Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Bristow Group Inc | d626357d8ka.htm |

Second Quarter FY14

Earnings Presentation

Bristow Group Inc.

November 8, 2013

Exhibit 99.1 |

2

Second quarter earnings call agenda

Introduction

CEO remarks and operational highlights

Current and future financial performance

Closing remarks

Questions and answers

Linda McNeill, Director Investor Relations

Bill Chiles, President and CEO

Jonathan Baliff, SVP and CFO

Bill Chiles, President and CEO |

3

Forward-looking statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

include

statements

about

our

future

business,

operations, capital expenditures, fleet composition,

capabilities and results; modeling information, earnings and adjusted earnings

growth guidance, expected operating margins, cash flow stability and other

financial projections; future dividends, share repurchases and other uses of excess cash; plans, strategies

and objectives of our management, including our plans and strategies to grow

earnings and our business, our general strategy going

forward

and

our

business

model;

expected

actions

by

us

and

by

third parties, including our customers, competitors and

regulators; impact of grounding and the effects thereof; the valuation of our

company and its valuation relative to relevant financial indices;

assumptions underlying or relating to any of the foregoing, including assumptions regarding factors impacting our business,

financial

results

and

industry;

and

other

matters.

Our

forward-looking

statements

reflect

our

views

and

assumptions

on

the

date

of

this

presentation

regarding

future

events

and

operating

performance.

They

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

many

of

which

may

be

beyond

our

control,

that

may

cause

actual

results

to

differ

materially

from

any

future

results,

performance or achievements expressed or implied by the forward-looking

statements. These risks, uncertainties and other factors include fluctuations in the demand for our services; fluctuations in worldwide prices of and demand for natural gas and oil;

fluctuations in levels of natural gas and oil exploration and development

activities; the impact of competition; actions by customers; the risk of

reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and regulations;

changes

in

foreign

exchange

rates

and

controls;

risks

associated

with international operations; operating risks inherent in our

business, including the possibility of declining safety performance; general

economic conditions including the capital and credit markets; our ability to

obtain financing; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our

ability to re-deploy our aircraft to regions with greater demand; our ability

to acquire additional aircraft and dispose of older aircraft through sales

into the aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment program;

availability

of

employees;

political

instability,

war

or

acts

of

terrorism in any of the countries where we operate; and those discussed

under

the

captions

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

our Annual Report on Form 10-K for the fiscal year ended March 31, 2013 and our

Quarterly Report on Form 10-Q for the quarter ended September 30, 2013.

We do not undertake any obligation, other than as required by law, to update or revise any forward-

