Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mirati Therapeutics, Inc. | a2216897z8-k.htm |

QuickLinks -- Click here to rapidly navigate through this document

Overview

We are a clinical-stage biopharmaceutical company focused on developing a pipeline of targeted oncology products. We focus our development programs on drugs intended to treat specific subsets of cancer patients with unmet needs. Our pipeline consists of three product candidates: MGCD265, MGCD516 and mocetinostat. MGCD265 and MGCD516 are orally-bioavailable, multi-targeted kinase inhibitors with distinct target profiles that are in development to treat patients with non-small cell lung cancer, or NSCLC, and other solid tumors. MGCD265 is in Phase 1/2 clinical development and MGCD516 is in advanced preclinical development, with Phase 1 clinical development anticipated to begin in the first half of 2014. Mocetinostat is an orally-bioavailable, spectrum-selective histone deacetylase, or HDAC, inhibitor for the first line treatment of patients with myelodysplastic syndromes, or MDS. We are planning to initiate a Phase 3 clinical trial of mocetinostat in the second half of 2014.

We believe that an increased understanding of the genomic factors that drive tumor cell growth can lead to the development of cancer drugs with increased efficacy while reducing side effects. We are leveraging this knowledge to develop targeted cancer therapies to address unmet needs in selected cancer patient populations. Our novel kinase inhibitors target specific mutations present only in cancer cells, and mocetinostat acts through epigenetic mechanisms important in treating certain cancers. We plan to identify additional opportunities by leveraging our deep scientific understanding of molecular drug targets and mechanisms of resistance and potentially in-licensing promising, early-stage novel drug candidates.

Our three product candidates are as follows:

- •

- MGCD265 is an

orally-bioavailable, potent, small molecule multi-targeted kinase inhibitor of Met, Axl and VEGFRs. MGCD265 is in development for the treatment of solid tumors, with an initial focus on NSCLC and

squamous cell carcinoma of the head and neck, or HNSCC. We have conducted single agent and combination dose escalation trials in 252 patients, with acceptable tolerability and promising early signs of

clinical efficacy in patients with advanced solid tumors who have failed standard therapies. Our preclinical studies, in a variety of in vivo tumor models, have suggested that MGCD265 has relatively

low toxicity and appears more potent than some of the leading approved kinase inhibitors, including Nexavar, Sutent and Xalkori. We have developed new formulations of MGCD265 designed to increase

plasma exposure, improve the degree of target inhibition and increase the likelihood of seeing single agent clinical activity. Assuming one or more of the new formulations achieve sufficient patient

exposure in ongoing studies, we intend to select one of the new formulations for introduction into ongoing dose escalation trials with the goal of identifying the maximum tolerated dose, or MTD, by

early 2014. Following identification of the MTD, we plan to initiate dose expansion cohorts in patients selected for certain biomarkers.

- •

- MGCD516 is an

orally-bioavailable, potent, small molecule multi-targeted kinase inhibitor of RET, TRK, DDR and EphRs, as well as Met, Axl and VEGFRs, in development for the treatment of solid tumors. We plan to

focus on solid tumors expressing RET, TRK and DDR, initially in NSCLC, and we plan to evaluate other tumor types where the profile of MGCD516 would suggest activity. MGCD516 is in advanced preclinical

development. We plan to file an investigational new drug application, or IND, with the U.S. Food and Drug Administration, or FDA, and initiate a Phase 1 clinical trial of this product candidate

in the first half of 2014, and identify the MTD and initiate expansion cohorts in patients selected for certain biomarkers by the end of 2014.

- •

- Mocetinostat is an orally-bioavailable, spectrum-selective HDAC inhibitor for which we plan to conduct a dose confirmation trial starting in the fourth quarter of 2013, with the goal of initiating a Phase 3 clinical trial in the second half of 2014. We have completed 13 clinical trials which enrolled 437 patients with a variety of hematologic malignancies and solid tumors. We intend to seek a Special Protocol Assessment, or SPA, from the FDA prior to the initiation of our planned Phase 3

1

trial. This trial will evaluate mocetinostat for the first line treatment of patients with MDS in combination with Vidaza, a hypomethylating agent, or HMA. We believe that mocetinostat has the potential to be the first HDAC inhibitor to market for this indication.

Our management team has extensive experience in leading the discovery and development of targeted oncology therapies. Our President and Chief Executive Officer, Charles M. Baum, M.D., Ph.D., was Senior Vice President for Biotherapeutic Clinical Research within Pfizer Inc.'s Worldwide Research and Development division and previously Head of Oncology Development for Pfizer. Prior to Pfizer, he was also responsible for the development of several oncology compounds at Schering-Plough Corporation (acquired by Merck & Co., Inc., or Merck). Our Chief Medical and Development Officer, Isan Chen, M.D., was Chief Medical Officer of Aragon Pharmaceuticals, Inc., which was acquired by Johnson & Johnson in 2013. At Aragon Pharmaceuticals, Dr. Chen was responsible for the clinical development strategy of all of the company's programs, including prostate and breast cancer. Our Vice President of Research, James Christensen, Ph.D., was previously the Senior Director of Oncology Precision Medicine at Pfizer, where he was responsible for strategy and translational research for the entire Pfizer oncology portfolio. The collective experience of our research and development team includes direct involvement in the development and approval of a number of oncology drugs including Inlyta, Sutent, Temodar and Xalkori. In addition, our Executive Vice President and Chief Operations Officer, Mark J. Gergen, has experience in operations, finance, strategy and corporate development and was previously Senior Vice President of Corporate Development at Amylin Pharmaceuticals, Inc. until its acquisition by Bristol-Myers Squibb Inc. in 2012.

We have a collaboration agreement with Taiho Pharmaceutical Co. Ltd., or Taiho, covering mocetinostat in certain Asian territories and we own all rights to mocetinostat outside of those territories.

Our Strategy

Our goal is to be a leading developer of targeted cancer therapies for selected patient populations. The key components of our strategy include:

- •

- Develop a pipeline of targeted cancer

therapies. We believe that an increased understanding of the genomic factors that drive tumor cell growth can lead to the development of

cancer drugs with increased efficacy while reducing side effects. We are leveraging this knowledge to develop targeted cancer therapies to address unmet needs in specific cancer populations. Our

current pipeline is comprised of novel kinase inhibitors that target specific mutations present only in cancer cells and one of the most advanced epigenetic therapies in development. We plan to

identify additional targets by leveraging our deep scientific understanding of molecular drug targets and mechanisms of resistance and potentially in-licensing promising, early-stage novel drug

candidates.

- •

- Employ efficient and flexible approaches to

accelerate clinical development. We will pursue indications and select specific patient populations in which activity of our product

candidates can be assessed early in clinical development. When designing clinical trials, we structure our clinical development approach to test multiple clinical hypotheses in a single trial and

design trials with the flexibility to adapt quickly and accelerate once a signal of clinical activity is observed. We believe our approach may increase the likelihood of seeing results early in

clinical trials with fewer patients, reducing our clinical development risk and allowing us to potentially accelerate the development of our product pipeline.

- •

- Advance our two lead kinase inhibitors. Kinase inhibitors have significantly improved the care of many cancer patients and represent a commercially successful category of targeted cancer therapies with sales of over $29.1 billion in 2011, according to BCC Research. We have two internally discovered novel kinase inhibitors in development: MGCD265 and MGCD516. These product candidates target pathways of high scientific interest, including Met, Axl, TRK, RET, DDR, EphRs and VEGFRs, and are believed to be important in the regulation of tumor growth. We plan to initiate a Phase 2 clinical trial for MGCD265 and a Phase 1 clinical trial for MGCD516 in 2014.

2

- •

- Advance mocetinostat, our later-stage product

candidate. HDAC inhibitors have been shown to be effective in treating hematologic malignancies, as evidenced by the approval of Istodax

and Zolinza. We have completed 13 clinical trials in 437 patients which have shown promising signs of activity of mocetinostat in MDS and other hematologic malignancies. We believe that the

combination of the epigenetic mechanisms of mocetinostat and Vidaza may be effective in treating MDS. Subject to receipt of additional financing and successful completion of our planned dose

confirmation trial, we are planning to initiate a Phase 3 registration trial of mocetinostat in 2014 under an SPA to be agreed upon with the FDA for the first line treatment of patients with

MDS in combination with Vidaza.

- •

- Leverage partnerships to develop our product candidates. We plan to collaborate with third parties and partner certain rights to our product candidates as a means to accelerate their broader clinical development and maximize their therapeutic and market potential. We plan to retain certain key development and commercialization rights in our partnerships. We believe that retaining this strategic flexibility will enable us to maximize shareholder value.

