Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CoreSite Realty Corp | a13-23092_18k.htm |

| EX-99.1 - EX-99.1 - CoreSite Realty Corp | a13-23092_1ex99d1.htm |

Exhibit 99.2

Earnings Release and

Supplemental Information

Quarter Ended September 30, 2013

|

Table of Contents |

|

|

Overview |

|

|

|

Earnings Release |

|

3 |

|

Company Profile |

|

8 |

|

Summary of Financial Data |

|

10 |

|

|

|

|

|

Financial Statements |

|

|

|

Consolidated Balance Sheets |

|

11 |

|

Consolidated Statements of Operations |

|

12 |

|

Reconciliations of Net Income to FFO, AFFO and EBITDA |

|

13 |

|

|

|

|

|

Operating Portfolio |

|

|

|

Operating Properties |

|

14 |

|

Leasing Statistics |

|

15 |

|

Geographic Diversification and 10 Largest Customers |

|

17 |

|

|

|

|

|

Development Summary and Capital Expenditures |

|

18 |

|

|

|

|

|

Capital Structure |

|

|

|

Market Capitalization and Debt Summary |

|

19 |

|

Interest Summary and Debt Covenants |

|

20 |

|

|

|

|

|

2013 Guidance |

|

21 |

|

|

|

|

|

Appendix |

|

22 |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

CoreSite Reports

|

|

DENVER, CO – October 31, 2013

CoreSite Realty Corporation (NYSE: COR), a leading provider of network-dense, cloud-enabled data center solutions, today announced financial results for the third quarter ended September 30, 2013.

Quarterly Highlights

· Reported third-quarter funds from operations (“FFO”) of $0.47 per diluted share and unit, representing a 17.5% increase year-over-year

· Reported third-quarter operating revenue of $60.6 million, representing a 12.8% increase year-over-year

· Executed new and expansion data center leases representing $4.0 million of annualized GAAP rent at a rate of $170 of annualized GAAP rent per square foot

· Realized rent growth on signed renewals of 6.6% on a cash basis and 10.7% on a GAAP basis and rental churn of 2.7%

· Commenced 37,243 net rentable square feet of new and expansion leases with annualized GAAP rent of $180 per square foot

Tom Ray, CoreSite’s Chief Executive Officer, commented, “Our third-quarter results reflect continued execution and focus upon our business plan. We executed 106 new and expansion leases in the quarter including agreements with 21 new customers, 67% of which were in our network and cloud verticals, and we executed a record 44 leases signed with customers deploying in more than one location.” Mr. Ray continued, “Our development activities are progressing and we look forward to delivering our build-to suit at SV5 as well as our first computer room at NY2 toward the end of the fourth quarter. Furthermore, we expect our additional development project at LA2 to deliver in the first quarter of 2014 and our VA2 project in Northern Virginia to deliver at the end of the second quarter in 2014. We remain focused upon and optimistic regarding executing upon our strategy of differentiating CoreSite as a leading provider of performance-sensitive colocation products and services, enhanced by a premium customer experience.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Quarter Ended September 30, 2013

|

|

Financial Results

CoreSite reported FFO attributable to shares and units of $21.9 million for the three months ended September 30, 2013, a 17.3% increase year-over-year and an increase of 3.6% quarter-over-quarter. On a per diluted share and unit basis, FFO increased 17.5% to $0.47 for the three months ended September 30, 2013, as compared to $0.40 per diluted share and unit for the three months ended September 30, 2012. Total operating revenue for the three months ended September 30, 2013, was $60.6 million, a 12.8% increase year over year. Revenue growth in the third quarter was diluted by 1.1% due to our customer at SV3 decreasing their metered power draw as they continue to transition certain applications out of that facility. CoreSite reported net income attributable to common shares of $2.9 million, or $0.14 per diluted share.

Sales Activity

CoreSite executed 106 new and expansion data center leases representing $4.0 million of annualized GAAP rent during the third quarter, comprised of 23,294 NRSF at a weighted average GAAP rate of $170 per NRSF.

CoreSite’s renewal leases signed in the third quarter totaled $4.6 million in annualized GAAP rent, comprised of 29,567 NRSF at a weighted average GAAP rate of $155 per NRSF, reflecting a 6.6% increase in rent on a cash basis and a 10.7% increase on a GAAP basis. The third-quarter rental churn rate was 2.7%.

CoreSite’s third-quarter data center lease commencements totaled 37,243 NRSF at a weighted average GAAP rental rate of $180 per NRSF, which represents $6.7 million of annualized GAAP rent.

Development Activity

CoreSite had 249,961 NRSF of data center space under construction at four key locations as of September 30, 2013. The projects under construction include new data centers at SV5 (San Francisco Bay Area), VA2 (Northern Virginia), NY2 (New York market) and additional inventory at LA2 (Los Angeles). As of September 30, 2013, CoreSite had incurred $111.5 million of the estimated $199.6 million required to complete these projects.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Quarter Ended September 30, 2013

|

|

Balance Sheet and Liquidity

As of September 30, 2013, CoreSite had $166.6 million of total long-term debt equal to 1.5x annualized adjusted EBITDA and $281.6 million of long-term debt and preferred stock equal to 2.6x annualized adjusted EBITDA.

At quarter end, CoreSite had $289.3 million of total liquidity, consisting primarily of available capacity under its credit facility.

Dividend

On August 30, 2013, CoreSite announced a dividend of $0.27 per share of common stock and common stock equivalents for the third quarter of 2013. The dividend was paid on October 15, 2013, to shareholders of record on September 30, 2013.

CoreSite also announced on August 30, 2013, a dividend of $0.4531 per share of Series A preferred stock for the period July 15, 2013, to October 14, 2013. The preferred dividend was paid on October 15, 2013, to shareholders of record on September 30, 2013.

2013 Guidance

CoreSite is tightening its FFO per share and OP unit guidance and now expects FFO per share in the range of $1.80 to $1.84, compared to the previous range of $1.76 to $1.84.

