Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILENT TECHNOLOGIES, INC. | body.htm |

| EX-99.1 - PRESS RELEASE - AGILENT TECHNOLOGIES, INC. | ex1.htm |

Agilent Technologies

Separating Into Two Industry-Leading

Public Companies

to Increase Strategic Flexibility

and Enhance Shareholder Value

Public Companies

to Increase Strategic Flexibility

and Enhance Shareholder Value

September 19, 2013

Page *

Exhibit 99.2

Safe Harbor

This presentation contains forward-looking statements (including, without limitation, information and future

guidance on the company’s goals, priorities, the planned separation of our Electronic Management Group,

revenues, demand, growth opportunities, customer service and innovation plans, new product introductions,

financial condition, earnings, the company’s ability to pay dividends, ability to access capital markets, the

continued strengths and expected growth of the markets the company sells into, operations, operating earnings,

and tax rates) that involve risks and uncertainties that could cause results of Agilent to differ materially from

management’s current expectations. The words “anticipate,” “plan,” “estimate,” “expect,” “intend,” “will,” “should”

“forecast” “project” and similar expressions, as they relate to the company, are intended to identify forward-

looking statements.

guidance on the company’s goals, priorities, the planned separation of our Electronic Management Group,

revenues, demand, growth opportunities, customer service and innovation plans, new product introductions,

financial condition, earnings, the company’s ability to pay dividends, ability to access capital markets, the

continued strengths and expected growth of the markets the company sells into, operations, operating earnings,

and tax rates) that involve risks and uncertainties that could cause results of Agilent to differ materially from

management’s current expectations. The words “anticipate,” “plan,” “estimate,” “expect,” “intend,” “will,” “should”

“forecast” “project” and similar expressions, as they relate to the company, are intended to identify forward-

looking statements.

In addition, other risks that the company faces in running its operations include the ability to execute successfully

through business cycles; the ability to successfully adapt its cost structures to continuing changes in business

conditions; ongoing competitive, pricing and gross margin pressures; the risk that our cost-cutting initiatives will

impair our ability to develop products and remain competitive and to operate effectively; the impact of

geopolitical uncertainties on our markets and our ability to conduct business; the ability to improve asset

performance to adapt to changes in demand; the ability to successfully introduce new products at the right time,

price and mix, and other risks detailed in the company's filings with the Securities and Exchange Commission,

including our quarterly report on Form 10-Q for the quarter ended July 31, 2013.

through business cycles; the ability to successfully adapt its cost structures to continuing changes in business

conditions; ongoing competitive, pricing and gross margin pressures; the risk that our cost-cutting initiatives will

impair our ability to develop products and remain competitive and to operate effectively; the impact of

geopolitical uncertainties on our markets and our ability to conduct business; the ability to improve asset

performance to adapt to changes in demand; the ability to successfully introduce new products at the right time,

price and mix, and other risks detailed in the company's filings with the Securities and Exchange Commission,

including our quarterly report on Form 10-Q for the quarter ended July 31, 2013.

The company assumes no obligation to update the information in these presentations. These presentations and

the Q&A that follows include non-GAAP measures. Non-GAAP measures exclude primarily the impacts of

acquisition and integration costs, future restructuring costs, asset impairment charges, and non-cash intangibles

amortization. Also excluded are tax benefits that are not directly related to ongoing operations and which are

either isolated or cannot be expected to occur again with any regularity or predictability. Most of these excluded

amounts pertain to events that have not yet occurred and are not currently possible to estimate with a

reasonable degree of accuracy. Accordingly, no reconciliation to GAAP amounts has been provided.

the Q&A that follows include non-GAAP measures. Non-GAAP measures exclude primarily the impacts of

acquisition and integration costs, future restructuring costs, asset impairment charges, and non-cash intangibles

amortization. Also excluded are tax benefits that are not directly related to ongoing operations and which are

either isolated or cannot be expected to occur again with any regularity or predictability. Most of these excluded

amounts pertain to events that have not yet occurred and are not currently possible to estimate with a

reasonable degree of accuracy. Accordingly, no reconciliation to GAAP amounts has been provided.

