Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RCS Capital Corp | v355859_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - RCS Capital Corp | v355859_ex99-2.htm |

1 September 2013 RCS Capital Corporation Investor Presentation

2 2 Forward - Looking Statements Certain statements made in this presentation are forward - looking statements. Those statements include statements regarding the intent, belief or current expectations of RCS Capital Corporation (“RCS Capital”) and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Actual results may differ materially from those contemplated by such forward - looking statements. Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update ore revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. The following are some of the possible risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : adverse developments in the direct investment program industry; deterioration in the business environment in the specific sectors of the economy in which RCS Capital focuses or a decline in the market for securities of companies within these sectors; substantial fluctuations in RCS Capital’s financial results; RCS Capital’s ability to retain senior professionals; pricing and other competitive pressures ; changes in laws and regulations and industry practices that adversely affect RCS Capital’s sales and trading business ; (Continued on next page)

3 2 Cautionary Note Regarding Forward - Looking Statements (Continued from prior page) incurrence of losses in the future; the singular nature of RCS Capital’s capital markets and strategic advisory engagements; competition from larger firms; larger and more frequent capital commitments in RCS Capital’s wholesale broker - dealer and investment banking businesses; limitations on RCS Capital’s access to capital; malfunctioning or failure in RCS Capital’s operations and infrastructure; strategic investments or acquisitions and joint ventures or RCS Capital’s entry into new business areas; failure to achieve and maintain effective internal controls; RCS Capital’s ability to make, on a timely or cost effective basis, the changes necessary to operate as an independent company; RCS Capital’s ability to adequately perform oversight or control functions over Realty Capital Securities, LLC that have been performed in the past by RCAP Holdings, LLC; and increased costs due to Realty Capital Securities, LLC becoming a part of public company separate from RCAP Holdings, LLC.

4 Company Overview 2 Advisory Services • Leading REIT M&A advisor • Executed four liquidity events in past 18 months; $19.3 billion in transaction value • Arranged $3.8 billion of debt in six separate transactions year - to - date Transfer Agent • Specialist transfer agent for direct investment programs • Registered with the SEC • Provides record - keeping and registrar services • Coordinates tax reporting, payment of distributions and redemptions Wholesale Broker - Dealer • An industry leading multi - product distributor of sector - specific direct investment programs • Distributed investment programs designed to provide “Durable Income” and capital preservation • Raised a record $6.1 billion of equity capital YTD through August 31, 2013 Experienced Senior Management • Experience in managing public companies with combined enterprise value over $20 billion • More than 50 years collective experience running publicly traded companies

5 Investment Highlights 2 Huge market with substantial growth opportunity ▪ Large, addressable target market with $7.5T+ in investable assets from mass affluent investors ▪ Significant expansion opportunity for direct investment products as asset class is under - represented (<3% investment allocation) Market leader in wholesale direct investment product distribution ▪ Market share leader in 2012 with 27.9% of equity raised in the non - traded REIT sector (2013 through August 31: 42.8%) 1 ▪ Exceptional growth profile: $6.1B in equity raised YTD through August 31, 2013 compared to $3.0B in FY‘12 1 ▪ Large distribution channel: over 300 broker dealers with more than 1,200 active selling agreements supporting 100,000 financial advisors that have access to RCS direct investment programs Attractive & specialized business model with a proven track record ▪ Superior direct investment industry market knowledge and expertise ▪ Proven profitable revenue growth ▪ Reliable, captive revenue streams ▪ Revenue diversification through multi - product/open architecture platform targeting 3rd party clients E xpansion opportunities within business lines ▪ Opportunity to unlock additional revenue streams inherent in captive client base ▪ Ability to leverage large, in - place broker - dealer and investment advisor networks for diverse product offerings and related service and transaction revenues Highly experienced and cohesive management team ▪ More than 50 years of combined experience leading public companies ▪ History of managing companies with combined $20B+ in enterprise value ▪ Supported by a team of over 200 professionals solely focused on the distribution and delivery of strategic advisory services to direct investment products (1) Source: Stanger Market Pulse, August 2013. Data through August 31, 2013

