As filed with the Securities and Exchange Commission on September 18, 2013

File No. 333-191003

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

IRELAND INC.

(Exact name of

Registrant as specified in its charter)

NEVADA

(State or other jurisdiction of

incorporation or organization)

1040

(Primary Standard Industrial

Classification Code Number)

91-2147049

(I.R.S. Employer Identification

Number)

2360 West Horizon Ridge Parkway, Suite 100

Henderson, Nevada, 89052

Tel: (702)

932-0353

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

CAMLEX MANAGEMENT (NEVADA) INC.

8275 S. Eastern

Avenue, Suite 200, Las Vegas, NV 89123

Tel: (702)

990-8405

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

NORTHWEST LAW GROUP

Suite

704, 595 Howe Street, Vancouver, BC V6C 2T5

Tel: (604) 687-5792

As soon as practicable after this

Registration Statement is declared effective.

(Approximate date of

commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

| CALCULATION OF REGISTRATION FEE |

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

| Common Stock, par value $0.001 per share |

25,994,922 |

$0.27 |

$7,018,628.94 |

$957.34 |

| (1) |

25,994,922 shares of common stock, par value $0.001 per share, of Ireland Inc., a Nevada corporation (the “Registrant”), are being registered hereunder. The shares consist of 50,000 shares previously issued to certain selling security holders described in the prospectus to this registration statement, plus an additional 25,944,922 shares issuable upon exercise of share purchase warrants issued to the selling security holders. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended. Based on the average high and low price of the common stock on August 29, 2013. |

| (3) |

Previously paid in connection with the initial filing of the Registration Statement on September 5, 2013. |

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine. |

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

i

| SUBJECT TO COMPLETION, DATED _________________, 2013 |

|

The information contained in this Prospectus is not complete and may be changed. The Selling Security Holders may not sell these securities until the registration statement filed with the United States Securities and Exchange Commission (the “SEC”) is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

PROSPECTUS

| 25,994,922 Shares of Common Stock |

We are registering 25,994,922 shares of common stock for resale by the selling security holders (the “Selling Security Holders”) listed in this Prospectus (the “Offering”), consisting of 50,000 shares of common stock previously issued by the Company and an additional 25,994,922 shares issuable upon the exercise of warrants (the “Warrants”) issued in private placements or for consulting services between 2007 and 2012. The Selling Security Holders may resell their shares from time to time in public or privately negotiated transactions or by other means described in this Prospectus in the section titled “Plan of Distribution.” The prices at which the Selling Security Holders may sell their shares will be determined by prevailing market prices, prices related to prevailing market prices or at privately negotiated prices.

We will not receive any proceeds from the sale of shares of common stock by the Selling Security Holders. We may receive proceeds on the exercise of the Warrants. However, the Selling Security Holders listed in this Prospectus are not required to exercise the Warrants and there is no assurance that they will exercise the Warrants. If all of the Warrants held by the Selling Security Holders are exercised for cash, we will receive total gross proceeds of $19,940,146.

We are bearing the costs, expenses and fees associated with the registration of the shares to be sold by the Selling Security Holders in this Prospectus. The Selling Security Holders named in this Prospectus will bear the costs of all commissions or discounts, if any, attributable to the sale of their shares.

Before investing in any of the securities being offered hereunder, you should carefully read this Prospectus and any prospectus supplement relating thereto.

Our shares are currently traded on the over the counter market, with quotations entered for our common stock on the OTCQB marketplace under the symbol “IRLD.” The last reported sale price of our common stock on the OTCQB at the close of business on September 16, 2013 was $0.24 per share.

The purchase of the securities offered through this Prospectus involves a high degree of risk. You should carefully read and consider the section of this Prospectus titled “Risk Factors” on page 2 before buying any shares of our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is Dated _________________, 2013

ii

IRELAND INC.

PROSPECTUS

TABLE OF CONTENTS

iii

SUMMARY

The following summary may not contain all the information that may be important to you. This Prospectus incorporates important business and financial information about us that is not included in, or delivered with this Prospectus. Before making an investment, you should read the entire Prospectus carefully. You should also carefully read the risks of investing discussed under “Risk Factors” and the financial statements included in this Prospectus, any prospectus supplement relating thereto, or in our other filings with the SEC.

About Ireland Inc.

We were incorporated on February 20, 2001 under the laws of the State of Nevada. We are an exploration stage company focused on the discovery and extraction of precious metals from mineral deposits in the Southwestern United States.