Page 2

The World’s Premier Measurement Company

Agilent Labs

Order Fulfillment

Life

Sciences

Group

FY13 Revenue $1.6B

Operating Margin 16%

Operating Margin 16%

Chemical

Analysis

Group

FY13 Revenue $1.6B

Operating Margin 22%

Operating Margin 22%

Electronic

Measurement

Group

FY13 Revenue $2.9B

Operating Margin 19%

Operating Margin 19%

Diagnostics &

Genomics

Genomics

Group

FY13 Revenue $0.7B

Operating Margin 15%

Operating Margin 15%

Finance, HR, Legal, IT, Workplace Services

FY13 Revenue $6.8B, Core Growth(2) -3%, Operating Margin 18.5%,

ROIC 16%, Free Cash Flow $900M, Debt/EBITDA 1.9x

ROIC 16%, Free Cash Flow $900M, Debt/EBITDA 1.9x

EM Markets

LDA Markets FY13(1) Revenue $3.9B, Operating Margin 18%

(1) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013.

(2) Core growth is reported growth adjusted for the effects of M&A and FX.

Page 3

Agilent to Split into Two Companies

Strategic Rationale for Separation

• Capitalizing on EMG, Agilent has grown LDA to be a sizeable and

highly competitive business

highly competitive business

• Spin-off to create two companies with greater strategic and

management focus, each well positioned for growth in its sector

management focus, each well positioned for growth in its sector

• Distinct industries and drivers

• Greater strategic focus

• Both businesses have the scope to stand on their own

• Two unique and compelling investment profiles

• Positioned to attract a more focused shareholder base

• Better aligned with research analyst coverage universe and peer

comparisons

comparisons

Move Designed to Increase Strategic Flexibility

and Enhance Shareholder Value

and Enhance Shareholder Value

Page 4

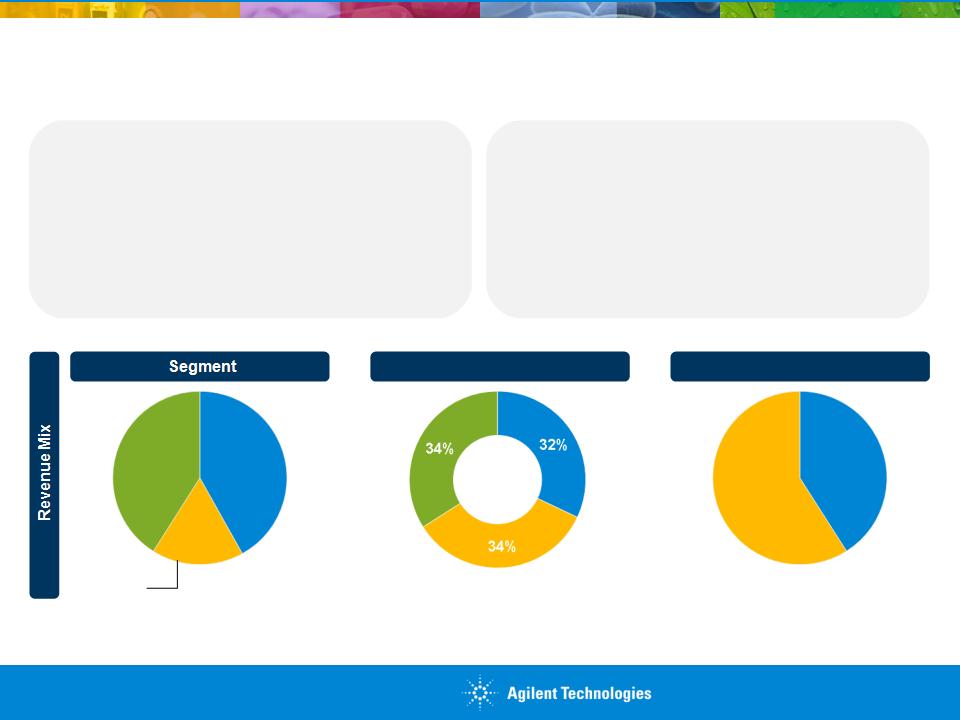

Two Independent Publicly Traded Companies

LDA-Focused Company

(New Agilent)

(New Agilent)

EM-Focused Company

(To Be Named)

Revenue Mix

Financial

Metrics(1)

Metrics(1)

Key

Platforms

Platforms

|

§ Revenue: $3.9B

§ Operating Margin: 18%

§ ROIC: 11%

|

§ Revenue: $2.9B

§ Operating Margin: 19%

§ ROIC: 31%

|

|

§ Liquid & Gas Chromatography

§ Mass Spectrometry

§ Spectroscopy

§ Nuclear Magnetic Resonance

§ Genomics & Diagnostics (Dako)

§ Consumables, Services, Software

|

§ Source & Signal Analyzers

§ Network Analyzers

§ One-box Testers

§ Oscilloscopes

§ Modular & Handheld

§ Services & Software

|

(1) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013.

