Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - ENVESTNET, INC. | a2216855zex-1_1.htm |

| EX-5.1 - EX-5.1 - ENVESTNET, INC. | a2216855zex-5_1.htm |

| EX-23.1 - EX-23.1 - ENVESTNET, INC. | a2216855zex-23_1.htm |

| EX-23.2 - EX-23.2 - ENVESTNET, INC. | a2216855zex-23_2.htm |

| EX-23.3 - EX-23.3 - ENVESTNET, INC. | a2216855zex-23_3.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on October 8, 2013

Registration No. 333-190852

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Envestnet, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

7389 (Primary Standard Industrial Classification Code Number) |

20-1409613 (I.R.S. Employer Identification Number) |

||||||||

35 East Wacker Drive, Suite 2400 Chicago, Illinois 60601 (312) 827-2800 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

||||||||||

Shelly O'Brien General Counsel Envestnet, Inc. 35 East Wacker Drive, Suite 2400 Chicago, Illinois 60601 (312) 827-2800 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

||||||||||

| Copies to: | ||||||||||

| Edward S. Best Mayer Brown LLP 71 South Wacker Drive Chicago, IL 60606 (312) 782-0600 |

Larry A. Barden Sidley Austin LLP One South Dearborn Chicago, IL 60603 (312) 853-7000 |

|||||||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 8, 2013

4,800,000 Shares

Envestnet, Inc.

Common Stock

The Selling Stockholders identified in this prospectus are offering 4,800,000 shares of our common stock. We will not receive any proceeds from the sale of the shares of our common stock in this offering.

Our common stock is listed on the New York Stock Exchange under the symbol "ENV." The last reported sale price of our common stock on the New York Stock Exchange on October 7, 2013 was $31.16 per share.

Investing in our common stock involves risks. Before buying any shares of our common stock, you should read the discussion of material risks described in "Risk Factors" beginning on page 14 of this prospectus and included in our Annual Report on Form 10-K for the year ended December 31, 2012, as well as the other information included or incorporated by reference in this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| |

Per share | Total(1) | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discounts(2) |

$ | $ | |||||

Proceeds, before expenses, to the Selling Stockholders |

$ | $ | |||||

- (1)

- Assumes

no exercise of the underwriters' over-allotment option described below.

- (2)

- The underwriters will also be reimbursed for certain expenses incurred in this offering. See "Underwriting."

One of the Selling Stockholders has granted the underwriters an option to purchase up to an additional 720,000 shares of our common stock at the public offering price, less underwriting discounts, within 30 days of the date of this prospectus, to cover over-allotments, if any. If the underwriters exercise their option in full, the total underwriting discount will be $ . Delivery of the shares of common stock is expected to be made on or about , 2013.

| William Blair | Stifel |

| BMO Capital Markets | Sandler O'Neill + Partners, L.P. | Sterne Agee |

| Avondale Partners | Barrington Research Associates | Sidoti & Company, LLC |

The date of this prospectus is , 2013

i

You should rely only on the information contained or incorporated by reference in this prospectus or in any related free writing prospectus filed by us with the Securities and Exchange Commission (the "SEC"). No person has been authorized by us to provide any information or to make any representations other than those contained in this prospectus or incorporated by reference in this prospectus. You should carefully evaluate the information provided by us in light of the total mix of information available to you recognizing that we can provide no assurance as to the reliability of any information not contained in this prospectus or incorporated by reference in this prospectus. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Unless otherwise indicated, you should assume that the information contained or incorporated by reference in this prospectus is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

It is important for you to read and consider all information contained or incorporated by reference in this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you in "Where You Can Find More Information."

References in this prospectus to "Envestnet," "we," "us," "our" and the "Company" refer to Envestnet, Inc. and, unless the context otherwise requires, its subsidiaries.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference, may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements may include forward-looking statements which reflect our current views with respect to future events and financial performance. Statements which include the words "expect," "intend," "plan," "believe," "project," "anticipate," "may," "will," "continue," "further," "seek" and similar words or statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. All forward-looking statements address matters that involve risks and uncertainties. These risks and uncertainties include, but are not limited to, economic, competitive, legal, governmental and technological factors. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include the following:

- •

- difficulty in sustaining rapid revenue growth, which may place significant demands on our administrative, operational and

financial resources;

- •

- fluctuations in our revenue;

- •

- the concentration of nearly all of our revenues from the delivery of investment solutions and services to clients in the

financial advisory industry;

- •

- the impact of market and economic conditions on our revenue;

- •

- our reliance on a limited number of clients for a material portion of our revenue;

- •

- the renegotiation of fee percentages or termination of our services by our clients;

- •

- our ability to identify potential acquisition candidates, complete acquisitions and successfully integrate acquired

companies;

- •

- compliance failures;

- •

- regulatory actions against us;

- •

- the failure to protect our intellectual property rights;

- •

- our inability to successfully execute the conversion of our clients' assets from their technology platform to our

technology platform in a timely and accurate manner;

- •

- general economic, political and regulatory conditions; and

- •

- management's response to these factors.

In addition, there may be other factors of which we are presently unaware or that we currently deem immaterial that could cause our actual results to be materially different from the results referenced in the forward-looking statements. All forward-looking statements contained in this prospectus and documents incorporated herein by reference are qualified in their entirety by this cautionary statement. Forward-looking statements speak only as of the date they are made, and we do not intend to update or otherwise revise the forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements.

iii

This summary highlights selected information appearing elsewhere in this prospectus or in documents incorporated herein by reference. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information set forth in the section entitled "Risk Factors" and the information that is incorporated by reference into this prospectus.

Our Business

We are a leading provider of unified wealth management software and services to financial advisors and institutions. By integrating a wide range of investment solutions and services, our technology platform provides financial advisors with the flexibility to address their clients' needs. As of June 30, 2013, over 25,000 advisors used our technology platform, supporting approximately $427 billion of assets in more than 1.9 million investor accounts.

Envestnet empowers financial advisors to deliver fee-based advice to their clients. We work with both Independent Registered Investment Advisors ("RIAs"), as well as advisors associated with financial institutions such as broker-dealers and banks. The services we offer and market to financial advisors address advisors' ability to grow their practice as well as to operate more efficiently—the Envestnet platform spans the various elements of the wealth management process, from the initial meeting an advisor has with a prospective client to the ongoing day-to-day operations of managing an advisory practice.

Our centrally-hosted technology platform, which we refer to as having "open architecture" because of its flexibility, provides financial advisors with access to a series of integrated services to help them better serve their clients. These services include risk assessment and selection of investment strategies and solutions, asset allocation models, research and due diligence, portfolio construction, proposal generation and paperwork preparation, model management and account rebalancing, account monitoring, customized fee billing, overlay services covering asset allocation, tax management and socially responsible investing, aggregated multi-custodian performance reporting and communication tools, as well as access to a wide range of leading third-party asset custodians.

We offer these solutions principally through the following product and services suites:

- •

- Envestnet's wealth management software empowers advisors to better manage

client outcomes and strengthen their practice. Our software unifies the applications and services advisors use to manage their practice and advise their clients, including financial planning; capital

markets assumptions; asset allocation guidance; research and due diligence on investment managers and funds; portfolio management, trading and rebalancing; multi-custodial, aggregated performance

reporting; and billing calculation and administration.

