Attached files

| file | filename |

|---|---|

| 8-K - ConnectOne Bancorp, Inc. | c75603_8k.htm |

Investor Presentation November 2013

Forward - Looking Statements This presentation contains forward - looking statements . Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward - looking . These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases . Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them . Our actual results could differ materially from those anticipated in such forward - looking statements as a result of several factors more fully described under “Risk Factors” in our Annual Report on Form 10 - k, Item 1 A, filed by us with the Securities and Exchange Commission . Any or all of our forward - looking statements in this presentation may turn out to be inaccurate . The inclusion of this forward - looking information should not be regarded as a representation by us that the future plans, estimates or expectations contemplated by us will be achieved . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward looking statements including, but not limited to : ( 1 ) changes in general economic and financial market conditions ; ( 2 ) changes in the regulatory environment ; ( 3 ) economic conditions generally and in the financial services industry ; ( 4 ) changes in the economy affecting real estate values ; ( 5 ) our ability to achieve loan and deposit growth ; ( 6 ) the completion of our future acquisitions or business combinations and our ability to integrate the acquired business into our business model ; ( 7 ) projected population and income growth in our targeted market areas ; and ( 8 ) volatility and direction of market interest rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans . All forward - looking statements are necessarily only estimates of future results and actual results may differ materially from expectations . You are, therefore, cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this presentation . Further, any forward - looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward - looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events . 1

Who We Are □ Commercial banking franchise headquartered in Englewood Cliffs, NJ □ Founded in 2005 by group of local business leaders □ Focused on commercial and business loans which are primarily funded by relationship - based core deposit accounts □ Unique organic growth story, with total assets reaching the $1 billion milestone in less than 8 years from inception. 2 □ Loans: $1.0 Billion; Securities: $25 Million; Deposits $898 million; Equity: $127 million □ Branches: 8 (New Branch in Newark early 2014) □ Employees: 101 □ Listed on NASDAQ: “CNOB” □ Approximate Market Cap: $190 million

Strategy and Vision 3 We position ourselves as “a better place to be” for customers, community, employees and shareholders by: □ Capitalizing on banking dislocation in our region □ Utilizing our exceptional market area to grow a high - quality, loyal customer base □ Offering high - quality, personal service vs. out - of - market competitors and minimizing turnover □ Operating with a “sense of urgency” culture that differentiates us from our competitors □ Continued planning and investing in scalable infrastructure for the “future of banking” □ Maintaining solid asset quality through strong credit culture

Accolades 4 □ Selected by SNL Financial as the 12 th best performing community bank for 2012 in the U.S. (out of more than 750 comm. banks with assets between $500 mm and $5 billion) □ Third consecutive year on SNL’s “best” list □ Named one of the 50 Fastest growing Companies by NJBIZ (New Jersey’s only weekly business journal) □ Won Forbes Enterprise Award honoring visionary small businesses □ Named 2012 Business of the Year among companies with 50 - 100 employees by NJBIZ □ Selected to Inc. 5000 Fastest Growing US Companies

Initial Public Offering 5 □ On February 12, 2013, we became a publicly traded bank holding company; the first successful IPO of a commercial bank since 2011 in the U.S. and the first in New Jersey since 2003 □ Issued 1.8 million shares raising net proceeds of $47.8 million □ Priced at a premium to tangible book value. □ Provides the capital required to fund future growth and maintain our momentum □ Offers liquidity to our stockholders □ Assists in attracting new management talent □ Gives us a “seat at the table” for potential opportunistic acquisitions

Our Experienced Management Team 6 Frank Sorrentino III, Chairman and Chief Executive Officer □ Founding Chairman in 2005 and CEO since 2007 □ Recognized industry commentator, frequently appearing in public media including CNBC, Fox News, Forbes.Com , WSJ William S. Burns, Chief Financial Officer □ 34 years of experience in the financial services industry □ Former CFO of Somerset Hills Bancorp and The Trust Company of New Jersey Elizabeth Magennis , Chief Lending Officer □ 24 years of experience in the banking industry and CLO of the Company since 2007 Laura Criscione, Chief Compliance Officer □ 22 years of experience in the banking industry including former CFO of the Company Aditya Kishore, Chief Technology/Operations Officer □ 20 years of experience in the financial services and technology industries Peter Tomasi , Chief Credit Officer □ 40 years experience in credit and lending, including former positions at Valley National and Hudson Valley Maria Gendelman , Chief Retail Officer □ 20 years experience in retail, including former positions at CapitalOne , Commerce and TD