Product Candidates

The following chart depicts the current state of our oncology development programs:

PRODUCT CANDIDATE |

INDICATION | TARGETS | COMMERCIAL RIGHTS |

STAGE OF DEVELOPMENT AND ANTICIPATED MILESTONES |

||||

|---|---|---|---|---|---|---|---|---|

| MGCD265 | Solid Tumors | Met, Axl, VEGFRs | Mirati: Global | • Initiate expansion cohorts Q1 2014 • Initiate Phase 2 Q4 2014 |

||||

MGCD516 |

Solid Tumors |

RET, TRK, DDR, EphRs, Met, Axl, VEGFRs |

Mirati: Global |

• Planned IND submission and initiate Phase 1 1H 2014 • Initiate expansion cohorts Q4 2014 |

||||

Mocetinostat |

MDS |

HDACs |

Taiho: Certain Asian Territories |

• Initiate dose confirmation trial Q4 2013 • Obtain SPA for Phase 3 1H 2014 • Initiate Phase 3 2H 2014 |

||||

Mirati: All Other Territories |

Our Targeted Kinase Programs

Targeted therapies selectively inhibit specific genes or pathways that are present in certain types of cancer cells and not in normal tissue. Receptor tyrosine kinases, or RTKs, are a family of kinases involved in the transmission of signals that regulate the expression of many genes, including those that control cell growth and cell division. RTKs may be inappropriately expressed in cancerous tissues resulting in uncontrolled tumor cell growth. Aberrant kinase function, caused by mutations or over-expression, underlies many cancer cell processes, making the kinome an important source for therapeutic targets in oncology. Discoveries of specific drivers of disease have led to the development of targeted therapies, or the tailoring of therapies to a particular tumor or disease profile. In some cases, these therapies have proven to be more efficacious while having fewer side effects than traditional non-targeted therapies, such as chemotherapy, which kill healthy cells along with cancer cells. Examples of successful development of oral targeted kinase inhibitors include Novartis AG's Gleevec, a BCR-ABL kinase inhibitor for the treatment of Philadelphia chromosome positive chronic myelogenous leukemia, and GlaxoSmithKline's Tykerb, a HER2 kinase inhibitor for the treatment of a subset of breast cancer patients over-expressing the HER2 kinase. Further examples of oral targeted kinase inhibitors include Pfizer's Xalkori and Bosulif and Bristol-Myers Squibb's Sprycel. We believe that therapies that target specific genetic abnormalities in subsets of cancer patients identified through diagnostic tests will result in streamlined clinical trials, stratified patient populations and improved patient outcomes and will be increasingly important in the continued evolution of the treatment of cancer.

3

We believe that by selecting patients whose tumors over-express specific genes, as well as patients with genetic mutations in the pathways that are critical for tumor growth and are potently inhibited by our drugs, we will increase the potential for clinical benefit. The greater clinical benefit in selected patients may increase the likelihood of seeing clinical activity earlier in development, potentially in Phase 1, which may allow us to move rapidly into registration trials. As a part of our ongoing development activities, we are using commercial diagnostic assays as well as assays developed internally for early clinical trials. We are working with external diagnostic providers to develop validated companion diagnostics for later stage clinical use and registration to ensure that the diagnostic is available for commercial use upon approval.

The clinical and commercial success of leading small molecule kinase inhibitors demonstrates the potential of new targeted treatments for cancer. BCC Research data indicates that the global kinase inhibitor market was $29.1 billion in 2011, and is expected to reach $40.2 billion by 2016. The following table lists retail sales figures for selected small molecule kinase inhibitors.

2012 Worldwide Retail Sales Figures of Selected Small Molecule Kinase Inhibitors

Brand Name

|

2012 Worldwide Sales(1) (in millions) | |||

|---|---|---|---|---|

Gleevec |

$ | 4,675 | ||

Tarceva |

$ | 1,401 | ||

Sutent |

$ | 1,236 | ||

Nexavar |

$ | 1,044 | (3) | |

Sprycel |

$ | 1,019 | ||

Tykerb |

$ | 380 | ||

Zelboraf(2) |

$ | 249 | ||

Xalkori(2) |

$ | 123 | ||

- (1)

- Source:

Thomson Pharma.

- (2)

- Launched

in 2011.

- (3)

- 792 euro converted into U.S. dollars based upon a published exchange rate of 0.7585 euro per U.S. dollar at December 31, 2012.

Our kinase inhibitor programs in clinical development include MGCD265 and MGCD516, which are multi-targeted kinase inhibitors with distinct target profiles. These new molecular entities are in development for the treatment of patients with NSCLC and other solid tumors. We own all global rights to MGCD265 and MGCD516.

MGCD265 — A Multi-targeted Kinase Inhibitor for Solid Tumors

Overview

MGCD265 is an orally-bioavailable, potent, small molecule multi-targeted kinase inhibitor of Met, Axl and VEGFRs. MGCD265 is in development for the treatment of solid tumors, with an initial focus on NSCLC and HNSCC. We have conducted single agent and combination dose escalation trials in 252 patients, with acceptable tolerability and signs of clinical efficacy in patients with advanced solid tumors who have failed standard therapies. Our preclinical studies, in a variety of in vivo tumor models, have suggested that MGCD265 has relatively low toxicity and appears more potent than some of the leading approved kinase inhibitors, including Nexavar, Sutent and Xalkori. We have developed new formulations of MGCD265 designed to increase plasma exposure, improve the degree of target inhibition and increase the likelihood of seeing single agent clinical activity. Assuming one or more of the new formulations achieve sufficient patient exposure in ongoing studies, we intend to select one of the new formulations for introduction into ongoing dose escalation trials with the goal of identifying the MTD by early 2014. Following identification of the MTD, we plan to initiate dose expansion cohorts in patients selected for certain biomarkers.

4

Our development strategy for MGCD265 is based on our understanding of the compound's target inhibition profile and, accordingly, our initial focus for this program will include NSCLC and HNSCC. Met and Axl are both over expressed in NSCLC and HNSCC, providing opportunities for targeted patient selection. In addition, we may target patients with certain mutations of Met and Axl that result in oncogenic activation of these targets and may be drivers of tumor growth.

The National Cancer Institute, or NCI, estimates that in 2013, approximately 228,200 patients in the United States will be diagnosed with lung cancer and 159,500 will die due to the disease. Approximately 85% of lung cancers are NSCLCs. Both Met and Axl are over-expressed in NSCLC tumors. Based on published literature, we believe Met to be over-expressed in 40% to 50% of NSCLC tumors, and Axl in over 40%. In addition, the potentially oncogenic mutations of Met and Axl that we are targeting may exist in up to 8% of NSCLC cases. In the United States, it is estimated that there will be approximately 41,400 new cases of head and neck cancer diagnosed and 7,900 deaths in 2013. Approximately 90% of head and neck cancers are HNSCC, and Met is overexpressed in 55% to 85% of HNSCC cases.

MGCD265 Market Overview

Although many tumor types may respond to treatment with MGCD265, NSCLC, HNSCC, hepatocellular carcinoma, or HCC, renal cell carcinoma, or RCC, and gastric cancers are of particular relevance to demonstrate the clinical activity of MGCD265. The selection of these indications is based on the expression or over-expression of markers such as Axl, Met and VEGFR. Key features of these markets are shown in the table below.

Estimated Market Size of Certain Cancer Therapies

Indication

|

Supporting Rationale |

Precedents for Targeted Therapy |

Estimated Market Size (United States, Europe and Japan) |

|||

|---|---|---|---|---|---|---|

| Lung Cancer | Over-expression of Axl, Met and VEGFR | Met inhibitor onartuzumab (MetMab) (Phase 2) (including patient selection) | $4.6B in 2011(1) $5.9B projected in 2021(1) |

|||

| Head & Neck Cancer | Over-expression of Axl and Met | EGFR inhibitor cetuximab | $700M in 2011(1) | |||

| Renal Cell Carcinoma | Over-expression of Axl, Met and VEGFR | VEGFR / RTK inhibitors: sunitinib, sorafenib, axitinib, bevacizumab/IFN | $1.6B in 2011(1) $2.0B projected in 2021(1) |

|||

| Liver Cancer | Over-expression of Axl, Met and VEGFR | Met inhibitor tivantinib (Phase 2) (including patient selection) RTK inhibitor sorafenib (Phase 3) |

$380M in 2009(3) $2.0B projected in 2015(2)(3) |

|||

| Gastric Cancer | Over-expression of Axl, Met and VEGFR | HGF inhibitor rilotumumab (Phase 2) (including patient selection) |

$1.1B in 2011(1) $2.3B projected in 2021(1) |

- (1)

- Source:

Decision Resources, 2012.

- (2)

- Source:

Global Industry Analysts Inc. 2010, Global Data 2010.

- (3)

- Worldwide market size.

