Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JPMORGAN CHASE & CO | jpmc3q13form8k.htm |

October 11, 2013 F I N A N C I A L R E S U L T S 3Q13

F I N A N C I A L R E S U L T S 3Q13 Financial highlights 1 See note 1 on slide 26 2 The Firm presents net income and earnings per share excluding the after-tax impact of reductions in the allowance for loan losses and litigation expense in Corporate. These non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Firm’s reported results. Management believes this information helps investors understand the effect of these items on reported results and provides an alternate presentation of the Firm's performance 3 Assumes a tax rate of 38% for items that are tax deductible 4 Reduced loan loss reserves in Real Estate Portfolios and Card Services 5 See note 4 on slide 26 and the Basel I Tier 1 capital ratio on page 39 of the Firm’s 3Q13 earnings release financial supplement 6 Including the impact of final Basel III capital rules issued July 2, 2013 3Q13 net loss of $0.4B; EPS of ($0.17); revenue of $23.9B1 3Q13 net income of $5.8B2, or $1.42 per share2, excluding significant items Continue to seek fair and reasonable settlement with the government on mortgage-related matters 3Q13 results included the following significant items Strong underlying performance across our businesses Fortress balance sheet Basel I Tier 1 common of $145B; ratio of 10.5%5 Estimated Basel III Tier 1 common of $146B; ratio of 9.3%6 Pretax Net income 3 EPS 3 Corporate – Legal expense, including reserves for litigation and regulatory proceedings ($9,150) ($7,200) ($1.85) Consumer & Community Banking – Benefit from reduced loan loss reserves 4 1,600 992 0.26 $mm, excluding EPS 1

F I N A N C I A L R E S U L T S Firmwide litigation reserves Reserves reflect what is probable and estimable Range of reasonably possible losses – in excess of reserves – is an estimate that incorporates management’s judgment based upon currently available information and taking into consideration management’s best estimate of such losses for those cases for which such estimates can be made4 Firmwide litigation reserves – 2010 through 3Q131 (pretax, $B) Litigation reserves relate to a broad range of matters, and include a significant reserve for mortgage-related matters, including securities and repurchase litigation exposure3 Litigation expense in the quarter and estimated range of reasonably possible losses reflect the highly unpredictable environment we are in – escalating demands and penalties from multiple government agencies Despite strengthening our reserves to this degree, there still remains uncertainty regarding litigation costs, albeit we expect them to abate and normalize over time 1 Excludes mortgage repurchase liability for GSEs and the estimate of reasonably possible losses associated with GSE repurchase claims 2 Includes firmwide of $9.3B in 3Q13 3 Includes MBS deals by JPMorgan Chase, Washington Mutual and Bear Stearns from 2005-2008; estimate > 80% of MBS deal losses relate to Washington Mutual and Bear Stearns 4 For further information on the range of reasonably possible losses in excess of reserves, see note 23 on pages 198-206 of JPMorgan Chase’s 2Q13 Form 10-Q 3Q13 2Q13 Range of rea nably possible losses (high-end) ~$5.7 ~$6.8 Range of reasonably possible losses in excess of reserves1 (pretax, $B) Res rves for litigation – beginning balance (1/1/10) ~$3 Add: Net increases to reserves 2 ~28 Less: Settlements and judgments (~8) Reserves for litigation – ending balance (9/30/13) ~$23 2

F I N A N C I A L R E S U L T S 3Q13 Financial results1 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/(under) 3 See note 3 on slide 26 $ O/(U) 3Q13 2Q13 3Q12 Revenue (FTE)1 $23,880 ($2,078) ($1,983) Credit costs (543) (590) (2,332) Expense 23,626 7,760 8,255 Reported net income/(loss) ($380) ($6,876) ($6,088) Net income/(loss) applicable to common stockholders ($650) ($6,751) ($5,996) Reported EPS ($0.17) ($1.77) ($1.57) ROE2 (1)% 13% 12% ROTCE2,3 (2) 17 16 $mm, excluding EPS 3

