Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Aramark | d574424dex232.htm |

| EX-21.1 - EX-21.1 - Aramark | d574424dex211.htm |

| EX-23.1 - EX-23.1 - Aramark | d574424dex231.htm |

| EX-10.67 - EX-10.67 - Aramark | d574424dex1067.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 9, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ARAMARK Holdings Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 5812 | 20-8236097 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

ARAMARK Tower

1101 Market Street

Philadelphia, Pennsylvania 19107

(215) 238-3000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Stephen R. Reynolds, Esq.

Executive Vice President, General Counsel and Secretary

ARAMARK Tower

1101 Market Street

Philadelphia, Pennsylvania 19107

(215) 238-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Joseph H. Kaufman, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017-3954 (212) 455-2000 |

Daniel J. Zubkoff, Esq. Douglas S. Horowitz, Esq. Timothy B. Howell, Esq. Cahill Gordon & Reindel LLP 80 Pine Street New York, New York 10005 (212) 701-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ | Accelerated filer | ¨ | |||||||||

| Non-accelerated filer |

x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.01 per share |

$100,000,000.00 | $13,640.00 | ||

|

| ||||

|

| ||||

| (1) | Includes shares to be sold upon exercise of the underwriters’ option. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated September 9, 2013

Shares

Common Stock

This is the initial public offering of shares of common stock of ARAMARK Holdings Corporation. We are selling of the shares to be sold in this offering. The selling stockholders named in this prospectus are selling an additional shares. We will not receive any proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of shares of our common stock is expected to be between $ and $ per share. We intend to apply for listing of shares of our common stock on the New York Stock Exchange under the symbol “ .”

After completion of this offering, certain stockholders will continue to beneficially own a majority of the voting power of all outstanding shares of our common stock. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal and Selling Stockholders.”

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to ARAMARK Holdings Corporation |

$ | $ | ||||||

| Proceeds, before expenses, to selling stockholders |

$ | $ | ||||||

We and the selling stockholders have granted the underwriters an option to purchase up to additional shares of common stock at the initial public offering price, less the underwriting discount.

Investing in shares of our common stock involves risks. See “Risk Factors” beginning on page 16.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2013.

| Goldman, Sachs & Co. | J.P. Morgan | Credit Suisse | Morgan Stanley |

| Barclays | BofA Merrill Lynch | RBC Capital Markets | Wells Fargo Securities | |||

| Baird | PNC Capital Markets LLC | Rabo Securities | Ramirez & Co., Inc. | |||

| Santander | SMBC Nikko | The Williams Capital Group, L.P. |

The date of this prospectus is , 2013

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | |||

| 69 | ||||

| 86 | ||||

| 134 | ||||

| 138 | ||||

| 140 | ||||

| 147 | ||||

| 155 | ||||

| Certain United States Federal Income and Estate Tax Considerations for Non-U.S. Holders |

158 | |||

| 161 | ||||

| 166 | ||||

| 166 | ||||

| 166 | ||||

| F-1 | ||||

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

You should rely only on the information contained in this prospectus or in any free writing prospectuses we have prepared. We have not authorized anyone to provide you with different information and we and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, the selling stockholders are not, and the underwriters are not, making an offer to sell or seeking offers to buy these securities in any state or jurisdiction where an offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

Table of Contents

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This prospectus contains “forward-looking statements” within the meaning of the federal securities laws, including, without limitation, statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy under “Prospectus Summary,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” You can identify forward-looking statements because they contain words such as “aim,” “anticipate,” “are confident,” “estimate,” “expect,” “will be,” “will continue,” “will likely result,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. All statements we make relating to our estimated and projected earnings, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations (“cautionary statements”) are disclosed under “Risk Factors” and elsewhere in this prospectus, including, without limitation, in conjunction with the forward-looking statements included in this prospectus. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe could affect our results include:

| • | unfavorable economic conditions; |

| • | natural disasters, global calamities, sports strikes and other adverse incidents; |

| • | the failure to retain current clients, renew existing client contracts and obtain new client contracts; |

| • | a determination by clients to reduce their outsourcing or use of preferred vendors; |

| • | competition in our industries; |

| • | increased operating costs and obstacles to cost recovery due to the pricing and cancellation terms of our food and support services contracts; |

| • | the inability to achieve cost savings through our cost reduction efforts; |

| • | our expansion strategy; |

| • | the failure to maintain food safety throughout our supply chain, food-borne illness concerns and claims of illness or injury; |

| • | governmental regulations including those relating to food and beverages, the environment, wage and hour and government contracting; |

| • | liability associated with noncompliance with applicable law or other governmental regulations; |

| • | changes in, new interpretations of or changes in the enforcement of the government regulatory framework; |

| • | currency risks and other risks associated with international operations, including Foreign Corrupt Practices Act, U.K. Bribery Act and other anti-corruption law compliance; |

| • | continued or further unionization of our workforce; |

| • | liability resulting from our participation in multiemployer defined benefit pension plans; |

| • | risks associated with suppliers from whom our products are sourced; |

| • | disruptions to our relationship with, or to the business of, our primary distributor; |

i

Table of Contents

| • | the inability to hire and retain sufficient qualified personnel or increases in labor costs; |

| • | healthcare reform legislation; |

| • | the contract intensive nature of our business, which may lead to client disputes; |

| • | seasonality; |

| • | our leverage; |

| • | the inability to generate sufficient cash to service all of our indebtedness; |

| • | debt agreements that limit our flexibility in operating our business; |

| • | potential conflicts of interest between our Controlling Owners (as defined herein) and us; and |

| • | other factors set forth under the heading “Risk Factors” in this prospectus. |

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this prospectus may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Unless otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “our,” “us,” “ARAMARK” and “the Company” and similar terms refer to ARAMARK Holdings Corporation and its subsidiaries and references to “Holdings” refer to ARAMARK Holdings Corporation and not any of its subsidiaries.

Our fiscal year ends on the Friday nearest September 30 in each year. In this prospectus, when we refer to our fiscal years, we say “fiscal” and the year number, as in “fiscal 2012,” which refers to our fiscal year ended September 28, 2012. In addition, “client” refers to those businesses and other organizations which engage us to provide services. “Consumers” refers to those consumers of our services, such as employees, students and patrons, to whom our clients provide us access.

