Attached files

| file | filename |

|---|---|

| 8-K - 8-K - POPULAR, INC. | d617576d8k.htm |

October 2013

Exhibit 99.1 |

1

Franchise Overview

Franchise

Executive

Team

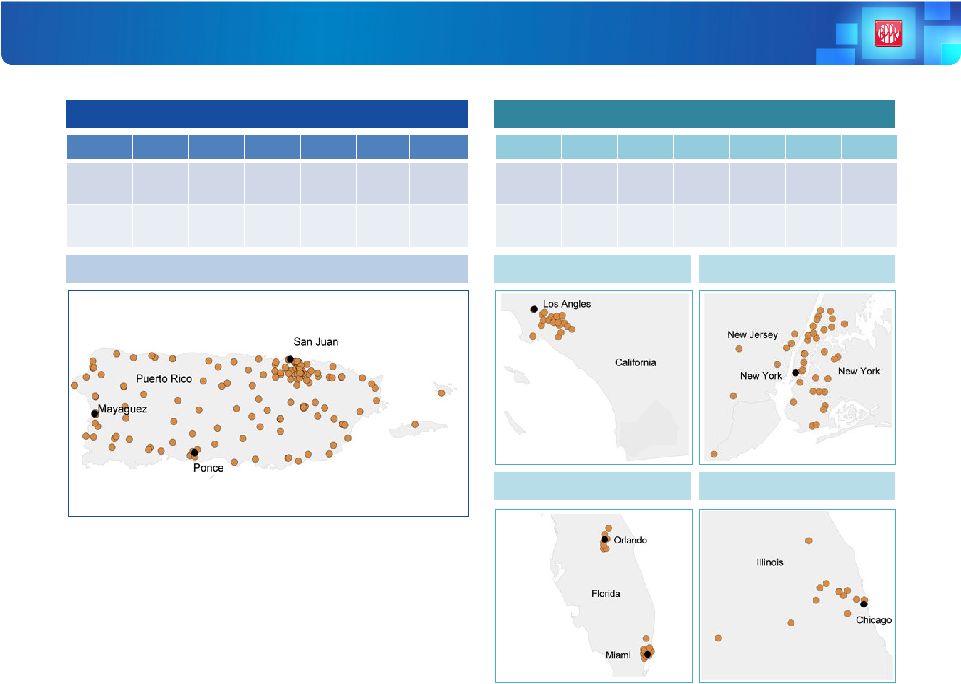

Founded in 1893, Popular is the leading financial services institution in Puerto

Rico with strong market share (38% of Puerto Rico deposits, net of

brokered) 288 branches serving customers in Puerto Rico, U.S. Virgin Islands,

New York, New Jersey, California, Florida, and Illinois

Primarily regulated by the Federal Reserve Bank of New York

Financial Data as of September 30, 2013

Market Data as of October 24, 2013:

Chief

Executive

Officer:

Richard

Carrión

Chief

Financial

Officer:

Carlos

Vázquez

EVP,

Corporate

Risk

Management:

Lidio

Soriano

EVP,

Chief

Legal

Officer:

Ignacio

Alvarez

EVP,

Commercial

Credit:

Eli

Sepúlveda

EVP,

Commercial

Credit

Administration

Group:

Ileana

González

EVP,

Consumer

Credit:

Gilberto

Monzón

SVP,

Corporate

Treasury:

Richard

Barrios

Each

member

of

the

management

team

has

over

20+

years

of

banking

experience

$36.1bn in assets (36th largest bank holding company in the U.S.)

–

~76%

in

Puerto

Rico

and

U.S.

Virgin

Islands,

~24%

in

the

continental

U.S.

$24.6bn in total loans

$26.4bn in total deposits

NASDAQ ticker symbol: BPOP

Market capitalization: $2.6bn |

2

Popular Has Emerged from the Credit Crisis as a Stronger Institution

Competitive position in Puerto Rico facilitates peer-leading core earnings

generation capacity Superior and stable NIM of 4.49%

versus peers

at 3.26%

Strong PPNR

/ Risk-Weighted Assets of 2.63%, significantly outperforming peers

at 1.61%

Source:

SNL

Financial

for

peer

data

1

Reflects

non-FTE

basis

2

Peers

include

Comerica

(CMA),

Huntington

(HBAN),

Zions

(ZION),

First

Niagara

(FNFG),

Synovus

(SNV),

First

Horizon

(FHN),

City

National

(CYN),

Associated

(ASBC),

and

First

Citizens

(FCNCA)