- •

- Envestnet | PMC®, our Portfolio Management

Consultants group, primarily engages in consulting services aimed at providing financial advisors with additional support in addressing their clients' needs, as well as the creation of proprietary

investment solutions and products. Envestnet | PMC's investment solutions and products include managed account and multi-manager portfolios, mutual fund portfolios and Exchange Traded

Fund ("ETF") portfolios. Envestnet | PMC also offers Prima Premium Research, comprising institutional-quality research and due diligence on investment managers, mutual funds, ETFs and

liquid alternatives funds.

- •

- Envestnet | TamaracTM provides leading portfolio accounting, rebalancing, trading, performance reporting and client relationship management software, principally to high-end RIAs.

1

- •

- Envestnet Reporting Solutions software aggregates and manages investment data and provides performance reporting and benchmarking, giving advisors an in-depth view of clients' various investments and empowering advisors to give holistic, personalized advice and consulting.

We believe that our business model results in a high degree of recurring and predictable financial results. The majority of our revenues is derived from fees charged as a percentage of the assets that are managed or administered on our technology platform by financial advisors. We also generate revenues from recurring, contractual licensing fees for providing access to our technology platform and from professional services.

For the year ended December 31, 2012, we earned fees of $127.2 million from assets under management ("AUM") or assets under administration ("AUA") or collectively ("AUM/A") by advisors using our technology platform. Asset-based fees accounted for approximately 81%, 81% and 77% of our total revenues for the years ended December 31, 2012, 2011 and 2010, respectively. Licensing and professional services fees accounted for 19%, 19% and 23% of our total revenues for the years ended December 31, 2012, 2011 and 2010, respectively.

For over 85% of our asset-based fee arrangements, we bill customers at the beginning of each quarter based on the market value of customer assets on our technology platform as of the end of the prior quarter, providing for a high degree of revenue visibility in the current quarter. Furthermore, our licensing fees are highly predictable because they are generally set in multi-year contracts providing longer-term visibility regarding that portion of our total revenues.

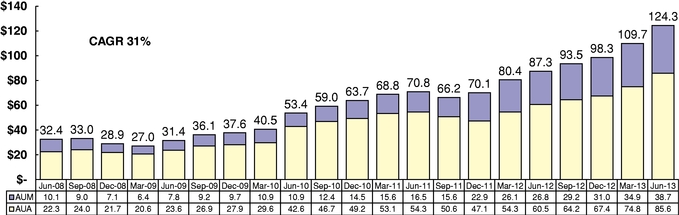

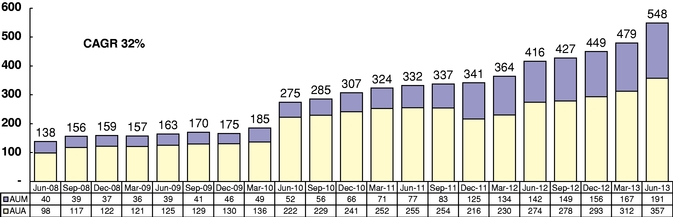

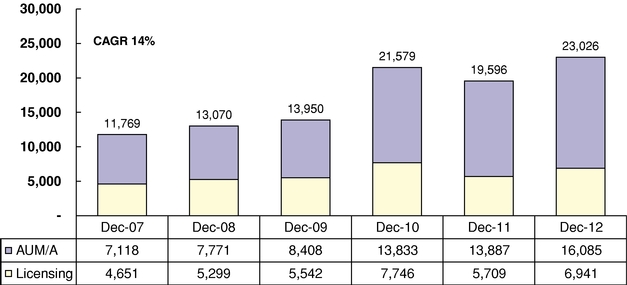

As the tables below indicate, our business has experienced steady and significant growth over the last several years. We believe this growth is attributable not only to secular trends in the wealth management industry as described below but also to the uniqueness and comprehensiveness of our product set.

The following table sets forth the assets under management or administration as of the end of the quarters indicated:

Quarterly Assets Under Management or Administration

($ In Billions)

2

The following table sets forth the number of accounts with assets under management or administration as of the end of the quarters indicated:

Quarterly Accounts Under Management or Administration

(In Thousands)

The following table sets forth as of the end of the years indicated the number of financial advisors that had client accounts on our technology platform:

Our Market Opportunity

The wealth management industry has experienced significant growth in terms of assets invested by retail investors in the past several years. According to the Federal Reserve, U.S. household and non-profit organization financial assets totaled $54.4 trillion as of December 31, 2012, up 7% from $50.6 trillion at December 31, 2011, and exceeding the 2007 peak of $52.2 trillion.

In addition to experiencing significant growth in financial assets, the wealth management industry is characterized by a number of important trends, including those described below, which we believe create a significant market opportunity for technology-enabled investment solutions and services like ours.

3

Increase in independent financial advisors. Based on industry research and news reports, we believe that over the past several years an increasing percentage of financial advisors have elected to leave large financial institutions and start their own financial advisory practices or move to smaller, more independent firms. According to an analysis done by Cerulli Associates, the number of RIAs and dually-registered advisors increased 7% annually from 34,000 in 2006 to 47,000 in 2011.

Increased reliance on technology among independent financial advisors. In order to compete effectively in the marketplace, independent financial advisors are increasingly relying on technology service providers to help them provide comparable services cost effectively and efficiently.

Increased use of financial advisors. We believe, based on an analysis done by Cerulli Associates, that the recent significant volatility and increasing complexity in securities markets have resulted in increased investor interest in receiving professional financial advisory services.

Increased use of fee-based investment solutions. Based on our industry experience, we believe that in order for financial advisors to effectively manage their clients' assets, they are seeking account types that offer the flexibility to choose among the widest range of investment solutions. Financial advisors typically charge fees for these types of flexible accounts based on a percentage of assets rather than on a commission or other basis.

More stringent standards applicable to financial advisors. Increased scrutiny of financial advisors to ensure compliance with current laws, coupled with the possibility of new laws focused on a fiduciary standard, may require changes to the way financial advisors offer advice. In order to adapt to these changes, we believe that financial advisors may benefit from utilizing a technology platform, such as ours, that allows them to address their clients' wealth management needs.

Our Business Model

We believe that a number of attractive characteristics significantly contribute to the success of our business model, including:

- •

- Positioned to capitalize on favorable industry trends. As

a leading provider of unified wealth management software and services to financial advisors, we believe we are well-positioned to take advantage of favorable secular trends in the wealth management

industry, particularly the increased prevalence and use of independent financial advisors, the movement toward fee-based pricing structures and advisors' increased reliance on technology.

- •

- Recurring and resilient revenue base. The substantial

majority of our revenues is recurring and derived either from asset-based fees, which generally are billed at the beginning of each quarter, or from fixed fees under multi-year license agreements. For

the year ended December 31, 2012, we derived 81% of our total revenues from asset-based fees and 19% from licensing and professional services revenues.

- •

- Strong customer retention. We believe that the breadth of

access to investment solutions and the multitude of services that we provide allow financial advisors to address a wide range of their clients' needs and, as a result, financial advisors are less

likely to move away from our technology platform. Because a technology platform is involved in nearly all of a financial advisor's activities needed to serve his or her clients, once a financial

advisor has moved clients and their assets onto our technology platform, significant time, costs and/or resources would be required for the financial advisor to shift to another technology platform.

