Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VECTOR GROUP LTD | v355870_8k.htm |

September 26, 2013 / Confidential Vector Group Ltd. Investor Presentation

Disclaimer This document and any related oral presentation does not constitute an offer or invitation to subscribe for, purchase or otherwise acquire any securities or other debt instruments of Vector Group Ltd. (“the Company”) and nothing contained herein or its presentation shall form the basis of any contract or commitment whatsoever. The distribution of this document and any related oral presentation in certain jurisdictions may be restricted by law and persons into whose possession this document or any related oral presentation comes should inform themselves about, and observe, any such restriction. Any failure to comply with these restrictions may constitute a violation of the laws of any such other jurisdiction. The information contained herein does not constitute investment, legal, accounting, regulatory, taxation or other advice and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making your own independent assessment of the information. You are solely responsible for seeking independent professional advice in relation to the information and any action taken on the basis of the information. The following presentation may contain "forward-looking statements,” including any statements that may be contained in the presentation that reflect our expectations or beliefs with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of the Company. Results actually achieved may differ materially from expected results included in these forward-looking statements as a result of these or other factors. Due to such uncertainties and risks, potential investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date on which such statements are made. 1 1

Management Team 2 2 Name Position Years at Company Howard M. Lorber President and Chief Executive Officer 19 Richard J. Lampen Executive Vice President 18 Ronald J. Bernstein President and Chief Executive Officer of Liggett Group LLC and Liggett Vector Brands LLC 22 J. Bryant Kirkland III Vice President, Chief Financial Officer and Treasurer 21 Marc N. Bell Vice President, General Counsel and Secretary 19 Key Management

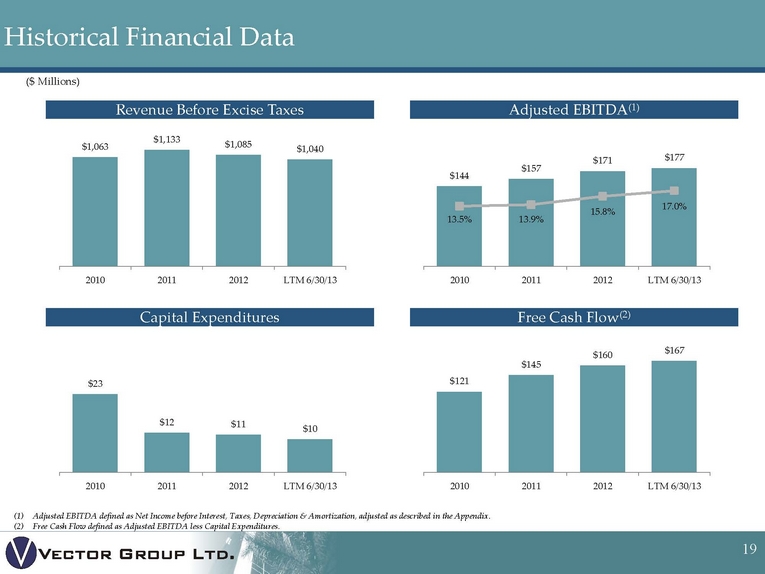

Introduction 3 3 Vector Group Ltd. (¡§Vector¡¨ or the ¡§Company¡¨) is a holding company that is engaged in: „X The manufacture and sale of cigarettes in the United States through its subsidiaries Liggett Group LLC and Vector Tobacco Inc. (together, ¡§Liggett¡¨) ¢w Fourth-largest U.S. tobacco company for the 12 months ended June 30, 2013 ¢w Strong and growing cash flow ¢w Stable market share driven by value price positioning „X Real estate operations conducted through New Valley LLC (¡§New Valley¡¨) ¢w Proven track record of successful real estate investments Publicly listed on the NYSE under ticker VGR with a market capitalization of approximately $1.5 billion For the twelve months ended June 30, 2013 (¡§LTM¡¨), the Company generated revenues and Adjusted EBITDA of $1,039.9 million and $176.7 million, respectively (17.0% margin)(1) 18-year track record of dividends The Company is modestly levered with 2.8x senior secured leverage and 0.3x net senior secured leverage (1) Adjusted EBITDA defined as Net Income before Interest, Taxes, Depreciation & Amortization, adjusted as described in the Appendix.

