved. Factors that could cause

actual results to differ materially from current expectations include volatility in the capital

markets and changes in borrowing rates; changes in macro-economic conditions and the demand

for retail space in the states in which Equity One owns properties; the continuing financial

success of Equity One’s current and prospective tenants; the risks that Equity One may not

be able to proceed with or obtain necessary approvals for development or redevelopment projects

or that it may take more time to complete such projects or incur costs greater than anticipated; the

availability of properties for acquisition; the timing, extent and ultimate proceeds realized

from asset dispositions; the extent to which continuing supply constraints occur in geographic

markets where Equity One owns properties; the success of its efforts to lease up vacant space;

the effects of natural and other disasters; the ability of Equity One to successfully integrate

the operations and systems of acquired companies and properties; changes in Equity One’s credit

ratings; and other risks, which are described in Equity One’s filings with the Securities

and Exchange Commission.

This presentation also contains non-GAAP financial measures, including Funds from Operations, or

FFO. Reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP measures can be found in Equity One’s quarterly supplemental information

package and in filings made with the SEC which are available on its website at

www.equityone.net. |

Investment Considerations

2

•

Proven management team that has successfully executed a stated transformation

strategy to upgrade and diversify a portfolio of dominant retail assets in

the most densely populated coastal markets of the U.S. •

Five year capital recycling plan is nearly complete

–

Approximately $2 billion of acquisitions since 2009 in target markets

–

Approximately $1 billion of dispositions since 2009 of non-strategic,

non-core assets •

Upgraded portfolio provides attractive shadow pipeline of redevelopment

opportunities that reflect over $500 million of possible investment

•

Recent

acquisitions

include

many

anchor

leases

with

below

market

rents

and

short

term

expirations

•

Strong balance sheet with modest leverage, ample liquidity and well-laddered

debt maturities •

Financial capacity and proven ability to execute on additional opportunistic

acquisitions and redevelopments We are a premier operator of quality retail

properties and are positioned for continued growth |

Corporate Snapshot

3

•

Equity One owns, manages, acquires, develops and redevelops quality retail properties located in

supply constrained communities in major coastal markets of the United States

•

As

•

Our capital recycling program has significantly improved our geographic diversification and portfolio

demographics

•

Our largest geographic markets as measured by approximate fair market values are Northeast (32%),

South Florida –

•

Our properties have average population density within 3 miles of 204k and average household income

within 3

•

The grocer sales in our portfolio average in excess of $550 per square foot

•

As of September 30, 2013, our total equity market capitalization and total enterprise value were $2.8

billion and •

We have investment grade credit ratings of Baa2 (stable) from Moody’s and BBB- (positive)

from S&P

(1)

Includes acquisitions and dispositions under contract as of 10/30/2013. Excludes land and

non-core assets not associated with retail centers. Additionally, we have joint

venture interests in eighteen retail properties and two office buildings totaling approximately 3.4

million sf. (2)

Based on total estimated fair market value of operating property portfolio as of 9/30/2013.

Includes acquisitions and dispositions under contract as of 10/30/2013. Excludes land and

unconsolidated JV properties.

(3)

Demographic data based on weighted estimated fair market value of assets. Includes acquisitions and

dispositions under contract as of 10/30/2013. Source: Sites USA.

(4)

Based on diluted shares of 129.4 million.

$4.3

billion,

respectively

(4)

miles of $95k

(3)

of

September

30,

2013,

we

owned

128

operating

properties

in

13

states

(1)

Non-core

properties

represent

only

7%

of

our

portfolio

(2)

(26%)

and

California

(22%)

(2) |

3Q13

Summary Highlights Earnings

•

3Q13 FFO and Recurring FFO were both $0.30/share, Recurring FFO was up 7% over

3Q12 •

Recurring

FFO

guidance

was

increased

to

$1.22

to

$1.23/share

(from

$1.20

-

$1.23/share)

Operating fundamentals

•

Same property NOI increased 3.7% vs. 3Q12, and full year guidance was updated to

+3.0% to 3.5% •

Consolidated Shopping Center occupancy was 92.4%, a 90 bps increase vs. 2Q13

•

Same property occupancy increased 30 bps to 92.1% vs. 2Q13, and was flat compared

to 3Q12 •

Executed 139 new leases, renewals and options totaling 812,495 sf at an average

rent spread of 9.3% on a same space basis •

Average base rents were up 7.2% over the prior year to $15.52/sf, and up 1.1%

sequentially Disposition activities

•

Substantial progress on asset disposition plan which is on target to reach budgeted

levels 4

Investing activities

•

Closed on three of the seven Westwood Complex parcels for a gross purchase price of

$23 million. Net of $17.8 million of financing previously provided

against these three parcels, the additional funding was $5.2 million.

•

In October, closed on The Village Center in Westport, CT for a gross purchase price

of $54.3 million, consisting of four buildings totaling 90,000 sf that are

98% leased. •

In October, acquired Pleasanton Plaza in Pleasanton, CA for a gross purchase price

of $30.9 million, anchored by JCPenny Home Store, OfficeMax, and Cost Plus

World Market. The center is approximately 163,000 sf and 96% leased.

•

Joint

Venture

with

NY

Common

Retirement

Fund

acquired

Riverfront

Plaza

in

Hackensack,

NJ

for

$47.8

million,

a

129,000

sf

97%

leased

shopping

center

anchored

by

ShopRite.

The

acquisition

closed

in

October.

Development and redevelopment activities

•

Broadway Plaza development and Serramonte redevelopment progressing on plan

–

Year

to

date

through

10/30/13,

29

non-core

assets

were

sold

for

$236.2

million

and

an

additional

seven

non-core

assets

were

under contract

for

sale

for

$65.9

million

(including

pro

rata

share

of

a

JV

property).

The

weighted

average

capitalization

rate

of

non-core

assets disposed and under contract as of 9/30/13 is approximately 7%

|

Meet

or exceed fundamental operating goals SS NOI growth + 2% to 3%

SS Occupancy + 50 to 100 bps

Recurring FFO of $1.18 to $1.22/share

Continue to upgrade portfolio quality and demographic profile

through strategic transactions

Core acquisition activity of $100 to $200 million

JV acquisition activity of $100 to $200 million

Non-core asset dispositions of $300 million

Continue to strengthen development and redevelopment pipeline

Complete lease up of The Gallery at Westbury Plaza

Significantly advance construction at the Broadway Plaza site

Establish additional redevelopment and densification plans at

Serramonte

Substantially complete Dick’s Sporting Goods

Develop expansion plans to add entertainment wing

Close on the Westwood Complex and work on redevelopment

plans

Maintain low leverage and ample liquidity

Continue to strengthen credit metrics and maintain large

unencumbered asset base

Upgrade

information

technology

systems

–

implement

IT

strategic plan that is aligned with our operational strategy

Operating

Fundamentals

Portfolio

Quality

Value

Creation

Balance

Sheet

Management

Operations

Progress Against 2013 Strategic Goals

2013 Goals

3Q Progress Assessment

Updated guidance to +3.0% to 3.5%

3Q SS Occupancy flat vs. 3Q12

Updated guidance to $1.22 to $1.23/share

On track for $100 to $200 million of core acquisition activity,

inclusive of Westwood

Revised JV acquisition guidance to $50 to $75 million in 2Q

As of 10/30/13, $236.2 million closed, $65.9 million under

contract (including pro rata share of JV)

The Gallery is now 95% leased or under LOI

Leases signed for 63% of GLA, additional 8% under LOI

Serramonte Phase II planning in process

On track to open Dick’s in 1Q 2014

In discussion with theater operators and restaurants

Closed on five Westwood parcels; remaining two

expected by January 2014 ($80 million value / $19.5

million net funding remaining)