Americans are living longer, yet 82% are NOT very confident they will have sufficient funds to retire comfortably. 6 2 The Opportunity 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% Percentage of Population Living to 80 Years of Age Source: U.S. Census Bureau; EBRI’s 2013 Retirement Confidence Survey: Employee Benefit Research Institute

7 2 America’s conventional foundations of financial security have eroded. The Opportunity 1980 - 1990 Change 2000 - 2010 Private sector workers covered by pension benefits 43% 10% Value of homes +113% +39% S&P 500 return +234% - 23% 10 - yr Treasury average yield 10.6% 4.4% % change in real personal income +112% +44% U.S. life expectancy 74 years 77 years Sources: MarketWatch/Wall Street Journal; U.S. Government Housing and Labor Data; World Bank; Bloomberg; EBRI; US Personal Income SAAR (PITL) In a world of rapidly declining income generators, RCS Capital delivers direct investment programs designed to provide “Durable Income”

8 2 In 2012, the Mass Affluent, those Americans able to afford a comfortable retirement, accounted for $7.5 trillion of investable assets, yet allocated less than 3% to direct investment programs. The Opportunity Sources: Bank of America Corp., April 2012; The Nielsen Company, 2012; Robert A. Stanger & Co., Inc.; Deloitte College Savings Plans (529) 1 % Brokerage/ Investment Accounts 25 % Other 3 % Workplace Retirement Plans (401(k), 403(b)) 23 % IRA / Roth IRA 21 % Cash/CDs/ Money Markets 16 % Life Insurance/ Annuities 11 % Includes all alternatives and direct investments

9 2 Market Overview / Opportunity Mass Affluent are households having between $250,000 and $1,000,000 in total investable assets, including retirement plans, c oll ege savings plans, stocks and bonds, mutual funds, exchange traded funds (“ETFs”), annuities, money market accounts, savings in cash, etc. $7.5 Trillion Investable Assets Increasing Use of Alternative Investments: 1) “Durable Income” 2) Capital Preservation 3) Tax - Efficiency 4) Inflation Protection Mass Affluent Investors Aging Population Living Longer Typical Sources of Retirement Income Have Eroded Low Interest Rates Greater Market Volatility

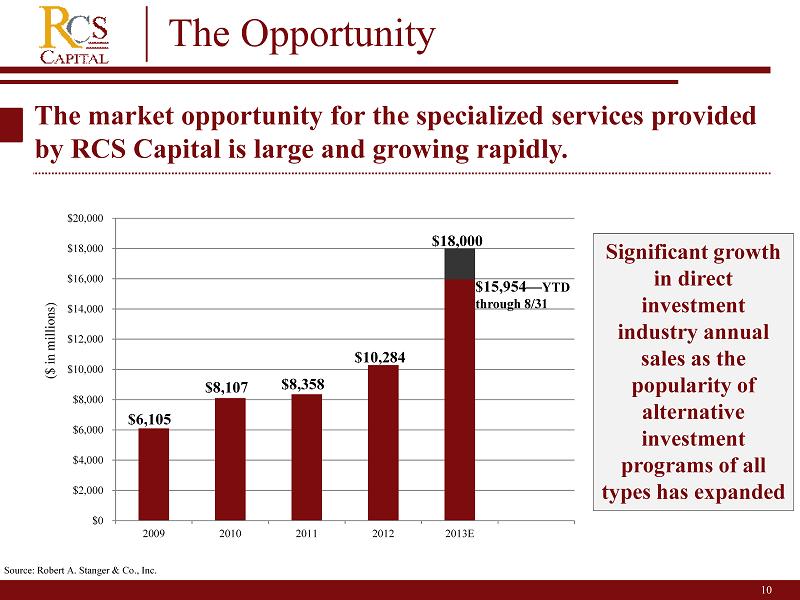

10 2 The market opportunity for the specialized services provided by RCS Capital is large and growing rapidly. Significant growth in direct investment industry annual sales as the popularity of alternative investment programs of all types has expanded Source: Robert A. Stanger & Co., Inc. The Opportunity $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 2009 2010 2011 2012 2013E $6,105 $8,107 $8,358 $10,284 $18,000 $15,954 — YTD through 8/31 ($ in millions)