- •

- Substantial operating leverage. Because we have designed our systems architecture to accommodate growth in the number of advisors and accounts we support and to provide the flexibility to add new investment solutions and services, our technology platform and infrastructure allow us to grow our business efficiently, without the need for significant

4

additional expenditures as assets grow. This scalability, combined with low marginal costs required to add additional accounts and new investment solutions and services, enables us to generate substantial operating leverage during the course of our relationship with a financial advisor, whether through growth of the advisor's accounts, growth of the assets of the advisor's clients or use by the advisor of additional services we provide.

Our Growth Strategy

Envestnet serves the fastest growing segments of the wealth management industry: independent financial advisors; fee-based solutions; and outsourced investment and technology solutions. We intend to increase revenue and profitability by continuing to pursue the following strategies:

- •

- Increase the advisor base. Through the outreach and

marketing activities of our sales and client service teams, we continue the process of leveraging existing enterprise client relationships to add new financial advisors to our technology platform, and

building new relationships to add additional advisors. Generally, when we establish an enterprise client relationship, we are provided access to the client's financial advisors and are given the

opportunity to convert them to our technology platform. During the five-year period ended December 31, 2012, within existing enterprises, we increased the number of advisors with AUM or AUA on

our platform at a compound annual growth rate of 9%. We added a comparable number of advisors through new enterprise relationships established during the past five years, resulting in the total number

of advisors with AUM or AUA on our platform growing at a compound annual growth rate of 18%. Even with that steady growth, we continue to have the opportunity to increase the number of financial

advisors we serve within our existing enterprise client relationships as advisors increasingly shift their businesses to fee-based practices.

- •

- Extend the account base within a given advisor

relationship. We work with existing clients to shift an increasing portion of their business to the Envestnet platform. During the

five-year period ended December 31, 2012, the average number of AUM or AUA accounts per advisor on our technology platform grew from approximately 16 to approximately 28, an increase of over

75%. As a result, total AUM or AUA accounts increased at a compound annual growth rate of 32% during the same period.

- •

- Expand the services utilized by each advisor. In most

cases, an advisor will leverage only a portion of Envestnet's services. Accordingly, through our sales and marketing efforts, we will continue to educate our financial advisor customers regarding our

capabilities in order to expand the scope of our investment solutions and services they employ.

- •

- Obtain new enterprise clients. Growing a fee-based

offering has become a strategic priority for financial services firms. Envestnet is positioned in the marketplace to empower these firms to deliver fee-based solutions to their advisors. These

enterprise clients provide us with access to a large number of financial advisors that may be interested in utilizing our technology platform, as well as to the assets that are managed by these

financial advisors. We believe that the current market opportunity for enterprise conversions continues to be significant. New enterprise clients also provide further opportunities to execute on the

other strategies discussed above.

- •

- Continue to invest in our technology platform. We intend

to continue to invest in our technology platform to provide financial advisors with access to investment solutions and services that address the widest range of financial advisors' front-, middle- and

back-office needs. In the years ended December 31, 2012, 2011 and 2010, our technology development expenditures totaled $8.7 million, $6.4 million and $5.6 million,

respectively.

- •

- Continue to pursue strategic transactions and other relationships. We intend to continue to selectively pursue acquisitions, investments and other relationships that we believe can enhance

5

- •

- In December 2011, we completed the acquisition of FundQuest Incorporated ("FundQuest"), a subsidiary of BNP Paribas

Investment Partners USA Holdings, Inc. FundQuest (which was renamed Envestnet Portfolio Solutions, Inc.), a provider of fee-based managed services and solutions.

- •

- In April 2012, we acquired Prima Capital Holding, Inc. ("Prima"). Prima, now part of

Envestnet | PMC, provides Prima Premium Research, including investment manager due diligence, consulting, and custom research to the wealth management and retirement industries.

Prima's clientele includes banks, independent RIAs, regional broker-dealers, family offices and trust companies.

- •

- In May 2012, we acquired Tamarac, Inc. ("Tamarac"). Tamarac, now operating as Envestnet |

Tamarac, provides leading portfolio accounting, rebalancing, trading, performance reporting and client relationship management software, principally to high-end RIAs.

- •

- In July 2013, we acquired the Wealth Management Solutions ("WMS") division of Prudential Investments for approximately $9.5 million in cash, subject to certain post-closing adjustments, plus contingent consideration of up to a total of $23.0 million in cash, based upon meeting certain performance targets, to be paid over three years. WMS is a provider of technology solutions that enables financial services firms to develop and enhance their wealth management offerings.

the attractiveness of our technology platform or expand our client base. Given our scale of operations and record of past transactions, we believe we are well-positioned to engage in such transactions in the future.

Corporate Information

We were incorporated in the State of Delaware in 2004. Our principal executive offices are located at 35 East Wacker Drive, Suite 2400, Chicago, Illinois 60601, and our telephone number is (312) 827-2800. Our website address is www.envestnet.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website as part of this prospectus.

6

Common shares offered by the Selling Stockholders |

4,800,000 shares (or 5,520,000 shares if the underwriters exercise their over-allotment option in full). | |

Common shares outstanding before and after this offering |

33,758,950 shares. |

|

Over-allotment option |

The underwriters have an option to purchase, from one of the Selling Stockholders, up to an additional 720,000 shares of our common stock to cover over-allotments, if any. |

|

Use of proceeds |

We will not receive any proceeds from the sale of shares by the Selling Stockholders. See "Use of Proceeds." |

|

NYSE symbol |

"ENV" |

|

Risk factors |

Investing in our common stock involves risks. Before buying any of our common shares, you should read the discussion of material risks described in "Risk Factors" beginning on page 14 of this prospectus and the discussion of material risks included in our Annual Report on Form 10-K for the year ended December 31, 2012, as well as the other information included or incorporated by reference in this prospectus. |

The number of shares of common stock that will be outstanding immediately before and after this offering is based on 33,758,950 shares of common stock outstanding as of September 30, 2013, and excludes, as of that date:

- •

- 4,790,458 shares of common stock issuable upon the exercise of outstanding options issued under our equity

incentive plans at a weighted average exercise price of $9.03;

- •

- 899,173 shares of unvested restricted common stock; and

- •

- 1,297,858 shares of common stock reserved for future issuance under our equity incentive plans.

