Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WASHINGTON BANKING CO | d616265d8k.htm |

| EX-99.1 - EX-99.1 - WASHINGTON BANKING CO | d616265dex991.htm |

Exhibit 99.2

HERITAGE FINANCIAL CORPORATION NASDAQ: HFWA Washington Banking Company NASDAQ: WBCO Attractive Pacific Northwest Partnership October 23, 2013

2 Forward?Looking Statements When used in this presentation and in other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public shareholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,”“project,”“plans,“orsimilar expressions are intended to identify “forward?looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward?looking statements, which speak only as of the date such statements are made. These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial information. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Statements about the expected timing, completion and effects of the proposed merger and all other statements in this release other than historical facts constitute forward?looking statements. In addition to the factors previously disclosed in Heritage’s and Washington Banking’s reports filed with the SEC, important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (1) expected revenues, cost savings, synergies and other benefits from the Heritage?Washington Banking merger might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected; (2) the requisite shareholder and regulatory approvals for the Heritage?Washington Banking merger might not be obtained; (3) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write?offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses, resulting both from loans originated and loans acquired from other financial institutions; (4) results of examinations by regulatory authorities, including the possibility that any such regulatory authority may, among other things, require increases in the allowance for loan losses or writing down of assets; (5) competitive pressures among depository institutions; (6) interest rate movements and their impact on customer behavior and net interest margin; (7) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (8) fluctuations in real estate values; (9) the ability to adapt successfully to technological changes to meet customers’ needs and developments in the market place; (10) the ability to access cost?effective funding; (11) changes in financial markets; (12) changesin economic conditionsingeneral andinWestern Washington andthe Pacific Northwest in particular; (13) the costs, effects and outcomes of litigation; (14) new legislation or regulatory changes, including but not limited to the Dodd?Frank Act and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd?Frank Act and the implementation of the Basel III capital standards, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (15) changes in accounting principles, policies or guidelines; (16) future acquisitions by Heritage of other depository institutions or lines of business; and (17) future goodwill impairment due to changes in Heritage’s business, changes in market conditions, or other factors. Annualized pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results. Neither Heritage nor Washington Banking undertakes any obligation to update any forward?looking statement to reflect circumstances or events that occur after the date on which the forward?looking statement is made. HERITAGE FINANCIAL CORPORATION Washington Banking Company

Strategic Merger Rationale Compelling Strategic Partnership Shareholder Value Proposition Low Risk Profile $3.3 billion in total assets with 73 branches from Bellingham, WA to Portland, OR(1) A strategic partnership between two culturally similar Washington community banks Significant franchise value Logical geographic fit: complementary Western Washington footprint along the I 5 corridor Combination of two respected market leaders in strong financial position Approximately 24% EPS accretion in 2015(2)(3) Effective use of capital will enhance returns and shareholder value for both HFWA and WBCO Achieve operational scale and realize efficiencies as a larger combined franchise Well positioned for continued growth and fill in opportunities Increased market visibility Low risk profile, considerable upside opportunity Conservative approach to pro forma assumptions supported by significant, mutual due diligence Experienced management teams working together Both companies are experienced integrators Similar customer base, markets and business strategy Shared credit quality discipline Strong pro forma capital position (1) 42 HFWA branches as of 9/30/2013 will be reduced to 35 branches as of 12/31/2013 (2) Mean EPS estimate for 2014 per SNL FactSet research. EPS estimate in 2015 based on 7.50% long term growth rate (3) EPS accretion excludes non recurring merger related costs 3 HERITAGE FINANCIAL CORPORATION Washington Banking Company

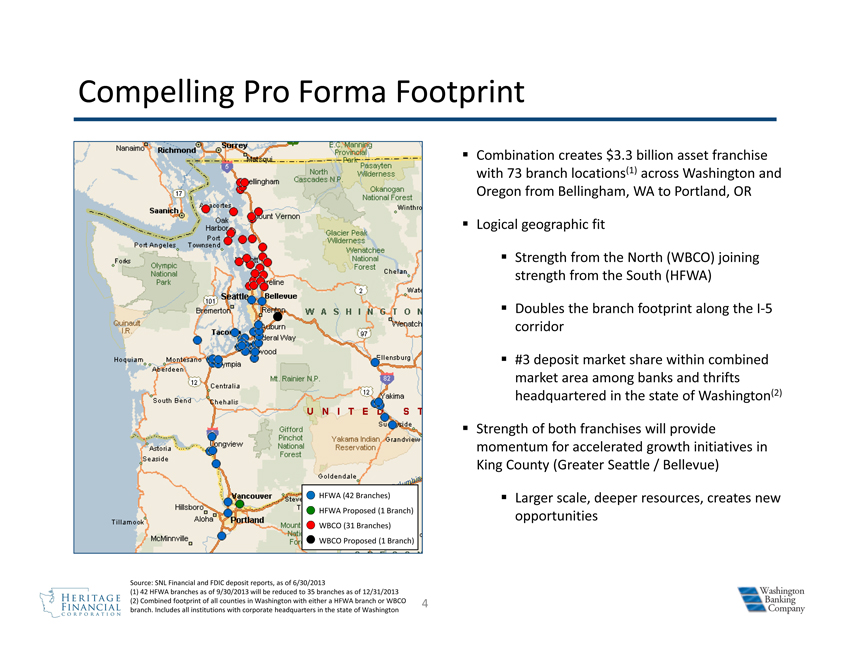

Compelling Pro Forma Footprint ¡ Combination creates $3.3 billion asset franchise with 73 branch locations(1) across Washington and Oregon from Bellingham, WA to Portland, OR Logical geographic fit Strength from the North (WBCO) joining strength from the South (HFWA) Doubles the branch footprint along the I?5 corridor #3 deposit market share within combined market area among banks and thrifts headquartered in the state of Washington(2) Strength of both franchises will provide momentum for accelerated growth initiatives in King County (Greater Seattle / Bellevue) ¡ Larger scale, deeper resources, creates new opportunities HFWA (42 Branches) HFWA Proposed (1 Branch) WBCO (31 Branches) WBCO Proposed (1 Branch) Source: SNL Financial and FDIC deposit reports, as of 6/30/2013 (1) 42 HFWA branches as of 9/30/2013 will be reduced to 35 branches as of 12/31/2013 (2) Combined footprint of all counties in Washington with either a HFWA branch or WBCO branch. Includes all institutions with corporate headquarters in the state of Washington 4 HERITAGE FINANCIAL CORPORATION Washington Banking Company

