Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - SRC Energy Inc. | syng_8k.htm |

EXHIBIT 99.1

NYSE MKT: SYRG

Important Cautions Regarding Forward

Looking Statements

Looking Statements

This presentation may contain forward-looking statements, within the meaning of the Private Securities Litigation

Reform Act of 1995. The use of words such as "believes," "expects," "anticipates," "intends," "plans," "estimates,"

"should," "likely" or similar expressions, indicates a forward-looking statement. These statements are subject to

risks and uncertainties and are based on the beliefs and assumptions of management, and information currently

available to management. The actual results could differ materially from a conclusion, forecast or projection in the

forward-looking information. Certain material factors or assumptions were applied in drawing a conclusion or

making a forecast or projection as reflected in the forward-looking information. The identification in this press

release of factors that may affect the company’s future performance and the accuracy of forward-looking

statements is meant to be illustrative and by no means exhaustive.

Reform Act of 1995. The use of words such as "believes," "expects," "anticipates," "intends," "plans," "estimates,"

"should," "likely" or similar expressions, indicates a forward-looking statement. These statements are subject to

risks and uncertainties and are based on the beliefs and assumptions of management, and information currently

available to management. The actual results could differ materially from a conclusion, forecast or projection in the

forward-looking information. Certain material factors or assumptions were applied in drawing a conclusion or

making a forecast or projection as reflected in the forward-looking information. The identification in this press

release of factors that may affect the company’s future performance and the accuracy of forward-looking

statements is meant to be illustrative and by no means exhaustive.

All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Factors

that could cause the company’s actual results to differ materially from those expressed or implied by forward-

looking statements include, but are not limited to: the success of the company’s exploration and development

efforts; the price of oil and gas; the worldwide economic situation; changes in interest rates or inflation; the ability

of the company to transport gas; willingness and ability of third parties to honor their contractual commitments;

the company’s ability to raise additional capital, as it may be affected by current conditions in the stock market

and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be affected by

delays or cost overruns; costs of production; environmental and other regulations, as the same presently exist or

may later be amended; the company’s ability to identify, finance and integrate any future acquisitions; and the

volatility of the company’s stock price.

that could cause the company’s actual results to differ materially from those expressed or implied by forward-

looking statements include, but are not limited to: the success of the company’s exploration and development

efforts; the price of oil and gas; the worldwide economic situation; changes in interest rates or inflation; the ability

of the company to transport gas; willingness and ability of third parties to honor their contractual commitments;

the company’s ability to raise additional capital, as it may be affected by current conditions in the stock market

and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be affected by

delays or cost overruns; costs of production; environmental and other regulations, as the same presently exist or

may later be amended; the company’s ability to identify, finance and integrate any future acquisitions; and the

volatility of the company’s stock price.

2

NYSE MKT: SYRG

Key Executives & Board Members

|

Edward Holloway

|

William Scaff, Jr.

|

Frank Jennings

|

George Seward

|

|

President & CEO

|

Vice President, Director

|

Chief Financial Officer

|

Board of Directors

|

|

• 30+ Years of Oil and Gas

Executive Leadership • Director of Synergy since

June 2008 • Former Co-Founder, Cache

Exploration Inc. • Co-Founder, Petroleum

Management, LLC and Petroleum Exploration & Management, LLC • Past Board Member of

Denver-Julesburg Petroleum Association • Past President of Colorado

Oil and Gas Association - 1990 |

• 30+ Years of Oil and Gas

Executive Leadership • Director of Synergy since

June 2008 • Former Dresser Industries

Area Manager and Total Petroleum Regional Manager • Co-Founder, Petroleum

Management, LLC and Petroleum Exploration & Management, LLC • Board Trustee of

Colorado/Wyoming Petroleum Marketers Association |

• 20+ years of accounting and

finance experience • Experience in oil and gas

drilling, services, exploration and production • Joined Synergy full time in

March 2011 • Five years as CFO of Gold

Resource Corporation (NYSE Amex: GORO) • 10 years as CPA with

PriceWaterhouseCoopers in Houston • Four years as audit manager

with The Walt Disney Companies • MBA from Indiana University

|

• George Seward was

appointed as a Director in July 2010. • Mr. Seward co-founded

Prima Energy in 1980 and served as its Secretary until 2004 when Prima was sold to Petro-Canada for $534 million. • Significant oil and natural