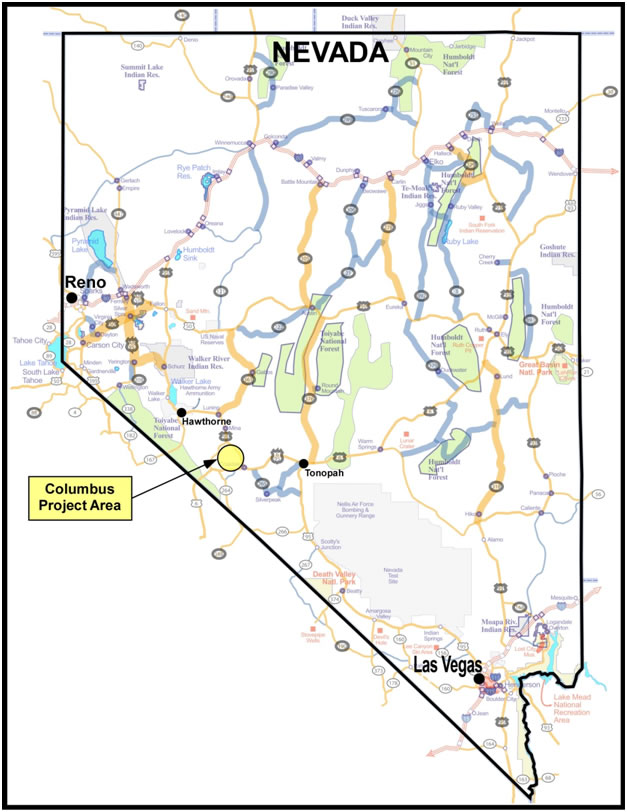

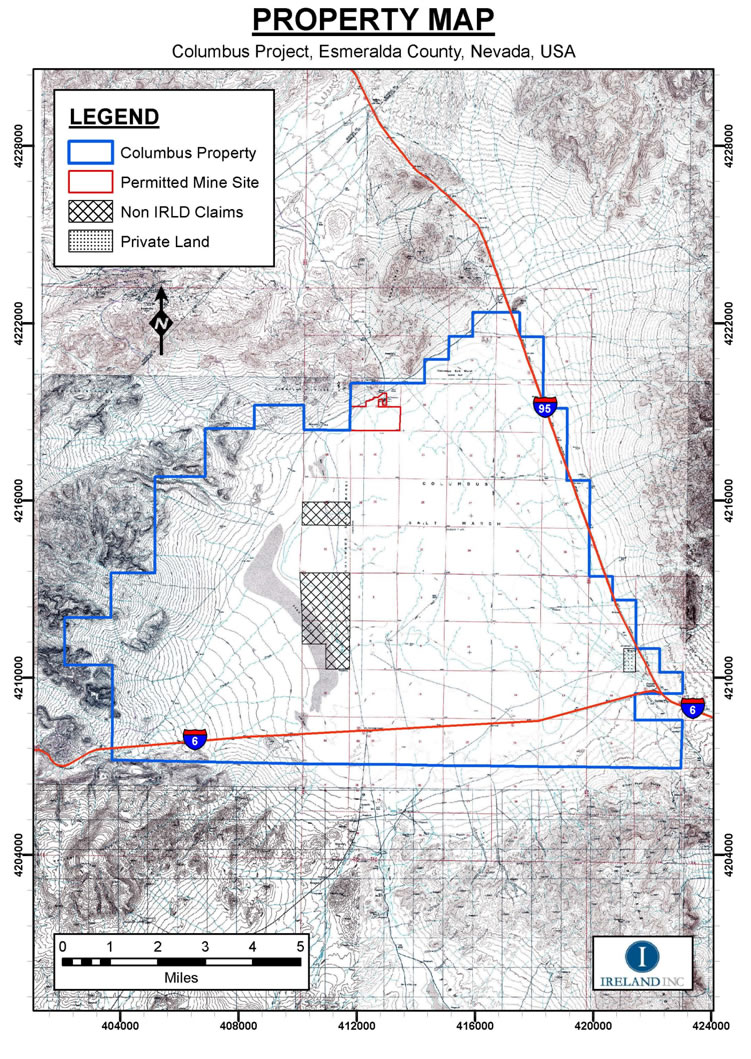

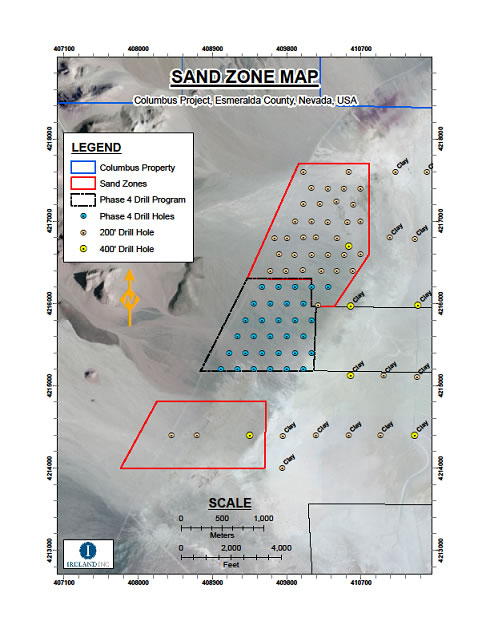

In February 2008, we acquired our lead project, a prospective gold, silver and calcium carbonate property located in Esmeralda County, Nevada, that we call the “Columbus Project.” The Columbus Project consists of 50,538 acres of placer mineral claims, including a 380 acre Permitted Mine Area (60 acre mill site and mill facility and a 266 acre mine site, with an additional 54 acres defined as “undisturbed area”). Our current permits allow us to mine up to 792,000 tons per year to 40 feet in depth for the purpose of extracting precious metals and calcium carbonate from the Permitted Mine Area. In addition, we own 80 acres of private land in the southeast quadrant of the project. Our current exploration efforts are focused on the North and South Sand Zones of the Columbus Project.

In addition to the Columbus Project, we own the right to acquire a prospective gold, silver and tungsten property located in San Bernardino County, California, that we call the “Red Mountain Project.” Our exploration program for the Red Mountain Project is not currently active.

146,159,542 shares of our common stock are issued and outstanding as of the date of this Prospectus, not including any shares that are issuable on exercise of the Warrants by the Selling Security Holders. Our shares are currently traded on the over the counter market, with quotations entered for our common stock on the OTCQB marketplace under the symbol “IRLD.”

Our principal executive office is located at 2360 West Horizon Ridge Parkway, Suite 100, Henderson, Nevada, 89052. Our telephone number is (702) 932-0353.

The Offering

The selling security holders (the “Selling Security Holders”) listed in this Prospectus may, from time to time, offer and sell up to 25,994,922 shares of our common stock. The shares being offered by the Selling Security Holders consist of 50,000 shares of common stock previously issued to the Selling Security Holders and 25,994,922 shares of common stock (the “Warrant Shares”) issuable to the Selling Security Holders upon the exercise of the warrants issued by us in private placements or for consulting services between 2007 and 2012 (collectively, the “Warrants”). See the section of this Prospectus titled “Description of Securities” for additional information about the Warrants.

We are voluntarily filing the registration statement of which this Prospectus forms a part and are paying all expenses relating thereto. The Selling Security Holders will, however, pay any other expenses incurred in selling their common stock, including any brokerage commissions or costs of sale. The Selling Security Holders do not have any registration rights with respect to the Warrants or the shares being offered by them in this Prospectus.

We will not receive any proceeds from the sale of common stock by the Selling Security Holders. We may receive proceeds in connection with the exercise of the Warrants. If all of the Warrants held by the Selling Security Holders are exercised for cash, we will receive gross proceeds of $19,940,146. There is no assurance that any of the Warrants will ever be exercised, for cash or otherwise. See the section titled “Use of Proceeds” for additional information.

1

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this Prospectus before investing in our common stock. Before making a decision to invest in our securities, you should carefully consider the following risk factors, as well as the risks described under “Risk Factors” in any applicable prospectus supplement and the risks described in our most recent Annual Report on Form 10-K, or any updates to our risk factors described in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this Prospectus or any applicable prospectus supplement.

If any of these risks occur, our business, operating results and financial condition could be seriously harmed, which could in turn adversely affect your investment. The market price of our securities could decline due to any of these risks, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those of which we are currently unaware or that we deem immaterial, could also affect our business or your investment in our securities.

We will require additional financing to complete our exploration programs for our mineral projects.

We expect to spend approximately $6,265,000 during the twelve months ending June 30, 2014 on the exploration of our Columbus and Red Mountain Projects and the general costs of operating and maintaining our business and mineral properties. We do not currently have sufficient financial resources to pay for our anticipated expenditures for that period. We anticipate that our existing financial resources are sufficient only to pay for the anticipated costs of our exploration programs until January 31, 2014. We will require additional financing to complete our exploration plans. In addition, actual costs of completing our exploration plans could be greater than anticipated and we may need additional financing sooner than anticipated. If we are unable to obtain sufficient financing to complete our exploration plans, we will scale back our plans depending upon our existing financial resources.

Our ability to obtain future financing will be subject to a number of factors, including the variability of market prices for gold and silver, investor interest in our mineral projects, and the performance of equity markets in general. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. If we are not able to obtain financing when needed or in an amount sufficient to enable us to complete our programs, we may be required to scale back our exploration programs.

If we complete additional financings through the sale of our common stock, our existing stockholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our mineral properties to be earned by another party or parties carrying out further exploration thereof, which is not presently contemplated. In addition, if our management decides to exercise the right to acquire a 100% interest in the Red Mountain Project, we will be required to issue significantly more shares of our common stock. Issuing shares of our common stock, for financing purposes or otherwise, will dilute the interests of our existing stockholders.

In order to maintain the rights to our mineral properties, we will be required to make annual filings with federal and state regulatory agencies and/or be required to complete assessment work or pay fees in respect of those properties.

In order to maintain the rights to our mineral projects, we will be required to make annual filings and pay fees with federal and state regulatory authorities. On June 16, 2011, the Governor of Nevada approved Senate Bill 493 (SB 493), which repealed a one-time tiered fee hike on mining claims in Nevada. SB 493 also eliminated a number of tax deductions that had previously been available for companies with mining operations in Nevada. We are currently an exploration stage company and do not have significant mineral extraction activities or any revenues from mining operations and do not expect the elimination of these tax deductions to have a significant impact on our current exploration activities or financial prospects. However, if we do, in the future engage in significant mineral extraction operations, of which there is no assurance, the elimination of these tax deductions could affect our future financial results.

2

There has been an increase in claim maintenance fees related to association placer claims. Previously, we paid $140 per year per placer claim. Claims can be up to 160 acres in size each. The new regulations require placer claimants to pay a fee of $140 for each twenty acres of a placer claim.

In addition to claim maintenance fees, we may be required by federal and/or state legislation or regulations to complete minimum annual amounts of mineral exploration work on our mineral properties. A failure by us to meet the annual maintenance requirements under federal and state laws could cause our mineral rights to lapse.

Because we are an exploration stage company, we face a high risk of business failure.

To date, our primary business activities have involved the acquisition of mineral claims and the exploration of these claims. We have not earned any revenues as of the date of this report. Potential investors should be aware of the difficulties normally encountered by exploration stage companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Because we anticipate that our operating expenses will increase prior to earning revenues, we may never achieve profitability.

Prior to exiting the exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to ever generate any operating revenues or achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages if and when conducting mineral exploration activities.

The search for valuable minerals involves numerous hazards. As a result, when conducting exploration activities we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found.

