Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Howmet Aerospace Inc. | d609058dex991.htm |

| 8-K - FORM 8-K - Howmet Aerospace Inc. | d609058d8k.htm |

3rd Quarter Earnings Conference

1

October 8, 2013

[Alcoa logo]

[Alcoa logo]

Exhibit 99.2 |

o[Alcoa logo]

Cautionary Statement

o[Alcoa

logo] Forward-Looking Statements

This

presentation

contains

statements

that

relate

to

future

events

and

expectations

and

as

such

constitute

forward-looking

statements.

Forward-looking

statements

include

those

containing

such

words

as

“anticipates,”

“estimates,”

“expects,”

“forecasts,”

“intends,”

“outlook,”

“plans,”

“projects,”

“should,”

“targets,”

“will,”

or

other

words

of

similar

meaning.

All

statements

that

reflect

Alcoa’s

expectations,

assumptions,

or

projections

about

the

future

other

than

statements

of

historical

fact

are

forward-looking

statements,

including,

without

limitation,

forecasts

concerning

global

demand

growth

for

aluminum,

end-market

conditions,

supply/demand

balances,

and

growth

opportunities

for

aluminum

in

automotive,

aerospace

and

other

applications,

trend

projections,

targeted

financial

results

or

operating

performance,

and

statements

about

Alcoa’s

strategies,

outlook,

and

business

and

financial

prospects.

Forward-looking

statements

are

subject

to

a

number

of

known

and

unknown

risks,

uncertainties,

and

other

factors

and

are

not

guarantees

of

future

performance.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-looking

statements

include:

(a)

material

adverse

changes

in

aluminum

industry

conditions,

including

global

supply

and

demand

conditions

and

fluctuations

in

London

Metal

Exchange-based

prices

and

premiums,

as

applicable

for

primary

aluminum,

alumina,

and

other

products,

and

fluctuations

in

indexed-based

and

spot

prices

for

alumina;

(b)

deterioration

in

global

economic

and

financial

market

conditions

generally;

(c)

unfavorable

changes

in

the

markets

served

by

Alcoa,

including

automotive

and

commercial

transportation,

aerospace,

building

and

construction,

distribution,

packaging,

defense,

and

industrial

gas

turbine;

(d)

the

impact

of

changes

in

foreign

currency

exchange

rates

on

costs

and

results,

particularly

the

Australian

dollar,

Brazilian

real,

Canadian

dollar,

euro,

and

Norwegian

kroner;

(e)

increases

in

energy

costs,

including

electricity,

natural

gas,

and

fuel

oil,

or

the

unavailability

or

interruption

of

energy

supplies;

(f)

increases

in

the

costs

of

other

raw

materials,

including

calcined

petroleum

coke,

caustic

soda,

and

liquid

pitch;

(g)

Alcoa’s

inability

to

achieve

the

level

of

revenue

growth,

cash

generation,

cost

savings,

improvement

in

profitability

and

margins,

fiscal

discipline,

or

strengthening

of

competitiveness

and

operations

(including

moving

its

alumina

refining

and

aluminum

smelting

businesses

down

on

the

industry

cost

curves

and

increasing

revenues

in

its

Global

Rolled

Products

and

Engineered

Products

and

Solutions

segments)

anticipated

from

its

restructuring

programs

and

productivity

improvement,

cash

sustainability,

and

other

initiatives;

(h)

Alcoa's

inability

to

realize

expected

benefits,

in

each

case

as

planned

and

by

targeted

completion

dates,

from

sales

of

non-core

assets,

or

from

newly

constructed,

expanded,

or

acquired

facilities,

including

facilities

supplying

aluminum-lithium

capacity,

or

from

international

joint

ventures,

including

the

joint

venture

in

Saudi

Arabia;

(i)

political,

economic,

and

regulatory

risks

in

the

countries

in

which

Alcoa

operates

or

sells

products,

including

unfavorable

changes

in

laws

and

governmental

policies,

civil

unrest,

or

other

events

beyond

Alcoa’s

control;

(j)

the

outcome

of

contingencies,

including

legal

proceedings,

government

investigations,

and

environmental

remediation;

(k)

the

business

or

financial

condition

of

key

customers,

suppliers,

and

business

partners;

(l)

adverse

changes

in

tax

rates

or

benefits;

(m)

adverse

changes

in

discount

rates

or

investment

returns

on

pension

assets;

(n)

the

impact

of

cyber

attacks

and

potential

information

technology

or

data

security

breaches;

and

(o)

the

other

risk

factors

summarized

in

Alcoa's

Form

10-K

for

the

year

ended

December

31,

2012

and

other

reports

filed

with

the

Securities

and

Exchange

Commission.

Alcoa

disclaims

any

obligation

to

update

publicly

any

forward-looking

statements,

whether

in

response

to

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law.

Non-GAAP Financial Measures

Some

of

the

information

included

in

this

presentation

is

derived

from

Alcoa’s

consolidated

financial

information

but

is

not

presented

in

Alcoa’s

financial

statements

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(GAAP).

Certain

of

these

data

are

considered

“non-GAAP

financial

measures”

under

SEC

rules.

These

non-GAAP

financial

measures

supplement

our

GAAP

disclosures

and

should

not

be

considered

an

alternative

to

the

GAAP

measure.

Reconciliations

to

the

most

directly

comparable

GAAP

financial

measures

and

management’s

rationale

for

the

use

of

the

non-GAAP

financial

measures

can

be

found

in

the

Appendix

to

this

presentation

and

on

our

website

at

www.alcoa.com

under

the

“Invest”

section.

Any

reference

during

the

discussion

today

to

EBITDA

means

adjusted

EBITDA,

for

which

we

have

provided

calculations

and

reconciliations

in

the

Appendix

and

on

our

website. |

o[Alcoa logo]

Strong Operational

Performance

in

3Q 2013

Increased

earnings

sequentially

and

YoY

–

Downstream:

Strong

Profitability

-

ATOI

up

22%

YoY

–

Upstream:

Improved

performance

8

consecutive

quarters

–

Productivity:

$825

million

across

all

segments

YoY

Days

Working

Capital:

Record

3Q

low;

5

days

lower

than

prior

year

[~$300

million

cash]

Cash

from

Operations:

$214

million;

Negative

free

cash

flow:

$36

million

Executed

curtailments

swiftly

and

safely

Strong third quarter driven by performance –

Repositioning working

3

3Q 2013 Overview |

o[Alcoa logo]

[Alcoa logo]

William Oplinger

Executive Vice President and Chief Financial Officer

4

October 8, 2013

[Alcoa logo] |

o[Alcoa logo]

Income Statement Summary

5

See appendix for Adjusted Income reconciliation

$ Millions, except aluminum prices and per-share amounts

3Q12

2Q13

3Q13

3

rd

Party

Realized Aluminum Price ($/MT)

$2,222

$2,237

$2,180

Revenue

$5,833

$5,849

$5,765

Cost of Goods Sold

$5,266

$4,933

$4,798

COGS % Revenue

90.3%

84.3%

83.2%

Selling,

General Administrative, Other

$234

$254

$248

SGA % Revenue

4.0%

4.3%

4.3%

Other (Income

) Expense, Net

($2)

$19

($7)

Restructuring and Other Charges

$2

$244

$151

Effective Tax Rate

15.9%

(16.5%)

41.3%

Net (Loss) Income

($143)

($119)

$24

Net (Loss) Income Per Diluted Share

($0.13)

($0.11)

$0.02

Income

per Diluted

Share excl

Special Items

$0.03

$0.07

$0.11

Prior Year

Change

Sequential

Change

($42)

($57)

($68)

($84)

($468)

($135)

(7.1 % pts.)