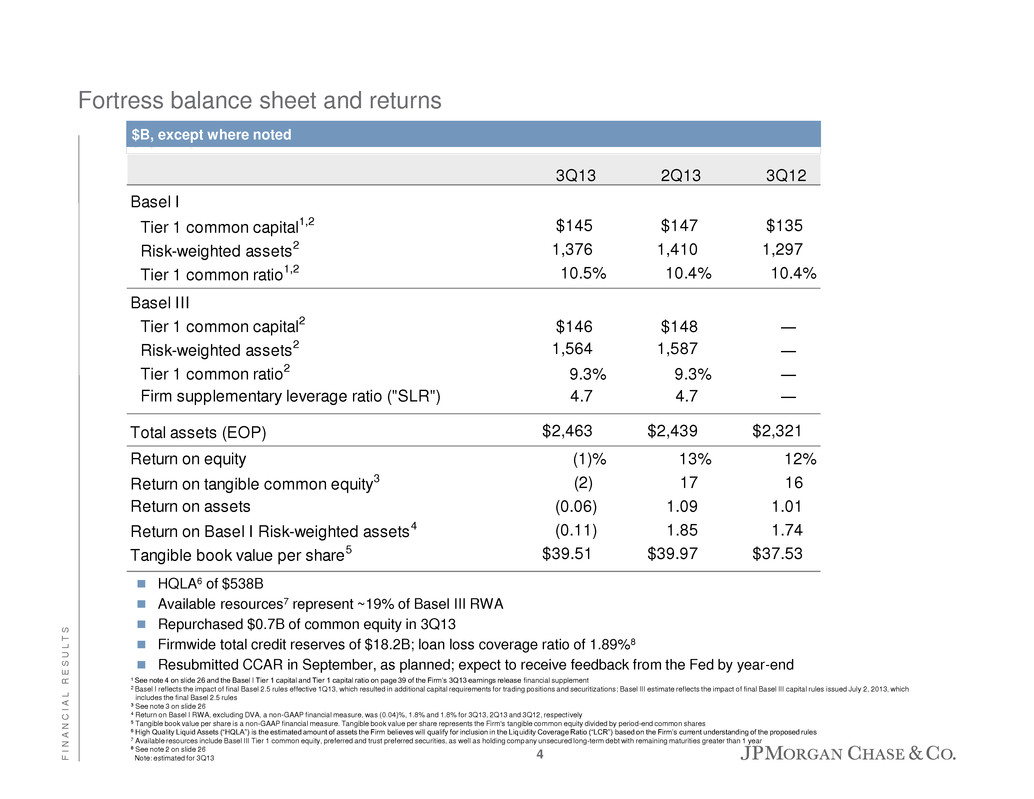

F I N A N C I A L R E S U L T S Fortress balance sheet and returns HQLA6 of $538B Available resources7 represent ~19% of Basel III RWA Repurchased $0.7B of common equity in 3Q13 Firmwide total credit reserves of $18.2B; loan loss coverage ratio of 1.89%8 Resubmitted CCAR in September, as planned; expect to receive feedback from the Fed by year-end 1 See note 4 on slide 26 and the Basel I Tier 1 capital and Tier 1 capital ratio on page 39 of the Firm’s 3Q13 earnings release financial supplement 2 Basel I reflects the impact of final Basel 2.5 rules effective 1Q13, which resulted in additional capital requirements for trading positions and securitizations; Basel III estimate reflects the impact of final Basel III capital rules issued July 2, 2013, which includes the final Basel 2.5 rules 3 See note 3 on slide 26 4 Return on Basel I RWA, excluding DVA, a non-GAAP financial measure, was (0.04)%, 1.8% and 1.8% for 3Q13, 2Q13 and 3Q12, respectively 5 Tangible book value per share is a non-GAAP financial measure. Tangible book value per share represents the Firm's tangible common equity divided by period-end common shares 6 High Quality Liquid Assets (“HQLA”) is the estimated amount of assets the Firm believes will qualify for inclusion in the Liquidity Coverage Ratio (“LCR”) based on the Firm’s current understanding of the proposed rules 7 Available resources include Basel III Tier 1 common equity, preferred and trust preferred securities, as well as holding company unsecured long-term debt with remaining maturities greater than 1 year 8 See note 2 on slide 26 Note: estimated for 3Q13 3Q13 2Q13 3Q12 Basel I Tier 1 common capital1,2 $145 $147 $135 Risk-weighted assets2 1,376 1,410 1,297 Tier 1 common ratio1,2 10.5% 10.4% 10.4% Basel III Tier 1 common capital2 $146 $148 ― Risk-weighted assets2 1,564 1,587 ― Tier 1 common ratio2 9.3% 9.3% ― Firm supplementary leverage ratio ("SLR") 4.7 4.7 ― Total assets (EOP) $2,463 $2,439 $2,321 Return on equity (1)% 13% 12% Return on tangible common equity3 (2) 17 16 Return on assets (0.06) 1.09 1.01 Return on Basel I Risk-weighted assets4 (0.11) 1.85 1.74 Tangible book value per share5 $39.51 $39.97 $37.53 $B, except where noted 4

F I N A N C I A L R E S U L T S Consumer & Community Banking1 Consumer & Business Banking #1 in deposit growth for the second year in a row, with growth rate more than twice the industry average3 #1 in customer satisfaction among the largest banks by both J.D. Power4 and the American Customer Satisfaction Index $179B client investment assets; over 1,900 Chase Private Client (“CPC”) locations and 190K CPC clients #1 ATM network5; #1 most visited banking portal – Chase.com6; #2 in branches5 Mortgage Banking #2 mortgage originator7 #2 retail mortgage originator7 #2 mortgage servicer7 #1 in customer satisfaction among the largest banks for originations by J.D. Power8 Card, Merchant Services & Auto #1 credit card issuer in the U.S. based on loans outstanding9 #1 global Visa issuer based on consumer and business credit card sales volume10 #1 U.S. co-brand credit card issuer9 #2 wholly-owned merchant acquirer11 #3 non-captive auto lender12 Leadership positions 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/(under) 3 Based on FDIC 2013 Summary of Deposits survey per SNL Financial 4 Chase ranked #4 by J.D. Power for customer satisfaction in retail banking among large bank peers 5 Based on disclosures by peers as of 2Q13 6 Per compete.com as of August 2013 7 Based on Inside Mortgage Finance as of 2Q13 8 Chase ranked #4 for customer satisfaction in originations on an overall basis 9 Based on disclosures by peers and internal estimates as of 2Q13 10 Based on Visa data as of 2Q13 11 Based on Nilson Report ranking of largest merchant acquirers for 2012 12 Per Autocount data for August 2013 YTD $mm $ O/(U) 3Q13 2Q13 3Q12 Net interest income $7,121 $27 ($174) Noninterest revenue 3,961 (960) (1,464) Revenue $11,082 ($933) ($1,638) Expense 6,867 3 (89) Credit costs (267) (248) (2,129) Net income $2,702 ($387) $347 Key drivers/statistics2 EOP Equity ($B) $46.0 $46.0 $43.0 ROE 23% 27% 22% Overhead ratio 62 57 55 Average loans ($B) $405.0 $411.1 $422.8 Average deposits ($B) 456.9 453.6 416.7 Number of branc es 5,652 5,657 5,596 Number of ATMs 19,171 19,075 18,485 Active online customers (000's) 32,916 32,245 30,765 Active mobile customers (000's) 14,993 14,013 11,573 5

F I N A N C I A L R E S U L T S Consumer & Community Banking Consumer & Business Banking 1 Actual numbers for all periods, not over/(under) 2 Includes checking accounts and Chase LiquidSM cards Net income of $762mm, down 2% YoY, but up 9% QoQ Net revenue of $4.4B, up 2% YoY and 3% QoQ Expense up 5% YoY and flat QoQ Average total deposits of $438.1B, up 11% YoY and 1% QoQ Deposit margin of 2.32%, down 24 bps YoY, but up 1 bp QoQ Accounts2 up 5% YoY and 1% QoQ, reflecting strong acquisitions and low customer attrition Business Banking loan originations down 23% YoY and 1% QoQ Average Business Banking loans up 2% YoY and flat QoQ Client investment assets up 16% YoY and 4% QoQ Financial performance Key drivers $mm $ O/(U) 3Q13 2Q13 3Q12 Net interest income $2,684 $70 $19 Noninterest revenue 1,746 73 89 Revenue $4,430 $143 $108 Expense 3,050 8 137 Credit costs 104 30 (3) Net income $762 $64 ($16) Key drivers/statistics1 ($B) EOP Equity $11.0 $11.0 $9.0 ROE 27% 25% 34% Average total deposits $438.1 $432.8 $393.8 Deposit margin 2.32% 2.31% 2.56% Accounts2 (mm) 29.3 28.9 27.8 Business Ba king loan originations $1.3 $1.3 $1.7 Business Banking loan balances (Avg) 18.6 18.7 18.3 Investment sales 8.2 9.5 6.3 Client investment assets (EOP) 179.0 171.9 154.6 6