11 2 RCS Capital Overview RCS Capital plays an essential role in the architecture, distribution and value monetization of yield - focused direct investment programs. Direct Investment Product Life Cycle Launch: Conceptualization, organization, formation, registration of programs Equity Sales: Equity sales, registration maintenance, product due diligence, education and training Capital Event: Strategic advisory services and capital markets intelligence Equity Sales

12 2 Wholesale Broker - Dealer Overview Source: Robert A. Stanger & Co., Inc. » Wholesale broker - dealer distributes REIT, BDC and other direct investment programs, as well as liquid funds, through independent broker - dealers » 16 total direct investment programs offered to date (14 REITs, 1 BDC) » Total value of 14 non - traded REIT offerings $21.4 billion; raised $10.8 billion through June 30, 2013 among all direct investment programs (1) » Significant expansion of distribution network since inception - Total broker - dealer firms increased from 197 to over 300 since 2009 - Active selling agreements increased from 334 to over 1,200 since 2009 - 100,000 financial advisors with access to RCS products » Expansion of distribution network resulted in significant market share gains RCS Market Share, Real Estate Remainder of Industry 41.8% 58.2% Q1 2013 2013 YTD 42.8% 57.2% (1) Includes all open and closed offerings. (August 31, 2013) 14.2% 85.8% 2010 20.7% 79.3% 2011 27.9% 72.1% 2012

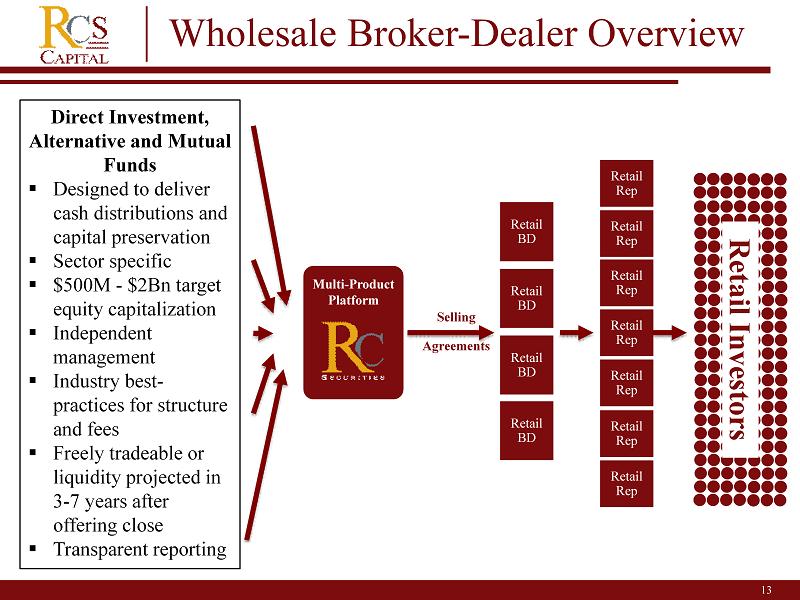

13 2 Wholesale Broker - Dealer Overview Selling Agreements Multi - Product Platform Retail BD Retail BD Retail BD Retail BD Retail Rep Retail Rep Retail Rep Retail Rep Retail Rep Retail Rep Retail Rep Retail Investors Direct Investment, Alternative and Mutual Funds ▪ Designed to deliver cash distributions and capital preservation ▪ Sector specific ▪ $500M - $2Bn target equity capitalization ▪ Independent management ▪ Industry best - practices for structure and fees ▪ Freely tradeable or liquidity projected in 3 - 7 years after offering close ▪ Transparent reporting

14 2 Advisory Services Overview Debt capital markets transactions 2013 YTD: $3.8 billion Debt Advisory Strategic Advisory M&A and capital markets activity in the past 18 months: $19.2 billion

$817 $3,563 $1,069 $2,367 $1,461 $6,105 $8,107 $8,358 $10,284 $ 18,000E $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 2009 2010 2011 2012 2013 Millions REIT IPO Capital Raised Public Non-Traded REIT Equity Sales 15 Traded vs. Non - Traded REIT Sales 2 INSTITUTIONAL COMMUNICATION – NOT FOR FURTHER DISTRIBUTION Source: SNL Financial & Robert A. Stanger & Co., Inc .

