Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Energy Future Holdings Corp /TX/ | d611938d8k.htm |

| EX-99.3 - EX-99.3 - Energy Future Holdings Corp /TX/ | d611938dex993.htm |

| EX-99.2 - EX-99.2 - Energy Future Holdings Corp /TX/ | d611938dex992.htm |

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

October 7, 2013

ILLUSTRATIVE TERM SHEET RELATING TO

ENERGY FUTURE HOLDINGS,

ENERGY FUTURE INTERMEDIATE HOLDING COMPANY,

AND TEXAS COMPETITIVE ELECTRIC HOLDINGS COMPANY

Exhibit 99.1 |

2

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

SITUATION OVERVIEW

Energy Future Holdings (“EFH”) has engaged in extensive negotiations

with its stakeholders; however, it has yet to reach agreement on the

terms of an orderly restructuring [Significant Creditor] is aware of the

significant benefits of a consensual agreement that will allow EFH to

avoid the significant cost, expense, and business risk due to a

protracted Chapter 11 and material breakage costs associated with a

deconsolidation of the structure, including:

–

Operational dissynergies;

–

Significant tax cost;

–

Value degradation of the retail business;

–

Regulatory uncertainty; and

–

Professional fees

[Significant Creditor] is a significant long-term investor in EFH with

material holdings in the indebtedness of EFH, Energy Future Intermediate

Holding Company (“EFIH”), and Texas Competitive Electric Holdings Company

(“TCEH”)

[Significant Creditor], together with its advisors, has developed a

restructuring proposal focused on the following key tenets:

–

Avoid unnecessary business risk, transaction costs and tax inefficiencies

–

Bridge constituent demands on EFIH and TCEH sides of the EFH structure

Balance relative value

Balance form of recovery

Maintain relative priority

Provide for sufficient deleveraging to avoid future restructuring risk

EFH and its advisors

have engaged in extensive

discussions with the

various stakeholders;

however, a consensual

resolution has not yet

been achieved

As a result of its

significant holdings at

various EFH entities,

[Significant Creditor] is

in a unique position to

help bridge the differences

between stakeholders at

EFH, EFIH, and

TCEH to achieve a

consensual restructuring

transaction and avoid

the significant costs and

value leakages associated

with a protracted and

contentious free fall

Chapter 11 |

3

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

TRANSACTION OVERVIEW

[Significant Creditor]’s term sheet provides for significant deleveraging

of EFIH and TCEH, including: –

EFIH: Refinancing of First Lien Debt, equity claw of 35% of Second Lien Debt

and equitization of Unsecured Debt –

TCEH: Equitization of significant portion of First Lien Debt and

cancelation of all junior debt (with value

protection through new warrants)

–

EFH: Equitization of EFH Unsecured Debt

The EFIH equitization will be completed through an offering of New Tracking

Stock at EFH which will track the value and business of EFIH and its

subsidiaries –

The New Tracking Stock will provide for distributions to current

holders of EFIH Unsecured Notes up to par value

plus accrued interest plus an annual return

–

The EFIH Unsecured Noteholders will backstop a rights offering for ~$0.8

billion of New Tracking Stock, the proceeds of which will be used to

claw 35% of the Second Lien Notes –

To provide for additional cash flow, the EFIH First Lien Debt will be

refinanced at market rates (while providing existing lenders with a

premium over par) Holders of TCEH First Lien Debt will exchange into

substantially all of the New EFH Equity

–

TCEH First Lien Lenders will receive 94.2%

(1)

of the New EFH Equity and approximately $8.0 billion of cash

(from proceeds of the issuance of new First Lien Debt at TCEH)

Holders of the EFH Unsecured Debt will receive 11.8% of the New Tracking Stock

and 3.8% (1)

of the New EFH

Equity

The existing equity Sponsors will receive 2.0% of the New EFH Equity and 2.0%

of the New Tracking Stock –

Other junior TCEH creditors will receive short duration warrants

in New EFH Equity to provide value at in-the-

money enterprise valuation levels

-

TCEH First Lien

lenders to receive

control of EFH and

substantially all of

the value of TCEH

-

EFIH Unsecured

Debt Holders to

receive a par recovery

over time

-

EFH debt and

equity to continue to

participate in the

value of EFH assets

-

Other claimants to

participate in EFH

value through

warrants

Notes:

(1)