3

Pre-provision

net

revenue

is

defined

as

net

interest

income

plus

noninterest

income

less

non-credit

related

expenses

4

Includes

sales

of

equity

participations

in

EVERTEC

resulting

in

gains

of

$531mm

(Q3

2010),

$157mm

(Q2

2013),

and

$168mm

(Q3

2013)

Superior

Revenue

Generation

Fortified

Capital

Derisked

Balance

Sheet

Robust Risk

Management and

Capital Planning

Strong

Liquidity

Contained

Exposure to Puerto

Rico Economy

Popular believes it is well-positioned to repay TARP

Improved capital adequacy with Tier 1 common capital (pro forma for TARP

repayment) more than doubling from 4.6% in Q3 2008 to 12.4% in Q3

2013 Raised ~$3.0bn

4

of common equity since 2009, putting Popular in a comparable position with other

U.S. banks Significant investments provide additional sources of capital

(e.g. EVERTEC and Centro Financiero BHD) Diversified balance sheet across

asset classes and geographies Materially improved credit quality to

pre-crisis levels with NPAs / assets as of Q3 2013 of 2.6% compared to a

peak level of 7.2% in Q1 2010

Completed four bulk sales of NPLs since 2011, substantial reduction in NPL

inflows, and aggressive internal resolutions of problem loans

Considerable enhancements to risk management, credit administration, and reserve

and underwriting policies, as well as capital planning and stress testing

processes Capital adequacy process is aligned with 2013 CCAR principles

Maintains 2+ years of cash flow coverage at the holding company

Noninterest bearing deposits / total deposits increased from 16%

in 2008 to 22% as of Q3 2013

Direct loan exposure to Puerto Rico government is tied to specific revenue sources

and direct tax revenues 1

2

3

2 |

3

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

4

BPOP subsidiaries and equity investments

($mm)

Banco Popular

de Puerto Rico

Banco Popular

North America

EVERTEC²

Centro Financiero

BHD³

Ownership stake

–

100.0%

100.0%

21.3%

20.0%

Total assets

$36,052

$26,680

$8,782

$947

$3,460

Total liabilities

$31,658

$23,874

$7,118

$781

$3,006

o/w deposits

26,395

20,436

6,042

–

1,587

o/w long-term debt (incl. TARP)

1,545

548

217

675

237

Total equity

$4,394

$2,806

$1,664

$167

$454

Net income (LTM)

$274

$197

$78

$109

$114

Popular

(consolidated)¹

Corporate Structure and Equity Ownership Stakes

Source: SNL Financial

Note:

Financial

data

for

the

quarter

ended

September

30,

2013

(unless

otherwise

noted);

Figures

for

subsidiaries

and

equity

holdings

represent

consolidated

company

financials

and

do

not

reflect

Popular’s

ownership

percentage

1

Popular

(consolidated)

LTM

net

income

based

on

non-GAAP

adjusted

earnings

as

reported

quarterly

in

Company’s

investor

presentations

2

EVERTEC

LTM

net

income

excludes

non-recurring

pre-tax

expenses

of

$142.4mm;

Market

value

of

Popular’s

stake

in

EVTC

~$400mm

as

of

October

24,

2013

3

Consolidated

financial

data

as

of

December

31,

2012;

All

figures

shown

in

USD

Banco Popular

North America

Puerto Rico

operations

U.S.

banking

operations

Assets = $36.1bn

Popular Securities, Inc.

Popular Insurance, Inc.

Popular North America,

Inc.

Popular Auto, Inc.

Banco Popular de

Puerto Rico

21.3% equity stake

Transaction processing, business

processes outsourcing

20.0% equity stake

$3.5bn-asset bank in the

Dominican Republic

Assets = $26.7bn

Assets = $8.8bn

Key Financial Information for Selected Popular Subsidiaries and Equity

Holdings |

5

Corporate History

Dec

2008

(%)

2008

2009

2010

2011

2012

2013

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3¹

Tier 1

common

4.6

3.2

3.1

2.4

6.9

6.4

6.1

9.2

11.4

11.0

11.6

11.5

12.0

12.1

12.5

12.3

12.7

13.2

12.4

13.0

12.4

780

bps

NPAs /

Assets

2.7

3.3

4.0

5.7

6.3

6.9

7.2

6.2

6.6

6.4

6.0

5.9

5.9

6.3

6.2

5.9

5.8

5.5

3.8

2.7

2.6

(10)

bps

Received $935mm in TARP in exchange for senior

preferred stock

Converted $934mm in trust

preferred securities and

perpetual preferred, issuing

357.5mm common shares

Exchanged $935mm of

TARP preferred for

new trust preferred

securities

Impact:

Generated

$1.4bn

in

Tier

1

common

capital

Dec

2010

Aug

2009

May

2010

Sept

2010

Apr

2013

Sept

2013

Issued $1.2bn of common stock

Impact:

