Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PEABODY ENERGY CORP | btu_8-k20130918.htm |

Exhibit 99.1

Life Empowered

Credit Suisse Global Steel and Mining Conference

September 19, 2013

Michael C. Crews Executive Vice President and Chief Executive Officer

Peabody Energy

The use of the words “Peabody,” “the company,” “our” and “we” relate to Peabody Energy Corporation, its subsidiaries and majority-owned affiliates. Certain statements in this presentation are forward-looking within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements are based on numerous assumptions that the company believes are reasonable, but they are open to a wide range of uncertainties and business risks that may cause actual results to differ materially from expectations as of September 19, 2013. These factors are difficult to accurately predict and may be beyond the company's control. The company does not undertake to update its forward-looking statements. Factors that could affect the company's results include, but are not limited to: global supply and demand for coal, including the seaborne thermal and metallurgical coal markets; price volatility, particularly in higher-margin products and in our trading and brokerage businesses; impact of alternative energy sources, including natural gas and renewables; global steel demand and the downstream impact on metallurgical coal prices; impact of weather and natural disasters on demand, production and transportation; reductions and/or deferrals of purchases by major customers and ability to renew sales contracts; credit and performance risks associated with customers, suppliers, contract miners, co-shippers, and trading, banks and other financial counterparties; geologic, equipment, permitting, site access and operational risks related to mining; transportation availability, performance and costs; availability, timing of delivery and costs of key supplies, capital equipment or commodities such as diesel fuel, steel, explosives and tires; impact of take-or-pay agreements with rail and port commitments for the delivery of coal; successful implementation of business strategies; negotiation of labor contracts, employee relations and workforce availability; changes in postretirement benefit and pension obligations and funding requirements; replacement and development of coal reserves; availability, access to and related cost of capital and financial markets; effects of changes in interest rates and currency exchange rates (primarily the Australian dollar); effects of acquisitions or divestitures; economic strength and political stability of countries in which we have operations or serve customers; legislation, regulations and court decisions or other government actions, including, but not limited to, new environmental and mine safety requirements; changes in income tax regulations, sales-related royalties, or other regulatory taxes and changes in derivative laws and regulations; litigation, including claims not yet asserted; terrorist attacks or security threats; impact of pandemic illnesses and other factors detailed in the company's reports filed with the Securities and Exchange Commission.

Adjusted EBITDA is defined as income (loss) from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses, depreciation, depletion and amortization, asset impairment and mine closure costs and amortization of basis difference related to equity affiliates. Adjusted EBITDA, which is not calculated identically by all companies, is not a substitute for operating income, net income or cash flow as determined in accordance with United States generally accepted accounting principles. Management uses Adjusted EBITDA to measure segment operating performance and also believes it is a useful indicator of the company's ability to meet debt service and capital expenditure requirements.

Adjusted (Loss) Income from Continuing Operations and Adjusted Diluted EPS are defined as (loss) income from continuing operations and diluted earnings per share from continuing operations, respectively, excluding the impacts of asset impairment and mine closure costs, net of tax, and the remeasurement of foreign income tax accounts on our income tax provision. The income tax benefits related to asset impairment and mine closure costs are calculated based on the enacted tax rate in the jurisdiction in which they have been or will be realized, adjusted for the estimated recoverability of those benefits. Management has included these measures because, in the opinion of management, excluding those foregoing items is useful in comparing the company's current results with those of prior and future periods. Management also believes that excluding the impact of the remeasurement of foreign income tax accounts represents a meaningful indicator of the company's ongoing effective tax rate.

09/19/13

2

Peabody Well Positioned with Significant Upside to Improving Markets

Peabody Energy

Successfully implementing cost improvements

Well-capitalized platform with low sustaining capital needs

Large asset base and long-term project profile

Portfolio diversity enables success in multiple markets

Coal markets showing signs of upturn

Global urbanization drives long-term coal growth

3

Global Coal Markets

Near Perfect Correlation Between Coal Use and GDP Growth

Peabody Energy

Electricity from Coal (TWh) 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000

1970 1980 1990 2000 2010 2020 2030

World GDP (Trillions of 2005 $) 10 20 30 40 50 60 70 80 90 $100

Global Electricity from Coal World GDP

Source: Developed from International Energy Agency World Energy Outlook (1995-2011); USDA 2011.