Background

MGCD265 is a small molecule, multi-targeted kinase inhibitor that potently inhibits Axl, Met and VEGFR 1, 2 and 3. These targets have been shown to play key roles in tumor development, tumor survival, tumor escape and blood vessel formation, or angiogenesis. MGCD265 is highly specific for these five targets and shows little to no activity against a panel of over 400 other RTKs. We believe this profile provides the following potential advantages for MGCD265:

- •

- therapeutic action against a novel target (Axl);

- •

- high specificity reduces the risk of side effects from off-target activity;

5

- •

- an opportunity to identify patients that express specific markers allowing a

predictive and tailored therapeutic strategy using companion diagnostics; and

- •

- an opportunity to identify patients whose tumors express genetic alterations that may be drivers of tumor growth and the inhibition of which may demonstrate single agent clinical activity of MGCD265.

Axl is an RTK which has been shown to correlate with clinical-stage and lymph node status in NSCLC. Recent data has shown that Axl is involved in the mechanism of resistance to EGFR inhibitors such as Tarceva. Axl is expressed in other tumor types and may be a significant driver in RCC, ovarian, pancreatic and other tumors.

The Met receptor is a protein that is found on the cell's surface that, when not properly regulated, plays a key role in the growth, survival and metastasis of various types of cancers. The Met target has generated significant scientific and pharmaceutical interest because of its direct involvement in tumor cell survival and angiogenesis. Met expression is elevated in several major tumor types including NSCLC, gastric cancer, RCC and HCC and is associated with poor prognosis. Met activation may also be associated with resistance to EGFR inhibitors such as Tarceva and Iressa and resistance to VEGFR inhibitors such as Sutent. In tumors with Met over-expression, persistent activation of EGFR-dependent signals may be sustained constituting an escape mechanism leading to EGFR-inhibitor resistance. Inhibition of Met appears to block the Met-driven escape mechanism used by tumor cells when treated with other targeted cancer therapies. Similarly, VEGFR resistance may be overcome by inhibiting Met.

MGCD265 Preclinical Development

Our preclinical studies, in a variety of in vivo tumor models, have suggested that MGCD265 has relatively low toxicity and appears more potent than some of the leading kinase inhibitors which have recently been approved or are in clinical trials, including Nexavar, Sutent and Xalkori.

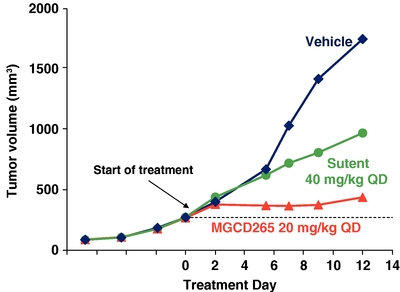

In preclinical studies, MGCD265 has demonstrated single agent activity as indicated in the figures below.

Anti-tumor Activity of MGCD265 Compared with Sutent in

a Met/HGF-Positive Glioblastoma Model

U87MG tumor cells were injected subcutaneously in immunocompromised mice. When tumor volume reached 50 mm3 mice were treated with MGCD265 or Sutent at the designated dose level or vehicle for 12 days. Tumor volume was measured at designated time points utilizing Vernier calipers.

6

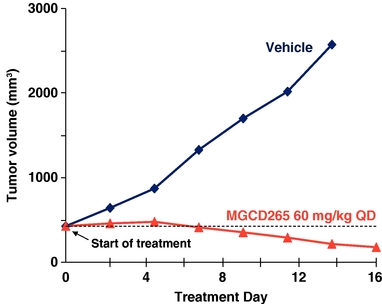

Potent Cytoreductive Activity of MGCD265 in a Met

Amplified Gastric Cancer Model

Met amplification positive MKN45 tumor cells (5 X106) were implanted subcutaneously in immunocompromised mice. When tumor volume reached 450 mm3 mice were treated with MGCD265 at the designated dose level or vehicle for 16 days. Tumor volume was measured at designated time points utilizing Vernier calipers.

MGCD265 Clinical Trials

Multiple Phase 1 clinical trials have been conducted with MGCD265 showing evidence of clinical activity as monotherapy as well as in combination studies. While MGCD265 showed some efficacy and selectively inhibited Met and Axl, it did not reach optimal plasma concentrations or sufficiently inhibit the targets. We are developing a new formulation of MGCD265 designed to increase plasma exposure, improve the degree of target inhibition and increase the likelihood of seeing single-agent clinical activity.

The original IND for MGCD265 was filed in December 2007 and became effective in January 2008. Three schedules of continuous dosing of MGCD265 were evaluated sequentially in the ongoing monotherapy and combination studies: once daily (QD), twice daily (BID) and three times daily (TID). MGCD265 has been generally well tolerated at all doses and schedules tested to date, both as monotherapy and in combination with either Taxotere or Tarceva.

Phase 1 Clinical Trial Evaluating MGCD265 in Solid Tumors (Ongoing)

This Phase 1, open-label, dose escalating clinical trial in patients with advanced solid tumors is evaluating MGCD265, administered orally every day in repeated 21-day cycles. Data is available for 79 patients who were treated with MGCD265 at doses escalating from 24 mg/m2 QD to a flat dose of 600 mg TID. Nine patients achieved stable disease for more than four months and up to nine months. One of these patients, who had squamous cell cancer, experienced a partial response after ten cycles of treatment based on one target axillary lesion. The non-target bone lesions remained stable. To date the safety profile continues to be favorable in this ongoing Phase 1 program. The most frequent treatment-related adverse events, observed in greater than 10% of patients, or grade 3 adverse events occurring in more than one patient, are summarized in the table below.

7

Adverse Events Observed in MGCD265

Monotherapy 265-101 (n=79)

| Most frequent treatment-related adverse events (>10%, all grades) |

Grade 3 adverse events occurring in > 1 patient | ||||||

|---|---|---|---|---|---|---|---|

Diarrhea |

52 | % | Diarrhea |

n=3 (DLT n=1) | |||

Fatigue |

30 | % | Fatigue |

n=3 (DLT n=1) | |||

Nausea |

33 | % | Lipase elevation |

n=2 (DLT n=1) | |||

Anorexia |

25 | % | Alk phosphatase elevation |

n=2 | |||

Vomiting |

20 | % | |||||

We expect to continue enrollment in this trial upon completion of ongoing MGCD265 formulation work.

Phase 1 Clinical Trial Evaluating MGCD265 in Solid Tumors (Complete)

In December 2011, we completed an open label Phase 1 clinical trial with dose-escalation of MGCD265 in patients with advanced solid tumors. We enrolled 47 patients with advanced solid tumors. Four patients (papillary renal cell, sarcomatoid bladder, neuroendocrine, and head and neck cancers) had prolonged stable disease with durations ranging from 4 to 12.9 months. The patient with sarcomatoid bladder cancer was stable for 7.5 months and exhibited decreases in Met and phospho-Met protein expression, as well as a change in intact vascular structures, in a post-treatment biopsy sample. The most frequent treatment-related adverse events, occurring in greater than 10% of patients, included diarrhea (30%), nausea (26%), and fatigue (26%). Most of these adverse events were reported as grade 1 or 2 in severity. The observed dose limiting toxicities, or DLTs, were grade 3 mood alteration (n=1) and grade 3 fatigue in the same patient and grade 3 hemoptysis (n=1) all at the dose of 170 mg/m2 BID (n=6). An additional grade 3 adverse event of increased lipase was also reported at a dose of 192 mg/m2 BID (n=1).

Phase 1/2 Clinical Trial Evaluating MGCD265 in Combination with Taxotere or Tarceva (Ongoing)

This dose-escalating Phase 2 clinical trial is evaluating MGCD265 in combination with Taxotere or Tarceva. Data is available for 124 patients treated with MGCD265 at doses of up to 700 mg BID taken with meals and administered in combination with full dose Tarceva or Taxotere. Overall, stable disease for 6 to 18 months was observed in nine patients: NSCLC (n=5), ovarian, prostate, pancreatic and head and neck cancer (n=1 each). Objective partial responses were observed in two out of sixteen patients with NSCLC, one out of four patients with prostate cancer, one out of two patients with head and neck cancer and the only patient with endometrial cancer.

Overall, the treatment was well tolerated and the adverse events observed are generally those associated with Taxotere or Tarceva treatment. The most common treatment-related non-hematologic adverse events observed to date have been constitutional or gastro-intestinal related and are summarized in the table below. Expected Taxotere associated adverse events of anemia (n=3, grade 3), leucopenia (n=5, grade 3-4) and neutropenia (n=31, grade 3 and 4) and one case of febrile neutropenia have also been observed. Grade 3 or higher adverse events occurring in more than one patient are summarized in the table below. In addition, one patient was reported to have a pulmonary embolism (grade 4) that was an incidental finding on CT scan. Another patient who had advanced NSCLC and was oxygen dependent at baseline, was diagnosed with fatal pneumonitis (inflammation of the lung tissue) (grade 5) in the context of worsening pleural effusion and increasing parenchymal consolidation. Additional cycle 1 DLTs reported in this study include grade 3 diarrhea (n=1), grade 3 lipase (n=1), grade 3 fatigue (n=1), elevated AST (n=1) and pancreatitis (n=1) in a patient with grade 3 lipase at baseline consistent with chronic pancreatitis.