Tier

1

common

rose

from

6.1%

to

9.2%

q-o-q

Sold majority stake in

EVERTEC

Impact:

After-tax

gain

of

$531mm,

retained

49%

stake

Sold additional equity participation

in EVERTEC IPO

Impact:

After-tax

gain

of

$157mm,

retained

32%

stake

Sold additional equity participation

in EVERTEC follow-on

Impact:

After-tax

gain

of

$186mm,

retained

21%

stake

Impact:

Solidified

capital

ratios

and

built

buffer

capital

Implemented restructuring plan, including exiting non-core

national businesses and direct internet-based lender

business (E-LOAN) and reducing branches and headcount

Impact:

Improved

operational

focus

and

protected

against

potential

downside

in

riskier

lines

of

business

Sold $396mm in US non-conventional

mortgages for 40% UPB

Impact:

Reduced

mortgage

NPLs

by

$395mm

Sold $128mm in PR commercial and

construction loans for 45% UPB

Impact:

Reduced

NPLs

by

$120mm,

retained

24.9%

in

JV

Sold $435mm in PR residential

mortgage NPLs for 48% UPB

Impact:

Reduced

NPL

ratio

to

2.9%

as

of

June

2013

Sold $509mm in PR

assets for 34% UPB

Impact:

Reduced

NPAs

by

$501mm

Feb

2011

Sept

2011

Mar

2013

Jun

2013

Total common equity

raised = ~$3.0 billion

Total reduction in NPLs

from peak= ~$1.7 billion

Popular Has Derisked its Loan Portfolio While Raising Substantial New Capital

1

Tier 1 common excludes TARP |

6

Diversified Asset Mix and Funding Sources

Total assets: $36bn

Total liabilities: $32bn

Total equity: $4bn

Proactive Balance Sheet Management

Liquid

balance

sheet

with

20%

cash

and

securities

Reduced

exposure

to

high

loss

content

portfolios

Stable

funding

base

with

93%

loans

/

deposits

and

69%

core

deposits

(cost

of

total

deposits

of

0.48%)

Commercially

focused

loans

make

up

41%

of

gross

loans

Note: Financial data for the quarter ended September 30, 2013

1

Excludes time deposits

Assets as of September 30, 2013

Liabilities and Equity as of September 30, 2013

1 |

7

Market Leadership in Puerto Rico

Popular’s Market Share Trend

Puerto Rico Market Share by Category

Popular's

Popular's

Popular / top

market

market

competitor

Category

rank

share

Institution

Share

market share

Total deposits (net of brokered)

1

38%

Santander

12%

3.2x

Total loans

1

36%

FirstBank

16%

2.3x

Commercial and construction loans

1

37%

FirstBank

20%

1.9x

Credits cards

1

51%

FirstBank

15%

3.4x

Mortgage loan production

1

30%

Doral

17%

1.8x

Personal loans

1

31%

Santander

5%

6.2x

Auto loans and leases

3

16%

Reliable

26%

0.6x

Assets under management

3

13%

UBS

46%

0.3x

Top competitor

Source: Puerto Rico Office of the Commissioner of Financial Institutions & 10K

reports; Mortgage origination data is not publicly available; Figures presented for BPPR and competitors were provided internally; Personal Loans: As a

group, Credit Unions represent the largest competitor with 52% market share (115

Credit Unions were in business as of December 31, 2012 guaranteed by COSSEC) |

8

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

9

Peer-Leading, Consistent Core Revenue Generation

Pre-Provision Net Revenue³

/ Risk-Weighted Assets

Source: SNL Financial for peer data

Note: GAAP / Non-GAAP reconciliation in the Appendix

1

Peers include Comerica (CMA), Huntington (HBAN), Zions (ZION), First Niagara (FNFG),

Synovus (SNV), First Horizon (FHN), City National (CYN), Associated (ASBC), and First Citizens (FCNCA)

2

2013Q3 reflects as-reported NIM for peers in GAAP reporting

3

Pre-provision net revenue is defined as net interest income plus noninterest

income less non-credit related expenses Net Interest Margin

(Non-FTE) |

10

Pro Forma Capital Ratios In-Line with Peers and CCAR Banks

Key Capital Adequacy Metrics

Source:

SNL

Financial

for

peer

data

1

Peers

include

Comerica

(CMA),

Huntington

(HBAN),

Zions

(ZION),

First

Niagara

(FNFG),

Synovus

(SNV),

First

Horizon

(FHN),

City

National

(CYN),

Associated

(ASBC),

and

First

Citizens

(FCNCA)

2

CCAR

banks

include

JPMorgan

Chase

(JPM),

Bank

of

America

(BAC),

Citigroup

(C),

Wells

Fargo

(WFC),

U.S.

