Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PANTRY INC | a10-15x2013xform8xk.htm |

The Pantry, Inc. 2013 Wells Fargo Securities Convenience Store Forum Atlanta, GA - October 15, 2013

2 Forward Looking Statements and Non-GAAP Measures Some of the statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than those of historical facts included herein, including those related to the company’s financial outlook, goals, business strategy, projected plans and objectives of management for future operations and liquidity, are forward-looking statements. These forward-looking statements are based on the company’s plans and expectations and involve a number of risks and uncertainties that could cause actual results to vary materially from the results and events anticipated or implied by such forward-looking statements. Please refer to the company’s Annual Report on Form 10-K and its other filings with the SEC for a discussion of significant risk factors applicable to the company. In addition, the forward-looking statements included in this presentation are based on the company’s estimates and plans as of the date of this presentation. While the company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. In this presentation, we will refer to certain non-GAAP financial measures that we believe are helpful in understanding our financial performance and / or liquidity. The Appendix to this presentation includes a description of each non-GAAP financial measure presented, as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure.

Opportunity: Unlocking Potential of Powerful C-Store Platform 3 The Pantry’s operational and financial performance has been disappointing in recent years: – Transition from roll-up strategy to focus on strengthening fundamentals – Declining fuel and cigarette volumes – Leadership changes – Challenging economy $1,659 $1,798 $1,779 $1,809 $1,794 35.4% 33.8% 33.9% 33.7% 34.1% 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 LT M Q 3 1 3 Merchandise Revenue % Margin 2,078 2,047 1,889 1,811 1,721 $0.149 $0.129 $0.135 $0.115 $0.112 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 LT M Q 3 1 3 Fuel Gallons Sold CPG Adjusted EBITDA2 Fuel Gallons Sold & CPG1 Merchandise Rev. & Gross Margin $284 $240 $232 $210 $206 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 LT M Q 3 1 3 Average Store Count 1,657 1,652 1,655 1,611 1,571 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 YT D Q 3 1 3 1 Fuel gross profit per gallon (cents per gallon or CPG) represents fuel revenue less cost of product and expenses associated with credit card processing fees for all of our products and services, and repairs and maintenance on fuel equipment. Fuel gross profit per gallon as presented may not be comparable to similarly titled measures reported by other companies. 2 See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure.

Historical Operating Performance Adjusted EBITDA1 4 Adjusted EBITDA Excluding Fuel Gross Profit1,2 ($ in millions) ($ in millions) $284 $240 $232 $210 $206 2009 2010 2011 2012 LTM Q3 2013 ($28) ($25) ($25) ($0) $11 2009 2010 2011 2012 LTM Q3 2013 1 See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. 2 Fuel gross profit represents fuel revenue less cost of product and expenses associated with credit card processing fees for all of our products and services, and repairs and maintenance on fuel equipment. Fuel gross profit as presented may not be comparable to similarly titled measures reported by other companies.

Fueling the Engine 5 Last 18 months: March 2012 - Present – Built strong leadership team – Creating a “merchant” mentality to improve total site performance – Positioning the company for sustained, profitable growth Progress report: – Leadership • Joe Venezia, SVP of Operations • Boris Zelmanovich, Chief Merchandising Officer • Clyde Preslar, Chief Financial Officer • Alex Garcia, Vice President – Real Estate • Andrew Hinton, Director Treasury Operations and Investor Relations – Merchandising initiatives • Local and lifestyle merchandising • Point of purchase advertising • Promotions – Fuel optimization system rolled out to entire store footprint allowing for better market intelligence and more consistent pricing position in our markets – Upgrading store base: • 70-80 remodels completed FY13, on pace to remodel 10% of store base in FY14 • 3 new stores and 3 rebuilds completed in FY13 • 16-18 new QSRs added in FY13, on pace to add 20+ in FY14

Fueling the Engine: Store Remodel and QSR Initiatives 6 Focused on refreshing stores, enhancing proprietary foodservice offering and adding QSR’s Target is to remodel 10% of store base each year Store selection driven by financial returns and market position Store Remodels New QSRs 0 ≈80 ≈150 FY12 FY13 FY14 6 16 20+ FY12 FY13 FY14

Fueling the Engine: New Store Construction 7 Opened three new stores in FY2013 Rebuilt three stores Plan to open at least four new stores in FY14 Will accelerate new store growth going forward Charlotte, NC: Opened Feb 2013 Myrtle Beach, SC: Opened Sep 2013

Powerful C-Store Platform: Leader in the Southeast 8 Pantry Store Locations 1,562 stores located in 13 states as of June 27, 2013 #1 or #2 in markets with high population growth (FL, NC, SC) – Customers accustomed to frequenting C-stores – According to the most recent U.S. Census data, population growth in the Southeast higher than the U.S. average (13.4% vs. 9.7% from 2000-2010) Revenue of $7.9 billion and Adjusted EBITDA of $2061 million during twelve months ended June 27, 2013 Leading independently operated convenience store retailer in the Southeastern United States 1 See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure.