Balance Sheet Growth 7 $1 Billion!!! $millions

Earnings Growth 8 9 Months 2013 Up 29% From Last Year

Core Profitability driven by Net Interest Income 9 …despite margin compression headwinds ___________ *1 st Nine Months 2013 Annualized $ in millions

Core Profitability driven by increasing Efficiency 10 ___________ Note: All data sourced from SNL Financial *Efficiency Ratio is not a measure recognized under GAAP and is therefore considered a non - GAAP financial measure **Publicly traded commercial banks with total assets between $500 mm and $2 b. Efficiency Ratio* Average of U.S. Community Banks **

Loan Composition ($1.031 B as of 9/30/13) 11 Well - diversified Loan Portfolio

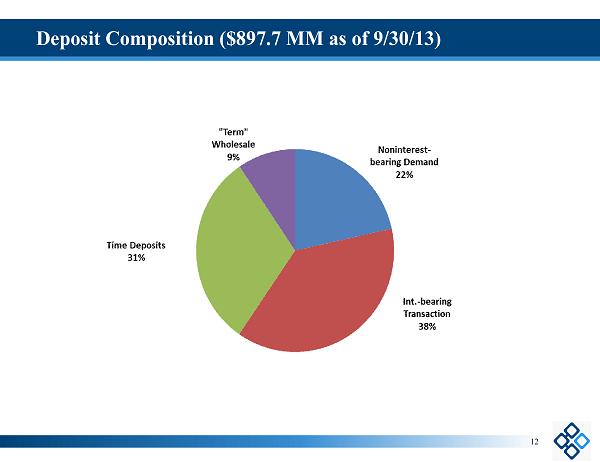

Deposit Composition ($897.7 MM as of 9/30/13) 12

Solid Asset Quality 13 □ Asset Quality remains a priority as we grow □ Asset quality metrics of ConnectOne compare favorably to industry averages: Nonperforming Asset Ratios* ConnectOne Community Bank** Average _____________ *Nonperforming Asset Ratio is defined as nonaccural loans plus OREO as a percentage of Total Assets. **Community Bank Average includes all commercial banks with Total Assets between $500mm and $2billion. Source: SNL Financial

Capital Strength and Access to Capital Markets 14 □ We have a proven track record of raising capital when required to support growth: □ Prior to the IPO, we have raised equity 9 times in private offerings □ In February 2013, we raised $47.8 million in an initial public offering □ We estimate that our current equity position will support growth (at our current pace) for 2 to 3 years. □ Our Tangible Common Equity Ratio of 11.24% as of 9/30/13 is well above the Community Bank* average of 8.52%. _________ * Publicly traded commercial banks with total assets between $500 mm and $2 b as of 6/30/13.

Investment in Infrastructure 15 □ We are constantly investing and adapting our scalable infrastructure to strengthen our competitive position □ Our infrastructure’s strength is in state of the art technology as opposed to brick and mortar u Smart investments in technology have enabled us to be competitive with even the largest banking institutions. Investments include, but not limited to: u Mobile banking u Remote deposit capture banking u Cash management services/Electronic payment solutions u Appropriate structural investments in key areas to ensure quality growth u Credit processes u Compliance and operations u Maintaining and recruiting top talent

Organic Growth - What Sets Us Apart 16 □ Attractive Operating Area u High growth area similar to New York City u Bergen county one of the wealthiest in the Nation □ Our lending niche of $2 million to $10 million is underserved u Most community banks not large enough to close loans in this size range □ Superior customer service u Our “Sense of Urgency” culture is appreciated by clients u Underwriting and closing process much faster than most banks u Repeat customers and referrals □ Focused Marketing u The ConnectOne message solidifies our reputation as banking industry experts

Non - Organic Growth Opportunities 17 □ Going public earlier this year gave us a “seat at the table”, something we never had before □ We recognize that our industry is consolidating and that valuations, including ours, can benefit from economies of scale associated with correctly priced and well - executed M&A □ Our marketplace has many small banks with insufficient infrastructures trading at discounted pricing multiples □ Increasing investor acceptance of merger - of - equals transactions □ Unlike many banking institutions, we are not reliant on acquisitions to grow and improve our franchise value We will be opportunistic – Shareholder Value is our #1 consideration

Building Shareholder Value 18

Dynamic growth story; solid financial performance and momentum Highly attractive franchise in key markets in NJ Unique service culture: customer - centric, relationship - oriented banking approach Solid asset quality and strong credit culture Engaged and experienced management team and board Stock trading at an attractive 13.7x 2014 EPS Estimate (KBW) x x x x x x Compelling Investment Opportunity 19