looking statements, whether as a result of new information, future events or

otherwise. |

4

Chief Executive Officer comments

Bill Chiles,

President

and

CEO |

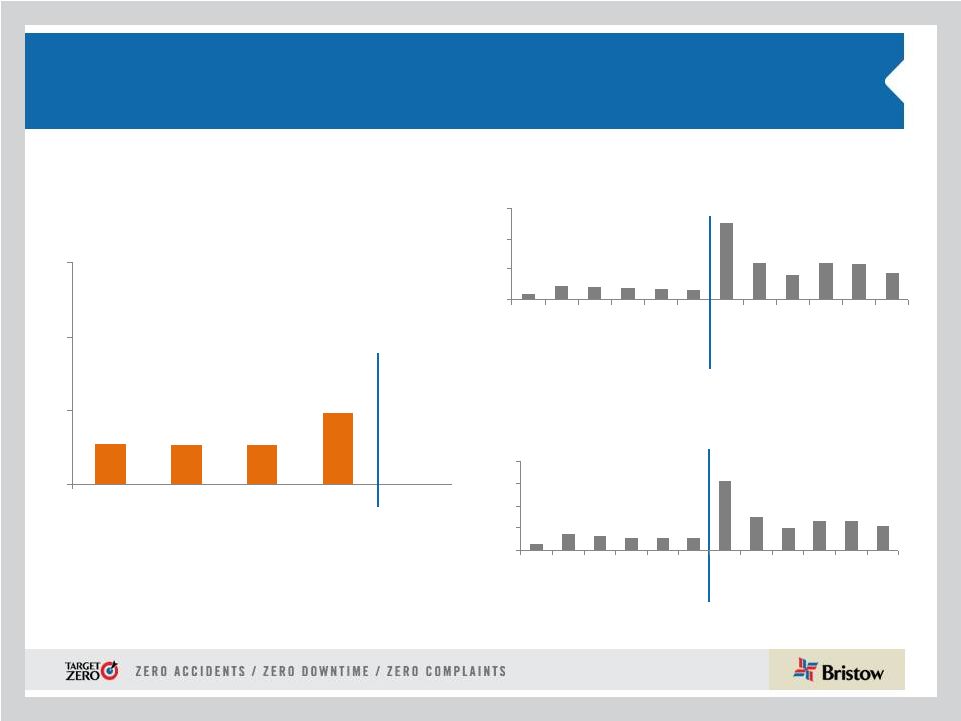

0.09

0.23

0.21

0.19

0.17

0.16

1.26

0.59

0.40

0.59

0.58

0.44

0

0.5

1

1.5

O

N

D

J

F

M

A

M

J

J

A

S

0.54

0.53

0.53

0.96

0

0

1

2

3

FY10

FY11

FY12

FY13

YTD FY14

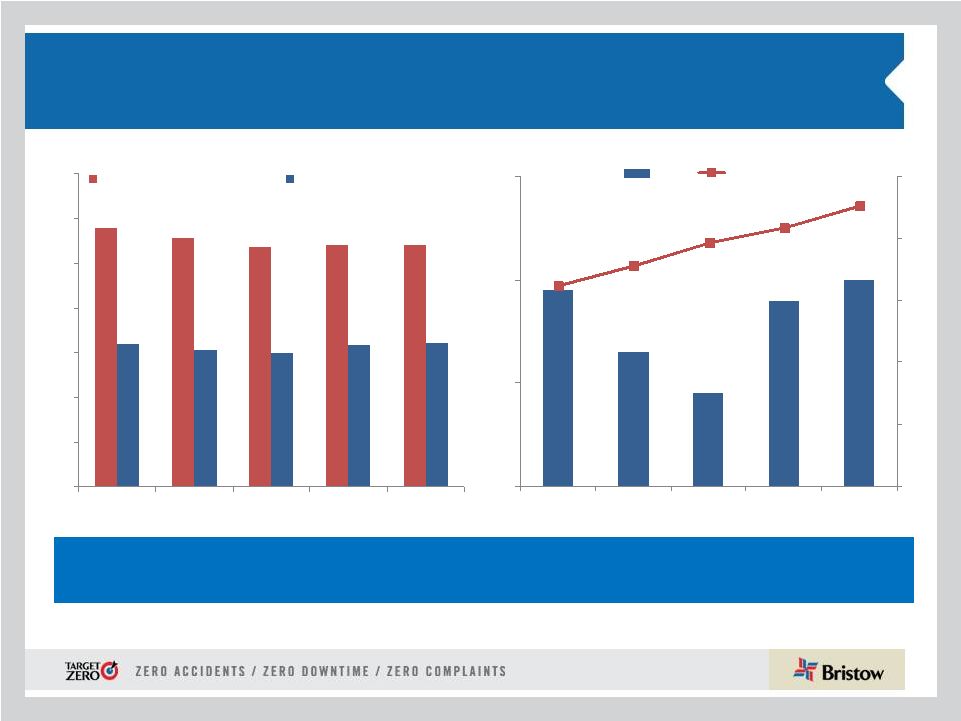

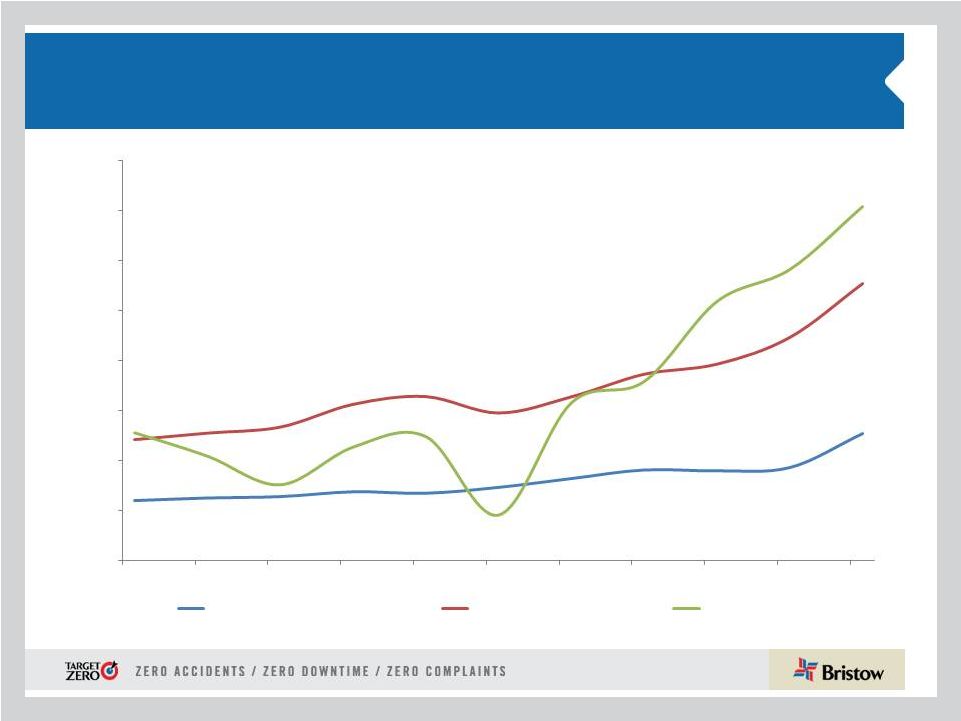

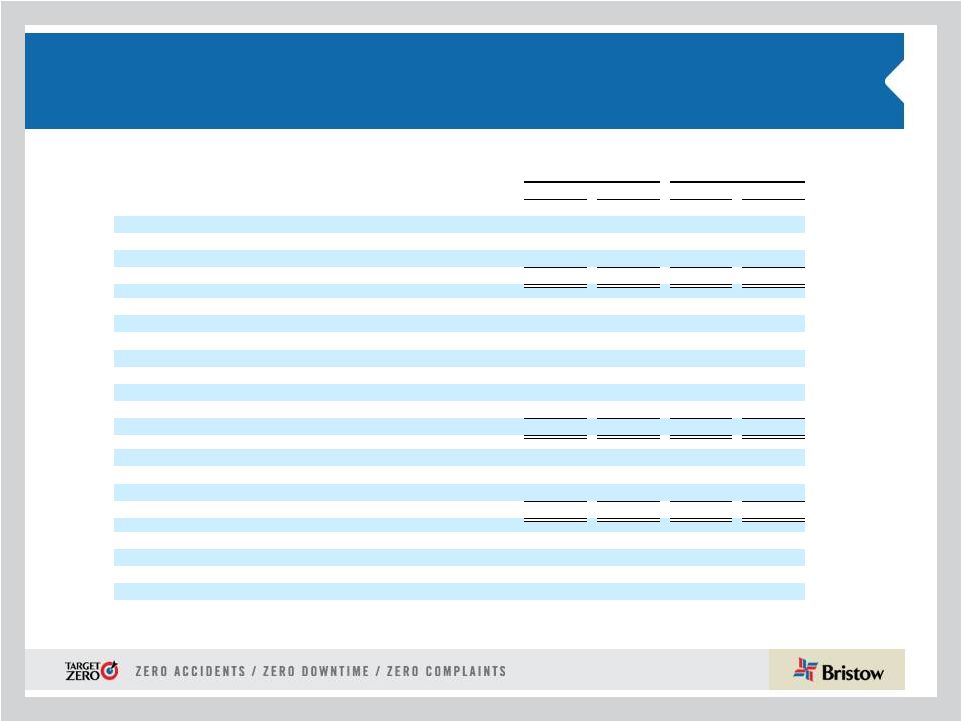

Operational safety review

* Includes consolidated commercial operations only

Total Recordable Injury Rate* per 200,000

man hours (cumulative)

Lost

Work

Case

Rate

*

per

200,000

man hours (cumulative)

Commercial

Air

Accident

Rate

*

per

100,000

flight hours (fiscal year)

FY13

FY14

FY13

FY14

5

0.13

0.35

0.31

0.28

0.28

0.26

1.57

0.74

0.50

0.66

0.64

0.54

0

0.5

1

1.5

2

O

N

D

J

F

M

A

M

J

J

A

S |

6

Q2 FY14 highlights

* Adjusted

EPS

and

adjusted

EBITDAR

amounts

exclude

gains

and

losses

on

dispositions

of

assets

and

any

special

items

during

the

period.

See

reconciliation

of

these

items

to

GAAP

measures

in

the

appendix

hereto

and

in

our

earnings

release

for

the

quarter

ended September 30, 2013.

** Please see our earnings release for more information regarding earnings

guidance. •

Q2 operating revenue of $378.6M (16.2% increase from Q2 FY13, 5.3% increase from

Q1 FY14) •

Q2

GAAP

EPS

of

$3.01

(267.1%

increase

from

Q2

FY13,

306.8%

increase

from

Q1

FY14)

•

Q2 adjusted EPS* of $1.27 (58.8% increase from Q2 FY13, 27% increase from Q1

FY14) •

Q2

adjusted

EBITDAR*

of

$108.5M

(27.8%

increase

from

Q2

FY13,

5.9%

increase

from Q1 FY14) •

Excellent top-line performance in Q2 FY14 with an increase in adjusted

EBITDAR driven by EBU and WASBU and the FY14 contribution from Cougar

•

GAAP

EPS

of

$3.01

includes

the

after

tax

gain

on

the

sale

of

our

interest in FB

Heliservices of $1.85 per share; adjusted EPS is $1.27

•

Total liquidity was $618 million even after the record first half’s ~$340

million capex spend for growth

•

Adjusted

EPS

guidance

for

the

full

FY14

is

increased

to

$4.25

-

$4.55** |

7

•

Regulatory approved interim solutions are being implemented, which

include aircraft modifications and new maintenance/operating

procedures. The new redesigned gear shaft is expected to be

available at the earliest in mid-CY14.