We present Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA, as defined under “Prospectus Summary—Summary Consolidated Financial Data,” as non-U.S. Generally Accepted Accounting Principles, or non-GAAP, financial measures in various places throughout this prospectus. Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA are supplemental measures used by management to measure operating performance. Our presentation of Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of our results as reported under generally accepted accounting principles in the United States (“U.S. GAAP”). We use Adjusted Net Income as a supplemental measure of our overall profitability because it excludes the impact of the non-cash amortization of certain intangible assets and depreciation of property and equipment that were created at the time of our 2007 going-private transaction (the “2007 Transaction”), non-cash share-based compensation expense and other costs that are not indicative of our ongoing operational performance. Similarly, we use Adjusted Operating Income and Adjusted EBITDA as supplemental measures of our operating profitability and to evaluate and control our cash operating costs because they exclude the impact of the items noted above relating to the calculation of Adjusted Net Income that are not indicative of our ongoing operational performance. We believe the presentation of Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA is appropriate to provide additional information to investors about our operating performance.

We also present Covenant EBITDA and Covenant Adjusted EBITDA as non-GAAP financial measures of ARAMARK Corporation and its restricted subsidiaries under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” Our presentation of Covenant

ii

Table of Contents

EBITDA and Covenant Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. In addition, Covenant EBITDA and Covenant Adjusted EBITDA are measures of ARAMARK Corporation and its restricted subsidiaries only and do not include the results of Holdings. We believe that the inclusion of Covenant EBITDA and Covenant Adjusted EBITDA in this prospectus is appropriate to provide additional information to investors about the calculation of certain financial measures in our senior secured credit facilities and the indenture governing our 5.75% Senior Notes due 2020, which we refer to as our senior notes. For instance, our senior secured credit facilities and the indenture governing our senior notes contain financial ratios that are calculated by reference to Covenant Adjusted EBITDA. Non-compliance with the financial ratio maintenance covenants contained in our senior secured credit facilities could result in the requirement to immediately repay all amounts outstanding under such facilities, while non-compliance with the debt incurrence ratio contained in our senior secured credit facilities and the indenture governing our senior notes would prohibit us from being able to incur additional indebtedness other than pursuant to specified exceptions.

Because Adjusted Net Income, Adjusted Operating Income, Adjusted EBITDA, Covenant EBITDA and Covenant Adjusted EBITDA are not measures determined in accordance with U.S. GAAP and are susceptible to varying calculations, we caution investors that these measures as presented may not be comparable to similarly titled measures of other companies. Under “Prospectus Summary—Summary Consolidated Financial Data” herein, we include a quantitative reconciliation of Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA to the most directly comparable U.S. GAAP financial performance measure, which is net income. Under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources,” we include a quantitative reconciliation of Covenant EBITDA and Covenant Adjusted EBITDA to the most directly comparable U.S. GAAP financial performance measure, which is net income attributable to ARAMARK Corporation stockholder.

MARKET AND INDUSTRY DATA

The data included in this prospectus regarding our industry and market opportunity, including the size of certain sectors and geographies, our position and the position of our competitors within these sectors and geographies and the portion of the market opportunity that is currently outsourced, are based on our management’s knowledge and experience in the sectors and geographies in which we operate. We believe these estimates to be accurate as of the date of this prospectus. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for the estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. While we believe internal company research is reliable, such research has not been verified by any independent source.

iii

Table of Contents

This summary does not contain all of the information that you should consider before making your investment decision. You should read the entire prospectus carefully, including the matters discussed under the caption “Risk Factors” and the detailed information and financial statements included in this prospectus.

Our Company

We are a leading global provider of food, facilities and uniform services to education, healthcare, business and industry and sports, leisure and corrections clients. Our core market is North America, which is supplemented by an additional 19-country footprint serving many of the fastest growing global geographies. We hold the #2 position in North America, a top 3 position in countries representing 98% of 2012 total sales, and are one of only 3 food and facilities competitors with the combination of scale, scope, and global reach. Through our established brand, broad geographic presence and approximately 267,000 employees, we anchor our business in our partnerships with thousands of education, healthcare, business, sports, leisure and corrections clients. Through these partnerships we serve millions of consumers including students, patients, employees, sports fans and guests worldwide. The scope and range of ARAMARK’s services are evidenced by the following:

| • | We provide services to 84% of the Fortune 500 |

| • | We serve over 500 million meals annually to approximately 5 million students at colleges, universities, and K-12 schools |

| • | We service over 2,000 healthcare facilities, collectively representing over 75 million patient days annually |

| • | We cater to approximately 100 million sports fans annually through our partnerships with over 150 professional and collegiate teams |

| • | We put over 2 million people in uniforms each day |

| • | We operate in 22 countries in North America, Europe, Asia and South America |

ARAMARK’s mission is to “Deliver experiences that enrich and nourish lives.” This mission is anchored in a set of core values that guide our execution in the marketplace:

| • | Sell and Serve with Passion. Placing clients and consumers at the center of all that we do by listening and responding to their needs with best-in-class quality, innovation and exceptional service |

| • | Set Goals. Act. Win. Maintaining a culture of accountability where performance matters and exhibiting leadership that achieves and exceeds expectations through industry-leading execution |

| • | Front-Line First. Providing our front-line employees with tools and training that empower them to deliver excellence at the “moment of truth”—at the time they are providing service to thousands of consumers and clients every day |

| • | Integrity and Respect Always. Doing the right things without exception is the cornerstone of the ARAMARK brand and helps us earn the trust of our key constituents |

ARAMARK is a well-recognized global brand, known for exceptional customer service and a compelling value proposition. We partner with clients on-site and integrate our employees within their operations, which enables us to obtain valuable consumer insights and innovate to satisfy each client’s unique needs and requirements. Our repeatable business model is founded on five core principles of excellence—selling, service, execution, marketing and operations—that allow us to deliver high quality service consistent with the values that the ARAMARK brand embodies. Our commitment to excellence has earned us numerous awards and recognitions; we have been named one of the “World’s Most Admired Companies” by Fortune Magazine every year since 1999 and we are recognized as one of the “World’s Most Ethical Companies” by the Ethisphere Institute.

