Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Dolan Co. | d622827d8k.htm |

Exhibit 10

EXECUTION VERSION

CONSENT, WAIVER AND SIXTH AMENDMENT TO

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

This CONSENT, WAIVER AND SIXTH AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”), made and entered into as of October 31, 2013, is by and among The Dolan Company, a Delaware corporation (“Dolan”), as a Borrower and as the Borrowers’ Agent, the Subsidiaries of Dolan from time to time party to the Credit Agreement defined below (together with Dolan, the “Borrowers”), the Lenders from time to time party to the Credit Agreement, and U.S. Bank National Association, a national banking association (“USBNA”), as LC Issuer, Swing Line Lender and Administrative Agent.

RECITALS

A. The Borrowers’ Agent, the Borrowers, the Lenders and the Administrative Agent are parties to that certain Third Amended and Restated Credit Agreement dated as of December 6, 2010, as amended by the Omnibus Reaffirmation and Amendment Agreement dated January 31, 2011, the First Amendment to Third Amended and Restated Credit Agreement dated as of September 30, 2011, the Second Amendment to Third Amended and Restated Credit Agreement dated as of March 6, 2012, the Third Amendment to Third Amended and Restated Credit Agreement dated as of October 5, 2012, the Fourth Amendment to Third Amended and Restated Credit Agreement dated as of January 22, 2013, and the Waiver and Fifth Amendment to Third Amended and Restated Credit Agreement dated as of July 8, 2013 (as further amended, supplemented or modified from time to time, the “Credit Agreement”).

B. The Borrowers have requested amendments to the Credit Agreement relating to the consolidation of APC and certain other matters.

C. The Lenders are willing to amend certain provisions of the Credit Agreement, in each case on and subject to the terms of this Amendment.

AGREEMENT

NOW, THEREFORE, for good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto hereby covenant and agree to be bound as follows:

Section 1. Capitalized Terms. Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to them in the Credit Agreement, unless the context shall otherwise require.

Section 2. Amendment. Subject only to the terms of Section 5, the Credit Agreement is hereby amended as follows:

2.1. New Definitions. The definitions of “APC Consolidation Transactions,” “Consolidated Senior Funded Indebtedness,” “Indemnified Taxes,” “Other Connection Taxes,” “Risk-Based Capital Guidelines,” “Senior Leverage Ratio,” “Sixth Amendment,” and “Sixth Amendment Closing Date,” are hereby added to Section 1.1 of the Credit Agreement, which read as follows:

“APC Consolidation Transactions” shall mean the consolidation of the Borrowers’ interests in APC substantially on the terms described in the APC Consolidation Description attached to the Sixth Amendment as Exhibit I.

“Indemnified Taxes” means Taxes imposed on or with respect to any payment made by or on account of any obligation of any Borrower under any Loan Document, other than Excluded Taxes and Other Taxes.

“Other Connection Taxes” means, with respect to any Lender, LC Issuer or Administrative Agent, Taxes imposed as a result of a present or former connection between such Lender, LC Issuer or Administrative Agent and the jurisdiction imposing such Tax (other than connections arising from such Lender, LC Issuer or Administrative Agent having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan or Loan Document).

“Senior Funded Debt” means Total Funded Debt minus Subordinated Debt.

“Risk-Based Capital Guidelines” means (i) the risk-based capital guidelines in effect in the United States on the date of this Agreement, including transition rules, and (ii) the corresponding capital regulations promulgated by regulatory authorities outside the United States, including transition rules, and, in each case, any amendments to such regulations.

“Senior Leverage Ratio”: means, as of any date of calculation, the ratio of (i) Senior Funded Debt outstanding on such date to (ii) Consolidated EBITDA for the Borrowers’ then most-recently ended four (4) fiscal quarters.

“Sixth Amendment”: The Consent and Sixth Amendment to Third Amended and Restated Credit Agreement dated as of October 31, 2013, by and between the Borrowers, the Lenders party to the Credit Agreement, and the Administrative Agent.

“Sixth Amendment Closing Date”: October 31, 2013.

2.2. Amended Definitions. The definitions of “Adjusted EBITDA,” “Aggregate Revolving Commitment,” “Excess Cash Flow,” “Excluded Taxes,” “Facility Termination Date,” “FATCA,” “Minimum Adjusted EBITDA,” “Non-U.S. Lender,” “Other Taxes,” “Revolving Commitment,” and “Taxes” in Section 1.1 of the Credit Agreement are amended in their entirety to read as follows:

2

“Adjusted EBITDA”: For any Person for any period of calculation, the Consolidated Net Income, excluding interest income, of such Person before provision for income taxes and interest expense (including imputed interest expense on Capitalized Leases), but including any non-controlling interest in the net income of Subsidiaries, all as determined in accordance with GAAP, excluding therefrom (to the extent included): (a) depreciation, amortization and goodwill impairment expense; (b) non-operating gains and losses (including extraordinary or nonrecurring gains and losses) from, and reasonable severance charges in connection with, the discontinuance of the operations of the Borrowers’ NDeX Florida, NDeX South, NDeX Indiana, NDeX Michigan and Datastream/LISA businesses and gains arising from the sale of assets (other than inventory) during the applicable period, and charges in fiscal year 2012 in an amount not to exceed $10,000,000 arising from an increase in reserves on accounts receivable from the Albertelli Law Firm; (c) cash distributions paid with respect to non-controlling interests in Subsidiaries; (d) share-based compensation and other non-cash compensation expense; (e) non-cash fair value adjustments on the earnout-related liabilities recorded in connection with Acquisitions; (f) reasonable severance charges in connection with termination of any employees of a Borrower where such termination occurred prior to October 1, 2013, and (g) other non-cash charges acceptable to the Administrative Agent.

“Aggregate Revolving Commitment”: The aggregate of the Revolving Commitments of all the Lenders, as reduced or increased from time to time pursuant to the terms hereof. As of the Sixth Amendment Closing Date, the Aggregate Revolving Commitment is $40,000,000, with step-downs over the remaining term of the Revolving Commitment as follows: $39,500,000 beginning after September 30, 2014.

“Excess Cash Flow”: For any period, (a) Adjusted EBITDA for such period, minus (b) income taxes paid in cash during such period, minus (c) Net Interest Expense paid in cash during such period, minus (d) all scheduled principal payments made in respect of Indebtedness during such period (excluding mandatory prepayments upon the Term Loans or Converted Term Loans made with Excess Cash Flow pursuant to Section 2.6.4), minus (e) any voluntary prepayment of Indebtedness during such period permitted pursuant to Section 6.18, provided that such prepayment is a permanent reduction of such Indebtedness, minus (f) Net Capital Expenditures paid in cash during such period, minus (g) Restricted Payments paid in cash during such period (other than (x) Restricted Payments from one Borrower to another Borrower, (y) stock repurchases made pursuant to Section 6.18(e) and (z) cash dividends made pursuant to Section 6.18(f)), plus or minus (as appropriate) (h) the net change in working capital (excluding changes in cash and Cash Equivalent Investments, changes in current Indebtedness, changes in Revolving Loans, changes in deferred taxes and changes in the deferred revenues), in each case without duplication and as calculated in accordance with GAAP and on a consolidated basis for the Borrowers and their Subsidiaries.

3

“Excluded Taxes” means, in the case of each Lender or applicable Lending Installation, the LC Issuer, and the Administrative Agent, (i) Taxes (a) imposed on its overall net income, franchise Taxes, and branch profits Taxes imposed on it, by the respective jurisdiction under the laws of which such Lender, the LC Issuer or the Administrative Agent is incorporated or is organized or in which its principal executive office is located or, in the case of a Lender, in which such Lender’s applicable Lending Installation is located or (b) that are Other Connection Taxes, (ii) in the case of a Lender or LC Issuer, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender or LC Issuer, with respect to an applicable interest in a Loan or Commitment pursuant to a law in effect on the date on which (x) such Lender or LC Issuer acquires such interest in the Loan or Commitment (other than pursuant to an assignment request by the Borrower under Section 2.19) or (y) such Lender or LC Issuer changes its lending office, except in each case to the extent that, pursuant to Section 3.5, amounts with respect to such Taxes were payable either to such Lender’s or LC Issuer’s assignor immediately before such Lender or LC Issuer became a party hereto or to such Lender or LC Issuer immediately before it changed its lending office, and (iii) any U.S. federal withholding taxes imposed by FATCA.