5

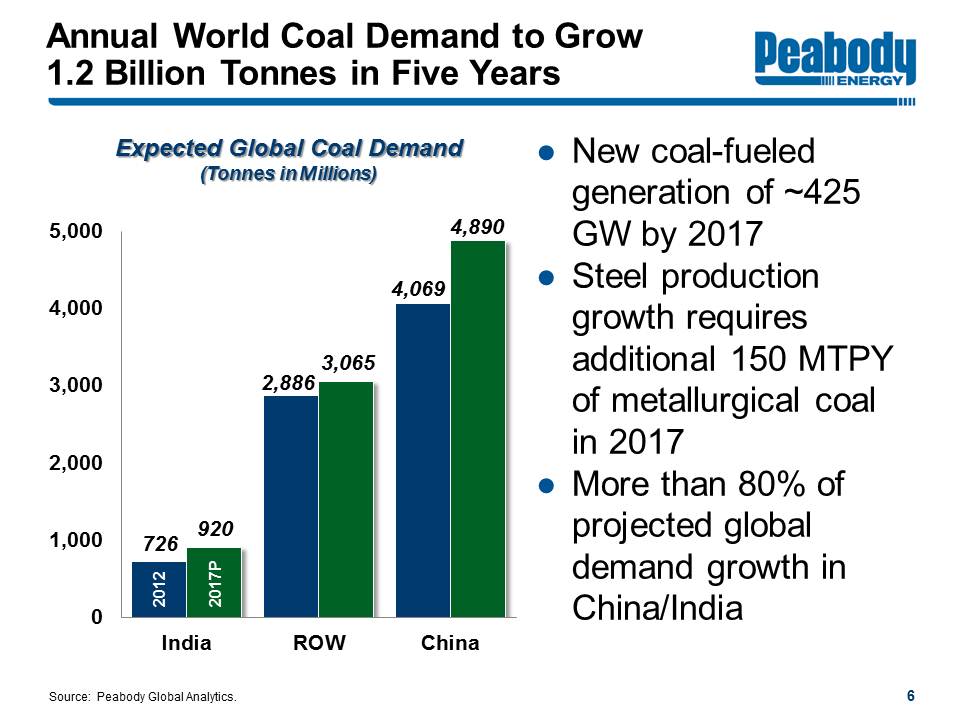

Annual World Coal Demand to Grow 1.2 Billion Tonnes in Five Years

Peabody Energy

Expected Global Coal Demand (Tonnes in Millions) 0 1,000 2,000 3,000 4,000 5,000

India ROW China

2012 726 2,886 4,069 2017P 920 3,065 4,890

New coal-fueled generation of ~425 GW by 2017

Steel production growth requires additional 150 MTPY of metallurgical coal in 2017

More than 80% of projected global demand growth in China/India

Source: Peabody Global Analytics.

