Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REPUBLIC AIRWAYS HOLDINGS INC | sharehodlermeetingpresenta.htm |

Annual Shareholder’s Meeting September 17, 2013

Disclaimer 2© Republic Airways Holdings Inc. Statements in this presentation, as well as oral statements that may be made by officers or directors of Republic Airways Holdings Inc., its advisors, affiliates or subsidiaries (collectively or separately the “Company”), that are not historical fact constitute “forward-looking statements”. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from historical results or from any results expressed or implied by the forward-looking statements. Such risks and uncertainties are outlined in the Company’s Annual Report on Form 10-K, most recent Quarterly Report and other documents filed with the SEC from time to time. The Company cautions users of this presentation not to place undue reliance on forward-looking statements, which may be based on assumptions and anticipated events that do not materialize. Certain financial figures presented herein have been presented on a non-GAAP basis. Reconciliations for non-GAAP financial measures to our reported U.S. GAAP measures are included in the appendix to this document. Disclaimer Non‐GAAP Information

Agenda I. Review 2012 Business Results II. Review 1st Half 2013 Business Results III. Review 2nd Half 2013 Business Updates IV. Frontier Transaction Update V. 2014 and Beyond VI. Questions © Republic Airways Holdings Inc. 3

I. 2012 RESULTS 4© Republic Airways Holdings Inc.

2012 Goals and Accomplishments Prepare Frontier for Divestiture 5© Republic Airways Holdings Inc. • Appointed new executive leadership team • Separated key business functions • Hired Barclays as advisor • Successful completion in Q4 2012Restructure Chautauqua Place idled small jet aircraft back to work Develop new growth opportunities Complete new labor agreements with our unionized employees • All small jets returned to productive CPA service • Opportunity seized with United for Q400s • Flight Dispatchers ratified in July 2013 • Flight Attendants ratified in August 2013 • Pilots – mediation suspended

2012 Consolidated Results YOY improvement of >$135M excluding impairments taken in 2011 6© Republic Airways Holdings Inc. ► Successful Frontier restructuring in Q4 2011 drove significant financial improvement in 2012 ► Successful ERJ restructuring in Q4 2012 lowered operating costs of 50- seat aircraft, enabling all parked ERJ aircraft to return to service by the end of 2012 *See appendix for listing of items and reconciliation to GAAP. Republic Frontier Republic Frontier Operating Revenues 1,533.9$ 1,330.6$ 2,864.5$ 1,377.4$ 1,433.5$ 2,810.9$ Operating Expenses Fuel Expense 303.4 517.7 821.1 161.4 532.3 693.7 All Other Expenses 1,247.4 901.6 2,149.0 1,032.5 871.8 1,904.3 Operating Income (loss) (16.9) (88.7) (105.6) 183.5 29.4 212.9 Other Income (expense) (130.2) (6.6) (136.8) (121.2) (5.5) (126.7) Income (loss) before Income Taxes (GAAP) (147.1) (95.3) (242.4) 62.3 23.9 86.2 Items 191.1 - 191.1 - - - Ex-item Income (loss) before Income Taxes 44.0$ (95.3)$ (51.3)$ 62.3$ 23.9$ 86.2$ ASMs (millions) 14,450 11,778 26,228 13,437 11,908 25,345 Block Hours (thousands) 731 219 950 701 214 915 For the Years Ended December 31, 2011 2012