42.9% net debt to gross real estate at 9/30/13

Unencumbered cash NOI exceeds 75% for 3Q

New budget system implementation completed,

utilized for 2014 budget cycle

5 |

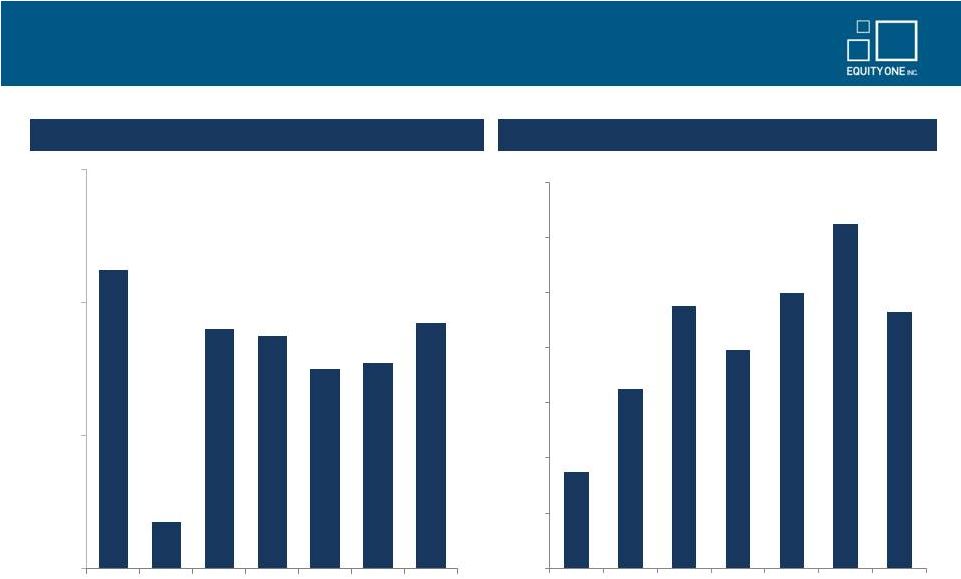

Improved Portfolio Quality Evident in Recent Operating Fundamentals

6

Rent

Spread

–

Total

New

Leases,

Renewals

&

Options

(2)

SS NOI Growth %

(1)

4.5%

0.7%

3.6%

3.5%

3.0%

3.1%

3.7%

0.0%

2.0%

4.0%

6.0%

Q1 '12

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Q3 '13

3.5%

6.5%

9.5%

7.9%

10.0%

12.5%

9.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Q1 '12

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Q3 '13

(1)

NOI growth is presented on a same property cash basis as of each respective quarter. (2)

Rent spreads for new leases reflect same-space leasing where amount of rent paid by prior tenant

is available regardless of the amount of time the space has been vacant. |

Portfolio Growth Greatly Improved From Capital Recycling

7

Strategy

to

upgrade

and

diversify

asset

base

commenced

in

2009

and

is

largely

completed

(1)

Growth profile enhanced through the acquisition of high quality assets

Assets acquired are larger, dominant assets in major trade areas

Property acreage in newly acquired assets much greater than non-core assets

which provides redevelopment and expansion opportunities

Larger assets with higher occupancy are more efficient to operate

Stability of cash flows enhanced by selling non-core assets in secondary

markets (1)

See Appendix for selected property metrics which reflect these capital recycling

results Grocer anchor tenant sales volumes are about 50% lower than dominant

assets being acquired Rental streams more uncertain in non-core markets

as fewer barriers to entry exist and new tenant demand is subject to much

more competition Assets targeted for dispositions are in smaller markets (average 3 mile

populations around 50,000) with lower average incomes (less than $65k) |

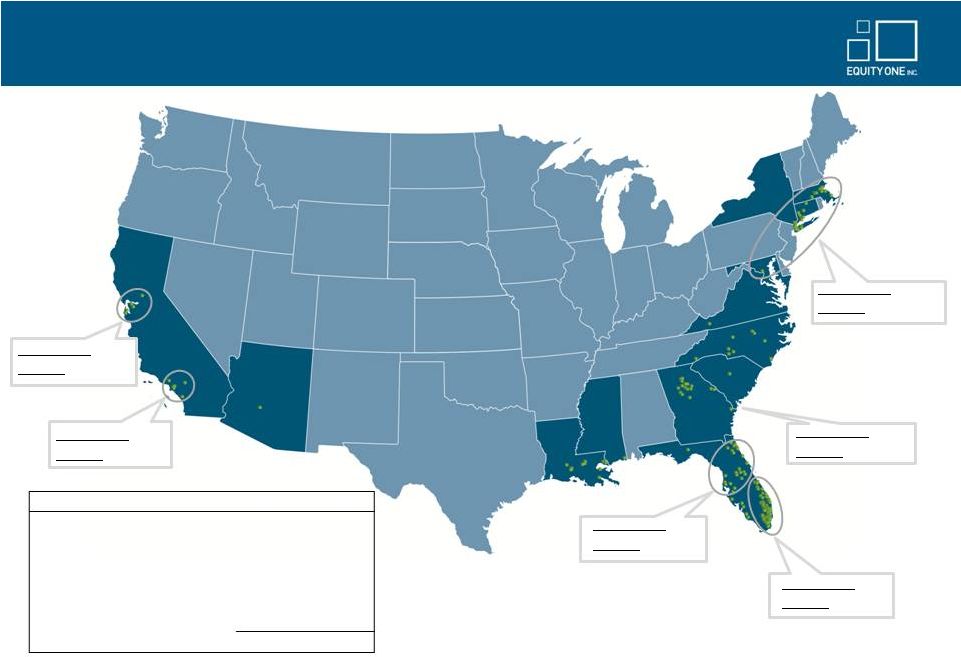

Portfolio Well Diversified in Major Supply Constrained Coastal Markets

8

Region

$ FMV

(1)

% FMV

Northeast

$1,217

32%

South Florida

$993

26%

West Coast

$826

22%

North Florida

$286

8%

Southeast

$202

5%

Non-Core (Southeast, Florida)

$245

7%

Total

$3,769

100%

(1)

Data includes acquisitions and dispositions completed and under contract as of

October 30, 2013. Excludes land and non-core assets not associated with retail

centers. IFRS fair market values are as of 9/30/13.

Estimated FMV: $1,217

% of FMV: 32%

Estimated FMV: $202

% of FMV: 5%

Estimated FMV: $993

% of FMV: 26%

Estimated FMV: $286

% of FMV: 8%

($ In Millions)

Estimated FMV: $185

% of FMV: 5%

Estimated FMV: $641

% of FMV: 17% |

Below market leases

•

Recent acquisitions provide opportunity to capture market rents in coming

years –

1175

Third

Avenue

(New

York,

NY)

-

Food

Emporium

was

paying

$42

psf,

now

paying

$105

psf

–

Aventura

Square

(Aventura,

FL)

-

Old

Navy

pays

$18

psf

lease

expires

1/2014,

executed

renewal

during 2Q at $45 psf commencing 2/2014; DSW pays $20 psf, lease expires 2018

–

101

7th

Avenue

(New

York,

NY)

-

Loehmann’

s

pays

$25

psf,

lease

expires

3/31/2016

–

Westwood

(Bethesda,

MD)

-

Giant

Food

pays

$2.00

psf,

lease

expires

2019

–

Copps

Hill

(Ridgefield,

CT)

-

Kohl’s

pays

$2.40

psf,

lease

expires

2021

–

Circle

Centers

(Long

Beach,

CA)

-

three

anchor

tenants

expiring

2016,

2018

and

2022,

each

paying ~50% of market

–

The

Village

Center

(Westport,

CT)