8

Adverse Events Observed in MGCD265 Combination Therapy

Combination Therapy 265-103 with Taxotere (n=56)

| Most frequent treatment-related adverse events (>10%, all grades) |

Grade 3 adverse events or higher occurring in > 1 patient |

||||||

|---|---|---|---|---|---|---|---|

Fatigue |

53 | % | Neutropenia |

n=31 | |||

Alopecia |

45 | % | Leucopenia |

n=5 | |||

Diarrhea |

38 | % | Diarrhea |

n=3 (DLT n=1) | |||

Nausea |

32 | % | Elevated lipase |

n=3 (DLT n=2) | |||

Anorexia |

23 | % | Hypophosphatemia |

n=2 | |||

Constipation |

17 | % | |||||

Mucosal inflammation |

16 | % | |||||

Taste disturbance |

15 | % | |||||

Vomiting |

15 | % | |||||

Myalgia |

11 | % | |||||

Rash |

11 | % | |||||

As of the last data review in July 2013, 68 patients have been treated in the MGCD265-plus-Tarceva arm of our combination trial. Tarceva was started at a dose level of 100 mg (first dose level) and then escalated to 150 mg in combination with MGCD265.

Data is available for 68 patients treated with MGCD265 at doses of up to 700 mg BID taken with meals and administered in combination with Tarceva. Eight patients with a variety of tumors have experienced stable disease for six months or more. This includes two NSCLC patients, one of which had a partial response (also positive for EGFR activating mutation). Three out of nine patients with gastroesophageal cancer remained on study for approximately 11 to 34 months. Overall, the combination of MGCD265 with Tarceva has been well tolerated and the most common treatment-related adverse events are consistent with known Tarceva toxicity and include skin-cutaneous or gastro-intestinal related events. The most frequent treatment-related adverse events are summarized in the table below. No grade 4 or grade 5 toxicities have been reported in the Tarceva combination study.

Adverse Events Observed in MGCD265 Combination Therapy with Tarceva

Combination Therapy 265-103 with Tarceva (n=61)

| Most frequent treatment-related adverse events (>10%, all grades) |

Grade 3 adverse events occurring in > 1 patient |

||||||

|---|---|---|---|---|---|---|---|

Diarrhea |

75 | % | Diarrhea |

n=12 (DLT n=3) | |||

Fatigue |

39 | % | Hypokalemia |

n=3 | |||

Rash |

33 | % | Hypophosphatemia |

n=2 | |||

Anorexia |

21 | % | Fatigue |

n=1 (DLT n=1) | |||

Nausea |

18 | % | |||||

Dermatitis acneiform |

15 | % | |||||

Dry skin |

15 | % | |||||

9

Phase 1 Clinical Trial Evaluating the Pharmacokinetics of MGCD265 in Healthy Volunteers in a Fed versus Fasted State (Complete)

In 2012, a Phase 1 study in healthy volunteers (n=14) was conducted to compare the pharmacokinetics of a single 100 mg dose of MGCD265 under fed conditions versus those after a 10-hour overnight fast. Safety was evaluated in all subjects for seven days after each single dose. On average, the fed condition was associated with an approximately three-fold increase in exposure. All treatment-related adverse events were mild except for one patient who reported moderate diarrhea when dosed under fasting conditions. The study results indicated that exposures could significantly improve up to three-fold in the fed subjects and provided support for the formulation improvement work that was undertaken earlier this year.

MGCD265 Developmental Initiatives and Objectives

Since January 2013, we have developed new formulations of MGCD265 designed to increase plasma exposure, improve the degree of target inhibition and increase the likelihood of seeing single-agent clinical activity. Assuming one or more of the new formulations achieve sufficient patient exposure in ongoing studies, we intend to select one of the new formulations for introduction into ongoing dose escalation trials with the goal of identifying the MTD by early 2014. After the MTD is identified, we plan to initiate dose expansion cohorts in patients selected for Met and/or Axl over-expression as well as a cohort of patients that have genetic mutations of Met or Axl that we believe are drivers of tumor growth. Our initial focus for this program will include both NSCLC and HNSCC. Because the trial is open-label, we may see evidence of clinical activity from the expansion cohorts by mid-2014.

We believe that by selecting patients with over-expression of Met and/or Axl as well as patients with genetic mutations associated with pathways that are critical to tumor growth that are potently inhibited by MGCD265 may increase the likelihood of seeing clinical activity earlier in clinical development. We are currently using commercially available diagnostic assays as well as assays developed internally for early clinical uses. We are developing companion diagnostics in collaboration with third parties that we plan to use for later stage registration trials and commercialization, if approved.

MGCD516 — A Novel Multi-targeted Kinase Inhibitor for Solid Tumors

MGCD516 is an orally-bioavailable, potent, small molecule multi-targeted kinase inhibitor of RET, TRK, DDR and EphRs, as well as Met, Axl and VEGFRs, in development for the treatment of solid tumors. We plan to focus on solid tumors expressing RET, TRK and DDR, initially in NSCLC, and we plan to evaluate other tumor types where the profile of MGCD516 would suggest activity. MGCD516 is in advanced preclinical development. We plan to file an IND with the FDA, and initiate a Phase 1 clinical trial of this product candidate in the first half of 2014, and identify the MTD and initiate expansion cohorts in patients selected for certain biomarkers by the end of 2014.

MGCD516 has shown potent inhibition in vitro of cell proliferation, cell motility and angiogenesis. In preclinical animal studies, MGCD516 shows good oral bioavailability in mice, rats and dogs, and anti-tumor activities in multiple human xenograft tumor models in mice.

10

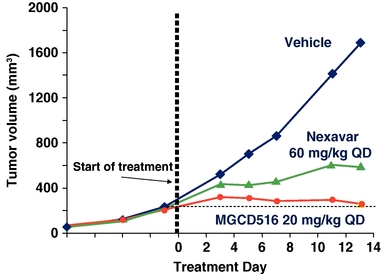

In preclinical lung cancer studies, MGCD516 demonstrated better tumor volume reduction activity than Nexavar as shown in the figure below.

Anti-tumor Activity of MGCD516 Compared with Nexavar

in the A549 Lung Cancer Model

A549 tumor cells were injected subcutaneously in immunocompromised mice. When tumor volume reached 50 mm3 mice were treated with MGCD516 or Nexavar at the designated dose level or vehicle for 13 days. Tumor volume was measured at designated time points utilizing Vernier calipers.

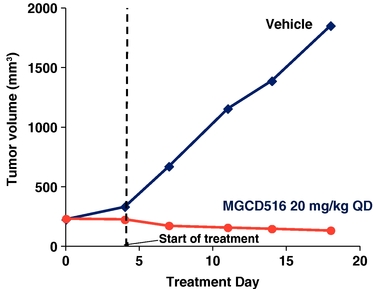

MGCD516 also demonstrated significant activity in a RET fusion lung cancer preclinical model shown in the figure below.

Potent Cytoreductive Activity of MGCD516 in a RET Fusion-

Positive Lung Cancer Model

KIF5B-RET fusion positive primary tumors were implanted subcutaneously in immunocompromised mice. When tumor volume reached 200 mm3 mice were treated with MGCD516 at the designated dose level or vehicle for 16 days. Tumor volume was measured at designated time points utilizing Vernier calipers.

11

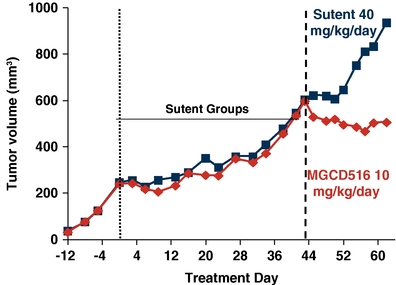

In addition, MGCD516 demonstrated activity in overcoming VEGFR resistance in a preclinical model treated with Sutent, as shown below.

Cytoreductive Anti-tumor Activity of MGCD516 in a Sutent-

Resistant Tumor Model

Primary tumors were implanted subcutaneously in immunocompromised mice. When tumor volume reached 250 mm3 mice were treated with Sutent for 44 days until they progressed to a volume of 600 mm3. Mice were randomized into two groups and treated with MGCD516 or Sutent at the designated dose level or vehicle for 18 additional days. Tumor volume was measured at designated time points utilizing Vernier calipers.