Pro

forma

EFH

equity

allocations

based

on

market-implied

value

of

TCEH

of

approximately

$16.5

billion

The illustrative term

sheet provides for: |

4

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

ILLUSTRATIVE TRANSACTION RATIONALE

TCEH FIRST

LIEN LENDERS

Receive substantially all of the value attributable to TCEH assets

Receive control of EFH without paying for control premium

Obtain expeditious control of TCEH assets

Receive upside value of Oncor assets, after redemption of the New Tracking

Stock Benefit from delevered EFIH with virtually no future restructuring risk

Avoid costs of contentious Chapter 11

Avoid diminution in value of the retail business associated with a potentially

lengthy and contentious Chapter 11 process EFIH FIRST

LIENS

Receive cash in excess of par value in near term

EFIH SECOND

LIENS

35% of holdings repaid at par plus coupon through utilization of equity claw

At each holder's election, may tender additional Notes for cash equal to equity

claw price Reinstated holders benefit from delevered capital structure and improved

liquidity profile EFIH

UNSECURED

NOTES

Receive New Tracking Stock designed to capture par plus accrued interest of

EFIH Unsecured Notes plus an annual return

Provides unlimited timeframe to recapture Oncor value through New Tracking

Stock Benefit from delevered EFIH, improved liquidity profile, and removal of

bankruptcy overhang Benefit from potential incremental value that may be generated through amending

Oncor ring-fenced structure Ability to prove value and backstop / participate in rights offering for New

Tracking Stock Protected from any future volatility of TCEH earnings

OTHER TCEH

CREDITORS

Receive limited duration warrants at appropriate strike prices to capture value

at in-the-money enterprise valuation levels Potential to participate in Oncor valuation upside as well

EFH

UNSECURED

DEBT

Continue to receive benefit of EFH and EFIH value through ownership of New

Tracking Stock and New EFH Equity SPONSORS

Continue to receive benefit of EFH and EFIH value through ownership of New

Tracking Stock and New EFH Equity Granted full releases

MANAGEMENT

To receive new incentive plan to ensure alignment of interests with new

ownership of EFH The table below illustrates certain potential benefits associated with the

proposed transaction A consensual

restructuring would

provide significant

benefits to all parties

by, among other things,

avoiding the significant

costs in money and

time associated with a

protracted and

contentious process |

5

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

AMOUNT ($BN)

TREATMENT, PRIOR TO DILUTION FROM MANAGEMENT INCENTIVE PLAN

EFH

Building Financing & First

Lien Debt

$0.1

Reinstated

Unsecured Notes

$0.6

Exchanged into 11.8% of New Tracking Stock and 3.8% of New EFH Equity

Inter-Company Debt

$1.7

Canceled

SPONSORS

Equity

-

2.0% of New EFH Equity

2.0% of New Tracking Stock

EFIH

First Lien Debt

$4.0

Refinanced

Existing First Lien Debt Holders receive cash at [105.2%]; proceeds of New EFIH

First Lien Debt Second Lien Debt

$2.2

$0.8 million / 35% clawed at average price of 111.6% with proceeds of offering

of New Tracking Stock Remaining principal provided option to receive:

Reinstatement, or

Repayment at equity claw price; proceeds of New EFIH

First Lien Debt Unsecured Debt

$1.5

Exchanged for 54.9% of New Tracking Stock

Holders to backstop rights offering for issuance of no less than $0.8 billion

of New Tracking Stock (31.3%), the proceeds of which will be used to

claw Second Lien Notes Providers of New Tracking Stock backstop to receive fee TBD

TCEH

Revolving Credit Facility

TBD

New revolving credit facility to be obtained on market terms

First Lien Debt

$24.4

Exchanged for pro rata share of:

$8.0 billion cash; proceeds of New First Lien

TCEH Bank Debt 94.2% of EFH equity

Capital Leases and Fixed

Secured Facility Notes

$0.1

[Reinstated]

Second Lien Debt

$1.6

Warrants for TBD of pro forma equity of EFH, set at a TBD strike price (with

limited duration) Unsecured Debt

$4.9

Warrants for TBD of pro forma equity of EFH, set at a TBD strike price (with

limited duration) EFCH

EFCH Debt

$0.1

Warrants for TBD of pro forma equity of EFH, set at a TBD strike price (with

limited duration) MGMT

PLAN

Equity

-

Terms TBD

SUMMARY ILLUSTRATIVE TERM SHEET

The table below highlights key terms of the illustrative term sheet

Notes:

(1)

All

equity

amounts

illustrated

are

prior

to

dilution

from

a

new

management

incentive

plan

and

warrants

to

TCEH

junior

creditors.