“Facility Termination Date”: December 31, 2014, or any earlier date on which the Aggregate Commitment is reduced to zero or otherwise terminated pursuant to the terms hereof.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), and any current or future regulations or official interpretations thereof.

“Minimum Adjusted EBITDA”: As of the last day of each month set forth below for the twelve consecutive months ending on the last day of such month, the following amount applicable to such twelve-month period ending on such date: (a) for the period ending September 30, 2013, $29,000,000, (b) for the period ending December 31, 2013, $26,000,000, (c) for the periods ending January 31, 2014, through March 31, 2014, $27,000,000, (d) for the periods ending April 30, 2014, through June 30, 2014, $28,000,000, (e) for the period ending July 31, 2014, $29,000,000, (f) for the period ending August 31, 2014, $30,000,000, (g) for the period ending September 30, 2014, $31,000,000, (h) for the period ending October 31, 2014, $32,000,000, and (i) for the periods ending November 30, 2014, and December 31, 2014, $33,000,000. For the avoidance of doubt, there is no Minimum Adjusted EBITDA for the twelve-month periods ending on October 31, 2013 and November 30, 2013.

“Non-U.S. Lender” means a Lender that is not incorporated under the laws of the United States of America or a state thereof.

4

“Other Taxes” means all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document.

“Revolving Commitment”: For each Lender, the obligation of such Lender to make Revolving Loans to, and participate in Facility LCs issued upon the application of, the Borrowers in an aggregate amount not exceeding the amount set forth on Schedule 1 as its Revolving Commitment, as the same may be reduced on a ratable basis to reflect scheduled reductions in the Aggregate Revolving Commitment (as set forth in the definition thereof), modified as a result of any assignment that has become effective pursuant to Section 12.3.2 or otherwise modified from time to time pursuant to the terms hereof.

“Taxes”: Any and all present or future taxes, duties, levies, imposts, deductions, charges or withholdings, and any and all liabilities with respect to the foregoing.

2.3. Required Prepayments. Section 2.2(f) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(f) Within five Business Days following the receipt thereof, the Borrowers shall, at any time a Term Loan or Converted Term Loan is outstanding, prepay to the Administrative Agent for the benefit of the Lenders (i) one hundred percent (100%) of the cash proceeds of any Divestiture Transaction received by the Borrower, net of the actual cash expenses and taxes paid by any Borrower in connection with such sale, (ii) all payments received on any Pledged Note received by any Borrower, and (iii) all amounts received by any Borrower pursuant to the proceeding described in the Divestiture Side Letter. All prepayments under this Section 2.2(f) shall be applied pro rata first to the unpaid principal balance of the Term Loans and the Converted Term Loans in inverse chronological order of the maturities (and pro-rata among such maturities). For purposes of this Section 2.2(f), cash proceeds of any Divestiture Transaction shall include payments (net of actual cash expenses) under the Software Purchase and Transition Services Agreement and the Trademark Assignment, each dated as of July 9, 2013, entered into in connection with the sale of NDeX South, but exclude payments under other continuing technology agreements with the purchasers in the Divestiture Transactions.

2.4. Excess Cash Flow. Section 2.6.4 of the Credit Agreement is hereby amended and restated in its entirety as follows:

2.6.4. Mandatory Prepayments of Excess Cash Flow. Commencing with the fiscal year ending December 31, 2013, on December 31 and June 30 of each fiscal year, for the twelve month period ending December 31, 2013 and for any six-month period ending on December 31 or June 30 thereafter that the Total

5

Cash Flow Leverage Ratio is greater than or equal to 3.00 to 1.00, calculated as of the last day of such twelve-month or six-month period, not later than 90 days immediately following the last day of such twelve-month or six-month period, the Borrowers shall prepay the Terms Loans and Converted Term Loans by an amount equal to (A) 62.5% of Excess Cash Flow, if any, for such twelve-month or six-month period, less (B) the amount of all prepayments made by the Borrowers pursuant to Section 2.6.5 that were applied to the Term Loans or the Converted Term Loans during the period from the last Excess Cash Flow payment date to the current Excess Cash Flow payment date. Any such prepayment shall be applied first to the outstanding Term Loans and then to the Converted Term Loans, in each case on a pro rata basis to all remaining scheduled principal payments of the Term Loans or Converted Term Loans, as applicable.

2.5. Mandatory Prepayment for Preferred Stock. Section 2.6.6 of the Credit Agreement is hereby amended and restated in its entirety as follows:

2.6.6 Mandatory Prepayment for Preferred Stock. Upon the issuance of any Preferred Stock, the Borrowers shall prepay the Loans with the Net Cash Proceeds received therefrom immediately upon receipt thereof by Dolan or any other Borrower as follows: all of the Net Cash Proceeds shall be applied ratably to the prepayment of the outstanding Term Loans and the outstanding Converted Term Loans, in each case to the remaining scheduled principal payments thereof in inverse order of maturity and then ratably to the outstanding Revolving Loans with no reduction of the Aggregate Revolving Commitment.

2.6. Additional Fee. Article II of the Credit Agreement is amended by adding a new Section 2.25 to read in its entirety as follows:

2.25. Additional Fee. The Borrowers agree to pay to the Administrative Agent for the account of each Lender according to its ratable share thereof, an additional fee equal to 1.00% of the sum of then outstanding Term Loans and Revolving Commitments on each of April 1, 2014, July 1, 2014, and October 1, 2014.

2.7. Yield Protection, Taxes. Article III of the Credit Agreement is hereby amended and restated in its entirety as follows:

ARTICLE III

YIELD PROTECTION; TAXES

3.1 Yield Protection. If, after the date of this Agreement, there occurs any adoption of or change in any law, governmental or quasi-governmental rule, regulation, policy, guideline, interpretation, or directive (whether or not having the force of law) or in the interpretation, promulgation, implementation or administration thereof by any governmental or quasi-governmental authority, central bank or comparable agency charged with the interpretation or administration thereof, including, notwithstanding the foregoing, all requests,

6

rules, guidelines or directives (x) in connection with the Dodd-Frank Wall Street Reform and Consumer Protection Act or (y) promulgated by the Bank for International Settlements, the Basel Committee on Banking Regulations and Supervisory Practices (or any successor or similar authority) or the United States financial regulatory authorities, in each case of clauses (x) and (y), regardless of the date enacted, adopted, issued, promulgated or implemented, or compliance by any Lender or applicable Lending Installation or the LC Issuer with any request or directive (whether or not having the force of law) of any such authority, central bank or comparable agency (any of the foregoing, a “Change in Law”) which:

(a) subjects any Lender or any applicable Lending Installation, the LC Issuer, or the Administrative Agent to any Taxes (other than with respect to Indemnified Taxes, Excluded Taxes, and Other Taxes) on its loans, loan principal, letters of credit, commitments, or other obligations, or its deposits, reserves, other liabilities or capital attributable thereto, or

(b) imposes or increases or deems applicable any reserve, assessment, insurance charge, special deposit or similar requirement against assets of, deposits with or for the account of, or credit extended by, any Lender or any applicable Lending Installation or the LC Issuer (other than reserves and assessments taken into account in determining the interest rate applicable to Eurocurrency Loans), or

(c) imposes any other condition (other than Taxes) the result of which is to increase the cost to any Lender or any applicable Lending Installation or the LC Issuer of making, funding or maintaining its Eurocurrency Loans, or of issuing or participating in Facility LCs, or reduces any amount receivable by any Lender or any applicable Lending Installation or the LC Issuer in connection with its Eurocurrency Loans, Facility LCs or participations therein, or requires any Lender or any applicable Lending Installation or the LC Issuer to make any payment calculated by reference to the amount of Eurocurrency Loans, Facility LCs or participations therein held or interest or LC Fees received by it, by an amount deemed material by such Lender or the LC Issuer as the case may be,

and the result of any of the foregoing is to increase the cost to such Person of making or maintaining its Loans or Commitment or of issuing or participating in Facility LCs or to reduce the amount received by such Person in connection with such Loans or Commitment, Facility LCs or participations therein, then, within fifteen (15) days after demand by such Person, the Borrower shall pay such Person, as the case may be, such additional amount or amounts as will compensate such Person for such increased cost or reduction in amount received.

