Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMB FINANCIAL CORP | d620771d8k.htm |

Third Quarter 2013

UMB Financial

Exhibit 99.1 |

Cautionary Notice about

Forward-Looking Statements

2

This presentation contains, and our other communications may contain, forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

can be identified by the fact that they do not relate strictly to historical or current facts.

All forward-looking statements

are

subject

to

assumptions,

risks,

and

uncertainties,

which

may

change

over

time

and

many

of

which

are

beyond

our

control.

You

should

not

rely

on

any

forward-looking

statement

as

a

prediction or guarantee about the future. Our actual future objectives, strategies, plans, prospects,

performance, condition, or results may differ materially from those set forth in any

forward-looking statement. Some of the factors that may cause actual results or other

future events, circumstances, or aspirations

to

differ

from

those

in

forward-looking

statements

are

described

in

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012,

our

subsequent

Quarterly

Reports

on

Form

10-Q

or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the

Securities and Exchange Commission (SEC). Any forward-looking statement made by us or on

our behalf speaks only as of the date that it was made. We do not undertake to update any

forward- looking statement to reflect the impact of events, circumstances, or results that

arise after the date that the

statement

was

made.

You,

however,

should

consult

further

disclosures

(including

disclosures

of

a forward-looking nature) that we may make in any subsequent Quarterly Report on Form 10-Q,

Current Report on Form 8-K, or other applicable document that is filed or furnished with

the SEC. |

A

Different Kind of Bank The company

The business model

The performance |

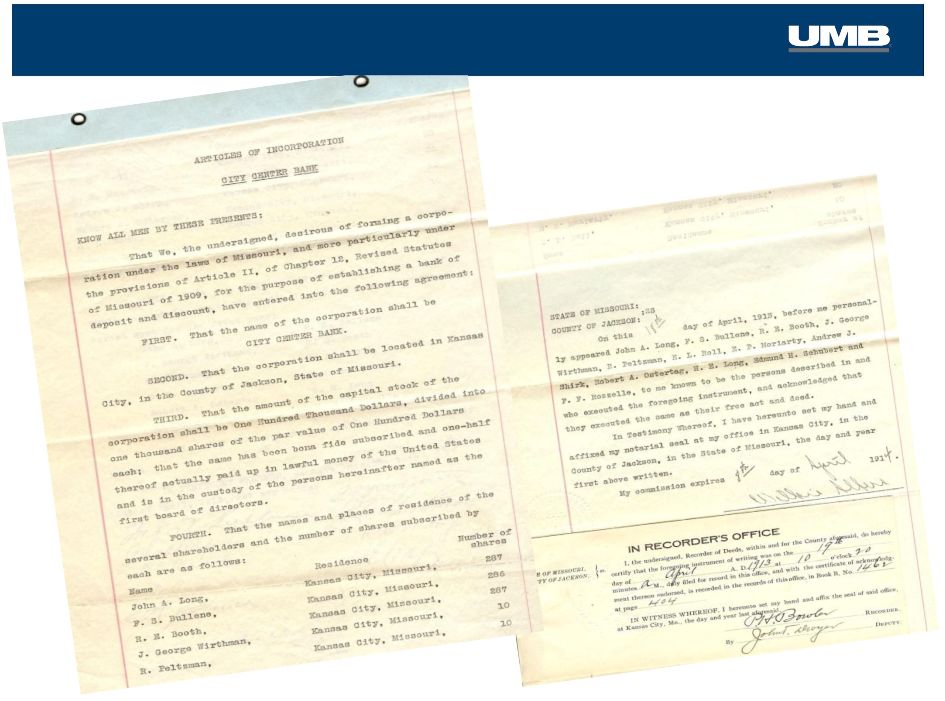

UMB

is

Born

as

City

Center

Bank

-

1913

4 |

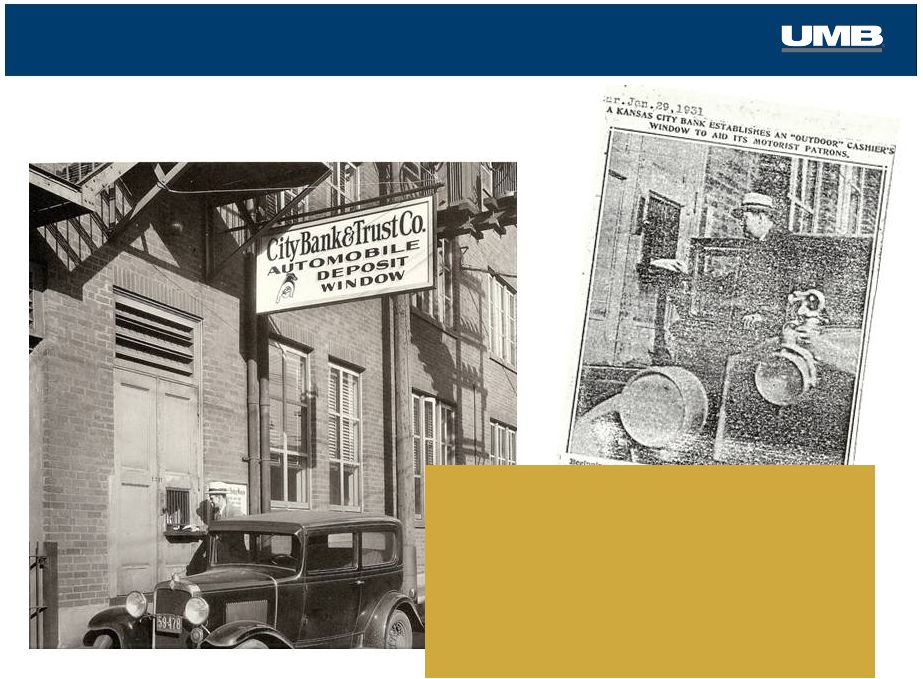

A Leader in Serving our

Customers

“Beginning today, motorists can do business with the

City Bank, Eighteenth Street & Grand Avenue, from the

alley between Grand & McGee streets. They can drive

to the new “cage”

and make deposits without leaving

the car.”

The City Bank is the first bank in Kansas City

to utilize such a plan to overcome traffic conditions

inconvenient for patrons.”

The Kansas City Star

January 29, 1931

1931

–

KC’s

First

“Drive

Through

Bank”

5 |

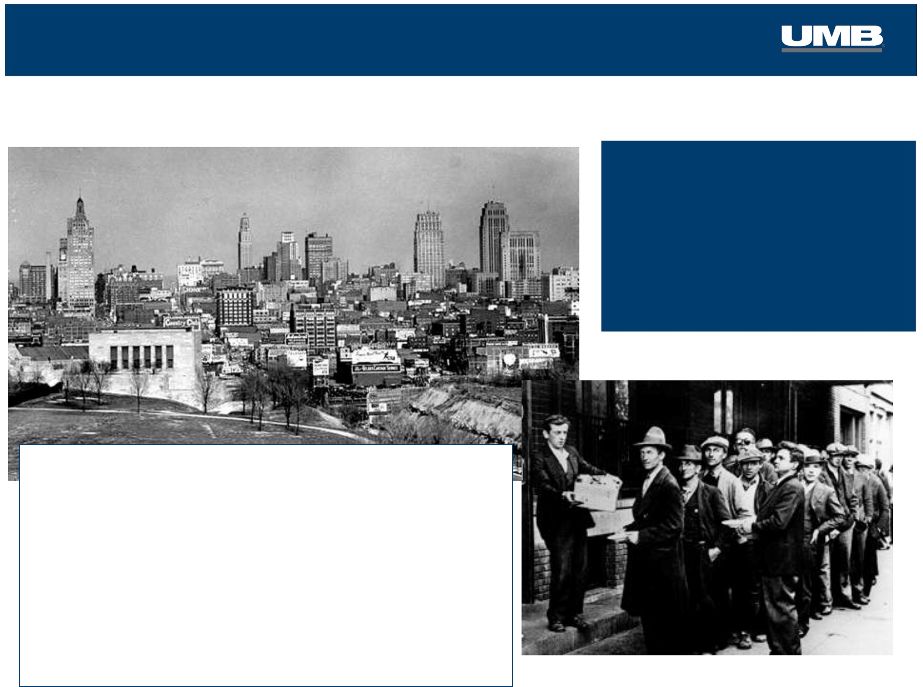

Self-Reliance and

Stability “If we were to liquidate this bank today, we

could pay our depositors one hundred cents

on the dollar and collect our entire Surplus

and Capital Account of $700,000 and a

large part of the Undivided Profits Account.”

-

R. Crosby Kemper, Sr. in a letter to the

Missouri Banking Commissioner, Oct. 1933

No need for

government

assistance –

then

or now.

1934 –

Emerging from the Great Depression

6 |

“Our company has remained

true to its values and the

results are evident in our

shareholder returns.”