Pro

forma

equity

allocations

based

on market-

implied

TCEH

First

Note

trading

value

of

approximately

$16.5

billion

(2)

Amount

excludes

Pollution

Control

Bonds,

which

are

assumed

to

be

reinstated

(1)

(1)

(1)

(2) |

6

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

ILLUSTRATIVE TERMS OF NEW TRACKING STOCK

INITIAL

REDEMPTION

PRICE

~$2.6 billion

REFERENCE

ENTITY

Tracks the value of EFIH

DIVIDEND

POLICY

To the extent EFIH dividends funds to EFH, a dividend will be paid on the New

Tracking Stock Subject to capital surplus at EFH; otherwise

funds to be reinvested into EFIH Dividends will reflect an annual

return of [TBD]% on the initial value of the New Tracking Stock REDEMPTION

Redeemable by EFH at a price equal to the initial value plus accrued but unpaid

dividends. Initial value of New Tracking Stock will reflect:

a) Par plus accrued interest on converted EFIH Unsecured Debt; plus

b) Proceeds of the New Tracking Stock rights offering

GOVERNANCE

/ OTHER

New Tracking Stock to receive voting rights at EFH only

Restrictions on issuances by EFH of securities senior to the New Tracking Stock

and other customary protections

Tax Sharing Agreements amended to provide that Oncor tax payments are made

directly to EFIH PRO FORMA

OWNERSHIP

New Tracking Stock issued for EFIH Second Lien Claw: 31.3%

EFIH Unsecured Debt Holders: 54.9%

EFH Unsecured Debt Holders: 11.8%

Sponsors: 2.0%

The New Tracking

Stock provides for

deleveraging of EFIH,

through unsecured debt

exchange and new

money to fund an

equity claw of EFIH

Second Lien Debt

The New Tracking

Stock would act

similar to preferred