gas experience • Spearheaded leasing effort

in Nebraska for Synergy. |

3

NYSE MKT: SYRG

Our Leased Acreage *

§ Area #1 All of our current

wells both vertical and

horizontal are in the oil and

high-liquids portion of the

Wattenberg Field

(Niobrara/Codell/J-Sand

formations)

wells both vertical and

horizontal are in the oil and

high-liquids portion of the

Wattenberg Field

(Niobrara/Codell/J-Sand

formations)

§ Area #2 Northern D-J Basin

acreage is highly

prospective for horizontal

Niobrara and horizontal

Greenhorn

acreage is highly

prospective for horizontal

Niobrara and horizontal

Greenhorn

§ Area #3 Eastern Colorado

Proven dry gas field,

economic @ $4/mcf

Proven dry gas field,

economic @ $4/mcf

§ Area #4 Nebraska acreage

flanks the Central Kansas

Uplift; highly prospective

for Mississippian and

Pennsylvanian formations

flanks the Central Kansas

Uplift; highly prospective

for Mississippian and

Pennsylvanian formations

#4 Nebraska

123,000 net (oily)

#3 Eastern Colorado

56,000 net (dry gas)

#1 Wattenberg Field,

CO

CO

~20,000 net

(high liquids)

4

* All lease acreage calculations are approximate

#2 Northern D-J Basin

(Wattenberg Extension Area)

20,040 net (high liquids)

NYSE MKT: SYRG

Fiscal 2014 Accelerated Drilling Budget and

Summary Sources & Uses

Summary Sources & Uses

5

Net

Net Non-

Total Net

Well Cost

Drilling Budget

Wattenberg Field

Horizontal

20

5

25

4.5

$

112.5

$

Total

26

11

37

122.5

$

Synergy Fiscal 2014 Drilling Program Ending 8/31/2014

Cash and Equivalents

(1)

70

Operated Horizontal Wells

90

$

Estimated Cash Flow From Operations

87.5

Non-Operated Horizontal Wells

Vertical Wells

10

Acquisitions

30

Land Leasing

Total Sources

157.5

$

Total Uses

157.5

$

(1) Includes $19.3 million in cash and short term instruments at May 31, 2013 and portion of cash proceeds from follow on common stock offering closed 6/19/13

and partial exercise of $6 warrants

Sources ($MM)

Uses ($MM)

NYSE MKT: SYRG

Strengths of the Wattenberg Field

• Wattenberg Field is highly defined by over 17,000 vertical wells

drilled since the 1970’s

drilled since the 1970’s

• Synergy has successfully completed 100% of its wells in the

Wattenberg Field

Wattenberg Field

• Significant upside potential: Multiple pay zones with horizontal

wells targeting the Niobrara A, B, & C Benches and Codell

formation

wells targeting the Niobrara A, B, & C Benches and Codell

formation

• Horizontal completion technology has enhanced well returns

• 50 to 100% Internal Rates of Return from Horizontal wells(1)

• Long life production and reserves: 30+ years

• Low lifting costs: Year-to-date $4.32/BOE (9 mos. Ended

5/31/13)

5/31/13)

• Takeaway capacity: Expanding in Rocky Mountain Region

6

“We call it the ‘magic of the short-cycle oil in the U.S. onshore.’ It is the best you

can get. If we could find 20 more Wattenbergs, we would probably quit drilling

anything else.”

can get. If we could find 20 more Wattenbergs, we would probably quit drilling

anything else.”