7

SUMMARY HISTORICAL FINANCIAL DATA

You should read the following summary historical consolidated financial data together with our financial statements and related notes and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our periodic reports incorporated by reference in this prospectus. We derived the summary statements of operations data for the years ended December 31, 2010, 2011 and 2012 from our audited consolidated financial statements. We derived the summary statements of operations data for the six months ended June 30, 2012 and 2013 and the balance sheet data as of June 30, 2013 from our unaudited financial statements. The unaudited financial statement data has been prepared on a basis consistent with our audited financial statements and includes, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of our financial position and results of operations for these periods. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period, and our results for any interim period are not necessarily indicative of results for a full fiscal year. The data should be read in conjunction with the consolidated financial statements, related notes and other financial information incorporated by reference in this prospectus.

| |

Year ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in thousands, except share and per share information) |

(unaudited) |

||||||||||||||

Statement of operations data: |

||||||||||||||||

Revenues: |

||||||||||||||||

Assets under management or administration |

$ | 75,951 | $ | 99,236 | $ | 127,213 | $ | 59,275 | $ | 77,570 | ||||||

Licensing and professional services |

22,101 | 23,942 | 30,053 | 11,329 | 20,687 | |||||||||||

Total revenues |

98,052 | 123,178 | 157,266 | 70,604 | 98,257 | |||||||||||

Operating expenses: |

||||||||||||||||

Cost of revenues |

31,444 | 42,831 | 56,119 | 25,075 | 36,446 | |||||||||||

Compensation and benefits |

37,027 | 40,305 | 54,973 | 24,770 | 34,412 | |||||||||||

General and administration |

21,607 | 21,856 | 30,617 | 14,921 | 18,855 | |||||||||||

Depreciation and amortization |

5,703 | 6,376 | 12,400 | 5,623 | 6,199 | |||||||||||

Restructuring charges |

961 | 434 | 115 | 115 | — | |||||||||||

Total operating expenses |

96,742 | 111,802 | 154,224 | 70,504 | 95,912 | |||||||||||

Income from operations |

1,310 | 11,376 | 3,042 | 100 | 2,345 | |||||||||||

Total other income (expense) |

(403 | ) | (796 | ) | 26 | 20 | 191 | |||||||||

Income before income tax provision |

907 | 10,580 | 3,068 | 120 | 2,536 | |||||||||||

Income tax provision |

1,533 | 2,975 | 2,603 | 48 | 877 | |||||||||||

Net income (loss) |

(626 | ) | 7,605 | 465 | 72 | 1,659 | ||||||||||

Less preferred stock dividends |

(422 | ) | — | — | — | — | ||||||||||

Less net income allocated to participating convertible preferred stock |

— | — | — | — | — | |||||||||||

Income (loss) attributable to common stockholders |

$ | (1,048 | ) | $ | 7,605 | $ | 465 | $ | 72 | $ | 1,659 | |||||

Net income (loss) per share attributable to common stockholders: |

||||||||||||||||

Basic |

$ | (0.05 | ) | $ | 0.24 | $ | 0.01 | $ | 0.00 | $ | 0.05 | |||||

Diluted |

$ | (0.05 | ) | $ | 0.23 | $ | 0.01 | $ | 0.00 | $ | 0.05 | |||||

Weighted average common shares outstanding: |

||||||||||||||||

Basic |

20,805,911 | 31,643,390 | 32,162,672 | 32,004,386 | 32,518,943 | |||||||||||

Diluted |

20,805,911 | 32,863,834 | 33,341,615 | 33,054,632 | 34,760,568 | |||||||||||

8

| |

As of June 30, 2013 |

|||

|---|---|---|---|---|

| |

(dollars in thousands, unaudited) |

|||

Balance sheet data: |

||||

Assets: |

||||

Cash and cash equivalents |

$ | 39,679 | ||

Working capital |

25,890 | |||

Goodwill and intangible assets |

89,642 | |||

Total assets |

176,030 | |||

Stockholders' equity |

134,607 | |||

| |

As of December 31, | As of June 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in millions) |

(unaudited) |

||||||||||||||

Operating data: |

||||||||||||||||

Platform assets: |

||||||||||||||||

Assets under management (AUM) |

$ | 14,486 | $ | 22,936 | $ | 30,970 | $ | 26,758 | $ | 38,705 | ||||||

Assets under administration (AUA) |

49,202 | 47,148 | 67,368 | 60,511 | 85,601 | |||||||||||

Subtotal AUM/A |

63,688 | 70,084 | 98,338 | 87,269 | 124,306 | |||||||||||

Licensing |

75,668 | 69,514 | 269,729 | 229,268 | 302,604 | |||||||||||

Total platform assets |

$ | 139,356 | $ | 139,598 | $ | 368,067 | $ | 316,537 | $ | 426,910 | ||||||

Platform accounts: |

||||||||||||||||

AUM |

65,663 | 124,636 | 156,327 | 141,695 | 190,883 | |||||||||||

AUA |

241,162 | 216,038 | 293,151 | 274,322 | 357,283 | |||||||||||

Subtotal AUM/A |

306,825 | 340,674 | 449,478 | 416,017 | 548,166 | |||||||||||

Licensing |

603,950 | 588,038 | 1,228,016 | 1,138,223 | 1,365,773 | |||||||||||

Total platform accounts |

910,775 | 928,712 | 1,677,494 | 1,554,240 | 1,913,939 | |||||||||||

Advisors: |

||||||||||||||||

AUM/A |

13,833 | 13,887 | 16,085 | 15,045 | 18,154 | |||||||||||

Licensing |

7,746 | 5,709 | 6,941 | 6,758 | 7,261 | |||||||||||

Total advisors |

21,579 | 19,596 | 23,026 | 21,803 | 25,415 | |||||||||||

| |

Year ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in thousands except per share information, unaudited) |

|||||||||||||||

Other financial and operating data(1): |

||||||||||||||||

Adjusted revenues |

$ | 98,052 | $ | 123,178 | $ | 158,514 | $ | 71,221 | $ | 98,417 | ||||||

Adjusted EBITDA |

18,115 | 27,436 | 23,988 | 10,408 | 17,513 | |||||||||||

Adjusted net income |

8,323 | 13,754 | 10,570 | 4,431 | 8,584 | |||||||||||

Adjusted net income per share |

0.27 | 0.42 | 0.32 | 0.13 | 0.25 | |||||||||||

- (1)

"Adjusted revenues" excludes the effect of purchase accounting on the fair value of acquired deferred revenue. Under generally accepted accounting principles ("GAAP"), we record at fair value the acquired deferred revenue for contracts in effect at the time the entities were acquired. Consequently, revenue related to acquired entities for periods subsequent to the acquisition does not

9

reflect the full amount of revenue that would have been recorded by these entities had they remained stand-alone entities.

"Adjusted EBITDA" represents net income before deferred revenue fair value adjustment, interest income, interest expense, income tax provision (benefit), depreciation and amortization, non-cash compensation expense, gain (loss) on investments, impairment of investments, other income, restructuring charges and transaction costs, re-audit related expenses, severance, impairment of customer inducement asset, contract settlement charges, bad debt expense, customer inducement costs, and litigation related expense.

"Adjusted net income" represents net income before deferred revenue fair value adjustment, non-cash compensation expense, restructuring charges and transaction costs, re-audit related expenses, severance, amortization of acquired intangibles, impairment of investments, impairment of customer inducement asset, bad debt expense, non-recurring tax items, customer inducement costs, contract settlement charges, contract settlement—reversal of deferred taxes, valuation allowance reversal, other income, imputed interest expense and litigation related expense. Reconciling items are tax-effected using the income tax rates in effect on the applicable date.

"Adjusted net income per share" represents adjusted net income divided by the diluted number of weighted-average shares outstanding.

Our Board of Directors and our management use adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share:

- •

- As measures of operating performance;

- •

- For planning purposes, including the preparation of annual budgets;

- •

- To allocate resources to enhance the financial performance of our business;

- •

- To evaluate the effectiveness of our business strategies; and

- •

- In communications with our Board of Directors concerning our financial performance.