–

several

below

market

leases

rolling

within

three

years

Increase occupancy with

focus on small shops

•

Small shop occupancy was 81.5% at 9/30/13 and represents opportunity to drive

incremental NOI •

“Mom and Pop”

shops being replaced by stronger franchise operators

•

Employment

and

housing

continue

to

strengthen,

especially

in

Florida

(1)

Redevelopment and site

densification

•

Recent acquisitions provide opportunity for redevelopment and densification

–

Serramonte

-

entertainment

wing

with

movie

theaters

and

restaurants

will

be

next

phase

–

Potrero -

opportunity to increase density

–

Danbury/Southbury/Compo

Acres/Darinor

Plaza

-

expansion

and

additional

outparcel

opportunities

Additional core

acquisitions

•

We plan to further build and increase our portfolio in our core urban

markets •

Assets

with

highly-productive

anchors,

below

market

anchor

rents,

and

redevelopment

opportunities

Expense control

•

Intense focus on managing general and administrative costs throughout

organization, and on cost recovery and careful management of

non-recoverable costs Our Path to Sustained NOI Growth

9

(1)

Florida unemployment rate at 7.1% in July 2013 (vs. 8.7% in July 2012 and 10.4% in July 2011), per

Bureau of Labor Statistics. Florida housing market improved with 14% year over year

increase in home price, per Florida Realtors for 2Q’13 vs. 2Q’12 for median price for single-family home, as of August 2013. |

Our

Path to Increased Occupancy 10

•

Through a combination of organic leasing and capital recycling, goal is to grow occupancy from 92.4%

to 95% by end of

2014

Approximately 100 bps of increased occupancy is expected to come from same property organic leasing

and 150 bps is expected to come from dispositions and redevelopment

•

Organic occupancy growth is being driven by:

Targeting tenants benefitting from improved local economic conditions (food users, value oriented/

discounters, franchise operators, and specialty grocers)

Investment in site redevelopment and anchor re-tenanting, as new and better anchor tenants can

drive traffic to shop space and increase demand for shop space

Focus on attracting stronger shop operators, including national franchise operators

•

We will continue to divest lower quality assets that have higher vacancy rates

These assets are generally located in secondary or tertiary markets with lower density, lower

household income and weaker retail demand characteristics

Typically these assets have a value of less than $10 million

The “Bottom 10” assets, with a cumulative estimated IFRS value of approximately $75 million

(as of 9/30/2013), had average occupancy of 67% and average base rents of $10.49 psf at

9/30/2013

Divesting these “Bottom 10” assets would raise the portfolio average core occupancy from

92.4% to 94.4%, and the portfolio average shop occupancy from 81.5% to 84.1%

–

–

–

–

–

–

–

– |

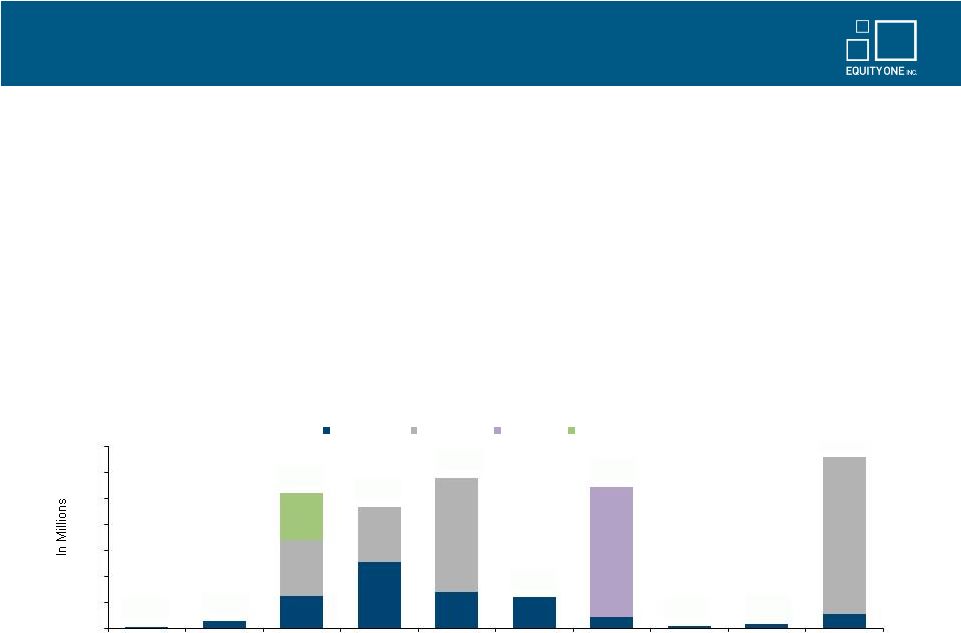

Disciplined Capital Allocation Has Preserved A Strong Balance Sheet

11

•

Key balance sheet statistics as of September 30, 2013:

•

Strong lending relationships with both traditional banks and life insurance

companies •

Demonstrated access to the public markets

•

$575 million revolving credit facility which matures September 30, 2015 with a one

year extension option •

Modest leverage, ample liquidity and well-laddered debt maturities

–

Adjusted EBITDA to fixed charges: 2.8x

–

Weighted

average

term

to

maturity

for

total

debt:

5.3

years

(1)

–

Weighted

average

interest

rate

on

total

debt:

4.99%

(1)

$2

$14

$259

$233

$289

$61

$273

$6

$9

$329

$0

$50

$100

$150

$200

$250

$300

$350

2013

2014

2015

2016

2017

2018

2019

2020

2021

Thereafter

Secured Debt

Senior Notes

Term Loan

Credit Facility

–

Net Debt to Total Market Cap: 32.8%

–

Net Debt to Gross Real Estate: 42.9%

–

Net Debt to Adjusted EBITDA: 6.6x

–

Adjusted EBITDA to interest expense: 3.1x

(1) Excludes amounts drawn under the revolving credit facility which expires on 9/30/15. Note: Debt maturity schedule as of 9/30/2013. Includes

scheduled principal amortization and excludes Brawley Commons. Credit facility is presented as due on the initial maturity

date. |

Significant Development and Redevelopment Opportunities Will Help

Drive Future Growth

Our upgraded portfolio of larger, dominant assets has created a shadow pipeline of

redevelopment opportunities in excess of $500 million. The opportunities

being evaluated fall into the following categories: 1)

Larger

scale

expansions

and

new

ground

up

construction

(potential

range

$250

million

-

$300

million)

•

Serramonte Center

-

Dick’s, restaurant outparcels, theater/entertainment wing, new anchors

•

Westwood

Center

-

redevelop

existing

1950

neighborhood

center

to

take

advantage

of

superior

demographics

•

Potrero Center

-

further densify site/consider multi-family component

2)

Consolidate poorly utilized shop space for junior/mid box anchors

•

Kirkman Shoppes

–

LA Fitness (41k sf) backfilling poorly configured corner space, adding Walgreens

outparcel •

Pablo Plaza

–

identified 30k sf of shops that can be backfilled with two junior boxes

•

Alafaya Commons

–

eliminate 37k sf of shop space to backfill with 45k sf LA Fitness

3)

Replace underperforming anchor stores with stronger operators

•

Charlotte Square

–

backfill local furniture operator with large national discount retailer

•

Sheridan Plaza

–

relocate and downsize Office Depot, backfill with TJ Maxx

4)

Expand successful anchor tenants

•

Boynton Plaza

–

expand Publix to a new 54k sf store

•

Countryside

Shops

–

build

a

new

Publix

and

backfill

existing

box

with

value-oriented

retail

and

restaurants

5)