This outlook is predicated on current economic conditions, internal assumptions about CoreSite’s customer base, and the supply and demand dynamics of the markets in which CoreSite operates. The guidance does not include the impact of any future financing, investment or disposition activities.

Upcoming Conferences and Events

CoreSite will participate in NAREIT’s REITWorld conference from November 13 through November 14 at the San Francisco Marriott Marquis in San Francisco, CA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Quarter Ended September 30, 2013

|

|

Conference Call Details

CoreSite will host a conference call on October 31, 2013, at 12:00 p.m., Eastern time (10:00 a.m., Mountain time), to discuss its financial results, current business trends and market conditions.

The call can be accessed live over the phone by dialing 877-407-3982 for domestic callers or 201 -493-6780 for international callers. A replay will be available shortly after the call and can be accessed by dialing 877-870-5176 for domestic callers or 858-384-5517 for international callers. The passcode for the replay is 10000326. The replay will be available until November 7, 2013.

Interested parties may also listen to a simultaneous webcast of the conference call by logging on to CoreSite’s website at www.CoreSite.com and clicking on the “Investors” tab. The on-line replay will be available for a limited time beginning immediately following the call.

About CoreSite

CoreSite Realty Corporation (NYSE: COR) propels customer growth and long-term competitive advantage by connecting Internet, private networking, mobility, and cloud communities within and across its fourteen high-performance data center campuses and through the CoreSite Mesh. More than 750 of the world’s leading carriers and mobile operators, content and cloud providers, media and entertainment companies, and global enterprises choose CoreSite to run their performance-sensitive applications and to connect and do business with each other. With direct access to more than 275 carriers and ISPs, North America inter-site connectivity and the nation’s first Open Cloud Exchange that provides access to the “most lit” buildings and cloud “on-ramps,” CoreSite provides easy, efficient and valuable gateways to global business opportunities. For more information, visit.

CoreSite Investor Relations Contact

Greer Aviv | CoreSite Investor Relations Director

+1 303.405.1012 | +1 303.222.7276

Greer.Aviv@CoreSite.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Quarter Ended September 30, 2013

|

|

Forward Looking Statements

This earnings release and accompanying supplemental information may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond CoreSite’s control, that may cause actual results to differ significantly from those expressed in any forward-looking statement. These risks include, without limitation: the geographic concentration of the company’s data centers in certain markets and any adverse developments in local economic conditions or the demand for data center space in these markets; fluctuations in interest rates and increased operating costs; difficulties in identifying properties to acquire and completing acquisitions; significant industry competition; the company’s failure to obtain necessary outside financing; the company’s failure to qualify or maintain its status as a REIT; financial market fluctuations; changes in real estate and zoning laws and increases in real property tax rates; and other factors affecting the real estate industry generally. All forward-looking statements reflect the company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause the company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company’s most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the company from time to time with the Securities and Exchange Commission.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Company Profile

|

|

The company serves over 750 customers across more than 2.5 million square feet, including NRSF held for development, and provides access to over 275 network service providers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Company Profile

|

|

NYSE-traded with a strong balance sheet

· NYSE: COR (2010); REIT status

· Predecessor entities founded in 2000

· Equity market cap: $1.6 billion at September 30, 2013

· Growth capacity: 1.5x debt to annualized adjusted EBITDA and 2.6x debt and preferred stock to annualized adjusted EBITDA at September 30, 2013

Dense network connectivity and ecosystems

· Over 275 network service providers

· Over 750 customers and 15,000 cross-connects

· Key ecosystems of customers and partners consisting of 34% networks & mobility, 25% cloud & IT service providers, 20% enterprise, 14% digital content & multimedia, and 7% systems integrators and managed services providers

· Partner-enabled value-added services supporting cloud computing

Scalable, broad platform in Tier-1 markets

· 14 operating data centers, 3 new data centers under construction

· 8 top North American markets located in network, financial, cloud and commerce hubs

· 2.5+ million gross square feet

· Ability to nearly double data center footprint on land and buildings currently owned

· 300+ employees

Product, services & operational excellence

· Cabinet, standard or custom cage, computer rooms

· Cross-connects, Any2 Internet Exchange, Cloud Exchange – Ethernet

· Breakered and metered power

· Six 9s uptime since 2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Summary of Financial Data

|

|

(in thousands, except share, per share and NRSF data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |||||||||||

|

|

|

|

|

|

| |||||||||||

|

Summary of Results |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |||||

|

Operating revenues |

|

$ |

60,635 |

|

$ |

57,667 |

|

$ |

53,762 |

|

$ |

173,393 |

|

$ |

151,682 |

|

|

Net income |

|

8,509 |

|

7,879 |

|

2,947 |

|

22,583 |

|

6,138 |

| |||||

|

Net income attributable to common shares |

|

2,901 |

|

2,618 |

|

1,320 |

|

7,368 |

|

2,749 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Funds from operations (FFO) to shares and units |

|

21,868 |

|

21,103 |

|

18,636 |

|

62,224 |

|

52,271 |

| |||||

|

Adjusted funds from operations (AFFO) |

|

20,562 |

|

20,405 |

|

17,155 |

|

58,675 |

|

46,468 |

| |||||

|

EBITDA |

|

25,683 |

|

25,127 |

|

21,642 |

|

73,564 |

|

59,098 |

| |||||

|

Adjusted EBITDA |

|

27,467 |

|

27,209 |

|

23,491 |

|

79,430 |

|

65,207 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Per share - diluted: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net income attributable to common shares |

|

$ |

0.14 |

|

$ |

0.12 |

|

$ |

0.06 |

|

$ |

0.34 |

|

$ |

0.13 |

|

|

FFO per common share and OP unit |

|

$ |

0.47 |

|

$ |

0.45 |

|

$ |

0.40 |

|

$ |

1.33 |

|

$ |

1.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

As of |

| |||||||||||||

|

|

|

|

| |||||||||||||

|

|

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Dividend Activity |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Dividends declared per common share and OP unit |