Our Compensation Committee, Board of Directors and management may also consider adjusted revenues and adjusted EBITDA, among other factors, when determining management's incentive compensation.

We also present adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share as supplemental performance measures because we believe that they provide our Board of Directors, management and investors with additional information to assess our performance. Adjusted revenues provide comparisons from period to period by excluding the effect of purchase accounting on the fair value of acquired deferred revenue. Adjusted EBITDA provides comparisons from period to period by excluding potential differences caused by variations in the age and book depreciation of fixed assets affecting relative depreciation expense and amortization of internally developed software, amortization of acquired intangible assets, re-audit related expenses, litigation-related expense, severance, gain on investments, and changes in interest expense and interest income that are influenced by capital structure decisions and capital market conditions. Our management also believes it is useful to exclude non-cash compensation expense from adjusted EBITDA, adjusted operating income and adjusted net income because non-cash equity grants made at a certain price and point in time do not necessarily reflect how our business is performing at any particular time.

We believe adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share are useful to investors in evaluating our operating performance because securities analysts use adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share as supplemental measures to evaluate the overall performance of companies, and we anticipate that our

10

investor and analyst presentations will include adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share.

Adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share are not measurements of our financial performance under GAAP and should not be considered as an alternative to revenues, net income, or any other performance measures derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of our profitability or liquidity.

We understand that, although adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share are frequently used by securities analysts and others in their evaluation of companies, these measures have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for an analysis of our results as reported under GAAP. In particular you should consider:

- •

- Adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share do not reflect our cash

expenditures, or future requirements for capital expenditures or contractual commitments;

- •

- Adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share do not reflect changes in, or

cash requirements for, our working capital needs;

- •

- Adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share do not reflect non-cash

components of employee compensation;

- •

- Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized often will have to

be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for such replacements;

- •

- Due to either net losses before income tax expenses or the use of federal and state net operating loss carryforwards from

2010 through 2013, we had cash income tax payments of approximately $171,000, $813,000, and $796,000 in the years ended December 31, 2010, 2011 and 2012, respectively, and $325,000 and

$2,955,000 in the six months ended June 30, 2012 and 2013, respectively. Income tax payments will be higher if we continue to generate taxable income and our existing net operating loss

carryforwards for federal and state income taxes have been fully utilized or have expired; and

- •

- Other companies in our industry may calculate adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share differently than we do, limiting their usefulness as a comparative measure.

Management compensates for the inherent limitations associated with using adjusted revenues, adjusted EBITDA, adjusted net income and adjusted net income per share through disclosure of such limitations, presentation of our financial statements in accordance with GAAP and reconciliation of adjusted revenues to revenues, adjusted EBITDA, adjusted net income and adjusted net income per share to net income and net income per share, the most directly comparable GAAP measures. Further, our management also reviews GAAP measures and evaluates individual measures that are not included in some or all of our non-GAAP financial measures, such as our level of capital expenditures and interest income, among other measures.

11

The following table sets forth a reconciliation of total revenues to adjusted revenues based on our historical results:

| |

Year ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in thousands, unaudited) |

|||||||||||||||

Total revenues |

$ | 98,052 | $ | 123,178 | $ | 157,266 | $ | 70,604 | $ | 98,257 | ||||||

Deferred revenue fair value adjustment |

— | — | 1,248 | 617 | 160 | |||||||||||

Adjusted revenues |

$ | 98,052 | $ | 123,178 | $ | 158,514 | $ | 71,221 | $ | 98,417 | ||||||

The following table sets forth a reconciliation of net income (loss) to adjusted EBITDA based on our historical results:

| |

Year ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2011 | 2012 | 2012 | 2013 | |||||||||||

| |

(dollars in thousands, unaudited) |

|||||||||||||||

Net income (loss) |

$ | (626 | ) | $ | 7,605 | $ | 465 | $ | 72 | $ | 1,659 | |||||

Add (deduct): |

||||||||||||||||

Deferred revenue fair value adjustment |

— | — | 1,248 | 617 | 160 | |||||||||||

Interest income |

(149 | ) | (77 | ) | (29 | ) | (23 | ) | (9 | ) | ||||||

Interest expense |

564 | 786 | 3 | 3 | — | |||||||||||

Income tax provision |

1,533 | 2,975 | 2,603 | 48 | 877 | |||||||||||

Depreciation and amortization |

5,703 | 6,376 | 12,400 | 5,623 | 6,199 | |||||||||||

Non-cash compensation expense |

1,731 | 3,062 | 4,037 | 1,930 | 4,447 | |||||||||||

(Gain) loss on investments |

(12 | ) | 4 | — | — | — | ||||||||||

Impairment of investments |

— | — | — | — | — | |||||||||||

Other income |

— | (1,100 | ) | — | — | — | ||||||||||

Restructuring charges and transaction costs |

961 | 1,054 | 2,718 | 1,997 | 1,054 | |||||||||||

Re-audit related expenses |

— | — | — | — | 2,887 | |||||||||||

Severance |

570 | 698 | 278 | 83 | 232 | |||||||||||

Impairment of customer inducement asset |

— | 174 | — | — | — | |||||||||||

Contract settlement charges |

— | 1,183 | — | — | — | |||||||||||

Bad debt expense |

2,668 | — | — | — | — | |||||||||||

Customer inducement costs |

3,239 | 4,568 | — | — | — | |||||||||||

Litigation related expense |

1,933 | 128 | 265 | 58 | 7 | |||||||||||

Adjusted EBITDA |

$ | 18,115 | $ | 27,436 | $ | 23,988 | $ | 10,408 | $ | 17,513 | ||||||

12

The following table sets forth a reconciliation of net income (loss) to adjusted net income and adjusted net income per share based on our historical results:

| |

Year ended December 31, | Six months ended June 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010* | 2011* | 2012* | 2012* | 2013* | |||||||||||