9 Powerful C-Store Platform: Leadership in Attractive Markets The Company maintains a leadership position in most of its largest DMAs1 Charlotte (474 stores) Jacksonville (269 stores) Nashville (162 stores) New Orleans (56 stores) #1 #2 #3 #1 #2 #3 #1 #2 #3 Source: Convenience Store News 2011/2012 Directory of Convenience Stores; 1DMAs as defined by Convenience Store News Columbia (241 stores) #1 #2 #3 #1 #2 #3 Memphis (82 stores) #1 #2 #3 Attractive Locations Pantry benefits from tourism in the SE region, particularly during summer Stores positioned in opportunistic areas: – Coastal/resort areas (approx. 32% of total stores) – Along major interstates and highways (approx. 23% of total stores) – Near colleges and universities

Key Strategic Initiatives to Unlock Potential 10 Store Remodel and QSR Program New Store Opportunities and Acquisitions Enhance Merchandise Mix to Increase Sales Per Customer Invest in Industry Leading Talent & Technology Focused Expense Management Increase Same Store Sales

Improving Balance Sheet Supports Strategic Initiatives 11 1 Total debt, net of cash including lease finance obligations ($ in millions) Pantry generates consistent free cash flow to invest in operations and reduce total debt The Company has reduced total debt approximately $336 million since 2008 Net debt is down $163 million since 2008 Debt, net of cash: $1,067 $1,069 $1,016 $991 $928 $904 1 $1,284 $1,239 $1,217 $1,205 $1,017 $948 2008 2009 2010 2011 2012 Q3 2013 Total Debt

Consistent Free Cash Flow and Debt Reduction Opportunity: Unlocking Potential of Powerful C-Store Platform 12 Leading Positions and Scale in Attractive Markets Resilient Underlying Industry Increasingly Attractive Merchandise Mix Demonstrated Expense Management Experienced Management Team The Pantry’s targeted business strategy, focus on operating efficiency and disciplined financial policy creates a profitable, long-term operating model

Appendix

15 Strong Offering of Convenience Products and Services Services QSRs Currently over 220 in-store QSRs World’s 5th largest operator of Subway restaurants ATMs Lottery Car wash Prepaid products / money orders Category Sales1 Cigarettes 30% Grocery 13% Beer/Wine 15% Foodservice 11% Packaged Beverage 16% Other Tobacco 6% Other Non-Food Merchandise 5% Services 4% 1 Results as of LTM June 2013

16 Major Fuel Operations The Company offers a mix of branded and private branded fuel Fuel purchased under supply agreements with major oil companies

17 Experienced Management Team Executive Position Industry Experience Past Employers Dennis G. Hatchell CEO and President 40+ years CEO Dennis Hatchell Strong New Management Team Executiv Position The Pantry Tenure Prior Professional Experience Keith Bell SVP, Fuels 6 Years BP, Amoco Thomas Carney SVP, General Counsel and Secretary 2 Years Borders Group, Hoover Universal, Inc. Keith Oreson SVP, Human Resources 3 Years Advance Auto Parts, Frank's Nursery and Crafts, ARAMARK Uniform Services Clyde Preslar SVP, Chief Financial Officer 6 Months RailAmerica, Cott Corporation, Lance, Black and Decker, RJR Nabisco Joe Venezia SVP, Operations 1 Year TitleMax, Walmart, Procter & Gamble Boris Zelmanovich SVP, Chief Merchandising Officer 3 Months Big Lots, Family Dollar