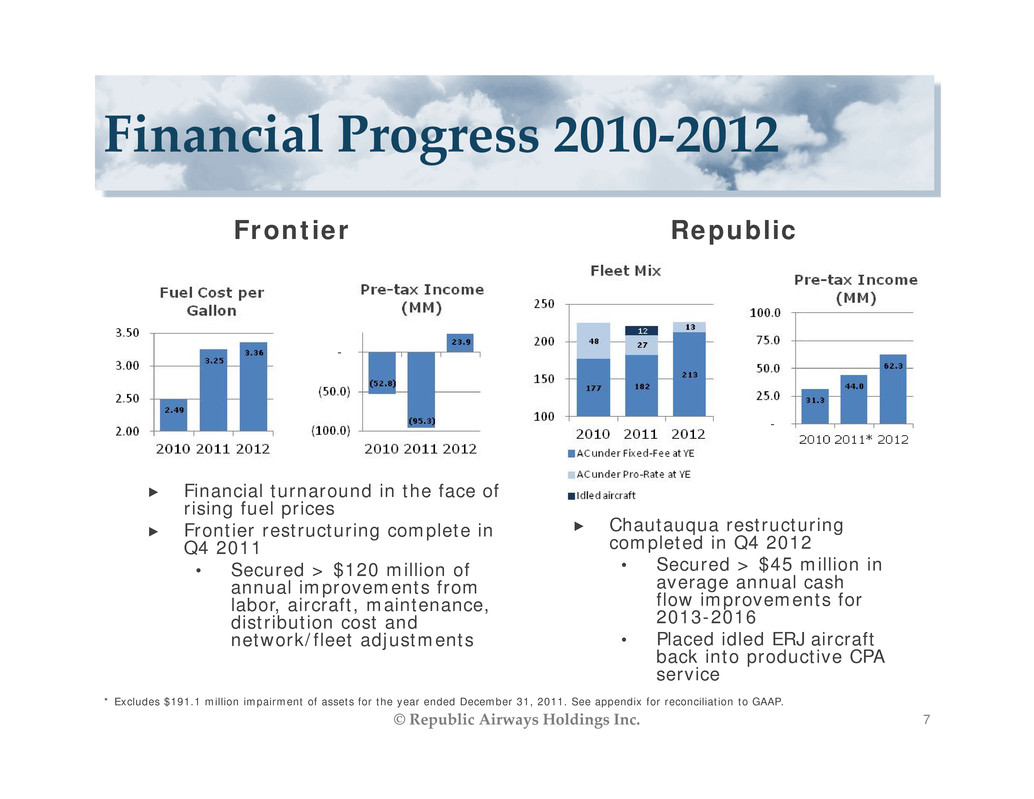

Financial Progress 2010‐2012 © Republic Airways Holdings Inc. 7 Frontier ► Financial turnaround in the face of rising fuel prices ► Frontier restructuring complete in Q4 2011 • Secured > $120 million of annual improvements from labor, aircraft, maintenance, distribution cost and network/fleet adjustments Republic ► Chautauqua restructuring completed in Q4 2012 • Secured > $45 million in average annual cash flow improvements for 2013-2016 • Placed idled ERJ aircraft back into productive CPA service * Excludes $191.1 million impairment of assets for the year ended December 31, 2011. See appendix for reconciliation to GAAP.

Republic Segment Improvement © Republic Airways Holdings Inc. 8 ► CHQ restructuring completed in Q4 2011 ► Approximately $25 million of improvements driven by fewer aircraft, especially 50-seat aircraft, operating under pro-rate agreement at Frontier ► Cost pressures on labor, idled aircraft and maintenance costs offset economic improvement * Excludes $191.1 million impairment of assets for the year ended December 31, 2011. See appendix for reconciliation to GAAP.

