Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlas Financial Holdings, Inc. | form8-kreq22013earningsrel.htm |

| EX-99.1 - PRESS RELEASE DATED AUGUST 12, 2013 - Atlas Financial Holdings, Inc. | q2-2013pressrelease.htm |

1 Second Quarter 2013 Conference Call August 13, 2013

Statements in this presentation, including the information set forth as to the future financial or operating performance of Atlas Financial Holdings, Inc., American Country Insurance Company, American Service Insurance Company and/or Gateway Insurance Company (collectively, “Atlas”), that are not current or historical factual statements may constitute “forward looking” information within the meaning of securities laws. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Atlas, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this presentation, such statements may include, among other terms, such words as “may,” “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “estimate” and other similar terminology. These statements reflect current expectations, estimates and projections regarding future events and operating performance and speak only as to the date of this presentation. Readers should not place undue importance on forward looking statements and should not rely upon this information as of any other date. These forward looking statements involve a number of risks and uncertainties. Some of the factors facing Atlas that could cause actual results to differ materially from those expressed in or underlying such forward looking statements include: (i) market fluctuations, changes in interest rates or the need to generate liquidity; (ii) access to capital; (iii) recognition of future tax benefits on realized and unrealized investment losses; (iv) managing expansion effectively; (v) conditions affecting the industries in which we operate; (vi) competition from industry participants; (vii) attracting and retaining independent agents and brokers; (viii) comprehensive industry regulation; (ix) our holding company structure; (x) our ratings with A.M. Best; (xi) new claim and coverage issues; (xii) claims payments and related expenses; (xiii) reinsurance arrangements; (xiv) credit risk; (xv) our ability to retain key personnel; (xvi) our ability to replace or remove management or Directors; (xvii) future sales of common shares; (xviii) public company challenges; and (xix) failure to effectively execute our business plan. The foregoing list of factors is not exhaustive. See also “Risk Factors” listed in the Company’s most recent registration statement filed with the SEC. Many of these issues can affect Atlas’ actual results and could cause the actual results to differ materially from those expressed or implied in any forward looking statements made by, or on behalf of, Atlas. Readers are cautioned that forward looking statements are not guarantees of future performance, and should not place undue reliance on them. In formulating the forward looking statements contained in this presentation, it has been assumed that business and economic conditions affecting Atlas will continue substantially in the ordinary course. These assumptions, although considered reasonable at the time of preparation, may prove to be incorrect. When discussing our business operations, we may use certain terms of art which are not defined under U.S. GAAP. In the event of any unintentional difference between presentation materials and our GAAP results, investors should rely on the financial information in our public filings. Safe Harbor 2

Atlas Snapshot NASDAQ: AFH Corporate Headquarters Elk Grove Village, IL (Chicago suburb) Subsidiaries / Brands American Country American Service Gateway (including Alano) Core Target Markets Taxi / Limo / Paratransit Cash and Investments $145.0M Total Assets $217.6M Total Shareholders’ Equity $69.6M Shares Outstanding 8,166,891 Book Value Per Share $6.07 3 (at 6/30/2013 unless otherwise noted)

4 2013 Second Quarter Highlights Continued Improvement in Underwriting Results • Combined ratio improved by 16.5 percentage points year-over-year to 95.0% • Underwriting results improved by $1.7 million Geographic Expansion / Core Growth • Gross premium written increased by 79.2%, which included an increase of 90.6% in core commercial auto business • Actively distributed core products in 40 states plus D.C. during the three month period ended June 30, 2013 • Increasing geographic diversification – 46.7% from top five states for the three months ended June 30, 2013, compared to 63.8% in the prior year period Strength in Agent Network / Pricing • Continued return of business from independent agent network • Pricing trends remain favorable Integration of Gateway Insurance Continuing as Planned • Majority of Gateway’s operations now completely integrated with Atlas platform • New state licenses obtained in acquisition beginning to benefit company