|

$ |

0.27 |

|

$ |

0.27 |

|

$ |

0.27 |

|

$ |

0.27 |

|

$ |

0.18 |

|

|

AFFO payout ratio |

|

61% |

|

62% |

|

71% |

|

78% |

|

49% |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Operating Portfolio Statistics |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Operating data center properties |

|

14 |

|

14 |

|

14 |

|

14 |

|

14 |

| |||||

|

Operating data center NRSF |

|

1,225,596 |

|

1,225,596 |

|

1,208,365 |

|

1,208,365 |

|

1,196,571 |

| |||||

|

Data center NRSF occupied |

|

987,416 |

|

986,646 |

|

963,442 |

|

930,245 |

|

922,018 |

| |||||

|

Data center % occupied |

|

80.6% |

|

80.5% |

|

79.7% |

|

77.0% |

|

77.1% |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Market Capitalization, Debt & Preferred Stock |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total enterprise value |

|

$ |

1,869,100 |

|

$ |

1,734,594 |

|

$ |

1,861,410 |

|

$ |

1,462,710 |

|

$ |

1,406,509 |

|

|

Total debt outstanding |

|

166,625 |

|

132,000 |

|

111,375 |

|

59,750 |

|

154,365 |

| |||||

|

Total debt and preferred stock outstanding |

|

281,625 |

|

247,000 |

|

226,375 |

|

174,750 |

|

154,365 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Debt to: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Annualized Adjusted EBITDA |

|

1.5x |

|

1.2x |

|

1.1x |

|

0.6x |

|

1.6x |

| |||||

|

Undepreciated book value of total assets |

|

15.0% |

|

12.7% |

|

11.1% |

|

6.3% |

|

16.8% |

| |||||

|

Debt & Preferred Stock to: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Annualized Adjusted EBITDA |

|

2.6x |

|

2.3x |

|

2.3x |

|

1.8x |

|

1.6x |

| |||||

|

Undepreciated book value of total assets |

|

25.4% |

|

23.8% |

|

22.5% |

|

18.4% |

|

16.8% |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Consolidated Balance Sheets

|

|

(in thousands)

|

|

|

September 30, |

|

December 31, |

| |||

|

Assets: |

|

|

|

|

| |||

|

Investments in real estate: |

|

|

|

|

| |||

|

Land |

|

$ |

76,227 |

|

$ |

85,868 |

| |

|

Building and building improvements |

|

668,580 |

|

596,405 |

| |||

|

|

Leasehold improvements |

|

92,996 |

|

85,907 |

| ||

|

|

|

837,803 |

|

768,180 |

| |||

|

|

Less: Accumulated depreciation and amortization |

|

(142,133) |

|

(105,433 |

) | ||

|

Net investment in operating properties |

|

695,670 |

|

662,747 |

| |||

|

Construction in progress |

|

157,200 |

|

61,328 |

| |||

|

|

Net investments in real estate |

|

852,870 |

|

724,075 |

| ||

|

Cash and cash equivalents |

|

702 |

|

8,130 |

| |||

|

Accounts and other receivables, net |

|

11,095 |

|

9,901 |

| |||

|

Lease intangibles, net |

|

12,460 |

|

19,453 |

| |||

|

Goodwill |

|

41,191 |

|

41,191 |

| |||

|

Other assets |

|

47,583 |

|

42,582 |

| |||

|

|

|

|

|

|

|

| ||

|

|

Total assets |

|

$ |

965,901 |

|

$ |

845,332 |

|

|

|

|

|

|

|

| |||

|

Liabilities and equity: |

|

|

|

|

| |||

|

Liabilities |

|

|

|

|

| |||

|

Revolving credit facility |

|

$ |

108,000 |

|

$ |

- |

| |

|

Mortgage loans payable |

|

58,625 |

|

59,750 |

| |||

|

Accounts payable and accrued expenses |

|

75,248 |

|

50,624 |

| |||

|

Deferred rent payable |

|

9,579 |

|

4,329 |

| |||

|

Acquired below-market lease contracts, net |

|

7,050 |

|

8,539 |

| |||

|

Prepaid rent and other liabilities |

|

11,697 |

|

11,317 |

| |||

|

|

Total liabilities |

|

270,199 |

|

134,559 |

| ||

|

|

|

|

|

|

| |||

|

Stockholders’ equity |

|

|

|

|

| |||

|

Series A cumulative preferred stock |

|

115,000 |

|

115,000 |

| |||

|

Common stock, par value $0.01 |

|

208 |

|

207 |

| |||

|

Additional paid-in capital |

|

265,483 |

|

259,009 |

| |||

|

|

Distributions in excess of net income |

|

(45,953) |

|

(35,987 |

) | ||

|

Total stockholders’ equity |

|

334,738 |

|

338,229 |

| |||

|

Noncontrolling interests |

|

360,964 |

|

372,544 |

| |||

|

|

Total equity |

|

695,702 |

|

710,773 |

| ||

|

|

|

|

|

|

| |||

|

|

Total liabilities and equity |

|

$ |

965,901 |

|

$ |

845,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Consolidated

|

|

(in thousands, except share and per share data)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| ||||||