Bancorp

(USB),

PNC

(PNC),

Capital

One

(COF),

BB&T

(BBT),

SunTrust

(STI),

Fifth

Third

(FITB),

Regions

(RF),

and

KeyCorp

(KEY)

3

Minimum

regulatory

requirements

for

well-capitalized

institutions

and

CCAR

minimum

under

stress

4

Excess

capital

defined

as

excess

capital

over

minimum

regulatory

requirements

for

well-capitalized

Basel

I

threshold

$1.7bn

$1.9bn

$1.3bn

–

Excess

capital

4 |

11

Significantly Improved Asset Quality

NPL Inflows (excl. Consumer Loans) ($mm)

NPLs / Total Loans

Weighted Classified Assets Ratio

Reserves / NPLs

Substantial Reduction in NPL Inflows Coupled with Bulk Asset Sales

Have Reduced Problem Assets and Boosted Reserve Coverage

1

Excludes covered loans

1 |

12

Loan Portfolio Composition

BPPR has derisked its

commercial loan portfolio by

reducing its exposure in

asset classes with

historically high loss content

Collateralized exposure now

represents a larger portion of

consumer loan portfolio

Unsecured loans credit

quality has improved as

overall FICO scores have

increased

($mm)

Q4 2007

Q3 2013

Q4 2007

Q3 2013

Q4 2007

Q3 2013

Variance

Commercial

$7,774

$6,255

$4,514

$3,591

$12,288

$9,845

($2,442)

Consumer

3,552

3,274

1,698

626

5,250

3,900

(1,350)

Mortgage

2,933

5,344

3,139

1,269

6,072

6,613

541

Construction

1,231

252

236

41

1,467

293

(1,174)

Leases

814

539

-

-

814

539

(275)

Legacy

-

-

2,130

236

2,130

236

(1,894)

Total

$16,304

$15,664

$11,717

$5,763

$28,021

$21,426

($6,595)

Puerto Rico

US

Total

NCOs

($mm)

(%)

($mm)

(%)

($mm)

(%)

Distribution¹

CRE SME²

$2,939

32%

$1,789

28%

($1,150)

(39%)

23%

C&I SME²

2,287

25%

931

14%

(1,356)

(59%)

28%

C&I Corp

1,592

18%

1,860

29%

268

17%

6%

Construction

1,231

14%

252

4%

(979)

(80%)

38%

CRE Corp

892

10%

1,590

24%

698

78%

4%

Multifamily

64

1%

85

1%

21

33%

1%

Total

$9,005

$6,507

($2,498)

(28%)

100%

($mm)

Q4 2007

Q3 2013

Variance

Loan Composition (Held in Portfolio)

Puerto Rico Commercial and Construction Portfolio Distribution

Overview

De-Risked

Loan

Portfolio

with

Reduced

Exposure

to

Historically

High

Loss

Content

1

NCOs distribution represents the percentage allocation of NCOs

from Q1 2008 through Q3 2013 per each loan category

2

Small and Medium Enterprises

Note: Legacy portfolio is comprised of certain commercial, construction and lease

financings lending products exited by the US Construction loan portfolio

is down by 80% since Q4

2007

SME

balances down by

48% from Q4 2007

2 |

13

Strong Liquidity with Stable Funding Sources

Loans / Deposits

Noninterest Bearing Deposits / Total Deposits

Cash and Securities / Assets

Time Deposits / Total Deposits

Maintains 2+ years of cash flow coverage at the holding company

|

14

Additional Detail on Holding Company Liquidity

Approximately

$400mm

in

holding

company

cash

as

of

September

30,

2013

12-month

required

debt

service

is

$121mm

(including

TARP)

Maintains

2+

years

of

cash

flow

coverage

at

the

holding

company

Next

maturity

not

until

February

2027

In

addition,

holding

company

owns

stake

in

EVERTEC

with

market

value

of

approximately

$400mm

Holding

company

subject

to

all

applicable

U.S.

banking

regulation

and

liquidity

requirements

Overview |

15

Strong Risk Management Culture

Responsible for overseeing and approving the Corporation’s risk management

program Popular has implemented an Enterprise Risk Management (ERM) function

within the Risk Management Group Credit Strategy

Committee

(“CRESCO”)

Asset Liability

Management

Committee (ALCO)

Operational Risk

Management

Committee (ORCO)

Reviews

credit

activities

to

ensure

a

proactive

and

coordinated

management

of

credit

origination,

exposures,

and

procedures,

including

the

adequacy

of

the

allowance

for

loan

losses,

monitoring

asset

quality,

and

approving

credit

policies

Analysis

of

the

allowance

adequacy

is

presented

to

the

RMC

of

the

BOD

Manages the risk assumed by Popular and its subsidiaries in order to maintain

policy compliance,

control

volatility

of

consolidated

net

interest

income,

and

the

consolidated

economic

value

of

equity

sensitivity.