- John Ford, Manager of Wattenberg Field for Anadarko, Oil & Gas Investor, 3/12

Wattenberg Overview

(1) IRRs are management estimates and are derived from operating experience, offset operator activity, and other published industry information

NYSE MKT: SYRG

Horizontal Drilling

Expands Opportunity

Expands Opportunity

• Advent of horizontal drilling has led to:

• Enhanced recovery of oil in place by 3 to 6 fold

over vertical drilling

over vertical drilling

• Increased production

• Reduced costs

• Mitigated environmental impact

• Completed and brought into production the

Renfroe Pad consisting of 3 Niobrara B and 2

Codell wells in September, 2013

Renfroe Pad consisting of 3 Niobrara B and 2

Codell wells in September, 2013

• Participated as a non-operator in 17

horizontal wells in the Wattenberg Field and

1 Niobrara B well in the Northern DJ (avg.

working interest ~ 19%)

horizontal wells in the Wattenberg Field and

1 Niobrara B well in the Northern DJ (avg.

working interest ~ 19%)

• Have received over 78 additional

notifications for horizontal wells from other

operators of which we have received 23 AFEs

with average working interest of 5.2%

notifications for horizontal wells from other

operators of which we have received 23 AFEs

with average working interest of 5.2%

Horizontal Drilling Allows Multiple Wells on a

Single Pad that Reach Multiple Zones

Single Pad that Reach Multiple Zones

|

|

|

|

|

|

|

|

|

|

|

|

7

Single Pad

NYSE MKT: SYRG

First Operated Horizontal Well Pads

Synergy First Operated Wattenberg Well Pads

2

1

2

Renfroe Pad - operated 5 well pad with ~99%

W.I. (first production early September, 2013)

W.I. (first production early September, 2013)

Leffler Pad - operated 6 well pad with ~99%

W.I. (drilling commenced 1Q:FY2014)

W.I. (drilling commenced 1Q:FY2014)

PDC

PDC

Noble

Future Long Lateral

Development

Development

PDC

PDC

8

PDC

NYSE MKT: SYRG

Wattenberg Midstream Ramp-Up

9

2013

Under Construction

Permit Pending

2014

Permits Submitted

2015

Permits Submitted

Expansion Projects

Current Capacity:

445 MMcf/day

445 MMcf/day

Future Capacity:

1,065 MMcf/d

1,065 MMcf/d

Additional NGL Capacity

Front Range NGL pipeline expected to add 150-230 Mbo/d - Mont Belvieu

access November 2013

access November 2013

140% Capacity

Increase

Increase

NYSE MKT: SYRG

Wattenberg Extension Area in the

Northern DJ Basin Overview

Northern DJ Basin Overview

Bonanza Creek

Hog Farm Purchase

$10,640 / net acre

Noble - East Pony

Drilled 3 wells on 80 acre spacing

30-day IP: 720 Boe/d

EURs: 345,000 Boe

EOG &

Continental

Synergy Wattenberg Extension Area Overview - ~20,040 Net Acres(1)

1. All offset operator data sources from published

presentations and acreage positions reflect

approximations.

presentations and acreage positions reflect

approximations.

Whiting Red Tail Project Razor Well

IP: 861 Boe/d

IP: 861 Boe/d

From Niobrara B

Synergy operated vertical well

to be drilled by 12/31/13

100% working interest

Bill Barrett Corporation

39,920 net acres

Whiting acreage acquisition 32,000

net acres announced

net acres announced

August 2013

Participating with Noble on

horizontal Niobrara well

horizontal Niobrara well

Participating with Carrizo on 3

extended laterals

extended laterals

Synergy operated D-Sand test well

to be drilled by 12/31/13

to be drilled by 12/31/13

35% working interest

NYSE MKT: SYRG

*Oil Weighted Reserve & Production Growth

11

Average Daily Net Production Per Period (Boe/d)

Proved Reserves: 13.6 Mmboe (2/28/2013) & Total Unrisked Potential of 182.0 Mmboe

Proved Reserves (2/28/2013) and Unrisked Potential

0

500

1,000

1,500

2,000

2,500

3,000

2010

2011

2012

Q1:13A

Q2:13A

Q3:13A

Q4:13E

2,256

2,067

1,658

1,152

452

122

Wells

Per 640

Net

Well

Spacing

(1)

Total

Potential

Per Well

EUR

(1)

Unrisked

Potential

Wattenberg Field (4,500 ft. Laterals)

Niobrara B Bench - Hz

9

20,000

71

281

80%

224

325

72.8

Niobrara A Bench - Hz

2

20,000

320

62

80%

49

325

15.9

Niobrara C Bench - Hz

4

20,000

160

125

80%

100

325

32.5

(2)

Northern Extension (4,500 ft. laterals)

(1) EURs and unrisked potential are management estimates based on experience in Wattenberg and publicly available information from other industry participants.

