Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CUMULUS MEDIA INC | d591188d8k.htm |

| EX-99.1 - EX-99.1 - CUMULUS MEDIA INC | d591188dex991.htm |

ACQUISITION OF

DIAL GLOBAL

August 30, 2013

Exhibit 99.2 |

IMPORTANT NOTICES

Page | 1

Forward-Looking Statements

This presentation contains “forward-looking” statements regarding,

among other things, the recently announced pending Dial Global acquisition, expected earnings, revenues, cost savings, leverage,

operations, business trends and other items, that are based on current expectations

and estimates or assumptions. These forward-looking statements involve risks and uncertainties that could cause actual

results to differ materially from those predicted in any such forward-looking

statements. Such factors include, but are not limited to Cumulus’ ability to complete the Dial Global acquisition on the expected

timeline, the failure to obtain necessary regulatory approvals or to satisfy any

other conditions to the acquisition, the failure to realize the expected benefits of the acquisition, and general economic and

business conditions that may affect the companies before or following the

acquisition. For additional information regarding risks and uncertainties associated with Cumulus, see Cumulus’ filings with the

Securities and Exchange Commission (“SEC”) made from time to time,

including its Form 10-K for the year ended December 31, 2012. Cumulus assumes no responsibility to update the forward-looking

statements contained in this presentation as a result of new information, future

events or otherwise. Non-GAAP Financial Information

This presentation contains the non-GAAP financial metrics Adjusted EBITDA and

net debt. We define Adjusted EBITDA as net income (loss) before any non-operating expenses, including net interest

expense, depreciation and amortization, stock-based compensation expense, gain

or loss on exchange or sale of assets or stations (if any), gain or loss on derivative instruments (if any), discontinued

operations (if any), impairment of intangible assets and goodwill (if any), local

marketing agreement (“LMA”) fees, acquisition-related costs and franchise taxes. Adjusted EBITDA is the financial metric

utilized by management to analyze the cash flow generated by our business. This

measure isolates the amount of income generated by our radio stations after the incurrence of corporate, general and

administrative expenses. Management also uses this measure to determine the

contribution of our radio station portfolio, including the corporate resources employed to manage the portfolio, to the funding of

our other operating expenses and to the funding of debt service and

acquisitions. In deriving this measure, management excludes depreciation, amortization and stock-based compensation expense, as

these do not represent cash payments for activities directly related to the

operation of the radio stations. In addition, we exclude LMA fees from our calculation of Adjusted EBITDA even though such fees

require a cash settlement, because they are excluded from the definition of Adjusted

EBITDA contained in our first lien credit facility. Management excludes any gain or loss on the exchange or sale of assets

or radio stations as they do not represent a cash transaction. Management also

excludes any realized gain or loss on derivative instruments as they do not represent a cash transaction nor are they

associated with radio station operations. Interest expense, net of interest income,

income tax (benefit) expense including franchise taxes, and expenses relating to acquisitions are also excluded from the

calculation of Adjusted EBITDA as they are not directly related to the operation of

radio stations. Management excludes any impairment of goodwill and intangible assets as they do not require a cash outlay.

Management believes that Adjusted EBITDA, although not a measure that is calculated

in accordance with GAAP, nevertheless is commonly employed by the investment community as a measure for

determining the market value of a radio company. Management has also observed that

Adjusted EBITDA is routinely employed to evaluate and negotiate the potential purchase price for radio broadcasting

companies and is a key metric for purposes of calculating and determining compliance

with certain covenants in our first lien credit facility. Given the relevance to our overall value, management believes that

investors consider the metric to be extremely useful. Adjusted EBITDA should

not be considered in isolation of, or as a substitute for, net income, operating income, cash flows from operating activities or

any other measure for determining our operating performance or liquidity that is

calculated in accordance with GAAP. We define net debt as the sum of long-term debt, short-term debt (if any) and capital

leases (if any) less unrestricted cash and cash equivalents. We believe that

net debt is a useful metric because it provides investors with an estimate of what the Company’s debt would be if all available

cash was used to repay outstanding indebtedness of the Company. The measure is

not meant to imply that management intends to use available cash in this manner.

A quantitative reconciliation of our Adjusted EBITDA as presented herein to net

income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, is provided

in the Appendix hereto. A reconciliation of net debt as presented herein to

total debt is self evident on the face of the relevant accompanying table.

|

TRANSACTION OVERVIEW

Cumulus Media Inc. (“Cumulus”) is acquiring Dial Global, Inc.