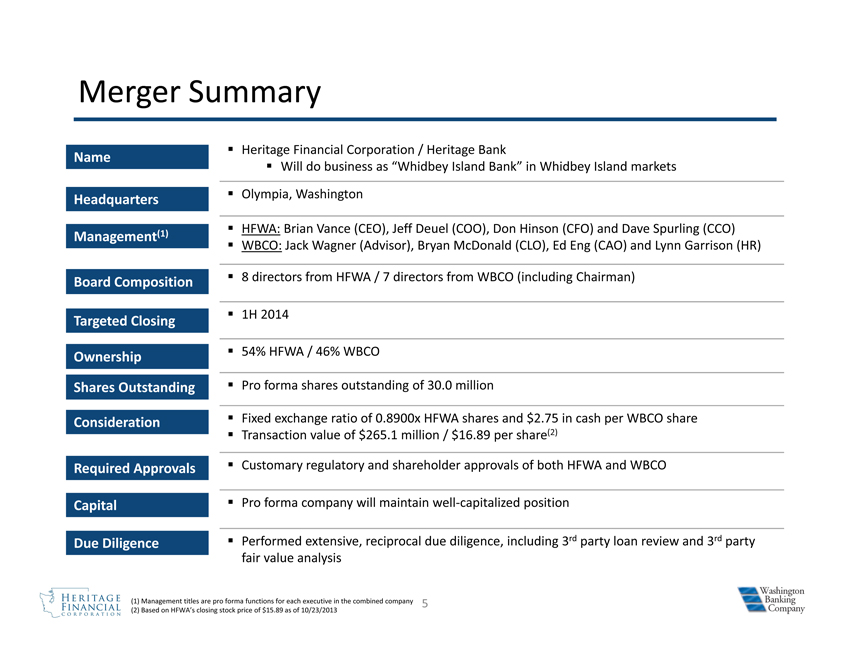

Merger Summary ¡ Heritage Financial Corporation / Heritage Bank Name ¡ Will do business as “Whidbey Island Bank” in Whidbey Island markets Headquarters¡ Olympia, Washington (1)¡ HFWA: Brian Vance (CEO), Jeff Deuel (COO), Don Hinson (CFO) and Dave Spurling (CCO) Management ¡ WBCO: Jack Wagner (Advisor), Bryan McDonald (CLO), Ed Eng (CAO) and Lynn Garrison (HR) Board Composition¡ 8 directors from HFWA / 7 directors from WBCO (including Chairman)¡ 1H 2014 Targeted Closing Ownership¡ 54% HFWA / 46% WBCO Shares Outstanding¡ Pro forma shares outstanding of 30.0 million Consideration¡ Fixed exchange ratio of 0.8900x HFWA shares and $2.75 in cash per WBCO share¡ Transaction value of $265.1 million /$16.89 per share(2) Required Approvals¡ Customary regulatory and shareholder approvals of both HFWA and WBCO Capital¡ Pro forma company will maintain well?capitalized position Due Diligence¡ Performed extensive, reciprocal due diligence, including 3rd party loan review and 3rd party fair value analysis (1) Management titles are pro forma functions for each executive in the combined company (2) Based on HFWA’s closing stock price of $15.89 as of 10/23/2013 5 HERITAGE FINANCIAL CORPORATION Washington Banking Company

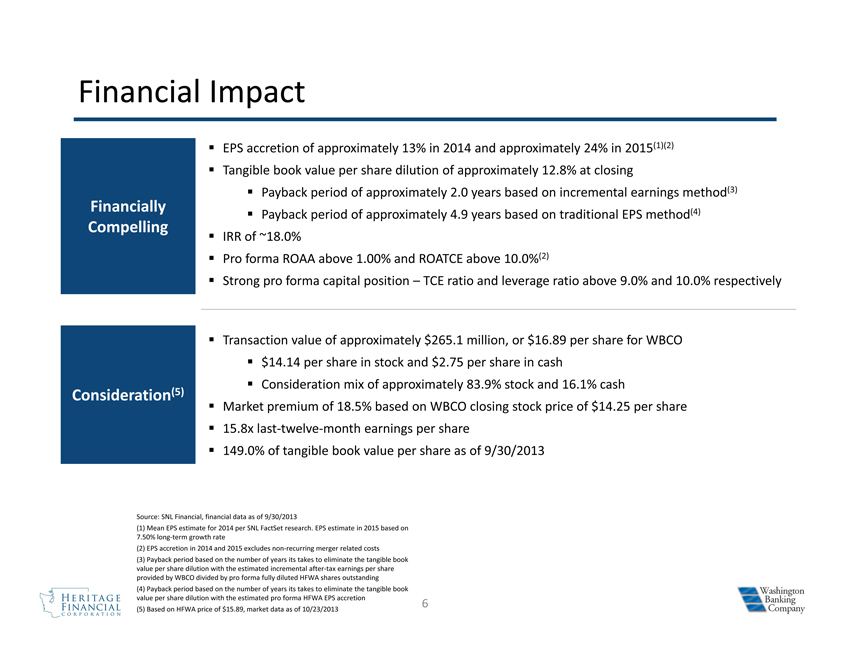

Financial Impact EPS accretion of approximately 13% in 2014 and approximately 24% in 2015(1)(2) Tangible book value per share dilution of approximately 12.8% at closing Payback period of approximately 2.0 years based on incremental earnings method(3) Financially (4) Payback period of approximately 4.9 years based on traditional EPS method Compelling IRR of ~18.0% Pro forma ROAA above 1.00% and ROATCE above 10.0%(2) Strong pro forma capital position TCE ratio and leverage ratio above 9.0% and 10.0% respectively Transaction value of approximately $265.1 million, or $16.89 per share for WBCO $14.14 per share in stock and $2.75 per share in cash Consideration mix of approximately 83.9% stock and 16.1% cash Consideration(5) Market premium of 18.5% based on WBCO closing stock price of $14.25 per share 15.8x last twelve month earnings per share 149.0% of tangible book value per share as of 9/30/2013 Source: SNL Financial, financial data as of 9/30/2013 (1) Mean EPS estimate for 2014 per SNL FactSet research. EPS estimate in 2015 based on 7.50% long term growth rate (2) EPS accretion in 2014 and 2015 excludes non recurring merger related costs (3) Payback period based on the number of years its takes to eliminate the tangible book value per share dilution with the estimated incremental after tax earnings per share provided by WBCO divided by pro forma fully diluted HFWA shares outstanding (4) Payback period based on the number of years its takes to eliminate the tangible book value per share dilution with the estimated pro forma HFWA EPS accretion (5) Based on HFWA price of $15.89, market data as of 10/23/2013 6 HERITAGE FINANCIAL CORPORATION Washington Banking Company