Add outparcels/expand existing food users

•

Darinor Plaza

–

add new Starbucks pad and relocate existing bank ATM pad

•

Point Royale

–

add bank pad to recently constructed Starbucks and Chipotle expansion

12 |

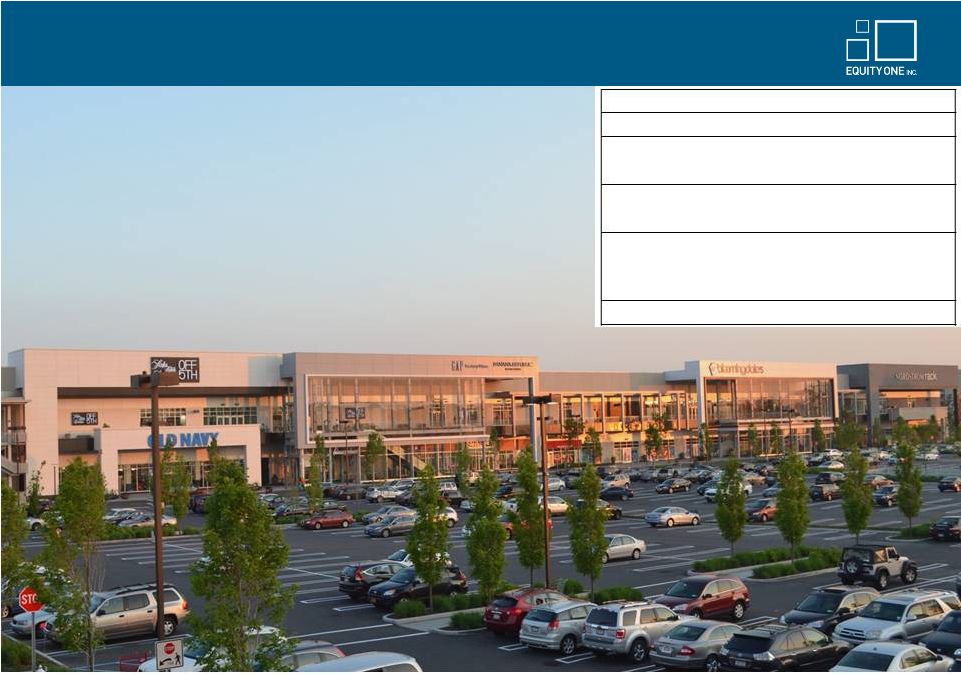

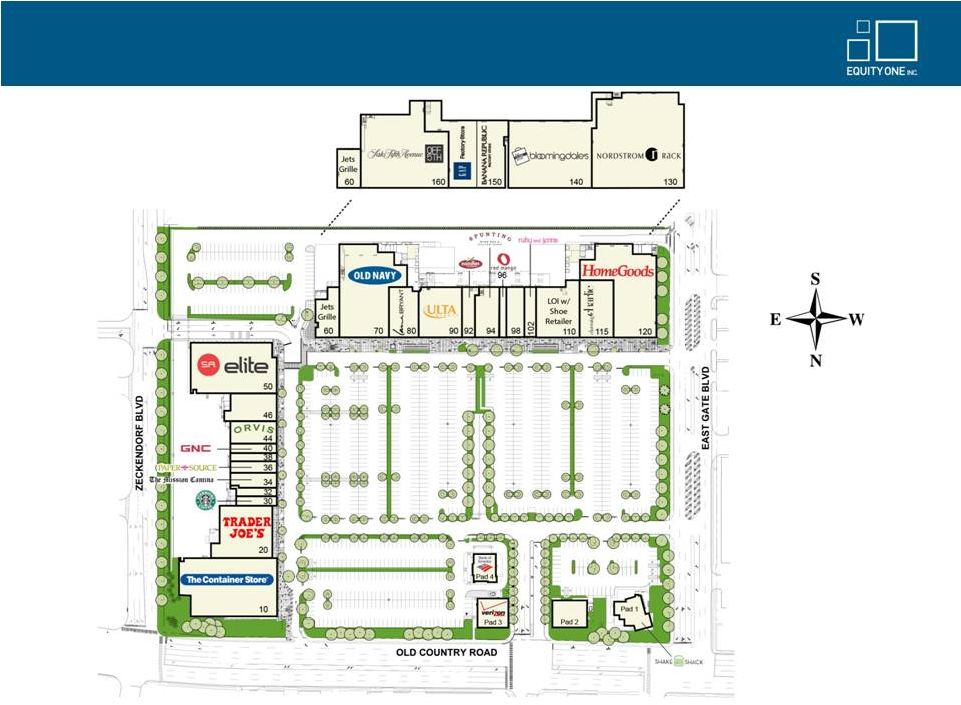

The

Gallery at Westbury Plaza – Garden City, NY

13

(1)

Net estimated cost including estimate of tax refunds for costs incurred as part of

participation in New York State’s Brownfield Cleanup Program.

Location

Westbury,

NY

GLA

312k sf

Development budget

(1)

$128.6 million

Estimated cost to complete as of 9/30/13

$10.3 million

Lease-up

Opened Fall 2012. 95% leased or under LOI as of 10/30/13.

Key tenants

Saks Fifth Avenue, Bloomingdale’s, Nordstrom Rack, Old

Navy, Trader Joe’s, Ulta, Home Goods, GAP, Banana Republic,

The Container Store, Shake Shack, Starbucks, SA Elite

Expected Stabilized yield

~11% |

The

Gallery at Westbury Plaza – Garden City, NY (Continued)