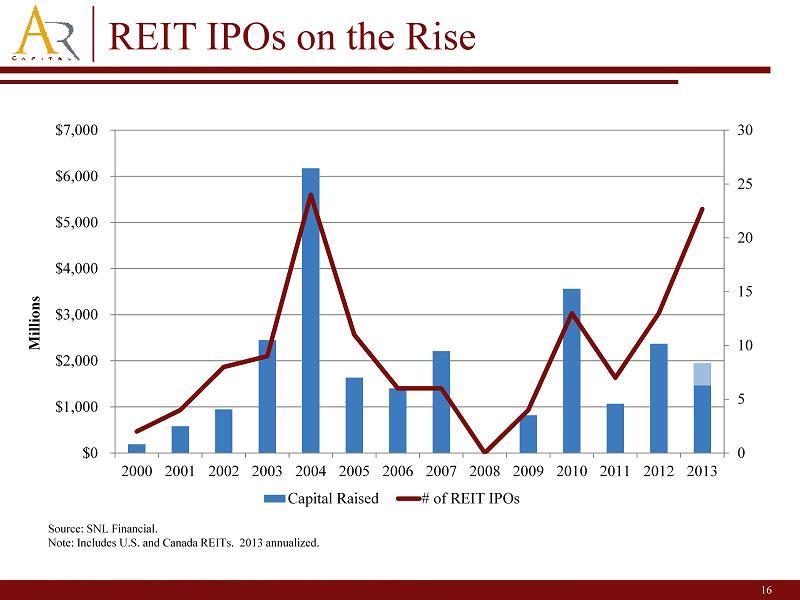

16 REIT IPOs on the Rise 2 INSTITUTIONAL COMMUNICATION – NOT FOR FURTHER DISTRIBUTION Source: SNL Financial. Note: Includes U.S. and Canada REITs. 2013 annualized. 0 5 10 15 20 25 30 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Millions Capital Raised # of REIT IPOs

17 Transforming the Net Lease Sector $12.9 $13.6 $16.2 $19.0 $33.0 $54.1 $0 $10 $20 $30 $40 $50 $60 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FQ2 YTD Billions Total Enterprise Value - Net Lease Sector STAG SRC ARCP COLE LSE WPC LXP NNN O Source: SNL Financial. Note: 2013 illustrates ARCP on a pro forma basis. Includes acquisition of LSE & ARCT IV

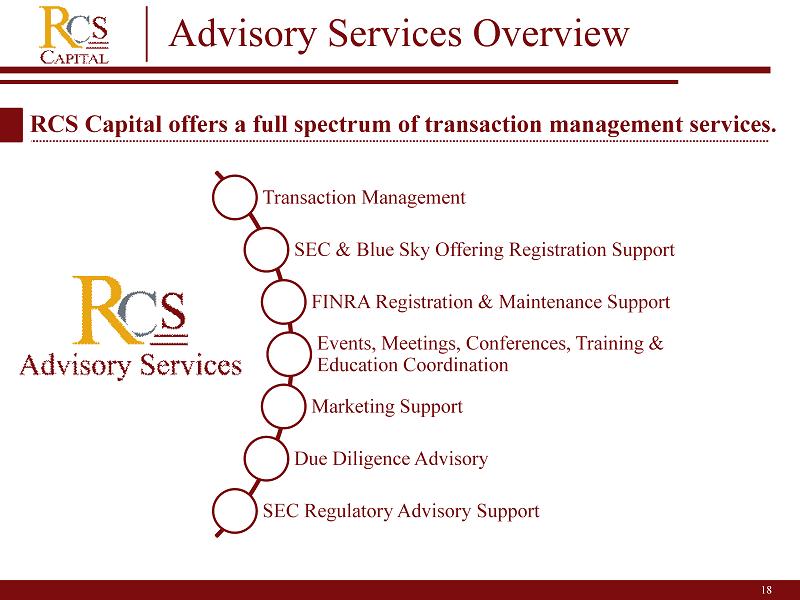

18 2 Advisory Services Overview RCS Capital offers a full spectrum of transaction management services. Transaction Management SEC & Blue Sky Offering Registration Support FINRA Registration & Maintenance Support Events, Meetings, Conferences, Training & Education Coordination Marketing Support Due Diligence Advisory SEC Regulatory Advisory Support