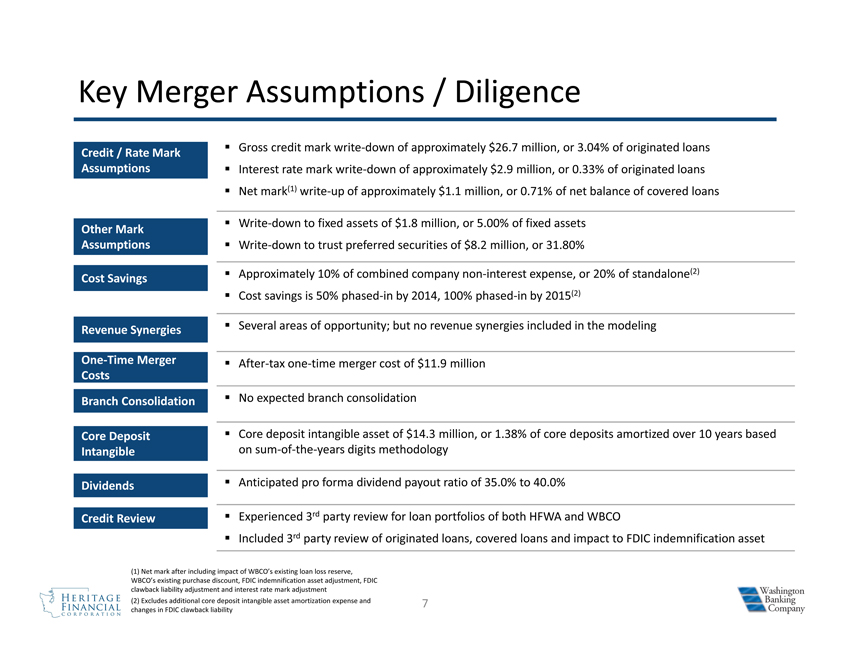

Key Merger Assumptions / Diligence ¡ Gross credit mark write down of approximately $26.7 million, or 3.04% of originated loans Credit / Rate Mark Assumptions¡ Interest rate mark write down of approximately $2.9 million, or 0.33% of originated loans¡ Net mark(1) write up of approximately $1.1 million, or 0.71% of net balance of covered loans ¡ Write down to fixed assets of $1.8 million, or 5.00% of fixed assets Other Mark Assumptions¡ Write down to trust preferred securities of $8.2 million, or 31.80% ¡ Approximately 10% of combined company non interest expense, or 20% of standalone(2) Cost Savings ¡ Cost savings is 50% phased in by 2014, 100% phased in by 2015(2) Revenue Synergies¡ Several areas of opportunity; but no revenue synergies included in the modeling One Time Merger ¡ After tax one time merger cost of $11.9 million Costs Branch Consolidation¡ No expected branch consolidation Core Deposit ¡ Core deposit intangible asset of $14.3 million, or 1.38% of core deposits amortized over 10 years based Intangible on sum of the years digits methodology Dividends¡ Anticipated pro forma dividend payout ratio of 35.0% to 40.0% Credit Review¡ Experienced 3rd party review for loan portfolios of both HFWA and WBCO ¡ Included 3rd party review of originated loans, covered loans and impact to FDIC indemnification asset (1) Net mark after including impact of WBCO’s existing loan loss reserve, WBCO’s existing purchase discount, FDIC indemnification asset adjustment, FDIC clawback liability adjustment and interest rate mark adjustment (2) Excludes additional core deposit intangible asset amortization expense and changes in FDIC clawback liability 7 HERITAGE FINANCIAL CORPORATION Washington Banking Company

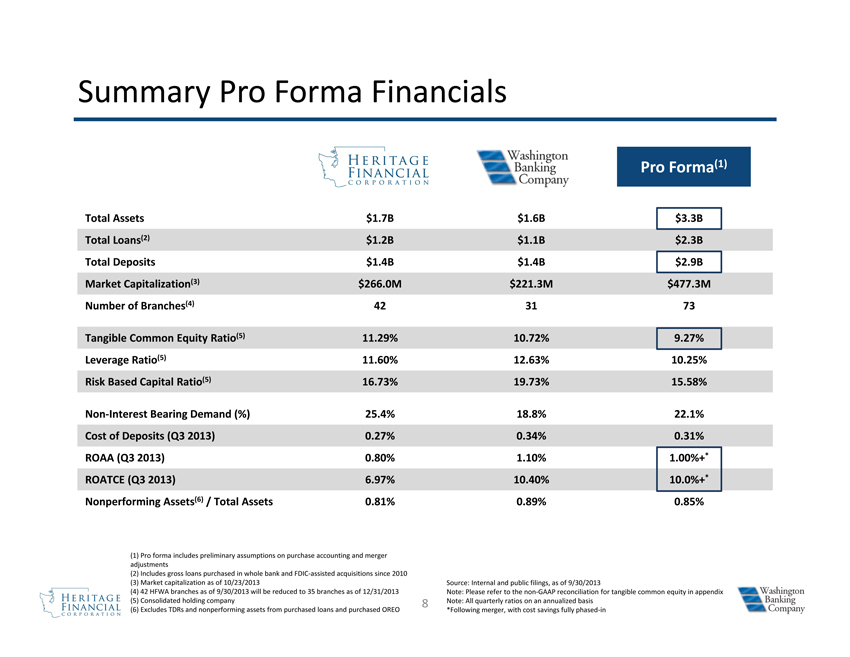

Summary Pro Forma Financials Total Assets $1.7B $1.6B $3.3B Total Loans(2) $1.2B $1.1B $2.3B Total Deposits $1.4B $1.4B $2.9B Market Capitalization(3) $266.0M $221.3M $477.3M Number of Branches(4) 42 31 73 Tangible Common Equity Ratio(5) 11.29% 10.72% 9.27% Leverage Ratio(5) 11.60% 12.63% 10.25% Risk Based Capital Ratio(5) 16.73% 19.73% 15.58% Non Interest Bearing Demand (%) 25.4% 18.8% 22.1% Cost of Deposits (Q3 2013) 0.27% 0.34% 0.31% ROAA (Q3 2013) 0.80% 1.10% 1.00%+* ROATCE (Q3 2013) 6.97% 10.40% 10.0%+* Nonperforming Assets(6) / Total Assets 0.81% 0.89% 0.85% (1) Pro forma includes preliminary assumptions on purchase accounting and merger adjustments (2) Includes gross loans purchased in whole bank and FDIC assisted acquisitions since 2010 (3) Market capitalization as of 10/23/2013 Source: Internal and public filings, as of 9/30/2013 (4) 42 HFWA branches as of 9/30/2013 will be reduced to 35 branches as of 12/31/2013 Note: Please refer to the non GAAP reconciliation for tangible common equity in appendix (5) Consolidated holding company 8 Note: All quarterly ratios on an annualized basis (6) Excludes TDRs and nonperforming assets from purchased loans and purchased OREO *Following merger, with cost savings fully phased in HERITAGE FINANCIAL CORPORATION Washington Banking Company