14 |

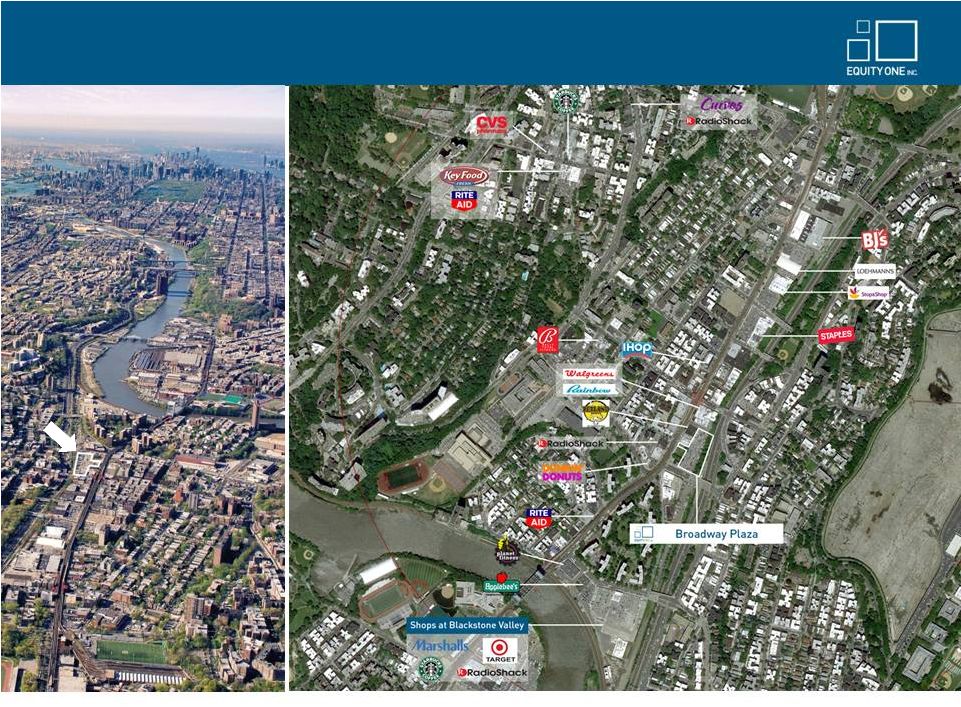

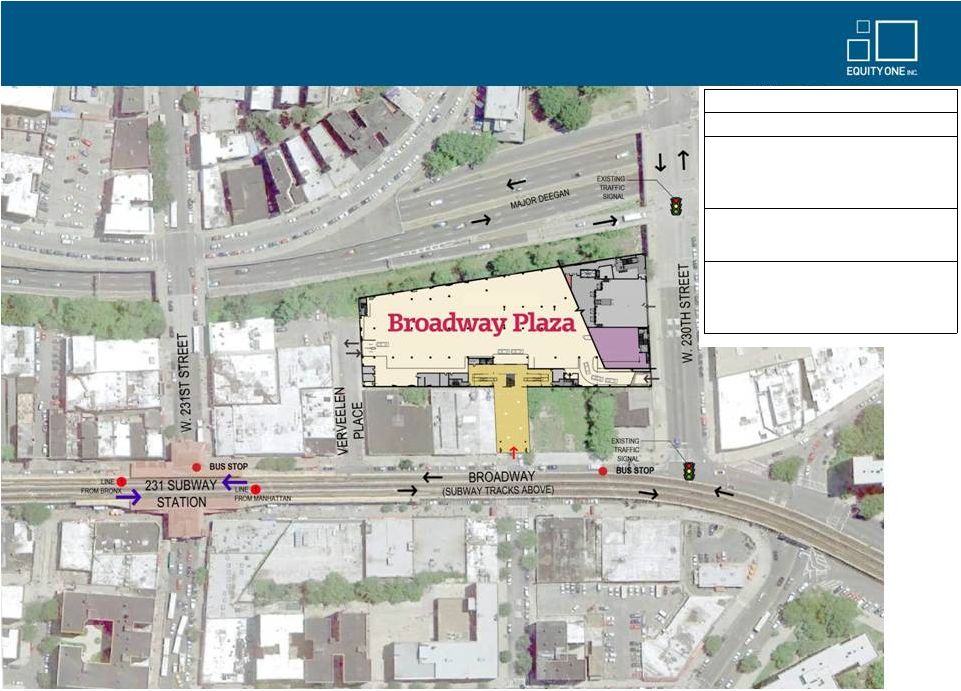

Broadway Plaza Development -

Bronx, New York

15 |

Broadway Plaza Development -

Bronx, New York (Continued)

16

Location

Bronx, NY

GLA

115k sf

Development budget

$52.8 million

Incurred as of 9/30/13

(1)

$19.4 million

Estimated cost to complete

$33.4 million

Lease-up

Leases executed with TJ Maxx (24k sf), The

Sports Authority (30k sf), and Aldi’s (18k sf)

Est. construction completion

4Q 2014

Target NOI stabilization

2016

Expected stabilized yield

8% -

9%

(1) Includes land cost. |

Broadway Plaza Development -

Bronx, New York (Continued)

17 |

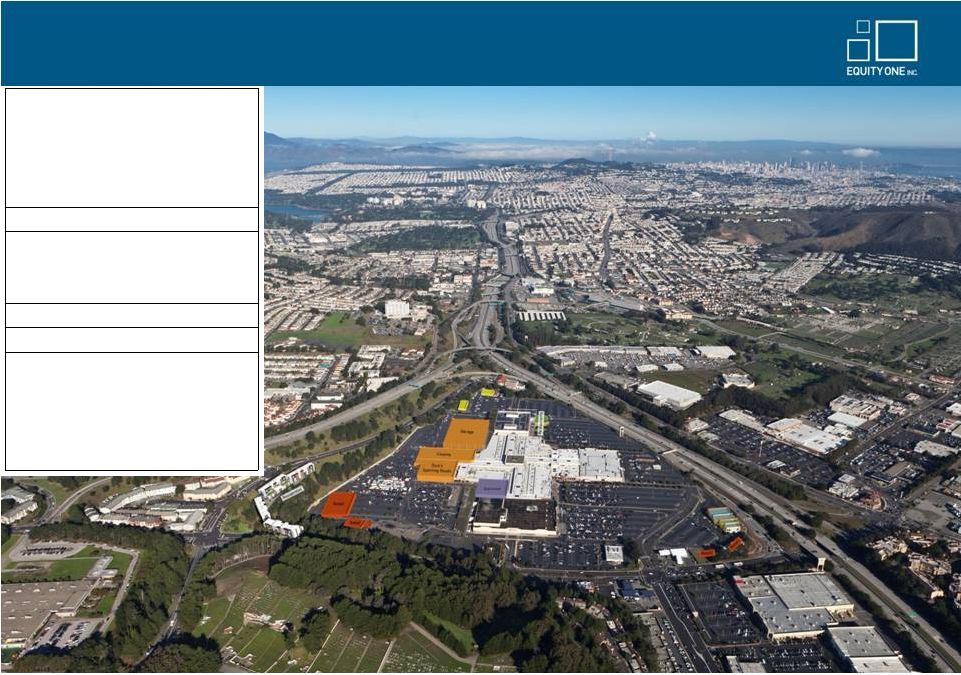

Serramonte Shopping Center -

Daly City, California

18

Active redevelopment

•

Constructing new two-story Dick’s

Sporting Goods which will become the

mall’s fourth anchor, joining Target, JC

Penney, and Macy’s

•

Phase I of a multi-phase plan to re-brand

and expand the property

Dick’s redevelopment GLA

83k sf

Redevelopment budget

$19.2 million

Incurred as of 9/30/13

$10.9 million

Estimated cost to complete

$8.3 million

Scheduled opening

Early 2014

Expected stabilized yield

~10%

Future redevelopment

•

Future phases at Serramonte will likely

add 150k to 200k sf of additional GLA

including a grocery store, pharmacy,

discounters, a theater, more restaurants,

entertainment, and possibly a residential

component. |

Serramonte Shopping Center -

Daly City, California (Continued)

19

Current Expansion Projects |

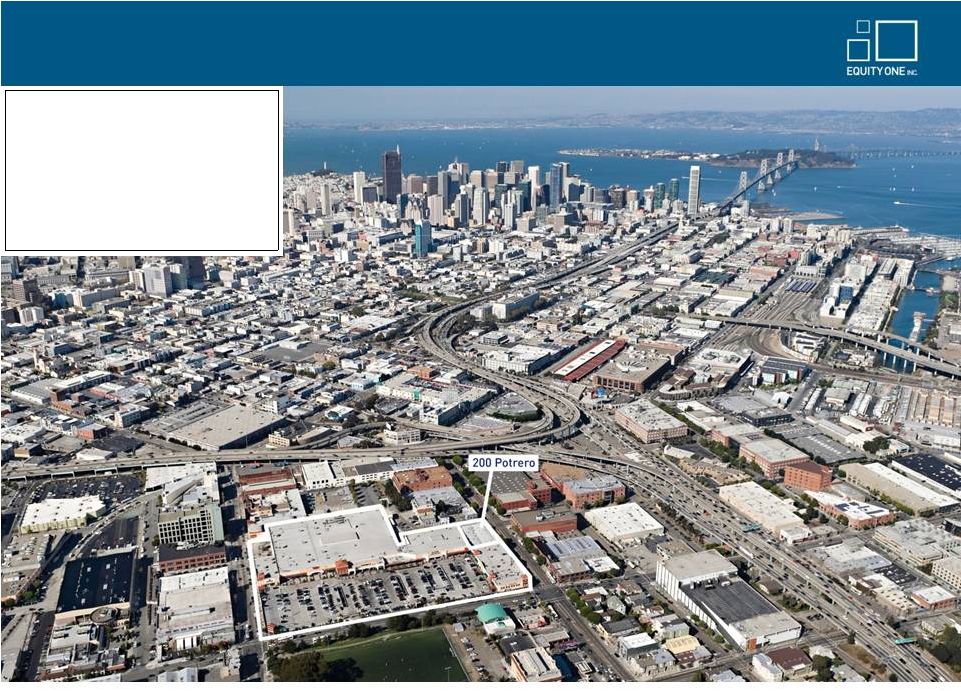

Potrero Shopping Center -

San Francisco, California

20

Future redevelopment goals

•

Densify the site with additional retail and

potentially residential units

•

May invest $75 million over the next several

years, excluding the residential component

•

Recently acquired 200 Potrero Avenue (an

adjacent 30k sf building) providing additional

flexibility to relocate tenants and improve

Potrero Center over time |

Westwood Shopping Center -

Bethesda, Maryland

21

•

In 4Q 2012, announced agreement to acquire Westwood Complex, a 22 acre property in Bethesda, MD for

$140 million

215k sf of retail space in the highly affluent and supply constrained market outside Washington, D.C.