F I N A N C I A L R E S U L T S Consumer & Community Banking Mortgage Banking Mortgage Production pretax income of $90mm, down $997mm YoY, reflecting lower volumes and lower margins, partially offset by lower repurchase losses Realized repurchase losses of $125mm Reduction of repurchase liability of $300mm Net servicing-related revenue of $632mm, down 16% YoY Mortgage Servicing expense down $205mm YoY MSR risk management loss of $180mm, compared with income of $150mm in the prior year Real Estate Portfolios pretax income of $1.5B, up $1.4B YoY Total net revenue of $809mm, down 20% YoY Credit cost benefit of $1.0B – Net charge-offs of $204mm – Reduction in allowance for loan losses of $1.25B – Purchased credit-impaired – $750mm – Non-credit impaired – $500mm Mortgage originations of $40.5B, down 14% YoY and 17% QoQ Purchase originations of $20.0B, up 57% YoY and 15% QoQ Expect headcount reduction of ~11,000 in FY136 1 Includes the provision for credit losses associated with Mortgage Production 2 Actual numbers for all periods, not over/(under) 3 Firmwide mortgage origination volume was $44.2B, $52.0B and $49.6B for 3Q13, 2Q13 and 3Q12, respectively 4 Real Estate Portfolios only 5 Excludes the impact of purchased credit-impaired loans acquired as part of the WaMu transaction. The allowance for loan losses was $5.0B, $5.7B, and $5.7B for these loans at the end of 3Q13, 2Q13 and 3Q12. To date, no charge-offs have been recorded for these loans 6 Includes employees and contractors Financial performance $mm $ O/(U) 3Q13 2Q13 3Q12 Mortgage Production Production-related revenue, excl. repurchase losses $584 ($702) ($1,194) Production expense1 669 (51) (9) Income, excl. repurchase losses ($85) ($651) ($1,185) Repurchase (losses)/benefit 175 159 188 Income before income tax expense $90 ($492) ($997) Mortgage Servicing Net servicing-related revenue $632 ($138) ($122) Default servicing expense 623 148 (196) Core servicing expense 235 (5) (9) Servicing expense $858 $143 ($205) Income/(loss), excl. MSR risk management (226) (281) 83 MSR risk management (180) (258) (330) Income/(loss) before income tax expense/(benefit) ($406) ($539) ($247) Real Estate Portfolios Revenue $809 ($99) ($197) Expense 375 (29) (11) Net charge-offs 204 (84) (1,216) Change in allowance (1,250) (300) (350) Credit costs ($1,046) ($384) ($1,566) Income before income tax expense $1,480 $314 $1,380 Mortgage Banking net income $705 ($437) $82 Key drivers/statistics ($B)2 EOP Equity $19.5 $19.5 $17.5 ROE 14% 23% 14% Mortgage originations3 $40.5 $49.0 $47.3 EOP third-party m rtgage loans serviced 831.1 832.0 811.4 EOP NCI own d portfolio4 115.7 114.6 120.3 ALL/EOP loans4,5 2.39% 2.85% 4.63% Net charge-off r te ,5 0.70 1.00 4.60 7

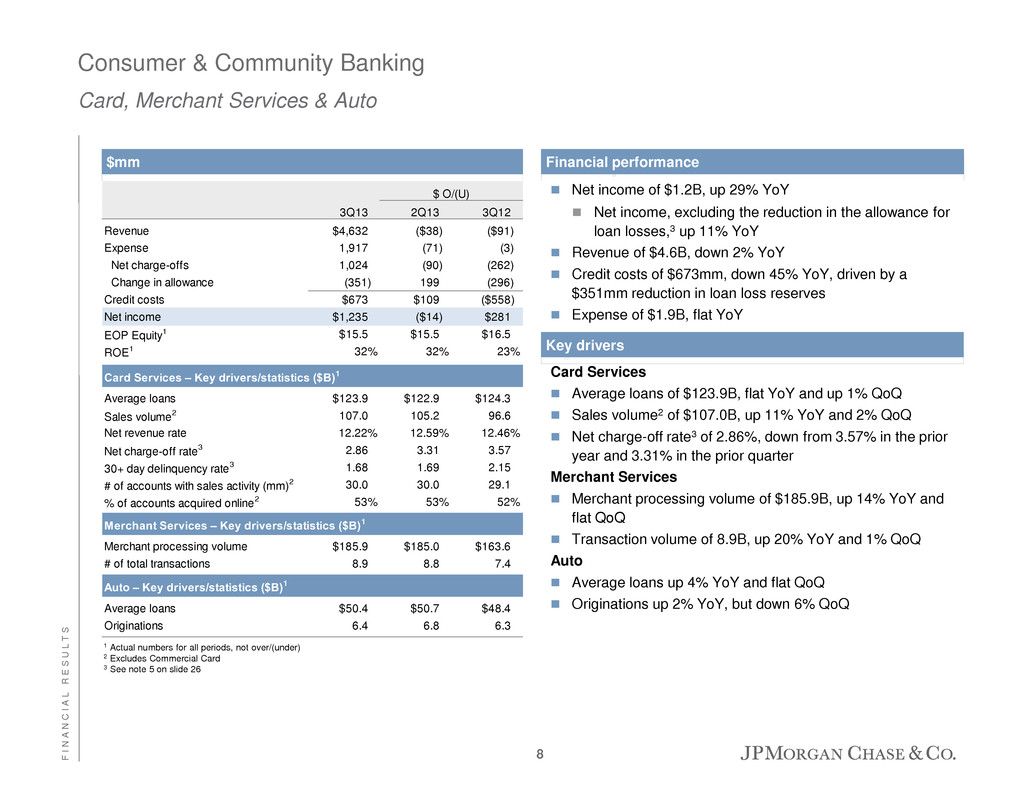

F I N A N C I A L R E S U L T S Net income of $1.2B, up 29% YoY Net income, excluding the reduction in the allowance for loan losses,3 up 11% YoY Revenue of $4.6B, down 2% YoY Credit costs of $673mm, down 45% YoY, driven by a $351mm reduction in loan loss reserves Expense of $1.9B, flat YoY 1 Actual numbers for all periods, not over/(under) 2 Excludes Commercial Card 3 See note 5 on slide 26 Card Services Average loans of $123.9B, flat YoY and up 1% QoQ Sales volume2 of $107.0B, up 11% YoY and 2% QoQ Net charge-off rate3 of 2.86%, down from 3.57% in the prior year and 3.31% in the prior quarter Merchant Services Merchant processing volume of $185.9B, up 14% YoY and flat QoQ Transaction volume of 8.9B, up 20% YoY and 1% QoQ Auto Average loans up 4% YoY and flat QoQ Originations up 2% YoY, but down 6% QoQ Consumer & Community Banking Card, Merchant Services & Auto $mm Financial performance Key drivers 3Q13 2Q13 3Q12 Revenue $4,632 ($38) ($91) Expense 1,917 (71) (3) Net charge-offs 1,024 (90) (262) Change in allowance (351) 199 (296) Credit costs $673 $109 ($558) Net income $1,235 ($14) $281 EOP Equity1 $15.5 $15.5 $16.5 ROE1 32% 32% 23% Card Services – Key drivers/statistics ($B)1 Average loans $123.9 $122.9 $124.3 Sales volume2 107.0 105.2 96.6 Net revenue rate 12.22% 12.59% 12.46% Net charge-off rate3 2.86 3.31 3.57 30+ day delinquency rate3 1.68 1.69 2.15 # of accounts with sales activity (mm)2 30.0 30.0 29.1 % of accounts acquired online2 53% 53% 52% Merchant Services – Key drivers/statistics ($B)1 Merchant processing volume $185.9 $185.0 $163.6 # of total transactions 8.9 8.8 7.4 Auto – Key rivers/statistics ($B)1 Average loans $50.4 $50.7 $48.4 Originations 6.4 6.8 6.3 $ O/(U) 8