(1.1 % pts.)

$14

($6)

0.3 % pts.

0.0 % pts.

($5)

($26)

$149

($93)

25.4 % pts.

57.8 % pts.

$167

$143

$0.15

$0.13

$0.08

$0.04 |

o[Alcoa logo]

Restructuring

and

Other

Special

Items

See

appendix

for

Adjusted

Income

reconciliation

6

$ Millions, except per-share amounts

2Q13

3Q13

Income Statement

Classification

Segment

Net (Loss) Income

($119)

$24

Net (Loss) Income Per Diluted Share

($0.11)

$0.02

Restructuring-Related

($113)

($109)

Restructuring

and COGS

Corporate /

Primary Metals

Government Investigation Reserve

($62)

-

Restructuring

Corporate

Discrete Tax Items

($11)

($7)

Income Taxes and

Noncontrolling

Interest

Corporate

Mark-to-Market Energy Contracts

($9)

$8

Other Expenses

(Income), Net

Corporate

Massena

Fire

-

$12

COGS

Primary Metals

/EPS /Corporate

Special Items

($195)

($96)

Net Income excl Special Items

$76

$120

Income

per Diluted

Share excl

Special Items

$0.07

$0.11 |

o[Alcoa logo]

Strong

performance

drives

58%

sequential

earnings

improvement

7

See

appendix

for

Adjusted

Income

reconciliation

Net Income excluding Restructuring & Other Special Items ($ Millions)

Market

+$17

Performance

+$27

Cost Headwinds

$0

120

76

Currency

38

+58%

21

2Q 13

3Q 13

Cost

Decreases

/ Other

22

Raw

Materials

1

Energy

23

Productivity

41

Price

/ Mix

3

Volume

11

LME |

o[Alcoa logo]

Earnings

rise

$88M

year-over-year

despite

LME

and

cost

headwinds

8

See

appendix

for

Adjusted

Income

reconciliation

Net Income excluding Restructuring & Other Special Items ($ Millions)

Market

+$0

Performance

+$206

Cost Headwinds

-$118

120

32

LME

62

3Q 12

+275%

108

Raw

Materials

9

Energy

19

Productivity

3Q 13

160

Price

/ Mix

11

Volume

35

Currency

62

Cost

Increases

/ Other |

o[Alcoa logo]

9

Engineered

Products

&

Solutions

year-over-

year

ATOI

increase

of

22%

See

appendix

for

Adjusted

EBITDA

reconciliation.

*

Prior

period

amounts

have

been

revised

to

conform

to

the

current

period

presentation.

See

appendix

for

additional

information.

$ Millions

Revenue

up

5%

year-over-year

driven

by

strong

share

gains

across

all

markets

Quarterly

ATOI

up

22%

year-over-year

to

$192M

driven

by

productivity

and

volume

across

all

Businesses

Highest-ever Quarter

for adjusted

EBITDA

margin,

up

2.5

percentage

points

year

-over-year

Aerospace

remains strong, temporarily impacted by engine market

inventory realignment

and lower U.S. Defense spare parts demand

Gradual recovery in N.A. Non-Residential Construction continues;

European

market weakening

Softening Global

Industrial Gas Turbine market

Weaker N.A. Heavy Duty Truck build rates offset by Europe

Share

gains

through

innovation

continue

across

all

sectors

ATOI up ~25% year-over-year; down ~10% sequentially

$ Millions

3Q 12

2Q 13

3Q 13

3

rd

Party

Revenue

1,367

1,468

1,437

ATOI*

158

193

192

Adjusted

EBITDA

Margin*

20.0%

22.2%

22.5%

3

Quarter

Results

3

Quarter

Business

Highlights

4

Quarter

Outlook

3

Quarter

Performance

Bridge

2Q 13

$193

3Q 13

$192

Massena

$2

Cost Increase

-$2

Productivity

$7

Price / Mix

-$2

Volume

-$6

3Q13

Actual

and

4Q13

Outlook -

EPS

rd

rd

rd

th |

o[Alcoa logo]

10

See

appendix

for

Adjusted

EBITDA

reconciliation.

*

Prior

period

amounts

have

been

revised

to

conform

to

the

current

period presentation. See appendix for additional information.

Volume and price headwinds impact Global Rolled Products

Auto demand

expected to remain strong

Aero plate shipments continue to be

impacted by high

OEM inventories

Seasonal Packaging

decline, price pressure continues

Price pressures in Europe and China

, along with

demand decline in Brazing

ATOI

expected to be down ~25%

excluding FX

and

assuming

no change in metal

price sequentially

Auto and Packaging

demand remained strong

Unfavorable volume/price impacts

from:

•

Aero plate seasonal declines/OEM inventories

•

Softening Industrial markets in N.A., Europe, Russia

•

Packaging price pressures (N.A., China)

Low metal prices

continued to negatively impact

results, albeit less than 2Q

Days working capital

improved 1 day year-over-year

3Q13 Actual and 4Q13 Outlook -

GRP

3

Quarter Business Highlights

4

Quarter Outlook

$ Millions

3Q 12

2Q 13

3Q 13

3

rd

Party Revenue

1,849

1,877

1,805

ATOI*

89

79

71

Adjusted EBITDA/MT*

365

322

312

$ Millions

3

Quarter Results

3

Quarter Performance Bridge

$2

$2

$12

$71

$79

Cost

Increase

2Q 13

Volume

Other

Metal

-$4

-$7

Currency

Prod-

uctivity

3Q 13

-$10

-$3

Price

/ Mix

rd

rd

rd

th |

o[Alcoa logo]

Alumina delivers performance improvement

11

Production increase

due

to

additional

day

Higher

3

rd

party shipment volume

offsets

lower

Alumina

prices

Productivity improvements

continued

Cost

increases

driven

by

higher mining costs

in

Suriname and two crusher sites operating in Australia

Record 3Q days working capital of

20 days

;

