Attached files

| file | filename |

|---|---|

| EX-23 - AUGUSTA GOLD CORP. | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM S-1/A

(AMENDMENT NO. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

| BULLFROG GOLD CORP. | ||

|

(Exact name of registrant as specified in its charter)

| ||

| Delaware | 1000 | 41-2252162 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.) |

|

897 Quail Run Drive Grand Junction, CO 81505 (970) 628-1670 | ||

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

| ||

|

David Beling President 897 Quail Run Drive Grand Junction, CO 81505 Telephone: (970) 628-1670 | ||

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| ||

| Copies of all communications, including communications sent to agent for service, should be sent to: | ||

|

Harvey J. Kesner, Esq. 61 Broadway, 32nd Floor New York, New York 10006 Telephone: (212) 930-9700 Fax: (212) 930-9725 | ||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 11 , 2013

PRELIMINARY PROSPECTUS

7,000,000 Shares

BULLFROG GOLD CORP.

Common Stock

_________________

This prospectus relates to the sale by the selling stockholders identified in this prospectus of up to 7,000,000 shares of our common stock, par value $0.0001 per share, which includes 7,000,000 shares of common stock issuable upon the exercise of outstanding warrants.

There are no underwriting arrangements to sell the shares of common stock that are being registered hereunder. The prices at which the selling stockholders may sell shares will be determined by the prevailing market price for the shares or in privately negotiated transactions. We will not receive any proceeds from the sale of these shares by the selling stockholders. All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by the selling stockholders will be borne by the selling stockholders.

Our common stock is quoted on the regulated quotation service of the OTC Bulletin Board under the symbol “BFGC.OB”. On September 5 , 2013, the last reported sale price of our common stock as reported on the OTC Bulletin Board was $0.30 per share.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties in the section entitled “Risk Factors” beginning on page 3 of this prospectus before making a decision to purchase our stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September , 2013

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 1 |

| Risk Factors | 3 |

| Special Note Regarding Forward Looking Statements | 12 |

| Use of Proceeds | 12 |

| Market for Our Common Stock and Related Stockholder Matters | 12 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operation | 14 |

| Business | 23 |

| Management | 41 |

| Executive Compensation | 44 |

| Certain Relationships and Related Transactions | 47 |

| Security Ownership of Certain Beneficial Owners and Management | 48 |

| Selling Stockholders | 50 |

| Description of Securities | 51 |

| Plan of Distribution | 55 |

| Legal Matters | 56 |

| Experts | 56 |

| Where You Can Find Additional Information | 56 |

| Index to Financial Statements | F-1 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2013 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Prospectus Summary

|

Our principal executive offices are located at 897 Quail Run Drive Grand Junction, CO 81505 and our telephone number is (970) 628-1670. Our website is www.bullfroggold.com. Information on or accessed through our website is not incorporated into this prospectus and is not a part of this prospectus.

As used in this prospectus, unless otherwise specified, references to the “Company,” “we,” “our” and “us” refer to Bullfrog Gold Corp. and, unless otherwise specified, its direct and indirect subsidiaries. |

||||

| The Offering | ||||

| Common stock offered by the selling stockholders: |

A total offering of 7,000,000 shares of common stock issuable upon the exercise of 7,000,000 warrants issued to RMB Australia Holdings Limited (“RMB”) as part of the December 10, 2012 debt facility (the “Facility”). The registration of the shares will satisfy the Company’s obligations to RMB as part of a facility agreement dated December 10, 2012 between the Company and RMB (the “Facility Agreement”).

|

|||

| Common stock outstanding before and after this offering: | 44,263,545(1) and 51,263,545 (2) | |||

| Use of proceeds: | We will not receive any proceeds from the sale of shares in this offering by the selling stockholders. | |||

| OTC Bulletin Board symbol: | BFGC.OB | |||

| Risk factors: | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 3 of this prospectus before deciding whether or not to invest in shares of our common stock. | |||

|

___________________ (1) The number of outstanding shares before the offering is based upon 44,263,545 shares outstanding as of September 5, 2013 and excludes: |

||||

| ● | 4,060,000 shares of common stock issuable upon the exercise of outstanding options; | |||

| ● | 21,352,285 shares of common stock issuable upon the exercise of outstanding warrants (which includes the 7,000,000 warrants issued to RMB); | |||

| ● | 687,500 shares of common stock issuable upon the exercise of outstanding shares of Series A Preferred Stock; and | |||

| ● | 400,000 shares of common stock issuable upon the exercise of outstanding shares of Series B Preferred Stock. | |||

| (2) The number of shares after the offering is based on 44,263,545 shares outstanding as of September 5, 2013, assuming all the warrants for which the underlying shares of common stock being offered (7,000,000) have been exercised. | ||||

| 1 |

GLOSSARY OF SELECTED MINING TERMS

| Breccia | Broken sedimentary and volcanic rock fragments cemented by a fine-grained matrix. |

| Clastic Rock | Fragments, or clasts, of pre-existing minerals. |

| Cutoff Grade: | The minimum mineral content included in mineral and ore reserve estimates and that may be economically mined and or processed. |

| Detachment Fault: | A regionally extensive, gently dipping normal fault that is commonly associated with extension in large blocks of the earth’s crust. |

| Exploration Stage: | The US Securities and Exchange Commission’s descriptive category applicable to public mining companies engaged in the search for mineral deposits and ore reserves and which are neither in the development or production stage. |

| Metamorphic Rock: | Rock that has transformed to another rock form after intense heat and pressure. |

| Miocene | A geologic era that extended form 5 million to 23 million years ago. |

| Net Smelter Royalty: | A percentage payable to an owner or lessee from the production or net proceeds received by the operator from a smelter or refinery, less transportation, insurance, smelting and refining costs and penalties as set out in a royalty agreement. For gold and silver royalties, the deductions are relatively low while for base metals the deductions can be substantial. |

| Paleozoic: | A geologic era extending from 230 million to 600 million years ago. |

| Photogrammetry: | The science of making measurements from photographs. The output is typically a map or a drawing. |

| Protozeroic: | A geologic era extending from 540 million years to 2,500 million years ago. |

| Reserves: | That part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve estimate |

| Reverse Circulation (RC): | A drilling method whereby drill cuttings are returned to the surface through the annulus between inner and outer drill rods, thereby minimizing contamination from wall rock. |

| Rhyolite | An igneous, volcanic extrusive rock containing more than 69% silica. |

| Schist | A group metamorphic rocks that contain more than 50% platy and elongated minerals such as mica. |

| Siliciclastic Rock: | Non-carbonate sedimentary rocks that are almost exclusively silicas-bearing, either as quartz or silicate minerals. |

| Tertiary | A geologic era from 2.6 million to 65 million years ago. |

| 2 |

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment.

Risks Relating to Our Business

We are a new company with a short operating history and have only lost money.