Page 5

Management Teams

New Agilent

EM Company

Bill Sullivan, President

and CEO

and CEO

Ron Nersesian, President

and CEO designate

and CEO designate

Didier Hirsch, Chief

Financial Officer

Financial Officer

Neil Dougherty, Chief

Financial Officer designate

Financial Officer designate

(formerly VP and Treasurer

of Agilent Technologies)

of Agilent Technologies)

Page 6

New Agilent: Life Sciences,

Diagnostics, and Applied

Markets

Diagnostics, and Applied

Markets

Page *

New Agilent Overview

• Global leader in Life Sciences, Diagnostics, and

Applied markets

Applied markets

• Attractive recurring revenue base

• Balanced geographic revenue profile

• Growth opportunities in emerging markets, molecular

diagnostics and clinical

diagnostics and clinical

• Significant margin expansion opportunities

• Revenues: $3.9B, +9% y/y (+5% core(2))

• Operating Margin: 18% of revenue

• ROIC: 11%

FY13(1) Financial Metrics

(1) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013.

(2) Core growth is reported growth adjusted for the effects of M&A and FX.

Geography

Type

Genomics &

Diagnostics

17%

Diagnostics

17%

Life

Sciences

42%

Sciences

42%

Chemical

Analysis

41%

Analysis

41%

Non-

Recurring

59%

Recurring

59%

Recurring

41%

41%

Americas

Europe

Asia Pacific

Page 8

New Agilent: Market Profile

|

End Markets

|

Market

Size(1) |

Long Term

Market Growth(1) |

Market

Position(1) |

Growth Drivers

|

|

$11B

|

4-6%

|

#3

|

• Shift to new biological

entities • Emerging markets

|

|

|

$10B

|

3-5%

|

#4

|

• Global investments in

Life Science research |

|

|

$7B

|

8-10%

|

#2 &

emerging |

• Increasing patient

population • Companion

diagnostics |

|

|

$4B

|

5-7%

|

#1

|

• Global food supply

• Government

regulations |

|

|

$5B

|

2-4%

|

#1 & #2

|

• New environmental

contaminants • Designer drugs

|

|

|

$4B

|

4-6%

|

#1

|

• Rising energy

demands • Alternative energy

|

Market Size(1): $41B

Long Term Market Growth(1): 4-

6%

6%

Revenue Mix(2)

by End Market

(1) Market size, growth, and position per Company estimates

(2) Percentage of LDA revenue based on Q4’12-Q3’13

Page 9

Growth through technology leadership,

customer intimacy, workflow solutions

customer intimacy, workflow solutions

Higher recurring revenue mix (from 29% to

41%(1))

41%(1))

Continued strategic push from lab to the

clinic. Ensuring the success of Dako

clinic. Ensuring the success of Dako

Focused on similar markets with higher

growth rates and lower cyclicality

growth rates and lower cyclicality

Leadership in Life Sciences, Diagnostics,

and Applied markets

and Applied markets

Pure play Life Sciences, Diagnostics, and

Analytical Company

Analytical Company

Same

Different

Margin improvement through reduced

manufacturing, logistics costs, and sales

channel leverage

manufacturing, logistics costs, and sales

channel leverage

Allows management to focus exclusively

on running LDA business

on running LDA business

Business model better aligned with

shareholder base and peer group

shareholder base and peer group

What’s Different for New Agilent?

Scale and financial strength to stand on its

own

own

Attracting and retaining top talent in the

industry

industry

Continuing to build on strong foundation in

emerging markets

emerging markets

(1) Percentage of recurring revenue based on Q4’12-Q3’13

Page 10

New Agilent: Strategy to Win

Creating Shareholder Value

§ Increase organic growth rate

ü Leverage large and growing installed base to expand recurring revenues and

core instrument sales

core instrument sales

ü Take advantage of greenfield opportunities in developed markets (clinical

instrumentation, integrated biology, sample preparation)

instrumentation, integrated biology, sample preparation)