Key Investment Highlights Historically strong financial performance „Ÿ Adjusted EBITDA from Vectorfs tobacco subsidiaries (gLiggett Adjusted EBITDAh) was $192.1 million for the LTM period ended June 30, 2013(1)(2) Key price advantage resulting from Master Settlement Agreement (gMSAh)(3) „Ÿ Current price advantage of 62 cents per pack compared to the three largest U.S. tobacco companies and quality advantage compared to smaller firms(4) „Ÿ Market share of 3.4% for the 12 months ended June 30, 2013 reflects price and quality advantages and the impact of strategic investments in brand development and strategic price increases „Ÿ MSA exemption worth approximately $164 million in 2013 for Liggett and Vector Tobacco 2014 expiration of the Tobacco Transition Payment Program (TTPP) could yield substantial incremental free cash flow „Ÿ Approximately $30.9 million based on Liggettfs 2012 TTPP payments Diversified New Valley assets „Ÿ 50% ownership in Douglas Elliman Realty, the largest residential real estate broker in the New York metropolitan area with LTM Revenue of $397.2 million „Ÿ Broad portfolio of domestic and international real estate investments Substantial liquidity with cash, marketable securities and long-term investments of $443.8 million as of June 30, 2013 Proven management team with substantial equity ownership „Ÿ Approximately 15.5% director and executive officer owned 4 4 Key Investment (1) Liggett Adjusted EBITDA is defined as Operating Income plus DA, excluding one-time restructuring, factory relocation, litigation charges and other one-time gains from litigation settlements. (2) All gLiggetth financial information in this presentation includes the operations of Liggett Group LLC, Vector Tobacco Inc. and Liggett Vector Brands LLC unless otherwise noted. (3) In 1998, various tobacco companies, including Liggett and the four largest U.S. cigarette manufacturers, Philip Morris, Brown & Williamson, R.J. Reynolds and Lorillard, entered into the Master Settlement Agreement (gMSAh) with 46 states, the District of Columbia, Puerto Rico and various other territories to settle their asserted and unasserted health care cost recovery and certain other claims caused by cigarette smoking (Brown & Williamson and R.J. Reynolds merged in 2004 to form Reynolds American). Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States. (4) Price advantage applies only to cigarettes sold below applicable market share exemption.

Tobacco Operations 5 5

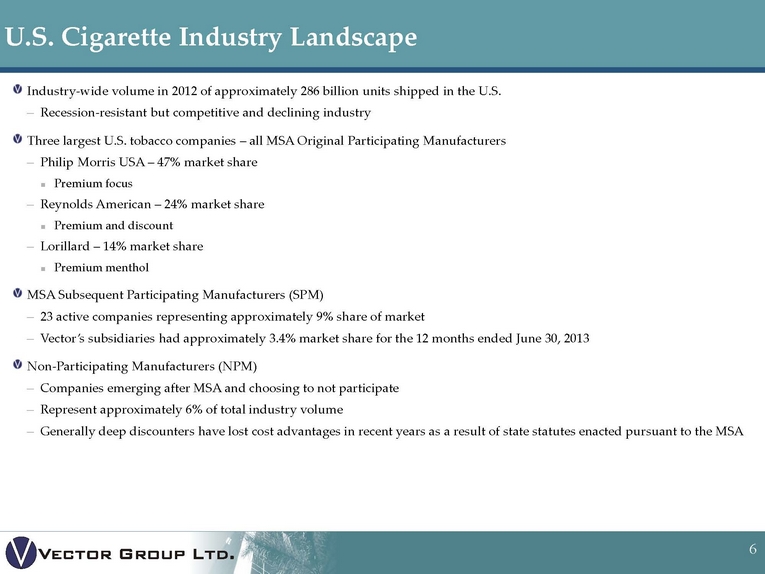

U.S. Cigarette Industry Landscape Industry-wide volume in 2012 of approximately 286 billion units shipped in the U.S. ¢w Recession-resistant but competitive and declining industry Three largest U.S. tobacco companies ¡V all MSA Original Participating Manufacturers ¢w Philip Morris USA ¡V 47% market share ƒÞ Premium focus ¢w Reynolds American ¡V 24% market share ƒÞ Premium and discount ¢w Lorillard ¡V 14% market share ƒÞ Premium menthol MSA Subsequent Participating Manufacturers (SPM) ¢w 23 active companies representing approximately 9% share of market ¢w Vector¡¦s subsidiaries had approximately 3.4% market share for the 12 months ended June 30, 2013 Non-Participating Manufacturers (NPM) ¢w Companies emerging after MSA and choosing to not participate ¢w Represent approximately 6% of total industry volume ¢w Generally deep discounters have lost cost advantages in recent years as a result of state statutes enacted pursuant to the MSA 6 6 U.S. Cigarette Industry

