Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InvenTrust Properties Corp. | a13-19410_18k.htm |

Exhibit 99.1

|

|

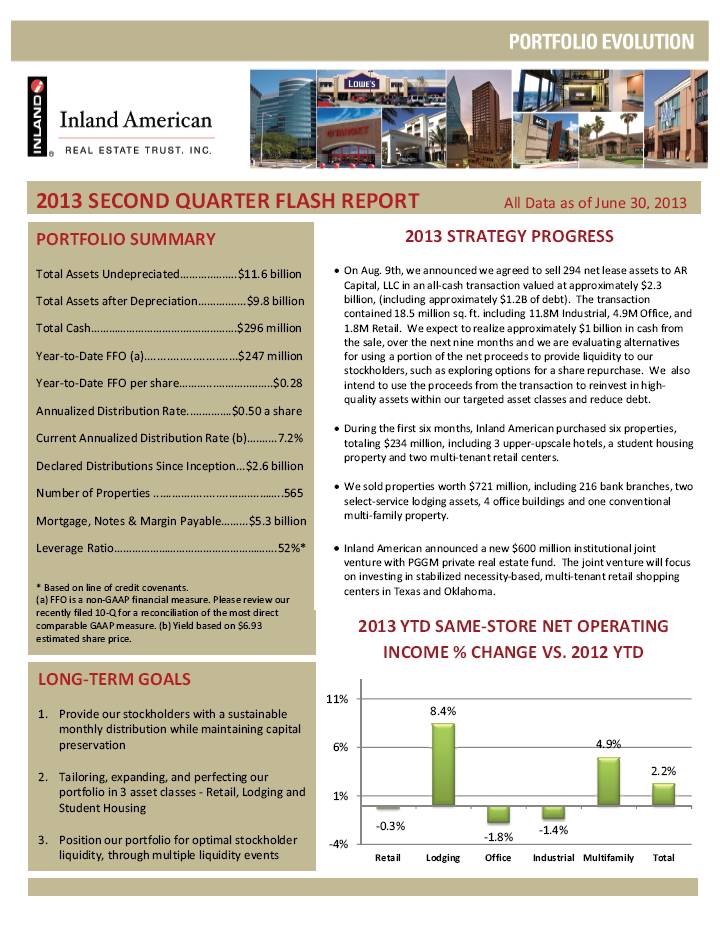

2013 SECOND QUARTER FLASH REPORT All Data as of June 30, 2013 PORTFOLIO SUMMARY Total Assets Undepreciated$11.6 billion Total Assets after Depreciation$9.8 billion Total Cash$296 million Year-to-Date FFO (a)$247 million Year-to-Date FFO per share$0.28 Annualized Distribution Rate$0.50 a share Current Annualized Distribution Rate (b)7.2% Declared Distributions Since Inception$2.6 billion Number of Properties 565 Mortgage, Notes & Margin Payable$5.3 billion Leverage Ratio.52%* * Based on line of credit covenants. (a) FFO is a non-GAAP financial measure. Please review our recently filed 10-Q for a reconciliation of the most direct comparable GAAP measure. (b) Yield based on $6.93 estimated share price. LONG-TERM GOALS 1. Provide our stockholders with a sustainable monthly distribution while maintaining capital preservation 2. Tailoring, expanding, and perfecting our portfolio in 3 asset classes - Retail, Lodging and Student Housing 3. Position our portfolio for optimal stockholder liquidity, through multiple liquidity events 2013 STRATEGY PROGRESS • On Aug. 9th, we announced we agreed to sell 294 net lease assets to AR Capital, LLC in an all-cash transaction valued at approximately $2.3 billion, (including approximately $1.2B of debt). The transaction contained 18.5 million sq. ft. including 11.8M Industrial, 4.9M Office, and 1.8M Retail. We expect to realize approximately $1 billion in cash from the sale, over the next nine months and we are evaluating alternatives for using a portion of the net proceeds to provide liquidity to our stockholders, such as exploring options for a share repurchase. We also intend to use the proceeds from the transaction to reinvest in highquality assets within our targeted asset classes and reduce debt. • During the first six months, Inland American purchased six properties, totaling $234 million, including 3 upper-upscale hotels, a student housing property and two multi-tenant retail centers. • We sold properties worth $721 million, including 216 bank branches, two select-service lodging assets, 4 office buildings and one conventional multi-family property. • Inland American announced a new $600 million institutional joint venture with PGGM private real estate fund. The joint venture will focus on investing in stabilized necessity-based, multi-tenant retail shopping centers in Texas and Oklahoma. 2013 YTD SAME-STORE NET OPERATING INCOME % CHANGE VS. 2012 YTD -0.3% 8.4% -1.8% -1.4% 4.9% 2.2% -4% 1% 6% 11% Retail Lodging Office Industrial Multifamily Total |

|

|

*Based on undepreciated (total investment) asset values RETAIL PROPERTY OVERVIEW 361 Properties · 19.5 Million Square Feet • Average lease rollover for next 9 years is about 9 percent annually • Economic occupancy equals 92% for the portfolio LODGING PROPERTY OVERVIEW 89 Properties · 16,645 Rooms • Same-Store average daily rate increased to $141 for the first six months and same-store RevPAR up 6% over last year • Occupancy for the first six months equaled 73% INDUSTRIAL PROPERTY OVERVIEW 53 Properties · 13.1 Million Square Feet • Economic occupancy equals 97% for the portfolio • Average lease rollover for the next nine years is about 7 percent OFFICE PROPERTY OVERVIEW 34 Properties · 8.5 Million Square Feet • Economic occupancy increased to 94% for the portfolio • Average lease rollover for next 9 years is about 9 percent annually Lodging Portfolio CONTACT custserv@inland-investments.com 800.826.8228 www.inlandamerican.com This material is neither an offer to sell nor a solicitation of an offer to buy any security. Consult Inland American’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q for a discussion of the specific risks. The companies depicted in the photographs herein may have proprietary interests in their trade names and trademarks and nothing herein shall be considered to be an endorsement, authorization, or approval of Inland American by the companies. Further, none of these companies are affiliated with the Inland American in any manner. The Inland name and logo are registered trademarks being used under license. MULTI-FAMILY PROPERTY OVERVIEW 28 Properties · 5,186 Units / 6,521 Beds • Same-Store portfolio is 93% occupied. • Rent per bed for our entire student housing portfolio increased 4.8% to $698. Purchased for approximately $80 million, the property is 14- stories and contains 228-rooms. Student Housing Portfolio University House @ University of ASU – Tempe, AZ Acquired in August 2013 for about $103 million, the property contains 640 beds with luxury amenities and is 100% occupied. The property also includes 22,000 square feet of retail space. Residence Inn Denver City Center – Denver, CO Retail 29% Lodging 30% Office 11% Ind/Dist 9% Multi-Family 9% Other / Non- Core 12% |

z

z