ü Leverage presence in emerging markets

ü Ensure success of Dako and Varian acquisitions

§ Grow earnings faster than revenues

ü Continued improvement in gross margins

ü Drive operating margin expansion and increase ROIC

§ Deliver complete workflow solutions for our customers

ü Core data system platform to easily enable application development in the lab

and correlate data from research to the clinic, allowing for deeper insight

and correlate data from research to the clinic, allowing for deeper insight

ü Bolt-on acquisitions that help complete the workflow. Focused on sequencing

and related technologies, molecular diagnostics, and consumables

and related technologies, molecular diagnostics, and consumables

Page 11

Electronic Measurement

Focused Company

Focused Company

Page *

• Leading position in major markets

• Global electronic measurement technology

and market leader

and market leader

• Growth opportunity in emerging markets

• Strong cash flow generation and ROIC

• Industry leading gross and operating

margins

margins

• $450M of recurring services & support

revenue. $300M of software sales

revenue. $300M of software sales

(1) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013.

(2) Core growth is reported growth adjusted for the effects of M&A and FX.

Q3’13 Revenue Mix

by Geography

Asia Pacific

Americas

Europe

FY13(1) Financial Metrics

Communications

#1

Industrial,

Computers,

Semiconductors

Computers,

Semiconductors

#1

Aerospace

Defense

#1

EM Company Overview

The World’s Premier Electronic Measurement Company

The World’s Premier Electronic Measurement Company

Page 13

EM Company: Market Profile

(2) Percentage of EM revenue based on Q4’12-Q3’13

(3) Excludes network assurance

|

End Markets

|

Market

Size(1) |

Long

Term Market Growth(1 ) |

Growth Drivers

|

Market

Position |

|

Communications(3

) |

$4B

|

4-6%

|

• Mobile data traffic growth

• Complex components and

chipsets • Subscriber growth in

China, India, Brazil |

#1

|

|

Aerospace &

Defense |

$3B

|

Flat

|

• Satellites and radar

modernization outside U.S. • Intelligence, surveillance,

reconnaissance (ISR) |

#1

|

|

Industrial,

Computer & Semiconductor |

$6B

|

3-5%

|

• Electronic content

proliferation • Mobile computing

• High performance cloud

infrastructure • Education and research in

emerging markets |

#1

|

Communications

34%

34%

Industrial,

Computer &

Semiconductor

43%

Computer &

Semiconductor

43%

Aerospace &

Defense

23%

Defense

23%

Market Size(1): $13B

Long Term Market Growth(1): 3-

4%

4%

Revenue Mix(2)

by End Market

Page 14

Electronic measurement top opportunities

are company’s top opportunities

are company’s top opportunities

Same customers and global footprint

New name

Top talent

Strong position in emerging markets

Organic growth, tuck-in acquisitions

Whole company 100% focused on EM and

customer success

customer success

Focus: profit and cash generation

#1 in key markets

Business model completely aligned with

shareholders and analysts

shareholders and analysts

Same

Different

Corporate headquarters in Santa Rosa

What’s Different for EM Company?

Technology leadership

Alignment between incentive compensation

and EM value creation

and EM value creation

Page 15

EM Company Strategy to Win

§ World’s premier electronic test and measurement provider in Communications,

Aerospace/Defense, and Industrial markets

Aerospace/Defense, and Industrial markets

§ First to market with leading edge customer-valued technology solutions

ü Take share in core platforms

ü Top opportunities in electronic measurement industry are now

the company’s top opportunities

the company’s top opportunities

ü Transform the measurement experience

§ World’s best customer satisfaction with lowest cost of ownership

§ Manage market volatility by continuing to generate strong cash flow, ROIC, and

solid earnings throughout the cycle

solid earnings throughout the cycle

§ Management team with deep EM experience and track record of delivering on

tough financial commitments

tough financial commitments

Page 16

|

Goal

|

Actions taken since 2009 downturn

|

EM Company Strong Profitability Throughout the

Cycle

Cycle

Restructured Operations to Maintain Strong Profitability

During Periods of Market Volatility

During Periods of Market Volatility

Lower Costs

Shift Fixed Costs

to Variable

Focus on Core

|

n Reduced headcount by 2700 people

n Focused on continuous GM improvement - value engineering

|

|

n Increased use of Contract Manufacturing

n Increased indirect channel for variable selling cost

n Increased use of external resources

|

|

n Maintained R&D investment for technology leadership and application solutions

n Leveraged technology investment throughout product portfolio

n Owns critical enabling technology in ASICS, microcircuits, and gallium arsenide

|

Page 17

Transaction Details

Transaction

Structure

Structure

Timing

Financial

Details

Details

|

n Agilent shareholders will receive a pro rata distribution of shares in EM Company via a tax