1

Table of Contents

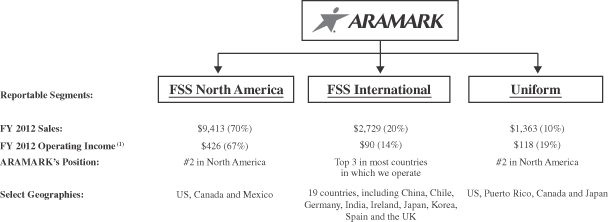

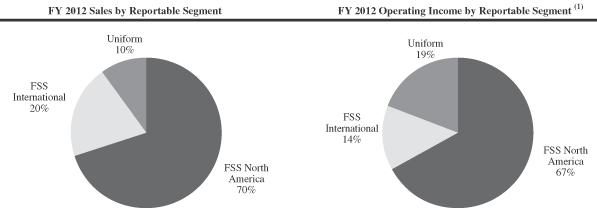

We operate our business in three reportable segments that share many of the same operating characteristics: Food and Support Services North America, or FSS North America, Food and Support Services International, or FSS International, and Uniform and Career Apparel, or Uniform. The following chart provides a brief overview of our reportable segments (dollars in millions):

| (1) | Fiscal 2012 operating income excludes $51.8 million of unallocated corporate expenses. |

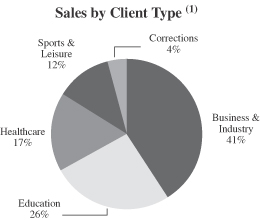

Within our reportable segments, our business is generally focused around key client types—Education, Healthcare, Business & Industry, Sports & Leisure and Corrections.

(1) Based on 2012 total sales.

Our broad range of services, diversified client base, global reach and repeatable business model position us well for continued growth and margin expansion opportunities. In fiscal 2012, we generated $13.5 billion of sales, and $1.1 billion of Adjusted EBITDA.

Our History and Recent Accomplishments

Since ARAMARK’s founding in 1959, we have broadened our service offerings and expanded our client base through a combination of organic growth and successful acquisitions, with the goal of further developing our food, facilities and uniform capabilities, as well as growing our international presence.

2

Table of Contents

On January 26, 2007, ARAMARK delisted from the NYSE in conjunction with a going-private transaction executed with investment funds affiliated with GS Capital Partners, CCMP Capital Advisors and J.P. Morgan Partners, Thomas H. Lee Partners and Warburg Pincus LLC as well as approximately 250 senior management personnel.

In May 2012, Eric Foss became the new CEO and President of our company. Previously, Mr. Foss was the CEO of Pepsi Beverages Company and was Chairman and CEO of the publicly-traded Pepsi Bottling Group. During his tenure with Pepsi Bottling Group, Mr. Foss implemented numerous growth and productivity initiatives designed to strengthen customer service and improve selling effectiveness, streamline operations, and rationalize supply chain infrastructure. Under Mr. Foss’ leadership at ARAMARK, we have sharpened our focus on achieving sustainable value creation through accelerating revenue and profit growth with expanding margins.

We continue to grow our existing business and win exciting new clients, including Airbus, the Ohio and Michigan departments of corrections, American University, the Minnesota Vikings, the Chicago Bears, and the Tampa Bay Buccaneers.

Our Market Opportunity

ARAMARK operates in large and highly fragmented markets with attractive industry dynamics. We believe that the global food and support services market and the North American uniform and career apparel market is approximately $900 billion. As only approximately 50% of this opportunity is outsourced, there is a substantial potential for growth by winning business with educational and healthcare institutions, businesses, sports and leisure facilities and correctional facilities that currently provide these services in-house. We expect that demand for increased outsourced services will continue to be driven by shifting client imperatives, including: the need to focus on core businesses, the desire to deliver a high level of consumer satisfaction, the pursuit of reduced costs and the attractiveness of consolidating services with a single provider. Our value-added provision of these services is increasingly important to our clients’ achievement of their own missions.

The food and support services market is highly fragmented, with the five largest competitors capturing only 9% of the global market. We expect larger service providers to continue to win a disproportionate amount of the business that is converted from self-operated services as clients are increasingly seeking services from partners with the scale and sophistication necessary to drive consumer satisfaction and increase operational efficiency.

Our core geographic market is North America, which we believe will remain a compelling opportunity due to the favorable underlying economic conditions, stability and opportunities for profitable growth, and growing trend towards outsourcing. We continue to focus on the Education and Healthcare sectors, which are only approximately 30% outsourced, and have increased as a percentage of GDP, representing significant growth opportunities. While cost reduction continues to be a key consideration, clients’ decisions are increasingly driven by the broader value proposition associated with outsourcing. Clients across sectors, from business to education to sports, recognize that providing higher quality, more efficient food and facilities services is critical to driving satisfaction of their key constituents: students and faculty, patients, employees and sports fans.

We also operate in select, high growth, emerging markets in Asia and South America. The GDP of the countries making up these markets grew at approximately 8.6% in 2012. The economic growth in these countries is driven by factors such as rising discretionary income and increased investment in growth sectors such as mining, education and healthcare. Additionally, we estimate emerging markets are approximately 70% self-operated, making them highly attractive opportunities for outsourcing expansion. Our operations in Europe are selectively centered around top 3 positions in Germany, the UK and Ireland and our exposure to southern Europe is limited to Spain, representing approximately 1% of our total sales.

3

Table of Contents

Our Strengths

We believe the following competitive strengths are key to our continued success:

Leader in a Large, Fragmented and Growing Market

We are a global market leader in the large, fragmented and growing food, facilities and uniform services industries. We hold the #2 position in North America and a top 3 position in countries representing 98% of 2012 total sales. We have developed these leadership positions primarily due to our commitment to helping build our clients’ success through leveraging our vast experience and sector knowledge while gaining deep consumer insight and providing a premier service offering to our clients. These leadership positions provide us with significant economies of scale, allow us to attract and retain top industry talent and position us to compete effectively for new business opportunities as clients are increasingly interested in service providers with a national or global reach, and a breadth of service offerings.

We estimate the combined addressable global food and support services market and the North American uniform and career apparel opportunity to be $900 billion collectively. We believe our market has the potential to grow in excess of GDP driven by the growing trend towards outsourcing. While the global food, facilities and uniform market is very large, it remains underpenetrated, with approximately 50% of the total opportunity currently outsourced. We expect to benefit disproportionately from the trend towards outsourcing as large service providers, such as ARAMARK, have had greater success in winning new client business relative to smaller outsourcing service providers. The global food and support services market’s highly fragmented nature, with the top three competitors accounting for only 7% of the market, enables additional opportunity for share gains and consolidation.

Favorable Geographic, Sector and Service Mix

We have the global reach and capability to deliver high quality services consistently and safely across 22 countries around the world, which represent approximately 65% of the world’s GDP. We believe that our strong and expanding presence in our core North American market will remain a principal growth driver. Also, utilizing the skills and experience we have developed over decades of service in the North American market, we have increasingly established our position in key, high growth, emerging markets in Asia and South America. Our sales in emerging markets have increased at an annual rate of approximately 14% over the last five years, and represent 7% of our sales in 2012 versus 4% in 2007. We believe that our expanding presence in these geographies will become increasingly important for our overall growth. We have a selective and stable position in Europe concentrated in Germany, the UK and Ireland with sales in southern Europe limited to Spain, which represents approximately 1% of our total sales. We believe our global footprint serves our clients in the most desirable geographies and provides a promising platform for further growth.