•

Five of our EC225s returned to full revenue service in Q2 FY14 and

we estimate that our remaining EC225 aircraft will be available for

return to full revenue service in the second half of FY14

•

Subsequent to the August 2013 AS332 L2 accident in U.K. Bristow

joined Avincis/Bond and CHC in a Joint Operator’s Review of Safety

to identify and share best practices in the offshore helicopter industry,

with a view to significantly enhance safety

•

Bristow intends to readily and actively participate in the U.K.’s

Parliamentary Inquiry on helicopter safety which commenced

November 6, 2013

Super Puma fleet update |

8

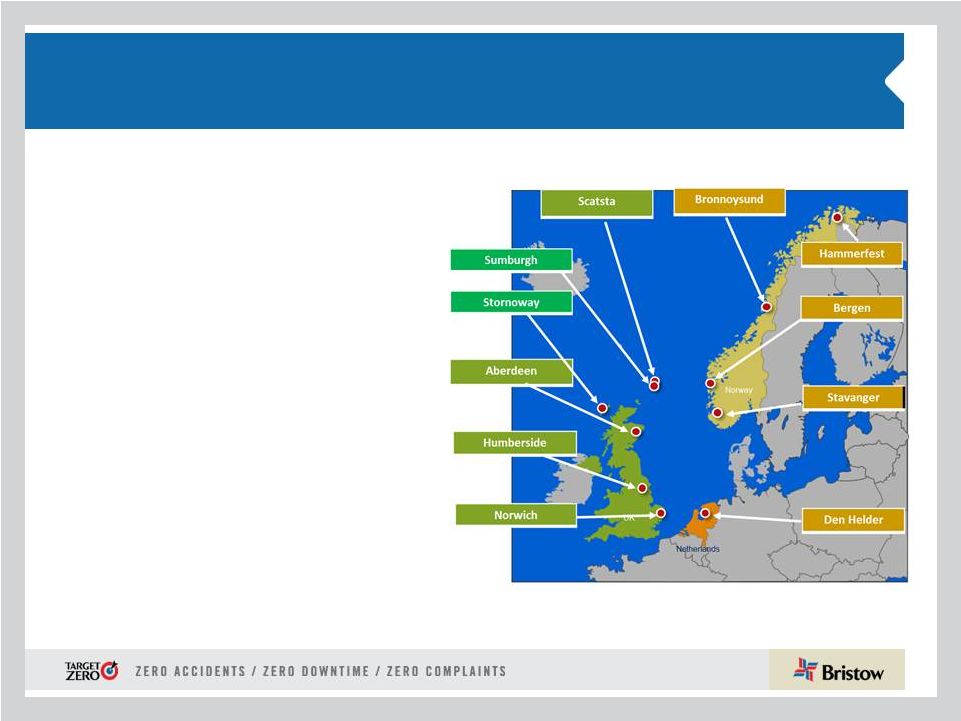

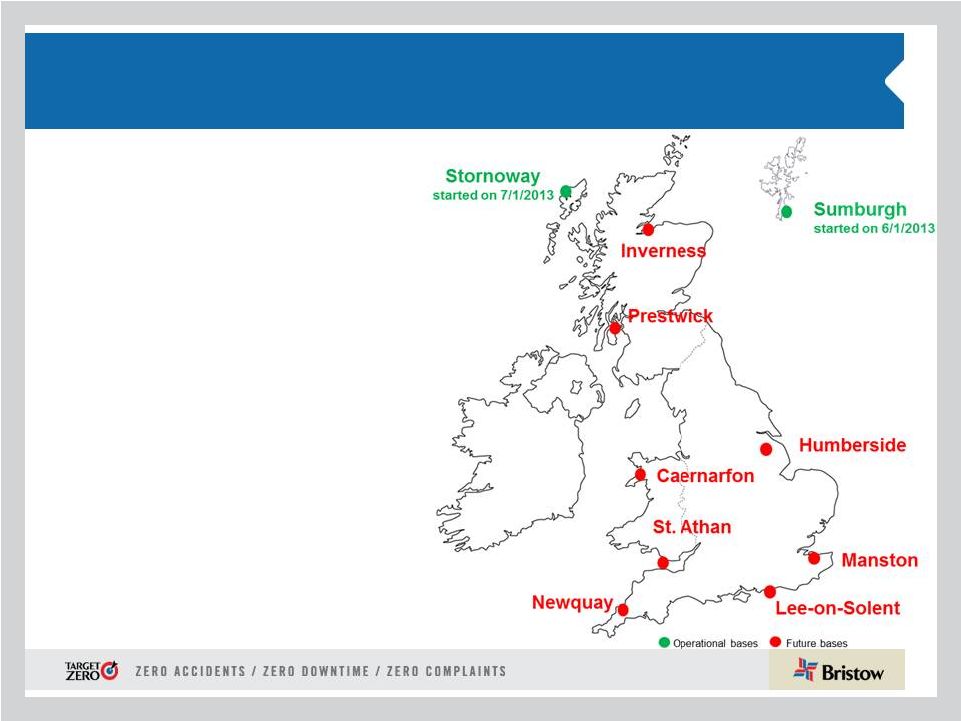

•

Europe contributed 43% of Bristow operating

revenue and 47% of adjusted EBITDAR* in Q2

FY14

•

Operating revenue increased to $156.4M in Q2

FY14 from $125.0M in Q2 FY13 with the addition

of eight new large a/c over the comparable

quarter and new contracts in the Northern North

Sea

•

Adjusted EBITDAR increased to $55.2M in Q2

FY14 from $43.2M in Q2 FY13 and adjusted

EBITDAR margin increased to 35.3% in Q2 FY14

from 34.6% in Q2 FY13 due to top line growth

and start of the GAP SAR operations

Outlook:

•

Previously announced a/c awards now

entering service

•

Expanding Sumburgh base for future

opportunities in East and West Shetlands

FY14 adjusted EBITDAR margin

Europe (EBU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other expected to be ~ mid thirties |

9

SAR update

•

Since the start of the Gap SAR contract,

we have conducted over 120 missions

and rescued and/or assisted over 110

persons

•

Sumburgh and Stornoway bases

generated $11.9M of revenue in Q2

FY14

•

Construction of first two UK SAR bases

has commenced

Outlook:

•

Finalizing lease documents for

aircraft

•

Up to 16 new SAR a/c

opportunities in various countries

including Australia, Brazil, the

Falklands, Libya, Netherlands and

Nigeria |

10

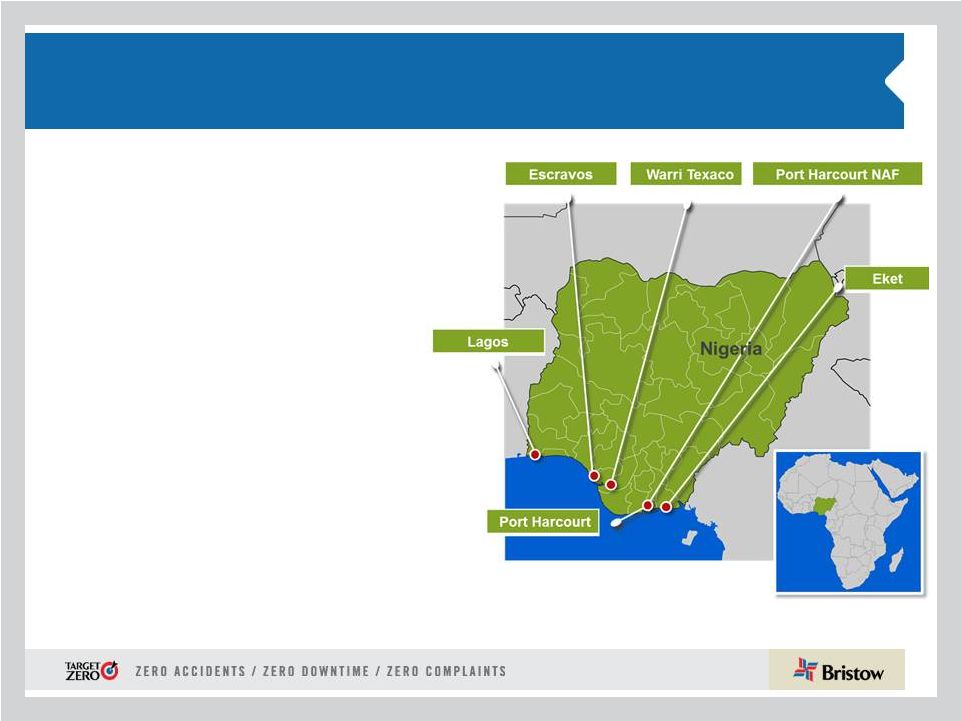

West Africa (WASBU)

•

Nigeria contributed 21% of Bristow operating

revenue and 20% of adjusted EBITDAR* in Q2

FY14

•

Operating revenue increased by 16.2% to $75.9M

in Q2 FY14 from $65.3M in Q2 FY13 due to

increased pricing, ad hoc flying and new contracts

•

Adjusted EBITDAR increased to $23.1M in Q2

FY14 from $17.3M in Q2 FY13 and adjusted

EBITDAR margin increased to 30.4% in Q2 FY14

vs. 26.5% in Q2 FY13 due to increased revenue

that was partially offset by an increase in

maintenance expense

Outlook:

•

Discussions with several IOCs for additional

deepwater support

•

Ongoing renewal tenders for twelve older

technology medium a/c with new technology

a/c

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other FY14 adjusted EBITDAR margin

expected to be ~ low thirties |

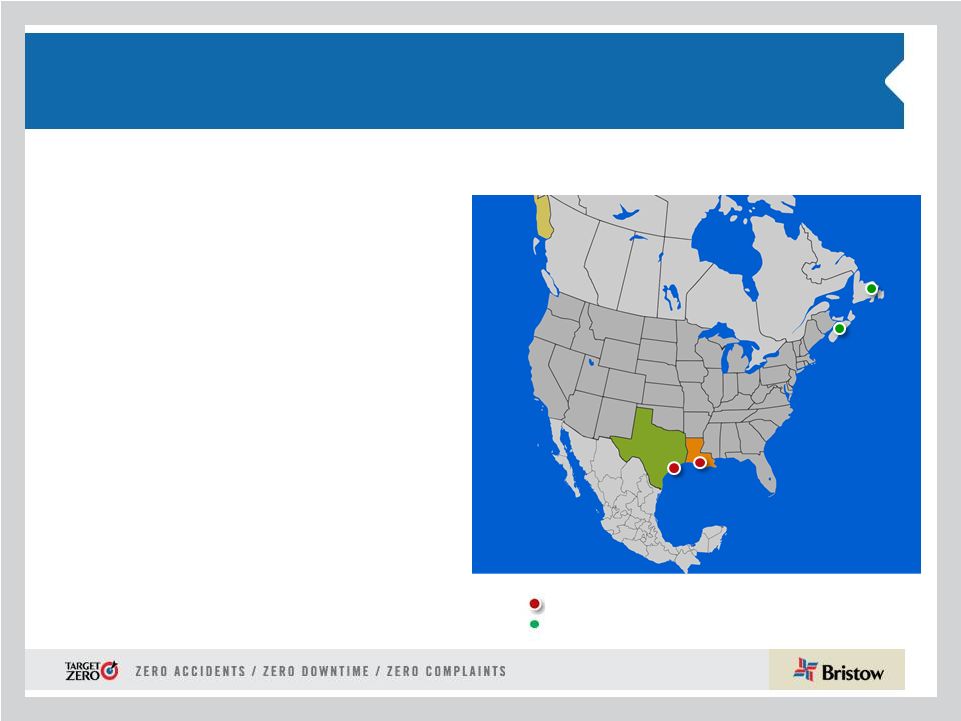

11

•

North America contributed 17% of Bristow operating

revenue and 16% of adjusted EBITDAR* in Q2 FY14

•

Operating revenue increased 5.9% to $60.4M in Q2

FY14 from $57.0M in Q2 FY13 primarily as a result

of the addition of eight aircraft dry leased to Cougar

in Canada offset by a decline in small a/c revenue

elsewhere

•

Adjusted EBITDAR increased to $18.7M in Q2 FY14

vs. $11.8M in Q2 FY13 and adjusted EBITDAR

margin increased to 31.0% vs. 20.7% in Q2 FY13

Outlook:

•

In the process of exiting our non core business in

Alaska

•

We continue to divest small a/c in response to

clients’

increasing demand for larger new

technology a/c

•

Recently signed LOI to sell our entire fleet of Bell

206 L4s as we focus on future deepwater growth

with higher margin large a/c

FY14 adjusted EBITDAR margin

expected to be ~ low thirties

North America (NABU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Bristow operated bases