-free spin-off |

|

n Expected to be completed by end of calendar year 2014, subject to the satisfaction of

customary closing conditions, including: — Final approval by the Agilent Board of Directors

— Receipt of favorable rulings from the IRS

— Effectiveness of a Form 10 filing with the SEC

— Receipt of regulatory approvals in all major jurisdictions

|

|

n Both companies to be well capitalized, have strong balance sheets and expected

investment grade profiles with target debt to EBITDA ratios below 2.0x n LDA-focused company is expected to continue to pay a dividend at least equal to the

current yield n Not anticipated to impact Agilent’s guidance for fiscal year 2013. Plan to provide fiscal

year 2014 guidance at next earnings announcement in mid November n Expected to incur one-time charges related to the transaction during the periods

preceding the separation, to be quantified at a later date n Expect to retire a portion of current Agilent long-term debt outstanding, utilizing EM

Company capital n During the transition Agilent expects to continue its dividend and repurchase shares to at

least maintain current share count |

Page 18

§ Leverage prior experience

ü Agilent has completed four major spin-offs/divestitures since 2005

§ Dis-synergies of ~ $100M cumulative over three year period

ü Little real estate overlap outside of sales offices

ü Clean ERP separation

ü Most dis-synergies in shared infrastructure organization

• Replicate current Colorado Springs Data Center to provide IT infrastructure

for both companies

for both companies

• New Agilent to provide infrastructure services, such as payroll, IT, financial

services until EM Company can operate independently (~1 year after spin)

services until EM Company can operate independently (~1 year after spin)

ü Both companies to develop specific action plans to minimize dis-synergies over time

Spin-off Execution Plan

Page 19

Appendix

Page *

New Agilent Historical Consolidated Income

Statement(1)

Statement(1)

Page 21

|

$M

|

FY 2010

|

FY 2011

|

FY 2012

|

|

Revenue

|

2,679

|

3,310

|

3,543

|

|

% YoY

|

30%

|

24%

|

7%

|

|

COGS

|

1,245

|

1,603

|

1,685

|

|

Gross Margin %

|

54%

|

52%

|

52%

|

|

Operating Expenses

|

936

|

1,157

|

1,225

|

|

% Revenue

|

35%

|

35%

|

35%

|

|

Operating Profit

|

498

|

550

|

633

|

|

% Revenue

|

19%

|

17%

|

18%

|

(1) Presented on a non-GAAP basis; reconciliations to closest GAAP equivalent provided

EM Company Historical Consolidated Income

Statement(1)

Statement(1)

Page 22

|

$M

|

FY 2010

|

FY 2011

|

FY 2012

|

|

Revenue

|

2,784

|

3,316

|

3,315

|

|

% YoY

|

15%

|

19%

|

0%

|

|

COGS

|

1,158

|

1,378

|

1,428

|

|

Gross Margin %

|

58%

|

58%

|

57%

|

|

Operating Expenses

|

1,188

|

1,178

|

1,136

|

|

% Revenue

|

43%

|

36%

|

34%

|

|

Operating Profit

|

438

|

760

|

751

|

|

% Revenue

|

16%

|

23%

|

23%

|

(1) Presented on a non-GAAP basis; reconciliations to closest GAAP equivalent provided

Broadest range of solutions across ecosystem, including

•Components and chipsets - Simulation tools, network analyzers

Market Reach, Customer Trust

•Global footprint with R&D in US, Europe and Asia

•Recognized leader in electronic test and measurement

•Leadership in standards bodies

• Handsets - One-box testers for R&D and manufacturing

• Base Stations - Signal analyzers, sources

• Wireline / Optical - Optical modulation analyzers

Key Drivers

How We Win

Key New Products

•Combination of bench-top and modular to deliver best solutions

•Highly differentiated platforms for mobile device R&D and manufacturing to launch in

H1’14

H1’14

• Mobile data traffic grows at double-digit rates each year

• Components and chipsets increase in complexity

• Subscriber growth in China, India, Brazil

EM Company in Communications

Market Size(1): $4B

Long Term Market

Growth(1): 4-6%

Growth(1): 4-6%

Market Position(1):