(2) Codell net acres subtracts net vertical wells already drilled on 20 acre spacing.

13.6

13.6

72.8

15.9

32.5

42.0

22.5

-

20

40

60

80

100

120

140

160

180

200

Proved (Mmboe)

Total Upside

Northern

Extension

Codell

C Bench

A Bench

B Bench

Proved + Unrisked

Potential:

Potential:

199.3 MMboe

* Management believes the Wattenberg Field acreage will support between 16 and 26 horizontal wells per 640 acres on a fully developed basis and have used a mid-point of 21 wells for illustrative purposes

NYSE MKT: SYRG

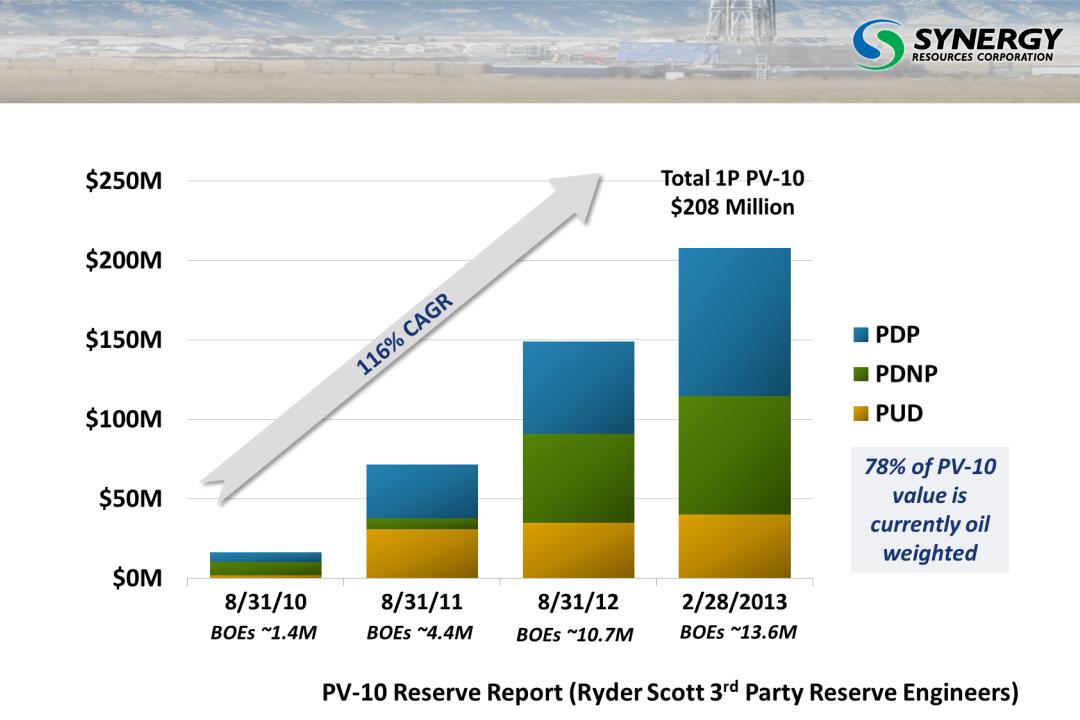

1P Reserve Growth by Year (PV-10)