7

3.2 Changes in Capital Adequacy Regulations. If a Lender or the LC Issuer determines that the amount of capital or liquidity required or expected to be maintained by such Lender or the LC Issuer, any Lending Installation of such Lender or the LC Issuer, or any corporation or holding company controlling such Lender or the LC Issuer is increased as a result of (i) a Change in Law or (ii) any change after the date of this Agreement in the Risk-Based Capital Guidelines, then, within fifteen (15) days of demand by such Lender or the LC Issuer, the Borrower shall pay such Lender or the LC Issuer the amount necessary to compensate for any shortfall in the rate of return on the portion of such increased capital or liquidity which such Lender or the LC Issuer determines is attributable to this Agreement, its Outstanding Credit Exposure or its Commitment to make Loans and issue or participate in Facility LCs, as the case may be, hereunder (after taking into account such Lender’s or the LC Issuer’s policies as to capital adequacy or liquidity), in each case that is attributable to such Change in Law or change in the Risk-Based Capital Guidelines, as applicable.

3.3 Availability of Types of Advances; Adequacy of Interest Rate. If the Administrative Agent or the Required Lenders determine that deposits of a type and maturity appropriate to match fund Eurocurrency Loans are not available to such Lenders in the relevant market or the Administrative Agent, in consultation with the Lenders, determines that the interest rate applicable to Eurocurrency Loans is not ascertainable or does not adequately and fairly reflect the cost of making or maintaining Eurocurrency Loans, then the Administrative Agent shall suspend the availability of Eurocurrency Loans and require any affected Eurocurrency Loans to be repaid or converted to Base Rate Advances, subject to the payment of any funding indemnification amounts required by Section 3.4.

3.4 Funding Indemnification. If (a) any payment of a Eurocurrency Loan occurs on a date which is not the last day of the applicable Interest Period, whether because of acceleration, prepayment or otherwise, (b) a Eurocurrency Loan is not made on the date specified by the Borrower for any reason other than default by the Lenders, (c) a Eurocurrency Loan is converted other than on the last day of the Interest Period applicable thereto, (d) the Borrower fails to borrow, convert, continue or prepay any Eurocurrency Loan on the date specified in any notice delivered pursuant hereto, or (e) any Eurocurrency Loan is assigned other than on the last day of the Interest Period applicable thereto as a result of a request by the Borrower pursuant to Section 2.19, the Borrower will indemnify each Lender for such Lender’s costs, expenses and Interest Differential (as determined by such Lender) incurred as a result of such prepayment. The term “Interest Differential” shall mean that sum equal to the greater of zero or the financial loss incurred by the Lender resulting from prepayment, calculated as the difference between the amount of interest such Lender would have earned (from the investments in money markets as of the Borrowing Date of such Advance) had prepayment not occurred and the interest such Lender will actually earn (from like investments in money markets as of the date of prepayment) as a result of the redeployment of funds from the prepayment. Because of the short-term nature of this facility, Borrower agrees that Interest Differential shall not be discounted to its present value.

8

3.5 Taxes.

(a) Any and all payments by or on account of any obligation of any Borrower under any Loan Document shall be made without deduction or withholding for any Taxes, except as required by applicable law. If any applicable law requires the deduction or withholding of any Tax from any such payment, then the applicable Borrowers shall be entitled to make such deduction or withholding and shall timely pay the full amount deducted or withheld to the relevant Governmental Authority in accordance with applicable law and, if such Tax is an Indemnified Tax or Other Tax, then the sum payable by the applicable Borrowers shall be increased as necessary so that after such deduction or withholding has been made (including such deductions and withholdings applicable to additional sums payable under this Section 3.5) the applicable Lender, the LC Issuer or the Administrative Agent receives an amount equal to the sum it would have received had no such deduction or withholding been made.

(b) The Borrowers shall timely pay to the relevant Governmental Authority in accordance with applicable law or at the option of the Administrative Agent timely reimburse it for the payment of, any Other Taxes.

(c) The Borrowers shall indemnify the Lender, the LC Issuer or the Administrative Agent, within fifteen (15) days after demand therefor, for the full amount of any Indemnified Taxes and Other Taxes (including Indemnified Taxes and Other Taxes imposed or asserted on or attributable to amounts payable under this Section 3.5) payable or paid by such Lender, the LC Issuer or the Administrative Agent or required to be withheld or deducted from a payment to such Lender, the LC Issuer or the Administrative Agent and any reasonable expenses arising therefrom or with respect thereto, whether or not such Indemnified Taxes and Other Taxes were correctly or legally imposed or asserted by the relevant governmental authority. A certificate as to the amount of such payment or liability delivered to the Borrower by a Lender or LC Issuer (with a copy to the Administrative Agent), or by the Administrative Agent on its own behalf or on behalf of a Lender or LC Issuer, shall be conclusive absent manifest error.

(d) Each Lender shall severally indemnify the Administrative Agent, within fifteen (15) days after demand therefor, for (i) any Indemnified Taxes and Other Taxes attributable to such Lender (but only to the extent that the Borrowers have not already indemnified the Administrative Agent for such Indemnified Taxes and Other Taxes and without limiting the obligation of the Borrowers to do so), (ii) any Taxes attributable to such Lender’s failure to comply with the provisions of Section 12.2.4 relating to the maintenance of a Participant Register, and

9

(iii) any Excluded Taxes attributable to such Lender, in each case, that are payable or paid by the Administrative Agent in connection with any Loan Document, and any reasonable expenses arising therefrom or with respect thereto, whether or not such Taxes were correctly or legally imposed or asserted by the relevant Governmental Authority. A certificate as to the amount of such payment or liability delivered to any Lender by the Administrative Agent shall be conclusive absent manifest error. Each Lender hereby authorizes the Administrative Agent to set off and apply any and all amounts at any time owing to such Lender under any Loan Document or otherwise payable by the Administrative Agent to the Lender from any other source against any amount due to the Administrative Agent under this paragraph (d).

(e) As soon as practicable after any payment of Taxes by any Borrower to a governmental authority pursuant to this Section 3.5, such Borrower shall deliver to the Administrative Agent the original or a certified copy of a receipt issued by such governmental authority evidencing such payment, a copy of the return reporting such payment or other evidence of such payment reasonably satisfactory to the Administrative Agent.

(f) (i) Any Lender that is entitled to an exemption from or reduction of withholding Tax with respect to payments made under any Loan Document shall deliver to the Borrowers’ Agent and the Administrative Agent, at the time or times reasonably requested by the Borrowers’ Agent or the Administrative Agent, such properly completed and executed documentation reasonably requested by the Borrowers’ Agent or the Administrative Agent as will permit such payments to be made without withholding or at a reduced rate of withholding. In addition, any Lender, if reasonably requested by the Borrowers’ Agent or the Administrative Agent, shall deliver such other documentation prescribed by applicable law or reasonably requested by the Borrowers’ Agent or the Administrative Agent as will enable the Borrowers’ Agent or the Administrative Agent to determine whether or not such Lender is subject to backup withholding or information reporting requirements. Notwithstanding anything to the contrary in the preceding two sentences, the completion, execution and submission of such documentation (other than such documentation set forth in Section 3.5(f)(ii)(A), (ii)(B) and (ii)(D) below) shall not be required if in the Lender’s reasonable judgment such completion, execution or submission would subject such Lender to any material unreimbursed cost or expense or would materially prejudice the legal or commercial position of such Lender.

10

(ii) Without limiting the generality of the foregoing,

(A) any Lender that is a United States Person for U.S. federal income Tax purposes shall deliver to the Borrowers’ Agent and the Administrative Agent on or prior to the date on which such Lender becomes a Lender under this Agreement (and from time to time thereafter upon the reasonable request of the Borrowers’ Agent or the Administrative Agent), executed originals of IRS Form W-9 certifying that such Lender is exempt from U.S. federal backup withholding Tax;

(B) any Non-U.S. Lender shall, to the extent it is legally entitled to do so, deliver to the Borrower and the Administrative Agent (in such number of copies as shall be requested by the recipient) on or prior to the date on which such Non-U.S. Lender becomes a Lender under this Agreement (and from time to time thereafter upon the reasonable request of the Borrower or the Administrative Agent), whichever of the following is applicable:

(1) in the case of a Non-U.S. Lender claiming the benefits of an income Tax treaty to which the United States is a party (x) with respect to payments of interest under any Loan Document, executed originals of IRS Form W-8BEN establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “interest” article of such Tax treaty and (y) with respect to any other applicable payments under any Loan Document, IRS Form W-8BEN establishing an exemption from, or reduction of, U.S. federal withholding Tax pursuant to the “business profits” or “other income” article of such Tax treaty;

(2) executed originals of IRS Form W-8ECI;

(3) in the case of a Non-U.S. Lender claiming the benefits of the exemption for portfolio interest under Section 881(c) of the Code, (x) a certificate to the effect that such Non-U.S. Lender is not a “bank” within the meaning of Section 881(c)(3)(A) of the Code, a “10 percent shareholder” of the Borrower within the meaning of Section 881(c)(3)(B) of the Code, or a “controlled foreign corporation” described in Section 881(c)(3)(C) of the Code and (y) executed originals of IRS Form W-8BEN; or

11

(4) to the extent a Non-U.S. Lender is not the beneficial owner, executed originals of IRS Form W-8IMY, accompanied by IRS Form W-8ECI, IRS Form W-8BEN, IRS Form W-8IMY or IRS Form W-9, and/or other certification documents from each beneficial owner, as applicable.