11 day

improvement

year-over-year

53%

of 3

party shipments on

spot or alumina price

index with

30-day lag

for 2013

3

party shipment volume

to

return

to

normal

levels

Energy prices increase

in

Western

Australia

Productivity improvements

to

continue

$ Millions

3Q13

Actual

and

4Q13

Outlook

-

Alumina

Quarter Results

3

rd

Quarter Business Highlights

4

th

Quarter Outlook

Quarter Performance Bridge

3Q 12

2Q 13

3Q 13

Production (kmt)

4,077

4,161

4,214

3

rd

Party Shipments (kmt)

2,368

2,328

2,603

3

rd

Party Revenue ($ Millions)

764

822

846

ATOI ($ Millions)

(9)

64

67

$0

+$3

$13

$5

$5

$28

$67

$64

-$20

Cost

Increase

3Q 13

Prod-

uctivity

Price

/ Mix

Volume

Currency

LME

-$28

2Q 13

Market

Performance

3

rd

3

rd

rd

rd |

o[Alcoa logo]

Primary Metals drives productivity gains to the bottom line

12

$ Millions

Market

Performance

-$8

+$42

3Q13

Actual

and

4Q13

Outlook

–

Primary

Metals

3

rd

Quarter Results

3

rd

Quarter Business Highlights

4

th

Quarter Outlook

Quarter Performance Bridge

3Q 13

$8

Anglesea/

US power

outages

$23

Cost

Decr/RM

$12

Energy

-$21

Prod-

uctivity

$24

Price

/Mix &

Vol.

$4

Currency

$8

LME

-$16

2Q 13

-$32

$6

Massena

Curtailments safely executed,

taking

274kmt

offline

Productivity improvements

continued;

result

of

aggressive

cost

cutting

initiatives

across

the

segment

Increased energy costs

due

to

peak consumer

demand

in

Europe

and

seasonal hydropower

increases

in

the

U.S.

Northwest

Record

3Q

days

working

capital of

20 days

;

2 day

improvement

year-over-year

Pricing

to

follow

15-day lag

to

LME

Curtailments

to

reduce

production

Productivity

improvements

to

continue

Massena

fire

insurance recovery

will

not

repeat

3Q 12

2Q 13

3Q 13

Production (kmt)

938

896

897

3

rd

Party Shipments (kmt)

768

693

686

3

rd

Party Revenue ($ Millions)

1,794

1,620

1,600

3

rd

Party Price ($/MT)

2,222

2,237

2,180

ATOI ($ Millions)

(14)

(32)

8

3

rd |

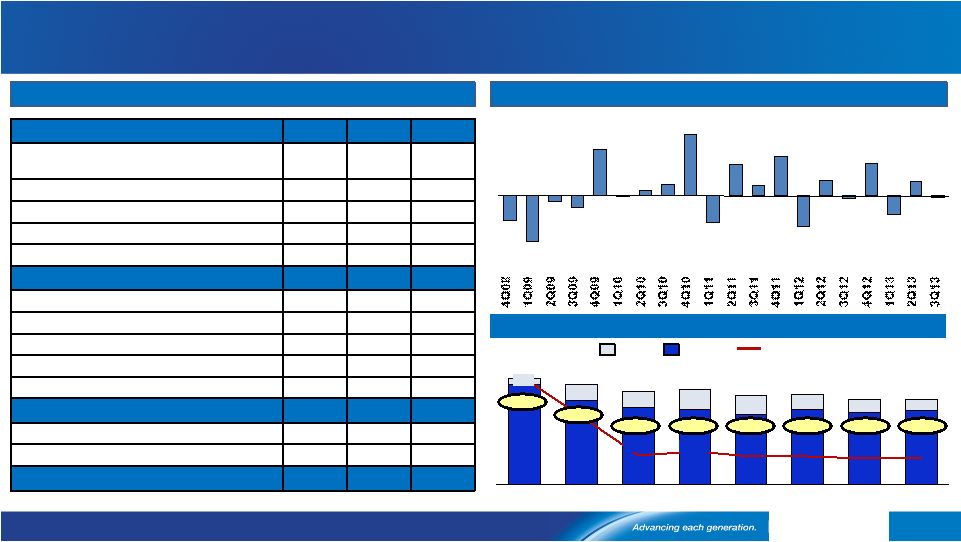

o[Alcoa logo]

Record third quarter days working capital level

See appendix for days working capital reconciliation

13

5 days

lower

Days Working Capital since Fourth Quarter 2008

5 days

lower

5 days

lower

28

27

28

33

33

32

38

38

39

43

44

41

48

50

55

24

27

30

33

43

5 days

lower

20 days;

$1.3 Billion |

o[Alcoa logo]

3

Quarter Cash Flow overview

14

See appendix for Free Cash Flow and Net Debt reconciliations

($ Millions)

3Q12

2Q13

3Q13

Net (Loss) Income before Noncontrolling

Interests

($175)

($148)

$44

DD&A

$366

$363

$348

Change in Working Capital

$88

$72

($61)

Pension Contributions

($163)

($98)

($173)

Other Adjustments

$147

$325

$56

Cash from Operations

$263

$514

$214

Dividends to Shareholders

($32)

($33)

($33)

Change in Debt

($273)

($531)

($5)

Distributions to

Noncontrolling

Interests

($1)

($2)

($53)

Contributions from

Noncontrolling

Interests

$22

($3)

$0

Other Financing Activities

$2

$1

($2)

Cash from Financing Activities

($282)

($568)

($93)

Capital Expenditures

($302)

($286)

($250)

Other Investing Activities

$40

$10

($54)

Cash from Investing Activities

($262)

($276)

($304)

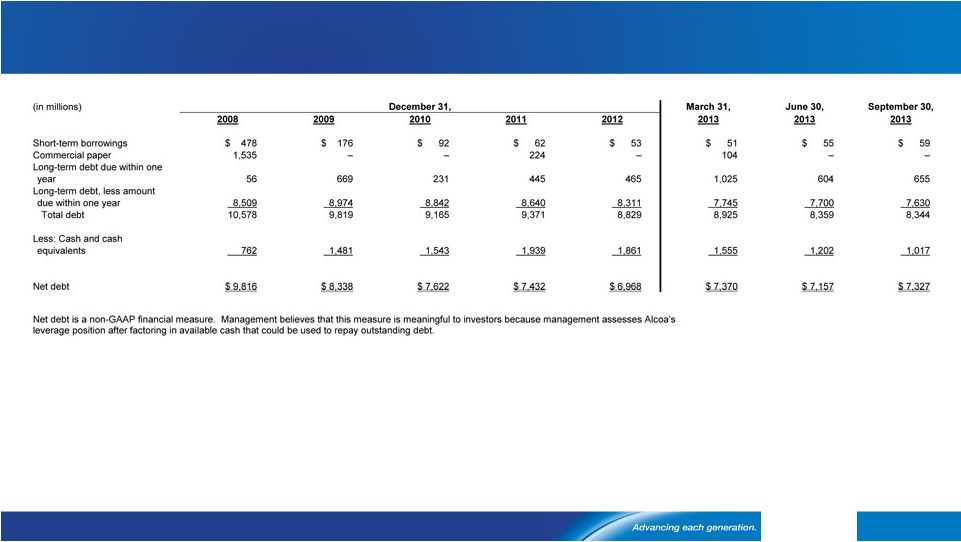

1,481

1,543

1,939

1,861

1,555

1,202

1,017

3Q13

8,344

7,327

2Q13

8,359

7,157

1Q13

8,925

7,370

2012

8,829

6,968

2011

9,371

7,432

2010

9,165

7,622

2009

9,819

8,338

2008

10,578

9,816

762

Debt to Cap

Net Debt

Cash

34.7%

42.5%

38.7%

34.9%

35.3%

34.8%

-to

-Cap stable

($ millions)