Standard Gold Corp., our exploration and operating subsidiary, was formed in January 2010. Our operating history consists of starting our preliminary exploration activities. We have no income-producing activities from mining or exploration. We have already lost money because of the expenses we have incurred in acquiring the rights to explore our properties and starting our preliminary exploration activities. Exploring for gold and other minerals or resources is an inherently speculative activity. There is a strong possibility that we will not find any commercially exploitable gold or other deposits on our properties. Because we are an exploration company, we may never achieve any meaningful revenue.

Since we have a limited operating history, it is difficult for potential investors to evaluate our business.

Our limited operating history makes it difficult for potential investors to evaluate our business or prospective operations. Since our formation, we have not generated any revenues. As an early stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays inherent in a new business. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

Exploring for gold is an inherently speculative business.

Natural resource exploration, and exploring for gold in particular, is a business that by its nature is very speculative. There is a strong possibility that we will not discover gold or any other resources which can be mined or extracted at a profit. Even if we do discover gold or other deposits, the deposit may not be of the quality or size necessary for us or a potential purchaser of the property to make a profit from actually mining it. Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures, fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent development of gold deposits.

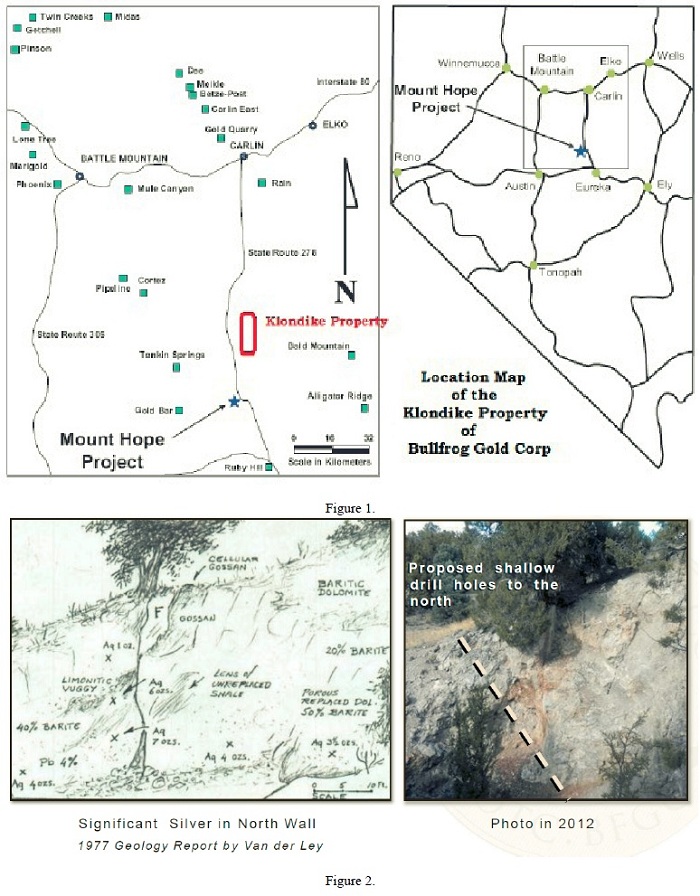

We will need to obtain additional financing to fund our Bullfrog and Klondike exploration programs.

We do not have sufficient capital to fund our exploration programs for the Bullfrog Project and Klondike Project as it is currently planned or to fund the acquisition and exploration of new properties. We will require additional funding to continue our planned exploration programs and cover the costs of being a public company. We do not have any sources of funding for the Bullfrog Project and the Klondike Project. We may be unable to secure additional financing on terms acceptable to us, or at all. Our inability to raise additional funds on a timely basis could prevent us from achieving our business objectives and could have a negative impact on our business, financial condition, results of operations and the value of our securities. If we raise additional funds by issuing additional equity or convertible debt securities, the ownership of existing stockholders may be diluted and the securities that we may issue in the future may have rights, preferences or privileges senior to those of the current holders of our common stock. Such securities may also be issued at a discount to the market price of our common stock, resulting

| 3 |

in possible further dilution to the book value per share of common stock. If we raise additional funds by issuing debt, we could be subject to debt covenants that could place limitations on our operations and financial flexibility.

As discussed in later detail (Liquidity and Capital Resources), the Company has obtained financing for the Newsboy Project and certain corporate expenses in the form of a debt facility of $4,200,000 available until March 31, 2014 with the full amount of the loan to be repaid on or before December 10, 2014.

The global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

The continued credit crisis and related turmoil in the global financial system may have an impact on our business and financial position. The high costs of fuel and other consumables may negatively impact costs of our operations. In addition, the financial crisis may limit our ability to raise capital through credit and equity markets. As discussed further below, the prices of the metals that we may produce are affected by a number of factors, and it is unknown how these factors will be impacted by a continuation of the financial crisis.

We do not know if our properties contain any gold or other minerals that can be mined at a profit.

The properties on which we have the right to explore for gold are not known to have any deposits of gold which can be mined at a profit (as to which there can be no assurance). Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection.

We are a junior gold exploration company with no mining operations and we may never have any mining operations in the future.

Our business is exploring for gold and other minerals. In the event that we discover commercially exploitable gold or other deposits, we will not be able to make any money from them unless the gold or other minerals are actually mined or we sell all or a part of our interest. Accordingly, we will need to find some other entity to mine our properties on our behalf, mine them ourselves or sell our rights to mine to third parties. Mining operations in the United States are subject to many different federal, state and local laws and regulations, including stringent environmental, health and safety laws. In the event we assume any operational responsibility for mining our properties, it is possible that we will be unable to comply with current or future laws and regulations, which can change at any time. It is possible that changes to these laws will be adverse to any potential mining operations. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, adversely affecting any potential mining operations. Our future mining operations, if any, may also be subject to liability for pollution or other environmental damage. It is possible that we will choose to not be insured against this risk because of high insurance costs or other reasons.

Our business is subject to extensive environmental regulations which may make exploring for or mining prohibitively expensive, and which may change at any time.

All of our operations are subject to extensive environmental regulations which can make exploration expensive or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal of waste products that may occur as the result of exploring and other related activities on our properties. We may have to pay to remedy environmental pollution, which may reduce the amount of money that we have available to use for exploration. This may adversely affect our financial position, which may cause you to lose your investment. If we are unable to fully remedy an environmental problem, we might be required to suspend operations or to enter into interim compliance measures pending the completion of the required remedy. If a decision is made to mine our properties and we retain any operational responsibility for doing so, our potential exposure for remediation may be significant, and this may have a material adverse effect upon our business and financial position. We have not purchased insurance for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste products from our exploration activities).

| 4 |

However, if we mine one or more of our properties and retain operational responsibility for mining, then such insurance may not be available to us on reasonable terms or at a reasonable price. All of our exploration and, if warranted, development activities may be subject to regulation under one or more local, state and federal environmental impact analyses and public review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right to operate under all material operating permits, increases in bonding requirements could prevent operations even if we are in full compliance with all substantive environmental laws.

