Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CorMedix Inc. | crmd_8k.htm |

EXHIBIT 99.1

NYSE MKT: CRMD

August 2013

Company Overview

© 2013 CorMedix Inc

2

Forward Looking Statements

This presentation contains certain statements that constitute forward-looking statements within the

meaning of the federal securities laws. Statements that are not historical facts, including statements

about our beliefs and expectations, are forward-looking statements. These statements are not

guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to

predict. The forward looking statements in this presentation include statements about our business,

including commercialization plans and potential markets for our products and product candidates,

clinical trials, potential indications for our product candidates, development timelines, regulatory

timelines and future events that have not yet occurred. Pharmaceutical and medical device

development inherently involves significant risks and uncertainties, including the risks outlined in “Risk

Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on

March 27, 2013 and in “Risk Factors” in our Quarterly Reports on Form 10-Q filed with the Securities

and Exchange Commission on May 15 and August 14, 2013. Our actual results may differ materially

from our expectations due to these risks and uncertainties, including, but not limited to, our

dependence on the success of our lead product candidate, and factors relating to commercialization

and regulatory approval thereof, ability to raise sufficient capital, retaining our stock’s listing on the

NYSE MKT, research and development activities, intellectual property protection, competition,

industry environment, and other matters. Any forward-looking statements included in this presentation

are based on information available to us on the date of this presentation. We undertake no obligation

to update or revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

meaning of the federal securities laws. Statements that are not historical facts, including statements

about our beliefs and expectations, are forward-looking statements. These statements are not

guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to

predict. The forward looking statements in this presentation include statements about our business,

including commercialization plans and potential markets for our products and product candidates,

clinical trials, potential indications for our product candidates, development timelines, regulatory

timelines and future events that have not yet occurred. Pharmaceutical and medical device

development inherently involves significant risks and uncertainties, including the risks outlined in “Risk

Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on

March 27, 2013 and in “Risk Factors” in our Quarterly Reports on Form 10-Q filed with the Securities

and Exchange Commission on May 15 and August 14, 2013. Our actual results may differ materially

from our expectations due to these risks and uncertainties, including, but not limited to, our

dependence on the success of our lead product candidate, and factors relating to commercialization

and regulatory approval thereof, ability to raise sufficient capital, retaining our stock’s listing on the

NYSE MKT, research and development activities, intellectual property protection, competition,

industry environment, and other matters. Any forward-looking statements included in this presentation

are based on information available to us on the date of this presentation. We undertake no obligation

to update or revise any forward-looking statement, whether as a result of new information, future

events or otherwise.

© 2013 CorMedix Inc

3

CorMedix: A Catheter Care Company

© 2013 CorMedix Inc

4

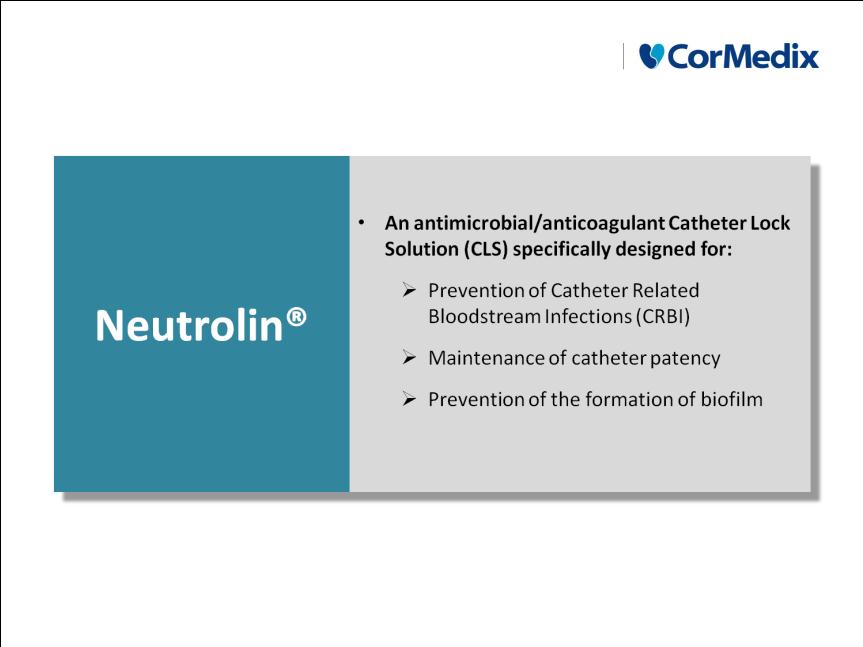

What is Neutrolin®?

© 2013 CorMedix Inc

5

Why Neutrolin®?