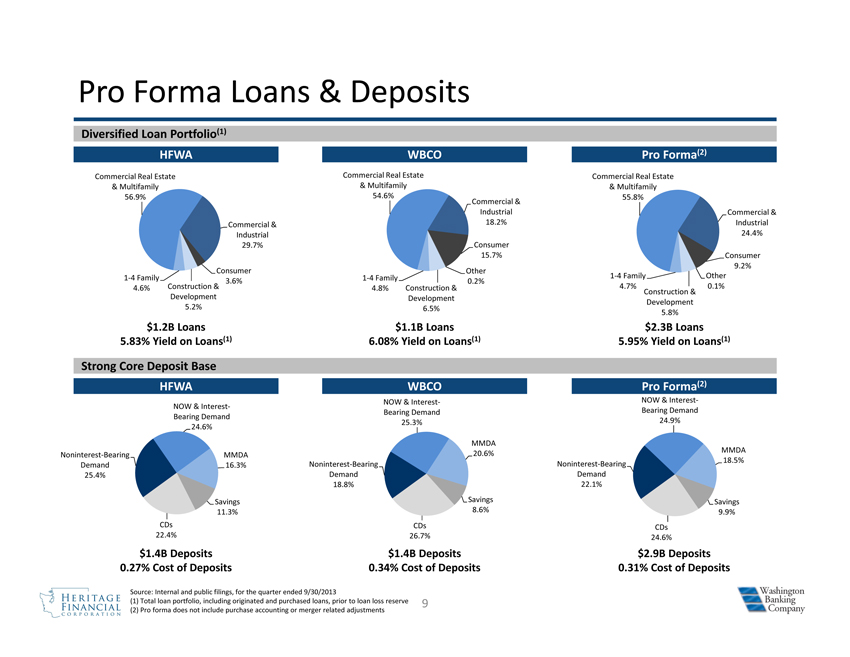

Pro Forma Loans & Deposits Diversified Loan Portfolio(1) HFWA WBCO Pro Forma(2) Commercial Real Estate Commercial Real Estate Commercial Real Estate & Multifamily & Multifamily & Multifamily 56.9% 54.6% Commercial & 55.8% Industrial Commercial & Commercial & 18.2% Industrial Industrial 24.4% 29.7% Consumer 15.7% Consumer 9.2% Consumer Other 1 4 Family 1 4 Family 1 4 Family Other 3.6% 0.2% 4.6% Construction & 4.8% Construction & 4.7% 0.1% Construction & Development Development Development 5.2% 6.5% 5.8% $1.2B Loans $1.1B Loans $2.3B Loans 5.83% Yield on Loans(1) 6.08% Yield on Loans(1) 5.95% Yield on Loans(1) Strong Core Deposit Base HFWA WBCO Pro Forma(2) NOW & Interest NOW & Interest NOW & Interest Bearing Demand Bearing Demand Bearing Demand 24.6% 25.3% 24.9% MMDA MMDA Noninterest Bearing MMDA 20.6% 18.5% Demand 16.3% Noninterest Bearing Noninterest Bearing 25.4% Demand Demand 18.8% 22.1% Savings Savings Savings 11.3% 8.6% 9.9% CDs CDs CDs 22.4% 26.7% 24.6% $1.4B Deposits $1.4B Deposits $2.9B Deposits 0.27% Cost of Deposits 0.34% Cost of Deposits 0.31% Cost of Deposits Source: Internal and public filings, for the quarter ended 9/30/2013 (1) Total loan portfolio, including originated and purchased loans, prior to loan loss reserve 9 (2) Pro forma does not include purchase accounting or merger related adjustments HERITAGE FINANCIAL CORPORATION Washington Banking Company