(36)

228

(305)

535

(39)

246

(506)

656

164

526

(440)

1,005

176

87

(22)

761

(186)

(90)

(742)

(409)

($ millions)

34.5%

34.5%

rd

Free

Cash

Flow

near

breakeven

target

in

3Q

Debt

3

rd

Quarter 2013 Cash Flow Overview |

o[Alcoa logo]

On track to meet all of our targets

15

Key Actions to Execute 2013 Cash Sustainability Program and year-to-date

results Maintain 30%-35% Debt-to-Capital

Manage Growth Capital of

$550M

Generate Productivity Gains of

$750M

Target Saudi JV Investment of

$350M

Overarching 2013 Financial Target

Taking the right actions

Control Sustaining Capital of

$1.0B

Positive

Free Cash

Flow

$825M

YTD:

$289M

$482M

$146M

34.5% |

o[Alcoa logo] Market

Fundamentals are stable; pricing pressure continues 16

Global

Aluminum

Demand

Growth

at

7%

Market Essentially

Balanced Inventory

is Stable

12%

-1%

4%

4%

7%

9%

8%

5%

6%

6%

2013E

23.1

6.5

6.2

4.0

2.0

1.9

1.9

1.0

1.0

49.5 mmt

(1)

Other includes Africa, E.Europe, Latin America ex Brazil and Oceania

2013 Primary Aluminum Consumption (mmt), Annualized Growth (%)

China

Europe

North America

North Asia

India

SE Asia

MENA

Russia

Brazil

Other ¹

1.9

2013 Demand +7%

Rest of World +4%

$0

$50

$100

$150

$200

$250

$300

$0

$50

$100

$150

$200

$250

$300

Regional Premiums over time

$ per metric

ton

Region

End of 3Q

13

Europe

$240/MT

Japan

$246/MT

Midwest

USA

$216/MT

Year on Year Change

Europe -17%

Japan -4%

Midwest USA -11%

Global Inventories vs. LME Price Over Time $

Supply/Demand Analysis

Lower Regional

Premiums |

o[Alcoa logo]

o[Alcoa

logo] |

o[Alcoa logo]

[Alcoa logo]

[Alcoa logo]

Klaus Kleinfeld

Chairman and Chief Executive Officer

18

October 8, 2013

[Alcoa logo] |

o[Alcoa logo]

Source: Alcoa Analysis

Growth continues in global end markets

19

Alcoa end markets: Current assessment of 2013 vs. 2012

|

o[Alcoa logo]

20

Contributions from Value-Add businesses continue to grow

Value-add 3 Party Revenue, Adjusted EBITDA and Adjusted

EBITDA margin – 2003, 2012 and 2013 Annualized

1) Pro forma 2003 amounts reflect current structure of EPS and GRP; 2) YTD

results annualized; does not represent a forecast of 4Q 2013 results;

3) ATOI for the respective periods: 2003 $358M, 2012 $956M and 2013

annualized $1,056M 13,324

13,156

8,785

1,955

1,799

855

14.7%

13.7%

9.7%

Revenue

($M)

Adjusted

EBITDA

(3)

($M)

Adjusted

EBITDA Margin

2003

(1)

2012

2013

Annualized

(2)

rd |

o[Alcoa logo]

Aero, Auto and Commercial B&C account for $5.9B of value-add revenue

Breakdown of 2012 Alcoa value-add revenue by market ($B)

21

8%

End

Market

CAGR

(2012

-

2015)

~8

year

production

backlog

(’12

rates)

for

large

commercial

aircraft

segment

From 2012 -

2015:

30-35%

CAGR

for

N.

America

auto

sheet

3.6x

increase

in

auto

sheet

revenue

3.2%

CAGR

for

N.

America

(2012

-

2015)

55%

of

non-residential

starts,

by

value

in

the U.S., will be green by 2016

(1)

Aerospace

Commercial Building and Construction

Automotive

1) McGraw Hill Construction, Green Outlook 2013.

Other

0.8

Industrial

Products

2.0

Commercial

Transportation

1.3

Packaging

3.2

Automotive

0.7

Commercial Building

and Construction

1.4

Aerospace

3.8

Revenues: $13.2B |

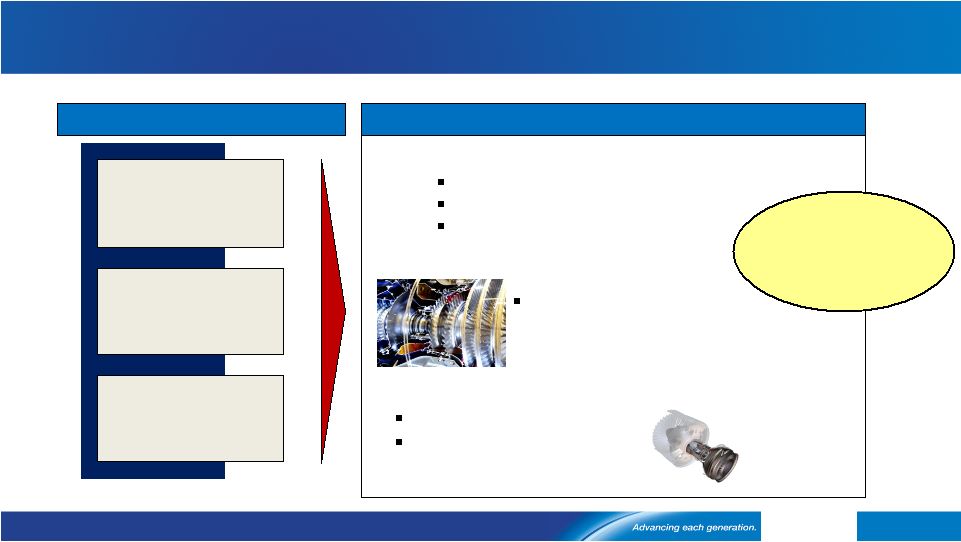

o[Alcoa logo]