Mocetinostat — An Oral HDAC Inhibitor for MDS

Overview

Mocetinostat is an orally-bioavailable, spectrum-selective HDAC inhibitor for which we plan to conduct a dose confirmation trial starting in the fourth quarter of 2013, with the goal of initiating a Phase 3 clinical trial in the second half of 2014. We have completed 13 clinical trials which enrolled 437 patients with a variety of hematologic malignancies and solid tumors. We intend to seek an SPA from the FDA prior to the initiation of our planned Phase 3 trial. This trial will evaluate mocetinostat for the first line treatment of patients with MDS in combination with Vidaza, an HMA. We believe that mocetinostat has the potential to be the first HDAC inhibitor to market for this indication.

We believe that the epigenetic mechanisms of HDAC inhibitors and HMAs may be complementary in the treatment of MDS. Epigenetics is the regulation of gene expression and resulting cellular phenotypes through mechanisms other than primary DNA sequence alterations. The epigenetic regulation of gene expression involves the regulation of DNA methylation and modification of certain histones via modulation of acetylation or methylation of specific amino acid residues. Epigenetic pathways can become dysregulated during cancer progression through a variety of mechanisms, including the genetic alteration of molecules that participate in DNA methylation and histone modification. These alterations often result in silencing of selected tumor suppressor genes and uncontrolled tumor growth in certain malignancies including MDS and lymphomas. Because the epigenetic regulation of gene expression is controlled by DNA methylation and histone modification, we have focused on the development of mocetinostat for the treatment of MDS in combination with HMAs.

We partnered mocetinostat with Pharmion Corporation (predecessor to Celgene Corporation) in 2006. In 2008, Celgene voluntarily placed the mocetinostat program on clinical hold with the FDA following an

12

observation of pericarditis in clinical trials. Celgene subsequently terminated the collaboration in January 2009 and all rights to the mocetinostat program reverted to us. Following the termination and based upon a review of the safety data and discussion with the FDA, the clinical hold was removed in 2009. However, no further development was conducted by us under our prior management team. When our current management team joined us in late 2012, we began a detailed portfolio review and subsequently determined that further development of mocetinostat was warranted.

Mocetinostat Market Overview

The potential of HDAC inhibitors for the treatment of hematological malignancies has already been validated by the approval of two HDAC inhibitors, Zolinza and Istodax, for the treatment of T-cell lymphoma. Our clinical studies of mocetinostat indicate that this agent may have promising activity in MDS and other hematological malignancies such as Hodgkin's lymphoma, or HL, and non-Hodgkin's lymphomas, or NHL, including diffuse large B-cell lymphoma, or DLBCL, and follicular lymphoma, or FL.

Our primary focus for mocetinostat is on the first line treatment of patients with MDS. MDS consists of a group of heterogeneous, clonal hematopoietic stem cell disorders that are characterized by abnormal bone marrow and blood cell development. According to NCI, MDS will be diagnosed in more than 10,000 people in the United States in 2013. Utilizing Surveillance Epidemiology and End Results data from NCI, Decision Resources estimates the prevalence of MDS to be over 52,000 patients in the United States and over 49,000 patients in the European Union.

MDS is a complex and heterogeneous disease, divided into patient subgroups with differing therapy objectives. The International Prognostic Scoring System, or IPSS, for MDS was developed to assess patient prognosis and guide the course of treatment of MDS, and utilizes clinical variables such as bone marrow blast percentage, number of peripheral blood cytopenias and cytogenic risk group to categorize MDS patients and provide prognostic expectations. Approximately one-quarter of MDS patients are classified as high-risk (Intermediate-2 or high IPSS risk category). Prognosis for these high-risk MDS patients is generally poor and there is a significant medical need for therapeutic regimens that will improve clinical outcomes.

The standard of care, according to the National Comprehensive Cancer Network, for first line therapy for Intermediate-2 and high-risk patients is treatment with HMAs. The HMAs Vidaza and Dacogen are approved as first line agents for the treatment of high-risk MDS patients in the United States, and 2012 U.S. sales were approximately $327 million and $240 million, respectively. Although these therapies represent the standard of care for the treatment of high-risk MDS patients, only a minority of patients achieve an objective response. Almost all patients who initially respond to therapy eventually relapse, and the survival time of MDS patients who have failed HMAs is less than six months. Allogenic hematopoietic stem cell transplantation, or HSCT, is the only potential curative treatment for MDS; however, its use is restricted to a relatively small number of eligible patients and requires an appropriate donor.

NHL (including the aggressive DLBCL and FL) is the most common form of blood cancer. NCI estimates that 70,000 patients will be diagnosed with NHL in the United States in 2013 and that the incidence has grown annually over the past ten years. The prevalence of NHL in the United States is 509,000. Aggressive NHL is treated with rituximab (anti-CD20) plus chemotherapy, which is effective in about 67% of cases, but relapsed or refractory aggressive NHL has a poor outlook with limited therapeutic options.

NCI estimates that 9,300 patients will be diagnosed with HL in the United States in 2013 and that the prevalence of HL in the United States is 182,000. Treatments of HL typically include radiation, chemotherapy and HSCT. Chemotherapy followed by consolidation radiation therapy is the most effective treatment for early-stage HL. Current approaches seek to balance efficacy against the risk of long-term complications such as cardiac disease and other types of cancer. Patients with refractory HL currently have few therapeutic options such as high dose chemotherapy followed by stem cell transplant or brentuximab vedotin (anti-CD30 antibody conjugated to cytotoxin).

13

We believe that a significant unmet medical need remains for effective treatment that increases the response rates in patients with Intermediate-2 and high-risk MDS, HL and NHL.

Mocetinostat Background

Histones are protein components of the structural architecture of DNA known as chromatin (chromatin is the material that chromosomes are made of, and is comprised of DNA and protein). Local gene expression activity can be controlled through epigenetic mechanisms by inducing changes in chromatin conformation through chemical modifications of histones. Acetylated histones are associated with a more open configuration of chromatin that is receptive to gene expression signals. In contrast, HDAC leads to a more compact structure where gene expression is restricted or suppressed. Tumor suppressor genes serve to regulate cell growth and cell death, but during oncogenesis these tumor suppressor genes may become silenced by the action of HDACs leading to unrestricted growth of tumor cells. HDAC is a family of 11 enzymes (the individual HDAC enzymes are referred to as isoforms) that appear to act as a master regulator of genes affecting many diseases, including cancer. HDAC inhibitors modulate inappropriate deacetylation of histones to restore normal acetylation patterns as well as tumor suppressor gene expression. Inhibition of HDACs may result in multiple anti-cancer effects such as (1) the inhibition of cancer cell proliferation, (2) the induction of apoptosis of cancer cells, (3) improved cell cycle regulation, and (4) the induction of tumor suppressor genes.

We believe that a key differentiating feature of mocetinostat is its spectrum of activity, targeting HDAC isoforms 1, 2, 3 and 11. We believe that these isoforms, and particularly isoforms 1 and 2, are the most relevant HDAC isoforms in cancer therapy. Compared to other HDAC inhibitors that have a broader spectrum of activity, the profile of mocetinostat may allow us to inhibit the targets relevant to cancer more potently and thereby potentially demonstrate improved clinical efficacy and reduced side effects.

Mocetinostat Clinical Development

Our IND for mocetinostat was submitted in December 2003 and became effective in January 2004. To date, we have evaluated mocetinostat as a monotherapy and in combination with other anticancer agents in 437 patients in Phase 1 and Phase 2 clinical trials with various malignancies, including MDS, HL, NHL (including DLBCL or FL), AML, chronic lymphocytic leukemia and chronic myelogenous leukemia, as well as advanced solid tumors. Through these trials, the safety and tolerability of mocetinostat as a single agent and in combination has been well characterized. The clinical trials showed activity as a single agent in HL and NHL and in combination with Vidaza in MDS and AML.

14

The historical mocetinostat clinical trials are set forth in the following table.

CLINICAL TRIALS EVALUATING MOCETINOSTAT

| Phase 1 Clinical Trial | Daily dosing regimen (14 days on, 7 days off) | |

Three times weekly (14 days on, 7 days off) |

||

Three times weekly (continuously) |

||

Twice weekly (continuously) |

||

Phase 2 Monotherapy Clinical Trial |

AML/High-risk MDS |

|

Relapsed/Refractory NHL (DLBCL, FL) |

||

Refractory chronic lymphocytic leukemia |

||

Relapsed/Refractory HL |

||

Phase 1/2 Combination Clinical Trial with Vidaza |

AML and MDS |

|

Other Clinical Trials |

Phase 1/2 clinical trial of Mocetinostat in Combination with Gemcitabine |

|

Combination of mocetinostat with Vidaza and with Taxotere |

MDS

In late 2012 and early 2013, our new management team reviewed the data from our prior clinical trials of mocetinostat. As a result, our management team concluded that the combination of mocetinostat and Vidaza demonstrated clinically meaningful responses in MDS patients and demonstrated an improvement over published responses of Vidaza alone. The objective response rate of Vidaza, as shown in its product label, is 15.7%, with 5.6% of patients achieving a complete response, or CR, compared to CR's in 11% of the patients in the mocetinostat data as set forth in the table below. A complete response generally refers to the disappearance of all signs of cancer in response to treatment, while a partial response generally refers to a decrease in the size of the tumor or in the extent of cancer in the body.