We have not yet established proved or probable reserves on the Columbus Project or on our other mineral properties. The search for valuable minerals as a business is extremely risky. Although we have been encouraged by the results of the exploration work conducted by us to date, further exploration work is required before proven or probable reserves can be established, and there are no assurances that we will be able to establish any proven or probable reserves. Exploration for minerals is a speculative venture, necessarily involving substantial risk. The expenditures to be made by us may not result in the discovery of commercial quantities of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. We intend to report the results of our exploration activities promptly after those results have been received and analysed. However, there is no assurance that the test results reported by us will be indicative of extraction rates throughout our mineral properties.

As a result of the public’s lack of familiarity with the assaying methods used by us to analyze samples taken from the sand and clay zones of the Columbus Project, we may occasionally encounter resistance to the reliability of our grade estimates for the Columbus Project. Although we use proven assaying methods, only report extracted and weighed gold and silver and have instituted rigorous testing to ensure the reliability of our exploration results, we may face resistance in the future, which could negatively impact our business, our ability to obtain future financing, and our stock price.

3

Contrary to popular belief, pyrometallurgical and hydrometallurgical tests on a rock sample do not determine the amount of gold or silver present in a sample. Instead, these tests report the amount of gold or silver that is extracted from the sample by the analytical method used. We have engaged in extensive research and testing to determine the best pyrometallurgical and hydrometallurgical methods for extracting gold and silver from the sands and clays present at the Columbus Project. Our research has indicated that caustic fusion (head ore, concentrates) and thiosulphate or cyanide leaching (concentrates) are the best pyrometallurgical and hydrometallurgical methods for extracting gold and silver from the Columbus Project. The pyrometallurgical and hydrometallurgical methods that were chosen by us result in the actual physical extraction of gold and silver from the tested samples.

Caustic fusion is a standard pyrometallurgical method that uses fluxes melted at low temperature to dissolve the sample rock and liberate the contained minerals or metals for subsequent extraction and analysis. Caustic fusion was developed in South Africa over 100 years ago and was first used to liberate diamonds from their refractory kimberlites. It has since been used to quantify other minerals/metals in rocks by analyzing the fused product. Caustic fusion has proven to be a very effective method for extracting gold and silver from the refractory minerals (organics, silicates) in the sand and clay at the Columbus Project, and has been confirmed by extracting comparable precious metal values from bulk leach tests (+/- 1 ton samples).

Fire assaying is the most common pyrometallurgical method used for extracting gold and silver from rock. Fire assaying relies on the use of standardized chemical fluxes to reduce the melting point of the minerals entombing the gold and silver so that they can be liberated and then collected in a lead “button” and examined. Although this process works well for extracting gold entombed in sulfides (e.g. pyrite) and silica, such as that found in Carlin-type gold deposits, the chemical fluxes used in fire assaying methods are ineffective at liberating the gold and silver from refractory minerals (organics and silicates (Fe-Mg-Al-Si-Ox)) as are found at the Columbus Project. As a result, in our tests, fire assaying has shown to be ineffective at extracting commercial values of gold and silver from the sand and clay from the Columbus Project. Similarly, aqua regia digestion has also proven to be ineffective at extracting gold and silver from the sands and clays at the Columbus Project.

To ensure the reliability of our results, we have instituted rigorous QA/QC protocols, including blind random sampling, and the inclusion of blanks, standards and duplicates. To further ensure reliability, we measure only the actual amount of gold and silver physically extracted from our test samples when reporting assay results. We also have extracted gold and silver from large samples (+/- 200-3000 lbs.) by thiosulphate leaching, with the extraction results being comparable to caustic fusion assay results on the same samples, thereby confirming the reliability of the caustic fusion process. However, because caustic fusion is not commonly used and understood for gold and silver assaying, and because gold and silver in the sands and clays at the Columbus Project cannot be confirmed by metal-in-hand extraction using fire assay or aqua regia digestion, we may encounter some resistance to our analytical methods and assay results, which could negatively impact our business, our ability to obtain additional financing, and our stock price.

Even if we establish proven or probable reserves on our mineral claims, we may not be able to successfully reach commercial production.

We anticipate using a low cost, high volume surface dredge operation to mine the Columbus Project. Our pre-feasibility program for the Columbus Project is designed to test and optimize our planned mining process for the Columbus Project. There is no assurance that this pre-feasibility program will result in a decision to enter into commercial production.

In addition, expanding our production facilities to accommodate commercial operations is expected to require substantially more financial resources than what we currently have available to us. There is a risk that we will not be able to obtain such financing if and when needed.

Although we have installed the leach circuit of the onsite pilot production module for the Columbus Project, there is no assurance that this project is commercially feasible.

We have begun testing and optimizing the onsite pilot production module at the Columbus Project. This pilot production module is part of our pre-feasibility study for the Columbus Project and is designed to evaluate the commercial viability of the Columbus Project. There is no assurance that the results of our pre-feasibility program will result in a decision to enter into commercial production.

4

Even if we can successfully reach commercial production, any change to mining laws or regulations or levy of additional taxes in the future may make our planned production process nonviable economically.

Several bills have been introduced by the US federal government that would levy resource taxes on mineral exploration companies. Any levy of additional taxes would have an adverse effect on our business. In addition, laws and regulations governing the exploration of mineral properties and the mining process are subject to change. Changes to mining laws and regulations that would have the effect of increasing the cost of mineral exploration and mining activities would adversely impact our business.

We are subject to compliance with government regulations. The costs of complying with these regulations may change without notice, and may increase the anticipated cost of our exploration programs.

There are several government regulations that materially restrict the exploration of minerals. We will be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

In addition, if our applications for permits from the relevant regulatory bodies are denied, we may not be able to proceed with our exploration programs.

If we decide to pursue commercial production, we may be subject to an environmental review process that may delay or prohibit commercial production.

Our planned method for mining the Columbus Project is not expected to generate any significant long term environmental impact. However, we have not yet had a comprehensive environmental review conducted on our planned mining operations for the Columbus Project.

Compliance with an environmental review process may be costly and may delay commercial production. Furthermore, there is the possibility that we would not be able to proceed with commercial production upon completion of the environmental review process if government authorities do not approve our mine or if the costs of compliance with government regulation adversely affected the commercial viability of the proposed mine.

The market for our common stock is limited and investors may have difficulty selling their stock.

Our shares are currently traded on the over the counter market, with quotations entered for our common stock on the OTCQB under the symbol “IRLD.” However, the volume of trading in our common stock is currently limited. As a result, holders of our common stock may have difficulty selling their shares.

Because our common stock is a penny stock, stockholders may be further limited in their ability to sell their shares.

Our shares constitute a penny stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and are expected to remain classified as a penny stock for the foreseeable future. Classification as a penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to Rules 15g-2 through 15g-9 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock.

No assurance that forward looking assessments will be realized.

Our ability to accomplish our objectives and whether or not we are financially successful is dependent upon numerous factors, each of which could have a material effect on the results obtained. Some of these factors are in the discretion and control of management and others are beyond management’s control. The assumptions and hypotheses used in preparing any forward-looking assessments contained herein are considered reasonable by management. There can be no assurance, however, that any projections or assessments contained herein or otherwise made by management will be realized or achieved at any level.

5

If we are, or were, a U.S. real property holding corporation, non-U.S. holders of our common stock or other security convertible into our common stock could be subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of such security.

If we are or ever have been a U.S. real property holding corporation (a “USRPHC”) under the Foreign Investment Real Property Tax Act of 1980, as amended (“FIRPTA”) and applicable United States Treasury regulations (collectively, the “FIRPTA Rules”), unless an exception applies, certain non-U.S. investors in our common stock (or options or warrants for our common stock) would be subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of shares of our common stock (or such options or warrants), and such non-U.S. investor would be required to file a United States federal income tax return. In addition, the purchaser of such common stock, option or warrant would be required to withhold from the purchase price an amount equal to 10% of the purchase price and remit such amount to the U.S. Internal Revenue Service.