(C) any Non-U.S. Lender shall, to the extent it is legally entitled to do so, deliver to the Borrower and the Administrative Agent (in such number of copies as shall be requested by the recipient) on or prior to the date on which such Non-U.S. Lender becomes a Lender under this Agreement (and from time to time thereafter upon the reasonable request of the Borrower or the Administrative Agent), executed originals of any other form prescribed by applicable law as a basis for claiming exemption from or a reduction in U.S. federal withholding Tax, duly completed, together with such supplementary documentation as may be prescribed by applicable law to permit the Borrower or the Administrative Agent to determine the withholding or deduction required to be made; and

(D) if a payment made to a Lender under any Loan Document would be subject to U.S. federal withholding Tax imposed by FATCA if such Lender were to fail to comply with the applicable reporting requirements of FATCA (including those contained in Section 1471(b) or 1472(b) of the Code, as applicable), such Lender shall deliver to the Borrowers’ Agent and the Administrative Agent at the time or times prescribed by law and at such time or times reasonably requested by the Borrowers’ Agent or the Administrative Agent such documentation prescribed by applicable law (including as prescribed by Section 1471(b)(3)(C)(i) of the Code) and such additional documentation reasonably requested by the Borrowers’ Agent or the Administrative Agent as may be necessary for the Borrowers’ Agent and the Administrative Agent to comply with their obligations under FATCA and to determine that such Lender has complied with such Lender’s obligations under FATCA or to determine the amount to deduct and withhold from such payment. Solely for purposes of this clause (D), “FATCA” shall include any amendments made to FATCA after the date of this Agreement.

12

(iii) Each Lender agrees that if any form or certification it previously delivered expires or becomes obsolete or inaccurate in any respect, it shall update such form or certification or promptly notify the Borrowers’ Agent and the Administrative Agent in writing of its legal inability to do so.

(g) If any party determines, in its sole discretion exercised in good faith, that it has received a refund of any Taxes as to which it has been indemnified pursuant to this Section 3.5 (including by the payment of additional amounts pursuant to this Section 3.5), it shall pay to the indemnifying party an amount equal to such refund (but only to the extent of indemnity payments made under this Section with respect to the Taxes giving rise to such refund), net of all out-of-pocket expenses (including Taxes) of such indemnified party and without interest (other than any interest paid by the relevant Governmental Authority with respect to such refund). Such indemnifying party, upon the request of such indemnified party, shall repay to such indemnified party the amount paid over pursuant to this paragraph (g) (plus any penalties, interest or other charges imposed by the relevant Governmental Authority) in the event that such indemnified party is required to repay such refund to such Governmental Authority. Notwithstanding anything to the contrary in this paragraph (g), in no event will the indemnified party be required to pay any amount to an indemnifying party pursuant to this paragraph (g) the payment of which would place the indemnified party in a less favorable net after-Tax position than the indemnified party would have been in if the indemnification payments or additional amounts giving rise to such refund had never been paid. This paragraph shall not be construed to require any indemnified party to make available its Tax returns (or any other information relating to its Taxes that it deems confidential) to the indemnifying party or any other Person.

(h) Each party’s obligations under this Section 3.5 shall survive the resignation or replacement of the Administrative Agent or any assignment of rights by, or the replacement of, a Lender, the termination of the Commitments and the repayment, satisfaction or discharge of all obligations under any Loan Document.

(i) For purposes of Section 3.5(d) and (f), the term “Lender” includes the LC Issuer.

3.6 Selection of Lending Installation; Mitigation Obligations; Lender Statements; Survival of Indemnity. To the extent reasonably possible, each Lender shall designate an alternate Lending Installation with respect to its Eurocurrency Loans to reduce any liability of the Borrowers to such Lender under Sections 3.1, 3.2 and 3.5 or to avoid the unavailability of Eurocurrency Loans under Section 3.3, so long as such designation is not, in the judgment of such Lender, disadvantageous to such Lender. Each Lender shall deliver a written

13

statement of such Lender to the Borrowers’ Agent (with a copy to the Administrative Agent) as to the amount due, if any, under Section 3.1, 3.2, 3.4 or 3.5. Such written statement shall set forth in reasonable detail the calculations upon which such Lender determined such amount and shall be final, conclusive and binding on the Borrower in the absence of manifest error. Determination of amounts payable under such Sections in connection with a Eurocurrency Loan shall be calculated as though each Lender funded its Eurocurrency Loan through the purchase of a deposit of the type and maturity corresponding to the deposit used as a reference in determining the Eurocurrency Rate applicable to such Loan, whether in fact that is the case or not. Unless otherwise provided herein, the amount specified in the written statement of any Lender shall be payable on demand after receipt by the Borrower of such written statement. The obligations of the Borrowers under Sections 3.1, 3.2, 3.4 and 3.5 shall survive payment of the Obligations and termination of this Agreement.

2.8. Covenants.

(a) Section 6.1(d) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(d) Together with the financial statements delivered pursuant to (i) Sections 6.1(a) and (b), a Compliance Certificate in the form attached hereto as Exhibit A signed by the chief financial officer of the Borrowers’ Agent on behalf of the Borrowers demonstrating in reasonable detail compliance (or noncompliance, as the case may be) with Sections 6.25, 6.26, 6.27, 6.31 and 6.32 for and as of the end of such period, and (ii) Section 6.1 (c), a certificate signed by the chief financial officer of the Borrowers’ Agent on behalf of the Borrowers setting forth the Borrowers’ Capital Expenditures for such period and for the period from the beginning of the current fiscal year and the end of such period, in each case stating that there did not exist any Default or Event of Default or, if a Default or Event of Default existed, specifying the nature and period of existence thereof and what action the Borrowers propose to take with respect thereto.

(b) Section 6.18 of the Credit Agreement is hereby amended and restated in its entirety as follows:

6.18 No Borrower or Subsidiary will make any Restricted Payments, other than (a) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, payments made under Acquisition Services Agreements, (b) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, Restricted Payments made to repurchase Equity Interests of any Borrower owned by an officer, director, consultant or employee of any Borrower in connection with the termination of such officer’s, director’s, consultant’s or employee’s employment, provided the aggregate amount of such

14

Restricted Payments under this Section 6.18(b) made by the Borrowers in any fiscal year does not exceed $1,000,000, (c) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, Restricted Payments made from one Borrower to another Borrower, (d) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, Restricted Payments consisting of dividends (including tax payments) payable to minority owners of a Subsidiary that is not a Wholly-Owned Subsidiary pursuant to the terms of the relevant constituent document, (e) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, Restricted Payments in the form of cash payments in lieu of the issuance of fractional shares upon conversion of any Permitted Convertible Debt, so long as the aggregate amount of such cash payments by the Borrowers in any fiscal year does not exceed $5,000, (f) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, Restricted Payments in the form of delivery of common stock of Dolan in connection with the conversion or settlement of any Permitted Convertible Debt, (g) so long as no Default or Event of Default has occurred and is continuing nor would result therefrom, payments made in satisfaction of Dolan’s obligations under Section 7.7 of the DiscoverReady LLC Agreement, as may be amended from time to time in accordance with the terms of this Agreement, and (h) Restricted Payments consisting of cash dividends payable to the holders of Preferred Stock, so long as (i) the dividend rate in respect of such Preferred Stock was approved in writing by the Administrative Agent on or prior to the issuance thereof, (ii) the aggregate amount of such cash payments by the Borrowers in any fiscal year does not exceed $1,500,000, and (iii) the Net Cash Proceeds of such Preferred Stock are used to pay down the Loans in accordance with Section 2.6.6, and (iv) no Event of Default under Section 7.2 exists.