6

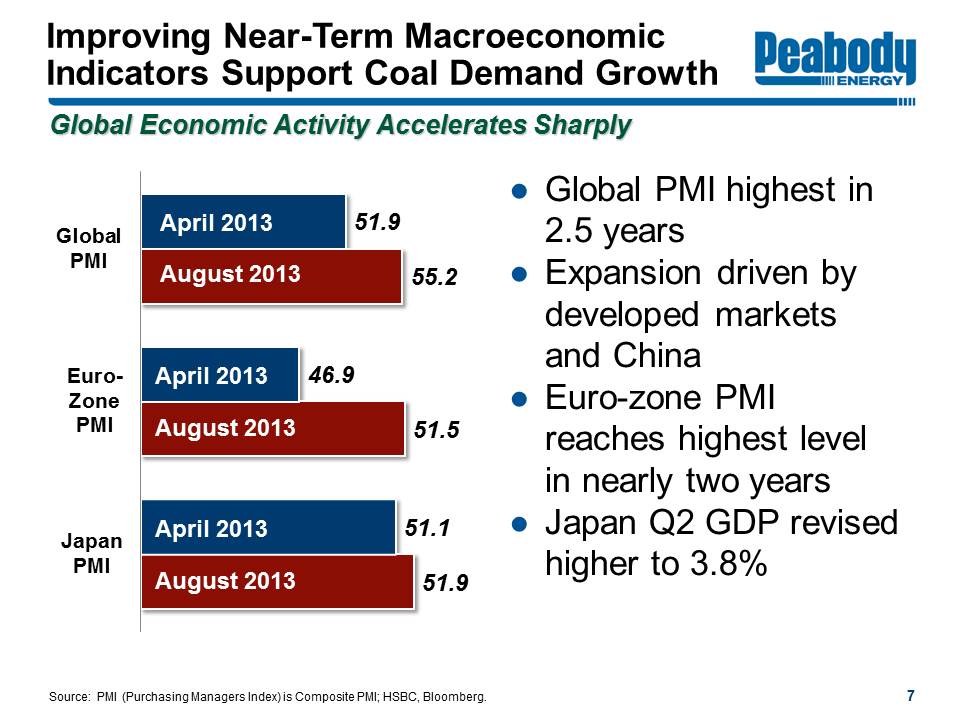

Improving Near-Term Macroeconomic Indicators Support Coal Demand Growth

Peabody Energy

Global Economic Activity Accelerates Sharply

Global PMI Euro-Zone PMI Japan PMI

April 2013 July 2013

51.9 55.2 46.9 51.5 51.1 51.9

Global PMI highest level in 2.5 years

Expansion driven by developed markets and China

Euro-zone PMI reaches highest level in nearly two years

Japan Q2 GDP revised higher to 3.8%

Source: PMI (Purchasing Managers Index) is Composite PMI; HSBC, Bloomberg.

7

China Economic Activity Rebounds; Drives Increased Coal Imports

Peabody Energy

Steal Production Up 12.8%

Composite PMI 51.8

Fixed Asset Investment Up 21.4%

Industrial Production Up 10.4%

Electricity Generation Up 13.4%

China Coal Imports Up 18%

Source: HSBC, World Steel Association, China Customs, China Electricity Council, China National Bureau of Statistics. Coal imports are July 2013 data. All other data is from August 2013. Percent change from prior year.

8

Metallurgical Coal Fundamentals Improving; Strong Long-Term Demand

Peabody Energy

Industrialization and Urbanization Drive Coal Growth

Spot met prices up >15% from recent lows

Near-term markets improving on strong Asian demand and declining U.S. exports

High-cost met coal supplies declining

Global investments in met coal cancelled/deferred, setting up strong potential rebound

Source: UBS Commodities Daily. Met prices as of July 20, 2013 and September 9, 2013.

9

New Generation Drives Significant Global Thermal Coal Demand

Peabody Energy

Global Seaborne Thermal Coal Demand (Tonnes in Millions)

2012 Atlantic Other Pacific India China 2017P

0 200 400 600 800 1,000 1,200

910 -20 +75 +80 +75 1,120

New coal fueled generation requires 210 million tonnes per year of additional seaborne demand

Asia accounts for all seaborne thermal growth

Largest thermal coal import growth from India

Source: Peabody Global Analytics, McCloskey, other industry sources.

10

China, India to Account for 85% of Global Coal Demand Growth

Peabody Energy

China and India Coal Imports (Tonnes in Millions)

India China 0 100 200 300 400 500 2012 2013P 2017P

135 160 235 290 325 410

China and India coal imports expected to grow 220 million tonnes by 2017

Significant new coal generation driving demand ~225 GW in China ~70 GW in India

China closing marginal cost production Costs rising >10% per year

New port projects underway to enable greater imports

Source: Peabody Global Analytics, China Customs, India Market Watch.