Mariner Kemper

Chairman & Chief Executive Officer |

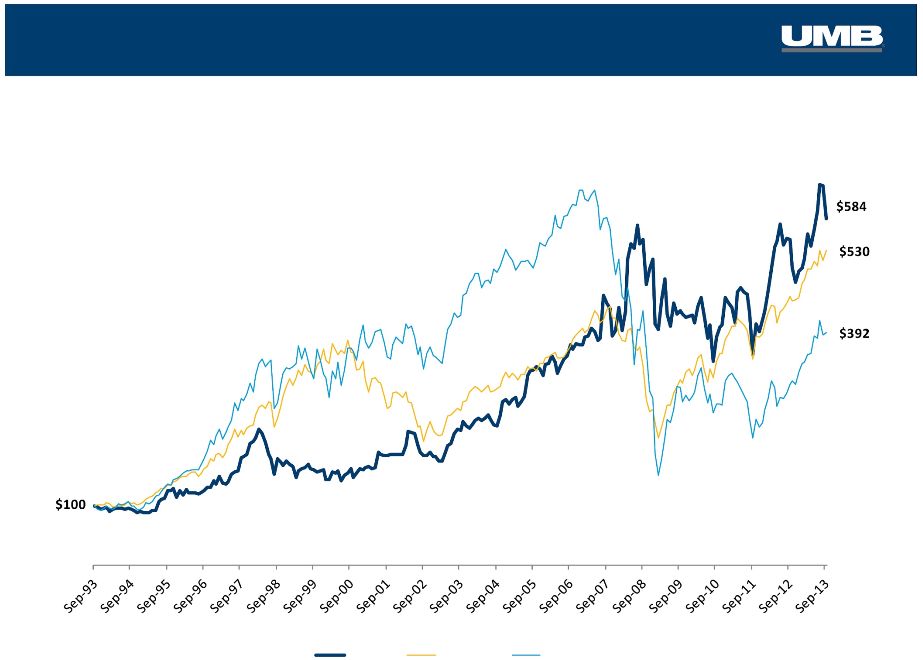

Total Returns Reflect

Long-Term Performance Total Shareholder Return

September 1993 –

September 2013

8

Source: SNL Financial

UMBF

S&P 500

SNL U.S. Bank |

UMB

At A Glance Assets under management

Banking presence

Branches/ATMs

Acquisitions last 10 years

Market cap

Dividend payout ratio*

$38.7B

8 states

115/320+

23

>$2.4B

30.3%

Total assets

$16.2B

Revenue from fee businesses

58.7%

*Average over past 4 quarters

As of September 30, 2013

9 |

We

Have Repositioned UMB… National

Regional

Low

High

Geographic

focus

Diversity of revenue streams

More than a typical bank

10

More stable earnings

Faster growth |

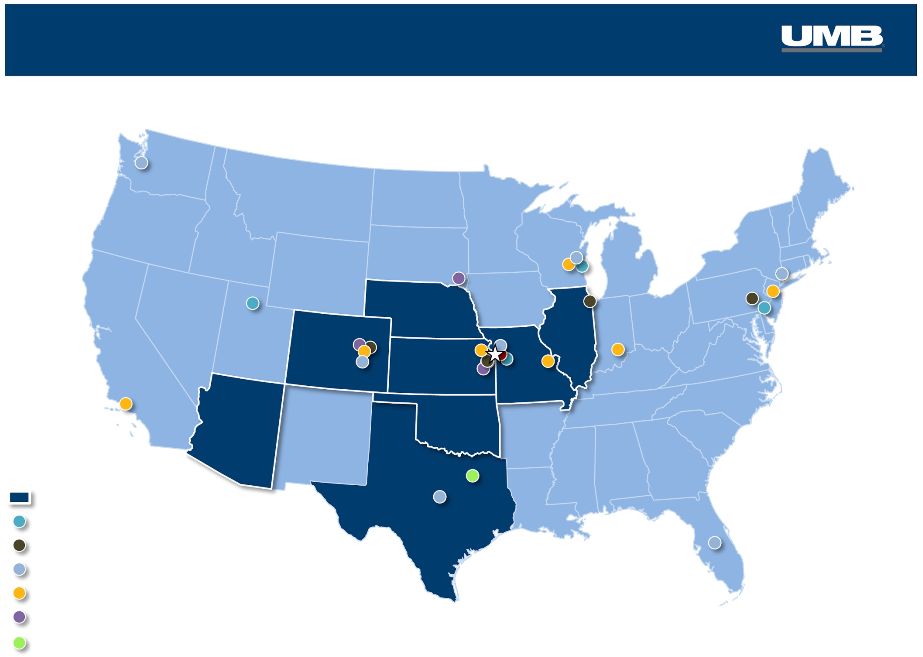

11

Fund Services

Prairie Capital

Corporate Trust

UMB Bank presence

Loan Production Office

…Resulting in a Growing National Presence

Healthcare Services – National Sales

Scout Investments – National Sales

|

Today: UMB is More

than a Regional Bank DIVERSIFIED FINANCIAL SERVICES

Healthcare

Services

Corporate

Trust

UMB Fund

Services

Scout

Investments

•JD Clark

Prairie

Capital

•Reams

…We are a diversified financial services company

Diversified

financial

Products / services

Banking

National

Regional

Geographic

focus

UMB

Insurance

12

Trust

Trust

Services

Services

TRADITIONAL BANKING

TRADITIONAL BANKING

Card

Card

Services

Services

Treasury

Treasury

Management

Management |

A

Financial Services Company The company

The business model

The performance |

+

+

+

High Quality Credit

Diverse Revenue Streams

Low-cost Funding

Strong Balance Sheet

Our Time-Tested Business Model |

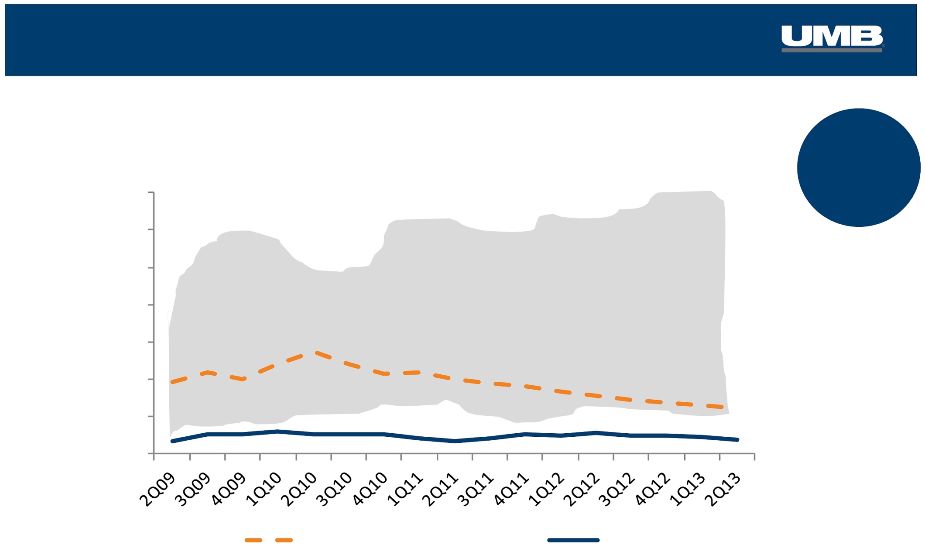

Our

Credit Quality Outpaces the Industry Peer Average as of 2Q13; Source: SNL

Financial 3Q 2013

0.48%

Shaded area is high/low range of the peer group

Non-Performing Loans

% of average loans

15

Traditional Peer Median

UMBF

1.24%

0.40%

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

NPLs = |

More Fee Revenue than

Our Peers % of Total Revenue from Fees

3Q13

•

More stable earnings

•

Greater growth opportunities

Industry Median as of 2Q13; Source: SNL Financial

16

19.1%

58.7%

3X

vs. Industry

Industry

Median |

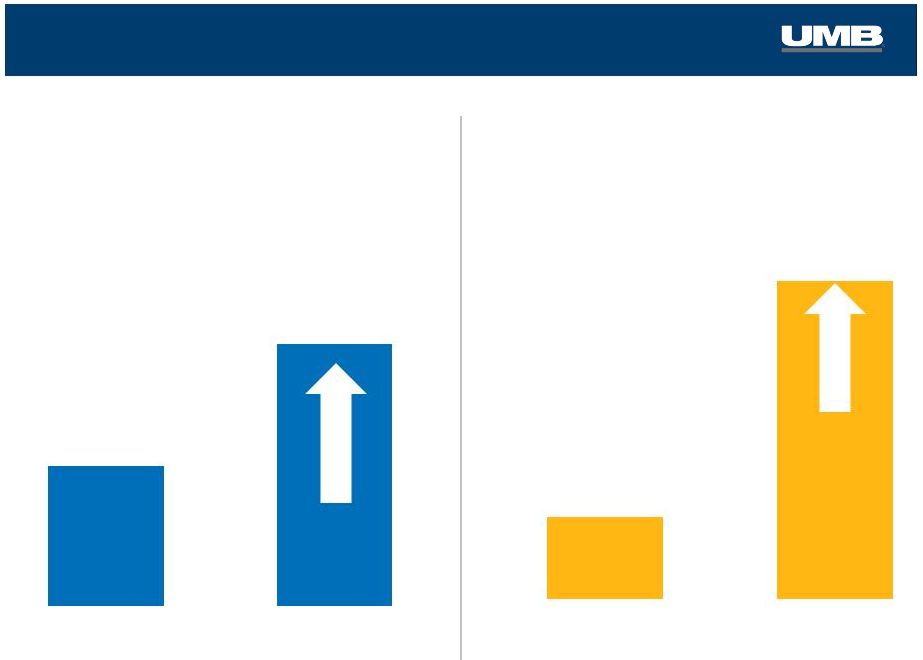

Successful Record Growing Fee Businesses

Noninterest

Income

($000’s)

*Includes Scout Investments and UMB Bank wealth management

Asset Management

Businesses

(Total Company Assets Under Management*)

17

$64.7

$121.6

3Q05

3Q13

$8.2B

$38.7B

2005

3Q13 |

Low-Cost Funding

Sources 18

>2X

vs. Industry

Non-Interest Bearing

Deposits

as

%

of

Total

Deposits

*Industry Median as of 2Q13; Source: SNL Financial

At September 30

43.2%

vs.