(c) Section 6.21 of the Credit Agreement is amended by deleting subsection (h) thereof and substituting the following therefor:

(h) Investments by any Borrower in DiscoverReady to the extent existing on the Sixth Amendment Closing Date;

(d) Sections 6.25, 6.26, 6.27 and 6.31 of the Credit Agreement are hereby amended and restated in their entirety as follows:

6.25. Fixed Charge Coverage Ratio. The Borrowers and their Subsidiaries will not permit the Fixed Charge Coverage Ratio, as of the last day of each month set forth below for the period of the twelve consecutive months ending on the dates indicated, to be not less than (a) 1.20 to 1.00 for the period ending on September 30, 2013, (b) 1.15 to 1.00 for the period ending on December 31, 2013 and for the periods ending January 31, 2014, through March 31, 2014, (c) 1.00 to 1.00 for the periods ending April 30, 2014, through August 31, 2014, (c) 1.10 to 1.00 for the

15

period ending September 30, 2014, and (d) 1.15 to 1.00 for the periods ending October 31, 2014, through December 31, 2014. For the avoidance of doubt, there is no Fixed Charge Coverage Ratio requirement for the twelve-month periods ending on October 31, 2013 and November 30, 2013.

6.26. Total Cash Flow Leverage Ratio. The Borrowers and their Subsidiaries will not permit the Total Cash Flow Leverage Ratio, as of the last day of each month set forth below for the period of the twelve consecutive months ending on the dates indicated, to be equal to or more than (a) 4.50 to 1.00 for the period ending on September 30, 2013, (b) 5.00 to 1.00 for the period ending December 31, 2013, and for the periods ending January 31, 2014, and February 28, 2014, (c) 4.75 to 1.00 for the period ending March 31, 2014, (d) 4.25 to 1.00 for the period ending April 30, 2014, (e) 3.00 to 1.00 for the period ending May 31, 2014, (f) 2.75 to 1.00 for the period ending June 30, 2014, and (g) 2.50 to 1.00 for each period ending the last day of a month thereafter. For the avoidance of doubt, there is no Total Cash Flow Leverage Ratio requirement for the twelve-month periods ending on October 31, 2013 and November 30, 2013.

6.27. Minimum Adjusted EBITDA. The Borrowers and their Subsidiaries will not permit the Borrowers’ Adjusted EBITDA, as of September 30, 2013, December 31, 2013 and the last day of each month thereafter, to be less than the Minimum Adjusted EBITDA.

6.31. Maximum Capital Expenditures. The Borrowers and their Subsidiaries will not permit Capital Expenditures in the aggregate for the Borrowers and their Subsidiaries in excess of (a) $6,400,000 for the fiscal year ending December 31, 2013; and (b) $3,900,000 in the fiscal year ending December 31, 2014.

2.9. Additional Covenants. Article VI of the Credit Agreement is amended by adding a new Section 6.32, a new Section 6.33 and a new Section 6.34 to read in their entirety as follows:

Section 6.32. Senior Leverage Ratio. The Borrowers and their Subsidiaries will not permit the Senior Leverage Ratio as of the last day of each month set forth below for the period of the twelve consecutive months ending on the dates indicated, to be equal to or more than (a) 4.50 to 1.00 for the period ending September 30, 2013, (b) 5.00 to 1.00 for the period ending December 31, 2013, and the periods ending January 31, 2014, and February 28, 2014, (c) 4.75 to 1.00 for the period ending March 31, 2014, (d) 4.25 to 1.00 for the period ending April 30, 2014, (e) 3.00 to 1.00 for the period ending May 31, 2014, (f) 2.75 to 1.00 for the period ending June 30, 2014, (g) 2.50 to 1.00 each period ending the last day of a month thereafter. For the avoidance of doubt, there is no Senior Leverage Ratio requirement for the twelve-month periods ending on October 31, 2013 and November 30, 2013.

16

Section 6.33. Delivery of Mortgages. The Borrowers shall provide to the Administrative Agent, on or before December 31, 2013 or such later date as may be agreed to by the Administrative Agent, mortgages or deeds of trust on the following properties (the “Mortgaged Properties”) to secure the Obligations:

| (a) | Arizona News Service, LLC |

d/b/a Arizona Capitol Times

1835 West Adams Street

Phoenix, AZ 85007;

| (b) | The Daily Record Company (MD) |

11-15 E. Saratoga Street

Baltimore, MD 21202-2199; and

| (c) | Finance and Commerce, Inc. |

615 South 7th Street

Minneapolis, MN 55415.

Together with such Mortgages or deeds of trust, the Borrowers shall provide, for each such property:

(i) UCC financing statements and fixture filings, covering the collateral described in such mortgages or deeds of trust, each in a form prescribed by the Administrative Agent;

(ii) Phase I environmental survey reasonably satisfactory to the Administrative Agent with respect to each Mortgaged Property;

(iii) a flood check satisfactory to the Administrative Agent and satisfying the requirements of 42 U.S.C. § 4104b and any rules and regulating promulgated provisions thereto with respect to each Mortgaged Property;

(iv) an Environmental and ADA Indemnification Agreement from the Borrowers in favor of the Lenders with respect to each Mortgaged Property;

(v) a title commitment in form and substance acceptable to the Agent for an ALTA lender’s title policy in the amount of $2,000,000, together with endorsements reasonably requested by the Agent with respect to all five tracts of the Stark County Property (as described on Schedule 3(a)(vii)); and

17

(vi) such other supporting information and other items as the Administrative Agent shall request, including, without limitation, access to the Mortgaged Properties for purposes of all of the foregoing and for obtaining appraisals on the Mortgaged Properties.

In addition, the Administrative Agent shall have received an appraisal of each Mortgaged Property, based on the fair market value of such Mortgaged Property, complying with the requirements of FIRREA, by a third party appraiser reasonably acceptable to the Administrative Agent and otherwise in form and substance reasonably satisfactory to the Administrative Agent.

Section 6.34. Liquidity Transaction. On or before March 31, 2014, Dolan shall have (i) completed one or more transactions (consisting of asset sales, issuances of equity or Subordinated Debt or other transactions satisfactory to the Required Banks) sufficient to raise at least $50 million in cash not arising from operating activities, and applied such cash to prepay the Term Loans, or (ii) have entered into definitive agreements to complete such transactions on or before May 31, 2014, and completed such transactions and applied such cash to prepay the Term Loans on or before May 31, 2014; provided, however, that this requirement will not be deemed to be a consent by the Lenders to any transaction that would otherwise be restricted by the terms of the Loan Documents.

2.10. Events of Default. Section 7.3 of the Credit Agreement is hereby amended and restated in its entirety as follows:

7.3 The breach by any Borrower or any Subsidiary of any of the terms or provisions of Section 6.2, 6.3 or any of Section 6.12 through Section 6.34.

2.11. Electronic Records. Article XIV is hereby amended to add a new Section 14.4 to read in its entirety as follows:

Section 14.4 Electronic Records. The Administrative Agent and each Lender are authorized to create electronic images and to destroy paper originals of any imaged documents and any such images maintained by the Administrative Agent or a Lender as a part of its normal business processes shall be given the same legal effect as the paper originals. The Administrative Agent and each Lender are authorized, when appropriate, to convert any instrument into a “transferable record” under the Uniform Electronic Transactions Act (“UETA”), with the image of such instrument in the Administrative Agent’s or a Bank’s possession constituting an “authoritative copy” under UETA.

2.12. Register. Section 12.2 is hereby amended by adding the following new Section 12.2.4:

Section 12.2.4 Participant Register. Each Lender that sells a participation shall, acting solely for this purpose as an agent of the Borrower, maintain a register on which it enters the name and address of each Participant and the principal amounts (and stated interest) of each Participant’s interest in any Outstanding Credit Exposure, any Note, any Commitment or any other obligations under the Loan Documents (the “Participant Register”); provided that

18

no Lender shall have any obligation to disclose all or any portion of the Participant Register (including the identity of any Participant or any information relating to a Participant’s interest in any Outstanding Credit Exposure, any Note, any Commitment or any other obligations under the Loan Documents) to any Person except to the extent that such disclosure is necessary to establish that such Outstanding Credit Exposure, any Note, any Commitment or any other obligations under the Loan Documents is in registered form under Section 5f.103-1(c) of the United States Treasury Regulations. The entries in the Participant Register shall be conclusive absent manifest error, and such Lender shall treat each Person whose name is recorded in the Participant Register as the owner of such participation for all purposes of this Agreement notwithstanding any notice to the contrary. For the avoidance of doubt, the Administrative Agent (in its capacity as Administrative Agent) shall have no responsibility for maintaining a Participant Register.