We have not conducted a formal analysis of whether we are or have ever been a USRPHC. However, we believe that we may be a USRPHC. In general, under the FIRPTA Rules, a company is a USRPHC if its interests in U.S. real property comprise at least 50% of the fair market value of its assets. If we are or were a USRPHC, so long as our common stock is “regularly traded on an established securities market” (as defined under the FIRPTA Rules), a non-U.S. holder who, actually or constructively, holds or held no more than 5% of our common stock is not subject to U.S. federal income tax on the gain from the sale, exchange or other disposition of our common stock under FIRPTA. In addition, other interests in equity of a USRPHC may qualify for this exception if, on the date such interest was acquired, such interests had a fair market value no greater than the fair market value on that date of 5% of our common stock. Any of our common stockholders (or owners of options or warrants for our common stock) that are non-U.S. persons should consult their tax advisors to determine the consequences of investing in our common stock (or options or warrants).

We have not held an annual meeting for the election of directors since our incorporation.

Pursuant to the provisions of the Nevada Revised Statutes (the “NRS”), directors are to be elected at the annual meeting of the stockholders. Pursuant to the NRS and our bylaws, our board of directors is granted the authority to fix the date, time and place for annual stockholder meetings. We expect to hold an annual stockholder meeting in 2013; however, no date, time or place has yet been fixed by our board for the holding of an annual stockholder meeting. Pursuant to the NRS and our bylaws, each of our directors holds office after the expiration of his term until a successor is elected and qualified, or until the director resigns or is removed. Under the provisions of the NRS, if an election of our directors has not been made by our stockholders within 18 months of the last such election, then an application may be made to the Nevada district court by stockholders holding a minimum of 15% of our outstanding stockholder voting power for an order for the election of directors in the manner provided in the NRS.

FOR ALL OF THE AFORESAID REASONS AND OTHERS SET-FORTH AND NOT SET-FORTH HEREIN, AN INVESTMENT IN OUR SECURITIES INVOLVES A CERTAIN DEGREE OF RISK. ANY PERSON CONSIDERING TO INVEST IN OUR SECURITIES SHOULD BE AWARE OF THESE AND OTHER FACTORS SET-FORTH IN THIS REPORT AND IN THE OTHER REPORTS AND DOCUMENTS THAT WE FILE FROM TIME TO TIME WITH THE SEC AND SHOULD CONSULT WITH HIS/HER LEGAL, TAX AND FINANCIAL ADVISORS PRIOR TO MAKING AN INVESTMENT IN OUR SECURITIES. AN INVESTMENT IN OUR SECURITIES SHOULD ONLY BE ACQUIRED BY PERSONS WHO CAN AFFORD TO LOSE THEIR TOTAL INVESTMENT.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Prospectus constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; changes in project parameters as plans continue to be refined; changes in labor costs or other costs of production; future mineral prices; equipment or processes to operate as anticipated; accidents, labor disputes and other risks of the mining industry, including but not limited to environmental hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or unfavourable operating conditions and losses; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section titled "Risk Factors" in this Prospectus.

6

Forward looking statements are based on a number of material factors and assumptions, including the results of exploration and drilling activities, the availability and final receipt of required approvals, licenses and permits, that sufficient working capital is available to complete proposed exploration and drilling activities, that contracted parties provide goods and/or services on the agreed time frames, the equipment necessary for exploration is available as scheduled and does not incur unforeseen break downs, that no labor shortages or delays are incurred and that no unusual geological or technical problems occur. While we consider these assumptions may be reasonable based on information currently available to it, they may prove to be incorrect. Actual results may vary from such forward-looking information for a variety of reasons, including but not limited to risks and uncertainties disclosed in the section titled “Risk Factors” in this Prospectus.

We intend to discuss in our Quarterly Reports and Annual Reports any events or circumstances that occurred during the period to which such documents relate that are reasonably likely to cause actual events or circumstances to differ materially from those disclosed in this Prospectus. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on our business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forwarding looking statement.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock sold by the Selling Security Holders. However, we will receive proceeds in connection with any exercise of the Warrants by the Selling Security Holders for cash. If all of the Warrants held by the Selling Security Holders are exercised for cash, we anticipate that we will receive gross proceeds of $19,940,146. However, there is no assurance that any of the Warrants will ever be exercised. We intend to use any proceeds from the exercise of the Warrants to fund our exploration, technical and feasibility programs for the Columbus Project, and for working capital and general corporate purposes.

The Warrants are not being offered by the Selling Security Holders under this Prospectus; however, the shares of our common stock underlying these securities are being offered under this Prospectus by the Selling Security Holders.

SELLING SECURITY HOLDERS

To our knowledge, the following information sets forth, in respect of each of the Selling Security Holders:

| 1. |

the number of shares beneficially owned by each prior to the Offering; |

| 2. |

the total number of shares that are to be offered by each; |

| 3. |

the total number of shares that will be beneficially owned by each upon completion of the Offering; |

| 4. |

the percentage owned by each upon completion of the Offering; and |

| 5. |

the identity of the beneficial holder of any entity that owns the shares. |

The Selling Security Holders listed below are not making any representation that any of the shares covered by this Prospectus will be offered for sale by them, and the Selling Security Holders may reject, in whole or in part, any proposed sale of the shares covered by this Prospectus.

The information provided below assumes that the Selling Security Holders do not sell any of our securities other than the securities specifically offered in this Prospectus under the Offering, and assumes that all of the securities offered by the Selling Security Holders in this Prospectus are sold.

7

Except as specifically disclosed below, none of the Selling Security Holders:

| (i) |

is, to our knowledge, a broker-dealer or an affiliate of a broker-dealer; | |

| (ii) |

has had a material relationship with us other than as a stockholder at any time within the past three years; or | |

| (iii) |

has ever been one of our officers or directors. |

Name Of Selling Security Holder |

Beneficial Ownership Before Offering (1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering (1) |