In an open-label, Phase 1/2 trial of patients with MDS or AML that was conducted starting in 2006, we evaluated the activity of mocetinostat in combination with Vidaza in patients with MDS. A total of 66 subjects were enrolled, including 28 patients with MDS as assessed by independent analysis. Patients with MDS were treated with mocetinostat at starting doses of 35 to 135 mg three times weekly, with most patients starting at 90 mg, and continued treatment until disease progression or prohibitive toxicity. Among the 28 patients with MDS, the ORR (CR+CRi+HI) was 61% (17 of 28), and the disease control rate (CR+CRi+HI+SD) was 93% (26 of 28) in an independent assessment. A summary of this data is set forth in the table below.

15

MOCETINOSTAT COMBINED WITH VIDAZA PHASE 2 CLINCIAL DATA

MDS Best Response Rates (n=28) |

n (%) | |

CR+CRi |

14 (50) | |

CR |

3 (11) | |

CRi |

11 (39) | |

HI |

3 (11) | |

SD |

9 (32) | |

ORR (CR + CRi +HI) |

17 (61) | |

Disease Control (CR + CRi + HI + SD) |

26 (93) |

CR = complete response; CRi = complete marrow response but without normalization of peripheral counts; HI = hematologic improvement; SD = stable disease; ORR = objective response rate.

Mocetinostat Safety

In the mocetinostat plus Vidaza study, the most commonly reported adverse events are set forth in the tables below. These adverse events are generally consistent with those seen in MDS and AML patients treated with this class of agent.

|

|

||||||||

|---|---|---|---|---|---|---|---|---|

| |

|

Treatment-related Adverse Events (Grades 3 and 4) Mocetinostat with Vidaza, MDS & AML Patients |

||||||

| Most Common Treatment-related Adverse Events (All Grades) Mocetinostat with Vidaza, MDS & AML Patients |

||||||||

| |

|

Grade 4 | ||||||

| EVENT | Patients, n(%) | EVENT | Grade 3(1) | |||||

Nausea |

44 (67) | Fatigue |

15 (23) | 0 (0) | ||||

Diarrhea |

43 (65) | Nausea |

14 (22) | 0 (0) | ||||

Fatigue |

32 (49) | Diarrhea |

11 (17) | 1 (2) | ||||

Anorexia |

30 (46) | Vomiting |

9 (14) | 0 (0) | ||||

Asthenia |

22 (33) | Anemia |

6 (9) | 1 (2) | ||||

Weight loss |

16 (24) | Anorexia |

6 (9) | 0 (0) | ||||

Thrombocytopenia |

13 (20) | Dehydration |

5 (8) | 0 (0) | ||||

Anemia |

10 (15) | Asthenia |

4 (6) | 0 (0) | ||||

Hypokalemia |

9 (14) | Thrombocytopenia |

3 (5) | 6 (9) | ||||

Constipation |

8 (12) | Leukopenia |

2 (3) | 2 (3) | ||||

Dysgeusia |

8 (12) | Neutropenia |

1 (2) | 4 (6) | ||||

Dehydration |

7 (11) | |||||||

Dizziness |

7 (11) | |||||||

- (1)

- Excludes Grade 3 adverse events with an incidence less than 5%.

Pericarditis Finding and Clinical Hold

In July 2008 Celgene instituted a voluntary clinical hold to new patient enrollment for mocetinostat, which was accepted by the FDA in August 2008. The voluntary clinical hold was put in place in response to an observation of pericarditis and pericardial effusion (inflammation of the pericardium, the fibrous sac surrounding the heart, and accumulation of fluid around the heart).

16

We provided the FDA with an integrated analysis of pericardial events identified in mocetinostat clinical studies. A causal association of mocetinostat with pericardial events was not established since the observed events could be related to the patient population and their prior therapy. Of the 437 patients treated with mocetinostat, there have been a total of 19 patients (4.3%) who had serious adverse events, or SAEs, where a pericardial adverse event was mentioned, and a total of 45 patients (10.3%) who had pericardial findings, which included the 19 SAE findings as well as 27 incidental findings identified through reviews of on-study CT scans, database searches and prospective echocardiogram monitoring, which did not have significant clinical sequellae. Only one pericardial SAE occurred among the 28 patients (3.6%) with MDS in the Phase 1/2 clinical trial. Based on literature reviews and other investigator-driven reviews, the rate of pericardial findings is approximately 10% of cancer patients, but rates have been reported to vary from 3% to approximately 40% for patients with advanced cancers who may have received multiple previous anticancer therapies. However, the potential exists for a relationship with treatment, and the possibility of mocetinostat being a contributing factor to the occurrence of pericardial events has not been excluded. We agreed with the FDA that the best way to assess the risk of pericarditis is in a sufficiently large randomized study of safety and efficacy.

Our complete response to the voluntary clinical hold was accepted by the FDA and the hold was lifted in September 2009. Our response included specific guidance for identifying patients at potential risk for, and guidance to manage patients who develop, pericarditis or pericardial effusions. As a result, new patient enrollment in mocetinostat clinical trials will include both the exclusion of patients who are diagnosed with cardiac abnormalities prior to starting mocetinostat therapy (i.e. myocardial infarction, congestive heart failure and pericardial disease) and patient monitoring by electrocardiogram and echocardiography at baseline and while on study. These diagnostic tests are non-invasive and relatively common procedures. The three patients with lymphoma who were enrolled after the voluntary clinical hold was lifted did not show signs of pericarditis or pericardial effusions.

Lymphoma

We tested the safety and efficacy of mocetinostat in patients with relapsed HL in a trial starting in 2006. Two doses were assessed (85 mg and 110 mg three times weekly), and patients were treated until disease progression or prohibitive toxicity. A total of 51 patients were enrolled. On the basis of intent-to-treat analysis, the disease control rate was 35% (8 of 23 patients) in the 110 mg group and 25% (7 of 28) in the 85 mg group. A total of 12 patients discontinued treatment because of adverse events, nine in the 85 mg cohort and three in the 110 mg cohort. The most frequent treatment-related grade 3 and 4 adverse events were neutropenia, fatigue and pneumonia. Four patients in the 110 mg cohort died during the study.

We also tested the safety and efficacy of mocetinostat in patients with relapsed/refractory DLBCL and FL in a trial starting in 2006. Patients continued treatment until disease progression or prohibitive toxicity. A total of 72 patients were enrolled. On the basis of intent-to-treat analysis, the objective response rate was 17% (7 of 41 patients) in patients with DLBCL and 10% (3 of 31) in patients with FL. Initially, 32 patients began treatment at 110 mg three times weekly (21 with DLBCL and 11 with FL), 37 additional patients were treated with a dose of 85 mg three times weekly (20 with DLBCL and 17 with FL) and 3 FL patients were treated with a dose of 70 mg three times weekly. The most commonly reported adverse events included myelosuppression and fatigue.

Mocetinostat Developmental Plans

Subject to successful completion of our planned dose confirmation trial, we are planning to initiate a Phase 3 registration trial for mocetinostat in the second half of 2014. The proposed randomized trial is intended to support regulatory approval of mocetinostat in combination with Vidaza for the treatment of patients with Intermediate or High-Risk MDS who have not previously received Vidaza, and for whom Vidaza is indicated.

In advance of the Phase 3 trial and subject to receipt of additional financing, we plan to conduct a dose confirmation trial to confirm the planned Phase 3 dose and to obtain further clinical data and test safety

17

monitoring protocols. The study is expected to be initiated in the fourth quarter of 2013 and to include approximately 30 patients, with 10 patients treated with mocetinostat at the 70 mg dose level and 20 patients treated at the 90 mg dose level, each in combination with Vidaza, in a single arm open-label study. The current proposed dose of mocetinostat for this Phase 3 clinical trial is 90 mg.

The proposed registration trial is expected to be a 1:1 randomized study comparing mocetinostat plus Vidaza with Vidaza alone in HMA naïve subjects who have been diagnosed with MDS and that have met criteria for the risk groups of Intermediate or high-risk according to IPSS. Although we have guidance from the FDA on certain key points, we intend to seek an SPA from the FDA on the design of the Phase 3 clinical trial. We intend to propose to the FDA an adaptive study design and intend to discuss both ORR and OS as potential endpoints for the basis for approval. While the detailed clinical and statistical plan are still under discussion and evaluation, the size range for the trial is currently estimated to be between 250 and 500.