Oversees

the

management

of

capital

and

approves

capital management strategies

Reviews

and

approves

the

Capital

Plan

for

consideration

by

the

RMC

of

the

BOD

Provides

guidance

on

overall

operational

risk

management,

including

design

and

implementation

of

the

levels

of

acceptable

exposures,

ensuring

these

are

consistent

with

Popular’s

stated

goals

Analysis

of

operational

risk

is

presented

to

the

RMC

of

the

BOD

Board of Director’s Risk Management Committee (RMC)

Management Committees

Compliance

Committees

Guide the implementation of compliance programs, policies and procedures

throughout the Corporation in matters related to fair lending,

anti-money laundering, and bank secrecy act, among

others.

In

addition,

these

monitor

compliance

with

federal

laws

Compliance-related

matters

are

presented

to

the

BOD,

RMC,

and

Audit

Committee |

16

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

17

Puerto Rico’s Indebtedness Has Been a Recent Area of Focus

Background on Puerto Rico’s Public Debt

Mitigating Actions Taken by the Government

Gross Public Debt of Puerto Rico ($bn)

Puerto Rico has ~$70bn total debt outstanding

Represents ~$14,000 debt per capita and 71% of

total GDP

24% of the public debt is insured

9% of Puerto Rico’s debt matures in or before 2015

Puerto Rico’s 2013 budget deficit was $1.3bn, or ~ 13%

of the budget

Puerto Rico is not eligible to file under Chapter 9 due to

its legal status

Fiscal 2014 budget was approved, reducing deficit by

36% from $1.3bn to $820mm, resulting in no change in

the Commonwealth credit ratings; reforms included:

Tax reform:

–

Increased marginal corporate tax rate from 30% to

39%

–

Act 154 excise tax was increased and fixed at 4%;

also extended for five years

–

Non-tax sources of revenue, such as utility fees

were increased

Pension overhaul:

–

Converted the pension system from a defined

benefit to a defined contribution plan, effective

June 30

–

Reforms have made the pension cash sufficient,

requiring no additional government outlays

beyond its $140mm contribution

–

Raised retirement age for some state workers,

increased the worker pension contribution

requirement, and changed monthly benefits for

some workers

Privatization of Public Facilities:

–

Completed privatization of Luis Muñoz Marín

International Airport and Highway 22

In October 2013, Moody’s affirmed Puerto Rico’s

general obligation rating at Baa3 (outlook negative),

citing the government’s significant fiscal measures

Source: Government Development Bank of Puerto Rico; Puerto Rico Planning Board

Statistical Index 2012; Equity research reports

|

18

Loans

to

the

Government

of

Puerto

Rico

and

Public

Corporations

are

either

collateralized

loans

or

obligations

that

have

a

specific

source

of

income

or

revenues

identified

for

their

repayment

Loans

to

various

municipalities

backed

by

unlimited

taxing

power

or

real

and

personal

property

taxes

collected

within

such

municipalities

Includes

$272

million

residential

mortgage

loans

to

individual

borrowers

with

a

government

guarantee

$52

million

in

FNMA,

GNMA

or

residential

loan

CMOs

$35

million

of

industrial

development

notes

payable

primarily

by

non

government tenants

Our current exposure to the PR government and its instrumentalities is $1.4

billion, of which $1.2 billion is outstanding Of the amount outstanding,

$951 million consists of loans and $204 million is securities Direct

Exposure $388 million

outstanding

Indirect Exposure

$359 million

outstanding

Municipalities

$408 million

outstanding

Popular’s Exposure to the Puerto Rican Government

Popular’s Exposure |

19

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

20

Financial Overview of Popular, Inc.

