Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Globalstar, Inc. | v352805_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Globalstar, Inc. | v352805_ex99-1.htm |

EARNINGS CALL PRESENTATION SECOND QUARTER 2013 August 13, 2013

SAFE HARBOR LANGUAGE This press release contains certain statements that are “ forward - looking statements ” within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward - looking statements . Forward - looking statements, such as the statements regarding our ability to finalize an amendment to our senior secured facility, to raise additional capital to pay or restructure our obligations as they come due, develop and expand our business, pay for our anticipated capital spending (including for future satellite procurements and launches), our ability to manage costs, our ability to exploit and respond to technological innovation, the effects of laws and regulations (including tax laws and regulations) and legal and regulatory changes, our ability to obtain regulatory authority to provide terrestrial mobile broadband services, the opportunities for strategic business combinations and the effects of consolidation in our industry on us and our competitors, our anticipated future revenues, our anticipated financial resources, our expectations about the future operational performance of our satellites (including their projected operational lives), the expected strength of and growth prospects for our existing customers and the markets that we serve, commercial acceptance of our new Simplex products, including our SPOT Global Phone and SPOT Gen 3 products, problems relating to the ground - based facilities operated by us or by independent gateway operators, worldwide economic, geopolitical and business conditions and risks associated with doing business on a global basis and other statements contained in this release regarding matters that are not historical facts, involve predictions . Any forward - looking statements made in this press release speak as of the date made and are not guarantees of future performance . Actual results or developments may differ materially from the expectations expressed or implied in the forward - looking statements, and we undertake no obligation to update any such statements . Additional information on factors that could influence our financial results is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K .

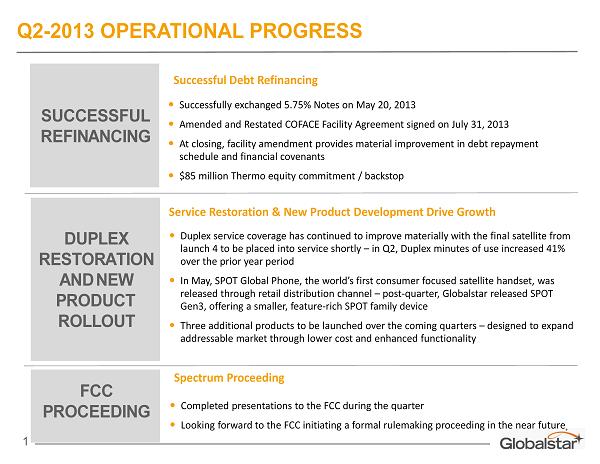

Duplex service coverage has continued to improve materially with the final satellite from launch 4 to be placed into service shortly – in Q2, Duplex minutes of use increased 41% over the prior year period In May, SPOT Global Phone, the world’s first consumer focused satellite handset, was released through retail distribution channel – post - quarter, Globalstar released SPOT Gen3, offering a smaller, feature - rich SPOT family device Three additional products to be launched over the coming quarters – designed to expand addressable market through lower cost and enhanced functionality Successfully exchanged 5.75% Notes on May 20, 2013 Amended and Restated COFACE Facility Agreement signed on July 31, 2013 At closing, facility amendment provides material improvement in debt repayment schedule and financial covenants $85 million Thermo equity commitment / backstop C ompleted presentations to the FCC during the quarter Looking forward to the FCC initiating a formal rulemaking proceeding in the near future 1 Q2 - 2013 OPERATIONAL PROGRESS Service Restoration & New Product Development Drive Growth Successful Debt Refinancing Spectrum Proceeding S U C C E S S F U L R E F I N A N C I N G D U P L E X R E S T O R A T I O N A N D N E W P R O D U C T R O L L O U T F C C P R O C E E D I N G