We may be denied the government licenses and permits which we need to explore on our properties. In the event that we discover commercially exploitable deposits, we may be denied the additional government licenses and permits which we will need to mine our properties.

Exploration activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented mineral claims requires a permit to be obtained from the United States Bureau of Land Management, which may take several months or longer to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. As with all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits. The needed permits may not be granted at all. Delays in or our inability to obtain necessary permits will result in unanticipated costs, which may result in serious adverse effects upon our business.

The values of our properties are subject to volatility in the price of gold and any other deposits we may seek or locate.

Our ability to obtain additional and continuing funding, and our profitability in the unlikely event we ever commence mining operations or sell our rights to mine, will be significantly affected by changes in the market price of gold. Gold prices fluctuate widely and are affected by numerous factors, all of which are beyond our control. Some of these factors include the sale or purchase of gold by central banks and financial institutions; interest rates; currency exchange rates; inflation or deflation; fluctuation in the value of the United States dollar and other currencies; speculation; global and regional supply and demand, including investment, industrial and jewelry demand; and the political and economic conditions of major gold or other mineral producing countries throughout the world, such as Russia and South Africa. The price of gold or other minerals have fluctuated widely in recent years, and a decline in the price of gold could cause a significant decrease in the value of our properties, limit our ability to raise money, and render continued exploration and development of our properties impracticable. If that happens, then we could lose our rights to our properties and be compelled to sell some or all of these rights. Additionally, the future development of our properties beyond the exploration stage is heavily dependent upon the level of gold prices remaining sufficiently high to make the development of our properties economically viable. You may lose your investment if the price of gold decreases. The greater the decrease in the price of gold, the more likely it is that you will lose money.

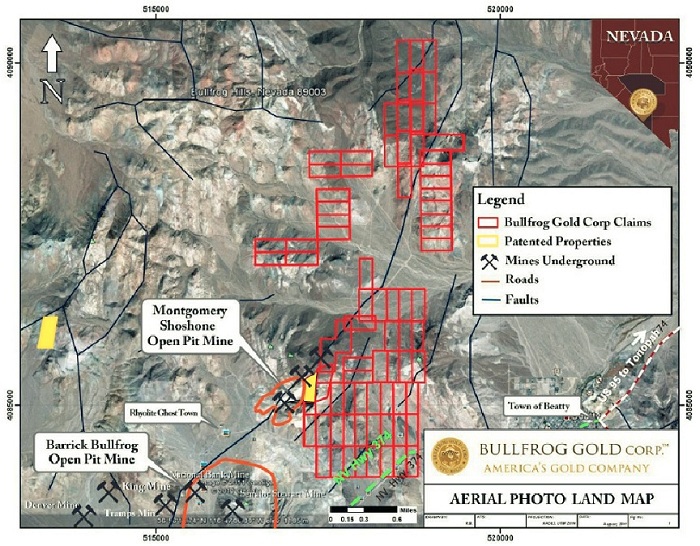

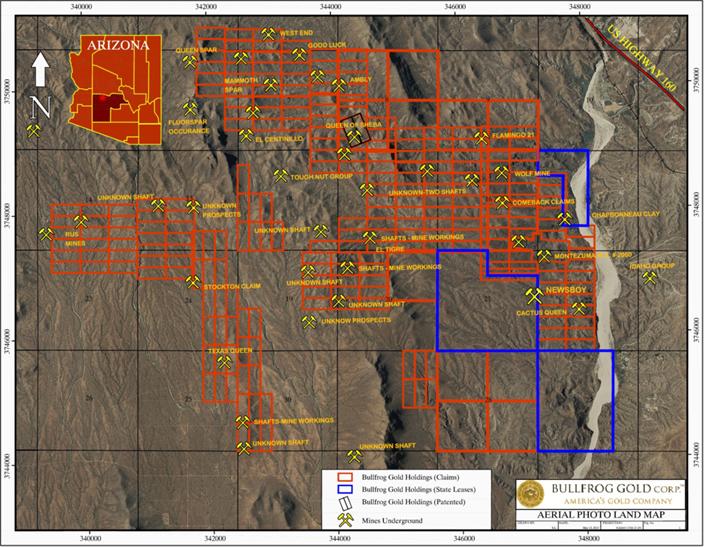

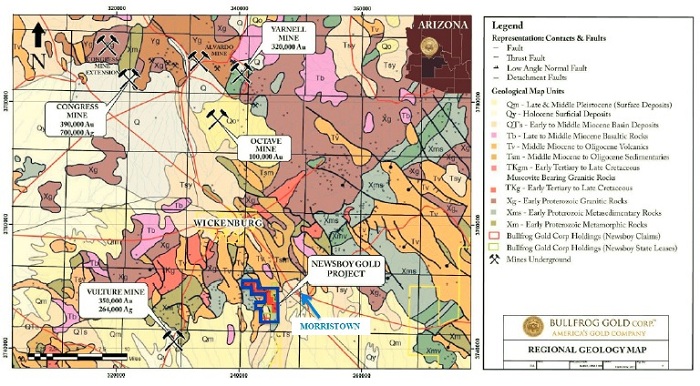

Our property titles may be challenged. We are not insured against any challenges, impairments or defects to our mineral claims or property titles. We have not fully verified title to our properties.

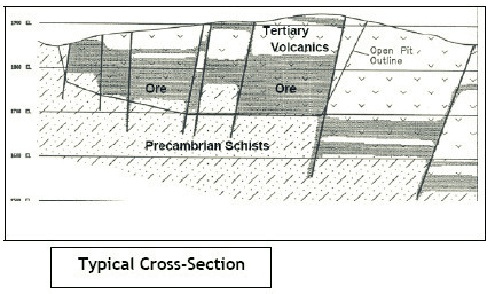

Our properties in Arizona and Nevada are comprised of two patented parcels, three State exploration permits, twelve unpatented placer claims, and four hundred and one unpatented lode claims. These unpatented claims were created and maintained in accordance with the federal General Mining Law of 1872. Unpatented claims are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests because the validity of unpatented claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations under the General Mining Law. Although the annual payments and filings for these claims, permits and patents have been maintained, we have conducted limited title search on our

| 5 |

Newsboy and Bullfrog project properties. The uncertainty resulting from not having comprehensive title searches on the properties leaves us exposed to potential title suits. Defending any challenges to our property titles may be costly, and may divert funds that could otherwise be used for exploration activities and other purposes. In addition, unpatented claims are always subject to possible challenges by third parties or contests by the federal government, which, if successful, may prevent us from exploiting our discovery of commercially extractable gold. Challenges to our title may increase our costs of operation or limit our ability to explore on certain portions of our properties. We are not insured against challenges, impairments or defects to our property titles, nor do we intend to carry extensive title insurance in the future. Potential conflicts to our mineral claims are discussed in detail elsewhere herein.