New A330 strengthens Alcoa’s metallic aero opportunity

22

Airbus A330 Updates and Alcoa Solutions

Airbus tailors new A330 for Asian markets

Opportunities to apply Alcoa solutions

September 2013: New variant of all-metallic

A330-300 announced by Airbus

Target

short,

high-density

routes

in

growth

markets

Airbus goals:

Reduce weight

Increase passenger capacity

Optimize engine thrust and

lifespan

Advanced alloys

Aerospace hard alloys

Aluminum Lithium

-

Weight / -

Corrosion

Value-add products

Extruded wing stringers

Floor beams and seat tracks

Forged wheel & brake systems

+ Passenger Capacity

Engine technology

Advanced airfoils

Structural engine components

Specialized coatings

New thrust requirements

Images: Airbus. 2013 |

o[Alcoa logo]

Alcoa technology powers next generation jet engine performance

23

Increases coating life 3.0-3.5X

Enhances

airfoil hot

corrosion

protection

3D Multi-wall Airfoils

Provides

customized targeted

cooling

of

critical

areas

of

the engine blades

Nickel-based

superalloys

Increases

blade

melting

point

by

12%

Improves oxidation resistance

Advanced Single Crystal Technology

Reduced Emissions

Engine Fuel Burn

Reduction

Lower Maintenance &

Operating Cost

Customer needs and Alcoa solutions in the aerospace airfoils market

Specialized Airfoil Coatings

Alcoa technology

enables operation at

highest temperatures

>3,000°F

Customer needs

Alcoa provides high temperature airfoil solutions |

o[Alcoa logo]

Aluminum Intensive Vehicles have the competitive edge

Comparison between baseline steel and aluminum intensive vehicles

1) Aluminum Association. 2) Oak Ridge National Laboratory. 2013

24

“Aluminum offers

the most promise

for cutting total automotive-related

carbon

emissions

and

energy

use”

(1)

Steel

Toyota

Venza:

3%

Al

content

Fuel Efficiency: +18%

(2)

Weight: -8%

(2)

CO2

Breakeven Point:

1,900 miles

Compared to baseline steel:

Over Lifecycle

(2

)

:

-

32% lower energy

-

29%

less CO2

Safe and Durable

Al

Intensive

Toyota

Venza:

37%

Al

content

Reduces CO

2

emissions

Improves fuel efficiency

Safer

–

can reduce stopping

distances

from 45 mph to zero by up

to 7 feet –

could mean the difference

between a serious collision and a

near-miss

More Durable

–

unlike steel,

aluminum auto body panels are

naturally corrosion resistant

Proven –

aluminum’s strength and

durability proven in harsh environments

e.g. military, space missions |

o[Alcoa logo]

Aluminum intensity is accelerating auto sheet demand

Projected aluminum content per vehicle (lbs) and auto sheet demand (kMT)

Sources: Ducker Worldwide , IHS , Alcoa analysis

25

136

55

14

2025

2015

2012

North America Aluminum Body Sheet

Content Per Vehicle (in lbs)

North America Market Demand –

Auto Aluminum (kMT)

2025

4,550

3,425

1,125

2015

3,150

2,720

430

2012

2,400

2,300

100

Increasing Aluminum Intensity

Drives Auto Sheet Demand

4x

increase

in

auto

sheet

already

locked

into

designs

of

2015

models

Auto Sheet

Other Auto

Aluminum

Castings

Actual

Projected

~10x

~4x |

o[Alcoa logo]

$275M investment

Enables flexible production

Much of volume secured

Broke ground in Aug. 2013

Complete by mid-2015

Alcoa’s auto triple play: 3 smart investments to capitalize on AIV growth

$300M investment

Supported by secured contracts

On time and on budget

First

coil

by

Dec.

2013

26

Davenport

Phase 1 Auto Expansion

Auto Treatment Line –

Davenport, IA

Saudi Arabia JV

Automotive growth projects

$380M total investment

*

Addition to can sheet mill

Cold mill, heat treat, finishing

Broke

ground

in

Dec.

2012

First auto coil

by Dec. 2014

Positioning

for

growth

in

MENA

Tennessee

Phase 2 Auto Expansion

Alcoa TN facility–

Alcoa, TN

Saudi Arabia JV –

KSA

AIV

=

Aluminum

Intensive

Vehicle;

MENA

=

Middle

East

and

North

Africa

*

Total

investment

relates

to

rolling

mill

capability

expansion

to

include

auto

sheet,

building

and

construction

sheet

and

foil

stock.

Alcoa’s

investment

portion

is

~$95M |

o[Alcoa logo]

Alcoa delivers in a world demanding greener buildings

27

Alcoa solutions for U.S. commercial building and construction requirements

U.S. vs. EU Building Facts

(1,2)

Increasing energy requirements

Target of ‘Net Zero’

Buildings

in EU by 2020

(4)

/

U.S.A. by 2030

(5)

Green buildings provide

(1)

:

Hurricane Resistance

Thermal Performance

Withstands

object impact

of

over 50 mph

20% improvement in dynamic

wind resistance

15% thermal performance

improvement

1630SS IR Curtain Wall

+

40%

Thermal

Perform.

Air and water

resistant

(superior

resistance

to

rot,

warp, buckle

due

to

moisture

or weather

exposure)

OptiQ™

Ultra Thermal Window

Blast Resistance

Improves

structural

performance

and

glass

retention

by

60%

54%

improvement

in

thermal

performance

IR 501UT Framing

Triple

Insulating

Glass

1) LEED Gold Building vs. avg. U.S. commercial building, LEED Green Building

Fact Sheet 2013, McGraw Hill. 2) Buildings Performance Institute Europe (BPIE), 2011.

3) U.S. EIA, 2013. Alcoa Analysis. 4) ACEEE, 2012. 5) European Commission Energy

Efficiency Directive, 2013 15% pts reduction

in U.S. consumption

equals ~$58B in

annual savings

(3)

73%

58%

15%

US

EU

Annual Electricity Consumption by Buildings (%)

-

25%

Energy

consumption

-

35% Emissions

+

27%

Occupant

satisfaction |

o[Alcoa logo]

Enhancing competitiveness in the upstream business

Largest

low-cost

global

bauxite

producer,

and

world

leader

in

refining

$171M

in

refinery

gross

productivity

gains

YTD,

Performance

contributed

$159M

YoY

to

ATOI

Alumina

Price

Index

deployment

has

reached

53%

11

day

reduction

in

working

capital

YoY

=

$160M

cash

$17M

reduction

in

total

capital

spend

YTD

651

kMT

or

16%

of

capacity

curtailed;

including

274

kMT

(60%)

of

the

460

kMT

under

review

in

2013

$228M

in

smelting

gross

productivity

gains

YTD,

Performance

contributed

$167M

YoY

to

ATOI

Casthouse

value-added

has

generated

$200M

in

2013

2

day

reduction

in

working

capital

YoY

=

$50M

cash

$114M

reduction

in

total

capital

spend

YTD

28

Actions taken by upstream

Alumina

Aluminum

Mining

Refining

Smelting

Energy

8

consecutive

quarters

of

performance

(1)

improvement

in

upstream

business

1) Performance includes the following factors in ATOI: price/mix, volume,

productivity, and cost impacts |

o[Alcoa logo]