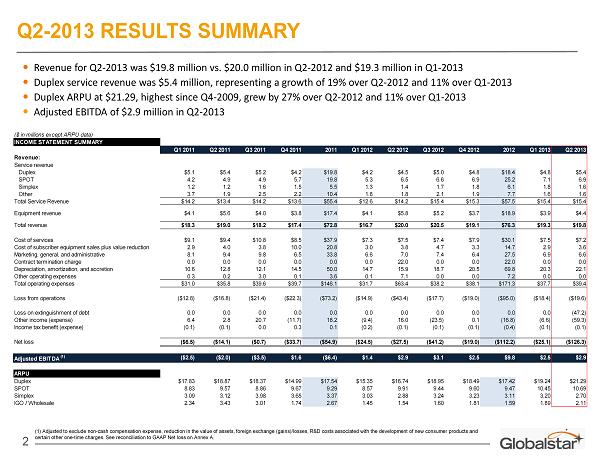

(1) Adjusted to exclude non - cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D co sts associated with the development of new consumer products and certain other one - time charges. See reconciliation to GAAP Net loss on Annex A. 2 Q2 - 2013 RESULTS SUMMARY Revenue for Q2 - 2013 was $19.8 million vs. $20.0 million in Q2 - 2012 and $19.3 million in Q1 - 2013 Duplex service revenue was $5.4 million, representing a growth of 19% over Q2 - 2012 and 11% over Q1 - 2013 Duplex ARPU at $21.29, highest since Q4 - 2009, grew by 27% over Q2 - 2012 and 11% over Q1 - 2013 Adjusted EBITDA of $2.9 million in Q2 - 2013 ($ in millions except ARPU data) INCOME STATEMENT SUMMARY Q1 2011 Q2 2011 Q3 2011 Q4 2011 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 2012 Q1 2013 Q2 2013 Revenue: Service revenue Duplex $5.1 $5.4 $5.2 $4.2 $19.8 $4.2 $4.5 $5.0 $4.8 $18.4 $4.8 $5.4 SPOT 4.2 4.9 4.9 5.7 19.8 5.3 6.5 6.6 6.9 25.2 7.1 6.9 Simplex 1.2 1.2 1.6 1.5 5.5 1.3 1.4 1.7 1.8 6.1 1.8 1.6 Other 3.7 1.9 2.5 2.2 10.4 1.8 1.8 2.1 1.9 7.7 1.6 1.6 Total Service Revenue $14.2 $13.4 $14.2 $13.6 $55.4 $12.6 $14.2 $15.4 $15.3 $57.5 $15.4 $15.4 Equipment revenue $4.1 $5.6 $4.0 $3.8 $17.4 $4.1 $5.8 $5.2 $3.7 $18.9 $3.9 $4.4 Total revenue $18.3 $19.0 $18.2 $17.4 $72.8 $16.7 $20.0 $20.5 $19.1 $76.3 $19.3 $19.8 Cost of services $9.1 $9.4 $10.8 $8.5 $37.9 $7.3 $7.5 $7.4 $7.9 $30.1 $7.5 $7.2 Cost of subscriber equipment sales plus value reduction 2.9 4.0 3.8 10.0 20.8 3.0 3.8 4.7 3.3 14.7 2.9 3.6 Marketing, general, and administrative 8.1 9.4 9.8 6.5 33.8 6.6 7.0 7.4 6.4 27.5 6.9 6.6 Contract termination charge 0.0 0.0 0.0 0.0 0.0 0.0 22.0 0.0 0.0 22.0 0.0 0.0 Depreciation, amortization, and accretion 10.6 12.8 12.1 14.5 50.0 14.7 15.9 18.7 20.5 69.8 20.3 22.1 Other operating expenses 0.3 0.2 3.0 0.1 3.6 0.1 7.1 0.0 0.0 7.2 0.0 0.0 Total operating expenses $31.0 $35.8 $39.6 $39.7 $146.1 $31.7 $63.4 $38.2 $38.1 $171.3 $37.7 $39.4 Loss from operations ($12.8) ($16.8) ($21.4) ($22.3) ($73.2) ($14.9) ($43.4) ($17.7) ($19.0) ($95.0) ($18.4) ($19.6) Loss on extinguishment of debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 (47.2) Other income (expense) 6.4 2.8 20.7 (11.7) 18.2 (9.4) 16.0 (23.5) 0.1 (16.8) (6.6) (59.3) Income tax benefit (expense) (0.1) (0.1) 0.0 0.3 0.1 (0.2) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) Net loss ($6.5) ($14.1) ($0.7) ($33.7) ($54.9) ($24.5) ($27.5) ($41.2) ($19.0) ($112.2) ($25.1) ($126.3) Adjusted EBITDA (1) ($2.5) ($2.0) ($3.5) $1.6 ($6.4) $1.4 $2.9 $3.1 $2.5 $9.8 $2.5 $2.9 ARPU Duplex $17.83 $18.87 $18.37 $14.99 $17.54 $15.35 $16.74 $18.95 $18.49 $17.42 $19.24 $21.29 SPOT 8.83 9.57 8.86 9.67 9.29 8.57 9.91 9.44 9.60 9.47 10.45 10.69 Simplex 3.09 3.12 3.98 3.65 3.37 3.03 2.88 3.24 3.23 3.11 3.20 2.70 IGO / Wholesale 2.34 3.43 3.01 1.74 2.67 1.45 1.54 1.60 1.81 1.59 1.89 2.11