Liggett Overview Fourth-largest U.S. tobacco company; founded in 1873 ¢w Core Discount Brands ¡VPyramid, Grand Prix, Liggett Select, Eve and Eagle 20¡¦s ¢w Partner Brands ¡V USA, Bronson and Tourney Consistent and strong cash flow ¢w LTM June Liggett Adjusted EBITDA of $192.1 million ¢w Very low capital requirements ƒÞ LTM June capital expenditures of $6.3 million ¢w Stable demand driven by value-price positioning and strategic investments in brand development ƒÞ Price increases have historically offset volume declines Current price advantage of 62 cents per pack versus the three largest U.S. tobacco companies expected to maintain volume and drive profit in core brands ¢w Pursuant to the MSA, Liggett has no payment obligations unless its market share exceeds a market share exemption of approximately 1.65% of total cigarettes sold in the United States, and Vector Tobacco has no payment obligations unless its market share exceeds a market share exemption of approximately 0.28% of total cigarettes sold in the United States ¢w MSA exemption worth approximately $164 million in 2013 for Liggett and Vector Tobacco 7 7 Liggett Overview

Proven Tobacco Management Ronald Bernstein, President and Chief Executive Officer of Liggett and Liggett Vector Brands LLC Appointed CEO of Liggett in September 2000 and of Liggett Vector Brands in 2002 „Ÿ Managed increase in Liggett Tobacco Adjusted EBITDA from $78.8 million in 1999 to $192.1 million for the LTM period ending June 30, 2013 Joined Liggett as Treasurer in 1991 and was named Chief Financial Officer in 1993 From 1996 to 2000 served as Chairman and General Director of Liggett-Ducat Ltd., Vectorfs Russian tobacco operations „Ÿ Under Bernsteinfs leadership, Liggett-Ducat became the #1 tobacco manufacturer in Russia, the worldfs fourth largest cigarette market „Ÿ Oversaw development and construction of new state-of-the-art cigarette manufacturing facility in Moscow with capacity of approximately 40 billion cigarettes; developed national distribution system „Ÿ Sold to Gallaher for $400 million; after-tax gain of $161 million 8 8 Proven Tobacco Management

$46 $79 $77 $121 $111 $127 $130 $144 $146 $158 $170 $165 $158 $174 $186 $192 1.3% 1.2% 1.5% 2.2% 2.4% 2.5% 2.3% 2.2% 2.4% 2.5% 2.5% 2.7% 3.5% 3.8% 3.5% 3.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $0 $30 $60 $90 $120 $150 $180 $210 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 LTM 6/30/13 History and Recent Developments Liggett signed the MSA as an SPM which established its ongoing price advantage versus the three largest U.S. tobacco companies 9 9 (1) Adjusted for restructuring, factory relocation and litigation charges, as well as one-time gains. Note: The Liggett and Vector Tobacco businesses have been combined into a single segment for all periods since 2007. Liggett Adjusted EBITDA(1) Liggett History 1998 1999 2006 2000 Domestic Market Share 2002 2005 2009 Today ($ Millions) Liggett introduced the deep discount brand Liggett Select taking advantage of the Company’s price advantage versus the three largest U.S. tobacco companies Liggett relocated to a state-of-the-art manufacturing facility in Mebane, North Carolina to enhance quality and efficiency Liggett purchased the Medallion Company, Inc. with approximately 0.28% market share exemption. Acquired the USA brand as part of this transaction and subsequently entered into a partner brand agreement with Wawa Liggett launched the deep discount brand Grand Prix, which quickly experienced widespread adoption Liggett began shipping Bronson cigarettes under “Partner Brands” agreement with QuikTrip In response to a large Federal Excise Tax increase, Liggett repositioned Pyramid as a low-price, box-only brand, which led to total Company volume growth of approximately 17% since 2009 Liggett focuses on margin enhancement resulting in continued earnings growth with Liggett Adjusted EBITDA reaching a high of $192.1 million for the LTM period ended June 30, 2013 2013 Liggett introduced Eagle 20’s, a brand positioned in the deep discount segment for long-term growth