11

Production Cutbacks Expected to Improve Supply-Demand Balance

Peabody Energy

151 U.S. coal mines idled in the first half of 2013.

Illinois Illinois Basin Missouri St. Louis Indiana Indianapolis Kentucky Tennessee Nashville Knoxville Ohio Cincinnati Cleveland West Virginia Charleston Central Appalachia Pennsylvania MD Baltimore Washington, D.C. Virginia Richmond Norfolk North Carolina Raleigh

Supply rationalization occurring

U.S. and China production down 4% YTD 45% of Shanxi producers reportedly not profitable

U.S. exports down >25% in June and July Large cutbacks from non-public companies

India coal production lags demand

Mongolia exports down 20% YTD; Mozambique supply struggles to grow

Source: SNL Energy, Shanxi Statistics Bureau, MSHA, Peabody Global Analytics. China and U.S. production data through July; Mongolia year-to-date data through May 2013.

12

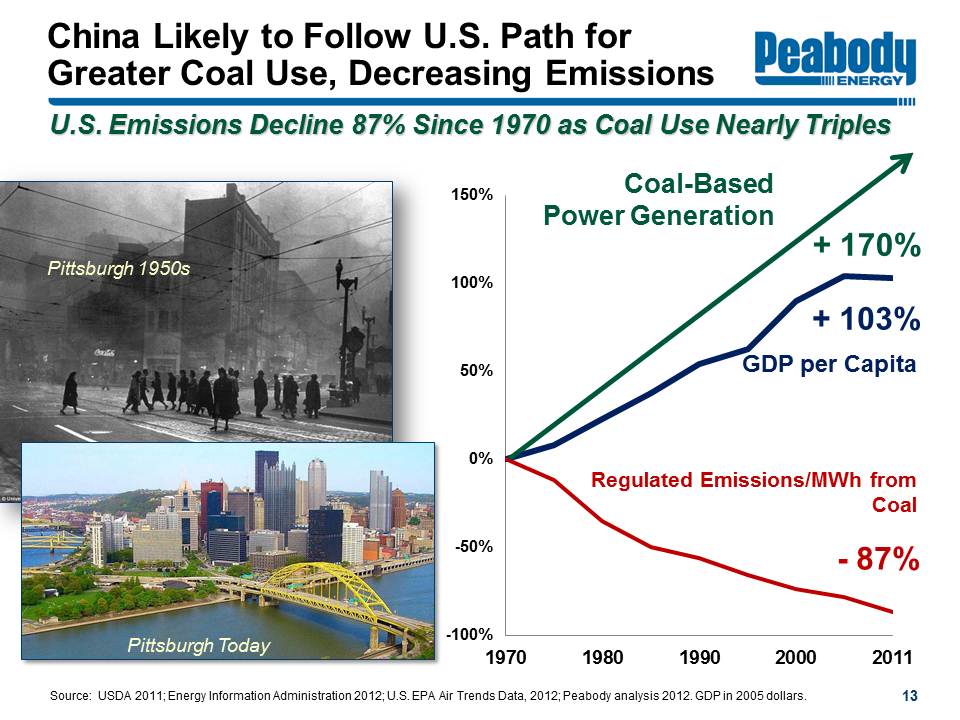

China Likely to Follow U.S. Path for Greater Coal Use, Decreasing Emissions

Peabody Energy

U.S. Emissions Decline 87% Since 1970 as Coal Use Nearly Triples

Pittsburgh 1950s Pittsburgh Today

1970 1980 1990 2000 2011 -100% -50% 0% 50% 100% 150%

Coal-Based Power Generation +170% GDP per Capita +103% Regulated Emissions/MWh from Coal -87%

Source: USDA 2011; Energy Information Administration 2012; U.S. EPA Air Trends Data, 2012; Peabody analysis 2012. GDP in 2005 dollars.

13

U.S. Markets: Fundamentals Improving as U.S. Coal Demand Rebounds in 2013

Peabody Energy

Natural Gas Prices Average 2013 Pricing Up 50% YTD Natural Gas Generation Down 15% YTD Coal Generation Up 8% YTD Coal Shipments Down 4% YTD SPRB Inventories ~30% Below Prior Year Peak Levels

Source: Peabody Global Analytics, MSHA and EIA. SPRB inventories at generators on a days-burn basis. YTD data through July 2013.