F I N A N C I A L R E S U L T S Corporate & Investment Bank1 Net income of $2.2B on revenue of $8.2B DVA loss of $397mm ROE of 16%; 17% excl. DVA Banking IB fees of $1.5B, up 6% YoY driven by higher equity and debt underwriting fees – Ranked #1 in YTD Global IB fees Treasury Services revenue of $1.1B Lending revenue of $351mm, primarily driven by NII on retained loans and fees on lending-related commitments Markets & Investor Services Markets revenue of $4.7B, down 2% YoY – Fixed Income Markets down 8% from a strong 3Q12 – Equity Markets up 20% with broad-based strength Securities Services revenue of $1.0B Credit Adjustments & Other loss of $409mm, predominantly driven by DVA Expense of $5.0B, down 7% YoY, primarily driven by lower compensation expense 3Q13 comp/revenue, excl. DVA, of 27% 1 See notes 1 and 7 on slide 26 2 Lending revenue includes net interest income, fees, gains or losses on loan sale activity, gains or losses on securities received as part of a loan restructuring, and the risk management results related to the credit portfolio (excluding trade finance) 3 Credit adjustments & Other primarily includes net credit portfolio credit valuation adjustments (“CVA”) and associated hedging activities; DVA related to both structured notes and derivatives; and nonperforming derivative receivable results effective in 1Q12 and thereafter 4 Actual numbers for all periods, not over/(under) 5 Return on equity excluding DVA, a non-GAAP financial measure, was 17%, 19% and 18%, for 3Q13, 2Q13 and 3Q12, respectively 6 Compensation expense as a percentage of total net revenue excluding DVA, a non-GAAP financial measure, was 27%, 31%, and 32%, for 3Q13, 2Q13 and 3Q12, respectively 7 ALL/EOP loans as reported was 1.09%, 1.21% and 1.35% for 3Q13, 2Q13 and 3Q12, respectively $mm $ O/(U) 3Q13 2Q13 3Q12 Corporate & Investment Bank revenue $8,189 ($1,687) ($171) Investment banking fees 1,510 (207) 81 Treasury Services 1,053 2 (11) Lending2 351 (22) (6) Total Banking $2,914 ($227) $64 Fixed Income Markets 3,439 (639) (287) Equity Markets 1,249 (47) 205 Securities Services 996 (91) 31 Credit Adjustments & Other3 (409) (683) (184) Total Markets & Investor Services $5,275 ($1,460) ($235) Credit costs (218) (212) (158) Expense 4,999 (743) (351) Net income $2,240 ($598) $248 Key drivers/statistics ($B)4 EOP equity $56.5 $56.5 $47.5 ROE5 16% 20% 17% Overhead ratio 61 58 64 Comp/revenue6 28 30 33 EOP loans $108.0 $110.8 $111.8 Average client deposits 386.0 369.1 351.4 Assets under custody ($T) 19.7 18.9 18.2 ALL/EOP loans x-co duits and trade7 2.01% 2.35% 2.92% Net charge-off/(recovery) rate (0.02) (0.31) (0.08) Average VaR ($mm) $45 $40 $122 Financial performance 9

F I N A N C I A L R E S U L T S Corporate & Investment Bank – Key metrics & leadership positions Comments Corporate & Investment Bank 48% of revenue is international for LTM 3Q13 International deposits increased 39% from FY2010 driven by growth across regions International loans up 47% since FY2010 Banking Improved ranking to #2 in Global Equity & Equity-related in YTD 2013 from #4 in FY2012 #1 in combined Fedwire and CHIPS volume5 LTM total international electronic funds transfer volume up 35% from FY2010 Markets & Investor Services #1 Fixed income markets revenue share of top 10 investment banks6 International AUC up 40% from FY2010; represents 45% of 3Q13 total AUC JPM ranked #1 for FY2013/12/11/10 for both All-America Fixed Income Research and Equity Research Note: Rankings included as available 1 Last twelve months 2 International client deposits and other third party liabilities 3 Includes TS product revenue reported in other LOBs related to customers who are also customers of those LOBs 4 International electronic funds transfer represents volume over the period and includes non-U.S. dollar Automated Clearing House ("ACH") and clearing volume 5 2Q13 volume; per Federal Reserve, 2002-2013 6 2Q13 rank of JPM Fixed Income Markets revenue of 10 leading competitors based on reported information, excluding DVA Corporate & Investment Bank Banking Markets & Investor Services ($B) LTM1 FY2012 FY2011 FY2010 Int rnational revenue $17.3 $16.3 $17.1 $15.7 International deposits (Avg)2 203.3 189.6 180.1 146.4 International loans (EOP) 66.3 67.7 67.0 45.3 Gross CIB reve ue from CB 3.8 4.0 3.7 4.0 Global IB fees (Dealogic) #1 #1 #1 #1 TS firmwide revenue3 $6.9 $6.9 $6.4 $6.6 Combined Fedwir /C IPS volume #1 #1 #1 #1 International elec ro ic funds transfer volume (mm)4 314.5 304.8 250.5 232.5 International AUC ($T, EOP) $8.8 $8.3 $7.1 $6.3 All-America Institutional Investor research r nkings #1 #1 #1 #1 10