29

Smelter

Rolling Mill

Mine

Refinery

Phase 1

Phase 2

Construction progressing as planned; world’s lowest cost facility

99%

complete

67%

complete

38%

complete

250kMT

production in 2013

At full capacity in 2014

Lowest

cost

smelter

2%

point

reduction

on

the

smelting

cost

curve

First

hot

coil

in

4Q

2013

First auto

coil in 4Q 2014

First alumina 4Q 2014

Lowest

cost

refinery

2%

point

reduction

on

the

refining

cost

curve

On

track

to

provide

bauxite

in

2014

88%

complete

Saudi Arabia JV construction update |

o[Alcoa logo]

Creating value by executing our strategy

30

Focusing

on

controllable

items

to

increase

upstream

profitability

Investing to capture growth and improve cost position

Leveraging

the

Alcoa

Advantage

to

deliver

Value-Add

products |

o[Alcoa logo]

o[Alcoa

logo] |

o[Alcoa logo]

Kelly

Pasterick

Director,

Investor

Relations

Alcoa

390

Park

Avenue

New

York,

NY

10022-4608

Telephone:

(212)

836-2674

www.alcoa.com

Additional

Information

32 |

o[Alcoa logo]

Annual

Sensitivity

Summary

33

Currency Annual Net Income Sensitivity

+/-

$100/MT = +/-

$240 million

LME Aluminum Annual Net Income Sensitivity

Australian $

+/-

$11 million

per 0.01 change in USD / AUD

Brazilian

$

+/-

$ 3 million

per 0.01 change in BRL / USD

Euro €

+/-

$ 2 million

per 0.01 change in USD / EUR

Canadian $

+/-

$ 5 million

per 0.01 change in CAD / USD

Norwegian Kroner

+/-

$ 5 million

per 0.10 change in NOK / USD |

o[Alcoa logo]

Revenue

Change

by

Market

34

(3%)

(6%)

3%

2%

(9%)

(9%)

(3%)

22%

3%

(1%)

5%

7%

9%

7%

(9%)

(5%)

(3%)

(1%)

11%

(11%)

17%

3%

7%

6%

7%

2%

14%

1%

15%

28%

Aerospace

Automotive

B&C

Comm. Transport

Industrial Products

IGT

Packaging

Distribution/Other

Alumina

Primary Metals

3Q’13 Third-Party Revenue

Sequential

Change

Year-Over-Year

Change |

o[Alcoa logo]

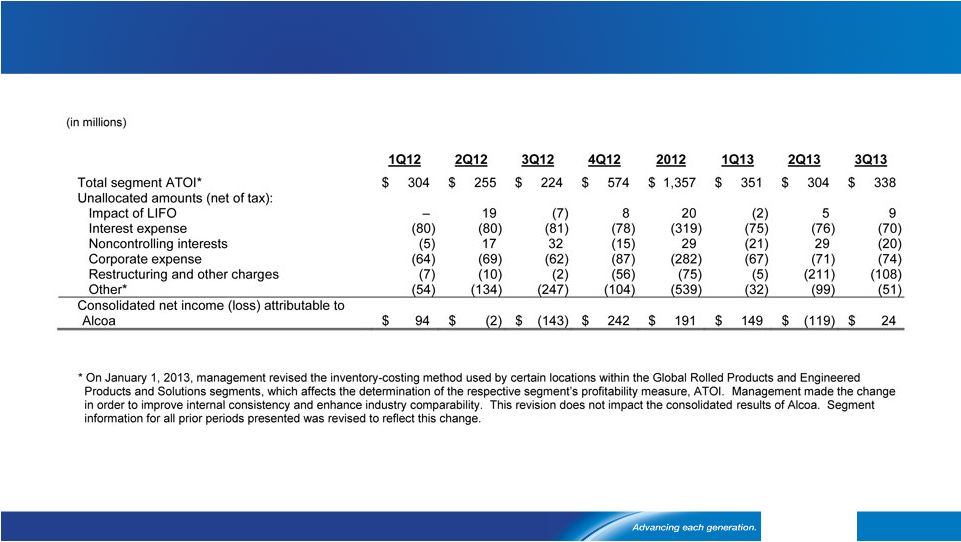

Reconciliation

of

ATOI

to

Consolidated

Net

Income

(Loss)

Attributable

to

Alcoa

35 |

o[Alcoa logo]

Reconciliation of Adjusted Income

36 |

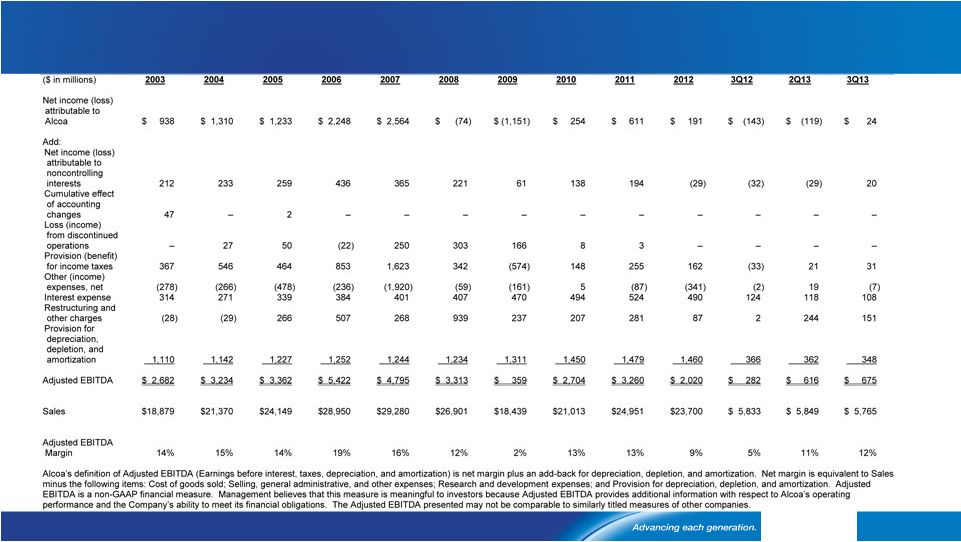

o[Alcoa logo]

Reconciliation

of

Alcoa

Adjusted

EBITDA

37 |

o[Alcoa logo]

Reconciliation

of

Alumina

Adjusted

EBITDA

38 |

o[Alcoa logo]