Year ending

Quarter ending

12/31/06

12/31/07

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

9/30/13

Balance sheet

Total assets

$47,404

$44,411

$38,883

$34,736

$38,815

$37,348

$36,508

$36,052

Gross loans

32,737

29,911

26,269

23,804

26,459

25,314

25,094

24,628

Total deposits

24,438

28,334

27,550

25,925

26,762

27,942

27,001

26,395

Total equity

3,620

3,582

3,268

2,539

3,801

3,919

4,110

4,394

Profitability

Net income

$357.7

($64.5)

($1,243.9)

($573.9)

$137.4

$151.3

$245.3

$229.1

ROAA

0.74%

(0.14%)

(3.04%)

(1.57%)

0.36%

0.40%

0.68%

2.51%

ROAE

9.7%

(2.1%)

(44.5%)

(33.0%)

4.4%

4.0%

6.4%

21.6%

Net interest margin¹

3.18%

3.59%

3.52%

3.23%

3.79%

4.34%

4.35%

4.49%

Capital ratios

TCE / TA

5.7%

6.2%

2.9%

5.4%

8.0%

8.6%

9.4%

10.3%

Tier 1 common

7.7%

7.1%

3.2%

6.4%

11.0%

12.1%

13.2%

14.2%

Tier 1 capital

10.6%

10.1%

10.8%

9.8%

14.5%

16.0%

17.4%

18.5%

Asset quality

NPAs / loans & OREO

2.44%

2.84%

4.90%

10.04%

9.33%

9.24%

7.85%

3.79%

NCOs / avg loans²

0.65%

1.01%

2.29%

4.17%

5.15%

2.61%

1.97%

1.08%

Reserves / NPLs³

73%

71%

73%

55%

50%

40%

44%

85%

Per share data

Shares out. (mm)

27.9

28.0

28.2

64.0

102.3

102.6

103.2

103.3

Avg. dil. shares (mm)

27.9

27.9

28.1

40.8

88.5

102.3

102.7

103.0

Tangible book value

$95.47

$96.23

$39.92

$28.78

$29.77

$30.77

$32.55

$35.32

Financial Highlights

1

Net interest margin does not reflect fully taxable equivalent basis

2

Excludes net write-downs related to loans transferred to loans

held-for-sale; Excludes covered loans 3

Excludes covered loans |

21

Regional Information

Banco Popular de Puerto Rico

Banco Popular North America

($mm)

2008

2009

2010

2011

2012

2013¹

Assets

$25,522

$23,271

$28,977

$27,941

$27,204

$26,680

Net

income

$200

$125

$17

$180

$237

$84

($mm)

2008

2009

2010

2011

2012

2013¹

Assets

$12,426

$10,847

$8,974

$8,581

$8,652

$8,782

Net

income

($552)

($738)

($352)

$18

$33

$64

1

Reflects YTD financials for the nine months ended September 30,

2013

Puerto Rico

California

New York Metro

Florida

Chicago Metro |

22

Financial Overview of Banco Popular de Puerto Rico

Year ending

Quarter ending

12/31/06

12/31/07

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

9/30/13

Balance sheet

Total assets

$25,020

$26,742

$25,522

$23,271

$28,977

$27,941

$27,204

$26,680

Gross loans

15,433

16,551

16,013

15,118

19,502

19,507

19,309

18,860

Total deposits

14,736

18,761

18,427

17,796

20,270

21,881

21,021

20,436

Total equity

1,691

1,818

1,900

1,913

2,523

2,627

2,810

2,806

Profitability

Net income

$322.5

$296.6

$200.0

$124.6

$16.6

$180.5

$236.7

$53.6

ROAA

1.27%

1.17%

0.78%

0.52%

0.06%

0.63%

0.88%

0.80%

ROAE

18.0%

15.7%

10.8%

6.7%

0.7%

7.3%

9.0%

7.7%

Net interest margin¹

3.73%

3.93%

3.97%

3.82%

4.45%

5.58%

5.59%

5.35%

Capital ratios

TCE / TA

6.6%

6.1%

6.8%

7.5%

7.8%

8.5%

9.4%

9.6%

Tier 1 common

9.2%

7.7%

7.8%

8.9%

10.9%

12.0%

12.9%

12.2%

Tier 1 capital

9.2%

7.7%

7.8%

8.9%

10.9%

12.0%

12.9%

12.2%

Asset quality

NPAs / loans & OREO

1.68%

2.59%

5.17%

10.33%

9.06%

9.88%

8.72%

3.82%

NCOs / avg loans²

0.76%

1.21%

2.16%

3.31%

4.67%

2.24%

1.92%

1.14%

Reserves / NPLs³

132%

96%

70%

44%

41%

33%

37%

87%

Financial Highlights

1

Net

interest

margin

does

not

reflect

fully

taxable

equivalent

basis

2

Excludes

net

write-downs

related

to

loans

transferred

to

loans

held-for-sale;