2.13. Schedules. The Pricing Schedule and Schedule 1 to the Credit Agreement are deleted in their entirety and replaced with the Pricing Schedule and Schedule 1 attached hereto.

2.14. Exhibit A. Exhibit A to the Credit Agreement is deleted in its entirety and replaced with Exhibit A attached hereto.

Section 3. Consent to the APC Consolidation Transactions. Notwithstanding anything in the Credit Agreement to the Contrary, the Required Lenders hereby consents to the APC Consolidation Transactions with such changes as are approved by the Administrative Agent; provided, that the aggregate amount expended by the Borrowers to redeem the minority interests in APC in connection therewith does not exceed $10,000. The consent set forth in this Section 3 is limited to the express terms thereof, and nothing herein shall be deemed a consent or waiver by the Administrative Agent or the Lenders with respect to any other term, condition, representation, or covenant applicable to the Borrower under the Credit Agreement or any of the other agreements, documents, or instruments executed and delivered in connection therewith, or of the covenants described therein. The consent set forth herein shall not be deemed to be a course of action upon which the Borrower or its Subsidiaries may rely in the future.

Section 4. Events of Default; Waiver. The Borrowers have informed the Administrative Agent and the Lenders that they are in violation of one or more of the covenants contained in Sections 6.26 and 6.27 of the Credit Agreement, as in effect before giving effect to this Sixth Amendment, for the period ending September 30, 2013 (the “Existing Defaults”). Such violations would constitute Events of Default under Section 7.3 of the Credit Agreement. Upon the date on which this Amendment becomes effective, the Lenders waive the Existing Defaults. The Lenders’ waiver is limited to the express terms hereof, and nothing herein shall be deemed a waiver or forbearance by the Lenders of any other Default or Event of Default that may have occurred or may occur, or any other term, condition, representation or covenant applicable to the Borrowers under the Credit Agreement, this Amendment and any other Loan Document. NOTWITHSTANDING THE WAIVER SET FORTH IN THIS AMENDMENT, THE LENDERS REQUIRE STRICT COMPLIANCE BY THE BORROWERS AT ALL TIMES WITH ALL TERMS, CONDITIONS AND PROVISIONS OF THE CREDIT AGREEMENT (AS AMENDED BY THE AMENDMENT DOCUMENTS), THIS AMENDMENT AND ANY OTHER LOAN DOCUMENT.

19

Section 5. Conditions to Effectiveness. This Amendment will be effective as of the Sixth Amendment Closing Date, subject to fulfillment of the following conditions precedent:

5.1. The Borrowers and the Required Lenders have executed and delivered this Amendment.

5.2. The Administrative Agent shall have received a certificate of the Secretary or Assistant Secretary (or other appropriate officer) of each Borrower dated as of the date hereof and certifying as to the following:

(a) a true and accurate copy of the resolutions or unanimous written consent of such Borrower authorizing the execution, delivery, and performance of this Amendment;

(b) the incumbency, names, titles, and signatures of the officers of such Person authorized to execute the Loan Documents (including this Amendment and the Divestiture Side Letter) to which such Borrower is a party and, as to the Borrowers’ Agent, to request Loans and the issuance of Letters of Credit;

(c) there has been no amendment to the articles of incorporation, certificate of formation, certificate of partnership or other equivalent documents of such Borrower since true and accurate copies of the same were last delivered to the Lenders, or specifying any changes; and

(d) the representations and warranties set forth in Section 6 of this Amendment are true and correct.

5.3. The Administrative Agent shall have received certified copies of all documents evidencing any necessary corporate action, consent or governmental or regulatory approval (if any) with respect to this Amendment.

5.4. All corporate and legal proceedings relating to the Borrowers and all instruments and agreements in connection with the transactions contemplated by this Amendment shall be reasonably satisfactory in scope, form and substance to the Administrative Agent, such documents where appropriate to be certified by proper corporate or governmental authorities.

5.5. The Administrative Agent shall have received from Dolan (a) an amendment fee in an amount equal to 0.50% of the Revolving Commitments and outstanding principal balance of the Term Loans after giving effect to this Amendment, for the account of the Lenders executing and delivering this Amendment, (b) an arrangement fee, for the account of the Administrative Agent, as separately agreed between the Borrowers and the Administrative Agent, and (c) any fees due to the Administrative Agent and the Lenders pursuant to the terms of this Amendment to the Loan Documents. The fees described in this Section 5.5 shall be nonrefundable and fully earned when paid.

20

Section 6. Representations, Warranties, Authority, No Adverse Claim.

6.1. Release of Claims. The Borrowers, for themselves and on behalf of their legal representatives, successors, and assigns, hereby (a) expressly waive, release, and relinquish the Administrative Agent and each of the Lenders from any and all claims, offsets, defenses, affirmative defenses, and counterclaims of any kind or nature whatsoever that the Borrowers have asserted, or might assert, against the Administrative Agent or the Lenders with respect to the Obligations, the Credit Agreement (including as amended by this Amendment), and any other Loan Document, in each case arising on or before the date hereof, such waiver and release being with full knowledge and understanding of the circumstances and effect thereof, and (b) expressly covenant and agree never to institute, cause to be instituted, or continue prosecution of any suit or other form of action or proceeding of any kind or nature whatsoever against the Administrative Agent or the Lenders by reason of or in connection with any of the foregoing matters, claims, or causes of action.

6.2. No Waiver. The execution of this Amendment and acceptance of any documents related hereto shall not be deemed to be a waiver of any Default or Event of Default under the Credit Agreement except as expressly set forth in Sections 3 and 4 of this Amendment, or breach, default, or event of default under any Security Document or other document held by the Administrative Agent or the Lenders, whether or not known to the Administrative Agent or the Lenders and whether or not existing on the date of this Amendment.

6.3. Reassertion of Representations and Warranties, No Default. Each Borrower hereby represents that on and as of the date hereof and after giving effect to this Amendment (a) all of the representations and warranties contained in the Credit Agreement are true, correct and complete in all material respects as of the date hereof as though made on and as of such date, except for changes permitted by the terms of the Credit Agreement and except for representations and warranties made as of a specific earlier date, which shall be true and correct in all material respects as of such earlier date, and (b) there will exist no Default or Event of Default under the Credit Agreement as amended by the Amendment Documents on such date that has not been waived by the Lenders.

6.4. Authority, No Conflict, No Consent Required. Each Borrower represents and warrants that such Borrower has the power and legal right and authority to enter into this Amendment and any other instrument or agreement executed by such Borrower in connection with this Amendment (the “Amendment Documents”) and has duly authorized as appropriate the execution and delivery of the Amendment Documents and other agreements and documents executed and delivered by such Borrower in connection herewith or therewith by proper corporate action, and none of the Amendment Documents nor the agreements contained herein or therein contravenes or constitutes a default under any agreement, instrument or indenture to which such Borrower is a party

21

or a signatory or a provision of such Borrower’s constituent documents or any other agreement or requirement of law, or result in the imposition of any Lien on any of its property under any agreement binding on or applicable to such Borrower or any of its property except, if any, in favor of the Lenders. Each Borrower represents and warrants that no consent, approval or authorization of or registration or declaration with any Person, including but not limited to any governmental authority, is required in connection with the execution and delivery by such Borrower of the Amendment Documents or other agreements and documents executed and delivered by such Borrower in connection therewith or the performance of obligations of such Borrower therein described, except for those which such Borrower has obtained or provided and as to which such Borrower has delivered certified copies of documents evidencing each such action to the Lenders.

6.5. No Adverse Claim. Each Borrower warrants, acknowledges and agrees that no events have taken place and no circumstances exist at the date hereof which would give such Borrower a basis to assert a defense, offset or counterclaim to any claim of the Lenders with respect to the Obligations.