(“Dial Global”) for approximately $45 million plus the

retirement of approximately $215 million of debt at closing for total cash

consideration of $260 million —

Purchase

price

will

pay off

all

Dial

Global

debt

and

Cumulus

will

acquire

100%

of

Dial

Global

equity

Transaction is substantially capital neutral

—

Cumulus is also selling 12 small and mid-sized radio markets to Townsquare

Media (“Townsquare”) in a separate transaction for $238

million in

cash

(1)

—

Monetization of other non-core, non-cash flow generating assets

—

Minimal balance sheet cash used to fund remainder of purchase price

—

Cumulus

is

also

swapping

two

small

and mid-sized radio markets with Townsquare in exchange for five stations in

Fresno,

CA

(DMA #68)

Regulatory approval and simultaneous closings expected by year end

(1)

Cash proceeds include acquisition of net working capital by Townsquare

In a deleveraging transaction, Cumulus solidifies its position as a producer

of premium content while reshaping its distribution footprint in the

top 100 markets Page | 2 |

STRUCTURE OF TRANSACTIONS

(1)

Unaudited, estimated Adjusted EBITDA for the twelve months ending 12/31/13, adjusted

for full realization of identified synergies (2)

Adjusted EBITDA for the twelve months ended 6/30/13

Dial Global business with

$66 million of EBITDA

(1)

12 radio markets with

$33 million of EBITDA

(2)

$260 million of cash

$238 million of cash

Page | 3 |

COMPELLING STRATEGIC OPPORTUNITY

Page | 4

1

2

3

4

5

Further value maximization from active strategic portfolio management

Deleveraging on identified cost synergies alone

Acquiring a leading provider of premium content and original

programming Creates attractive content, distribution and monetization

platform $40+ million of estimated cost synergies and substantial

incremental revenue growth opportunities

|

DIAL

GLOBAL OVERVIEW A

leading

nationwide

independent,

full-service

network

radio

company

Distributes,

produces

and

syndicates

programming

and

services

to

more

than

8,200

radio

stations

—

Over 200 news, sports, music, talk and entertainment radio programs, services and

digital applications —

Syndicates

live

events,

24/7

formats,

prep

services,

jingles

and

imaging

libraries

In

exchange

for

programming

and

services,

Dial

Global

receives

commercial

air

time

from

radio

stations

—

Air time is aggregated to sell to national advertisers

—

Provides advertisers a cost effective way to reach a broad audience while

targeting on a demographic and geographic basis

Page | 5 |

CONTENT, DISTRIBUTION & MONETIZATION

PLATFORM

Multi-platform monetization engine to seamlessly serve the needs of local,

regional and national advertisers Page | 6

(1)

Giving effect to completion of transactions with Townsquare

460

(1)

Owned &

Operated Stations

10,000 Combined

3

Party

Affiliates

Mobile

Streams

Websites

Podcasts

BROADCAST DISTRIBUTION

DIGITAL DISTRIBUTION

CONTENT CREATION

AUDIO, VIDEO, LIVE EVENTS

rd |

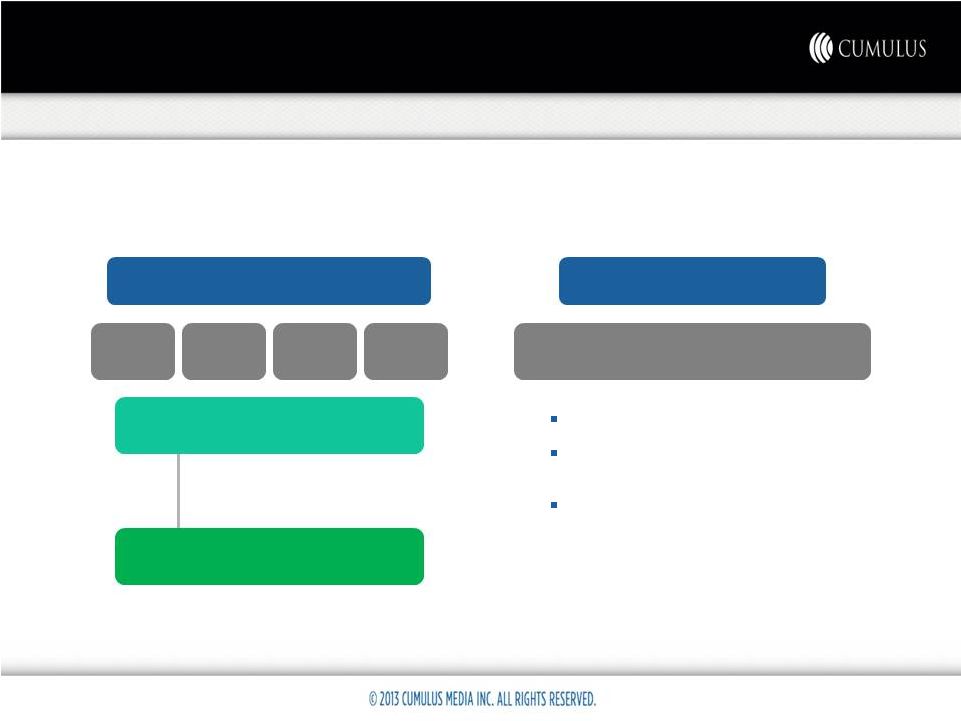

IDENTIFIABLE COST SYNERGIES

SOLID TRACK RECORD OF ACHIEVING IDENTIFIED SYNERGIES

PREVIOUSLY ACHIEVED COST SYNERGIES

EXPECTED COST SYNERGIES

Cumulus + Dial Global

Acquisition

Corporate

Overlap

Markets

Operations

Networks

$40+ million of cost synergies identified

$50+ million of cost synergies identified

at transaction announcement (3/14/11)