||

| Number of Shares |

Percent (2) |

Number of Shares |

Percent (2) | ||

| 246 LTD. (3) | 130,000 | * | 50,000 | 80,000 | * |

| 0741673 BC LTD. (4) | 10,000 | * | 10,000 | -- | * |

| ABBI HOLDING, INC. (5) | 55,000 | * | 20,000 | 35,000 | * |

| GILLIAN FRANCES JOAN AGER | 150,000 | * | 50,000 | 100,000 | * |

| LOGAN ANDERSON | 117,000 | * | 50,000 | 67,000 | * |

| SIMON AUERBACHER | 507,692 | * | 100,000 | 407,692 | * |

| ADAM BASS | 200,000 | * | 100,000 | 100,000 | * |

| WILLIAM BELZBERG REVOCABLE LIVING TRUST (6) | 1,561,400 | * | 550,000 | 1,011,400 | * |

| MOKHTARI BENAMAR | 50,000 | * | 25,000 | 25,000 | * |

| ALLISON BIBICOFF | 250,000 | * | 90,000 | 160,000 | * |

| THE BIBICOFF FAMILY TRUST DATED MAY 16, 2000 (7) | 1,220,686 | * | 680,000 | 540,686 | * |

| PAIGE BIRNIE (8) | 2,250 | * | 750 | 1,500 | * |

| ROBERTA BIRNIE (9) | 41,250 | * | 13,750 | 27,500 | * |

| BLASHEK LIVING TRUST DATED 12/21/94 (10) | 232,000 | * | 75,000 | 157,000 | * |

| GUDRUN BOYSON | 300,000 | * | 100,000 | 200,000 | * |

| PAUL BRAGG | 250,000 | * | 50,000 | 200,000 | * |

| BRAHMA FINANCE (BVI) LIMITED (11) | 11,254,327 | 6.53% | 3,482,626 | 7,771,701 | 4.51% |

| JOAN BRANDHAM | 17,900 | * | 5,000 | 12,900 | * |

| MARK H. BRENNAN IRA (12) | 1,377,197 | * | 70,000 | 1,307,197 | * |

| JOHN G. BRITTINGHAM REVOCABLE TRUST (13) | 818,181 | * | 272,727 | 545,454 | * |

| ELLEN BROUS | 100,000 | * | 100,000 | -- | * |

| ROBERT J. BROUS (14) | 806,500 | * | 200,000 | 606,500 | * |

| RYAN B. BRUNSON (15) | 157,454 | * | 1,818 | 155,636 | * |

| DAL S. BRYNELSEN | 60,586 | * | 50,000 | 10,586 | * |

| GEORGE R. BUNN, JR. | 24,500 | * | 17,500 | 7,000 | * |

| CALVERT FAMILY TRUST U/T/D 10-01- 1993 (16) | 305,000 | * | 50,000 | 255,000 | * |

| CRAIG CELNIKER | 62,500 | * | 12,500 | 50,000 | * |

| DEWAYNE E. CHITWOOD | 150,000 | * | 50,000 | 100,000 | * |

| ROBERT E. COURSON | 2,100,000 | 1.22% | 700,000 | 1,400,000 | * |

| MINDY CROSSFIELD | 30,000 | * | 10,000 | 20,000 | * |

| CARRIE D. CU | 4,000 | * | 4,000 | -- | * |

| CUTLER FAMILY TRUST DTD 5/4/89 (17) | 530,000 | * | 150,000 | 380,000 | * |

| CAROLYN DALLAMORA | 12,500 | * | 12,500 | -- | * |

8

Name Of Selling Security Holder |

Beneficial Ownership Before Offering (1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering (1) |

||

| Number of Shares |

Percent (2) |

Number of Shares |

Percent (2) | ||

| KENNETH G. DALLAMORA | 365,000 | * | 50,000 | 315,000 | * |

| ELEANOR DEAR LIVING TRUST (18) | 75,000 | * | 25,000 | 50,000 | * |

| DESERTAIRE ENTERPRISES, LP (19) | 54,150 | * | 54,150 | -- | * |

| SANJAN DHODY (20) | 390,209 | * | 95,454 | 294,755 | * |

| SCOTT E. DOUGLASS | 200,000 | * | 100,000 | 100,000 | * |

| JOSEPH M. DRINON | 394,664 | * | 25,000 | 369,664 | * |

| MITCHELL DUNITZ | 75,000 | * | 25,000 | 50,000 | * |

| ROBERT EDWARDS | 38,885 | * | 38,462 | 423 | * |

| EFKTV HOLDINGS LLC (21) | 350,000 | * | 150,000 | 200,000 | * |

| BRANDT ENGLAND | 25,000 | * | 25,000 | -- | * |

| MAURY FAGAN ATF 1997 GEORGE SCHECHTER REV TRUST DATED 8/12/1997 FBO MAURY FAGAN (22) | 150,000 | * | 50,000 | 100,000 | * |

| ESTATE OF HENRY FAIRLEY, III (23) | 48,000 | * | 33,000 | 15,000 | * |

| KEN FRIED | 800,000 | * | 400,000 | 400,000 | * |

| RITCHIE L. GEISEL AND PAMELA K. GEISEL | 170,000 | * | 50,000 | 120,000 | * |

| ROBERT GHERGHETTA | 50,000 | * | 50,000 | -- | * |

| GLADSTONE HOLDINGS LTD. (24) | 10,000 | * | 10,000 | -- | * |

| CHRIS GLYNN | 325,700 | * | 50,000 | 275,700 | * |

| MICHAEL M. GOLDBERG | 3,596,924 | 2.09% | 200,000 | 3,396,924 | 1.97% |

| MICHAEL M. GOLDBERG FAMILY TRUST (25) | 200,000 | * | 100,000 | 100,000 | * |

| GREIF FAMILY LIMITED PARTNERSHIP L.P. (26) | 4,276,924 | 2.48% | 600,000 | 3,676,924 | 2.13% |

| KENNETH GREIF (27) | 8,426,924 | 4.89% | 1,450,000 | 6,976,924 | 4.05% |

| GUNTHER FAMILY TRUST (28) | 4,722,677 | 2.74% | 1,750,000 | 2,972,677 | 1.72% |

| MARK HACHEM | 300,000 | * | 100,000 | 200,000 | * |

| MARK HAGER | 150,000 | * | 50,000 | 100,000 | * |

| LEO A. GUTHART, TRUSTEE, ANTHONY C. HARPEL TRUST 40 U/A DTD 1/3/1994 (29) | 750,000 | * | 200,000 | 550,000 | * |

| LEO A. GUTHART, TRUSTEE, JAMES W.HARPEL, JR. TRUST 40 U/A DTD 1/2/1990 (29) | 750,000 | * | 200,000 | 550,000 | * |

| JAMES W. HARPEL | 3,938,000 | 2.28% | 1,900,000 | 2,038,000 | 1.18% |

| JUDY HOWARD HARPEL | 400,000 | * | 200,000 | 200,000 | * |

| MACQUARIE PRIVATE WEALTH ITF HATCH FAMILY TRUST (30) | 150,000 | * | 50,000 | 100,000 | * |

| MACQUARIE PRIVATE WEALTH ITF PATRICIA HATCH (31) | 350,000 | * | 250,000 | 100,000 | * |

| HEBRIDES L.P. (32) | 1,973,045 | 1.14% | 473,045 | 1,500,000 | * |

| RICHARD HERMAN | 500,000 | * | 200,000 | 300,000 | * |

| DR. DUNCAN W. HIGGINS INC. (33) | 50,000 | * | 50,000 | -- | * |

9

Name Of Selling Security Holder |

Beneficial Ownership Before Offering (1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering (1) |