14

SPRB and Illinois Basin: 135 Million Ton Increase Through 2017

Peabody Energy

Expected U.S. Generation Demand (Tons in Millions)

0 200 400 600 485 -35 +10 +160 620 SPRB and ILB +135

0 200 400 340 -45 +5 +35 335 Other Basins -5

2012 Retirements New Generation Utilization/Switching 2017P

65 - 75 GW of coal generation expected to be retired by 2017 80 million ton impact on demand

Current coal fleet utilization 60%, up from 55% in 2012 Remaining fleet has potential to run up to 80% Every 1% utilization change = ~15 million tons of coal

Coal market share increases from ~33% in April 2012 to 40%

Source: Peabody Global Analytics.

15

U.S. Markets: Stockpile Levels Improving on Significant Gas-to-Coal Switching

Peabody Energy

SPRB Utility Stockpiles (Tons in Millions)

May 2012 Aug. 2012 Nov. 2012 Feb. 2013 May 2013 60 70 80 90 100

U.S. coal demand expected to rebound 45 - 55 million tons in 2013 PRB and ILB competitive at $2.50 - $2.75 and ~$3.50 gas price, respectively

SPRB approaching 60 days of supply

Target level is mid-to-low 50-day range

Source: Peabody Global Analytics and EIA.

16

Coal to Account for More Than 40% of Global Electricity Generation Growth

Peabody Energy

Expected Electricity Generation Growth (2010 - 2035) Coal Nat. Gas Nuclear Hydro Other

Coal: The World's Fastest Growing Major Fuel

Coal grew twice as fast as average of other major fuels in past decade

Coal expected to pass oil as world's largest energy source in coming years

Source: Peabody Energy Analytics; BP Statistical Review of World Energy 2013; International Energy Agency (IEA); World Energy Outlook 2012 'Current Policies' scenario.

17

Peabody Energy Outlook

Peabody's Global Platform Provides Growth and Earnings Diversification

Peabody Energy

London Essen Urumqi New Delhi Ulaanbaatar Beijing Sinapore Jakarta Balikpapan NCIG St. Louis DTA Brisbane Newcastle

Mining Operations Position Sales* Reserves SPRB Midwest Southwest Colorado Australia

1 1 1 1 3 141 30 17 8 40 3.6 3.4 1.0 0.2 1.1

Reported 2012 sales volumes in millions of tons. Reserves based on 2012 10-K filing in billions of tons.

* Total sales include sales sourced from third parties via Trading & Brokerage.

19

Well Capitalized Platform and Strong Cost Containment Drive Superior Margins

Peabody Energy

3-Year Average Gross Margins Peabody 31% U.S. Peer Average 24%

Peabody's average gross margins 30% above U.S. peers over past three years

Margins driven by successful cost containment programs

Leading presence in growing regions: Australia, SPRB and Illinois Basin

Source: Company filings. 3-year average is 2010 - 2012. Peabody gross margins from mining operations and excludes depreciation, depletion, and amortization and asset retirement obligation; U.S. peer gross margins include ACI, ANR, CNX, CLD, PCX, WLT, ICO, and MEE in years of operation.