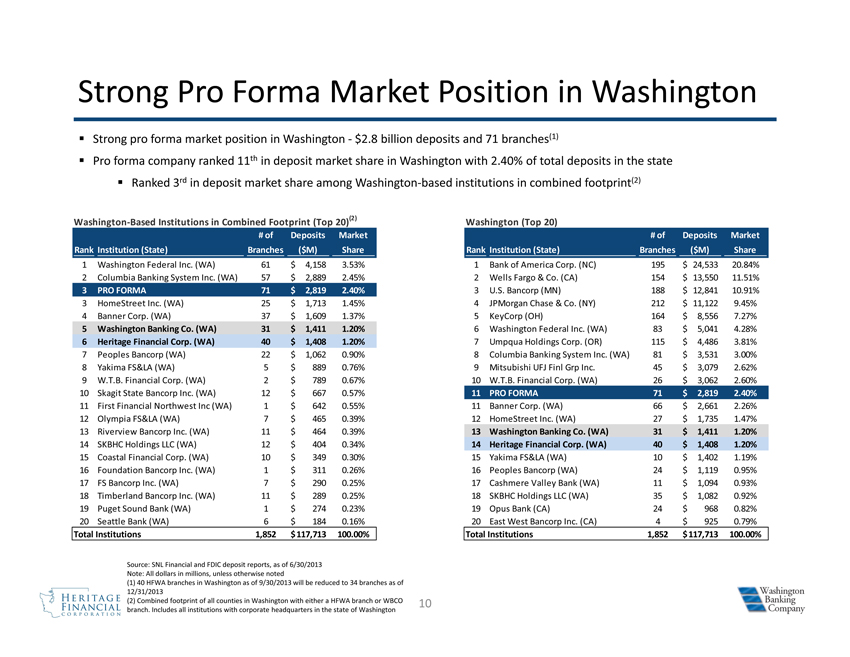

Strong Pro Forma Market Position in Washington ¡ Strong pro forma market position in Washington $2.8 billion deposits and 71 branches(1) ¡ Pro forma company ranked 11th in deposit market share in Washington with 2.40% of total deposits in the state¡ Ranked 3rd in deposit market share among Washington based institutions in combined footprint(2) Washington Based Institutions in Combined Footprint (Top 20)(2) Washington (Top 20) # of Deposits Market # of Deposits Market Rank Institution (State) Branches ($M) Share Rank Institution (State) Branches ($M) Share 1Washington Federal Inc. (WA) 61 $ 4,158 3.53% 1 Bank of America Corp. (NC) 195 $ 24,533 20.84% 2 Columbia Banking System Inc. (WA) 57 $ 2,889 2.45% 2 Wells Fargo & Co. (CA) 154 $ 13,550 11.51% 3 PRO FORMA 71 $ 2,819 2.40% 3 U.S. Bancorp (MN) 188 $ 12,841 10.91% 3 HomeStreet Inc. (WA) 25 $ 1,713 1.45% 4 JPMorgan Chase & Co. (NY) 212 $ 11,122 9.45% 4 Banner Corp. (WA) 37 $ 1,609 1.37% 5 KeyCorp (OH) 164 $ 8,556 7.27% 5 Washington Banking Co. (WA) 31 $ 1,411 1.20% 6 Washington Federal Inc. (WA) 83 $ 5,041 4.28% 6 Heritage Financial Corp. (WA) 40 $ 1,408 1.20% 7 Umpqua Holdings Corp. (OR) 115 $ 4,486 3.81% 7 Peoples Bancorp (WA) 22 $ 1,062 0.90% 8 Columbia Banking System Inc. (WA) 81 $ 3,531 3.00% 8 Yakima FS&LA (WA) 5 $ 889 0.76% 9 Mitsubishi UFJ Finl Grp Inc. 45 $ 3,079 2.62% 9 W.T.B. Financial Corp. (WA) 2 $ 789 0.67% 10 W.T.B. Financial Corp. (WA) 26 $ 3,062 2.60% 10 Skagit State Bancorp Inc. (WA) 12 $ 667 0.57% 11 PRO FORMA 71 $ 2,819 2.40% 11 First Financial Northwest Inc (WA) 1 $ 642 0.55% 11 Banner Corp. (WA) 66 $ 2,661 2.26% 12 Olympia FS&LA (WA) 7 $ 465 0.39% 12 HomeStreet Inc. (WA) 27 $ 1,735 1.47% 13 Riverview Bancorp Inc. (WA) 11 $ 464 0.39% 13 Washington Banking Co. (WA) 31 $ 1,411 1.20% 14 SKBHC Holdings LLC (WA) 12 $ 404 0.34% 14 Heritage Financial Corp. (WA) 40 $ 1,408 1.20% 15 Coastal Financial Corp. (WA) 10 $ 349 0.30% 15 Yakima FS&LA (WA) 10 $ 1,402 1.19% 16 Foundation Bancorp Inc. (WA) 1 $ 311 0.26% 16 Peoples Bancorp (WA) 24 $ 1,119 0.95% 17 FS Bancorp Inc. (WA) 7 $ 290 0.25% 17 Cashmere Valley Bank (WA) 11 $ 1,094 0.93% 18 Timberland Bancorp Inc. (WA) 11 $ 289 0.25% 18 SKBHC Holdings LLC (WA) 35 $ 1,082 0.92% 19 Puget Sound Bank (WA) 1 $ 274 0.23% 19 Opus Bank (CA) 24 $ 968 0.82% 20 Seattle Bank (WA) 6 $ 184 0.16% 20 East West Bancorp Inc. (CA) 4 $ 925 0.79% Total Institutions 1,852 $ 117,713 100.00% Total Institutions 1,852 $ 117,713 100.00% Source: SNL Financial and FDIC deposit reports, as of 6/30/2013 Note: All dollars in millions, unless otherwise noted (1) 40 HFWA branches in Washington as of 9/30/2013 will be reduced to 34 branches as of 12/31/2013 (2) Combined footprint of all counties in Washington with either a HFWA branch or WBCO 10 branch. Includes all institutions with corporate headquarters in the state of Washington HERITAGE FINANCIAL CORPORATION Washington Banking Company

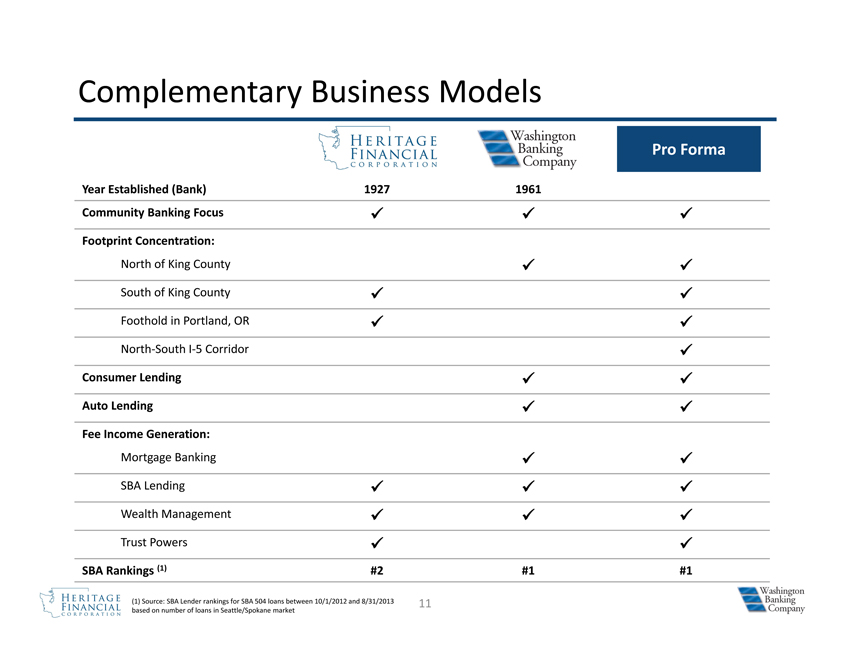

Complementary Business Models Pro Forma Year Established (Bank) 1927 1961 Community Banking Focus Footprint Concentration: North of King County South of King County Foothold in Portland, OR North South I 5 Corridor Consumer Lending Auto Lending Fee Income Generation: Mortgage Banking SBA Lending Wealth Management Trust Powers SBA Rankings (1) #2 #1 #1 (1) Source: SBA Lender rankings for SBA 504 loans between 10/1/2012 and 8/31/2013 based on number of loans in Seattle/Spokane market 11 HERITAGE FINANCIAL CORPORATION Washington Banking Company