Industry Median* of

19.7%

non-interest bearing

deposits

2Q'13

2009

2010

2011

2012

2008

2007

2006

2005

2004

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

UMBF

Industry Median |

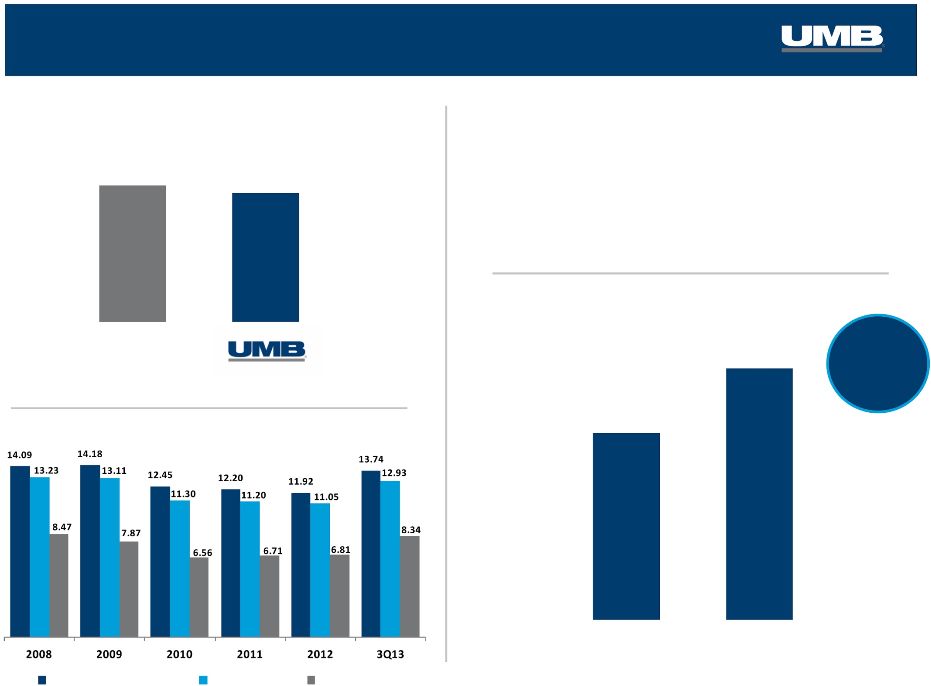

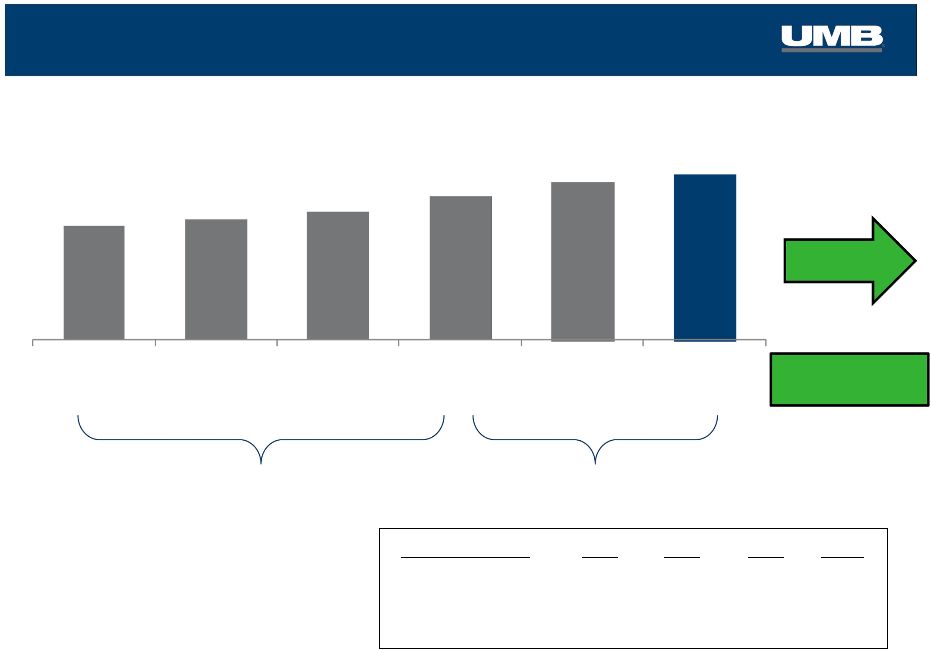

Balance

Sheet

–

Strong

Capital

Position

Tier 1 Capital Ratio vs. Industry

3Q 2013

Without Federal bailout funds

Industry Median as of 2Q13; Source: SNL Financial

19

Average Equity

Successful Equity Offering Supports Our Growth

September 2013

•

Strong interest from existing and new investors

•

Issued 3.9 million shares plus 15% overallotment

•

Gross proceeds of $242.2 million

Capital Ratio Trends

5 yr

CAGR

6.1%

$1,260.3

$936.1

3Q '08

3Q '13

13.69%

12.93%

Industry

Median

Total Risk-Based Capital

Tier 1 Capital

Tier 1 Leverage |

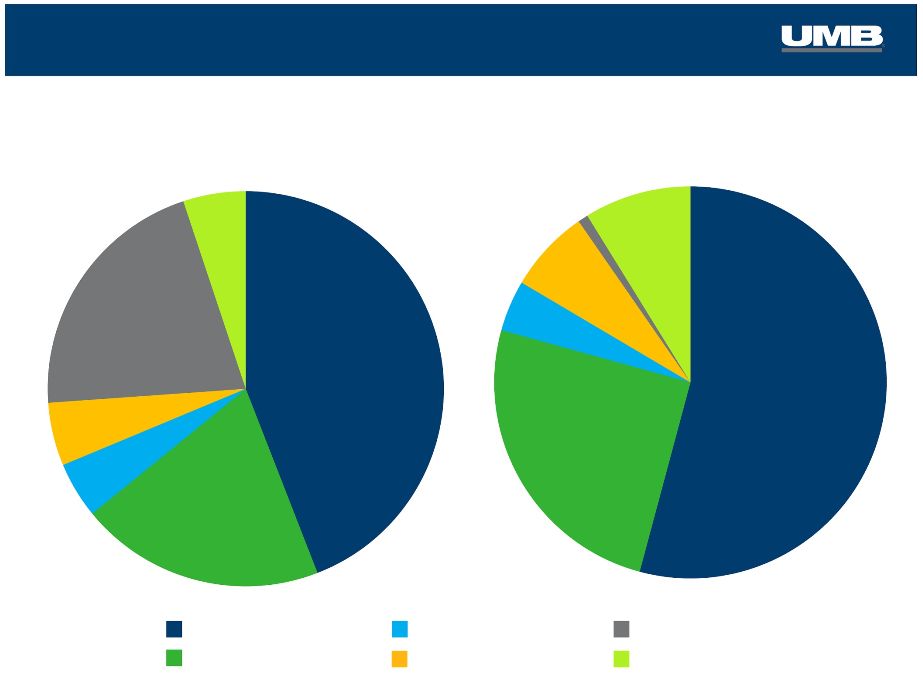

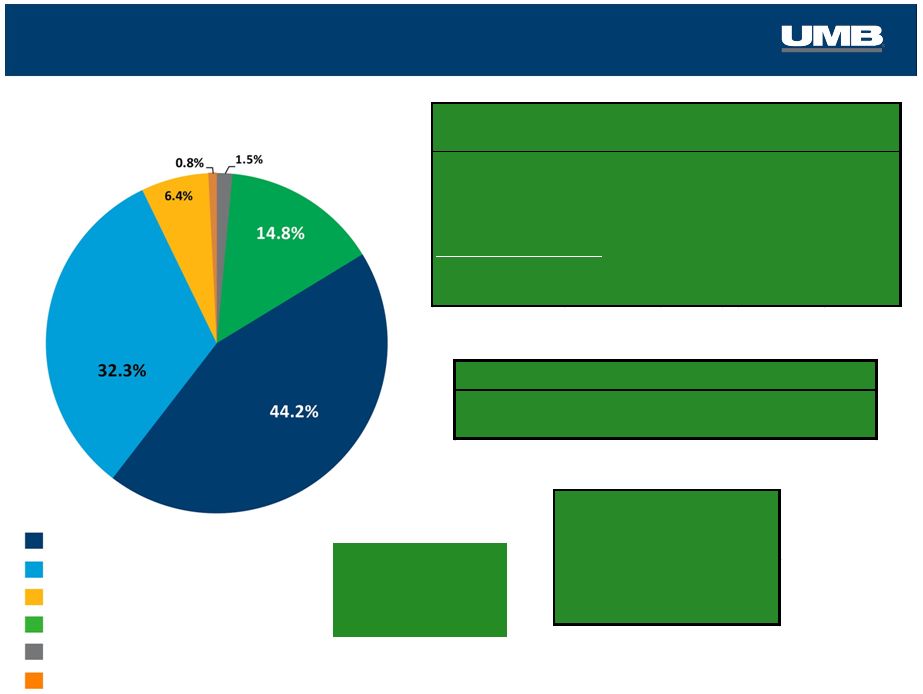

Commercial Real Estate

Commercial & Industrial

Consumer Real Estate

Credit Card

Home Equity

Consumer

Changing Loan Mix

Quality Loan Composition

3Q 2013

Year-End 2006

20

6.8%

0.8%

8.8%

4.2%

25.2%

54.2%

20.0%

44.1%

4.6%

5.2%

21.0%

5.1% |

A

Financial Services Company The company

The business model

The performance |

22

Consistent Performance –

Despite Headwinds

7.3%

11.6%

6.1%

9.4%

Revenue growth

Average Asset Growth

Average Equity Growth

EPS growth

5 year CAGR

(3Q’08--3Q’13)