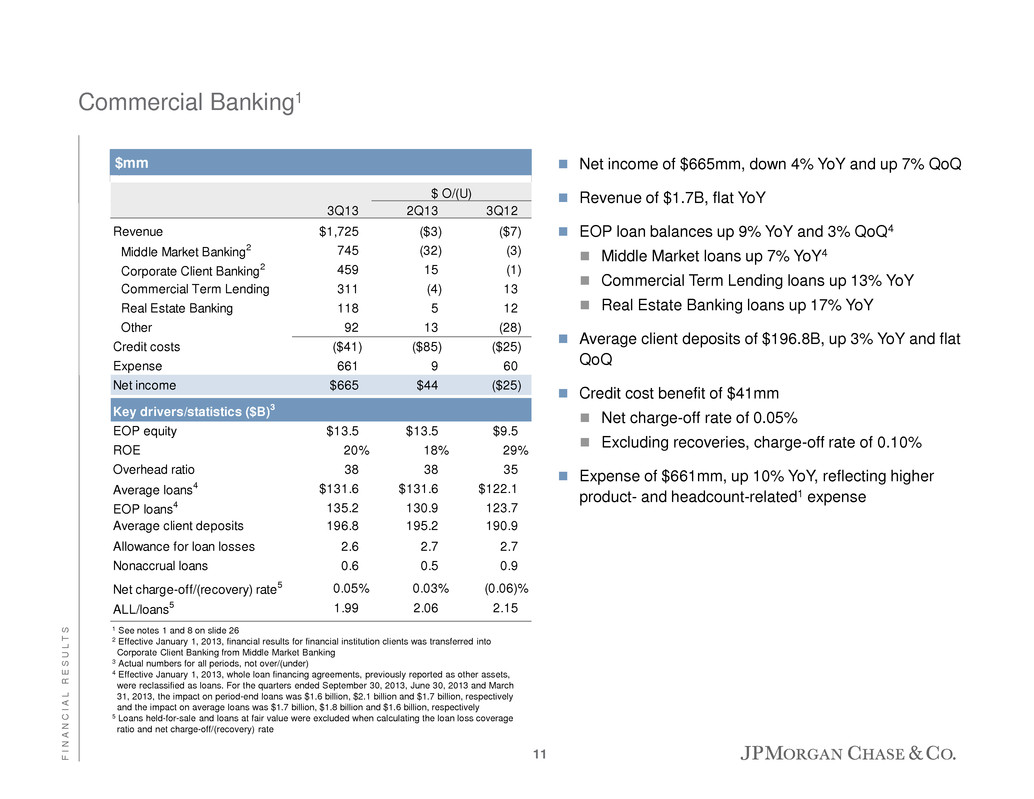

F I N A N C I A L R E S U L T S Commercial Banking1 Net income of $665mm, down 4% YoY and up 7% QoQ Revenue of $1.7B, flat YoY EOP loan balances up 9% YoY and 3% QoQ4 Middle Market loans up 7% YoY4 Commercial Term Lending loans up 13% YoY Real Estate Banking loans up 17% YoY Average client deposits of $196.8B, up 3% YoY and flat QoQ Credit cost benefit of $41mm Net charge-off rate of 0.05% Excluding recoveries, charge-off rate of 0.10% Expense of $661mm, up 10% YoY, reflecting higher product- and headcount-related1 expense 1 See notes 1 and 8 on slide 26 2 Effective January 1, 2013, financial results for financial institution clients was transferred into Corporate Client Banking from Middle Market Banking 3 Actual numbers for all periods, not over/(under) 4 Effective January 1, 2013, whole loan financing agreements, previously reported as other assets, were reclassified as loans. For the quarters ended September 30, 2013, June 30, 2013 and March 31, 2013, the impact on period-end loans was $1.6 billion, $2.1 billion and $1.7 billion, respectively and the impact on average loans was $1.7 billion, $1.8 billion and $1.6 billion, respectively 5 Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate $mm 3Q13 2Q13 3Q12 Revenue $1,725 ($3) ($7) Middle Market Banking2 745 (32) (3) Corporate Client Banking2 459 15 (1) Commercial Term Lending 311 (4) 13 Real Estate Banking 118 5 12 Other 92 13 (28) Credit costs ($41) ($85) ($25) Expense 661 9 60 Net income $665 $44 ($25) Key drivers/statistics ($B)3 EOP equity $13.5 $13.5 $9.5 ROE 20% 18% 29% Overhead ratio 38 38 35 Average loans4 $131.6 $131.6 $122.1 EOP loans4 135.2 130.9 123.7 Average client deposits 196.8 195.2 190.9 Allowance for loan losses 2.6 2.7 2.7 Nonaccrual loans 0.6 0.5 0.9 Net charge-off/(r covery) rate5 0.05% 0.03% (0.06)% ALL/loans5 1.99 2.06 2.15 $ O/(U) 11

F I N A N C I A L R E S U L T S Asset Management1 1 See note 1 on slide 26 2 Actual numbers for all periods, not over/(under) 3 See note 9 on slide 26 Net income of $476mm, up 7% YoY Revenue of $2.8B, up 12% YoY AUM of $1.5T, up 12% YoY AUM net inflows for the quarter of $32B, driven by net inflows of $19B to long-term products and $13B to liquidity products Client assets of $2.2T, up 11% YoY and 4% QoQ Record EOP loan balances of $90.5B, up 21% YoY and 5% QoQ Strong investment performance 74% of mutual fund AUM ranked in the 1st or 2nd quartiles over 5 years Expense of $2.0B, up 16% YoY $mm 3Q13 2Q13 3Q12 Revenue $2,763 $38 $304 Private Banking 1,488 5 123 Institutional 553 (35) (10) Retail 722 68 191 Credit costs $0 ($23) ($14) Expense 2,003 111 272 Net income $476 ($24) $33 Key drivers/statistics ($B)2 EOP equity $9.0 $9.0 $7.0 ROE 21% 22% 25% Pretax margin3 28 30 29 Assets under management (AUM) $1,540 $1,470 $1,381 Client assets 2,246 2,157 2,031 Average loans 87.8 83.6 71.8 EOP loans 90.5 86.0 74.9 Average deposits 138.7 136.6 127.5 $ O/(U) 12

F I N A N C I A L R E S U L T S Private Equity Private Equity net income was $242mm, primarily due to net valuation gains on private investments Private Equity portfolio of $8.7B Treasury and CIO Treasury and CIO net loss of $193mm, compared to a net loss of $429mm in 2Q13 Negative NII of $261mm, compared with negative NII of $558mm in 2Q13 Expect Treasury and CIO NII to improve over the next several quarters Other Corporate Noninterest expense includes legal expense for litigation reserves and regulatory proceedings of ~$9.2B (pretax) and ~$7.2B after-tax Expect Other Corporate quarterly net income to be $100mm +/-; likely to vary each quarter 1 See note 1 on slide 26 $mm Corporate/Private Equity1 3Q13 2Q13 3Q12 Private Equity $242 $30 $331 Treasury and CIO (193) 236 (562) Other Corpor te (6,512) (6,177) (6,460) Net income/(loss) ($6,463) ($5,911) ($6,691) $ O/(U) 13

F I N A N C I A L R E S U L T S Mortgage Banking Total quarterly net charge-offs expected to be $200mm+/- in 4Q13, if current trends continue If charge-offs and delinquencies continue to trend down, there will be continued reserve reductions Mortgage Production pretax income – Expect 4Q13 pretax margin to be slightly negative Card, Merchant Services & Auto Portfolio improvements – delinquencies and restructured loans – Expect $150mm+/- reserve release in 4Q13 Outlook Firmwide guidance Expect NII to be approximately flat in the near term Expect FY2013 firmwide adjusted expense1 of $59.5-$60B Consumer & Community Banking Basel III Tier 1 common ratio target of 10-10.5% Firm SLR target of 5.5%+/- Bank SLR target of 6%+ Capital and leverage 1 Firmwide adjusted expense excludes Corporate litigation and foreclosure-related matters Corporate/Private Equity Expect Treasury and CIO NII to improve over the next several quarters Expect Other Corporate quarterly net income to be $100mm+/-; likely to vary each quarter 14