Possible amendments to the General Mining Law could make it more difficult or impossible for us to execute our business plan.

The U.S. Congress has considered proposals to amend the General Mining Law of 1872 that would have, among other things, permanently banned the sale of public land for mining. The proposed amendment would have expanded the environmental regulations to which we are subject and would have given Indian tribes the ability to hinder or prohibit mining operations near tribal lands. The proposed amendment would also have imposed a royalty of 8% of gross revenue on new mining operations located on federal public land, which would have applied to substantial portions of our properties. The proposed amendment would have made it more expensive or perhaps too expensive to recover any otherwise commercially exploitable gold deposits which we may find on our properties. While at this time the proposed amendment is no longer pending, this or similar changes to the law in the future could have a significant impact on our business model.

Market forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other resources.

Gold exploration, and resource exploration in general, has demands for contractors and unforeseen shortages of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled times for our exploration program. Fuel prices are extremely volatile as well. We will attempt to locate suitable equipment, materials, manpower and fuel if sufficient funds are available. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect our exploration activities and financial condition.

We may not be able to maintain the infrastructure necessary to conduct exploration activities.

Our exploration activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial condition.

Our exploration activities may be adversely affected by the local climates, which could prevent or impair us from exploring our properties year round.

The local climates in Arizona and Nevada may impair or prevent us from conducting exploration activities on our properties year round. Because of their rural locations and current limited infrastructure on site, our properties are generally impassible for several days per year as a result of infrequent but significant rain or snow events. The main access coming from the east to the Newsboy project in Arizona requires crossing a normally dry river bed. However, this access route may be impaired for approximately six days per year, mainly during the monsoon rain season from July through early September. Notwithstanding, the property may be accessed through another, longer route coming from the west. The elevation of the Newsboy project is less than 2,000 feet above mean sea level (amsl). The Bullfrog property has occasional snow that can impair exploration activities for a few days per year but would not likely interfere with possible production operations. The elevation of the Bullfrog project ranges from 3,600 to 4,300 feet amsl. The Klondike property ranges in elevation from 6,400 to 7000 feet amsl. Limited snowfall from November through February may impair exploration activities for a few days per year, but is not expected to significantly impact possible production operations. Earthquakes, heavy rains, snowstorms,

| 6 |

and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our properties, or may otherwise prevent us from conducting exploration activities on our properties.

We do not carry any property or casualty insurance, however we intend to carry such insurance in the future.

Our business is subject to a number of risks and hazards generally, including but not limited to adverse environmental conditions, industrial accidents, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to our properties, equipment, infrastructure, personal injury or death, environmental damage, delays, monetary losses and possible legal liability. You could lose all or part of your investment if any such catastrophic event occurs. We do not carry any property or casualty insurance at this time, however we intend to carry this type of insurance in the future (we carry all insurances that we are required to by law, such as motor vehicle and workers compensation plus other coverage that may be in the best interest of the Company). Even if we do obtain insurance, it may not cover all of the risks associated with our operations. Insurance against risks such as environmental pollution or other hazards as a result of exploration and operations are often not available to us or to other companies in our business on acceptable terms. Should any events against which we are not insured actually occur, we may become subject to substantial losses, costs and liabilities which will adversely affect our financial condition.

Risks Relating to our Organization and our Common Stock

Exercise of options and warrants and/or conversion of preferred stock will dilute your percentage of ownership.

We have authorized for issuance options to purchase 4,060,000 shares of our common stock and may issue options to purchase up to an aggregate of 4,500,000 shares of common stock under our 2011 Equity Incentive Plan. We also have warrants to purchase 21,152,285 shares of our common stock outstanding (which includes the 7,000,000 warrants that we issued to RMB) and 687,500 shares of Series A Preferred Stock and 400,000 shares of Series B Preferred Stock outstanding both of which are convertible into shares of common stock on a one for one basis . In the future, we may grant additional stock options, warrants and convertible securities. The exercise or conversion of stock options, warrants or convertible securities will dilute the percentage ownership of our other stockholders. The dilutive effect of the exercise or conversion of these securities may adversely affect our ability to obtain additional capital. The holders of these securities may be expected to exercise or convert them when we would be able to obtain additional equity capital on terms more favorable than these securities.

Difficulties we may encounter managing our growth could adversely affect our results of operations.

As our business needs expand, we may need to hire a significant number of employees. This expansion may place a significant strain on our managerial and financial resources. To manage the potential growth of our operations and personnel, we will be required to:

| · | improve existing, and implement new, operational, financial and management controls, reporting systems and procedures; | |

| · | install enhanced management information systems; and | |

| · | train, motivate and manage our employees. |

We may not be able to install adequate management information and control systems in an efficient and timely manner, and our current or planned personnel, systems, procedures and controls may not be adequate to support our future operations. If we are unable to manage growth effectively, our business would be seriously harmed.

If we lose key personnel or are unable to attract and retain additional qualified personnel we may not be able to successfully manage our business and achieve our objectives.

We believe our future success will depend upon our ability to retain our key management, including Mr. Beling, our Chief Executive Officer, President, Chief Financial Officer, Treasurer, Secretary and director, and Mr.

| 7 |

Lindsay, the Chairman of our Board of Directors. We may not be successful in attracting, assimilating and retaining our employees in the future.

As a result of the reverse merger on September 30, 2011, Standard Gold became a subsidiary of ours and since we are subject to the reporting requirements of federal securities laws, this can be expensive and may divert resources from other projects, thus impairing its ability to grow.

As a result of the reverse merger consummated on September 30, 2011, Standard Gold became a subsidiary of ours and, accordingly, is subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission (including reporting of the reverse merger) and furnishing audited reports to stockholders will cause our expenses to be higher than they would have been if Standard Gold had remained privately held and did not consummate the merger.

The Sarbanes-Oxley Act and new rules subsequently implemented by the Securities and Exchange Commission have required changes in corporate governance practices of public companies. As a public company, these new rules and regulations have increased our compliance costs in 2012 and we expect such increased costs to continue beyond 2012 and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

Our stock price may be volatile.

The stock market in general has experienced volatility that often has been unrelated to the operating performance of any specific public company. The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| · | changes in our industry; | |

| · | competitive pricing pressures; | |

| · | our ability to obtain working capital financing; | |

| · | additions or departures of key personnel; | |

| · | limited “public float” in the hands of a small number of persons who sales or lack of sales could result in positive or negative pricing pressure on the market prices of our common stock; | |

| · | sales of our common stock; | |

| · | our ability to execute our business plan; | |

| · | operating results that fall below expectations; | |

| · | loss of any strategic relationship; | |

| · | regulatory developments; | |

| · | economic and other external factors; and | |

| · | period-to-period fluctuations in our financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We have never paid nor do we expect in the near future to pay dividends.