Superior demographics with 141k population within 3 miles and average household income of $199k

Initially structured as a $95 million funded mortgage loan, with outright purchase of property

anticipated by early 2014

•

Significant opportunities for value creation through below market rents, redevelopment and expansion

Asset has had only one owner and will benefit from capital investment and intensive asset management

Anchored by high volume Giant Food since 1959, with below market lease expiring 2019

Main center has parking ratio of 10 spaces per 1,000 sf, more than double typical shopping centers

•

Closed on five of the seven parcels comprising the Westwood Complex during second and third quarter

The remaining two parcels are expected to be acquired by January 2014

Remaining parcels purchase price of $80 million, $19.5 million net of existing financing

–

–

–

–

–

–

–

– |

Westwood

Shopping

Center

-

Bethesda,

Maryland

(Continued)

22 |

Westwood Shopping Center -

Bethesda, Maryland (Continued)

23 |

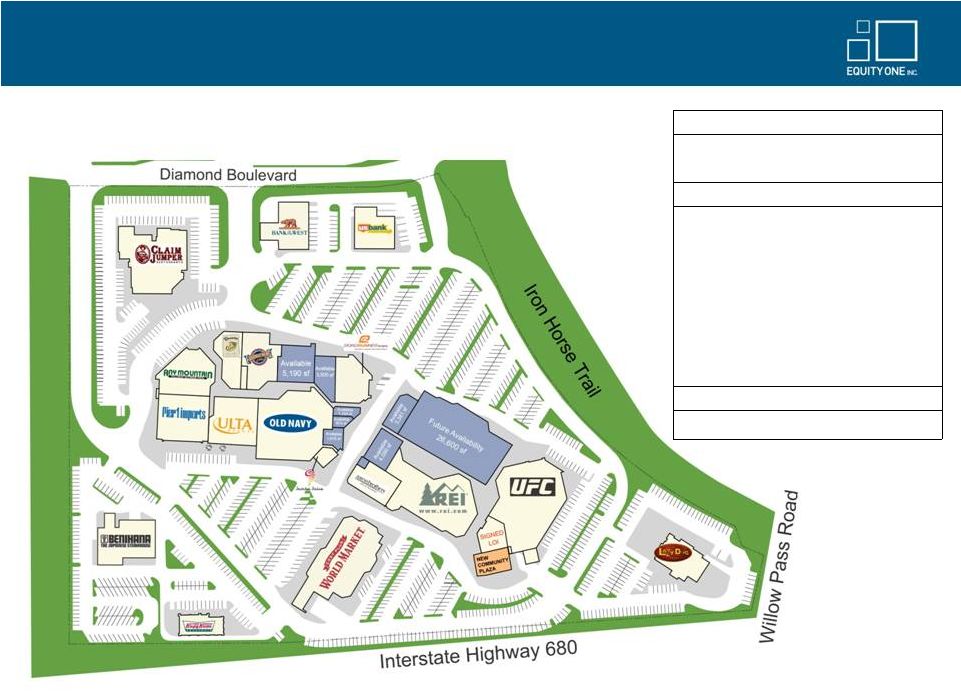

Willows Shopping Center Redevelopment –

Concord, CA

24

Redevelopment Plan

Challenges

•

Too many interior facing shop spaces

•

Poor traffic patterns limiting shopping in

the rear of the center

•

Insufficient gathering spaces and

amenities to take advantage of the

center’s longstanding connection to the

community

•

Architectural design is unconventional

and outdated

•

Create new access road to improve

circulation and visibility for shop

tenants

•

New architectural design to improve

roof lines, refresh color scheme and

use modern materials

•

Create a community plaza with play

areas and green space well suited to

host events and drive ancillary income

Current Site Plan |

Willows

Shopping

Center

Redevelopment

–

Concord,

CA

(Continued)

25

Proposed Site Plan

Location

Concord, CA

GLA total center

251k sf

GLA redevelopment

~50k sf

Redevelopment budget

~$13 million

Project

•

Will invest $12 million to construct 20k sf of

new buildings for a new Ulta junior anchor,

an expanded UFC Gym, and new shop

space; renovate facades on 20k sf of

challenging shop space; and construct two

new vehicular roads and an open

pedestrian area.