© 2013 CorMedix Inc

6

Neutrolin®

Strategic Pillars

© 2013 CorMedix Inc

Key Activities:

•Successful launch in Germany and Austria

• Experienced sales team targets early

adopters

adopters

• Increase healthcare provider awareness

•Negotiate Partner Arrangements

• Position Neutrolin® strategically

§ Pricing

§ Understand payer reimbursement policies

Neutrolin®

Strategic Pillars

© 2013 CorMedix Inc

9

Key Activities:

•Expansion into oncology, ICU, Total

Parenteral Nutrition, and peritoneal

dialysis fields

Parenteral Nutrition, and peritoneal

dialysis fields

•Submission of required data to TUV

•Develop target list of physicians and

expand the sales force

expand the sales force

Neutrolin®

Strategic Pillars

© 2013 CorMedix Inc

10

Key Activities:

•Identify and prioritize key countries

•Identify best sales partners in key

countries

countries

§ Screening/due diligence / deal

negotiations conducted with

country and regional specific

advisors

negotiations conducted with

country and regional specific

advisors

•Complete agreements

•Monitor product positioning and

coordinate manufacturing capacity

coordinate manufacturing capacity

Neutrolin®

Strategic Pillars

© 2013 CorMedix Inc

11

Potential Opportunity for Consideration:

• U.S. FDA discussions (pre-IND meeting, timelines)

• Clinical trial requirements by FDA

§ Patient population size

§ Duration

• Clinical trial execution decision

§ Strategic partner

§ Go alone if sufficient internal funding

Neutrolin®

Strategic Pillars

© 2013 CorMedix Inc

12

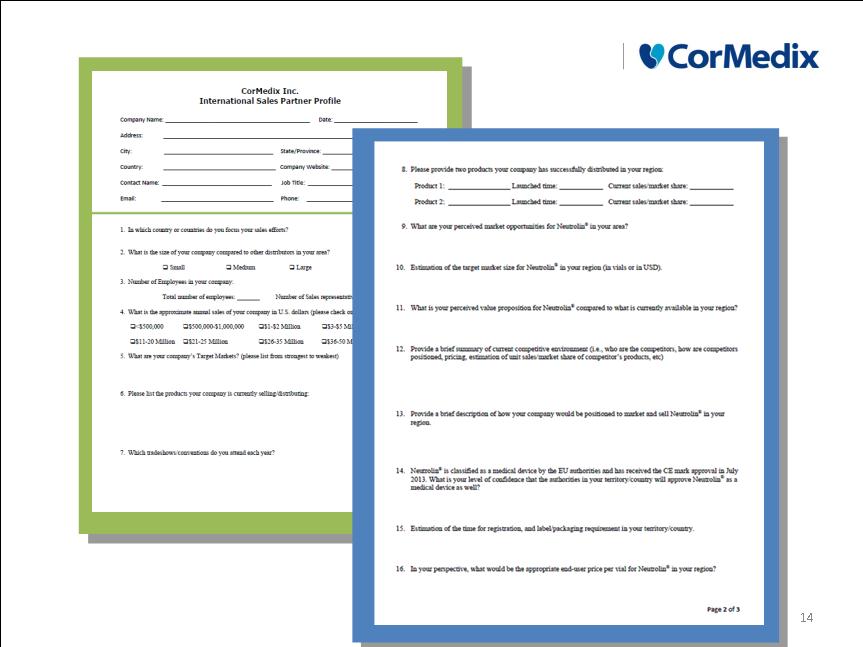

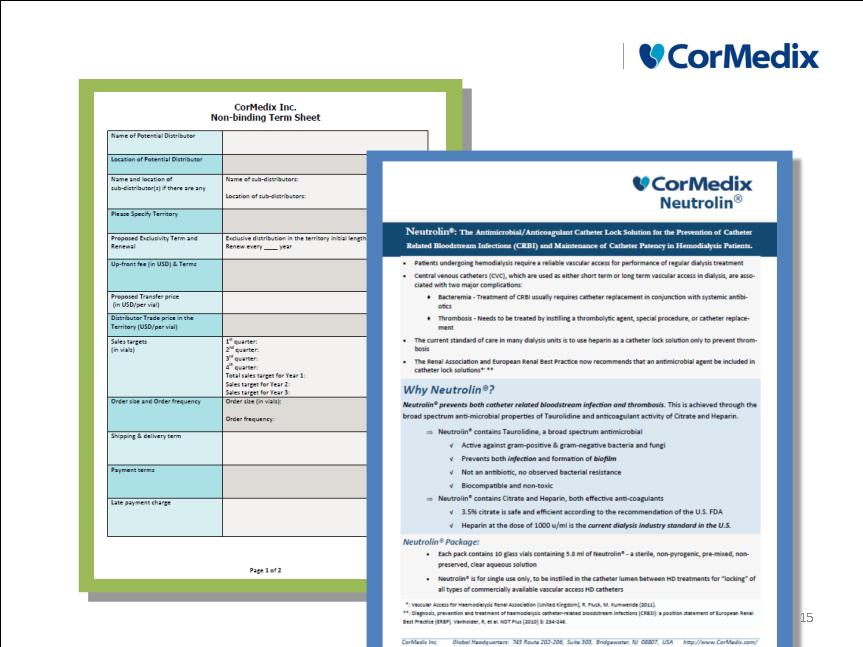

Business Development to Target Countries with

High Catheter Use and Favorable Reimbursement

High Catheter Use and Favorable Reimbursement

• Major Countries: U.S., Japan,

China, Brazil, Germany, Canada

China, Brazil, Germany, Canada

Source: Derived from USRDS, 2011, and Dialysis Outcomes and Practice Pattern Study (DOPPS) Annual