|

|

|

2013 |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| ||||||

|

Operating revenues: |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

Rental revenue |

|

$ |

35,283 |

|

$ |

34,205 |

|

$ |

31,603 |

|

$ |

102,590 |

|

$ |

91,837 |

|

|

|

Power revenue |

|

15,979 |

|

14,486 |

|

14,230 |

|

43,994 |

|

39,543 |

| |||||

|

|

Interconnection revenue |

|

7,441 |

|

7,053 |

|

6,177 |

|

21,066 |

|

15,268 |

| |||||

|

|

Tenant reimbursement and other |

|

1,932 |

|

1,923 |

|

1,752 |

|

5,743 |

|

5,034 |

| |||||

|

|

Total operating revenues |

|

60,635 |

|

57,667 |

|

53,762 |

|

173,393 |

|

151,682 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

Property operating and maintenance |

|

17,368 |

|

15,118 |

|

16,360 |

|

47,013 |

|

46,029 |

| |||||

|

|

Real estate taxes and insurance |

|

2,226 |

|

2,304 |

|

2,158 |

|

6,750 |

|

6,304 |

| |||||

|

|

Depreciation and amortization |

|

16,424 |

|

16,261 |

|

16,583 |

|

48,634 |

|

47,991 |

| |||||

|

|

Sales and marketing |

|

3,206 |

|

3,936 |

|

2,231 |

|

10,931 |

|

6,941 |

| |||||

|

|

General and administrative |

|

7,045 |

|

6,177 |

|

6,389 |

|

20,225 |

|

18,777 |

| |||||

|

|

Rent |

|

5,082 |

|

4,756 |

|

4,689 |

|

14,631 |

|

13,957 |

| |||||

|

|

Transaction costs |

|

25 |

|

249 |

|

293 |

|

279 |

|

576 |

| |||||

|

|

Total operating expenses |

|

51,376 |

|

48,801 |

|

48,703 |

|

148,463 |

|

140,575 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

Operating income |

|

9,259 |

|

8,866 |

|

5,059 |

|

24,930 |

|

11,107 |

| |||||

|

|

Interest income |

|

14 |

|

2 |

|

5 |

|

18 |

|

12 |

| |||||

|

|

Interest expense |

|

(708) |

|

(783) |

|

(1,595) |

|

(1,930) |

|

(3,922) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Income before income taxes |

|

8,565 |

|

8,085 |

|

3,469 |

|

23,018 |

|

7,197 |

| |||||

|

|

Income tax expense |

|

(56) |

|

(206) |

|

(522) |

|

(435) |

|

(1,059) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Net income |

|

8,509 |

|

7,879 |

|

2,947 |

|

22,583 |

|

6,138 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Net income attributable to noncontrolling interests |

|

3,524 |

|

3,176 |

|

1,627 |

|

8,962 |

|

3,389 |

| |||||

|

|

Net income attributable to CoreSite Realty Corporation |

|

4,985 |

|

4,703 |

|

1,320 |

|

13,621 |

|

2,749 |

| |||||

|

|

Preferred dividends |

|

(2,084) |

|

(2,085) |

|

- |

|

(6,253) |

|

- |

| |||||

|

|

Net income attributable to common shares |

|

$ |

2,901 |

|

$ |

2,618 |

|

$ |

1,320 |

|

$ |

7,368 |

|

$ |

2,749 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Net income per share attributable to common shares: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Basic |

|

$ |

0.14 |

|

$ |

0.13 |

|

$ |

0.06 |

|

$ |

0.35 |

|

$ |

0.13 |

|

|

|

Diluted |

|

$ |

0.14 |

|

$ |

0.12 |

|

$ |

0.06 |

|

$ |

0.34 |

|

$ |

0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

Basic |

|

20,871,504 |

|

20,829,375 |

|

20,554,893 |

|

20,793,596 |

|

20,514,713 |

| |||||

|

|

Diluted |

|

21,479,971 |

|

21,445,875 |

|

21,027,635 |

|

21,465,710 |

|

20,890,894 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Reconciliations of Net Income

|

|

(in thousands, except share and per share data)

|

Reconciliation of Net Income available to FFO

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| ||||||

|

Net income |

|

$ |

8,509 |

|

$ |

7,879 |

|

$ |

2,947 |

|

$ |

22,583 |

|

$ |

6,138 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Real estate depreciation and amortization |

|

|

15,443 |

|

15,309 |

|

15,689 |

|

45,894 |

|

46,133 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

FFO |

|

$ |

23,952 |

|

$ |

23,188 |

|

$ |

18,636 |

|

$ |

68,477 |

|

$ |

52,271 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Preferred stock dividends |

|

(2,084) |

|

(2,085) |

|

- |

|

(6,253) |

|

- |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

FFO available to common shareholders and OP unit holders |

|

$ |

21,868 |

|

$ |

21,103 |

|

$ |

18,636 |

|

$ |

62,224 |

|

$ |

52,271 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Weighted average common shares outstanding - diluted |

|

21,479,971 |

|

21,445,875 |

|

21,027,635 |

|

21,465,710 |

|

20,890,894 |

| ||||||

|

Weighted average OP units outstanding - diluted |

|

25,353,942 |

|

25,353,709 |

|

25,346,805 |

|

25,353,787 |

|

25,345,998 |

| ||||||

|

Total weighted average shares and units outstanding - diluted |

|

46,833,913 |

|

46,799,584 |

|

46,374,440 |

|

46,819,497 |

|

46,236,892 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

FFO per common share and OP unit - diluted |

|

$ |

0.47 |

|

$ |

0.45 |

|

$ |

0.40 |

|

$ |

1.33 |

|

$ |

1.13 |

| |

|

Reconciliation of FFO to AFFO

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |||||||||||

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |||||

|

|

|

2013 |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| |||||

|

FFO available to common shareholders and unit holders |

|

$ |

21,868 |

|

$ |

21,103 |

|

$ |

18,636 |

|

$ |

62,224 |

|

$ |

52,271 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Amortization of deferred financing costs |