$65+ million of synergies achieved to

date

Initial synergy estimate exceeded by

$15+ million within original timeframe

~10% of combined network expense base

Duplicative infrastructure provides significant

synergy opportunities

Expect to realize within the first two years

with more than 50% generated in the first 12

months after closing

Page | 7

Cumulus + CMP

(1)

+ Citadel Merger

(2011)

(1)

Cumulus Media Partners, an independent entity managed by Cumulus prior

to acquisition in August 2011 |

PRO

FORMA CUMULUS FINANCIAL SNAPSHOT

($ in millions)

Cumulus

(1)

Pre-Transactions

Dial Global

(2)

Synergies

(3)

Stations Being

Sold to

Townsquare

(4)

Cumulus

Pro Forma

Net Revenue

$1,088.4

$216.7

($64.1)

$1,241.0

Adjusted EBITDA

$388.2

$25.7

$40.5

($32.6)

$421.8

Adj. EBITDA Margin

35.7%

11.9%

NM

34.0%

(1)

Twelve months ended 6/30/13

(2)

Dial Global unaudited financial results, estimated for the twelve months ending

12/31/13 (3)

Expect to fully achieve cost synergies within first two years, with more than 50% in

the first 12 months after closing (4)

Twelve months ended 6/30/13

(5)

Calculated as Adjusted EBITDA divided by net revenue

Page | 8

Pro forma Cumulus generates >$150 million of

incremental revenue and >$30 million of

incremental Adjusted EBITDA

(5) |

DELEVERAGING TRANSACTION

Pro Forma Cumulus Capitalization Table:

(1)

Balance sheet items as of 6/30/13

(2)

Estimate of cash on balance sheet used to consummate transaction

Page | 9

($ in millions)

Pre -Transactions

Capitalization

(1)

Cumulative

Leverage

x Adj. EBITDA

Transaction

Adjustment

(2)

Unrestricted Cash

$46.2

($15.0)

$31.2

Revolving Credit Facility

0.0

0.0x

0.0

0.0x

First Lien Term Loan

1,287.3

3.3x

1,287.3

3.1x

Second Lien Term Loan

785.5

5.3x

785.5

4.9x

Senior Notes

610.0

6.9x

610.0

6.4x

Total Debt

$2,682.8

6.9x

$2,682.8

6.4x

Net Debt

2,636.5

6.8x

2,651.5

6.3x

Preferred Stock

75.8

7.0x

75.8

6.5x

Net Debt + Preferred Stock

$2,712.3

7.0x

$2,727.3

6.5x

Adjusted EBITDA

$388.2

$421.8

Pro Forma

Capitalization

(1)

Cumulative

Leverage

x Adj. EBITDA |

BUILDING SHAREHOLDER VALUE

Deleveraging Transaction

Acquiring a Leading Audio Content Provider

Creation of Significant Growth Opportunities

Value Creation Through Portfolio Management

Page | 10

Substantial Identified Cost Synergies |

APPENDIX |

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

Reconciliation of Non-GAAP Financial Measures to Most Directly Comparable

GAAP Measures The following table reconciles net income (loss), the most

directly comparable financial measure calculated and presented in accordance with GAAP, to actual, historical

Adjusted EBITDA for the twelve months ended June 30, 2013 of Cumulus on a

consolidated basis and of the 12 small markets being sold to Townsquare: Page

| 12 Cumulus

Stations Being Sold to

Consolidated

Townsquare Media

LTM

LTM

($ in millions)

6/30/2013

6/30/2013

Net income (loss)

(48.9)

$

24.2

$

Income tax expense (benefit)

(32.0)

-

Non-operating expenses, including net interest expense

193.9

(0.0)

LMA fees

3.6

0.1

Depreciation and amortization

129.4

8.3

Stock-based compensation expense

11.0

-

Loss on sale of stations

1.4

-

(Gain) loss on derivative instrument

(3.6)

-

Impairment of intangible assets

114.7

-

Loss on early extinguishment of debt

2.4

-

Acquisition-related costs

5.5

-

Franchise taxes

0.4

-

Discontinued operations

10.4

-

Adjusted EBITDA

388.2

$

32.6

$

|