12

NYSE MKT: SYRG

Revenue and EBITDA Growth

Oil

Gas

NGL

13

|

Average Sales Price per Quarter

|

||||||||

|

|

4Q Aug-11

|

1Q Nov-11

|

2Q Feb-12

|

3Q May-12

|

4Q Aug-12

|

1Q Nov-12

|

2Q Feb-13

|

3Q May-13

|

|

Oil (Bbls)

|

$ 89.91

|

$ 83.03

|

$92.33

|

$91.21

|

$82.89

|

$81.03

|

$84.20

|

$83.98

|

|

Gas & Liquids (Mcf)

|

$ 6.22

|

$ 5.23

|

$4.09

|

$3.62

|

$2.82

|

$4.27

|

$4.77

|

$4.76

|

|

NGL Premium (%)

|

39%

|

41%

|

41%

|

48%

|

15%

|

35%

|

32%

|

34%

|

$38.3M

**

* MRQ = Most Recent Quarter **TTM = Trailing Twelve Months Generated 74% EBITDA margin on revenues

NYSE MKT: SYRG

Fully Funded

2014 CAPEX

Budget

2014 CAPEX

Budget

Fiscal 2014 budget of ~$157.5 million to drill/participate in horizontal and

vertical wells, additional lease hold, and acquisitions in the Wattenberg Field

is fully funded with cash on hand and projected free cash flow from revenues.

vertical wells, additional lease hold, and acquisitions in the Wattenberg Field

is fully funded with cash on hand and projected free cash flow from revenues.

~20,040 net acres in the Wattenberg Extension area in the Northern DJ

Basin provides additional +125 net total locations and +22.5 Mmboe

of un-risked potential(1)

Basin provides additional +125 net total locations and +22.5 Mmboe

of un-risked potential(1)

Borrowing base increased to $75 million from $47 million on 6/4/13. Current

liquidity of $39 million(2) on borrowing base as of August 31, 2013.

liquidity of $39 million(2) on borrowing base as of August 31, 2013.

To date, operated 80% of our Wattenberg Field wells. Allows for control over

timing and production, operating, and administrative costs.

timing and production, operating, and administrative costs.

Company Highlights & Key Takeaways

14

Senior management has an average of 30+ years of Wattenberg experience

and have owned and operated over 300+ DJ Basin wells. Management and

Directors own ~17%(3) of the Company including options.

and have owned and operated over 300+ DJ Basin wells. Management and

Directors own ~17%(3) of the Company including options.

1. Management estimates. Derivation of unrisked potential provided on slide 11. 2. $36 million outstanding as of 8/31/13. Pro forma for recent equity offering.

.

Significant

Exposure to

Wattenberg

Field

Exposure to

Wattenberg

Field

~20,000 net acres in the oil and liquids portion of the Wattenberg Field in

Weld County, CO. 608 net total locations - 163 Mmboe of un-risked

potential(1). 34 horizontal permits approved and 41 currently in process.

Weld County, CO. 608 net total locations - 163 Mmboe of un-risked

potential(1). 34 horizontal permits approved and 41 currently in process.

NYSE MKT: SYRG

Appendix

NYSE MKT: SYRG

Iowa

New Mexico

Kennedy Basin

DJ Basin

Central Kansas

Basin

Forest City

Basin

Basin

Cherokee Basin

Morgan

Weld

Washington

Laramie

Kimball

Banner

Logan

Phillips

Powder River

Basin

Basin

Chase

Hitchcock

Hay

s

s

Red

Willow

Willow

Frontier

Salina Basin

Richardso

n

n

Missouri

Hugoton Embayment

Wyoming

16

Mississippian & Pennsylvanian Plays Moving North

Current Pennsylvanian

Horizontal Test Wells

Credo Petroleum Corp.

Pennsylvanian Vertical

Well Initial Production

Pennsylvanian Vertical

Well Initial Production

218 BOPD

NYSE MKT: SYRG

Multiple Stacked Play

Nebraska Acreage Multiple Stacked Play

• 123,000 net acres in Nebraska that is highly prospective for Upper

Pennsylvanian, Cherokee and Mississippian Lime

Pennsylvanian, Cherokee and Mississippian Lime

• Historical production from vertical wells

• Multiple stacked oil play

• Long term leases (7+ years average remaining term)