Liggett’s Strategy 10 10 Liggett’s Strategy Capitalize upon pricing advantage in the U.S. cigarette market due to the favorable treatment that it receives under the MSA Focus marketing and selling efforts on the discount segment, continue to capitalize on opportunities to build volume and/or margin in our core discount brands (Pyramid, Grand Prix, Liggett Select, Eve and Eagle 20’s) and utilize core brand equity to selectively enhance distribution Continue product development to provide the best quality relative to other discount products in the marketplace Increase efficiency by adapting an organizational structure as well as practices to maximize profit Identify, develop and launch relevant new cigarette brands and other tobacco products opportunistically to the market in the future Utilize technology to increase selling efficiency and effectiveness, while minimizing headcount

Litigation History and Regulatory Overview Litigation History Liggett led the industry in acknowledging the addictive properties of tobacco while seeking a legislated settlement of litigation „Ÿ Liggettfs gtraitoroush act was followed by the industry, which led to the MSA The industry settled much of its outstanding litigation with the MSA, which reduced the uncertainty of future cash flows and restored value to tobacco stocks Liggett has continued to fight individual and third-party payor actions aggressively. The Company will continue to evaluate settlement strategies, where appropriate Since 1998, the MSA has restricted advertising and marketing of tobacco products In 2009, Family Smoking Prevention and Tobacco Control Act granted the FDA power to regulate the manufacture, sale, marketing and packaging of tobacco products „Ÿ FDA prohibited from issuing regulations which ban cigarettes Current Federal Excise Tax of $1.01/pack (since April 1, 2009) Additional state and municipal excise taxes The TTPP, also known as the tobacco quota buyout, was established in 2004 and is set to expire at the end of 2014 „Ÿ In 2012, Liggett was required to pay approximately $30.9 million under the TTPP 11 11 Litigation History and Regulatory Overview Litigation History Regulatory Overview

Summary of Pending Litigation (1) Engle progeny cases ¢w Liggett is a defendant in 3,043 state court and 1,257 federal court cases in Florida ¢w 14 Engle progeny cases, excluding 2002 Lukacs v. R.J. Reynolds case where Liggett was a defendant, have resulted in verdicts with nine plaintiffs' verdicts and five defendants¡¦ verdicts ƒÞ Excluding Lukacs v. R.J. Reynolds case, compensatory damages have ranged from $1,000 to $3 million ƒÞ Based on current rate of trials per year, remaining cases may take decades to adjudicate ¢w Liggett has settled 144 Engle progeny cases for approximately $1.1 million in aggregate ƒÞ In addition to up to $16.4 million of damages assessed in cases currently under appeal, Liggett believes the loss range could be between $34 million and $85 million if Liggett were theoretically able to resolve all remaining Engle cases on an aggregate basis 63 individual actions, 4 class actions and 1 health care recovery action currently pending Liggett has secured approximately $7.6 million of outstanding bonds related to adverse verdicts which were on appeal as of June 30, 2013 Historical litigation expenses and other litigation costs: ¢w $9.2 million for the LTM period ended June 30, 2013 ¢w $9.7 million in fiscal year 2012 ¢w $7.8 million in fiscal year 2011 ¢w $26.2 million in fiscal year 2010 12 12 (1) Figures are as of June 30, 2013. Summary of Pending Litigation(1)

Real Estate Operations 13

New Valley LLC Overview „«New Valley LLC is presently a wholly-owned subsidiary of Vector Group Ltd. (NYSE: VGR) „«Douglas Elliman Realty (currently 50% owned by New Valley LLC): ¢w Largest residential brokerage company in the New York metropolitan area and ranked as the fourth-largest residential brokerage company in the U.S. in 2012 based on closed sales volume ƒÞ Revenue and Adjusted EBITDA of $397.2 million and $35.7 million for the LTM period ended June 30, 2013 ƒÞ $89.5 million of cash as of June 30, 2013 ¢w Douglas Elliman Realty is in discussions with Prudential to redeem an approximate 20% equity interest owned by a former affiliate of Prudential. The redemption price for such equity interest is to be determined through an appraisal process. Upon completion of the redemption, Vector will own more than 50% of and will consolidate Douglas Elliman Realty 14 14 New Valley LLC Overview New York City Long Island & Westchester County Agents(1) 2,350 1,950 Offices(1) 20 43 2012 Real Estate Sales $8.4 Billion $3.6 Billion (1) As of June 30, 2013.