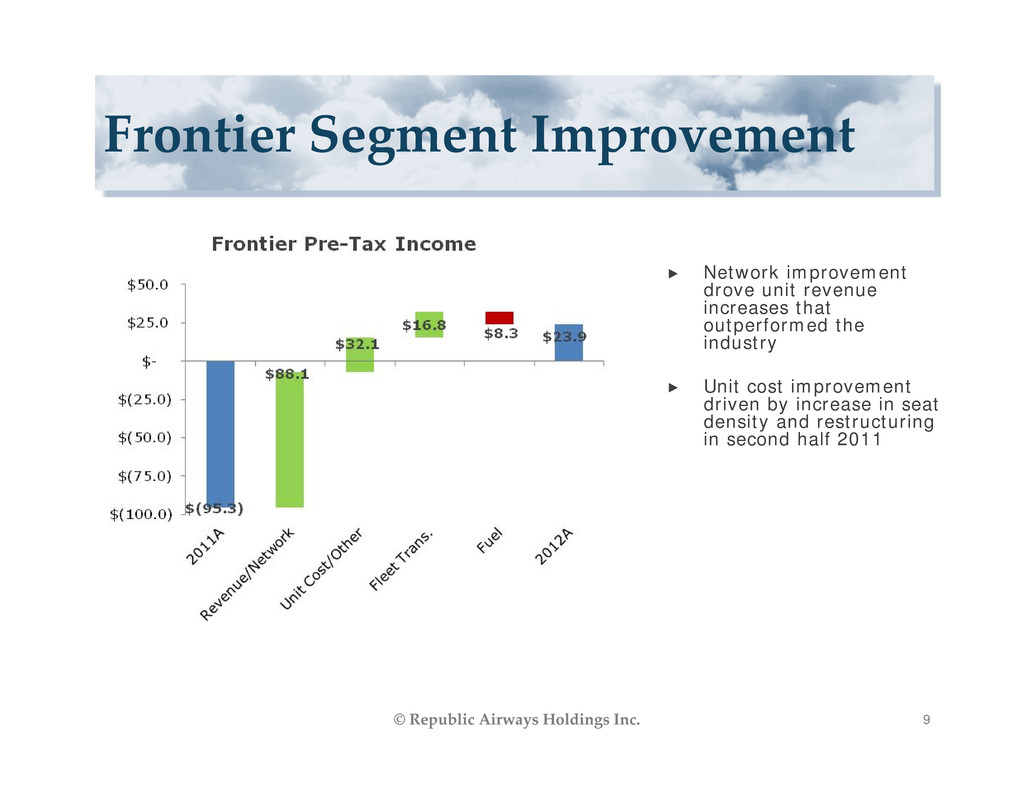

Frontier Segment Improvement © Republic Airways Holdings Inc. 9 ► Network improvement drove unit revenue increases that outperformed the industry ► Unit cost improvement driven by increase in seat density and restructuring in second half 2011