||

| Number of Shares |

Percent (2) |

Number of Shares |

Percent (2) | ||

| THE TRUST UNDER THE WILL OF IRENE HORN (34) | 2,365,384 | 1.37% | 650,000 | 1,715,384 | 1.00% |

| LARRY HORN (35) | 2,238,460 | 1.30% | 300,000 | 1,938,460 | 1.12% |

| DR. ROBERT H. JOHNSON | 396,500 | * | 90,000 | 306,500 | * |

| KAHALA FINANCIAL CORP. (36) | 20,000 | * | 20,000 | -- | * |

| 2002 KAPLAN FAMILY TRUST (37) | 60,000 | * | 20,000 | 40,000 | * |

| BRIAN KARP AND DEBRA KARP, JTWROS | 75,000 | * | 25,000 | 50,000 | * |

| ERNST HERMANN KELTING | 725,000 | * | 300,000 | 425,000 | * |

| KEMPTOWN HOLDINGS INC. (38) | 20,000 | * | 10,000 | 10,000 | * |

| STEVE KLEIN (39) | 3,777,814 | 2.19% | 225,000 | 3,552,814 | 2.06% |

| WILLIAM KOHANE (40) | 2,092,306 | 1.21% | 200,000 | 1,892,306 | 1.10% |

| BRUCE E. LAZIER (41) | 1,179,167 | * | 279,167 | 900,000 | * |

| BRUCE E. LAZIER DEFINED BENEFIT PLAN & TRUST (42) | 825,000 | * | 275,000 | 550,000 | * |

| DANIELLE LAZIER | 226,000 | * | 50,000 | 176,000 | * |

| CHRISTOPHER LEFAIVRE | 10,000 | * | 10,000 | -- | * |

| DAVID LETTIERE | 10,000 | * | 10,000 | -- | * |

| EDWARD N. LEVINE, IRA R/O ETRADE AS CUSTODIAN (43) | 95,786 | * | 50,000 | 45,786 | * |

| LIECHTENSTEINISCHE LANDESBANK (SWITZERLAND) LTD. (FBO MATTHIAS NAUER) (44) | 37,500 | * | 37,500 | -- | * |

| TATE LILLIES | 30,000 | * | 10,000 | 20,000 | * |

| VERN LILLIES | 15,000 | * | 5,000 | 10,000 | * |

| THOMAS LING | 310,275 | * | 50,000 | 260,275 | * |

| LIVINGSTON HEALTHCARE PARTNERS, LP (45) | 150,000 | * | 50,000 | 100,000 | * |

| LONDON FAMILY TRUST (46) | 616,666 | * | 222,222 | 394,444 | * |

| DENNIS E. LONG | 83,250 | * | 27,750 | 55,500 | * |

| GEORGE LONG | 46,884 | * | 46,884 | -- | * |

| TERRI MACINNIS | 60,000 | * | 60,000 | -- | * |

| SHANNON MACLEOD | 22,500 | * | 7,500 | 15,000 | * |

| BILLIE W. MAINE | 741,000 | * | 75,000 | 666,000 | * |

| DALTON C. MAINE | 650,464 | * | 225,000 | 425,464 | * |

| MAURY INC. (47) | 75,000 | * | 25,000 | 50,000 | * |

| DONALD GARY MCKAY | 50,000 | * | 50,000 | -- | * |

| KENNON MCLEAN | 82,000 | * | 40,000 | 42,000 | * |

| MICHELE R. MELET IRA | 14,604 | * | 14,604 | -- | * |

| BERNARD MERMELSTEIN | 630,768 | * | 200,000 | 430,768 | * |

| HELEN BRODSKY MIEHLS AND BRENT CARLTON MIEHLS, JTWROS | 128,800 | * | 25,000 | 103,800 | * |

| DANIEL MILLER & PAMELA MILLER, JTWROS (48) | 41,500 | * | 16,500 | 25,000 | * |

10

Name Of Selling Security Holder |

Beneficial Ownership Before Offering (1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering (1) |

||

| Number of Shares |

Percent (2) |

Number of Shares |

Percent (2) | ||

| THE CHARLES SCHWAB TRUST COMPANY, CUSTODIAN ASSOCIATED BOND BROKER 401K FBO PAMELA MILLER (49) | 20,000 | * | 20,000 | -- | * |

| PATRICK LEE MORGAN (50) | 313,650 | * | 4,550 | 309,100 | * |

| RODNEY MOSS LIVING TRUST (51) | 75,000 | * | 25,000 | 50,000 | * |

| MUSGRAVE INVESTMENTS LTD (52) | 150,000 | * | 50,000 | 100,000 | * |

| MACQUARIE PRIVATE WEALTH ITF WILSON NG (53) | 110,000 | * | 50,000 | 60,000 | * |

| PETER K. NITZ | 176,922 | * | 50,000 | 126,922 | * |

| JULIA NOWEK | 50,000 | * | 50,000 | -- | * |

| BRIAN O’NEILL | 1,000 | * | 1,000 | -- | * |

| ERIN O’NEILL | 500 | * | 500 | -- | * |

| O’NEILL FAMILY TRUST (54) | 500 | * | 500 | -- | * |

| MARYNA O’NEILL | 1,000 | * | 1,000 | -- | * |

| MICHELLE O’NEILL | 22,500 | * | 22,500 | -- | * |

| STEPHEN F.X. O’NEILL | 24,000 | * | 24,000 | -- | * |

| SEAN O’NEILL | 500 | * | 500 | -- | * |

| THOMAS O’NEILL | 50,000 | * | 50,000 | -- | * |

| PANCANUSA HOLDINGS CORP. (55) | 2,002,500 | 1.16% | 597,500 | 1,405,000 | * |

| JAMES R. POAGE | 700,000 | * | 200,000 | 500,000 | * |

| LANI POWERS | 75,000 | * | 25,000 | 50,000 | * |

| DALLAS PRETTY | 40,000 | * | 40,000 | -- | * |

| PHILIP M. PROCTOR | 25,000 | * | 25,000 | -- | * |

| RON PUTZI | 250,000 | * | 250,000 | -- | * |

| THE REEVES FAMILY TRUST OF 1989 (56) | 473,800 | * | 200,000 | 273,800 | * |

| RALPH REIS REVOCABLE TRUST (57) | 11,976 | * | 11,976 | -- | * |

| ROSALIND M. REIS IRA | 6,937 | * | 6,937 | -- | * |

| ALLAN ROCKLER AND CHARLENE ROCKLER | 112,500 | * | 25,000 | 87,500 | * |

| DENNIS ROSENBERG | 297,000 | * | 50,000 | 247,000 | * |

| DENNIS ROSENBERG & IRIS ROSENBERG, JTWROS | 297,000 | * | 50,000 | 247,000 | * |

| DETLEF ROSTOCK | 600,000 | * | 200,000 | 400,000 | * |

| JAMES L. ROTHENBERG | 156,000 | * | 150,000 | 6,000 | * |

| BRET SABERHAGEN | 550,000 | * | 250,000 | 300,000 | * |

| A. PAUL SAVAGE | 55,800 | * | 10,000 | 45,800 | * |

| BRAD SAVAGE | 17,000 | * | 5,000 | 12,000 | * |

| WILFRIED SCHNOOR | 333,500 | * | 100,000 | 233,500 | * |

| LEE J. SEIDLER REVOCABLE TRUST DTD APRIL 10, 1990 (58) | 600,000 | * | 300,000 | 300,000 | * |

| PAUL D. SELVER AND ELLEN J. ROLLER, JTWROS | 85,000 | * | 25,000 | 60,000 | * |

| ERIC L. SICHEL | 122,000 | * | 50,000 | 72,000 | * |

| KATHRYN A. SLAWSON (59) | 200,000 | * | 100,000 | 100,000 | * |

11

Name Of Selling Security Holder |

Beneficial Ownership Before Offering (1) |

Number of Shares Being Offered |

Beneficial Ownership After Offering (1) |

||

| Number of Shares |

Percent (2) |

Number of Shares |

Percent (2) | ||

| STEVEN E. SLAWSON (60) | 1,096,422 | * | 450,000 | 646,422 | * |

| TOD B. SMITH | 150,000 | * | 50,000 | 100,000 | * |

| DAVID SNOW | 597,765 | * | 100,000 | 497,765 | * |

| AL SOLOMON | 70,000 | * | 50,000 | 20,000 | * |

| JERRY & STEPHANIE STERN FAMILY TRUST (61) | 280,000 | * | 50,000 | 230,000 | * |

| DAVID STRICKLER (62) | 496,150 | * | 4,550 | 491,600 | * |

| MARVIN TARNOL | 150,000 | * | 50,000 | 100,000 | * |

| HOWARD THOMSON | 16,000 | * | 5,000 | 11,000 | * |

| PAULA TOTI | 230,000 | * | 50,000 | 180,000 | * |

| BART ULANSEY | 75,000 | * | 25,000 | 50,000 | * |

| LISA VINCENT | 18,675 | * | 5,000 | 13,675 | * |

| DEBRA VOGEL | 200,000 | * | 100,000 | 100,000 | * |

| DANIEL WALLEN | 750,000 | * | 250,000 | 500,000 | * |

| GREG WALLIN | 295,000 | * | 50,000 | 245,000 | * |

| JEFFREY L. WERDESHEIM (63) | 331,700 | * | 125,000 | 206,700 | * |

| WES-TEX DRILLING COMPANY, L.P. (64) | 150,000 | * | 50,000 | 100,000 | * |

| MELVIN L. WILLIAMS | 100,000 | * | 40,000 | 60,000 | * |

| DAGMAR WINTERSTELLER | 400,000 | * | 100,000 | 300,000 | * |

| GREGOR WINTERSTELLER | 489,500 | * | 250,000 | 239,500 | * |

| JACOB WIZMAN | 215,000 | * | 100,000 | 115,000 | * |

| DON WOHL | 1,843,000 | 1.07% | 500,000 | 1,343,000 | * |

| CHRISTOPHER WORCESTER | 50,000 | * | 50,000 | -- | * |

| JAMES R. WRIGHT | 1,464,444 | * | 275,000 | 1,189,444 | * |

| W. DAN WRIGHT | 450,000 | * | 150,000 | 300,000 | * |

| JOSEPH & CHERYL ZARACHOFF | 30,000 | * | 15,000 | 15,000 | * |

| STUART ZERNER | 255,000 | * | 220,000 | 35,000 | * |

| Total | 93,056,894 | 25,994,922 | 67,061,972 | ||

Notes:

| * | Represents less than 1%. |

| (1) |

The number of shares of our common stock beneficially owned has been determined in accordance with Rule 13d-3 under the Exchange Act, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under Rule 13d-3, beneficial ownership includes any shares as to which a selling stockholder has sole or shared voting power or investment power and also any shares which that selling stockholder has the right to acquire within 60 days of the date of this prospectus through the exercise of any stock options, warrants or other rights. The number of shares beneficially owned after the Offering assumes that each selling security holder (1) sells all of the securities being offered by them in this prospectus; (2) does not dispose of any security of the Company other than the securities being offered in this prospectus; and (3) does not require any additional securities of the Company. |

| (2) |

The percentages of beneficial ownership are based on 172,383,352 shares, which assumes the exercise of the all of the Warrants held by the Selling Security Holders as a group. |

| (3) |

Jesse Anderson has investment and voting power over these securities. |

| (4) |

Mark Reynolds has investment and voting power over these securities. |

| (5) |

Pamela Miller has investment and voting power over these securities. |

| (6) |

William Belzberg has investment and voting power over these securities. |

| (7) |

Harvey Bibicoff and Jacqueline Bibicoff have investment and voting power over these securities. |

| (8) |

Paige Birnie is the sister of Douglas D.G. Birnie. |

| (9) |

Roberta Birnie is the mother of Douglas D.G. Birnie. |

| (10) |

Robert D. Blashek has investment and voting power over these securities. |

12

| (11) |

Nicholas Barham has investment and voting power over these securities. |

| (12) |

Mark Brennan has investment and voting power over these securities. Mr. Brennan is a director of the Company. |

| (13) |

John G. Brittingham has investment and voting power over these securities. |

| (14) |

Mr. Brous has indicated that he is an affiliate of a broker-dealer. Mr. Brous has also indicated that he acquired the securities being offered by him in the ordinary course of business and that he did not have any agreements or understandings with any person to distribute those securities. |

| (15) |

Mr. Brunson is an employee of the Company. |

| (16) |

William S. Calvert and Rose Angela Calvert have investment and voting power over these securities. Mr. Calvert has indicated that he is an affiliate of a broker-dealer. Mr. Calvert has also indicated that he acquired the securities being offered by him as a personal investment and that he did not have any agreements or understandings with any person to distribute those securities. |

| (17) |

Burton Cutler and Diana Cutler have investment and voting power over these securities. |

| (18) |

Morton Dear has investment and voting power over these securities. |

| (19) |

Ronald Taylor has investment and voting power over these securities. |

| (20) |

Mr. Dhody has indicated that he is an affiliate of a broker-dealer. Mr. Dhody has also indicated that he acquired the securities being offered by him as a personal acquisition and that he did not have any agreements or understandings with any person to distribute those securities. |

| (21) |

Jerome Snyder has investment and voting power over these securities. |

| (22) |

Maury Fagan has investment power and voting power over these securities. |

| (23) |

Preston D. Morton has investment and voting power over these securities as the executor for the Estate of Henry Fairley, III. |

| (24) |

Chris Wrede and Dan Goluboff have investment and voting power over these securities. |

| (25) |

Judith Goldberg has investment and voting power over these securities. |

| (26) |

Kenneth Greif and Susan Greif have investment and voting power over these securities. Mr. Greif has indicated that he is an affiliate of a broker-dealer. Mr. Greif has also indicated that the securities being offered by the Limited Partnership were acquired as a personal investment and that there were no agreements or understandings with any other person to distribute those securities. |

| (27) |

Securities listed as beneficially owned by Mr. Greif include the securities held by the Greif Family Limited Partnership LP as Mr. Greif has shared investment and voting power over the securities held by the Limited Partnership. The securities listed as beneficially owned by Mr. Greif after the Offering assume the sale of only those securities held by Mr. Greif and not the Limited Partnership. Mr. Greif has indicated that he is an affiliate of a broker-dealer. Mr. Greif has also indicated that he acquired the securities being offered by him as a personal investment and that he did not have any agreements or understandings with any other person to distribute those securities. |

| (28) |

Richard S. Gunther and Lois O. Gunther have investment and voting power over these securities. |

| (29) |

Leo Guthart has investment and voting power over these securities. |

| (30) |

Patricia Hatch has investment and voting power over these securities. |

| (31) |

Patricia Hatch has investment and voting power over these securities. |

| (32) |

Anthony Bune has investment and voting power over these securities. |

| (33) |

Dr. Duncan W. Higgins has investment and voting power over these securities. |

| (34) |

Steve Klein has investment and voting power over these securities. Mr. Klein has indicated that he is an affiliate of a broker-dealer. Mr. Klein has also indicated that the securities being offered by the Trust were purchased by the trust for investment purposes and that there were no agreements or understandings with any other person to distribute those securities. Mr. Klein is also a director of the Company. |

| (35) |

Mr. Horn has indicated that he is an affiliate of a broker-dealer. Mr. Horn has also indicated that the securities being offered by him were acquired as a personal investment and that he did not have any agreements or understandings with any other person to distribute those securities. |

| (36) |

Richard W. Donaldson has investment and voting power over these securities. |

| (37) |

Kalman R. Kaplan and Linda S. Kaplan have investment and voting power over these securities. |

| (38) |

Donald Sutherland and Angela Sutherland have investment and voting power over these securities. |

| (39) |

Mr. Klein is a director of the Company. The securities listed as beneficially owned by Mr. Klein include the securities held by the Trust Under the Will of Irene Horn as Mr. Klein has voting and investment power over the securities held by the Trust. The securities listed as beneficially owned by Mr. Klein after the Offering assume the sale of only those securities held by Mr. Klein and not the Trust. Mr. Klein has also indicated that he is an affiliate of a broker- dealer, that the securities being offered by him were acquired as a personal investment and that he did not have any agreements or understandings with any other person to distribute those securities. |

| (40) |

Mr. Kohane has indicated that he is an affiliate of a broker-dealer. Mr. Kohane has also indicated that he acquired the securities being offered by him as a personal investment and that he did not have any agreements or understandings with any other person to distribute those securities. |

| (41) |

The securities listed as beneficially owned by Mr. Lazier include the securities listed as beneficially owned by the Bruce E. Lazier Defined Benefit Plan and Trust as Mr. Lazier has investment and voting power over the securities held by the Trust. The securities listed as beneficially owned by Mr. Lazier after the Offering assume the sale only of those securities held by Mr. Lazier and not the Trust. Mr. Lazier acquired Warrants for 104,167 shares as compensation for acting as placement agent for a private placement completed by the Company in 2007. The remainder of the securities being offered by Mr. Lazier were acquired for personal investment purposes. Mr. Lazier has indicated that he did not have any agreements or understandings with any other person for the distribution of any of the securities being offered by him. |