We have never paid cash dividends on our capital stock and do not anticipate paying any cash dividends on our common stock for the foreseeable future. Investors should not rely on an investment in our Company if they require income generated from dividends paid on our capital stock. Any income derived from our common stock would only come from rise in the market price of our common stock, which is uncertain and unpredictable.

| 8 |

There is currently no liquid trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

To date there has been no liquid trading market for our common stock. We cannot predict how liquid the market for our common stock might become. Since August 11, 2011, our common stock has been quoted for trading on the OTC Bulletin Board under the symbol BFGC.OB, and, as soon as is practicable, we intend to apply for listing of our common stock on either the NYSE Amex, The Nasdaq Capital Market or other national securities exchange, assuming that we can satisfy the initial listing standards for such exchange. We currently do not satisfy the initial listing standards, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remain listed on the OTC Bulletin Board or suspended from the OTC Bulletin Board, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility. Furthermore, for companies whose securities are traded in the OTC Bulletin Board, it is more difficult (1) to obtain accurate quotations, (2) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (3) to obtain needed capital.

Our common stock is subject to the “Penny Stock” rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Our common stock is considered a “Penny Stock”. The Securities and Exchange Commission (the “SEC”) has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock. The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock. In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit investors’ ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 9 |

Our common stock may be affected by limited trading volume and price fluctuation which could adversely impact the value of our common stock.

There has been limited trading in our common stock and there can be no assurance that an active trading market in our common stock will either develop or be maintained. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially. These fluctuations may also cause short sellers to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market upon the expiration of any statutory holding period, under Rule 144, or issued upon the exercise of outstanding options or warrants or upon the conversion of our Series A or Series B Preferred Stock, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity related securities in the future at a time and price that we deem reasonable or appropriate.

We use paid-for media coverage as part of our investor relations activities.

The Company has entered into third party agreements for activities that we refer to as investor awareness activities. These activities are intended to familiarize targeted audiences with our business. These activities may result in attracting interest in our business from writers, bloggers, analysts, newsletters and others. We are not responsible and we may not be aware of the content or timing of materials produced by such persons. We may seek to suspend these activities from time to time when we are engaged in capital raising transactions. Because third parties may continue to disseminate information about us we may be unable to persuade third parties to discontinue these activities.

Our investor relations activities may include paid-for media coverage, personal video and telephone conferences and non-deal road shows in which our executives meet with prospective investors to discuss the Company’s business plans and methods and our management delivers a presentation about our business that is publicly available on our website. In addition, to our investor relations activities, we also, in the ordinary course of our business, will attend trade shows and speak at industry conferences and may meet with investors and prospective investors. We do not consider these activities to be part of our investor relations activities or solicitations for the sale or offer of any of our securities.

The Company will sometimes provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns that are produced for us by third parties. The Company seeks to direct the third parties to publicly-available information concerning the Company. The Company does not intend to review or approve the content of such reports or materials produced based upon their own industry, market or company research or methods. Investor relations firms should generally disclose when they are compensated for their efforts, including the amount and nature of such compensation, but whether such disclosure is made or complete or in compliance with SEC laws, rules or regulations, is not under our control nor is the content of such news stories. In addition, investors in the Company may, from time to time, also take steps to encourage investor awareness through similar activities that may be undertaken at the expense of the investors. Investor relations activities may also be suspended or discontinued which may impact the trading market of our common stock. Since we do not control the content and opinions expressed by third parties in connection with our paid-for media coverage, some of the information written or expressed by such third parties about our Company may contain inaccurate information about our Company.

| 10 |

Involvement in media interviews could result in violations of the Securities Act of 1933, and in such case we could become obligated to repurchase securities sold in prior offerings and we could become subject to penalties,

enforcement actions or fines with respect to any violations of securities laws. You should rely only this prospectus in determining whether to invest in our common stock.

Management interviews which may result as part of our paid-for media coverage, links to certain of those articles and interviews in our website and otherwise, may be seen by investors or potential investors in our securities. To the extent these are deemed an offer, we could incur liability or become involved in litigation. Although we have not authorized statements, we may give the impression that we endorsed the statements made by third parties in those articles. We do not endorse any of those third party statements and expressly disavow any obligation to ensure the accuracy of statements made by third parties in such articles. Those and statements made by third parties did not disclose many of the related risks and uncertainties described in this prospectus. The articles should not be considered in isolation, and you should make your investment decision in investing in our common stock only after reading this entire prospectus carefully and without regard to such statements.

There may exist circumstances in which our IR Activities may constitute offers as defined in Section 2(a)(3) of the Securities Act of 1933. While we do not agree with this position, if the staff of the SEC or investors claimed this as being correct then we may be in violation of Section 5 of the Securities Act and, consequently, certain may have rescission rights as to securities acquired and we could be required to repurchase shares sold to the investors in the most recent private placements at the original purchase price, possibly for a period of one year or longer following the date of violation. Additionally, we could be subject to other penalties, enforcement actions or fines with respect to any violations of securities laws. We would expect to contest vigorously any claim that any such violation occurred. We are not aware and do not believe we are in violation of such Section 5.

| 11 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

You should review carefully the section entitled “Risk Factors” beginning on page 3 of this prospectus for a discussion of these and other risks that relate to our business and investing in shares of our common stock.

USE OF PROCEEDS

The selling stockholders will receive all of the proceeds from the sale of the shares offered by them under this prospectus. We will not receive any proceeds from the sale of the shares by the selling stockholders covered by this prospectus.

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market Information

Our common stock has been publicly traded since October 17, 2011 on the OTC Bulletin Board. Our common stock is quoted under the symbol “BFGC.OB.” Prior to that, our common stock was quoted under the symbol “KOPR.OB” and had no trading activity. The following table sets forth for the periods indicated the range of high and low bid quotations per share as reported by the OTC Bulletin Board. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

| Year 2011 | High | Low |

| Period from October 17, 2011 to December 31, 2011 | $0.95 | $0.60 |

| Year 2012 | High | Low |

| First Quarter | $0.86 | $0.50 |

| Second Quarter | $0.75 | $0.40 |

| Third Quarter | $0.85 | $0.16 |

| Fourth Quarter | $0.50 | $0.16 |

| Year 2013 | High | Low |

| First Quarter | $0.51 | $0.27 |

| Second Quarter | $0.30 | $0.14 |

| July 1, 2013 to September 5 , 2013 | $0.30 | $0.18 |

Holders

On September 5, 2013:

| · | The closing price of our common stock as reported on the Over-the-Counter Bulletin Board was $0.30 per share. |

| · | We had approximately 465 holders of record of common stock. |

| 12 |

| · | 44,263,545 shares of our common stock were issued and outstanding and 1,087,500 shares of preferred stock were issued and outstanding. |

| · | We had outstanding warrants to purchase 21,352,285 shares of common stock (which includes the 7,000,000 warrants that were issued to RMB) and outstanding options to purchase 4,060,000 shares of common stock. |

Dividend Policy

We have not paid any cash dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. We intend to retain any earnings to finance the growth of the business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the future will depend on the financial condition, results of operations and other factors that the Board of Directors will consider.