•

An additional ~$1 million is being invested

to replace a 12k sf dated restaurant building

with a popular new concept occupying 9k sf

Target stabilization date

3Q 2015

Expected stabilized yield

~8% |

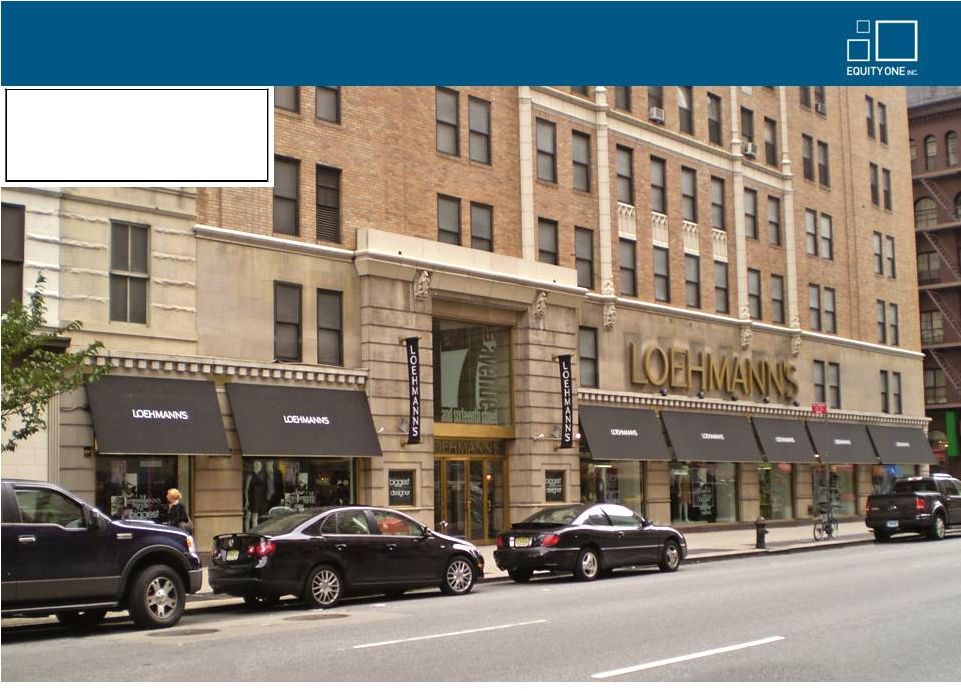

101

7

Avenue

-

New

York,

New

York

26

Highlights

•

57k sf four-story retail condominium

•

Loehmann’s lease expires March 2016

•

In-place rent of $25 psf, well below market

th |

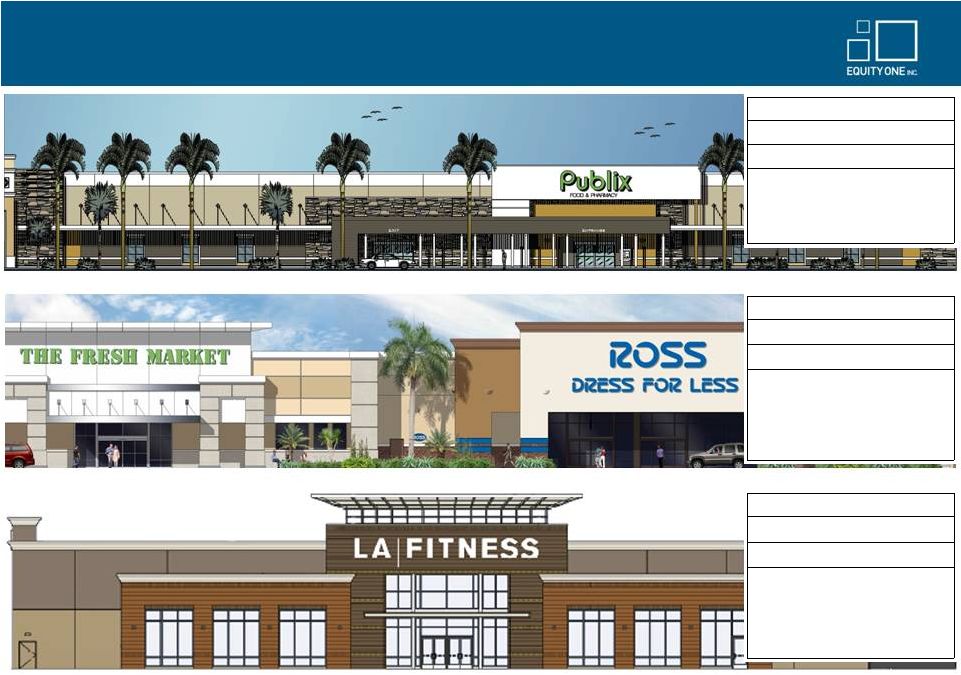

Florida Redevelopment Opportunities

27

Lake Mary Centre, Lake Mary, FL

Boynton Plaza, Boynton Beach, FL

Kirkman Shoppes, Orlando, FL

Budget

(1)

$7.6 million

Incurred as of 9/30/13

$0.3 million

Target stabilization

(2)

1Q15

Description

•

Publix expansion

•

54k sf project GLA, 107k sf

property GLA

Budget

$4.0 million

Incurred as of 9/30/13

$1.6 million

Target stabilization

(2)

3Q14

Description

•

Anchor re-tenanting (Ross and

Fresh Market)

•

Future phase includes

re-tenanting former Kmart space

Budget

$6.6 million

Incurred as of 9/30/13

$0.1 million

Target stabilization

(2)

3Q15

Description

•

Anchor re-tenanting with L.A.

Fitness

•

41k sf project GLA, 100k sf

property GLA

(1)

Net estimated project cost.

(2)

Date that construction is expected to be complete and the anchors commence

rent. |

Florida Redevelopment Opportunities (Continued)

28

Boca Village, Boca Raton, FL

Budget

(1)

$10.9 million

Incurred as of 9/30/13

$7.5 million

Target stabilization

(2)

2Q14

Description

•

Redevelopment of CVS Pharmacy

adding a drive-thru

•

Eliminating interior courtyard

space and enhancing shop

visibility

•

42k sf project GLA, 93k sf property

GLA

(1)

Net estimated project cost.

(2)

Date that construction is expected to be complete and the anchors commence

rent. |

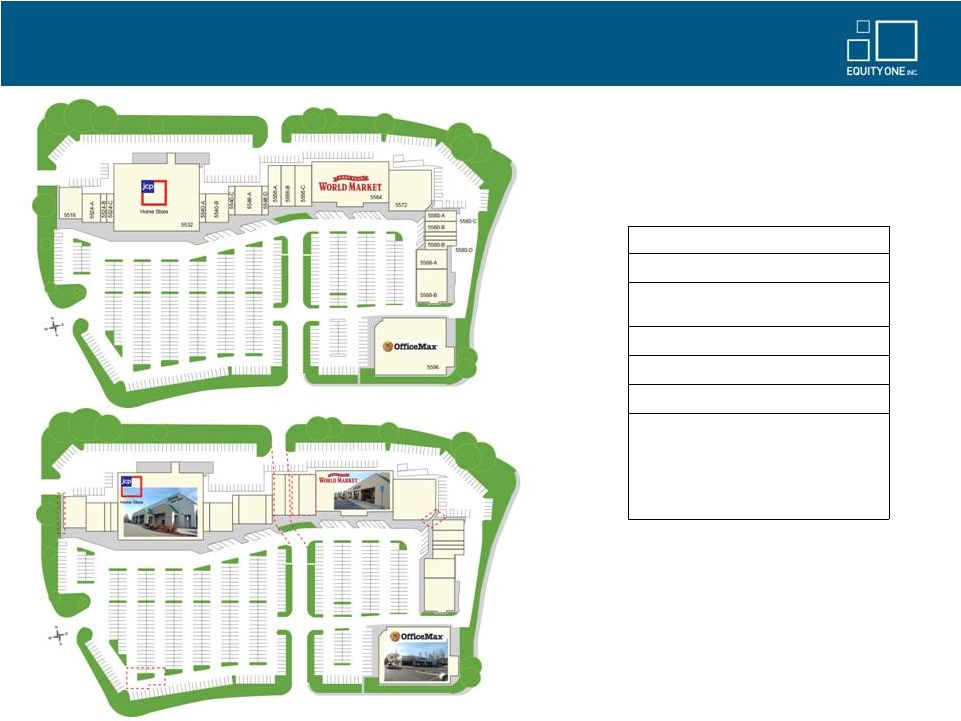

Recent Acquisition: Pleasanton Plaza –

Pleasanton, CA

29

Acquisition Date

October 2013

Price

$30.9 million

Debt

$20.0 million

due 6/15

Total sf

163,000

Leased Rate

96%

3 mile avg income

>$120k

Asset Strategy

•

Anchors significantly below market

•

Expansion and redevelopment opportunities

•

Upgrade facade, parking lot, and add

amenities and restaurants |

Recent Acquisition: Pleasanton Plaza –

Pleasanton, CA (Continued)