19 2 Transfer Agency Overview » W ell - positioned to service the more than 400,000 investors in ARC - sponsored entities » Captive investor base for transfer agent services » Service agreement in place provides access to scaled structure » SEC registered transfer agent allows “higher touch” customer - facing services » Generates attractive operating margins » Provides record - keeping services » Executes the transfer, issuance and cancellation of shares or other securities » Reports t ax payments, distributions and redemptions » Generates fees from a variety of services performed for issuers of direct investment products and registered investment companies Key Opportunities: » Vertical integration may allow for low - risk revenue expansion » Natural extension of an already existing retail service offering » Conversion of a captive client base with significant inherent operating leverage » Benefit of a scaled client base from day one » Ability to market services to 3rd party funds

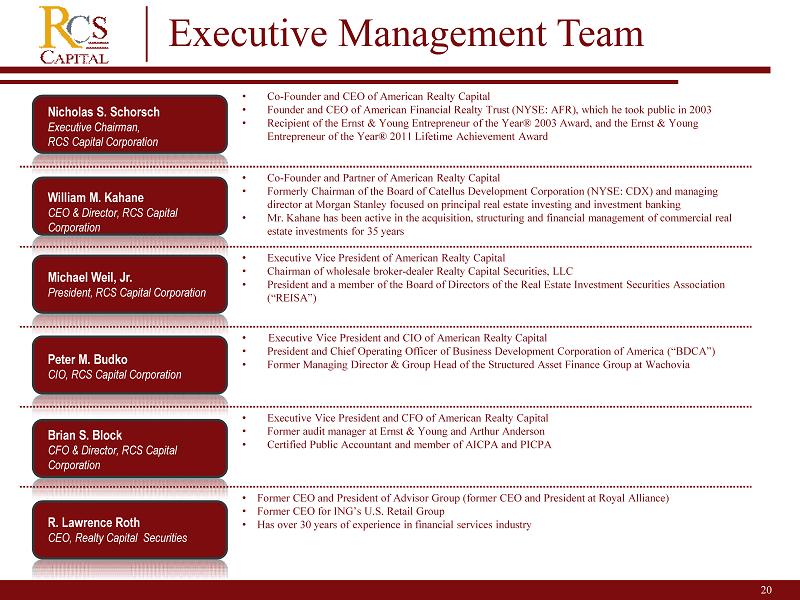

20 2 Executive Management Team • Co - Founder and CEO of American Realty Capital • Founder and CEO of American Financial Realty Trust (NYSE: AFR), which he took public in 2003 • Recipient of the Ernst & Young Entrepreneur of the Year® 2003 Award, and the Ernst & Young Entrepreneur of the Year® 2011 Lifetime Achievement Award • Co - Founder and Partner of American Realty Capital • Formerly Chairman of the Board of Catellus Development Corporation (NYSE: CDX) and managing director at Morgan Stanley focused on principal real estate investing and investment banking • Mr. Kahane has been active in the acquisition, structuring and financial management of commercial real estate investments for 35 years • Executive Vice President of American Realty Capital • Chairman of wholesale broker - dealer Realty Capital Securities, LLC • President and a member of the Board of Directors of the Real Estate Investment Securities Association (“REISA”) • Executive Vice President and CIO of American Realty Capital • President and Chief Operating Officer of Business Development Corporation of America (“BDCA”) • Former Managing Director & Group Head of the Structured Asset Finance Group at Wachovia • Executive Vice President and CFO of American Realty Capital • Former audit manager at Ernst & Young and Arthur Anderson • Certified Public Accountant and member of AICPA and PICPA • Former CEO and President of Advisor Group (former CEO and President at Royal Alliance) • Former CEO for ING’s U.S. Retail Group • Has over 30 years of experience in financial services industry Nicholas S. Schorsch Executive Chairman, RCS Capital Corporation William M. Kahane CEO & Director, RCS Capital Corporation Michael Weil, Jr. President, RCS Capital Corporation Peter M. Budko CIO, RCS Capital Corporation Brian S. Block CFO & Director, RCS Capital Corporation R. Lawrence Roth CEO, Realty Capital Securities