Securities Authorized for Issuance under Equity Compensation Plans

On September 30, 2011, our board adopted the 2011 Equity Incentive Plan. The 2011 Equity Incentive Plan reserves 4,500,000 shares of common stock for grant to directors, officers, consultants, advisors or employees of the Company. On September 30, 2011, we authorized for issuance under the 2011 Equity Incentive Plan options to purchase an aggregate of 4,060,000 shares of our common stock at an exercise price of $0.40 per share, of which options to purchase 1,250,000 shares were issued to Mr. Beling, our Chief Executive Officer, President, Chief Financial Officer, Treasurer, Secretary and a director, options to purchase 1,200,000 shares were issued to Mr. Lindsay, the Chairman of our board of directors, and options to purchase 1,610,000 shares were issued to certain consultants and employees of the Company.

Equity Compensation Plan Information:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||

| (a) | (b) | (c) | ||||

| Equity compensation plans approved by security holders | 4,060,000 | $0.40 | 440,000 | |||

| Equity compensation plans not approved by security holders | 0 | 0 | 0 | |||

| Total | 4,060,000 | $0.40 | 440,000 |

| 13 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

Overview

During the first half of 2012 the Company focused on drilling and testing the Newsboy Project. We also acquired the option to purchase the Klondike Project in Nevada. The Newsboy Project completed two phases of drilling and testing in 2012 and we completed phase 3 drilling and testing at the Newsboy Project in March 2013. The continued operations of the Company are based on our ability to raise additional financing in order to fund our programs.

Results of Operations

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011

| Year | Year | |||||||

| Ended | Ended | |||||||

| 12/31/12 | 12/31/11 | |||||||

| Revenue | $ | - | $ | - | ||||

| Operating Expenses | ||||||||

| General and Administrative | 1,598,502 | 608,750 | ||||||

| Exploration Costs | 967,323 | 127,336 | ||||||

| Marketing | 1,271,551 | 374,853 | ||||||

| Total Operating Expenses | 3,828,376 | 1,110,939 | ||||||

| Net Operating Loss | (3,828,376 | ) | (1,110,939 | ) | ||||

| Gain on Forgiveness of Debt | 0 | 28,499 | ||||||

| Interest Expense | (39,771 | ) | (18,941 | ) | ||||

| Revaluation of Warrant Liability | 2,498,597 | (1,126,696 | ) | |||||

| Net Loss | $ | (1,369,550 | ) | $ | (2,228,077 | ) | ||

We are still in the exploration stage and have no revenues to date.

During the year ended December 31, 2012 we had a net loss of $1,369,550 compared to a net loss of $2,228,077 for the year ended December 31, 2011. The decrease of $858,527 is due primarily to:

| 1. | General and Administrative variances due to the following: |

| a. | The mining claim filing fees increased from approximately $36,000 in 2011 to approximately $111,000 in 2012. This increase in mining claim filing fees is due to the addition of the Klondike Project in June 2012, which increased the mining claim filing fees in 2012 by approximately $71,000. |

| b. | Professional fees (legal, accounting and other) of approximately $385,000 in 2012 increased by approximately $143,000 compared to 2011. This increase in professional fees was mainly due to the filing of the registration statement on the Form S-1 in September and the subsequent amendments to the registration statement that were filed in November and December. Additionally, the 2012 Private Placement in November and December and the RMB debt facility in that closed in December required legal services along with the filing of current reports on Form 8K. |

| c. | The employment of two individuals for the full 12 months in 2012 versus approximately five months in 2011. This increased that payroll expenses by $244,000 in 2012. There was also a non-cash year-end stock bonus that was awarded in December 2012 of $185,000. |

| 14 |

| d. | Stock-based compensation of approximately $348,000 in 2012 versus $156,000 in 2011 is a result of issuances pursuant to the 2011 Equity Incentive Plan. See Note 2 in the Notes to the Consolidated Financial Statements for additional discussion and valuation of common stock options |

| 2. | Exploration costs increased from approximately $127,000 in 2011 to approximately $967,000 in 2012. This increase of approximately of $840,000 is due to the phase 1 drilling program at the Newsboy Project was started at the end of the year in 2011 with the majority of the cost being incurred in 2012. Additionally, there was a phase 2 drilling program that was started and completed in 2012. These 2 drilling programs also increased the cost of professional consulting services from approximately $61,000 in 2011 to approximately $198,000 in 2012. |

| 3. | Marketing expenses in 2012 of approximately $1,272,000 versus $375,000 resulted in an increase of approximately $897,000 due to the following: |

| a. | The Company engaged marketing and public relations companies to introduce Bullfrog to the mining industry as a new gold mining company that has projects in Arizona and Nevada. The expense in 2012 to these marketing companies was approximately $681,000 versus $71,000 in 2011. |

| b. | Also included is stock-based compensation for marketing consultants of approximately $529,000 in 2012 versus approximately $237,000 in 2011. See Note 2 in the Notes to the Consolidated Financial Statements for additional discussion and valuation of common stock options. |

| 4. | The forgiveness of all accrued interest by the note holders in 2011 in conjunction with the reverse merger which was recognized as a gain on forgiveness of debt of $28,499. |

| 5. | The Revaluation of Warrant Liability of a gain of approximately $2,500,000 in 2012 versus a loss of approximately $1,127,000 in 2011 resulting from warrants issued as part of the 2011 Private Placement and 2012 Private Placement. See Note 3 in the Notes to the Consolidated Financial Statements for additional discussion and valuation of the warrant liability. |

Six Months Ended June 30, 2013 Compared to Six Months Ended June 30, 2012

| Six months ended | ||||||||

| 6/30/13 | 6/30/12 | |||||||

| Revenue | $ | - | $ | - | ||||

| Operating Expenses | ||||||||

| General and Administrative | 651,937 | 540,112 | ||||||

| Exploration Costs | 463,235 | 860,512 | ||||||

| Marketing | 1,181,410 | 837,905 | ||||||

| Total Operating Expenses | 2,296,582 | 2,238,529 | ||||||

| Net Operating Loss | (2,296,582 | ) | (2,238,529 | ) | ||||

| Loss on Extinguishment of Debt | (6,845 | ) | - | |||||

| Interest Expense | (364,819 | ) | - | |||||

| Revaluation of Warrant Liability | 1,216,051 | 1,213,857 | ||||||

| Net Loss | $ | (1,452,195 | ) | $ | (1,024,672 | ) | ||

We are still in the exploration stage and have no revenues to date.