|

445 |

|

427 |

|

435 |

|

1,293 |

|

1,307 |

| |||||

|

Non-cash compensation |

|

1,759 |

|

1,683 |

|

1,556 |

|

5,337 |

|

4,082 |

| |||||

|

Non-real estate depreciation |

|

981 |

|

952 |

|

894 |

|

2,740 |

|

1,858 |

| |||||

|

Straight-line rent adjustment |

|

(539) |

|

(339) |

|

(734) |

|

(970) |

|

(2,877 |

) | |||||

|

Amortization of above and below market leases |

|

(241) |

|

(199) |

|

(444) |

|

(672) |

|

(1,241 |

) | |||||

|

Recurring capital expenditures |

|

(1,174) |

|

(935) |

|

(822) |

|

(3,808) |

|

(2,010 |

) | |||||

|

Tenant improvements |

|

(1,578) |

|

(1,027) |

|

(1,362) |

|

(4,218) |

|

(3,378 |

) | |||||

|

Capitalized leasing commissions |

|

(959) |

|

(1,260) |

|

(1,004) |

|

(3,251) |

|

(3,544 |

) | |||||

|

AFFO available to common shareholders and OP unit holders |

|

$ |

20,562 |

|

$ |

20,405 |

|

$ |

17,155 |

|

$ |

58,675 |

|

$ |

46,468 |

|

|

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |||||||||||

|

|

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |||||

|

|

|

2013 |

|

2013 |

|

2012 |

|

2013 |

|

2012 |

| |||||

|

Net income |

|

$ |

8,509 |

|

$ |

7,879 |

|

$ |

2,947 |

|

$ |

22,583 |

|

$ |

6,138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Interest expense, net of interest income |

|

694 |

|

781 |

|

1,590 |

|

1,912 |

|

3,910 |

| |||||

|

Income taxes |

|

56 |

|

206 |

|

522 |

|

435 |

|

1,059 |

| |||||

|

Depreciation and amortization |

|

16,424 |

|

16,261 |

|

16,583 |

|

48,634 |

|

47,991 |

| |||||

|

EBITDA |

|

$ |

25,683 |

|

$ |

25,127 |

|

$ |

21,642 |

|

$ |

73,564 |

|

$ |

59,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Non-cash compensation |

|

1,759 |

|

1,683 |

|

1,556 |

|

5,337 |

|

4,083 |

| |||||

|

Transaction costs / litigation |

|

25 |

|

399 |

|

293 |

|

529 |

|

2,026 |

| |||||

|

Adjusted EBITDA |

|

$ |

27,467 |

|

$ |

27,209 |

|

$ |

23,491 |

|

$ |

79,430 |

|

$ |

65,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Operating Properties

|

|

(in thousands, except NRSF data)

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre- |

|

|

|

|

| |||||

|

|

|

|

|

|

|

Office and Light- |

|

|

|

|

|

Stabilized |

|

Development |

|

|

| |||||

|

|

|

Annualized |

|

Data Center(2 ) |

|

Industrial(3 ) |

|

Total |

|

NRSF(7 ) |

|

NRSF(8 ) |

|

Total |

| |||||||

|

|

|

Rent |

|

|

|

Percent |

|

|

|

Percent |

|

|

|

Percent |

|

|

|

|

|

Portfolio |

| |

|

Market/Facilities |

|

($000) (4) |

|

Total |

|

Occupied(5 ) |

|

Total |

|

Occupied(5) |

|

Total(6) |

|

Occupied(5 ) |

|

Total |

|

Total |

|

NRSF(1 ) |

| |

|

Los Angeles One Wilshire Campus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

LA1* |

|

$ |

23,856 |

|

150,278 |

|

75.2 |

% |

7,500 |

|

41.0 |

% |

157,778 |

|

73.6 |

% |

- |

|

- |

|

157,778 |

|

|

LA2 |

|

14,403 |

|

159,617 |

|

87.0 |

|

6,055 |

|

72.7 |

|

165,672 |

|

86.4 |

|

31,585 |

|

236,902 |

|

434,159 |

| |

|

Los Angeles Total |

|

38,259 |

|

309,895 |

|

81.3 |

|

13,555 |

|

55.2 |

|

323,450 |

|

80.2 |

|

31,585 |

|

236,902 |

|

591,937 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

San Francisco Bay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SV1 |

|

11,366 |

|

84,045 |

|

87.3 |

|

206,255 |

|

80.2 |

|

290,300 |

|

82.3 |

|

- |

|

- |

|

290,300 |

| |

|

SV2 |

|

6,186 |

|

76,676 |

|

65.5 |

|

- |

|

- |

|

76,676 |

|

65.5 |

|

- |

|

- |

|

76,676 |

| |

|

Santa Clara Campus |

|

19,305 |

|

119,067 |

|

82.8 |

|

71,196 |

|

91.7 |

|

190,263 |

|

86.1 |

|

31,497 |

|

274,490 |

|

496,250 |

| |

|

San Francisco Bay Total |

|

36,857 |

|

279,788 |

|

79.5 |

|

277,451 |

|

83.2 |

|

557,239 |

|

81.3 |

|

31,497 |

|

274,490 |

|

863,226 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Northern Virginia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

VA1 |

|

22,169 |

|

201,719 |

|

76.5 |

|

61,050 |

|

79.7 |

|

262,769 |

|

77.2 |

|

- |

|

- |

|

262,769 |

| |

|

VA2 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

198,000 |

|

198,000 |

| |

|

DC1* |

|

2,603 |

|

22,137 |

|

84.6 |

|

- |

|

- |

|

22,137 |

|

84.6 |

|

- |

|

- |

|

22,137 |

| |

|

Northern Virginia Total |

|

24,772 |

|

223,856 |

|

77.3 |

|

61,050 |

|

79.7 |

|

284,906 |

|

77.8 |

|

- |

|

198,000 |

|

482,906 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Boston |

|

11,927 |

|

166,026 |

|

93.3 |

|

19,495 |

|

54.2 |

|

185,521 |

|

89.2 |

|

- |

|

87,650 |

|

273,171 |

| |

|

BO1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Chicago |

|

11,212 |

|

158,167 |

|

84.0 |

|

4,946 |

|

62.3 |

|

163,113 |

|

83.4 |

|

20,240 |

|

- |

|

183,353 |

| |

|

CH1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

New York |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

NY1* |

|

4,746 |

|

48,404 |

|

67.1 |

|

209 |

|

100.0 |

|

48,613 |

|

67.3 |

|

- |

|

- |

|

48,613 |

| |

|

NY2 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

283,000 |

|

283,000 |

| |

|

New York Total |

|

4,746 |

|

48,404 |

|

67.1 |

|

209 |

|

100.0 |

|

48,613 |

|

67.3 |

|

- |

|

283,000 |

|

331,613 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Miami |

|

1,676 |

|

30,176 |

|

44.2 |

|

1,934 |

|

57.9 |

|

32,110 |

|

45.0 |

|

- |

|

13,154 |

|

45,264 |

| |

|

MI1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Denver |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