Excludes

covered

loans

3

Excludes

covered

loans |

23

Financial Overview of Banco Popular North America

Year ending

Quarter ending

12/31/06

12/31/07

12/31/08

12/31/09

12/31/10

12/31/11

12/31/12

9/30/13

Balance sheet

Total assets

$12,244

$13,358

$12,426

$10,847

$8,974

$8,581

$8,652

$8,782

Gross loans

8,787

10,288

10,244

8,677

6,922

5,778

5,755

5,766

Total deposits

9,761

9,791

9,697

8,270

6,587

6,168

6,076

6,042

Total equity

1,352

1,485

1,291

1,173

1,581

1,631

1,657

1,664

Profitability

Net income

$94.3

($211.7)

($552.2)

($738.1)

($352.3)

$17.5

$33.4

$21.7

ROAA

0.77%

(1.62%)

(4.28%)

(6.31%)

(3.57%)

0.20%

0.39%

0.99%

ROAE

7.1%

(12.7%)

(38.1%)

(61.3%)

(27.3%)

1.1%

2.1%

5.2%

Net interest margin¹

3.26%

3.16%

2.99%

2.86%

3.33%

3.63%

3.60%

3.68%

Capital ratios

TCE / TA

7.8%

8.1%

7.2%

7.2%

13.6%

14.9%

15.1%

15.0%

Tier 1 common

10.1%

9.1%

8.9%

9.5%

17.6%

20.5%

22.8%

23.9%

Tier 1 capital

10.1%

9.1%

8.9%

9.5%

17.6%

20.5%

22.8%

23.9%

Asset quality

NPAs / loans & OREO

0.78%

1.86%

4.48%

9.52%

10.13%

7.09%

4.93%

3.66%

NCOs / avg loans²

0.40%

0.60%

2.42%

5.50%

6.01%

3.26%

1.98%

0.91%

Reserves / NPLs

148%

71%

80%

76%

73%

65%

76%

72%

Financial Highlights

1

Net

interest

margin

does

not

reflect

fully

taxable

equivalent

basis

2

Excludes

net

write-downs

related

to

loans

transferred

to

loans

held-for-sale |

24

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

25

Conclusions

Popular

has

emerged

from

the

crisis

as

a

strongly-capitalized

institution

with

materially

improved

asset

quality

It

has

a

dominating

franchise

in

its

home

market,

which

provides

a

solid

base

of

PPNR

and

profitability

The

management

team

has

considerable

experience

with

a

deep

bench

of

talent

Its

capital

management

process

is

robust

and

closely

follows

CCAR

principles

With

$1.7

billion

in

excess

capital

and

$400

million

in

holding

company

cash,

as

well

as

a

de-

risked

loan

portfolio,

Popular

is

well

positioned

to

exit

TARP

while

maintaining

a

solid

capital

base

The Commonwealth’s financial problems are challenging, but manageable

Material, important steps have been taken to address market concerns: pension plan

reform, material deficit reduction, the privatization of key public

assets These measures will pressure the economy in the short-term, but

should be positive, longer- term

Popular

Puerto Rico |

26

Popular, Inc. Credit Ratings

October

2013:

Moody’s

revised

outlook

to

negative

January

2013:

Fitch

raised

to

BB-

from

B+;

outlook

revised

to

stable

December

2012:

Moody’s

downgraded

BPOP

to

B1;

stable

outlook

assigned

April

2012:

Moody’s

placing

most

of

the

PR

banks

under

review

with

the

possibility

of

downgrades,

due

to

the

state

of

the

Puerto

Rico

economy

January

2012:

Fitch

raised

BPOP’s

outlook

to

positive

December

2011:

S&P

raised

its

ratings

on

BPPR

to

BB

from

BB-

and

changed

outlook

to

stable

given

revised

bank

criteria

to

regional

banks

July

2011:

S&P

raised

our

senior

unsecured

rating

by

one

notch

to

B+

As

the

Puerto

Rico

economy

stabilizes

and

our

credit

metrics

improve,

we

should

see

upward

pressure

on

the

ratings

Agency

Rating

Outlook

Date of last BHC action

Moody’s

B1

Negative

October 2013

Fitch

BB-

Stable

January 2013

S&P

B+

Stable

July 2011

Credit Ratings

Popular’s Senior Unsecured Ratings Have Gradually Improved Since 2010

|

27

Agenda

Corporate Overview

Financial Performance and Developments

Macroeconomic Update

Consolidated and Regional Financials

Conclusion

Appendix |

28

GAAP / Non-GAAP Reconciliation –

Popular, Inc.