Cougar operated bases |

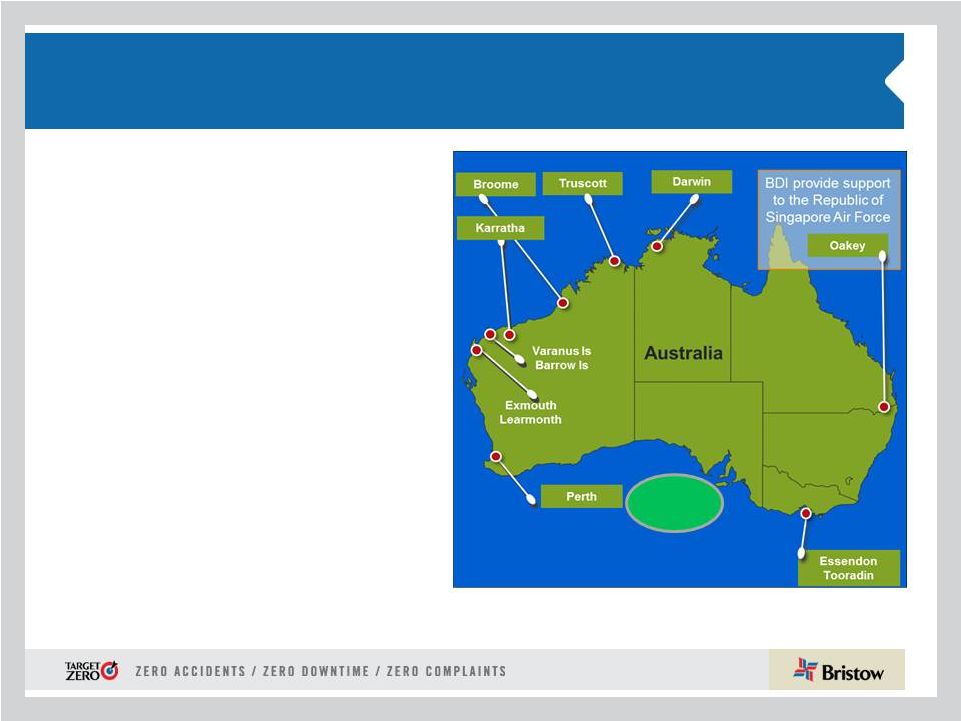

12

Australia (AUSBU)

•

Australia contributed 10% of Bristow operating

revenue and 6% of adjusted EBITDAR* in Q2

FY14

•

Operating revenue decreased to $35.3M in Q2

FY14 from $38.4M in Q2 FY13 due to the ending

of short term contracts and the negative impact of

foreign currency exchange rate changes

•

Adjusted EBITDAR decreased to $7.4M in Q2

FY14 from $10.8M in Q2 FY13 and adjusted

EBITDAR margin decreased to 21.0% in Q2 FY14

from 28.0% in Q2 FY13 due to costs incurred in

anticipation of contracts that are due to start in Q4

FY14, including INPEX

Outlook:

•

Two S-92s to arrive this month for new work

starting in Q4 FY14

•

Two new oil and gas SAR opportunities

•

Exploration opportunities materializing in the

Great Australian Bight

FY14 adjusted EBITDAR margin

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Great

Australian

Bight

expected to be ~ low twenties

Great

Australian

Bight |

13

Other International (OIBU)

Other International (OIBU)

•

Other International contributed 9% of Bristow operating

revenue and 11% of adjusted EBITDAR* in Q2 FY14

•

Operating revenue slightly increased to $32.2M in Q2

FY14 vs. $32.1M in Q2 FY13 due to increased activity

in Trinidad and Brazil offset by a decline in aircraft on

contract in Malaysia and the end of a short term

contract in Guyana

•

Adjusted EBITDAR decreased to $12.6M in Q2 FY14

from $14.2M in Q2 FY13 and adjusted EBITDAR margin

decreased to 39.3% in Q2 FY14 from 44.2% in Q2

FY13 due to decline in a/c on contract in Malaysia and

increase in maintenance expense in Russia offset by

increased activity in Brazil and Trinidad.

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other Consolidated in OIBU

Unconsolidated Affiliate

Outlook

:

•

Additional potential contracts in East and North Africa, Russia,Trinidad

and the Falklands

•

•

Líder’s EBITDAR remains very strong

FY14 adjusted EBITDAR margin

expected to be ~ low to mid forties

Petrobras

is

expected

to

issue

a

bid

for

SAR

a/c

in

CY15

–

CY

16 |

14

Financial discussion

Jonathan

Baliff,

SVP and CFO |

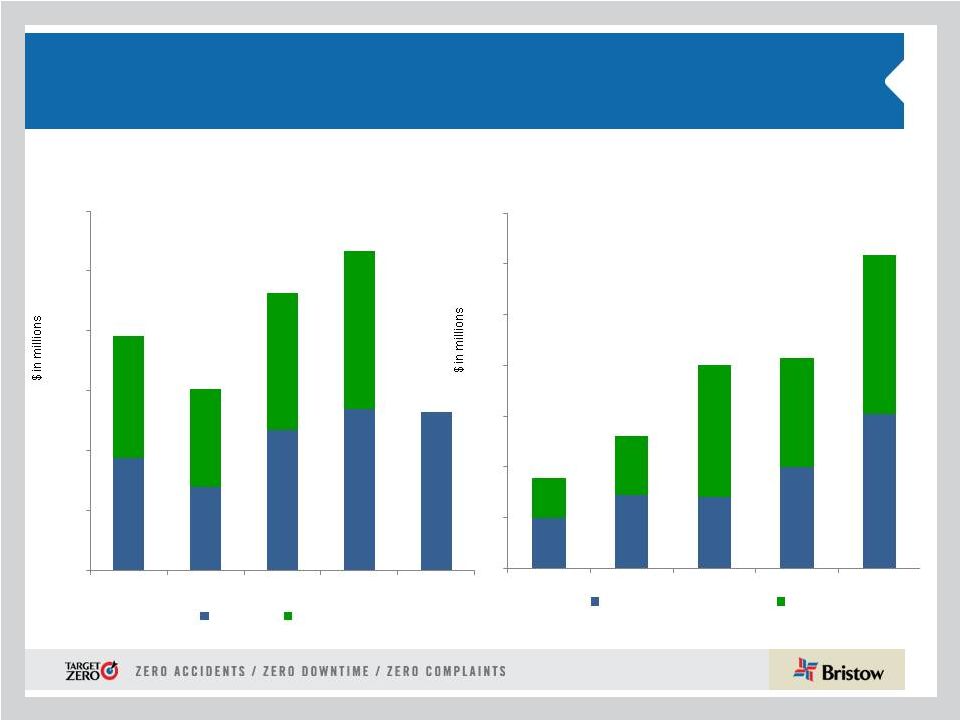

15

$84.9

$108.5

$23.6

$3.3

$3.3

Q2 FY13

Operations

Corporate and Other

FX Changes

Q2 FY14

$0.80

$1.27

$0.61

$0.06

$0.08

Q2 FY13

Operations

Corporate and Other

FX Changes

Q2 FY14

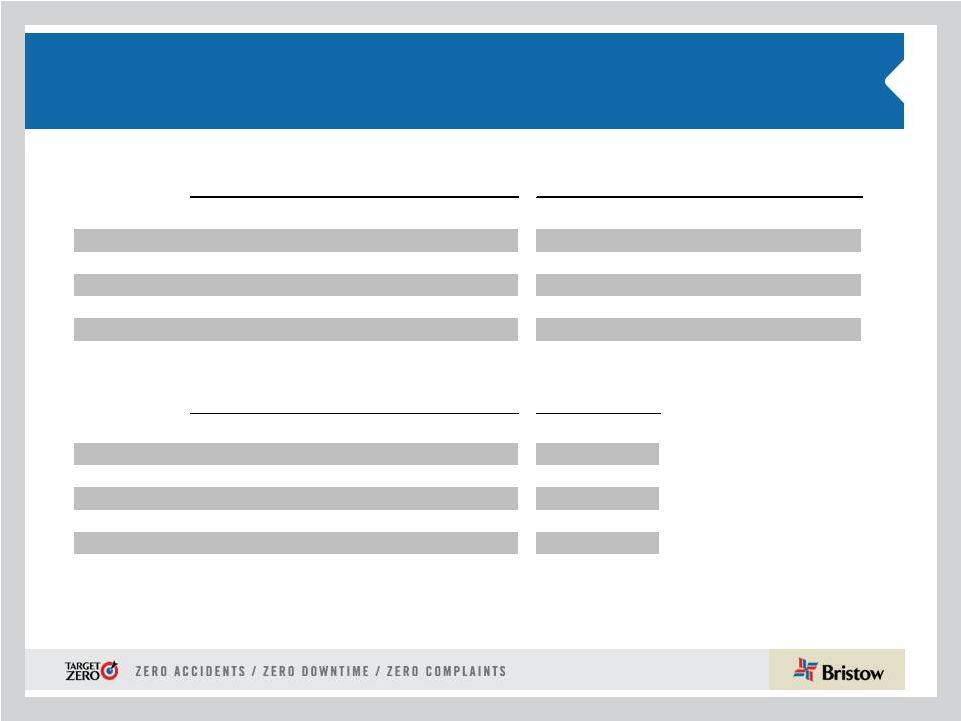

Financial highlights Q2:

Adjusted EPS and EBITDAR summary

Q2 FY13 to Q2 FY14 adjusted EPS bridge

Q2 FY13 to Q2 FY14 adjusted EBITDAR bridge (in millions)

* Adjusted EPS and EBITDAR amounts exclude gains and losses on dispositions of

assets and any special items. See reconciliation of these items to GAAP in the appendix hereto and in our earnings release for the quarter ended

September 30, 2013. |

16

$168.7

$211.8

$38.0

$6.4

$1.3

YTD FY13

Operations

Corporate and Other

FX Changes

YTD FY14

$1.60

$2.28

$0.62

$0.09

$0.03

YTD FY13

Operations

Corporate and Other

FX Changes

YTD FY14

Financial highlights YTD:

Adjusted EPS and EBITDAR summary

YTD FY13 to YTD FY14 adjusted EPS bridge

YTD FY13 to YTD FY14 adjusted EBITDAR bridge (in millions)

* Adjusted EPS and EBITDAR amounts exclude gains and losses on dispositions of

assets and any special items. See reconciliation of these items to GAAP in the appendix hereto and in our earnings release for the quarter ended

September 30, 2013. |

17

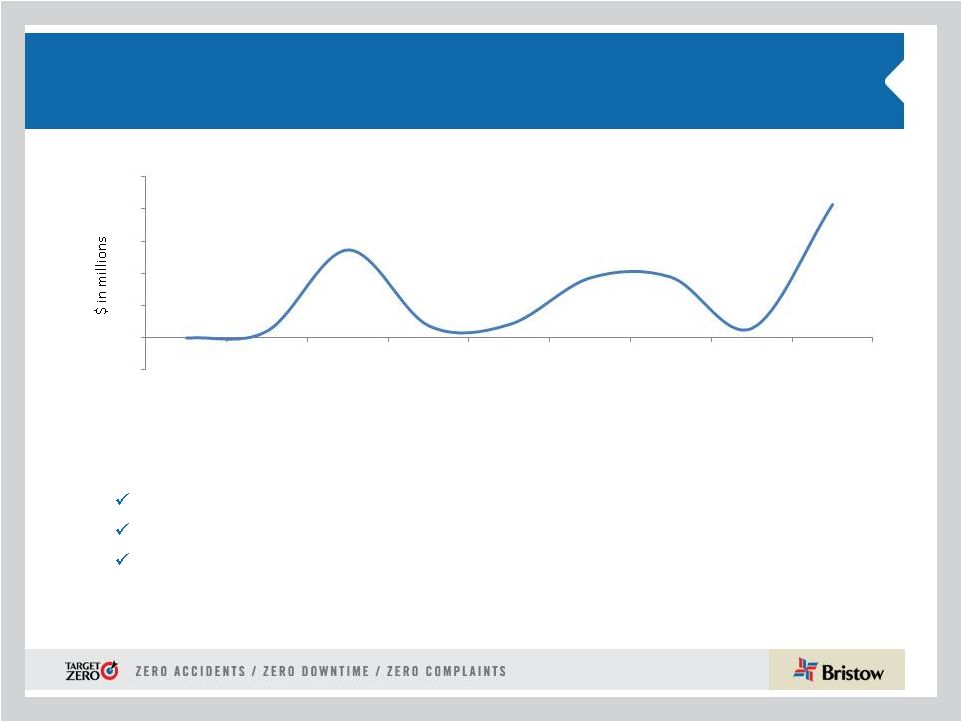

LACE and LACE rate continue to increase led by

new technology a/c and improved utilization/terms

($ in millions)

* See appendix hereto for more information on LACE and LACE Rate. LACE

and LACE Rate excludes Bristow Academy, affiliate a/c, aircraft held for sale, a/c

construction in progress, and reimbursable revenue.

290

279

268

271

271

159

153

149

158

160

0

50

100

150

200

250

300

350

FY10

FY11

FY12

FY13

YTD FY14

159

153

149

158

160

6.494

7.15

7.89

8.35

9.07

0

2

4

6

8

10

140

150

160

170

FY10

FY11

FY12

FY13

YTD FY14

LACE*

LACE Rate*

Shift in fleet management strategy to larger aircraft has led to a slight decrease in FY14 LACE

guidance to 160 - 164 and to an increase in LACE rate guidance of $8.95 - $9.25 Consolidated

commercial

aircraft

Large Aircraft Equivalent (LACE)* |

18

Combination of revenue growth and capital efficiency

drives quarterly BVA improvement

•

Bristow Value Added (BVA) is calculated by taking gross cash flow less the product

of gross operating assets times a capital charge of 10.5%. Example calculation for

Q2 FY14 and Q2 FY13 can be found in the appendix hereto.

Absolute

BVA*

Q2

FY12

–

Q2

FY14

•

Q2 FY14 BVA is positive $20.6M, record improvement of $18.5M over Q2 FY13

•

YTD FY14 consolidated BVA is positive $22.1M, a $18.1M increase from YTD

FY13 •

Year-over-year change in BVA is driven by:

Excellent top line growth which offset record organic capex

Margin improvement and capital efficiency efforts including our successful lease

strategy Lider contributed $11.0M to the YTD BVA of the total business

•

WASBU, EBU and OIBU are the key performers year-over-year

0.0

1.1

13.6

1.9

2.1

9.3

9.4

1.5

20.6

-5

0

5

10

15

20

25

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Q3 FY13

Q4 FY13

Q1 FY14

Q2 FY14 |

Our

progress on BVA yields stronger liquidity for growth . . .

Net cash provided by operating activities*

* See 10-Q for more information on cash flow provided by operating

activities Total liquidity

94

69

117

135

132

0

50

100

150

200

250

300

FY10

FY11

FY12

FY13

YTD FY14

YTD period

Full year

195

151

267

231

100

144

140

199

305

78

116

262

216

314

-

100

200

300

400

500

600

700

FY10

FY11

FY12

FY13

YTD FY14

Undrawn borrowing capacity

Cash

178

261

402

415

618

19 |

20

…

with FY14 guidance increased

•

FY14

adjusted

EPS

guidance

increased

to

$4.25

-

$4.55,

excluding

special items and a/c sales. Other specific items include:

* Assuming FY14 revenue earned in same regions and same mix as in FY13

Long

term

adjusted

EPS

growth

of

10

-

15%

combined

with

a

20

-

30%

dividend payout policy reflects management’s commitment to deliver a

more stable, growing and predictable total return for shareholders

LACE (Large AirCraft Equivalent)

~160 - 164

Interest expense

~ $30 - $35M

LACE Rate

~ $8.95 - $9.25M

Rent expense (a/c only)

~$85 - $90M

G & A expense (all inclusive)