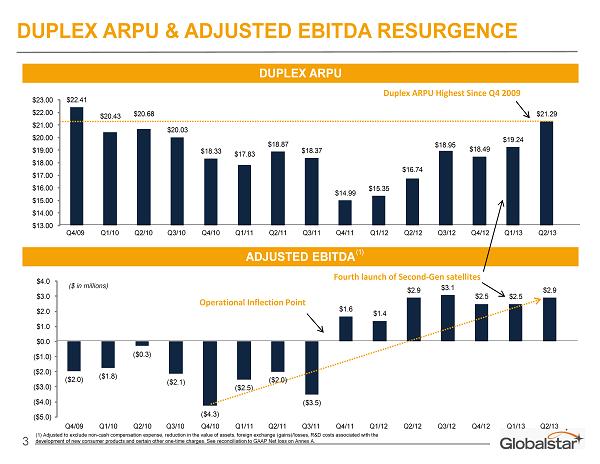

3 DUPLEX ARPU & ADJUSTED EBITDA RESURGENCE DUPLEX ARPU $22.41 $20.43 $20.68 $20.03 $18.33 $17.83 $18.87 $18.37 $14.99 $15.35 $16.74 $18.95 $18.49 $19.24 $21.29 $13.00 $14.00 $15.00 $16.00 $17.00 $18.00 $19.00 $20.00 $21.00 $22.00 $23.00 Duplex ARPU Highest Since Q4 2009 ADJUSTED EBITDA ($2.0) ($1.8) ($0.3) ($2.1) ($4.3) ($2.5) ($2.0) ($3.5) $1.6 $1.4 $2.9 $3.1 $2.5 $2.5 $2.9 ($5.0) ($4.0) ($3.0) ($2.0) ($1.0) $0.0 $1.0 $2.0 $3.0 $4.0 Q1/10 Q2/10 Q3/10 Q4/10 Q1/11 Q1/13 Q2/11 Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q2/13 Q4/09 Fourth launch of Second - Gen satellites Operational Inflection Point ($ in millions) (1) Q1/10 Q2/10 Q3/10 Q4/10 Q1/11 Q1/13 Q2/11 Q3/11 Q4/11 Q1/12 Q2/12 Q3/12 Q4/12 Q2/13 Q4/09 (1) Adjusted to exclude non - cash compensation expense, reduction in the value of assets, foreign exchange (gains)/losses, R&D co sts associated with the development of new consumer products and certain other one - time charges. See reconciliation to GAAP Net loss on Annex A.

Material improvement in primary Duplex metrics including usage, gross adds and ARPU over the prior year period: − Usage: Increased 41% − Gross subscriber additions: 2x greater − ARPU increased by 27% New Duplex and M2M products set to drive distribution into previously unserved markets Government & Enterprise customers are returning across core markets driven by material improvement in coverage and competitive advantages 4 GLOBALSTAR OPERATIONAL UPDATE Returning customers include: Last Second - Gen satellite to be placed into service within following weeks