II. 1ST HALF 2013 RESULTS 10© Republic Airways Holdings Inc.

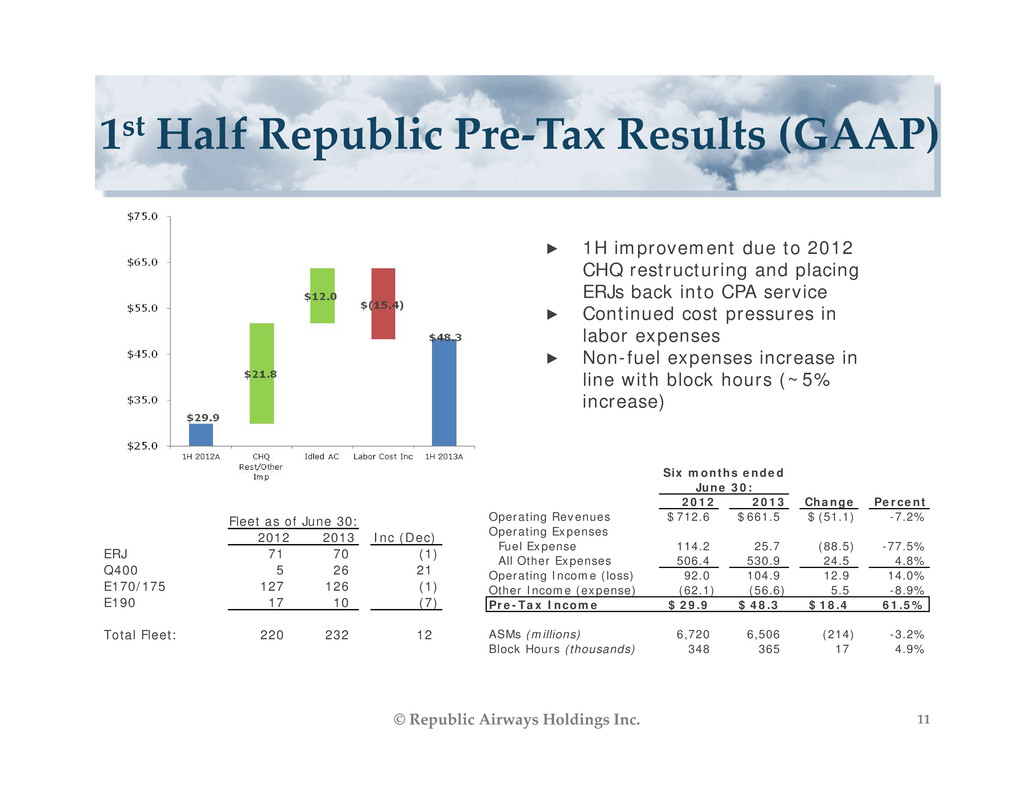

1st Half Republic Pre‐Tax Results (GAAP) 11© Republic Airways Holdings Inc. ► 1H improvement due to 2012 CHQ restructuring and placing ERJs back into CPA service ► Continued cost pressures in labor expenses ► Non-fuel expenses increase in line with block hours (~5% increase) 2012 2013 Inc (Dec) ERJ 71 70 (1) Q400 5 26 21 E170/175 127 126 (1) E190 17 10 (7) Total Fleet: 220 232 12 Fleet as of June 30: 2012 2013 Change Percent Operating Revenues 712.6$ 661.5$ (51.1)$ -7.2% Operating Expenses Fuel Expense 114.2 25.7 (88.5) -77.5% All Other Expenses 506.4 530.9 24.5 4.8% Operating Income (loss) 92.0 104.9 12.9 14.0% Other Income (expense) (62.1) (56.6) 5.5 -8.9% Pre-Tax Income 29.9$ 48.3$ 18.4$ 61.5% ASMs (millions) 6,720 6,506 (214) -3.2% Block Hours (thousands) 348 365 17 4.9% Six months ended June 30:

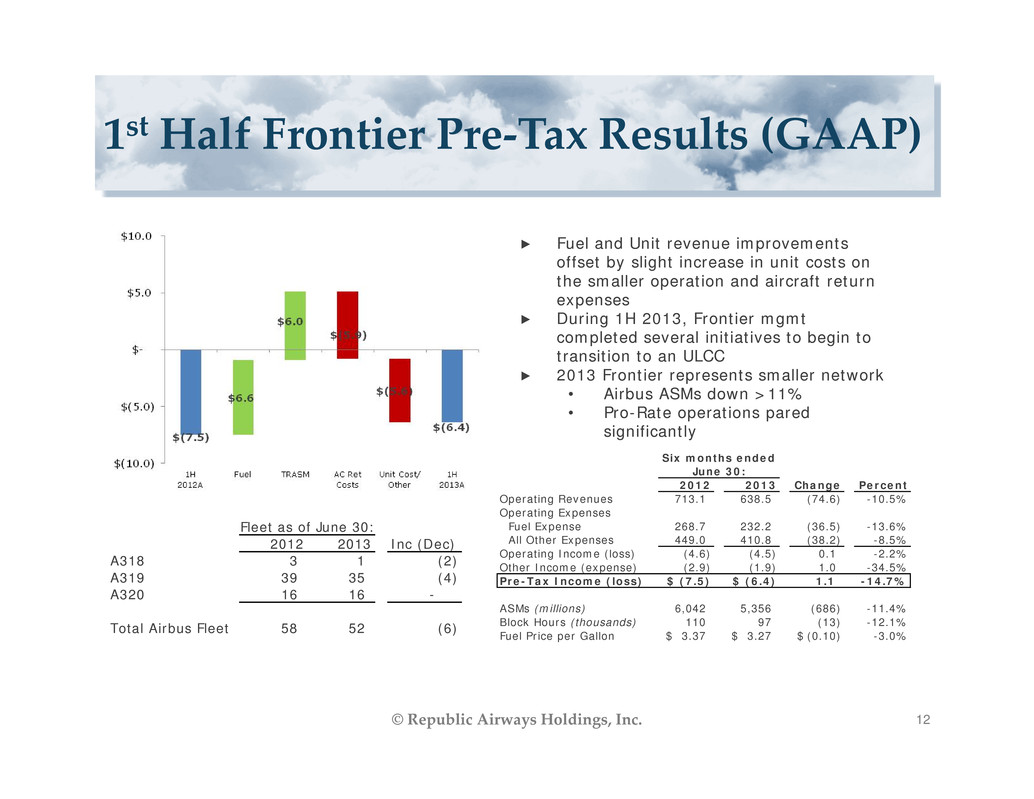

1st Half Frontier Pre‐Tax Results (GAAP) 12© Republic Airways Holdings, Inc. ► Fuel and Unit revenue improvements offset by slight increase in unit costs on the smaller operation and aircraft return expenses ► During 1H 2013, Frontier mgmt completed several initiatives to begin to transition to an ULCC ► 2013 Frontier represents smaller network • Airbus ASMs down >11% • Pro-Rate operations pared significantly 2012 2013 Inc (Dec) A318 3 1 (2) A319 39 35 (4) A320 16 16 - Total Airbus Fleet 58 52 (6) Fleet as of June 30: 2012 2013 Change Percent Operating Revenues 713.1 638.5 (74.6) -10.5% Operating Expenses Fuel Expense 268.7 232.2 (36.5) -13.6% All Other Expenses 449.0 410.8 (38.2) -8.5% Operating Income (loss) (4.6) (4.5) 0.1 -2.2% Other Income (expense) (2.9) (1.9) 1.0 -34.5% Pre-Tax Income (loss) (7.5)$ (6.4)$ 1.1 -14.7% ASMs (millions) 6,042 5,356 (686) -11.4% Block Hours (thousands) 110 97 (13) -12.1% Fuel Price per Gallon 3.37$ 3.27$ (0.10)$ -3.0% June 30: Six months ended

1st Half Consolidated Pre‐Tax Results 13© Republic Airways Holdings Inc. ► In 2013, Republic reported its best consolidated first half performance since acquiring Frontier in late 2009 ► Fuel as a % of total RJET revenue decreased from 27% in 1H 2012 to under 20% in 1H 2013 ► Republic segment pre-tax margin of 7.3% at top end of guidance provided in early 2013 Republic Frontier 2012 Republic Frontier 2013 Operating Revenues 712.6$ 713.1$ 1,425.7$ 661.5$ 638.5$ 1,300.0$ Operating Expenses Fuel Expense 114.2 268.7 382.9 25.7 232.2 257.9 All Other Expenses 506.4 449.0 955.4 530.9 410.8 941.7 Operating Income (loss) 92.0 (4.6) 87.4 104.9 (4.5) 100.4 Other Income (expense) (62.1) (2.9) (65.0) (56.6) (1.9) (58.5) Income (loss) before Income Taxes 29.9$ (7.5)$ 22.4$ 48.3$ (6.4)$ 41.9$ ASMs (millions) 6,720 6,042 12,762 6,506 5,356 11,862 Block Hours (thousands) 348 110 458 365 97 462 For the Six Months Ended June 30,

III. 2ND HALF 2013 UPDATES 14© Republic Airways Holdings Inc.

2013 Operational Update 15© Republic Airways Holdings Inc. • UA Q400 CPA – Original plan to operate 32 aircraft, 28 lines and 4 spares by July 2013 – Behind schedule due to mechanical reliability challenges; may reduce total number of aircraft under CPA • AA E175 CPA flying began August 1, 2013 – Total of 47 aircraft, 15 in-service by year-end – Smooth induction thus far • F9 E190 Pro-Rate down from 5 to 2 aircraft, effective September 9, 2013; Basically just flying DCA P2P flights – Working on alternatives for idled aircraft

Fleet Plan Thru YE 2013 16© Republic Airways Holdings Inc. • Republic to add 15 E175s for AA CPA over last 6 months • Q400 forecast now at 28 total aircraft at YE 2012 • Working on alternatives for idled E190 aircraft • Frontier continues to transition to higher seat density aircraft Actual Actual Forecast Forecast YE 2012 6/30/13 9/30/13 YE 2013 ERJs E135 1 - - - E140 15 15 15 15 E145 55 55 55 55 17 26 28 28 E170 72 72 72 72 E175 54 54 60 69 E190 12 10 10 10 226 232 240 249 Airbus A318 2 1 - - A319 37 35 35 35 A320 16 16 17 18 55 52 52 53 TOTAL 281 284 292 302 SUBTOTAL F r o n t i e r R e p u b l i c EJets Q400 SUBTOTAL