13

| (42) |

Bruce E. Lazier has investment and voting power over these securities. Mr. Lazier is a broker-dealer. Mr. Lazier has indicated that the securities being offered by the Trust were acquired in the ordinary course of its business and that there were no agreements or understandings to distribute the securities being offered by the Trust. |

| (43) |

Edward Levine has investment and voting power over these securities. |

| (44) |

Matthias Nauer has investment and voting power over these securities. |

| (45) |

Eric L. Sichel has investment and voting power over these securities. |

| (46) |

Robert S. London and Heath H. London have investment and voting power over these securities. |

| (47) |

Maury Fagan and Deborah Fagan have investment and voting power over these securities. |

| (48) |

Ms. Miller has indicated that she is an affiliate of a broker-dealer. Ms. Miller has indicated that the securities being offered were acquired as a personal investment and that there were no agreements or understandings to distribute any of these securities. |

| (49) |

Ms. Miller has investment and voting power over these securities. Ms. Miller has indicated that she is an affiliate of a broker-dealer. Ms. Miller has indicated that the securities being offered were acquired as a personal investment and that there were no agreements or understandings to distribute those securities. |

| (50) |

Mr. Morgan is an employee of the Company. |

| (51) |

David Moss has investment and voting power over these securities. |

| (52) |

Peter Grut has investment and voting power over these securities. |

| (53) |

Wilson Ng has investment and voting power over these securities. |

| (54) |

Stephen F.X. O’Neill has investment and voting power over these securities. |

| (55) |

John Boschert has investment and voting power over these securities. |

| (56) |

Samuel T. Reeves has investment and voting power over these securities. |

| (57) |

Ralph I. Reis has investment and voting power over these securities. |

| (58) |

Lee J. Seidler has investment and voting power over these securities. |

| (59) |

Steven E. Slawson has investment power over 100,000 shares registered in the name of this selling securities holder. |

| (60) |

The securities listed as beneficially owned by Mr. Slawson include 100,000 shares held by Kathryn Slawson over which Mr. Slawson has investment power. The securities listed as beneficially owned by Mr. Slawson after the Offering assume the sale of only those shares held by Mr. Slawson and not Kathryn Slawson. |

| (61) |

Jerry Stern and Stephanie Stern have investment and voting power over these securities. |

| (62) |

Mr. Strickler is the Company’s Vice President of Finance and Administration. |

| (63) |

Mr. Werdesheim has indicated that he is a broker-dealer. Mr. Werdesheim indicated that he purchased the securities being offered by him as a personal investment and that he did not have any agreements or understandings to distribute those securities. |

| (64) |

Dewayne Chitwood, David Morris and Robert W. Richards have investment and voting power over these securities. |

PLAN OF DISTRIBUTION

Each Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the OTCQB marketplace or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

- ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

- block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

- purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

- an exchange distribution in accordance with the rules of the applicable exchange;

- privately negotiated transactions;

- settlement of short sales entered into after the effective date of the registration statement of which this Prospectus is a part;

- in transactions through broker-dealers that agree with the Selling Security Holders to sell a specified number of such securities at a stipulated price per security;

- through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

- a combination of any such methods of sale; or

- any other method permitted pursuant to applicable law.

14

The Selling Security Holders may also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this Prospectus.

Broker-dealers engaged by the Selling Security Holders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Security Holders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Security Holders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Security Holders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Security Holders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this Prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this Prospectus (as supplemented or amended to reflect such transaction).

The Selling Security Holders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

Because Selling Security Holders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this Prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this Prospectus.

The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Security Holders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the common stock by the Selling Security Holders or any other person. We will make copies of this Prospectus available to the Selling Security Holders and have informed them of the need to deliver a copy of this Prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

DESCRIPTION OF SECURITIES

Description of Common Stock

Our authorized capital consists of 400,000,000 shares of common stock, par value $0.001 per share, of which 146,159,542 shares of common stock were issued and outstanding as of the date of this Prospectus.

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Holders of not less than one percent (1%) of the outstanding shares of stock entitled to vote shall constitute a quorum for the transaction of business at meetings of our stockholders. Except as otherwise provided by law, our Articles of Incorporation or our Bylaws, all action taken by the holders of a majority of the votes cast, excluding abstentions, at any meeting at which a quorum is present shall be valid and binding; provided, however, that directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Where a separate vote by a class or classes or series is required, except where otherwise provided by the statute or by our Articles of Incorporation or our Bylaws, a majority of the outstanding shares of such class or classes or series, present in person or represented by proxy, shall constitute a quorum entitled to take action with respect to that vote on that matter and, except where otherwise provided by the statute or by our Articles of Incorporation or our Bylaws, the affirmative vote of the majority (plurality, in the case of the election of directors) of the votes cast, including abstentions, by the holders of shares of such class or classes or series shall be the act of such class or classes or series. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation.

15

The holders of our common stock are entitled to receive dividends when and if declared by the directors out of funds legally available therefore and to share pro rata in any distribution to common stockholders. The shares of common stock do not carry any subscription, redemption or conversion rights, nor do they contain any sinking fund or purchase fund provisions.

Upon our liquidation, dissolution, or winding up, the holders of the common stock, after payment of all liabilities, are entitled to receive our net assets in proportion to the respective number of shares held by them.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Description of Warrants Held by Selling Security Holders

The shares being offered by the Selling Security Holders consist of 25,944,922 shares of our common stock (the “Warrant Shares”) issuable upon exercise of the Warrants. The Warrants were issued by us in private placements or for consulting services between 2007 and 2012, with terms described below.

The holders of the Warrants do not have any registration rights. We are voluntarily registering the resale of Warrant Shares issuable on exercise of the Warrants by those holders of Warrants who provided us with the information set out in this Prospectus under the section titled “Selling Security Holders.” As such, the total number of shares being offered in this Prospectus is less than the total number of Warrant Shares issuable on exercise of all of the outstanding Warrants.

Period Issued |

No. of Warrants Outstanding |

Exercise

Price |

Expiration Date |

Acceleration Right Trigger(1) |

| Jun. – Oct. 2007 | 10,160,650 | $0.75 | Nov. 30, 2013 | VWAP $4.50 |

| Aug. – Nov. 2009 | 6,894,677 | $0.75 | Nov. 30, 2013 | VWAP $4.50 |

| Dec. 2009 | 200,000 | $0.55 | Nov. 30, 2013 | No acceleration rights. |

| Jan. 2010 | 5,517,500 | $0.75 | Nov. 30, 2013 | VWAP $4.50 |

| Feb. 2010 | 500,000 | $0.75 | Nov. 30, 2013 | VWAP $4.50 |

| May – Jun. 2011 | 2,509,099 | $0.80 | Jun. 30, 2014 | VWAP $2.80 |

| Feb. – Mar. 2012 | 9,588,000 | $0.80 | Mar. 31, 2015 | VWAP $2.40 |

| (1) |

Except where indicated, each of the Warrants described above contain acceleration rights whereby we may accelerate the expiration date of the Warrants if (a) our shares trade at or above the indicated minimum volume weighted average price (VWAP) for 20 consecutive trading days; and (b) there is a minimum average trading volume of 0.2% of our free float during those 20 trading days. If triggered, the acceleration rights allow us to accelerate the expiration date for the Warrants to 30 days after we give notice that the acceleration rights have been exercised. |

16

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this Prospectus as having prepared or certified any part of this Prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company, or any of its parents or subsidiaries, a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Northwest Law Group has assisted us in the preparation of this Prospectus and registration statement and will provide counsel with respect to other legal matters concerning the registration and offering of the common stock. Attorneys who are members of or employed by Northwest Law Group who have provided advice with respect to this matter may own shares and warrants to purchase shares of our common stock. As a group, these persons own less than 1% of our outstanding common stock.

Brown Armstrong Accountancy Corporation (“Brown”), our independent accountant, has audited our financial statements included in this Prospectus and registration statement to the extent and for the periods set forth in their audit report. Brown has presented their report with respect to our audited financial statements. The report of Brown is included in reliance upon their authority as experts in accounting and auditing.

DESCRIPTION OF OUR BUSINESS

General

We were incorporated on February 20, 2001 under the laws of the State of Nevada. We are an exploration stage minerals exploration company focused on the discovery and extraction of precious metals from mineral deposits in the Southwestern United States.

In February 2008, we acquired our lead project, a prospective gold, silver and calcium carbonate property located in Esmeralda County, Nevada, that we call the “Columbus Project.” The Columbus Project consists of 50,538 acres of placer mineral claims, including a 380 acre Permitted Mine Area (58-acre mill site and mill facility, 266-acre mine site with 54 acres defined as “undisturbed area”). Our current permits allow us to mine up to 792,000 tons per year to 40 feet in depth for the purpose of extracting precious metals and calcium carbonate from the Permitted Mine Area. In addition, we own 80 acres of land in the southeast quadrant of the project. Our current exploration efforts are focused on the North and South Sand Zones in the northwest quadrant of the Columbus Project.

In addition to the Columbus Project, we own the right to acquire a prospective gold, silver and tungsten property located in San Bernardino County, California, that we call the “Red Mountain Project.”

Competition