We serve a large and diversified client base across a wide range of sectors and businesses, including Education, Healthcare, Business & Industry and Sports, Leisure and Corrections, with no single client accounting for more than 1% of 2012 sales (other than collectively a number of U.S. government entities). The Education and Healthcare sectors, which together contributed 43% of our 2012 sales globally, are large, underpenetrated, and only approximately 30% outsourced, representing attractive growth opportunities for ARAMARK.

We believe that the breadth of our service capabilities and ability to innovate position ARAMARK well to meet evolving consumer needs and address our clients’ increasing desire to conduct business with an experienced single provider of multiple services. ARAMARK is a trusted partner across a variety of services, sectors and geographies, from offering safe living and working environments for miners in Latin America to patient transportation services for healthcare clients in China.

4

Table of Contents

Deep Client and Consumer Insight Leads to Attractive Growth Opportunities

ARAMARK’s leading positions, scale and breadth of product offering enable us to continue to grow our business through higher penetration into existing clients and cross-selling of additional services. We have long-lasting relationships with our clients due to our service excellence and our overall value proposition, which is evidenced by our approximately 95% annual retention rate and an average client relationship of approximately 10 years. We believe we are able to maintain these strong relationships year after year by providing value-added services which help our clients achieve their own mission and also improve satisfaction of their key constituencies: employees, students and faculty, patients and sports fans. This is increasingly important as, for example, businesses compete for employees, colleges compete for students and hospitals compete for patients. Given that only 9% of our current clients utilize both food and facilities services, we believe substantial opportunities remain for us to provide additional services to our existing client base. Further, we aim to increase the per capita spending of our target consumers and expand the participation rates of these populations in our existing service offering, through innovative marketing and merchandising programs.

We continuously innovate our existing services to better meet our clients’ evolving needs. We use ARAMARK’s consumer insights and other research to increase our awareness of market trends, client needs and consumer preferences. Annualized revenue from new clients contracted during 2012 was over $1.0 billion. Our recent wins span sectors and geographies, including Airbus, the Ohio and Michigan departments of corrections, American University, the Minnesota Vikings, the Chicago Bears and the Tampa Bay Buccaneers.

Improving Profitability with Resilient Cash Flow

We have and continue to implement a number of programs and tools to increase our profitability, including enhanced management of our key costs—food, labor and overhead—through SKU rationalization, portioning, waste control, enhanced labor scheduling, turn-over reduction and SG&A discipline, among others. Because of the leverage inherent in our business model, we believe the implementation of these measures will increase our profitability. Since instituting these new productivity initiatives in 2012, we have seen positive momentum in our performance. During the first nine months of fiscal 2013, we achieved year-over-year growth in our Adjusted Operating Income of 10% and sales growth of 3%.

We have a favorable business mix that allows us to deliver consistent profitability in most macroeconomic environments. We can react quickly to changing conditions in our day to day operations due to our highly variable cost structure. We generate strong and stable cash flow as a result of our consistent profitability and limited working capital and capital expenditure requirements. Our capital expenditures in the last 5 years have averaged only 2.4% of sales. In the economic downturn in 2009 for example, our cash flow actually increased as lower capital expenditures and a reduction in working capital more than offset a modest earnings decline. We believe that the low capital intensity of our business model positions us to continue to generate significant cash flow, which should give us the flexibility to reduce debt, pursue strategic acquisitions and return capital to our stockholders.

Strong Management Team with Diverse Experience

Our management team is a carefully constructed group of successful long-tenured leaders with significant industry and company experience blended with talented outside leaders with significant Fortune 500 management, consumer/retail and food industry experience. Our CEO and President, Eric Foss, is an experienced Fortune 500 public company CEO with a demonstrated multi-year track record of success and stockholder value creation. Since joining ARAMARK in 2012, he has further enhanced ARAMARK’s strong foundation with an integrated strategy focusing on growth, productivity, people and delivering on financial commitments. The average tenure of our principal operating leaders is 20 years, with individual tenure ranging from 33 years to less

5

Table of Contents

than one year. Our remaining senior management team and business unit presidents’ tenure averages 12 years. ARAMARK has a long history of broad management ownership dating back to the 1980s, and our management team collectively has a significant equity position in ARAMARK.

Our Strategies

Our core strategy is to provide the highest quality food, facilities and uniform services to our clients and consumers through a consistent, repeatable business model anchored around five core principles of excellence—selling, service, execution, marketing and operations. We will continue to build our core business in North America, and expand our emerging markets platform through the following growth and operational strategies:

Grow Our Base Business

• Drive Incremental Revenue from Existing Clients

We intend to increase penetration within our existing client base. We have implemented a framework that establishes high levels of excellence in service and execution across our food, facilities and uniform businesses. We leverage our extensive industry knowledge and decades of experience, which has allowed us to gain deep client and consumer insight in our efforts to provide the highest quality of service in the industry. We believe our ideas and innovations are a key differentiating factor for ARAMARK in winning new business at existing clients. Opportunities exist to increase penetration in each of our major service lines—food service, facilities service and uniform service. In each of our sectors we have identified the top items that drive demand and have established rigorous executional frameworks at the location level to maximize results. At our Major League Baseball venues where these programs have been introduced, per-capita expenditures by fans are 5.7% higher than last season.

Currently, 9% of our clients use both our food and facilities services. Having an on-site team successfully providing one service positions us well to expand the services we provide. An example of a recent success is American University, where we have been providing facilities services since 2001 and recently won the dining business from a competitor based on our strategic vision for the campus and the local management teams that have consistently delivered high quality services.

• Increase Client Retention Rates

ARAMARK has historically experienced high and consistent client retention rates. In 2012, our client retention rate was 95%. Our front-line focus and increased emphasis on providing world class service enables us to uphold excellence in all facets of our client-facing operations. Our service orientation is centered on creating a culture of excellence. We focus our consumer facing employees on adhering to stringent quality standards, which create an enhanced consumer experience. By delivering high quality, innovative and consistent service to our clients, we believe our attractive value proposition will drive client and consumer loyalty, enabling us to increase our retention rates and enhance profitability for our stockholders.