Report 2010, and Canadian Institute for Health Information, Canadian Organ Replacement Registry

Report 2010, and Canadian Institute for Health Information, Canadian Organ Replacement Registry

© 2013 CorMedix Inc

13

1

Process in Place to Select Best Sales Partner

© 2013 CorMedix Inc

© 2013 CorMedix Inc

© 2013 CorMedix Inc

© 2013 CorMedix Inc

17

Large Worldwide Hemodialysis Opportunity

European Union Sales Partnerships:

• 91,000 hemodialysis catheter patients

• 28 countries

U.S. Clinical Development Funding and Sales Partnerships

• 104,000 hemodialysis catheter patients

Top 5 Hemodialysis markets: U.S., Japan, China, Brazil, Germany.

Source: Derived from USRDS, 2011, and Grassman, Neprol. Dial. Transplant (Dec 2005) 20 (12):25-87-2593, and

Dialysis Outcomes and Practice Pattern Study (DOPPS) Annual Report 2010, CorMedix estimates

Asia/Middle East/North and South America Sales Partnerships

• 106,000 hemodialysis catheter patients

• China, Japan, Korea, Saudi Arabia, Brazil, Canada

© 2013 CorMedix Inc

18

Opportunity to Grow with Label Expansion into other

Catheter Applications

European Union Sales Partnerships:

• 145,600 catheter patients

• 28 countries

U.S. Clinical Development Funding and Sales Partnerships

• 124,800 catheter patients

Other catheter applications: chemotherapy, intensive care, total parenteral nutrition.

Source: CorMedix estimates based on hemodialysis catheter patients derived from USRDS, 2011, and Grassman,

Neprol. Dial. Transplant (Dec 2005) 20 (12):25-87-2593, and Dialysis Outcomes and Practice Pattern Study (DOPPS)

Asia/Middle East/North and South America Sales Partnerships

• 106,000 catheter patients

• China, Japan, Korea, Saudi Arabia, Brazil, Canada

© 2013 CorMedix Inc

19

Significant Near Term Hemodialysis Opportunity in E.U.

Initially CorMedix will target the Hemodialysis market:

• E.U. : 91,000 hemodialysis catheter patients

These patients represent ~14.2 million HD sessions per year

(91,000 HD catheter patients * 3 weekly dialysis sessions/week * 52 weeks per year = 14.2 million)

Potential Hemodialysis Market Size in E.U. :

USD $40 - $80 million

Source: Derived from USRDS, 2011, and Grassman, Neprol. Dial. Transplant (Dec 2005) 20 (12):25-87-2593, and

Dialysis Outcomes and Practice Pattern Study (DOPPS)

© 2013 CorMedix Inc

20

…..and Even Greater Opportunity in the Long Term

with Other Key Countries and an Expanded Label

with Other Key Countries and an Expanded Label

Hemodialysis and Expanded Label market:

• E.U.: 236,600 catheter patients

• Other Key Countries: 212,000 catheter patients

Long Term Potential Market Size in E.U. and Other Key Countries

for Hemodialysis and Expanded Label:

for Hemodialysis and Expanded Label:

USD $180 - $340 million

Top 5 Hemodialysis markets: U.S., Japan, China, Brazil, Germany.

Source: Derived from USRDS, 2011, and Grassman, Neprol. Dial. Transplant (Dec 2005) 20 (12):25-87-2593, and

Dialysis Outcomes and Practice Pattern Study (DOPPS)

© 2013 CorMedix Inc

21

Option to Enter the United States with Strategic

Partnerships or Internal Funding

Partnerships or Internal Funding

U.S. Hemodialysis and Expanded Label market:

• 228,800 catheter patients

Long Term Potential Market Size in U.S. for Hemodialysis and

Expanded Label:

Expanded Label:

USD $140 - $270 million

Top 5 Hemodialysis markets: U.S., Japan, China, Brazil, Germany.

Source: Derived from USRDS, 2011, and Grassman, Neprol. Dial. Transplant (Dec 2005) 20 (12):25-87-2593, and

Dialysis Outcomes and Practice Pattern Study (DOPPS)

© 2013 CorMedix Inc

22

IP Status Update

• Global Patent Estate - 17 issued patents provide protection

through 2019-2025

through 2019-2025

§ Freedom to Operate

§ Proprietary

Ø Sodemann: A method of inhibiting or preventing infection and blood

coagulation as a medical prosthetic device using a pharmaceutical

composition comprising taurolidine and citric acid

coagulation as a medical prosthetic device using a pharmaceutical

composition comprising taurolidine and citric acid

Ø Prosl: A locking solution comprising a taurinamide derivative, a

biologically acceptable acid and low concentration heparin

biologically acceptable acid and low concentration heparin

Ø Polaschegg: gel technology with taurolidine

• Planned additional filings under prosecution to extend

protection

protection

© 2013 CorMedix Inc

23

Neutrolin®

Strategic Pillars

http://www.CorMedix.com/

NYSE MKT: CRMD

August 2013

Thank You!