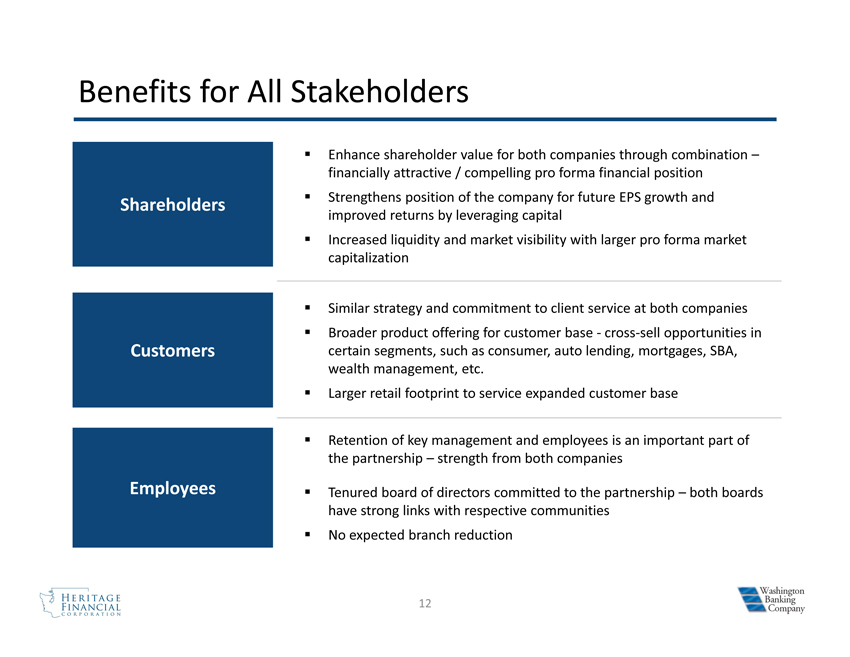

Benefits for All Stakeholders ¡ Enhance shareholder value for both companies through combination –financially attractive /compelling pro forma financial position¡ Strengthens position of the company for future EPS growth and Shareholders improved returns by leveraging capital ¡ Increased liquidity and market visibility with larger pro forma market capitalization ¡ Similar strategy and commitment to client service at both companies¡ Broader product offering for customer base cross sell opportunities in Customers certain segments, such as consumer, auto lending, mortgages, SBA, wealth management, etc. ¡ Larger retail footprint to service expanded customer base ¡ Retention of key management and employees is an important part of the partnership – strength from both companies Employees¡ Tenured board of directors committed to the partnership – both boards have strong links with respective communities¡ No expected branch reduction HERITAGE FINANCIAL CORPORATION Washington Banking Company 12

Summary Creates a premier Western Washington and Pacific Northwest community banking franchise More valuable as a combined entity versus two independent companies More branches than any other Washington based bank in combined footprint(1) Logical fit geographically, strategically and financially attractive Achieves quality operational scale Leverages the capital resources of both companies Both sets of shareholders reinvesting in pro forma company Company is well positioned for future organic and acquisitive growth Creates value for all stakeholders shareholders, customers, employees and communities Source: SNL Financial and FDIC deposit reports, as of 6/30/2013 (1) Combined footprint of all counties in Washington with either a HFWA branch or WBCO 13 branch. Includes all institutions with corporate headquarters in the state of Washington HERITAGE FINANCIAL CORPORATION Washington Banking Company

Questions & Answers Heritage Financial Corporation Washington Banking Company Brian Vance, President and CEO Jack Wagner, President and CEO Jeff Deuel, President and COO of Heritage Bank Bryan McDonald, President and CEO of Whidbey Island Bank Don Hinson, EVP and CFO Rick Shields, EVP and CFO 14 HERITAGE FINANCIAL CORPORATION Washington Banking Company

Appendix 15

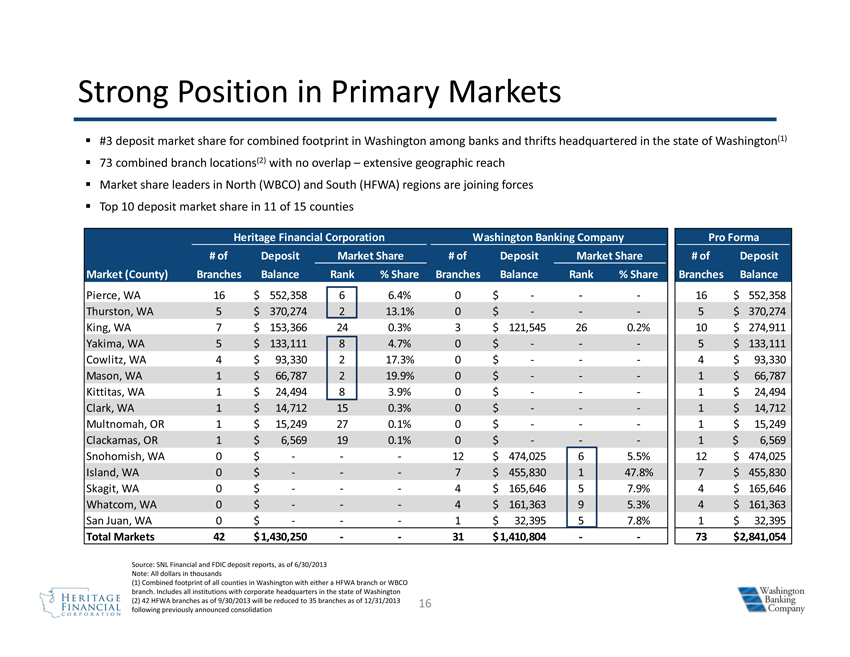

Strong Position in Primary Markets ¡ #3 deposit market share for combined footprint in Washington among banks and thrifts headquartered in the state of Washington(1)¡ 73 combined branch locations(2) with no overlap – extensive geographic reach¡ Market share leaders in North (WBCO) and South (HFWA) regions are joining forces¡ Top 10 deposit market share in 11 of 15 counties Heritage Financial Corporation Washington Banking Company Pro Forma # of Deposit Market Share # of Deposit Market Share # of Deposit Market (County) Branches Balance Rank % Share Branches Balance Rank % Share Branches Balance Pierce, WA 16 $ 552,358 6 6.4% 0 $ 16 $ 552,358 Thurston, WA 5 $ 370,274 2 13.1% 0 $ 5 $ 370,274 King, WA 7 $ 153,366 24 0.3% 3 $ 121,545 26 0.2% 10 $ 274,911 Yakima, WA 5 $ 133,111 8 4.7% 0 $ 5 $ 133,111 Cowlitz, WA 4 $ 93,330 2 17.3% 0 $ 4 $ 93,330 Mason, WA 1 $ 66,787 2 19.9% 0 $ 1 $ 66,787 Kittitas, WA 1 $ 24,494 8 3.9% 0 $ 1 $ 24,494 Clark, WA 1 $ 14,712 15 0.3% 0 $ 1 $ 14,712 Multnomah, OR 1 $ 15,249 27 0.1% 0 $ 1 $ 15,249 Clackamas, OR 1 $ 6,569 19 0.1% 0 $ 1 $ 6,569 Snohomish, WA 0 $ 12 $ 474,025 6 5.5% 12 $ 474,025 Island, WA 0 $ 7 $ 455,830 1 47.8% 7 $ 455,830 Skagit, WA 0 $ 4 $ 165,646 5 7.9% 4 $ 165,646 Whatcom, WA 0 $ 4 $ 161,363 9 5.3% 4 $ 161,363 San Juan, WA 0 $ 1 $ 32,395 5 7.8% 1 $ 32,395 Total Markets 42 $ 1,430,250 31 $ 1,410,804 73 $ 2,841,054 Source: SNL Financial and FDIC deposit reports, as of 6/30/2013 Note: All dollars in thousands (1) Combined footprint of all counties in Washington with either a HFWA branch or WBCO branch. Includes all institutions with corporate headquarters in the state of Washington (2) 42 HFWA branches as of 9/30/2013 will be reduced to 35 branches as of 12/31/2013 16 following previously announced consolidation HERITAGE FINANCIAL CORPORATION Washington Banking Company