We anticipate that the trial will include eligibility criteria to exclude patients with pre-existing pericardial effusion, on-study monitoring including echocardiograms and electrocardiograms in both treatment arms, and data monitoring safety committee oversight for potential adverse events including those specifically related to pericardial events.

We are also evaluating potential future development of mocetinostat in patients with NHL and HL.

Strategic Alliances and Commercial Agreements

Collaboration with Taiho

In October 2003, we entered into a license and research and development collaboration agreement with Taiho, a leading Japanese specialty oncology company, for mocetinostat and our small molecule HDAC inhibitor program for oncology for Japan, South Korea, Taiwan and China, or collectively the Taiho Territory. Under the terms of the agreement, we received an up-front license fee, equity investment and a contract research payment of $3.8 million. In addition, we may receive milestone payments based on successful development, regulatory approval, and commercialization of an HDAC oncology product totaling up to $16.2 million. We may also receive royalty payments in connection with commercial sales of HDAC oncology products as a percentage of annual net sales, which percentage is in the mid-single digit to mid-teen percent range, depending upon the total dollar amount of annual net sales. Such royalties may be reduced, subject to a mid-single digit floor, by (i) credits against recoupable development costs paid by Taiho to us and/or (ii) reduction by a percentage in the range of 20-30% in the event a generic competitor is introduced in a particular market, other than in China. Taiho provided us with contract research payments for scientists for two years at $2.0 million per year as well as funding for contract preclinical and contract clinical development costs in North America for mocetinostat, which totaled, in the aggregate, $5.4 million. In total, we have received $15.0 million from Taiho under the agreement, including a $1.5 million milestone payment relating to the start of the first Phase 2 trial with mocetinostat. However, upon the execution of our agreement with Celgene in 2008, Taiho's funding obligations for clinical trials in North America ceased. In addition, Taiho's collaboration entailed in-kind support in their research laboratories in order to select a next generation compound, and in some cases, will support a portion of preclinical development costs in North America. Currently, there are no efforts by either (i) Taiho to further advance mocetinostat in the Taiho Territory or (ii) Taiho or us to further advance other small molecule HDAC inhibitors that would be covered by this agreement. However, Taiho has retained rights in the Taiho Territory to certain sirtuin inhibitors for cancer. The term of the agreement will, on a country-by-country basis, continue until expiration of the last to expire issued patent, or ten years after the first commercial sale in Japan. Additionally, Taiho has a unilateral right to terminate the agreement for any reason with 30 days written notice, and we have a unilateral right to terminate the agreement if Taiho fails to make an undisputed payment. An arbitrator may terminate the agreement for a breach of obligations if such breach has remained uncured for 90 days. As long as the agreement continues, we are obligated to use reasonable efforts to contract with Taiho for our supply of the active bulk compounds for the sale of mocetinostat

18

outside of the Taiho Territory. In the event the parties wish to collaborate on the development of another HDAC inhibitor covered by this agreement or sirtuin inhibitor retained by Taiho, Taiho would be obligated to contribute to preclinical and clinical costs of such a compound. Such a compound would also be subject to potential development milestones and royalties. We are in preliminary discussions with Taiho to consider whether any amendments to the agreement should be made based upon our development plans for mocetinostat and their rights under the agreement.

Collaboration with Otsuka

In March 2008, we entered into a worldwide research collaboration and license agreement with Otsuka, a global Japanese pharmaceutical company, for the development of novel, small molecule, kinase inhibitors for local delivery and treatment of ocular diseases, excluding cancer. We were responsible for the design, characterization and initial screening of kinase inhibitors and control over determining which compounds to synthesize. Otsuka was responsible for funding efficacy and toxicity studies, as well as preclinical and clinical development of compounds. Otsuka is also responsible for the global commercialization of any resulting product. Under the terms of the agreement, we received an up-front license fee of $2.0 million. We may receive additional payments based on successful development, regulatory, commercialization and sales milestones that could total up to $50.5 million. We may also receive royalty payments in connection with commercial sales of licensed products under the agreement as a percentage of annual net sales, which percentage is in the mid-single digit to mid-teen percent range, depending upon the total dollar amount of annual net sales, subject to reduction by a percentage in the range of 40-50% in the event a generic competitor is introduced in a given market or intellectual property protection in a particular market does not exist or expires in a given market. We may receive aggregate milestone payments of up to $50.5 million under this agreement as follows: $7.5 million relates to development activities, $22.0 million relates to the completion of regulatory approvals and $21.0 million relates to the achievement of certain sale goals. Otsuka provided $1.9 million in research funding for the initial 18 months of the research collaboration, which was extended on three occasions: September, 2009; April 2010 and June 2010. The research component of the agreement ended on June 30, 2011. We received a total of $4.5 million in research funding from the research component of this agreement. In October 2009, Otsuka made, in connection to the terms of the agreement, a $1.5 million equity investment in our shares of common stock at a share price of CND$21.30 (or US$20.27, as converted), which was a 20% premium over the five-day volume-weighted average closing price at the date of the transaction. On June 30, 2010, the collaboration agreement was amended to, among certain other changes, provide Otsuka the rights to synthesize a limited number of compounds predetermined by us. A lead molecule was selected in June 2011 for further development. The research portion of the collaboration between us and Otsuka concluded on June 30, 2011; however, the term of the agreement will, on a country-by-country basis, continue until expiration of the last to expire issued patent, or if no patent has issued in such country, then 12 years after the first sale of a licensed product by Otsuka. Otsuka has a unilateral right to terminate the agreement for any reason with 90 days written notice and either party may terminate the agreement for a breach of obligations of the other party if such breach has remained uncured for 120 days (or 30 days for a breach of payment). Otsuka is currently advancing the lead compound through late preclinical development.

Collaboration with EnVivo

In March 2004, we entered into a proof of concept and option agreement with EnVivo, a private U.S. biotechnology company focusing on the treatment and prevention of certain neurodegenerative diseases, to exploit our HDAC inhibitors in diseases such as Huntington's disease, Parkinson's disease and Alzheimer's disease. In February 2005 we signed an exclusive research, collaboration and license agreement. Over the course of 2005, EnVivo paid us $0.6 million for research, plus a $0.5 million license fee, for a total of $1.1 million. As part of this agreement, EnVivo received a warrant to purchase 1,050 shares of common stock at an exercise price of CND$214.30 (or US$203.76, as converted). The warrant expired in March 2007. In February 2008, we exercised our right to opt-out of the program. As a result, we granted EnVivo exclusive rights to our HDAC inhibitors for neurodegenerative diseases and we ceased research and development funding for this program. We are prohibited under the surviving terms of the agreement with

19

EnVivo from developing or commercializing any HDAC products in the field of certain neurodegenerative diseases, including Huntington's disease, Parkinson's disease and Alzheimer's disease. We may receive royalty payments in an aggregate amount equal to a single digit percentage of net sales of any approved compound and will share in any sublicense income from future partnerships that EnVivo may enter into.

Intellectual Property

Patents and Proprietary Technology

Our goal is to obtain, maintain and enforce patent protection wherever appropriate for our product candidates, formulations, processes, methods and any other proprietary technologies and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries. Our practice is to actively seek to obtain, where appropriate, intellectual property protection for our current product candidates and any future product candidates, proprietary information and proprietary technology through a combination of patents, protection of proprietary know-how and trade secrets, and contractual arrangements, both in the United States and abroad. However, patent protection may not afford us with complete protection against competitors who seek to circumvent our patents. We also depend upon the skills, knowledge, experience and know-how of our management and research and development personnel as well as that of our advisors, consultants and other contractors. To help protect our proprietary know-how that is not patentable, we seek to put in place appropriate internal policies for the management of confidential information, and require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit the disclosure of confidential information and which require disclosure and assignment to us of the ideas, developments, discoveries and inventions important to our business.