21 Appendix

22 2 ($ in millions) 1H 2013 2012 2011 2010 2009 2008 Equity capital sales (1) $4,458.9 $2,952.2 $1,765.1 $1,147.9 $284.5 $23.1 Actual number of publicly registered products distributed 10 10 10 5 3 1 Revenues from product distribution $431.8 $286.6 $174.7 $114.1 $28.2 $1.4 Revenues from other services $6.8 $0.9 NA NA NA NA Total revenues $448.6 $287.5 $174.7 $114.1 $28.2 $1.4 Profit/(loss) $53.2 $7.4 $3.7 $ (2.4) $ (4.0) $ (2.6) Registered personnel (2) 170 133 108 90 62 NA RCS sales as a % of Direct Investment Real Estate industry (1) 41.6% 27.9% 20.7% 14.2% 4.7% 0.2% (1) Source : Robert A . Stanger & Co . , Inc . Data as of June 30 , 2013 . Aggregate gross proceeds from direct investment program equity sold by Realty Capital Securities . (2) 1 H 2013 data is as of September 24 , 2013 . RCS Capital Financial Highlights

Number of Registered Personnel $ 53.2 23 2 Financial and Operating Overview Industry - leading growth in equity sales, revenues and earnings (1) Source: Robert A. Stanger & Co., Inc. — As of August 31, 2013. (2) As of September 24, 2013. 62 90 108 170