F I N A N C I A L R E S U L T S Simplifying and de-risking our business Exiting products non-core to our customers or with outsized operational risk – for example: One Equity Partners Physical commodities Student lending originations Canadian Money Orders Co-branded business debit cards and gift cards Rationalization of products in Mortgage Banking Identity theft protection Credit insurance De-risking through client selection – discontinuing certain business with select clients: Lending to check cashing businesses Clearing services to approximately 500 foreign banks Checking accounts for certain foreign domiciled clients Checking accounts for foreign Politically Exposed Persons Simplifying our business Control agenda #1 priority – led by Operating Committee Increased our total spend on controls by about $1 billion this year Unprecedented efforts with 23 workstreams, including: – CCAR – Consent orders Significant resources committed to addressing control and regulatory agendas ~5,000 people added firmwide Building a more open and transparent relationship with our regulators Investments in control – significant resources committed Increased cost of control and compliance is partly permanent – but will make us a better company Total overhead very competitive Simplification of our business is important – affected products and businesses are not core Fortress balance sheet intact Higher levels of capital and liquidity will effect pricing/clients – but we will optimize our business Excellent franchises with exceptional underlying growth – and strong long-term outlook Unwavering service and support to our clients and communities Employee morale still high Investor Day update Implications for future of the business 15

Agenda Page F I N A N C I A L R E S U L T S 16 Appendix 16

A P P E N D I X Firmwide NIM lower QoQ by 2bps and Core NIM unchanged. Decline in firmwide NIM primarily due to: Increase in cash balances Lower loan yields Partially offset by higher investment securities yields Core net interest margin1 Firmwide NII up slightly, primarily driven by: Increase in investment securities NII Largely offset by lower balances of trading assets 1 See note 6 on slide 26 2 The core and market-based NII presented for FY2010 and FY2011 represent their quarterly averages (e.g. total for the year divided by 4); the yield for all periods represent the annualized yield 3.67% 3.29% 3.10% 3.00% 2.92% 2.85% 2.83% 2.60% 2.60% 1.51% 1.41% 1.29% 1.07% 1.11% 1.17% 1.14% 1.05% 0.89% 3.06% 2.74% 2.61% 2.47% 2.43% 2.40% 2.37% 2.20% 2.18% FY2010 FY2011 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 Core NII Market-based NII Core NIM Market-based NIM JPM NIM Net interest income trend Comments 2 2 Average balances Deposits with banks $48B $80B $111B $111B $127B $125B $157B $266B $321B 17

A P P E N D I X Consumer credit – Delinquency trends1 Note: Prime mortgage excludes held-for-sale, Asset Management and government-insured loans 1 Excluding purchased credit-impaired loans 2 Credit card delinquencies prior to January 1, 2010 included certain reclassification adjustments that assumed credit card loans securitized by Card Services remained on the balance sheet $500 $2,000 $3,500 $5,000 $6,500 $8,000 $9,500 $11,000 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 30+ day delinquencies 30-89 day delinquencies Credit card delinquency trend2 ($mm) Prime mortgage delinquency trend ($mm) Home equity delinquency trend ($mm) Subprime mortgage delinquency trend ($mm) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 $0 $1,000 $2,000 $3,000 $4,000 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Dec-09 May-10 Oct-10 Mar-11 Aug-11 Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies 30 – 149 day delinquencies 150+ day delinquencies 18

A P P E N D I X 2.0% 2.5% 3.0% 3.5% 4.0% Dec-08 Aug-09 Jun-10 Mar-11 Dec-11 Aug-12 Jun-13 Mar-14 Dec-14 Card Services Credit update Comments and outlook Given improved delinquencies, lower volume of new TDR together with portfolio seasoning – expect a $500mm+/- reserve release in 2H13 If delinquencies continue to improve in 2014 – potential incremental reserve releases Credit card: 0-30 $ roll rate1 Source: Internal Chase Data Note: TDR stands for troubled debt restructuring Note: Totals may not sum due to rounding 1 Credit card delinquencies prior to January 1, 2010 to principally reflect managed portfolio performance; the dotted part of the line has been adjusted to eliminate impact of legacy payment strategy TDR portfolio and NCO rates $10.1B / 92% $2.1B / 53% $0.6B / 5% $0.9B / 22% $0.3B / 3% $0.9B / 24% Mar-10 Jun-13 0-24 TDR 25-36 TDR 37+ TDR 22.0% 12.1% $10.9B $3.9B Total NCO rate NCO rate 0-24 25-36 37+ Mar-10 22.9% 13.4% 8.7% Jun-13 16.4% 8.5% 6.0% Peak level 2Q13 Potential incremental reserve releases in 2014 As disclosed on September 9, 2013 (not updated) 19