Grow New Business

• Expand New Business Through Selling Excellence

ARAMARK’s platform for achieving consistent selling excellence is centered on listening to and understanding our clients’ needs, creating innovative service offerings that meet those needs and selling our services with passion. Our market leadership and extensive industry experience position us to capitalize on the

6

Table of Contents

large, under-penetrated and growing food, facilities and uniform services markets. We believe that the current rate of penetration will accelerate as more businesses and organizations continue to see the benefits of outsourcing non-core activities.

We are particularly focused on the Education and Healthcare sectors due to their lower level of economic sensitivity and strong growth. Despite recent economic weakness, total spending on Education and Healthcare has increased as a percentage of total GDP. Additionally, we believe the addressable Education and Healthcare sectors represent opportunities of $87 billion and $31 billion, respectively, and are only approximately 30% outsourced to third party providers, which provides a significant opportunity for further growth.

• Increase Our Presence in Emerging Markets

The favorable growth characteristics and relatively low outsourcing rates in emerging market regions present a substantial opportunity for accelerated growth. Our emerging markets presence currently consists of 7 countries across Asia and South America. Our growth strategy in select emerging market geographies is focused on three initiatives: supporting existing clients as they expand into emerging markets, growing in geographies in which we already operate profitably, and entering new geographies where we have identified attractive prospects for profitable expansion. Over the last several years, our China business has experienced high double-digit organic growth and we are well positioned to utilize our deep industry and country knowledge to continue to expand in this key geography. Additionally, we have established a strong presence in South America and are focused on growing our presence in this region.

Given the scale and coordination required to successfully execute a multinational contract, we believe we are one of a very small group of global companies currently capable of competing for these highly attractive contracts within emerging markets.

• Pursue Strategic Acquisitions

We anticipate that continued consolidation in the global food, facilities and uniform services markets will create opportunities for us to acquire businesses with complementary geographic and service offering profiles. We intend to continue strengthening our existing business through selective, accretive acquisitions that will solidify our position, enhance and expand our service capabilities, further develop our differentiated positions, or allow us to enter into high growth geographies. We have a history of successful acquisitions, which we have successfully integrated into our existing operations while achieving targeted synergies with minimal client losses. For example, in fiscal 2012 we acquired Filterfresh, a leader in providing quality office refreshment services to employees in the workplace, and in fiscal 2011 we acquired Masterplan, a clinical technology management and medical equipment maintenance company, which expanded our capability to service all levels of hospital clinical technology and strengthened our position in a key sector within the North American market. Both acquisitions were integrated into larger, similar ARAMARK operations.

Accelerate Margin Expansion through Operational Excellence

Since the 2007 Transaction, we have delivered solid, consistent performance in Adjusted Operating Income as a percentage of sales, despite periods of instability in the global economy. During that time we have also implemented a disciplined process to achieve operational excellence and capture productivity for growth through a standard, repeatable business model. To achieve this, we are investing in the systems, tools and training utilized by our front-line employees, and establishing quality standards and processes to more efficiently manage our food, merchandise, labor, and above-unit costs. For example, we have implemented several productivity initiatives, including SKU rationalization, waste reduction, improved labor scheduling and menu standardization. Additionally, our scale and operating leverage allow us to effectively manage these costs, which together

7

Table of Contents

accounted for 77% of our operating costs in fiscal 2012. We are also incorporating automated, standardized and centralized processes that have resulted in the reduction of above-unit overhead costs through the elimination of redundancies in our finance and HR functions.

The successful implementation of these initiatives has led to increased profitability, a portion of which we are reinvesting in our business to achieve additional growth and margin expansion. This reinvestment is focused on two primary goals: improving the efficiency of standard tools and selling resources, and continuing to recruit, train and develop employees to maintain our culture of high performance. Through continued reinvestment in our business, we expect to both increase our ability to execute upon our core strategies and maintain our operational excellence.

Risks Relating to Our Business and This Offering

Participating in this offering involves substantial risk. Our ability to execute our strategies also is subject to certain risks. The risks described under the heading “Risk Factors” immediately following this summary may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategies. Some of the more significant challenges and risks include the following:

| • | unfavorable economic conditions, as well as natural disasters, global calamities, sports strikes and other adverse incidents, have, and in the future could, adversely affect our results of operations and financial condition; |

| • | our failure to retain our current clients, renew our existing client contracts and obtain new clients could adversely affect our business; |

| • | we may be adversely affected if clients reduce their outsourcing or use of preferred vendors; |

| • | competition in our industries could adversely affect our results of operations; |

| • | increased operating costs and obstacles to cost recovery due to the pricing and cancellation terms of our FSS contracts may constrain our ability to make a profit; |

| • | our inability to achieve cost savings through our cost reduction efforts could impact our results of operations; |

| • | a failure to maintain food safety throughout our supply chain and food-borne illness concerns may result in reputational harm and claims of illness or injury that could adversely affect us; |

| • | governmental regulations, including those relating to food and beverages, the environment, wage and hour, anti-corruption and our government contracts, may subject us to significant liability; |

| • | our business may suffer if we are unable to hire and retain sufficient qualified personnel or if labor costs increase; |

| • | our leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industries, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations; and |

| • | the other factors set forth under the “Risk Factors” in this prospectus. |

Before you participate in this offering, you should carefully consider all of the information in this prospectus, including those matters set forth under the heading “Risk Factors.”

8

Table of Contents

Company Information

ARAMARK Holdings Corporation is organized under the laws of the State of Delaware. Our business traces its history back to the 1930s.

Our executive offices are located at ARAMARK Tower, 1101 Market Street, Philadelphia, Pennsylvania 19107. Our website is www.aramark.com. Please note that our Internet website address is provided as an inactive textual reference only. Information on our website does not constitute part of this prospectus.