New Valley LLC Overview (Cont¡¦d) 15 15 New Valley LLC Overview (Cont¡¦d) „« Unconsolidated investment properties at June 30, 2013 include: ƒÞ 101 Murray Street ¡V New Valley has invested $19.3 million for a 25% interest in a joint venture that has the rights to acquire a 15-story building on a 31,000 square-foot lot in the Tribeca neighborhood of Manhattan ƒÞ Queens Plaza ¡V New Valley has invested $7.4 million for an approximate 45% indirect interest in a condominium conversion project in Queens, New York ƒÞ Chrystie Street ¡V New Valley has invested $2.0 million for an approximate 18% indirect ownership interest in a condominium conversion project located in Manhattan ƒÞ Sesto Holdings S.r.l. ¡V New Valley owns a 3.0% interest in entity that owns a 322-acre land plot in Milan, Italy ƒÞ The Whitman ¡V New Valley has an approximate 12% interest in Lofts 21 LLC, which is being marketed at The Whitman in the Flatiron District / NoMad neighborhood of Manhattan in New York City. ƒÞ 10 Madison Square West ¡V New Valley has invested approximately $6.6 million for an approximate 5% interest in the owner of 10 Madison Square West. 10 Madison Square West is a luxury residential condominium located in the Flatiron District / NoMad neighborhood of Manhattan in New York City. ƒÞ Hotel Taiwana ¡V New Valley has invested $6.3 million for an approximate 17% interest in Hill Street Partners LLP which owns a hotel in St. Barts, French West Indies ƒÞ The Marquand (HFZ East 68th Street )¡V New Valley owns an approximate 18% interest in 11 East 68th Street, also known as The Marquand located on 68th Street between Fifth Avenue and Madison Avenue in Manhattan ƒÞ 11 Beach Street Investor LLC ¡V New Valley has invested $10.4 million for a 49% interest in a Manhattan luxury residential condominium conversion project ƒÞ 701 Seventh Avenue ¡V New Valley owns approximately 12% of a 120,000 square foot building in Times Square submarket, which will be the first new mixed use development in Times Square in more than a quarter century ƒÞ NV Maryland LLC ¡V Invested $5.0 million for an approximate 7.5% interest in a portfolio of approximately 5,500 apartment units primarily located in Baltimore County, Maryland „« Additional consolidated real estate investment in Escena, a master planned community in Palm Springs, California with a book value of $13.1 million and Indian Creek, a residential real estate conversion project in Indian Creek, Florida with a book value of $10.1 million (both as of June 30, 2013)

New Valley LLC Overview (Cont’d) 16 16 New Valley LLC Overview (Cont’d) 701 Seventh Ave – Manhattan, NY Hotel Taiwana - St. Barth, French West Indies The Marquand - 11 East 68th St. – Manhattan, NY 10 Madison Square West – Manhattan, NY

New Valley LLC Overview (Cont’d) 17 17 New Valley LLC Overview (Cont’d) Escena – Palm Springs, CA The Whitman – Manhattan, NY 11 Beach Street – Manhattan, NY

Vector Group Ltd. Financial Summary 18

$144 $157 $171 $177 13.5% 13.9% 15.8% 17.0% 2010 2011 2012 LTM 6/30/13 Summary Historical Financial Data 19 19 ($ Millions) Historical Financial Data $23 $12 $11 $10 2010 2011 2012 LTM 6/30/13 Capital Expenditures Revenue Before Excise Taxes Adjusted EBITDA(1) Free Cash Flow(2) $1,063 $1,133 $1,085 $1,040 2010 2011 2012 LTM 6/30/13 $121 $145 $160 $167 2010 2011 2012 LTM 6/30/13 (1) Adjusted EBITDA defined as Net Income before Interest, Taxes, Depreciation & Amortization, adjusted as described in the Appendix. (2) Free Cash Flow defined as Adjusted EBITDA less Capital Expenditures.