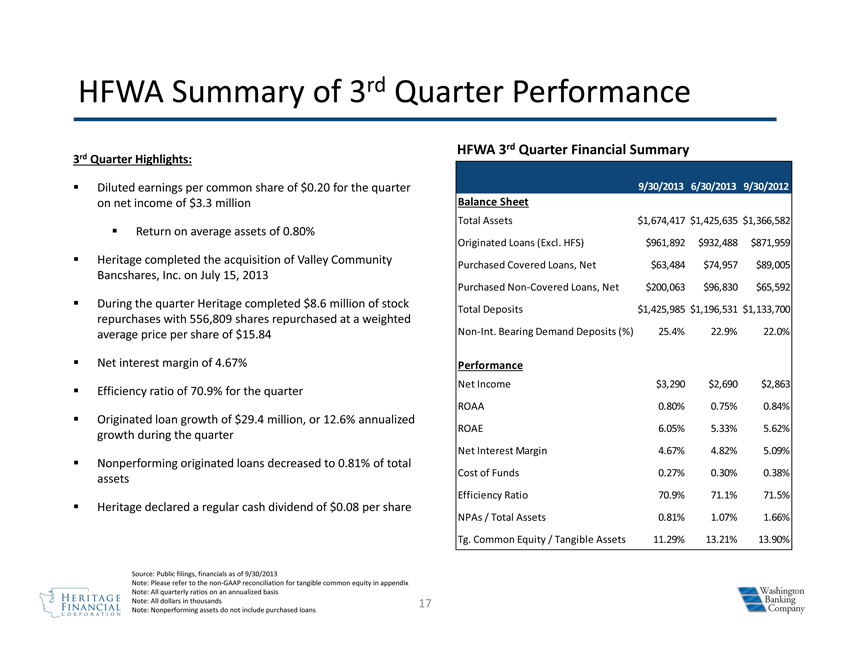

HFWA Summary of 3rd Quarter Performance HFWA 3rd Quarter Financial Summary 3rd Quarter Highlights: ¡ Diluted earnings per common share of $0.20 for the quarter 9/30/2013 6/30/2013 9/30/2012 on net income of $3.3 million Balance Sheet Total Assets $1,674,417 $1,425,635 $1,366,582 ¡ Return on average assets of 0.80% Originated Loans (Excl. HFS) $961,892 $932,488 $871,959 ¡ Heritage completed the acquisition of Valley Community Purchased Covered Loans, Net $63,484 $74,957 $89,005 Bancshares, Inc. on July 15, 2013 Purchased Non Covered Loans, Net $200,063 $96,830 $65,592 ¡ During the quarter Heritage completed $8.6 million of stock repurchases with 556,809 shares repurchased at a weighted Total Deposits $1,425,985 $1,196,531 $1,133,700 average price per share of $15.84 Non Int. Bearing Demand Deposits (%) 25.4% 22.9% 22.0% ¡ Net interest margin of 4.67% Performance Net Income $3,290 $2,690 $2,863 ¡ Efficiency ratio of 70.9% for the quarter ROAA 0.80% 0.75% 0.84% ¡ Originated loan growth of $29.4 million, or 12.6% annualized ROAE 6.05% 5.33% 5.62% growth during the quarter Net Interest Margin 4.67% 4.82% 5.09% ¡ Nonperforming originated loans decreased to 0.81% of total Cost of Funds 0.27% 0.30% 0.38% assets Efficiency Ratio 70.9% 71.1% 71.5% ¡ Heritage declared a regular cash dividend of $0.08 per share NPAs /Total Assets 0.81% 1.07% 1.66% Tg. Common Equity / Tangible Assets 11.29% 13.21% 13.90% Source: Public filings, financials as of 9/30/2013 Note: Please refer to the non GAAP reconciliation for tangible common equity in appendix Note: All quarterly ratios on an annualized basis Note: All dollars in thousands 17 Note: Nonperforming assets do not include purchased loans HERITAGE FINANCIAL CORPORATION Washington Banking Company