29.4%

Total Assets Under Management

(diluted) |

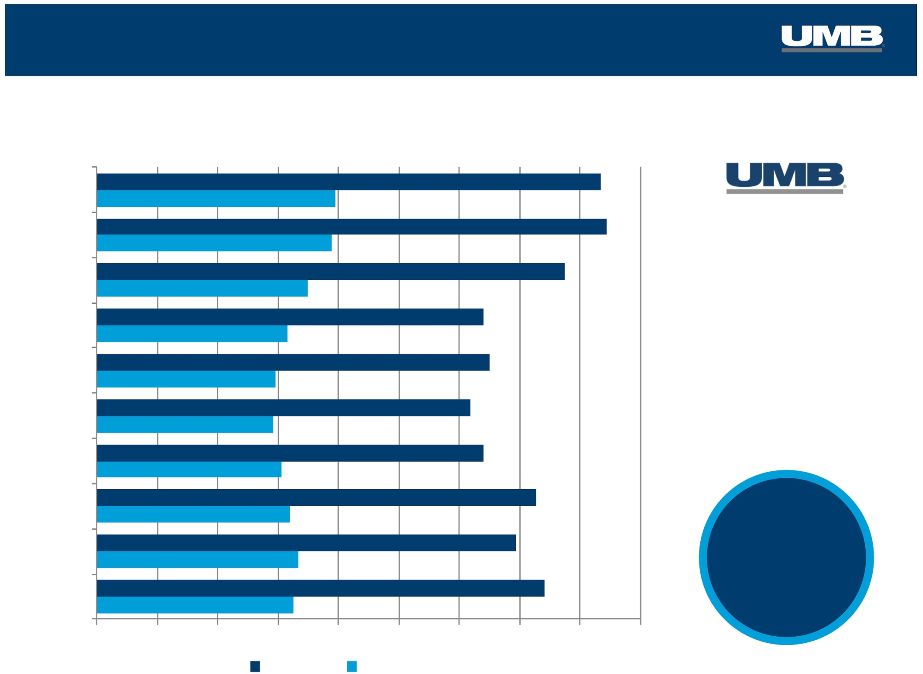

5-Year

Diluted

Earnings

Per

Share

3Q’08

–

3Q’13

CAGR

UMBF vs. Traditional Peers

*Bank industry defined as all publicly traded banks per SNL Financial;

EPS Growth vs. the Industry & Peers

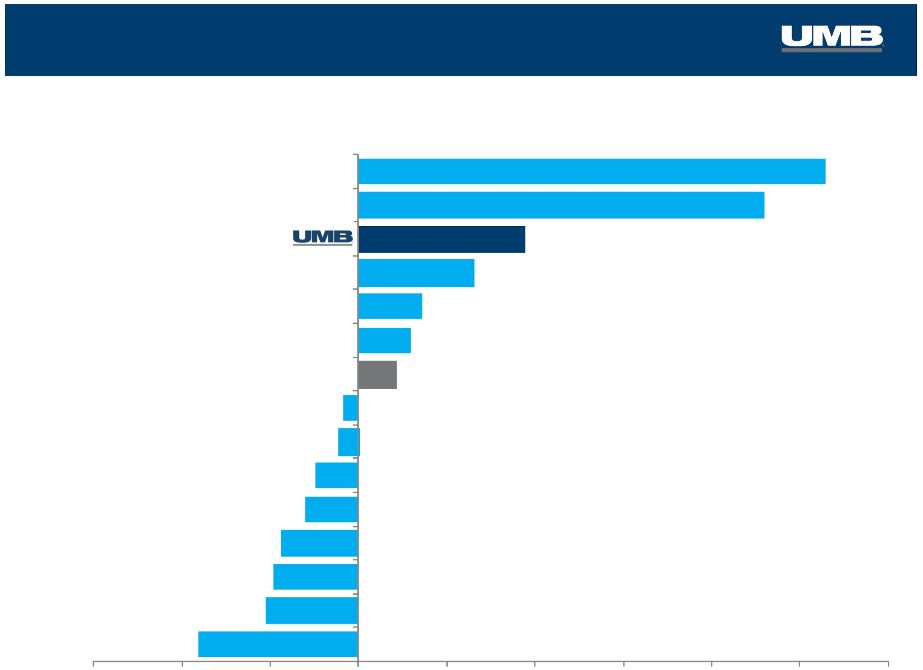

CBSH

COBZ

HBHC

ONB

BXS

FMBI

CFR

CYN

BOKF

BOH

TCB

TRMK

FMER

*All publicly traded banks with 3Q’13 reported EPS per SNL Financial

23

Bank Industry Median *

26.5%

23.0%

9.4%

6.48%

3.6%

3.0%

2.1%

-0.85%

-1.1%

-2.4%

-3.0%

-4.4%

-4.8%

-5.2%

-9.1% |

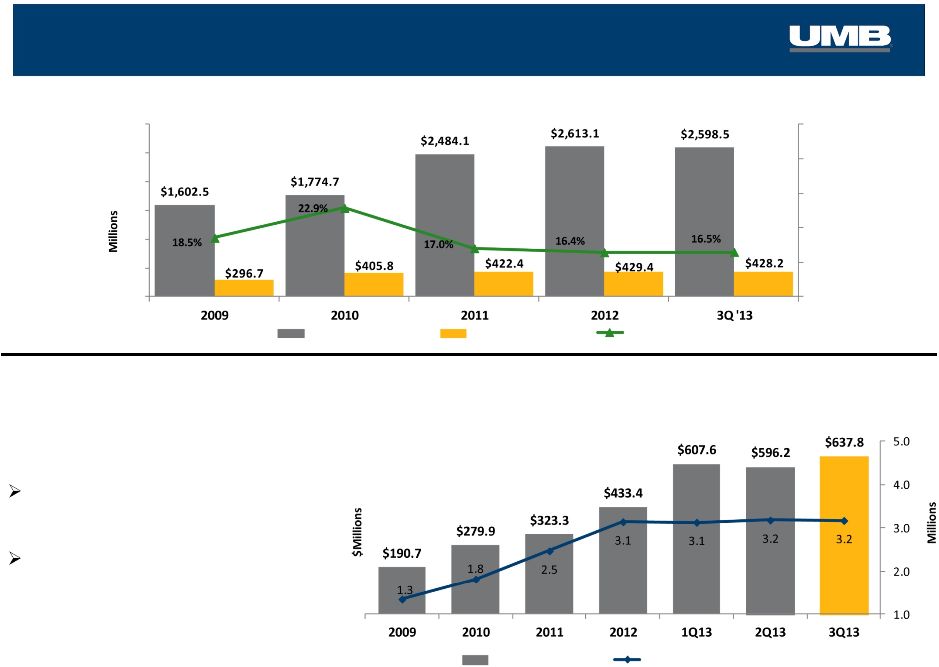

24

Slowing Annual Expense Growth

Total Noninterest Expense

+5.6%

+7.1%

+11.3%

+9.8%

+4.9%

Year-over-

Year

Increase

Completed 20 strategic

acquisitions from 2007 -

2010

Focus on improved profit margins

in fee businesses

2013…

Increased focus on

expense control

pre-tax profit margin

Inst Investment Mgmt:

Asset Servicing:

Payment Solutions:

Bank:

2011

23.8%

9.7%

30.3%

18.8%

2012

29.5%

11.9%

28.2%

20.5%

2010

18.0%

9.9%

25.8%

19.0%

3Q’13

37.6%

18.0%

12.5%

22.3%

2007

2008

2009

2010

2011

2012

$407.2

$430.2

$460.6

$512.6

$562.7

$590.5

(millions) |

3

Quarter 2013 Highlights

rd |

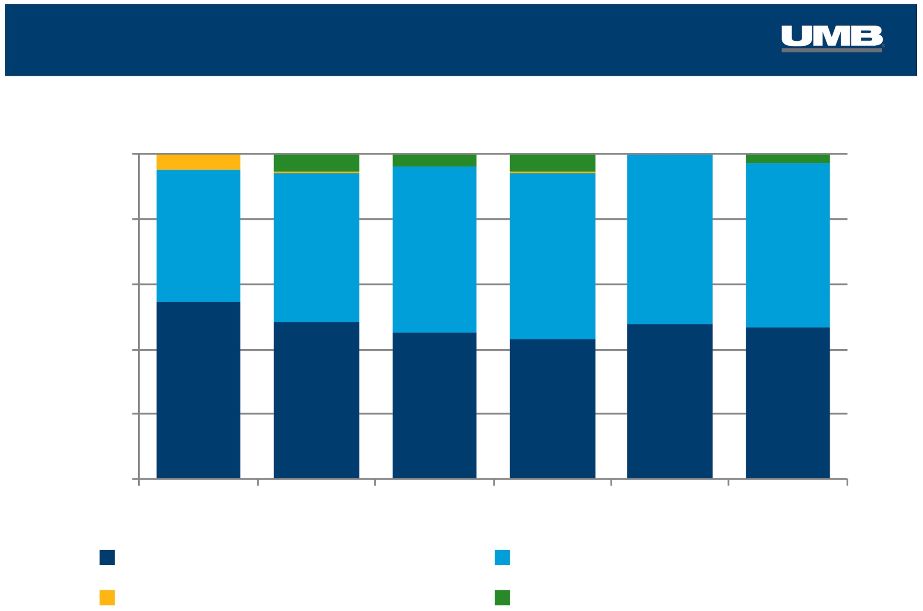

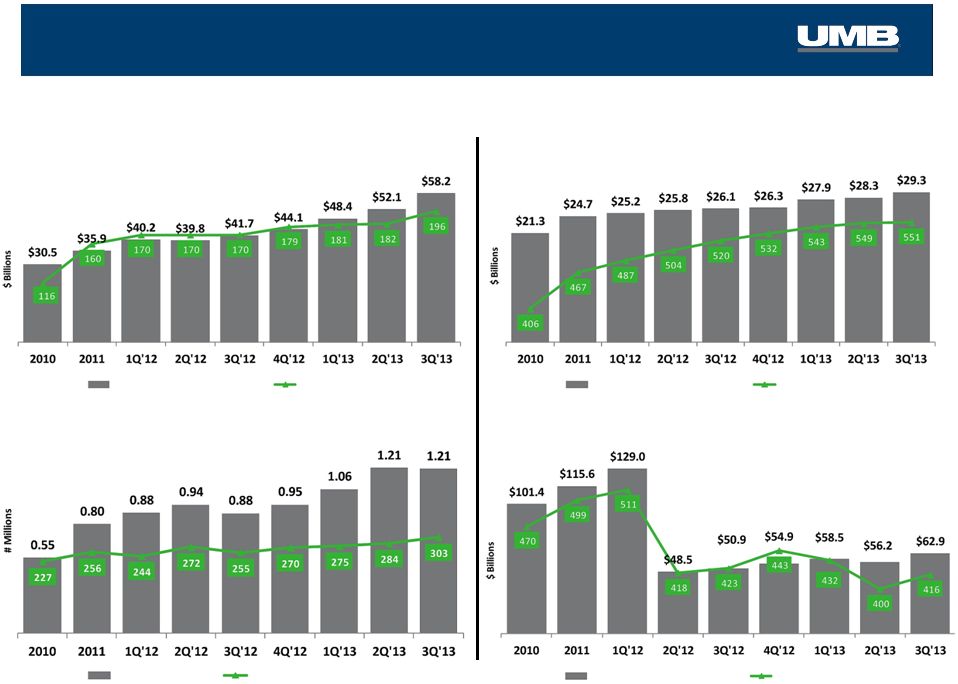

Changing Earning Asset Mix

26

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

54.6%

46.1%

48.2%

50.9%

45.3%

51.2%

43.1%

58.7%

47.6%

50.6%

46.5%

3Q'08

3Q'09

3Q'10

3Q'11

3Q'12

3Q'13

Net loans

Fed funds & resell agreements

Total securities

Interest Bearing Due From Banks

40.5% |

Average Balance:

$7.0 billion

Average Yield:

1.99%

Investment Mix

As of September 30, 2013

Mortgage-Backed Securities

Municipals

CDs & Corporates

Agencies

Treasuries

Trading Securities

Investment Portfolio Statistics

27

Duration/Life

(in months)

at 09/30/13

at 06/30/13

Avg. Life Total

49.39

48.67

Duration Total

46.31

46.80

Securities Gains

($ millions)

3Q12

259

$

4Q12

210

$

1Q13

5,893

$

2Q13

1,519

$

3Q13

1,140

$

Roll off

Purchased

($ millions)

Yield

($ millions)

Yield

1Q13

$413

1.98%

$769

1.31%

2Q13

$340

2.13%

$815

1.41%

3Q13

$265

1.85%

$77

1.02%

Scheduled Cash Flow

4Q13

$305

2.02%

Next 12 months

$1,127

1.88% |

Liabilities

Deposit Growth & % of Free Funds

($ billions)

3Q’13

Cost of Funds 0.16%

Including DDA 0.10%

28

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

$8.6

$9.4

$10.6

$13.0

32.3%

38.5%

41.6%

43.2%

Interest Bearing

Non-Interest Bearing |

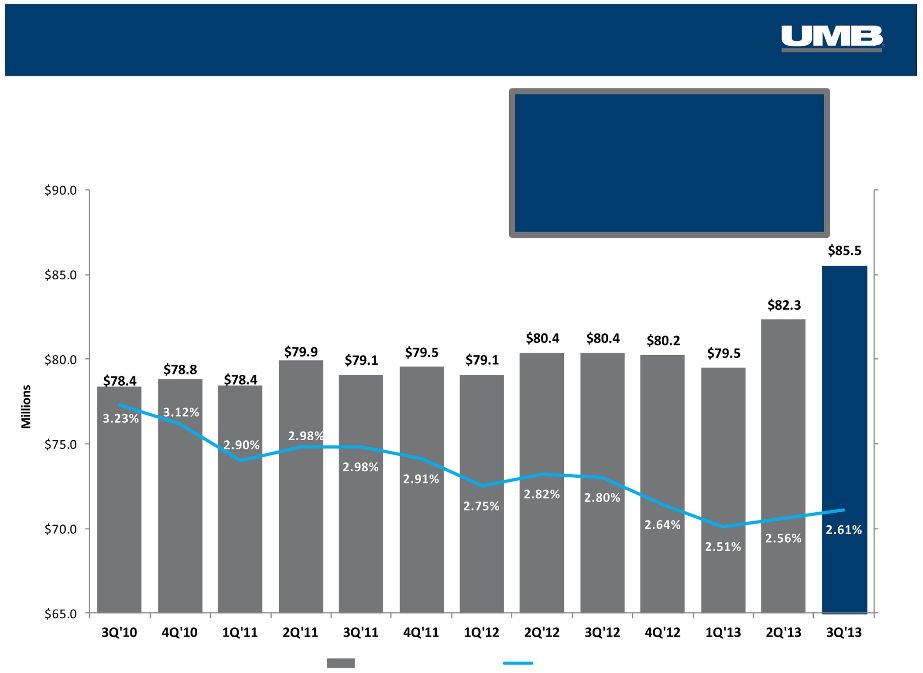

Net Interest

Income 29

+6.4%

3Q 13 vs. 3Q 12

•

Earning asset growth

•

Improved deposit pricing

’

’

Net Interest Income

NIM% |

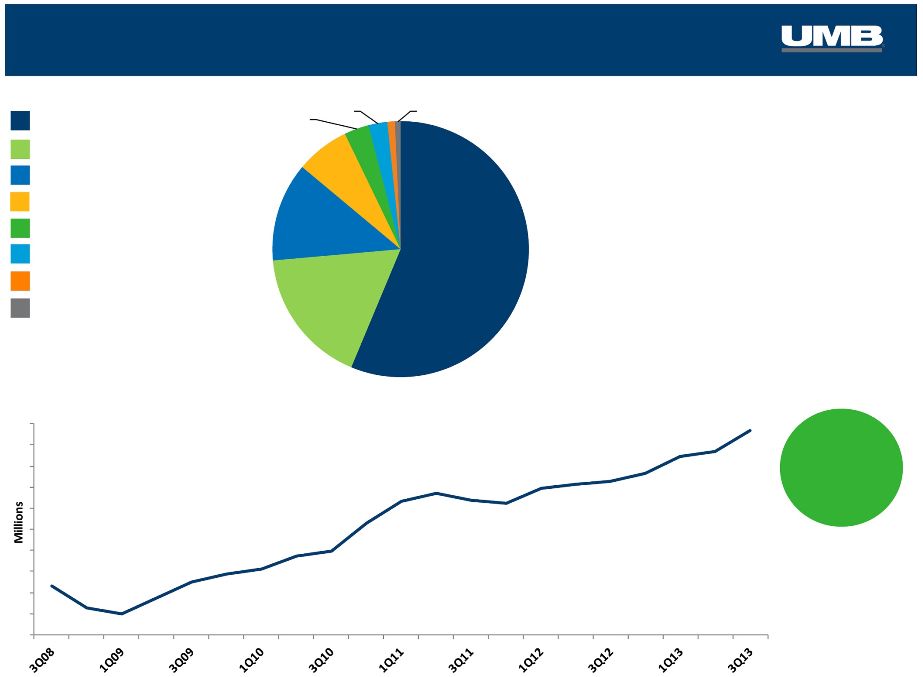

Noninterest Income Highlights

5 Year

CAGR

3Q’08–

3Q’13

16.8%

Trust & Securities Processing Revenue

Trust & Securities Processing Composition:

Bankcard Fees

Deposit Service Charges

Insurance Fees & Commissions

Trading & Investment Banking

Trust & Securities Processing

Gains on Sale of Securities

Brokerage Fees

Other

$68.5 million in 3Q13

Primary components:

•$20.3M

–

Asset

Servicing

the Bank segment

30

3.1%

2.4%

0.9%

0.7%

17.3%

6.8%

12.5%

56.3%

$31.5

$32.6

$39.8

$51.9

$56.3

$68.5

•$32.9M - Institutional Investment Management

•$15.2M – Personal & Institutional Asset Mgmt in |

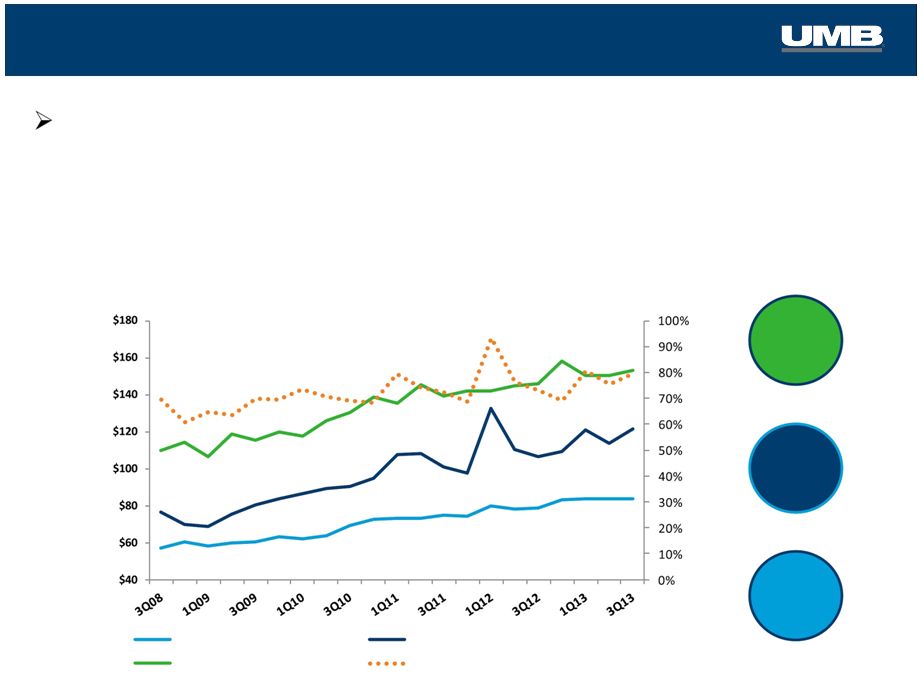

Noninterest Expense

•

Increase primarily driven by higher salary and benefits expense of $4.9 million,

increased equipment expense of $1.9 million and increased processing fees

of $1.5 million related to fees paid to third-party distributors of the

Scout Funds. Salary

CAGR

7.9%

NI

Income

CAGR

9.0%

NI

Expense

CAGR

6.8%

Managed FTE Costs; Growing Noninterest Income

31

* Noninterest Income/Noninterest Expense

Noninterest

expense

increased

4.9%

to

$153.1

million

vs.

3Q’12

Salary/Benefit Expense

Total Noninterest Expense

Noninterest income

Coverage Ratio* |

Business Segment Updates |

Institutional Investment Management

* Industry data source: Strategic Insight

3 Quarter 2013 Highlights

33

$22.6

$23.5

$25.7

$26.3

$29.3

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

Total Scout Assets Under Management

($ billions)

AUM increased 29.6% year-

over-year to $29.3 billion

Record net inflows of $1.9

billion for Q3’13; year-to-date

flows of $4.4 billion

Q3’13 industry stats: Equity

funds realized $113.2B in net

inflows; Taxable bond funds

realized $14.7B in net outflows

rd

Institutional Investment Management Operating Results

(unaudited, $000s)

3 mos Ended

June 30,

Year-Over-Year

Linked-Quarter

2013

2012

2013

Net Interest income

(11)

(1)

(10)

1000.0%

10.0%

Noninterest income

33,836

24,789

29,160

36.5%

16.0%

Noninterest expense

21,097

17,316

18,932

21.8%

11.4%

NI before taxes

12,728

7,472

10,218

70.3%

24.6%

Income tax expense

3,501

2,098

2,691

66.9%

30.1%

Net income

9,227

5,374

7,527

71.7%

22.6%

pre-tax profit margin

37.6%

30.1%

35.1%

September 30,

% Change

3 mos Ended |

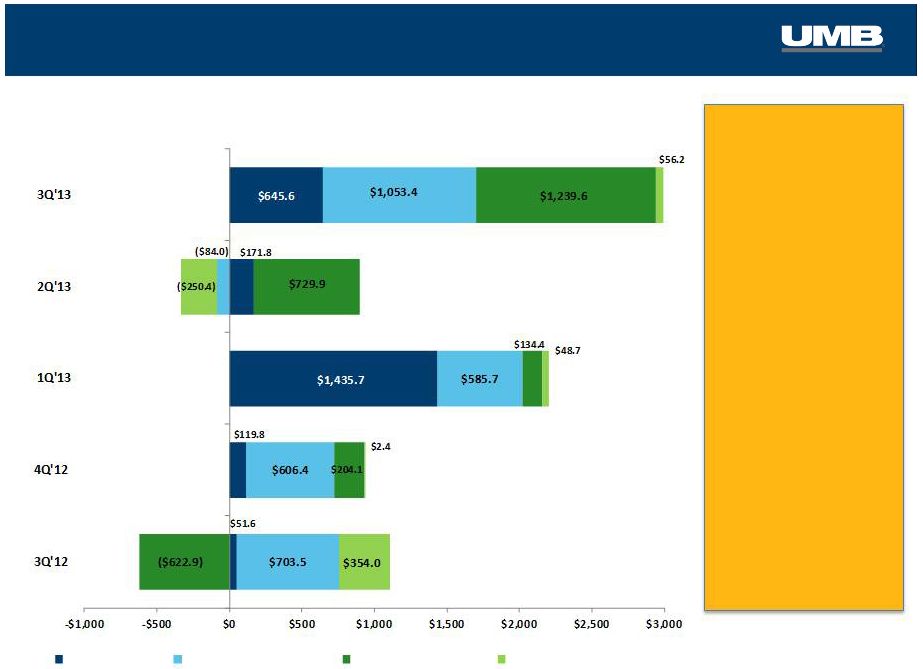

AUM Drivers

($millions)

Institutional Investment Management

34

$2,994.8

$29,308.9

Total Change

($millions)

Total AUM

($millions)

$2,204.5

$932.7

$486.2

$25,746.8

$23,542.3

$22,609.6

$567.3

$26,314.1

Equity Flows

Equity Market Impact

Fixed Income Flows

Fixed Income Market Impact |

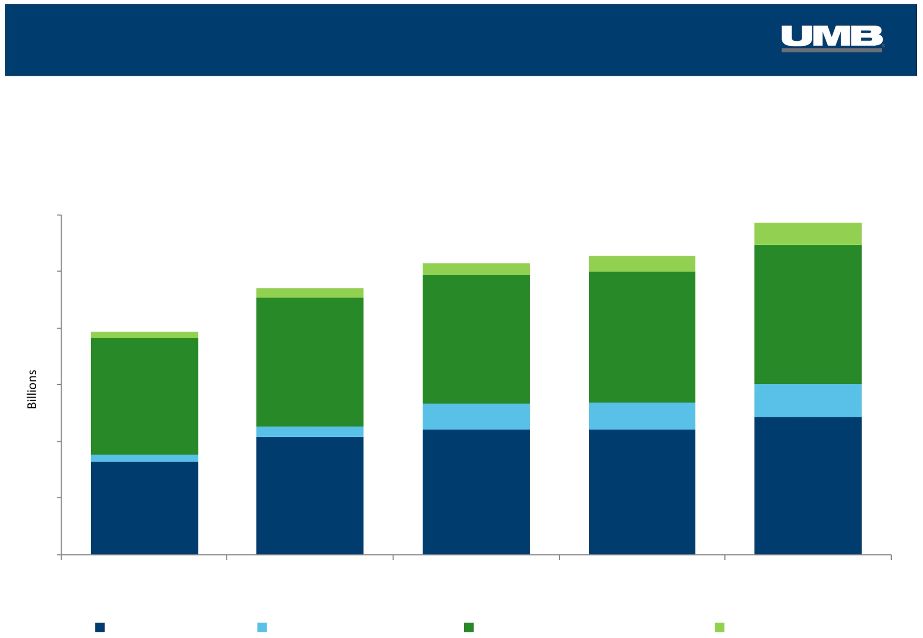

Total AUM

$19.7B

$23.5B

$25.7B

$26.3B

Institutional Investment Management

35

$29.3B

2011

2012

1Q13

2Q13

3Q13

Equity Mutual Funds

Equity Institutional & Other

Fixed Income Institutional & Other

Fixed Income Mutual Funds

$8.2

$10.4

$11.0

$11.1

$12.1

$10.3

$11.4

$11.4

$11.6

$12.3

$0.6

$0.9

$2.3

$2.3

$3.0

$0.6

$0.8

$1.0

$1.3

$1.9 |

AUM

by

Strategy

–

As

of

3Q’13

Fixed Income Strategies

Equity Strategies

International

Mid Cap

International ADR

Emerging Markets

Global

Small Cap

Other:

36

Core Plus

Low Duration

Long Duration

Core

Intermediate

Unconstrained

Global Aggregate

Real Return

Equity

Fixed Income |

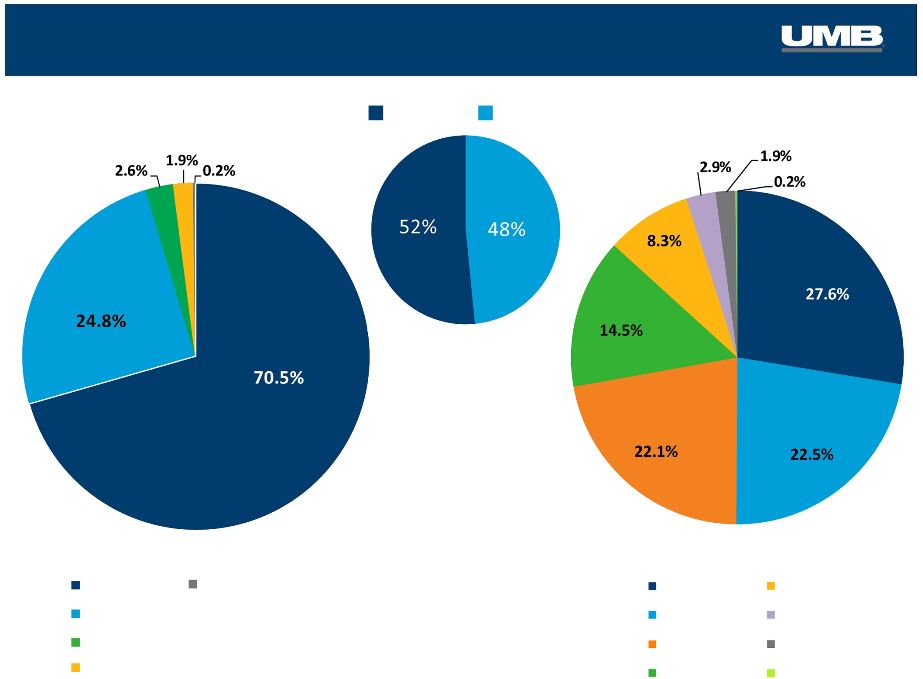

Fixed Income Rotation

Fixed Income AUM

Strategy Mix

3Q’13

3Q’12

37

Core Plus

Low Duration

Long Duration

Unconstrained

Core

Intermediate

Global Aggregate

Real Return

27.6%

22.5%

22.1%

14.5%

8.3%

13.7%

16.3%

25.1%

40.9%

2.3%

1.5%

0.2%

2.9%

1.9%

0.2% |

Asset Servicing

3

Quarter 2013 Highlights

38

Assets Under Administration

($billions)

Asset Servicing Operating Results (

unaudited, $000s)

3 mos Ended

June 30,

Year-Over-Year

Linked-Quarter

2013

2012

2013

Net interest income

550

472

587

16.5%

-6.3%

Noninterest income

20,429

18,300

19,275

11.6%

6.0%

Noninterest expense

17,201

17,142

17,054

0.3%

0.9%

NI before taxes

3,778

1,630

2,808

131.8%

34.5%

Income tax expense

1,468

608

967

141.4%

51.8%

Net income

2,310

1,022

1,841

126.0%

25.5%

pre-tax profit margin

18.0%

8.7%

14.1%

% Change

September 30,

3 mos Ended

Total

AUA

increased

by

21%

to

$181.7 billion year-over-year

In the past 12 months, fund

accounting and administration

AUA grew by 40%; 26 new funds

added

rd |

Asset Servicing

Fund Accounting & Administration

Alternative Asset Servicing

Custody

Transfer Agency

Business Metrics

39

Assets Under Administration

# of Funds Serviced

Assets Under Administration

# of Funds Serviced

Assets Under Administration

# of Custody Accounts

# of Shareholders

# of Funds Serviced |

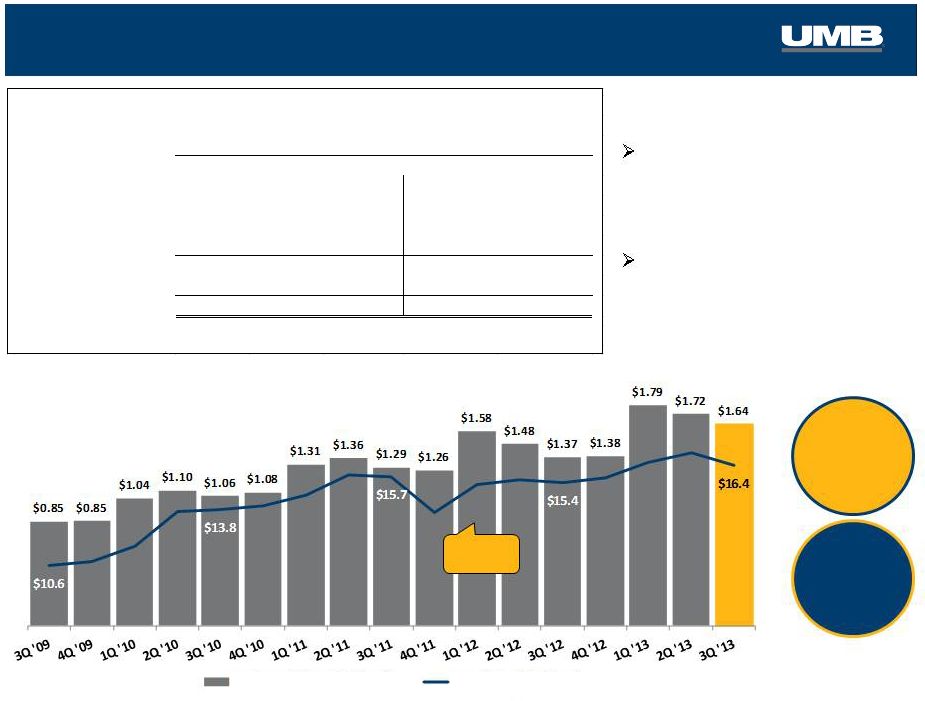

Payment Solutions

Total Card Purchase Volume

& Interchange Revenue

CAGR

Commercial credit card

purchase volume +9.8% year-

over-year to $321 million;

provided 46% of interchange

Interchange revenue +6.6%

year-over-year to $16.4 million

3

Quarter 2013 Highlights

40

Durbin

effective

Purchase

Volume

3Q ‘09–’13

17.9%

Inter-

change

3Q ‘09–’13

11.7%

rd

Purchase Volume ($ billions)

Interchange ($ millions)

Payment Solutions Operating Results (

3 mos Ended

June 30,

Year-Over-Year

Linked-Quarter

2013

2012

2013

Net interest income

11,587

10,843

11,192

6.9%

3.5%

Provision for loan losses

4,667

1,570

3,318

197.3%

40.7%

Noninterest income

18,409

16,081

18,649

14.5%

-1.3%

Noninterest expense

21,566

17,764

21,986

21.4%

-1.9%

NI before taxes

3,763

7,590

4,537

-50.4%

-17.1%

Income tax expense

1,311

2,024

1,350

-35.2%

-2.9%

Net income

2,452

5,566

3,187

-55.9%

-23.1%

pre-tax profit margin

12.5%

28.2%

15.2%

% Change

September 30,

3 mos Ended

unaudited, $000s) |

Payment Solutions

Health Savings Accounts & Balances

* Deposits and investment assets

Healthcare card purchase volume

+52% to $680.2 million vs. 3Q’12

Customer deposits and assets +50%

to $637.8 million vs. 3Q’12

3

Quarter

2013

Highlights

Healthcare Services

Card Utilization

41

Commitments

Outstandings

Utilization

HSA Balances*

# of HSA & FSA accounts

rd |

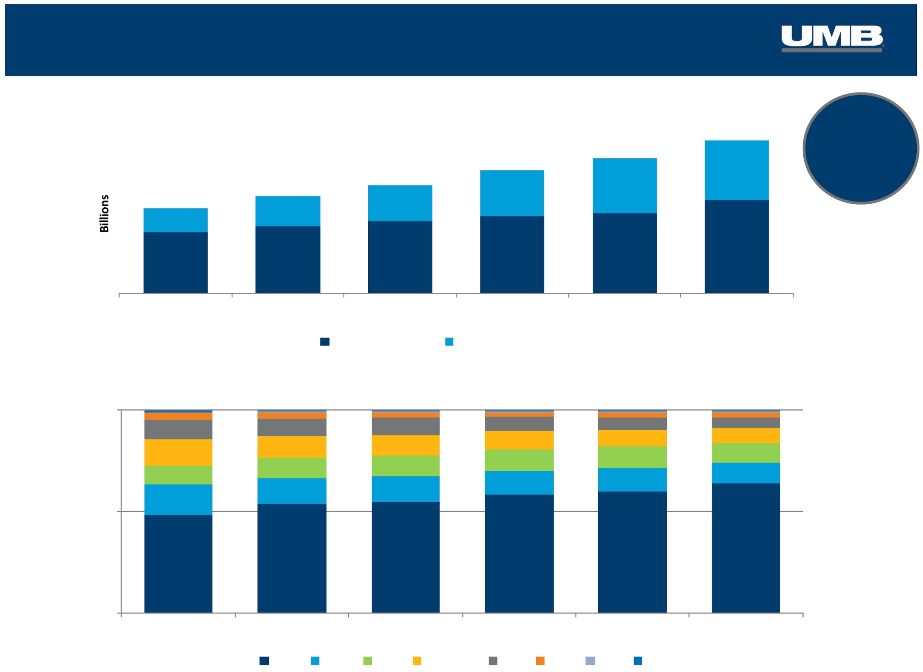

Bank

Assets Under Management

($

billions)