Reconciliation

of

Primary

Metals

Adjusted

EBITDA

39

($

in

millions , except

per

metric

ton

amounts

)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

3Q12

2Q13

3Q13

After-tax operating

income (ATOI)

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 481

$ 309

$ (14)

$ (32)

$ 8

Add:

Depreciation,

depletion, and

amortization

310

326

368

395

410

503

560

571

556

532

130

132

131

Equity (income) loss

(55)

(58)

12

(82)

(57)

(2)

26

(1)

7

27

5

7

13

Income taxes

256

314

307

726

542

172

(365)

96

92

106

(19)

(25)

(16)

Other

12

20

(96)

(13)

(27)

(32)

(176)

(7)

2

(422)

2

(3)

2

Adjusted

EBITDA

$ 1,180

$ 1,410

$ 1,413

$ 2,786

$ 2,313

$ 1,572

$ (567)

$ 1,147

$ 1,138

$ 552

$ 104

$ 79

$ 138

Production

(thousand metric

tons) (kmt)

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

3,775

3,742

938

896

897

Adjusted

EBITDA

/

Production ($ per

metric ton)

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 301

$ 148

$ 111

$ 88

$

154

Alcoa’s

definition

of

Adjusted

EBITDA

(Earnings

before

interest,

taxes,

depreciation,

and

amortization)

is

net

margin

plus

an

add-back

for

depreciation,

depletion,

and

amortization.

Net

margin

is

equivalent

to

Sales

minus

the

following

items:

Cost

of

goods

sold;

Selling,

general

administrative,

and

other

expenses;

Research

and

development

expenses;

and

Provision

for

depreciation,

depletion,

and

amortization.

The

Other

line

in

the

table

above

includes

gains/losses

on

asset

sales

and

other

nonoperating

items.

Adjusted

EBITDA

is

a

non-GAAP

financial

measure.

Management

believes

that

this

measure

is

meaningful

to

investors

because

Adjusted

EBITDA

provides

additional

information

with

respect

to

Alcoa’s

operating

performance

and

the

Company’s

ability

to

meet

its

financial

obligations.

The

Adjusted

EBITDA

presented

may

not

be

comparable

to

similarly

titled

measures

of

other

companies. |

o[Alcoa logo]

Reconciliation of Global Rolled Products Adjusted EBITDA

($ in millions, except

per metric ton

amounts)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

3Q12

2Q13

3Q13

After-tax operating

income (ATOI)*

$ 232

$ 290

$ 300

$ 317

$ 151

$ (41)

$ (106)

$ 241

$ 260

$ 346

$ 89

$ 79

$ 71

Add:

Depreciation,

depletion, and

amortization

190

200

220

223

227

216

227

238

237

229

57

55

56

Equity loss

1

1

–

2

–

–

–

–

3

6

1

2

3

Income taxes*

77

97

135

113

77

14

12

103

98

159

39

32

32

Other

(5)

1

1

20

1

6

(2)

1

1

(2)

(3)

–

–

Adjusted EBITDA*

$ 495

$ 589

$ 656

$ 675

$ 456

$ 195

$ 131

$ 583

$ 599

$ 738

$ 183

$ 168

$ 162

Total shipments

(thousand metric

tons) (kmt)

1,893

2,136

2,250

2,376

2,482

2,361

1,888

1,755

1,866

1,943

501

521

519

Adjusted EBITDA

/ Total shipments

($ per metric ton)*

$ 261

$ 276

$ 292

$ 284

$ 184

$ 83

$ 69

$ 332

$ 321

$ 380

$ 365

$ 322

$ 312

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general administrative, and other expenses;

Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in

the table above includes gains/losses on asset sales and other nonoperating items. Adjusted

EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because

Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and

the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to

similarly titled measures of other companies.

* On January 1, 2013, management revised the inventory-costing method used by certain locations

within the Global Rolled Products segment, which affects the determination of the segment’s profitability measure,

ATOI. Management made the change in order to improve internal consistency and enhance industry

comparability. This revision does not impact the consolidated results of Alcoa. Segment information for all prior

periods presented was revised to reflect this change.

40 |

o[Alcoa logo]

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

($ in millions)

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

3Q12

2Q13

3Q13

After-tax operating

income (ATOI)*

$ 126

$ 161

$ 276

$ 382

$ 423

$ 522

$ 311

$ 419

$ 537

$ 612

$ 158

$ 193

$ 192

Add:

Depreciation,

depletion, and

amortization

166

168

160

152

163

165

177

154

158

158

39

39

40

Equity loss

(income)

–

–

–

6

–

–

(2)

(2)

(1)

–

–

–

–

Income taxes*

57

70

120

164

184

215

138

198

258

296

77

94

91

Other*

11

106

(11)

(2)

(7)

2

1

–

(1)

(8)

–

–

–

Adjusted EBITDA*

$ 360

$ 505

$ 545

$ 702

$ 763

$ 904

$ 625

$ 769

$ 951

$ 1,058

$ 274

$ 326

$ 323

Third-party sales

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 4,584

$ 5,345

$ 5,525

$ 1,367

$ 1,468

$ 1,437

Adjusted EBITDA

Margin*

9%

12%

11%

13%

13%

15%

13%

17%

18%

19%

20%

22%

22%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus

the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research

and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table

above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a

non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted

EBITDA provides additional information with respect to Alcoa’s operating performance and the

Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled

measures of other companies.

* On January 1, 2013, management revised the inventory-costing method used by certain locations

within the Engineered Products and Solutions segment, which affects the determination of the segment’s profitability

measure, ATOI. Management made the change in order to improve internal consistency and enhance

industry comparability. This revision does not impact the consolidated results of Alcoa. Segment information for all

prior periods presented was revised to reflect this change.

41 |

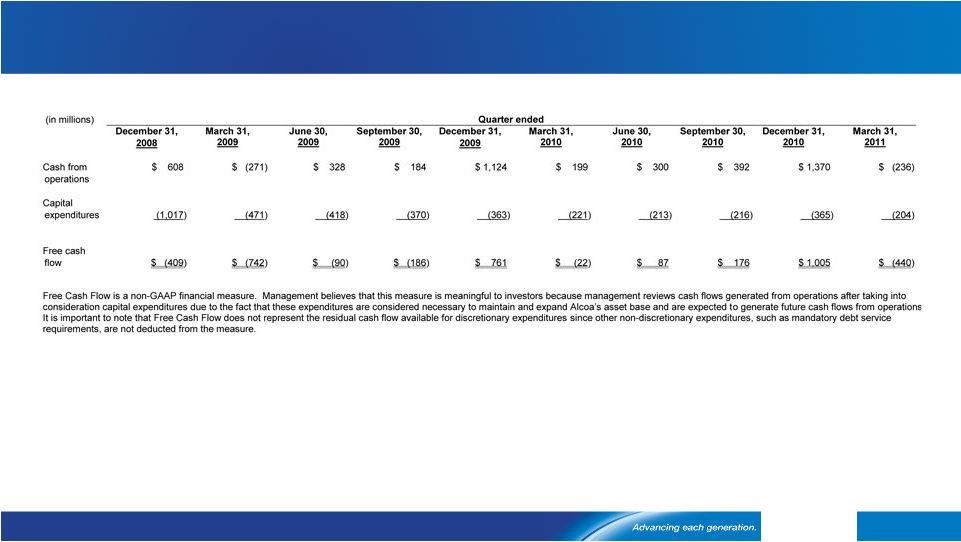

o[Alcoa logo]