DE1* |

|

646 |

|

4,144 |

|

80.9 |

|

- |

|

- |

|

4,144 |

|

80.9 |

|

- |

|

- |

|

4,144 |

| |

|

DE2* |

|

143 |

|

5,140 |

|

66.3 |

|

- |

|

- |

|

5,140 |

|

66.3 |

|

- |

|

- |

|

5,140 |

| |

|

Denver Total |

|

789 |

|

9,284 |

|

72.8 |

|

- |

|

- |

|

9,284 |

|

72.8 |

|

- |

|

- |

|

9,284 |

| |

|

Total Facilities |

|

$ |

130,238 |

|

1,225,596 |

|

80.6 |

% |

378,640 |

|

79.7 |

% |

1,604,236 |

|

80.4 |

% |

83,322 |

|

1,093,196 |

|

2,780,754 |

|

|

* Indicates properties in which we hold a leasehold interest. | ||

|

(1) |

|

Represents the square feet at each building under lease as specified in existing customer lease agreements plus management’s estimate of space available for lease to customers based on engineers’ drawings and other factors, including required data center support space (such as mechanical, telecommunications and utility rooms) and building common areas. Total NRSF at a given facility includes the total stabilized operating NRSF, pre-stabilized NRSF and development NRSF, but excludes our office space at a facility and our corporate headquarters. |

|

|

|

|

|

(2) |

|

Represents the NRSF at each operating facility that is currently occupied or readily available for lease as data center space. Both occupied and available data center NRSF includes a factor to account for a customer’s proportionate share of the required data center support space (such as the mechanical, telecommunications and utility rooms) and building common areas, which may be updated on a periodic basis to reflect the most current build-out of our properties. |

|

|

|

|

|

(3) |

|

Represents the NRSF at each operating facility that is currently occupied or readily available for lease as space other than data center space, which is typically space offered for office or light-industrial uses. |

|

|

|

|

|

(4) |

|

Represents the monthly contractual rent under existing commenced customer leases as of September 30, 2013, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and excludes power revenue, interconnection revenue and operating expense reimbursement. On a gross basis, our annualized rent was approximately $135.7 million as of September 30, 2013, which reflects the addition of $5.5 million in operating expense reimbursements to contractual net rent under modified gross and triple-net leases. |

|

|

|

|

|

(5) |

|

Includes customer leases that have commenced and are occupied as of September 30, 2013. The percent occupied is determined based on leased square feet as a proportion of total operating NRSF. The percent occupied for data center space, office and light industrial space, and space in total would have been 82.2%, 79.7%, and 81.6%, respectively, if all leases signed in current and prior periods had commenced. |

|

|

|

|

|

(6) |

|

Represents the NRSF at an operating facility currently occupied or readily available for lease. This excludes existing vacant space held for development and pre-stabilized NRSF. |

|

|

|

|

|

(7) |

|

Represents pre-stabilized NRSF of projects/facilities which recently have been developed and are in the initial lease-up phase. Effective January 1, 2013, new pre-stabilized projects/facilities are excluded from stabilized operating NRSF. Pre-stabilized projects/facilities become stabilized operating properties at the earlier of achievement of 85% occupancy or 24 months after development completion. |

|

|

|

|

|

(8) |

|

Represents vacant space and entitled land in our portfolio that requires significant capital investment in order to develop into data center facilities as of September 30, 2013. Includes NRSF under construction for which substantial activities are ongoing to prepare the property for its intended use following development. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Leasing Statistics

|

|

|

Data Center Leasing Activity

|

|

|

|

|

|

|

|

|

|

GAAP |

|

GAAP |

|

|

|

| |||||

|

|

|

Leasing |

|

Number |

|

Total |

|

Annualized |

|

Annualized |

|

Rental |

Cash |

GAAP | |||||

|

|

|

Activity |

|

of |

|

Leased |

|

Rent per |

|

Rent |

|

Churn |

Rent |

Rent | |||||

|

|

|

Period |

|

Leases(1) |

|

NRSF(2) |

|

NRSF |

|

(000s) |

|

Rate(3) |

(4) |

(4) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

New/expansion leases commenced |

|

YTD 2013 |

|

320 |

|

119,291 |

|

$ |

162 |

|

$ |

19,276 |

|

|

|

|

|

|

|

|

|

Q3 2013 |

|

110 |

|

37,243 |

|

180 |

|

6,688 |

|

|

|

|

|

|

| |||

|

|

|

Q2 2013 |

|

121 |

|

42,672 |

|

147 |

|

6,267 |

|

|

|

|

|

|

| ||

|

|

|

Q1 2013 |

|

89 |

|

39,376 |

|

161 |

|

6,320 |

|

|

|

|

|

|

| ||

|

|

|

Q4 2012 |

|

100 |

|

21,372 |

|

137 |

|

2,924 |

|

|

|

|

|

|

| ||

|

|

|

Q3 2012 |

|

92 |

|

39,991 |

|

146 |

|

5,851 |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

New/expansion leases signed |

|

YTD 2013 |

|

331 |

|

96,903 |

|

$ |

153 |

|

$ |

14,831 |

|

|

|

|

|

|

|

|

|

Q3 2013 |

|

106 |

|

23,294 |

|

170 |

|

3,965 |

|

|

|

|

|

|

| |||

|

|

|

Q2 2013 |

|

115 |

|

30,810 |

|

188 |

|

5,782 |

|

|

|

|

|

|

| ||

|

|

|

Q1 2013 |

|

110 |

|

42,799 |

|

119 |

|

5,084 |

|

|

|

|

|

|

| ||

|

|

|

Q4 2012 |

|

100 |

|

156,704 |

|

74 |

(5) |

11,583 |

|

|

|

|

|

|

| ||

|

|

|

Q3 2012 |

|

77 |

|

11,387 |

|

177 |

|

2,012 |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Renewal leases signed |