Updating Q3 Guidance (ex‐items) 17© Republic Airways Holdings Inc. Consolidated EPS $0.55 ‐ $0.65 $0.65 ‐ $0.75 Unrestricted Cash $235‐$245 million $250‐$260 million Fuel cost per gallon (net of hedges) $3.20 ‐ $3.30 No change Frontier TRASM + 1‐3% + 3‐5% Frontier CASM (excluding fuel) + 3‐5% No change Frontier Operating Margin 8.0% ‐ 10.0% 10.0% ‐ 12.0% Republic Revenue $335‐$345 million No change Republic Pre‐tax margin 6.0% ‐ 8.0% No change Q3 2013 Guidance Provided on Q2 2013 Call Revised Q3 2013 Guidance (ex‐items)(ex‐items)

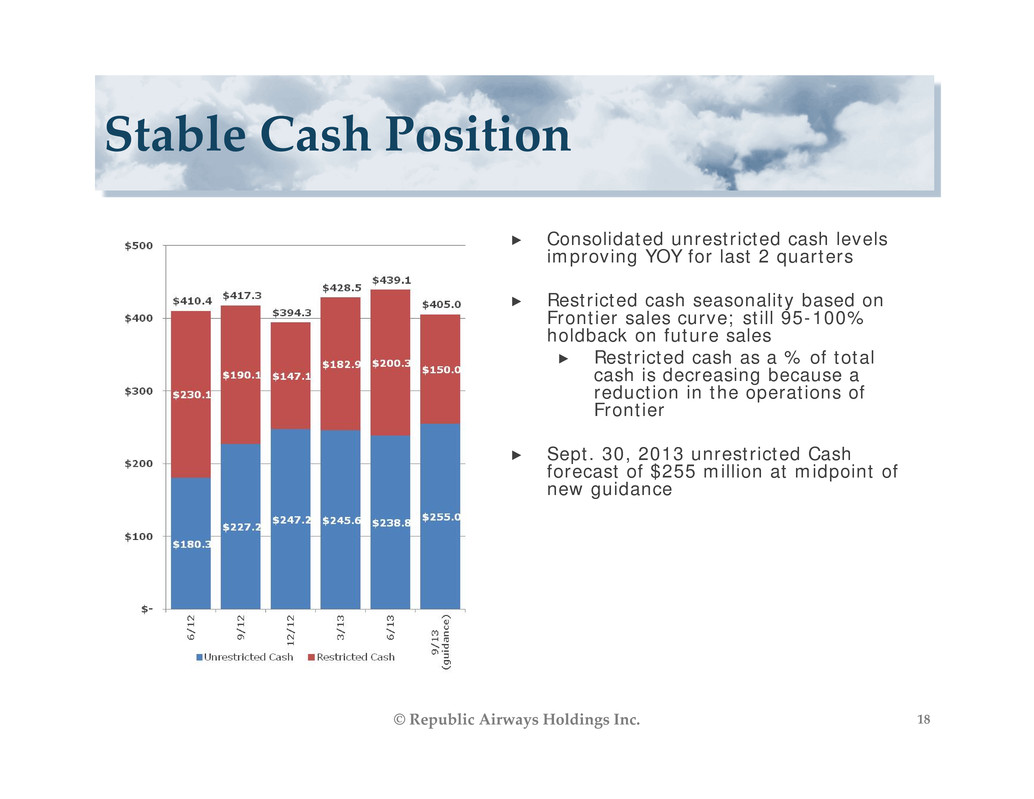

Stable Cash Position 18© Republic Airways Holdings Inc. ► Consolidated unrestricted cash levels improving YOY for last 2 quarters ► Restricted cash seasonality based on Frontier sales curve; still 95-100% holdback on future sales ► Restricted cash as a % of total cash is decreasing because a reduction in the operations of Frontier ► Sept. 30, 2013 unrestricted Cash forecast of $255 million at midpoint of new guidance

IV. FRONTIER TRANSACTION UPDATE 19© Republic Airways Holdings Inc.

Process Update • Two week extension to exclusivity granted to buyer (Through Sep 30) • Substantial progress toward definitive agreement • Both parties working diligently to satisfy all remaining conditions of the term sheet 9/17/2013 20© Republic Airways Holdings, Inc.