equity in EFIH,

without risk of

triggering adverse tax

consequences for the

broader EFH group

The table below illustrates certain key terms of the New Tracking Stock

|

7

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

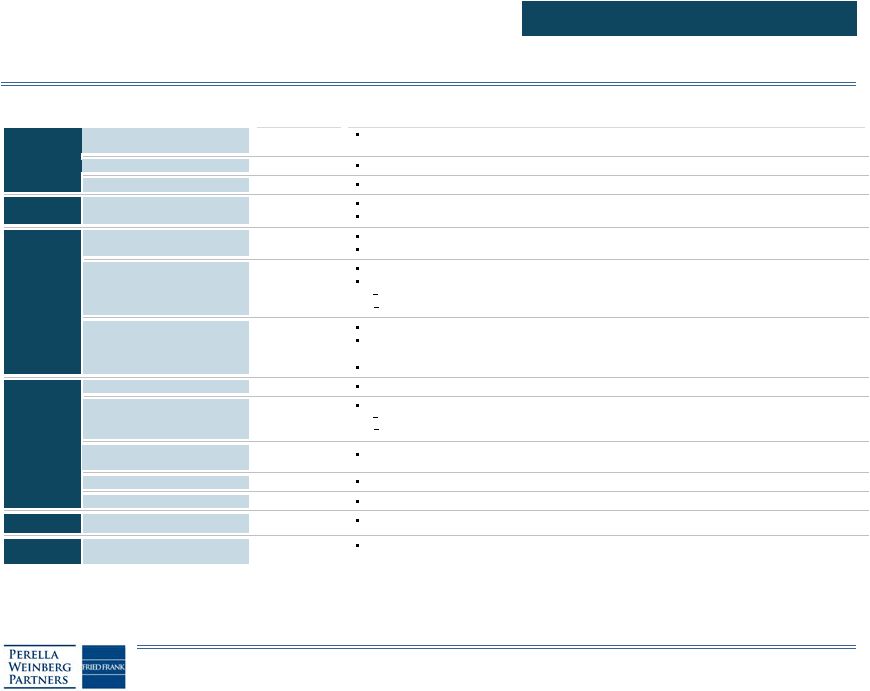

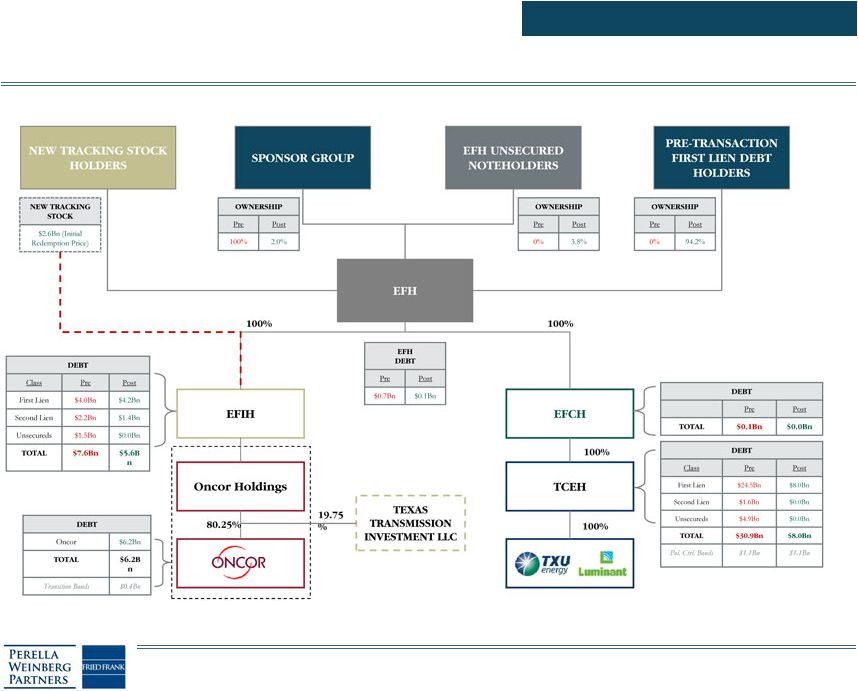

SUMMARY CORPORATE STRUCTURE

Source:

Company

filings

Note:

Debt

amounts

illustrated

prior

to

unamortized

premium

/

discount

Deconsolidated and Ring-fenced entities

The chart below summarizes the corporate structure of EFH, TCEH,

EFCH, and EFIH |

8

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

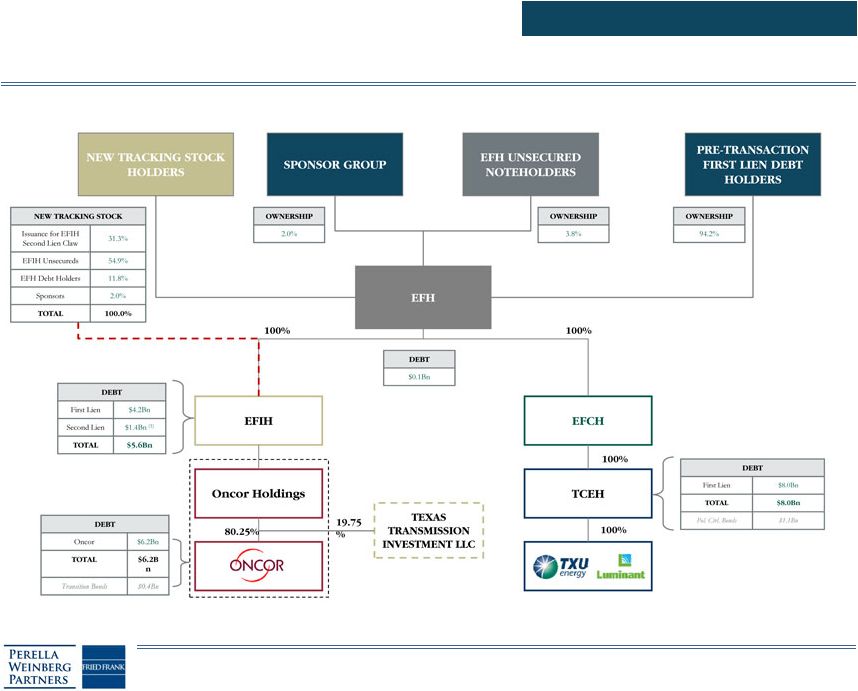

SUMMARY OF PROPOSED RESTRUCTURING PROPOSAL

The chart below summarizes the illustrative proposed restructuring transaction

of EFH, TCEH, EFCH, and EFIH Notes:

All

equity

amounts

illustrated

are

prior

to

dilution

from

a

new

management

incentive

plan

and

warrants |

9

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

Confidential –

Subject to F.R.E. 408

SUMMARY OF PRO FORMA STRUCTURE

The chart below summarizes the illustrative proposed restructuring transaction

of EFH, TCEH, EFCH, and EFIH Notes:

All

equity

amounts

illustrated

are

prior

to

dilution

from

a

new

management

incentive

plan

and

warrants

(1)

For

illustrative

purposes

only,

assumes

100%

of

Second

Lien

Notes

outstanding

subsequent

to

equity

claw

decline

cash

redemption |

10

DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED

AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408

LEGAL DISCLAIMER

Confidential

–

Subject

to

F.R.E.

408 |