9

Table of Contents

The Offering

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Common stock to be outstanding after this offering |

shares ( shares if the underwriters exercise their option to purchase additional shares in full). |

| Option to purchase additional shares |

We and the selling stockholders have granted the underwriters an option to purchase up to additional shares. The underwriters could exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds we will receive from the sale of shares of our common stock we are offering, after deducting underwriters’ discounts and commissions and estimated expenses payable by us, will be approximately $ million (or $ million if the underwriters exercise their option to purchase additional shares in full). This estimate assumes an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. For a sensitivity analysis as to the initial public offering price and other information, see “Use of Proceeds.” |

| We intend to use the net proceeds received by us from this offering to repay certain of our existing indebtedness, including a portion of the outstanding term loans due July 26, 2016 under our senior secured credit facilities. See “Description of Certain Indebtedness.” |

| Dividend policy |

Following completion of this offering, we intend to commence the payment of cash dividends on our common stock, subject to our compliance with applicable law, and depending on, among other things, our results of operations, financial condition, level of indebtedness, capital requirements, contractual restrictions, business prospects and other factors that our board of directors may deem relevant. Our ability to pay dividends on our common stock is limited by the covenants of our senior secured credit facilities and the indenture governing our senior notes and may be further restricted by the terms of any future debt or preferred securities. See “Dividend Policy” and “Description of Certain Indebtedness.” |

| Controlled company |

After the completion of this offering, certain stockholders will continue to control a majority of the voting power of our outstanding common stock. As a result, we will be a “controlled company” within the meaning of the NYSE corporate governance standards. |

10

Table of Contents

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| New York Stock Exchange symbol |

We intend to apply for listing of shares of our common stock on the New York Stock Exchange under the symbol “ .” |

| Conflicts of interest |

Goldman, Sachs & Co. and J.P. Morgan Securities LLC and/or their respective affiliates each own in excess of 10% of our issued and outstanding common stock and it is expected that, by selling shares of common stock in this offering, they will collectively receive more than 5% of the net proceeds of the offering, not including underwriting compensation and as a result are deemed to have a “conflict of interest” with us within the meaning of Rule 5121 of the Financial Industry Regulatory Authority (“Rule 5121”). Therefore, this offering will be conducted in accordance with Rule 5121, which requires that Goldman, Sachs & Co. and J.P. Morgan Securities LLC will not make sales to discretionary accounts without the prior written consent of the account holder and that a qualified independent underwriter (“QIU”) as defined in Rule 5121 participate in the preparation of the registration statement of which this prospectus forms a part and perform its usual standard of due diligence with respect thereto and has agreed to act as QIU for this offering. |

| Certain of the underwriters or their affiliates are lenders or have committed to lend under our senior secured credit facility due July 26, 2016. As described under “Use of Proceeds”, the Company intends to repay outstanding amounts under such senior secured credit facility using a portion of the net proceeds of this offering received by the Company and will pay such amounts to the underwriters or their respective affiliates in proportion to their respective current commitments thereunder. |

The number of shares of our common stock to be outstanding following this offering is based on shares of common stock outstanding as of and excludes:

| • | shares issuable upon the exercise of options to purchase shares outstanding as of ; with an exercise price of $ per share; and restricted stock units, shares of restricted stock and director deferred stock units and |

| • | shares reserved for future issuance under our share-based compensation plans as of . |

Unless otherwise noted, the information in this prospectus reflects and assumes no exercise by the underwriters of their option to purchase additional shares.

11

Table of Contents

Summary Consolidated Financial Data

The following table sets forth summary consolidated financial data as of the dates and for the periods indicated. The summary consolidated financial data for the fiscal years 2012, 2011 and 2010 have been derived from our consolidated financial statements appearing elsewhere in this prospectus, which have been audited by KPMG LLP. The summary consolidated financial data as of October 1, 2010 has been derived from our consolidated financial statements that are not included in this prospectus, which have been audited by KPMG LLP.

The summary consolidated financial data as of June 28, 2013, and for the nine months ended June 28, 2013 and June 29, 2012, have been derived from our unaudited condensed consolidated financial statements appearing elsewhere in this prospectus. The summary consolidated financial data as of June 29, 2012 has been derived from our unaudited condensed consolidated financial statements that are not included in this prospectus. The unaudited financial data presented have been prepared on a basis consistent with our audited consolidated financial statements. In the opinion of management, such unaudited financial data reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The financial data set forth in this table should be read in conjunction with the section titled “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus, as well as with our consolidated financial statements and related notes and our unaudited condensed consolidated financial statements and related notes that are also included elsewhere in this prospectus.

| Fiscal year(1) | Nine months ended | |||||||||||||||||||

| 2012 | 2011 | 2010 | June 28, 2013 |

June 29, 2012 |

||||||||||||||||

| (dollars in millions, except per share data) | (unaudited) | (unaudited) | ||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||

| Sales |

$ | 13,505 | $ | 13,082 | $ | 12,419 | $ | 10,430 | $ | 10,104 | ||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Cost of services provided |

12,191 | 11,836 | 11,247 | 9,482 | 9,141 | |||||||||||||||

| Depreciation and amortization |

529 | 511 | 503 | 405 | 396 | |||||||||||||||

| Selling and general corporate expenses |

203 | 188 | 191 | 164 | 151 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

582 | 547 | 478 | 379 | 416 | |||||||||||||||

| Interest and other financing costs, net |

457 | 451 | 445 | 341 | 357 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from continuing operations before income taxes |

125 | 96 | 33 | 38 | 59 | |||||||||||||||

| Provision (benefit) for income taxes |

18 | (1 | ) | 1 | 7 | 12 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from continuing operations |

107 | 97 | 32 | 31 | 47 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from discontinued operations, net of tax(2) |

— | (12 | ) | (1 | ) | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

107 | 85 | 31 | 31 | 47 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Net income attributable to noncontrolling interests |

3 | 1 | — | 1 | 2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to ARAMARK stockholders |

$ | 104 | $ | 84 | $ | 31 | $ | 30 | $ | 45 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

12

Table of Contents

| Fiscal year(1) | Nine months ended | |||||||||||||||||||

| 2012 | 2011 | 2010 | June 28, 2013 |

June 29, 2012 |

||||||||||||||||

| (dollars in millions, except per share data) | (unaudited) | (unaudited) | ||||||||||||||||||

| Per Share Data: |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| Income from continuing operations |

$ | 0.51 | $ | 0.47 | $ | 0.16 | $ | 0.15 | $ | 0.22 | ||||||||||

| Loss from discontinued operations |

0.00 | (0.06 | ) | (0.01 | ) | — | 0.00 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to ARAMARK stockholders |

$ | 0.51 | $ | 0.41 | $ | 0.15 | $ | 0.15 | $ | 0.22 | ||||||||||

| Diluted: |

||||||||||||||||||||

| Income from continuing operations |

$ | 0.49 | $ | 0.46 | $ | 0.16 | $ | 0.15 | $ | 0.21 | ||||||||||

| Loss from discontinued operations |

0.00 | (0.06 | ) | (0.01 | ) | — | 0.00 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to ARAMARK stockholders |