20

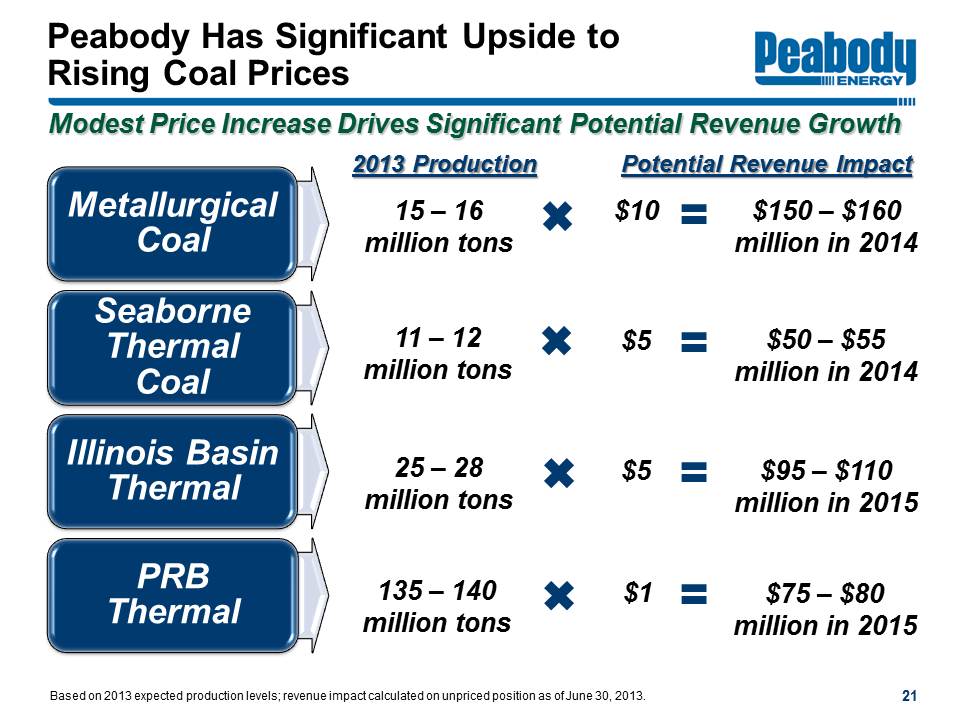

Peabody Has Significant Upside to Rising Coal Prices

Peabody Energy

Modest Price Increase Drives Significant Revenue Growth

Metallurgical Coal Seaborne Thermal Coal Illinois Basin Thermal PRB Thermal 2013 Production Potential Revenue Impact 15 - 16 million tons $10 $150 - $160 million in 2014 11 - 12 million tons $5 $50 - $55 million in 2014 25 - 28 million tons $5 $95 - $110 million in 2015 135 - 140 million tons $1 $75 - $80 million in 2015 x =

Based on 2013 expected production levels; revenue impact calculated on unpriced position as of June 30, 2013.

21

Australian Platform Targets Growing Asia Markets

Peabody Energy

Targeted Australia Volumes (Tons in Millions) 0 10 20 30 40

2005 8 Seaborne Thermal 2 Metallurgical 6

2011 25 Domestic Thermal 6 Seaborne Thermal10 Metallurgical 9

2012 33 Domestic Thermal 7 Seaborne Thermal 12 Metallurgical 14

2013P 33-36 Domestic Thermal 7-8 Seaborne Thermal 11-12 Metallurgical 15-16

90% of production from expanded/improved mining operations

Resetting cost base and benefitting from lower Australian dollar

Significant platform for future development and portfolio optimization

Competitive advantage over other nations with mines close to port; ports close to high-growth markets

Sales volumes exclude discontinued operations.