| |

(dollars in thousands except share and per share information, unaudited) |

|||||||||||||||

Net income (loss) |

$ | (626 | ) | $ | 7,605 | $ | 465 | $ | 72 | $ | 1,659 | |||||

Add: |

||||||||||||||||

Deferred revenue fair value adjustment |

— | — | 746 | 369 | 93 | |||||||||||

Non-cash compensation expense |

1,077 | 1,831 | 2,414 | 1,154 | 2,579 | |||||||||||

Restructuring charges and transaction costs |

598 | 630 | 1,810 | 1,194 | 611 | |||||||||||

Re-audit related expenses |

— | — | — | — | 1,674 | |||||||||||

Severance |

355 | 417 | 166 | 50 | 135 | |||||||||||

Amortization of acquired intangibles |

694 | 559 | 3,687 | 1,557 | 1,829 | |||||||||||

Impairment of investments |

— | — | — | — | — | |||||||||||

Impairment of customer inducement asset |

— | 104 | — | — | — | |||||||||||

Bad debt expense |

2,668 | — | — | — | — | |||||||||||

Non-recurring tax items |

— | — | 1,124 | — | — | |||||||||||

Customer inducement costs |

2,015 | 2,732 | — | — | — | |||||||||||

Contract settlement charges |

— | 1,183 | — | — | — | |||||||||||

Contract settlement—reversal of deferred taxes |

— | (1,187 | ) | — | — | — | ||||||||||

Valuation allowance reversal |

— | — | — | — | — | |||||||||||

Other income |

— | (658 | ) | — | — | — | ||||||||||

Imputed interest expense |

340 | 461 | — | — | — | |||||||||||

Litigation related expense |

1,202 | 77 | 158 | 35 | 4 | |||||||||||

Adjusted net income |

8,323 | 13,754 | 10,570 | 4,431 | 8,584 | |||||||||||

Less: Preferred stock dividends |

(422 | ) | — | — | — | — | ||||||||||

Less: Net income allocated to participating preferred stock |

(2,069 | ) | — | — | — | — | ||||||||||

Adjusted net income attributable to common stockholders |

$ | 5,832 | $ | 13,754 | $ | 10,570 | $ | 4,431 | $ | 8,584 | ||||||

Basic number of weighted-average shares outstanding |

20,805,911 | 31,643,390 | 32,162,672 | 32,004,386 | 32,518,943 | |||||||||||

Effect of dilutive shares: |

||||||||||||||||

Options to purchase common stock |

992,753 | 974,192 | 954,056 | 900,085 | 1,605,065 | |||||||||||

Unvested restricted stock |

— | 34,757 | 47,630 | 6,085 | 113,540 | |||||||||||

Common warrants |

154,364 | 211,495 | 177,257 | 144,076 | 523,020 | |||||||||||

Diluted number of weighted-average shares outstanding |

21,953,028 | 32,863,834 | 33,341,615 | 33,054,632 | 34,760,568 | |||||||||||

Adjusted net income per share |

$ | 0.27 | $ | 0.42 | $ | 0.32 | $ | 0.13 | $ | 0.25 | ||||||

- *

- Adjustments, excluding bad debt expense, contract settlement charges and contract settlement—reversal of deferred taxes, are tax effected using income tax rates as follows: for 2010—37.8%; for 2011 and 2012—40.2%; and for 2013—42.0%.

13

The purchase of our common stock involves certain risks. Before making a decision to invest in the common stock, you should carefully consider the risks set forth below, as well as other information contained in this prospectus and the documents contained and incorporated by reference herein, including those set forth under the caption "Risk Factors" in our Annual Report Form 10-K for the year ended December 31, 2012. The risks specifically relating to this offering are set forth below and the risks related to our business and our corporate structure are set forth in our Annual Report Form 10-K for the year ended December 31, 2012. These risks may adversely affect our business, financial condition and operating results. As a result, the trading price of our common stock could decline, and you could lose some or all of your investment.

Risks related to this offering

Our share price may be volatile, and the value of an investment in our common stock may decline.

An active, liquid and orderly market for our common stock may not be sustained, which could depress the trading price of our common stock. The price of our common stock has been, and is likely to continue to be volatile, which means that it could decline substantially within a short period of time. The market price of shares of our common stock could be subject to wide fluctuations in response to various factors, many of which are beyond our control, including:

- •

- actual or anticipated fluctuations in our financial condition and operating results;

- •

- changes in the economic performance or market valuations of other companies engaged in providing wealth management

software and services;

- •

- loss of a significant amount of existing business;

- •

- actual or anticipated changes in our growth rate relative to our competitors;

- •

- actual or anticipated fluctuations in our competitors' operating results or changes in their growth rates;

- •

- issuance of new or updated research reports by securities analysts;

- •

- our announcement of actual results for a fiscal period that are higher or lower than projected results or our announcement

of revenue or earnings guidance that is higher or lower than expected;

- •

- regulatory developments in our target markets affecting us, our customers or our competitors;

- •

- fluctuations in the valuation of companies perceived by investors to be comparable to us;

- •

- share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

- •

- sales or expected sales of additional common stock;

- •

- terrorist attacks or natural disasters or other such events impacting countries where we or our customers have operations;

and

- •

- general economic and market conditions.

Furthermore, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions, interest rate changes or international currency fluctuations, may

14

cause the market price of shares of our common stock to decline. In the past, companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management's attention from other business concerns, which could seriously harm our business.

Our insiders who are significant stockholders may have interests that conflict with those of other stockholders.

Our directors and executive officers, together with members of their immediate families, as a group, beneficially own, in the aggregate, approximately 24% of our outstanding capital stock as of June 30, 2013. As a result, when acting together, this group has the ability to exercise significant influence over most matters requiring our stockholders' approval, including the election and removal of directors and significant corporate transactions. The interests of our insider stockholders may not be aligned with the interests of our other stockholders and conflicts of interest may arise. In addition, the concentration of our shares may have the effect of delaying, deterring or preventing significant corporate transactions which may otherwise adversely affect the market price of our shares.

The future sale of shares of our common stock may negatively impact our stock price.

If our stockholders sell substantial amounts of our common stock, the market price of our common stock could fall. A reduction in ownership by a large stockholder could cause the market price of our common stock to fall. In addition, the average daily trading volume in our stock is relatively low. The lack of trading activity in our stock may lead to greater fluctuations in our stock price. Low trading volume may also make it difficult for stockholders to execute transactions in a timely fashion.

Certain provisions in our charter documents and agreements and Delaware law may inhibit potential acquisition bids for our company and prevent changes in our management.

Our amended and restated certificate of incorporation and amended and restated by-laws contain provisions that could depress the trading price of our common stock by acting to discourage, delay or prevent a change of control of our company or changes in management that our stockholders might deem advantageous. As a result of these provisions in our amended and restated certificate of incorporation, the price investors may be willing to pay for shares of our common stock may be limited.

In addition, we are subject to Section 203 of the Delaware General Corporation Law, which imposes certain restrictions on mergers and other business combinations between us and any holder of 15% or more of our common stock.

We do not currently intend to pay dividends on our common stock for the foreseeable future and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of our common stock.

We do not anticipate paying any cash dividends to holders of our common stock in the foreseeable future. Consequently, investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not purchase our common stock.

15

All of the shares of our common stock in this offering are being sold by the Selling Stockholders. We will not receive any proceeds from the sale of shares of our common stock in this offering.

DETERMINATION OF OFFERING PRICE

Our common stock is listed on the NYSE under the symbol "ENV." The public offering price will be determined through negotiations among us, representatives of the Selling Stockholders and the underwriters. In addition to the then prevailing market price for our common stock on the NYSE and market conditions, the factors to be considered in determining the public offering price will include:

- •

- our history and prospects, including our past and present financial performance and our prospects for future earnings;

- •

- the history and prospects of companies in our industry;

- •

- our capital structure;

- •

- an assessment of our management and their experience;

- •

- general conditions of the securities markets at the time of the offering; and

- •

- other relevant factors.