We typically file for patents in the United States with counterparts in certain countries in Europe and certain key market countries in the rest of the world, thereby covering the major pharmaceutical markets. As of September 30, 2013, we own or co-own 51 U.S. patents and patent applications and their foreign counterparts, including 25 issued U.S. patents as reflected in the following table:

Granted and Pending U.S. Patents

Program

|

Granted (United States) | Pending (United States) | |||||

|---|---|---|---|---|---|---|---|

Kinase |

8 | 10 | |||||

Hos 2 and HDAC |

10 | 15 | |||||

Beta-Lactamase |

6 | 1 | |||||

DNMT |

1 | 0 | |||||

TOTAL |

25 | 26 | |||||

Kinase — (8 granted U.S. patents; 10 pending U.S. patent applications)

As of September 30, 2013, we have eight issued patents and ten pending patent applications in the United States covering inhibitor compounds, including MGCD265 and MGCD516, and methods of use of these compounds. Of these issued patents, one covers multiple series of kinase inhibitors and protects MGCD265 generically. Another issued patent, which expires no earlier than 2026, protects a selection of compounds including MGCD265, as well as methods of inhibiting VEGF and HGF receptor signaling dual methods of treating angiogenesis-mediated cell proliferative disease or inhibiting solid tumor growth. Exclusivity arising from our issued patents for MGCD265 extends to at least 2026, including our patents covering the specific composition of matter of MGCD265 (expires 2026, prior to any legal or regulatory extensions, including any patent term extension, that may be available under the Hatch Waxman Act) and the generic class of compounds to which MGCD265 belongs (expires 2025, prior to legal or regulatory extensions, including any patent term extension, that may be available under the Hatch Waxman Act). Another four issued patents

20

cover several distinct classes of compounds. Such coverage includes specific claims to MGCD516, generic coverage of the class of compounds to which MGCD516 belongs, as well as patents covering methods of use of such compounds. Exclusivity arising from our patent protection for MGCD516 extends to at least 2029, prior to legal or regulatory extensions, including any patent term extension that may be available under the Hatch Waxman Act.

Our pending patent applications relating to our kinase inhibitors seek coverage of a broader scope of kinase inhibitors both for oncology and for the treatment of ophthalmic diseases. Methods of use of these inhibitors, such as methods of inhibiting VEGF and HGF receptor signaling, methods of treating angiogenesis-mediated cell proliferative disease or inhibiting solid tumor growth, as well as processes of manufacturing kinase inhibitors such as MGCD265 and synthetic intermediates required for the purpose are also being pursued.

Hos2 and HDAC Programs — (10 granted U.S. patents; 15 pending U.S. patent applications)

Our patent estate for our Hos2 and HDAC programs covers multiple series of HDAC inhibitors, including MGCD290 and mocetinostat. This group of patents includes 10 issued patents and 15 pending patent applications in the United States protecting composition of matter and method of use. One issued patent covers the Hos2 inhibitor MGCD290 both generically and specifically. Exclusivity arising from our patent protection for MGCD290 should extend to at least 2020, and exclusivity arising from our issued patents claiming the combination of MGCD290 with antifungal agents extends to 2026, prior to any legal or regulatory extensions that may be available to us. Exclusivity for mocetinostat extends to 2022 prior to legal or regulatory extensions, including any patent term extension that may be available under the Hatch Waxman Act.

In aggregate, these U.S. patents and patent applications cover the following inventions: novel HDAC inhibitors, including mocetinostat (eight issued patents and nine patent applications), methods of inhibiting HDACs, methods for treating cell proliferative disease or cancer, specific methods for treating colon, lung and pancreatic cancers, methods for treating polyglutamine expansion diseases (such as Huntington's disease) and methods for treating fungal infection. Three applications claim compositions of HDAC/Hos2 inhibitors with antifungal compounds, methods of enhancing the activity of the antifungal compounds with HDAC/Hos2 inhibitors, and methods of treating fungal infection. One pending application also seeks protection of the analogs of MGCD290 as well as prodrugs of HDAC/Hos2 inhibitors and their use, while another pending application claims methods for identifying/screening potentiators of antifungal compounds, the inhibitors of ergosterol biosynthesis. A provisional application is directed to novel HDAC/Hos2 inhibitors and their use.

Beta-Lactamase — (6 granted U.S. patents; 1 pending U.S. patent applications)

For our beta-lactamase inhibitor program, we co-filed two patent applications with Merck and Merck has since returned all rights to these patents to us. In line with our corporate objectives to promote the partnering and development of our lead beta-lactamase inhibitor, MG96077, we are currently supporting the prosecution of only one granted patent (coverage until 2027) that protects this molecule both specifically and generically. The majority of the other patents are in the process of abandonment.

DNMT Program — (1 granted U.S. patent)

In our DNA methyltransferase program, we own one U.S. patent specifically covering MG98. This U.S. patent covers MG98 and methods for inhibiting tumor growth with it. We may abandon this patent in the future as we are no longer pursing this program.

Licensing Agreements

We may enter into license or sub-license agreements when we believe such license is required to pursue a specific program.

21

Competition

Competitors in Oncology — Small Molecule Kinase Inhibitors

A large number of kinase inhibitors are currently in clinical trials, with many more in the early research stage. Biotechnology and pharmaceutical companies are also developing monoclonal antibodies to kinase targets and their ligands.

The Met kinase inhibitor field has recently generated intense scientific and industry interest. We believe that most of the biotechnology and pharmaceutical companies developing small molecule drugs for cancer have significant and active kinase inhibitor programs (including Met programs) that may be competitive with our own and these competitors are described below. Our MGCD265 program is attractively positioned in the pipeline of Met-targeted molecules and is characterized by potential advantages including: a unique kinase spectrum including the emerging RTK target Axl; a lack of activity against over 400 off-target kinases, supporting a favorable safety profile; and excellent tolerability to date with other anti-cancer agents (including chemotherapy), thus optimizing the potential for combination therapy approaches.

Companies with Met inhibitors believed to be in late preclinical or clinical development include, but are not limited to: Amgen Inc., ArQule Inc. and its partners Kyowa Hakko Kirin Pharma Inc. and Daiichi Sankyo Company Limited, Aveo Pharmaceuticals Inc., Bristol-Myers Squibb Company, Exelixis Inc., F. Hoffman-LaRoche Ltd., GlaxoSmithKline PLC, Novartis AG and Pfizer.

Axl is a newly emergent RTK target. However, a small number of RTK inhibitors that are launched in development are believed to inhibit Axl. These include foretinib (in Phase 2 development by Exelixis) and Xalkori.

Many companies have filed, and continue to file, patent applications which may or could affect our program if and when they issue, either because they protect a product that may compete with our product candidates, or because they protect intellectual property rights that are necessary for us to develop and commercialize our product candidates. These companies include, but are not limited to: Bristol-Myers Squibb, Compugen Limited, Exelixis, GlaxoSmithKline, Novartis and Pfizer. Since this area is competitive and of strong interest to pharmaceutical and biotechnology companies, we expect that these and other companies will continue to publish and file patent applications in this space in the future, as well as pursuing research and development programs in this area. We continue to monitor these and other companies in order to be aware of any third party products and/or intellectual property rights relevant to our products.

Competitors in Oncology — Mocetinostat Competitors

We believe that a key differentiating feature of mocetinostat is its spectrum of activity, covering only isoforms 1, 2, 3 and 11, the most relevant HDAC isoforms in human disease. Other companies that are developing spectrum-selective HDAC inhibitors in development include but are not limited to Acetylon Pharmaceuticals, Inc., Chroma Therapeutics Ltd., Shenzen Chipscreen Biosciences Ltd. and Syndax Pharmaceuticals Inc.

Companies with Pan-HDAC inhibitors, which are HDAC inhibitors that have an effect across a broader range of HDAC isoforms and therefore not as selective as molecules like mocetinostat, include but are not limited to: Celgene, Curis Inc., MEI Pharma Inc., Merck, Novartis, Pharmacyclics Inc. and others. We expect that these and other companies may continue to pursue research and development in relation to HDAC inhibitors. We continue to monitor these and other companies in order to be aware of any third party products and/or intellectual property rights relevant to our products.

Competitors in Oncology — General Competitors

In addition to companies that have HDAC inhibitors or kinase inhibitors addressing oncology indications, our competition also includes hundreds of private and publicly traded companies that operate in the area of oncology but have therapeutics with different mechanisms of action. The oncology market in general is highly competitive, with over 1,000 molecules currently in clinical development. Other important competitors, in addition to those mentioned above, include, but are not limited to: small and large

22

biotechnology companies, including but not limited to Amgen, Ariad Pharmaceuticals Inc., ArQule, Biogen Idec Inc, Celgene and Exelixis; and specialty and regional pharmaceutical companies and multinational pharmaceutical companies, including but not limited to, Abbott Laboratories Inc., Astellas Pharma Inc., AstraZeneca plc, Bayer-Schering Pharmaceutical, Boehringer Ingelheim AG, Bristol-Myers Squibb, Eisai Co. Ltd., Eli Lilly and Company, F. Hoffmann-LaRoche Ltd., GlaxoSmithKline, Johnson & Johnson, Merck, Novartis, Pfizer, Sanofi-Aventis, Taiho and Takeda Pharmaceutical Co.

Manufacturing

We do not own or operate manufacturing facilities for the production of MGCD265, mocetinostat or any of our other product candidates, nor do we plan to develop our own manufacturing operations in the foreseeable future. We currently depend on third-party contract manufacturers for all of our required raw materials, API and finished products for our preclinical and clinical trials.