22

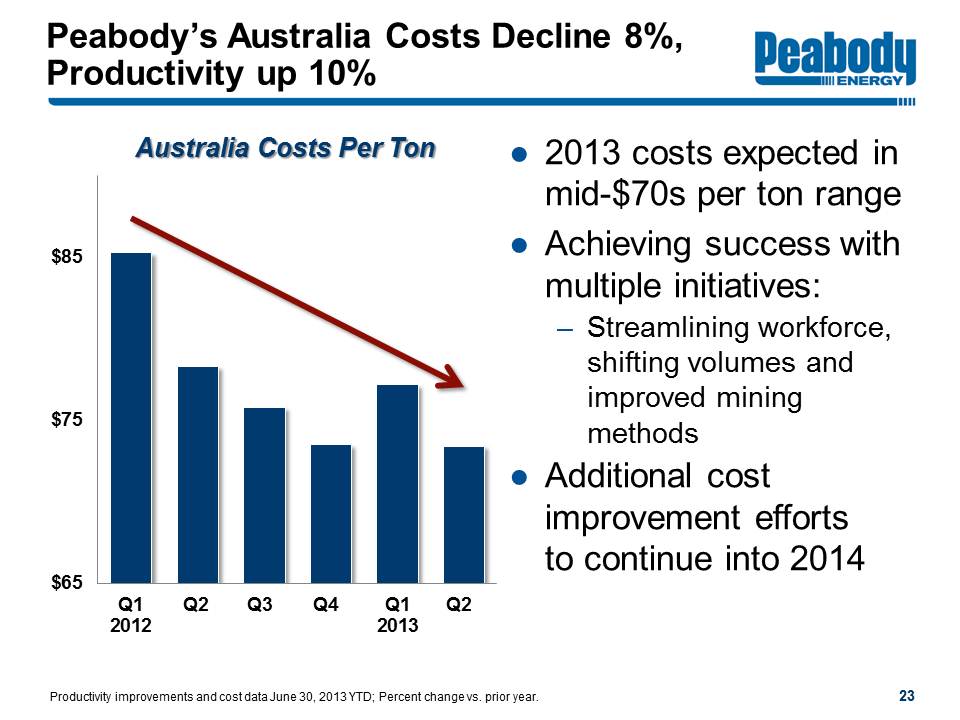

Peabody's Australia Costs Decline 8%, Productivity up 10%

Peabody Energy

Australia Costs Per Ton Q1 2012 Q2 Q3 Q4 Q1 2013 Q2 $65 $75 $85

2013 costs expected in mid-$70s per ton range

Achieving success with multiple initiatives: Streamlining workforce, shifting volumes and improved mining methods

Additional cost improvement efforts to continue into 2014

Productivity improvements and cost data June 30, 2013 YTD; Percent change vs. prior year.

23

Early Success from Second Quarter 2013 Owner-Operator Conversions

Peabody Energy

Owner-Operator Volumes Increase from ~35% to ~85%

Eliminated Contractor Margins Robust Mine Planning Better Workforce Alignment Right-Sized Equipment

Improved operating efficiency and productivity drive cost reduction

Costs reduced 20% from prior year

Wilpinjong: One of the lowest cost mines in Australia

24

PCI Mines Cost Base Reset After Significant Remediation Work

Peabody Energy

PCI Productivity (Million Units)

October 2011 June 2013 0 20 40 60 80 100 +40%

Successfully completed remediation efforts at acquired PCI mines

Increased productivity nearly 40% since acquisition Record dragline performance and overburden removal at Coppabella

Second quarter costs improved 20% from 2012 levels

Additional benefit from converting preparation plants and enhancing mining methods

25

U.S. Platform Well Positioned in Current Market

Peabody Energy

Improving cost profile and long-term contracting strategies contribute more than half of Peabody's global earnings Targeting 180 - 190 million tons of production in 2013 Fully priced for 2013; 70% - 80% priced for 2014

Maximizing margins across operations 2013 cost per ton expected to be 2 - 3% below 2012 levels

Priced position as of June 30, 2013, based on expected 2013 production levels.

26

U.S. Cost Containment Initiatives Taking Hold

Peabody Energy

Delivered significant cost and productivity improvements U.S. costs per ton down 2% U.S. productivity up 8%

Shifting volumes to more productive operations

Benefiting from recent investments NARM most productive mine Bear Run largest eastern surface mine Reserve LBA acquisitions sufficient for 10 years

Productivity and cost data June 30, 2013 YTD vs. prior year.

27

Maintaining Financial Strength Through Capital Discipline and Debt Repayment

Peabody Energy

Capital Discipline

Capex down 62% YTD

Targeting 2013 capex of $350 - $450 million

Deferring growth projects

Sustaining capital trending below historical range of $1.25 - $1.75/ton

Previous investments enable low sustaining capex for multiple years

Debt Repayment

Debt reduction is top priority >$630 million since 2012

Strong liquidity of $2.0 billion at end of second quarter

Continue to pursue asset sales

Currently refinancing credit facility to provide additional financial flexibility