Section 7. Limited Purpose Amendment. Notwithstanding anything contained herein, this Amendment (a) is a limited amendment, (b) is effective only with respect to the specific instance and the specific purpose for which it is given, (c) shall not be effective for any other purpose, and (d) except as expressly set forth in Section 4 of this Amendment, does not constitute the basis for a waiver and, except as expressly set forth in Sections 2 and 3 of this Amendment, does not constitute an amendment of any of the provisions of the Credit Agreement. Except as expressly provided in Sections 2, 3 and 4 of this Amendment, (i) all of the terms and conditions of the Credit Agreement remain in full force and effect and none of such terms and conditions are, or shall be construed as, otherwise amended or modified, and (ii) nothing in this Amendment shall constitute a waiver by the Lenders of any Default or Event of Default, or of any right, power or remedy available to the Lenders under the Credit Agreement or any other Loan Document, whether any such defaults, rights, powers or remedies presently exist or arise in the future.

Section 8. Affirmation of Credit Agreement, Further References, Affirmation of Security Interest. The Lenders and the Borrowers each acknowledge and affirm that the Credit Agreement, as amended by this Amendment, is hereby ratified and confirmed in all respects and all terms, conditions and provisions of the Credit Agreement, except as amended by this Amendment, shall remain unmodified and in full force and effect. All references in any document or instrument to the Credit Agreement are hereby amended and shall refer to the Credit Agreement as amended by this Amendment. Each Borrower confirms to the Lenders that the Obligations are and continue to be secured by the security interest granted by the Borrowers in favor of the Lenders under the Collateral Documents, and all of the terms, conditions, provisions, agreements, requirements, promises, obligations, duties, covenants and representations of the Borrowers under such documents and any and all other documents and agreements entered into with respect to the obligations under the Credit Agreement are incorporated herein by reference and are hereby ratified and affirmed in all respects by the Borrowers.

22

Section 9. Merger and Integration, Superseding Effect. This Amendment and the items described in Section 5.2, from and after the date hereof, embodies the entire agreement and understanding between the parties hereto and supersedes and has merged into this Amendment and the fee letter, all prior oral and written agreements on the same subjects by and between the parties hereto with the effect that this Amendment and the fee letter shall control with respect to the specific subjects hereof and thereof.

Section 10. Severability. Whenever possible, each provision of this Amendment and the fee letter and any other statement, instrument or transaction contemplated hereby or thereby or relating hereto or thereto shall be interpreted in such manner as to be effective, valid and enforceable under the applicable law of any jurisdiction, but, if any provision of this Amendment, the fee letter or any other statement, instrument or transaction contemplated hereby or thereby or relating hereto or thereto shall be held to be prohibited, invalid or unenforceable under the applicable law, such provision shall be ineffective in such jurisdiction only to the extent of such prohibition, invalidity or unenforceability, without invalidating or rendering unenforceable the remainder of such provision or the remaining provisions of this Amendment, the fee letter or any other statement, instrument or transaction contemplated hereby or thereby or relating hereto or thereto in such jurisdiction, or affecting the effectiveness, validity or enforceability of such provision in any other jurisdiction.

Section 11. Successors. This Amendment shall be binding upon the Borrowers and the Lenders and their respective successors and assigns, and shall inure to the benefit of the Borrowers and the Lenders and the successors and assigns of the Lenders.

Section 12. Legal Expenses. As provided in Section 9.6 of the Credit Agreement, the Borrowers agree to pay or reimburse the Administrative Agent, upon execution of this Amendment, for all reasonable out-of-pocket expenses paid or incurred by the Administrative Agent, including filing and recording costs and fees, charges and disbursements of outside counsel to the Administrative Agent (determined on the basis of such counsel’s generally applicable rates, which may be higher than the rates such counsel charges the Administrative Agent in certain matters) and/or the allocated costs of in-house counsel.

Section 13. Headings. The headings of various sections of this Amendment have been inserted for reference only and shall not be deemed to be a part of this Amendment.

Section 14. Counterparts. This Amendment and any other Amendment Document may be executed in several counterparts as deemed necessary or convenient, each of which, when so executed, shall be deemed an original, provided that all such counterparts shall be regarded as one and the same document, and any party to the Amendment or any other Amendment Document may execute any such agreement by executing a counterpart of such agreement. Signature pages delivered by facsimile or other electronic transmission (including by email in .pdf format) shall be considered original signatures hereto, all of which shall be equally valid.

Section 15. Governing Law. THE AMENDMENT DOCUMENTS SHALL BE GOVERNED BY THE INTERNAL LAWS OF THE STATE OF MINNESOTA, WITHOUT GIVING EFFECT TO CONFLICT OF LAW PRINCIPLES THEREOF, BUT GIVING EFFECT TO FEDERAL LAWS APPLICABLE TO NATIONAL BANKS, THEIR HOLDING COMPANIES AND THEIR AFFILIATES.

[The next page is the signature page.]

23

IN WITNESS WHEREOF, parties hereto have executed this Amendment as of the date first above written.

| THE DOLAN COMPANY | ||

| By: | /s/ Vicki J. Duncomb | |

| Name: | Vicki J. Duncomb | |

| Title: | Chief Financial Officer | |

| DAILY JOURNAL OF COMMERCE, INC. DAILY REPORTER PUBLISHING COMPANY DOLAN DLN LLC DOLAN PUBLISHING COMPANY DOLAN PUBLISHING FINANCE COMPANY NOPG, L.L.C. | ||

| By: | /s/ Scott J. Pollei | |

| Name: | Scott J. Pollei | |

| Title: | Vice President, CFO & Treasurer | |

| DISCOVERREADY LLC | ||

| By: | /s/ Scott J. Pollei | |

| Name: | Scott J. Pollei | |

| Title: | Vice President, Secretary & Treasurer | |

| AMERICAN PROCESSING COMPANY, LLC By: Dolan APC LLC, its Managing Member | ||

| By: | /s/ Scott J. Pollei | |

| Name: | Scott J. Pollei | |

| Title: | Vice President | |

[Signature Page 1 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| THE DAILY RECORD COMPANY, LLC | ||

| IDAHO BUSINESS REVIEW, LLC | ||

| THE JOURNAL RECORD PUBLISHING CO., LLC | ||

| LAWYER’S WEEKLY, LLC | ||

| LONG ISLAND BUSINESS NEWS, LLC | ||

| MISSOURI LAWYERS MEDIA, LLC | ||

| NEW ORLEANS PUBLISHING GROUP, L.L.C. | ||

| DATASTREAM CONTENT SOLUTIONS, LLC | ||

| LEGISLATIVE INFORMATION SERVICES OF AMERICA, LLC | ||

| FINANCE AND COMMERCE, INC. | ||

| DOLAN MEDIA HOLDING COMPANY | ||

| COUNSEL PRESS, LLC | ||

| DOLAN APC LLC | ||

| ASSURE 360, LLC | ||

| By: | /s/ Scott J. Pollei | |

| Name: | Scott J. Pollei | |

| Title: | Vice President | |

| ARIZONA NEWS SERVICE, LLC | ||

| FEDERAL NEWS SERVICE LLC | ||

| NATIONAL DEFAULT EXCHANGE GP, LLC | ||

| NATIONAL DEFAULT EXCHANGE HOLDINGS, LP | ||

| NATIONAL DEFAULT EXCHANGE, LP | ||

| NATIONAL DEFAULT EXCHANGE MANAGEMENT, INC. | ||

| NDEX TECHNOLOGIES, LLC | ||

| THP / NDEX AIV CORP. | ||

| THP / NDEX AIV, L.P. | ||

| By: | /s/ Scott J. Pollei | |

| Name: | Scott J. Pollei | |

| Title: | Vice President & Secretary | |

[Signature Page 2 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| U.S. BANK NATIONAL ASSOCIATION, as a Lender, as LC Issuer and as Administrative Agent | ||

| By: | /s/ James P. Cecil | |

| Name: | James P. Cecil | |

| Title: | Vice President | |

[Signature Page 3 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| WELLS FARGO BANK, NATIONAL ASSOCIATION as a Lender and Syndication Agent | ||

| By: | /s/ Kristine Netjes | |

| Name: | Kristine Netjes | |

| Title: | Senior Vice President | |

[Signature Page 4 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| BANK OF THE WEST, as a Lender | ||

| By: | /s/ Kathryn McDonald | |

| Name: | Kathryn McDonald | |

| Title: | Vice President | |

[Signature Page 5 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| ASSOCIATED BANK, N.A., as a Lender | ||

| By: | /s/ Alison R. Tregilgas | |

| Name: | Alison R. Tregilgas | |

| Title: | Vice President | |

[Signature Page 6 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| BANK OF AMERICA, N.A., as a Lender | ||

| By: |

||

| Name: |

||

| Title: |

||

[Signature Page 7 to Sixth Amendment to Third Amended and Restated Credit Agreement]

| COMERICA BANK, as a Lender | ||

| By: | /s/ Sarah R. Miller | |

| Name: | Sarah R. Miller | |

| Title: | Vice President | |

[Signature Page 8 to Sixth Amendment to Third Amended and Restated Credit Agreement]