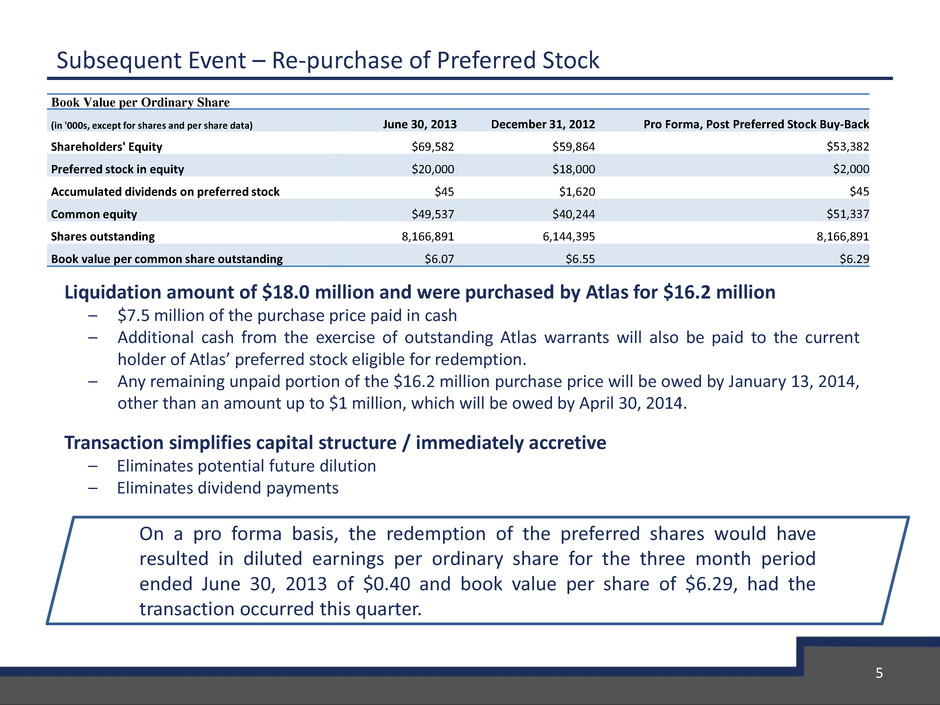

5 Subsequent Event – Re-purchase of Preferred Stock Liquidation amount of $18.0 million and were purchased by Atlas for $16.2 million – $7.5 million of the purchase price paid in cash – Additional cash from the exercise of outstanding Atlas warrants will also be paid to the current holder of Atlas’ preferred stock eligible for redemption. – Any remaining unpaid portion of the $16.2 million purchase price will be owed by January 13, 2014, other than an amount up to $1 million, which will be owed by April 30, 2014. Transaction simplifies capital structure / immediately accretive – Eliminates potential future dilution – Eliminates dividend payments On a pro forma basis, the redemption of the preferred shares would have resulted in diluted earnings per ordinary share for the three month period ended June 30, 2013 of $0.40 and book value per share of $6.29, had the transaction occurred this quarter. Book Value per Ordinary Share (in '000s, except for shares and per share data) June 30, 2013 December 31, 2012 Pro Forma, Post Preferred Stock Buy-Back Shareholders' Equity $69,582 $59,864 $53,382 Preferred stock in equity $20,000 $18,000 $2,000 Accumulated dividends on preferred stock $45 $1,620 $45 Common equity $49,537 $40,244 $51,337 Shares outstanding 8,166,891 6,144,395 8,166,891 Book value per common share outstanding $6.07 $6.55 $6.29

Atlas’ Core Focus – “Light” Commercial Auto Target Market • Taxi, limousine, livery and non-emergency paratransit • Owner-operated and small operation fleets – 1-10 vehicles • Insured to minimum required policy limits Agent Returns Improving with Each Quarter • Strong brand recognition and market presence • Long-standing distribution relationships • Underwriting expertise, loss data and technology • Specialized claims handling Renewal Business Continues Positive Trend • Greater percentage of growing book 90.6% Growth in Core Commercial Lines in Q2 2013 Target Level Renewal Retention 0.00% 20.00% 40.00% 60.00% 80.00% 100.00% 6

0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% Operating Activities: Underwriting (commercial business only) Renewal Retention (Policy Count) New Business Submissions (Monthly Vehicles Submitted) New Business Submissions (Car Years Annualized) 0 5000 10000 15000 20000 25000 Actual 0 500 1000 1500 2000 2500 3000 Actual Last Year Target of 85% based on current market conditions 7

0% 10% 20% 30% 40% 50% 60% 70% 80% Bound/Application Ratio Application Count by Agent Category 0 50 100 150 200 250 300 New Agents Existing Agents Operating Activities: Underwriting (commercial business only) Current target of 60%. January was higher due primarily to “pre sold” Chicago owner operators. Marginal firming of market conditions may support a higher ratio later in the year. Continuing incremental volume from new and existing agents with continuing volume related to “book rolls” from other markets 8