28

Peabody Strategy and Operating Success Drive Value in All Market Conditions

Peabody Energy

Leading presence in growing markets

Superior margins vs. peers

Significant upside to improving coal markets

Well-capitalized platform

Successful cost improvements

Large asset base for future development

29

Peabody Energy

www.PeabodyEnergy.com

Life Empowered

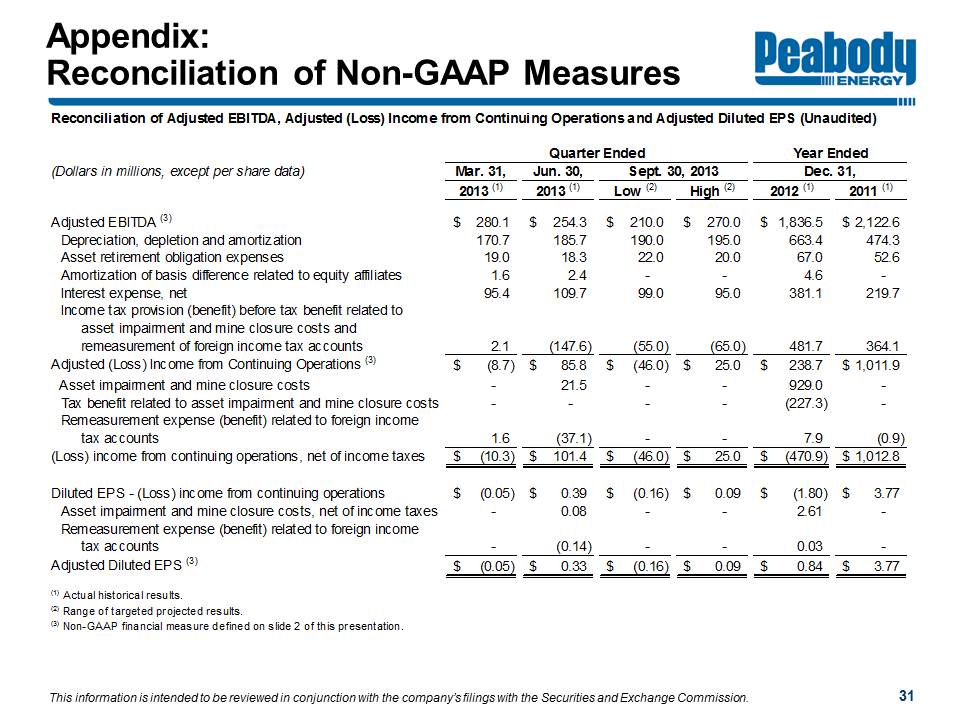

Appendix: Reconciliation of Non-GAAP Measures

Peabody Energy

Reconciliation of Adjusted EBITDA, Adjusted (Loss) Income from Continuing Operations and Adjusted Diluted EPS (Unaudited)

Quarter Ended Year Ended (Dollars in millions, except per share data)

Mar. 31, Jun. 30, Sept. 30, 2013 Dec. 31,

2013 (1) 2013 (1) Low (2) High (2) 2012 (1) 2011 (1)

Adjusted EBITDA (3) $280.1 $254.3 $210.0 $270.0 $1,836.5 $2,122.6

Depreciation, depletion and amortization 170.7 185.7 190.0 195.0 663.4 474.3

Asset retirement obligation expenses 19.0 18.3 22.0 20.0 67.0 52.6

Amortization of basis difference related to equity affiliates 1.6 2.4 - - 4.6 -

Interest expense, net 95.4 109.7 99.0 95.0 381.1 219.7

Income tax provision (benefit) before tax benefit related to asset impairment and mine closure costs and remeasurement of foreign income tax accounts 2.1 (147.6) (55.0) (65.0) 481.7 364.1

Adjusted (Loss) Income from Continuing Operations (3) $(8.7) $85.8 $(46.0) $25.0 $238.7 $1,011.9

Asset impairment and mine closure costs - 21.5 - - 929.0 -

Tax benefit related to asset impairment and mine closure costs - - - - (227.3) -

Remeasurement expense (benefit) related to foreign income tax accounts 1.6 (37.1) - - 7.9 (0.9)

(Loss) income from continuing operations, net of income taxes $(10.3) $101.4 $(46.0) $25.0 $(470.9) $1,012.8

Diluted EPS - (Loss) income from continuing operations $(0.05) $0.39 $(0.16) $0.09 $(1.80) $3.77

Asset impairment and mine closure costs, net of income taxes - 0.08 - - 2.61 -

Remeasurement expense (benefit) related to foreign income tax accounts - (0.14) - - 0.03 -

Adjusted Diluted EPS (3) $(0.05) $0.33 $(0.16) $0.09 $0.84 $3.77

(1) Actual historical results.

(2) Range of targeted projected results.

(3) Non-GAAP financial measure defined on slide 2 of this presentation.

This information is intended to be reviewed in conjunction with the company's filings with the Securities and Exchange Commission.

31