PRICING SCHEDULE

| Applicable Margin |

10/1/13 – Facility Termination Date | |

| Eurocurrency Rate |

6.50% | |

| Base Rate |

5.00% | |

| Applicable Fee Rate |

||

| Commitment Fee |

0.75% |

EXHIBIT A

FORM OF COMPLIANCE CERTIFICATE

EXHIBIT A TO

THIRD AMENDED AND RESTATED

CREDIT AGREEMENT

FORM OF COMPLIANCE CERTIFICATE

| To: | The Lenders parties to the |

Credit Agreement Described Below

This Compliance Certificate is furnished pursuant to that certain Third Amended and Restated Credit Agreement dated as of December 6, 2010 (as amended, modified, renewed or extended from time to time, the “Agreement”) by and among The Dolan Company, as a Borrower and as the Borrowers’ Agent (the “Borrowers’ Agent”), the Subsidiaries of the Borrowers’ Agent from time to time party thereto (together with the Borrowers’ Agent, the “Borrowers”), the Lenders from time to time party thereto, and U.S. Bank National Association, as LC Issuer, Swing Line Lender and Administrative Agent. Unless otherwise defined herein, capitalized terms used in this Compliance Certificate have the meanings ascribed thereto in the Agreement.

THE UNDERSIGNED HEREBY CERTIFIES THAT:

1. The Person executing on behalf of the undersigned is the duly elected chief financial officer of the Borrowers’ Agent;

2. The chief financial officer has reviewed the terms of the Agreement and has made, or has caused to be made under his or her supervision, a detailed review of the transactions and conditions of the Borrowers and their Subsidiaries during the accounting period covered by the attached financial statements;

3. The examinations described in paragraph 2 did not disclose, and the undersigned has no knowledge of, the existence of any condition or event which constitutes a Default or Event of Default during or at the end of the accounting period covered by the attached financial statements or as of the date of this Certificate, except as set forth below; and

4. Schedule I attached hereto sets forth financial data and computations evidencing the Borrowers’ compliance with certain covenants of the Agreement, all of which data and computations are true, complete and correct.

5. Schedule II attached hereto sets forth the various reports and deliveries which are required at this time under the Credit Agreement, the Security Agreement and the other Loan Documents and the status of compliance.

Described below are the exceptions, if any, to paragraph 3 by listing, in detail, the nature of the condition or event, the period during which it has existed and the action which the Borrower has taken, is taking, or proposes to take with respect to each such condition or event:

A-1

The foregoing certifications, together with the computations set forth in Schedule I hereto and the financial statements delivered with this Certificate in support hereof, are made and delivered this day of , .

| THE DOLAN COMPANY, as Borrowers’ Agent | ||

| By: |

||

| Its: |

Chief Financial Officer | |

A-2

SCHEDULE I TO COMPLIANCE CERTIFICATE

Compliance as of , with

Provisions of , , and of

the Agreement

| Fixed Charge Coverage Ratio (Minimum: to 1.00) (Section 6.25) |

to 1.00 | |

| Total Cash Flow Leverage Ratio (Maximum: to 1.00) (Section 6.26) |

to 1.00 | |

| Minimum Adjusted EBITDA (Minimum $ ) (Section 6.27) |

$ | |

| Maximum Capital Expenditures (Maximum $ ) (Section 6.31) |

$ | |

| Senior Leverage Ratio (Maximum: to 1.00) (Section 6.32) |

to 1.00 | |

| Investments |

||

| Investments permitted under Section 6.21(j) (Maximum $10,000,000) |

$ |

The computations with respect to the foregoing are set forth on the attached spreadsheet.

A-3

SCHEDULE II TO COMPLIANCE CERTIFICATE

Reports and Deliveries Currently Due

A-4

EXHIBIT I

DOLAN – APC CONSOLIDATION STEP PLAN

| Name |

Abbreviation |

Status | ||

| Dolan APC LLC |

Dolan APC | Delaware LLC | ||

| American Processing Company, LLC (dba NDeX) |

APC | Michigan LLC | ||

| THP/NDEX AIV CORP. |

THP-Corp | Delaware corporation | ||

| THP/NDEX AIV, L.P. |

THP-LP | Delaware limited partnership | ||

| National Default Exchange Management, Inc. |

NDEX Mgmt | Delaware corporation | ||

| National Default Exchange Holdings, LP |

NDEX Holdings LP | Delaware limited partnership (will be converted into NDEX Holdings LLC) | ||

| National Default Exchange Holdings, LLC |

NDEX Holdings LLC | Delaware LLC (converted to an LLC from NDEX Holdings LP) | ||

| NDEx Technologies, LLC |

NDEX Tech | Texas LLC | ||

| National Default Exchange GP, LLC |

NDEX GP | Delaware LLC | ||

| National Default Exchange, LP |

NDEX LP | Delaware limited partnership | ||

EXECUTIVE SUMMARY—As a result of the transactions described in Steps 1-6 below:

| • | The Dolan Company will become the owner of 100% of the limited liability company interests of Dolan APC |

| • | Dolan APC will become the owner of 100% of limited liability company interests of APC |

| • | APC will become the owner of 100% of the limited liability company interests of NDEX Holdings LLC (formerly NDEX Holdings LP) |

| • | The separate existence of THP-Corp, THP-LP, NDEX Mgmt, NDEX Tech, NDEX GP and NDEX LP will be terminated |

Step 1 – Convert NDEX Holdings LP from a Delaware limited partnership into NDEX Holdings LLC, a Delaware limited liability company

Step 2 – Merge THP-CORP and THP-LP and redeem APC’s minority interests in accordance with specific timing requirements as follows:

PART A – File Certificate of Merger for THP-LP to merge into APC with APC as the surviving company

| • | Certificate of merger filed in MI and DE should indicate a future effective date that will be after the redemptions in Step 2 PART C have occurred |

PART B – Merge THP-Corp into APC with APC as the surviving company

| • | Step 2 PART B should occur at least 1 day after Step 2 PART A in order to ensure validity of the merger approval and filing in Step 2 PART A |

| • | THP-Corp’s separate existence will terminate |

I-1

PART C – Redeem minority APC members

| • | Step 2 PART C fund transfers (which funds will be an aggregate amount less than $100) should occur at least 1 day after Step 2 PART B merger of THP-Corp into APC becomes effective |

| • | Consummate redemptions in executed Redemption Agreement by transferring funds (which funds will be an aggregate amount less than $100) to redeeming minority APC members |

| • | APC will become a wholly owned subsidiary of Dolan APC as a result of these redemptions |

PART D – Consummate merger of THP-LP into APC with APC as the surviving company

| • | Step 2 PART D effective date should occur at least 1 day after Step 2 PART C redemption of minority APC members is consummated in order to ensure that THP-LP actually mergers into APC when APC is a wholly owned subsidiary of Dolan APC |

| • | THP-LP’s separate existence will terminate as a result of this merger |

Step 3 – Merge NDEX Mgmt into APC with APC as the surviving company

| • | NDEX Mgmt’s separate existence will terminate as a result of this merger |

Step 4 – Merge NDEX Technologies into NDEX Holdings LLC with NDEX Holdings LLC as the surviving company

| • | NDEX Technologies’ separate existence will terminate as a result of this merger |

Step 5 – Merge NDEX GP into NDEX Holdings LLC with NDEX Holdings LLC as the surviving company

| • | NDEX GP’s separate existence will terminate as a result of this merger |

Step 6 – Merge NDEX LP into NDEX Holdings LLC with NDEX Holdings LLC as the surviving company

| • | NDEX LP’s separate existence will terminate as a result of this merger |

Notes:

Steps 4, 5 and 6 to be effective simultaneously

I-2

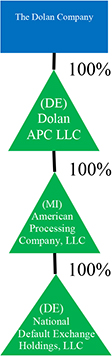

The final structure of Dolan APC, APC and NDEX Holdings will be as follows:

(DE)

Dolan

APC LLC

(MI)

American

Processing

Company, LLC

(DE)

National

Default Exchange

Holdings, LLC

100%

100%

The Dolan Company

100%

I-3