~ $160 - $170M

Tax rate*

~ 21 - 24%

Depreciation expense

~ $95 - $100M

Adj. EPS guidance

$4.25 - $4.55 |

21

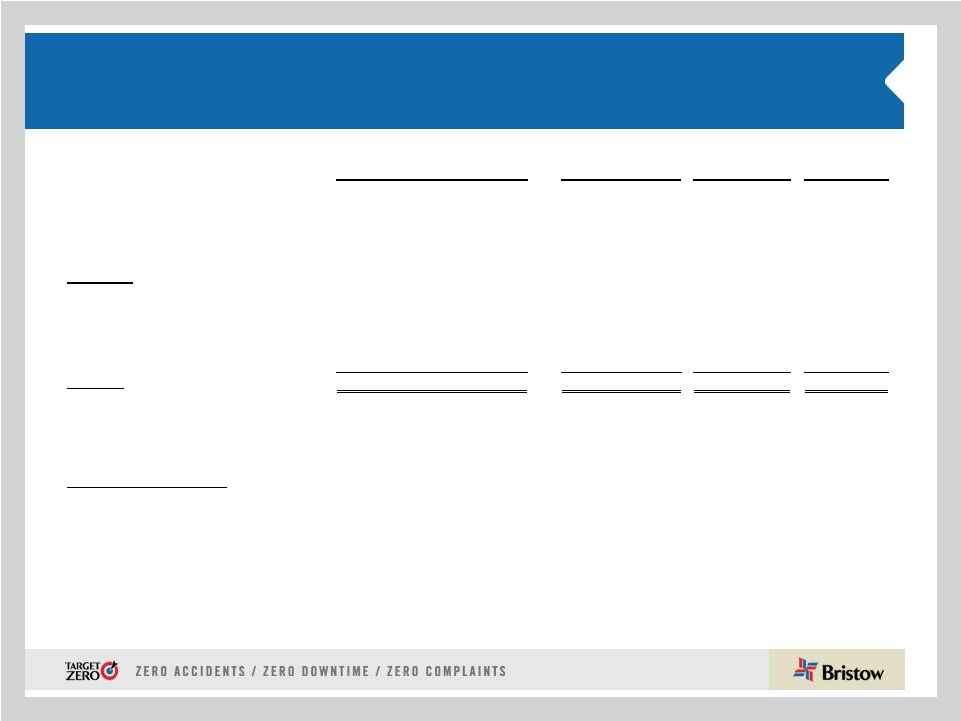

Conclusions

•

Safety continues to be our #1 core value as we strive to achieve

Target

Zero

•

Bristow

is

positioned

in

the

major

markets

that

have

high

growth

for

helicopter services required for offshore drilling, production and SAR

•

Clients are turning to Bristow as their provider of choice due to our size,

global reach, financial strength and operational safety performance

•

Confidence in continued revenue growth and excellent cash flow from core

business

allows

us

to

increase

our

adjusted

EPS

guidance

in

FY14

to

$4.25

-

$4.55

•

Investor Day on November 21, 2013 in New York, where we will focus on

Líder, our affiliate in Brazil, and prospects for this market

|

22

Appendix |

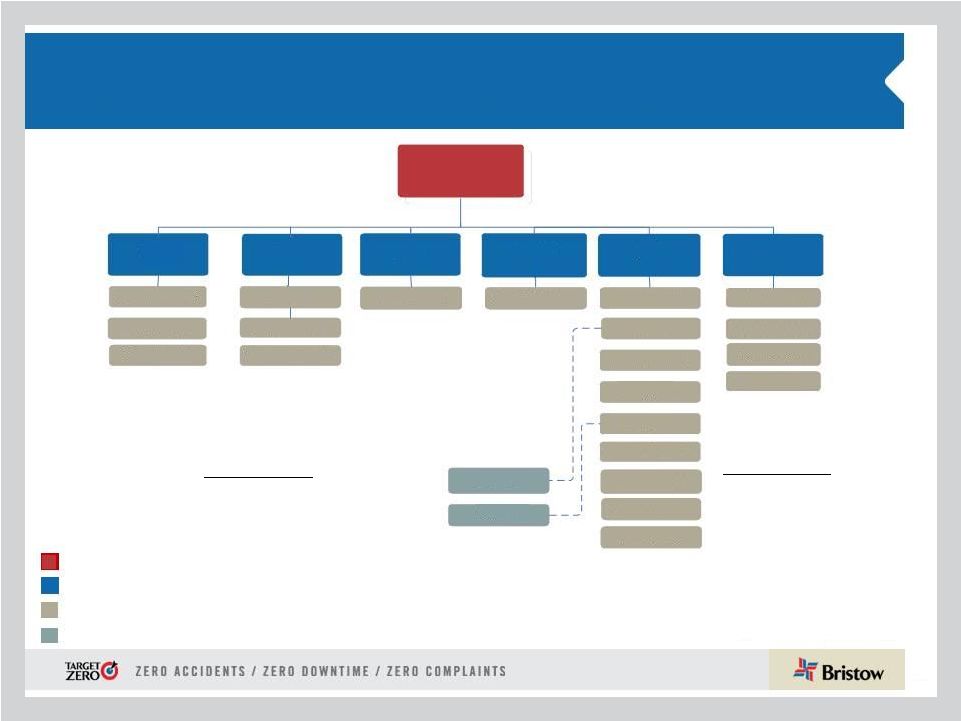

23

Organizational chart -

as of September 30, 2013

Business Unit

(% of FY14 operating revenue)

Corporate

Region

( # of a/c / # of Locations)

Joint Venture

(# of a/c)

Key

Operated Aircraft

Bristow owned and/or operated 350

aircraft as of September 30, 2013

Affiliated Aircraft

Bristow affiliates and joint

ventures operated 127 aircraft

as of September 30, 2013

* Includes corporate and other

Bristow

NABU

16

%

Trinidad –

10/1

Alaska

–

12/3

Mexico –

6/6

Brazil –

11/9

Lider -

85

Norway –

17/4

Nigeria –

44/6

Australia –

24/10

Other –

6/3

Russia –

7/3

Egypt

–

–/–

Turkmenistan

–

2/1

PAS -

42

AUSBU

10

%

EBU

40

%

Florida

–

57/1

Louisiana

–

13/1

U.K. –

3/1

WASBU

21

%

OIBU

9%

BRS Academy

4

%*

Canada

–

8/2

Netherlands –

2/1

Malaysia

-

3/2

Nevada

–

3/1

Tanzania –

21

U.S.

GoM

–

73/6

UK –

45/5 |

24

Aircraft Fleet –

Medium and Large

as of September 30, 2013

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 16-25 passengers

Mature Aircraft

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332 L Super Puma

18

Twin Turbine

20

-

20

-

AW189

16

Twin Turbine

-

-

-

17

EC175

16

Twin Turbine

-

-

-

5

EC225

25

Twin Turbine

20

-

20

3

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

50

7

57

17

99

7

106

42

LACE

99

Medium Helicopters

AW139

12

Twin Turbine

14

2

16

5

Bell 212

12

Twin Turbine

-

14

14

-

Bell 412

13

Twin Turbine

29

17

46

-

EC155

13

Twin Turbine

1

-

1

-

Sikorsky S-76A/A++

12

Twin Turbine

4

5

9

-

Sikorsky S-76C/C++

12

Twin Turbine

51

34

85

-

Sikorsky S-76D

12

Twin Turbine

-

-

-

10

99

72

171

15

LACE

47

Fair market value of our owned fleet is ~$2.0 billion and leased fleet is ~$750 million |

25

Aircraft Fleet –

Small, Training and Fixed

as of September 30, 2013 (continued)

Mature Aircraft

Small capacity 4-7 passengers

Training capacity 2-6 passengers

* LACE does not include held for sale, training helicopters and fixed wing

Next Generation Aircraft

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

AS350BB

4

Turbine

-

2

2

-

Bell 206B

4

Turbine

1

2

3

-

Bell 206 L Series

6

Turbine

28

6

34

-

Bell 407

6

Turbine

36

-

36

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

4

3

7

-

73

13

86

-

LACE

14

Training Helicopters

AS 355

5

Twin turbine

3

-

3

-

Bell 206B

4

Single Engine

12

-

12

-

Robinson R22

2

Piston

11

-

11

-

Robinson R44

4

Piston

5

-

5

-

Sikorsky 300CB/CBi

2

Piston

44

-

44

-

Fixed Wing

1

-

1

-

76

-

76

-

Fixed Wing

3

35

38

-

Total

350

127

477

57

TOTAL LACE (Large Aircraft Equivalent)*

160 |

26

Operating lease strategy: lowering the cost and amount of

capital needed to grow

•

Of the 76 a/c currently leased in our fleet, 46 are commercial (35 LACE) and 30

are training 35 LACE a/c represent approximately 22% of our commercial fleet

•

Our

goal

is

for

commercial

fleet

operating

leases

to

account

for

approximately

30-35% of our LACE

Leased aircraft as of September 30, 2013

Small

Medium

Large

Total

Leased LACE

Total LACE

% Leased

EBU

-

1

20

21

21

59

35%

WASBU

-

1

-

1

1

21

2%

NABU

1

13

3

17

10

33

29%

AUSBU

2

2

3

7

5

19

24%

OIBU

-

-

-

-

-

28

-

Total

3

17

26

46

35

160

22%

See

10-Q

Note

5

“Commitments

and

contingencies”

for

more

information

provided

on

operating

leases |

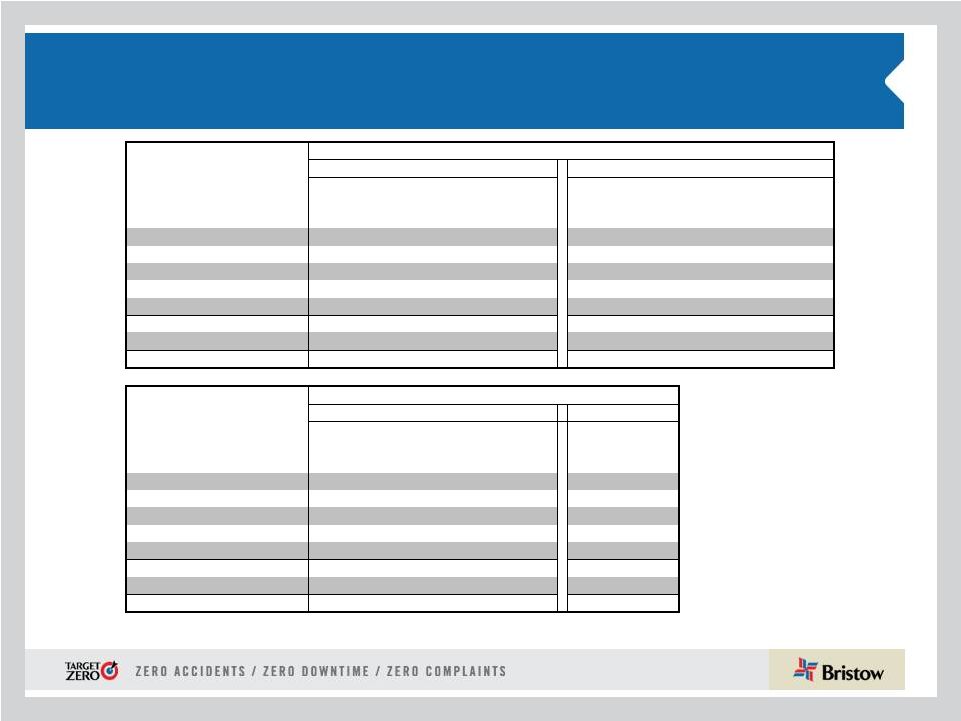

27

Small

Medium

Large

Training

Total

EBU

-

1

20

-

21

WASBU

-

1

-

-

1

NABU

1

13

3

-

17

AUSBU

2

2

3

-

7

OIBU

-

-

-

-

-

Academy

-

-

-

30

30

Total

3

17

26

30

76

Leased aircraft in consolidated fleet

Consolidated fleet changes and aircraft sales for

Q2 FY14

See 10-Q Note 5

“Commitments and contingencies”

for more information provided on operating leases.