• Apache views this as an extension of their horizontal oil play

• Majors pursuing acres: i.e., Apache Corp. (NYSE:APA) acquired

580,000 net acres in Nebraska & Kansas

580,000 net acres in Nebraska & Kansas

Chase County,

NE

NE

Chase County,

NE

NE

48,321 net (oily)

48,321 net (oily)

Dundy County,

NE

NE

Dundy County,

NE

NE

23,751 net (oily)

23,751 net (oily)

Hayes County,

NE

NE

Hayes County,

NE

NE

43,920 net (oily)

43,920 net (oily)

Hitchcock

County, NE 2,492

net (oily)

County, NE 2,492

net (oily)

Hitchcock

County, NE 2,492

net (oily)

County, NE 2,492

net (oily)

Type Log

17

NYSE MKT: SYRG

Key Stats: SYRG (NYSE MKT)

Stock Price (9/12/13)

$10.00

52 Week High/Low

$10.18-$3.11

Shares Outstanding

71.95 M

Public Float

54.6M

Warrants Outstanding

7 M

Options Outstanding

1.8 M

Avg. Daily Vol. (3 month)

592,000

Market Capitalization

$719M

Institutional Holdings

42%

Insider Holdings, est.

17%

Total Capital Raised (net)

$154.4 M

|

Revenue (ttm)

|

$38.2 M

|

|

Net Income (ttm)

|

$10.53 M

|

|

EPS (ttm)

|

$0.20

|

|

Cash & STI (pf)

|

$ 96.6 M

|

|

Total Assets (pf)

|

$269.7 M

|

|

Long Term Debt (pf)

|

$44.5 M

|

|

Current Credit Facility

|

$150 M

|

|

Borrowing Base

|

$75.0 M

|

|

Fiscal 2014 CAPEX

|

$157 M

|

|

Founded

|

2008

|

|

Fiscal Year End

|

August 31

|

18

Sources: Capital IQ, SEC, Thomson Reuters, Company estimates

ttm = trailing twelve months; pf = pro-forma disclosure incorporates data from most recent quarter and recent financing transactions; STI=