During the six months ended June 30, 2013 we had a net loss of $1,452,195 compared to a net loss of $1,024,672 for the six months ended June 30, 2012. The increase of $427,523 is due primarily to:

| 15 |

| 1. | The increase in general and administrative expenses to approximately $652,000 for the six month period ended June 30, 2013 versus $540,000 for the same period in 2012 is due to the increase in professional fees of approximately $100,000. This increase is due to the five amendments to a registration statement on Form S-1 that were filed with the SEC in 2013 pursuant to our obligations under certain registration rights agreements entered into in connection with certain private placements with investors, the related correspondence and the subsequent registration withdrawal on May 29, 2013. | |||

| 2. | Exploration costs for the six months ended June 30, 2013 were approximately $463,000 versus $861,000 for the same period in 2012, a decrease of approximately $398,000 due to the following: | |||

| a. | Each phase of drilling costs at the Newsboy project ranges from $325,000 to $350,000 for drilling and assaying. The Company had costs of approximately $43,000 for the six months ended June 30, 2013 due to phase 3 drilling that was largely completed by March 31, 2013. However, the costs incurred after March 31, 2013 was due to project consultants compiling the data received from phase 3. The costs of approximately $430,000 in the three months ended June 30, 2012 were due to costs related to the conclusion of phase 1 drilling and the start and completion of phase 2. | |||

| b. | In June 2012 the Company purchased a substantial historic data base from Moneta Porcupine Mines, who owned the property from 1993 through 1995. The Company paid approximately $100,000 for this data base. | |||

| 3. | Marketing expenses for the six months ended June 30, 2013 were approximately $1,181,000 versus $838,000 for the same period in 2012. On December 17, 2012, the Company entered into the Consulting Agreement with Antibes to provide management consulting, business advisory, shareholder information and public relations services to the Company. In connection with the Consulting Agreement, the Company paid Antibes $500,000 from the proceeds of a private placement that was completed on December 17, 2012. On January 31, 2013, the Company amended the Consulting Agreement with Antibes to reduce the aggregate cash compensation payable thereunder from $1 million to $900,000 and paid the remaining $400,000 from the proceeds of the February 2013 Private Placement. The Consulting Agreement is being amortized through July 2013. This resulted in approximately $752,000 in investor relations expense versus $485,000 for the same period in 2012. | |

| 4. | The increase in interest expense of approximately $365,000 is due to on December 10, 2012, the Company entered into the Facility with RMB, as the lender, in the amount of $4.2 million. In conjunction with the Facility with RMB, the Company paid financing fees of approximately $1,300,000 in cash and warrants in 2012. These fees were capitalized as deferred financing fees and will be amortized over the life of the Facility using the effective interest method. Amortization of deferred financing fees included in interest expense for the six months ended June 30, 2013 was approximately $327,000. See Note 4 in the Notes to the Consolidated Financial Statements for additional discussion and valuation of the RMB warrants and related note payable. |

Seasonality

The local climates in Arizona and Nevada may impair or prevent us from conducting exploration activities on our properties year round. Because of their rural locations and current limited infrastructure on site, our properties are generally impassible for several days per year as a result of infrequent but significant rain or snow events. The main access coming from the east to the Newsboy project in Arizona requires crossing a normally dry river bed. However, this access route may be impaired for approximately six days per year, mainly during the monsoon rain season from July through early September. Notwithstanding, the property may be accessed through another, longer route coming from the west. The elevation of the Newsboy project is less than 2,000 feet above mean sea level (amsl). The Bullfrog property has occasional snow that can impair exploration activities for a few days per year but would not likely interfere with possible production operations. The elevation of the Bullfrog project ranges from 3,600 to 4,300 feet amsl. The Klondike property ranges in elevation from 6,400 to 7000 feet amsl. Limited snowfall from November through February may impair exploration activities for a few days per year, but is not expected to significantly impact possible production operations. Earthquakes, heavy rains, snowstorms, and floods could result in serious damage to or the destruction of facilities, equipment or means of access to our properties, or may otherwise prevent us from conducting exploration activities on our properties.

| 16 |

Liquidity and Capital Resources

As a result of the 2011 Private Placement (the “2011 Private Placement”) of $3,650,900 (which includes the conversion of debt owed by the Company in the aggregate amount of $940,900 which was converted on a dollar for dollar basis into the 2011 Private Placement), we received net cash proceeds of $2,710,000. Losses from operations have been incurred since inception and there is an accumulated deficit of approximately $5,090,000 as of June 30, 2013. Continuation as a going concern is dependent upon raising additional funds and attaining profitable operations. As part of the 2012 Private Placement (the “2012 Private Placement”) the following was received (i) on November 19, 2012, we sold an aggregate of 4,300,000 units with gross proceeds to the Company of $1,075,000 to six accredited investors pursuant to a subscription agreement and (ii) on December 17, 2012, we sold an aggregate of 2,000,000 units with gross proceeds to the Company of $500,000 to three accredited investors pursuant to a subscription agreement.

In addition, on December 10, 2012, the Company entered into the Facility with RMB, as the lender, in the amount of $4.2 million. The loan proceeds from the Facility will be used to fund an agreed work program relating to the Newsboy gold project located in Arizona and for agreed general corporate purposes. Standard Gold and the Company’s wholly owned subsidiary is the borrower under the Facility and the Company is the guarantor of Standard Gold’s obligations under the Facility. Standard Gold paid an arrangement fee of 7% of the Facility upon receiving the first draw down advanced under the Facility. A total of $294,000 was paid of which $50,000 was paid May 2012 and the balance upon receipt of the first draw down on December 11, 2012, which with the first drawdown advance of approximately $745,000 constituted approximately all of the available credit under the Facility at the time of the draw down. The Company will be required to complete additional work as described herein in order to receive additional advances under the Facility. The Facility will be available until March 31, 2014 with the final repayment date due 24 months after the Closing Date. Standard Gold has the option to prepay without penalty any portion of the Facility at any time subject to 30 day notice, any broken period costs and minimum prepayment amounts of $500,000. The Facility bears interest at the rate of LIBOR plus 7% with interest payable quarterly in cash. In connection with the Facility, the Company issued 7,000,000 warrants to purchase shares of the Company’s common stock for $0.35 per share to be exercisable for 36 months after the Closing Date, with the proceeds from the exercise of the warrants to be used to repay the Facility. The Company met all of the conditions precedent to complete the closing for the Facility and is receiving funds from RMB as requested by the Company based on the agreed work program. The Company must deliver to RMB (i) financial reports no later than 90 days after the end of each financial year and 45 days after each quarter end, (ii) monthly reports no later than 21 days at the end of each month detailing the status of development of Newsboy, including actual to budget reconciliations, (iii) any proposed changes to the Corporate and Newsboy budget, and (iv) a Proceeds Account (as defined in the Facility Agreement) report no later than 21 days after the end of each quarter summarizing deposits and withdrawals, the Company has provided the required reports to RMB as of the date of this filing.