Geographic Expansion • Actively distributed products in 40 states plus Washington D.C. – Written premium in 39 of these during the second quarter of 2013 • Expanded into CA, HI, MT, NE, ND, SD, WA, WV and DC through Gateway acquisition 9 Large enough to generate $1 to $5 million in core premium within first 18 months Competitive strength of Atlas’ value proposition Favorable insurance environment Core Target Criteria

Geographic Diversification 10 Gross premium written by state (in '000s) Three Month Periods Ended Six Month Periods Ended June 30, 2013 June 30, 2012 June 30, 2013 June 30, 2012 Michigan $ 2,052 12.4 % $ 1,833 19.8 % $ 4,112 10.6 % $ 3,724 17.7 % New York 1,951 11.8 % 817 8.8 % 4,446 11.4 % 2,333 11.1 % Minnesota 1,429 8.6 % 1,139 12.3 % 2,261 5.8 % 1,595 7.6 % Illinois 1,156 7.0 % 1,448 15.7 % 7,978 20.5 % 7,012 33.4 % Texas 1,147 6.9 % 655 7.1 % 1,966 5.1 % 856 4.1 % Louisiana 987 6.0 % 296 3.2 % 1,608 4.1 % 303 1.4 % Ohio 697 4.2 % 237 2.6 % 1,356 3.5 % 337 1.6 % South Carolina 659 4.0 % 186 2.0 % 888 2.3 % 252 1.2 % Georgia 654 3.9 % 107 1.2 % 1,889 4.9 % 602 2.9 % California 562 3.4 % — — % 1,585 4.1 % — — % Nevada 547 3.3 % 478 5.2 % 543 1.4 % 478 2.3 % Other 4,721 28.5 % 2,046 22.1 % 10,284 26.3 % 3,503 16.7 % Total $ 16,562 100.0 % $ 9,242 100.0 % $ 38,916 100.0 % $ 20,995 100.0 %

Small Accounts Medium Accounts Large Accounts Average Second Quarter 2013 4.6% 4.7% 3.8% 4.3% First Quarter 2013 5.2% 5.3% 4.9% 5.2% Fourth Quarter 2012 5.5% 5.1% 4.4% 5.0% Third Quarter 2012 3.7% 4.5% 3.5% 3.9% Second Quarter 2012 4.3% 4.9% 3.7% 4.3% Fourth Quarter 2011 3.1% 3.5% 1.6% 2.7% High (2001,Q4) 20.8% 31.7% 33% 28.5% Low (2007,Q3) -10% (2008, Q1) -15% -15.9% -13.3% 11 Steady Rate Increases In Commercial Auto Majority of Atlas’ Target Market are Individual Entrepreneurs and Small Fleet Operators Source: The Council of Insurance Agents & Brokers

Financial Highlights

Q2 2013 Financial Results • Gross premium written increased by 79.2% to $16.6 million • Underwriting results improved by $1.7 million • Net income was $1.7 million, compared to $130,000 in Q2 2012 • Basic and diluted earnings per common share were $0.18 and $0.16, respectively, net of accounting treatment for preferred shares 13 06/30/2013 06/30/2012 Loss Ratio 64.6% 71.6% Acquisition Cost Ratio 13.1% 18.5% Other Underwriting Expenses 17.3% 21.4% Combined Ratio 95.0% 111.5% Return on equity (annualized) 9.7% 0.9% Return on common equity (annualized) 11.8% (0.8%) Operating income / (loss) per common share $0.12 ($0.03) Diluted earnings / (loss) per common share $0.16 ($0.01) Book Value per common share $6.07 $6.15

Considerable Financial Improvement Since 2010 Realignment – Focus on Core 14 Combined Operating Ratio (“COR”) 114.1% 119.7% 169.7% 107.3% 111.5% 97.6% 97.5% 98.1% 95.0% 75.0% 100.0% 125.0% 150.0% 175.0% Q2'11 Q3'11 Q4'11 Q1'12 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Approximately 49% of Q4 ‘11 COR related to wind-down of ACIC pension and non-core legacy reserve strengthening