Reconciliation

of

Free

Cash

Flow

42 |

o[Alcoa logo]

Reconciliation of Free Cash Flow, con’t

43 |

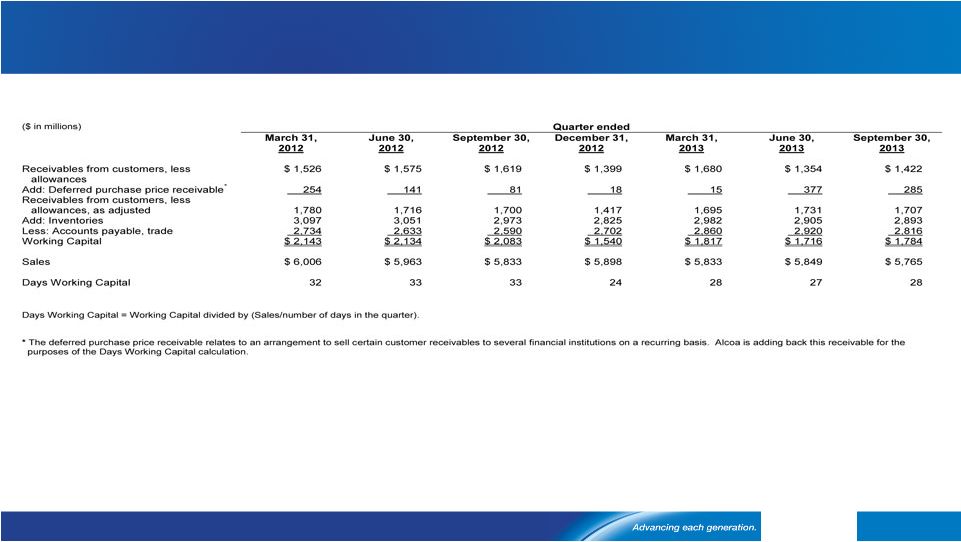

o[Alcoa logo]

Days Working Capital

44 |

o[Alcoa logo]

Reconciliation of Net Debt

45 |

o[Alcoa logo]

Reconciliation of Net Debt-to-Capital

46 |

o[Alcoa logo]

Composition of Upstream Production Costs

47

Fuel Oil

14%

Natural gas

10%

Caustic

11%

Bauxite

24%

Conversion

41%

Input Cost

Inventory flow

Pricing

convention

Annual ATOI

Sensitivity

Fuel oil

1 –

2 months

Prior month

$4m per $1/bbl

Natural gas

N/A

Spot

1

$16m per $1/GJ

1

Caustic soda

3 -

6 months

Spot & semi-

annual

$9m per

$10/DMT

Refining Cost Structure

Alumina

33%

Carbon

13%

Power

25%

Materials

6%

Conversion

23%

Smelting Cost Structure

Input Cost

Inventory flow

Pricing convention

Annual ATOI

Sensitivity

Coke

1 -

2 months

Spot, quarterly &

semi-annual

$9m per

$10/MT

Pitch

1 -

2 months

Spot, quarterly &

semi-annual

$2.5m per

$10/MT

1

Natural gas information corresponds to Point Comfort, as Australia is priced on a

rolling 16 quarter average |

o[Alcoa logo]

48

Source: Alcoa estimates, Brook Hunt, CRU, Harbor

Global aluminum demand growth at 7%

7%

5%

12%

-1%

4%

9%

6%

4%

8%

6%

2013E

6.5

6.2

4.0

1.0

1.0

1.9

1.9

2.0

23.1

49.5 mmt

(1)

Other includes Africa, E.Europe, Latin America ex Brazil and Oceania

2013 Primary Aluminum Consumption (mmt), Annualized Growth (%)

China

Europe

North America

North Asia

India

SE Asia

MENA

Russia

Brazil

Other ¹

1.9

2013 Demand +7%

Rest of World +4% |

o[Alcoa logo]

49

Source: Alcoa analysis, Brook Hunt, CRU, CNIA, NBS, Chinese Customs

Market essentially balanced

2013E Aluminum Supply/Demand Balance

‘000 mt

China

Rest of World

2013 Production (August annualized)

22,775

25,447

2013 Production to be added

360

704

2013 Capacity to be curtailed

(145)

(56)

Total supply

22,990

26,095

Demand

(23,125)

(26,360)

Net Balance

(135)

(265)

2013E Alumina Supply/Demand Balance

‘000 mt

China

Rest of World

2013 Production

(August annualized)

42,100

54,149

2013 Production to be added

-

700

2013 Capacity to be curtailed

(500)

-

Imports/(exports)

3,400

(3,400)

Total supply

45,000

51,449

Demand

(44,750)

(51,063)

Net Balance

250

386

2Q2013

Surplus

130

2Q2013

Deficit

(315)

Supply

Demand

Deficit

(400)

Supply

Demand

Surplus

636

Supply/Demand Analysis |

o[Alcoa logo]

Inventory is Stable

50

$1,000

$1,500

$2,000

$2,500

$3,000

0

7

14

21

28

35

42

49

56

63

70

77

84

91

98

105

China Incl SRB

Producer

Japan Port

LME On Warrant

Cancelled Warrants

Off Exchange

LME 3 Mon

Days of

Consumption

108 days

LME Price

$2,214/MT

Days of

Consumption

83 days

LME Price

$2,686/MT

Global Inventories

Decline 34 days

from the ’09 peak

Days of

Consumption

Days of

Consumption

74.5 days

LME Price

$1,808/MT

$ per metric ton

Global Inventories vs. LME Price Over Time $ |

o[Alcoa logo]

Lower

regional

premiums

51

Source:

Month

end

pricing

-

Platts

Metals

Week

and

Metal

Bulletin

$0

$50

$100

$150

$200

$250

$300

$0

$50

$100

$150

$200

$250

$300

Regional Premiums over time

$ per metric

ton

$ per metric

ton

Region

End of 3Q

13

Europe

$240/MT

Japan

$246/MT

Midwest

USA

$216/MT

Year on Year Change

Europe -17%

Japan -4%

Midwest USA -11% |

o[Alcoa logo]

o[Alcoa

logo] |