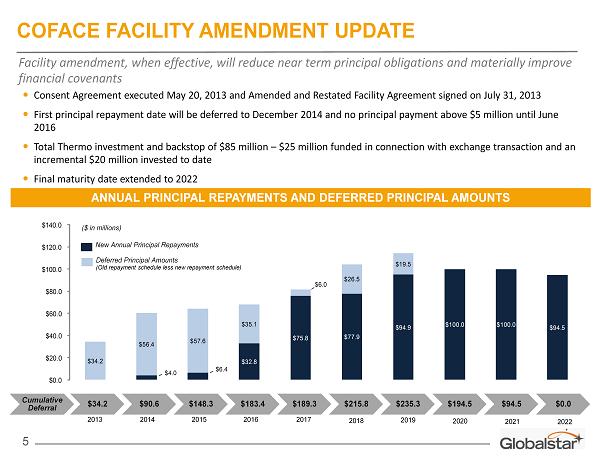

$4.0 $6.4 $32.8 $75.8 $77.9 $94.9 $100.0 $100.0 $94.5 $34.2 $56.4 $57.6 $35.1 $6.0 $26.5 $19.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Facility amendment, when effective, will reduce near term principal obligations and materially improve financial covenants Consent Agreement executed May 20, 2013 and Amended and Restated Facility Agreement signed on July 31, 2013 First principal repayment date will be deferred to December 2014 and no principal payment above $5 million until June 2016 Total Thermo investment and backstop of $85 million – $25 million funded in connection with exchange transaction and an incremental $20 million invested to date Final maturity date extended to 2022 ANNUAL PRINCIPAL REPAYMENTS AND DEFERRED PRINCIPAL AMOUNTS 2013 2014 2015 2016 2017 2018 2019 2020 $34.2 $90.6 $148.3 $183.4 $189.3 $215.8 $235.3 $194.5 $94.5 $0.0 ($ in millions) Cumulative Deferral New Annual Principal Repayments Deferred Principal Amounts (Old repayment schedule less new repayment schedule) 2021 2022 5 COFACE FACILITY AMENDMENT UPDATE

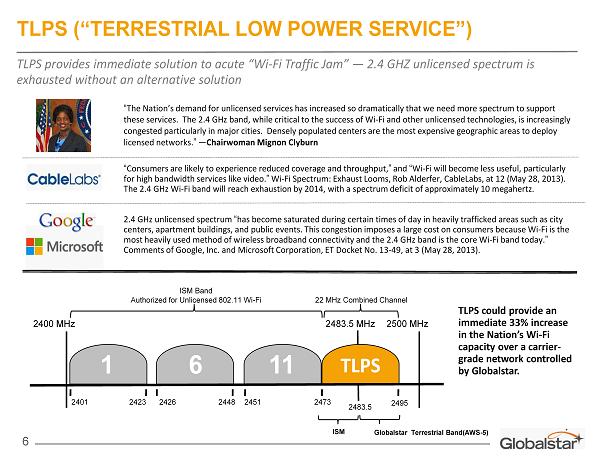

“ Consumers are likely to experience reduced coverage and throughput, ” and “ Wi - Fi will become less useful, particularly for high bandwidth services like video. ” Wi - Fi Spectrum: Exhaust Looms, Rob Alderfer, CableLabs, at 12 (May 28, 2013). The 2.4 GHz Wi - Fi band will reach exhaustion by 2014, with a spectrum deficit of approximately 10 megahertz. 2.4 GHz unlicensed spectrum “ has become saturated during certain times of day in heavily trafficked areas such as city centers, apartment buildings, and public events. This congestion imposes a large cost on consumers because Wi - Fi is the most heavily used method of wireless broadband connectivity and the 2.4 GHz band is the core Wi - Fi band today. ” Comments of Google, Inc. and Microsoft Corporation, ET Docket No. 13 - 49, at 3 (May 28, 2013). 6 TLPS (“TERRESTRIAL LOW POWER SERVICE”) “ The Nation’s demand for unlicensed services has increased so dramatically that we need more spectrum to support these services. The 2.4 GHz band, while critical to the success of Wi - Fi and other unlicensed technologies, is increasingly congested particularly in major cities. Densely populated centers are the most expensive geographic areas to deploy licensed networks. ” — Chairwoman Mignon Clyburn TLPS 2400 MHz 2483.5 MHz 2500 MHz 2401 2423 2426 2448 2451 2473 2495 Globalstar Terrestrial Band(AWS - 5) ISM Band Authorized for Unlicensed 802.11 Wi - Fi 2483.5 22 MHz Combined Channel ISM 1 6 11 TLPS could provide an immediate 33% increase in the Nation ’ s Wi - Fi capacity over a carrier - grade network controlled by Globalstar. TLPS provides immediate solution to acute “Wi - Fi Traffic Jam” — 2.4 GHZ unlicensed spectrum is exhausted without an alternative solution