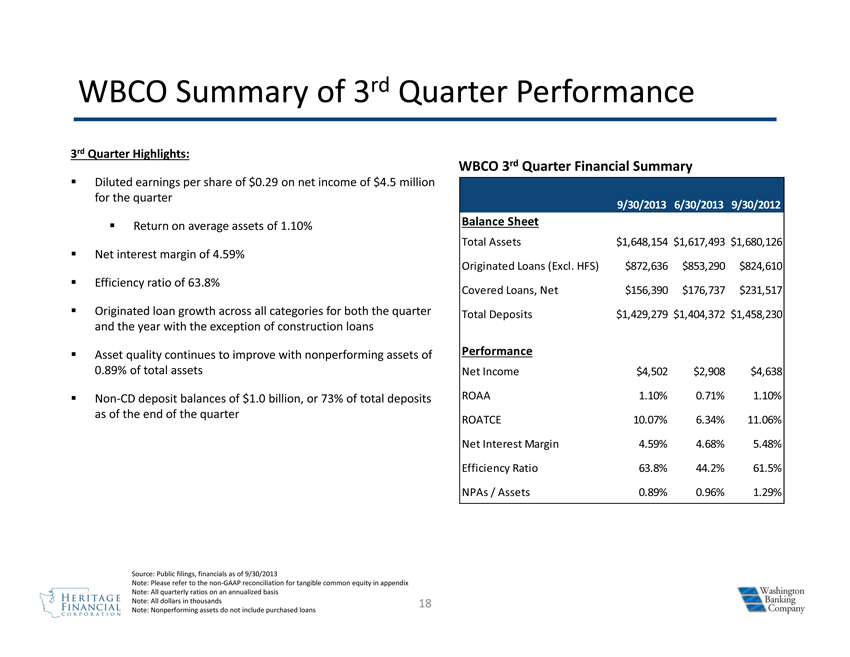

WBCO Summary of 3rd Quarter Performance 3rd Quarter Highlights: WBCO 3rd Quarter Financial Summary Diluted earnings per share of $0.29 on net income of $4.5 million for the quarter 9/30/2013 6/30/2013 9/30/2012 Return on average assets of 1.10% Balance Sheet Total Assets $1,648,154 $1,617,493 $1,680,126 Net interest margin of 4.59% Originated Loans (Excl. HFS) $872,636 $853,290 $824,610 Efficiency ratio of 63.8% Covered Loans, Net $156,390 $176,737 $231,517 Originated loan growth across all categories for both the quarter Total Deposits $1,429,279 $1,404,372 $1,458,230 and the year with the exception of construction loans Asset quality continues to improve with nonperforming assets of Performance 0.89% of total assets Net Income $4,502 $2,908 $4,638 Non CD deposit balances of $1.0 billion, or 73% of total deposits ROAA 1.10% 0.71% 1.10% as of the end of the quarter ROATCE 10.07% 6.34% 11.06% Net Interest Margin 4.59% 4.68% 5.48% Efficiency Ratio 63.8% 44.2% 61.5% NPAs / Assets 0.89% 0.96% 1.29% Source: Public filings, financials as of 9/30/2013 Note: Please refer to the non GAAP reconciliation for tangible common equity in appendix Note: All quarterly ratios on an annualized basis Note: All dollars in thousands 18 Note: Nonperforming assets do not include purchased loans HERITAGE FINANCIAL CORPORATION Washington Banking Company

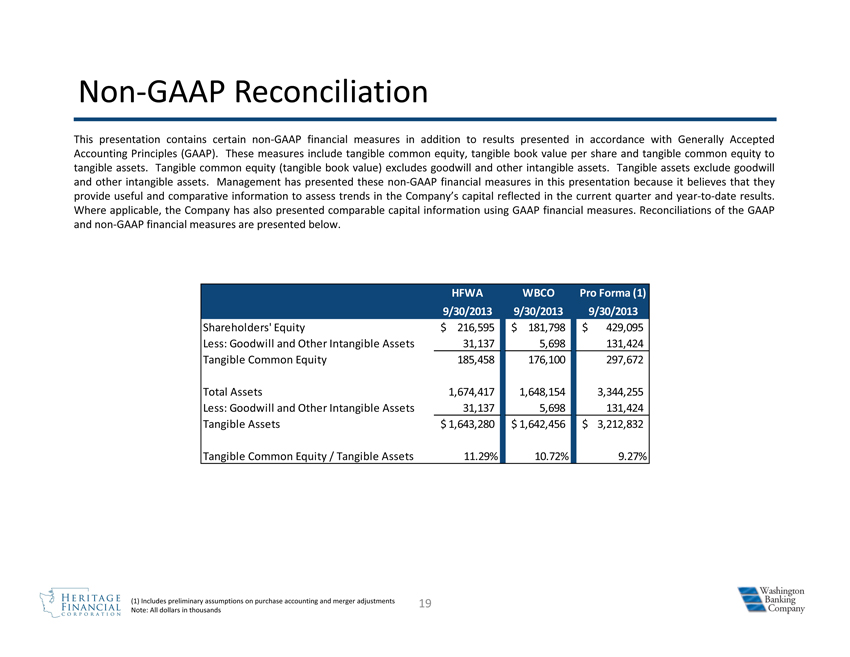

Non GAAP Reconciliation This presentation contains certain non GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles (GAAP). These measures include tangible common equity, tangible book value per share and tangible common equity to tangible assets. Tangible common equity (tangible book value) excludes goodwill and other intangible assets. Tangible assets exclude goodwill and other intangible assets. Management has presented these non GAAP financial measures in this presentation because it believes that they provide useful and comparative information to assess trends in the Company’s capital reflected in the current quarter and year to date results. Where applicable, the Company has also presented comparable capital information using GAAP financial measures. Reconciliations of the GAAP and non GAAP financial measures are presented below. HFWA WBCO Pro Forma (1) 9/30/2013 9/30/2013 9/30/2013 Shareholders’ Equity $ 216,595 $ 181,798 $ 429,095 Less: Goodwill and Other Intangible Assets 31,137 5,698 131,424 Tangible Common Equity 185,458 176,100 297,672 Total Assets 1,674,417 1,648,154 3,344,255 Less: Goodwill and Other Intangible Assets 31,137 5,698 131,424 Tangible Assets $ 1,643,280 $ 1,642,456 $ 3,212,832 Tangible Common Equity / Tangible Assets 11.29% 10.72% 9.27% (1) Includes preliminary assumptions on purchase accounting and merger adjustments 19 Note: All dollars in thousands HERITAGE FINANCIAL CORPORATION Washington Banking Company

Additional Information For Shareholders Heritage will file a registration statement on Form S 4 with the SEC in connection with the proposed transaction. The registration statement will include a joint proxy statement of Heritage and Washington Banking that also constitutes a prospectus of Heritage, which will be sent to the shareholders of Heritage and Washington Banking. Shareholders are advised to read the joint proxy statement/prospectus when it becomes available because it will contain important information about Heritage, Washington Banking and the proposed transaction. When filed, this document and other documents relating to the merger filed by Heritage and Washington Banking can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing Heritage’s website at http://www.hf wa.com/docs.aspx iid=1024198 or by accessing Washington Banking’s website at http://investor.washingtonbanking.info/docs.aspx iid=1025104. Alternatively, these documents, when available, can be obtained free of charge from Heritage upon written request to Heritage Financial Corporation, Secretary, 201 Fifth Avenue S.W., Olympia, WA 98501 or by calling (360) 943 1500, or from Washington Banking, upon written request to Washington Banking Company, Secretary, 450 SW Bayshore Drive, Oak Harbor, Washington 98277 or by calling (360) 240 6458. Heritage, Washington Banking and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders in connection with the proposed transaction under the rules of the SEC. Information about these participants may be found in the definitive proxy statement of Heritage relating to its 2013 Annual Meeting of Shareholders filed with the SEC by Heritage on March 19, 2013 and the definitive proxy statement of Washington Banking relating to its 2013 Annual Meeting of Shareholders filed with the SEC on March 26, 2013. These definitive proxy statements can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants will also be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. 20 HERITAGE FINANCIAL CORPORATION Washington Banking Company