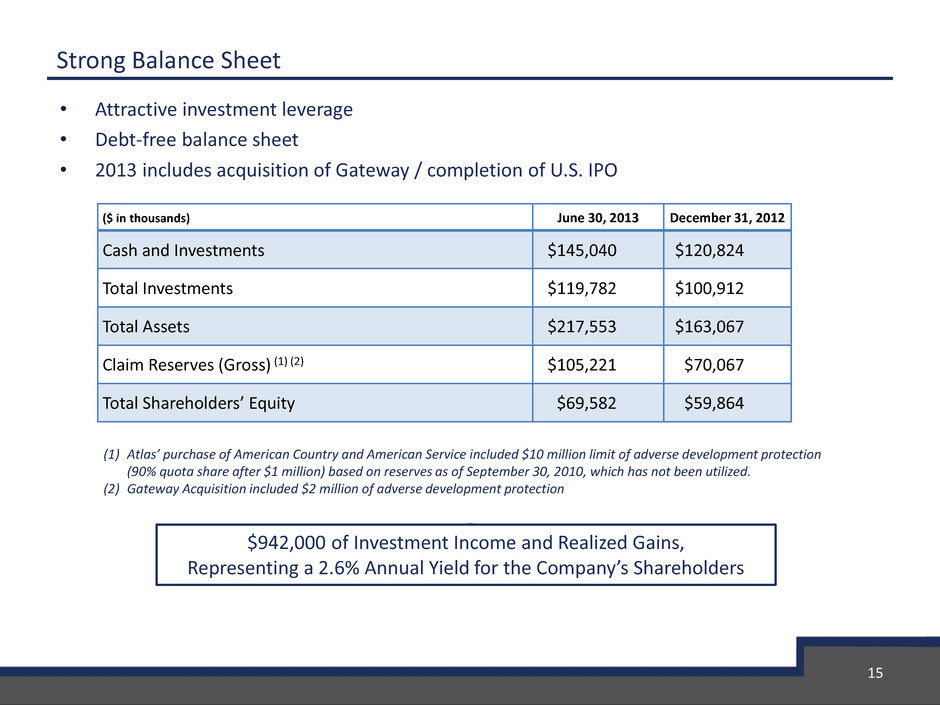

($ in thousands) June 30, 2013 December 31, 2012 Cash and Investments $145,040 $120,824 Total Investments $119,782 $100,912 Total Assets $217,553 $163,067 Claim Reserves (Gross) (1) (2) $105,221 $70,067 Total Shareholders’ Equity $69,582 $59,864 15 (1) Atlas’ purchase of American Country and American Service included $10 million limit of adverse development protection (90% quota share after $1 million) based on reserves as of September 30, 2010, which has not been utilized. (2) Gateway Acquisition included $2 million of adverse development protection • Attractive investment leverage • Debt-free balance sheet • 2013 includes acquisition of Gateway / completion of U.S. IPO Strong Balance Sheet $942,000 of Investment Income and Realized Gains, Representing a 2.6% Annual Yield for the Company’s Shareholders

Investment Portfolio Conservative Investment Approach • Emphasize preservation of capital, market liquidity to support payment of liabilities and diversification of risk • Investment duration re-positioned to match core commercial auto reserve liabilities Substantial Investment Portfolio • As of June 30, 2013, total investments equaled $119.8 million, of which $117.7 are fixed income • Predominantly corporate and government bonds • Average duration of 3.8 years • Average S&P rating of AA 16 Government 39% Corporate 33% Commerical Mortgage 18% Other Asset Backed 9% Equities 1% Investment Portfolio (6/30/2013) (1) (1) American Country Insurance Company, American Service Insurance Company, Inc. and Gateway Insurance Company Credit ratings of fixed income securities portfolio (in '000s) As of: June 30, 2013 December 31, 2012 Amount % of Total Amount % of Total AAA/Aaa $ 71,247 61 % $ 58,765 60 % AA/Aa 12,128 10 % 7,569 8 % A/A 23,260 20 % 19,894 20 % BBB/Baa 11,097 9 % 11,617 12 % Total Securities $ 117,732 100 % $ 97,845 100 %

For Additional Information At the Company: Scott Wollney Chief Executive Officer swollney@atlas-fin.com 847-700-8600 Investor Relations Counsel: The Equity Group Inc. Adam Prior Senior Vice President APrior@equityny.com 212-836-9606 Terry Downs Associate TDowns@equityny.com 212-836-9615 Nasdaq: AFH August 13, 2013