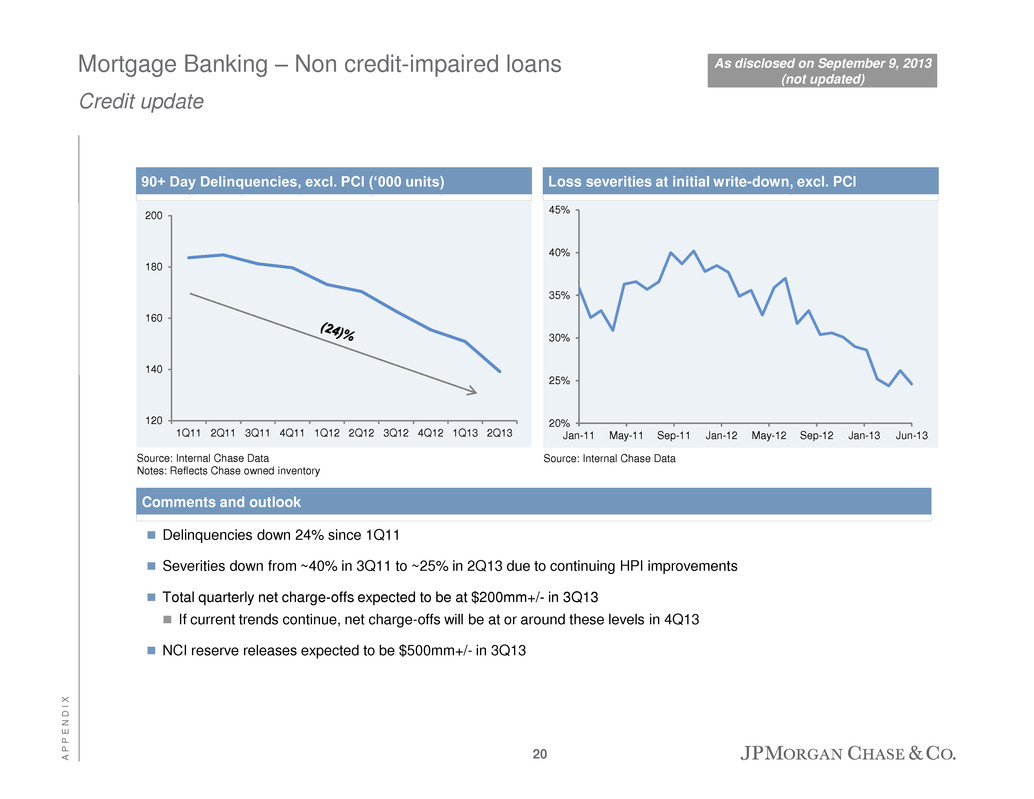

A P P E N D I X 90+ Day Delinquencies, excl. PCI (‘000 units) Comments and outlook Delinquencies down 24% since 1Q11 Severities down from ~40% in 3Q11 to ~25% in 2Q13 due to continuing HPI improvements Total quarterly net charge-offs expected to be at $200mm+/- in 3Q13 If current trends continue, net charge-offs will be at or around these levels in 4Q13 NCI reserve releases expected to be $500mm+/- in 3Q13 Mortgage Banking – Non credit-impaired loans Credit update Source: Internal Chase Data Notes: Reflects Chase owned inventory 120 140 160 180 200 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 Source: Internal Chase Data Loss severities at initial write-down, excl. PCI 20% 25% 30% 35% 40% 45% Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 Jun-13 As disclosed on September 9, 2013 (not updated) 20

A P P E N D I X Mortgage Banking – Purchased credit-impaired loans Credit update Commentary Initial fair value mark reflected $30.5B of estimated lifetime principal credit losses Incremental impairments of $5.7B1 recorded in the allowance for loan losses since acquisition Recent HPI improvements have resulted in a probable and significant decrease in lifetime loss estimates Expect reserve reduction of $750mm+/- in 3Q13 taken through provision expense We could see additional reserve reductions if HPI and delinquencies continue to improve HPI assumptions – change from peak Changes in HPI since last PCI impairment Source: Moody’s July 2013 national HPI assumptions 1 Impairments taken 2009-2011; last impairment 4Q11 (40)% (35)% (30)% (25)% (20)% (15)% (10)% (5)% 0% 2005 2007 2009 2011 2013 2015 2017 2019 Current HPI assumptions 4Q11 HPI assumptions As of year-end 2013 2014 2015 2016 4Q11 (31)% (26)% (22)% (19)% Current (23) (18) (15) (13) Improvement 8% 8% 7% 6% As disclosed on September 9, 2013 (not updated) 21

A P P E N D I X Real Estate Portfolios and Card Services – Coverage ratios Real Estate Portfolios and Card Services credit data ($mm) 1 3Q12 adjusted net charge-offs and adjusted net charge-off rate for Real Estate Portfolios exclude the effect of an incremental $825mm of net charge-offs based on regulatory guidance 2 Net charge-offs annualized (NCOs are multiplied by 4) 3 See note 5 on slide 26 4 4Q10 adjusted net charge-offs exclude a one-time $632mm adjustment related to the timing of when the Firm recognizes charge-offs on delinquent loans 5 2Q12 adjusted net charge-offs for Card Services were $1,254mm or 4.03%; excluding the effect of a change in charge-off policy for troubled debt restructurings, 2Q12 reported net charge-offs were $1,345mm or 4.32% 6 4Q12 adjusted net charge-offs and adjusted net charge-off rate reflect a full quarter of normalized Chapter 7 Bankruptcy discharge activity, which exclude one-time adjustments related to the adoption of Chapter 7 Bankruptcy discharge regulatory guidance 2,075 1,372 1,214 1,157 1,076 954 899 876 808 696 595 520 448 288 204 4,512 3,721 3,133 2,671 2,226 1,810 1,499 1,390 1,386 1,254 1,116 1,097 1,082 1,014 892 $0 $1,000 $2,000 $3,000 $4,000 $5,000 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 Real Estate Portfolios Card Services NCOs ($mm) 4 5 1 6 1 1 O/(U) Adjusted1 3Q13 2Q13 3Q12 3Q12 Real Estate Portfolios (NCI) Net charge-offs $204 $288 $595 ($391) NCO rate 0.70% 1.00% 1.93% (123)bps Allowance for loan losses $2,768 $3,268 $5,568 ($2,800) LLR/annualized NCOs2 339% 284% 234% Card Services Net charge-offs $892 $1,014 $1,116 ($224) NCO rate3 2.86% 3.31% 3.57% (71)bps Allowance for loan losses $4,097 $4,445 $5,503 ($1,406) LLR/annualized NCOs2 115% 110% 123% 22

A P P E N D I X Firmwide – Coverage ratios $17.6B of loan loss reserves at September 30, 2013, down ~$5.3B from $22.8B in the prior year, reflecting improved portfolio credit quality Loan loss coverage ratio of 1.89%1 1 See note 2 on slide 26 2 NPLs at 3Q13, 2Q13, 1Q13, 4Q12 and 3Q12 include $1.9B, $1.9B, $1.9B, $1.8B and $1.7B, respectively, in accordance with regulatory guidance requiring loans discharged under Chapter 7 bankruptcy and not reaffirmed by the borrower, regardless of their delinquency status to be reported as nonaccrual loans. In addition the Firm’s policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance JPM credit summary 3Q13 2Q13 3Q12 Consumer, ex. credit card LLR/Total loans 1.92% 2.16% 3.11% LLR/NPLs2 56 58 77 Credit Card LLR/Total loans 3.31% 3.58% 4.42% Wholesale LLR/Total loans 1.30% 1.38% 1.46% LLR/NPLs 424 424 261 Firmwide LLR/Total loans 1.89% 2.06% 2.61% LLR /NPLs (ex. credit card)2 94 96 104 LLR /NPLs2 140 143 154 11,005 9,993 10,605 10,068 11,370 10,720 10,426 9,734 9,096 28,350 27,609 25,871 23,791 22,824 21,936 20,780 19,384 17,571 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 3Q1 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 0% 100% 200% 300% 400% 500% $mm Loan loss reserve Nonperforming loans Loan loss reserve/Total loans1 Loan loss reserve/NPLs1 2 2 2 2 2 23

A P P E N D I X Peripheral European exposure1 Securities and trading Lending AFS securities Trading Derivative collateral Portfolio hedging Net exposure Spain $3.1 $0.4 $3.4 ($1.9) ($0.4) $4.6 Sovereign 0.0 0.4 (0.2) 0.0 (0.1) 0.1 Non-sovereign 3.1 0.0 3.6 (1.9) (0.3) 4.5 5 Italy $2.5 $0.0 $11.2 ($2.3) ($4.6) $6.8 Sovereign 0.0 0.0 8.4 (1.0) (4.1) 3.3 Non-sovereign 2.5 0.0 2.8 (1.3) (0.5) 3.5 Other (Ireland, Portugal, and Greece) $0.8 $0.0 $1.7 ($1.0) ($0.2) $1.3 Sovereign 0.0 0.0 0.0 0.0 (0.1) (0.1) Non-sovereign 0.8 0.0 1.7 (1.0) (0.1) 1.4 Total firmwide exposure $6.4 $0.4 $16.3 ($5.2) ($5.2) $12.7 $12.7B total firmwide net exposure as of 3Q13, down from $14.0B as of 2Q13 The Firm continues to be active with clients in the region 1 Exposure is a risk management view. Lending is net of liquid collateral. Trading includes net inventory, derivative netting under legally enforceable trading agreements, net CDS underlying exposure from market-making flows, unsecured net derivative receivables and under-collateralized securities financing counterparty exposure As of September 30, 2013 ($B) 24