16

The following sets forth our cash and cash equivalents and capitalization as of June 30, 2013:

| |

As of June 30, 2013 | |||

|---|---|---|---|---|

| |

(unaudited) | |||

| |

(dollars in thousands, except share and per share information) |

|||

Cash and cash equivalents |

$ | 39,679 | ||

Total debt |

$ | — | ||

Stockholders' equity: |

||||

Preferred stock, par value $0.005, 50,000,000 shares authorized, no shares issued or outstanding |

— | |||

Common stock, par value $0.005, 500,000,000 shares authorized, 45,147,083 shares issued and 33,395,377 shares outstanding |

226 | |||

Treasury stock at cost, 11,751,706 shares |

(11,144 | ) | ||

Additional paid-in capital |

181,143 | |||

Accumulated deficit |

(35,618 | ) | ||

Total stockholders' equity |

134,607 | |||

Total capitalization |

$ | 134,607 | ||

17

PRICE RANGE OF OUR COMMON STOCK AND DIVIDEND POLICY

Our common stock is listed for trading on the New York Stock Exchange (the "NYSE") under the symbol "ENV." The following table sets forth on a per share basis the high and low sales prices for consolidated trading in our common stock as reported on the NYSE for the quarters indicated.

We have not paid dividends for the most recent two years or for the six month period ended June 30, 2013 and we do not anticipate declaring or paying any cash dividends on our common stock for the foreseeable future.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

Year 2011 |

|||||||

First Quarter |

$ | 17.59 | $ | 11.56 | |||

Second Quarter |

15.09 | 12.81 | |||||

Third Quarter |

15.00 | 9.59 | |||||

Fourth Quarter |

12.33 | 9.60 | |||||

Year 2012 |

|||||||

First Quarter |

13.05 | 11.12 | |||||

Second Quarter |

13.00 | 10.79 | |||||

Third Quarter |

12.85 | 11.16 | |||||

Fourth Quarter |

14.00 | 11.60 | |||||

Year 2013 |

|||||||

First Quarter |

17.88 | 13.15 | |||||

Second Quarter |

25.93 | 16.87 | |||||

Third Quarter |

31.86 | 24.58 | |||||

Fourth Quarter (through October 7, 2013) |

32.29 | 30.76 | |||||

The closing price of our common stock on the NYSE on October 7, 2013, was $31.16 per share. As of October 7, 2013, there were approximately 192 holders of record of our common stock.

18

The following table provides the name of each selling stockholder (a "Selling Stockholder"), the number of shares of our common stock offered by each Selling Stockholder under this prospectus and the number of shares of our common stock offered by our executive officers as a group.

Information with respect to beneficial ownership is based on our records, information filed with the SEC or information furnished to us by each Selling Stockholder. Beneficial ownership has been determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power and investment power with respect to those securities. Unless otherwise indicated by footnote, to our knowledge, the persons and entities named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them.

| |

Beneficial Ownership of Shares Before the Offering |

|

Beneficial Ownership of Shares After the Offering |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of Shares Offered |

|||||||||||||||

Name

|

Number | Percent(1) | Number | Percent(1) | ||||||||||||

Entities associated with Upfront Ventures, f/k/a GRP Partners(2) |

6,801,017 | 20.1 | % | 3,200,000 | 3,601,017 | 10.7 | % | |||||||||

Judson Bergman(3)(4) |

1,527,063 | 4.4 | % | 35,000 | 1,492,063 | 4.3 | % | |||||||||

Entities associated with Foundation Capital III, L.P.(5) |

1,431,237 | 4.2 | % | 384,393 | 1,046,844 | 3.1 | % | |||||||||

Entities associated with Apex Investment Fund IV, L.P.(6) |

1,115,607 | 3.3 | % | 1,115,607 | — | — | ||||||||||

William Crager(3) |

582,939 | 1.7 | % | 15,000 | 567,939 | 1.7 | % | |||||||||

Scott Grinis(3) |

324,203 | 1.0 | % | 10,000 | 314,203 | * | ||||||||||

Peter D'Arrigo(3) |

301,056 | * | 20,000 | 281,056 | * | |||||||||||

Shelly O'Brien(3) |

129,711 | * | 20,000 | 109,711 | * | |||||||||||

All executive officers named above as a group |

2,864,972 | 8.1 | % | 100,000 | 2,764,972 | 7.8 | % | |||||||||

Total |

12,212,833 | 34.3 | % | 4,800,000 | 7,412,833 | 20.8 | % | |||||||||

- *

- Denotes

ownership of less than 1%.

- (1)

- Based

on 33,758,950 shares of our common stock issued and outstanding as of September 30, 2013.

- (2)

- Represents shares owned by Upfront II Investors, L.P. ("Upfront II Investors"), Upfront II Partners, L.P. ("Upfront II Partners"), Upfront GP II, L.P. ("Upfront GP"), and AOS Partners, L.P. ("AOS"). Hique, Inc. is the general partner of AOS. Upfront GP is the general partner of Upfront II Partners. GRP Management Services Corp. ("GRPMS") is the general partner of each of Upfront GP and Upfront II Investors. Steven Dietz, Brian McLoughlin and Mark Suster are members of the investment committee of AOS and share voting and dispositive power over the securities held by this fund. Yves Sisteron, one of our directors, Steven Dietz and Brian McLoughlin, are officers of GRPMS. Mr. Sisteron, Steven Dietz, Brian McLoughlin and Mark Suster are members of the investment committee of Upfront II Partners and share voting and dispositive power over the securities held by this fund. Pursuant to contractual arrangements, Upfront II Investors has granted GRPMS the authority to vote and dispose of the shares held by it in the same manner as the investment committee votes or disposes of the shares held by Upfront II Partners. Mr. Sisteron disclaims beneficial ownership of the shares, except to the extent of his pecuniary interest therein. Upfront GP and Upfront II Investors are affiliates of a broker-dealer and (i) purchased the shares in the ordinary course of business, and (ii) at the time of purchase, had no agreements or understandings, directly or indirectly, with any person, to

19

distribute the shares. The entities associated with Upfront Ventures have granted the underwriters an option to purchase up to an additional 720,000 shares of our common stock. If the underwriters' over-allotment option is exercised in full, the entities associated with Upfront Ventures will beneficially own 8.5% of our common stock after the offering.

- (3)

- Includes

shares of common stock issuable upon exercise of options that are exercisable within 60 days of the date of this prospectus as follows:

Mr. Bergman—882,317 shares, Mr. Crager—433,004 shares, Mr. Grinis—79,065 shares, Mr. D'Arrigo—300,565 shares and

Ms. O'Brien—129,269 shares.

- (4)

- Includes

135,250 shares pledged as collateral to or held in a margin account with a stockbroker.

- (5)

- Represents

shares owned by Foundation Capital III, L.P. ("FC3") and Foundation Capital III Principals, LLC ("FC3P"). Paul Koontz, one

of our directors, is a Manager of Foundation Capital Management Co. III, L.L.C. ("FCM3"), which serves as the sole general partner of FC3 and FC3P. FCM3 exercises sole voting and investment power over

the shares owned by FC3 and FC3P. William B. Elmore, Kathryn C. Gould, Michael N. Schuh and Mr. Koontz, acting in their capacity as managing members of the funds, share

voting and dispositive power over the securities held by these funds. Each of the Managing Members of FCM3 disclaims beneficial ownership of the securities held by FC3 and FC3P, except to the extent

of his or her pecuniary interest therein.