short term investments

short term investments

NYSE MKT: SYRG

Capitalization

19

NYSE MKT: SYRG

• Total CAPEX Budget of $157.5 million

• $90 million to drill 20 net new horizontal wells as operator

• $22.5 million to participate in 5 net non-operated horizontal wells

• $10 million for 12 vertical wells

• $30 million for acquisitions

• $5 million for land leasing

• CAPEX will be funded with cash on hand and cash flow from operations

2014 CAPEX Budget

20

NYSE MKT: SYRG

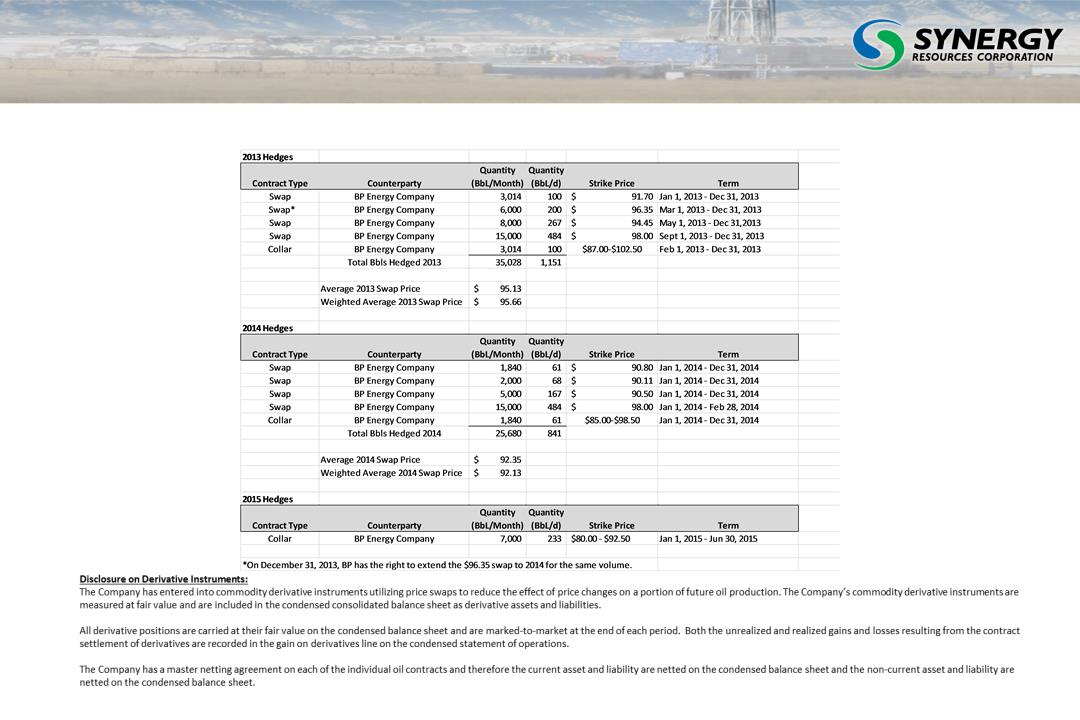

Hedging Summary

• The company’s commodity derivative contracts as of July 15, 2013 are summarized below:

NYSE MKT: SYRG

Board of Directors

|

Edward Holloway

•Synergy Resources President & CEO

•Director since June 2008

•30+ years of Oil and Gas Executive Leadership

•Co-Founder of Cache Exploration & Petroleum Management

|

Bill Conrad

•Independent director since May 2005

•Former President of Wyoming Oil & Gas

•Involved in the oil & gas industry for over 20 years

|

|

William Scaff, Jr.

•Synergy Resources Executive Vice President

•Director since June 2008

•30+ years of Oil & Gas Executive Leadership

•Co-Founder of Petroleum Management

|

Rick Wilber

•Independent director since June 2008

•Board member of Ultimate Software Group, Inc. (ULTI - NASDAQ)

•Private Investor and Consultant to numerous start up and early

stage companies |

|

George Seward

•Director since July 2010

•Co-Founded Prima Energy in 1980, sold to Petro-Canada in 2004

for $534 million •Significant oil and gas experience

|

R.W. “Bud” Noffsinger, III

•Independent director since September 2009

•President &CEO of RWN3

•Former Chief Credit Officer for First Western Trust Bank

|

|

Raymond McElhaney

•Independent director since May 2005

•Co-Founded & current president of MCM Capital Management

•Former Founder and President of Spartan Petroleum and

Exploration |

|

22

NYSE MKT: SYRG

Sell-Side Research Coverage

|

Firm

|

Analyst

|

|

Brean Capital

|

Jeff Connolly

|

|

Cannacord Genuity

|

Stephen Berman

|

|

Euro Pacific Equities

|

Joel Musante, CFA

|

|

Global Hunter Securities

|

Mike Kelly

|

|

Johnson Rice & Co.

|

Welles Fitzpatrick

|

|

Iberia Capital Partners

|

David Beard, CFA

|

|

Key Banc

|

Jack Aydin

|

|

Northland Capital Markets

|

Jared Lewis

|

|

Sidoti & Co.

|

Gabriel Daoud

|

|

SunTrust Robinson Humphrey

|

Ryan Oatman

|

|

Wunderlich Securities

|

Irene Haas

|

Please note that any opinions, estimates or forecasts regarding Synergy Resources performance made by these analysts are theirs alone

and do not represent opinions, forecasts or predictions of Synergy Resources or its management. Synergy Resources does not by its

reference above imply its endorsement of or concurrence with such information, conclusions or recommendations. This list includes

analysts currently known by Synergy Resources to follow the company, but may not be complete and may change as firms add or delete

coverage. Synergy Resources does not undertake any duty to update this information or any information provided by third parties.

and do not represent opinions, forecasts or predictions of Synergy Resources or its management. Synergy Resources does not by its

reference above imply its endorsement of or concurrence with such information, conclusions or recommendations. This list includes

analysts currently known by Synergy Resources to follow the company, but may not be complete and may change as firms add or delete

coverage. Synergy Resources does not undertake any duty to update this information or any information provided by third parties.

23