#1

#1

Page 23

(1) Market size, growth, and position per Company estimates

EM Company in Aerospace & Defense

Market Size(1): $3B

Long Term Market

Growth(1): Flat

Growth(1): Flat

Market Position(1): #1

Key Drivers

How We Win

• Growth comes from outside US (Russia, China, India, Middle East) driven by new

satellites and radar technologies

satellites and radar technologies

• Growth of intelligence, surveillance, and reconnaissance

Leading Technology, Application Solutions, including

•Direct wideband radar - 90000 X-Series oscilloscopes

•Wideband radar simulation -- Arbitrary waveform generator

•Lowest phase noise for radar - Performance signal generators

•Best amplifier characterization for satellite communications - PNA-X

•Mission-critical network surveillance - unique contribution

Market Reach, Customer Trust

•Largest installed base

•World-class, long-term service and support

•Network of system integrators and in-house capabilities

Key New Products

•Leading high-performance oscilloscopes with proprietary technology

•RF and microwave modular products with lab-quality measurements

•Industry’s highest performing handhelds

Page 24

(1) Market size, growth, and position per Company estimates

EM Company in Industrial, Computer &

Semiconductors

Semiconductors

Market Size(1): $6B

Long Term Market

Growth(1): 3-5%

Growth(1): 3-5%

Market Position(1): #1

Key Drivers

How We Win

• Electronic content in industrial segment continues to proliferate

• Mobile computing driven by smartphones, tablets, and notebook PCs

• Cloud computing requires high-performance infrastructure

• Semiconductor R&D-driven innovation

• Strategic investments in education and research in emerging countries

Leading Technology, Application Solutions, including

•Industry-leading PCI-Express Gen3 - Oscilloscopes, bit error rate testers (BERTs),

protocol analyzers

protocol analyzers

•Premier battery drain characterization - Source measure units (SMUs)

•First THz materials research solution - Performance network analyzers

Market Reach, Customer Trust

•Award-winning products plus expanded indirect channel

•Leadership in high-speed digital standards: PCI Express, USB, HDMI

Key New Products

•Differentiated oscilloscope offering with ongoing ease-of-use innovation and value

integration

integration

Page 25

(1) Market size, growth, and position per Company estimates

|

Applications

|

Market

Position (1) |

Markets

|

Competitors

|

|

|

Designs, simulates, & optimizes

electronic circuit performance prior to building the prototype |

#1

|

Communications,

Aerospace/Defense, Industrial/Computer/S emi (ICS) |

•Cadence

•National Instruments

|

|

|

For wireless

devices—measures performance at chip, module or device level prior to deploying in network |

#3

|

Communications

|

•Anritsu

•Rohde & Schwarz

•Teradyne (LitePoint)

|

|

|

Characterizes responses of

devices & components in an electrical network |

#1

|

Communications,

Aerospace/Defense, ICS |

•Anritsu

•Rohde & Schwarz

|

|

|

Measures changing electrical

signals at different points in a circuit or system |

#2

|

Communications,

Aerospace/Defense, ICS |

•Danaher (Tektronix)

•LeCroy (Teledyne)

|

|

|

Measures magnitude or power

of signal versus frequency |

#1

|

Communications,

Aerospace/Defense |

•Anritsu

•Rohde & Schwarz

|

|

|

Applies signals to circuits under

development in order to predict device behavior |

#1

|

Communications,

Aerospace/Defense |

•Rohde & Schwarz

•Aeroflex

|

|

|

|

|

|

|

|

HP/Agilent

Introduced

Introduced

1983

1967

1956

1964

1939

1985

EM Company: Key Product Platforms

Key platforms account for >50% of revenue

Page 26

(1) Source: Prime Data

New Agilent: Life Sciences Overview

Pharma & Biotech

Academia &

Government Research

Markets & Market Position

#3

#4

Market Size(1): $21B

#1 in Liquid Chromatography (LC)

#3 in Mass Spectrometry (MS)

#2 in Nuclear Magnetic Resonance (NMR)

Q3’13 Revenue Mix

by Geography

Asia Pacific

Americas

Europe

LSG also sells into the applied markets

• Revenues: $1.6B, +3% y/y (+4% core(3))