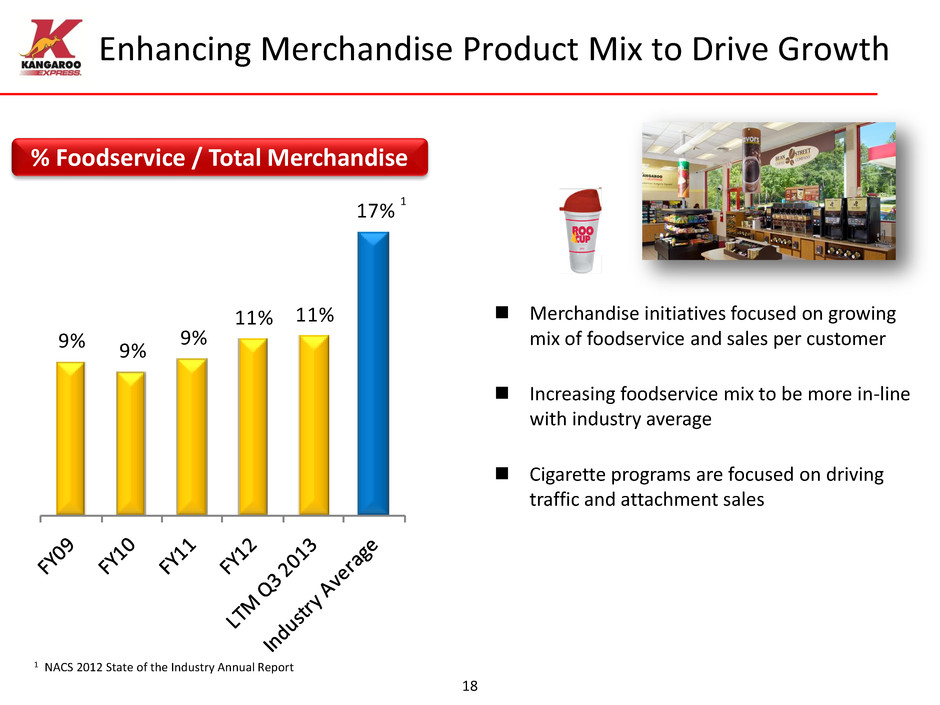

Enhancing Merchandise Product Mix to Drive Growth 18 Merchandise initiatives focused on growing mix of foodservice and sales per customer Increasing foodservice mix to be more in-line with industry average Cigarette programs are focused on driving traffic and attachment sales 9% 9% 9% 11% 11% 17% % Foodservice / Total Merchandise 1 1 NACS 2012 State of the Industry Annual Report

Investing in Industry Leading Talent & Technology 19 Key recent senior management hires – SVP of Operations: Joe Venezia – Chief Merchandising Officer: Boris Zelmanovich – CFO: Clyde Preslar Technology – Fuel pricing optimization – Category / space planning systems

Focused Expense Management 20 OSG&A cost management is a critical focus area Since FY2010, OSG&A cost have been reduced $31 million Other Store and G&A Costs (OSG&A) ($ in millions) Avg. Store Count: 1,652 1,655 1,611 1,571 $632 $629 $610 $601 35.2% 35.3% 33.7% 33.5% 30% 31% 32% 33% 34% 35% 36% 37% 38% 39% 40% $580 $585 $590 $595 $600 $605 $610 $615 $620 $625 $630 $635 FY10 FY11 FY12 LTM Q3 2013 OSG&A % of Merch Sales

Targeted capital deployment into new store and/or selective acquisition growth opportunities with rigorous evaluation of “build vs. buy” economics Focused on individual stores or chains of stores within our current geographic footprint Acquired two individual stores in FY2013 in Hilton Head, SC and Myrtle Beach, SC Acquisition priorities: – Enhanced density within core footprint – Free cash flow enhancing – Potential to reduce effective purchase multiple through operating synergies 21 Acquisition Opportunities

-3.3% -4.9% -7.4% -3.1% -5.0% 2009 2010 2011 2012 LTM Q3 2013 $1,659 $1,798 $1,779 $1,809 $1,794 35.4% 33.8% 33.9% 33.7% 34.1% 2009 2010 2011 2012 LTM Q3 2013 Merchandise Revenue % Margin Historical Operating Performance Fuel Gallons Sold & CPG1 Merchandise Revenue & Gross Margin 22 (gallons in millions) ($ in millions) Fuel Gallons Comps % Inside Comps % 0.0% 5.6% 0.2% 3.3% 1.2% 2009 201 2011 2012 LTM Q3 2013 1 12010 Comp sales ex. cigarettes were up 0.2%; cigarette comps were up 18.1% driven by excise tax increases. 2,078 2,047 1,889 1,811 1,721 $0.149 $0.129 $0.135 $0.115 $0.112 2009 2010 2011 2012 LTM Q3 2013 Fuel Gallons Sold CPG 1 Fuel gross profit per gallon (cents per gallon or CPG) represents fuel revenue less cost of product and expenses associated with credit card processing fees for all of our products and services, and repairs and maintenance on fuel equipment. Fuel gross profit per gallon as presented may not be comparable to similarly titled measures reported by other companies.