Additionally, during Q2 FY14 we sold seven aircraft $145.6M, which we subsequently

leased back. Small

Medium

Large

Training

Total

EBU

-

-

-

-

-

WASBU

-

1

-

-

1

NABU

19

-

-

-

19

AUSBU

-

-

-

-

-

OIBU

-

4

-

-

4

Academy

-

-

-

2

2

Total

19

5

-

2

26

Held for sale aircraft in consolidated fleet

# of a/c Sold

Cash

received*

Q1 FY14

4

2.0

$

Q2 FY14

4

7.9

Total

8

9.9

$

* Amounts stated in millions

Q1 FY14

Q2 FY14

YTD

Fleet Count Beginning

351

353

351

Delivered

-

Large

3

2

5

Medium

2

3

5

Total Delivered

5

5

10

Removed

Sales

(4)

(4)

(8)

Other*

1

(4)

(3)

Total Removed

(3)

(8)

(11)

353

350

350

* Includes lease returns and commencements

Fleet changes |

28

Operating revenue, LACE and LACE Rate by BU

1)

$ in millions

2)

LACE Rate is annualized

3)

$ in millions per LACE

4)

Excludes Bristow Academy

Op revenue

1

LACE

LACE Rate

2,3

EBU

$294

59

$9.95

WASBU

152

21

14.62

NABU

119

33

7.13

AUSBU

74

19

7.74

OIBU

65

28

4.73

Total

$724

160

$9.07

Operating Revenue, LACE and LACE Rate by BU

as of September 30, 2013

4 |

29

Historical LACE by BU

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

EBU

45

45

45

42

42

43

48

46

44

46

46

45

WASBU

23

23

24

25

24

24

21

22

23

22

22

22

NABU

39

36

36

36

39

35

34

29

30

29

30

30

AUSBU

20

20

22

22

20

23

24

20

19

20

20

19

OIBU

36

34

34

35

33

33

33

38

39

38

38

34

Consolidated

163

158

161

160

157

158

159

154

154

154

155

149

Q1

Q2

Q3

Q4

Q1

Q2

EBU

47

45

51

55

57

59

WASBU

22

22

20

21

21

21

NABU

30

31

39

37

37

33

AUSBU

18

17

17

19

19

19

OIBU

32

28

27

27

27

28

Consolidated

147

142

154

158

161

160

LACE

FY11

FY12

FY10

FY13

FY14 |

30

Historical LACE Rate by BU

1) $ in millions

2) LACE Rate is annualized

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

EBU

$8.36

$8.28

$8.40

$8.76

$8.20

$8.50

$7.90

$8.40

$9.80

$9.60

$9.63

$10.09

WASBU

9.08

8.81

8.66

8.34

9.70

9.40

10.70

9.90

9.10

10.30

11.17

11.46

NABU

5.05

5.44

5.26

5.23

5.40

6.10

6.00

6.60

5.80

6.30

5.89

5.79

AUSBU

5.38

5.56

5.59

5.67

6.80

6.00

6.00

7.50

8.60

7.10

6.96

7.78

OIBU

3.66

4.09

4.06

3.78

3.90

4.10

4.40

3.90

3.50

3.70

3.78

4.22

Consolidated

6.31

6.52

6.49

6.45

6.70

6.90

6.90

7.10

7.30

7.40

7.43

7.89

Q1

Q2

Q3

Q4

Q1

Q2

EBU

$10.60

$11.03

$9.74

$9.13

$9.63

$9.95

WASBU

12.35

12.24

13.71

13.28

14.26

14.62

NABU

7.05

7.11

5.84

6.12

6.34

7.13

AUSBU

8.48

9.29

9.55

8.58

8.04

7.74

OIBU

4.22

4.62

4.76

4.94

4.97

4.73

Consolidated

8.55

8.95

8.49

8.35

8.78

9.07

LACE Rate

1,2

FY10

FY11

FY12

FY13

FY14 |

31

Order and options book as of September 30, 2013

* 22 large a/c on order and 6 large a/c on option are subject to the

successful development and certification of the aircraft #

Helicopter

Class

Delivery Date

Location

Contracted

1

Medium

December 2013

OIBU

1 of 1

3

Medium

December 2013

NABU

3

Large

December 2013

EBU

2 of 3

2

Large

December 2013

AUSBU

1

Large

December 2013

WASBU

1

Medium

March 2014

OIBU

1 of 1

1

Large

March 2014

OIBU

1

Large

March 2014

NABU

1 of 1

3

Medium

June 2014

OIBU

3 of 3

1

Large

June 2014

EBU

1

Large

June 2014

OIBU

4

Medium

September 2014

WASBU

2

Medium

September 2014

OIBU

1

Medium

September 2014

NABU

3

Large

September 2014

EBU

2 of 3

1

Large

December 2014

EBU

1

Large

December 2014

AUSBU

1 of 1

1

Large

March 2015

EBU

1

Large

June 2015

EBU

1

Large

September 2015

NABU

1

Large

December 2015

NABU

1

Large

March 2016

EBU

2

Large

March 2016

NABU

1

Large

June 2016

NABU

1

Large

June 2016

EBU

39

11 of 39

ORDER BOOK*

#

Helicopter

Class

Delivery Date

3

Medium

December 2014

4

Large

March 2015

2

Medium

March 2015

3

Large

June 2015

3

Medium

June 2015

3

Large

September 2015

2

Medium

September 2015

3

Large

December 2015

2

Medium

December 2015

3

Large

March 2016

1

Medium

March 2016

3

Large

June 2016

2

Medium

June 2016

3

Large

September 2016

2

Medium

September 2016

4

Large

December 2016

2

Medium

December 2016

3

Large

March 2017

1

Medium

March 2017

3

Large

June 2017

1

Medium

June 2017

3

Large

September 2017

1

Medium

September 2017

4

Large

December 2017

1

Medium

December 2017

1

Large

March 2017

63

OPTIONS BOOK |

32

Order and options book as of September 30, 2013

(continued)

#

Helicopter

Class

Delivery Date

Location

Contracted

1

Large

June 2014

EBU

1 of 1

3

Large

September 2014

EBU

3 of 3

2

Large

December 2014

EBU

2 of 2

4

Large

March 2015

EBU

4 of 4

2

Large

June 2015

EBU

2 of 2

4

Large

September 2015

EBU

4 of 4

2

Large

December 2015

EBU

2 of 2

18

18 of 18

SAR CONFIGURED ORDER BOOK |

33

Adjusted EBITDAR margin* trend

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

EBU

29.8%

31.5%

34.6%

34.4%

32.7%

33.0%

31.4%

30.7%

36.1%

32.9%

WASBU

33.7%

36.9%

35.8%

34.3%

35.2%

29.5%

35.5%

37.2%

36.6%

35.0%

NABU

20.8%

25.8%

15.9%

8.5%

18.5%

14.3%

20.6%

14.8%

19.4%

17.3%

AUSBU

33.2%

26.1%

27.0%

31.1%

29.3%

20.2%

14.4%

23.5%

35.6%

24.3%

OIBU

18.3%

40.2%

37.4%

59.4%

39.3%

48.1%

19.1%

47.8%

42.9%

39.5%

Consolidated

23.8%

27.5%

25.9%

29.6%

26.7%

23.4%

24.0%

27.6%

31.2%

26.6%

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

EBU

32.2%

34.6%

39.5%

38.3%

36.2%

30.3%

35.3%

WASBU

31.9%

26.5%

35.0%

31.8%

31.5%

31.3%

30.4%

NABU

23.2%

20.7%

29.1%

29.5%

25.7%

29.2%

31.0%

AUSBU

27.0%

28.0%

27.3%

26.0%

27.1%

17.7%

21.0%

OIBU

36.2%

44.2%

55.7%

51.6%

46.6%

67.4%

39.3%

Consolidated

26.3%

26.1%

31.5%

29.4%

28.3%

28.5%

28.7%

2011

2012

2013

2014

* Adjusted EBITDAR excludes special items and asset dispositions and margin is calculated by taking