A P P E N D I X Source: Dealogic. Global Investment Banking fees reflects ranking of fees and market share. Remainder of rankings reflects transaction volume rank and market share. Global announced M&A is based on transaction value at announcement; because of joint M&A assignments, M&A market share of all participants will add up to more than 100%. All other transaction volume-based rankings are based on proceeds, with full credit to each book manager/equal if joint 1 Global Investment Banking fees rankings exclude money market, short-term debt and shelf deals 2 Long-term debt rankings include investment-grade, high-yield, supranational, sovereigns, agencies, covered bonds, asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”); and exclude money market, short-term debt, and U.S. municipal securities 3 Global Equity and equity-related ranking includes rights offerings and Chinese A-Shares 4 Announced M&A reflects the removal of any withdrawn transactions. U.S. announced M&A represents any U.S. involvement ranking IB League Tables For YTD 2013, JPM ranked: #1 in Global IB fees #1 in Global Debt, Equity & Equity-related #1 in Global Long-term Debt #2 in Global Equity & Equity-related #2 in Global M&A Announced #1 in Global Loan Syndications YTD 2013 FY12 Rank Share Rank Share Based on fees: Global IB fees1 1 8.8% 1 7.5% Based on volumes: Global Debt, Equity & Equity-related 1 7.4% 1 7.2% US Debt, Equity & Equity-related 1 11.8% 1 11.5% Global Long-term Debt2 1 7.3% 1 7.1% US Long-term Debt 1 11.7% 1 11.6% Global Equity & Equity-related3 2 8.2% 4 7.8% US Equity & Equity-related 2 12.1% 5 10.4% Global M&A Announced4 2 27.2% 2 19.8% US M&A Ann unced 2 39.8% 2 24.3% Global Loan Syndications 1 9.9% 1 9.6% US Loan Syndications 1 17.7% 1 17.6% League table results 25

Notes on non-GAAP financial measures 1. In addition to analyzing the Firm’s results on a reported basis, management reviews the Firm’s results and the results of the lines of business on a “managed” basis, which is a non-GAAP financial measure. The Firm’s definition of managed basis starts with the reported U.S. GAAP results and includes certain reclassifications to present total net revenue for the Firm (and each of the business segments) on a fully taxable-equivalent (“FTE”) basis. Accordingly, revenue from investments that receive tax credits and tax-exempt securities is presented in the managed results on a basis comparable to taxable securities and investments. This non-GAAP financial measure allows management to assess the comparability of revenue arising from both taxable and tax-exempt sources. The corresponding income tax impact related to tax-exempt items is recorded within income tax expense. These adjustments have no impact on net income as reported by the Firm as a whole or by the lines of business. 2. The ratio of the allowance for loan losses to end-of-period loans excludes the following: loans accounted for at fair value and loans held-for-sale; purchased credit- impaired (“PCI”) loans; and the allowance for loan losses related to PCI loans. Additionally, Real Estate Portfolios net charge-off rates exclude the impact of PCI loans. 3. Tangible common equity (“TCE”) represents the Firm’s common stockholders’ equity (i.e., total stockholders’ equity less preferred stock) less goodwill and identifiable intangible assets (other than MSRs), net of related deferred tax liabilities. Return on tangible common equity measures the Firm’s earnings as a percentage of average TCE. Tangible book value per share represents the TCE divided by the period-end number of common shares. In management’s view, these measures are meaningful to the Firm, as well as to analysts and investors, in assessing the Firm’s use of equity and in facilitating comparisons with peers. 4. The Tier 1 common ratio under both Basel I and Basel III are both non-GAAP financial measures. These measures, along with other capital measures, are used by management, bank regulators, investors and analysts to assess and monitor the Firm's capital position and to compare the Firm's capital to that of other financial services companies. The Basel I Tier 1 common ratio is Tier 1 common capital divided by Basel I risk-weighted assets. Tier 1 common capital is defined as Tier 1 capital less elements of Tier 1 capital not in the form of common equity, such as perpetual preferred stock, noncontrolling interests in subsidiaries, and trust preferred securities. In July 2013, U.S. federal banking agencies approved a final rule for implementing Basel III in the U.S. For further information on Basel I and Basel III, see Regulatory capital on pages 117-119 of JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2012, and on pages 60-63 of the Firm’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2013. 5. In Consumer & Community Banking, supplemental information is provided for Card Services to enable comparability with prior periods. The change in net income is presented excluding the change in the allowance, which assumes a tax rate of 38%. The net charge-off rate and 30+ day delinquency rate presented include loans held-for-sale. 6. In addition to reviewing JPMorgan Chase's net interest income on a managed basis, management also reviews core net interest income to assess the performance of its core lending, investing (including asset-liability management) and deposit-raising activities (which excludes the impact of Corporate & Investment Bank's ("CIB") market-based activities). The core net interest data presented are non-GAAP financial measures due to the exclusion of CIB"s market-based net interest income and the related assets. Management believes this exclusion provides investors and analysts a more meaningful measure by which to analyze the non-market-related business trends of the Firm and provides a comparable measure to other financial institutions that are primarily focused on core lending, investing and deposit-raising activities. 7. CIB provides several non-GAAP financial measures which exclude the impact of DVA. These measures are used by management to assess the underlying performance of the business. The ratio for the allowance for loan losses to period-end loans is calculated excluding the impact of trade finance loans and consolidated Firm- administered multi-seller conduits, to provide a more meaningful assessment of CIB’s allowance coverage ratio. Additional notes on financial measures 8. Headcount-related expense includes salary and benefits (excluding performance-based incentives), and other noncompensation costs related to employees. 9. Pretax margin represents income before income tax expense divided by total net revenue, which is, in management’s view, a comprehensive measure of pretax performance derived by measuring earnings after all costs are taken into consideration. It is, therefore, another basis that management uses to evaluate the performance of Asset Management against the performance of its respective peers. Notes 26 F I N A N C I A L R E S U L T S

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of JPMorgan Chase & Co.’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10-K for the year ended December 31, 2012, and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2013 and June 30, 2013, which have been filed with the Securities and Exchange Commission and are available on JPMorgan Chase & Co.’s website (http://investor.shareholder.com/jpmorganchase), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 27 F I N A N C I A L R E S U L T S