Current Capital Structure 23 ($ in millions) 1 Excludes L/Cs outstanding of $93.8 million as of 6/27/13. 2 Based on a common stock price of $11.63 as of 10/10/2013 and 23.6 million common shares outstanding as of 9/26/2013. As of 6/27/13 Cash 44.1$ Debt: $225M Revolver(1) - Term Loan B 253.7 Lease Finance Obligations 446.8 Total Senior Secured Debt 700.5 8.375% Senior Notes due 8/2020 250.0 Total debt 950.5$ Less - unamortized debt discount 2.2 Total debt, net of discount 948.3$ Market Capitalization(2) 274.5 Total capitalization 1,225.0$ Net debt 904.2$ Total Liquidity as of 6/27/13: 175.3$

Use of Non-GAAP Measures Adjusted EBITDA Adjusted EBITDA is defined by the Company as net income (loss) before interest expense, net, gain/loss on extinguishment of debt, income taxes, impairment charges and depreciation and amortization. Adjusted EBITDA is not a measure of operating performance or liquidity under generally accepted accounting principles in the United States of America (“GAAP”) and should not be considered as a substitute for net income, cash flows from operating activities or other income or cash flow statement data. The Company has included information concerning Adjusted EBITDA because it believes investors find this information useful as a reflection of the resources available for strategic opportunities including, among others, to invest in the Company’s business, make strategic acquisitions and to service debt. Management also uses Adjusted EBITDA to review the performance of the Company's business directly resulting from its retail operations and for budgeting and compensation targets. Adjusted EBITDA does not include impairment of long-lived assets and other charges. The Company excluded the effect of impairment losses because it believes that including them in Adjusted EBITDA is not consistent with reflecting the ongoing performance of its remaining assets. Adjusted EBITDA does not include gain/loss on extinguishment of debt because it represents financing activities and is not indicative of the ongoing performance of the Company’s remaining stores. Slide 24

Use of Non-GAAP Measures Adjusted EBITDA Excluding Fuel Gross Profit Adjusted EBITDA Excluding Fuel Gross Profit is Adjusted EBITDA before fuel gross profit. Adjusted EBITDA Excluding Fuel Gross Profit is not a measure of operating performance or liquidity under GAAP and should not be considered as a substitute for net income, cash flows from operating activities or other income or cash flow statement data. The Company has included information concerning Adjusted EBITDA Excluding Fuel Gross Profit because it believes investors find this information useful as a helpful measure in assessing the performance of the merchandise portion of its business. 25

Use of Non-GAAP Measures Free Cash Flow Free cash flow represents net cash provided by operating activities less net capital expenditures. Free cash flow is not a measure of operating performance or liquidity under GAAP and should not be considered as a substitute for cash flows provided by operating activities or other cash flow statement data. We have included information concerning free cash flow because we believe it provides useful information to management and investors about the amount of cash generated by the business after capital expenditures, which can then be used to, among other things, retire debt, make strategic acquisitions and strengthen the balance sheet. A limitation on the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in our cash balance for the period. Slide 26

Additional Information Regarding Non-GAAP Measures Any measure that excludes interest expense, gain/loss on extinguishment of debt, depreciation and amortization, impairment charges, income taxes, or fuel gross profit has material limitations because the Company uses debt and lease financing in order to finance its operations and acquisitions, uses profit, capital and intangible assets in its business and must pay income taxes and rent as a necessary element of its operations. Due to these limitations, the Company uses non-GAAP measures in addition to and in conjunction with results and cash flows presented in accordance with GAAP. The Company strongly encourages investors to review its consolidated financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, the non-GAAP financial measures referenced herein, as defined by the Company, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare our use of non-GAAP financial measures with non-GAAP financial measures having the same or similar names used by other companies. Slide 27