$ | 0.49 | $ | 0.40 | $ | 0.15 | $ | 0.15 | $ | 0.21 | ||||||||||

| Cash dividend per share(3) |

$ | — | $ | 3.50 | $ | — | $ | — | $ | — | ||||||||||

| Statement of cash flows data: |

||||||||||||||||||||

| Net cash provided by/(used in): |

||||||||||||||||||||

| Operating activities(4) |

$ | 692 | $ | 304 | $ | 634 | $ | 136 | $ | 137 | ||||||||||

| Investing activities |

(482 | ) | (363 | ) | (354 | ) | (252 | ) | (363 | ) | ||||||||||

| Financing activities(4) |

(287 | ) | 112 | (344 | ) | 77 | 114 | |||||||||||||

| Other financial data: |

||||||||||||||||||||

| Adjusted Net Income(5) |

$ | 209 | $ | 200 | $ | 130 | $ | 162 | $ | 124 | ||||||||||

| Adjusted Operating Income(5) |

750 | 717 | 640 | 596 | 544 | |||||||||||||||

| Adjusted EBITDA(5) |

1,126 | 1,075 | 1,002 | 885 | 826 | |||||||||||||||

| Capital expenditures, net of disposals |

343 | 272 | 264 | 255 | 219 | |||||||||||||||

| Balance sheet data (at period end): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 137 | $ | 213 | $ | 161 | $ | 98 | $ | 101 | ||||||||||

| Noncash working capital(4)(6) |

(105 | ) | (101 | ) | (321 | ) | 242 | 239 | ||||||||||||

| Total assets(4) |

10,487 | 10,523 | 10,222 | 10,127 | 10,431 | |||||||||||||||

| Total debt (including current portion of long term debt)(4)(7) |

6,009 | 6,232 | 5,402 | 6,217 | 6,377 | |||||||||||||||

| Total equity(3) |

967 | 882 | 1,397 | 829 | 927 | |||||||||||||||

| (1) | Fiscal years 2012, 2011 and 2010 refer to the fiscal years ended September 28, 2012, September 30, 2011 and October 1, 2010, respectively. All periods presented are 52-week periods. |

| (2) | During fiscal 2011, the Company completed the sale of its wholly-owned subsidiary, Galls, for approximately $75.0 million in cash. The transaction resulted in a pretax loss of approximately $1.5 million (after-tax loss of approximately $12.0 million). Galls is accounted for as a discontinued operation. Galls’ results of operations have been removed from the Company’s results of continuing operations for all periods presented. |

| (3) | During fiscal 2011, the Company paid a dividend of approximately $711 million to its stockholders. On October 29, 2012, we completed the spin-off of our majority interest in Seamless North America, LLC, an online and mobile food ordering service, to our stockholders in the form of a dividend. Each stockholder received one share of the common stock of Seamless Holdings, a newly formed company created to hold our former interest in Seamless North America, LLC, for each share of our common stock held as of the record date. |

| (4) | In the first quarter of fiscal 2011, the Company adopted the new authoritative accounting guidance regarding transfers of financial assets. The impact upon adoption resulted in the recognition of both the receivables securitized under the program and the borrowings they collateralize on the Consolidated Balance Sheet, which led to a $220.9 million increase in “Receivables” and “Long-Term Borrowings.” As a result of implementing the new guidance, funding under the agreement of $220.9 million on October 2, 2010 was reflected in the Company’s Consolidated Statement of Cash Flows as a use of cash from the securitization of accounts receivables under net cash provided by/(used in) operating activities and as a source of cash under net cash provided by/(used in) financing activities. |

13

Table of Contents

| (5) | We use Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA as supplemental measures to evaluate our performance. Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA are not measurements of financial performance under generally accepted accounting principles in the United States, or U.S. GAAP. Adjusted Net Income represents net income adjusted to eliminate the impact from discontinued operations, net of tax; the increased amortization of acquisition-related customer relationship intangible assets and depreciation of property and equipment resulting from the 2007 Transaction; the impact of changes in the fair value of our gasoline and diesel fuel derivative instruments; severance and other charges; and share-based compensation, less the tax impact of these adjustments. Adjusted Operating Income represents Adjusted Net Income further adjusted to exclude the impact from income taxes and interest and other financing costs. Adjusted EBITDA represents Adjusted Operating Income further adjusted to exclude the impact of all other depreciation and amortization expense. |

We use Adjusted Net Income as a supplemental measure of our overall profitability because it excludes the impact of the non-cash amortization of certain intangible assets and depreciation of property and equipment that were created at the time of the 2007 Transaction, non-cash share-based compensation expense and other items which are not indicative of our ongoing operational performance. Similarly, we use Adjusted Operating Income and Adjusted EBITDA as supplemental measures of our operating profitability and to evaluate and control our cash operating costs because they exclude the impact of the items noted above relating to the calculation of Adjusted Net Income that are not indicative of our ongoing operational performance. We believe the presentation of Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA is appropriate to provide additional information to investors about our operating performance.

Our presentation of these measures has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. You should not consider these measures as alternatives to net income or operating income, determined in accordance with U.S. GAAP. Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA, as presented by us, may not be comparable to other similarly titled measures of other companies because not all companies use identical calculations. Moreover, our definition of Adjusted EBITDA as presented here, although similar, is not the same as Covenant EBITDA and Covenant Adjusted EBITDA, which are calculated for ARAMARK Corporation in connection with our financial covenants in the indenture governing our senior notes and in our senior secured credit facilities.

14

Table of Contents

A directly comparable U.S. GAAP measure to Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA is net income. Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA are reconciled from net income as follows:

| Fiscal year | Nine months ended | |||||||||||||||||||

| (unaudited, dollars in millions) | 2012 | 2011 | 2010 | June 28, 2013 |

June 29, 2012 |

|||||||||||||||

| Net Income (as reported) |

$ | 107 | $ | 85 | $ | 31 | $ | 31 | $ | 47 | ||||||||||

| Adjustment: |

||||||||||||||||||||

| Loss from Discontinued Operations, net of tax |

— | 12 | 1 | — | — | |||||||||||||||

| Increased Amortization of Acquisition-Related Customer Relationship Intangible Assets and Depreciation of Property and Equipment Resulting from the 2007 Transaction |

153 | 153 | 141 | 116 | 114 | |||||||||||||||

| Change in Fair Value of Gasoline and Diesel Fuel Derivative Instruments |

(1 | ) | — | — | 1 | 1 | ||||||||||||||

| Severance and Other Charges (a) |

— | — | — | 88 | — | |||||||||||||||

| Share-Based Compensation |

16 | 17 | 21 | 12 | 13 | |||||||||||||||

| Tax Impact of Adjustments to Adjusted Net Income (b) |

(66 | ) | (67 | ) | (64 | ) | (86 | ) | (51 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income |