Allow Globalstar to offer any permitted terrestrial wireless service within its 2.4 GHz spectrum, including mobile broadband services including TLPS and LTE Dramatically expand the Nation’ s spectral capacity to relieve existing Wi - Fi congestion Be managed over a carrier - grade network of access points; minimize impact on Globalstar’ s continued provision of MSS services Not displace any existing or future unlicensed use in the ISM band Be implemented quickly, leveraging existing network / handset investment and infrastructure Provide 20,000 TLPS - capable access points free of charge Provide MSS free of charge to Globalstar subscribers in federally declared disaster areas 7 AN IMMEDIATE SOLUTION & LONG - TERM PLAN GLOBALSTAR ’ S IMMEDIATE SOLUTION WILL: GLOBALSTAR ’ S LONG - TERM PLAN WILL: Add uplink spectrum to AWS - 5 terrestrial license in order to provide low power uplink services between 1610 and 1617.775 MHz Utilize FDD - LTE protocol Provide a full rulemaking to address any potential interference issues from neighboring wireless interests Complement S - band terrestrial authority to provide LTE terrestrial service in all bands designated for terrestrial use – option to rollout LTE or TLPS in a given metropolitan area or territory Provide terrestrial capability while maintaining robust MSS operations

NEW PRODUCTS – UPCOMING Battery life 2x SPOT 2 Enhanced customization features Smaller form factor USB connection for line power eliminates the need for battery replacement New movement messaging, theft alerting capabilities Extreme Tracking at 2.5 minute intervals Extremely small and inexpensive consumer asset tracking device Traces the path of anything, anywhere, anytime for consumer assets such as cars, ATVs, motorcycles, jet skis etc. Broadens addressable market and leverages retail distribution network SPOT GEN3 UNIVERSAL KIT Smallest and most efficient simplex M2M transmitter ever Will result in greater M2M market penetration and broadened customer appeal Used in ASIC - based devices which enable equipment to be smaller, lighter, more cost effective and power efficient SPOT GLOBAL PHONE STX3 Small, lightweight, consumer - oriented satellite phone Leverages the brand equity of SPOT in the recreational and consumer marketplace Portable device with a long battery life Airtime pricing will match current Duplex price plans CONSUMER ASSET TRACKER Feature - rich two - way communication device designed to penetrate the maritime industry Rugged form factor built around the GIK - 1700 cradle Improved usability: water protection, amplified speaker phone & data connectivity via USB NEW PRODUCTS LAUNCHED THIS YEAR 8 NEW PRODUCTS: EXPANDING ADDRESSABLE MARKETS New Asset Tracking device shown in relative size next to a quarter Device shown in relative size next to a smartphone

Breakthrough Mass Market Products Valuable Spectrum Assets Debt refinancing provides financial flexibility and eliminates near - term financial uncertainty Second - Gen provides significant cost benefits and network performance enhancements years before our competitors With the final Second - Gen satellite being placed into service in August, Globalstar achieves full Duplex service restoration Poised for continued growth in profitability Successfully launched two products in 2013; three additional products to be launched over the coming quarters – designed to expand addressable market through lower costs and enhanced functionality 10,000 retail points of distribution – only satellite company to have successfully penetrated mass consumer market – now selling the new SPOT Global Phone and SPOT Gen3 through this existing distribution network Further expansion into new distribution networks and vertical markets Non - replicable 25 MHz of globally - harmonized spectrum with 19.275 MHz targeted for licensed terrestrial broadband use in the U.S. Unique spectrum position allows for rapid deployment of 22 MHz of 2.4 GHz spectrum for consumer broadband service to relieve existing Wi - Fi congestion Awaiting issuance of Notice of Proposed Rulemaking 9 GLOBALSTAR VALUE DRIVERS Operational Improvements & Second - Gen benefits x x x