adjusted EBITDAR divided by operating revenue |

34

Adjusted EBITDAR* reconciliation

* Adjusted EBITDAR excludes special items and asset dispositions

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

Net income

$20.9

$38.8

$42.3

$31.2

$133.3

$21.2

$3.0

$26.5

$14.6

$65.2

Income tax expense

8.5

3.3

-11.8

7.1

7.1

6.6

-1.9

7.1

2.4

14.2

Interest expense

11.1

11.5

13.8

9.9

46.2

9.0

9.5

9.8

10.0

38.1

Gain on disposal of assets

-1.7

-1.9

0.0

-5.1

-8.7

-1.4

1.6

2.9

28.6

31.7

Depreciation and amortization

19.3

21.0

21.3

27.7

89.4

22.7

25.4

22.7

25.3

96.1

Special items

0.0

0.0

-1.2

2.4

1.2

0.0

24.6

0.0

3.4

28.1

Adjusted EBITDA Subtotal

58.1

72.7

64.4

73.3

268.5

58.1

62.1

68.9

84.3

273.4

Rental expense

6.6

6.1

8.7

7.7

29.2

9.0

9.1

12.8

15.1

46.0

Adjusted EBITDAR

$64.7

$78.8

$73.1

$81.1

$297.7

$67.0

$71.2

$81.8

$99.5

$319.5

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Net income

$24.2

$30.4

$36.7

$40.4

$131.7

$26.9

$109.9

Income tax expense

6.2

8.3

7.8

12.7

35.0

7.6

41.1

Interest expense

8.8

8.6

14.7

10.3

42.4

20.4

9.1

Gain on disposal of assets

5.3

1.3

-7.4

-7.2

-8.1

1.7

3.1

Depreciation and amortization

21.4

23.3

24.9

26.7

96.3

22.8

23.9

Special items

2.2

-2.3

14.9

1.9

16.2

0.0

-101.8

Adjusted EBITDA Subtotal

68.0

69.6

91.6

84.8

313.5

79.4

85.2

Rental expense

16.3

15.3

17.6

18.3

67.4

23.1

23.3

Adjusted EBITDAR

$84.3

$84.9

$109.2

$103.0

$381.0

$102.5

$108.5

Fiscal year ended,

3/31/2011

3/31/2012

3/31/2013

3/31/2014

Fiscal year ended, |

35

Bristow stock price reflects improved operational

performance and increasing shareholder returns

Note: The net asset FMV per share does not include our UK SAR aircraft

47.67

62.68

70.39

35.00

40.00

45.00

50.00

55.00

60.00

65.00

70.00

75.00

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Sep-12

Dec-12

Mar-13

Jun-13

Sep-13

Book value of equity per share

Net asset FMV per share

Average stock price

$

$

$ |

36

Net asset fair market value (FMV) per share

calculation as of September 30, 2013

(in millions)

(+) FMV of a/c

1,896

$

(+) FMV of leased a/c

753

(+) NBV of PPE w/o a/c

446

(+) Working capital

521

(-) LT debt

(824)

(-) Leased imputed debt

(349)

(-) Pension liability

(127)

Net asset FMV

2,316

$

# of common shares

37

Net asset FMV per share

62.68

$ |

37

Bristow Value Added (BVA)

Sample calculation for Q2 FY14 and Q2 FY13

Bristow

Value

Added

=

Gross

Cash

Flow

–

(Gross

Operating

Assets

X

Capital

Charge)

BVA

= GCF -

(

GOA X 10.5%** )

Bristow Value Added calculation for Q2 FY14

$20.6

= $109.2* -

( $3,376*

X 2.625%**) Bristow Value Added

calculation for Q1 FY13 $2.1

=

$78.8*

-

(

$2,922*

X

2.625%**)

* Reconciliation for these items follows right after this

slide ** Quarterly capital charge of 2.625% is based on annual

capital charge of 10.5% |

38

Gross cash flow reconciliation

(in millions)

Gross Cash Flow Reconciliation

Q2 FY13

Q2 FY14

Net Income

29.7

110.6

Depreciation and Amortization

23.3

23.9

Interest Expense

8.6

9.1

Interest Income

(0.3)

(0.8)

Rent

15.3

23.3

Other Income/expense-net

0.2

(1.5)

Gain/loss on Asset Sale

1.3

3.1

Gain on sale of unconsolidated affiliate - net of tax

0.0

(67.9)

Special Items

0.0

2.9

Tax Effect from Special Items

0.3

(1.3)

Earnings (losses) from Unconsolidated Affiliates, Net

(7.0)

(3.1)

Non-controlling Interests

0.8

(0.7)

Gross Cash Flow (before Lider)

72.2

97.6

Gross Cashflow -Lider proportional

6.6

11.6

Gross Cash Flow after Lider

78.8

109.2 |

39

Adjusted gross operating assets reconciliation

(in millions)

Adjusted Gross Operating Assets Reconciliation

Q2 FY13

Q2 FY14

Total Assets

3,166

Accumulated Depreciation

518

Capitalized Operating Leases

225

373

Cash and Cash Equivalents

(348)

(314)

Investment in Unconsolidated Entities

(215)

(272)

Goodwill

(30)

(30)

Intangibles

(4)

(2)

Assets Held for Sale: Net

(20)

(27)

Assets Held for Sale: Gross

83

56

Adj. for gains & losses on assets sales

120

59

Accounts Payable

(56)

(70)

Accrued Maintenance and Repairs

(19)

(17)

Other Accrued Taxes

(8)

(10)

Accrued Wages, Benefits and Related Taxes

(45)

(49)

Other Accrued Liabilities

(27)

(24)

Income Taxes Payable

(13)

(33)

Deferred Revenue

(13)

(21)

ST Deferred Taxes

(15)

(2)

LT Deferred Taxes

(144)

(155)

Adjusted Gross Operating Assets before Lider

$2,723

$3,146

Adjusted Gross Operating Assets-Lider proportional

199

230

Adjusted Gross Operating Assets after Lider

$2,922

$3,376

2,785

464 |

40

GAAP reconciliation

(i) See information about special items in 10-Q or earnings release for Q2

FY14 (ii)

These amounts are presented after applying the appropriate tax effect to each item

and dividing by the weighted average shares outstanding during the related period to calculate the earnings per share impact

Three Months Ended

September 30,

Six Months Ended

September 30,

2013

2012

2013

2012

(In thousands, except per share amounts)

Adjusted operating income

$

59,087

$

46,274

$

117,752

$

93,276

Loss on disposal of assets

(3,064)

(1,262)

(4,785)

(6,577)

Special items

(i)

(2,088)

2,316

(2,913)

622

Operating income

$

53,935

$

47,328

$

110,054

$

87,321

Adjusted EBITDAR

$

108,508

$

84,922

$

211,806

$

168,727

Loss on disposal of assets

(3,064)

(1,262)

(4,785)

(6,577)

Special items

(i)

101,836

2,316

101,011

622

Depreciation and amortization

(23,858)

(23,321)

(46,677)

(44,693)

Rent expense

(23,314)

(15,282)

(46,375)

(31,556)

Interest expense

(9,078)

(8,597)

(29,448)

(17,371)

Provision for income taxes

(41,146)

(8,342)

(48,736)

(14,522)

Net

income

$

109,884

$

30,434

$

136,796

$

54,630

Adjusted net income

$

46,504

$

29,153

$

83,544

$

58,425

Loss on disposal of assets

(ii)

(2,438)

(990)

(3,780)

(5,196)

Special items

(i) (ii)

66,540

1,505

57,728

101

Net income attributable to Bristow Group

$

110,606

$

29,668

$

137,492

$

53,330

Adjusted diluted earnings per share

$

1.27

$

0.80

$

2.28

$

1.60

Loss on disposal of assets

(ii)

(0.07)

(0.03)

(0.10)

(0.14)

Special items

(i) (ii)

1.81

0.04

1.58

—

Diluted earnings per share

3.01

0.82

3.75

1.46 |

41

Leverage reconciliation

*Adjusted EBITDAR excludes gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of September 30, 2013

831.1

$

1,760.5

$

2,591.6

$

32.1%

Adjust for:

Unfunded Pension Liability

127.3

127.3

NPV of Lease Obligations

348.9

348.9

Letters of credit

2.4

2.4

Adjusted

1,309.6

$

(d)

1,760.5

$

3,070.1

$

42.7%

Calculation of debt to adjusted EBITDAR multiple

TTM Adjusted EBITDAR*:

FY 2014

424.0

$

(e)

= (d) / (e)

3.09:1 |

42

Bristow Group Inc. (NYSE: BRS)

2103

City

West

Blvd.,

4

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact Us

th |