- (6)

- Represents shares owned by Apex Investment Fund IV, L.P., ("AIF IV"), Apex Strategic Partners IV, LLC ("ASP IV") and Apex Investment Fund V, L.P. ("AIF V"). James Johnson, one of our directors, is a Managing Member of Apex Management IV, LLC, which is the sole general partner of AIF IV and the Manager of ASP IV. Mr. Johnson is also a Member of Apex Management V, LLC, the sole general partner of AIF V. Wayne Boulais, Lon Chow, George Middlemas, Armando Pauker and Mr. Johnson, acting in their capacity as managing members of the funds, share voting and dispositive power over the securities held by these funds. Each of the Managing Members of the funds disclaims beneficial ownership of the securities held by the funds, except to the extent of his pecuniary interest therein.

20

We are authorized to issue 500,000,000 shares of common stock, par value $0.005 per share, and 50,000,000 shares of undesignated preferred stock. The following is a summary description of the material terms of our capital stock. Our amended and restated by-laws and our amended and restated certificate of incorporation, which are incorporated as exhibits herein by reference, provide further information about our capital stock.

Common Stock

As of September 30, 2013, there were 33,758,950 shares of common stock outstanding.

The holders of common stock are entitled to one vote per share on all matters to be voted upon by stockholders, including elections of directors. No holder of common stock may cumulate votes in voting for our directors. Subject to the rights of any holders of any outstanding preferred stock, the holders of common stock are entitled to receive dividends, if any, that the Board of Directors may from time to time declare out of funds legally available. In the event of our liquidation, dissolution or winding up, the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock then outstanding.

The common stock has no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock. All outstanding shares of common stock are fully paid and non-assessable, and the shares of common stock to be issued and sold by us in this offering will be fully paid and non-assessable.

The rights, preferences and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which we may designate and issue in the future.

Preferred Stock

The board of directors has the authority, without action by our stockholders, to designate and issue preferred stock in one or more series and to fix the rights, preferences, privileges and related restrictions, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any series or the designation of the series. The issuance of preferred stock may delay, impede or prevent the completion of a merger, tender offer or other takeover attempt of our company without further action of our stockholders, including a tender offer or other transaction that some, or a majority, of our stockholders might believe to be in their best interests or in which stockholders may receive a premium for their stock over its then current market price. At present, we have no plans to issue any preferred stock following this offering.

Anti-Takeover Effects of Provisions of our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws

Board of Directors

Our amended and restated certificate of incorporation and amended and restated by-laws provide:

- •

- That the Board of Directors be divided into three classes, as nearly equal in size as possible, with staggered three-year

terms;

- •

- That there is no cumulative voting in the election of our directors;

- •

- That directors may be removed only for cause by the affirmative vote of the holders of at least a majority of the shares of our capital stock entitled to vote; and

21

- •

- That any vacancy on the Board of Directors, however occurring, including a vacancy resulting from an enlargement of the Board of Directors, may only be filled by vote of a majority of the directors then in office.

These provisions could make it more difficult for a third party to acquire us or discourage a third party from acquiring us.

Stockholder Actions and Special Meetings

Our amended and restated certificate of incorporation and amended and restated by-laws also provide that:

- •

- Any action required or permitted to be taken by the stockholders at an annual meeting or special meeting of stockholders

may only be taken if it is properly brought before such meeting and may not be taken by written action in lieu of a meeting; and

- •

- Special meetings of the stockholders may only be called by the Chairman of the Board of Directors, our Chief Executive Officer, or by the Board of Directors.

Our amended and restated by-laws provide that in order for any matter to be considered "properly brought" before a meeting, a stockholder must comply with requirements regarding advance notice to us. These provisions could delay stockholder actions which are favored by the holders of a majority of our outstanding voting securities until the next stockholders meeting. These provisions may also discourage another person or entity from making a tender offer for our common stock because such person or entity, even if it acquired a majority of our outstanding voting securities, would be able to take action as a stockholder (such as electing new directors or approving a merger) only at a duly called stockholders meeting and not by written consent.

Amendment

Delaware law provides that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation's certificate of incorporation or by-laws, unless a corporation's certificate of incorporation or by-laws, as the case may be, requires a greater percentage. Our amended and restated certificate of incorporation requires the affirmative vote of the holders of at least 662/3% of the shares of our capital stock entitled to vote to amend or repeal any of the foregoing provisions of our amended and restated certificate of incorporation. Our amended and restated by-laws may be amended or repealed by a majority vote of the Board of Directors or the holders of at least 662/3% of the shares of our capital stock issued and outstanding and entitled to vote. The stockholder vote would be in addition to any separate class vote that might in the future be required pursuant to the terms of any series preferred stock that might be outstanding at the time any such amendments are submitted to stockholders.

Preferred Stock

The authorization of undesignated preferred stock makes it possible for the Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change the control of our company.

These and other provisions may deter hostile takeovers or delay changes in control or management of our company.

Delaware Business Combination Statute

Section 203 of the Delaware General Corporation Law provides that, subject to exceptions set forth therein, an interested stockholder of a Delaware corporation shall not engage in any business

22

combination, including mergers or consolidations or acquisitions of additional shares of the corporation, with the corporation for a three-year period following the date that the stockholder becomes an interested stockholder unless:

- •

- Prior to that date, the board of directors of the corporation approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder;

- •

- Upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested

stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, other than statutorily excluded shares; or

- •

- On or subsequent to such date, the business combination is approved by the board of directors of the corporation and authorized at an annual or special meeting of stockholders by the affirmative vote of at least 662/3% of the outstanding voting stock which is not owned by the interested stockholder.

Except as otherwise set forth in Section 203, an interested stockholder is defined to include:

- •

- Any person that is the owner of 15% or more of the outstanding voting stock of the corporation, or is an affiliate or

associate of the corporation and was the owner of 15% or more of the outstanding voting stock of the corporation at any time within three years immediately prior to the date of determination; and

- •

- The affiliates and associates of any such person.

Section 203 may make it more difficult for a person who would be an interested stockholder to effect various business combinations with a corporation for a three-year period. We have not elected to be exempt from the restrictions imposed under Section 203. The provisions of Section 203 may encourage persons interested in acquiring us to negotiate in advance with our Board of Directors because the stockholder approval requirement would be avoided if a majority of the directors then in office approves either the business combination or the transaction which results in any such person becoming an interested stockholder. These provisions also may have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions which our stockholders may otherwise deem to be in their best interests.

Transfer Agent and Registrar

The transfer agent and registrar for the common stock is American Stock Transfer & Trust Company, LLC.

NYSE Listing

Our common stock is listed on the NYSE under the symbol "ENV."

23

MATERIAL UNITED STATES FEDERAL TAX CONSIDERATIONS TO NON-U.S. HOLDERS

Except as described in "—FATCA" below, this discussion is limited to the material United States federal income and estate tax consequences of the ownership and disposition of shares of our common stock by a non-U.S. holder. When we refer to a non-U.S. holder, we mean a beneficial owner of our common stock that, for U.S. federal income tax purposes, is other than:

- •

- an individual who is a citizen or resident of the United States;

- •

- a corporation (including for this purpose any other entity treated as a corporation for U.S. federal income tax purposes)

created or organized in or under the laws of the United States or any political subdivision thereof;

- •

- an estate the income of which is subject to U.S. federal income taxation regardless of its source;

- •