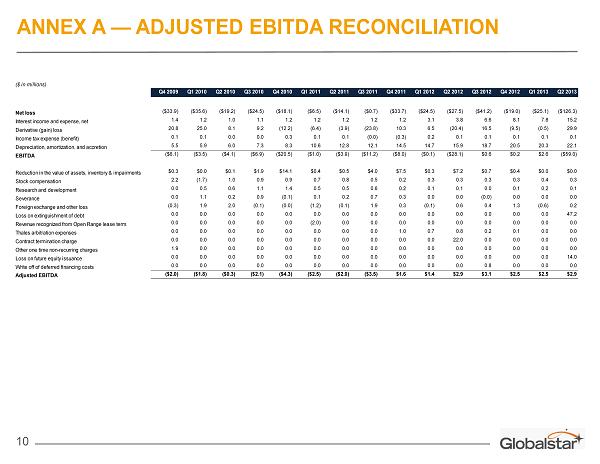

10 ANNEX A — ADJUSTED EBITDA RECONCILIATION ($ in millions) Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Net loss ($33.9) ($35.6) ($19.2) ($24.5) ($18.1) ($6.5) ($14.1) ($0.7) ($33.7) ($24.5) ($27.5) ($41.2) ($19.0) ($25.1) ($126.3) Interest income and expense, net 1.4 1.2 1.0 1.1 1.2 1.2 1.2 1.2 1.2 3.1 3.8 6.6 8.1 7.8 15.2 Derivative (gain) loss 20.8 25.0 8.1 9.2 (12.2) (6.4) (3.9) (23.8) 10.3 6.5 (20.4) 16.5 (9.5) (0.5) 29.9 Income tax expense (benefit) 0.1 0.1 0.0 0.0 0.3 0.1 0.1 (0.0) (0.3) 0.2 0.1 0.1 0.1 0.1 0.1 Depreciation, amortization, and accretion 5.5 5.9 6.0 7.3 8.3 10.6 12.8 12.1 14.5 14.7 15.9 18.7 20.5 20.3 22.1 EBITDA ($6.1) ($3.5) ($4.1) ($6.9) ($20.5) ($1.0) ($3.9) ($11.2) ($8.0) ($0.1) ($28.1) $0.6 $0.2 $2.6 ($59.0) Reduction in the value of assets, inventory & impairments $0.3 $0.0 $0.1 $1.9 $14.1 $0.4 $0.5 $4.0 $7.5 $0.3 $7.2 $0.7 $0.4 $0.0 $0.0 Stock compensation 2.2 (1.7) 1.0 0.9 0.9 0.7 0.8 0.5 0.2 0.3 0.3 0.3 0.3 0.4 0.3 Research and development 0.0 0.5 0.6 1.1 1.4 0.5 0.5 0.6 0.2 0.1 0.1 0.0 0.1 0.2 0.1 Severance 0.0 1.1 0.2 0.9 (0.1) 0.1 0.2 0.7 0.3 0.0 0.0 (0.0) 0.0 0.0 0.0 Foreign exchange and other loss (0.3) 1.9 2.0 (0.1) (0.0) (1.2) (0.1) 1.9 0.3 (0.1) 0.6 0.4 1.3 (0.6) 0.2 Loss on extinguishment of debt 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 47.2 Revenue recognized from Open Range lease term. 0.0 0.0 0.0 0.0 0.0 (2.0) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Thales arbitration expenses 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 1.0 0.7 0.8 0.2 0.1 0.0 0.0 Contract termination charge 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 22.0 0.0 0.0 0.0 0.0 Other one time non-recurring charges 1.9 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Loss on future equity issuance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 14.0 Write off of deferred financing costs 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.8 0.0 0.0 0.0 Adjusted EBITDA ($2.0) ($1.8) ($0.3) ($2.1) ($4.3) ($2.5) ($2.0) ($3.5) $1.6 $1.4 $2.9 $3.1 $2.5 $2.5 $2.9