28 Adjusted EBITDA & Adjusted EBITDA Excluding Fuel Gross Profit Reconciliation ($ in thousands) September 24, September 30, September 29, September 27, June 27, 2009 2010 2011 2012 2013 Fuel revenue 4,731,205$ 5,467,402$ 6,359,681$ 6,443,955$ 6,097,125$ Fuel cost of goods sold 4,419,861 5,202,717 6,102,607 6,233,638 5,901,638 Fuel gross profit 311,344$ 264,685$ 257,074$ 210,317$ 195,487$ Adjusted EBITDA excluding fuel gross profit (27,803)$ (24,837)$ (25,346)$ (191)$ 10,665$ Fuel gross profit 311,344 264,685 257,074 210,317 195,487 Adjusted EBITDA 283,541$ 239,848$ 231,728$ 210,126$ 206,152$ Impairment charges (2,084) (267,079) (12,555) (6,257) (5,469) Gain (loss) on extinguishment of debt 4,007 (791) (15) (5,532) (2,993) Interest expense, net (91,483) (88,256) (87,491) (84,219) (90,155) Depreciation and amortization (108,712) (120,605) (117,025) (119,672) (120,800) Income tax benefit (expense) (31,178) 71,268 (4,827) 3,007 4,506 Net income (loss) 54,091$ (165,615)$ 9,815$ (2,547)$ (8,759)$ Adjusted EBITDA excluding fuel gross profit (27,803)$ (24,837)$ (25,346)$ (191)$ 10,665$ Fuel gross profit 311,344 264,685 257,074 210,317 195,487 Adjusted EBITDA 283,541$ 239,848$ 231,728$ 210,126$ 206,152$ Gain (loss) on extinguishment of debt 4,007 (791) (15) (5,532) (2,993) Interest expense, net (91,483) (88,256) (87,491) (84,219) (90,155) Income tax (expense) benefit (31,178) 71,268 (4,827) 3,007 4,506 Stock-based compensation expense 6,367 3,478 2,153 2,823 3,001 Changes in operating assets and liabilities (18,050) (13,593) 6,621 6,931 (17,555) Expense (Benefit) for deferred income taxes 10,337 (68,611) 22,071 (2,516) (1,868) Other 5,895 11,482 8,470 13,397 8,542 Net cash provided by operating activities 169,436$ 154,825$ 178,710$ 144,017$ 109,630$ Additions to property and equipment, net (117,244) (97,511) (92,760) (54,980) (63,876) Acquisitions of businesses, net (48,768) (10) (47,564) - (502) Net cash used in investing activities (166,012)$ (97,521)$ (140,324)$ (54,980)$ (64,378)$ Net cash used in financing activities (50,732)$ (26,547)$ (25,255)$ (213,630)$ (180,899)$ Net increase (decrease) in cash (47,308)$ 30,757$ 13,131$ (124,593)$ (135,647)$ Twelve Months Ended 1 1 Our fiscal year ended September 30, 2010 included 53 weeks; all other fiscal years presented included 52 weeks.

29 Free Cash Flow Reconciliation 1 Our fiscal year ended September 30, 2010 included 53 weeks; all other fiscal years presented included 52 weeks. ($ in thousands) September 25, September 24, September 30, September 29, September 27, June 27, 2008 2009 2010 2011 2012 2013 Additions to property and equipment (109,496)$ (122,656)$ (101,127)$ (100,726)$ (69,261)$ (70,213)$ Proceeds from sales of property and equipment 7,456 5,309 3,616 7,663 10,543 5,254 Insurance recoveries 1,223 103 - 303 3,738 1,083 Capital expenditures, net (100,817)$ (117,244)$ (97,511)$ (92,760)$ (54,980)$ (63,876)$ Acquisitions (14,696) (48,768) (10) (47,564) - (502) Net cash used in investing activities (115,513)$ (166,012)$ (97,521)$ (140,324)$ (54,980)$ (64,378)$ ($ in thousands) September 25, September 24, September 30, September 29, September 27, June 27, 2008 2009 2010 2011 2012 2013 Net cash provided by operating activities 157,504$ 169,436$ 154,825$ 178,710$ 144,017$ 109,630$ Capital expenditures, net (100,817) (117,244) (97,511) (92,760) (54,980) (63,876) Free cash flow 56,687$ 52,192$ 57,314$ 85,950$ 89,037$ 45,754$ Net cash used in investing activities (115,513)$ (166,012)$ (97,521)$ (140,324)$ (54,980)$ (64,378)$ Net cash provided by (used in) financing activities 103,694$ (50,732)$ (26,547)$ (25,255)$ (213,630)$ (180,899)$ Twelve Months Ended Twelve Months Ended 1