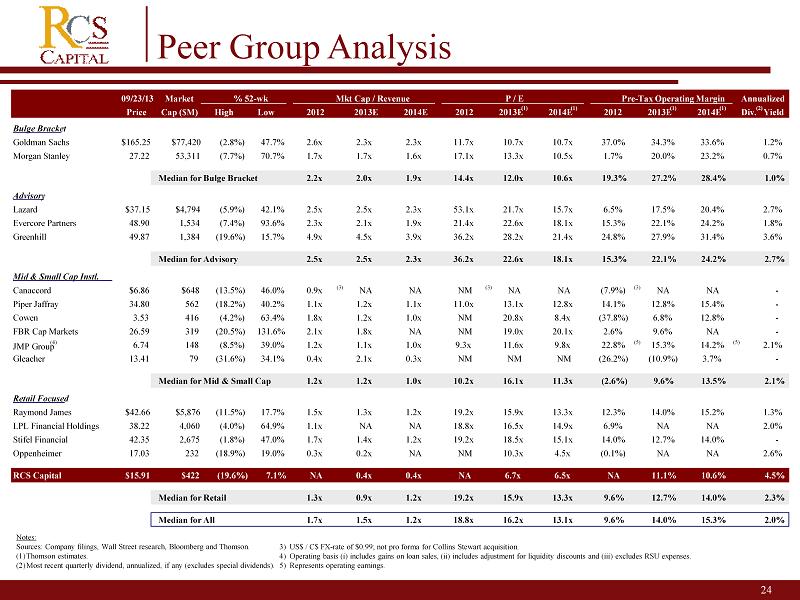

24 09/23/13 Market % 52 - wk Mkt Cap / Revenue P / E Pre - Tax Operating Margin Annualized Price Cap ($M) High Low 2012 2013E 2014E 2012 2013E (1) 2014E (1) 2012 2013E (1) 2014E (1) Div. (2) Yield Bulge Bracket Goldman Sachs $165.25 $77,420 (2.8%) 47.7% 2.6x 2.3x 2.3x 11.7x 10.7x 10.7x 37.0% 34.3% 33.6% 1.2% Morgan Stanley 27.22 53,311 (7.7%) 70.7% 1.7x 1.7x 1.6x 17.1x 13.3x 10.5x 1.7% 20.0% 23.2% 0.7% Median for Bulge Bracket 2.2x 2.0x 1.9x 14.4x 12.0x 10.6x 19.3% 27.2% 28.4% 1.0% Advisory Lazard $37.15 $4,794 (5.9%) 42.1% 2.5x 2.5x 2.3x 53.1x 21.7x 15.7x 6.5% 17.5% 20.4% 2.7% Evercore Partners 48.90 1,534 (7.4%) 93.6% 2.3x 2.1x 1.9x 21.4x 22.6x 18.1x 15.3% 22.1% 24.2% 1.8% Greenhill 49.87 1,384 (19.6%) 15.7% 4.9x 4.5x 3.9x 36.2x 28.2x 21.4x 24.8% 27.9% 31.4% 3.6% Median for Advisory 2.5x 2.5x 2.3x 36.2x 22.6x 18.1x 15.3% 22.1% 24.2% 2.7% Mid & Small Cap Instl . Canaccord $6.86 $648 (13.5%) 46.0% 0.9x (3) NA NA NM (3) NA NA (7.9%) (3) NA NA - Piper Jaffray 34.80 562 (18.2%) 40.2% 1.1x 1.2x 1.1x 11.0x 13.1x 12.8x 14.1% 12.8% 15.4% - Cowen 3.53 416 (4.2%) 63.4% 1.8x 1.2x 1.0x NM 20.8x 8.4x (37.8%) 6.8% 12.8% - FBR Cap Markets 26.59 319 (20.5%) 131.6% 2.1x 1.8x NA NM 19.0x 20.1x 2.6% 9.6% NA - JMP Group (4) 6.74 148 (8.5%) 39.0% 1.2x 1.1x 1.0x 9.3x 11.6x 9.8x 22.8% (5) 15.3% 14.2% (5) 2.1% Gleacher 13.41 79 (31.6%) 34.1% 0.4x 2.1x 0.3x NM NM NM (26.2%) (10.9%) 3.7% - Median for Mid & Small Cap 1.2x 1.2x 1.0x 10.2x 16.1x 11.3x (2.6%) 9.6% 13.5% 2.1% Retail Focused Raymond James $42.66 $5,876 (11.5%) 17.7% 1.5x 1.3x 1.2x 19.2x 15.9x 13.3x 12.3% 14.0% 15.2% 1.3% LPL Financial Holdings 38.22 4,060 (4.0%) 64.9% 1.1x NA NA 18.8x 16.5x 14.9x 6.9% NA NA 2.0% Stifel Financial 42.35 2,675 (1.8%) 47.0% 1.7x 1.4x 1.2x 19.2x 18.5x 15.1x 14.0% 12.7% 14.0% - Oppenheimer 17.03 232 (18.9%) 19.0% 0.3x 0.2x NA NM 10.3x 4.5x (0.1%) NA NA 2.6% RCS Capital $15.91 $422 (19.6%) 7.1% NA 0.4x 0.4x NA 6.7x 6.5x NA 11.1% 10.6% 4.5% Median for Retail 1.3x 0.9x 1.2x 19.2x 15.9x 13.3x 9.6% 12.7% 14.0% 2.3% Median for All 1.7x 1.5x 1.2x 18.8x 16.2x 13.1x 9.6% 14.0% 15.3% 2.0% Peer Group Analysis Notes: Sources: Company filings, Wall Street research, Bloomberg and Thomson. (1) Thomson estimates. (2) Most recent quarterly dividend, annualized, if any (excludes special dividends ). 3) US$ / C$ FX - rate of $0.99; not pro forma for Collins Stewart acquisition . 4) Operating basis ( i ) includes gains on loan sales, (ii) includes adjustment for liquidity discounts and (iii) excludes RSU expenses. 5) Represents operating earnings .

2 Brian D. Jones Managing Director, Head of Investment Banking RCS Capital T: (646) 937 - 6903 F: (212) 421 - 5799 bjones@rcscapital.com Brian S. Block Chief Financial Officer, RCS Capital T: (212) 415 - 6512 M: (215) 906 - 9122 bblock@arlcap.com RCS Capital 405 Park Avenue, New York, NY 10022 RCS Capital Corporation | 405 Park Avenue, 15 th Floor, New York, NY 10022 | 866 - 904 - 2988 For Further Information