|

YTD 2013 |

|

292 |

|

121,867 |

|

$ |

138 |

|

$ |

16,867 |

|

5.9 |

% |

3.6 |

% |

12.9 |

% |

|

|

|

Q3 2013 |

|

100 |

|

29,567 |

|

155 |

|

4,575 |

|

2.7 |

% |

6.6 |

% |

10.7 |

% | ||

|

|

|

Q2 2013 |

|

112 |

|

44,702 |

|

166 |

|

7,404 |

|

2.0 |

% |

2.9 |

% (6) |

9.0 |

% (6) | ||

|

|

|

Q1 2013 |

|

80 |

|

47,598 |

|

103 |

|

4,887 |

|

1.1 |

% |

2.0 |

% |

21.6 |

% | ||

|

|

|

Q4 2012 |

|

50 |

|

52,225 |

|

140 |

|

7,323 |

|

2.1 |

% |

11.7 |

% |

15.6 |

% | ||

|

|

|

Q3 2012 |

|

69 |

|

18,332 |

|

164 |

|

3,012 |

|

1.1 |

% |

4.0 |

% |

9.1 |

% | ||

|

(1) |

|

Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

|

|

|

|

|

(2) |

|

Total leased NRSF is determined based on contractually leased square feet for leases that have commenced on or before September 30, 2013. We calculate occupancy based on factors in addition to contractually leased square feet, including required data center support space (such as the mechanical, telecommunications and utility rooms) and building common areas. |

|

|

|

|

|

(3) |

|

Rental churn is calculated based on the annualized rental revenue of expired leases terminated in the period, compared with total annualized rental revenue at the beginning of the period. |

|

|

|

|

|

(4) |

|

Rent growth represents the increase in rental rates on renewed leases commencing during the period, as compared with the previous rental rates for the same space. |

|

|

|

|

|

(5) |

|

The GAAP Annualized Rent per Leased NRSF for new/expansion leases signed in Q4 2012 includes a 101,250 NRSF build-to-suit lease. Excluding this lease, the GAAP Annualized Rent per Leased NRSF for new/expansion leases signed in Q4 2012 would have been $151. |

|

|

|

|

|

(6) |

|

These amounts have been modified from the previously reported results of 5.4% in cash rent growth and 11.7% in GAAP rent growth due to a correction in reporting a Q2 2013 renewal at VA1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Leasing Statistics

|

|

|

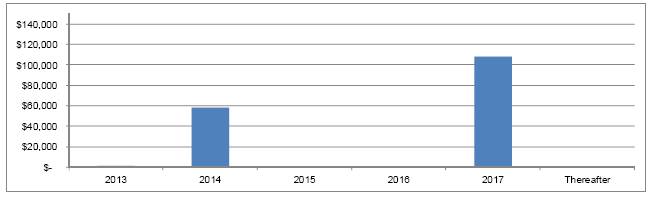

Lease Expirations (total operating properties, excluding pre-stabilized)