Current Capitalization 20 20 ($ Millions) (1) Cash and cash equivalents are defined as cash and investments with original maturities of 90 days or less which are readily convertible into cash. (2) Investment securities available for sale are carried at fair value under SFAS No. 115, “Accounting for Certain Investments in Debt and Equity Securities“. (3) Long-term investments consist of partnerships investing in real estate and investment securities. The fair value was provided by the partnerships based on the indicated market value of the underlying assets or portfolio. The investments in these partnerships are illiquid and the ultimate realization of these investments is subject to the performance of the underlying partnership and its management by the general partners. (4) The fair value of the derivatives embedded within the Variable Interest Senior Convertible Note due 2014 ($9.0 million), the Variable Interest Senior Convertible Exchange Notes due 2014 ($17.1 million), the Variable Interest Senior Convertible Debentures due 2019 ($97.6 million) and the Variable Interest Senior Convertible Debentures due 2026 ($43.0 million) and is separately classified as a derivative liability in the condensed consolidated balance sheets. (5) Amount included in the table above is net of unamortized discount of $25.9 million. (6) Amount included in the table above is net of unamortized discount of $36.6 million. (7) Amount included in the table above is net of unamortized discount of $159.0 million. (8) Amount included in the table above is net of unamortized discount of $36.0 million. (9) The revolving credit facility currently provides for a total commitment of $50.0 million. (10) Net secured debt defined as secured debt less cash and cash equivalents, investment securities available for sale and long-term investments. (11) Net debt defined as total debt less cash and cash equivalents, investment securities available for sale and long-term investments. As of 6/30/13 Cash and Cash Equivalents(1) $ 2 81.7 Investment Securities Available for Sale(2) 1 34.1 Long-Term Investments(3) 2 8.0 Total Cash and Investments $ 4 43.8 Vector Group Ltd. (Holding Company): Senior Secured Notes due 2021 4 50.0 Var. Int. Convertible Senior Convertible Notes due 2014(4)(5) 2 4.1 Var. Int. Convertible Senior Convertible Exchange Notes due 2014(4)(6) 7 0.9 Variable Convertible Senior Notes due 2019(4)(7) 7 1.0 Var. Int. Convertible Senior Convertible Debentures due 2026(4)(8) 7 .2 Liggett Group LLC (Operating Company): Revolving Credit Facility(9) $ 2 7.0 Term Loan & Other 2 2.0 Total Debt $ 6 72.3 Market Capitalization as of (8/26/13) 1 ,478.4 Total Capitalization $ 2 ,150.7 Secured Debt / LTM 6/30/13 Adjusted EBITDA 2.8x Net Secured Debt(10) / LTM 6/30/13 Adjusted EBITDA 0.3x Total Debt / LTM 6/30/13 Adjusted EBITDA 3.8x Net Debt(11) / LTM 6/30/13 Adjusted EBITDA 1.3x

Appendix 21

Summary Historical Financial Data 22 22 ($ Millions) Vector Group Ltd. Adjusted EBITDA Reconciliation Source: Company Filings. FYE Dec. 31, LTM 6 Months Ended June 30 2010 2011 2012 6/30/2013 2013 2012 Net Income $54.1 $75.0 $30.6 $46.2 $11.8 ($3.8) Income Tax Provision (Benefit) 31.5 48.1 23.1 35.0 9.7 (2.3) Interest Expense 84.1 100.7 110.1 122.8 65.5 52.8 Depreciation & Amortization 10.8 10.6 10.6 10.5 5.2 5.3 EBITDA 180.5 234.5 174.4 214.6 92.2 52.0 Changes in Fair Value of Derivatives Embedded Within Convertible Debt (11.5) (8.0) 7.5 (25.1) (5.5) 27.1 Loss on Extinguishment of Debt - - - 21.5 21.5 - Gain on Liquidation of Long-Term Investments - (25.8) - - - - Provision for Loss on Investments - - - - - - Equity (Loss) Income on Long-Term Investments (1.5) 0.9 1.3 (0.9) (0.8) 1.3 Gain on Sale of Investment Securities Available for Sale (19.9) (23.3) (1.6) (6.8) (5.2) - Equity Income From Non-Consolidated Real Estate Businesses (24.0) (20.0) (29.8) (29.0) (7.3) (8.1) Gain on Townhomes - (3.8) - - - - Acceleration of Interest Expense Related to Debt Conversion - 1.2 15 7.1 - 7.9 Stock-Based Compensation Expense 2.7 3.2 5.6 5.2 1.3 1.6 Litigation Expenses 19.2 - - - - - Impact of NPM Settlement - - - (6.9) (6.9) - Other, Net (1.4) (1.8) (1.2) (2.9) (2.3) (0.5) Adjusted EBITDA $144.0 $157.1 $171.1 $176.7 $86.9 $81.3