30

Possible Facade Improvement Plan |

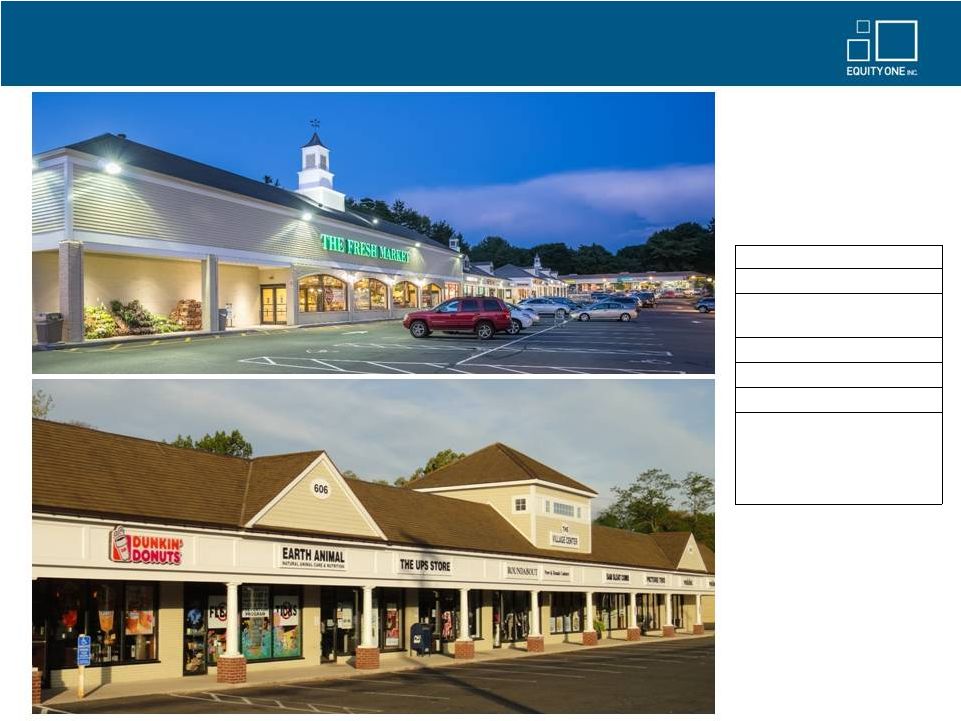

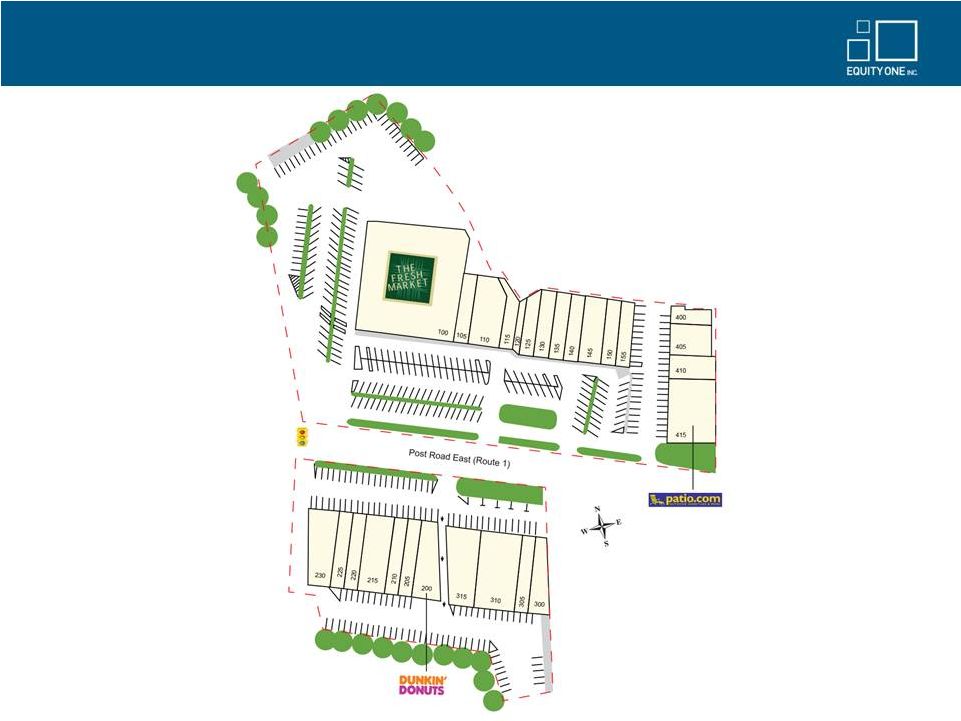

Recent Acquisition: The Village Center –

Westport, CT

31

Acquisition Date

October 2013

Price

$54.3 million

Debt

$15.7 million

due 6/19

Total sf

90,000

Leased Rate

98%

3 mile avg income

>$225k

Asset Strategy

•

Recapture below market leases

•

Redevelop center via significant

improvement to tenant mix and

upgraded retailer quality |

Recent Acquisition: The Village Center –

Westport, CT (Continued)

32 |

Appendix

33

•

Summary of Capital Recycling – 2009 to Date |

Summary of Capital Recycling –

2009 to Date

34

Remaining

Pro Forma

+

-

=

Pro Forma

-

Non-Core

=

Core

12/31/2008

(1)

Acquisitions

(2)

Dispositions

(3)

10/30/2013

(4)

Properties

(5)

Portfolio

Number

of

Properties

(6)

171

37

80

128

33

95

Total

Gross

Leasable

Area

(GLA)

(6)

18,945,330

6,011,813

8,123,476

16,659,715

3,653,249

13,006,466

Average GLA per Property

110,791

162,481

101,543

130,154

110,705

136,910

Property

Value

(000s)

(7)

2,730,789

1,915,168

1,032,190

3,769,160

244,964

3,524,196

Property Value PSF

144

319

127

226

67

271

Average Property Value (000s)

15,970

51,761

12,902

29,447

7,423

37,097

Demographics

(8)

3-Mile Population

81,238

278,350

53,903

203,726

51,021

214,341

3-Mile Average Household Income

76,077

109,710

73,047

95,339

60,840

97,737

Grocer Sales PSF

(9)

473

854

441

558

336

609

Average

Rent

PSF

(9)

11.97

22.43

11.42

16.23

8.40

18.27

Please see footnotes on following page.

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$ |

Summary of Capital Recycling –

2009 to Date

Footnotes

35

(1)

Includes 21 DIM Vastgoed properties. Equity One owned 48% of the outstanding shares of DIM at

12/31/2008, and increased its voting control to 75% during 1Q 2009. The 12/31/2008

property value ascribed to DIM properties is the value paid as of 10/30/2013 for all DIM

equity, plus assumed mortgage debt at assessed market value as of 3/31/2009.

(2)

Acquisitions include properties acquired subsequent to 12/31/2008 or under contract for purchase as of

10/30/2013, as well as the budgeted cost of ground up development activities. (3)

Dispositions include properties sold subsequent to 12/31/2008 or under contract for sale as of

10/30/2013, and excludes the sales of outparcels. (4)

Includes properties under development or redevelopment based on 9/30/2013 IFRS fair values, except for

Broadway Plaza, which is included at budgeted construction cost. Excludes properties

under contract for sale as of 10/30/2013, which are included within Dispositions. (5)

Remaining Non-Core Properties consist of retail properties which are inconsistent with the

company's long-term strategy and which may be sold in the future. These properties

are generally in smaller, secondary or tertiary markets.

(6)

Number of Properties and associated value exclude Other/Non Retail Properties (except for those

properties acquired and subsequently disposed between 12/31/2008 and 10/30/2013) and Land Held

for Development. Gross Leasable Area (GLA) does not cross foot from 12/31/2008 to

10/30/2013 due to additions and reductions of GLA from redevelopment activities, outparcel

sales, and other activities that affect GLA.

(7)

Property Value is based on IFRS fair value except for (i) Acquisitions and Dispositions, which are

based on purchase price and sale price, respectively, (ii) the value of DIM Vastgoed assets

(see footnote above), and (iii) in-process ground up development, which is based on budgeted

construction cost. 12/31/2008 Property Value is based on IFRS fair value as of 12/31/2008;

10/30/2013 Property Value is based on IFRS fair value as of 9/30/2013. (8)

Demographic information derived from a third-party source. All demographic information, including

with respect to properties sold prior to 2013, is as of May 2013. (9)

All per square foot amounts are based on the gross leasable area (GLA). Grocer Sales PSF exclude

grocers who have vacated but are still paying rent. Average Rent PSF for Pro Forma

12/31/2008 and for Dispositions is as of 12/31/2008, except DIM Vastgoed properties which are

as of 12/31/2009; Average Rent PSF for Acquisitions and Pro Forma 10/30/2013 is as of

9/30/2013.

|

www.equityone.net |