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

Annualize |

| ||||

|

|

|

Number |

|

Operating |

|

Percentage |

|

|

|

Percentage |

|

Annualize |

|

Annualized |

|

Rent Per |

| ||||

|

|

|

of |

|

NRSF of |

|

of Total |

|

Annualized |

|

of |

|

Rent Per |

|

Rent at |

|

Leased |

| ||||

|

|

|

Leases |

|

Expiring |

|

Operating |

|

Rent |

|

Annualized |

|

Leased |

|

Expiration |

|

NRSF at |

| ||||

|

Year of Lease Expiration |

|

Expiring(1) |

|

Leases |

|

NRSF |

|

($000)(2) |

|

Rent |

|

NRSF(3) |

|

($000)(4) |

|

Expiration |

| ||||

|

Available as of September 30, 2013(6) |

|

- |

|

314,994 |

|

19.6 |

% |

$ |

- |

|

- |

% |

$ |

- |

|

$ |

- |

|

$ |

- |

|

|

2013 |

|

272 |

|

109,907 |

|

6.8 |

|

12,267 |

|

9.5 |

|

111.61 |

|

12,539 |

|

114.09 |

| ||||

|

2014(7) |

|

410 |

|

307,288 |

|

19.2 |

|

30,666 |

|

23.5 |

|

99.80 |

|

31,049 |

|

101.04 |

| ||||

|

2015 |

|

254 |

|

141,287 |

|

8.8 |

|

24,152 |

|

18.5 |

|

170.94 |

|

25,916 |

|

183.43 |

| ||||

|

2016 |

|

224 |

|

221,247 |

|

13.8 |

|

20,490 |

|

15.7 |

|

92.61 |

|

22,656 |

|

102.40 |

| ||||

|

2017 |

|

110 |

|

158,292 |

|

9.9 |

|

19,870 |

|

15.3 |

|

125.53 |

|

25,523 |

|

161.24 |

| ||||

|

2018 |

|

56 |

|

144,271 |

|

9.0 |

|

13,407 |

|

10.3 |

|

92.93 |

|

17,557 |

|

121.69 |

| ||||

|

2019 |

|

4 |

|

80,942 |

|

5.0 |

|

1,696 |

|

1.3 |

|

20.95 |

|

1,822 |

|

22.51 |

| ||||

|

2020 |

|

3 |

|

30,093 |

|

1.9 |

|

968 |

|

0.7 |

|

32.17 |

|

1,176 |

|

39.08 |

| ||||

|

2021 |

|

8 |

|

15,534 |

|

1.0 |

|

1,672 |

|

1.3 |

|

107.63 |

|

2,407 |

|

154.95 |

| ||||

|

2022 |

|

10 |

|

33,356 |

|

2.1 |

|

3,112 |

|

2.4 |

|

93.30 |

|

4,865 |

|

145.85 |

| ||||

|

2023-Thereafter |

|

7 |

|

47,025 |

|

2.9 |

|

1,938 |

|

1.5 |

|

41.21 |

|

3,691 |

|

78.49 |

| ||||

|

Portfolio Total / Weighted Average |

|

1,358 |

|

1,604,236 |

|

100.0 |

% |

$ |

130,238 |

|

100.0 |

% |

$ |

101.02 |

|

$ |

149,201 |

|

$ |

115.73 |

|

|

(1) |

Includes leases that upon expiration will automatically be renewed, primarily on a month-to-month basis. Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

|

(2) |

Represents the monthly contractual rent under existing commenced customer leases as of September 30, 2013, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and it excludes power revenue, interconnection revenue and operating expense reimbursement. |

|

(3) |

Annualized rent as defined above, divided by the square footage of leases expiring in the given year. |

|

(4) |

Represents the final monthly contractual rent under existing customer leases as of September 30, 2013, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and it excludes operating expense reimbursement, power revenue and interconnection revenue. |

|

(5) |

Annualized rent at expiration as defined above, divided by the square footage of leases expiring in the given year. This metric reflects the rent growth inherent in the existing base of lease agreements. |

|

(6) |

Excludes NRSF held for development or under construction. |

|

(7) |

Includes an office lease, which is an interim lease in place that expires on May 31, 2014. Upon the expiration of the interim lease and the substantial completion of tenant improvements by us, a new lease that has already been executed by both parties will commence. The new lease includes 119,729 NRSF with a ten-year term and a termination option at the end of year eight. |

|

Lease Distribution (total operating properties, excluding pre-stabilized)

|

|

|

|

|

|

|

|

Total |

|

Percentage |

|

|

|

Percentage |

| |

|

|

|

Number |

|

Percentage |

|

Operating |

|

of Total |

|

Annualized |

|

of |

| |

|

|

|

of |

|

of All |

|

NRSF of |

|

Operating |

|

Rent |

|

Annualized |

| |

|

Square Feet Under Lease(1) |

|

Leases(2) |

|

Leases |

|

Leases(3) |

|

NRSF |

|

($000)(4) |

|

Rent |

| |

|

Available colocation(5) |

|

- |

|

- |

% |

238,179 |

|

14.8 |

% |

$ |

- |

|

- |

% |

|

Available office and light-industrial |

|

- |

|

- |

|

76,815 |

|

4.8 |

|

- |

|

- |

| |

|

Colocation NRSF: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

5,000 or less |

|

1,301 |

|

95.8 |

|

476,534 |

|

29.7 |

|

72,321 |

|

55.6 |

| |

|

5,001 - 10,000 |

|

20 |

|

1.5 |

|

143,896 |

|

9.0 |

|

14,207 |

|

10.9 |

| |

|

10,001 - 25,000 |

|

11 |

|

0.9 |

|

182,955 |

|

11.4 |

|

25,888 |

|

19.9 |

| |

|

Greater than 25,000 |

|

2 |

|

0.1 |

|

61,614 |

|

3.8 |

|

7,086 |

|

5.4 |

| |

|

Powered Shell |

|

6 |

|

0.4 |

|

166,738 |

|

10.4 |

|

4,693 |

|

3.6 |

| |

|

Office and light-industrial(6) |

|

18 |

|

1.3 |

|

257,505 |

|

16.1 |

|

6,043 |

|

4.6 |

| |

|

Portfolio Total |

|

1,358 |

|

100.0 |

|

1,604,236 |

|

100.0 |

% |

$ |

130,238 |

|

100.0 |

|

|

(1) |

Represents all leases in our portfolio, including data center and office and light-industrial leases. |

|

|

|

|

(2) |

Includes leases that upon expiration will automatically be renewed, primarily on a month-to-month basis. Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

|

|

|

|

(3) |

Represents the square feet at a building under lease as specified in the lease agreements plus management’s estimate of space available for lease to third parties based on engineers’ drawings and other factors, including required data center support space (such as mechanical, telecommunications and utility rooms) and building common areas. |

|

|

|

|

(4) |

Represents the monthly contractual rent under existing commenced customer leases as of September 30, 2013, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and it excludes power revenue, interconnection revenue and operating expense reimbursement. |

|

|

|

|

(5) |

Excludes NRSF held for development or under construction. |

|

|

|

|

(6) |

Excludes office and light-industrial space of 44,320 NRSF that is a component of colocation leases. The 44,320 NRSF of office and light-industrial space is leased to data center tenants as incremental space to their data center lease space. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Overview |

Financial |

Operating |

Development

|

Capital |

2013 |

Appendix |

© Copyright 2013 CoreSite. All Rights Reserved. | Quarter Ended September 30, 2013

|

Geographic Diversification

|

|

(in thousands, except NRSF data)

|

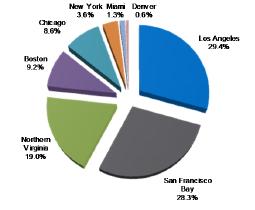

Geographic Diversification

|

|

|

|

Metropolitan Market |

|

Percentage of Total |

|

|

|

Los Angeles |

|

29.4 |

% | |

|

|

San Francisco Bay |

|

28.3 |

| |

|

|

Northern Virginia |

|

19.0 |

| |

|

|

Boston |

|

9.2 |

| |

|

|

Chicago |

|

8.6 |

| |

|

|

New York |

|

3.6 |

| |

|

|

Miami |

|

1.3 |

| |

|

|

Denver |

|

0.6 |

| |

|

|

Total |

|

100 |

% | |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

10 Largest Customers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|