HELOC Lending

(average balances)

Total

net

loans

grew

for

the

14

consecutive quarter, increasing

20.9% year-over-year to

$6.4 billion Private Banking exceeded $305 million

in average loan balances, an increase

of

38.4%

over

Q3

2012

Average Small Business Banking loans

increased

25%

year-over-year

to

$167.2

million

42

3 mos Ended

June 30,

Year-Over-Year

Linked-Quarter

2013

2012

2013

Net interest income

73,419

69,051

70,558

6.3%

4.1%

Provision for loan losses

1,833

2,930

1,682

-37.4%

9.0%

Noninterest income

48,951

47,151

46,501

3.8%

5.3%

Noninterest expense

93,199

93,683

92,339

-0.5%

0.9%

NI before taxes

27,338

19,589

23,038

39.6%

18.7%

Income tax expense

6,895

5,426

5,664

27.1%

21.7%

Net income

20,443

14,163

17,374

44.3%

17.7%

pre-tax profit margin

22.3%

16.9%

19.7%

3 mos Ended

% Change

September 30,

Commitments

Balances

Utilization

Private Wealth & Institutional Asset Mgmt

Prairie Capital Management

3

Quarter 2013 Highlights

rd

th

Bank Operating Results (

unaudited, $000s) |

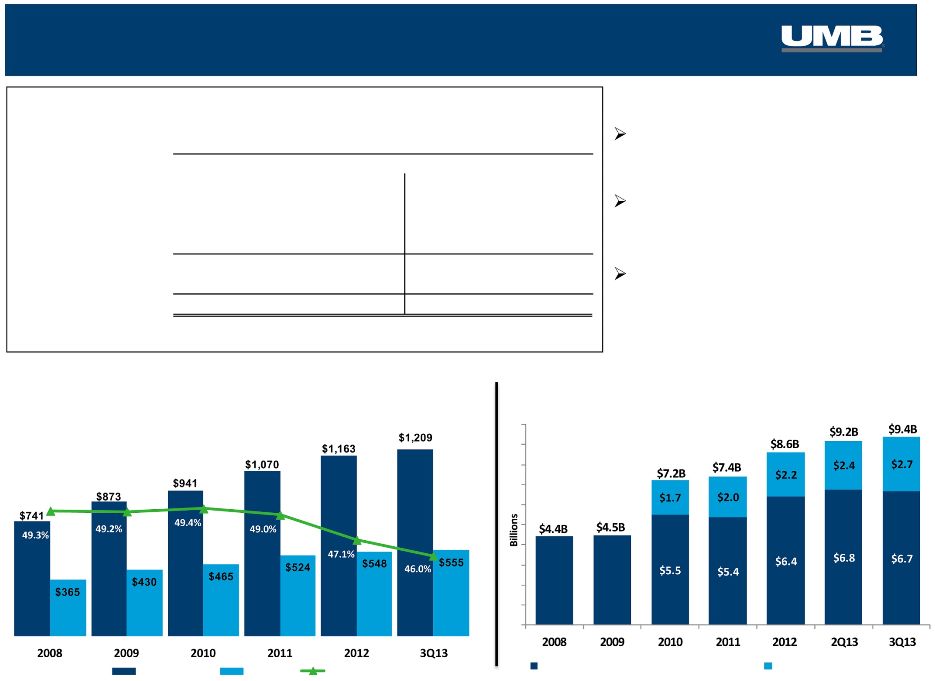

Bank

High Growth Regions

3Q’13 vs. 3Q’12

•

Arizona

+65%

•

Nebraska

+32%

Commercial Loans By Region

•

St. Louis

+32%

•

Oklahoma +25%

•

Colorado +21%

Commercial Loan Growth

(C&I and CRE Loans)

5 yr

CAGR

3Q ‘08–’13

10.9%

43

KC

CO

STL

Greater MO

KS

OK

AZ

NE

TX |

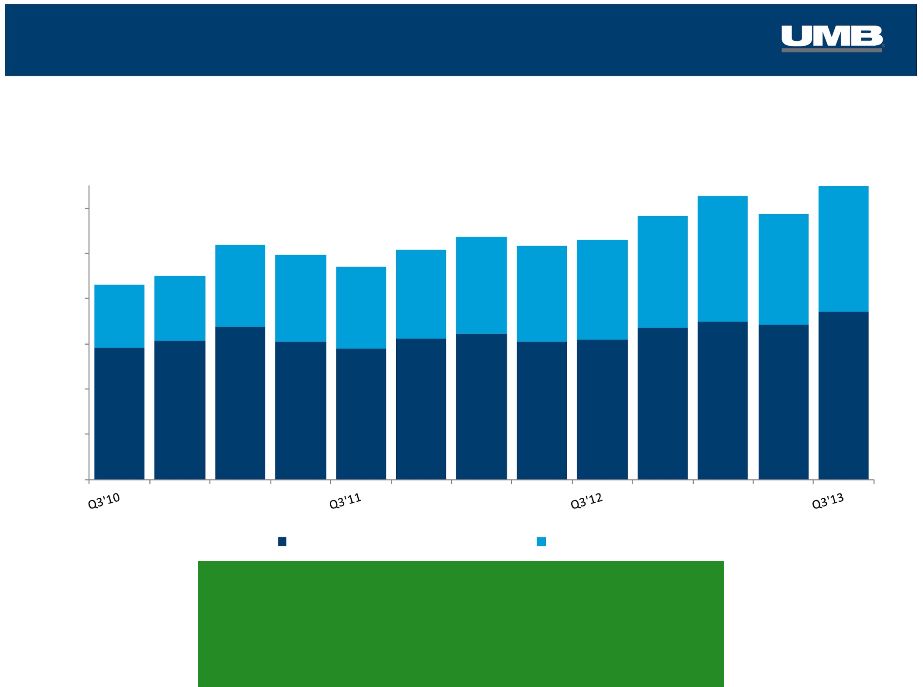

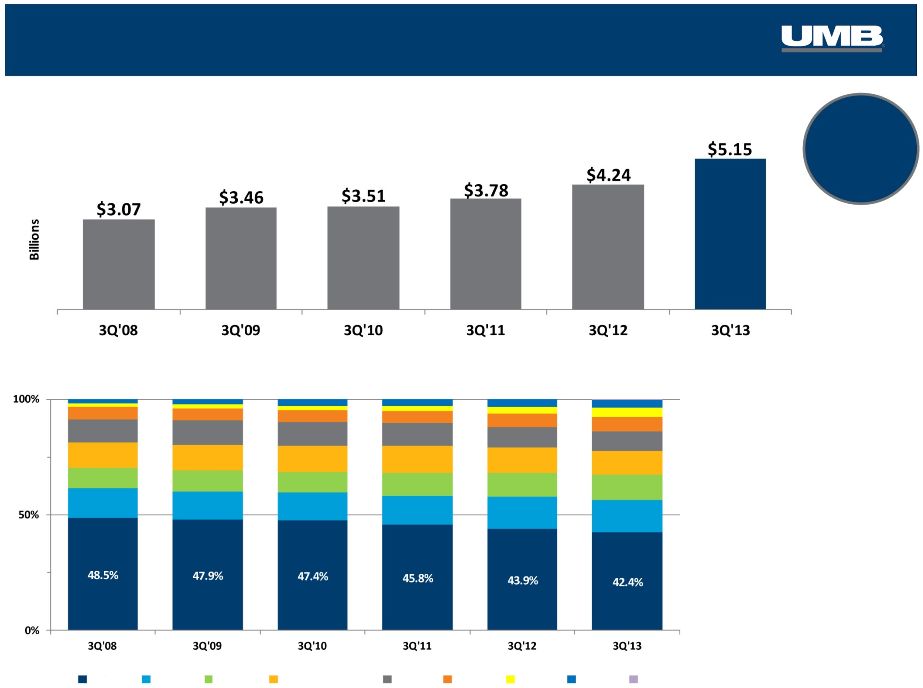

Bank

Average Deposits

5 yr

CAGR

3Q ‘08–’13

12.6%

Deposits By Region

44

KC

STL

CO

Gtr MO

KS

OK

AZ

NE

Interest Bearing

Non-Interest Bearing

3Q'08

3Q'09

3Q'10

3Q'11

3Q'12

3Q'13

3Q'08

3Q'09

3Q'10

3Q'11

3Q'12

3Q'13

48.1%

53.8%

55.0%

58.3%

60.0%

64.1%

28.6%

30.8%

32.7%

37.1%

40.4%

39.6%

$6.5

$7.5

$8.3

$9.5

$10.4

$11.8

100%

50%

0% |

Deposit

Composition 45

Deposit Composition by Line of Business

At September 30, 2013

Actual

Pro-forma,

After deposit migration

Commercial

Consumer

Asset Servicing

Private Wealth Management

Healthcare

Inst. Banking & Investor Services

Small Business

Inst. Asset Management

0.3%

4.4%

4.9%

6.6%

12.0%

17.1%

26.0%

28.6%

0.3%

4.8%

5.4%

7.3%

13.2%

9.0%

28.6%

31.4% |

Strengths We are Leveraging

Diversified

revenue

Growing fee

businesses

Infrastructure

Success building a diversified

financial services company

Building scale through

strategic acquisitions

Existing technology, operations,

products, distribution

46 |

Building a company

for the next 100 years.

UMB Financial

Third Quarter 2013 |