• Operating Margin: 16% of revenue

FY13(2) Financial Metrics

(1) Market size, growth, and position per Company estimates

(2) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013

(3) Core growth is reported growth adjusted for the effects of M&A and FX

• Pharma shift from new chemical entities (NCEs) to new

biological entities (NBEs) and biosimilars

biological entities (NBEs) and biosimilars

• Significant potential for our platforms in emerging markets

• Relocation, decentralization of pharma infrastructure

• Investments in world-class academic base

Global Trends

Page 27

New Agilent: Diagnostics and Genomics Overview

Anatomic Pathology

Molecular Diagnostics

Market Size(1): $7B

Markets & Market Position

#2

Emerging

Q3’13 Revenue Mix

by Geography

Asia Pacific

Americas

Europe

DGG also sells into the pharmaceutical

and research markets

and research markets

• Revenues: $0.7B, +65% y/y (+9% core(3))

• Operating Margin: 14.5% of revenue

• Increasing patient population (aging, lifestyle impacts)

• Increasing understanding of cancer markers and pathways

• Greater access to healthcare in emerging markets

• Companion diagnostics bring diagnostic and treatment

solutions together to enable personalized medicine

solutions together to enable personalized medicine

• Improved molecular diagnostic approaches

Global Trends

FY13(2) Financial Metrics

Page 28

(1) Market size, growth, and position per Company estimates

(2) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013

(3) Core growth is reported growth adjusted for the effects of M&A and FX

New Agilent: Chemical Analysis Group Overview

Market Size(1): $13B

Q3’13 Revenue Mix

by Geography

Asia Pacific

Americas

Europe

Food

#1

Environmental

and Forensics

and Forensics

#1 and #2

Chemical

and Energy

#1

Markets and Market Position

New Global Trends

•Global food supply

•New environmental contaminants

•Designer drugs

•Rising energy demands

• Revenues: $1.6B, +2% y/y (+4% core(3))

• Operating Margin: 22% of revenue

FY13(2) Financial Metrics

Page 29

(1) Market size, growth, and position per Company estimates

(2) FY13 numbers are estimates based on the midpoint of Company guidance provided on August 14, 2013

(3) Core growth is reported growth adjusted for the effects of M&A and FX

New Agilent: Key Product Platforms

Key platforms account for >50% of revenue

Key platforms account for >50% of revenue

|

Platform

|

Applications

|

Markets

|

Market

Position(1) |

Competitors

|

|

LC

|

Pharma R&D and QC

Molecular biology, cancer research

Education & Research / Routine testing

|

Pharma & Biotech

Academia & Government

|

#1

|

Waters, Shimadzu,

Thermo |

|

LC-MS

|

Discovery and Development

Differential Expression and Pathway Analysis

Protein ID, Protein Quantitation

|

Pharma & Biotech

Applied Markets

|

#3

|

Waters, Danaher

Thermo, Bruker,

Shimadzu |

|

GC

|

Separate a liquid or gas sample into its individual

components |

Chemical & Energy

Forensics

|

#1

|

Shimadzu,

PerkinElmer, Thermo, Bruker |

|

GC-MS

|

Identify known and unknown components or

contaminants |

Environmental/Forensics

Food Safety

Chemical & Energy

|

#1

|

Thermo, Shimadzu,

Bruker, Perkin Elmer

|

|

Spectroscopy

|

ATOMIC: Identify and measure the concentrations

of elements in a solid or liquid sample MOLECULAR: Measure the amount, presence or

distribution of molecular material in a sample |

Environmental

Chemical & Energy

Pharma & Biotech

|

#3

|

Thermo,

PerkinElmer, Thermo, Bruker, Shimadzu

|

|

Genomics

|

Sample prep for next-gen sequencing

Microarrays for research and cytogenetic testing

FISH for research and clinical applications

|

Academia & Government

Pharma & Biotech

Diagnostics & Clinical

|

#2 in Target

Enrichment and Microarray |

Thermo (Life),

Illumina, Affymetrix |

|

NMR

|

Structure elucidation, molecular dynamics and in

vivo imaging for broad range of small molecules, nucleic acids, proteins |

Academia & Government

Pharma & Biotech

|

#2

|

Bruker, JEOL

|

|

Dako

|

Cancer diagnostics within anatomic pathology

|

Diagnostics & Clinical

|

#2

|

Roche (Ventana)

Danaher (Leica)

|

Page 30

(1) Market position per Company estimates