Potential Sale Impact to RJET • Finding alternate use or sale of idled E190 Aircraft • Lost synergies post transition of services • NEO agreement and CFM engine agreement expected to be assigned to Frontier • No ongoing Republic guarantees of Frontier obligations • Indemnities in stock purchase agreement could result in some ongoing exposure to Republic 9/17/2013 21© Republic Airways Holdings, Inc.

V. 2014 AND BEYOND 22© Republic Airways Holdings Inc.

RJET’s Flight Plan 23© Republic Airways Holdings Inc. ► Two week extension to exclusivity granted (through September 30) ► Sign purchase agreement ► Close transaction in Q4 Divest Frontier Grow the Business Motivated and engaged team members Competitive cost structure across our product lines Creativity and flexibility in our partnerships with our global airline partners Superior focus on operational performance and brand stewardship Keys to Success Keep ERJs in CPA Flying ► Need to obtain a pilot CBA which recognizes the contributions of our pilots ► Allows us to retain and attract talented professionals ► Allows us to remain competitive within our peer group Obtain new Pilot Labor Agreement ► Solid growth already under contract for remainder of 2013 and 2014 ► Desire to place our E175 options for 2015-2016 under CPA contracts ► Evaluating other creative possibilities ► 43 aircraft currently operating under short- term CPAs ► Desire to keep the ERJ fleet productively deployed ► Flexibility, economics, and reliability will be keys to our success

Recent RJ Contract Awards • Republic obtained ~ 25% market share on recent awards; Mesa, Endeavor and SkyWest each also obtained ~40 growth aircraft • AA/US merger delay will impact timing of any new awards • Republic hopes to obtain at least 25% market share of any new awards, but is hampered by lack of a new pilot CBA 9/17/2013 24© Republic Airways Holdings, Inc. Potential Orders: 30 120 TBD TBD 150 Carrier Quantity Product Regional Operator 40 CRJ900 30 E175 40 E175 9 CRJ900 47 E175 166

RJET’s Regional Fleet Plan 9/17/2013 25© Republic Airways Holdings, Inc. Assumes final 4 Q400s in operation Q1 2014 Does not include any E‐Jet options being exercised in 2015 3 E190s assumed to be returned on lease in 2015 Actual Actual Forecast Forecast Pro-Forma Pro-Forma YE 2012 6/30/13 9/30/13 YE 2013 YE 2014 YE 2015 ERJs E135 1 - - - - - E140 15 15 15 15 15 15 E145 55 55 55 55 55 55 71 70 70 70 70 70 17 26 28 28 32 32 E170 72 72 72 72 72 72 E175 54 54 60 69 94 101 E190 12 10 10 10 10 7 138 136 142 151 176 180 TOTAL 226 232 240 249 278 282 EJets Q400 SUBTOTAL SUBTOTAL

First Look at 2014 Republic 9/17/2013 26© Republic Airways Holdings, Inc. • Full year effect of 2013 growth on Q400 CPA and 2014 growth on E175 AA CPA lead to 14-18% increases in Republic’s block hours and ASMs respectively • 2014 stats assumes extension of all CPA terms for ERJs under short-term CPA (ERJs represent ~ 24% and 14% of 2014 projected block hours and ASMs respectively

Fleet Risks for 2014 27© Republic Airways Holdings Inc. • Current ERJ CPA 2014 Expirations: • Lack of a new pilot CBA makes obtaining contract extensions more difficult • Acceptance of final 4 Q400 aircraft dependent on the success of a maintenance modification program we have planned with Bombardier in Q4 2013 • Development of alternative uses for 5 idled E190 aircraft previously used in Frontier pro-rate operations Q1 Q2 Q3 Q4 FY 2014 Totals: 5 23 6 7 41

VI. QUESTIONS 28© Republic Airways Holdings Inc.

APPENDIX 29© Republic Airways Holdings Inc. ► Reconciliations to GAAP basis accounting

Non‐GAAP Reconciliation 30© Republic Airways Holdings Inc. Reconciliation of Non-GAAP to GAAP Pre-Tax Income for Republic Segment: 2011 Income (Loss) before income taxes (147.1)$ Adjustments: Impairment Charge 191.1 Ex-item Pre-Tax Income 44.0$