The Company is allowed to submit a draw down request once a month in accordance with the amounts set out in the agreed upon Corporate budget and Newsboy work program unless otherwise agreed upon between the Company and RMB. The draw down request cannot be for an amount greater than the agreed upon Corporate and Newsboy budgets, see Table 1 and Table 2 below. Once the draw down request is submitted, RMB has up to five business days to fund the request. As stated in the Facility, once the draw down request is presented to RMB they are obligated to provide the requested funds without discretion assuming no default has occurred and the draw down request complies with the requirements of the Facility. As of the date of this filing all draw down requests that have been presented by the Company to RMB have been properly funded. However, it the Company is in default or a material adverse effect has occurred which will prevent the Company from developing or operating the projects in accordance with the Corporate and Newsboy budgets then RMB has the option of not fulfilling the funding request. The Company is considered to be in default of the Facility if all or any material part of the Newsboy Project is abandoned. If there is an Event of Default (as defined in Section 11.1 of the Facility Agreement) RMB may also cancel the commitment. In addition, a material adverse effect is defined as a material adverse effect on: (i) any transaction party’s inability to perform any of its obligations under any transaction document; (ii) the rights of the finance parties under, or enforceability of, a transaction document, (iii) the value of the Secured property, or (iv) the assets, business or operations of any transaction party (including a project and the project assets relating to that project). Accordingly, RMB is able to exercise discretion in connection with any draw down requests under certain circumstances. The foregoing is not a complete summary of the terms of the Facility, and is qualified in its entirety by reference to the complete text of the Facility Agreement, the Security Agreements, the Pledge Agreement and the Form of Warrant attached as Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5, respectively, to the Current Report on Form 8-K that we filed with the SEC on December 12, 2012.

| 17 |

Table 1 is the agreed work program for the Newsboy Project for December 2012 through May 2014, with a comparison to actual expenses:

| TABLE 1 | ||||||||||||||||||||||

| NEWSBOY AGREED WORK PROGRAM | ||||||||||||||||||||||

| Dollars in thousands | ||||||||||||||||||||||

| 2012 | 2013 | 2014 | ||||||||||||||||||||

| Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | TOTAL | ||||

| BUDGET | ||||||||||||||||||||||

| Drill Holes | 8 | 14 | 14 | 10 | 13 | 10 | 69 | |||||||||||||||

| Office & Warehouse Rent | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 18 | |||

| Office Supplies | - | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | - | - | 15 | |||

| Professional Consulting | 13 | 13 | 8 | 8 | 18 | 18 | 23 | 23 | 24 | 24 | 23 | 24 | 24 | 23 | 24 | 24 | 9 | 9 | 332 | |||

| Technician Consulting | 4 | 4 | - | - | 4 | 4 | - | - | - | - | - | - | 4 | 4 | - | - | - | - | 24 | |||

| Consulting Expense | 1 | 1 | 1 | 1 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 1 | 1 | 30 | |||

| Land Fees | 27 | - | - | - | - | - | 7 | 21 | - | - | - | - | 7 | - | - | - | - | - | 62 | |||

| Insurance | - | - | - | - | - | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | - | - | 11 | |||

| Project Public Relations | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | - | - | 16 | |||

| Drilling & Coring | 105 | 189 | - | - | 189 | 147 | - | - | - | - | - | - | 189 | 147 | - | - | - | - | 966 | |||

| Assaying | - | 24 | 43 | - | - | 43 | 34 | - | - | - | - | - | - | 43 | 34 | - | - | - | 221 | |||

| Support Equipment Services | 10 | 10 | 8 | 8 | - | 8 | 8 | - | - | - | - | - | - | 8 | 8 | - | - | - | 68 | |||

| Geochem, Geophysics etc | - | 5 | 10 | 10 | 10 | - | - | - | - | - | - | - | - | - | - | - | - | - | 35 | |||

| Surveying | - | - | - | 5 | - | - | - | 5 | - | - | - | - | - | - | - | 5 | - | - | 15 | |||

| Field Supplies | 2 | 2 | - | - | - | 2 | 2 | - | - | - | - | - | - | - | - | - | - | - | 8 | |||

| Metallurgical Testing | - | - | - | - | - | - | - | - | 10 | 10 | - | - | - | - | - | - | - | - | 20 | |||

| Process Consulting Services | - | - | - | - | - | - | - | - | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | - | - | 40 | |||

| Process Consulting Expense | - | - | - | - | - | - | - | - | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | - | - | 16 | |||

| Environmental Permitting | - | - | - | - | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | - | - | 60 | |||

| Environmental Services | - | - | - | - | 5 | 5 | 10 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 | - | - | 155 | |||

| Environmental Expense | - | - | - | - | 1 | 1 | 3 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | - | - | 41 | |||

| Engineering & Resource Est. | - | - | - | 20 | 30 | 30 | 30 | 40 | 40 | 40 | 40 | 30 | 30 | 30 | 30 | 30 | - | - | 420 | |||

| Data Compilation | 5 | 5 | 5 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 15 | |||

| Land payments | 200 | - | - | - | - | - | 200 | - | - | - | - | - | 250 | - | - | - | - | - | 650 | |||

| Capital expenses | - | 10 | 10 | 10 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 16 | 16 | 16 | - | - | 132 | |||

| TOTAL | 369 | 266 | 88 | 65 | 273 | 275 | 334 | 125 | 117 | 117 | 106 | 97 | 547 | 308 | 149 | 112 | 11 | 11 | 3,370 | |||

| ACTUAL | ||||||||||||||||||||||

| Drill Holes | - | - | 21 | 5 | - | - | - | 26 | ||||||||||||||

| Office & Warehouse Rent | 1 | 1 | 1 | 1 | 2 | 1 | 1 | 7 | ||||||||||||||

| Office Supplies | - | - | - | - | - | - | - | - | ||||||||||||||

| Professional Consulting | 11 | 16 | 18 | 31 | 12 | 14 | 2 | 104 | ||||||||||||||

| Technician Consulting | 1 | 2 | 3 | 1 | 1 | 0 | 1 | 9 | ||||||||||||||

| Consulting Expense | 3 | 4 | 2 | 2 | 2 | 1 | - | 14 | ||||||||||||||

| Land Fees | 20 | - | 2 | 32 | - | 2 | - | 56 | ||||||||||||||

| Land Expansion | - | 8 | - | 18 | - | - | - | 26 | ||||||||||||||