$ | 209 | $ | 200 | $ | 130 | $ | 162 | $ | 124 | ||||||||||

| Adjustment: |

||||||||||||||||||||

| Tax Impact of Adjustments to Adjusted Net Income (b) |

66 | 67 | 64 | 86 | 51 | |||||||||||||||

| Provision (Benefit) for Income Taxes |

18 | (1 | ) | 1 | 7 | 12 | ||||||||||||||

| Interest and Other Financing Charges |

457 | 451 | 445 | 341 | 357 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Operating Income |

$ | 750 | $ | 717 | $ | 640 | $ | 596 | $ | 544 | ||||||||||

| Adjustment: |

||||||||||||||||||||

| Increased Amortization of Acquisition-Related Customer Relationship Intangible Assets and Depreciation of Property and Equipment Resulting from the 2007 Transaction |

(153 | ) | (153 | ) | (141 | ) | (116 | ) | (114 | ) | ||||||||||

| Depreciation and Amortization |

529 | 511 | 503 | 405 | 396 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 1,126 | $ | 1,075 | $ | 1,002 | $ | 885 | $ | 826 | ||||||||||

| (a) | Severance and Other Charges includes severance and related costs of $47.4 million, goodwill impairments of $11.7 million, asset write-offs of $11.4 million and costs related to transformation initiatives of $17.1 million for the nine months ended June 28, 2013. |

| (b) | Represents the tax benefit, using an effective tax rate of 39.5%, associated with the adjusted expenses. |

| (6) | Noncash working capital represents accounts receivable, net, plus inventories, prepayments and other current assets, minus accounts payable, accrued payroll and related expenses, and other accrued expenses and current liabilities, exclusive of assets held for sale. |

| (7) | During fiscal 2011, the Company completed a private placement of $600 million, net of a 1% discount, in aggregate principal amount of 8.625% / 9.375% Senior Notes due 2016. In the second quarter of fiscal 2013, the Company completed a refinancing, repurchasing ARAMARK Corporation’s outstanding 8.50% Senior Notes due 2015 and Senior Floating Rate Notes due 2015 and our 8.625% / 9.375% Senior Notes due 2016. The Company refinanced that debt with new term loan borrowings and the issuance of our senior notes. |

15

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider each of the following risks as well as the other information included in this prospectus, including “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, before investing in our common stock. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

Unfavorable economic conditions have, and in the future could, adversely affect our results of operations and financial condition.

A national or international economic downturn has, and in the future could, reduce demand for our services in each of our operating segments, which may result in the loss of business or increased pressure to contract for business on less favorable terms than our generally preferred terms. Economic hardship among our client base can also impact our business. For example, during the recent period of economic distress, certain of our businesses have been negatively affected by reduced employment levels at our clients’ locations and declining levels of business and consumer spending. In addition, insolvency experienced by clients, especially larger clients, has, and in the future could, make it difficult for us to collect amounts we are owed and could result in the voiding of existing contracts. Similarly, financial distress or insolvency, if experienced by our key vendors and service providers such as insurance carriers, could significantly increase our costs.

The portion of our food and support services business that provides services in public facilities such as convention centers and tourist and recreational attractions is particularly sensitive to an economic downturn, as expenditures to take vacations or hold or attend conventions are funded to a partial or total extent by discretionary income. A decrease in such discretionary income on the part of potential attendees at our clients’ facilities has, and in the future could, result in a reduction in our sales. Further, because our exposure to the ultimate consumer of what we provide is limited by our dependence on our clients to attract those consumers to their facilities and events, our ability to respond to such a reduction in attendance, and therefore our sales, is limited. There are many factors that could reduce the numbers of events in a facility or attendance at an event, including labor disruptions involving sports leagues, poor performance by the teams playing in a facility, number of playoff games, inclement weather and adverse economic conditions which would adversely affect sales and profits.

Natural disasters, global calamities, sport strikes and other adverse incidents could adversely affect our sales and operating results.

Natural disasters, including hurricanes and earthquakes, or global calamities have, and in the future could, affect our sales and operating results. In the past, ARAMARK experienced lost and closed client locations, business disruptions and delays, the loss of inventory and other assets, and the effect of the temporary conversion of a number of ARAMARK client locations to provide food and shelter to those left homeless by storms. In addition, any terrorist attacks, particularly against venues that we serve, and the national and global military, diplomatic and financial response to such attacks or other threats, also may adversely affect our sales and operating results. Sports strikes, particularly those that are for an extended time period, can reduce our sales and have an adverse impact on our results of operations. For example, in 2012, the collective bargaining agreement for the players in the National Hockey League expired. As a result, the 2012/2013 season was significantly shortened and our sales and profits were negatively impacted. Any decrease in the number of games played would mean a loss of sales and reduced profits at the venues we service.

16

Table of Contents

Our failure to retain our current clients, renew our existing client contracts and obtain new client contracts could adversely affect our business.

Our success depends on our ability to retain our current clients, renew our existing client contracts and obtain new business. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourselves from our competitors. We cannot assure you that we will be able to obtain new business, renew existing client contracts at the same or higher levels of pricing or that our current clients will not turn to competitors, cease operations, elect to self-operate or terminate contracts with us. The failure to renew a significant number of our existing contracts would have a material adverse effect on our business and results of operations and the failure to obtain new business could have an adverse impact on our growth.

We may be adversely affected if clients reduce their outsourcing or use of preferred vendors.

Our business and growth strategies depend in large part on the continuation of a current trend toward outsourcing services. Clients will outsource if they perceive that outsourcing may provide quality services at a lower overall cost and permit them to focus on their core business activities. We cannot be certain that this trend will continue or not be reversed or that clients that have outsourced functions will not decide to perform these functions themselves.

In addition, labor unions representing employees of some of our current and prospective clients have occasionally opposed the outsourcing trend to the extent that they believed that current union jobs for their memberships might be lost. In these cases, unions typically seek to prevent public sector entities from outsourcing and if that fails, ensure that jobs that are outsourced continue to be unionized, which can reduce our pricing and operational flexibility with respect to such businesses.

We have also identified a trend among some of our clients toward the retention of a limited number of preferred vendors to provide all or a large part of their required services. We cannot be certain that this trend will continue or not be reversed or, if it does continue, that we will be selected and retained as a preferred vendor to provide these services. Unfavorable developments with respect to either outsourcing or the use of preferred vendors could have a material adverse effect on our business and results of operations.

Competition in our industries could adversely affect our results of operations.