($ in millions)

2008 Y

2009 Y

2010 Y

2011 Y

2012Y

Nine months

ended

9/30/13

Net (loss) income

($680)

($554)

$146

$150

$244

$436

Income tax expense (benefit)

462

(8)

101

115

(25)

(276)

Provision for loan losses (PLL)

991

1,406

1,012

576

409

546

Less: Realized gain (loss) on AFS securities

70

220

4

11

(2)

6

Less: Gain on sale of processing and technology business

–

–

641

–

–

–

Less: Gain on sale of equity method investment

–

–

–

21

–

–

Less: Unfavorable HFS loan valuation adjustment

–

–

–

–

(27)

–

Less: Proportionate share of EVERTEC's tax benefit

–

–

–

–

32

–

Less: Bulk sales of NPA's

–

–

–

–

–

(118)

Less: EVERTEC's IPO and SPO

–

–

–

–

–

337

Less: Mirror impact on PLL for covered loans on LSA

–

–

–

110

58

53

Less: Restructuring charges

23

11

–

–

–

–

Less: OREO expenses

23

26

47

22

24

20

Less: FDIC special assessment

–

18

–

–

–

–

Less: Early extinguishment

–

(78)

13

8

25

–

Less: Transaction costs (sale of processing and technology business)

–

–

25

–

–

–

Less: Uninsured portion of the settlement of certain class action lawsuits

–

–

8

–

–

–

Less: Settlements of representation and warranty arrangements

–

–

33

–

–

–

Less: Implementation of employee retirement window

–

–

–

16

–

–

Less: Amortization of intangibles

24

9

9

10

10

7

Pre-provision net revenue

$773

$608

$749

$755

$626

$455

Risk weighted assets

$30,270

$26,147

$25,721

$24,414

$23,392

$23,052

PPNR / risk-weighted assets (%)

2.55%

2.32%

2.91%

3.09%

2.68%

2.63%

Popular, Inc. |

29

GAAP / Non-GAAP Reconciliation –

Banco Popular de Puerto Rico

($ in millions)

2008 Y

2009 Y

2010 Y

2011 Y

2012Y

Nine months

ended

9/30/13

Net income

$200

$125

$24

$181

$237

$84

Income tax (benefit) expense

0

(20)

2

100

(40)

(277)

Provision for loan losses (PLL)

519

624

610

487

356

546

Less: Realized gain on AFS securities

70

227

4

9

(0)

(0)

Less: Unfavorable HFS loan valuation adjustment

–

–

–

–

(27)

–

Less: Bulk sales of NPA's

–

–

–

–

–

(118)

Less: Mirror impact on PLL for covered loans on LSA

–

–

–

110

58

53

Less: OREO expenses

4

11

30

16

31

35

Less: Early extinguishment

–

–

2

–

25

–

Less: Implementation of employee retirement window

–

–

–

16

–

–

Less: Amortization of intangibles

6

5

5

6

7

5

Pre-provision net revenue

659

518

669

687

585

458

Risk weighted assets

$19,461

$17,793

$18,635

$18,148

$17,695

$17,441

PPNR / risk-weighted assets (%)

3.38%

2.91%

3.59%

3.79%

3.31%

3.49%

Banco Popular de Puerto Rico |

30

Forward Looking Statements

The

information

contained

in

this

presentation

includes

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

based

on

management’s

current

expectations

and

involve

risks

and

uncertainties

that

may

cause

the

Company's

actual

results

to

differ

materially

from

any

future

results

expressed

or

implied

by

such

forward-looking

statements.

Factors

that

may

cause

such

a

difference

include,

but

are

not

limited

to

(i)

the

rate

of

growth

in

the

economy

and

employment

levels,

as

well

as

general

business

and

economic

conditions;

(ii)

changes

in

interest

rates,

as

well

as

the

magnitude

of

such

changes;

(iii)

the

fiscal

and

monetary

policies

of

the

federal

government

and

its

agencies;

(iv)

changes

in

federal

bank

regulatory

and

supervisory

policies,

including

required

levels

of

capital;

(v)

the

relative

strength

or

weakness

of

the

consumer

and

commercial

credit

sectors

and

of

the

real

estate

markets

in

Puerto

Rico

and

the

other

markets

in

which

borrowers

are

located;

(vi)

the

performance

of

the

stock

and

bond

markets;

(vii)

competition

in

the

financial

services

industry;

(viii)

possible

legislative,

tax

or

regulatory

changes;

(ix)

the

impact

of

the

Dodd-Frank

Act

on

our

businesses,

business

practice

and

cost

of

operations;

and

(x)

additional

Federal

Deposit

Insurance

Corporation

assessments.

Other

than

to

the

extent

required

by

applicable

law,

the

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement.

Please

refer

to

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012

and

other

SEC

reports

for

a

discussion

of

those

factors

that

could

impact

our

future

results.

The

financial

information

included

in

this

presentation

for

the

quarter

ended

September

30,

2013

is

based

on

preliminary

unaudited

data

and

is

subject

to

change. |